Abstract

We present a simple model in which (1) households select their country of residence depending on income taxation and on the cost of migrating and living abroad, and (2) globalization comes with a continuous cut in this cost. Globalization modifies the income tax and redistribution schemes which display three successive stages. In the first stage, the redistribution goal is compatible with tax progressivity. In the second, the redistribution goal makes taxation to become regressive at the top. Third, if the migration cost continues to decline, the government can no longer achieve its redistribution goal and the tax structure becomes volatile. Globalization reduces both redistribution and progressivity, and it generates and magnifies a tradeoff between redistribution and tax progressivity. Making redistribution and progressivity contradictory, the model provides a new explanation for the concomitance of growing redistribution expenditure and growing inequality, and to the social democracy curse experienced by a number of advanced countries in the last three decades.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Since the early 1980s, the shape of income tax has significantly changed in all advanced economies. First, income taxation has become less progressive and the top marginal income tax rates have significantly decreased. Second, the between-country gap in top marginal income tax rates has substantially shrunk and the tax structures have converged. Third, taxation has become regressive at the top in a number of countries, i.e. the effective tax rates are decreasing for the highest incomes. Forth, these moves have not come with a decrease in social and redistribution public expenditures, which suggests that the tax burden has moved towards the middle class. Finally, the after-tax and transfers inequality has increased in most advanced countries since the mid-1990s despite the rise in public social expenditures. Those facts are exposed in the Section “Stylized Facts”.

An abundant economic literature has studied the effects of taxpayers’ mobility on income tax structures and income tax competition (see the literature review in “Literature” section). In this paper, we show that if globalization lessens the cost of migrating between advanced countries, this leads to a progressivity–redistribution tradeoff and a social democracy curse.

Globalization lessens the cost of migration through several channels. First, the adoption of English as lingua franca at the World level and the harmonization of living standards across countries have typically reduced the every day’s sacrifice of living abroad. Second, the international recognition of diplomas and skills allows the migrants from advanced countries to work abroad without reducing their incomes, particularly for the highest skills.Footnote 1 Third, the decrease in transportation costs and the expansion of financial globalization and international communications through the internet substantially lower the cost of moving to and living abroad. These developments began in the 1980s, and they have known a rapid and general extension in the 1990s and 2000s.

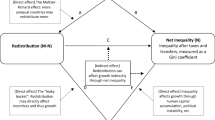

In the model developed here, we assume that globalization results in a continuous decrease in the cost of migrating and living abroad. This reduces the between-country differences in income tax rates consistent with no-migration, and it is shown that this gap is lower and its reduction greater for the highest incomes. We subsequently introduce a government with a threefold goal, i.e. disposable income of the national residents, redistribution and tax progressivity. We then analyse the occurrence of setting progressive income tax schedules and the relation between redistribution and tax progressivity.

We firstly show that the decrease in the cost of migrating and living abroad generates three stages in the taxation schedule. When this cost is above an endogenously determined first level, the policy maker can achieve its redistribution goal with a progressive income tax. Below this level but above a second cost threshold, the achievement of the redistribution goal requires a regressive-at-the-top tax structure. Below this second threshold, the policy maker cannot enforce his redistribution objective and the taxation schedules become volatile. We secondly show that the decrease in migration cost produces and magnifies a tradeoff between redistribution and progressivity. This makes redistribution and progressivity to become contradictory and generates thereby a social democracy curse.

Second section exposes the stylized facts and the literature related to the subject. The third section builds the model framework in terms of taxation and migration. The fourth section presents the governments’ objectives, determines the equilibrium tax structures and reveals the model major findings. These findings are discussed and we conclude in the fifth section.

Stylized Facts and Literature

Stylized Facts

The model developed here is motivated by a series of observed characteristics of advanced economies: (1) a decrease in income tax progressivity, a convergence of the income tax structures and the setting of regressive at the top income taxation in a number of countries; (2) a decrease in the cost of migrating and living abroad; (3) a rise in both inequality and public social expenditures; (4) a decline of social democracy since the mid-1980s.

Declining Progressivity and Regressive at the Top Income Taxation

Since the early 1980s, the progressivity of income taxation has declined in all advanced countries (Foster et al. 2015; Alvaredo et al. 2017). The decrease in top marginal tax rates and their convergence are now well documented. The resulting loss in levies has been offset by a general increase in consumption taxes. In OECD countries, the average VAT rate has increased from 16% to more than 19% from the mid-1970s to the late 2010s (OECD, Consumption Tax Trends 2016, Chap.2, Fig. 2.1).

In addition, the average income tax and social contribution rate is now decreasing at the top in a number of advanced countries (Fig. 1).

Income tax and social contribution rate. . Ratio \(\frac{{{\text{Central and sub - central income tax}} + {\text{Employee social security contribution}}}}{{\text{Gross labour income}}}\). Values of the marginal ratio (y-axis) for 67, 100, 133 and 167% of the average income (x-axis). Nordic countries: Denmark, Finland, Norway, Sweden. South Europe: Greece, Italy, Portugal, Spain

Redistribution

In the last thirty years, despite an increase in the share of GDP allocated to social public expenditures in all OECD countries (Fig. 2), the relative redistribution rate has not changed much (Fig. 3) and this has led to a rise in inequality (Fig. 4).

Source: OECD Stat. WIID, 2016. All indicators are non-weighted average. Continental Europe: Austria, Belgium, France, Germany, Netherlands. Non-US Anglo-Saxon: Australia, Canada, Ireland, New Zealand, UK. Nordic countries: Denmark, Finland, Norway, Sweden. South Europe: Greece, Italy, Portugal, Spain.

Post-redistribution income inequality (Gini).

Globalization and Cost of Migrating and Living Abroad

The decrease in the costs of migrating and living abroad is one of the major characteristics of the globalization process.

It is rather difficult to summarize within one indicator all the components of the cost of migrating and living abroad. However, the KOF index of social globalization provides a synthetic value of different elements which are essential in both the monetary and the cultural costs of migrating abroad.Footnote 2

Figure 5 shows a constant increase in social globalization in advanced economies as well as a constant and substantial decrease in the standard deviation across countries. This typically suggests a decrease in migration costs. It must be added that this decrease is typically greater for educated and rich households because highly educated workers have acquired higher foreign language skills and better knowledge and practice of international relations.

Source: KOF Swiss Economic Institute. Advanced countries = Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany Greece, Ireland, Israel, Italy, Japan, Luxembourg, Netherlands, New Zealand, Norway, Portugal, Spain, Sweden, Switzerland, UK, US

KOF index of social globalization (advanced countries).

The Decline of Social Democracy

Considering 31 countries, Benedetto et al. (2020, Fig. 1) show that the share of the votes for social democracy in the total electorate remained around 25% from the early 1950s to the mid-1980s. Afterwards, this share continuously declined to attain less than 15% in 2017.

Literature

The model developed here relates to (1) the literature on income tax and welfare and (2) the literature on income tax competition.

Income Tax and Welfare

Following Mirrlees (1971), the early literature on optimal income tax rates was based on a game between the social planner and the tax payers. When increasing the marginal income tax rate, the social planner discourages labour supply and effort, which in turn lessens the amount of income and the perceived taxes. This literature is not summarized here, and we refer to Mankiw et al. (2009) who distinguish five major resultsFootnote 3 and show that the policies pursued over the last thirty years have only partially followed the theoretical recommendations.

In fact, this literature focuses on the influence of the marginal tax rate on the behaviour of individuals in their production activity, and on the related impact on welfare. It thereby depends on the weight the welfare function gives to production and to equality. In addition, those analyses consider the behaviour of individuals inside their home country excluding thereby the possible migration to escape from high levies.

Income Tax Competition

The analysis of the impact of taxpayers’ migration on income taxation has known a significant expansion over the last three decades. This literature reveals various and sometimes opposite results depending on the model and its assumptions.

The impact of labour mobility on optimal income taxation was first tackled by Mirrlees (1982). The subsequent literature focused on the behaviour of jurisdictions competing in income taxation and income redistribution because of potential migration of both the net taxpayers and the net transfer recipients. Wildasin (1991) showed that the benefits for both types of individuals must be equalized across jurisdictions and that this can be achieved either by coordination or by a central government. Assuming no coordination and no central adjustment, Hindriks (1999) determined the Nash equilibria when the poor and the rich are imperfectly mobile and jurisdictions compete either in tax, in transfers or in both. He showed (1) that the cut in redistribution is larger when competing in transfers than when competing in taxes and (2) that the mobility of the rich is detrimental to redistribution, whereas the effect of the mobility of the poor depends on whether we are in a tax competition or a redistribution competition regime. In a model with productivity divergence between countries, Bucovetsky (2003) shows that migration can increase tax progressivity in the high-productivity country.

In a series of papers, Simula and Trannoy (2005, 2010, 2012) have analysed taxation and welfare when countries are competing in income taxes because of labour mobility. These approaches combine the impacts of taxes on labour supply and on taxpayers’ migration in models with skill (productivity) heterogeneity across individuals. They determine optimal tax schemes depending on whether the welfare function is national-oriented, citizen-oriented or resident-oriented, and on whether the individuals’ productivities are perfectly known or not. The cut in redistribution to the low-skilled due to tax competition is common to almost all configurations. In a number of configurations, the marginal tax rate on the highest skill is reduced and it can even be decreasing. This can also lead to a curse of the middle-skilled who pay more taxes to fund redistribution.

Bierbrauer et al. (2013) analyse the choices of income tax systems in a model with tax competition between two countries, a welfare function depicting the average utility of residents, non-observable skills, and perfect mobility across countries. They show that there is no equilibria in which individuals with the highest skill make positive tax payments and no equilibria in which the lowest-skilled residents receive a subsidy, in either country. In equilibrium, it is even possible for the highest skilled to receive a net transfer funded by taxes on lower skilled individuals.

Lehmann et al. (2014) determine the optimal marginal income tax rate corresponding to the Nash equilibrium between two countries maximizing a welfare objective (maximin) with individuals who differ in both skills and migration costs. The solution crucially depends on the semi-elasticity of migration. The simulations implemented for the USA reveal a welfare loss between 0.4 and 5.3% for the worst-off and a gain between 18.9 and 29.3% for the top 1%.

In a world with a finite number of countries whose governments attempt to maximize the welfare of the low-skilled by taxing skilled workers' labour income, Tobias (2016) shows that a race to the bottom does not always emerge, the sustainability of the welfare state depending on the shape of the probability distribution of skilled workers’ location preferences.

The empirical works on income tax competition are both more recent and rather scarce compared to the theoretical literature. If the decrease in the top marginal tax rates and their convergence are well documented, their relation to the threat of migration of tax bases is rather difficult to estimate. A number of works, however, suggest the existence of income tax competition. Several studies are centred on the Swiss case because of the key position of this country as a tax haven. By comparing the Swiss cantons, Feld and Reulier (2009) reveal a race to the bottom dynamics, with, however, no full convergence because of cultural divergence. Schaltegger et al. (2011) show the influence of income taxes on the residence of taxpayers in Zurich area. Johannesen (2014) analyse the impact of the recent reform introducing a withholding tax which limits the scope for tax evasion on interest income for EU residents but not for non-EU residents. The after-reform large decline in deposits owned by EU residents relative to non-EU suggests that those deposits were motivated by tax evasion. In the case of Denmark, Kleven et al. (2014) show that the Danish preferential foreigner tax scheme introduced in 1991 has had a significant effect on the inflow of highly paid foreigners.

In the reviewed literature, a decrease in the migration cost fosters income outflows and tax competition by encouraging migration. In addition, if this literature has clearly analysed (1) the reduction in tax and redistribution linked to the potential migration of tax payers and transfers recipients, (2) the race to the bottom and (3) the middle class curse, the existence of a tradeoff between redistribution and income tax progressivity and the related social democracy curse has not been studied. This paper intends to fill this gap.

The Model

General Framework

There are two countries, Home and Foreign (a star * depicts Foreign values).

In both countries, there is a continuum of households which are identical except in their income. Hence, redistribution is only based on income differences.

Without loss of generality, we normalize the Home population to 1, and households h are ranked by decreasing order of income in both countries.

An income distribution \(\left\{ {y(h),\left[ {\underline {I} ,\overline{I}} \right]} \right\}\) is a continuously decreasing function \(y(h), \, \partial y/\partial h < 0\), which binds the household \(h \in \left[ {0,1} \right]\) to its income \(y(h) \in \left[ {\underline {I} ,\overline{I}} \right]\) with \(y(0) = \overline{I}\) and \(y(1) = \underline {I} > 0\) in the Home country. Consequently, the Home total income without migration, denoted \(\overline{Y}\), is \(\overline{Y} = \int_{0}^{1} {y(h){\text{d}}h} .\)Footnote 4 As \(\partial y/\partial h < 0\), there is a one-to-one correspondence between h and y. The same definitions hold for the Foreign country.

In each country, the government sets income tax rates which are functions of personal income y, \(\tau (y)\) and \(\tau *(y)\).

The rates \(\tau (y)\) and \(\tau *(y)\) are defined as an effective income tax rates which encompass the direct income taxation but also the sales taxes such as the VAT and all the transfers and redistribution provided to households. Consequently, the rates \(\tau (y)\) and \(\tau *(y)\) can be positive or negative. When the rate is negative, this indicates net redistribution, the household receiving the transfer \(- \tau (y) \times y\) with the redistribution rate \(- \tau (y) > 0\). In addition, for any non-nil income y, \(\tau (y)\) belongs to the interval \(\left] { - \infty ,\overline{\overline{\tau }}} \right]\). The assumption of both positive and negative tax rates aims at depicting the whole of the income tax and redistribution scheme. The sum of the \(\tau (y) \times y, \, \tau (y) > 0\) determines the country’s income tax burden and the sum of the \(- \tau (y) \times y, \, \tau (y) < 0\), the country’s total redistribution. The ceiling value \(\overline{\overline{\tau }} < 1\) indicates that there is a maximum tax rate which is socially acceptable.

A taxation function \(\tau (y)\) in income interval \(\mathcal{I}^{\prime }\) binds the tax rates \(\tau (y) \ge 0\) to the incomes \(y \in \mathcal{I}^{\prime }\). A tax and redistribution function \(\tau (y)\) in income interval \(\mathcal{I}\) binds the tax rates \(\tau (y) > 0\) and the redistribution rates \(- \tau (y) > 0\) to the incomes \(y \in \mathcal{I}\).

The tax rate \(\tau (y)\) concerns the sole incomes which do exist in the country. Hence, the function \(\tau (y) = 0\) for all the incomes which are missing. As a country is characterized by a continuum of incomes in an interval \(\left[ {\underline {I} ,\overline{I}} \right]\), this means that \(\tau (y) = 0\) for any \(y \notin \left[ {\underline {I} ,\overline{I}} \right]\).Footnote 5

It is finally assumed that taxation has no impact on labour supply and pre-tax incomes. This simplifying assumption permits to focus on the sole income migration as a channel of influence of income tax upon disposable income.Footnote 6

In both countries, redistribution is reserved to national residents, whereas taxes are levied on all residents, national or immigrants. This assumption is just a simple way to model the fact that most advanced countries have set barriers to prevent the unwanted inflow of poor migrants, including a restricted access to social transfers.Footnote 7 In addition, our approach does not consider refugees’ migration.

We suppose that living abroad induces an additional migration cost C(y), which depends on the income y and is similar for the migrants in both countries. Hence, a Home national resident with before-tax income y has the after-tax and redistribution income \(\left( {1 - \tau (y)} \right)y\) if she lives in the Home country and \(\left( {1 - \max \left\{ {\tau^{*} (y),0} \right\}} \right) \times y - C(y)\) if she migrates to the Foreign country. Symmetrically, a Foreign national with before-tax income y has the after-tax and redistribution income \(\left( {1 - \tau *(y)} \right)y\) if she lives in her country and \(\left( {1 - \max \left\{ {\tau (y),0} \right\}} \right)y - C(y)\) if she migrates to the Home country.

Finally the tax and redistribution function \(\tau (y)\) can be expressed in terms of the taxed household since \(y = y(h)\). We denote \(\tau_{y} (h)\) the function \(\tau \left( {y(h)} \right)\).

Tax and Redistribution Schedules

We now provide a number of definitions which are necessary for the subsequent analyses.

Definition 1

We define as:

-

(1)

Tax schedule \(\left\{ {\tau (y), \, \mathcal{I}} \right\}\), a taxation function \(\tau (y)\) in income interval \(\mathcal{I}\): \(y \in \mathcal{I} \mapsto \tau (y) \in \left[ {0,\overline{\overline{\tau }}} \right], \, \overline{\overline{\tau }} < 1\).

-

(2)

Tax and Redistribution schedule \(\left\{ {\tau (y), \, \mathcal{I}} \right\}\), a tax and redistribution function \(\tau (y)\) in income interval \(\mathcal{I}\): \(y \in \mathcal{I} \mapsto \tau (y) \in \left] { - \infty ,\overline{\overline{\tau }}} \right[\) such that \(\int_{0}^{1} {\tau_{y} (h) \times } y(h){\text{d}}h = 0\).

A Tax schedule (T-schedule) defines the set of positive or nil tax rates which apply to the incomes inside interval \(\mathcal{I}\) and a Tax and Redistribution schedule (TR-schedule) a set of tax and redistribution rates such that all taxes fully fund redistribution.

Definition 2

A Tax and Redistribution schedule is Progressive in the income interval \(\mathcal{I}\) if \(y_{2} > y_{1} \Rightarrow \tau (y_{2} ) \ge \tau (y_{1} )\), \(y_{1} ,y_{2} \in \mathcal{I}\).

Definition 3

A Tax schedule is:

-

(1)

Progressive in the income interval \(\mathcal{I} = \left[ {\underline {I} ,\overline{I}} \right]\) if (1) \(y_{2} > y_{1} \Rightarrow \tau (y_{2} ) \ge \tau (y_{1} )\), \(y_{1} ,y_{2} \in \mathcal{I}\) and (2) \(\tau \left( {\overline{I}} \right) > \tau \left( {\underline {I} } \right)\);

-

(2)

Regressive in the income interval \(\mathcal{I} = \left[ {\underline {I} ,\overline{I}} \right]\) if (1) \(y_{2} > y_{1} \Rightarrow \tau (y_{2} ) \le \tau (y_{1} )\), \(y_{1} ,y_{2} \in \mathcal{I}\) and (2) \(\tau (\overline{I}) < \tau (\underline {I} )\).

Definition 4

A tax schedule \(\left\{ {\tau (y), \, \mathcal{I} = \left[ {\underline {I} ,\overline{I}} \right]} \right\}\) is regressive at the top if there is an income level \(\tilde{I} \in \mathcal{I}\) such that the income tax is regressive for all incomes \(y \ge \tilde{I}\).

Definition 5

Assume two tax schedules \(\mathcal{T}_{1} = \left\{ {\tau_{1} (y),\left[ {\underline {I}_{1} ,\overline{I}} \right]} \right\}\) and, \(\mathcal{T}_{2} = \left\{ {\tau_{2} (y),\left[ {\underline {I}_{2} ,\overline{I}} \right]} \right\}\), \(\left[ {\underline {I}_{1} ,\overline{I}} \right]{\text{ and }}\left[ {\underline {I}_{2} ,\overline{I}} \right] \subset \mathcal{I} = \left[ {\underline {I} ,\overline{I}} \right]\). Then:

-

(1)

\(\mathcal{T}_{1}\) is more progressive than \(\mathcal{T}_{2}\) (equivalently, \(\mathcal{T}_{2}\) is less progressive than \(\mathcal{T}_{1}\)) if there is an income \(\tilde{y} \in \mathcal{I}\) such that (1) \(\tau_{1} (y) \le \tau_{2} (y), \, y \le \tilde{y}\), and \(\tau_{1} (y) \ge \tau_{2} (y), \, y > \tilde{y}\), and (2) there is \(\, y < \tilde{y}\) such that \(\tau_{2} (y) > \tau_{1} (y)\) and/or \(y > \tilde{y}\) such that \(\tau_{1} (\overline{I}) > \tau_{2} (\overline{I})\).

-

(2)

\(\mathcal{T}_{1}\) is strictly more progressive than \(\mathcal{T}_{2}\) (equivalently, \(\mathcal{T}_{2}\) is strictly less progressive than \(\mathcal{T}_{1}\)) if there is an income \(\tilde{y} \in \mathcal{I}\) such that (1) \(\tau_{1} (\tilde{y}) = \tau_{2} (\tilde{y}), \, y < \tilde{y}\), (2) \(\tau_{1} (y) < \tau_{2} (y), \, y < \tilde{y}\) and \(\tau_{1} (y) > \tau_{2} (y), \, y > \tilde{y}\), and (3) \(\tau_{1} (y) - \tau_{2} (y)\), increases with y.

Figure 6 illustrates the situation in which \(\mathcal{T}_{2}\) is more progressive than \(\mathcal{T}_{3}\) and \(\mathcal{T}_{1}\) strictly more progressive than \(\mathcal{T}_{3}\).

Migration Cost and Tax-Related Migration

We call ‘migration cost’ a cost of migrating and living abroad which applies to the income of a migrant. It is not a sunk cost (only paid when migration occurs).

We assume a migration cost C(y) which is identical in the Home and in the Foreign country and such that

C is called the migration cost coefficient.

Function (1) allows for a large range of migration costs, going from a cost which decreases with income (\(\beta < 0\)) to a cost increasing with income (\(\beta > 0\)), with, however, a decreasing marginal cost (\(\beta < 1\)). The cost is fixed whatever the income for \(\beta = 0\).

We assume that globalization is characterized by a decrease in the migration cost coefficient C.

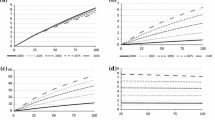

We define the unit migration cost as \(c(y) = C(y)/y\). Hence:

Lemma 1

The unit migration cost c(y) decreases with income y.

Proof

As \(\beta < 1\), then \(\partial c/\partial y < 0\).

The unit migration cost exhibits the shape depicted in Fig. 7.

Consider a household in the Home country with income y. He decides not to migrate if his after-tax and migration cost income is higher in the Home country than in the Foreign country, i.e. \(\tau (y) \times y > \max \left\{ {\tau *(y),0} \right\} \times y + C(y)\). This establishes the no-migration condition:

If condition (3) is not fulfilled, income y migrates to the Foreign country.

Similarly, all the Foreign households with an income y such that \(\tau *(y) > c(y) + \max \left\{ {\tau (y),0} \right\}\) migrate to the Home country, and all those such that \(\tau *(y) \le c(y) + \max \left\{ {\tau (y),0} \right\}\) stay in the Foreign country.

Lemma 2

In both countries, the redistribution net recipients never migrate.

Proof

Because they lose both the redistribution gain and the migration cost.

Lemma 3

Suppose that both \(\tau (y)\) and \(\tau *(y)\) are positive. Then:

-

(1)

The condition for no migration between the two countries is

$$\left| {\tau (y) - \tau *(y)} \right| \le c(y)$$(4) -

(2)

The higher the income y, the more restrictive condition (4).

-

(3)

A decrease in C (globalization) makes this condition more restrictive.

Proof

Feature 1: because \(\tau (y) \le \tau *(y) + c(y)\) and \(\tau *(y) \le \tau (y) + c(y)\). Feature 2: \(\partial c(y)/\partial y < 0\). Feature 3: \(\partial c(y)/\partial C > 0\) and globalization comes with a decrease in C.

The maximum taxation gap \(\left| {\tau (y) - \tau *(y)} \right|\) consistent with no migration is c(y). Hence, if both countries want to prevent the migration of their tax bases, their governments are critically constrained in the taxation of high incomes by the taxation schedule of the other country, whereas this constraint is minor for low or medium incomes. In addition, this constraint strengthens when globalization increases.

Finally, since \(y = y\left( h \right)\), the migration cost \(C\left( y \right)\) and the relative migration cost c(y) can be defined in terms of household \(h \in \left[ {0,1} \right]\). We, respectively, denote \(C_{y} (h)\) and \(c_{y} (h)\) the functions \(C\left( {y(h)} \right)\) and \(c\left( {y(h)} \right)\), with \(\partial c_{y} /\partial h > 0\) since \(\partial c/\partial h < 0\) and \(\partial y/\partial h < 0\).

Governments’ Objectives

In each country, the government has a twofold objective. It firstly wants to increase the national residents’ disposable income. It secondly has a goal in terms of taxation and redistribution.

The National Residents’ Disposable Income

Let \(H_{R}\) be the set of Home nationals who live in the Home country and \(H_{M}\) the set of Foreign nationals who have migrated to and live in the Home country.

The disposable income of national residents, Y, can be divided in two components. First, it comprises all the national residents’ pre-tax incomes \(\int_{{h \in H_{R} }} {y(h)}\) since all taxes are redistributed. Second, it includes the taxes paid by immigrants, \(\int_{{h \in H_{M} }} {\tau_{y} (h) \times y(h)}\), which are redistributed to the nationals. Hence: \(Y = \int_{{h \in H_{R} }} {y(h)} + \int_{{h \in H_{M} }} {\tau_{y} (h) \times y(h)}\).

An inflow of incomes with a positive net taxation increases the national residents’ disposable income because the taxes they pay are redistributed. In contrast, an outflow of nationals reduces this income.

Tax and Redistribution

On top of the national residents’ income, the government has a taxation and redistribution goal. Redistribution consists in transferring income from high to low income earners. Hence, no net transfer can be given to any income which is higher than that of a net taxpayer.

Lemma 4

Assume an economy with a given income distribution \(\left\{ {y(h),\left[ {\underline {I} ,\overline{I}} \right]} \right\}\) . Then:

-

(1)

Any progressive tax and redistribution schedule \(\left\{ {\tau (y),\left[ {\underline {I} ,\overline{I}} \right]} \right\}\) defines one unique redistribution expenditure \(R\) , one unique income threshold \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I}\) and a related household \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{h} = y^{ - 1} \left( {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I} } \right)\) which separates the redistribution recipients ( \(\tau (y) < 0\) , \(y < \underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I}\) ) from the net taxpayers ( \(\tau (y) \ge 0\) , \(y \ge \underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I}\) ) and one unique progressive tax schedule \(\left\{ {\tau (y),\left[ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I} ,\overline{I}} \right]} \right\}\) , \(\tau (y) \ge 0\) .

-

(2)

For any redistribution expenditure \(\overline{R}\) , there is an infinite number of tax schedules and progressive tax schedules consistent with \(\overline{R}\) .

Proof

Appendix 1.

Lemma 4 highlights the fact that (1) a progressive TR-schedule fully defines redistribution and the income threshold which separates the redistribution recipients from the taxpayers, and (2) there is in contrast an infinite number of TR-schedules, progressive and non-progressive, which are consistent with a given redistribution expenditure R.

The No-reversal Constraint

The government is not allowed to reverse the income hierarchy through taxes and redistribution, which is consistent with the fact that individuals only differ in their incomes. This defines the no-reversal constraint (5) (proof in Appendix 2):

The no-reversal constraint stipulates that all the tax rates must be below or on the curve \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{\tau } (i)\) for incomes above \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I}\) as depicted in Fig. 8.

Social Welfare

Consider a progressivity-oriented government. Without migration inflows and/or outflows, its most preferred Tax and Redistribution schedule is \(\overline{\mathcal{T}} = \left\{ {\overline{\tau }(y),\left[ {\underline {I} ,\overline{I}} \right]} \right\}\), \(\overline{\tau }^{\prime}(y) \ge 0\). Lemma 5 indicates that \(\overline{\mathcal{T}}\) fully defines the redistribution goal \(\overline{R}\) and the most preferred progressive Tax schedule \(\left\{ {\overline{\tau }(y) \ge 0, \, \left[ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I} ,\overline{I}} \right]} \right\}\).

The government’s welfare function must increase with the national residents’ total income Y and decrease with both cuts in redistribution below \(\overline{R}\) and divergences from the taxation goals \(\overline{\tau }(y)\). In addition, since \(\overline{\mathcal{T}}\) is the government’s most preferred schedule, any increase in redistribution above \(\overline{R}\) which is funded by an increase in the national residents’ tax burden lessens social welfare. In contrast, an increase in redistribution which is funded by foreign immigrants (through taxes) is welfare enhancing. So as to distinguish redistribution from tax progressivity, the redistribution goal is defined by \(\overline{R}\) and the taxation goal by \(\left\{ {\overline{\tau }(y) \ge 0, \, \left[ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I} ,\overline{I}} \right]} \right\}\). Consequently, the government’s welfare function is:Footnote 8

with: \(G_{Y} (0) = 0, \, \frac{{\partial G_{Y} }}{\partial Y} > 0, \, \frac{{\partial^{2} G_{Y} }}{{\partial Y^{2} }} < 0\); \(L_{R} (0) = 0, \, \frac{{\partial L_{R} }}{\partial \Delta R} > 0, \, \frac{{\partial^{2} L_{R} }}{{\partial \Delta R^{2} }} > 0, \, \Delta R = \left| {R - \overline{R}} \right|\).

\(L_{R} (0) = 0\), \(\frac{{\partial L_{\tau } }}{\partial \Delta \tau } > 0, \, \frac{{\partial^{2} L_{\tau } }}{{\partial \Delta \tau^{2} }} > 0, \, \Delta \tau = \int_{0}^{{\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{h} }} {\left| {\overline{\tau }_{y} (h) - \tau_{y} (h)} \right|{\text{d}}h}\).

Function \(G_{Y} \left( Y \right)\) measures the welfare gain due to the national residents’ total income Y. This gain increases with Y and the marginal gain decreases.

Function \(L_{R} \left( {\Delta R} \right), \, \Delta R = \overline{R} - R\), measures the welfare loss due to a downward deviation from the redistribution goal \(\overline{R}.\) This loss as well as the marginal loss increase with the deviation \(\Delta R\). Ceteris paribus, an increase in R above \(\overline{R}\) increases welfare.

\(L_{\tau } \left( {\Delta \tau } \right)\) measures the welfare loss due to deviations from the tax goal \(\left\{ {\overline{\tau }(y),\left[ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I} ,\overline{I}} \right]} \right\}\). This loss and the marginal loss increase with the sum of the deviations \(\left| {\overline{\tau }_{y} (h) - \tau_{y} (h)} \right|\), \(y \in \left[ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I} ,\overline{I}} \right]\).

Note that the welfare function makes a clear distinction between (1) redistribution which is represented by \(\overline{R}\), with the government distributing discretionarily this amount between the households below income \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I}\), and (2) tax progressivity which is represented by the tax rates above \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I}\). Consequently, redistribution combines both the redistributed amount \(\overline{R}\) and the income threshold \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I}\).

In each country, the government maximizes the welfare function subject to (1) the redistribution funding constraint, (2) the no-reversal constraint and (3) the taxation schedule of the other country.

Lemma 5

A government never sets a tax rate \(\tau (y)\) which entails an outflow of any national resident's income y. Hence, the no-migration condition always holds in both countries: \(\tau (y) \le \tau *(y) + c(y)\) and \(\tau *(y) \le \tau (y) + c(y)\) for \(y \in \left[ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I} ,\overline{I}} \right]\).

Proof

An outflow of income concerns \(y > \underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I}\) such that \(\overline{\tau }(y) > \tau *(y) + c(y)\). Any outflow of \(y > \underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I}\) (1) decreases total income Y, (2) decreases redistribution funding compared to a decrease in \(\tau (y)\) just below \(\tau *(y) + c(y) > 0\), and (3) augments the tax deviation by the amount \(\overline{\tau }(y) > \overline{\tau }(y) - (\tau *(y) + c(y))\). It thus reduces more W than the setting of \(\tau (y) = \tau *(y) + c(y)\).

Equilibrium and the Redistribution–Progressivity Tradeoff

We firstly analyse the case in which governments’ welfare depends on the sole disposable income and redistribution. This permits to determine the tax schedules and their progressivity which are consistent with a given redistribution goal. We subsequently consider the three objectives (total income, redistribution and tax progressivity) to analyse the redistribution–progressivity tradeoff.

Tax Progressivity Consistent with a Given Redistribution Goal

From Eq. (6), the welfare function depending on the sole disposable income and redistribution is (the Foreign welfare function is similar):

Each government maximizes its welfare function subject to the no-reversal constraint, the migration costs and the tax schedule of the other country. This defines a non-cooperative game between the Home and Foreign governments.

Proposition 1

Assume two countries with the same migration cost c(y), the redistribution goals \(\overline{R}\) and \(\overline{R}*\), and the welfare functions (7). Then:

-

(1)

All the tax schedules \(\left\{ {\tau (y),\left[ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I} ,\overline{I}} \right]} \right\}\) and \(\left\{ {\tau *(y),\left[ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I} *,\overline{I}} \right]} \right\}\) which exactly finance the redistribution goals \(\overline{R}\) and \(\overline{R}*\), and such that \(\tau (y) \le \min \left\{ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{\tau } *(y),c(y)} \right\}\) and \(\tau *(y) \le \min \left\{ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{\tau } (y),c(y)} \right\}\) are equilibrium tax schedules .

-

(2)

All the progressive tax schedules \(\left\{ {\tau (y),\left[ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I} ,\overline{I}} \right]} \right\}\) and \(\left\{ {\tau *(y),\left[ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I} *,\overline{I}} \right]} \right\}\) which exactly finance the redistribution goals \(\overline{R}\) and \(\overline{R}*\), and such that \(\tau (y) \le \min \left\{ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{\tau } (y),c(\overline{I})} \right\}\) and \(\tau *(i) \le \min \left\{ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{\tau } *(y),c(\overline{I})} \right\}\), are progressive equilibrium tax schedules.

Proof

Appendix 3. It is also shown at the end of this appendix that those results are still valid when the welfare function considers the total income of all residents (national and foreign) or that of all nationals (residents and non-resident).

Proposition 1 determines two sets of tax schedules which are pictured in Fig. 9.

The dimmed surface below curve \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I} BC\) contains all the Home equilibrium tax schedules and the dimmed surface below curve \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I} AC\) all the Home progressive equilibrium tax schedules. Note that the Foreign sets of schedule are similarly determined by the curves \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{\tau } *\left( y \right)\) and \(c(y)\).

Proposition 1 can be explained as follows for the Home country (the reasoning is the same for the Foreign country). Consider an income y such that \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{\tau } (y) > \tau (y) > c(y)\) and \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{\tau } *(y) > \tau *(y) > c(y)\). Provided that its redistribution goal can be achieved, the Home government is incited to lessen its rate \(\tau (y)\) at a level just below that of the Foreign country minus the migration cost c(y) because this permits to attract the Foreign income y and thereby to increase Y and welfare. The resulting equilibrium is \(\tau (y) = \tau *(y) = c(y)\) because, for this value, attracting y from the other country would make \(\tau (y)\) become negative, which is contradictory with redistribution. For \(\tau (y) > c(y) > \underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{\tau } (y)\), the equilibrium is \(\tau (y) = \underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{\tau } (y)\) because of the no-reversal constraint. In addition, the highest progressive tax schedule inside the set of equilibria is \(\tau (y) \le \min \left\{ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{\tau } (y),c(\overline{I})} \right\}\) because, for progressivity to be ensured, (1) no tax rate \(\tau (y)\) can be higher than \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{\tau } (y)\) and (2) no tax rate can be higher than \(c(\overline{I})\) because \(c(y)\) is decreasing (Fig. 9).

Proposition 2

Consider the government with the redistribution goal \(\overline{R}\) and the decreasing migration cost coefficient C (globalization). Then, there is a couple of cost coefficients \(\left( {C_{1} ,C_{2} } \right)\) with \(C_{2} < C_{1}\) such that:

-

(1)

The government can achieve redistribution \(\overline{R}\) with a progressive tax schedule when \(C \ge C_{1} .\)

-

(2)

The government can only achieve \(\overline{R}\) with a regressive at the top tax schedule when \(C_{2} \le C < C_{1}\) .

-

(3)

The government cannot achieve redistribution \(\overline{R}\) and there is no equilibrium if \(C < C_{2}\)

-

(4)

Both thresholds \(C_{1}\) and \(C_{2}\) are increasing functions of redistribution \(\overline{R}\) .

Proof

Appendix 4.

Proposition 2 reveals that, as globalization comes with a decrease in the migration cost coefficient C, the country moves from a first phase (\(C \ge C_{1}\)) in which both redistribution \(\overline{R}\) and tax progressivity are compatible, to a second phase (\(C_{2} \le C < C_{1}\)) where redistribution \(\overline{R}\) requires regressive-at-the-top taxations, and finally to a third phase (\(C < C_{2}\)) in which the redistribution goal cannot be attained and there is no equilibrium schedule.

It must be highlighted that, the higher redistribution, the higher C1 and C2 (Feature 4 of Proposition 2), and the sooner the country attains thresholds C1 and C2 during the globalization process. This typically means that a government with a high redistribution goal meets sooner the obligation to move from a progressive to a regressive at the top taxation than a government with a low redistribution goal.

The Redistribution–Progressivity Tradeoff

We now consider the welfare function (6) in which both redistribution and tax progressivity are governments’ goals.

We assume two countries with the same income distribution, but the governments have different orientations. The Home government is ‘highly progressive’ and the Foreign government ‘poorly progressive’, which means that the Home tax schedule is strictly more progressive and the Home redistribution goal is higher than the Foreign schedule.

We finally assume that attracting incomes from migration by lessening the tax rates does not improve one country’s welfare. This typically corresponds to the less progressive Foreign country being large compared to the Home country because then the gain in total income Y is small compared to the losses in redistribution and tax rates deviation. This permits to focus on the impact of between-country differences in redistribution and progressivity orientations.

The most preferred tax schedules of the Home and Foreign country are depicted by the curves \(\overline{\tau }(y)\) and \(\overline{\tau }*(y)\) in Figs. 10 and 11. We denote \(\theta (y) \equiv \overline{\tau }*\left( y \right) + c\left( y \right)\) and \(\theta_{y} (h) \equiv \theta \left( {y(h)} \right)\). Given the characteristics of functions \(\overline{\tau }*\left( y \right)\) and \(c\left( y \right)\), the function \(\theta (y)\) can display two shapes. The first is depicted in Fig. 10 and corresponds to \(\partial \theta /\partial y < 0\). The second (Fig. 11) corresponds to \(\partial \theta /\partial y > 0\).

In both figures, the tax rates \(\overline{\tau }(y)\) are higher than \(\theta (y)\) above income \(\tilde{I}\), i.e. for \(h < \tilde{h} = y^{ - 1} (\tilde{I})\).

As long as \(\overline{\tau }(\overline{I})\) is lower than \(\theta (\overline{I})\), each country remains at its most preferred tax and redistribution schedule because it is not constrained by the other country’s taxation. As the unit migration cost function moves downwards (globalization), a time comes when \(\theta (\overline{I})\) moves under \(\overline{\tau }(\overline{I})\). From then on, the top tax rates are constrained in the Home country by the no-migration condition (Lemma 5). The optimal response of the Home government consists in moving the rates \(\tau (y)\) at the level \(\theta (y)\) for all the incomes y such that \(\overline{\tau }(y) > \theta (y)\), i.e. the incomes \(y > \tilde{I}\) in Figs 10 and 11. If \(\partial \theta /\partial y > 0\) (Fig. 11), this corresponds to a tax schedule which is less progressive than the most preferred schedule \(\left\{ {\overline{\tau }(y),\left[ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I} ,\overline{I}} \right]} \right\}\). If \(\partial \theta /\partial y < 0\) (Fig. 10), the tax schedule becomes regressive at the top. The corresponding tax rates are depicted by the curve \(\theta (y)\) in the income segment \(\left[ {\tilde{I},\overline{I}} \right]\).

The cuts in tax rates above \(\tilde{I}\) cause a loss in welfare due to both a loss in redistribution \(\widetilde{\Delta R} = \int_{0}^{{\tilde{h}}} {\left( {\overline{\tau }_{y} (h) - \theta_{y} (h)} \right)y(h)dh}\) and a deviation in taxation \(\widetilde{\Delta \tau } = \int_{0}^{{\tilde{h}}} {\left( {\overline{\tau }_{y} (h) - \theta_{y} (h)} \right)dh}\).Footnote 9

Any increase in the tax rates \(\tau (y)\) on incomes \(y < \tilde{I}\) which brings \(\tau (y)\) at a value smaller than or equal to \(\theta (y)\) increases welfare by augmenting redistribution and decreases welfare by raising tax deviation. Moreover, for \(y_{1} > y_{2}\) an additional point of tax rate \(\tau (y_{1} )\) augments redistribution more than an additional point of tax rate \(\tau (y_{2} )\) for the same tax deviation loss. Consequently, if the government can increase welfare by taxing more some incomes below \(\tilde{I}\), it begins by applying the maximum tax rates \(\theta (y)\) to the highest incomes below \(\tilde{I}\), i.e. by applying \(\theta_{y} (h)\) to the successive h above \(\tilde{h}\), and it stops when the marginal gain (higher redistribution) of increasing the h to which \(\theta_{y} (h)\) applies equals the marginal loss (higher tax deviation). Since the national residents total income \(\overline{Y}\) is given, the welfare function can now be written: \(W(h) = G_{Y} \left( {\overline{Y}} \right) - L_{R} \left( {\widetilde{\Delta R} - \int_{{\tilde{h}}}^{h} {\theta_{y} (h) \times y(h){\text{d}}h} } \right) - L_{\tau } \left( {\widetilde{\Delta \tau } + \int_{{\tilde{h}}}^{h} {\left( {\theta_{y} (h) - \overline{\tau }_{y} (h)} \right){\text{d}}h} \, } \right)\).

Let \(\hat{h} \equiv \mathop {\arg \max }\limits_{h} \left[ {W(h)} \right]\) and \(\hat{I} = y(\hat{h})\). It can be easily verified that \(\hat{h}\) increases, and hence \(\hat{I}\) decreases, with C. The optimal tax schedule of the Home country is then:

This optimal schedule is depicted by the bold curve in Fig. 12 for \(\partial \theta /\partial y < 0\). A decrease in the migration cost C (globalization) moves the curve \(\theta (y)\) downwards and income \(\hat{I}\) to the left. Hence, globalization reduces progressivity, expands regressivity at the top and displaces the tax burden downward on the income ladder.

The above analyses determine the following two propositions.

Proposition 3

Consider the decrease in the migration cost C (globalization). There is a cost \(\tilde{C}\) below which

-

(1)

If \(\partial \theta /\partial y > 0\) , globalization increasingly reduces the progressivity of the optimal tax schedule.

-

(2)

If \(\partial \theta /\partial y < 0\) , globalization makes the optimal tax schedule increasingly regressive at the top.

Proposition 4

Consider an external shock which makes the government increase its redistribution goal \(\overline{R}\) . Then

-

(1)

Without migration constraint, the increase in R is funded by an increase in progressivity.

-

(2)

When the migration constraint is effective, the increase in R magnifies the globalization-driven decrease in progressivity.

Proof

The redistribution goal increases from \(\overline{R}_{1}\) to \(\overline{R}_{2} > \overline{R}_{1}\). In welfare function (6), \(L_{R} \left( {\overline{R}_{1} - R} \right)\) is replaced by \(L_{R} \left( {\overline{R}_{2} - R} \right)\) and the initial most preferred tax schedule no longer finances redistribution. If the migration constraint is ineffective, the optimal welfare corresponding to redistribution \(\overline{R}_{2}\) is attained by an increase in R which is funded by a rise in tax rates at the top (lower or equal to \(\overline{\overline{\tau }}\)) because the same deviation from the most preferred taxation brings more taxes to finance redistribution when this deviation is applied at the top of the income ladder.Footnote 10 When the migration constraint is effective, the optimum is defined by relation (8) and the government cannot increase taxation for incomes above \(\hat{I} = y(\hat{h}_{1} )\). The rise in redistribution leads to increase the tax rates from \(\tau_{y} (h)\) to \(\theta_{y} (h)\) for the incomes y(h), \(h \in \left[ {\hat{h}_{1} ,\hat{h}_{2} } \right]\), where \(\hat{h}_{1}\) is the optimum of the welfare function \(W(h)\) characterized by \(\overline{R} = \overline{R}_{1}\), and \(\hat{h}_{2}\) the optimum of the welfare function \(W(h)\) with \(\overline{R} = \overline{R}_{2}\).

Typically, an external shock such as technological change or offshoring to emerging countries lessens earnings at the bottom of the income ladder and incites governments to increase redistribution and thereby taxes. When the migration constraint is effective, this rise in taxes applies to the households in the middle of the income spectrum and the affected households are located increasingly low on the income ladder (in Fig. 12, the income threshold \(\hat{I}\) moves to the left). Hence, the increase in redistribution implies a decrease in progressivity. This generates a redistribution–progressivity tradeoff.

Discussion: Progressivity, Redistribution and Social Democracy Curse

The social democracy curse is the situation in which a policy improving the position of low incomes requires to hurt the position of middle incomes, impeding to attract the votes of both the lower and the middle class.

From a simple model in which (1) governments collect income taxes for redistribution and (2) individuals can migrate to escape from taxation, we have shown that globalization significantly modifies the shape of tax policies.

First, the tax and redistribution scheme experiences three successive stages (Proposition 2). Above a certain level of the migration cost, the redistribution goal can be combined with progressive taxation. Below this level but above a second level of cost, the redistribution objective requires income taxation to be regressive at the top. Below this last level of migration cost, the expected redistribution cannot be achieved, and there is no equilibrium in the successive optimal decisions of governments which become volatile.

Second, the reduction in migration costs reduces progressivity, fosters regressivity at the top and generates a tradeoff between tax progressivity and redistribution (Propositions 3 and 4). This tradeoff arises when the no-migration constraint becomes effective.

Determined by entering the total income of the sole national residents in the government’s utility function, those findings are still valid when considering the total income of all nationals or the total income of all residents. They consequently apply to the three cases analysed in the literature.

Those results are in line with observed facts and provide an explanation for the observed concomitance of (1) growing social and redistribution expenditures and (2) growing inequality in most advanced economies. In the last thirty years, income tax progressivity has decreased and regressivity at the top is observed in a majority of advanced economies (Section “Stylized Facts and Literature”). In addition, we find that both a decrease in migration cost and an increase in redistribution lead to a downward displacement of the tax burden on the income ladder, generating a middle class curse already highlighted in several works (e.g. Simula and Trannoy 2005, 2010, 2012). This also increases inequality (the after tax and redistribution Lorentz curve moves down in the middle and the Gini rises) and the financing of redistribution contributes to this increase when the migration constraint is effective. In contradiction with the common belief, redistribution and inequality become complementary. This gives credence to Grimalda et al. (2020) conclusion that the redistribution frame should be rethought in the age of hyper-globalization because of high income earners’ mobility and tax competition.

The decrease in migration costs leads to a reduction in both redistribution and progressivity, and maintaining (or increasing) redistribution implies to lower progressivity, generating thereby a redistribution–progressivity tradeoff. This result is important because, in in the after-war period and until the early 1980s, redistribution and tax progressivity were complementary tools of anti-inequality policies. First, tax progressivity permits to finance redistribution. Second, by concentrating the tax burden on high incomes, it significantly decreases inequality by acting on both tails of the income spectrum.

Both the constraint on tax progressivity and the redistribution–progressivity tradeoff jeopardize the position of social democracy on the political exchequer.

First, the constrained country is the one with the highest progressivity, which is the characteristic of social democratic governments. Note that, if the conservative country has a most preferred schedule which is regressive at the top the result is similar to that presented in the case \(\partial \theta /\partial y < 0\) (Figs. 10, 12) but with a decreasing at the top schedule which both comes sooner and is more pronounced.

Second, the traditional social democratic project consisted in redistributing in favour of low incomes by taxing the highest incomes. This permitted to realize an implicit political alliance between the lower and the middle class. The gain for the lower class was redistribution. The gain for the middle class was threefold. First, tax progressivity shrunk the income differential between the middle and the upper class. Second, a share of redistribution was captured by the middle class through social insurance and education. Third, redistribution made a number of lower class children escape from their social origin and integrate the middle class, which reinforced its weight in the society. The progressivity–redistribution tradeoff destroys the bases of social democracy because it makes the interests of the lower and the middle class to diverge. On the one hand, if the government does not want to increase the tax burden of the middle class, it must accept the impoverishment of the lower class and the lower middle class, which has occurred in the USA (Alvaredo et al. 2018). On the other hand, if redistribution towards the lower class is augmented to limit poverty, this is detrimental to the middle class which suffers an increase in its tax burden, as in several European countries.

Finally, the model predicts that governments’ tax policies result in no migration of the richest. However, income tax-related migration does exist in several advanced countries at the top of the income ladder. Three major reasons can explain this. In a democracy with electoral competition, politicians are reluctant to reduce taxes on the richest because of their high visibility (Bracco et al. 2019), and they may prefer to let a limited number of rich leave the country than to lose the elections. In addition, certain countries have set a twofold income tax scheme, where the rich immigrants are less taxed than the rich national residents. Finally, the emergence and development of a global elite with no national tie and no migration costs result in the fact that countries cannot avoid the migration of some tax bases.

Notes

The KOF index of globalization is published by the KOF Swiss Economic Institute of the ETH Zurich. The index is available for a large number of countries from 1970 and has three dimensions: economic, social and political globalization. The social globalization index combines three components: (1) personal contacts, which measure the personal interactions between one country and abroad (telecom traffic, journeys, number of immigrants, number of letters), (2) information flows which measure the potential flows of information between one country and other countries, and (3) cultural proximity denoting the openness of the population to international cultural standards. It is clear that the rise in those components leads to both lower monetary cost and lower cultural and psychological costs of migrating and living abroad. The original contribution introducing the index is exposed in Dreher (2006).

(1) Optimal marginal tax rate schedules depend on ability distribution; (2) The optimal marginal tax schedule could decline at high incomes; (3) A flat tax with a universal lump-sum transfer could be close to optimal; (4) The optimal redistribution rises with wage inequality; (5) Taxes should depend on personal characteristics as well as income; (6) Only final goods ought to be taxed, and typically uniformly; (7) Capital income ought to be untaxed, at least in expectation; (8) in stochastic, dynamic economies, optimal tax policy requires increased sophistication.

If the two countries have the same income distribution but different sizes with the Foreign country being N times bigger than the Home country, then the Foreign country total income is \(\overline{Y}* = N\int_{0}^{1} {y(h){\text{d}}h} = N \times \overline{Y}\).

The reason for this assumption will appear when the social welfare function will be presented.

It is in line with the efficiency cost of redistribution being small in closed economies (Grimalda et al. 2020).

We could also endogenize the migration of low incomes due to social transfers and, provided that the unit cost of migration is shown to be decreasing with income (see Fig.7), demonstrate that low incomes have no incentive to migrate under realistic conditions. This would nevertheless complicate the model with no analytical gain.

Function (6) refers to the Home country. The Foreign welfare function is similar.

Both \(\widetilde{\Delta R}\) and \(\widetilde{\Delta \tau }\) decrease with C and hence increase with globalization.

As the marginal losses due to the redistribution gap and to the tax rate deviation are equal at the optimum, this leads to an optimal redistribution below \(\overline{R}_{2}\).

References

Alvaredo, F., L. Chancel, T. Piketty, E. Saez and G. Zucman. 2017. World Inequality Report 2018. http://wir2018.wid.world/.

Benedetto, G., S. Hix, and N. Mastrorocco. 2020. The rise and fall of social democracy, 1918–2017. American Political Science Review 114(3): 928–939.

Bierbrauer, F., C. Brett, and J.A. Weymark. 2013. Strategic nonlinear income tax competition with perfect labor mobility. Games and Economic Behavior 82: 292–311.

Bracco, E., F. Porcelli, and M. Redoano. 2019. Political competition, tax salience and accountability. Theory and evidence from Italy. European Journal of Political Economy 58: 138–163.

Bucovetsky, S. 2003. Efficient migration and income tax competition. Journal of Public Economic Theory 5(2): 249–278.

De Mooij, R.A., and S. Ederveen. 2008. corporate tax elasticities: A reader’s guide to empirical findings. Oxford Review of Economic Policy 24: 68–97.

Dhillon, A., M. Wooders, and B. Zissimos. 2007. Tax competition reconsidered. Journal of Public Economic Theory 9(3): 391–423.

Dreher, Axel. 2006. Does globalization affect growth? Evidence from a new index of globalization. Applied Economics 38(10): 1091–1110.

Feld, L.P., and E. Reulier. 2009. Strategic tax competition in Switzerland: Evidence from a panel of the Swiss Cantons. German Economic Review 10(1): 91–114.

Foster, M., A. Llena-Nozal and V. Nafilyan. 2015. Trends in Top Incomes and Their Taxation in OECD Countries. OECD Social, Employment and Migration Working Papers, No. 159, OECD Publishing. https://doi.org/10.1787/5jz43jhlz87f-en.

Grimalda, G., A. Trannoy, F. Figueira, and K.O. Moene. 2020. Egalitarian redistribution in the era of hyper-globalization. Review of Social Economy. https://doi.org/10.1080/00346764.2020.1714072.

Hindriks, J. 1999. The consequences of labour mobility for redistribution: Tax vs. transfer competition. Journal of Public Economics 74: 215–234.

Hou, A.Y.-C., R. Morse, and W. Wang. 2017. Recognition of academic qualifications in transnational higher education and challenges for recognizing a joint degree in Europe and Asia. Studies in Higher Education 42(7): 1211–1228.

Johannesen, N. 2014. Tax evasion and Swiss bank deposits. Journal of Public Economics 111: 46–62.

Kleven, H.J., C. Landais, E. Saez, and E. Schultz. 2014. Migrations and the wage effects of taxing top earners: Evidence from the foreigners’ tax scheme in Denmark. Quarterly Journal of Economics 129(1): 333–378.

Lehmann, E., L. Simula, and A. Trannoy. 2014. Tax me if you can! Optimal nonlinear income tax between competing governments. Quarterly Journal of Economics 129(4): 1995–2030.

Mankiw, N.G., M.C. Weinzierl, and D.F. Yagan. 2009. Optimal taxation in theory and practice. Journal of Economic Perspectives 23(4): 147–174.

Mirrlees, J.A. 1971. An exploration in the theory of optimal income taxation. Review of Economic Studies 38: 175–208.

Mirrlees, J.A. 1982. Migration and optimal income taxes. Journal of Public Economics 18: 319–341.

Peixoto, J. 2001. Migration and policies in the European Union: Highly skilled mobility, free movement of labour and recognition of diplomas. International Migration 39(1): 33–61.

Schaltegger, C.A., F. Somogyi, and J.-E. Sturm. 2011. Tax competition and income sorting: Evidence from the Zurich metropolitan area. European Journal of Political Economy 27: 455–470.

Simula, L. and A. Trannoy. 2005. The curse of the middle-skilled workers, Mimeo.

Simula, L., and A. Trannoy. 2010. Optimal income tax under the threat of migration by top-income earners. Journal of Public Economics 94: 163–173.

Simula, L., and A. Trannoy. 2012. Shall we keep the highly skilled at home? The optimal income tax perspective. Social Choice and Welfare 39(4): 751–782.

Tobias, A. 2016. Income redistribution in open economies. Journal of Public Economics 134: 19–34.

Wildasin, D.E. 1991. Income redistribution in a common labor market. The American Economic Review 81(4): 757–774.

Acknowledgements

I am grateful for valuable comments to the participants of the UECE 2020 Conference in Lisbon and to two anonymous referees who helped me to improve this paper.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1: Proof of Lemma 4

Consider the progressive tax and redistribution schedule \(\left\{ {\tau (y),\left[ {\underline {I} ,\overline{I}} \right]} \right\}, \, \partial \tau /\partial y > 0.\)

-

(1)

As \(\tau \left( {\underline {I} } \right) < 0\), \(\tau \left( {\overline{I}} \right) > 0\) and \(\partial \tau /\partial y > 0 \Rightarrow\) There is a unique \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I}\) such that \(\tau \left( {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I} } \right) = 0\) and hence a unique \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{h} = y^{ - 1} \left( {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I} } \right)\). Then: \(\tau (y) < 0, \, y < \underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I}\) and \(\tau (y) > 0, \, y > \underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I}\). The related redistribution \(R = \int_{0}^{{\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{h} }} {\tau_{y} (h)y(h){\text{d}}h} = - \int_{{\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{h} }}^{1} {\tau_{y} (h)y(h){\text{d}}h}\) is unique.

-

(2)

The highest possible redistribution which ensures perfect income equality is attained for \(\tau (y) = \frac {y - \overline{y}}{y}\), \(y \in \left[ {\underline {I} ,\overline{I}} \right]\), where \(\overline{y}\) is the average income. For any redistribution expenditure \(\overline{R}\) below this highest level, all the TR-schedules \(\left\{ {\tau (y),\left[ {\underline {I} ,\overline{I}} \right]} \right\}\) such that \(\overline{R} = \int_{0}^{{\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{h} }} {\tau_{y} (h)y(h){\text{d}}h}\), \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{h} \in \left[ {\underline {h} ,\overline{h}} \right]\), are consistent with \(\overline{R}\).

Appendix 2: The No-reversal Constraint

The no-reversal constraint stipulates that the after-tax income \((1 - \tau (y))y\) increases with income: \(\frac{{\partial \left[ {(1 - \tau (y))y} \right]}}{\partial y} \ge 0\), and hence: \(\frac{1 - \tau (y)}{y} \ge \frac{\partial \tau }{{\partial y}}\). The upper limit of \(\tau (y)\), \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{\tau } (y)\), is determined by the differential equation \(\frac{{\partial \underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{\tau } }}{\partial y} = \frac{{1 - \underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{\tau } (y)}}{y}\) such that \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{\tau } (y) = 0\) for \(i = \underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I}\), i.e. \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{\tau } (y) = \frac{{y - \underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I} }}{y}\). This establishes the no-reversal constraint (5).

Appendix 3: Proof of Proposition 1 and Extension

Proposition 1 When Considering the Total Income of National Residents

Consider one country’s government. It firstly faces the no-reversal constraint: \(\tau (y) \le \underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{\tau } (y), \, \forall y \in \left[ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I} ,\overline{I}} \right]\). Second, it adjusts the income tax to impede national citizens to leave the country (Lemma 2). Third, provided that the redistribution goal can be achieved, it places the country’s tax rates \(\tau (y), \, y \in \left[ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I} ,\overline{I}} \right]\) below the value \(\tau *(y) - c(y)\) to increase the national residents total income and thereby welfare. Finally, we assume to simplify that both countries have the same highest income \(\overline{I}\). Then:

-

(1)

All the \(\left( {\tau (y),\tau *(y)} \right)\) with \(\tau (y) \le \min \left\{ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{\tau } (y),c(y)} \right\}\) and \(\tau *(y) \le \min \left\{ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{\tau } (y),c(y)} \right\},{\text{ y}} \in \left[ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I} ,\overline{I}} \right]\), and such that \(\overline{R} = \int_{0}^{{\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{h} }} {\tau_{y} (h) \times y(h){\text{d}}h}\) and \(\overline{R}* = \int_{0}^{{\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{h} *}} {\tau_{y}^{*} (h) \times y*(h){\text{d}}h}\), are Nash equilibria of this non-cooperative game since the Home government has no incentive to lessen the tax rate \(\tau (y)\) below \(\tau^{*} (y) - c(y)\) once \(\tau^{*} (y) \le c(y)\), and the Foreign government has no incentive to lessen \(\tau^{*} (y)\) below \(\tau (y) - c(y)\) once \(\tau (y) \le c(y)\). This establishes feature 1 of Proposition 1.

-

(2)

Given the no-migration constraint, the highest possible tax rate applied to income \(\overline{I}\) is \(c(\overline{I})\). Consequently, amongst the above-defined equilibrium tax schedules, the highest progressive tax schedule is \(\left\{ {\tau (y)} \right\}, \, y \in \left[ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I} ,\overline{I}} \right]\) such that \(\tau (y) \le \min \left\{ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{\tau } (y),c(\overline{I})} \right\}\) for the Home country and \(\left\{ {\tau *(y)} \right\}, \, y \in \left[ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I} *,\overline{I}} \right]\), such that \(\tau *(y) \le \min \left\{ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{\tau } *(y),c(\overline{I})} \right\}\) for the Foreign country. This establishes feature 2 of Proposition 1.

Extension When Considering the Total Income of All Residents or that of All Nationals

In addition to the no-reversal constraint, the demonstration of Proposition 2 is based on two features which are true when considering the total income of national residents: (1) the no-migration constraint which stipulates that governments never let nationals migrate at the optimum, and (2) the fact that they are incited to attract rich foreigners to increase the total income. If these two features are still valid when considering the total income of all residents (national and foreign) and when considering the total income of all nationals (resident and non-resident), then the above demonstration can be extended to the cases in which Y depicts the total income of all residents or the total income of all nationals.

The no-migration constraint (Lemma 3) is still true in the case of the total income of all residents because the migration of national residents reduces this total income.

The no-migration constraint is still true in the case of the total income of all nationals because the migration of some of them reduces this total income by the amount of taxes they pay in the foreign country, whereas those taxes would have remained in the total income of nationals if they had not moved abroad because of redistribution.

Finally attracting foreign taxpayers always improves social welfare whatever the considered case because it always increases total income, either by the amount of their incomes (when considering all residents’ total income) or by the amount of taxes they pay for redistribution to the nationals (when considering all nationals’ or national residents’ total income).

Hence, Proposition 1 is valid in the three cases, as well as Proposition 2 (proof below) which is an extension of Proposition 1.

Appendix 4: Proof of Proposition 2

In Fig. 9, the decrease in C makes both the curves c(y) and \(c(\overline{I})\) to move downwards. Assume that curves \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{\tau } (y)\) and c(y) intersect at an income level lower than \(\overline{I}\), which occurs sooner or later when c(y) moves downward. The decrease in c(y) lowers the levies \(T = \int_{0}^{{\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{h} }} {\min \left\{ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{\tau }_{y} (h),c_{y} (h)} \right\}y(h){\text{d}}h}\) related to the tax schedule \(\left\{ {\tau (y) = \min \left\{ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{\tau } (y),c(y)} \right\},\left[ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I} ,\overline{I}} \right]} \right\},\) as well as the levies \(T_{{{\text{prog}}}} = \int_{0}^{{\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{h} }} {\min \left\{ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{\tau }_{y} (h),c_{y} (\overline{I})} \right\} \times y(h){\text{d}}h}\) related to the tax schedule \(\left\{ {\tau (y) = \min \left\{ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{\tau } (y),c(\overline{I})} \right\},\left[ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I} ,\overline{I}} \right]} \right\}\), with \(T_{{{\text{prog}}}} < T\). Then:

-

(1)

When C reaches C1 such that \(c_{1} (\overline{I}) = C_{1} \times \overline{I}^{\beta }\) and \(T_{1} = \int_{0}^{{\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{h} }} {\min \left\{ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{\tau }_{y} (h),c_{y} (\overline{I})} \right\}y(h){\text{d}}h} = \overline{R}\), the highest progressive tax schedule \(\left\{ {\tau (y) = \min \left\{ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{\tau } (y),c(\overline{I})} \right\},\left[ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I} ,\overline{I}} \right]} \right\}\) is just sufficient to achieve redistribution \(\overline{R}\). When C moves under C1, the highest progressive tax schedule no longer covers redistribution \(\overline{R}\). To achieve \(\overline{R}\), the social planner must set a regressive at the top schedule.

-

(2)

When C reaches \(C_{2} < C_{1}\) such that \(T_{2} = \int_{0}^{{\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{h} }} {\min \left\{ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{\tau }_{y} (h),c_{y} (y)} \right\}y(h){\text{d}}h} = \overline{R}\), the highest equilibrium tax schedule \(\left\{ {\tau (y) = \min \left\{ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{\tau } (y),c(y)} \right\},\left[ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I} ,\overline{I}} \right]} \right\}\) is just sufficient to achieve redistribution \(\overline{R}\). When C moves under \(C_{2}\), then the highest equilibrium tax schedule does not fund redistribution \(\overline{R}\) and the social planner can no longer maintain this goal.

Suppose now that \(C < C_{2}\). The government can reach its goal \(\overline{R}\) by setting \(\tau (y)\) just below \(\tau *(y) + c(y)\) for any \(y \in \left[ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{I} ,\overline{I}} \right]\). The Foreign social planner can lessen a number of \(\tau *(y)\) below the value \(\tau (y) - c(y)\) and set others at a level just below \(\tau (y) + c(y)\) so as to increase both the disposable income (by attracting the y such that \(\tau *(y) < \tau (y) - c(y)\)) and the funding of redistribution (though the taxes generated by the \(\tau *(y)\) just below \(\tau (y) + c(y)\)). The Home government will then adopt the same strategy, and so on ... There is no Nash equilibrium in this situation and the government strategies tend to change over time, becoming thereby volatile.

-

(3)

As \(\int_{0}^{{\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{h} }} {\min \left\{ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{\tau }_{y} (h),c_{1} (\overline{I})} \right\}y(h){\text{d}}h} = \overline{R}\) and \(\int_{0}^{{\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{h} }} {\min \left\{ {\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle\thicksim}$}}{\tau }_{y} (h),c_{2y} (h)} \right\} \times y(h){\text{d}}h} = \overline{R}\), then: the higher \(\overline{R}\), the higher \(c_{1} (\overline{I})\) and \(c_{2} (y)\), and hence the higher C1 and C2.

Rights and permissions

About this article

Cite this article

Hellier, J. Globalization, Income Tax and the Redistribution–Progressivity Tradeoff. Comp Econ Stud 63, 384–410 (2021). https://doi.org/10.1057/s41294-021-00152-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41294-021-00152-5