Abstract

Government accountability requires autonomous and demanding citizens. Even in consolidated democracies, however, there are segments of the population that are systematically supportive of authority. Why? I argue that material dependence on income coming from the state is an important driver of pro-authority attitudes (PAA). Integrating and generalizing previous claims in the literature, I argue that (a) all forms of economic dependence on public coffers, particularistic or not, make citizens closer to rulers, and (b) the result is not just support for the specific incumbent who first provided (or later maintained) a benefit, but a general positive predisposition towards authority—all rulers, ruling parties, government institutions, and public policies. Survey data from 18 Latin-American countries show that citizens who receive four common and diverse types of income originating in the state—public sector salaries, pensions, welfare assistance, and conditional cash transfers—hold, ceteris paribus, attitudes more favorable to authority than other citizens (the opposite is true for those receiving remittances, which enhance economic autonomy from the state). This effect, however, is conditional on three country-level characteristics that affect incumbents’ control and discretion over fiscal resources: level of democracy, government effectiveness, and economic freedom.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Democracy thrives when autonomous and demanding citizens hold rulers accountable. Citizens, however, are sometimes uncritically supportive of authorities. Why? This question is not about specific behaviors, such as voting for an incumbent in a given election, or about contingent judgements, such as approving of a ruling party at a given time. It is about a general and enduring mental orientation that I call pro-authority attitudes (PAA). A citizen who circumstantially approves of her country’s president has an opinion; a citizen who approves of the current, past and future presidents, governors, and mayors, and of their parties and policies, holds pro-authority attitudes.

The central argument of this paper is that economic dependence on income originating in the state is an important driver of PAA. Individuals whose material well-being hinges on public sector salaries, state-run pensions, welfare payments, and other types of income obtained from a government’s budget are expected to develop, ceteris paribus, more positive attitudes towards authorities than those whose livelihood depends on non-governmental streams of income.

This pro-authority effect of state dependence is likely to be context dependent, i.e., stronger where rulers have more power and discretion over the allocation of fiscal resources and weaker (or inexistent) where decisions about jobs or welfare programs, for example, are constrained by democratic checks and balances, clear and effective rules, and a professional bureaucracy.

Public employees and state pensioners constitute large segments of the population in most of the world and in all the Latin-American cases studied below. Moreover, the remarkable expansion of pensions and conditional cash transfers (CCTs) to millions of poor, unemployed, and/or informal Latin Americans that took place in the 1990s and 2000s (Garay 2016) greatly expanded the number of people whose material welfare hinges on income originating in the state. Thirty-six percent of respondents in the surveys analyzed below depend significantly on them for their livelihoods. In the Latin-American countries with the largest public sectors (which account for over 40% of GDP in Argentina, Brazil, and VenezuelaFootnote 1), close to half of the total population regularly receives a government payment in the form of salaries, pensions, welfare, or CCTs.Footnote 2 This fact, often criticized by free-market think tanks and conservative politicians, has become part of the public agenda in several countries. A former majority leader of the Argentine Senate recently diagnosed his country’s economic woes as follows: “there are 10 million people who work and 17 million who collect a check from the state” (author’s translation).Footnote 3

The rest of the paper proceeds as follows. In the first section I review several literatures related to the argument. In the second section, I define PAA and explain the argument in detail. The following section spells out its observable implications in the form of eight hypotheses. The fourth section presents the empirical strategy used to test them. The fifth section implements the empirical strategy. The last section summarizes the findings and discusses their theoretical and normative implications.

Related literatures

According to several social psychology frameworks, the tendency to approve of rulers and ruling institutions is rooted in human minds. System justification theory poses that people tend to support the existing order, for reasons that go from the need to approve of the system to which one belongs, to the potential costs of opposing powerful ruling structures (Jost et al 2004). Research on decision making has documented a related “status-quo bias” (Samuelson and Zeckhauser 1988), which may arise from prospect theory’s “loss aversion” (Kahneman et al 1991): the tendency for individuals to derive more disutility from a loss than utility from a gain of equal magnitude.

Political science and related disciplines have produced a significant literature on political support (Norris 1999), and on the related concepts of trust in authority (Levi and Stoker 2000; Oskarsson 2010; Torney-Purta et al 2004) and deference to authority (Paluck and Green 2009). Some authors see causal relations among them, for example, from trust to support (Parker 1989). Normative works debate whether democracy is better served by trusting or distrustful citizens (Cleary and Stokes 2006). Most explanations for these outcomes can be classified in two groups, politically exogenous and politically endogenous (Oskarsson 2010). The first approach stresses psycho- and socio-cultural factors, in particular childhood experiences (Adorno 1950), national cultures (Zhai 2017), individual values (Skitka et al 2009), and media messages that might potentially change values (Paluck and Green 2009). The second approach focuses on performance-based political factors, such as “people’s experiences of political authorities and institutions and evaluations of their performance” (Oskarsson 2010: 424). Of note, material dependence on income from the state is seldom mentioned as an explanatory factor.

There is a large literature on the determinants of support (and in particular electoral support) for specific authorities. The idea that particularistic forms economic dependence on the state causes citizens to be more supportive of the incumbents responsible for those non-programmatic benefits, is common in the literature on “pork,” patronage, and clientelism: rulers discretionally allocate state-funded public works, jobs, and handouts in exchange for political support (Gherghina and Nemčok 2021; Golden and Min 2013; Stokes et al 2013). One stream of this scholarship sees recipients as truly grateful to incumbents (or obliged by rules of reciprocity) (Auyero 2000; Lawson and Greene 2014). A second view emphasizes that beneficiaries strategically support incumbents in order to secure their privileges (Calvo and Murillo 2019; Greene 2007), or to avoid punishment (Stokes 2005). Scholars have proposed, also in a strategic vein, that political appointees and clients have a vested interest in backing incumbents because they fear new rulers will discontinue their benefits (Haveric et al 2019; Oliveros 2021).

Programmatic material benefits dispensed by the state have also been linked to support for specific authorities. CCTs, which in Latin America are regarded as largely universalistic (Corrêa and Cheibub 2016)Footnote 4 have been found to “foster pro-incumbent support” in the emblematic cases of Mexico (De La O 2012, 12) and Brazil (Zucco 2013; Zucco and Power 2013). The issue, however, is far from settled, as some of these findings have been challenged (Imai et al 2020). When all studies are considered, the balance is in favor of a causal impact of CCTs on the likelihood of voting for incumbents. Two multi-nation studies find that Latin-American recipients of social assistance and CCTs are, other things being equal, more likely to vote for the incumbents who implemented them (Layton and Smith 2015; Pavao 2016), a conclusion confirmed by a recent meta-analysis of experimental and regression discontinuity designs in Latin-American (and Asian) countries (Araújo 2021). These studies, however, focus on just one manifestation of PAA, electoral support,Footnote 5 and not for all authorities, but for the particular national incumbent who first implemented a program.

Two of these works do find, in line with my argument that CCTs make recipients not only more likely to vote for the administration that first established them, but also for future rulers (of different parties) who keep CCTs in place (Corrêa and Cheibub 2016; Zucco 2013). Their focus, however, is still on specific incumbents: The explanatory logic is one of programmatic, strategic or emotional connection between beneficiaries and the presidents or national ruling parties who first implemented or later continued a program. The causal effects this scholarship documents, however, may well be a particular instance of a broader phenomenon: that any form of economic dependence on the state leads to the development of positive attitudes towards state authorities in general, i.e., to all incumbents, at all levels of government.

A separate literature that on regime type, has long emphasized that democracy in unlikely to thrive where the state is economically dominant. The typical causal mechanism posits that individuals and organizations who depend economically on the state tend to support (or defer to) incumbents, and to shun the opposition, thus creating the conditions for authoritarianism (Dahl 1971). Statism and the economic dependence of constituents it brings about is often seen as a cause of authoritarian survival (Fish 2005; Greene 2007; Pei 2021). Class approaches to political regimes posit that the supposedly pro-democratic bourgeoisie, middle class or working class support authoritarian incumbents when their material welfare depends on government budgets (Bellin 2000; Rosenfeld 2017, 2021). In a similar vein, the rentier state approach suggests that citizens and businesses whose income derives from the plentiful coffers of oil-rich countries tend to be submissive (Ross 2001). Popular support for autocratic incumbents in Africa has been linked to the dictators’ provision of welfare benefits (Han 2020). Low levels of subnational democracy have also been attributed to citizens’ limited economic autonomy from the state (Gervasoni 2018; McMann 2006).

The common thread uniting these otherwise disparate literatures on patronage, CCTs, and regime type is the simple idea that most people care deeply about the level and security of their income, and that when such income depends directly on decisions made by political authorities, they will tend to support them. This support, however, is typically conceived as narrowly focused on the specific incumbent in control of a benefit.

Economic dependence on the state and pro-authority attitudes

The argument I propose differs from those reviewed above in two key aspects: (1) it generalizes the causal claim to all sources of individuals’ income coming from government budgets, and (2) it poses that the effect is not just generating support for the particular incumbent who first provided a benefit (or for the incumbent currently dispensing it), but to foster positive attitudes towards everything related to rulers and ruling institutions. In terms of causal variables, the argument goes well beyond particularistic government payments (such as patronage salaries) or material benefits targeted to the poor (such as CCTs): economic dependence on the state is a broad concept that encompasses any sort of regular income originating in a government budget. In terms of the outcome variable, PAA are also broadly defined, as the predisposition to systematically feel close to, or supportive of, all political authorities, that is, all the politicians and parties in high office (and the policies associated with them), at all levels of government (national and subnational).Footnote 6 PAA are attitudes because they are general (i.e., about all authorities) and stable (do not change much over time).Footnote 7

Notice that this generalized support might emerge from many sources, including the related attitudes mentioned earlier, like deference (some individuals might hold PAA as a consequence of deep deference to authority) or trust (trusting individuals might be more likely to support any authorities; Parker 1989). Pro-authority attitudes, however, are different from, and may arise in the absence of, deference, or trust, for example, when they emerge from the type of strategic calculus emphasized by the literatures on clientelism or patronage.

In short, I posit that individuals whose economic well-being significantly depends on any type of income coming from a government source will tend to become generally supportive of authority. This causal process surely coexists with related but different processes identified by previous research: clients may reciprocate a mayor for providing particularistic handouts, voters may reward a ruling party for implementing their preferred programmatic policies, citizens may express support for a governor’s good performance on valence issues, such as public safety. All of these differ from the argument put forward above because a) the support is targeted to a specific authority, and/or b) the causal factor is not economic dependence on the state.

Why would state-dependent citizens develop stronger PAA than other citizens? A modified version of the emotional and strategic causal mechanisms reviewed above provides a plausible rationale: receiving a state-funded benefit may engender sincere feelings of gratitude or strategic reciprocation, but establishing what authorities to thank or reciprocate might be cognitively difficult for most citizens. People are not especially interested in, knowledgeable of, or attentive to politics (Delli Carpini and Keeter 1996; Zaller 1992), so their political judgements are typically characterized by low-information rationality and by the use of informational shortcuts and heuristics (Sniderman et al 1991). Furthermore, these cognitively limited citizens face complex political systems in which decisions are made and implemented by many officials, agencies and levels of government, and in which political actors often engage in false credit claiming and blame avoidance. State-dependent citizens surely understand that their material welfare hinges on decisions made in political spheres above them, but would be hard pressed to identify the exact officials, formal rules and informal practices that are involved in decisions to maintain, reduce or withdraw a benefit. Developing a “PAA heuristic” is a cost-effective alternative to investing time and effort in determining what authority should be supported.

The psychological approaches summarized above provide other plausible causal mechanisms. System justification theory may apply especially well to state-dependent citizens, as the emotional need to approve of the established political order may be stronger among those who are economically and socially connected to it. They may also be particularly prone to developing status-quo bias and loss aversion: following a “better the devil you know” logic, they may prefer a certain benefit under the status quo over uncertain alternatives, even if the expected payoff of the latter is greater. Because of space and data limitations, below I test several of the argument’s observable implications, but not the mechanisms themselves.

The proposed argument applies more plausibly to empirical domains in which rulers have much discretion over decisions regarding public employment, welfare programs, and the like. In democratic countries with Weberian bureaucracies operating under the rule of law, people who obtain a benefit may perceive (correctly) that this type of income is distributed by the impersonal application of legally mandated procedures by largely apolitical bureaucrats. Conversely, in contexts of democratic and institutional weakness and politicized bureaucracies, citizens may perceive (again correctly) that obtaining and maintaining a benefit depends on the particularistic decisions of current rulers, who will favor supporters.

Likewise, the pro-authority effects of state dependence might be stronger in statists’ settings in which governments own or heavily regulate much of the economy. Opportunities for economic progress outside the public sector are scarce under statism, so state-dependent individuals may have stronger incentives to support authorities. Much scholarship documents this phenomenon in diverse developing world contexts such as Indonesia (Berenschot 2018), Kyrgyzstan (McMann 2006), Mexico (Greene 2007), and Russia (Fish 2005).

Sources of income originating in the state differ in many ways. For example, typical public sector salaries are regular and sizable payments, while CCTs are often conditional and small in value. Public employees tend to be middle class, while CCT recipients are typically poor. The argument I propose abstracts from this great diversity of incomes, focusing on what they all have in common: making recipients dependent on the state for their material welfare. Whether the four very different types of such income analyzed here – salaries, pensions, welfare payments, and CCTs – have similar or different impacts on PAA is an empirical question tackled by the statistical models below.

Hypotheses

I test the argument through eight hypotheses. The first four constitute its main observational implications at the individual level. They are all special cases of a more general expectation: Other things being equal, PAA should be higher among citizens whose economic welfare depends on streams of income originating in the state.

Hypotheses 1 to 4

Public employees (H1), pensioners (H2), welfare beneficiaries (H3), and CCT recipients (H4) should, ceteris paribus, manifest higher levels of PAA than other citizens.

A related observable implication of the argument reflects the other side of the phenomenon: citizens with access to sources of income clearly independent from the government should be less pro-authority. Remittances are an excellent case in point because they a) are in all likelihood exogenous to the dependent variable (i.e., not driven by PAA), b) are measured by an AmericasBarometer item, and c) benefit a significant share of Latin-American households (11.8% in the sample). A recent study shows that remittances can weaken or boost recipients’ electoral support for Latin-American incumbents, depending on their level of satisfaction with those incumbents (Ahmed 2017):

Hypothesis 5

Individuals who receive (or live in households that receive) remittances should, ceteris paribus, manifest lower levels of PAA than other citizens.

A second set of hypotheses is about the conditional, contextual side of the argument. They are also special cases of a more general claim: The effects postulated by hypotheses 1 to 4 should be stronger where governments command more power, and in particular discretionary power over the allocation of fiscal resources.

Hypotheses 6 to 8

The positive effect of state dependence on PAA should increase as levels of democracy (H6), government effectiveness (H7), and economic freedom (H8) decrease.

Empirical strategy: data and methods

Testing these hypotheses through true experiments is not feasible, as a researcher cannot randomly assign the five key individual-level independent variables or the three country-level predictors: it would be impossible and/or unethical, for example, to assign a pensioner to the “no pension” treatment or a highly democratic country to a “low democracy” treatment. Natural experiments or quasi-experimental approaches (such as regression discontinuity designs) can provide valuable exogenous variation in the independent variables, but conditions to implement these methods are very stringent, and, where possible, there are costs in terms of the generality of the findings, the number of forms of state dependence that can be tested, and of the number of countries covered (a notable and quite exceptional example is the analysis of the randomly phased application of the Mexican Progresa program carried out by Imai et al, 2020). Therefore I rely on the observational data provided by LAPOP’s AmericasBarometer surveys,Footnote 8 which include indicators of diverse forms of state dependence for a large sample of individuals (N = 29,064) residing in diverse countries (18 Latin-American nationsFootnote 9) that differ widely in their level of democracy, government effectiveness, and economic freedom, and that also contains several indicators of political preferences that can validly measure PAA. This relatively large and diverse sample of individuals and nations represents an advantage in terms of external validity. The observational nature of the data, however, implies that the statistical associations between predictors and PAA reported below have to be cautiously interpreted in terms of causal inferences.

Operationalizing pro-authority attitudes

I measure PAA using all the AmericasBarometer items that tap judgements or behaviors that imply support/opposition to authorities, political institutions and policies. Unlike vote-recall questions, which typically include significant nonrandom measurement error due to social desirability bias (Zucco and Power 2013, 10–12), these items are mostly non-electoral and refer to the present. Of course, a citizen might express support for a president, a mayor, a ruling party, or a policy for many reasons other than PAA. Moreover, these indicators surely contain, like all public opinion survey items, much random measurement error (Ansolabehere et al 2008). However, the “signal” of PAA should by captured by all of them: individuals who are systematically pro-authority (anti-authority) will tend to approve (disapprove) of everything relating to rulers and policies. There is a clear logic of effect (or reflective) indicators: high (low) levels of PAA should cause (or be reflected in) systematically positive (negative) answers to these items. Therefore, an index that aggregates many items should amplify the signal (PAA) and cancel out the noise (i.e., other drivers of approval/disapproval plus measurement error), thus, outperforming single items in terms of reliability, and, as a consequence, in terms of the precision of the statistical inferences based on them (Ansolabehere et al 2008).

I exploit the 11 AmericasBarometer items (listed below) that tap opinions on rulers (national and subnational), government institutions, public policies, the state of the economy, and the political system itself. I rescaled them from zero (most anti-authority response) to one (most pro-authority response). (For item details see Table A in the online appendix).

-

1.

Trusts President (A lot = 1)

-

2.

Trusts National Congress (A lot = 1)

-

3.

Trusts local or municipal government (A lot = 1)

-

4.

Assessment of performance of President (Very good = 1)

-

5.

Assessment of performance of Congress (Very well = 1)

-

6.

Vote intention in next presidential election (Incumbent’s candidate = 1)

-

7.

Satisfaction with public schools (Very satisfied = 1)

-

8.

Satisfaction with public health (Very satisfied = 1)

-

9.

Satisfaction with roads (Very satisfied = 1)

-

10.

Retrospective assessment of country’s economy (Better than a year ago = 1)

-

11.

Pride of living under country’s political system (Very proud = 1)

Factor analysis confirms these items are strongly unidimensional. The first factor explains 88.8% of their common variance, and is the only one with an eigenvalue (= 3.47) above one. All items correlate positively and relatively strongly with this factor. Following standard practice (Ansolabehere et al 2008), I define the PAA Index as the unweighted arithmetic mean of all the effectiveFootnote 10 responses to the 11 items (the resulting scale is highly reliable; α = 0.81). This alternative has two advantages over the first-factor scores: 1) it generates fewer missing observations (N = 26,676 and 22,064, respectively), and b) its 0–1 scale produces easily interpretable regression coefficients (vis-à-vis the Z-scores in which factors are expressed). Otherwise the choice makes little difference, as the two indices are very highly correlated (r = 0.99). The PAA Index is approximately bell-shaped, with a slight positive skew (mean = 0.42; SD = 0.18).

Of note, the PAA Index includes offices and policies that are often controlled by different political forces. For example, the Peruvian survey was conducted during the presidency of Pedro Pablo Kuczynski, who faced a congress dominated by the main opposition party (Keiko Fujimori’s Fuerza Popular; 56% of the seats). Nevertheless, the correlation between Trust President and Trust National Congress in Peru is 0.41 (p value = 0.000). This and other similar positive associations – which may appear odd to informed scholars with highly structured political attitudes – are partly driven by pro-authority (and anti-authority) citizens, i.e., people who trust (distrust) both the president and a congress that strongly opposes him.

I also provide two alternative operationalizations of the dependent variable, based on subsets of the 11 indicators above. These indices tap different aspects of authority, and therefore, help both check the robustness of the findings to different ways of measuring PAA, and determine whether state dependence has differential impacts on different dimensions of PAA. The first, PAA Executives, measures support for the individuals and parties occupying national and subnational chief executive offices (items 1, 3, 4, and 6; α = 0.72). Conversely, PAA Impersonal excludes indicators about specific rulers in favor of those that capture support for policies, governing institutions, and the political system (items 2, 5, 7, 8, 9 and 11; α = 0.70).

In spite of tapping different aspects of PAA and not sharing indicators, these alternative indices observe a solid positive correlation (r = 0.59, p value = 0.000), which is consistent with the idea that individuals’ underlying levels of PAA are manifested in all survey questions related to rulers, government institutions and policies.Footnote 11

Independent variables

To operationalize economic dependence on the state I constructed four AmericasBarometer-based dichotomous indicators identifying respondents who 1) are civil servants (Public employee), 2) are retired from work and receive a state-funded pension (PensionerFootnote 12), 3) receive (themselves or their households) some type of welfare assistance (Government assistance), or 4) conditional cash transfers (CCT). Latin Americans in any of these four categories generally depend heavily on the state, as their salaries, pensions, welfare payments or CCTs typically make up all or a considerable portion of their income.Footnote 13 These categories cover sizeable proportions of the sample: 7.1% of interviewees are public employees and 6.6% are pensioners, while 11.5% and 21.9% of respondents benefit (directly or through a member of their households) from government assistance or CCTs, respectively (36.3% of all interviewees receive at least one of these types of income).

An indicator of economic independence from the state, Remittances, also comes from an AmericasBarometer item (on whether the respondent or someone in her household receives remittances). This item, however, appears in only 12 of the 18 country surveys,Footnote 14 which significantly reduces the N in models using it. The details of these indicators are shown in Table 1.

The three country-level control variables come from secondary sources. Democracy is measured using Varieties of Democracy’s Liberal Democracy Index. Government effectiveness is the World Bank's Government Effectiveness Index. Economic freedom is the Heritage Foundation’s Index of Economic Freedom, rescaled to vary from zero to one. All of them are measured in the year in which a country’s survey was conducted. Because Democracy and Government effectiveness are highly correlated (r = 0.86, their VIFs in model 1 of Table 2 below are 4.45 and 5.22) I run two alternative sets of models using one of them at the time (in the models below I use Democracy; models using Government effectiveness are shown in the online appendix).Footnote 15

The statistical models shown below also control for several potential individual-level confounders. The most important of these is identification with the incumbent party at the national level (Incumbent Party ID): if party identification is understood as a deep-rooted identity internalized by individuals in their early stages of political socialization (Green et al 2002), then it is clear that it should be controlled for: individuals identified with the national ruling party might partly be pro-authority because of this identity (although notice that all PAA indices include items not related to the national executive). Alternatively, if a respondent “identifies” with the ruling party as a way of expressing her contingent support for it, then Incumbent Party ID is more appropriately thought of as an additional indicator of the dependent variable (i.e., a manifestation of PAA). This distinction is important in Latin America, where parties are often fleeting electoral vehicles unlikely to generate long-term identities (Mainwaring 2016). Both rationales are surely present in the sample: A Mexican respondent identifying with the old, well-institutionalized PRI is likely to hold a firm identity, while a Peruvian who says he “identifies” with Peruanos por el Kambio (the short-lived party founded in 2014 by presidential candidate Kuczynski.) surely does so for reasons different than an entrenched social identity. To the extent that expressing identification with the national ruling party is sometimes a consequence of PAA (rather than of an ingrained identity), Incumbent Party ID is partly endogenous. Conditioning on it, therefore, produces over-control bias (Elwert and Winship 2014) in the regression results below. Not conditioning, on the other hand, likely leads to omitted-variable bias. To conservatively err on the side of rejecting the hypotheses, all statistical models below control for Incumbent Party ID.

A second key individual-level control variable is Life satisfaction. It is possible that PAA in part reflect people’s overall happiness, so that attitudinally happy citizens might express more PAA than gloomier ones. This control may also introduce bias: if benefiting from government income makes people more satisfied with their lives, and this in turn leads to PAA, then controlling for life satisfaction would lead to post-treatment bias and, consequently, to attenuated coefficients for the state-dependence indicators. Here also I make the methodologically cautious choice of adding this control in all models, thus, stacking the analysis against the hypotheses.

Other individual-level controls are Gender, Age, SES (socioeconomic status), Education, Municipality size, and Urban locality. The latter four are indicators of modernization, and therefore, are expected to be negatively associated with PAA: citizens with higher levels of income and education, and those living in larger, more urban settings have been hypothesized to be less concerned about survival (material) values and more demanding of political rights (Inglehart 1997) and, one can conjecture, more critical of authorities. Tables A and B in the online appendix provide the details of all control variables and the summary statistics for all variables, respectively.

Estimation

The statistical results presented below are estimated using linear multilevel models (also known as hierarchical linear or mixed-effects models) with random intercepts at the country level. These estimation choices account for the hierarchical and clustered nature of the data: respondents (level 1) are nested within countries (level 2). The random intercepts allow for different baseline levels of PAA in each country due to unobserved explanatory variables. The fact that, in spite of a very large number of level-1 cases (individuals), the number of level-2 units (countries) is limited, brings about inferential problems when models are estimated via MLE: “anti-conservative” standard errors and overconfident test of hypotheses (Stegmueller 2013). Following the current state of the art regarding multilevel modeling with a modest number of countries (Elff et al 2021), I estimate all models using REML (instead of MLE), combined, for significance testing purposes, with the Satterthwaite approximation for the distribution of the Wald test statistic (i.e., a t-distribution with the appropriate degrees of freedom for complex multilevel models, rather than the standard normal distribution; Elff et al 2021).

Statistical analysis

The first three models in Table 2 test hypotheses 1 through 4, using the three alternative dependent variables: PAA Index (model 1), PAA Executives (model 2) and PAA Impersonal (model 3). All coefficients for Public employee, Government assistance and CCT are positive and statistically significant (one of them only at the 0.90 level). Results for Pensioners are somewhat weaker: the slopes are positive in models 1 and 3 (and significant at the 0.90 or 0.95 level, respectively) and essentially zero in model 2. Other things being equal, citizens receiving state income – regardless of whether it comes from salaries, welfare, or CCTs (and possibly pensions) – are more pro-authority than the rest. As indicated above, these coefficients are likely downwardly biased, because of the over-control and post-treatment bias introduced by Incumbent Party ID and Life satisfaction.

The largest coefficients are those corresponding to Government assistance (range: 0.024 − 0.043), followed by those of CCT (0.016 − 0.021), Public employee (0.007 to 0.021) and Pensioner (0.000 − 0.012).

Models 4 to 6 in Table 2 add Remittances as a predictor in order to test hypothesis 5 (at the cost of a significantly smaller number of countries and observations, see endnote 14). As expected (hypothesis 5), the three coefficients are negative and significant at the 0.90 or 0.99 level, indicating that benefitting from exogenous (in the double sense of coming from abroad and not being driven by the dependent variable) income is associated, ceteris paribus, with weaker PAA. Of note, the twelve coefficients corresponding to the indicators of state dependence in models 4 to 6 remain positive and are all larger than in models 1 to 3 (and of similar significance in spite of the smaller sample), suggesting that the statistical associations between state dependence and PAA in models 1 to 3 are underestimated due to the omitted-variable bias introduced by not controlling for Remittances.

I illustrate the magnitudes of these coefficients on the basis of model 4 (which uses the broadest index of PAA and includes Remittances): a very state-dependent individual, say a public employee who lives with family members receiving government assistance and CCTs, is expected to have a PAA Index score almost 0.1 higher than a non-dependent self-employed individual whose household receives no government assistance or CCTs but does get remittances.Footnote 16 In other words, around half of the standard deviation of the PAA Index (= 0.183) can be accounted for by these five variables.

Are these statistical associations consistent across countries? I ran model 1 in Table 2 separately for each of them. Tables C and D in the online appendix summarize the results for the four key slopes: 28 of the 70 coefficientsFootnote 17 are positive and significant (i.e., consistent with the hypotheses), 40 are non-significant (inconclusive), and only one is negative and significant. Government assistance and CCT obtain positive and significant coefficients in most countries, Public employee does so in six, and Pensioner in one country only.

The 40 non-significant slopes may reflect either the lack of statistical power of the country-specific models or the actual absence of the hypothesized effect in several countries. The latter alternative would suggest causal heterogeneity, that is, that the impact of state dependence on PAA varies across nations. The interactive models shown in Table 3 explore precisely this possibility: that the size of the individual-level effects are a function of country-level variables, as indicated in hypotheses 6 through 8.

All individual control variables are also significant predictors of the three PAA indices in Table 2. Citizens at the highest level of SES are, ceteris paribus, 0.03 to 0.05 units less pro-authority than those at the lowest level. Even controlling for SES, Education also predicts weaker PAA: Each additional 10 years of formal education is associated with a decrease of 0.04 to 0.06 units in the PAA indices. Likewise, living in demographically larger localities predicts weaker PAA: Each increase of one unit in the scale of Municipality size is associated with a fall of 0.04 to 0.06 units in the three dependent variables. Even controlling for this, people living in cities have on average PAA scores 0.008 to 0.015 units lower than those in rural areas. In sum, all factors associated with modernization – income, education, urbanization – appear to make citizens more critical of authority.

A quadratic specification of Age fits the data considerably better than a linear one, and reveals a U-shaped pattern, with higher PAA for younger and senior respondents, and a minimum at around the age of 45.

Incumbent Party ID has the expected positive, strong, and highly significant association with all measures of PAA. Its coefficients are larger for PAA Executives (0.278) than for PAA Index (0.169) and PAA Impersonal (0.093), which is consistent with the specific content of each measure. Of note, because of the over-control bias introduced by Incumbent Party ID (explained above) all slopes for the state-dependence indicators become considerably larger and more significant if it is dropped.Footnote 18 The coefficients for Life satisfaction are always positive and highly significant, and of similar magnitude across all models (ranging from 0.077 to 0.092).

Moving to the country-level factors, neither Democracy nor Economic freedom are significantly associated with PAA in any of the six models (see parallel, also insignificant results for Government effectiveness in Table C of the online appendix). The more theoretically important role of these variables, however, is not their potential direct impact on PAA, but their interactions with the four main individual-level explanatory factors.

Conditional effects

Models 2 to 4 in Table 3 show the results of the interactive models (additive model 1 from Table 2 is repeated for comparison). Each of them adds to model 1 four multiplicative terms between the indicators of state dependence and one of the country-level variables, thus, testing hypotheses 6 to 8. The coefficients are, as expected, negative, and generally significant for Public employee, Government assistance, and CCT.Footnote 19 The three coefficients for Pensioner, on the other hand, are statistically indistinguishable from zero. In other words, public employees and beneficiaries of government assistance and of CCTs (but not pensioners) are, ceteris paribus, more sympathetic to authority in countries with low levels of democracy, poor government effectiveness and limited economic freedom.

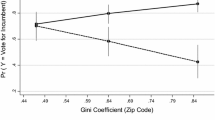

How large are these interactive effects (assuming a causal interpretation of the interactive coefficients)? For space reasons I focus on Democracy (in Fig. 1, see similar analyses for the other two country-level variables in the online appendix, figures A and B). Model 1 shows that, ceteris paribus, the mean level of PAA of public servants is 0.012 units higher than that of other citizens. However, panel (a) in Fig. 1 reveals that where Democracy is higher than 0.6 (Argentina, Chile, Costa Rica and Uruguay) the pro-authority effect of being a public employee is indistinguishable from zero. Conversely, in the sample’s least democratic nations – Nicaragua and Venezuela (Democracy = 0.14) – the estimated conditional slope of Public employee equals 0.032, almost three times larger the average slope of 0.012.

Panels (b), (c), and (d) in Fig. 1 show the conditional slopes for the other three state-dependence variables. The lines for Government assistance and CCT reveal a similar downward slope (as Democracy grows) and a similar threshold, after which the pro-authority effects (in a causal interpretation) of these variables become statistically insignificant. The conditional association for Pensioners, on the other hand, is nowhere significant.

In sum, the results of the interactive models show that the pro-authority tendencies of public employees and of recipients of government assistance and CCTs are weak or nonexistent a) in highly democratic contexts, b) where governments are effective and bureaucracies professional, and c) when markets operate with moderate or low levels of government intervention. Conversely, state dependence fosters PAA especially strongly in less democratic settings, in countries with politicized bureaucracies, and in statist economies.

Economic dependence and non-state authorities

An additional testable implication of the argument is that the PAA of state-dependent citizens should be limited to state authorities. If they hold PAA because they understand their income hinges upon decisions made by government officials about sources of income such as pensions or CCTs, there is no reason for these citizens to be also systematically favorable to non-state (e.g., religious) authorities that are clearly not in charge of such decisions.

The AmericasBarometer surveys contain items about levels of trust in three important, visible, and influential institutions that, however, do not make decisions on the income of state-dependent individuals: the Catholic Church, which is the most important religious institution in Latin America, and two international organizations: the Organization of American States (OAS) and the United Nations (UN). The first item is available only for four countries (Argentina, Colombia, El Salvador and Honduras, providing a respectable sample size of 5,315 cases) and the latter two appear in all countries but Peru, with N of 14,517 and 16,451, respectively. Table F in the online appendix shows the results of baseline model 1 of Table 2 (in which the PAA Index is the dependent variable) compared to the same model in which Trust church (model 2), Trust OAS (model 3) and Trust UN (model 4) are the dependent variables (all rescaled to a 0 to 1 scale for comparison with the PAA Index results).Footnote 20 Models 5 to 7 add Remittances as a predictor (and, therefore, should be compared with models 4, 5 and 6 in Table 2).

Results are consistent with expectations. None of the four groups of state-dependent citizens is – ceteris paribus – systematically more favorable to the three non-state authorities included in Table F. In models 2, 3, and 4 only two of the twelve relevant coefficients are positive and significant (those for Pensioners in the case of Trust church and for Government assistance in the case of Trust UN), while the other ten are not significant (and four of them are negatively signed). Results are even stronger in models 5, 6 and 7 (with Remittances), with just one positive and significant coefficient, and seven of the remaining eleven key slopes negatively signed. The coefficients for Remittances are also consistent with the argument, as they show no systematic tendency by beneficiaries of remittances to be critical of non-state authorities (two are in fact positive and significant, while the one for the Catholic Church is negative and significant). In sum, state-dependent citizens observe a marked tendency to support state authorities (as shown in Table 2), but such tendency is absent for non-state authorities. Likewise, the economic independence of the state afforded by remittances is systematically associated with lower levels of PAA, but not with systematically colder attitudes towards non-state authorities.

Issues of causality

I have used the regression results above to test a causal argument, which of course is problematic in the context of observational data. The statistical associations between indicators of state dependence and PAA are certainly consistent with the hypotheses, but could be explained by two alternative causal structures: confounding and reverse causality.

Confounding would occur if state dependence and PAA shared causes. The statistical models include a set of individual and country-level controls that reduce this possibility. Two particularly critical ones are Education and SES, given that low levels in these variables should increase the probability of receiving welfare benefits and CCTs (and reduce the probability of being a public employeeFootnote 21), at the same time that may foster PAA.Footnote 22 It is also plausible that Incumbent Party ID causes both PAA and state dependence (especially for Public employee and Government assistance, where politicized decisions occur relatively frequently), so it is controlled for in all models even if, as explained above, this leads to the (methodologically cautious) underestimation of the key regression coefficients.

The three country-level controls also reduce the chance of spuriousness, as they preclude the possibility that factors such authoritarianism or statism affects both the likelihood of receiving government income and of holding PAA. If country (or provinceFootnote 23) fixed effects are used instead – to hold constant all country (or province)-specific factors – the coefficients for all the indicators of state dependence remain positive and keep essentially the same significances and magnitudes as in model 1 (see these two models in Table G in the online appendix).Footnote 24

Reverse causality is plausible, as pro-authority individuals may disproportionally obtain patronage jobs or discretionary government assistance. This is not the case, however, for the bulk of pensioners and CCT recipients, as their benefits originate in largely universalistic programs based on objective criteria (Sugiyama and Hunter 2013) which are hardly ever denied to deserving government opponents or given to underserving supporters.

A mix of both directions of causality is likely in the more politicized world of public employment. All Latin-American countries have both a) large numbers of stable civil servants who typically remain in their positions throughout the tenure of different incumbents (e.g., teachers, nurses, policemen, soldiers, and most bureaucrats), and b) a nontrivial number of patronage jobs given to operatives of new (national and subnational) rulers. The coefficients for Public employee, then, might somewhat overestimate the conditional association of this variable with PAA, as they may also capture the fact that incumbent supporters have more chances of obtaining a public job. This bias, however, is likely small, as employees in the “a” group far outnumber those in the “b” group. Moreover, controlling for Incumbent Party ID likely reduces this endogeneity, as (national-level) patronage public employees should disproportionally express identification with the national ruling party. These considerations imply that the “dependence-breeds-PAA” effect should greatly outweigh the “PAA-breed-dependence” effect in the relevant regression coefficients.

Some uncertainty about the causal direction of the statistical associations shown above is inevitable given the observational nature of the data. This limitation is offset by several strengths of the dataset, especially in terms of thematic breadth (it includes data on four important and diverse forms of state dependence) and external validity (as inferences are based on large probabilistic samples of the general population in 18 diverse nations).

Conclusions

A significant proportion of the world’s population depends economically on income originating in the state. This paper explored a politically relevant side of this fact: the possibility that such dependence causes pro-authority attitudes (PAA). Evidence from 18 Latin-American electoral regimes provides support for this thesis: three of the four types of sate-based income studied – public employment, welfare benefits, and CCTs – are, after holding key potential confounders constant, positively associated with PAA (the evidence about pensions is weaker but points in the same direction). Moreover, an external source of economic autonomy, remittances, is negatively associated with PAA. The findings regarding CCTs and remittances are especially telling, because these independent variables are almost certainly not caused by the dependent variable.

The magnitude of the conditional statistical associations is modest, but the five key independent variables together (remittances included) account for a sizable share of the variance in PAA. Pro-authority tendencies are strongest for those receiving government assistance, somewhat weaker among public employees and CCT recipients, and still weaker for pensioners. This hierarchy roughly maps the conventional wisdom on levels of politicization in Latin America. These variables, then, may be “proper names” for the true variable of interest: the extent to which obtaining and keeping state-financed sources of income depends on particularistic and fickle decisions or on universalistic and entrenched rules. This interpretation is buttressed by the findings of the interactive models: in the same way that the association between state dependence and PAA is stronger (within countries) for more politicized categories of state-based income, it is also stronger (between countries) in less democratic, more patrimonial and more statist settings. It is normatively encouraging (and policy relevant) that the pro-authority inclination of state-dependent citizens is not a fact of life, but one largely contingent upon nations’ political and economic characteristics.

These findings have clear implications for the literatures on political behavior, incumbency advantage, authoritarianism, social policies and public administration. It seems of particular relevance that rulers, intuiting the causal effects proposed above, may increase the size of the state-dependent population, and their level of discretion over it, not just to reward adherents, but to foster support. Concurring evidence from settings as diverse as Persian Gulf petro-states, post-Soviet competitive authoritarianisms, and African personal dictatorships concludes that rulers purposefully place many citizens, businesses, media outlets, and NGOs on the government budget to preempt pressures for rights, freedoms, and accountability.

Future research should explore the external validity of these findings in at least two ways. First, geographically: would similar conclusions hold beyond Latin America? Second, would the findings hold for forms of dependence on state budgets not tested here, such as those generated by government procurement, official publicity, and clientelistic handouts? Future studies should also attempt to find or generate data that will allow for higher-certainty causal inferences, in particular panel datasets and experimental or quasi-experimental designs – like natural experiments or RD – in which the individual-level independent variables would be largely exogenous.

None of the findings above imply that public employment, social security systems, welfare benefits or CCTs are undesirable. Many worthy goals – such as the public provision of education, poverty alleviation, and socioeconomic equity – are well served by these instruments of modern states. Like many things in politics, however, they may have unexpected and even perverse consequences.

A key implication of the findings above is that the most effective way to minimize pro-authority biases is not to reduce the size of the state-dependent population, but to insure that all streams of income originating in government budgets are assigned according to clear, universal, stable, and respected rules.

Data Availability

The dataset generated and analysed for this study is available in the Harvard Dataverse repository. See Gervasoni, Carlos, 2023, “Replication Data for: “Economic Dependence on the State and Pro-Authority Attitudes: Evidence from 18 Latin American Countries””, https://doi.org/10.7910/DVN/UUMZ0W, Harvard Dataverse.

Notes

“Pesada carga administrativa. Más de 21 millones de personas cobran del Estado.” Clarín, 30 April 2017. The estimated 21 million people represented 48% of Argentina’s 2017 population.

“Pichetto: ‘Acá hay 10 millones de personas que trabajan y 17 millones que cobran un cheque del Estado’”. La Nación, 4 May 2018.

An exception is Manacorda et al (2011), who find a positive effect of CCTs not on electoral support but on beneficiaries’ evaluations of incumbents.

Strictly, the expression “PAA” identifies one end of a continuous variable that has high values for those who systematically support authorities, low values for those who systematically oppose them, and intermediate values for those in between.

Attitudes are relatively enduring psychological predispositions to evaluate positively or negatively a particular entity (Price 1992). They have a broader scope, are more deeply rooted, and are more stable than opinions. Attitudes are similar to Zaller’s (1992) “values” in that they are both broad and lasting evaluative predispositions.

All Spanish and Portuguese speaking Latin-American countries except Cuba.

That is, considering only substantive responses and discarding “don’t know” or “no answer” responses.

The Pearson correlations of PAA Executives and PAA Impersonal with the PAA Index are 0.88 and 0.87, respectively.

The item identifies not only pensioners but other people retired from work or not working because of disability (see Table 1). It can be safely assumed that a large majority of respondents in this condition receive state-funded pensions. Their median age is 67 years, against 35 years for the rest of the respondents. Pensioners in Chile are not considered state dependent (and, therefore, Pensioner = 0) because most of them obtain their income from private pension funds.

The fact that the survey items are dichotomous, but the actual level of dependence on the state varies from individual to individual (for example because some pensioners count on complementary sources of non-state income like rents) means that the key individual-level independent variables suffer from measurement error induced by a “coarse” scale.

The excluded countries are Argentina, Brazil, Chile, Colombia, Peru and Uruguay.

When only one of these two highly correlated variables is kept, VIF falls to 2.02 (Democracy) and 2.37 (Government effectiveness).

The exact figure is 0.094: the expected difference in the PAA Index between these two individuals is 0.018 + 0.039 + 0.022 – (− 0.015).

Two coefficients cannot be estimated because the item measuring CCTs was not included in the Nicaraguan questionnaire and pensioners in Chile are not state dependent.

For example, the coefficients in model 1 (Table 2) change as follows when Incumbent Party ID is not included: Public employee from 0.012 to 0.023, Pensioner from 0.009 to 0.013, Government assistance from 0.030 to 0.042, and CCT from 0.016 to 0.021.

The interactive term of Government assistance with Economic freedom does not reach conventional levels of significance, but is close to them. Its p value is equal to 0.15.

See wording and summary statistics of these items in tables A and B, online appendix.

Public employees in Latin America are typically better paid than workers of similar qualifications in the private sector; see Calvo and Murillo (2019), Chapter 8.

The correlation between SES and CCT is negative in all countries (r from − 0.09 to − 0.30); the SES-Public employee correlation is positive in all countries (r from 0.04 to 0.21); the SES-PAA Index correlation is negative in all countries but two (r from 0.07 to − 0.22).

There are a total of 324 first-level subnational units (“provinces” in the AmericasBarometer jargon).

Country fixed effects and country-level controls cannot be included in the same model because of perfect multicollinearity.

References

Adorno, Theodor, Else Frenkel-Brunswik, and Daniel Levinson, and Nevitt Sanford. 1950. The Authoritarian Personality. New York: Harper.

Ansolabehere, Stephen, Jonathan Rodden, and James Snyder. 2008. The Strength of Issues: Using Multiple Measures to Gauge Preference Stability, Ideological Constraint, and Issue Voting. American Political Science Review 102 (2): 215–232.

Ahmed, Faisal. 2017. Remittances and incumbency: Theory and Evidence. Economics & Politics 29 (1): 22–47.

Araújo, Victor. 2021. Do Anti-Poverty Policies Sway Voters? Evidence from a Meta-Analysis of Conditional Cash Transfers. Research and Politics 8 (1).

Auyero, Javier. 2000. Poor People’s Politics: Peronist Survival Networks and the Legacy of Evita. Durham: Duke University Press.

Bellin, Eva. 2000. Contingent Democrats: Industrialists, Labor, and Democratization in Late-Developing Countries. World Politics 52 (2): 175–205.

Berenschot, Ward. 2018. The Political Economy of Clientelism: A Comparative Study of Indonesia’s Patronage Democracy. Comparative Political Studies 51 (12): 1563–1593.

Bryan, Mark, and Stephen Jenkins. 2016. Multilevel Modelling of Country Effects: A Cautionary Tale. European Sociological Review 32 (1): 3–22.

Calvo, Ernesto, and María Victoria. Murillo. 2019. Non-Policy Politics. Richer Voters, Poorer Voters, and the Diversification of Electoral Strategies. Cambridge: Cambridge University Press.

Cleary, Matthew, and Susan Stokes. 2006. Democracy and the Culture of Skepticism: The Politics of Trust in Argentina and Mexico. Russell Sage Foundation.

Corrêa, Diego Sanches, and José Antonio. Cheibub. 2016. The Anti-Incumbent Effects of Conditional Cash Transfer Programs. Latin American Politics and Society 58 (1): 49–71.

Dahl, Robert. 1971. Polyarchy. Participation and Opposition. New Haven: Yale University Press.

De La O, Ana. 2012. Do Conditional Cash Transfers Affect Electoral Behavior? Evidence from a Randomized Experiment in Mexico. American Journal of Political Science 57 (1): 1–14.

Delli Carpini, Michael, and Scott Keeter. 1996. What Americans Know about Politics and Why It Matters. Yale: Yale University Press.

Elff, Martin, Jan Paul Heisig, Merlin Schaeffer, and Susumu Shikano. 2021. Multilevel Analysis with Few Clusters: Improving Likelihood-based Methods to Provide Unbiased Estimates and Accurate Inference. British Journal of Political Science 51: 412–426.

Elwert, Felix, and Christopher Winship. 2014. Endogenous Selection Bias: The Problem of Conditioning on a Collider Variable. Annual Review of Sociology 40 (1): 31–53.

Fish, Steven M. 2005. Democracy Derailed in Russia: The Failure of Open Politics. Cambridge: Cambridge University Press.

Garay, Candelaria. 2016. Social Policy Expansion in Latin America. New York: Cambridge University Press.

Gervasoni, Carlos. 2018. Hybrid Regimes within Democracies: Fiscal Federalism and Subnational Rentier States. Cambridge University Press.

Gherghina, Sergiu, and Miroslav Nemčok. 2021. Political Parties, State Resources and Electoral Clientelism. Acta Politica 56: 591–599.

Golden, Miriam, and Brian Min. 2013. Distributive Politics around the World. Annual Review of Political Science 16: 73–99.

Green, Donald, Bradley Palmquist, and Eric Schickler. 2002. Partisan Hearts and Minds. Political Parties and the Social Identities of Voters: Yale University Press.

Greene, Kenneth. 2007. Why Dominant Parties Lose: Mexico Democratization in Comparative Perspective. New York: Cambridge University Press.

Han, Kangwook. 2020. Autocratic Welfare Programs, Economic Perceptions, and Support for the Dictator: Evidence from African Autocracies. International Political Science Review. First published online: 19 February 2020.

Haveric, Sabina, Stefano Ronchi, and Laura Cabeza. 2019. Closer to the State, Closer to the Polls? The Different Impact of Corruption on Turnout among Public Employees and Other Citizens. International Political Science Review 40 (5): 659–675.

Imai, Kosuke, Gary King, and Carlos Velasco Rivera. 2020. Do Nonpartisan Programmatic Policies Have Partisan Electoral Effects? Evidence from Two Large Scale Experiments. Journal of Politics 81 (2): 714–730.

Inglehart, Ronald. 1997. Modernization and Postmodernization: Cultural, Economic, and Political Change in 43 Societies. Princeton University Press.

Jost, John, Mahzarin Banaji, and Brian Nosek. 2004. A Decade of System Justification Theory: Accumulated Evidence of Conscious and Unconscious Bolstering of the Status Quo. Political Psychology 25 (6): 881–919.

Kahneman, Daniel, Jack Knetsch, and Richard Thaler. 1991. Anomalies: The Endowment Effect, Loss Aversion, and Status Quo Bias. Journal of Economic Perspectives 5 (1): 193–206.

Lawson, Chappell, and Kenneth Greene. 2014. Making Clientelism Work: How Norms of Reciprocity Increase Voter Compliance. Comparative Politics 47 (1): 61–85.

Layton, Matthew, and Amy Smith. 2015. Incorporating Marginal Citizens and Voters: The Conditional Electoral Effects of Targeted Social Assistance in Latin America. Comparative Political Studies 48 (7): 854–881.

Levi, Margaret, and Laura Stoker. 2000. Political Trust and Trustworthiness. Annual Review of Political Science 3 (1): 475–507.

Mainwaring, Scott. 2016. Party System Institutionalization, Party Collapse and Party Building. Government and Opposition 51 (4): 691–716.

Manacorda, Marco, Edward Miguel, and Andrea Vigorito. 2011. Government Transfers and Political Support. American Economic Journal: Applied Economics 3: 1–28.

McMann, Kelly. 2006. Economic Autonomy and Democracy: Hybrid Regimes in Russia and Kyrgyzstan. New York: Cambridge University Press.

Norris, Pippa, ed. 1999. Critical Citizens. Global Support for Democratic Government. Oxford: Oxford University Press.

Oliveros, Virginia. 2021. Working for the Machine: Patronage Jobs and Political Services in Argentina. Comparative Politics 53 (3): 373–391.

Oskarsson, Sven. 2010. Generalized Trust and Political Support: A Cross-National Investigation. Acta Politica 45: 423–443.

Paluck, Elizabeth, and Donald Green. 2009. Deference, Dissent, and Dispute Resolution: An Experimental Intervention Using Mass Media to Change Norms and Behavior in Rwanda. American Political Science Review 103 (4): 622–644.

Parker, Glenn. 1989. The Role of Constituent Trust in Congressional Elections. The Public Opinion Quarterly 53 (2): 175–196.

Pavao, Nara. 2016. Conditional Cash Transfer Programs and Electoral Accountability: Evidence from Latin America. Latin American Politics and Society 58 (2): 74–99.

Pei, Minxin. 2021. China: Totalitarianism’s Long Shadow. Journal of Democracy 32 (2): 5–21.

Price, Vincent. 1992. Public Opinion. Sage.

Rosenfeld, Bryn. 2017. Reevaluating the Middle-Class Protest Paradigm: A Case-Control Study of Democratic Protest Coalitions in Russia. American Political Science Review 111 (4): 637–652.

Rosenfeld, Bryn. 2021. State Dependency and the Limits of Middle Class Support for Democracy. Comparative Political Studies 54 (3–4): 411–444.

Ross, Michael. 2001. Does Oil Hinder Democracy? World Politics 53 (3): 325–361.

Samuelson, William, and Richard Zeckhauser. 1988. Status Quo Bias in Decision Making. Journal of Risk and Uncertainty 1: 7–59.

Skitka, Linda, Christopher Bauman, and Brad Lytle. 2009. Limits on Legitimacy: Moral and Religious Convictions as Constraints on Deference to Authority. Journal of Personality and Social Psychology 97 (4): 567–578.

Sniderman, Paul, Richard Brody, and Philip Tetlock. 1991. Reasoning and Choice: Explorations in Political Psychology. Cambridge University Press.

Stegmueller, Daniel. 2013. How Many Countries for Multilevel Modeling? A Comparison of Frequentist and Bayesian Approaches. American Journal of Political Science 57 (3): 748–761.

Stokes, Susan. 2005. Perverse Accountability: A Model of Machine Politics with Evidence from Argentina. American Political Science Review 99 (3): 315–325.

Stokes, Susan, Thad Dunning, Marcelo Nazareno, and Valeria Brusco. 2013. Brokers, Voters, and Clientelism. The Puzzle of Distributive Politics. New York: Cambridge University Press.

Sugiyama, Natasha, and Wendy Hunter. 2013. Whither Clientelism? Good Governance and Brazil’s ‘Bolsa Família’ Program. Comparative Politics 46 (1): 43–62.

Torney-Purta, Judith, Carolyn Henry Barber, and Wendy Klandl Richardson. 2004. Trust in Government-related Institutions and Political Engagement among Adolescents in Six Countries. Acta Politica 39: 380–406.

Zaller, John. 1992. The Nature and Origins of Mass Opinion. Cambridge University Press.

Zhai, Yida. 2017. Values of Deference to Authority in Japan and China. International Journal of Comparative Sociology 58 (2): 120–139.

Zucco, César. 2013. When Payouts Pay Off: Conditional Cash Transfers and Voting Behavior in Brazil 2002–10. American Journal of Political Science 57 (4): 810–822.

Zucco, Cesar, and Timothy Power. 2013. Bolsa Familia and the Shift in Lula’s Electoral Base, 2002–2006: A Reply to Bohn. Latin American Research Review 48 (2): 3–24.

Acknowledgments

I thank Agostina De Leo for her excellent research assistantship.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Gervasoni, C. Economic dependence on the state and pro-authority attitudes: evidence from 18 Latin-American countries. Acta Polit 59, 98–123 (2024). https://doi.org/10.1057/s41269-022-00282-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41269-022-00282-3