Abstract

This article empirically investigates whether the level of non-performing loans (NPLs) affects the bank lending behaviour using the bank-level data across 42 countries, spanning over the period from 2000 to 2017. We find a negative and statistically significant relationship between NPL and bank loan growth. This impact is not geographically restricted and is confirmed for the EU, non-EU, advanced, and emerging countries subsamples. We also examine the channels through which NPLs affect loan growth. Our results show that the association between NPL and loan growth is more pronounced for well-capitalized banks. We find no evidence in support of an effect of asset management companies on the negative association between NPLs and loan growth. In addition, our results are robust with respect to alternative measure of credit risk and different specifications.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The global financial crisis of 2008 exposed deteriorating asset quality of European banks as a possible constraint on financial intermediation and further expansion of credit. We empirically investigate whether a higher level of NPLs leads to a decrease in lending activity, using annual bank financial data across EU and non-EU member countries for 6,434 banks in the 2000 to 2017 period. Our results show a robust support that a higher level of NPLs is associated with a reduction in the level of lending. This finding is statistically significant across several econometric specifications and robustness test. The result is also economically significant. Specifically, an increase in the level of NPLs for one standard deviation is associated with an expected decrease in lending for 0.096 standard deviations.

We find that the negative association between NPLs and bank loan growth is stronger for well-capitalized banks. A potential explanation could be that the effects of high levels of NPLs might increase the cost of capital, which might cause lowering bank lending activity. We report no statistical evidence that asset companies' presence influences the link between non-performing loans and loan growth in a country. In addition, we show that the effect of NPLs on lending activity is less pronounced during the pre-crisis period. From a policy perspective, these results put a question mark over facilitating roles of bank resolution tools as well as strengthened capital regulation in mitigating the effects of NPL overhang on the provision of credit.

The rest of the paper is structured as follows. “Literature review, theoretical framework, and hypothesis development” section reviews the literature and presents the theoretical framework and hypothesis development. “Data and methodology” section discusses the data and variables used in our empirical analysis. “Empirical model” section describes the model and method of estimation. “Results of regression analysis” section presents the empirical results, whereas “Robustness checks” section provides robustness checks. “Conclusion” section summarizes our findings and sets out conclusions.

Literature review, theoretical framework, and hypothesis development

In an extensive review of the evidence, Aiyar et al. (2015) point out that many countries in the Southern parts of the Euro area, as well as Eastern and Southeastern Europe experienced high levels of non-performing loans (NPLs), which impaired bank lending through profitability, capital, and funding channels. Makri et al. (2014) find that non-performing loans were strongly correlated with macroeconomic and bank-specific factors.

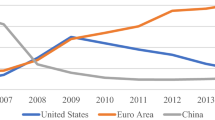

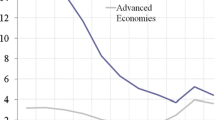

The level of NPLs in the Euro area increased substantially during the crisis, from a low of 2.5% at end-2007 to as high as 7.7% at end-2013. This only declined somewhat to 6.7% by mid-2016 as a result of concerted policy actions taken in a number of EU member countries, notably on portfolio segments targeting and on- and off- balance sheet exposures (ECB, Annual report 2016). At the same time, double-digit pre-crisis credit growth plummeted and never fully recovered, with loan growth rates only surpassing 2.3% in December 2015 and rising to 4.7% in December 2016. These co-movements beg the question: to what extent and under which conditions do NPLs affect bank lending behaviour?

Conceptually, the relationship between NPLs and bank lending runs in both directions. On the one hand, lowering lending standards associated with rapid credit expansion may lead to greater levels of NPLs in the future (Erdinc and Abazi 2014; Shahzad et al. 2019; Chavan and Gambacorta 2019). Koudstaal and Wijnbergen (2012) found that banks with more troubled loan portfolios engage in excessive risk-taking behaviour in a study of US banks from 1993 to 2010. Furthermore, Dell’Ariccia and Marquez (2006) further mention the interaction between the loan market's informational structure and bank lending volume, backing a positive association between credit growth and risky loans at the aggregated level. Klein (2013) along with Keeton (1999) shows that rapid loan growth leads to increased loan losses. On the other hand, higher levels of NPLs tie down bank capital, reduce bank net income, and narrow access to funding due to higher perception of risk by market participants (Aiyar et al. 2015). Ibrahim and Rizvi (2018) analyse the relationship between credit risk and credit growth for conventional and Islamic banks. They found that higher credit risk is associated with lower credit growth, regardless of whether the banks are Islamic or conventional. These factors may in turn constrain future lending. The focus of our article is on this second relationship, which is particularly relevant in the aftermath of the last financial crisis.

Our paper is closely related to the study by Cheisa and Mansilla-Fernández (2019), which investigates the impact of NPLs on the cost of capital, lending, and liquidity supply. Their results revealed that the cost of capital acts as a transmission channel for the negative effect of NPLs on lending supply and liquidity creation (see also Cucinelli 2016; Vo 2018; Chavan and Gambacorta 2019). Our contribution is to look at additional factors through which NPLs may affect bank lending behaviour, similar to the approach by Thornton and Di Tommaso (2020). Their study found that bank capital and profitability mitigate the negative effects of NPLs on credit expansion. On top of bank capitalization, we identify the bank size and the presence of asset management companies, mandated with restructuring NPLs, as additional factors, conditioning the effects of NPLs on bank lending. Furthermore, we also expand the geographic and time dimension of research. Whereas earlier studies only used data for Euro zone banks, we include annual bank balance sheet data of banks from EU member states and non-member countries over the period 2000–2017 and distinguish the effects of NPLs in different time periods (before, during, and after the crisis).

Our paper builds on and contributes to the banking literature studying the relationship between bank risks and lending behaviour, in particular loan growth. Several papers highlighted this relationship, with the level of NPLs often used as a proxy for credit portfolio quality. The level of non-performing loans is used as a proxy for credit portfolio quality (see Kuzucu and Kuzucu 2019; Gulati et al. 2019; Kabir et al. 2015; Dimitrios et al. 2016; Klein 2013; Ghosh 2015; Louzis et al. 2012; Salas and Saurina 2002; among others).

In a cross-country study, Louhichi and Boujelbene (2017) showed that the level of NPLs could be seen as a significant factor negatively affecting bank lending activity in addition to the relationship between bank capital and lending (see also Jeong and Jung 2013). In a study of the Japanese banking system, Vithessonthi (2016) emphasized that the relationship between credit growth and NPLs may be time varying: positive before the financial crisis and negative afterwards. These results could imply that a lower quality of bank assets discourages loan growth whereas a higher quality encourages it. Vo (2018) found that bank lending behaviour significantly depends on bank-specific characteristics and macroeconomic factors in a study of Vietnamese commercial banks from 2006 to 2015. The effects of bank risk, measured by credit risk provisions, were insignificant in this study, however. Cucinelli (2015) documented that credit risk, measured by NPLs and loan loss provisions, negatively impacts bank lending behaviour using data from Italian listed and non-listed banks during the 2007 to 2013 period. Focusing on the lending behaviour of Italian banks before and during the recent financial crisis, Cucinelli (2016) also showed that a majority of banks that grew faster before the financial crisis subsequently faced higher levels of NPLs and implemented deeper cuts in lending activity during the global financial crisis. This again points to a negative relationship between NPLs and lending after the onset of the financial crisis. Using a panel dataset of banks in 18 Westerns European countries, Meriläinen (2016) found that decrease in lending growth due to the global financial crisis is also contingent upon the type of bank ownership. In particular, stakeholder-oriented banks (i.e. cooperatives and publically owned banks) experienced less pronounced swings in lending growth.

Whereas the studies above provide an argument for the negative relationship between NPLs and loan growth, it might be possible to construe an alternative explanation. For example, Louhichi and Boujelbene (2017) found a positive relationship between NPLs and loan growth during the financial crisis period in a subsample of conventional (as opposed to Islamic) banks. A potential reason could be that the tendency of banks to undertake risk and expand the loan portfolio increases in the case of higher levels of NPLs. In a similar fashion, Eisdorfer (2008) argued that due to a risk-shifting strategy, financial institutions facing financial contraction are predisposed to increase investment in risky projects or lower quality borrowers. Finally, Chavan and Gambacorta (2019) studied the procyclical behaviour of the NPL ratio in the emerging economy of India. Their results revealed that a one-percentage point increase in loan growth is associated with an increase in the NPL ratio of 4.1%, with response being higher during economic expansions. The reviewed articles led us to the following hypothesis:

Hypothesis 1

Non-performing loans are negatively related to loan growth.

Bank size is considered another important determinant of bank lending decisions (Berger and Udell 2006). Several empirical articles provide different results regarding whether small and large banks react differently in low and high bank riskiness environment. On the one hand, there is evidence that bank size is negatively associated with credit risk and credit growth. Salas and Saurina (2002) found a negative relationship between bank size and bank credit risk for commercial banks in Spain using data on commercial and savings banks over the period from 1985 to 1997. They attributed their results to the fact that larger commercial banks in Spain are substantially more geographically diversified relative to the savings banks. Chouchène et al. (2017) found that bank size has a negative impact on bank lending using 85 French banks from 2005 to 2010 period. This is in line with Schnabl (2012) findings that an increase in the total asset by 10% causes a 0.1% decrease in bank lending. In a study of the effects of government ownership on NPLs, Hu et al. (2004) reported similar results, showing that bank size is negatively related to credit risk among forty Taiwanese commercial banks during the 1996 to 1999 period. Laeven et al. (2016) showed that systemic risk is lower and standalone bank returns are higher in better capitalized banks, with this effect being especially pronounced for large banks (see also Ranjan and Dhal 2003). Also, Košak et al. (2015) documented that larger banks experienced lower credit growth rates than smaller banks during the years before the financial crisis (see also Peek and Rosengren, 1995). In a similar vein, Vo (2018) found that smaller banks in Vietnam were riskier during the financial crisis and generally experienced higher loan growth rates. This led the author to conclude that smaller banks may even increase lending in a time of crisis to compensate for the decrease in profitability.

On the other hand, Stein (2002) argued that small banks have a comparative advantage in lending using soft information whereas large banks dominate in lending using hard information. However, large and complex banks may rely on soft information in their lending decisions about small and medium-sized enterprises when such information can be processed through technical expertise. Similarly, Berger and Udell (2006) pointed out that conclusions that emphasize the disadvantage of large banks in lending to small businesses may be misleading because they fail to take into account the complexity of the actual lending process, including diverse lending technologies and the overall financial structure. This literature narrative points to a possible positive relationship between bank size and lending. Taking both literature views into account, the effects of bank size on lending behaviour could be ambiguous (either positive or negative). This could mean that lending behaviour is affected by the quality of the loan portfolio. This led us to the following hypothesis:

Hypothesis 2

The relationship between NPL and loan growth is influenced by bank size.

The third strand of research pertains to the role of bank capital in determining bank lending behaviour. The main role of bank capital is to help banks cover any losses and insulate them from the propagation of financial shocks and potential insolvency (Košak et al. 2015). From this point of view, more capitalized banks could expand their lending and experience rapid loan growth compared to less capitalized loans. Carlson et al. (2013) found that the positive association between capital ratios and bank lending growth is stronger for banks that experienced loan contraction as opposed to the banks that experienced loan growth using data from the Reports of Income and Condition in the period from 2001 to 2011. Focusing on 125 countries over the period of 1998–2010, Deli and Hasan (2017) showed that in general, capital stringency has a negative effect on loan growth. However, this effect is less pronounced for well-capitalized banks and is completely offset for banks with an equity capital ratio equal to 11%. Similarly, Abdul-Karim et al. (2014) analysed Islamic and conventional banks in 14 Organization of Islamic Conference (OIC) countries over the 1999–2009 period and found that when banks are better capitalized, they are not constrained by regulatory capital adequacy ratio (CAR) requirements, and their lending and borrowing capacity are less impacted by changes in the level of capital. Gambacorta and Shin (2018) found that a 1-percentage point increase in the equity-to-total assets ratio is associated with a 0.6 percentage point increase in lending growth per year. These findings indicate that a larger capital base reduces the banks’ financial constraint, allowing them to grant more loans to the economy (see also Cantú et al. 2019) and provide the grounds for our third hypothesis:

Hypothesis 3

The link between NPL and loan growth is influenced by bank capital.

Asset management companies (AMCs) are considered one of the main recovery and resolution tools to deal with problematic loan portfolios of distressed banks (Gandrud and Hallerberg 2014). The objective of AMCs is to separate non-performing and healthy assets. Mandated with acquiring and managing banks’ non-performing assets, AMCs have played a valuable role in bank rehabilitation in the euro area after the crisis (Lehmann 2017). Lehmann (2017) argued that a large proportion of NPLs ties up banks’ capital and discourages credit supply. Marinč et al. (2014) showed that the level of stringency of capital regulation varies substantially across the EU countries. Gandrud and Hallerberg (2014) showed that banks burdened by distressed and delinquent assets are unable to further supply loans to the economy. In this context, the purpose of AMCs is to stabilize the banking system, reduce the pressure on bank balance sheets, and enable the banks to restart financial intermediation. Based on the abovementioned arguments, we can expect AMCs to be a moderating factor in the relationship between credit risk and bank lending behaviour, which leads us to our last hypothesis:

Hypothesis 4

The link between non-performing loans and loan growth is less pronounced for the banks in the presence of asset management companies.

Data and methodology

Data description

We conduct our analysis using annual bank-level data retrieved from the Fitch Connect database. The sample period ranges from 2000 to 2017. Our sample includes commercial, savings, and co-operative banks from the EU member states and non-EU countries. We only use data on non-consolidated bank financial statements to consider the behaviour of individual bank subsidiaries. We include active and inactive banks for which data are available for at least five consecutive years. We remove negative values for non-performing loans, total assets, and loans to customer deposits and 'winsorize' the remaining dataset at 1% interval to eliminate extreme values. Based on this initial screening, our final sample is an unbalanced panel composed of 6,434 banks with 79,098 observations in 42 countries. All explanatory variables are lagged by one period to avoid endogeneity bias (see Cantero-Saiz et al. 2014). We augment bank-level data with macroeconomic indicators from various sources. Macroeconomic data are obtained from the World Bank (World Development Indicators and International Financial Statistics).

Table 1 provides the descriptive statistics of the variables included in our analysis. First, we present results for the bank-specific variables. The average annual loan growth rate (ΔlogGL) in our sample is 6.4%, ranging from − 74.4% to 105%. The mean share of impaired loans (NPL) is 6.378% with a standard deviation 8.531%, ranging from 0% to 50.25%. The average logarithm of total assets (Bank Size) is 7.139, ranging from 0.095 to 19.889. Its substantial variation underscores the importance of bank size differences in the banking system. Bank capitalization ratio has a mean of 11.698% with a standard deviation of 13.279%, the deposits to assets ratio has a mean 63.59%, whereas the average loan loss provision ratio is 0.80%. The average net interest margin (NIM) is 2.416% and the mean return on average equity (ROAE) is 9.084%, ranging from − 0.06% to 9.29% and from − 49.53% to 63.37%, respectively.

Second, we include two country-level indicators, namely GDP growth and the real interest rate (RIR), to control for the changes in macroeconomic conditions during the business cycle. The averages for GDP growth and RIR in our sample are 1.547% and 3.049%, respectively. Furthermore, we note that some countries have negative GDP growth with a minimum value of − 5.69%, which is reflective of the fact that our sample period includes the global recession after the financial crisis. Finally, the averages of the bank type dummy variables denote the shares of each bank type (commercial, co-operative, and savings bank) in the total sample.

In Table 2, we present the correlations between our key variables. These correlations are generally in line with the underlying economic theory. Furthermore, correlations among our independent variables (all variables, except ΔlogGL) are below 0.8, implying no presence of multicollinearity among the variables in our base model (O’Brien 2007). We recognize that NPL is significantly negatively correlated with loan growth, real interest rate, deposits to total assets ratio, and the return on average equity. The correlations between loan growth, bank size, and GDP growth are positive and highly significant. Capitalization is significantly positively correlated with the loan growth rate.

Empirical model

Our baseline model investigates the impact of non-performing loans on loan growth, controlling for the effects of bank-specific variables and country-level indicators. In line with the recent literature on bank lending determinants in panel data studies (e.g. see Salas and Saurina 2002; Košak et al. 2015), our model is specified as follows:

where \(\alpha_{i}\) is the intercept, whereas \(\rho\), \(\beta\), \(\gamma\), \(\delta\), ∂, and \(\theta\) are the coefficient vectors.

Our dependent variable, \(\Delta \log LG_{i,j,t}\), is the loan growth rate for bank i, located in country j, in year t (see Sanfilippo-Azofra et al. 2018; Košak et al. 2015; Laeven and Majnoni 2003; Gambacorta and Mistrulli 2004). Our main explanatory variable, \(NPL_{i,j,t - 1}\), represents the non-performing loans ratio, measured by total impaired loans over total gross loans for bank i, located in country j, in year t − 1. In line with Louzis et al. (2012), Tarchouna et al. (2017), Vithessonthi (2016), and Ghosh (2015), we use the NPL ratio as a measure of credit portfolio quality. An increase in the value of the ratio represents a worsening quality of the loan portfolio. We expect the NPL ratio to have a negative effect on loan growth. We also include the one-year lagged dependent variable (\(\Delta \log LG_{i,j,t - 1}\)) in our model to capture the persistence of loan growth rates.

We account for several bank-specific control variables in the \(Bank_{i,j,t - 1}\) matrix. We use the natural logarithm of total assets for bank i, located in country j, in year t at the end of each year \(Bank size_{i,j,t}\). The expected relationship between bank size and lending is ambiguous and could be either positive (see Thornton and Di Tommaso 2020; Abdul-Karim et al. 2014; Hau et al. 2013) or negative (see Fang et al. 2020; Vo 2018; Košak et al. 2015; Puri et al. 2011). \(Capitalization_{i,j,t}\) is the ratio of equity over total assets for bank i, located in country j, in year t. According to Foos et al. (2010) and Kishan and Opiela (2006) banks that are more solvent play an important role in lending. Thus, a positive relationship is expected. \(Deposits/Assets_{i,j,t}\) is the ratio of total customer deposits over total assets for bank i, located in country j, in year t. \(ROAE_{i,j,t}\) is the return on average equity for each bank i, located in country j, in year t. We use ROAE as a proxy for management efficiency (Bonin et al. 2005) and expect its relationship with loan growth to be positive (Iwanicz-Drozdowska and Witkowski 2016). We use ROAE due to the observed increase in the equity capital of banks on the global market (see Iwanicz-Drozdowska and Witkowski 2016; Athanasoglou et al. 2008; among others). \(NIM_{i,j,t}\) stands for the net interest margin for bank i, located in country j, in year t. We use NIM as a measure of core bank profitability (Iwanicz-Drozdowska and Witkowski 2016).

Additionally, we control for the impact of macroeconomic factors in the \(Macro_{i,j,t - 1}\) matrix, which includes two country-level indicators. \(GDP growth_{j,t}\) denotes the annual percentage growth rate of GDP in country j, in year t and serves as a proxy for credit demand as mentioned in Klein (2013) and Gambacorta and Mistrulli (2004). We expect a positive relationship between loan growth and GDP growth. \(RIR_{j,t}\) is the real interest rate in a country j, at time t.

Finally, we account for different bank specializations in the \(BankType_{i,j,t}\) matrix. The dummy variables included in this matrix distinguish commercial, co-operative, and savings banks basted on ownership and organizational characteristics of banks (commercial dummyi, co-operative dummyi, and savings dummyi); \(Year_{t}\) denotes yearly dummy variables to control for unobserved time specific effects; \(\varepsilon_{i,j,t}\) represents the error term. The standard errors are robust and clustered at the bank level.

We setup two data estimation approaches. First, we use the fixed and random effects estimators with robust standard errors to account for unobserved heterogeneity across banks (Micco and Panizza 2006; Carlson et al. 2013). Second, we use system generalized method of moments (GMM) estimator for dynamic panel data (see Arellano and Bover 1995; Blundell and Bond 1998) to resolve endogeneity issues and to obtain consistent and efficient estimates. We use lags of 1 up to 3 as instruments for our explanatory variables in order to address the problem of endogeneity. We use the Hansen J specification test to test the overall validity of the instruments which confirms the consistency of our estimation results. We test the assumption of serially uncorrelated errors for the first-order autocorrelation AR(1) and the second-order autocorrelation AR(2) (see Arellano and Bond 1991; Roodman 2006; Baum et al. 2003; Baum 2006). The null hypothesis of the second-order serial correlation AR(2) is that the errors in the first-differenced equation exhibit no second-order serial correlation. We confirm the validity of instruments chosen and no presence of the second-order autocorrelation which indicates that our GMM estimate coefficients are consistent and unbiased.

Results of regression analysis

Baseline results

We begin our analysis by estimating the baseline regression in (1) using both RE, FE, and GMM models (see Table 3). We use Hausman test (Hausman 1978) to choose between FE or RE estimator. Hausman specification test leds to a rejection of the RE in favour of the FE specification (with Prob > chi2(25) = 0.0000 < 0.05). The estimated regression coefficient between the NPL ratio and loan growth is negative and statistically significant in all specifications. The NPL coefficient ranges from 0.00235 for GMM to 0.00270 for FE. This result confirms our Hypothesis 1 and is consistent with the results of previous studies (Cucinelli 2015, 2016; Louhichi and Boujelbene 2016). The result is also economically significant. For example, in model (3), a one standard deviation increase of the NPL ratio is associated with an expected 0.096 standard deviations decrease of the loan growth rate (where 0.096 equals to the estimated NPL regression coefficient, 0.00235, multiplied by the standard deviation of NPL, 8.531, and divided by the standard deviation of loan growth, 0.208). Furthermore, the positive and significant coefficient of the lagged dependent variable is also in line with expectations and reflects persistence in the growth of loans (Table 3, column 3).

Our results in Table 3 also confirm that both bank-specific variables and macroeconomic indicators are important determinants of bank lending behaviour. Bank size is positively and significantly (at 5% level) related with loan growth in the static specification (the coefficient is insignificant, but still positive in the dynamic specification). This indicates that larger banks experience higher credit growth rates than small banks. The deposit-to-assets ratio coefficient is positive and significant in all estimations. The same is true for the capitalization coefficient. Higher capital ratios are related to increased bank lending activity, as banks with more equity capital are less constrained by regulatory capital requirements. This finding is consistent with those of previous studies (see Foos et al. 2010). Return on average equity and net interest margin coefficients are significant and positive in all estimations. The last result reveals that increased bank profitability, which may be associated with effective management practices, is conducive for bank lending activity.

Next, we turn to the effect of macroeconomic indicators. The results in Table 3 suggest that loan growth is positively and highly significantly correlated with GDP growth, and negatively and highly significantly correlated with the real interest rate. This implies that better economic conditions positively affect credit growth. This result corroborates the empirical findings by Louhichi et al. (2017), Vithessonthi (2016), and Dell’Ariccia and Marquez (2006).

Channels through which NPL affects bank lending behaviour

Having identified the main determinants of loan growth, we analyse the interaction terms between the non-performing loans and bank-specific variables in order to investigate the channels through which the level of NPLs impacts the loan growth. We introduce three interaction terms: non-performing loans and bank size, non-performing loans and bank capitalization, and non-performing loans and asset management companies. The results of these additional regressions are presented in Table 4. In line with our previous findings, the level of NPLs is negatively and significantly related to the level of loan growth. All bank-specific variables and macroeconomic indicators are similar to those in the basic model specification.

The interaction term between the level of NPLs and bank size is negatively related to the level of loan growth but the relationship is only statistically significant in column 1 but not in column 2. The results provide some evidence that the effects of a higher level of NPLs on loan growth are more pronounced for larger banks but the results are not conclusive because of statistical insignificance of the interaction term in column 2. Therefore, we cannot doubtlessly confirm Hypothesis 2.

The interaction term between the level of NPLs and bank capitalization is also negatively and significantly related to the level of loan growth. At first take, this result is counter-intuitive, since it implies that the negative effect of NPLs on loan growth rate is more pronounced for better capitalized banks. However, this may be due to the possibility that higher bank capital ratios (on a non-weighted basis) are a reflection of the underlying loan portfolio risks. Banks with riskier loan portfolios have higher levels of NPLs and require more capital to cover loan loss provisions and adhere to capital adequacy standards. In such a situation, more capitalized banks in the presence of NPLs may actually be more reluctant to further extend risky loans. This provides ground to support our Hypothesis 3. The results for bank size and capitalization channels also imply that lending behaviour of larger and better capitalized banks is more procyclical with respect to non-performing loans relative to smaller and less capitalized banks.

To control for the impact of asset management companies on lending growth, we also include an AMC dummy variable, which takes the value of 1 for countries that have an asset management company present in a given year or the value of 0 for countries without an asset management company in a given year. We interact this variable with the level of NPLs. We find that the interaction term between NPL and AMC is statistically insignificant, suggesting no evidence related to loan growth level. This finding does not provide support to Hypothesis 4.

Bank lending behaviour and NPLs in different regions

To assess the impact of non-performing loans on loan growth in different geographic regions, four subsample regressions were computed, separately for banks in EU countries, non-EU countries, advanced economies, and emerging economies. The model estimates are presented in Table 5 for each region based on the system GMM estimator. In all subsamples, the impact of non-performing loans on the level of bank lending is negative and statistically significant. This shows that the effect of non-performing loans remains a crucial problem for bank lending across different regions and economies. The coefficient is also larger (in absolute terms) for the advanced economies, indicating that the advanced economies may be more prone to credit cycles as a result of NPLs. This may be related to greater overall level of financialization of advanced economies relative to emerging economies.

Bank lending behaviour and NPLs during and after the global financial crisis

The effect of the global financial crisis radically changed the perception of credit risk. To account for this structural break, we divide the analysis into a pre-crisis (2000–2007), crisis (2008–2010), and post-crisis (2011–2017) period to identify how the global financial crisis might have affected the association between NPLs and credit growth (see Allen et al. 2017). The results of the estimated models are presented in Table 6. The effect of NPL on loan growth is negative and significant in all three subperiods. The interaction term of NPL with the pre-crisis dummy variable is significantly negative, indicating that before the crisis period the negative effect of NPLs on credit growth is more pronounced. The interaction terms of NPL with the crisis and post-crisis period dummy are not significant.

Robustness checks

Alternative credit risk measurement

In our first robustness check, we use loan loss provision (LLP) as an alternative credit risk variable instead of NPLs. We find a negative and significant relationship between loan loss provision and loan growth. The magnitude of the impact is higher than the NPL impact, and it is equal to 0.00683 in the fixed effect model.Footnote 1 This indicates that an increase in the level of LLP has a negative impact on bank lending activity. The finding is consistent with the results of Košak et al. (2015) and Cucinelli (2016). Other control variables remain unchanged under this alternative credit risk measurement specification relative to our baseline model. The results are presented in Table 7.

Subsample of commercial banks

Finally, we perform a robustness check using the subsample of commercial banks only. The results remain largely unchanged. The non-performing loans are negatively and significantly related to bank lending in both estimation methods (FE and GMM). This confirms the view that commercial banks reduce their lending at higher NPL levels (Table 8).

Conclusion

In this article, we evaluate the relationship between non-performing loans and bank lending behaviour. Our analysis is based on a sample of 6434 banks distributed across 42 EU and non-EU member countries and observed over the period from 2000 to 2017. We find a significant and negative impact of non-performing loans on bank lending, indicating that higher levels of NPLs are associated with a reduction of credit growth. Furthermore, our empirical results provide evidence that other bank-specific variables and macroeconomic determinants affect bank lending behaviour.

We find some evidence that the association between NPLs and bank lending is stronger for well-capitalized banks. The better capitalized the bank is, the higher the relationship between NPL and lending growth. This finding suggests that well-capitalized banks tend to behave more procyclically than weakly capitalized, expanding their loan portfolio faster in times of low NPLs and contracting it further in times of high NPLs.

We also analyse the role of asset management companies on the impact of NPLs on loan growth. We find no statistical evidence that the link between NPLs and loan growth is less pronounced for banks operating in countries where an AMC is present. This puts a question mark over the role of AMCs as a policy tool to kick-start bank lending in a high NPL environment.

Notes

The impact of NPL on growth lending in the fixed effect model is 0.0027, see Table 4.

References

Abdul-Karim, M., M.K. Hassan, T. Hassan, and S. Mohamad. 2014. Capital adequacy and lending and deposit behaviors of conventional and Islamic banks. Pacific Basin Finance Journal 28: 58–75.

Aiyar, S., W. Bergthaler, J.M. Garrido, A. Ilyina, A. Jobst, and K. Kang. 2015. A strategy for resolving europe’s problem loans. International Monetary Fund 15: 1–37.

Allen, F., K. Jackowicz, O. Kowalewski, and Ł Kozłowski. 2017. Bank lending, crises, and changing ownership structure in Central and Eastern European countries. Journal of Corporate Finance 42: 494–515.

Arellano, M., and S. Bond. 1991. Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. The Review of Economic Studies 58 (2): 277.

Arellano, M., and O. Bover. 1995. Another look at the instrumental variable estimation of error-components models. Journal of Econometrics 68 (1): 29–51.

Athanasoglou, P.P., S.N. Brissimis, and M.D. Delis. 2008. Bank-specific, industry-specific and macroeconomic determinants of bank profitability. Journal of International Financial Markets, Institutions and Money 18 (2): 121–136.

Baum, C.F. 2006. An Introduction to Modern Econometrics Using Stata. Stata Corp.

Baum, Christopher F., M.E. Schaffer, and S. Stillman. 2003. Instrumental variables and GMM: Estimation and testing. Stata Journal 3 (1): 1–31.

Berger, A.N., and G.F. Udell. 2006. A more complete conceptual framework for SME finance. Journal of Banking and Finance 30 (11): 2945–2966.

Blundell, R., and S. Bond. 1998. Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics 87 (1): 115–143.

Bonin, J.P., I. Hasan, and P. Wachtel. 2005. Bank performance, efficiency, and ownership in transition countries. Journal of Banking and Finance 29 (1): 31–53.

Cantero-Saiz, M., S. Sanfilippo-Azofra, B. Torre-Olmo, and C. López-Gutiérrez. 2014. Sovereign risk and the bank lending channel in Europe. Journal of International Money and Finance 47: 1–20.

Cantú, C., S. Claessens, and L. Gambacorta. 2019. How do bank-specific characteristics affect lending? New evidence based on credit registry data from Latin America. Bank for International Settelments (BIS) Working Paper, No. 798.

Carlson, M., H. Shan, and M. Warusawitharana. 2013. Capital ratios and bank lending: A matched bank approach. Journal of Financial Intermediation 22 (4): 663–687.

Chavan, P., and L. Gambacorta. 2019. Bank lending and loan quality: An emerging economy perspective. Empirical Economics 57 (1): 1–29.

Cucinelli, D. 2015. The impact of non-performing loans on bank lending behavior: Evidence from the Italian banking sector. Eurasian Journal of Business and Economics 8 (16): 59–71.

Cucinelli, D. 2016. Can speed kill? The cyclical effect of rapid credit growth: Evidence from bank lending behavior in Italy. The Journal of Risk Finance 17 (5): 562–584.

Cheisa, G., and M. Mansilla-Fernández. 2019. Disentangling the transmission channel NPLs-cost of capital-lending supply. Applied Economics Letters 26 (16): 1333–1338.

Chouchène, M., Z. Ftiti, and W. Khiari. 2017. Bank-to-bank lending channel and the transmission of bank liquidity shocks: Evidence from France. Research in International Business and Finance 39: 940–950.

Deli, Y.D., and I. Hasan. 2017. Real effects of bank capital regulations: Global evidence. Journal of Banking and Finance 82: 217–228.

Dell’Ariccia, G., and R. Marquez. 2006. Lending booms and lending standards. Journal of Finance 61 (5): 2511–2546.

Dimitrios, A., L. Helen, and T. Mike. 2016. Determinants of non-performing loans: Evidence from euro-area countries. Finance Research Letters 18: 1–4.

Eisdorfer, A. 2008. Empirical evidence of risk shifting in financially distressed firms. Journal of Finance 63 (2): 609–637.

Erdinc, D., and E. Abazi. 2014. The determinants of NPLs in emerging Europe, 2000–2011. Journal of Economics and Political Economy 1 (2): 112–125.

European Central Bank (ECB). 2016. Annual report. Retrieved from https://www.ecb.europa.eu/pub/pdf/annrep/ar2016en.pdf

Fang, X., D. Jutrsa, S.M. Peria, A.F. Presbitero, and L. Ratnovski. 2020. Bank capital requirements and lending in emerging markets: The role of bank characteristics and economic conditions. Journal of Banking and Finance.

Foos, D., L. Norden, and M. Weber. 2010. Loan growth and riskiness of banks. Journal of Banking and Finance 34 (12): 2929–2940.

Gambacorta, L., and P.E. Mistrulli. 2004. Does bank capital affect lending behavior? Journal of Financial Intermediation 13 (4): 436–457.

Gambacorta, L., and H.S. Shin. 2018. Why bank capital matters for monetary policy. Journal of Financial Intermediation 35: 17–29.

Gandrud, C., and M. Hallerberg. 2014. Bad banks in the EU: The impact of eurostat rules. Bruegel Working paper. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2241290

Ghosh, A. 2015. Banking-industry specific and regional economic determinants of non-performing loans: Evidence from US states. Journal of Financial Stability 20: 93–104.

Gulati, R., A. Goswami, and S. Kumar. 2019. What drives credit risk in the Indian banking industry? An empirical investigation. Economic Systems 43 (1): 42–62.

Hausman, J.A. 1978. Specification tests in econometrics. Econometrica 46 (6): 1251–1271.

Hau, H., S. Langfield, and D. Marques-Ibanez. 2013. Bank ratings: What determines their quality? Economic Policy 13 (April): 289–333.

Hu, J.-L., Y. Li, and Y.-H. Chiu. 2004. Ownership and nonperforming loans: Evidence from Taiwan’s banks. The Developing Economies 42 (3): 405–420.

Ibrahim, M.H., and S.A.R. Rizvi. 2018. Bank lending, deposits and risk-taking in times of crisis: A panel analysis of islamic and conventional banks. Emerging Markets Review 35: 31–47.

Iwanicz-Drozdowska, M., and B. Witkowski. 2016. Credit growth in Central, Eastern, and South-Eastern Europe: The case of foreign bank subsidiaries. International Review of Financial Analysis 43: 146–158.

Jeong, S., and H. Jung. 2013. Bank wholesale funding and credit procyclicality: Evidence from Korea. Panoeconomicus 5: 615–631.

Kabir, N., A. Worthington, and R. Gupta. 2015. Comparative credit risk in Islamic and conventional bank. Pacific Basin Finance Journal 34: 327–353.

Keeton, R., and W. 1999. Does faster loan growth lead to higher loan losses? Economic Review 84 (2): 57–75.

Kishan, R.P., and T.P. Opiela. 2006. Bank capital and loan asymmetry in the transmission of monetary policy. Journal of Banking and Finance 30 (1): 259–285.

Klein, N. 2013. Non-performing loans in CESEE: Determinants and impact on macroeconomic performance. IMF Working Papers 13 (72): 1.

Koodstaal, M., and S.V. Wijnbergen. 2012. On risk, leverage, and banks: Do highly leveraged banks take on excessive risk? SSRN Working Paper 2170008.

Košak, M., S. Li, I. Lončarski, and M. Marinc. 2015. Quality of bank capital and bank lending behavior during the global financial crisis. International Review of Financial Analysis 37: 168–183.

Kuzucu, N., and S. Kuzucu. 2019. What drives non-performing loans? Evidence from emerging and advanced economies during pre- and post-global financial crisis. Emerging Markets Finance and Trade 55 (8): 1694–1708.

Laeven, L., and G. Majnoni. 2003. Loan loss provisioning and economic slowdowns: Too much, too late? Journal of Financial Intermediation 12 (2): 178–197.

Laeven, L., L. Ratnovski, and H. Tong. 2016. Bank size, capital, and systemic risk: Some international evidence. Journal of Banking and Finance 69: S25–S34.

Lehmann, A. 2017. Carving out legacy assets: a successful tool for bank restructuring? Policy Contribution. http://www.europarl.europa.eu/RegData/etudes/IDAN/2017/587397/IPOL_IDA(2017)587397_EN.pdf. (No. 9).

Louhichi, A., and Y. Boujelbene. 2016. Credit risk, managerial behaviour and macroeconomic equilibrium within dual banking systems: Interest-free vs. interest-based banking industries. Research in International Business and Finance 38: 104–121.

Louhichi, A., and Boujelbene, Y. 2017. Bank capital, lending and financing behaviour of dual banking systems. Journal of Multinational Financial Management 41 (September 2008): 61–79.

Louzis, D.P., A.T. Vouldis, and V.L. Metaxas. 2012. Macroeconomic and bank-specific determinants of non-performing loans in Greece: A comparative study of mortgage, business and consumer loan portfolios. Journal of Banking and Finance 36 (4): 1012–1027.

Makri, V., A. Tsagkanos, and A. Bellas. 2014. Determinants of non-performing loans: The case of Eurozone. Panoeconomicus 2: 193–206.

Marinč, M., M. Mrak, and V. Rant. 2014. Dimensions of bank capital regulation: A cross-country analysis. Panoeconomicus 4: 415–439.

Meriläinen, J.M. 2016. Lending growth during the financial crisis and the sovereign debt crisis: The role of bank ownership type. Journal of International Financial Markets, Institutions and Money 41: 168–182.

Micco, A., and U. Panizza. 2006. Bank ownership and lending behavior. Economics Letters 93: 248–254.

O’Brien, R.M. 2007. A caution regarding rules of thumb for variance inflation factors. Quality and Quantity 41 (5): 673–690.

Peek, J., and E. Rosengren. 1995. The capital crunch: Neither a borrower nor a lender be. Journal of Money, Credit and Banking 27 (3): 625–638.

Puri, M., J. Rocholl, and S. Steffen. 2011. Global retail lending in the aftermath of the US financial crisis: Distinguishing between supply and demand effects. Journal of Financial Economics 100 (3): 556–578.

Ranjan, R., and SCh. Dhal. 2003. Non-performing loans and terms of credit of public sector Banks in India: An empirical assessment. Reserve Bank of India Occasional Papers 24 (3): 81–121.

Roodman, D. 2006. How to do xtabond2: An introduction to difference and system GMM in Stata (No. 103). Stata Journal.

Salas, V., and J. Saurina. 2002. Credit risk in two institutional regimes: Spanish commercial and savings banks. Journal of Financial Services Research 22: 203–224.

Sanfilippo-Azofra, S., B. Torre-Olmo, M. Cantero-Saiz, and C. López-Gutiérrez. 2018. Financial development and the bank lending channel in developing countries. Journal of Macroeconomics 55 (October 2017): 215–234.

Schnabl, P. 2012. The international transmission of bank liquidity shocks: Evidence from an emerging market. Journal of Finance 67 (3): 897–932.

Shahzad, F., Z. Fareed, B. Zulfiqar, U. Habiba, and M. Ikram. 2019. Does abnormal lending behavior increase bank riskiness? Evidence from Turkey. Financial Innovation 5 (1): 37.

Stein, J.C. 2002. Information production and capital allocation. Journal of Finance 57 (5): 1891–1921.

Tarchouna, A., B. Jarraya, and A. Bouri. 2017. How to explain non-performing loans by many corporate governance variables simultaneously? A corporate governance index is built to US commercial banks. Research in International Business and Finance 42 (July): 645–657.

Thornton, J., and C. Di Tommaso. 2020. The effect of non-performing loans on credit expansion: Do capital and profitability matter? Evidence from European banks. International Journal of Finance and Economics 26: 4822.

Vithessonthi, C. 2016. Deflation, bank credit growth, and non-performing loans: Evidence from Japan. International Review of Financial Analysis 45: 295–305.

Vo, X.V. 2018. Bank lending behavior in emerging markets. Finance Research Letters 27 (February): 129–134.

Funding

Funding was provided by Javna Agencija za Raziskovalno Dejavnost RS (Grant No. P5-0161) and Erasmus Mundus project Green Tech WB (Grant No. 551984-EM-1-2014-1-ES-ERA MUNDUS-EMA2).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Gjeçi, A., Marinč, M. & Rant, V. Non-performing loans and bank lending behaviour. Risk Manag 25, 7 (2023). https://doi.org/10.1057/s41283-022-00111-z

Accepted:

Published:

DOI: https://doi.org/10.1057/s41283-022-00111-z