Abstract

Since 1980, foreign investors have timed their purchases and sales of U.S. Treasurys to yield particularly low returns. Their annual “dollar-weighted” returns, measured by the internal rate of return on their purchases and sales of Treasury bonds, are over 3.26 percentage points (pp) lower than a buy-and-hold strategy over the same horizon. Their returns are 1.62 pp lower than the returns earned by domestic investors. We also explore the heterogeneity across foreign investors, and find that official investors and developing country investors underperform more than other foreign investors. Our results are consistent with theories in which foreign investors are price-inelastic buyers of safe dollar assets, and increase their demand for dollar assets in stress periods.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The literature on safe assets ascribes a special role to dollar safe assets in the international financial system (Caballero et al. 2017; Farhi and Maggiori 2018; He et al. 2016, 2019; Gopinath and Stein 2021). In terms of quantities, there is a large amount of safe dollar debt outstanding (Shin 2012; Bruno and Shin 2015; Maggiori et al. 2020). The U.S. is a major provider of these dollar debt claims, with its gross foreign asset position resembling a long position in risky foreign claims and a short position in safe dollar debt claims (Gourinchas and Rey 2007b, 2022; Bernanke et al. 2011). In terms of prices, safe dollar debt claims are highly valued. Jiang et al. (2021) show that U.S. Treasury bonds, on a currency-hedged basis, have lower yields than the sovereign bonds of other G10 countries (see also Du et al. 2018; Engel and Wu 2023; Du and Schreger 2022). Since the Global Financial Crisis in 2008, a similar gap has opened up between U.S. and foreign bank deposit rates (Du et al. 2018). The same pattern also holds for short-dated high-grade corporate bonds (Liao 2020). The picture that emerges from the quantities and prices is that foreign investors hold a large quantity of safe dollar debt claims, accepting a low return on these holdings.

This paper adds a new timing dimension to these facts that characterize foreign investors’ safe dollar asset portfolios. We track the purchases and sales of U.S. Treasury bonds by foreign investors and show that their market timing yields a return that is substantially below the return on a buy-and-hold strategy. In other words, foreign investors buy U.S. Treasurys when they are expensive and offer low future returns, and they exit their positions when Treasury bonds are cheap and offer high future returns. That is, foreign investors earn low returns on their Treasury holdings partly because their purchases and sales are poorly timed.

We measure the dollar-weighted return earned by the foreign investors (labeled as the ROW, i.e., the Rest of the World) on their holdings of U.S. Treasurys by computing the internal rate of return (IRR) on their net purchases and sales of Treasurys, as reported in the Flow of Funds and TICS data. The ROW absorbs a significant share of the U.S. issuance of Treasurys, especially between 1990 and 2015. For comparison, we also compute the time-weighted return (i.e., the geometric mean return), which measures the return earned by a buy-and-hold investor who invests $1 dollar and then holds the investment until the final period. This time-weighted return is commonly used in the literature discussed above to measure safe dollar debt’s low buy-and-hold returns.

To understand how the dollar-weighted returns differ from the time-weighted returns, consider the following example with two investment periods. In year 1 the Treasury yield is high at 5%. In year 2 the Treasury yield is low at 1%. Table 1 illustrates the returns and the holdings of home and foreign investors. The foreign investors buy more Treasurys when the yield is lower in period 2, whereas the home investors buy more Treasurys when the yield is higher in period 1. The time-weighted average as measured by the geometric mean of the returns over the two years is exactly the same 2.98% for the U.S. and the foreign investors. In other words, the home and the foreign investors are receiving the same returns from their Treasury portfolios in each period.

In comparison, the dollar-weighted average as measured by the IRR is 1.37% for the foreign investors and 4.65% for the home investors–leading to a difference of 3.28% per annum between home and foreign investors. This IRR measure, incorporating how well different investors time the market, suggests that the foreigners earn a much lower return from their dynamic trading strategy even when the underlying asset offers the same return.Footnote 1

We run this calculation in the data and document four results following Krishnamurthy and Lustig (2019). First, the dollar-weighted returns (i.e., the IRRs) offer a very different picture than the time-weighted returns (i.e., the geometric mean return). Since 1980, the ROW’s dollar-weighted return is 322 basis points per annum lower than the time-weighted return. The gap is particularly large in the pre-2000 sample, and the gaps are statistically different from zero.

Second, foreign investors consistently earn lower dollar-weighted returns relative to other investors. We compare the foreign investors’ IRRs to the IRRs earned by domestic investors excluding the Federal Reserve. In the 1980–2023 sample, home investors’ IRR is 162 basis points per annum higher than the ROW’s. In comparison, the ROW’s IRR is higher than the IRR earned by the Federal Reserve, which is known to be a price-inelastic buyer in the Treasury market.

Third, there is heterogeneity within foreign investors. We find that the gap is larger when we focus on the foreign official sector as opposed to the foreign private sector. That said, the foreign private sector’s IRR is still significantly lower than the domestic investors’ IRR. As a result, the ROW’s low dollar-weighted returns cannot be attributed solely to the demand for dollar reserve assets by foreign central banks. Moreover, among the foreign countries, we find that developed economies such as the Euro Area and Japan tend to achieve higher dollar-weighted returns than emerging economies such as China and India.

Fourth, the foreign investors’ willingness to buy U.S. Treasurys when they are expensive seems to vary at a low frequency. In terms of returns, we estimate the ROW’s IRR in 10-year rolling windows, and find that the ROW’s IRR does not underperform the buy-and-hold strategy in the decade ending with the Covid-19 crisis. In terms of quantities, foreigner investors became net sellers of U.S. Treasury Notes and Bonds during the Covid-19 crisis, whereas they used to be net buyers during past global recessions. It is possible that the foreign demand for the U.S. Treasurys was at a tipping point as some have argued (see Duffie 2020; Schrimpf et al. 2020; Vissing-Jorgensen 2020; He et al. 2022). However, after 2021, the foreign demand for U.S. Treasurys has rebounded, leading to both lower IRRs achieved by foreign investors and positive capital inflows into the U.S. Treasury market. The data do not offer a clear picture on a possible shift away from Treasuries by ROW investors.

Our finding about investment timing should be understood in conjunction with the findings reported by the papers cited earlier on the demand for dollar safe assets. Our finding is consistent with the notion that U.S. Treasurys are the ROW’s preferred safe asset, and foreign investors hoard Treasurys exactly when Treasurys are already expensive. Put differently, the ROW’s demand for U.S. Treasurys is price inelastic. Krishnamurthy and Vissing-Jorgensen (2007) estimate demand curves for Treasurys by the main holders of Treasurys and find that the ROW demand curves are far more price inelastic than other holders.

Dollar-weighted returns are standard performance metrics in asset management (see Dichev and Yu 2011, for an example from the hedge fund industry). To compute the IRR in the data, we assume that in each period the ROW holds the market portfolio of Treasury Notes and Bonds, whose return we measure using standard Treasury bond indices. Our measurement using market returns requires an assumption about the portfolio composition of investors, but not about the timing. In particular, the maturity composition (the fractions of long-term vs short-term bonds) is assumed to be the same across classes of investors. This assumption is validated in recent work by Tabova and Warnock (2021) who use security-level holdings data. They show that the returns on Treasury portfolios of different investor classes, accounting for their compositional differences, are small in each period, thus offering support for our measurement assumption.

The pattern of returns and flows that we document in this paper provides a different but complementary perspective to the analysis of U.S. Treasurys’ convenience yields. Jiang et al. (2021) measures the U.S. Treasury basis and its correlation with the dollar exchange rate to infer the size of the convenience yield. Using a demand system approach, Koijen and Yogo (2020) estimate foreign convenience yields of 215 basis points per annum on U.S. long term bonds. While convenience yields already provide a source of seigniorage revenue for the U.S. government (Jiang et al. 2019, 2020), our evidence suggests that the U.S. government further benefits from the market timing of the foreigners’ purchases, which significantly reduces the U.S. government’s cost of funding on a dollar-weighted basis (see Hall and Sargent 2011; Hall et al. 2018, for an analysis of the determinants). This novel form of U.S. exorbitant privilege also plays a key role in the country-level imbalances, allowing the U.S. to run persistent twin deficits (Gourinchas and Rey 2007b; Jiang et al. 2020). It also shapes the dollar’s exchange rate cyclicality and currency risk premium (Jiang 2021, 2022).

Lastly, there is an ongoing debate about the fiscal capacity of the U.S. (see, e.g. Blanchard 2019; Jiang et al. 2019; Furman and Summers 2020). Some have argued that low rates have increased the U.S. fiscal capacity. Our evidence suggests that foreign investors’ demand for dollar safe assets have lowered the U.S. effective (i.e., dollar-weighted) cost of borrowing.

2 Framework

This section lays out a simple framework to understand our results and place them in the context of existing findings and theory. Consider an economy with a U.S. investor and a foreign investor, along the lines of the example in Table 1. Suppose that both investors have a demand function for a one-period Treasury bond, which we denote as \(B^H(r_t)\) for home investors and \(B^F(r_t;\omega _t)\) for foreign investors, with quantity demanded increasing in the Treasury bond’s interest rate \(r_t\). The home investor represents an amalgam of households, institutional investors such as pension funds and insurance companies, and banks. The foreign investor represents foreign official holders such as central banks, as well as banks and other institutional investors. These investors may have a special demand for dollar Treasury bonds as foreign exchange reserves to precaution against sudden stops (Caballero and Panageas 2008) or global downturns (Gourinchas and Rey 2022), to purchase dollar-invoiced goods (Gopinath and Stein 2021; Chahrour and Valchev 2022), or to settle dollar financial transactions (Coppola et al. 2023). The foreign demand is state-dependent, indicated by the dependence on the state \(\omega _t\). For simplicity, we assume that there is no state-dependence in the demand of the U.S. investor and in the supply of the Treasury bond, \({\bar{B}}\). But more generally, to understand our results, we require that U.S. investor demand is less sensitive to the state than foreign investors.

The existing literature has presented quantity evidence that \(B^F(r_t;\omega _t)\) is large and has been growing (Gourinchas and Rey 2007a; Bernanke et al. 2011). Additionally, the savings glut argument of Caballero et al. (2017) is that as \(B^F(r_t;\omega _t)\) has grown, \(r_t\) has fallen leading to low real interest rates in the U.S. In the context of the model outlined, the market clearing condition at date t is,

High foreign demand leads to a low equilibrium rate on U.S. Treasury bonds. Note that this evidence on asset prices and quantities regards only the trend and the average interest rate.

Next, consider state dependence. Suppose that there are states—i.e., global crises—where \(\omega _t\) worsens and \(B^F(r_t;\omega _t)\) rises. Then we would find that in these states the interest rate \(r_t\) would fall as in a flight-to-safety. More generally, in a model with exchange rates, the dollar would appreciate in this state to give an expected depreciation and lead to a fall in the expected returns earned by foreign investors. These asset pricing facts are also established in the literature. For example, Jiang et al. (2021) show that in crises periods the premium on Treasury bonds—measured as the Treasury basis—rises and the dollar exchange rate appreciates. Thus, the asset pricing evidence is that U.S. rates are low on average because foreign safe asset demand reduces the equilibrium return on Treasury bonds, and these returns fall further in bad \(\omega _t\) states.

The new evidence we bring regards the comovement between the quantities held by foreign investors and the asset prices, induced by variation in the state. In the crisis \(\omega _t\) state, the foreign demand \(B^F(r_t;\omega _t)\) rises, lowers the interest rate \(r_t\) and crowds out the domestic demand \(B^H(r_t)\). That is, quantity movements will align with the interest rate movements and lead to the pattern in Table 1. The key to this identification is that foreign demand rises more in the \(\omega _t\) state than U.S. demand; if U.S. demand rose more, then, the quantity patterns would have the opposite sign. But under the hypothesis that foreign demand is more sensitive, the comovement between quantity and price will show up as poor market timing and low measured dollar-weighted returns. Thus, the evidence we present can be seen to support the hypothesis that foreign demand for safe asset rises in bad \(\omega _t\) states and more than U.S. investor demand.

3 Data and Methods

3.1 Data Sources

Our main bond return index is obtained from the CRSP. We calculate the value-weighted return on all marketable Treasury securities based on the security level data. We exclude T-bills from our main analysis, because there is less consistent data on the quantity and returns on T-bills. We include them in the robustness section. This CRSP index excludes all securities held by the Federal Reserve. For robustness, we use three more return indices. The Barclays index (Bloomberg Barclays/US Treasury Total Return Index) and the BofA index (ICE BofA U.S. Treasury Return Index) are obtained from Bloomberg.Footnote 2 These indices exclude T-bills. The Barclays index seeks to produce an investable return index, which excludes securities held by the Federal Reserve because these are no longer traded in secondary markets. The BofA index does not. We also obtain a return index from Hall et al. (2018), which is based on all securities issued by the U.S. Treasury including T-bills. We report the pairwise correlations between these return indices in Appendix Table 5, which shows that they are highly correlated.

We do not have security-level data on the portfolio holdings of the ROW. Instead, we assume that the ROW holds the market portfolio. This assumption is validated by the findings of Tabova and Warnock (2021) who use security-level data to show that ROW investors roughly hold the market portfolio.Footnote 3

We obtain the flow data from the Flow of Funds Flow Table F.210 for Treasury securities. These series are seasonally adjusted and reported at annual rates. We use the Rest of the World, Other Treasury securities, excluding Treasury bills (FA263061120.Q) as the ROW’s net purchases of Treasurys at annual rates, NPA(t). We define \(NPQ(t)=NPA(t)/4\) as the quarterly net purchase by ROW of Treasurys. We also use the equivalent series for the Fed (FA713061125.Q), and the total issuance of all other investable securities, excluding T-bills (FA313161275.Q). The net purchases of Treasurys by other investors is defined as Total Issuance minus the Fed and ROWs net purchases.

In addition, we use data from Bertaut and Tryon (2007); Bertaut and Judson (2014, 2022) to distinguish between the ROW official and private purchases of U.S. Treasurys, as well as between ROW investors of different nationalities.

3.2 Return Definitions

Next, we describe how we compute the dollar-weighted returns. First, we construct the AUM series as follows using the accounting identity

where R(t) denotes the quarterly cum-coupon return from one of the return indices. We initialize this procedure with \(AUM(1979.Q4)=0\). The cash flow series is given by \(CF(t)=-NPQ(t)\) for \(t=\)1980.Q1 to 2021.Q1, which captures the net inflows of the investors’ funds into the Treasury market. In the last period, we assume that the investors cash out from the market, receiving a net outflow of \(CF(T)=AUM(T-1)\cdot R(T)\).

Our measure of the dollar-weighted return is the internal rate of return (IRR) such that the net present value (NPV) of these cash flows is exactly zero:

For comparison, we also compute the time-weighted returns as the standard geometric mean (GM):Footnote 4

If an investor implements a buy-and-hold strategy with no interim cash flow, then the IRR thus computed would equal the geometric mean return. In this paper, we are going to study the difference between the IRR and the geometric mean return, which allows us to evaluate the performance of various investors relative to the buy-and-hold benchmark.

4 The ROW’s Net Purchases of Treasurys

We first discuss the net flows to U.S. Treasurys. Figure 1, panel (a) plots the annualized net flows into U.S. Treasurys (including T-Bills), and decomposes the flows into three components: domestic investors, the Fed, and the rest of the world (ROW). The numbers are annualized and expressed as % of GDP. We observe three different regimes. First, from the mid 1970s until the mid 1990s, the U.S. domestic agents, including the financial sector such as banks, insurance companies, pensions and the household sector, absorbed a significant fraction of the new debt issuance. They were the major players in the Treasury market, whereas the flows and the positions of the Fed and the ROW were relatively small.

There was a distinct shift in the mid-to-late 1990s, when the ROW became the main Treasury buyers while the domestic investors became net sellers. In this second regime through 2015, the ROW was by far the most important buyer of U.S. Treasurys. Their inflows were particularly pronounced during the global financial crisis, which is consistent with the flight to safety observed in safe dollar bond prices. The Fed also started playing a more active role since the global financial crisis as it undertook quantitative easing and expanded its balance sheet.

Since 2015, we have entered a third regime characterized by weaker demand from the ROW. In fact, contrary to its countercyclical purchases of the U.S. Treasurys in previous decades, it became a net seller in the Treasury market during the Covid-19 crisis. In comparison, the Fed became a much more active buyer during the Covid-19 crisis. The typical ROW pattern re-emerges after the Covid-19 crisis, albeit smaller in magnitude than prior to 2015.

When we focus only on the T-Notes and Bonds, as in the measurements of the next section, the patterns remain the same. Figure 1, panel (b) plots the annualized flows in U.S. Treasury Bonds and Notes, excluding T-Bills. Between 1995 and 2015, the ROW absorbed a significant fraction of the net issuance. Since 2015, the demand for Treasury Notes and Bonds from the ROW has weakened considerably. The primary difference between the flows into T-Bills and the flows into the T-Notes and Bonds is during the pandemic: the ROW and the U.S. private investors became large sellers of Notes and Bonds, while the Fed had to purchase more than the entire issuance of new Treasury debt.

5 The ROW’s Dollar-Weighted Returns

5.1 Main Results

Now, we report the IRRs and geometric mean returns as defined in Section 3.2. Table 2 reports these numbers using the CRSP return data. We report the returns realized by the ROW, the Fed, and the remaining domestic investors. The cash flows for the remaining domestic investors are determined by the issuance less the quantities purchased by the ROW investors and the Fed. We also include a row representing the aggregate market.

First, we find that the IRR realized by the ROW is 3.22%, whereas the geometric mean return (GM) is 6.48%. In other words, the ROW investors underperform the buy-and-hold benchmark by 326 basis points (basis points) per annum. We confirm this result using other return series, which we report in Appendix Table 6.

The ROW’s return gaps are statistically different from zero. We report standard errors in parentheses, which are bootstrapped from the difference between the simulated IRR and the GM returns. Specifically, we draw 10,000 samples of the index returns with replacement from the original data set. Each sample has the same length as the actual dataset. We calculate the IRR and GM return within each simulated sample, and compute the standard error of the IRR–GM differential across the 10,000 simulated samples. Note that we use the actual flows as measured in the data. Under the null that flows are unrelated to future returns, there should no difference between the IRR and GM returns.

Second, the comparison across investor categories is also revealing. Using the CRSP return index, we find that the IRR realized by the U.S. domestic investors is 4.84% per annum, which is 162 basis points higher than the ROW’s IRR. In other words, the foreign investors not only underperform relative to the buy-and-hold benchmark, they also underperform relative to the domestic investors. When we compare the ROW’s IRRs to those realized by the Federal Reserve Bank, we find that the ROW does 127 basis points better than the Fed in dollar-weighted terms. We find the relative performance gap illuminating, since the Fed’s Treasury holdings are driven by its monetary policy objectives that are orthogonal to risk versus return objectives. In recent years, the Fed tends to purchase Treasurys precisely when economic conditions are weak and bond yields are low. The fact that the ROW’s IRR is closer to the Fed’s than to the domestic investors’ therefore suggests that the ROW’s Treasury holdings are likewise not driven by a risk versus return trade-off.

Third, we report the IRR for the aggregate market representing the universe of all investors. By market clearing, their total cash flows are equal to the aggregate issuance by the Treasury, which also implies an adding-up constraint that equates the IRR of the aggregate market’s purchase flows to the IRR of the Treasury’s issuance flows. Using the CRSP return index, the Market IRR is 3.88%, which is higher than the IRRs of the ROW and the FED, and lower than the IRR of domestic investors. This IRR is also lower than the geometric mean return, suggesting that the government issuer times the market to exploit variations in the bond yields and achieve a low effective funding cost.

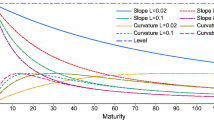

ROW’s IRR in 10-year Rolling Windows. We plot the difference between foreign investors’ GM and IRR, computed over 10-year rolling windows ending at the year indicated in the x axis. We use the Treasury return data from CRSP, and the ROW investors’ cash flows from the Flow of Funds, excluding T-bill holdings

We also perform these calculations in sub-periods. Figure 2 plots the 10-year IRR realized by the ROW against the 10-year GM using a rolling window. In this computation, we initialize the AUM at zero in the period prior to the start of the rolling window, and then calculate the IRR based on the actual flows during the 10-year window. We find that the ROW has largely underperformed the geometric return in the rolling windows. In our sample, the average 10-year IRR is 57 basis points lower than the geometric average return per annum. Since 2015, the gap between the ROW’s IRR and GM has shrunk, and briefly turned positive in the Covid-19 crisis. This pattern is consistent with our earlier characterization of weaker ROW demand since 2015 in Section 4. However, more recently, the ROW’s IRR has again turned negative, so that the data do not offer a clear picture regarding a possible shift away from Treasuries by world investors.

To evaluate statistical significance, we also bootstrap the bond returns and generate the 10-year IRRs in rolling windows. As discussed above, our null hypothesis posits that flows are unrelated to future returns and there is no difference between the IRR and GM returns. Under this null, we find that only in 1.1% of our simulated samples is the average gap between the IRR and the geometric mean across 10-year windows greater than or equal to what we observe in the data. Thus the ROW’s IRR and GM differential is statistically significantly different from zero.

5.2 Official Versus Private Foreign Sectors

Using the Bertaut and Tryon (2007), Bertaut and Judson (2014, 2022) data (henceforth the BJ data) of sector-specific foreign capital flows, we can drill down and analyze the dollar-weighted returns of the foreign official sector (Official ROW) and the foreign private sector (Private ROW). We refer to the sum of these two sectors as the Total ROW.

We repeat our exercise for these subgroups of the ROW investors, and report the results in Table 3. First, because the BJ data start from 1985, the dollar-weighted return obtained for Total ROW is slightly different at 2.85% per annum. It is still very close to the dollar-weighted return obtained using the Flow of Funds data in the same period, which is 2.78% per annum.

Second, we note that the dollar-weighted return realized by the foreign private sector (i.e., Private ROW) is higher than the aggregate ROW, whereas the dollar-weighted return realized by the foreign official sector (i.e., Official ROW) is lower. However, the Private ROW’s dollar-weighted return is still 55 basis points lower than the domestic investors’, and this difference is statistically significantly. We also confirm this result using other return series, which we report in Appendix Table 8. Therefore, the low IRRs realized by the ROW are not only a feature of the official sector, which is mainly based on central bank foreign reserves, but also a feature of foreign private investors.

5.3 Foreign Investors by Nationality

The BJ data also decompose the foreign investors by their nationalities. We examine the ten largest foreign holders of the U.S. Treasury as of 2023, which are the Euro Area, Japan, China, United Kingdom, Taiwan, India, Switzerland, Canada, Brazil, and Singapore. We report the results in Table 4.

We find a considerable amount of heterogeneity across these foreign holders. For example, foreign investors in advanced economies such as the Euro Area tend to have higher dollar-weighted return than the total ROW, whereas foreign investors in emerging economies such as China and India tend to have lower dollar-weighted return than the total ROW. We also confirm this result using other return series, which we report in Appendix Table 10. The difference between emerging and advanced economies may reflect the more active use of dollar foreign reserves by emerging economies to stabilize their currencies and domestic economies.

The poor market timing of emerging economies’ investors as captured by our IRR measure is also consistent with the cyclicality of their flows. We define the flow beta as the beta coefficient in the regression of the ratio between each ROW investor’s flow \(f^i_t\) and total outstanding debt \(d_t\) on the 10-year Treasury yield:

where we standardize the flow/debt ratio by demeaning and dividing by its standard deviation to make the magnitude comparable across countries. For example, India has a flow beta of \(\beta ^{IN} = -12.9\), which means that a 1% decrease in the annualized 10-year Treasury yield is associated with a 0.129-standard-deviation increase in India’s flow/debt ratio.

Figure 3 plots this yield beta of each major foreign ROW holder against their IRR. We find a positive relationship between a country’s IRR and its flow beta. This result is consistent with the notion that emerging economies tend to buy Treasurys when the Treasurys are expensive: if we regress the IRR on the flow beta in the cross-section of countries, the linear regression coefficient as represented by the slope of the blue line in Figure 3 is 0.137. To take the uncertainty in the parameter estimates of the flow beta into account, we run a bootstrap algorithm similar to Table 2, by drawing the bond yields and returns with replacement from the original data set and recomputing the IRRs, flow betas, and their linear relationship. From 10,000 samples, the standard deviation of this slope coefficient is 0.038, which confirms its statistical significance.

5.4 Inflation Timing Versus Real Return Timing

We also ask whether the ROW investors’ low dollar-weighted returns on U.S. Treasurys are due to their timing in inflation or timing in real bond returns. In Appendix Table 7, we compute the real IRR and real GM returns by deflating the cash flows and the bond returns at the U.S. CPI. The gap between the ROW’s real IRR and real GM return remains large and significantly different from zero, albeit somewhat smaller than the gap computed using nominal yields. This comparison indicates that the ROW’s demand for U.S. Treasurys is mainly characterized by their real return timing rather than their inflation timing.

In Appendix Table 9, we repeat our exercise in Table 3, which uses the breakdown between foreign official and private sectors, using real flows and returns. In Appendix Table 11, we similarly repeat our exercise in Table 4 using real flows and returns. We also find that these results are mainly driven by the ROW investors’ real return timing as opposed to inflation timing.

5.5 Robustness Tests

Longer Sample. In Appendix Table 12, we repeat our exercise in Table 2 but start our sample in 1952, which is when the Flow of Funds data begins. In this longer sample, only the CRSP index and the Hall et al. (2018) index are available to measure returns. Based on the CRSP index, the gap between the ROW’s IRR and the domestic investors’ IRR over this 70-year sample is 117 basis points, and the gap between the ROW’s IRR and the geometric mean return is 161 basis points. These numbers are smaller than those in Table 2. As such, the evidence across different samples indicates that the underperformance of the ROW’s dollar-weighted returns is particularly pronounced in the period from 1980 to 2010.

Including T-Bills. Finally, in Appendix Table 14, we repeat our exercise in Table 2 but use the flow and return data that include T-bills. We obtain the flow data that include not only Treasury Notes and Bonds but also Bills from the Flow of Funds. We construct a new CRSP index from security-level data including the T-bills, and we also use the Hall et al. (2018) since it includes all Treasury debt securities. The results are similar to that of Table 2.

6 Conclusion

The stand-in foreign investor in Treasurys has poor investment timing. As a result, he or she earns Treasury returns that are well below the buy-and-hold strategy. Our timing fact should be understood in conjunction with the facts documented in other papers that foreign investors own a large quantity of safe U.S. Treasury bonds and that U.S. Treasury bonds have unconditionally low average returns relative to the bonds of other G-10 sovereigns. The results are consistent with theories that emphasize that U.S. dollar safe assets are in special demand around the world, carrying a convenience yield, and that this special demand is due to price-inelastic foreign investors. Given the quantitative importance of foreign Treasury purchases, the ROW investments have significantly lowered the effective cost of funding of the U.S. government.

Notes

The computation in this example assumes that all bonds are bought at the end-of-year bond price. If the bond purchases occur gradually throughout year 2, and these purchases bid up the bond price, then, the bonds bought at the beginning of year 2 would have a higher dollar-weighted return. In this sense, the reported comparison between the dollar-weighted and the time-weighted returns in this example is a ceiling for the actual difference.

For readers interested in downloading the BofA series from Bloomberg, the series to use is the price index, which is a cum-coupon return index. Bloomberg also has a field called “cumulative return," which is actually a price index minus a starting value and misleadingly not a cumulative return.

Tabova and Warnock (2021) report that foreign investors earned returns of 3.21 percent per annum and that these returns are lower than the market returns of 3.59 percent. U.S. private investors at 4.34 percent had higher than market returns. They report standard errors in their 2021 version, which suggest that these differences are not statistically significant. However, if we take the mean differences and ignore statistical significance, then this gap in bond selection will further depress the foreign investor’s performance relative to the U.S. investors, and strengthen our market timing finding.

This time-weighted return is in fact an unweighted average of the per-period returns in the sample. The term “time-weighted return” is commonly used in the investment literature. See https://en.wikipedia.org/wiki/Time-weighted_return.

References

Bernanke, B.S., C.C. Bertaut, L. Demarco, and S.B. Kamin. 2011. International capital flows and the return to safe assets in the United States, 2003–2007. In FRB International Finance Discussion Paper, 1014.

Bertaut, C., and R. Judson. 2022. Estimating US cross-border securities flows: Ten years of the TIC SLT, working paper, Board of Governors of the Federal Reserve System (U.S.).

Bertaut, C.C., and R. Judson. 2014. Estimating US cross-border securities positions: New data and new methods. In FRB International Finance Discussion Paper, 1113.

Bertaut, C.C., and R.W. Tryon. 2007. Monthly estimates of US cross-border securities positions. In FRB International Finance Discussion Paper, 910.

Blanchard, O. 2019. Public debt and low interest rates. American Economic Review 109 (4): 1197–1229.

Bruno, V., and H.S. Shin. 2015. Cross-border banking and global liquidity. The Review of Economic Studies 82 (2): 535–564.

Caballero, R.J., E. Farhi, and P.-O. Gourinchas. 2017. The safe assets shortage conundrum. Journal of Economic Perspectives 31 (3): 29–46.

Caballero, R.J., and S. Panageas. 2008. Hedging sudden stops and precautionary contractions. Journal of Development Economics 85 (1–2): 28–57.

Chahrour, R., and R. Valchev. 2022. Trade finance and the durability of the dollar. The Review of Economic Studies 89 (4): 1873–1910.

Coppola, A., A. Krishnamurthy, and C. Xu. 2023. Liquidity, debt denomination, and currency dominance. In Working paper, National Bureau of Economic Research.

Dichev, I.D., and G. Yu. 2011. Higher risk, lower returns: What hedge fund investors really earn. Journal of Financial Economics 100 (2): 248–263.

Du, W., J. Im, and J. Schreger. 2018. The U.S. treasury premium. Journal of International Economics 112: 167–181.

Du, W., and J. Schreger. 2022. CIP deviations, the dollar, and frictions in international capital markets. In Handbook of International Economics, vol. 6, pp. 147–197. Elsevier.

Du, W., A. Tepper, and A. Verdelhan. 2018. Deviations from covered interest rate parity. The Journal of Finance 73 (3): 915–957.

Duffie, D. 2020. Still the world’s safe haven, Redesigning the US treasury market after the COVID-19 crisis. Hutchins center on fiscal and monetary policy at brookings.

Engel, C., and S.P.Y. Wu. 2023. Liquidity and exchange rates: An empirical investigation. The Review of Economic Studies 90 (5): 2395–2438.

Farhi, E., and M. Maggiori. 2018. A model of the international monetary system. The Quarterly Journal of Economics 133 (1): 295–355.

Furman, J., and L. Summers. 2020. A reconsideration of fiscal policy in the era of low interest rates. Unpublished manuscript, Harvard University and Peterson Institute for International Economics.

Gopinath, G., and J.C. Stein. 2021. Banking, trade, and the making of a dominant currency. The Quarterly Journal of Economics 136 (2): 783–830.

Gourinchas, P.-O., and H. Rey. 2007a. From world banker to world venture capitalist: US external adjustment and the exorbitant privilege. In G7 current account imbalances: Sustainability and adjustment, 11–66. University of Chicago Press.

Gourinchas, P.-O., and H. Rey. 2007. International financial adjustment. Journal of Political Economy 115 (4): 665–703.

Gourinchas, P.-O., and H. Rey. 2022. Exorbitant privilege and exorbitant duty. Working paper.

Hall, G.J., J. Payne, T.J. Sargent, and B. Szőke. 2018. US federal debt 1776-1940: Prices and quantities. Working paper.

Hall, G.J., and T.J. Sargent. 2011. Interest rate risk and other determinants of post-WWII US government debt/GDP dynamics. American Economic Journal: Macroeconomics 3 (3): 192–214.

He, Z., A. Krishnamurthy, and K. Milbradt. 2016. What makes US government bonds safe assets? American Economic Review 106 (5): 519–523.

He, Z., A. Krishnamurthy, and K. Milbradt. 2019. A model of safe asset determination. American Economic Review 109 (4): 1230–1262.

He, Z., S. Nagel, and Z. Song. 2022. Treasury inconvenience yields during the Covid-19 crisis. Journal of Financial Economics 143 (1): 57–79.

Jiang, Z. 2021. US Fiscal cycle and the dollar. Journal of Monetary Economics 124: 91–106.

Jiang, Z. 2022. Fiscal cyclicality and currency risk premia. The Review of Financial Studies 35 (3): 1527–1552.

Jiang, Z., A. Krishnamurthy, and H. Lustig. 2020. Dollar safety and the global financial cycle. Working paper, National Bureau of Economic Research.

Jiang, Z., A. Krishnamurthy, and H. Lustig. 2021. Foreign safe asset demand and the dollar exchange rate. The Journal of Finance 76 (3): 1049–1089.

Jiang, Z., H. Lustig, S. Van Nieuwerburgh, and M.Z. Xiaolan. 2019. The US public debt valuation puzzle. Working paper, National Bureau of Economic Research.

Jiang, Z., H. Lustig, S. Van Nieuwerburgh, and M.Z. Xiaolan. 2020. Manufacturing risk-free government debt. Working paper, National Bureau of Economic Research.

Koijen, R. S., and M. Yogo. 2020. Exchange rates and asset prices in a global demand system. Working paper, National Bureau of Economic Research.

Krishnamurthy, A., and H.N. Lustig. 2019. Mind the gap in sovereign debt markets: The U.S. treasury basis and the dollar risk factor. In 2019 Jackson Hole Economic Symposium, Stanford University Graduate School of Business Research Paper, No. 3443231.

Krishnamurthy, A., and A. Vissing-Jorgensen. 2007. The demand for Treasury debt. Working paper, National Bureau of Economic Research.

Liao, G.Y. 2020. Credit migration and covered interest rate parity. Journal of Financial Economics 138 (2): 504–525.

Maggiori, M., B. Neiman, and J. Schreger. 2020. International currencies and capital allocation. Journal of Political Economy 128 (6): 2019–2066.

Schrimpf, A., H.S. Shin, and V. Sushko. 2020. Leverage and margin spirals in fixed income markets during the Covid-19 crisis. Available at SSRN 3761873.

Shin, H.S. 2012. Global banking glut and loan risk premium. IMF Economic Review 60 (2): 155–192.

Tabova, A.M., and F.E. Warnock. 2021. Foreign investors and US treasuries. Working paper, National Bureau of Economic Research.

Vissing-Jorgensen, A. 2020. Bond markets in spring 2020 and the response of the Federal Reserve. In Presentation at “ECB Conference on Monetary Policy: bridging science and practice”, Online event on 19 and 20 October 2020.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We thank Xuning Ding and Jialu Sun for excellent research assistance. We thank Xiang Fang for discussions.

Appendix

Appendix

This appendix contains additional empirical results for the manuscript (See Tables 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, and 15).

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Jiang, Z., Krishnamurthy, A. & Lustig, H. The Rest of the World’s Dollar-Weighted Return on U.S. Treasurys. IMF Econ Rev (2023). https://doi.org/10.1057/s41308-023-00226-7

Published:

DOI: https://doi.org/10.1057/s41308-023-00226-7