Abstract

Recent voting behavior literature is concerned with the consequences of the global financial and economic crisis. During 2008–2009, most European countries faced a considerable slowdown in economic growth and an increase in unemployment levels. Theoretically, this would lead us to expect strong economic effects on incumbent support. However, recent academic work suggests that diminishing clarity of responsibility makes it increasingly difficult for voters to attribute blame for economic outcomes, consequently making punitive voting less likely. Has the sanctioning-rewarding mechanism then changed over time? Was economic voting more or less pronounced during the crisis than it was prior to the economic downturn? Analyzing the European Election Studies (EES) data for 12 Western European countries in 1989, 1994, 2004, 2009 and 2014, this paper finds support for neither proposition: there is very little abrupt change in economic effects over time. The statistical relationship between the economy and voting remained remarkably constant and was not subject to short-term fluctuations, even after the most dramatic economic recession in our lifetime. The stability of economic voting is particularly noteworthy considering that levels of voter dissatisfaction with national economic performance skyrocketed in 2009.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

In recent decades, a significant amount of scholarly attention has been paid to conditions of individual voting behavior. Rapid changes in the socioeconomic environment suggest that the context in which parties and voters operate is growing more and more sophisticated, calling for further scrutiny of democratic accountability to see how it has responded to developments in the global environment. The economic and financial crisis in particular has emphasized the need to revisit the responsibility attribution process. Since the beginning of the crisis in 2007–2008, the vast majority of countries in the Western world have experienced its worst recession since World War II. Plummeting economic growth and rising levels of unemployment, accompanied by banking system crises and followed by the Eurozone debt crisis, have left European governments struggling to cope with dropping revenues, increased expenditure and record high borrowing. To tackle the excessive levels of public debt and deficit, many governments pursued painful reductions in public jobs, services and benefits, while simultaneously implementing tax increase. According to classic economic voting theories, such remarkable economic instability should have major political consequences. Indeed, civil unrest and large-scale public protests have taken place in Greece, Ireland, Iceland, France, the United Kingdom and in various Eastern European countries. In a number of countries, governing parties witnessed landslide electoral defeat. However, on several other occasions incumbents managed to maintain their positions despite the unprecedented economic turmoil. This has highlighted the need to better understand the link between economic conditions and popular evaluations of political incumbents. Have the traditional accountability mechanisms changed with the coming of the recent crisis?

Theoretically, the most severe economic shock of our time gives us reason to expect increased punishment of incumbents for weak economic outcomes. Previous findings indicate that the impact of economic performance on government support is stronger during hard times and less intense when the economy is performing well (Mueller, 1973). On the other hand, there is evidence that in the increasingly interwoven world economic voting is becoming less pronounced. The sanctioning appears stronger when responsibility is relatively easy to apportion (Powell and Whitten, 1993), but as national economies become more interlinked and interdependent, the capacity of national governments to shape macroeconomic outcomes diminishes. In the European Union (EU), the world’s largest single market, Member States’ economic policy is considered ‘a matter of common concern’ (Article 121 TFEU). It is closely coordinated in the fields of monetary and trade policy, with fiscal policy being centrally monitored as well. The national policy response to the global crisis was also regulated at the European level through increased financial supervision, bailout agreements and stabilization funds. In a system such as this, economic responsibility is divided between various levels of governance. However, when accountability is blurred the tendency of voters to hold governments responsible for economic outcomes decreases as it is harder to assign credit or blame (Hellwig and Samuels, 2007; Duch and Stevenson, 2010). Have the traditional mechanisms of economic accountability then changed? And if so, should we expect to see more or less intense electoral punishing in times of crisis than at other times? This paper addresses these questions by exploring the performance of economic voting in Western Europe over time.

This work contributes to the existing knowledge by providing empirically and methodologically rigorous testing of retrospective voting in ordinary times, and during the 2007–2008 financial and economic crisis in particular. More specifically, it focuses on economic effects on Prime Minister’s (PM) party before, during and after the outbreak of the global crisis. Although the literature on the political impact of crises is growing, we still know little about wider political consequences of the Great Recession. Existing research by political scientists remains incomplete, often only focusing on single elections, countries and regions, making it difficult to draw broader conclusions. This analysis employs a cross-sectional comparative framework by utilizing the EES Voter study data from 1989, 1994, 2004, 2009 and 2014 for 12 countries, with a total sample of more than 65,000 respondents. While exploring context-specific conditions is undoubtedly necessary, this paper rather opts for broadening the understanding of the core mechanisms of voting behavior from more systematic analyses as this constitutes a foundation for further studies and helps build comprehensive theory. The findings provide evidence of strong economic vote as well as its temporal stability. The economy is a powerful predictor of electoral support in Europe, and the strength of the punishing-rewarding mechanism seems to be largely immune to external shocks.

Economic Voting in (the) Crisis?

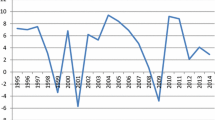

Traditionally, citizens are believed to hold governments responsible for economic outcomes, and depending on economic circumstances either reward or punish them accordingly (Campbell et al, 1960; Key, 1966; Kramer, 1971; Fiorina, 1981; Lewis-Beck, 1988). At the macro level, GDP growth, unemployment and inflation rate correlate with incumbent popularity (Goodhart and Bhansali, 1970; Mueller, 1973; Jacobson, 1990). At the individual level, support for government is influenced by voter economic perceptions (Key, 1966; Fiorina, 1981; Kinder and Kiewiet, 1981; Lewis-Beck, 1988). In recent years, the economy has emerged as the most salient issue on the public agenda and can easily be expected to play a key role in voter considerations. By mid-2009, European countries faced significant slowdown in GDP growth and increasing levels of unemployment (see Figure 1). According to classic economic voting theories, such enormous economic instability should have resulted in major political consequences for the ruling parties. Moreover, previous evidence shows that economic voting can be asymmetric: it may be more prevalent during uncertain economic times and less pronounced when the economy is performing well. Namely, negative information has been found to play a greater role in voting behavior, resulting in the tendency for voters to penalize incumbents for negative economic trends rather than reward them for positive ones (Mueller, 1973; Kernell, 1977; Kiewiet, 1983; Anderson, 1995). Studies in psychology have shown that because people are risk averse, they may be more responsive to negative messages. This ‘negativity effect’ means that greater weight is given to negative information (Lau, 1985). Studies in political communication indicate that similar trends are evident in mass media content, which enhances the asymmetry in public responsiveness (Soroka, 2006). Furthermore, in times of economic hardship the saliency of the economy increases, resulting in voters perceiving stronger impact of the economy on their personal situation and consequently giving greater weight to economic issues (Singer, 2011). Given the magnitude of the negative macroeconomic changes that occurred around the year 2009, we would therefore expect that economic voting in crisis-time Europe was stronger than in ordinary times. We should witness that individual vote decision is first and foremost motivated by national economic performance.

On the other hand, there are reasons to hypothesize that economic effects on political support have weakened with the crisis. Voters are more eager to punish incumbents when the clarity of responsibility for economic conditions is high (Powell and Whitten, 1993), but recent developments are sending signals to citizens that government economic performance is externally constrained. Globalization, growing economic integration, openness and interdependence have left voters confused assigning responsibility for national economic outcomes, and have consequently weakened the link between the economy and the vote (Katzenstein, 1985; Hellwig, 2001; Fernández-Albertos, 2006; Hellwig and Samuels, 2007; Kayser, 2007; Duch and Stevenson, 2010). Economic voting is also depressed in systems of multilevel governance, where the EU is held responsible for national economies (Costa Lobo and Lewis-Beck, 2012). Economic globalization could be expected to have become especially salient to voters during the recession, which carries a strong global character. Citizens may blame other actors such as banks or international financial institutions for the bleak economic conditions, and assign less responsibility to local political leaders. In the EU and the Eurozone, national response to the economic earthquake was strongly coordinated, constraining the ability of governments to steer macroeconomic conditions. To the extent that voters are aware of such limitations, we could expect their propensity to hold incumbent authorities responsible for economic outcomes to diminish during the worldwide recession. Uncertain responsibility attribution amidst the transnational and complex crisis would therefore suggest that economic voting has become less pronounced.

Studies on the crisis impact on economic voting have hitherto arrived at mixed conclusions. Analyzing the German parliamentary election of 2009, Anderson and Hecht (2012) find no evidence of retrospective voting, whereas Rattinger and Steinbrecher (2011) argue that the economy was an important factor for German voters in making party choices that year. Tillman (2011) demonstrates that in the 2010 British general election blame attribution was exercised only by more knowledgeable voters. More explicit retrospective voting has been detected in countries that were hit harder by the crisis: Cyprus, Ireland, Iceland, Greece, Italy, Spain and Portugal (Kanol and Pirishis, 2016; Marsh and Mikhaylov, 2012; Indridason, 2014; Nezi, 2012; Bellucci, 2012; Fraile and Lewis-Beck, 2012; Freire and Santana-Pereira, 2012; Hernández and Kriesi, 2014). Torcal’s (2014) results confirm that incumbents were also punished in Spain in 2011, but punishment was mediated by deep ideological divisions among the electorate. Bellucci (2014) finds some evidence of retrospective economic voting in the 2013 Italian election, but concludes that the effect was conditioned by the extent to which the EU was blamed for the crisis. Several single-country studies demonstrate that while there is clear evidence of the sanctioning of political leaders, the first post-crisis elections were relatively ‘normal’: the economic shock did not substantially redefine the political landscape (Marsh and Mikhaylov, 2014; Indridason, 2014; Magalhães, 2014a).

This paper aims to advance our understanding of the impact of the most recent global crisis on voter behavior. Single-country and regional studies provide valuable insight into the influence of the crisis on economic voting in local contexts, but the lack of extensive comparative studies limits our ability to make generalizations. In an effort to reveal larger patterns of crisis-time voting, this study employs a comparative analytical framework. The use of survey data from 60 cross sections enables us to cover a large variety of economic and political conditions and to provide a robust systematic test of the stability of economic effects both over time and across nations. Especially in the rapidly changing socioeconomic environment, research findings can easily be affected by country-specific idiosyncrasies and only tell a partial story. In order to identify the universal structure of economic voting before, during and after the crisis, a comparative approach is needed. A number of comparative studies examining the consequences of the recent crisis have been published, but are oftentimes based on the analyses of aggregated economic and political data (LeDuc and Pammett, 2013; Dassonneville and Lewis-Beck, 2014). These studies provide confirmation that in times of crises macroeconomic conditions strongly move national election outcomes, but do not enable to make claims regarding the individual-level behavior of voters. In order to look at individual voter’s motivations and understand the mechanisms that determine political behavior, this analysis primarily relies on the micro-approach. However, where necessary and possible, the micro-level tendencies will be controlled using aggregate-level data in order to assure the robustness of the results.

Data, Measurement and Methods

To empirically test the stability of economic effects, the analysis utilizes individual-level survey data obtained from the EES Voter study, which is carried out as a post-election survey1 immediately after European Parliament (EP) elections every five years since 1979. From every EU member-country, a representative sample of voters aged 18 and over is interviewed. The analysis presented here includes surveys conducted in 1989 (van der Eijk et al, 1993), 19942 (del Castillo et al, 1997), 2004 (Schmitt et al, 2009), 2009 (van Egmond et al, 2011) and 2014 (Schmitt et al, 2015). The 1979 and 1984 waves are excluded because they lack data on the key explanatory variable, retrospective economic evaluations. Data for 1999 are excluded due to a conceptually different measure of economic evaluations compared with other years. The number of countries involved in the EES Voter study ranges from 12 in 1989 to 28 in 2014. Here, in order to observe temporal dynamics, only countries participating in all five survey waves are included: Belgium, Denmark, France, Germany3, Greece, Ireland, Italy, Luxembourg, the Netherlands, Portugal, Spain and the United Kingdom4. This determines that the focus in the paper is on Western Europe.5 To maximize the variation in economic and political conditions and consequently more accurately estimate economic effects, data for five years and 12 countries were pooled into one dataset. Such an approach is made possible by extensive similarities in survey design, sample setups, interviewing procedures and questionnaires across all surveys. The final data pool exhausts the total of N = 65,467 respondents (n ≈ 1000 interviews per survey per country), providing sufficient statistical power to explore the individual-level relationship between variables. Additionally, aggregate-level dynamics are modeled using national macroeconomic indicators from the OECD databases available online. Macrolevel variables for all countries and years were merged with the survey data into a combined, hierarchically structured database.

The dependent variable is incumbent support, measured as vote intention for PM party in next national elections.6 Respondents were shown a list of parties and asked who they would vote for if there were a general election the following day. The answers were recoded as 1 for the PM party in office at the time of fieldwork and 0 for any other party. Don’t knows, refusals, respondents who said they would not vote, would spoil the vote or vote blank, and missing answers were excluded. In many individual-level studies, the outcome variable is a dichotomous choice between government and opposition. However, the size and the type of governments differ remarkably between countries and moments in time, possibly making the drawing of conclusion complex. Furthermore, van der Brug et al (2007, 9) emphasize that such a setup fails to take into account the possibility that parties are differently affected by the economy. In diverse coalition governments, parties have dissimilar responsibilities and may suffer or gain from economic changes to a different extent. Although the role of the PM party can vary in political systems depending on, for example, its dominance, size, strength and whether government comprises multiple party participants, previous work shows that in multiparty systems the head of the government is still typically held more accountable by voters for economic performance than any other party (Duch and Stevenson, 2008; Fisher and Hobolt, 2010; Debus et al, 2014). Voters are able to identify the party that holds the key position in the cabinet – usually also the largest, the strongest and the most visible party in the coalition – and recognize its role as the main decision maker. Moreover, as demonstrated by Debus et al (2014), looking at the impact of economic evaluations on the coalition as a whole can even lead to null findings, masking important differences in assigning economic responsibility. The authors argue that their findings for Germany from 1987 to 2009 showing that economic voting is clearly targeted at the head of the government – even compared to key economics-related ministries – ‘demonstrate the importance of assessing the impact of the economy on support for specific parties rather than for the governing coalition as a whole’ (2014, 63). For these reasons, in this study I too expect the PM party to be the primary target of economic voting. That said, various robustness checks are conducted in the analysis using alternative ways to measure political support.

The main independent variable in the analysis is perceived economic performance. Respondents were asked to assess on a 5-point scale whether they thought that compared to 12 months previous the general economic situation in a country had gotten a lot better, a little better, stayed the same, gotten a little worse or a lot worse. Because the substantive interest in economic voting studies lies in the distinction between negative, positive and neutral evaluations, the original 5-category variable was recoded into a 3-point scale where 1 = worse, 2 = stayed the same and 3 = better. Being able to select one of five responses is useful for the respondent, but in the analysis we are substantively interested in only detecting how much more likely are citizens to vote for the incumbent if they move from category ‘worse’ to ‘same’ or to ‘better’. Even though broader than the original one, the recoded variable reflects a meaningful division of response categories, while still maintaining the ordinal nature of the data. However, here, too, robustness tests are provided using the original measurement of the variable.

To test the relative impact of economic perceptions, a standard set of control variables, known to influence voter political preferences, are included in the models. These include left–right ideology (1 = left, 10 = right), age (in full years), gender (1 = male, 2 = female), education (age when stopped full-time education, 0 = still studying, 1 = up to 15 years, 2 = 16−19 years, 3 = 20 years or more), social class (1 = working class, 2 = middle class, 3 = higher class) and attendance of religious services (1 = several times a week, 2 = once a week, 3 = few times a year, 4 = once a year or less, 5 = never). To ensure correct model specification, respondent’s left–right ideology, social class and religiosity were adjusted to match the ideology of the PM party in office at the time of the survey fieldwork (for a similar approach, see Nadeau et al, 2013).7 Additionally, in order to account for possible effects of the electoral cycle, cabinet time in office is controlled for (number of months from last cabinet change to the start of survey fieldwork). For this variable, logarithmic transformation was used as its relationship with incumbent support is expected to be nonlinear.8 In all models, country dummies are used as a control for unobserved heterogeneity across nations.

Finally, dummies for each five survey years are added in the models and are later on interacted with economic perceptions. This allows us to observe whether economic effects on incumbent support vary over time. But since year alone may not be enough to capture the drastic economic changes that took place in 2008–2009, additional tests are conducted using an alternative measure of the crisis. More specifically, survey year is replaced with a numerical value that represents changes in actual macroeconomic conditions: GDP growth rate for each country in each five time points. Interacting these 60 figures with respondent economic assessments enables to examine how retrospective voting varies at different levels of the economic downturn, thus providing a robustness check to individual-level findings.

For the sake of within-model comparison, all predictors are recoded on a scale from 0 to 1. Summary statistics of variables appear in Appendix 1.

Empirical Results

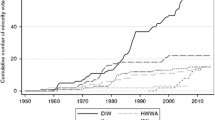

By year 2009, the worst of the worldwide crisis, macroeconomic conditions had worsened significantly. Many European countries were experiencing severe economic decline, rising unemployment and worrying levels of public debt and deficit. Now, let us explore how voter assessments of the state of the economy evolved during that time. Overall, 25.2% of respondents in the total sample (60 surveys) said that the general economic situation in their country had improved compared to 12 months previous and 42.9% stated that they felt it had deteriorated. These assessments, however, vary greatly over time. In 1989, only 29.8% of respondents stated that the economy had worsened compared to the year previous. By 2009, the proportion of people sharing this opinion had more than doubled (up to 75.7%), before stabilizing again by 2014 (34.6%) (see Figure 2). Both survey data and factual macroeconomic trends, then, indicate a severe economic downturn in 2009.

Surprisingly, despite the sharp economic decline, there is no major difference in levels of incumbent support before versus after the crisis. In the data pool of 60 surveys, an average of 21.1% of respondents supported the party of the incumbent PM, and the numbers for 2009 do not differ much, with 20.9% of respondents willing to vote for the incumbent (see Figure 2). Interestingly, the proportion of people with no clear vote intention did not increase during the worst year of the crisis either. Compared to the average of 29.4%, the vote preference of 29.9% remains unknown in 2009 (incl. don’t know, refused, would vote blank, would spoil the vote, would not vote or no answer provided; not shown on the figure). Unfortunately, differences in coding do not allow us to engage in a more detailed temporal comparison of non-voter categories. Finally, data from the post-crisis period in 2014 indicate a slight decline in incumbent support (17%) and a modest increase in the proportion of respondents whose vote preference is unknown (32.1%).

To statistically test the relationship between the economy and incumbent support, logistic regression is used to first estimate a basic economic voting model. The economic variable is defined as categorical (1 = worse, 2 = same, 3 = better), which allows us to observe the effect for all three groups of economic evaluations separately. In order to account for the possibility that responses are nested within countries and time points, robust clustered standard errors are used. The results in Model 1 in Table 1 show that the way Europeans perceive the status of the national economy is strongly associated with their political preferences. Compared to citizens who think that the economy in their country has not changed over the past year, support to incumbents is significantly lower among people who think the economy has deteriorated and higher among those who think it has become better. Transforming regression coefficients into marginal effects (not shown), the likelihood of incumbent vote decreases by 7 percentage points with negative economic opinions and increases by 9 percentage points with positive ones. These results point to strong economic effects in the dataset that covers a heterogeneous geographical range and includes, among others, the period of the severe global crisis. Furthermore, the effect appears relatively symmetric, in that negative economic opinions reduce the likelihood of an incumbent vote to a similar magnitude as positive evaluations increase voter support for incumbent. In addition to economic assessments, respondent’s ideological leaning, social class, religiosity, age, gender and education, as well as national electoral cycle are associated with governing party’s support levels.

A similar basic model can now be estimated for each survey year. The results in Appendix 2 show that the coefficients in separate models are similar overall, although 2004 differs from other time points with electoral sanctioning being slightly more pronounced. Leaving 2004 aside, however, negative performance evaluations seem to reduce and positive ones to raise incumbent approval in a similar manner across years. Comparing separate models across years has an essential limitation, however: it does not enable us to properly estimate the effect of time because in each of those models time is constant (van der Eijk et al, 2006; Lewis-Beck and Nadeau, 2012). For this reason, a pooled dataset is used next, including dummy variables for each survey year in order to account for unobserved heterogeneity over time. The main time point of interest, 2009, is defined as reference category. In such a model, the economic main effect can be interpreted as the average effect of the economy on incumbent support across all years and can be measured against that in the baseline model. The comparison indicates that there is practically no difference in the coefficient for economic perceptions: even when the temporal variation is considered, retrospective assessments continue to have a strong impact on political support (see Model 2 in Table 1). The only year dummy showing a weak significant effect is 1989, when the support for PM party appears slightly higher than during the crisis peak in 2009.

Moving on to the variation of retrospective voting over time, economic evaluations are next interacted with year. The results as average marginal effects are presented in Figure 3, and as logged odds in Model 3 in Table 1. The graph first tells us that in each year, people are significantly less inclined to vote for incumbents if their economic perceptions are poor, and more willing to do so if their evaluations are good. In other words, the sanctioning and rewarding mechanism performs as expected in all five years. Turning to the temporal variation in economic effects, we observe that change in economic perceptions from ‘same’ to ‘worse’ decreases the probability of an incumbent vote by 10 percentage points in 1989, by 6 percentage points in 1994, by 11 percentage points in 2004, by 6 percentage points in 2009 and by 4 percentage points in 2014. The differences between the years remain within 7 percentage points. The outcome is even more stable for electoral rewarding, where economic evaluations changing from ‘same’ to ‘better’ increase the probability of incumbent vote by 7–9 percentage points in all five years. We see, then, that economic effects are somewhat weaker in 2009 and 2014 compared to the pre-crisis years, with especially the effect of negative perceptions being slightly lower than before. This could mean that incumbents are held accountable for economic conditions to a lesser extent after the period of recession. However, respective interaction terms in Model 3 do not appear statistically significant, indicating that the null hypothesis, which states that the difference in effects is zero, cannot be rejected. Hence, data do not support the claim that economic voting varies over time, suggesting that neither punishing nor rewarding of incumbents was substantially different during periods of economic decline compared to ordinary times. The analyses were replicated using alternative measurement of incumbent support – specifying as the dependent variable the support levels for any government party instead of only PM party, adding non-voters in the models and focusing on vote choice in last EP elections instead of vote intention in national elections. The conclusions are not altered by these changes (see Appendix 3).9 In a similar manner, the results remain the same when economic evaluations are measured using the original 5-point scale (see Model 1 in Appendix 4).10

In a yearly comparison, it is in fact 2004 that stands out (see Figure 3 and Model 3 in Table 1). Economic effects on political support appear somewhat more pronounced in 2004 than in other years, and attitudes toward the incumbent PM party are more pessimistic. Since the focus in this article is on the crisis period, explaining the divergent results for 2004 is a task for another analysis. With macroeconomic conditions being relatively stable that year (recall Figure 1 above), we can only speculate that the strong anti-government inclination may have been due to rising Euroscepticism in Western Europe following the EU Eastern enlargement, which left public opinion in the old member states strongly divided. One way to minimize the weight of the atypical 2004 is to recode year into a crisis variable, defined as 1 for 2009 and 0 for all other years. However, neither this nor excluding 2004 from the analysis altogether provide support for the expectation that economic effects vary significantly over time.

The Restricted Variance Problem

Despite the data not demonstrating any temporal variation in economic effects, the results do not allow us to argue that the recent economic turbulence did not alter economic voting in any way. From a statistical point of view, a failure alone to find evidence of influence of the crisis is not a confirmation that there is none (Rainey, 2014). Instead, the analysis enables us to say that there is no evidence in favor of the opposite. One reason why we are not able to detect significant crisis-time changes in economic voting could be the restricted variance problem. It can be difficult to methodologically obtain evidence of the link between the economy and the vote when variance in economic opinions in crisis years is limited. When all scores on the independent variable are similar, this variable cannot explain variation in the outcome (Fraile and Lewis-Beck, 2014; Lewis-Beck and Costa Lobo, 2016). Indeed, only 8.8% of respondents evaluated the economy positively in 2009 compared to the average of 25.2% in the pooled EES Voter study dataset (see Figure 2 above). In other words, there is little variance in economic assessments between individuals during the crisis as most people agree that things are going downhill. This does not mean that incumbents are not punished at elections for poor economic performance, but it does reveal difficulties in assessing the magnitude of economic voting using cross-sectional survey data (Fraile and Lewis-Beck, 2014).

One way to address the restricted variance problem is to use, for the pooled data, an aggregate measure of the economy that is independent of voter perceptions. Although there is little variance in economic opinions between individuals in the crisis year of 2009, there is considerable variance between all surveys (Lewis-Beck and Costa Lobo, 2016). For this reason, individual-level economic evaluations are next replaced with an aggregated economic variable, as suggested by Fraile and Lewis-Beck (2012; 2014). The new variable reflects the percentage of respondents in each survey who said that the national economic situation was good or very good. As before, the model is estimated for the data pool of 60 surveys; all control variables remain the same. The results of an additive model (not shown) demonstrate that although regression estimates are now much smaller than in previous models due to scale differences (the values of the new economic variable range from 0 to 100), there is a firmly significant positive aggregate-level impact of the economy on incumbent support11. An interaction term between the aggregated economic variable and year points to rather large confidence intervals for 2009, suggesting that variation in positive economic perceptions is still relatively low between countries in the crisis year (see Figure 4). Nevertheless, using the above approach to exogenize the economy does not provide confirmation that there is a significant difference in economic effects between 2009 and other survey years (see Model 2 in Appendix 4). The test does not provide sufficient empirical evidence to support the claim that the crisis has brought about a change in economic voting.

Addressing the Objective Economy

To ascertain the robustness of the results, let us experiment with another measure of the crisis. It is necessary to consider that survey year alone may not fully capture the contextual changes that took place during the timeframe in question. Temporal differences in economic effects may only become apparent when one takes into account the severity of the economic downturn in 2008–2009. This can be done by assigning each survey year a numerical value based on objective macroeconomic conditions. The most widely used measure of the state of the economy is change in GDP growth rate. A steep decline in GDP growth was clearly apparent by 2009. According to the OECD data, average annual GDP growth rate in the 12 European countries in question was 4.8% in 1989, 3.1% in 1994 and 2.9% in 2004. It then dropped to a remarkable −4.3% in 2009 and recovered again to 1.3% in 2014. Recalling Figure 1 above, change in two other macroeconomic indicators commonly used in economic voting studies – rates of inflation and unemployment – did not occur nearly as sharply or as fast.

Based on the latter, the survey year variable is next replaced with annual GDP growth rate, which measures the actual magnitude of economic changes. A separate value is given to every country-year, which enables us to capture the variation in economic fluctuations across nations in different time points. These 60 figures are interacted with subjective economic evaluations in order to estimate whether retrospective voting varies depending on the macroeconomic context. Using aggregated economic indicators provides a robustness test to the previous findings, which indicate relative temporal stability in the economic vote. It also helps to address the restricted variance problem in economic opinions as GDP growth is an exogenous variable which is independent from the calculations of the individual voter. Furthermore, the macromodel enables us to address the issue of the year 2004 potentially being an outlier because on the macroeconomic level it does not appear substantially different from other pre-crisis years.

The results visualized in Figure 5 illustrate the magnitude of economic effects for three macroeconomic scenarios: severe negative change in GDP growth (−4%), no change in GDP growth (0%) and solid positive change in GDP growth (4%). Negative economic growth, marked with a dotted line, represents a country in economic crisis. If economic effects vary depending on national macroeconomic performance, we should witness significant differences between the steepness of the three lines. For example, if the punishing of political leaders is less pronounced when the economy is performing poorly, then the prediction line for economic recession should be flatter than the other lines. This would imply that during the economic downturn the difference in incumbent support between people with negative and positive economic evaluations is less than in non-crisis times, i.e., retrospective voting is less intense. However, the interaction does not appear to be statistically significant in the model (see Model 3 in Appendix 4). The lines in Figure 5 below are similar to one another, confirming that the differences in effects are not significant. Improvement in economic evaluations increases the probability of incumbent vote to a similar extent in different macroeconomic conditions. In other words, voter economic perceptions by and large influence incumbent support by a comparable magnitude both in weak and healthy economic times. Thus, using alternative ways to measure the recession does not lend support for the expectation that economic voting changed during the recent recession.

Conclusions

This article sought to clarify how the latest financial and economic crisis has shaped economic voting. In line with severe economic troubles being experienced by European countries by mid-2009, the EES Voter study data indicates great public dissatisfaction with the economy in 12 Western democracies with as much as 75.7% of respondents expressing pessimistic views toward national economic performance. At the same time, no evident drop occurred in levels of incumbent support during the years of the crisis: analogous to previous survey years, roughly every 5th respondent was still willing to vote for PM party in 2009. These patterns contradict the basic logic of economic voting, according to which incumbent popularity is positively correlated with perceptions of economic performance.

Recent academic work therefore proposes that as a consequence of the worldwide crisis, the mechanism of economic accountability may have changed. The hypothesis according to which economic voting is asymmetric and more pronounced during difficult times suggests that crises should lead to substantial electoral punishment of political leaders. On the other hand, arguments emphasizing the ambiguity of responsibility propose that globalization and economic integration have resulted in governments having less control over national economic outcomes. With reduced ability of voters to assign economic responsibility, economic effects may weaken. This study, analyzing large-scale data from diverse political and economic contexts, finds support for neither expectation. In Western Europe, the nature of retrospective voting, defined as sanctioning or rewarding of PM party in office, did not change significantly between 1989 and 2014. Rather, the mechanism of economic voting appears to be relatively immune to external shocks. This is not to argue that the economic crisis had no impact on voter considerations. The dramatic deterioration of economic opinions by 2009 marks the awareness and high discontent of citizens with economic performance, which negatively affected support for incumbents. Moreover, if the crisis drags on, the cumulated effect of the Great Recession may go beyond short-term punishment of the leaders, eroding trust in political elites and giving rise to radical forces (Hernández and Kriesi, 2014). However, our data do not allow to conclude that the sanctioning mechanism itself was more or less intense amidst the Great Recession than it was before. Instead, the magnitude of economic effects seems to have remained remarkably stable over time. The findings hold strong across various robustness tests using alternative methodological approaches, variable operationalization and coding decisions.

While data provide no empirical evidence of economic voting being less or more intense during the crisis, part of the puzzle remains. If the statistical relationship between the economy and the vote stayed the same, the Great Recession should have led to a significant decline in incumbent support. Neither survey data nor post-crisis election results in Europe, however, demonstrate that this was necessarily the case. This raises critical questions about the performance of the accountability mechanism. If economic voting has not changed, why did high levels of economic discontent not lead to heavy electoral sanctioning? One reason for the failure to identify these patterns could be endogeneity. Critics claim that contrarily to classic economic voting theory, the causal relationship between economic assessments and political support may in reality be reverse in direction: citizens’ economic perceptions can be biased by their party affiliation (Wlezien et al, 1997; Evans and Andersen, 2006; Anderson, 2007). Furthermore, recent findings suggest that the impact of partisanship varies over time, with economic perceptions being less biased during the recession (Parker-Stephen, 2013; Bisgaard, 2015). This cyclical asymmetry could mean that the relationship between economic opinions and incumbent support in the context of crisis is actually more pronounced than the current analysis reveals. Regrettably, cross-sectional survey data do not enable to properly address the concerns of endogeneity, therefore highlighting the need for longitudinal or experimental data to make proper causal inferences. Additionally, given that two contrasting hypotheses were tested in the analysis, it cannot be excluded that both mechanisms – negative asymmetry and increased awareness of globalization – are at work, but mutually counterbalance each other. For this to happen, both phenomena would have to move simultaneously in an opposite direction, but unfortunately variables used in this study do not allow to directly assess how voter attribution of economic responsibility changes.

From a substantive point of view, additional factors may play a crucial role in defining political preferences in hard times. Upon closer inspection, the global crisis was about more than merely plummeting macroeconomic figures. As time progressed, governments in Europe were placed in the challenging position of having to choose an adequate policy response, while confronted with alarmingly high unemployment levels, the need to use public finances to bail out private banks and international stabilization requirements. Different policy approaches led to generous stimulus packages in some countries and belt-tightening austerity measures in others, often causing political distrust and wide-scale public unrest. Recent literature has suggested that precisely these developments may have played an important moderating effect in electoral sanctioning (Magalhães, 2014b). Past years have seen macroeconomic indicators speak of recovery, but the aftermath of the recession is ongoing as governments continue to struggle to balance public finances. Turbulent times have brought economic management under greater public scrutiny. Citizens are able to observe and assess national policy choices, and take this information into account in evaluations of government economic competence. Furthermore, large variation in government national policy response across nations may indicate that public reactions to these decisions were not identical everywhere. Future work needs to observe more closely how policy perceptions frame political preferences and to what extent vote in times of crisis is a function of various economic dimensions.

Notes

-

1

The fieldwork in 1989 was carried out before the EP elections. Pre-electoral survey was selected for the analysis due to the availability of variables needed for the cross-survey comparison.

-

2

In 1989 and 1994, the survey was carried out as a part of the regular Eurobarometer. Depending on the availability of variables needed for the cross-survey comparison, the 1st wave of the 1989 survey (EB30) and the 4th wave of the 1994 survey (EB42) were used.

-

3

In 1989 only West Germany was included in the study. In 1994, the fieldwork was conducted separately in West and East Germany, but because Germany was officially reunified and elections were held federally, two datasets were combined for the purpose of the analysis.

-

4

In 1989, 1994 and 2004, the fieldwork was carried out separately in Great Britain and Northern Ireland. For the sake of comparability with later waves, which focus on the United Kingdom as a whole, data for Great Britain and Northern Ireland were combined.

-

5

Covering only Western Europe could be considered a limitation, but the purpose of this analysis is not to draw conclusions on the entire continent. Rather, the aim is to explore overall voting behavior dynamics over time, while still assuring large contextual variability in the sample. By including data for 12 countries over the course of 25 years, this requirement is easily satisfied.

-

6

The EES Voter study also measures respondent vote choice in last EP elections, but this analysis focuses on national elections instead because EP elections are widely regarded as second-order elections (Reif and Schmitt, 1980), where accountability attribution operates differently.

-

7

All PM parties were divided into left and right depending on which side of the midpoint of a typical left–right scale they fall on. In categorizing, internet resources (e.g., Parliament and government composition database http://parlgov.org) and country experts were consulted. The ideology scores remained unaltered (1 = left, 10 = right) if the PM party is positioned right from the center, but were reversed (1 = right, 10 = left) if the PM party is left. This enables an ambiguous situation to be avoided in combined models where in some elections a positive regression coefficient would indicate higher support for a left-wing PM party and in others for a right wing one. In a similar manner, the scores of religious attendance and self-assigned social class were reversed if the governing PM party was left-wing.

-

8

It is a robust finding in political science research that government popularity follows a cyclical pattern. Incumbents begin their turns with high approval rates, but the post-election honeymoon period is followed by a decline in popularity by mid-term, which then increases again toward the end of the electoral cycle (see Miller and Mackie, 1973; Tufte, 1975; Stimson, 1976).

-

9

Although focusing on vote intention for PM party is well justified for this analysis, robustness tests were carried out with alternative dependent variables. Model 1 in Appendix 3 looks at vote intention for all coalition government parties, Model 2 investigates vote choice in EP elections and Model 3 considers non-voting as a form of electoral punishment. The results confirm that economic effects in 2009 and 2014 do not differ significantly from those in other survey years.

-

10

For substantive reasons, the original 5-point scale variable was recoded on a 3-point scale. However, since estimated coefficients are a function of the variance of the independent variable, then, to account for the possibility that recoding increases standard errors and risks biasing the results, robustness test is conducted using the original variable.

-

11

Regression coefficient is 0.015, standard error 0.007, effect significant at a 0.05 level. It must be assured that country and year fixed effects in such a model are not perfectly multicollinear with aggregated economic opinions. Economic evaluations are measured at the country-year level, but the model does not include country-year dummies (which would yield 5 years × 10 countries = 50 variables). Instead, it includes country and year dummies (5 years + 10 countries = 15 variables). Country dummies address time-constant between-country changes, whereas year dummies account for changes over time that are common to all countries. What remains for aggregated economic evaluations to explain are temporal changes within countries that differ from the overall trend. Still, if the model is replicated with country fixed effects only, then the results point to an even stronger correlation between aggregate overtime shifts in economic sentiment and PM party’s popularity (regression coefficient 0.016, standard error 0.004, effect significant at a 0.01 level). This model does not enable to assess changes in the correlation over time, but demonstrates the strength of economic voting in a period that includes one of the worst economic crises in history.

References

Anderson, C.J. (1995) Blaming the Government: Citizens and the Economy in Five European Democracies. Armonk, NY: ME Sharpe.

Anderson, C.J. (2007) The end of economic voting? Contingency dilemmas and the limits of democratic accountability. Annual Review of Political Science 10(1): 271–296.

Anderson, C.J. and Hecht, J.D. (2012) Voting when the economy goes bad, everyone is in charge, and no one is to blame: The case of the 2009 German election. Electoral Studies 31(1): 5–19.

Bellucci, P. (2012) Government accountability and voting choice in Italy, 1990–2008. Electoral Studies 31(3): 491–497.

Bellucci, P. (2014) The political consequences of blame attribution for the economic crisis in the 2013 Italian National Election. Journal of Elections, Public Opinion and Parties 24(2): 243–263.

Bisgaard, M. (2015) Bias will find a way: Economic perceptions, attributions of blame, and partisan-motivated reasoning during crisis. The Journal of Politics 77(3): 849–860.

Campbell, A., Converse, P.E., Miller, W.E. and Stokes, D.E. (1960) The American Voter. New York, NY: Wiley.

Costa Lobo, M. and Lewis-Beck, M.S. (2012) The integration hypothesis: How the European Union shapes economic voting. Electoral Studies 31(3): 522–528.

Dassonneville, R. and Lewis-Beck, M.S. (2014). Macroeconomics, economic crisis and electoral outcomes: A National European Pool. Acta Politica 49(4): 372–394.

Debus, M., Stegmaier, M. and Tosun, J. (2014) Economic voting under coalition governments: Evidence from Germany. Political Science Research and Methods 2(1): 49–67.

del Castillo, P., van der Eijk, C., Franklin, M., Katz, R., Mannheimer, R., Marsh, M., Norris, P. et al (1997) European Election Study 1994 (EES 1994). GESIS Data Archive, Cologne. Data file Version 1.1.0, doi:10.4232/1.2865.

Duch, R.M. and Stevenson, R.T. (2008). The Economic Vote: How Political and Economic Institutions Condition Election Results. Cambridge, NY: Cambridge University Press.

Duch, R.M. and Stevenson, R.T. (2010) The global economy, competency, and the economic vote. The Journal of Politics 72(1): 105–123.

Evans, G. and Andersen, R. (2006). The political conditioning of economic perceptions. Journal of Politics 68(1): 194–207.

Fernández-Albertos, J. (2006). Does internationalisation blur responsibility? Economic voting and economic openness in 15 European countries. West European Politics 29(1): 28–46.

Fiorina, M. (1981) Retrospective Voting in American National Elections. New Haven: Yale University.

Fisher S.D. and Hobolt, S.B. (2010) Coalition government and electoral accountability. Electoral Studies 29(3): 358–369.

Fraile, M. and Lewis-Beck, M.S. (2012) Economic and elections in Spain (1982–2008): Cross-measures, cross-time. Electoral Studies 31(3): 485–490.

Fraile, M. and Lewis-Beck, M.S. (2014) Economic vote instability: Endogeneity or restricted variance? Spanish Panel evidence from 2008 and 2011. European Journal of Political Research, 53(1): 160–179.

Freire, A. and Santana-Pereira, J. (2012) Economic voting in Portugal, 2002–2009. Electoral Studies 31(3): 506–512.

Goodhart, C.A.E. and Bhansali, R.J. (1970) Political economy. Political Studies 18(1): 43–106.

Hellwig, T.T. (2001) Interdependence, government constraints, and economic voting. The Journal of Politics 63(4): 1141–1162.

Hellwig, T.T. and Samuels, D. (2007) Voting in open economies: The electoral consequences of globalization. Comparative Political Studies 40(3): 283–306.

Hernández, E. and Kriesi, H. (2014) The electoral consequences of the financial and economic crisis in Europe. European Journal of Political Research 55(2): 203–224.

Indridason, I.H. (2014) The collapse: Economic considerations in vote choice in Iceland. Journal of Elections, Public Opinion and Parties 24(2): 134–159.

Jacobson, G.C. (1990) Does the economy matter in mid-term elections? American Journal of Political Science 34(2): 400–404.

Kanol, D. and Pirishis, G. (2016) The role of voters’ economic evaluations in February 2013 presidential elections in the Republic of Cyprus. Comparative European Politics 6(1): 1–14.

Katzenstein, P.J. (1985) Small States in World Markets: Industrial Policy in Europe. Ithaca, NY: Cornell University Press.

Kayser, M.A. (2007). How domestic is domestic politics? Globalization and elections. Annual Reviews of Political Science 10(1): 341–362.

Kernell, S. (1977) Presidential Popularity and Negative Voting: An Alternative Explanation of the Midterm Congressional Decline of the President’s Party. American Political Science Review 71(1): 44–66.

Key, V.O. (1966) The Responsible Electorate: Rationality in Presidential Voting, 1936–1960. Cambridge: Belknap Press of Harvard University Press.

Kiewiet, D.R. (1983) Macroeconomics and Micropolitics: The Electoral Effects of Economic Issues. Chicago, IL: University of Chicago Press.

Kinder, D.R. and Kiewiet, D.R. (1981) Sociotropic politics: The American case. British Journal of Political Science 11(2): 129–161.

Kramer, G.H. (1971) Short-term fluctuations in US voting behavior, 1896–1964. American Political Science Review 65(1): 131–143.

Lau, R.R. (1985) Two explanations for negativity effects in political behavior. American Journal of Political Science 29(1): 119–138.

LeDuc, L. and Pammett, J.H. (2013) The fate of governing parties in times of economic crisis. Electoral Studies, Economics and Elections: Effects Deep and Wide 32(3): 494–499.

Lewis-Beck, M.S. (1988) Economics and Elections: The Major Western Democracies. Ann Arbor, MI: University of Michigan Press.

Lewis-Beck, M.S. and Costa Lobo, M. (2016) The economic vote: Ordinary vs extraordinary times. In: K. Arzheimer et al. (eds.) The Sage Handbook of Electoral Behavior. New York: Sage.

Lewis-Beck, M.S. and Nadeau, R. (2012) PIGS or not? Economic voting in Southern Europe. Electoral Studies 31(3): 472–477.

Magalhães, P.C. (2014a) The elections of the great recession in Portugal: Performance voting under a blurred responsibility for the economy. Journal of Elections, Public Opinion and Parties 24(2): 180–202.

Magalhães, P.C. (2014b) Introduction – Financial crisis, austerity, and electoral politics. Journal of Elections, Public Opinion and Parties 24(2): 125–133.

Marsh, M. and Mikhaylov, S. (2012) Economic voting in a crisis: The Irish election of 2011. Electoral Studies 31(3): 478–484.

Marsh, M. and Mikhaylov, S. (2014) A conservative revolution: The electoral response to economic crisis in Ireland. Journal of Elections, Public Opinion and Parties 24(2): 160–179.

Miller, W.L. and Mackie, M. (1973) The electoral cycle and the asymmetry of government and opposition popularity: An alternative model of the relationship between economic conditions and political popularity. Political Studies 21(3): 263–279.

Mueller, J.E. (1973) War, Presidents and Public Opinion. New York, NY: Wiley.

Nadeau, R., Lewis-Beck, M.S. and Bélanger, É. (2013) Economics and elections revisited. Comparative Political Studies 46(5): 551–573.

Nezi, R. (2012) Economic voting under the economic crisis: Evidence from Greece. Electoral Studies 31(3): 498–505.

Parker-Stephen, E. (2013) Tides of disagreement: How reality facilitates (and inhibits) partisan public opinion. The Journal of Politics 75(4): 1077–1088.

Powell, G.B. and Whitten, G.D. (1993) A cross-national analysis of economic voting: Taking account of the political context. American Journal of Political Science 37(2): 391–414.

Rainey, C. (2014) Arguing for a negligible effect. American Journal of Political Science, 58(4), 1083–1091.

Rattinger, H. and Steinbrecher, M. (2011) Economic voting in times of economic crisis. German Politics 20(1): 128–145.

Reif, K. and Schmitt, H. (1980) Nine second-order national elections – A conceptual framework for the analysis of European elections results. European Journal of Political Research 8(1): 3–44.

Schmitt, H., Bartolini, S., van der Brug, W., van der Eijk, C., Franklin, M.N., Fuchs, D., Toka, G., Marsh, M. and Thomassen, J. (2009) European Election Study 2004 (2nd ed.). GESIS Data Archive, Cologne. ZA4566 Data file Version 2.0.0. doi:10.4232/1.10086.

Schmitt, H., Hobolt, S.B., Popa, S.A. and Teperoglou, E. (2015) European Parliament Election Study 2014, Voter Study. GESIS Data Archive, Cologne. ZA5160 Data file Version 1.0.0. doi:10.4232/1.5160.

Singer, M.M. (2011) When do voters actually think ‘it’s the economy’? Evidence from the 2008 presidential campaign. Electoral Studies 30(4): 621–632.

Soroka, S.N. (2006) Good news and bad news: Asymmetric responses to economic information. Journal of Politics 68(2): 372–385.

Stimson, J.A. (1976) Public support for American presidents: A cyclical model. Public Opinion Quarterly 40(1): 1–21.

Tillman, E. (2011) Political Knowledge, the Global Economic Crisis, and Voting Behavior in the 2010 British General Election. Paper presented at Conference on European Responses to the Economic Crisis; April 7–8, Indiana University, Bloomington, IN.

Torcal, M. (2014) The incumbent electoral defeat in the 2011 Spanish national elections: The effect of the economic crisis in an ideological polarized party system. Journal of Elections, Public Opinion and Parties 24(2): 203–221.

Tufte, E.R. (1975) Determinants of the outcomes of midterm congressional elections. American Political Science Review 69(3): 812–826.

van der Brug, W., van der Eijk, C. and Franklin, M. (2007) The Economy and the Vote: Economic Conditions and Elections in Fifteen Countries. New York, NY: Cambridge University Press.

van der Eijk, C., Oppenhuis, E. and Schmitt, H. (1993) European Election Study 1989 (EES 1989). European Commission [Principal investigator], GESIS Data Archive, Cologne. ZA2320 Data file Version 1.0.0. doi:10.4232/1.2320.

van der Eijk, C., van der Brug, W., Kroh, M. and Franklin, M. (2006) Rethinking the dependent variable in voting behavior: On the measurement and analysis of electoral utilities. Electoral Studies 25(3): 424–447.

van Egmond, M., van der Brug, W., Hobolt, S.B., Franklin, M.N. and Sapir, E.V. (2011) European Parliament Election Study 2009, Voter Study. GESIS Data Archive, Cologne. ZA5055 Data file Version 1.1.0. doi:10.4232/1.11760.

Wlezien, C., Franklin, M. and Daniel Twiggs, D. (1997) Economic perceptions and vote choice: Disentangling the endogeneity. Political Behavior 19(1): 7–17.

Acknowledgements

I would like to thank Michael S. Lewis-Beck, Piret Ehin, Kristjan Vassil and Thomas Biegert, as well as three anonymous referees for their insightful, detailed and constructive comments. Large parts of this work were conducted at the University of Tartu and were supported by the Doctoral School of Behavioural, Social and Health Sciences and the Archimedes Foundation.

Author information

Authors and Affiliations

Corresponding author

Appendices

Rights and permissions

About this article

Cite this article

Talving, L. Economic voting in Europe: Did the crisis matter?. Comp Eur Polit 16, 695–723 (2018). https://doi.org/10.1057/s41295-017-0092-z

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41295-017-0092-z