Abstract

Estimating potential output and the corresponding output gap plays a key role, not only for inflation forecasting and the assessment of the economic cycle, but also for the fiscal governance of the European Union (EU). Potential output is, however, an unobservable and extremely uncertain variable. Empirical measurements differ considerably depending on the econometric approach adopted, the specification of the data generating process and the dataset used. The method adopted at the EU level, which was agreed within the Output Gap Working Group, has been subject to considerable debate. The fiscal councils of the various Member States contribute to the discussion over the output gap modelling. This paper aims at estimating the potential output of the Italian economy, using a combination of five different models proposed by the relevant literature. More specifically, in addition to a statistical filter, we use unobserved components models based on the Phillips curve, the Okun law and the production function. The approach adopted allows to reconcile the parsimony of the econometric specification with the economic interpretation of the results. Estimates of the output gap obtained with the five selected models present important properties: low pro-cyclicity, stability with respect to the preliminary data and consistency with the economic theory. The use of multiple models also enables the construction of confidence bands for the output gap estimates, which are helpful for policy analysis. In the empirical application for Italy, estimates and forecasts of the output gap recently produced by relevant organisations tend to fall within the confidence interval calculated on the basis of the five selected models.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Potential output, i.e. the maximum value of output obtainable by efficiently using the productive factors of an economic system with stable inflation, is a key variable for economic policy. The output gap, the difference between actual output and potential output, identifies both the cyclical fluctuations and the imbalances in the use of the production factors, which have an impact on prices.

Potential output and the output gap are very useful for policy institutions but extremely difficult to tackle empirically. They are unobserved variables, for which statistical offices do not provide figures and which can only be estimated with a very high degree of uncertainty due to a variety of factors. First, the econometric approaches presented in the literature to measure them are many and varied. Moreover, even with the same specification, the choice made by the analyst about the initial conditions and the variances of the stochastic processes can lead to very different measures of potential output (Fioramanti 2015; Fioramanti and Waldmann 2017). Given the approach and the econometric specifications, potential output estimates are also affected by the uncertainty generated by the data. Revisions of official time series and updates of the input macroeconomic forecasts engender further variability in the real-time estimates. As a result, the use of the output gap for economic policy decisions could lead to inappropriate ex post choices (Orphanides and Van Norden 2002). The fiscal policy of the European Union (EU) Member States is affected by the uncertainty surrounding the real-time estimates of potential output and the output gap, as these variables have a significant role in the main EU fiscal rules.

This paper proposes to estimate potential output and the output gap for the Italian economy using multiple models, all estimated by means of the unobserved components approach, as in Zizza (2006), but based on different economic theories. Specifically, we start from simple models that connect the gap with inflation (a bivariate model based on the Phillips curve) and with unemployment (a trivariate model based on the Phillips curve and on the Okun law), possibly corrected to consider structural changes that occurred during Italy’s double-dip recession; a production function is also proposed, characterised by a systemic approach in which the different components are estimated simultaneously, with a multivariate model. Finally, we consider a univariate statistical filter, based on the estimates of the Phillips curve from the bivariate model.

The proposed multi-model approach enables us to take account of a variety of methods proposed in the literature and therefore to provide an economic interpretation of the estimates obtained in the light of different theories. Differently from the multi-model approaches adopted in other studies for the Italian economy (as in Bassanetti et al. 2010) all the models proposed here are estimated with the same econometric approach (the unobserved components of time series). This consistency in the econometrics behind different models is extremely relevant in our context, as it allows for a comparison of the different measures of OG obtained; in this regard, we benefit of the plurality of output gap series obtained in order to build a measure of uncertainty. The econometric specifications of the models are selected taking into consideration the statistical properties and the real-time stability as well as the plausibility with respect to economic theory. This allows us to built a coherent and synthetic measure based on the performance of the five different specifications.

Moreover, the estimates of our models do not depend on a priori constraints or parameters, as in the institutional approach adopted by the European Commission (described in “The European Commission Model” section).

The analysis shows that the bivariate model for GDP and inflation is reliable from a statistical point of view and is consistent with the interpretation of the potential output as the level of GDP that does not generate inflationary pressures. The trivariate model also enables the identification of NAIRU, but is less stable when the information set is updated. The multivariate model, based on the production function, also takes account of the degree of capacity utilisation. This latter is the most suitable for the economic interpretation, but appears less stable than the bivariate model. Finally, the univariate statistical filter of GDP is an alternative to the simple statistical filters, such as the HP, in which the parameters are normally defined independently of the properties of the specific time series under examination.

The paper is organised as follows: after a synthetic review of the most relevant literature, section three outlines the use of the estimates of potential output for the PBO’s institutional purposes. Sections four, five, and six describe the models in detail, while section seven presents an assessment of the models along with some diagnostics. Finally, section eight compares our range of output gap estimates with the measures recently published by other organisations.

Literature Review

The literature on potential output and the output gap is huge, and the models used to extract these unobservable variables refer to different econometric approaches. One can use purely statistical models, which do not incorporate strong hypotheses about economic relations, but are rather based on the properties of time series, as in the case of the Hodrick and Prescott (1997) (HP) filter. An extension of this statistical approach relies on unobservable component models (Zizza 2006). Alternatively, potential output can be estimated on the basis of economic relationships, as in the case of methods based on the production function or on structural models that consider short-term frictions (Parigi et al. 2001; Vetlov et al. 2011). The approaches can be combined, giving rise to hybrid models, in which for example the production function is estimated by jointly extracting the unobserved components of the time series (Proietti et al. 2007; ECB 2018). Another line of analysis, although so far less explored in the literature, relies on large databases. For example, Szörfi and Töth (2018) exploit information drawn from economic surveys on capacity utilisation, Fantino (2018) produces estimates using firm-level data, and Murray (2014) uses principal component analysis to summarise a large number of indicators. Even when the same econometric approach is adopted, several possible combinations are available in the specification of the equations, which are equally acceptable from the statistical properties, however, leading to different estimates of potential output (Jarociński and Lenza 2018; Frale and De Nardis 2018).

The European Commission’s (EC) estimates of the output gap, which are based on the production function according to the Common Agreed Methodology (CAM), often differ from those of other international organisations such as, for example, the International Monetary Fund (IMF) or the Organization for Economic Cooperation and Development (OECD), which nevertheless use similar approaches. Compared with these, the EC estimates tend to be too procyclical and unstable in real time. In the case of Italy, the Ministry of the Economy and Finance (MEF) has several times observed that the estimates of the EC are not always interpretable within the framework of economic theory and are also highly influenced by the choice of parameters for the initialisation of estimates (as documented in the 2018 Economic and Financial Document (EFD)).

Fiscal councils invest in the analysis of potential output and the output gap for various reasons. The quantification of potential growth is useful for analysing the long-term sustainability of the public debt. In the medium term, moreover, the estimation of the output gap is necessary to assess the fiscal stance of fiscal policy, as well as inflation forecasts. Finally, in the short term, the estimation of the output gap identifies the cyclical position of an economy.

In the United States the Congressional Budget Office (CBO) recently documented the evolution of its model (Shackleton 2018), which is based on the production function. In Europe, research in this area has being conducted by various organisations (Casey 2018; Cuerpo et al. 2018; EUIFIs 2018).

In Italy, the Parliamentary Budget Office (PBO) has developed research into potential output already in the past (Fioramanti et al. 2015; Frale and De Nardis 2018).

The Methodology of the PBO

The estimate of potential output plays a central role in European fiscal governance, as it is used to calculate the output gap and therefore the structural balance of the Member States. Starting from January 2015, the European Commission has also used the output gap estimates to characterise the cyclical position of the Member States and therefore to determine the size of the required structural adjustment for individual countries.Footnote 1 Potential output is also used to calculate the expenditure benchmark and to verify the compliance with the debt rule.

The MEF adopts the methodology agreed among the European Commission and the Member States (CAM), which is based on the production function (the model is briefly described in “The European Commission Model” section). The CAM has been criticised by many, for both the lack of transparency of the initialisation of the estimates and the excessive procyclicality of the trend components, in particular the NAWRU, which in the case of Italy is determined on the basis of a model with low statistical fit.Footnote 2 From an econometric point of view, the CAM approach is not systematic because it is a patchwork of different approaches and methods.Footnote 3 Over the years, all of these criticisms have led to a lively discussion between national and European authorities, as well as among analysts.

The institutional duties of the PBO include the endorsement of macroeconomic forecasts and the assessment of the government’s public finance forecasts. The process is governed by a memorandum of understanding with the MEF which, in order to ensure the completeness of the information, shall also provide the PBO with the variables necessary to calculate potential output and the output gap. The PBO should be able to reproduce the European Commission’s estimates in order to assess the MEF’s fiscal policy; in view of the considerable uncertainty surrounding the quantification of the output gap, which in real time differs between the MEF and the EC despite the use of the same model, the PBO has also an interest in using alternative tools and measures of the output gap.Footnote 4

The PBO has conducted studies of potential output and the output gap for the Italian economy since its establishment and has recently focussed on the development of alternative models to the CAM. No dominant model has emerged from these analyses, as different models capture different statistical or economic relationships. It was therefore decided to adopt a multi-model approach, as in the case of the Bank of Italy (Bassanetti et al. 2010). Following this approach, in addition to obtaining a point estimate of potential output and the output gap, a plausibility interval can be generated to provide a measure of the uncertainty of the estimate.

Following the analysis, we selected the five models listed below:

-

1.

a bivariate model for output and inflation;

-

2.

a bivariate model for output and inflation with a cyclical shock in 2009;

-

3.

a trivariate model for output, inflation and the unemployment rate;

-

4.

a multivariate model using the production function approach but with an integrated system to estimate the various components;

-

5.

a univariate statistical filter, the parameters of which are calibrated on the basis of the estimates from the bivariate model in point 1.

Model 1 considers a bivariate relationship between output and inflation, where GDP is decomposed into a trend and a cyclical component, and this latter enters a Phillips curve defined on the GDP deflator. Inflation also depends on the expectations of agents and exogenous foreign variables, such as oil price and the exchange rate. This model represents the minimum structure compatible with the standard definition of the output gap, i.e. the maximum value of GDP that does not cause prices acceleration.

Model 2 is an extension of the previous approach, taking into account the anomalous cyclical conditions of the last decade, inserting an intervention variable in 2009 to foster the fit of the equation on the economic cycle with the historical data.

The two models mentioned above do not allow to consider a critical element in estimating potential output, that is labour market. Therefore, model 1 has been extended to include an equation linking the employment gap to the output gap. In this specification (model 3), unemployment is decomposed into the trend component, namely NAIRU, and in the cyclical component, which is linked to the output gap with a lag of one period. This approach considers the Phillips curve as in the case of the bivariate model and the Okun (1962) law, although the relationship between the output and unemployment gaps is not strictly proportional, but is expressed by means of a coefficient estimated endogenously by the model.

An integrated view of economic phenomena is provided by the multivariate model (model 4), which frames the problem of estimating potential output within the context of the production function. The approach is characterised by multivariate econometric estimates for the factors of production, while in the EC model the NAWRU and trend TFP are estimated separately; GDP is reconstructed on the basis of the factors of production, namely labour, capital and the Solow residual, and the associated trend and cyclical components are then identified. The output gap is obtained as a combination of the gaps of the different series; a capacity utilisation indicator (CUBS) is also considered, calculated using Istat business confidence surveys. This model enables a broader economic interpretation of the phenomena underlying the potential growth of an economy, at the cost of the greater complexity of the structure.

Finally, potential output was estimated with model 5, a statistical filter, similar to the HP filter, characterised by two interesting features. On the one hand, it is calibrated to match the properties of the cycle estimated with the bivariate model 1; on the other hand, it may also be applied to each component of the production function equation in order to derive specific trends that are consistent with the filter GDP series.

In the empirical application for Italy, we have used yearly data from 1970 to 2019 provided by Eurostat and reconstructed for the historical part (before 1997) in the AMECO dataset by the European Commission. For the forward-looking interval, we use the forecast made by PBO for the validation of the Economic and Financial Document of 2019. The choice of annual data versus more disaggregated information (e.g. quarterly data) is bound by the availability of sufficiently long series to disentangle temporary versus structural components. As for the exogenous variables, oil price is collected from the public dataset of the Federal Reserve Bank of St. Louis, while inflation expectations are drawn from the Bank of Italy’s survey of inflation and growth expectations. In the multivariate model, the CUBS indicator computed by the European Commission on the basis of the Business and Tendency survey is also included (see for more details Havik et al. 2014).

Estimating Potential Output Using Unobserved Components Models

Unobserved components models for the time series are a very general but parsimonious framework for decomposing a variable into trend and cycle, on the basis of stochastic components that reproduce its features (for a complete discussion, see Harvey 1989). Following this approach, given a time series \(y_{t}\), for example GDP, we consider the decomposition into two underlying processes \(\mu _t\) and \(\psi _t\), such that:

where \(\mu _t\) represents the long-term trend component, while \(\psi _t\) is the transitory, or cyclical, term.

A very general formalisation of the trend \(\mu _t\) is given by the local linear trend model:

where it is usually assumed that \(\eta _t\) and \(\zeta _t\) are independent causal errors.

The model encompasses a number of cases of special interest for the time series:

-

with \(\sigma ^2_\zeta =0\) the trend is a random walk with constant drift \(\beta _t=\beta _0\). If we also set \(\beta _0 = 0\) the process is a random walk without drift: \(\mu _t = \mu _{t-1}+\eta _t\).

-

if \(\sigma ^2_\eta =\sigma ^2_\zeta =0\) the trend is deterministically linear: \(\mu _t = \mu _0 + \beta _0 t\).

-

if \(\sigma ^2_\eta =0\) the trend is an integrated random walk, \(\Delta ^2 \mu _t = \zeta _{t-1}\). The restriction \(\sigma ^2_\eta =0\) is sometimes called a smoothness prior.

Within the analysis of economic series, the cyclical component \(\psi _t\) is generally represented with a second-order stationary autoregressive process:

The coefficients \(\phi _1\) and \(\phi _2\) can be reparametrised as follows:

where the parameter \(\lambda _c\) is usually interpreted as cyclical frequency with a period equal to \(\tau _c = \frac{2\pi }{\lambda _c}\) and \(\rho\) is the damping factor for the cycle.

This specification has a long tradition in the analysis of time series (beginning with Yule 1927), thanks to its flexibility in modelling cyclical phenomena. This formulation has taken on a leading role in the output gap literature, beginning with Clark (1989).

Unobserved components models can be estimated either by maximum likelihood or by Bayesian techniques. In this paper, we adopt the former approach, but without imposing constraints on the variances of the stochastic processes as done in the CAM.

Bivariate Model for Output and Inflation

In the early 1990s, Kuttner (1994) proposed a model for the US economy based on the bivariate relationship between economic activity and prices. The output gap entered the inflation equation through a Phillips curve and potential output was defined as the level of output consistent with stable prices. The empirical literature has recently highlighted the importance of inflation expectations. Mavroeidis et al. (2014) documented its role in a neo-Keynesian context, which varies depending on the specification of the model and the estimation method; other contributions have been made by Ball and Mazumder (2011), Blanchard (2016) and Coibion and Gorodnichenko (2015). The critical aspects of estimating the Phillips curve for the purpose of analysing Italy’s potential output were examined by Fioramanti and Waldmann (2017), in particular for the accelerationist version of the curve. A central element in the estimation of the Phillips curve also concerns the choice of the price variable.

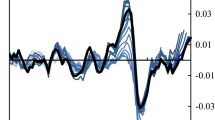

The confidence bands were constructed by adding and subtracting twice the conditional standard deviation of the component. The lower left-hand panel shows the difference between inflation and expectations and the exogenous variables (\(\pi _t-{\tilde{\gamma }}_e \pi _t^e-\sum _k {\tilde{\beta }}_k x_{kt}\)) along with the contribution of the output gap to inflation

Bivariate model for GDP (in log) and inflation (GDP deflator).

Our investigations for Italy seem to favour a price measure based on the GDP deflator, rather than wage inflation, in terms of stability of the results and coherence with the economic theory. Starting from these considerations, we define a bivariate model for GDP (\(y_t\)) and its deflator, as in the “triangle model” presented by Gordon (1997), extended by the inclusion of inflation expectations.Footnote 5 The real GDP series is decomposed into a trend and a cycle component, which corresponds to the output gap. The transitory component follows a second-order autoregressive process, while the trend is represented by a local linear trend model.Footnote 6 The Phillips curve includes an inertial component, inflation expectations and the output gap. The gap enters in both contemporaneous and lagged term, to capture its dynamics in addition to the level effect. The specification is completed by a number of exogenous variables, such as the terms of trade and the oil price. The accelerationist version is nested in this representation (for more details, see the extended formalisation presented in “The Bivariate Model with Output and Inflation” section).

Figure 1 presents the estimates of potential output, its growth rate and the output gap for the bivariate model presented in this section. It also shows the Phillips curve, which seems to fit the historical data well.

The bivariate model has a number of important properties in terms of the stability of the results (which is discussed in “Assessment of the Models” section), statistical significance, parsimony and economic interpretability (as it incorporates the theoretical relationship between output and prices). However, it is a simple model that does not consider the labour market and which is affected by the sharp recessions that have characterised the Italian economy over the last decade. The following sections analyse a number of possible extensions, both to improve the statistical fit of the model and to take into account labour market variables.

Bivariate Model with Cyclical Shocks

The residuals of the bivariate model, presented in the previous section, show an outlier in 2009, in coincidence with the global financial crisis. This induced us to assess the possibility of inserting shocks in the specification, in order to take into account changes in the properties of the series induced by the recession.

Compared with the basic model, a number of special cases have been considered to incorporate the effects of the double dip recession experienced by the Italian economy in the last decade: (i) a change in the level of potential output; (ii) a structural change in the growth rate of potential output; (iii) a shock in the equation for the cycle. We adopted an intervention variable, which eliminates the potential output outlier in 2009 (for more details, see “The Bivariate Model with Output and Inflation” section). The estimated model produces clear evidence of a break in 2009 in all three cases; however, there is no clear difference in terms of statistical significance between the three specifications of the shock. The Great Recession could therefore have produced structural changes in the series, although it is difficult to discriminate between changes in levels from those in the cycle.

In any case, it is plausible that a severe and prolonged economic crisis, such as that of the last decade, can be considered anomalous compared with the characteristics of a standard economic cycle. Ultimately, the bivariate model with the cyclical shock was chosen. From the comparison of Figs. 1 and 2, we see that the model modified with the cyclical shock produces a widening of the gap during the crisis and a more gradual reduction during the recovery.

The confidence bands were constructed by adding and subtracting twice the conditional standard deviation of the component. The lower left-hand panel shows the difference between inflation and expectations and the exogenous variables (\(\pi _t-{\tilde{\gamma }}_e \pi _t^e-\sum _k {\tilde{\beta }}_k x_{kt}\)) along with the contribution of the output gap to inflation

Bivariate model with cyclical shocks for GDP (in log) and inflation (GDP deflator).

Trivariate Model for Output, Inflation and Unemployment

Alternatively, potential output can be obtained starting from the empirical relationship of direct proportionality between the output gap and the unemployment gap, the so called Okun’s low. The existence and stability of this relationship has been repeatedly examined, with mixed results. Ball et al. (2017) consider the robustness of the law fifty years after its formulation and conclude that it appears strong and stable in most developed economies, albeit with differences between countries.

The bivariate model of the previous section can be extended to include a relationship that links the unemployment gap to the output gap. Okun’s law can be specified in two ways: the relationship between the gaps can be strictly proportional, with the output gap generating the common cycle in unemployment, or the unemployment gap can be decomposed into a component proportional to the output gap and a specific one.

The empirical evidence suggests that the relationship between the employment gap and output gap is significant for Italy, although with a lag. The estimate of the trivariate model, presented in detail in “The Trivariate Model with Output, Inflation and Unemployment” section, produces the series shown in Fig. 3. The NAIRU obtained is not a deterministic trend, although it appears indistinguishable from it in statistical terms.

Multivariate Model Based on the Production Function

The production function approach is the most widely used among international institutions to estimate potential output.Footnote 7

The method assumes a neoclassical Cobb-Douglas production function, characterised by constant returns to scale, where aggregate output, Y, is a combination of total hours worked, L, and the capital stock, K:

where A is total factor productivity (TFP) and \(\alpha\) is the elasticity of output to labour.Footnote 8 We decompose output (Y) into potential output (\(Y_{P}\)) and the output gap (\(Y_{G}\)),

(\(Y_{G}\)),

where designating the potential level of the variables with the subscript P, we have

The European Commission estimates the different components of Eq. (5) separately, while in this paper a multivariate model is used, which obtains all of them simultaneously. There have been few attempts to do so: Proietti et al. (2007) considers different specifications of a multivariate system for (5) and recently the European Central Bank has developed a similar model (ECB 2018). The model proposed here assumes that the trend components of the various variables are orthogonal to each other, while the cycles are all correlated. If \(h_t\) denotes total hours worked, \(e_t\) the employment rateFootnote 9 , \(a_t\) the participation rate and \(p_t\) the working age population, we have the following relationship (in logarithms):

In addition, if \(k_t\) denotes the capital stock,

The first equation decomposes GDP using the production function approach. Potential output \(\mu _t\) is the linear combination of the underlying components TFP, labour and capital, while the output gap is the combination of TFP gap and hours worked (decomposed into the contribution of the participation rate, the employment rate and hours worked per capita). Population contributes exclusively in defining the potential output of the economy. To extract the cyclical component of TFP, we consider the composite indicator of capacity utilisation (CUBS) calculated by the European Commission (see “The European Commission Model” section).

Figure 4 shows the trend extracted using the multivariate model, while Fig. 5 presents the gaps of all the element of the production function. The cyclical coherence of the extracted components is rather low, but increases in conjunction with the Great Recession.

The model generates estimates of the output gap for recent years that are larger than those produced with the other models. All the gaps (Fig. 5) tend to close, albeit at different speeds. However, the population and the capital stock contribute to the estimates of potential output, which have declined in the last few years and are not incorporated in the other models.

Statistical Model Based on a Univariate Filter

An alternative approach to extracting the long-term components of (4) consists in the application of a univariate filter to the individual time series.Footnote 10 A popular approach has been the use of the HP filter, which is also applied by the CAM for some variables of the production function (hours worked and participation rate). Although simple and easy to implement, the filter suffers from distortion at the end of the sample (end-point bias), as a result of which real-time estimates are unstable.

In this paper, we use an ad hoc filterFootnote 11 derived from the optimal filter for estimating potential output and the gap in the bivariate model for output and inflation considered in subsection. The filter reflects the statistical properties of the GDP series, in terms of the decomposition of the series into cyclical and trend components and implicitly incorporates the concept of the potential output of the economy as the level at which prices remain stable. The potential output series is obtained by applying the smoother associated to the model of Eq. (1) to the GDP series, imposing the following restrictions derived from the parameters of the bivariate model (described in "Bivariate Model for Output and Inflation” section):

where \(\rho\) is the damping factor of the cyclical wave and \(\lambda _c\) is the angular frequency of the cycle expressed in radians.

The choice of the bivariate model as a reference to constrain the filter parameters was prompted by the fact that it produces more stable estimates than those obtained with the trivariate model (see “Assessment of the Models” section). This stability is reflected by the statistical filter. Overall, the filter is justified by the need to achieve a reduction in volatility, optimised with reference to a Phillips curve model.Footnote 12

The same filter can be applied to the single components of Eq. (4) in order to obtain their trends, as shown in Fig. 6, coherently with the direct estimate of trend GDP. It emerges that the behaviour of hours worked is procyclical at the end of the sample, while the participation rate is less so.

Assessment of the Models

In order to better compare the results of the five models, we present a visual inspection of the different estimates.

In Fig. 7, the estimates of potential output growth since 1970 display a clear downward trend, consistent with the lower growth rates recorded for GDP. This underlying trend is common to all models, but there are differences that depend both on the information set and on the different econometric specification, as shown in Fig. 8 for a shorter time spam.

Comparing the two bivariate models, we see that the cyclical shock, marked by the start of the global financial crisis, produces faster growth of the potential output in expansionary phases; the intervention variable explains part of the decline in output in the first crisis, but subsequently reflects a decrease in capacity. The simple bivariate model produces less volatile estimates of potential output, thus with slower growth prior to the crisis, a negligible loss of potential output during the recession, but slower growth subsequently.

The potential growth estimated using the trivariate model appears even less procyclical than that obtained with model 1. The breakdown of the trivariate model is such that part of the contraction in GDP, attributed to the cyclical component, explains the gap in unemployment through Okun’s law. The negative relationship that links the two cycles implies a smaller NAWRU and therefore a larger potential labour factor in recessions. In the recent years, a large component of unemployment is considered cyclical, so values of the output gap tend to be lower than those in the bivariate model.

In the multivariate model, economic information is mainly connected with the Phillips curve, while for TFP, employment, hours worked and CUBS the decomposition is performed with a statistical cycle-trend model, albeit using a simultaneous estimate. The developments in potential output are more volatile than those obtained with the other specifications, since this model tends to estimate flat trend components. After 2015 the growth in potential output is low, mainly due to increases in the measure of capacity utilisation (CUBS).

Finally, potential output estimated with our filter lies between that estimated with the bivariate model and that under the trivariate model. From the comparison with the HP filter, however, it is evident that the potential output estimated with the models presented here is much less procyclical. This property also improves the stability of the models compared with the preliminary data, as documented in “Real Time Stability” section.

Real Time Stability

As mentioned earlier, policy-makers need to evaluate and take account of the magnitude of revisions, whenever a new observation enters the sample. For this purpose, it is possible to evaluate the characteristic of the proposed models in real time, i.e. considering the information sets that have become available over time. Macroeconomic indicators are regularly revised by the national statistical institutes in order to incorporate new information, so that time series are often modified between one publication and the next (generating the so-called data vintages), sometimes considerably. This phenomenon is very significant in quarterly series, but it also has an impact on annual data. To account for this, the five models selected here were estimated for ten vintages of GDP and deflator released from October 2014 to September 2018. Data revisions influence the estimates through two channels: (i) the statistical filter is applied to a different time series (with more data but also with the revision of past observations), and (ii) the model parameters are re-estimated and since the underlying data partially differ, the estimated parameters may also vary. The first panel of Fig. 9 allows us to evaluate the first effect, as it shows the estimates of the output gap obtained with the statistical filter proposed in section 6, which by construction in the exercise is not subject to variability of the parameters and therefore is only affected by the revision of the input data. As expected, the revisions have a larger impact on the final part of the sample. The other panels of the figure show the joint effect of the variability of data and parameters on the estimates.

Figure 9 shows that the two bivariate models are very stable, even the one with the shock. The series for the unemployment rate, on the other hand, appears difficult to be decomposed into a cyclical and trend component and therefore induces greater instability in the output gap in the models including it, i.e. the trivariate and the multivariate models. This latter appears to be the less stable, in particular in the last decade, a period in which the volatility of the economic cycle has grown. The complexity of the specification generally makes the estimations more difficult, presumably due to a basically flat likelihood.

Inflation Forecasting Ability

All models examined here imply an economic relationship, such as the Phillips curve or Okun’s law. A criterion for evaluating them can therefore be based on the models’ ability to reproduce a stylised representation of the underlying theory and to project it forward. Since all the models consider, more or less explicitly, the Phillips curve, a simple exercise was performed to evaluate their capacity to forecast inflation. The sample was divided into two parts: the estimation interval, in which the model parameters were estimated, and the evaluation interval, for which the forecasts with the various models are compared. The exercise was repeated by recursively moving forward the estimation interval, by one observation at a time, in the range 2012–2018. Using annual data, the number of observations is necessarily small, so the analysis provides a qualitative assessment.

Table 1 shows different measures of prediction accuracy of the proposed models, together with those of a simple benchmark represented by a random walk process. The latter, despite its simplicity, is often a good predictor of inflation measures.

To assess the accuracy of the forecasts, a number of diagnostics are reported. Denoting the one-step ahead inflation forecast with \({\hat{y}}_{t+1/t}\) and the actual value with \(y_{t+1}\), Table 1 gives: the mean error (ME) (based on \({\hat{y}}_{t+1/t}-y_{t+1}\)), which indicates the distortion of the estimate, i.e. if there is a tendency to overestimate or underestimate the variable; the mean absolute error (MAE) which deals with cases of overestimation and underestimation in an analogous way \(\mid {\hat{y}}_{t+1/t}-y_{t+1} \mid\); the root mean squared forecast error (RMSFE) based on the mean of \(({\hat{y}}_{t+1/t}-y_{t+1} )^2\), which tends to emphasise large errors.

With the exception of the trivariate, all models generate better forecasts than the benchmark. The best model is the multivariate, especially after 2014. All the forecasts appear distorted (ME), in most cases producing underestimates except for the multivariate model. The errors tend to be of a similar size (as deduced by the proximity of MAE and RMSFE) without dominant observations. A more extensive assessment of the predictive power of the models would require the application of a statistical test, as the differences between the errors could derive from random factors. However, the small number of observations available makes these exercises unfeasible.

Comparison with the Output Gap Estimates of Other Organisations

The PBO has developed five models, which together with the method agreed at the EU level and the HP filter constitute a set of useful tools for the evaluation of the output gap made by the MEF.

From the operational point of view, the models of potential output incorporate the results of other quantitative instruments of the PBO. As part of the endorsement process, the PBO first develops medium-term macroeconomic forecasts using the econometric model MeMo-It, taking into account the information coming from the nowcasting models. Subsequently, the forecasts for growth, inflation and the labour market are incorporated in the procedures for estimating potential output and the output gap.

The five proposed models are also combined to quantify the uncertainty that characterises the individual measurements obtained. Using the method adopted to endorse the macroeconomic scenario, it is possible to obtain a range of variation defined by the maximum and minimum values, as well as the median.Footnote 13

In addition, the results of the five models could be combined by using suitable pooling weights. These are not immediately available, as the models use a different information set and have different complexity. In principle, the weights should be proportional to the precision in the estimation of the output gap, but the latter is unobserved and thus some alternative validation strategy is needed. One possibility is to use the accuracy by which GDP is predicted one year ahead or, perhaps more consistently, to use weights proportional to the reciprocal of the mean square prediction errors of inflation (as reported in Table 1).

Figure 10 compares the output gap values obtained in the spring of 2019 by the major international institutions and the MEF with the PBO’s median, maximum and minimum, along with the proposed pooled estimates based on the predictive performance concerning inflation. The underlying macroeconomic scenario considered by different institutions is similar; therefore, the divergences in the OG are mainly due to the different models of the potential output. Compared with the time series of the European Commission, the median of the PBO model estimates does not differ considerably, the turning points are basically the same, but our output gap tends to be more volatile, as the potential output is less procyclical. However, the values estimated by the European Commission are almost always within the interval between the maximum and minimum values produced by the PBO models. The pooled measure appears quite similar to OECD estimate for the historical part, while it approaches the values proposed by the EC in the most recent years. As for the MEF’s estimates in the last EFD, which are publicly available for a shorter period, the values lie within or close to the confidence interval up to 2019, while starting from the following year they appear to move apart.

Finally, compared with the output gaps estimated by the OECD and the IMF, the past estimates are often within the range produced by the PBO models, at least from the early 2000s (previously the fluctuation bands are very narrow). From the forward-looking perspective, the OECD’s profile is more similar to that of the MEF, while IMF’s estimates are close to those of the median of the PBO models and the pooled series almost reaches the maximum.

Conclusions

Potential output and the output gap are central to economic analysis and policy. However, their measurement suffers from various sources of uncertainty, ranging from the specification of the model to data availability, as it is well documented in the literature. The difficulties are compounded in the Italian case, for which the long-run decline in the underlying growth rate of the economy and two consecutive recessions of unprecedented depth concurred to make rather difficult to disentangle the permanent dynamics from the transitory ones in both inputs and output.

This paper has proposed an eclectic approach to the estimation of potential output and the output gap. We considered alternative and complementary estimates that incorporate key economic relationships, such as the expectations-augmented Phillips curve, relating the level and change in inflation to the output gap, and multivariate specifications implementing the production function approach. Finally, we proposed an ad hoc filter, derived from a the optimal filter for GDP that distills the trend level of output that does not induce inflationary pressures, as an alternative to traditional filtering methods based on the Hodrick-Prescott filter.

While we cannot deny the intrinsic uncertainty of the measurement, the merits of our approach are the following. The use of multiple models enables an economic interpretation of the results in the light of different theories, and is also useful for assessing the variability of the estimates. The econometric specifications adopted are parsimonious and the estimation techniques do not require the imposition of particular restrictions on the parameters by the analyst, nor arbitrary prior assumptions on their distribution.

Interestingly, the estimates produced by the models are characterised by low procyclicality, which also explains their stability with respect to the preliminary data; the estimates are also consistent with the economic theory, as they improve the accuracy of the inflation forecasts. Estimates and forecasts of the output gap recently produced by other organisations tend to fall within the confidence interval calculated on the basis of the models presented here. Finally, the estimates can be combined so as to produce a consensus estimate using pooling weights that reflect the predictive ability with respect to inflation.

Notes

For more on this issue, see PBO Focus Paper (2015) “The new policies of the European Commission on flexibility in the Stability and Growth Pact”, no. 1 (in Italian).

See Cacciotti et al. (2017).

It adopts a classic approach based on the likelihood for the Phillips curve leading to the calculation of the NAWRU. A Bayesian estimation is made to estimate the trend of TFP, and the HP filter is applied to decompose the other components of output.

The estimates of the MEF and the EC differ because the macroeconomic forecasts of the two institutions are different and because they reflect the choices of certain initial parameters (constraints on the variances of the stochastic processes of NAWRU and the a priori of the TFP model), which have an appreciable impact.

Expectations are drawn from the Bank of Italy’s survey of inflation and growth expectations, reconstructed backwards on the basis of previous surveys.

For the specification of the trend, various alternative formulations were assessed, partly reflecting the observations of Frale and De Nardis (2018).

The parameter \(\alpha\) has been estimated empirically at 0.63 and approximated at 0.65 by the European Commission.

Taking the unemployment rate \(U_t\) (in the original scale, not as a percentage) in place of \(e_t\) is equivalent: if we start with \(e_t = \log (1-U_t)\) and take the first-order Taylor approximation around the average unemployment rate \({\bar{U}}\), we have \(e_t = \frac{{\bar{U}}}{1-{\bar{U}}} + \log (1-{\bar{U}}) -\frac{1}{1-{\bar{U}}} U_t\). For the Italian case, the approximation has an average margin of error on the order of \(10^{-4}.\)

As it is a univariate filter, combining the cyclical components of the variables in (4) (labour, capital and TFP) gives the same result as directly applying the filter to GDP.

As demonstrated by King and Rebelo (1993), the estimator of the trend obtained with an HP filter can be derived equivalently using the Kalman filter and the associated smoothing algorithm for the corresponding state space form with appropriate restrictions. For the state space approach, see Harvey (1989) and Durbin and Koopman (2012).

Nevertheless, the filter is supported in terms of the likelihood compared with the unconstrained filter.

In this regard, it has been demonstrated (Hogg et al. 2015) that the interval between the maximum and minimum estimates is a confidence range around a median value. The only hypothesis that needs to be verified is that the reference variable is continuous, while no specific hypothesis is required concerning the probability distribution.

References

Ball, L., D. Leigh, and P. Loungani. 2017. Okun’s law: Fit at 50? Journal of Money, Credit and Banking 49(7): 1413–1441.

Ball, L., and S. Mazumder. 2011. Inflation dynamics and the great recession. NBER Working Papers No. 17044. National Bureau of Economic Research.

Bassanetti, A., M. Caivano, and A. Locarno. 2010. Modelling Italian potential output and the output gap (Temi di discussione (Economic working papers) No. 771). Bank of Italy, Economic Research and International Relations Area.

Blanchard, O. 2016. The Phillips curve: Back to the ‘60s? American Economic Review 106(5): 31–34.

Cacciotti, M., R. Conti, R. Morea, and S. Teobaldo. 2017. The estimation of potential output for Italy: An enhanced methodology. Rivista Internazionale di Scienze Sociali (4/2018): 351–388.

Casey, E. 2018. Inside the “Upside Down”: Estimating Ireland’s Output Gap. Working Paper No. 5. Irish Fiscal Advisory Council.

CBO. 2001. CBO’s Method for Estimating Potential Output: An Update. Congressional Budget Office Paper.

Clark, P.K. 1989. Trend reversion in real output and unemployment. Journal of Econometrics 40(1): 15–32.

Coibion, O., and Y. Gorodnichenko. 2015. Is the Phillips curve alive and well after all? Inflation expectations and the missing disinflation. American Economic Journal Macroeconomics 7(1): 197–232.

Cuerpo, C., Á. Cuevas, and E.M. Quilis. 2018. Estimating output gap: A beauty contest approach. SERIEs: Journal of the Spanish Economic Association 9(3): 275–304.

De Masi, P. 1997. IMF estimates of potential output: Theory and practice. Working Paper No. 177. International Monetary Fund.

Durbin, J., and S.J. Koopman. 2012. Time Series Analysis by State Space Methods, 2nd ed. Oxford: Oxford University Press.

ECB. 2018. ECB Economic Bulletin (Vol. 7). European Central Bank.

EUIFIs. 2018. A Practitioner’s Guide to Potential Output and the Output Gap. EUIFIs Papers and Reports.

Fantino, D. 2018. Potential output and microeconomic heterogeneity (Temi di discussione (Economic working papers) No. 1194). Bank of Italy, Economic Research and International Relations Area.

Fioramanti, M. 2015. Potential output, output gap and fiscal stance: Is the EC estimation of the NAWRU too sensitive to be reliable. Italian Fiscal Policy Review 1: 123.

Fioramanti, M., F. Padrini, and C. Pollastri. 2015. La stima del PIL potenziale e dell’output gap: analisi di alcune criticità. Nota di lavoro UPB 1.

Fioramanti, M., and R.J. Waldmann. 2017. The Econometrics of the EU Fiscal Governance: Is the European Commission methodology still adequate?. Rivista Internazionale di Scienze Sociali (4/2017): 389–404.

Frale, C., and S. De Nardis. 2018. Which gap? Alternative estimations of the potential output and the output gap in the Italian economy. Politica economica 34(1): 3–22.

Giorno, C., P. Richardson, D. Roseveare, and P. van den Noord. 1995. Estimating Potential Output, Output Gaps and Structural Budget Balances. OECD Economics Department Working Papers No. 152. OECD Publishing.

Gordon, R.J. 1997. The time-varying NAIRU and its implications for economic policy. Journal of Economic Perspectives 11(1): 11–32.

Harvey, A. 1989. Forecasting, Structural Time Series Models and the Kalman Filter. Cambridge: Cambridge University Press.

Havik, K., K. Mc Morrow, F. Orlandi, C. Planas, R. Raciborski, W. Röger, A. Rossi, A. Thum-Thysen, and V. Vandermeulen. 2014. The Production Function Methodology for Calculating Potential Growth Rates & Output Gaps. European Economy Economic Papers No. 535. Directorate General Economic and Financial Affairs (DG-ECFIN), European Commission.

Hodrick, R.J., and E.C. Prescott. 1997. Postwar US business cycles: An empirical investigation. Journal of Money, Credit, and Banking 29(1): 1–16.

Hogg, R.V., E. Tanis, and D. Zimmerman. 2015. Probability and Statistical Inference, 9th ed. Pearson: Oxford University Press.

Jarociński, M., and M. Lenza. 2018. An inflation-predicting measure of the output gap in the Euro area. Journal of Money, Credit and Banking 50(6): 1189–1224.

King, R.G., and S.T. Rebelo. 1993. Low frequency filtering and real business cycles. Journal of Economic Dynamics and Control 17(1): 207–231.

Kuttner, K.N. 1994. Estimating potential output as a latent variable. Journal of Business & Economic Statistics 12(3): 361–368.

Mavroeidis, S., M. Plagborg-Møller, and J.H. Stock. 2014. Empirical evidence on inflation expectations in the new Keynesian Phillips curve. Journal of Economic Literature 52(1): 124–188.

Murray, J. 2014. Output Gap measurement: Judgement and uncertainty. Working Paper No. 5. Office for Budget Responsibility.

Okun, A.M. 1962. Potential GNP: Its measurement and significance. In Proceedings of the Business and Economics Statistics Section, American Statistical Association, 98–103.

Orphanides, A., and S. Van Norden. 2002. The unreliability of output-gap estimates in real time. The Review of Economics and Statistics 84(4): 569–583.

Parigi, G., and S. Siviero. 2001. An investment-function-based measure of capacity utilisation: Potential output and utilised capacity in the Bank of Italy’s quarterly model. Economic Modelling 18(4): 525–550.

Proietti, T., A. Musso, and T. Westermann. 2007. Estimating potential output and the output gap for the Euro area: A model-based production function approach. Empirical Economics 33(1): 85–113.

Shackleton, R. 2018. Estimating and Projecting Potential Output Using CBO’s Forecasting Growth Model. Working Papers No. 03. Congressional Budget Office.

Szörfi, B., and M. Töth. 2018. Measures of slack in the Euro area. Economic Bulletin No. 3. European Central Bank.

Vetlov, I., M. Pisani, T. Hlédik, M. Jonsson, and H. Kucsera. 2011. Potential Output in DSGE Models. Working Paper Series No. 1351. European Central Bank.

Yule, G.U. 1927. On a method of investigating periodicities disturbed series, with special reference to Wolfer’s sunspot numbers. Philosophical Transactions of the Royal Society of London. Series A, Containing Papers of a Mathematical or Physical Character 22(6): 267–298.

Zizza, R. 2006. A measure of output gap for Italy through structural time series models. Journal of Applied Statistics 33(5): 481–496.

Acknowledgements

We are very grateful to Giuseppe Pisauro, Chiara Goretti and Alberto Zanardi for supporting the research project from which this article originated. We also thank Sergio De Nardis for his insightful comments and suggestions in the initial phase of the project. Finally we thank the anonymous referees for their careful reading that helped improving the quality of the manuscript.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

The European Commission Model

In the CAM, the estimates of the potential level of four variables are aggregated within the framework of the production function (see Havik et al. 2014). Total Factor Productivity—TFP (A), unemployment rate (U), participation rate (PR) and hours worked per worker (H). For the last two series, a univariate decomposition using the Hodrick-Prescott filter is adopted. The greatest modelling effort has been devoted to the specification and estimation of the two bivariate models for the two remaining components. The TFP model is treated with Bayesian inference, while that for the NAWRU is based on a maximum likelihood approach. The output decomposition model is not log-additive. A mixed multiplicative-additive approach is adopted (as far as the NAWRU is concerned). The CAM obtains the potential value of TFP using a bivariate structural model that links the logarithm of the Solow residual to a cyclical composite indicator (the CUBS, obtained as a weighted average of measurements from qualitative surveys of capacity utilisation in the manufacturing sector and the climate of confidence in construction and services).

Potential labour input (in terms of total hours worked) is obtained first by factoring L into the product of four components:

where H is the number of annual hours per employed person, E is the employment rate, PR is the participation rate (active population of working age) and POP is the population of working age (those aged 15–74).

The potential level for PR and H is obtained by applying the Hodrick-Prescott filter, while for \(E=1-U\), where U is the unemployment rate, the following decomposition is used

where the subscript P indicates the potential level of the variable. In addition to information drawn from the characteristics of the series and extracted through decomposition of unobserved components, the natural unemployment rate (Non-Accelerating Wage Rate of Unemployment) is obtained using information from the Phillips curve that links the growth rate of wages to cyclical unemployment, represented as a second-order autoregressive process. We thus have

The EC’s estimate of the NAWRU for Italy is based on the accelerationist version of the Phillips curve (see Havik et al. 2014), such that a reduction in the inflation rate in wages is associated with a positive unemployment gap (i.e. the NAWRU is below the observed rate). The estimate is then corrected by an ad hoc procedure for anchoring it to a long-term reference value obtained using a panel estimate that explains the unemployment rate as a function of structural variables for the labour market. The constraints adopted by the EC give rise to procyclical estimates of the NAWRU. Fioramanti (2015) has studied the role played by the constraints imposed on the variance of the model’s stochastic disturbances, highlighting how the choice of upper and lower limits crucially determines the evolution of NAWRU over time.

The Bivariate Model with Output and Inflation

The bivariate model presented in “The Bivariate Model with Output and Inflation” section can be represented as follows:

in which the GDP series, \(y_t\), is decomposed into trend \(\mu _{t}\) and cycle \(\psi _{t}\) and the inflation series \(\pi _t\), measured using the GDP deflator, follows a standard Phillips curve, with an inertial component, \(\pi _t^*\), expectations \(\pi _t^e\), the output gap and a number of exogenous variables \(x_{kt}\), such as the terms of trade and the oil price. The extension with the shock in the cycle is obtained by substituting the specification of the cycle with the following: \(\psi _{t} =\phi _1 \psi _{t-1} + \phi _2 \psi _{t-2} + \kappa _{t}+ \lambda I(t = \tau )\), with \(\tau = 2009\).

Table 2 shows the maximum likelihood estimates of the parameters of the model based on the series from 1970 to 2018. The regression coefficient associated with inflation expectations is not significantly different from 1. The estimated period of the cycle is very high (the estimated cyclical frequency is not different from zero).

The introduction of an intervention variable in the cycle equation—in the specification with cyclical shocks—reduces the estimated variance of cyclical shocks. The coefficient associated with the variable (in the last row of Table 2) is negative and highly significant. Furthermore, it substantially improves the fit of the model, as shown in Table 3 which reports the value of the log-likelihood, the Wald test for the joint significance of the two coefficients of the Phillips curve, together with the test of the hypothesis of the long-term neutrality of the output gap, \(H_0:\theta _0+\theta _1 = 0\), and a number of diagnostics concerning the GDP equation and calculated on the standardised residuals of the Kalman filter: the Ljung-Box autocorrelation test with 4 lags, the Jarque-Bera normality test, the Goldfeld and Quandt heteroscedasticity test and the first-order conditional heteroscedasticity test (ARCH (1)).

In particular, for the specification with a cyclical shock, the output gap has a significant impact (at the 5% level) on the level of inflation, but not on the acceleration of prices. In general, the introduction of the shock improves the statistics.

The Trivariate Model with Output, Inflation and Unemployment

The trivariate model is an extension of the bivariate and is obtained by adding the relationship linking the unemployment gap to the output gap to the specification presented in “The Bivariate Model with Output and Inflation” section:

where \(U_t\) is the unemployment rate and \(\psi _{u,t-1}\) is the unemployment gap. The unemployment gap model is sufficiently generic and contains a number of particularly interesting cases. Where \(\delta _0 = \delta _1 = 0\), the unemployment gap model becomes purely idiosyncratic. Okun law can manifest itself in two ways: rewriting

we see that under the restrictions \(\phi _u=0\) and \(\delta _1=0\), \(\psi _{ut}= \delta _0 \psi _t +\kappa _{ut}\). If \(\sigma ^2_{\kappa u} = 0\), the relationship between the gaps is strictly proportional, with the output gap generating the common cycle with unemployment. Otherwise, in case \(\delta _1 = -\delta _0\phi _u\), \(\psi _{ut}\) has one component proportional to the output gap and a specific component represented by an AR(1) process.

The likelihood associated with the unrestricted model is equal to − 188.73. The maximum likelihood estimates for the parameters are reported in Table 4. The model estimated for the output gap is more persistent than the bivariate model (\(\phi _1\) and \(\phi _2\) are 1.3687 and − 0.4699 respectively) and characterised by cyclical shocks with low variabilities. The relationship connecting inflation to the gap through the Phillips curve seems to have loosened, but the output gap is significantly linked to the unemployment gap, as shown by the Wald test of the hypothesis \(H_0:\delta _0+\delta _1=0\) reported in Table 5. The coefficient \(\phi _u\) is high and significant, and the restriction \(\phi _u=0\) is clearly rejected.

The Integrated Multivariate Model Based on the Production Function

Starting with (6), the integrated multivariate model can be represented as follows. Let \(\mathbf {y}_t = (f_t, a_t, h_t, e_t, c_t)'\), where the series \(c_t\) represents the CUBS composite indicator, \(\varvec{\mu }_t = (\mu _{ft}, \mu _{ht}, \mu _{at}, \mu _{et})',\)\(\varvec{\psi }_t = (\psi _{ft}, \psi _{ht}, \psi _{at}, \psi _{et})',\)\(\psi _t=\varvec{\gamma }' \varvec{\psi }_t,\)\(\varvec{\gamma }= (1, \alpha , \alpha , \alpha )'\).

where it is assumed that \(\Sigma _\zeta\) is a diagonal matrix, while \(\Sigma _\kappa\) is a full matrix. The multivariate cycle has scalar coefficients and is such that the output gap also has an AR(2) representation with the same coefficients. The CUBS replicates that used in the CAM’s TFP model. The maximum likelihood estimation of the matrix \(\Sigma _\kappa\) implies correlations between relatively small cyclical disturbances:

f | a | h | e | |

|---|---|---|---|---|

f | 1.00 | − 0.05 | − 0.30 | 0.32 |

a | − 0.05 | 1.00 | 0.18 | − 0.26 |

h | − 0.30 | 0.18 | 1.00 | 0.10 |

e | 0.32 | − 0.26 | 0.10 | 1.00 |

The complexity of the model and the small number of observations, compared with the large number of parameters, makes the estimation especially difficult and the measurement of standard errors using the Delta Method imprecise. Future applications envisage the use of bootstrap simulation techniques to overcome this drawback.

Rights and permissions

About this article

Cite this article

Proietti, T., Fioramanti, M., Frale, C. et al. A Systemic Approach to Estimating the Output Gap for the Italian Economy. Comp Econ Stud 62, 465–493 (2020). https://doi.org/10.1057/s41294-020-00127-y

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41294-020-00127-y