Abstract

The global property protection gap in natural catastrophe risk has widened steadily over the past 40 years. In historical terms, we find that most underinsurance of extreme events is for climate-related events such as flood and windstorm, but in expected terms, earthquakes comprise the largest share of underinsurance. Using a framework to define the protection gap in historical and expected terms, this paper breaks down the gap by geography and risk type and presents an empirical analysis of the key drivers of the gap. First, uninsured expected Cat losses are estimated using models that combine geophysical vulnerability maps, economic exposure data and insurance market information. Second, each country’s expected (or optimal) property insurance penetration is modelled and compared to actual penetration to derive a measure of property underinsurance. Third, we explore the factors that affect property insurance demand, applying regression analysis to an unbalanced panel data set that includes 53 countries observed over a 15-year period. Several significant economic, financial market, sociodemographic, cultural and institutional variables are identified. The results lead to a taxonomy of the root causes of underinsurance and a set of proposed measures to narrow the protection gap.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction: underinsurance of extreme risks and climate-related events

Globally, an estimated USD 4 trillion has been lost over the past 40 years to extreme natural disaster events, of which USD 2.9 trillion were caused by climate-related events such as windstorm, flood, drought, hail and brushfire, and USD 1.1 trillion by other natural catastrophes such as earthquake and tsunami. Some USD 1.1 trillion were recovered through insurance, and about 2.9 trillion remained uninsured.Footnote 1 This aggregate loss data illustrates the large protection gap for extreme, and particularly climate-related, risks. Narrowing the gap requires a more detailed understanding of the components of the gap and the root causes in order to design relevant and actionable measures.

This paper addresses the protection gap for extreme events by focusing on natural catastrophe (“Nat Cat”) perils, and specifically by analysing the property insurance market. The protection gap is defined as the uninsured portion of losses resulting from an event, namely the difference between total economic and insured losses. The term “underinsurance”, on the other hand, may be defined as the difference between the amount of insurance that is economically beneficial—which may include some rationally chosen self-insurance—and the amount purchased.

A key contribution of this paper is combining historical data and probabilistic models to estimate the protection gap. We exploit a unique dataset of property insurance premiums for 53 countries that allows us to quantify the protection gap in property risks by geography and risk type. First, we assess the trend in losses and coverage over time using historical and modelled data. Combining historical loss data and simulation of future scenarios yields a global estimate of the expected uninsured losses from natural disasters by country. Using a benchmarking approach to estimate underinsurance for a broader scope of property risks—including fire, business interruption and agriculture risks—for 45 countries, underinsurance is estimated by the difference in insurance penetration rates between “best practice” countries and others.

Next, we analyse the drivers of property insurance penetration with a panel dataset of 53 countries and 15 years. Multivariate panel specifications are used to test whether economic, sociodemographic, legal–political, financial and insurance market structural variables can significantly explain variation in the purchase of property insurance. To our knowledge, this is the first paper analysing property insurance in a cross-country panel analysis, which allows greater focus on the uninsured portion of climate-related extreme events. Most previous literature has investigated the non-life insurance industry as a whole, with premium data aggregated across all lines of insurance, including motor, liability, property and speciality.

The paper proceeds as follows: “Theoretical framework, literature review, and hypotheses” summarises the relevant literature, sets out a framework for quantifying the protection gap, and states the hypotheses to be addressed; “Data and descriptive statistics” section explains the data sources and presents the descriptive statistics; “Modelling the expected gap from geophysical scenarios” section quantifies the expected gap using geophysical scenario models; “Measuring the gap from optimal insurance penetration” section quantifies property underinsurance by modelling the difference between potential and actual penetration; “Modelling drivers of the demand for property insurance” section analyses drivers of property penetration with multivariable panel regression analysis; “Dealing with underinsurance” section proposes a taxonomy of measures to close the protection gap, linked to the findings of this paper; and “Conclusions” section summarises the findings.

Theoretical framework, literature review and hypotheses

Framework and literature review

This section summarises the root causes of underinsurance identified in previous literature, including example references, and provides an outline for the investigation of insurance penetration drivers. Although the extensive related literature on non-life insurance demand will not be comprehensively reviewed here, Outreville,Footnote 2 Esho et al. Footnote 3 and TreerattanapunFootnote 4 provide literature surveys on the topic.

Economic reasons for not fully insuring

Risk takers (individuals, households or firms) may choose not to fully insure their assets. There are rational reasons for not fully insuring, given the transaction costs involved. MossinFootnote 5 concludes that it is not optimal to purchase full insurance when the premium contains a loading. For many property insurance lines, cost ratios are around 30 per cent of premiums. Large corporations usually self-insure part of their risk, backed by their globally diversified portfolios. Similarly, individuals may prefer not to insure high frequency/low severity losses and instead use savings or credit as substitutes for risk transfer. Moreover, insurers use retention and co-insurance to reduce moral hazard, leading to lower sums insured.

Affordability is perhaps one of the biggest reasons for underinsurance, particularly for lower-income households and small and medium-sized enterprises. For instance, Eling et al. Footnote 6 and Cole et al. Footnote 7 find a significant price elasticity of demand for microinsurance. On the supply side, insurance contracts cannot be scaled down efficiently for lower-income customers due to transaction costs.Footnote 8 Sustainability of insurance markets requires that insurance premiums are commensurate with the underlying risk. Risk-adjusted premiums can also provide risk takers with price signals about their hazard exposures and thereby encourage risk reduction and mitigation measures. Risk-based premiums also reflect the cost of capital that insurers must hold as buffer against the risk of catastrophic losses.Footnote 9 Risk-adjusted premiums challenge low-income individuals residing in hazard-prone areas. Born and KleinFootnote 10 find trade-offs between regulation that is intended to promote affordability and the competitiveness of the market.

Another reason for underinsurance relates to limitations in the supply of insurance for certain risks. Insurable risks are measurable, have independent loss occurrences, manageable average and maximum losses, premium rates that are acceptable to both insurer and insured and adequate industry capacity.Footnote 11 Insurability can be challenged by situations of ambiguity, in which insurers do not know the probability distribution of a risk.Footnote 12 Some catastrophes change the insurer’s perception of the underlying risk, leading to capacity shortages. However, the industry typically overcomes such periods through the adaptation of data and modelling, leading to a subsequent recovery in capacity. Examples are the market disruptions caused by Hurricane Andrew (1992) and Hurricane Katrina (2005), both of which were followed by significant improvements in risk modelling and waves of new capital entering the market to increase capacity. Low barriers for capital to enter the natural catastrophe reinsurance market facilitated the swift replenishment of capital after each market disruption. In most years, supply-side capacity has not been a constraint on catastrophe risk coverage.Footnote 13

The diversification of a market portfolio can be incomplete for risks with fat tails and dependencies, resulting in more capital requirements and higher premiums.Footnote 14,Footnote 15 Extreme cases of a non-diversification trap could lead to market failure, according to modelled results.Footnote 16 The diversification of extreme event scenarios is increasingly facilitated by the evolution of capital market instruments like Cat bonds which spread risks to a much broader base of investors.Footnote 17 Scenarios that may have challenged diversification in the global reinsurance market are better diversified in the global capital markets.

Financial development

The degree of development of the financial sector strongly affects non-life insurance penetration.Footnote 18 Not only is the insurance industry highly interdependent with financial markets, but also a well-functioning banking system increases consumer confidence in financial transactions. Credit drives the financing of insurable assets and may require insurance to protect collateral, such as when property insurance is required for mortgages.

The religious acceptance of insurance varies across cultures and is therefore part of the financial inclusion topic. Traditional insurance is not permitted as a means of risk management under Islamic law. Park and LemaireFootnote 19 and Treerattanapun4 find that the share of Muslims in the population reduces insurance penetration. Markets for sharia-compliant (takaful) solutions are less developed, accounting for 0.33 per cent of global insurance premiums in 2015.Footnote 20

Institutional framework and market structure

Weak property rights, prevalent particularly in emerging economies, may limit insurance demand. Esho et al. 3 show a positive relationship between the protection of property rights and insurance purchases. GilbertFootnote 21 suggests that dwellings may be uninsurable without legal title or official recognition. Treerattanapun4 finds that corruption and political risk may reduce insurance demand since they are detrimental to the enforcement of insurance contracts.

The competitiveness of insurance markets can further affect product attractiveness. Browne et al. Footnote 22 suggest that the presence of foreign competitors, which often increases competition and product variety, could increase insurance penetration. Market concentration, leading to lower competitiveness, could reduce penetration.

Risk perceptions

Behavioural research indicates that people underestimate the risk of low-probability events such as natural catastrophes. Kunreuther and PaulyFootnote 23 observed that people often fail to purchase insurance against low-probability high-loss events, even when it is offered at favourable premiums. One reason for low awareness about low-probability risks is a lack of experience with rare events. Lazo et al. Footnote 24 find that personal experience is a key determinant of disaster mitigation behaviour; for example, people are more likely to evacuate from hurricanes if they have had previous experience with evacuations. By definition, much of the population has not experienced a 1 in 100 year flood or earthquake in their lifetime, so risk salience for such low-probability catastrophic events would be lower than for more frequent events. Tversky and KahnemanFootnote 25 or KunreutherFootnote 26 referred to this as availability bias: people judge the likelihood of events based on salience and memorability. Furthermore, Dillon et al. Footnote 27 show that people may interpret “near misses” as successful risk prevention rather than as a warning of possible loss. Meyer et al. Footnote 28 see the effects of this low perception in other risk-reducing measures such as disaster preparation.

There is evidence that experience with events changes insurance demand behaviour. Cameron and ShahFootnote 29 find that people who have recently experienced catastrophes report higher probabilities for catastrophic events in the following year. GallagherFootnote 30 observes that affected communities as well as surrounding communities significantly increase flood insurance take-up in the year following floods. The effect on demand declines gradually back to pre-flood take-up levels after about nine years on average. Similarly, Browne and HoytFootnote 31 find that flood insurance purchases are highly correlated with flood losses in the same state in the previous year. In line with a hypothesis that businesses make more rational purchase decisions than individuals or households, Aseervatham et al. Footnote 32 show that catastrophic events have no effect on commercial lines demand.

The expectation of government post-disaster assistance may reduce the demand for private insurance31 in both developed and emerging markets. For example, one study of U.S. homeownersFootnote 33 finds that a USD 1 increase in average aid grants decreases average insurance take-up by about USD 6.

Insurance perceptions

Financial literacy and consumer education on insurance are critical for supporting take-up.Footnote 34 While insurance is an abstract product that relies heavily on trust in the insurance company to pay potential claims, catastrophe insurance adds an additional layer of comprehension and trust.

Homeowners may misperceive the coverage provided by their insurance policies. For example, in a survey of a high flood risk community in the U.S., 35 per cent of respondents reported having flood insurance, but 57 per cent of these were under the false impression that their standard homeowner’s policy covered flooding.Footnote 35 There is also misperception about the availability of government post-disaster assistance. While the majority of individuals expect some form of government post-disaster funding, the majority of federal post-disaster assistance goes to emergency relief services and to rebuilding public infrastructure. In the U.S., 11 per cent of FEMA’s Disaster Relief Fund was spent on individual assistance between 2014 and 2016, while 74 per cent was spent on public assistance.Footnote 36

In emerging economies, many potential customers have never had formal insurance before. For example, surveys by one major microinsurance intermediary, which operates in Africa, Asia and Latin America, shows that 77 per cent of customers have never had insurance before. Especially in markets where there is little previous knowledge of insurance products, personal experience can be critical in making a “first impression” in the market. Cai et al. Footnote 37 and Cole et al. 7 suggest that lack of trust is a significant barrier to participation in formal insurance programmes.

Ease of purchase may also impact insurance buying behaviour. In a recent global survey, while 50 per cent of consumers reported buying insurance policies based on cost, nearly 30 per cent reported that frequency of communication with their insurer was an important factor, while 30 per cent cited the quality of service.Footnote 38 Insurance is an abstract concept that often requires customised explanation.

A model of the protection gap

The historical protection gap can be defined as the difference between total economic losses L and total insured losses I for past extreme events. The following expression describes the total historical protection gap:

where protection gaps for specific events (i) can be summed across different types of extreme events j (= earthquake, windstorm, or flood), countries c and years y. Therefore, the protection gap for any individual historical event is the simple difference in terms L i and I i, and we can segment the data by geography, time and event type to describe trends.

It follows that the modelled (or expected) protection gap can be defined as the difference between total expected economic losses E(L) and expected insured losses E(I):

It is important to note that this model is static, and the expected losses and insured/underinsured values were calculated for one year, 2015.Footnote 39

Calculation of the expected economic loss value is important because each year between 1980 and 2015 the available historical data have been a random draw from the underlying risk distribution. For extreme events, for example 1 in 100 year events, the historical data may not be a good representation of the underlying risk distribution.Footnote 40 Therefore, E(L j,c) gives a better measure of the underlying economic loss expectation in a particular event type (e.g. earthquake, windstorm, flood) and country. E(I j,c) is the portion of the expected loss that is estimated to be covered by insurance in case of a loss of event type j in country c. These assumptions are based on current information gathered on take-up rates and regulatory frameworks for each peril in each country.

This framework will be useful as we discuss measuring and closing the protection gap. To narrow the gap, either E(L j,c) must be reduced or E(I j,c) must be increased. First, we provide descriptive statistics of the historical gap, summarising briefly what we know about trends in climate-related events across event type, geography and time. Next, we model the estimated gap based on simulation of E(L j,c) and industry data gathered on E(I j,c).

Finally, we perform an empirical test of significant determinants of E(I p,c), where p encompasses property lines rather than specific event types. Although the property penetration measure would include coverage for both “extreme” events and “general” property losses, it serves as the best available proxy for changes in take-up rates over time, allowing us to illuminate what could be significant demand-side reasons for the protection gap. In addition, in many markets, having a property policy is a necessary pre-requisite to coverage for natural catastrophe damages.

Variables and hypotheses

Previous studies conclude that economic development is the most important factor affecting insurance purchasing decisions. One reason is that increased income allows for higher total consumption. Another reason is that economic development tends to increase asset values, creating greater demand for insurance to safeguard those assets. Previous literature has focused on GDP per capita, but we observe that consumption per capita is correlated to insurance demand. The intuition behind this is that consumption per capita is a more direct measure of spending habits. We expect consumption per capita to have a strong, positive impact on property insurance demand.

We hypothesise that high exposure to natural catastrophes increases the perception of risk and therefore raises demand for property insurance products. This effect is expected to be stronger for more recent events due to the availability bias described above. On the other hand, many low-income economies have high exposure to natural catastrophes, which could lead to a negative relationship between Nat Cat exposure and property insurance demand if risk perception is outweighed by the income constraint.

Urbanisation: as countries transition from agricultural to industrialised societies, the city becomes the centre of economic development, changing traditional values and risk perceptions. Families become smaller, economic security in the form of informal agreements within a family or village no longer exists, so additional sources of financial security are needed. Insurance is an efficient tool to provide this security. The concentration of potential customers in a city facilitates the marketing and distribution of insurance. Property rights also tend to be better defined in urban areas, with more competitive markets creating higher turnover and more professional property management. Prior studies found weakFootnote 41 or inconclusiveFootnote 42 results for this variable. The tested hypotheses were different though, assuming urbanisation to be a proxy for loss probability.

Mortgage penetration as well as access to the formal financial sector and domestic credit to the private sector are expected to be positively correlated with property insurance penetration. Insurance requirements by mortgage lenders are a major cause of buying property coverage among private households. A higher developed mortgage market allows households to invest more in their homes, raising values that are at risk. At the same time, insurance protection of the collateral facilitates mortgage lending since lenders would otherwise carry the risk of natural catastrophes on top of the credit risk.

Ehrlich and BeckerFootnote 43 find that savings can function as a substitute for insurance in dealing with the economic consequences of disasters. When households are saving more, they have more financial resources available to cover for losses, which means they may need less insurance. At the same time, paying insurance premiums and adding to savings are competing uses of income. Savings are expected to have a negative coefficient.

Access to technology: Internet access provides both increased transparency and information in markets, which could not only increase consumer awareness of the need for insurance but also increase the availability of product and pricing information. Digital and mobile distribution can leapfrog access to insurance in countries where no traditional distribution system has developed. Metrics for internet access and mobile access are expected to be positive drivers of property insurance.

Islamic Law: since traditional insurance is not permitted as a means of risk management under Islamic law, the time-invariant variable is expected to be negatively correlated with insurance market penetration.

Since insurance involves the legal transfer of risk, the value of the contract is dependent on legal rules and the enforceability of property rights through the judiciary. Similarly, we expect metrics for corruption and political risk to be negative factors for property insurance demand.

Data and descriptive statistics

Data sources

Historical data on disaster losses and insured losses are taken from the Swiss Re database of natural and man-made disasters. This database has been created and updated each year since 1973, based on claims reports, data from contemporary news sources and other catastrophe databases such as PCS and EM-DAT. A property event is classified as a catastrophe and included in the sigma database when insured claims exceed USD 48.8 million or total (economic) losses exceed USD 97.7 million. These threshold values are adjusted every year for U.S. consumer price inflation. Further details of the database can be found in the annual sigma report on natural and man-made disastersFootnote 44

Inputs to the catastrophe simulation are GDP by country (or GDP by province for countries where provincial data are available), insurance take-up rate by country and peril, and risk exposure and property concentration by locality. Insurance take-up rate by country and peril are our best approximations, given knowledge of each country’s insurance markets and regulatory frameworks. Property concentration and risk exposure by locality are based on data collected on insured asset portfolios and natural science-based risk factors, which are proprietary data to Swiss Re.

Data on property insurance penetration (property direct premiums as a percentage of GDP) and the market share of the top 10 non-life insurers come from Swiss Re.Footnote 45 Real GDP growth is taken from Oxford Economics. Consumption per capita (in 2010 real dollars), gross domestic savings (percentage of GDP), domestic credit to private sector (percentage of GDP), the percentage of urban population, the share of the industrial sector (percentage of GDP), the penetration of mobile cellular subscriptions (per 100 people) and the penetration of internet users (per 100 people) are taken from the World Bank’s World Development Indicators.Footnote 46 Average historical economic damages from Nat Cat (percentage of GDP) are taken from the World Bank’s 2014Footnote 47 World Development Report.

Indices for the prevalence of foreign ownership, the quality of education, property rights and political risk index are from World Economic Forum.Footnote 48 The percentage of adults with loans for home purchase and the share of adults with an account at a formal financial institution come from the World Bank/IMF Financial Access survey, available in World Bank.Footnote 49 The freedom from corruption index (in which a higher score indicates lower corruption) is from the Heritage Foundation.Footnote 50 The share of Muslim population by country is taken from Wikipedia.Footnote 51 As a proxy for property insurance prices, we used Guy Carpenter’s regional Cat price indices, retrieved via Bloomberg.

Trends in the historic Cat loss data

Based on historical data, our calculations indicate that there is a substantial natural catastrophe protection gap worldwide. Swiss Re’s sigma data show that economic losses from natural disaster events averaged USD 171 billion each year in the last decade (2007–2016), with 72 per cent of that uninsured.Footnote 52 Earthquakes, floods and windstorms are the costliest perils, particularly in areas of high population and property value concentration.

The relative importance of the three major natural world perils—storms, floods and earthquakes—in the natural catastrophe protection gap has been relatively stable over time. Individual events generate considerable variation in uninsured losses, but from 1990 to 2016 the average uninsured portions have been around 53 per cent for windstorms and 87 per cent for both, floods and earthquakes.Footnote 53 The share of uninsured property losses as a result of natural catastrophes varies by region. Typically, the gap is smaller in the mature (59 per cent) than in emerging markets, where an average 94 per cent of economic losses was uninsured (Figure 1).

Emerging economies have consistently larger protection gaps (as a percentage of GDP) compared to mature economies. Their stronger economic growth and higher share of uninsured losses are the cause of the global protection gap growing faster than GDP. Compound annual average growth of uninsured losses (10-year averages) in nominal USD terms was 9.1 per cent globally, 9.4 per cent for emerging economies and 8.8 per cent for mature economies.

The data for emerging markets’ Cat losses are strongly influenced by a few very large earthquakes which limit the ability to interpret growth trends. We therefore separated out the trend for the climate-related perils of wind, flood, drought, etc. Compound annual average growth of weather-related uninsured losses (10-year averages) in nominal USD terms was 11.3 per cent for emerging economies and 7.2 per cent for mature economies. This compares to average nominal GDP growth of 10.3 per cent and 5.2 per cent, respectively.

In relation to economic activity measured by GDP, global uninsured losses are growing, and we see a shift of exposures moving to emerging economies, which are less resilient in coping with the economic disruptions caused by large catastrophes. Figure 2 shows the 10-year average of uninsured weather-related losses as a percentage of GDP since 1990. The data for emerging economies’ uninsured losses are dominated by a clustering of large events in the mid-1990s. Globally, uninsured losses from natural catastrophes have increased from 0.09 per cent of GDP in 1990 to about 0.17 per cent of GDP in 2016. The increase in global uninsured losses is due to a combination of exposure growth and a shift towards emerging markets.

Weather-related uninsured losses are growing at one (emerging) to two percentage points (mature) faster than GDP. The contribution of economic development to the long-term loss (insured and uninsured) would be even higher if we assumed that exposure growth has a GDP elasticity larger than one. We present below robust empirical evidence from cross-section data analysis—which is insulated from any trends in frequency and severity—for a GDP elasticity of premium volumes of larger than one, especially for emerging economies. Assuming that premiums follow losses and exposures in the long run, we deduct that exposures also grow faster than GDP. We thus conclude that most of the growth in uninsured Cat losses can be attributed to economic development and the shifting patterns of growth to less-insured high-growth economies.

Modelling the expected gap from geophysical scenarios

Methodology

Using a Monte Carlo simulation tool, we estimate expected losses for a sample of 30 countries. The tool contains information on assets and risks by location. Monte Carlo type models generate global hazard maps for windstorm, earthquake and flood. Geophysical scenarios are represented with probability distributions at the sub-national (typically province or zip code) level. Next, a vulnerability module relates the expected damage of various insured objects to the intensity of the modelled events. Then, data on the value of insured objects are added to yield the expected economic loss potential. This is similar to the model that would be used by a property underwriter, but instead of an insured client’s portfolio, our model inputs total estimated value at risk. Finally, information about insurance market conditions is combined with the expected economic loss to estimate what proportion of the loss is insured.

Results

Figure 3 shows the results of the simulation of expected protection gap calculations. Three countries (the U.S., Japan, China) have the largest uninsured Nat Cat risk in absolute USD terms. These are the three largest economies in the world, with large property values exposed, in combination with peak natural risk exposures including tropical storm, earthquake and flood.

Natural catastrophes also pose significant risks to smaller economies in relation to GDP. For instance, as a percentage of GDP, Taiwan, Turkey and Chile stand to lose the most from earthquake risk, while Taiwan, the Philippines, Hong Kong and Mexico would lose most from windstorm risk. Figure 4 shows the combined scenarios for the perils of windstorm, earthquake and flood for the ten most exposed countries of the sample (see Table 4 for model output by country in Appendix). Emerging economies are more vulnerable to suffering from the disruptions caused by uninsured catastrophes.

To complete the probabilistic assessment of the global natural catastrophe property protection gap, the uninsured loss potential for countries not in the sample needs to be estimated. We extrapolate the results to missing countries in proportion to GDP. The resulting estimate of global expected uninsured annual Cat losses is USD 153 billion.

This estimate has shortcomings. On the one hand, it overestimates the protection gap since the modelled total economic losses include some public infrastructure and commercial property where partial self-insurance may be preferred. However, the vast majority of the modelled gap would not fall into the category of optimal self-insurance and can therefore be considered underinsured. On the other hand, it underestimates the protection gap since perils like hail, drought, tornadoes, mudslides and volcanoes are not included in the probabilistic models, suggesting that the gap could be larger.

Measuring the gap from optimal insurance penetration

Methodology

Our next step in measuring underinsurance focuses on identifying the gap between the amount of insurance purchased and the optimal level. Insurance penetration (direct premiums as a percentage of GDP) is used as a metric for insurance demand.Footnote 54 On average, countries with higher incomes are more able to afford insurance and have accumulated more assets to be protected. Economic development is measured by consumption per capita (CPC).Footnote 55

Insurance penetration (p) rises with CPC, but different levels of CPC are accompanied by different CPC elasticities of penetration. The development of insurance is slower in the first stages of economic development then grows more proportional (i.e. elasticities larger than one) than for middle-income countries and ultimately slows down again for higher-income countries. These are properties of the classic “S-curve” model that has been used in previous analyses of insurance data.Footnote 56

In the case of c 3 < 1, penetration increases with real GDP per capita, and the minimum and maximum penetration are

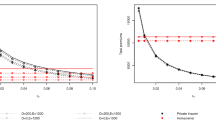

Using a logistic model, we estimated a “best practice benchmark” (p*) for insurance penetration for a cross-section sample of 45 countries. The modelled curve represents the average relationship between economic development and penetration, but the better-insured countries set the benchmark (p* > \(\hat{p}\)). Since there is more variation in penetration rates for emerging economies, countries are grouped into three categories: low, medium and high consumption per capita.Footnote 57 As a proxy for the best practice benchmark, we used the difference of the top quartile to the median within each of the three consumption ranges to lift the modelled curve to a higher level. Due to the poor fit of the curve for the poorest countries (all actual values are below the curve), the uplift of the best practice curve begins at zero and is gradually phased in for the low-income group of countries (Figure 5).

Results

Summing up the shortfalls for all the countries below the elevated benchmark curve yields an estimated general property risk underinsurance of USD 74 billion for the 45 countries in the sample. See Table 4 in the Appendix for the results of \(\hat{p}\) and p* by country.

After extrapolating for missing countries, the global estimate amounts to USD 85 billion.Footnote 58 Middle-income economies are most underinsured in relation to GDP. This group includes many high-growth markets where a rapidly growing middle class has accumulated substantial wealth over the last 10 to 20 years. Yet, insurance buying patterns in these countries still lag, suggesting that risk perceptions, buying behaviour and other hurdles, such as barriers to entry and inefficient market structures, still need to be overcome.

There are limitations to the application of a logistic function.Footnote 59 The symmetrical design implies that low-income countries are as slow in advancing from low penetration at the earliest stages of development as high-income countries are in decelerating when reaching maturity. Empirical evidence in our sample indicates a poorer fit of the logistic model for low-income countries compared to high-income countries. On the other hand, linear models to the income–insurance relationship face theoretical shortcomings since greater-than-one elasticities lead to unreasonably high values of the penetration rate. Non-linear functional forms can be used to put an upper bound on the elasticity. However, the empirical evidence for saturation of the property insurance penetration is weak. A linear or double-log model may therefore be appropriate for modelling drivers of insurance. As a robustness check, we performed the benchmark analysis with a double-log model, which produced almost identical quantitative results (Figure 6).

Modelling drivers of the demand for property insurance

Methodology

To investigate trends in insurance buying behaviour, we estimate several multivariate specifications. Property insurance penetration p c,y (property premiums as a percentage of GDP) is the dependent variable, where normalising by GDP allows for time series and cross-section comparisons, controlling for inflation and exchange rate fluctuations. Economic development is measured by consumption per capita (CPC). Other explanatory variables measure economic, sociodemographic, legal and cultural factors. Some of these variables are time series (θ) and some are time invariant (φ).

The unbalanced panel data set covers annual data from 2000 to 2015 for 51 countries, which accounts for about 90 per cent of the world’s GDP. We use several model specifications to assess the robustness of variables given the potential multi-collinearity between indicators of economic development. Model 1 has a log–log specification with the complete set of independent variables, Model 2 is reduced to significant variables, Model 3 is log-linear with all independent variables and Model 4 is a random effects model with all variables. Model 5 reports the results of specifications in which the variable of interest and CPC are the only two explanatory variables.

Results

Table 1 compares the results. Significant economic variables include consumption per capita, GDP growth in the prior decade and savings. Prior economic growth has a negative impact on penetration, supporting the hypothesis that the development of supply and demand for insurance is lagging behind the creation of wealth and income in many fast-growing emerging economies. In line with previous studies, our results show that savings and insurance act as substitutes. Urbanisation and the share of the industrial sector positively impact insurance penetration.

Modelled Cat exposures were less significant than the recent history of actual losses. Average Cat losses from the more recent period (hazard, 2003–2013) were strongly significant, while average losses from the previous period (hazard2, 1993–2003) were less significant. This could support the hypothesis of availability bias that people tend to assess disaster risks by focusing on more recent experience.

Mortgage penetration significantly increases insurance penetration. On the other hand, domestic credit to the private sector as a share of GDP, a more general measure, is weak, likely due to strong correlation with mortgage penetration. Other significant financial development and structure variables were the percentage of adult population with an account at a formal financial institution, the prevalence of foreign ownership and the market share of top 10 insurers. The first captures financial market access and therefore supports insurance buying behaviour. The second variable is a proxy for product diversity, also increasing penetration. Market share measures concentration and shows weak evidence for a negative impact on penetration.

For variables relating to digital distribution, Internet access is weakly positive, while mobile phone access has a negative sign. Interestingly, this negative correlation is driven by the wide dispersion in the number of mobile subscriptions per capita, which can be explained by the common practice of using multiple SIM cards in many low-income countries. Furthermore, access to mobile technology does not measure the availability of mobile insurance products and therefore reflects that product design and market regulation have not yet caught up with technological penetration.

The share of the Muslim population is negatively correlated with insurance penetration. However, in model specifications combined with other variables, we found the evidence to be inconclusive. Similarly, results on metrics for property rights, corruption and political risk were found to be inconclusive in multivariable specifications.

An insurance price index was added to control for the impact of the underwriting cycle on premium volumes and hence on penetration rates. This variable is not significant in changes or levels. Other variables that were tested without significant results included quality of education and population density.

Dealing with underinsurance

Narrowing the protection gap requires either reducing expected losses E(L) or increasing the insured portion E(I). This section outlines a set of measures aimed at either approach, first providing a taxonomy of underinsurance categories and then reviewing specific proposals for narrowing the gap.

Taxonomy of underinsurance

We distinguish four types of underinsurance: entirely uninsured, insured but with certain perils not covered, insured but with restrictions and insured but at too low a valuation.Footnote 60

Entirely uninsured

Some households or businesses do not buy insurance, either because they do not think about it or because they believe that the cost of insurance outweighs the benefit. This group holds the majority of uninsured risk in many emerging markets. Tailored concepts are required to convince buyers in this group to purchase property insurance. Natural catastrophe cover—in particular on a standalone basis—is not likely to be the most effective product offering to promote coverage because disaster events may be very remote according to the uninsured individual’s perception. Risks that rank higher with uninsured consumers, for instance agriculture, motor or health insurance, could be good entry points to introduce insurance buying behaviour. Indeed, mandatory motor liability cover has been the gateway to developing a broad-based personal lines insurance sector in many emerging countries.

Insured, but certain perils are not covered

In this group, insureds typically have a fire policy, but coverage excludes certain perils such as floods and earthquakes. This category is fundamentally different from the previous category in that the general concept of insurance is understood. Policyholders may be unaware that certain perils are not covered, they may not see sufficient benefit in natural catastrophe coverage, or coverage may not be available due to limited insurability. The world’s top two uninsured perils, Japan and California earthquakes, are prominent examples. Other prominent examples include floods in the Netherlands and Canada, and earthquakes and floods in Italy.

Insured, but policy terms are restrictive

In this case, the insured holds a policy that covers natural catastrophes, but the cover is restrictive, perhaps due to limited insurability. Examples are secondary effects of a natural disaster event, such as business interruption, contingent business interruption or loss of income. Normally, more comprehensive coverage is either unavailable or is deemed to be unaffordable for many. Two top protection gaps provide prominent examples: California Earthquake Authority (CEA) and Japanese Earthquake Response programme offer policies that leave homeowners to cover a large portion of the expected losses out of their own pocket.

Insured, but undervalued

In this case, the perils are covered and the policy terms are in line with a desired level of coverage, but the valuation is too low. There is a variety of reasons for undervaluation in both commercial and residential property, including lack of awareness or outdated assessments.

Actions to narrow the protection gap

There are numerous ways to deal with underinsurance and close the protection gap for property risks. The following chapter discusses a range of such measures which relate to findings discussed above. These measures involve insurers and governments enhancing the awareness, attractiveness, access and affordability of insurance. All areas from risk perception and assessment to risk reduction and mitigation and finally to risk transfer are part of a broad solution mix (Table 2). Alternative classifications of measures to narrow the property protection gap can be found, for example, in Schanz and SommerrockFootnote 61 and—with a focus on technology—in Schanz and Wang.Footnote 62

Mitigation, building standards and zoning

In line with our framework, reducing expected losses is one side of closing the gap. Governments, households and firms and the insurance industry all play an important role in establishing and enforcing risk reduction standards. For example, in mature markets such as the U.S., Japan, Canada and Australia, building codes have reduced risks and improved insurability. DeryuginaFootnote 63 found that stricter building codes reduce the amount of money spent by the federal government following a hurricane. Such effective building codes may require elevating buildings in flood risk zones or bracing home frames to foundations and securing gas-fuelled appliances in earthquake risk areas.Footnote 64 Dumm et al. Footnote 65 show that homeowners can capitalise on some of these safety benefits in high-risk areas through increased values of their homes. Governments can also discourage development of high-risk areas through zoning or through providing incentives to relocate from high-risk areas after a disaster.

Insurers can play an important role in encouraging investment in mitigation. Mitigation is a necessary condition for some risks to become insurable. Actuarial and underwriting expertise can help measure the relative costs and benefits of mitigation decisions. Premium rates can provide ex ante incentives for better risk management and prevention investments in physical structures. However, homeowners may be reluctant to make investments due to uncertainty about their ability to capture the benefits of lower premiums in the future. Long-term contract features relating to premium discounts could strengthen the economic incentives to invest in safety features. Long-term contracts can also be tied to the property instead of annually renewable policies tied to the individual homeowner.Footnote 66 Creating industry standards on premium discounts would enable homeowners to capture the payback via lower premiums even after changing insurance carriers.

Homeowners and developers may underinvest in mitigation due to the limited ability to recover the costs in the value of their homes. This is consistent with evidence that housing markets fail to capitalise flood risks into prices of properties.Footnote 67 Safety information is usually not a standard feature in the process of buying and selling a home. Transparency about safety investments could be increased by including this information in data collected and analysed by realtors, appraisers and mortgage banks. Providing the real estate market with the necessary critical amount of data is a public good that may require a regulatory nudge by making data collection on safety features and retrofitting mandatory.

Product design

Coverage may be provided as an opt-out, where property owners in high-risk areas are required to carry insurance unless they specifically decline it. Such framing techniques have been successful elsewhere, for example for enrolment into employer sponsored retirement plans.Footnote 68 The applicability for property insurance remains to be tested.Footnote 69

A related concept is product bundling, which can reduce distribution and underwriting costs and also reduce the decision-making efforts if the Cat cover is added to a larger purchase. To reach farmers in rural or remote regions in the emerging markets, insurers are exploring bundling agricultural insurance products, either as an add-on to existing products and services or through already existing distribution networks. Agricultural insurance can be bundled with, for example, credit products (through banks or microfinance institutions) or input suppliers (via fertiliser stores or seed distributors).

Another area of opportunity for product bundling is in mortgage products. Some mortgage banks require their customers to pay home insurance and property taxes through an escrow system alongside the mortgage payments. This reduces transaction costs and subsumes the insurance purchase/renewal process under the larger cost of housing decision. Findings from our panel data analysis point to a strong correlation between mortgage and insurance penetration. A developed mortgage market can support the demand for property insurance; in turn, property insurance facilitates private homeownership and mortgage financing. However, if customers are unaware of product bundling, they may neglect to continue insuring after paying off a mortgage. Targeted distribution could help to close the protection gap for customers who will soon finish paying mortgages. Moreover, it remains important for insurers to design products and distribution for non-mortgage holders, for example through affiliation with homeownership-related services such as utilities.

Inertia and unwillingness to deal with negative events can cause insured values to lag behind actual exposures. This suggests opportunities for product design with index features, especially in high-inflation environments.

There is also ample room for innovation in policy wording. Simple language, while maintaining product integrity, is an important way for insurers to reach more customers, especially in countries with multiple languages. It can help build awareness by making the concept of insurance more understandable, which is in itself is an important step to building trust in the insurance industry.

Mobile distribution models

Our analysis points to a lag in the development of insurance penetration for fast-growing (emerging) economies. Supporting evidence comes from our empirical result that the lack of access to the formal financial system is negatively associated with developing insurance penetration. Digital and mobile distribution can leapfrog access to insurance in countries where no traditional distribution system has developed yet.Footnote 70 Mobile microinsurance has been sold through partnerships with companies in other sectors that already have close contact with potential customers, such as mobile network operators, pharmacies or agricultural input companies. Three key criteria for successful distribution partnerships are good brand reputation, the capacity to collect payments and frequent customer interactions that allow collection of small premium amounts.

In Sub-Saharan Africa, the most prominent partnerships have been between mobile operators and insurers, facilitated by third-party technology service providers (TSPs). The insurers provide the licences and capital required, and the TSPs offer the technical infrastructure, product design and underwriting customised to the new market. In some cases, the TSPs also provide a full agent network. Mobile network operators provide a trusted brand and customer interface for communications.

Microinsurance

Microinsurance can provide low-income, vulnerable households with affordable insurance products by using product design, distribution and claims management processes that are significantly different from traditional insurance. By providing small amounts of coverage and premiums per person and using culturally specific product designs, microinsurance can be both affordable for low-income populations and financially sustainable for providers. Distribution is often done through existing networks, sometimes bundling the insurance cover with other financial or non-financial products. To keep costs affordable, microinsurance products require an efficient claims handling system, and in many microinsurance business models there is some form of community involvement in the claims process to reduce risk-taking, improve verification and build consumer trust. Trust in the insurance provider is a key determinant of insurance demand.Footnote 71 Lack of product understanding is an important impediment to purchasing insurance.Footnote 72 For property risks, many microinsurance programmes have used weather index-based insurance products to cover crop damages.Footnote 73 By paying claims according to local weather parameters rather than individual damages, index products reduce the costs of underwriting and claims processing. They also allow insurers to overcome the lack of underwriting and claims infrastructure which can be especially helpful in economies with low access to the formal financial sector, including emerging economies that have experienced rapid macroeconomic growth but not fully developed insurance sector practices. Despite the problematic basis risk inherent in index-based products,Footnote 74 there is scope to expand microinsurance to other property types.

Developing the takaful sector

The data in our sample indicate low property insurance penetration for Muslim-majority countries, which suggests that reducing underinsurance in these countries can be more effectively achieved by improving access to sharia-compliant insurance (takaful). Takaful products can help to overcome objections against insurance that are rooted in sharia, or Islamic, law. A thriving takaful industry requires some key factors. First, a comprehensive and consistent regulatory framework can help form a level playing field without an overburdening corporate governance or compliance costs. Second, prescribing one standard model for takaful can help. Also, strict monitoring and enforcement of rules are vital to ensure policyholder protection and trust in the takaful industry. Finally, takaful is dependent on the availability of sharia-compliant assets. While equity and real estate investments are generally available, the market for sukuks (sharia-compliant bonds) must be developed so that takaful companies can match liabilities with assets. Malaysia, with its well-developed regulatory framework, proactive regulator and deeply Islamic financial market, is one of the most advanced takaful markets.

Mandatory insurance programmes

Governments can help further expand the availability of risk transfer solutions to individuals and corporations by introducing compulsory insurance schemes to create a sufficiently large risk community. Compulsory insurance is used in virtually all countries, albeit mostly as part of social security schemes related to health, old age and unemployment, or as compulsory liability insurance (e.g. motor liability insurance). However, mandatory insurance schemes are rare for property Cat perils.

Although the mandatory schemes differ in terms of coverage and institutional set-up, almost all are attached to standard fire policies for buildings. However, with the exception of Switzerland and Iceland, fire policies themselves are not mandatory. Mandatory catastrophe insurance schemes that are not linked to fire policies typically do not achieve broad coverage due to the difficulty of enforcement. For example, in Turkey, residential buildings within municipal boundaries must have earthquake coverage through a private insurance company on behalf of the state-owned Turkish Catastrophe Insurance Pool (TCIP).Footnote 75 Initial take-up rates were low as compliance was not strongly enforced. With a new catastrophe law enacted in 2012, however, take-up improved considerably as homeowners now need earthquake coverage to sign up for electricity or water services, obtain a mortgage, or receive rebuilding aid from the government if their homes are damaged in an earthquake.

In markets such as India and the Philippines, crop insurance is compulsory for farmers seeking credit from banks or financial institutions. The same applies in Brazil for loans from state-owned banks. Compulsory loan-linked agricultural insurance has multiple benefits. It can provide collateral to farmers seeking credit, increase risk awareness, mitigate adverse selection through wider participation, and reduce distribution and transaction costs.

The main advantage of mandatory schemes is that they form the widest possible risk community and eliminate adverse selection. Premiums are often made affordable by standardising premium rates across risk types, allowing the cross-subsidisation of higher-risk policyholders with the premiums paid by lower-risk policyholders. Risk bundling of various types of natural perils can help to improve societal acceptance of such schemes by pooling risks more broadly, though combining risks may be more difficult when there is a high-risk disparity among regions. Finally, in cases where affordability remains the key constraint, voucher or subsidy programmes may be considered to further boost penetration.Footnote 76

Government-backed insurance for risks that are not fully insurable

In many countries, governments also act as insurers or reinsurers for certain risks in order to supplement private schemes. Government “back stop” programmes can facilitate a limited private-sector insurance solution where risk assessment is particularly challenging, and where the magnitude of a potential loss exceeds private sector capacity. Terrorism, for example, remains an uninsurable risk for catastrophic scenarios. First, there is inherent ambiguity about the probability distribution of the risk since acts of terrorism are human acts without a regular historical pattern. In fact, terrorists often deliberately choose circumstances to reduce predictability. Second, acts of terrorism are not independent. In contrast, for most weather-related and other natural catastrophe risks, the private sector has the data and expertise to allow robust modelling, enabling insurance coverage. When the private market can ultimately provide efficient coverage, public sector involvement should focus on facilitating the availability and affordability of insurance schemes, as well as setting standards for risk reduction and mitigation.Footnote 77

There are other public sector funded insurance programmes that target increasing consumer affordability and access rather than market efficiency. Examples include the U.S. National Flood Insurance, the California Earthquake Authority or state-based windstorm pools such as Citizens fund in Florida. These programmes have largely come about as market-correcting responses to specific catastrophe loss eventsFootnote 78 but are not necessarily optimal long-term solutions for sustainable risk transfer. Since the National Flood Insurance Program has gone into debt, the U.S. government has sought to incorporate more private insurance and reinsurance markets.Footnote 79

Public sector insurance programmes

Many government and public sector entities are increasingly utilising new forms of risk transfer. The cost of natural disasters, extreme weather events, climate change and other risks present a growing burden on government budgets in emerging economies. A study by the Bank of International Settlements on the macroeconomic impact of natural catastrophe events concluded that countries with higher insurance penetration had lower indirect costs and a faster economic recovery than less insured countries.Footnote 80

By taking some of the contingent costs of natural catastrophe damage off government balance sheets and into the capital markets, governments—particularly those in emerging markets that may be more severely affected by catastrophic financial losses—can reduce fiscal vulnerability to disasters. Some examples include a sovereign catastrophe bond issued by Mexico with the assistance of the World Bank in 2009, the Caribbean Catastrophe Risk Insurance Facility (CCRIF) that was set up as a donor-backed multi-country disaster relief fund into which governments pay premiums, the similar Pacific Catastrophe Risk Insurance Pilot that is a natural catastrophe programme for several Pacific Island countries, and the African Risk Capacity (ARC) that insures the five participating nations against drought risk, using a modelled loss index based on satellite rainfall data.

Conclusions

Underinsurance of property risks is a global challenge. Much of the protection gap is due to uninsured natural catastrophe risk, which has steadily risen over recent decades (9.1 per cent CAGR in nominal USD from 1990 to 2015). Weather-related uninsured losses grew at the same pace globally and one (emerging economies) to two percentage points (mature economies) faster than GDP. We conclude that most of the historical growth of weather-related economic and insured losses can be attributed to economic development and the shift of growth to less-insured lower-income economies. Given the volatility of Cat loss data, we cannot attribute increased losses specifically to climate change. This does not imply that climate-related factors are not relevant to model expected losses but rather that historical losses are only an imperfect sample of expected losses.

Historical data do not capture all major catastrophe scenarios. Modelling potential future events yields a global estimate of USD 153 billion expected uninsured losses from natural disasters. Underinsurance is not unique to low- and middle-income countries; it is also an issue for high-income countries. In absolute terms, the U.S., Japan and China account for most of the global protection gap (USD 81 billion). Expected losses in emerging economies are not as high in absolute USD terms but can be significantly higher in relation to their economic resources.

Underinsurance falls into several categories: completely uninsured, insured for certain perils, insured with restrictive policy terms (deductibles/exclusions) and insured with asset undervaluation. Certain risks such as some peak natural catastrophes, terrorism, cyber or contingent business interruption, can challenge the bounds of insurability. For individuals, factors like perception of risk, insurance knowledge, affordability, reliance on government post-disaster relief, trust in insurers and ease of doing business can hinder adequate coverage.

We analysed a range of economic, financial, geographic and social variables to identify significant determinants of property insurance penetration. First, increased economic development drives insurance penetration, both by increasing income, which allows for greater spending on insurance, and by increasing the stock of assets at risk. The speed of development matters. Countries that went through rapid growth during the prior decade lag behind in protection compared to countries that reached comparable levels of income and consumption at a slower pace. Beyond economic development, property insurance penetration is driven by financial sector development, access to the formal financial sector, specifically mortgage penetration, openness to foreign competition and low market concentration.

Closing the gap will require specific measures by insurers and governments to change buying behaviour and market structures. Insurers can better design customised products for the most underinsured groups, such as urban dwellers in emerging Asian countries or Islamic markets using takaful, and target distribution to key channels such as mortgage markets. Governments play an important role in setting standards for risk mitigation, building standards and zoning. Some governments have even established government-backed insurance programmes or multi-country insurance funds. They can further extend the reach of risk transfer solutions by introducing compulsory insurance schemes to create a sufficiently large risk community or by using insurance principles to prepare disaster recovery plans for the most economically vulnerable populations.

Notes

1977 to 2016 in 2016 USD terms; Source: Swiss Re database of natural catastrophes.

Esho et al. (2004).

Treerattanapun (2011).

Mossin (1968).

Eling et al. (2014).

Cole et al. (2013).

Demirguc-Kunt et al. (2008).

Kousky and Kunreuther (2014).

Born and Klein (2016).

See Cummins and Weiss (2016) for a discussion on the stability of the U.S. property and casualty industry capitalisation over time.

Kousky and Cooke (2012).

Terrorism risks are examples of dependencies between individual risk scenarios due to their man-made character which limits their insurability. This is a key difference to Nat Cat risks which are mostly independent.

See Cummins and Barrieu (2013).

Park and Lemaire (2011).

Gilbert (2001).

Browne et al. (2000).

Kunreuther and Pauly (2004).

Lazo et al. (2014).

Tversky and Kahneman (1973).

Kunreuther (2015).

Dillon et al. (2014).

Meyer et al. (2014).

Cameron and Shah (2012).

Gallagher (2014).

Browne and Hoyt (2000).

Aseervatham et al. (2013).

Kousky et al. (2013).

Old Dominion University Social Science Research Center (2016).

FEMA (2014–2016).

Cai et al. (2009).

Ernst and Young (2014).

Our model does not address how the underlying risk expectation changes due to long-term climate change scenario models, economic development or changes in insurance penetration. This is beyond the scope of this paper and we leave this for future research.

For example, earthquake losses are under-represented in the historical data. They account for 33 per cent of historical losses (1977-2016) but for 51 per cent of modelled exposures.

Ehrlich and Becker (1972).

Swiss Re (2016b).

See annual Swiss Re sigma report on World Insurance: http://institute.swissre.com/research/overview/sigma/

Source: World Bank, http://data.worldbank.org/

World Bank (2014).

World Economic Forum (2015).

World Bank (2015).

Source: Heritage Foundation, http://www.heritage.org/index/explore

Source: Wikipedia, https://en.wikipedia.org/wiki/Islam_by_country

Swiss Re (2015).

Source for these data is Swiss Re's global Cat loss database. This view allocates all losses of one catastrophe to the dominant peril since the miscellaneous data sources do not allow a split-out. For example, flood losses from Hurricane Katrina are allocated to the wind category.

Our analysis shows that the relationship between economic development and insurance penetration is more significant if development is measured by consumption rather than GDP per capita.

The groups are defined for 2014 CPC < 10,000 USD; 10,000–25,000 USD; and CSP > 25,000 USD. See Table 4 in the Appendix.

We applied the average protection gap for each of the three income groups to multiply with the missing GDP for the countries not in groups.

See also Swiss Re (2015).

Schanz and Sommerrock (2016).

Schanz and Wang (2014).

Deryugina (2013).

For a review of cost–benefit analyses on disaster mitigation measures see Shreve and Kelman (2014).

Dumm et al. (2011).

Bin and Landry (2013).

Thaler and Sunstein (2008).

See Cole (2015).

See Cole et al. (2013) regarding rainfall insurance in India.

See Giné et al. (2008).

For example, see Barnett et al. (2008).

See Clarke (2016).

World Bank (2011).

See Cummins (2006).

See Jaffee and Russell (1997) for description of the case of market disruption after the Northridge Earthquake in 1994.

See, for example, Michel-Kerjan et al. (2015).

Von Peter et al. (2012).

References

Aseervatham, V., Born, P. and Richter, A. (2013) Demand reactions in the aftermath of catastrophes and the need for behavioral approaches, Working Paper Presented at the American Risk and Insurance Association 2013 Annual Conference.

Barnett, B.J., Barrett, C.B. and Skees, J.R. (2008) ‘Poverty traps and index-based risk transfer productsʼ, World Development 36(10): 1766–1785.

Berliner, B. (1985) ‘Large risks and limits of insurabilityʼ, The Geneva Papers on Risk and Insurance—Issues and Practice 10(4): 313–329.

Bin, O. and Landry, C.E. (2013) ‘Changes in implicit flood risk premiums: Empirical evidence from the housing marketʼ, Journal of Environmental Economics and Management 65(3): 361–376.

Born P. and Klein, R. (2016) ‘Catastrophe risk and the regulation of property insurance marketsʼ, Journal of Insurance Regulation 35(5): 105–139.

Browne, M.J., Chung, J. and Frees, E.W. (2000) ‘International property-liability insurance consumptionʼ, The Journal of Risk and Insurance 67(1): 73–90.

Browne, M.J. and Hoyt, R.E. (2000) ‘The demand for flood insurance: Empirical evidenceʼ, Journal of Risk and Uncertainty 20(3): 291–306.

Cai, H., Chen, Y., Fang, H. and Zhou, L.-A. (2009) Microinsurance, trust and economic development: Evidence from a randomized natural field experiment, Working Paper No. 15396, National Bureau of Economic Research.

Cameron, L. and Shah, M. (2012) Risk-taking behavior in the wake of natural disasters, IZA Discussion Papers No. 6756, Institute for the Study of Labor (IZA).

Clarke, D.J. (2016) ‘A theory of rational demand for index insuranceʼ, American Economic Journal: Microeconomics 8(1): 283–306.

Cole, S. (2015) ‘Overcoming barriers to microinsurance adoption: Evidence from the fieldʼ, The Geneva Papers on Risk and Insurance—Issues and Practice 40(4): 720–740.

Cole, S., Giné, X., Tobacman, J., Topalova, P., Townsend, R. and Vickery, J. (2013) ‘Barriers to household risk management: Evidence from Indiaʼ, American Economic Journal: Applied Economics 5(1): 104–135.

Courbage, C. and Liedtke, P.M. (2003) ‘On insurability, its limits and extensionsʼ, Insurance Research and Practice 18(2): 44–49.

Cummins, J.D. (2006) ‘Should the government provide insurance for catastrophes’, Federal Reserve Bank of St. Louis Review 88(4): 337–379.

Cummins, J.D. and Barrieu, P.M. (2013) ‘Innovations in insurance markets: Hybrid and securitized risk transfer solutionsʼ, in G. Dionne (ed.) Handbook of Insurance, 2nd ed. New York: Springer.

Cummins, J.D. and Weiss, M.A. (2016) ‘Equity capital, internal capital markets, and optimal capital structure in the US property-casualty insurance industryʼ, Annual Review of Financial Economics 8(1): 121–153.

Demirguc-Kunt, A., Beck, T. and Honohan, P. (2008) Finance for All? Policies and Pitfalls in Expanding Access. Washington, DC: World Bank.

Deryugina, T. (2013) Reducing the Cost of Ex Post Bailouts with Ex Ante Regulation: Evidence from Building Codes (July 18, 2013). Available at SSRN: https://ssrn.com/abstract=2314665

Dillon, R.L., Tinsley, C.H. and Burns, W.J. (2014) ‘Near-misses and future disaster preparednessʼ, Risk Analysis, 34(10): 1907–1922.

Dumm, R.E., Sirmans, G.S. and Smersh, G. (2011) ‘The capitalization of building codes in house pricesʼ, The Journal of Real Estate Finance and Economics 42(1): 30–50.

Ehrlich, I. and Becker, G.S. (1972) ‘Market Insurance, self-insurance, and self-protectionʼ, The Journal of Political Economy 80(4): 623–648.

Eling, M., Pradhan, S. and Schmit, J. (2014) ‘The determinants of microinsurance demandʼ, The Geneva Papers on Risk and Insurance—Issues and Practice 39(2): 224–263.

Enz, R. (2000) ‘The S-curve relation between per-capita income and insurance penetrationʼ, The Geneva Papers on Risk and Insurance—Issues and Practice 25(3): 396–406.

Ernst and Young (2014) Global Consumer Insurance Survey. Available at http://www.ey.com/gl/en/industries/financial-services/insurance/ey-2014-global-customer-insurance-survey

Esho N., Kirievsky, A., Ward, D. and Zurbruegg, R. (2004) ‘Law and the determinants of property-casualty insuranceʼ, The Journal of Risk and Insurance 71(2): 265–283.

FEMA (2014–2016) Monthly reports December 2014, December 2015, December 2016. Available at https://www.fema.gov/media-library/assets/documents/31789

Feyen, E., Lester, R. and Rocha, R. (2011) What Drives the Development of the Insurance Sector?—An Empirical Analysis Based on a Panel of Developed and Developing Countries, Policy Research Working Paper No. 5572, World Bank, Washington, DC.

Gallagher, J. (2014) ‘Learning about an infrequent event: evidence from flood insurance take-up in the United Statesʼ, American Economic Journal: Applied Economics 6(3): 206–233.

Gilbert, R. (2001) Doing more for those made homeless by natural disasters, Disaster Risk Management Working Paper Series 1, World Bank, 2001.

Giné X., Townsend, R. and Vickery, J. (2008) ‘Patterns of rainfall insurance participation in rural Indiaʼ, World Bank Economic Review 22(3): 539–566.

Gollier, C. (1997) ‘About the insurability of catastrophic risksʼ, The Geneva Papers on Risk and Insurance—Issues and Practice 22(2) 177–186.

Ibragimov, R., Jaffee, D. and Walden, J. (2009) ‘Nondiversification traps in catastrophe insurance marketsʼ, Review of Financial Studies 22(3): 959–993.

Ibragimov, R. and Walden, J. (2007) ‘The limits of diversification when losses may be largeʼ, Journal of Banking & Finance 31(8): 2551–2569.

Jaffee, D., Kunreuther, H. and Michel-Kerjan, E. (2010) ‘Long-term property insuranceʼ, Journal of Insurance Regulation 29, 167–187.

Jaffee, D.M. and Russell, T. (1997) ‘Catastrophe insurance, capital markets, and uninsurable risksʼ, The Journal of Risk and Insurance 64(2), 205–230.

Kleindorfer, P.R, Kunreuther, H. and Ou-Yang, C. (2012) ‘Single-year and multi-year insurance policies in a competitive marketʼ, Journal of Risk and Uncertainty 45(1): 51–78.

Kousky, C. and Cooke, R. (2012) ‘Explaining the failure to insure catastrophic risksʼ, The Geneva Papers on Risk and Insurance—Issues and Practice 37(2): 206–227.

Kousky, C., Michel-Kerjan, E.O. and Raschky, P.A. (2013) Does federal disaster assistance crowd out private demand for insurance, Working paper 2013–10, Risk Management and Decision Processes Center, The Wharton School, University of Pennsylvania.

Kousky C. and Kunreuther, H. (2014) ‘Addressing Affordability in the National Flood Insurance Programʼ, Journal of Extreme Events 1(1): 1–28.

Kunreuther, H. (2015) ‘The role of insurance in reducing losses from extreme events: the need for public–private partnershipsʼ, The Geneva Papers on Risk and Insurance—Issues and Practice 40(4): 741–762.

Kunreuther, H. and Lyster, R. (2016) ‘The role of public and private insurance in reducing losses from extreme weather events and disastersʼ, Asia Pacific Journal of Environmental Law 19: 29–54.

Kunreuther, H., Meszaros, J., Hogarth, R.M. and Spranca M. (1995) ‘Ambiguity and underwriter decision processesʼ, Journal of Economic Behavior and Organization 26(3): 337–352.

Kunreuther, H and Michel-Kerjan, E. (2010) ‘Market and government failure in insuring and mitigating natural catastrophes: how long-term contracts can helpʼ in J.R. Brown (ed.) Public Insurance and Private Markets. Washington: The AEI Press, pp. 115–142.

Kunreuther, H.C. and Michel-Kerjan, E.O. (2007) Climate change, insurability of large-scale disasters and the emerging liability challenge, NBER Working Paper No. 12821, National Bureau of Economic Research.

Kunreuther, H. and Pauly, M. (2004) ‘Neglecting disaster: Why don’t people insure against large losses? ʼ Journal of Risk and Uncertainty 28(1): 5–21.

Lazo, J.K., Bostrom, A., Morss, R.E., Demuth J.L. and Lazrus, H. (2014) ‘Communicating hurricane warnings: Factors affecting protective behaviorʼ, Submitted to Risk Analysis, June 2014.

McKinsey (2014) Global insurance industry insights: An in-depth perspective. Available at https://www.mckinsey.com/industries/financial-services/our-insights/global-insurance-industry-insights–an-in-depth-perspective

Meyer, R.J., Baker, J., Broad, K., Czajkowski, J. and Orlove, B. (2014). ‘The dynamics of hurricane risk perception: Real-time evidence from the 2012 Atlantic hurricane season’, Bulletin of the American Meteorological Society 95(9): 1389–1404.

Michel-Kerjan, E., Czajkowski, J. and Kunreuther, H. (2015). ‘Could flood insurance be privatised in the United States? A primer’, The Geneva Papers on Risk and Insurance—Issues and Practice, 40(2): 179–208.

Milliman (2017) Global Takaful Report 2017: Market trends in family and general Takaful. Available at http://www.milliman.com/Takaful2017/

Millo, G. (2016a) ‘The S-curve and realityʼ, The Geneva Papers on Risk and Insurance—Issues and Practice 41(4): 608–625.

Millo, G. (2016b) ‘The income elasticity of nonlife insurance: A reassessmentʼ, The Journal of Risk and Insurance 83(2): 335–362.

Mossin, J. (1968) ‘Aspects of rational insurance purchasingʼ, Journal of Political Economy, 76(4, Part 1): 553–568.

Old Dominion University Social Science Research Center. (2016) Life in Hampton Roads survey, Press Release No. 5. Available at http://www.odu.edu/content/dam/odu/col-dept/al/docs/survey/press-release-5-sea-level-rise-flooding-2016.pdf

Outreville, J.F. (1990) ‘The economic significance of insurance markets in developing countriesʼ, Journal of Risk and Insurance 57(3): 487–498.

Outreville J.F. (2011) The Relationship between insurance growth and economic development: 80 empirical papers for a review of the literature, ICER Working Paper No. 12/2011.

Park, S.C. and Lemaire, J. (2011) The Impact of Culture on the Demand for Non-Life Insurance, University of Pennsylvania, Wharton School Working Paper IRM WP2011-02.

Schanz, K.U. and Sommerrock F. (eds.) (2016) Harnessing Technology to Narrow the Insurance Protection Gap. Zurich: The Geneva Association.

Schanz, K.U. and Wang S. (eds.) (2014) The Global Insurance Protection Gap—Assessment and Recommendations, A Geneva Association Research Report. Geneva: The Geneva Association.

Shreve, C.M. and Kelman, I. (2014) ‘Does mitigation save? Reviewing cost-benefit analyses of disaster risk reductionʼ, International Journal of Disaster Risk Reduction 10 (Part A): 213–235.

Swiss Re (2015) Underinsurance of property risks: closing the gap, sigma No. 5/2015.

Swiss Re (2016a) World insurance in 2015: steady growth amid regional disparities, sigma No. 3/2016.

Swiss Re (2016b) Natural catastrophes and man-made disasters in 2015: Asia suffers substantial losses, sigma No. 1/2016.

Treerattanapun, A. (2011) ‘The impact of culture on non-life insurance consumptionʼ, Wharton Research Scholars Journal, Paper 78.

Thaler, R. and Sunstein, C. (2008) Nudge: The gentle power of choice architecture. New Haven, CT: Yale University Press.

Tversky, A. and Kahneman, D. (1973) ‘Availability: A heuristic for judging frequency and probabilityʼ, Cognitive Psychology 5(2): 207–232.

Von Peter, G., Von Dahlen, S. and Saxena, S. (2012) Unmitigated disasters? New evidence on the macroeconomic cost of natural catastrophes, BIS Working Papers No. 394, December 2012.

World Bank. (2011) Turkish catastrophe insurance pool: providing affordable earthquake risk insurance. Disaster risk financing and insurance, case study. Washington D.C.: World Bank.

World Bank. (2014) World Development Report 2014: Risk and Opportunity: Managing Risk for Development. Washington, D.C.: World Bank.