Abstract

Inefficient port infrastructures is one of the challenges facing Sub-Saharan Africa, particularly as regards the West African region’s economic progress. Using a dynamic computable general equilibrium model, the paper examines how improving port infrastructure in Senegal can increase the potential of seaborne trade, and accelerate economic and social development in the country and the wider region. Despite Senegal's strategic location along the Trans-Saharan trade route in West Africa, infrastructural limitations pose challenges to port capacity. Our findings suggest that improving port infrastructure can increase port productivity, leading to a reduction in costs of imported food products and domestic inputs. As a result, the country's competitiveness in international markets would be enhanced and could stimulate the production of cash crops, industrial food, and chemical products. This would lead to increased food supply and improved purchasing power, supporting the country's food security. Results show that increased efficiencies in maritime exports and imports lead to an overall increase in economic activity, resulting in significant GDP growth, improved welfare, and a reduction in poverty incidence. This growth can be attributed to higher exports and greater availability of imported intermediate inputs at lower prices, making exports more competitive in the global market as export prices decrease.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Inefficient port infrastructure, poor port-handling and logistical inefficiencies in African countries pose major challenges for the region’s economic progress. These challenges lead to delays and increased transportation costs, which have had detrimental effects on trade and economic growth in the region. Senegal heavily depends on the Port of Dakar for trade, a vital transhipment centre for landlocked West Africa nations, handling almost 90% of Senegal’s trade, including crucial commodities like petroleum products, fish, cotton, and mineral products. The port plays a crucial role in country’s trade industry (Africa Development Bank 2021a; Osinski and Sylla 2019). Despite a cumulative average growth of 8% in import volume and 6% in export volume from 2012 to 2019 (Port Autonome de Dakar), persistent issues continue to affect its operations.

According to the Global Competitiveness Report 2019, Senegal’s infrastructure quality, scoring 51.3 out of 100 in terms of infrastructure quality, lags behind other African countries, like South Africa (68.1), Namibia (58.5) and Kenya (53.6) (Schwab 2019). The efficiency index for seaport services and liner shipping connectivity in Senegal, at 50.2 and 14.4, respectively, falls below that of Kenya (54 and 21.2), South Africa (59 and 40.1), and Namibia (64.6 and 15.3) (Schwab 2019), indicating challenges in the operational efficiency of its ports. Despite rapid growth in maritime activities at the Dakar Port Authority (PAD) from 2008 to 2018, reaching about 7% annually, associated cost escalations and negative impacts on efficiency have arisen due to increased pressure on infrastructure and port capacity (IFDC 2019; Osinski and Sylla 2019).

Osinski and Sylla (2019) have identified some of the challenges, including higher freight rates and longer transit times for shipments from the USA; lack of modern cold chain operations for perishable food products; and higher port fees compared to neighbouring African countries. High-cost and inadequate shipping services; undeveloped technologies; low port capacity; and poor maintenances have contributed the most to inefficiencies in port logistics in West and Central Africa (Fouda et al. 2014).

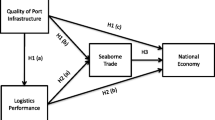

Port infrastructure plays a crucial role in international seaborne trade. Improving port efficiency and infrastructure has the potential to substantially reduce freight rates (Sánchez et al. 2003; Clark et al. 2004; Blonigen and Wilson 2008; Lei and Bachmann 2020; Chang et al. 2021). This, in turn, could lead to a significant increase in trade flows (Limao 2001; Blonigen and Wilson 2008; Herrera Dappe et al. 2017; Chang et al. 2021; Ayesu et al. 2022a, b), and higher economic growth (Gherghina et al. 2018; Munim and Schramm 2018; Özer et al. 2021; Ayesu et al. 2023). Blonigen et al. (2008) found that improving port efficiency from the 25th percentile to the 75th percentile would result in a modest 5% increase in trade for the US, compared to other ports. Similarly, a study by Herrera Dappe et al. (2017) used a Data Envelope Analysis on ports in the Indian and Western Pacific Oceans to measure port efficiency scores, considering the time-varying relationship between the use of port assets and port throughput. The study found that if ports would approach the efficient frontier, they could reduce average maritime transport costs by up to 14% and increase exports by up to 2.2%.

Additionally, research has also supported the crucial role of seaport efficiency in driving trade performance, economic growth, and welfare in Africa (Portugal-Perez and Wilson 2009; Sakyi et al. 2017; Ayesu et al. 2023; Ayesu et al. 2022a, b). In African context, trade facilitation, by reducing costs needed to exports and imports, can positively affect economic growth (Sakyi et al. 2017).

To address these challenges, the Senegalese Government initiated the Priority Action Plan for an Emerging Senegal, Plan Senegal Emergente (PSE), emphasizing the structural transformation of its macro-economic framework with a priority on infrastructure development. While Phase I showed increased factor productivity, performance has been sluggish. Thus, Phase II (2019–2024) focuses on private sector-driven investment projects, including expanding the Dakar port to enhance trade capacity and efficiency, aimed at the economic emergence of Senegal by 2035 (Africa Development Bank 2021a, b).

The country aims to stimulate new investments to expand the Dakar port, addressing infrastructure challenges and enhancing the capacity of port infrastructure. This expansion holds the potential to raise port efficiency and trade capacity and -as a result- reduce waiting and cargohandling times, as well as logistics costs linked to infrastructural constraints. The $1.1 billion deep-water port development project, Port of Ndayane, fully funded by the private sector, is underway. The first phase, started in 2021 at a cost of $837 million, aiming to boost trade equivalent to 3% of Senegal's GDP, with a vision to reach 18% by 2035.Footnote 1

The costs of the overall seaborne transport chain can be represented as iceberg costs that include a distance-based cost for the maritime and land legs, and a port-specific cost for cargohandling. The concept of “iceberg costs” in international trade, an assumption due to Samuelson (1954) and Krugman (1991), reflects the idea that the costs of transporting goods over distance can be modelled as if a portion of the value of goods melts away during transportation, at port-handling and transhipment. This abstraction allows for the consideration of the impact of distance, transportation costs, and trade barriers on the flow of goods and overall welfare of consumers and producers in different regions. Iceberg costs act as barriers or additional costs that impede the smooth flow of goods across borders, leading to a reduction in the volume of traded goods. They can reduce trade efficiencies by creating additional hurdles, such as compliance costs, administrative burdens, and delays in customs procedures, which can lead to a decrease in the volume and efficiency of trade.

The study suggests that investing in improved infrastructure would lead to higher port productivity, resulting in a reduction in port-related costs as well as decreasing shipping costs. Consequently, these improvements would contribute to a more efficient and cost-effective seaborne trade process. The expansion of port infrastructure, with the implied effects of reduced port-related costs, is expected to have economy-wide effects through linkages with other sectors and the general price level. Therefore, a recursive dynamic computable general equilibrium (CGE) model is employed here, to evaluate the impacts of increased port efficiency on the potential growth, welfare, food security, and poverty of the country. Benefits are expected to extend to competitive sectors like cash crops, mining, and industrial food products, crucial for both domestic and export markets. Lower shipping cost deriving from improved port efficiencies will enhance the affordability of imported staple foods and inputs used in domestic production.

Research on port efficiency within a CGE framework is limited, particularly for Sub-Saharan African countries. Cheong and Suthiwartnarueput (2015) conducted a study that estimated the impacts of logistics reforms on the demand for port services. They utilized a global dynamic CGE model, to evaluate the impact of lowering logistics cost on port throughput in ASEAN countries. Haddad et al. (2010) applied a spatial computable general equilibrium model on Brazil’s transport network system. The authors found that the largest positive economic impacts occurred when all regional ports matched the efficiency of the country's most efficient port. Additionally, Eltalla (2016) applied a static CGE model to explore the ex-ante effects of the planned construction of Gaza seaport on the Palestinian economy.

The present study is an effort to contribute to the literature related to economy-wide modelling of port efficiencies in Sub-Saharan Africa. The research considers iceberg costs associated with maritime exports and imports as existing baseline trade inefficiencies. Therefore, increasing port efficiency is expected to have widespread growth and distributional impacts on the Senegalese economy.

The rest of the paper is structured into four sections. Section 2 presents the methodology employed which comprises the database and the economic framework of the economy and the model specification, while Sect. 3 discusses the empirical results of the different scenarios. Finally, the last section concludes the paper with some policy suggestions.

2 Methodology overview

2.1 Data

The Senegal CGE model is calibrated using the benchmark equilibrium Social Accounting Matrix (SAM) for the year 2014 (Mainar-Causapé et al. 2018), subsequently updated to 2021 based on growth rates. This model represents the structure of the Senegalese economy, encompassing 14 regions contributing to production activities. Factors of production are distinguished between regional skilled and unskilled labour; irrigated and non-irrigated land; agricultural and non-agricultural capital and livestock. There are rural and urban households for each of the 14 regions, contributing to factor endowment and demand systems. The model has 61 activities (including 14 regional marginal crop producers) and 70 commodities (including nine non-marketable subsistence food crops). Transport activities and commodities are categorized into three types: maritime transport, air transport, and other transport. Each sector pays the transport costs on its exported goods and those intended for domestic demand. Transaction costs on goods to be exported are split into maritime, air, and other transport.

Table 1 provides an overview of Senegal’s macro-economic structure in the base year. The service sector comprises the largest share of the nation’s GDP (66.4%). Agriculture contributes 12.8% to GDP, accounting for 18.5% of total employment and 5.5% of export earnings. Within the agriculture sector, crop activities contribute about 9% to the national GDP and over 14% to national employment. Agro-processing and mining industries are the primary contributors to exports, representing 26.7% and 14.6%, respectively. Mining, chemicals, and food processing industries are the major players in the export market. A significant part of the mining output caters to the export market (97.8%), followed by chemicals (68%) and food processing (34.2%). In agricultural exports, around 15% of fish catch and a similar share of crop production go to the export market.

On the other hand, mining and agro-processing are the major importing industries, making up approximately 13.6% and 12.8% of national imports, respectively. It should be noted that a significant part of the domestic demand for mining (98.8%), chemicals (83.8%), petroleum (49.5%), and agro-processing (34.2%) products is satisfied through imports. Additionally, around 46.3% of the demand for rice and 52% for cash crops of the domestic market are met through imports. It is evident that mining, chemicals and, to some extent, petroleum imports serve as inputs for domestic activities, playing important roles in influencing trade efficiency impacts. Processed food holds a substantial share in household consumption basket (22.5%), dominating over the agricultural consumption.

2.2 Model specification

The study employs a recursive dynamic CGE model, designed to solve iteratively for each period by integrating economic behaviours and assumptions that link one period to the next, until the year 2022. This model closely aligns with the structure of the single country Dynamic Equilibrium Model for Economic development, Resources, and Agriculture (DEMETRA) (Aragie, Mcdonald, and Thierfelder 2016; Nechifor et al. 2021). The key attributes of the model encompass a flexible constant elasticity of substitution (CES) nested production function, with the presence of home production for home consumption’ separating marketable and semi-subsistence production activities. Additionally, the model integrates a flexible CES and linear expenditure system (LES) of household demand system, coupled with factor market segmentation across regions. We incorporate intricate technological assumptions to account for multi-product activities, wherein factor supplies by institutions are fixed and mobile between activities.

Trade and transport costs, running from factory gate and port of entry, and ultimately to the consumer, are integrated into domestic market prices. Consequently, these margins are transferred to the consumers through an augmented consumer price. Margins associated with the trade and transport of exportable goods are split into sea, air, and other transport costs.

Following the standard “small country” assumption, Senegal is a price taker for imports and exports, unable to affect world prices (Francois and Reinert 1997). Distinctions are made between domestically produced, exported, and imported goods, with domestic production exportable through a constant elasticity of transformation (CET), and foreign goods substituting domestic produce via a constant elasticity of substitution (CES), following the Armington assumption (Armington 1969). Our scenarios with interventions on export and import efficiencies are done in export (CET) and import (CES) functions, respectively.

Equation 1 presents the CET equation, where domestic production of a commodity (\({QXC}_{c}\)) is transformed into domestic supply for domestic demand (\({QD}_{c}\)) and export supply (\({QE}_{c}\)) to meet foreign demand, given the elasticity of transformation (\({\rho }_{c}\)), the CET scale parameter (\({\alpha }_{c}\)), and the share parameter (\({\gamma }_{c}\)). Equation 2 represents the first-order condition (FOC), where relative supply transformation of \({QE}_{c}\) and \({QD}_{c}\) depends on relative prices, \({PE}_{c}\) and \({PD}_{c}\), given the elasticity of transformation (\({\rho }_{c}\)) and the share parameter (\({\gamma }_{c}\)). The efficiency parameter (\({effe}_{c}\)) attached to the export supply in Eq. 1 is also figured in FOC Eq. 2.

Similar to the export CET function, the composite demand of a commodity (\({QQ}_{c}\)) in Eq. 1.3 is the CES aggregation of imported good (\({QM}_{c}\)) and domestically produced (\({QD}_{c}\)), given the elasticity of substitution (\({\mu }_{c}\)), the CES scale parameter (\({\beta }_{c}\)), and the share parameter (\({\sigma }_{c}\)). The FOC equation presents dependence of relative demand of QM and QD on relative prices of domestic product (\({PD}_{c}\)) and imported good (\({PM}_{c}\)), given the elasticity of substitution (\({\mu }_{c}\)) and the share parameter (\({\sigma }_{c}\)). The \({effm}_{c}\) represents the efficiency parameter of the demand for imports.

For model dynamics, the capital in each sector is updated annually, considering both capital depreciation and investments from the previous period. Existing capital stock is fixed and sector specific, and is subject to economic depreciation. On the other hand, new capital generated by investment is mobile and enters a pool (Tables 2, 3, 4, 5), which is distributed across activities in the current period based on the return to capital and the level of existing stock. The business-as-usual (BAU) scenario closely replicates the long-run expected growth of the economy, which typically involves forecasts of several macro aggregates, such as baseline growth in GDP, investment, savings, population, and world prices.

2.3 Scenarios

According to the Africa Development Bank (2021a), 77% of Senegal’s exports go outside Africa; something that demonstrates the significance of maritime transport for the country. However, its border-clearance efficiency score for trade is only 29 (score is on a 0 to 100 scale, 100 representing optimal situation), compared to 44 for Côte d'Ivoire and 78 for Germany (Schwab 2019). Private sector involvement in Dakar port services has substantially reduced handling costs, according to the World Bank (2011). However, Senegal’s import costs per container are still 1.6 times higher than those of OECD countries, despite improvements. Moreover, the median waiting time of a containership at the port of Dakar is still 38 h (1.58 days), compared to 36 for Ghana, 33 for Togo, and 28 for Benin (UNCTADSTAT 2020). Torres et al. (2011) previously estimated the average general-cargo-handling charge (ship to gate) of $15 per tonne in Dakar, higher than the $8-$10 range in Nigeria, Benin, and Togo. These challenges in port efficiency and trade costs highlight the complexities faced by countries in optimizing their infrastructure, trade processes, administrative procedures, port logistics, and supply-chain processes (Haralambides 2019).

Investing in port infrastructure can facilitate trade by reducing transaction and handling costs. The efficiency index for seaport services as well as liner shipping connectivity in Senegal is found to be lower than that of other leading African ports, e.g. South Africa, Kenya, and Namibia (Schwab 2019). It is assumed that the low port efficiency in Senegal results from handling and distribution costs stemming from maritime infrastructural constraints. Improving port infrastructure would reduce waiting times and associated inefficiencies, promoting better practices in the country’s seaborne trade. However, the positive impacts of investing in the expansion of port capacity would be significant only if port expansion becomes operational (Ginting et al. 2015). Hence, the expansion of port infrastructure in the study can also include improved port extension services.

Port-related costs in CGE frameworks may be represented as efficiency losses/gains, as rent for domestic/foreign producers, and as additional trade costs. In many CGE literature, the indirect non-tariff costs (ad valorem equivalents) represent hindrances in trade facilitation and are implemented as non-tariff barriers through ad valorem equivalents (AVEs). Improvements in port productivity can be incorporated into global CGE models as change in efficiency by shifting the import augmenting technical change in the constant elasticity of substitution (CES) Armington function for imports (Hertel et al. 2001; Fox et al. 2003; Francois et al. 2005; Fugazza and Maur 2008). Hummels and Schaur (2013) and Hummels et al. (2007) estimated the AVE willingness to pay for a reduction in trade time (e.g. due to delays in customs clearance, etc.). In addition to the method of willingness to pay, the mechanism of adjusting exporters’ production costs is applied and contrasted against the traditional iceberg costs within a global CGE model by Walmsley and Minor (2015), Walmsley and Minor (2020), and Walmsley and Strutt (2021).

In existing CGE assessments of the African Continental Free Trade Area (AfCFTA), the most commonly used database for AVEs is adapted from Kee et al. (2009) and Cadot et al. (2015). Recently, Simola et al. (2021) calculated and updated AVE iceberg costs for tradable commodities in all African countries using methodology by Kee et al. (2009), and Kee and Nicita (2016). The weighted average of iceberg costs for exports and imports in Senegal is estimated to be approximately 4.3% and 5.2%, respectively.

Our study incorporates iceberg costs estimates for both exports and imports in Senegal from Simola et al. (2021). Acknowledging that ad valorem equivalent iceberg costs represent maximum limit on trade or existing port inefficiencies, our scenarios entail a 50% increase in efficiencies (or a 50% reduction in iceberg costs) by 50% across the exporting or importing sectors from 2022 to 2025 (refer to Table 6 in the Appendix). To achieve these efficiency enhancements, we simulate the efficiency parameters associated with both export and import variables in the constant elasticity of transformation (CET) export supply and CES Armington import demand functions, respectively.

In the business-as-usual baseline, the model projects to the year 2025 based on the expected growth of macro drivers such as GDP, investment, exogenous world price, and population growth.Footnote 2 We then compare the impacts resulting from alternative scenarios with efficiency simulations against the baseline in 2025. The following scenarios are developed for the analysis:

-

Increase export efficiencies (ExEf) by 50% to the extent of reducing the sector-wise AVE export iceberg costs between 2022 and 2025.

-

Increase import efficiencies (ImEf) by 50%, leading to a reduction in the sector-wise AVE import iceberg costs between 2022 and 2025.

-

Increase both export and import efficiencies (total trade efficiencies) (TotEf) by 50%, resulting in a reduction in sector-wise AVE export and import iceberg costs between 2022 and 2025.

3 Results and discussion

3.1 Economic impacts

The results of improved port infrastructure for export, import, and total trade are presented as a percent change in the long-run year 2025, compared to the baseline.

From 2022 to 2025, the cumulative GDP experiences a 1.3% increase compared to the baseline due to the overall trade efficiencies (TotEf) improvements in both imports and exports. Figure 1 illustrates the impacts on macro aggregates, with the primary macro influences attributed to the increase in import efficiencies. The boost in export efficiencies contributes the most to the GDP increase. Notably, the increase in export efficiencies has a larger positive impact on both exports and imports compared to the increase in import efficiencies. This is because major exporting industries depend on imports for their intermediate inputs. As the production of these exporting industries increases under the export efficiency scenario, the demand for intermediate imports also rises. Exports and imports grow at rates of 3.3% and 2.2%, respectively, from 2022 to 2025, as both export and import efficiencies almost equally contribute to the increase.

Figure 2 presents the economic impacts at the macro level in 2025, showing almost similar patterns compared to the baseline. An increase in total efficiency leads to a 2.5% rise in GDP and household consumption demand. Exports and imports increase by 6.4% and 4.4%, respectively. However, higher import efficiency has the most significant impact on other macro variables, influencing the availability of intermediate inputs, which are highly import dependent. Thus, an increase in import efficiency results in a higher use of intermediate inputs, leading to increased economic activities and final demand in the economy.

Improving the efficiencies of exports and imports would result in reducing their respective prices, thereby driving the demand for both exports and imports, as indicated in Table 2. Based on the data presented in Table 1, it is evident that mining, food processing, and chemicals are the primary tradable sectors in Senegal, with significant shares of exports in their respective output and imports in their domestic demand. Sectors with higher comparative advantage in exports, such as cash crops, processed food (excluding processed meat), chemicals, and other manufacturing, experience substantial increases in exports by 11%, 16%, 23.6%, and 12%, respectively, as shown in Table 2. Despite Senegal’s cash crop exports having had a much lower base compared to their imports, improved import efficiencies contribute to increased production and, consequently, higher exports. However, the rise in exports of processed food, chemicals, and other manufacturing is primarily attributed to the increase in export efficiencies. While higher export efficiencies are conducive, rice, fish, livestock, and forest products lose their respective export markets due to inadequate production growth to meet their domestic demand. Notably, Senegalese livestock and forest products have low initial export volumes. On the other hand, imports to Senegal become more competitive, resulting in an overall increase, except for processed meat. Imports of food crops other than rice (6.4%), cash crops (7.9%), mining (5.7%), and chemical products (4.4%) are driven up by improved import and export efficiencies. Increased domestic activities lead to a rise in non-maritime import services, influenced by maritime efficiencies.

In addition to the increased domestic activities driven by increased exports, productivity gains achieved by importing industries from lower shipping rates also contribute to increased production by lowering production costs. Most sectors experience growth in production, except for mining and processed meat activities (Table 2). Mining, as a crucial intermediate input, plays a significant role in domestic production. Due to lower shipping rates, imports of mining products become cheaper compared to domestic production, leading to a significant expansion in highly competitive industries like chemicals and processed food, which see a large expansion in activities- 19.4% and 8.7%, respectively. This growth is attributed to the increased availability of imported intermediate inputs at competitive prices and higher demand for exports. Cash crop activities also benefit more compared to other agricultural activities, as they can access relatively cheaper imported manufactured inputs for their production activities.

Higher port productivity leads to lower import costs and higher product supply, resulting in decreased composite domestic prices for most commodities, except for food crops other than rice, forest products, and services. Lower prices stimulate overall domestic demand in the economy, as indicated in Table 3. Cash crops, mines, petroleum, and chemical experience a substantial increase in domestic demand from the efficiency gains.

The benchmark household factor income distribution shows that, in general, urban households earn their income from skilled labour and non-agricultural capital, while rural households, living outside Dakar, rely heavily on income from unskilled labour. Higher port efficiencies result in increasing factor demand and, consequently, factor incomes. Figures 3 and 4 illustrate the scenario impacts on returns to factors and household income, respectively. An increase in total export and import efficiencies leads to a 3% increase in the returns to non-agricultural capital, a 2.5% increase in skilled labour, a 2.4% increase in unskilled labour, and only a 0.9% increase in returns to land income. In general, urban households experience higher income gains compared to rural households and higher benefits come from enhancing import efficiencies. Compared to enhancing import efficiencies, increased export efficiencies exert lower impacts on the factors and household income. Export efficiencies can potentially enhance competitiveness in global markets. However, the impacts on domestic resources household income could be indirect. Senegal depends heavily on imports of essential intermediate goods and might experience more direct impacts on economic activities and household income when import efficiencies are enhanced.

Urban households in Dakar are the primary beneficiaries of increased port efficiencies in terms of income, followed by urban households in other regions. Rural households still experience some income gains due to increased marginal farming activities and employment of unskilled labour and land activities. Income gains for regional rural households such as Tambacounda and Kédougou are relatively higher compared to rural households in other regions.

In general, consumers benefit from lower consumer prices and higher income. Figure 5 illustrates the change in consumption across household groups. Lower shipping costs result in higher earnings and lower consumer prices, leading to increased consumption across households. Food consumption shows a greater increase compared to non-food consumption (see Table 7 in the Appendix for consumption impacts across 14 regional household groups by rural and urban). It is worth noting that food consumption also includes processed industrial food, which enjoys a comparative advantage in our scenarios. Urban households, particularly those in Dakar, enjoy a larger consumption gain compared to rural households.

Figure 6 presents household welfare as equivalent variation in income change at the initial price of representative household across the 14 regions in Senegal. Urban households, in general, outperform rural households in terms of welfare gains. However, major welfare gains are also observed among rural inhabitants in the Ziguincho, Tambacounda, and Kédougou regions.

3.2 Poverty analysis

The study employs a top-down approach, linking macro CGE impacts to the microsimulation model for poverty analysis, as discussed in Ahmed and O’Donoghue (2007) and Cockburn et al. (2010). The CGE model provides household expenditure data for 14 regional representative household categories. Detailed micro household consumption for Senegal is based on the 2018–2019 Harmonized Survey on Households Living Standards (EHCVM) conducted by the Agence Nationale de la Statistique et de la Démographie (ANSD) (ANSD 2021). The changes in real consumption of the representative households from the CGE model are then integrated into corresponding detailed households at the micro level, requiring a mapping between the representative households in the CGE model and the micro households in the survey.

The after-shock levels of real consumption expenditure are compared against at the given poverty line. The annual poverty line, based on minimum vital needs, is set at a value of FCFA 333,440 in Senegal currency, according to ANSD (2021). The EHCVM 2018–2019 survey provides benchmark poverty estimates, based on FGT measures (Foster et al. 1984). Poverty impacts are evaluated based on the three types of measures: poverty head-count ratio or poverty incidence (P0), which is the number of people below the poverty line; poverty gap (P1), which is the ratio by which the mean income of the poor falls below the poverty line; poverty severity (P2), which assigns higher weights to the poverty of the poorest individuals. The most commonly used poverty measure is the poverty incidence or head-count ratio (P0).

The observed poverty incidence, based on the household survey for 2019, varies across regions, with the lowest incidence of 9% in Dakar and the highest of 65.6% in Sédhiou. The national poverty rate is 37.8%, with rural areas experiencing a higher incidence of 53.6%. The scenario results in Table 4 present the impacts of improved port productivity on the poverty incidence in Senegal. The baseline poverty incidence is estimated to be 29.7% at national level, with urban and rural poverty incidences at 44.2% and 13.3%, respectively. This shows that an increase in total trade efficiency leads to a decline of 3.9 percentage points in poverty incidence at national level. Poverty among rural households deceases by 4.5 percentage points, while urban households see a reduction of about 3.2 percentage points. Regions like Tambacounda, Kédougou, Ziguincho, Kolada, and Fatick experience significant poverty reduction compared to other regions, while households in Dakar have the least impact on poverty.

Improvements in port productivity, as in the scenario ImEf, have larger impacts on poverty reduction compared to export efficiencies increases. Similarly to the impacts on household income, enhancing export efficiencies has smaller impacts on poverty compared to increasing import efficiencies. Even the Diourbel and Kaffrine regions suffer an increase in poverty by 0.9 and 0.3 percentage point, respectively, under the scenario of increased export efficiencies. Although there is an increase in aggregated consumption at the macro level for the representative households in these regions, the poor income impact leads to a decrease in consumption of some of the non-rice food and non-food items (refer to Table 7 and Fig. 8 in the Appendix), potentially resulting in a negative distributional impact at the micro household level.

The impact of increased trade efficiencies on poverty gap and severity is lower compared to poverty incidence, as shown in Table 5. The baseline poverty gap, which measures the ratio by which the average consumption falls below the poverty line, is 7.2% at the national level compared to a poverty ratio of 29.7%. Similarly, poverty severity is even much lower than the poverty gap at 2.5%. While an increase in total seaport trade efficiencies can reduce the poverty severity by 0.5 percentage point compared to the reduction of 1.2 percentage points in the poverty ratio, the marginal reduction in poverty severity still indicates that trade efficiency can impact extreme poor households. It is observed from Table 6 that all the regions show marginal reduction in the poverty severity due to improved port productivity.

3.3 Sensitivity analysis

The scenarios in the study consider potential economy-wide impacts of enhanced export and import efficiencies by 50%. To ensure the robustness of our scenarios, a sensitivity analysis is conducted by systematically increasing trade efficiencies (or reducing base iceberg costs) from a lower 10% increase to the higher 70%. This sensitivity analysis helps us understand the pattern of model outcomes and provides insights into the economy’s responsiveness to changes in trade efficiencies using Gross Domestic Product (GDP) as a key indicator of overall economic performance.

Figure 7 illustrates the change in GDP gains with incremental enhancement of export and import efficiencies. The analysis shows that GDP gains from the increase in import efficiencies consistently remain above the gains from the export efficiencies. However, the rate of GDP gain shows minimal change with incremental shocks in import efficiencies. Conversely, the rate of GDP gain slightly increases with the gradual enhancement of export efficiencies, particularly after a 50% increase.

4 Conclusion and policy recommendations

Given the rapid growth of maritime traffic at the port of Dakar (Osinski and Sylla 2019), which is the main port in Senegal, there is increasing pressure on port capacity. Consequently, essential investments in port infrastructure are expected to enhance efficiency in seaborne trade by reducing the existing iceberg types of costs. This study quantitatively assesses the potential improvement in efficiencies in Senegal’s maritime exports and imports. A recursive dynamic CGE model has been implemented, specifying efficiency parameters in export supply and import demand functions through a 50% reduction of iceberg costs for each exported and imported sector from 2022 to 2025. The results are compared against the projected baseline, considering three scenarios: increased export efficiencies, increased import efficiencies, and a simultaneous increase in both export and import efficiencies.

Results show that increased port productivity can lead to an overall increase in economic activities, resulting in a 2.5% GDP growth in 2025. This growth is attributed to higher exports and increased availability of imported intermediate inputs at lower prices, making Senegalese exports more competitive in the global market as export prices decline. The increased demand for Senegalese exports (6.4%) boosts domestic activities. Some studies conducted in regions other than Africa have confirmed the lower trade costs and trade gains resulting from increase in seaborne trade efficiencies.

Commodities with a higher comparative advantage, such as cash crops, processed food, petroleum and chemicals, display a significant increase in exports. However, despite improved port efficiencies, rice, livestock, fish, forest, mining, and processed meat products are seen to be losing their export capacities due to their poor comparative advantage against other sectors. Their production fails to increase enough to meet their respective domestic demand. Enhanced trade efficiencies result in imported commodities being available at reduced prices, while an increase in output of export-oriented sectors determines a higher demand for imported intermediate inputs. Overall imports to the country increase by 4.4%, with cash and food crops, mining, and chemicals, ranking as the top imported merchandized commodities. Notably, there is also an increase in import of services (e.g. financial, insurance, communication, etc.) due to the indirect effects of increased domestic activities.

The reduced production costs and increased export demand stimulate domestic activities. With improved port efficiencies, the production of chemicals, cash crops, and processed food (excluding meat) significantly increases, as these industries gain a higher comparative advantage in their respective exports. On the other hand, mining activities decline, as relatively cheaper imported mining products take over the domestic supply. Port efficiencies in both export and import have clear positive impacts on households, leading to higher income and lower domestic prices. Food consumption increases more than non-food items, due to the availability of more affordable imported food products, including industrialized ones. Results indicate that urban households, especially in Dakar, benefit more than rural ones in terms of income and welfare gains. Although, in general, food crop activities, livestock, and fish benefit from efficiency improvements, their benefits are not enough to match those in non-food activities. Consequently, rural households engaged in food crop activities, including fish and livestock, experience lower incomes compared to their urban counterparts.

Increasing trade efficiencies can significantly reduce poverty at the national level, with larger impacts observed in rural areas compared to urban ones. Import efficiencies have greater impact on poverty reduction than export efficiencies. Some regions perform better than others, underscoring the potential of trade efficiency improvements in addressing poverty disparities. The impacts on extremely poor households, whose consumption falls significantly below the poverty threshold, are positive but substantially lower than the overall poverty incidence.

Port competition along the West African Coast, coupled with a lack of past investments to expand and improve port infrastructure, has resulted in chronic congestion, creating bottlenecks for the region’s economy. The findings of the study highlight the need for investments in port infrastructure to increase efficiency and capacity by streamlining trade processes, enhancing trade facilitation, and making seaborne trade more cost-effective. Efforts to prioritize and promote sectors with a comparative advantage, such as cash crops, processed food, and chemicals, can boost exports and enhance global competitiveness. However, rural households engaged in agricultural activities may not benefit in terms of income as much as urban households from increased port efficiencies. Thus, there may be need for targeted policies supporting agricultural activities like non-cash crops, fish, and livestock.

It is crucial to note that the application of efficiency shocks in our study is indicative. The lack of detailed information on recent infrastructural investments and expansion of the Port of Dakar prevent us from making an exact estimation of efficiency resulting from development of port infrastructure. Accessing recent feasibility or appraisal reports on the proposed investment and expansion projects of Dakar Port Authority is challenging, making it difficult to compare existing seaport performances with the projected ones, including container traffic, physical capacity of seaports, daily shipping services, average waiting time of ships, and dwell time of containers. However, in the absence of above information, the use of iceberg costs as the source inefficiencies in our study could provide a valuable alternative. We have conducted a sensitivity analysis to support the robustness of our increase in trade efficiencies.

Data Availability

The database is a version of the SAM which is publicly available and downloadable from here https://datam.jrc.ec.europa.eu/datam/mashup/SAM_SN_2014/. The version used is available upon request.

Notes

British International Investment, link: https://www.bii.co.uk/en/story/port-of-dakar/.

Growth rates are based on https://data.worldbank.org/indicator/ and https://secure.iiasa.ac.at/web-apps/ene/SspDb/dsd?Action=htmlpage&page=about.

References

Africa Development Bank. 2021a. Senegal Country Strategic Paper 2021–2025. https://www.afdb.org/en/documents/senegal-country-strategy-paper-2021-2025.

Africa Development Bank. 2021b. West Africa Economic Outlook 2021, Debt Dynamics: The Path to Post-Covid Recovery. Africa Economic Outlook Report. www.africaneconomicoutlook.org/en/outlook.

Ahmed, Vaqar, and Cathal O’Donoghue. 2007. CGE-Microsimulation Modelling: A Survey. Planning Commission Pakistan, TEAGASC Ireland. file:///paper/CGE-Microsimulation-Modelling%3A-A-Survey-Ahmed-Donoghue/39a5bb1638575804ca4445813a9e5294048492c3%0Ahttps://www.semanticscholar.org/paper/CGE-Microsimulation-Modelling%3A-A-Survey-Ahmed-Donoghue/39a5bb1638575804ca4445813a9e5294048492c3.

ANSD. 2021. Enquête Harmonisée Sur Les Conditions de Vie Des Ménages (EHCVM) Au Sénégal.

Aragie, Emerta, Scott Mcdonald, and Karen Thierfelder. 2016. A Static Applied General Equilibrium Model: Technical Documentation STAGE Version 2: August 2016. www.cgemod.org.uk.

Armington, Paul S. 1969. A Theory of Demand for Products Distinguished by Place of Production. Staff Papers-International Monetary Fund, 159–78.

Ayesu, Enock Kojo, Daniel Sakyi, Eric Arthur, and Anthony Kofi Osei-Fosu. 2022a. The Impact of Trade on African Welfare: Does Seaport Efficiency Channel Matter? Research in Globalization 5 (July). Elsevier Ltd: 100098. https://doi.org/10.1016/j.resglo.2022.100098.

Ayesu, Enock Kojo, Daniel Sakyi, and Samuel Tawiah Baidoo. 2022b. The Effects of Seaport Efficiency on Trade Performance in Africa. Maritime Policy & Management. https://doi.org/10.1080/03088839.2022.2135178.

Ayesu, Enock Kojo, Daniel Sakyi, and Alexander Bilson Darku. 2023. Seaport Efficiency, Port Throughput, and Economic Growth in Africa. Maritime Economics and Logistics 25 (3): 479–498. https://doi.org/10.1057/s41278-022-00252-8.

Blonigen, Bruce A., and Wesley W. Wilson. 2008. Port Efficiency and Trade Flows*. Review of International Economics 16 (1): 21–36. https://doi.org/10.1111/j.1467-9396.2007.00723.x.

Cadot, Oliver, Alan Aspirilla, Julien Gourdon, Christian Knebel, and Ralf Peters. 2015. Deep Regional Integration and Non-Tariff Measures: A Methodology for Data Analysis. https://unctad.org/system/files/official-document/itcdtab71_en.pdf.

Chang, Young-Tae., Ahhyun Jo, Kyoung-Suk. Choi, and Suhyung Lee. 2021. Port Efficiency and International Trade in China. Transportmetrica a: Transport Science 17 (4): 801–823. https://doi.org/10.1080/23249935.2020.1817169.

Cheong, Inkyo, and Kamonchanok Suthiwartnarueput. 2015. ASEAN’s Initiatives for Regional Economic Integration and the Implications for Maritime Logistics Reforms. The International Journal of Logistics Management 26 (3): 479–493. https://doi.org/10.1108/IJLM-08-2013-0092.

Clark, Ximena, David Dollar, and Alejandro Micco. 2004. Port Efficiency, Maritime Transport Costs, and Bilateral Trade. Journal of Development Economics 75 (2): 417–450. https://doi.org/10.1016/j.jdeveco.2004.06.005.

Cockburn, John, Erwin Corong, and Caesar Cororaton. 2010. Integrated Computable General Equilibrium (CGE) Micro-Simulation Approach. International Journal of Microsimulation 3 (1): 60–71.

Eltalla, Abdel Hakeem, and Ahmad. 2016. The Economic Impact of Constructing a Gaza Seaport: Evidence from a Computable General Equilibrium Model. Journal of Economic Cooperation and Development 37 (2): 35–50.

Foster, James, Joel Greer, and Erik Thorbecke. 1984. A Class of Decomposable Poverty Measures. Econometrica 52 (3): 761. https://doi.org/10.2307/1913475.

Fouda, Regine Adele, Nana Darcis Ngono, Muhammad Azizi Romeo, and S. Rick Fernandez. 2014. Port Logistics in West and Central Africa: A Strategic Development under Globalization. Open Journal of Applied Sciences 04 (02): 76–84. https://doi.org/10.4236/ojapps.2014.42009.

Fox, Alan K, Joseph F Francois, and Pilar Londono-Kent. 2003. Measuring Border Crossing Costs and Their Impact on Trade Flows: The United States-Mexican Trucking Case. In GTAP Conference Paper, 1–17. https://www.gtap.agecon.purdue.edu/resources/download/1492.pdf.

Francois, Joseph, Hans Van Meijl, and Frank Van Tongeren. 2005. Trade Liberalization in the Doha Development Round. Economic Policy 20 (42): 350–391. https://doi.org/10.1111/j.1468-0327.2005.00141.x.

Francois, Joseph F., and Kenneth A. Reinert. 1997. Applied Methods for Trade Policy Analysis: A Handbook. Cambridge: Cambridge University Press.

Fugazza, Marco, and Jean-Christophe. Maur. 2008. Non Tariff Barriers in Computable General Equilibrium Modelling. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.921008.

Gherghina, Ştefan Cristian, Mihaela Onofrei, Georgeta Vintilă, and Daniel Ştefan Armeanu. 2018. Empirical Evidence from EU-28 Countries on Resilient Transport Infrastructure Systems and Sustainable Economic Growth. Sustainability (switzerland). https://doi.org/10.3390/su10082900.

Ginting, Edimon, Arief Anshory Yusuf, Priasto Aji, and Mark Horridge. 2015. Economy-Wide Impact of a More Efficient Tanjung Priok Port. www.adb.org;

Haddad, E., G. Hewings, F. Perobelli, and R. dos Santos. 2010. Regional Effects of Port Infrastructure: A Spatial CGE Application to Brazil. International Regional Science Review 33 (3): 239–263. https://doi.org/10.1177/0160017610368690.

Haralambides, H.E. 2019. Gigantism in Container Shipping, Ports and Global Logistics: A Time-Lapse into the Future. Maritime Economics & Logistics 21 (1): 1–60.

Herrera Dappe, Matias, Charl Jooste, and Ancor Suárez-Alemán. 2017. How Does Port Efficiency Affect Maritime Transport Costs and Trade? Evidence from Indian and Western Pacific Ocean Countries. World Bank, Washington, DC. https://doi.org/10.1596/1813-9450-8204.

Hertel, Thomas, Terrie Walmsley, and Ken Itakura. 2001. Dynamic Effects of the ‘New Age’ Free Trade Agreement between Japan and Singapore. Journal of Economic Integration 16 (4): 446–484.

Hummels, David L., and Georg Schaur. 2013. Time as a Trade Barrier. American Economic Review 103 (7): 2935–2959. https://doi.org/10.1257/aer.103.7.2935.

Hummels, David, Peter Minor, Matthew Reisman, and Erin Endean. 2007. Calculating Tariff Equivalents for Time in Trade. Agency, United States Development, International. https://krannert.purdue.edu/faculty/hummelsd/papers/tariff_equivalents.pdf.

IFDC. 2019. Enhancing Growth through Regional Agricultural Input Systems (EnGRAIS) Project for West Africa. Washington DC. https://ifdc.org/wp-content/uploads/2020/03/Project1_EnGRAIS-FY19-Annual-Report.pdf.

Kee, Hiau Looi, and Alessandro Nicita. 2016. Trade Frauds, Trade Elasticities and Non-Tariff Measures. In 5th IMF-World Bank-WTO Trade Research Workshop. Washington DC. https://thedocs.worldbank.org/en/doc/315201480958601753-0050022016/original/3KEEpaper.pdf.

Kee, Hiau Looi, Alessandro Nicita, and Marcelo Olarreaga. 2009. Estimating Trade Restrictiveness Indices. The Economic Journal 119 (534): 172–199. https://doi.org/10.1111/j.1468-0297.2008.02209.x.

Krugman, Paul. 1991. Increasing Returns and Economic Geography. Journal of Political Economy 99 (3): 483–499. https://doi.org/10.1086/261763.

Lei, Qiao, and Chris Bachmann. 2020. Assessing the Role of Port Efficiency as a Determinant of Maritime Transport Costs: Evidence from Canada. Maritime Economics & Logistics 22 (4): 562–584. https://doi.org/10.1057/s41278-019-00135-5.

Limao, N. 2001. Infrastructure, Geographical Disadvantage, Transport Costs, and Trade. The World Bank Economic Review 15 (3): 451–479. https://doi.org/10.1093/wber/15.3.451.

Mainar-Causapé, Alfredo, Emanuele Ferrari, Hasan Dudu, Pierre Boulanger, and Arnaldo Caivano. 2018. SAM - Sénégal - 2014. http://data.europa.eu/89h/9a0bbce0-be19-474e-ad9d-2c671d4861d0.

Munim, Ziaul Haque, and Hans-Joachim. Schramm. 2018. The Impacts of Port Infrastructure and Logistics Performance on Economic Growth: The Mediating Role of Seaborne Trade. Journal of Shipping and Trade 3 (1): 1–19. https://doi.org/10.1186/s41072-018-0027-0.

Nechifor, Victor, Maria Priscila Ramos, Emanuele Ferrari, Joshua Laichena, Evelyne Kihiu, Daniel Omanyo, Rodgers Musamali, and Benson Kiriga. 2021. Food Security and Welfare Changes under COVID-19 in Sub-Saharan Africa: Impacts and Responses in Kenya. Global Food Security 28 (February). Elsevier B.V.: 100514. https://doi.org/10.1016/j.gfs.2021.100514.

Osinski, Jasmine, and Fana Sylla. 2019. Senegal Exporter Guide. Annual 2018. Dakar. https://apps.fas.usda.gov/newgainapi/api/report/downloadreportbyfilename?filename=ExporterGuide_Dakar_Senegal_3-13-2019.pdf.

Özer, Mustafa, Şerif Canbay, and Mustafa Kırca. 2021. The Impact of Container Transport on Economic Growth in Turkey: An ARDL Bounds Testing Approach. Research in Transportation Economics 88 (September): 101002. https://doi.org/10.1016/j.retrec.2020.101002.

Portugal-Perez, Alberto, and John S. Wilson. 2009. Why Trade Facilitation Matters to Africa. World Trade Review 8 (3): 379–416. https://doi.org/10.1017/S147474560900439X.

Sakyi, Daniel, José Villaverde, Adolfo Maza, and Isaac Bonuedi. 2017. The Effects of Trade and Trade Facilitation on Economic Growth in Africa. African Development Review 29 (2): 350–361. https://doi.org/10.1111/1467-8268.12261.

Samuelson, Paul A. 1954. The Transfer Problem and Transport Costs, II: Analysis of Effects of Trade Impediments. The Economic Journal 64 (254): 264. https://doi.org/10.2307/2226834.

Sánchez, Ricardo J., Jan Hoffmann, Alejandro Micco, Georgina V. Pizzolitto, Martín Sgut, and Gordon Wilmsmeier. 2003. Port Efficiency and International Trade: Port Efficiency as a Determinant of Maritime Transport Costs. Maritime Economics & Logistics 5 (2): 199–218. https://doi.org/10.1057/palgrave.mel.9100073.

Schwab, Klaus. 2019. The Global Competitiveness Report 2019. World Economic Forum. http://www3.weforum.org/docs/WEF_TheGlobalCompetitivenessReport2019.pdf

Simola, Antti, Ole Boysen, Emanuele Ferrari, Victor Nechifor, and Pierre Boulanger. 2021. Potential Effects of the African Continental Free Trade Area (AfCFTA) on African Agri-Food Sectors and Food Security. https://doi.org/10.2760/531308.

Torres, Clemencia, Cecilia Briceño-Garmendia, and Carolina Dominguez. 2011. Sengal’s Infrastructure : A Continental Perspective. Africa Infrastructure Country Diagnostic Development. The Internal Bank For Reconstruction and Development/ The World Bank. Washington DC. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1792254.

UNCTADSTAT. 2020. Maritime Profile: Senegal. https://unctadstat.unctad.org/countryprofile/maritimeprofile/en-gb/686/index.html.

Walmsley, Terrie, and Peter Minor. 2015. Willingness to Pay in CGE Models: Estimating the Benefits of Improved Customs Efficiencies within the WTO Trade Facilitation Agreement. ImpactECON. Vol. 002.

Walmsley, Terrie, and Peter Minor. 2020. Demand Shifts and Willingness to Pay in Applied Trade Models. The World Economy 43 (6): 1499–1520. https://doi.org/10.1111/twec.12890.

Walmsley, Terrie, and Anna Strutt. 2021. A Comparison of Approaches to Modelling Non-Tariff Measures. Journal of Global Economic Analysis 6 (1): 1–33. https://doi.org/10.21642/JGEA.060101AF.

World Bank. 2011. Doing Business 2011: Making a Difference for Entrepreneurs. Washington DC. https://www.ngbusiness.org/content/dam/ngBusiness/media/Annual-Reports/English/DB11-FullReport.pdf.

Acknowledgements

The authors extend their gratitude to the editor and reviewers for their valuable suggestions and advice to improve the paper in line with the requirements of their esteemed journal. The authors would also like to express their appreciation to Dr. Panayotis Christidis of the European Commission, Joint Research Centre, for his insightful comments on the final version of the paper.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Sahoo, A., Nechifor, V., Ferrari, E. et al. On the positive economic impacts of port infrastructure development and seaborne trade efficiencies in Sub-Saharan Africa: the case of Senegal. Marit Econ Logist (2024). https://doi.org/10.1057/s41278-024-00293-1

Accepted:

Published:

DOI: https://doi.org/10.1057/s41278-024-00293-1