Abstract

This article investigates the location strategies of Canadian and Chinese multisite firms in international and domestic investment decisions at the metropolitan level. By integrating research from international business studies and economic geography, we combine knowledge-based understandings of multinational corporations and industrial clusters to develop propositions regarding the location strategies of multisite firms in cluster networks. It is argued that firms from clusters are more likely to adopt knowledge strategies than firms from other areas and that they tend to choose cluster locations that are specialized in the same or similar industries to achieve their knowledge goals – both in domestic and international investment decisions. We establish and analyze a database of 3500 investment cases within and between Canada and China to test our propositions. The results show that firms in knowledge-intensive industrial environments with substantial business experience are especially inclined to direct their investments to clusters. Consistent with our emphasis of the subnational as opposed to the national scale, we find that cluster-of-origin effects are more important than country-of-origin effects in explaining firms’ investment choices in clusters. These findings support the idea that multisite firms, particularly MNEs, leverage local knowledge pools by strategically locating affiliates across clusters.

Résumé

Cet article étudie les stratégies de localisation des entreprises multi-sites canadiennes et chinoises concernant les décisions d’investissements nationaux et internationaux à l’échelle métropolitaine. En intégrant les recherches de l’international business et de la géographie économique, nous combinons les conceptions fondées sur la connaissance des entreprises multinationales et des clusters industriels pour élaborer des propositions concernant les stratégies de localisation des entreprises multi-sites au sein de réseaux de clusters. Nous considérons que les entreprises implantées dans des clusters sont plus susceptibles d’adopter des stratégies de la connaissance que les entreprises d’autres secteurs et qu’elles ont tendance à choisir leur localisation dans des clusters qui sont spécialisés dans les industries identiques ou similaires pour atteindre leurs objectifs de connaissance – pour les décisions d’investissements nationaux comme internationaux. Pour tester nos propositions, nous établissons et analysons une base de données de 3500 cas d’investissements au sein et entre le Canada et la Chine. Les résultats montrent que les entreprises situées dans des environnements de savoirs industriels forts avec une importante expérience des affaires sont particulièrement enclines à diriger leurs investissements vers des clusters. Conformément à l’emphase mise sur l’échelle sub-nationale par opposition à l’échelle nationale, nous constatons que les effets du cluster d’origine sont plus importants que les effets du pays d’origine pour expliquer les choix d’investissements des entreprises dans les clusters. Ces résultats confortent l’idée que les entreprises multi-sites, particulièrement les multinationales, tirent parti de bassins locaux de connaissances en plaçant stratégiquement leurs filiales dans différents clusters.

Resumen

Este artículo investiga las estrategias de localización de empresas multi-céntricas canadienses y chinas y las decisiones de inversión doméstica a nivel metropolitano. Al integrar la investigación de los estudios de negocios internacionales y de la geografía económica, combinamos los entendimientos basados en conocimiento de las empresas multinacionales y los clústeres industriales para desarrollar proposiciones con relación a las estrategias de ubicación de empresas multi-céntricas en redes de clústeres. Se argumenta que las empresas de clústeres son más propensas a adoptar estrategias de conocimiento que las empresas de otras áreas y que tienden a escoger ubicaciones en clúster que son especializadas en la misma industria o en industrias similares para alcanzar sus metas de conocimiento –tanto en las decisiones de inversión domesticas como internacionales. Establecemos y analizamos una base de datos con 3500 casos de inversiones dentro y entre Canadá y China para probar nuestras proposiciones. Los resultados muestran que las empresas en entornos industriales intensivos en conocimiento con experiencia sustancial en negocios son especialmente inclinadas a dirigir sus inversiones a clústeres. De manera consistente con nuestro énfasis en la escala sub-nacional en contraste con la escala nacional, encontramos que los efectos del origen del clúster son más importantes que los efectos del país de origen en explicar las decisiones de las empresas en clústeres. Estos hallazgos apoyan la idea que las empresas multi-céntricas, particularmente las multinacionales aprovechan las reservas locales de conocimiento mediante la ubicación estratégica de las filiales entre los clústeres.

Resumo

Este artigo investiga as estratégias de localização de firmas estabelecidas em vários locais do Canadá e da China em decisões de investimentos internacionais e domésticos no nível metropolitano. Ao integrar pesquisas em estudos de negócios internacionais e geografia econômica, combinamos entendimentos baseados no conhecimento de corporações multinacionais e clusters industriais para desenvolver proposições sobre as estratégias de localização de empresas estabelecidas em vários locais em redes de cluster. Argumenta-se que as empresas de clusters são mais propensas a adotar estratégias de conhecimento do que empresas de outras áreas e que tendem a escolher locais de cluster especializados nas mesmas indústrias ou similares para alcançar seus objetivos de conhecimento - tanto em decisões de investimento nacionais quanto internacionais. Nós estabelecemos e analisamos um banco de dados de 3500 casos de investimento dentro e entre Canadá e China para testar nossas proposições. Os resultados mostram que empresas em ambientes industriais intensivos em conhecimento com experiência comercial substancial são especialmente inclinadas a direcionar seus investimentos para clusters. De acordo com a nossa ênfase na escala subnacional em vez da escala nacional, achamos que os efeitos do cluster de origem são mais importantes do que os efeitos do país de origem ao explicar as escolhas de investimento das empresas em clusters. Essas descobertas sustentam a ideia de que as empresas estabelecidas em vários locais, particularmente as multinacionais, alavancam os pools de conhecimento local, localizando estrategicamente afiliados entre os clusters.

概要

本文探讨在大都市层面加拿大和中国多位点公司的国际国内投资决策的位置策略。通过整合国际商务研究和经济地理,我们结合对跨国公司和产业集群基于知识的理解提出关于集群网络多位点公司位置策略的命题。我们认为,无论是在国内还是国际投资决策中,集群型公司与其它公司相比更倾向于采用知识策略,且倾向于选择那些从事相同或相近行业的集群位置,以实现它们的知识目标 。我们建立和分析在加拿大和中国以及它们之间的3500个投资案例的数据库,以测试我们的命题。结果表明,知识密集型工业环境里商业经验丰富的公司尤其倾向于直接向集群投资。与我们强调次国家而不是国家规模相一致,我们发现,原产群效应对解释公司的集群投资选择比原产国效应更重要。这些发现支持这一想法,即多位点公司,特别是跨国公司,通过跨集群战略定位分支机构来充分利用本土知识池。

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Shenzhen in China and Waterloo in Canada are both regarded as new ‘Silicon Valleys’ in their home countries. Within the two high-technology clusters, Huawei and Blackberry are pivotal local firms that are highly innovative but have proceeded along rather different pathways in the recent past. Blackberry, the ancestor of the smartphone industry, is on the verge of bankruptcy after losing much of its original market share over the past years. By contrast, Huawei, an emerging multinational from China, has quickly become a global leader in telecommunications innovation. A geographical perspective is quite revealing when trying to understand the divergence of the two firms. While once dominating the smartphone market in many countries, Blackberry has always been a ‘local firm’ with most research and production activities carried out in the Waterloo region, peripheral to the leading ‘hotspots’ of the industry. In contrast, Huawei, originating from a similarly peripheral location with a relatively weak knowledge base, has established multiple research centers in innovative telecommunications clusters worldwide, including Silicon Valley, Dallas, Ottawa, Seoul, Bangalore, and Stockholm (Fan, 2006; Gillette, Brady, & Winter, 2013). The resulting subsidiary network across clusters enables Huawei to identify, access, and mobilize new knowledge efficiently and quickly at a global scale.

Inspired by these cases, this article examines location strategies of Canadian and Chinese firms in cluster networks. Over the past few decades, it has been widely emphasized that innovation is crucially a local process that, because of its reliance on tacit knowledge, must be embedded in social contexts (Saxenian, 1994; Gertler, 2003; Owen-Smith & Powell, 2004; Storper & Venables, 2004). Firms have traditionally relied on localized competences for new ideas and technologies as it has frequently been found that knowledge is generated from interaction and communication of professionals and engineers within their local communities. It is through such processes that firms in the ‘Third Italy’ and ‘Silicon Valley’ have been able to achieve competitive advantages. While this argument has been supported in many case studies, it neglects the global dimension of knowledge generation processes. In fact, if knowledge was indeed largely localized in industrial clusters, the landscape of the global knowledge economy would be a world of separate, scattered local knowledge pools. Tapping into the different knowledge pools and integrating knowledge across clusters thus becomes an attractive strategy for firms to overcome local limitations, engage in global innovation, and succeed in the knowledge economy (Ghoshal, Korine, & Szulanski, 1994; Gupta & Govindarajan, 2000; Sölvell & Birkinshaw, 2000; Frost, 2001; Cantwell & Mudambi, 2005; Saxenian, 2006; Ghemawat, 2007; Chung & Yeaple, 2008; Alcácer & Chung, 2011; Lorenzen & Mudambi, 2013; Bathelt & Li, 2014). To implement such a strategy, firms need to go beyond their home locations and develop multisite operations, either nationally or internationally, or both.

However, many questions arise when exploring the processes of how firms can successfully build knowledge networks across clusters (Iammarino & McCann, 2010; Mudambi & Swift, 2012). Following this line of thought, this article aims to identify the structure of cluster networks by analyzing locational choices of more than 3500 domestic and international investment cases in Canada, a developed economy, and China, the largest and fastest growing developing economy. Specifically, this article investigates the conditions under which firms are likely to choose cluster locations in their investment decisions. The goal is to demonstrate that firms from clusters are more likely to locate their investment affiliates (or subsidiaries) in clusters that are specialized in the same or similar industries, even when other factors that may be associated with their location strategy are controlled for.

In connecting knowledge-based theories of industrial clusters (Porter, 1990; Maskell 2001; Bathelt et al., 2004) and network-based understandings of multinational corporations (Ghoshal and Bartlett, 1990; Gupta and Govindarajan, 2000; Cantwell & Mudambi, 2005), we develop the argument that firms originating from high-competition local settings within industrial clusters will be more likely than firms from other settings to pursue knowledge-seeking strategies and invest into clusters. In detecting cluster networks, this article extends the investigation of social learning processes from local settings to global contexts and contributes to understanding the global learning patterns of industrial communities (Bathelt and Cohendet, 2014). By examining domestic and international investments across cluster and non-cluster areas, this article also extends prior discussions about location strategies of multisite corporations from the national level to the metropolitan and cluster level, which is more suitable to capture the knowledge spillovers related to agglomeration economies (Alcácer & Chung, 2007, 2014).

This article is organized into six sections. Section "Background" contextualizes this research by summarizing and integrating two literatures on knowledge generation processes in economic geography and international business studies. By combining ideas on spatial and organizational dimensions of innovation in the two fields, we develop five propositions in Section "Propositions". In the empirical part, after a short introduction of the data collection and analysis procedures in Section "Data and Methods", we present the results of locational choice models of Canadian and Chinese firms in Section "Results", followed by some robustness checks. We finish in Section "Conclusions" by discussing the conclusions and limitations of this research.

Background

This section develops a framework to study location strategies in investment decisions of multinational firms by connecting literature on innovation processes produced by economic geographers with that by international business scholars: (i) local and global knowledge flows within and beyond clusters, and (ii) knowledge networks and global strategies of multinational firms.

Local and Global Knowledge Flows in Economic Geography

A fundamental finding of studies in economic geography has been that industrial firms, especially knowledge-intensive firms, tend to agglomerate in certain regions that are sometimes referred to as ‘sticky places’ because of their ability to systematically retain and reproduce their knowledge bases (Markusen, 1996; Bathelt et al., 2004; Storper & Venables, 2004; Scott, 2005; Boschma, 2005; Dicken, 2011). While not benefiting from low-cost advantages, these industrial communities develop specialized knowledge-creating capabilities within their territories. Observations in different regional contexts have shown that specific knowledge pools are generated and shared locally in embedded business structures, which support high levels of face-to-face communication and labor mobility (Saxenian, 1994; Baptista & Swann, 1998; Almeida & Kogut, 1999; Fallick, Fleischman, & Rebitzer, 2006). From this perspective, innovation is a localized process that is contextualized in community settings.

While the argument of localized social learning and innovation processes is powerful in explaining successful industrial clusters, it becomes weaker over time as multiple regional economies develop their own specialized and contextualized practices of innovation. In this changing map of the global economy, no single region, no matter how innovative it may be, can handle all stages of complex innovation processes by itself. This is because technological breakthroughs and disruptive creativity become more unpredictable in the context of globally differentiated knowledge pools. This dynamic process provides substantial challenges to traditional localized understandings of knowledge generation. In response to these challenges, leading firms move beyond localized learning practices and target distant knowledge pools to generate new competitive advantages (Saxenian, 2006; Munari, Sobrero, & Malipiero 2011; Bathelt & Cohendet, 2014).

This transformation from a localized to a globalized architecture of innovation reflects the increasing complexity of knowledge generation processes (Beaverstock, 2004; Faulconbridge, 2006; Rigby & Essletzbichler, 2006; Hannigan et al., 2015). However, in much of this literature, spatial patterns of trans-local and global knowledge flows are under-explored. When local firms feel pressure to acquire knowledge over distance, studies on localized innovation processes provide little advice in terms of where and how to access valuable industrial knowledge beyond the local and regional scale (Bathelt & Henn, 2014; Maskell, 2014; Feldman, Kogler, & Rigby, 2015). Therefore, it becomes important to unravel the structure of trans-local and global knowledge pipelines from both a conceptual and an empirical perspective. Building on studies about local knowledge ecologies in industrial clusters, this article aims to investigate whether and how investment and organizational networks of multisite corporations are constructed between clusters that specialize in the same or similar industries to channel trans-local knowledge flows.

Knowledge Strategies of Multinational Enterprises in International Business Studies

The idea that knowledge flows between distant locations when a firm establishes multisite operations is not new to international business studies. Multinational enterprises have long been regarded as organizations that create knowledge, rather than just reduce transaction costs, when they establish international activities (Ghoshal & Bartlett, 1990; Kogut & Zander, 1993; Dunning, 1993; Sölvell & Birkinshaw, 2000). A major advantage of multinational or multisite corporations in knowledge management results from the fact that their international networks of corporate units connect differentiated knowledge pools. In this sense, multinational firms can be viewed as inter-organizational networks for knowledge mobilization and generation across borders (Ghoshal & Bartlett, 1990).

From this network-based understanding of multinational enterprises, locational choices of subsidiaries become strategically important in establishing competitive advantages (Dunning, 1998). For knowledge-creating multinationals, places where specific industries and their respective innovations agglomerate become highly attractive locations, even though local production costs may be high due to strong competition for highly skilled labor (Florida & Kenney, 1994; Head, Ries, & Swenson, 1995; Alcácer & Chung, 2014). In empirical research, ideas about knowledge networks and location strategies of multinational enterprises have generally been substantiated by studies at a high level of aggregation using country- or state-/province-level data (Kafouros, Buckley, & Clegg, 2012). Since knowledge generation tends to be localized within communities and clusters (Jaffe et al., 1993; Almeida & Kogut, 1999; Fallick et al., 2006), a more fine-grained approach toward the examination of the global networks of multinational corporations would target location strategies of investments at smaller spatial scales, such as the metropolitan or regional level (Kuemmerle, 1999; Beugelsdijk & Mudambi, 2013; Iammarino & McCann, 2013). This has also been emphasized in recent studies of foreign direct investments (FDIs) that extend location models of multinational firms to the substate level (Alcácer & Chung, 2007, 2014). In this article, we similarly analyze investment decisions in China and Canada at the metropolitan level in order to capture agglomeration and localized learning effects.

Another important shift in conceptualizing knowledge networks of multinational enterprises that has yet to be adopted more widely is to extend investment studies from only focusing on one end, either the destination or origin of the investment, toward analyzing both ends simultaneously. Taking a comprehensive perspective on multinational corporate linkages helps us identify which region types and knowledge bodies are connected with each other and why (Chung & Yeaple, 2008; Kafouros et al., 2012). Due to data limitations, most studies of multinational enterprises focus on the host country, where detailed investment and industrial data are accessible. However, this only provides a partial view of global networks of multinational firms. To address the effects of different origins in the location strategy of international investments, a common practice has been to introduce control variables that differentiate countries of origin (Head et al., 1995; Chung & Alcácer, 2002). However, since the local environment at the community or metropolitan level has a crucial impact on firms’ strategies, it becomes important to go beyond country-of-origin effects and explore the influence of smaller geographical contexts. In other words, we need to know more about the specific local environments within which investment decisions are made. For example, a telecommunications firm from Shenzhen like Huawei may adopt very different strategies than its counterparts from less innovative metropolitan areas in China. Like Kogut and Chang (1991) and Branstetter (2006) who adopted a research strategy focusing on two countries with FDI linkages, we examine investment networks between China and Canada where investment and industrial data at the metropolitan level are available.

Propositions

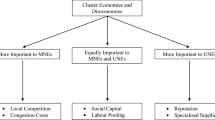

In this section, we create a conceptual framework to develop propositions about location strategies in cluster networks based on the discussion of knowledge generation processes in local communities and multinational corporations in economic geography and international business studies, as illustrated in Figure 1. Our general argument is that the decision of firms to invest in clusters is influenced by a combination of factors related to the internal capabilities and strategies of firms and the external environments within which they operate. Internal factors include the firms’ strategy regarding knowledge exploration or exploitation (March 1991; Kuemmerle, 1999; Cantwell & Mudambi, 2005) and their capacity to manage knowledge flows across spatially dispersed units (Ghoshal & Bartlett, 1990; Gupta & Govindarajan, 1991; Kogut & Zander, 1992; Alcácer & Chung, 2011). External factors include the national and metropolitan context from which the firms originate and the industrial environment within which they are embedded. Building on the finding that agglomeration economies, particularly knowledge spillovers, sharply decay with distance (Jaffe et al., 1993; Saxenian, 1994; Audretsch & Feldman, 1996; Rosenthal & Strange, 2003; Owen-Smith & Powell, 2004; Bathelt et al., 2004; Storper & Venables, 2004), we propose that firms from clusters are more likely than other firms to pursue innovation and competence augmentation strategies and therefore tend to target clusters with similar specialization in their investment and geographical expansion processes. It is further suggested that the locational choices to invest in clusters are mediated by the experience and transnational knowledge management capabilities of firms, as well as the knowledge intensity of the industrial environments in which they operate. In the following, we generate a set of propositions from this conceptual framework.

Knowledge Strategies and Cluster Origins

In a geographical perspective, knowledge generation is highly agglomerated in industrial clusters. We interpret clusters as business communities at the metropolitan level that are composed of a large group of firms involved in similar and related activities. Such a knowledge-based understanding of clusters acknowledges that certain forms of knowledge, especially its tacit dimensions, can be shared more effectively in localized settings (Porter, 1990; Saxenian, 1994; Maskell, 2001). Clusters in this respect refer to specialized localized knowledge pools where new technologies and ideas are likely to emerge within the same technology context or organizational field (DiMaggio & Powell, 1983). This understanding of clusters is reflected in the cluster-detecting procedure applied in this study and is consistent with the rationale of our main argument that firms invest in cluster networks to gain advantages in knowledge combination and creation. While clusters help confer knowledge advantages, they may also pose potential barriers for investments. Since clusters also include a larger group of competitors and related firms, they are as much locations of intense learning as places of fierce competition and high production costs.

Because clusters are both highly innovative and highly competitive areas, they can never be an ideal location type for every sort of firm. As suggested by Alcácer and Chung (2007), firms are extremely heterogeneous in their locational choices. International business research has emphasized that the country of origin and local environment within which a firm is based have a strong influence on its strategies and behaviors. For instance, Cantwell and Janne (1999) found that leading multinational firms from innovative areas in Europe tend to pursue knowledge differentiation strategies. In other studies, Cantwell and Mudambi (2005), (2011) suggested that strategies of subsidiaries regarding competence exploitation or augmentation are shaped by the characteristics of their respective locations.

Within the context of clusters as localized knowledge pools, the mobility of engineers and professionals between firms and regular meetings in social spaces makes knowledge sharing an easy and natural process (Saxenian, 1994; Fallick et al., 2006; Li, 2014). By being embedded in this kind of supportive knowledge ecology, firms learn that long-term survival and economic success are directly related to the development of new products and solutions rather than simply being a consequence of cutting corners and engaging in low-cost production (Porter, 1990). By being accustomed to an environment with strong competition and high production costs, cluster firms are more likely than firms from non-cluster areas to pursue a differentiation and innovation agenda in making investment decisions, as this is their primary strategy for survival in such contexts. In contrast, it is quite challenging for firms from non-cluster areas to learn how to adjust to cluster settings, where their actions are constantly monitored by local competitors. Being located inside or outside a cluster thus has a substantial impact on how firms do business and manage know-how and knowledge flows. Overall, we expect that firms from innovative clusters are more likely to develop strategies of knowledge exploration or home-base augmentation rather than competence exploitation.

Research about the locational choices of FDIs indicates that firms with knowledge creation mandates tend to choose destinations that are characterized by well-developed knowledge bases. It was found, for instance, that agglomeration economies, including local knowledge spillovers, play a significant role in the location decisions made by Japanese investors in the United States (Florida & Kenney, 1994; Head et al., 1995). In China, it was observed that American multinationals tend to locate in areas where Chinese firms with similar activities and knowledge bases agglomerate (Du et al., 2008). Examining multinationals at the global scale, Alfaro and Chen (2014) similarly concluded that agglomeration economies play a significant role in locational choices of investments. Due to data limitations, however, most previous studies about locational choices of FDIs are restricted to the national and state level. Therefore, findings remain somewhat inconclusive with respect to the role of knowledge spillovers because such spillovers mainly occur in the localized context of industrial communities (Rosenthal & Strange, 2003). In advancing the study of location strategies of FDIs to a smaller geographical scale, Alcácer and Chung (2007, 2014) analyzed the county and city level and provided more solid evidence of the significance of local knowledge pools in locational choices of FDIs, particularly for investments of advanced technology firms.

By combining the two arguments that firms with knowledge-creating strategies will more likely originate from clusters than other firms and will more likely choose clusters as their investment destination than non-clusters, we develop the main argument of this article, which suggests that firms from clusters tend to invest in clusters. This proposition is consistent with the findings regarding subsidiary strategies in international business studies. For example, Birkinshaw and Hood (2000) found that subsidiaries in clusters are more embedded, autonomous, and internationally oriented than those in other areas. Frost (2001) also provided evidence that the local context constitutes an important source of knowledge for innovation processes of subsidiaries. And Cantwell and Mudambi (2005) indicated that subsidiaries in innovative local environments are more likely to generate knowledge than those in other environments. Subsidiaries, according to this work, are able to develop specific advantages that both benefit from and contribute to local business communities (Birkinshaw & Sölvell, 2000; Rugman & Verbeke, 2001; Branstetter, 2006).1

As the case of Huawei illustrates, it is important to note that firms with a global innovation strategy build organizational networks across clusters of similar, but varied activities in their organizational field since innovation is stimulated by the combination of related, yet differentiated knowledge. Unrelated knowledge bodies offer less value to innovation-driven organizations. Therefore, clusters are attractive investment hotspots for firms that operate in similar or related fields. For firms from a different technology or organizational field, even for innovative ones from specialized clusters, other cluster areas with remote knowledge pools are of little attraction. This suggests that innovative firms build a knowledge network that connects clusters in the same or a similar industry context (Bathelt & Li, 2014), for example, high-technology firms from Silicon Valley with those from Hsinchu and Bangalore (Saxenian, 2006), film studios from Hollywood with Vancouver (Scott & Pope, 2007), garment manufacturers from Wenzhou in China with Prato in Italy (Hooper, 2010; Lan, 2015), or ceramic firms from Emilia in Italy with Castellon in Spain (Oliver et al., 2008). Our main proposition thus suggests that cluster firms tend to locate in clusters that are specialized in the same or similar industries (P1). This proposition echoes the findings at the national level by Chung and Yeaple (2008) that industries in a country with similar technical specialization as the United States attract more FDIs from America than from less related country industries. This leads to our first proposition about global cluster networks:

Home cluster effect in international investments (P1):

In international investments, firms that originate from clusters are more likely than firms from non-clusters to invest in clusters that are specialized in the same or similar industries. This generates what we refer to as global cluster networks.

Although deduced in a logical manner, there is no guarantee that the suggested relationship holds. A counter-argument against the idea that innovative firms tend to invest in clusters is that such locational choices may increase the risk of technological imitation as clusters are also locations where competitors agglomerate (Shaver & Flyer, 2000). Additionally, in industries with only few players, strategic considerations among competitors and their choices may influence firms to select non-cluster locations (Alcácer, Dezső, & Zhao, 2015). The same may be true if subsidiaries conduct activities that are quite different from those of their parent firms.

Home Country Effect

An important geographical indicator used in international business studies to understand the strategies of firms is their country of origin (Grosse & Trevino, 1996; Gupta & Govindarajan, 2000; Harzing & Sorge, 2003; Wan & Hoskisson, 2003). The business environment of the home country, which includes specific aspects of culture, institutional arrangements, and business practices, provides valuable information that helps understand the strategies and behaviors of firms. For example, it has been found that Japanese firms are very different in their internationalization strategies from their European and American counterparts (Le Bas & Sierra, 2002). The home country effect also suggests that significant differences in strategies exist between multinationals from developing and developed countries (Athreye & Kapur, 2009; Ramamurti, 2009). Since firms from a developed context are more likely to pursue an innovation strategy than their counterparts from a developing context, it can be expected that firms from a developed country are more inclined to choose cluster locations for their investments than firms from a developing country. Since this study focuses on Canada and China, a developed and an emerging economy, the second proposition suggests that Canadian firms have a stronger tendency to invest in clusters than Chinese firms.

Home country effect (P2):

Firms from Canada are more likely to choose clusters in their investment decisions than firms from China.

The rationale that the country of origin configures a firm’s knowledge and location strategies can be challenged, however, especially when investigating large country cases such as Canada and China where the business environment can vary substantially within national borders. Because of the high degree of heterogeneity that exists when zooming into the subnational level, we can expect that the regional or metropolitan origin of an investment is more revealing with respect to a firm’s knowledge strategies and locational choices than its country of origin. Firms from clusters, even in developing economies, may prefer to source knowledge from advanced knowledge pools in developed countries in order to catch up with industrial leaders (e.g., Awate et al., 2015). This suggests that we may observe a dominance of the home cluster effect over the home country effect in cluster locational choices.

Domestic Investments

The above argument about firms from clusters investing in clusters with similar specialization draws from a network-based interpretation of multinational firms and thus applies to international investments. The idea that innovative firms can gain advantages by investing across clusters to tap into related, yet differentiated knowledge pools, however, also holds for investment decisions within national borders because a similar network understanding can be applied to domestic multisite firms (Gupta & Govindarajan, 1991; Alcácer & Delgado, 2016). For countries with a large territory, such as the United States, Canada, or China, regions differ remarkably in terms of their business environment and technological development, even in the same industry.2 An excellent example to illustrate this diversity of national knowledge pools is the development of the computer industry in the United States during the 1970s when firms in Boston’s Route 128 area focused on the production of minicomputers in a proprietary knowledge context, while Silicon Valley firms adopted personal computers with a very different, open knowledge architecture (Saxenian, 1994). Similar cases of differentiated regional clusters in the same organizational field can be found in the media, chemical, machinery, shoe, and many other industries in different economies (Cortright & Mayer, 2001; Dicken, 2011). It is reasonable to assume that clusters in the same country create specialized knowledge pools with advantages in their field of specialization. Such overlapping and differentiated knowledge pools generate opportunities for innovation-oriented firms to establish cross-cluster linkages and to leverage differences in technologies and ideas. Moreover, domestic investments are less risky than the international ones. The third proposition therefore extends the home cluster effect to the national context:

Home cluster effect in domestic investments (P3):

In domestic investments, firms that originate from clusters are more likely than firms from non-clusters to invest in clusters that are specialized in the same or similar industries. This creates what we refer to as national cluster networks.

Industry Knowledge Intensity

Aside from the locational context, the specific industrial and technological environment also affects a firm’s location strategy. When making investment decisions, the knowledge intensity of an organizational field can have a strong impact on whether innovation or cost considerations dominate (Chung & Alcácer, 2002). In a dynamic industrial environment, quick knowledge acquisition and generation practices are important because they enable the development of new products and solutions in a timely manner. A dynamic high-technology industry creates a knowledge-intensive business environment within which firms are more likely innovation-oriented than in a low-technology, mature industry where low-cost production plays a larger role. When combining this insight with the argument that innovative firms prefer to establish new affiliates in cluster areas, we can expect that firms from a knowledge-intensive industry are more likely to choose cluster locations for new affiliates than firms from a less knowledge-intensive environment. In a mature industry with stable technologies, successful strategies likely focus on how to produce and deliver established products in a faster way and at a lower cost, rather than on generating new products and technologies. For firms in such industries, locational choices in investment decisions are less likely directed to cluster areas and instead can be expected to prioritize other locations (for instance those with cost advantages). This leads to our fourth proposition:

Knowledge intensity effect (P4):

Firms from knowledge-intensive industries are more likely to direct their investments to clusters than firms from less knowledge-intensive industries.

Again, we have to exercise some care with this argument. For instance, with increasing fragmentation of economic activities and a deepening social division of labor among firms, assembly processes of products can be performed in a low-cost fashion even in high-technology industries. Therefore, the industrial designation may not always be a sufficient indicator that tells us whether a firm operates in a knowledge-intensive environment or not.

Capability and Experience of Firms

By strategically directing investment affiliates to leading innovation hubs worldwide (Engel & del-Palacio 2009), multinational enterprises like Huawei become part of multiple decentralized industrial communities and can quickly detect, mobilize, and utilize new and promising technologies and business practices from distant knowledge pools that are related to their organizational field. Through such global networks across clusters, multinational firms can achieve a unique competitive advantage by leveraging differences across distant knowledge pools (Ghemawat, 2007; Bathelt & Li, 2014). However, developing a global network of operations to effectively transfer and generate knowledge is a challenging task that requires organizational capability building and cross-cultural learning to be successful (Teece, 1977).

In making locational choices in international and domestic investment decisions, firms’ past investment experience plays an important role in determining where to invest (Henisz & Delios, 2001). Similarly important are firms’ absorptive and combinative capabilities to mobilize and transfer knowledge from their environment into the organization and across corporate units located in different regions (Kogut & Zander, 1992; Alcácer & Chung, 2007). Knowledge generation is a cumulative process because part of the knowledge remains tacit and is embodied in organizational routines and communication patterns across operations (Nelson & Winter, 1982). In a similar vein, valuable knowledge components in clusters are also not stored in codified form, but are embedded in the ‘local buzz’ and interaction networks of local professionals and firms (Bathelt et al., 2004; Tallman et al., 2004). For firms to get involved in the respective localized knowledge ecologies, it is crucial to have a solid technical background in the cluster’s field of specialization and to understand the ways how local firms interact. Accumulated expertise thus becomes a crucial prerequisite for firms to successfully tap into a local cluster’s knowledge pool.

Since cluster-based subsidiaries are located within a localized community of firms and are also a part of multisite organizations that enable knowledge flows over distance, they take the position of twofold knowledge gatekeepers. First, they acquire new ideas from within the cluster and transfer them to corporate units elsewhere. Second, they share new organizational practices derived from their multisite corporate structure with local cluster firms (Bathelt & Li, 2014). However, to achieve broad embeddedness both within corporate networks and local contexts is a challenging task for multisite enterprises in terms of knowledge management (Meyer et al., 2011). To overcome this challenge, subsidiaries’ abilities to absorb, combine, and share different ideas and technologies across the different sites of a firm and across the different firms within a cluster become highly significant (Cantwell & Mudambi, 2005; Monteiro & Birkinshaw, 2017). The stronger the absorptive and combinative capabilities multisite firms have developed (Cohen & Levinthal, 1990; Kogut & Zander, 1992), the more they will be able to benefit from investing in clusters. As experience grows and capabilities develop in establishing knowledge networks across clusters, firms become more aware of the significance of investing in cluster areas and getting access to differentiated knowledge ecologies over time. Accordingly, they are more likely to locate their investment affiliates in similarly specialized clusters. This leads to the final proposition, suggesting that the location strategy of firms in cluster networks entails a learning process, according to which more experienced firms are more likely to invest in clusters:

Learning capability effect (P5):

Firms with more experience and stronger knowledge management capabilities are more likely to direct their investments to clusters than firms with less experience and weaker knowledge management capabilities.

Here, also, some caution is necessary. While more experience may increase absorptive and combinative capabilities and provide an incentive for firms to investigate in related, yet differentiated cluster areas, a counter-effect may be at work when firms already have a large network of subsidiaries and new complementary knowledge pools may be difficult to find or knowledge management costs may increase sharply – i.e., aspects we return to in the next section.

Data and Methods

Data and Cluster Identification

In order to investigate the locational choices of firms’ investments at the cluster level in Canada and China, detailed industrial data were collected from various sources. We started by compiling a sample of over 3500 investment cases within and between the two countries based on the ORBIS database maintained by Bureau van Dijk, a firm that establishes extensive corporate databases from various government and corporate sources (Bureau van Dijk, 2014). In order to eliminate diversified portfolio investments from this database, we selected only investment linkages in affiliates with an ownership share of 10% or more as suggested by the OECD (2000). This left us with 1045 Canadian investments and 2494 Chinese investments. These investments, of which only 235 are international investment cases, will be referred to as affiliates or subsidiaries below, including both greenfield and brownfield investments.

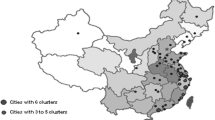

In order to determine whether a firm and/or its subsidiary are located in a cluster area, we analyzed Canadian and Chinese industrial data at the metropolitan level. Similar to Holmes and Stevens (2004) and Alcácer and Chung (2014) in their studies of the United States, we used the Canadian Business Patterns (Statistics Canada, 2006), which provide the most detailed and comprehensive industrial statistics at the metropolitan level, to detect clusters in Canada. In China, we accessed comprehensive industrial data at the metropolitan level from the Economic Census (National Bureau of Statistics of China, 2004) and the China City Statistical Yearbook (National Bureau of Statistics of China, 2005). Using industrial data at the same geographical level in almost the same period allowed us to define clusters that were comparable in both countries.

We adopted a three-stage procedure to define clusters at the metropolitan level for each country following the approach of Bathelt and Li (2014). First, since the ORBIS database only provides industry information for headquarters, we needed to code the industry groups of subsidiaries in order to define cluster industries at the investment destination. Generally, we identified headquarter and subsidiary industry groups at the three- or four-digit level according to the North American Industry Classification System in Canada and at the two- to four-digit level according to China’s Industry Classification System. Subsidiaries were assigned to specific industry groups according to their names or through internet searches. We then calculated the location quotients (LQs) for those industries matching the FDI activities, using both the number of establishments and the number of employees. This was done for the source and destination metropolitan areas of the investments. LQs of establishments and employees that are both larger than 1 were used to identify local industry agglomerations. The reason to use LQs for establishments and for employees was to rule out extreme cases of agglomerations consisting of either (i) many small firms, but low employment overall, or (ii) large employment numbers, yet concentrated in only few large firms. The two extreme cases are inconsistent with our interpretation of clusters as industrial communities with sufficiently large populations of firms and employees that generate dynamic local knowledge ecologies. Similar to Enright (2000) and Alcácer and Chung (2014), we argue that these extreme cases are less attractive for knowledge-seeking investments. Industrial agglomerations identified at this stage encompass local communities with an above-average concentration of both firms and employees.

In the second step, we combined local agglomerated industries with co-localized, technologically related industries (at the three- or four-digit industry level) in a case-by-case fashion. For the same agglomerated industry in different cities, we pooled the same technologically related industries to insure a consistent internal structure of the identified clusters. This process was based on fine-grained industry classifications and existing case studies (e.g., Spencer et al., 2010). The process of selecting and combining technologically related industries was consistent with the argument that knowledge ecologies in clusters develop from localized interactions between technologically related firms (Saxenian, 1994; Porter, 1990; Maskell, 2001).

The third step of the cluster identification process involved recalculating the establishment and employment LQs for aggregated, technologically related industry groups and applying minimum-size criteria. The latter were derived from the argument that knowledge ecologies in clusters require a critical mass in terms of their localized industrial community to be able to develop and continue to grow (Delgado et al., 2014). We identified local industry groups as clusters3 if they surpassed a critical mass with respect to their size (more than 100 establishments and more than 5000 employees) and, at the same time, showed a high level of aggregate agglomeration (LQs for establishments and employment both larger than 1). In subsequent robustness checks, we adopted more rigid criteria in terms of agglomeration requirements when detecting clusters.4

Variables

Locational choice. After detecting clusters in the two countries, we were able to construct a binary dependent variable (Investment in clusters) to measure whether a subsidiary is located in a cluster (value of 1) or non-cluster (value of 0). There is one important difference in this approach compared to studies about specific locational choices of investments (e.g., Head et al., 1995; Alcácer and Chung, 2014). The binary variable Investment in clusters allows us to differentiate whether an investment is made in a cluster or not, but it does not specify which metropolitan area this investment is directed to. In line with the prior conceptual debate, we used logit models to examine the locational choices of investment decisions in a binary space: clusters versus non-clusters. In other words, we modeled a categorical locational choice. Because of this we did not need to control for specific regional characteristics.

Country origin. Since we focus on the investments of Chinese and Canadian firms within and between the two countries, we defined a binary variable Country origin to differentiate whether the investing firm originates from Canada (value of 1) or China (value of 0). This variable measures the home country effect to capture whether Canadian and Chinese firms differ in making investment decisions in clusters. It captures potentially different strategies of firms from developed and developing or emerging economies.

Cluster origin. Based on the detected clusters in the two countries, we were able to construct a binary variable Cluster origin that measures, similar to Investment in clusters, whether the parent firm is located in a cluster (value of 1) or non-cluster (value of 0). This variable operationalizes the home cluster effect of locational choices in investment decisions.

(Industry) Knowledge intensity. Since the main activities of the firms included in our sample span across a number of different industries, we used the variable Knowledge intensity to differentiate whether a firm’s industrial environment is knowledge-intensive or not. We adopted Hatzichronoglou’s (1997) classification of manufacturing industries, which is based on technological intensity, and defined high- and medium–high-technology industries as knowledge-intensive manufacturing activities (value of 1). As Hatzichronoglou’s (1997) classification does not cover services, we included finance, motion pictures, engineering, and architectural services from the activities in our sample as knowledge-intensive services (value of 1). The base group of non-knowledge-intensive industries consists of mining, agriculture, forestry, retail, logistics, and medium–low- and low-technology manufacturing activities (value of 0). In these industries, we assumed that knowledge played a less important role.

Experience and capabilities of firms. It is hard to measure the experience and capabilities of firms to observe, acquire, and mobilize knowledge from external sources and transfer it across corporate units (Cohen & Levinthal, 1990; Kogut & Zander, 1992; Ghoshal et al., 1994; Phene & Almeida, 2008). Our database does not include any direct variable to measure these effects. Instead, we used Firm age as a proxy for the experience and accumulated knowledge firms have acquired in their organizational field. By adopting this variable, it is assumed that older firms, which have been operating for a longer period of time, have a better understanding of their field in terms of the strategic places where important knowledge is generated and where competitors and related firms can provide crucial inputs for innovation. These firms can be expected to better recognize the value of cluster areas in investment decisions.

Additionally, we used the total number of subsidiaries of the investing firm (Subsidiary network size) at the global scale (not just in Canada and China) as an indicator to measure the combinative capabilities of firms to integrate knowledge within their organizational networks across different sites. The rationale for adopting this variable is that building an effective trans-local network for knowledge generation is a challenging task. Compared to a single-site firm, corporations with an existing network of subsidiaries have advantages in accessing a broader set of knowledge pools and transferring knowledge between sites. Following this argument, it can be expected that a multisite firm is more likely than a single-site firm to choose a cluster location for its investment. However unlike Firm age, Subsidiary network size can also be associated with more difficulties or higher costs of trans-local knowledge management. When organizational networks grow larger, knowledge acquisition and integration can become more problematic and returns from leveraging knowledge differences across clusters may diminish. There can be several reasons for decreasing returns in building organizational networks across clusters. First, in each organizational field there are only a limited number of innovative hotspots with distinct specialization. For firms that have already invested in major clusters, the chances for acquiring additional industrial knowledge from establishing new cluster subsidiaries may decrease. Second, given cognitive limitations of managers (Simon, 1947) the costs of knowledge management and coordination across corporate units can increase with growing complexity of knowledge sources (Meyer et al., 2011). These aspects also limit the search for trans-local knowledge (Laursen & Salter, 2006; Leiponen & Helfat, 2010; Love et al., 2014) and we may even expect a negative impact of Subsidiary network size on making investment decisions in clusters.

International investment. Related to propositions P1 and P3, we distinguish international investments (value of 1) from the domestic ones (value of 0) using the binary control variable International investment. As the possibility of knowledge generation increases when investing in foreign clusters, we expect that International investment is positively related to investments in clusters.

We also included two other sets of control variables in our models. First, to rule out heterogeneity in investment choices across industries, we grouped the sample into 7 industry groups (agriculture, mining, manufacturing, finance, telecommunications, media and culture, and others) and included industry-group fixed effects in all regressions. Second, a considerable proportion of the investment cases in our sample (39%) are subsidiaries established in the same metropolitan areas as their parents. While these cases are not at the core of our argument, a possible explanation may be related to internal agglomeration effects that derive if a firm establishes new operations in its existing location region, as indicated by Alcácer and Delgado (2016). To differentiate such internal from external agglomeration effects, we created the binary variable Same-city investment to control for those cases where subsidiaries and parent firms are located in the same metropolitan area (value of 1), as opposed to different metropolitan areas (value of 0). One might expect a negative regression coefficient for the variable Same-city investment, as trans-local investments offer more opportunities for leveraging knowledge pools across clusters. However, in early stages of corporate expansion same-city investments may be very beneficial, especially if firms are already located in a cluster and can use such investments to extend agglomeration economies. This would lead to a positive regression coefficient and appears more likely in the two country cases investigated here.

Table 1 presents the correlations and descriptive statistics of all variables.

Results

Investment Patterns

Before presenting the results of our regression models, Table 2 shows the general patterns of investments between cluster and non-cluster areas in Canada and China. For domestic investments in Canada, the table shows that 73% of the investments originating from clusters were directed to clusters (376 of 516) and only 27% to non-clusters (140). In contrast, only 21% of the investments from non-clusters were directed to clusters (50 of 236), while 79% targeted non-clusters (186). In China, the formation of cluster networks resulting from domestic investments was similarly strong: 57% of the investments made by cluster firms were directed to clusters (603 of 1056), while only 11% of the investments by non-clusters firms targeted clusters (128 of 1130). In international investments, similar patterns were identified. Fifty-nine percent of the investments from clusters were directed to clusters in the other country (49 of 83), while only 36% of investments of non-cluster firms adopted a cluster location strategy (54 of 152). Chi-square tests of the three types of domestic and international investment patterns were all highly significant at the 0.01 level, suggesting that subsidiary locational choices in clusters are not independent from the cluster origins of the parent firms. Overall, both domestic and international investments exhibited a strong association between the cluster status of the parent firms and that of their subsidiaries.

Having collected industry information for both headquarters and subsidiaries, we further distinguished between intra-industry and inter-industry investments.5 From Table 2, it can be suggested that the general investment pattern from clusters to clusters and from non-clusters to non-clusters only holds for intra-industry investment cases, but is not significant in inter-industry investments. Since we defined clusters based on the industry groups, intra-industry investments imply that, if clusters are connected through FDIs, these linkages are between similar industries. In contrast, inter-industry cases when connecting two clusters represent links between clusters in different industries. The corresponding columns in Table 2 indicate that intra-industry investments are very common (2810 cases). They connect similarly specialized region types while inter-industry investment cases are less common (363 cases) and do not generate a pattern of cluster-to-cluster and non-cluster-to-non-clusters networks. This finding is in line with propositions P1 and P3 and supports our claim that global and national cluster networks are constructed in a field-specific manner.

Overall, these investment linkages are consistent with P1 and P3 regarding the home cluster effects for international and domestic investments and do not provide strong support for the home country effect P2 which assumes different location strategies for Chinese and Canadian firms.

Regression Results

Table 3 displays the logit regression results for our main models. Model 1 includes the variables of interest and Model 2 adds controls, both being fully consistent. In all models, to account for unobserved heterogeneity at the industry and firm levels, industry-group fixed effects were included6 and standard errors were grouped at the firm level. Model 2, which is fully specified with controls and regressed with the pooled sample, serves as a reference point in our analysis. In Model 2, the variables of interest show the expected signs in their coefficients. Country origin has a positive but insignificant impact on a firm’s decision to invest in a cluster area. This does not provide strong support for P2 regarding the home country effect. In contrast, Cluster origin has a significantly positive coefficient, suggesting that firms with a cluster origin are more likely to invest in clusters than other firms, consistent with P1 and P3.

As Country origin and Cluster origin are binary variables, we calculated their average marginal effects, using the delta method while keeping other variables unchanged. The results suggest that the cluster-of-origin effect, aside from being highly significant, is also much stronger than the country-of-origin effect. In comparison, when shifting from a developing or emerging to a developed country the likelihood that a firm invests in a cluster increases by 1.9%, whereas the shift from a non-cluster origin to a cluster origin increases this likelihood by 39.7%. To test the difference between home country and home cluster effect, we conducted a Wald test (Χ2 = 32.2, p < 0.000), which showed that the two coefficients are significantly different. Significance levels and average marginal effects suggest that the home cluster effect is more important than the home country effect when making decisions to locate subsidiaries in cluster areas. This is consistent with the argument that small geographical scales are more revealing to understand location strategies of firms than large scales (Kuemmerle, 1999; Alcácer & Chung, 2014).

In Model 2, the significantly positive coefficient of Knowledge intensity supports P4 that specifically firms operating in a knowledge-intensive industrial environment prefer cluster locations for their investments. The average marginal effect of Knowledge intensity is also substantial with 11.8%.

To decide whether Subsidiary network size and Firm age should enter our regression model in a linear or non-linear form, we conducted model specification checks.7 As these tests did not support the inclusion of quadratic terms, we chose a linear form for both variables in all models. In the robustness checks, we conducted some further analyses regarding the stability of these results. In Model 2, the coefficient of Firm age is moderately significant and positive, suggesting that older, experienced firms are more likely to choose cluster locations in their investment decisions. In terms of the average marginal effect, one more year of experience increases the likelihood of investing in a cluster by 0.16%. This result is in line with Alcácer and Chung’s (2014) finding that advanced and experienced firms prefer locations with deep knowledge pools. Since the variable Subsidiary network size measures the global number of subsidiaries and can be very large, its coefficient is small, but significant and negative. The average marginal effect of Subsidiary network size is even smaller than that of Firm age, suggesting that one additional subsidiary reduces the likelihood of a firm of investing in a cluster by 0.007%. We interpret the negative sign of Subsidiary network size as being consistent with the argument that costs of knowledge integration from clusters increase as the organizational network becomes more extensive (Henderson, 2003). As emphasized by Meyer et al. (2011) and Mudambi (2011), knowledge mobilization and integration generate substantial management challenges for multisite organizations. Our results suggest that, as a firm’s subsidiary network expands, it becomes more difficult to profit from mobilizing distant knowledge and fewer cluster locations are left from where complementary knowledge can be acquired. In such situations, clusters become less attractive for investments. Considering Firm age and Subsidiary network size together, the results in Model 2 provided mixed evidence regarding P5. While they suggest a positive learning capability effect on a firm’s decision to invest in a cluster, the impact of multisite knowledge management costs and the limited pool of complementary knowledge sites from which large organizations can choose reduce the likelihood of directing investments to a cluster.

In Model 2, the coefficient of International investment is significantly positive, implying that firms are more likely to choose cluster locations for investments in international settings than in the domestic context as knowledge diversity in foreign clusters is larger than in the domestic ones. The positive and significant coefficient of Same-city investment does not per se support the importance of accessing trans-local knowledge pools, but suggests that internal agglomeration effects in domestic settings play a significant role (Alcácer & Delgado, 2016).

When excluding same-city investments, 1863 cases were left for the analysis with subsidiaries and headquarters being located in different cities. As Model 3 shows, the home cluster effect for such trans-local investments remains highly significant, although the coefficient is substantially smaller compared to Model 2 due to the exclusion of same-city investment cases. The average marginal effect (14.9%) is still very high. The home country effect is insignificant and even negative in Model 3. When focusing on trans-local investment cases, the results support the greater importance of the home cluster effects (P1 and P3) compared to the home country effect (P2). Consistent with Models 1 and 2, a knowledge-intensive industrial environment and a firm’s business experience increase the likelihood that clusters will be chosen as locations in investment decisions, while Subsidiary network size has a negative impact.

Models 4 and 5 report the results for intra-industry and inter-industry investments, respectively. For intra-industry investment cases in Model 4, Canadian firms are more likely to invest in clusters than Chinese firms (at a moderate significance level). However, as before, the average marginal effect of Cluster origin is much greater than that of Country origin (43.3 compared to 8.8%). Since intra-industry investments imply that the cluster of origin and the cluster of destination both focus on a similar set of industries, the model provides strong evidence in support of the argument that investment linkages connect clusters with similar specialization as expressed in P1 and P3. Further, operating in a knowledge-intensive industrial environment also significantly increases the probability of choosing clusters. The coefficients of Firm age and Subsidiary network size have the same signs as before but are insignificant in Model 4.

In contrast to all other models, the strong cluster network link disappears in Model 5 when only inter-industry investments are analyzed. In Model 5, all variables become insignificant. The results are in line with our previous arguments. Since knowledge pools of clusters that specialize on different industries are usually unrelated to each other, there is little benefit for firms when leveraging knowledge across such different clusters. Consequently, Models 4 and 5 together suggest that intra-industry and inter-industry investments follow very different rationales in their location strategies.8 These results are consistent with Alfaro and Charlton’s (2009) findings that intra-industry investments are more directed toward higher skill intensity (i.e., knowledge orientation) and follow competitive advantages, while inter-industry investments tend to be more focused on lower skill intensity following comparative advantages.

To further explore location strategies of Chinese and Canadian firms, we differentiated our sample according to the firms’ nationalities and into domestic versus international investments. The results are presented in Table 4. Models 6 and 7 only include Canadian firms, while Models 8 and 9 present the respective findings for Chinese firms. The models show similar results as the main models in Table 3. While the subsample of Canadian investments is much smaller than that of Chinese investments, the results in Models 6 to 9 are similar. In Model 7 for Canadian trans-local investments, the subsample size consists of only 456 cases, which leads to lower significance levels in the analysis. Because of this smaller sample size, we do not over-interpret the respective results. Overall in both countries, Cluster origin, Knowledge intensity, and Firm age tend to have a positive impact on the investment decision to locate in a cluster. These results suggest that, when focusing on locational choice at the cluster level, the behaviors of Canadian and of Chinese firms are not systematically different – i.e., a finding which again does not support P2.

In Models 10 and 11, we separated domestic investment cases from the international ones. The significantly positive coefficient of Cluster origin in Model 10 for domestic investments provides strong evidence supporting P3 that investments across clusters are an important characteristic in domestic investment decisions. The insignificant coefficient of Country origin indicates that there is no clear difference in the way Canadian and Chinese firms invest in clusters within their national territories. Consistent with the models before, Knowledge intensity and Firm age are significant and positively influence locational choices in clusters in domestic settings, and the coefficient for Subsidiary network size is negative and significant. In Model 11, which only investigates international investments, the sample size is drastically reduced,9 which may be the reason why many coefficients become insignificant. However, the signs of the variables remain consistent with the models before, with Cluster origin and Firm age being positive and Knowledge intensity significantly positive.

Overall, we found strong evidence that firms from clusters, be they from China or Canada, are more likely to choose similarly specialized clusters for their investment affiliates. The analysis shows that investment decisions that are both domestic and international in character lead to the development of cluster networks. We found strong evidence for domestic investments and, due to data limitations, moderate support for international investments. The results suggest that there is a mutually beneficial relationship between multisite firms and innovative clusters (Birkinshaw & Hood, 2000; Enright, 2000; Rugman & Verbeke, 2001; Cantwell & Iammarino, 2003; De Propris & Driffield, 2006; Bathelt & Li, 2014).

Robustness Checks

To examine whether the previous results still hold under different assumptions and settings, we conducted several robustness checks, related to (i) the potential of reverse causality for the home cluster proposition, (ii) the cut-off criteria used in defining clusters, and (iii) potential outlier problems.

-

(i) Reverse causality. Since we do not have information about the dates of the investments investigated, a concern may be that subsidiaries generate clusters rather than that the presence of clusters attracts investments, which would suggest reverse causality in our conceptualization. Empirically, such a concern can be rationalized by cases such as the software cluster in Bangalore, which was triggered by investments from the United States (Saxenian, 2006). In the context of China and Canada, there are good reasons to doubt such an interpretation. First, our sample firms only represent a very small proportion of firms in the two countries. Since we defined clusters based on information about all firms and industries in the respective metropolitan areas, it is unlikely that the subsidiaries included in our analysis played a major role in creating clusters in the two countries. Second, in terms of international investments in our sample, these started only relatively recently between the two countries (Bathelt & Li, 2014). This latecomer status of international investments between Canada and China on the one hand explains the relatively small number of international investment cases in our sample, but on the other hand helps rule out reverse causality since the most innovative clusters in the two countries already developed much earlier. Furthermore, based on a different data source, we accessed another sample of international investment cases from Canada to China between 2006 and 2010 (299 cases). After detecting clusters using industrial data from 2004 with the same method adopted in this article, we found similar investment patterns across clusters with similar specialization (Bathelt & Li, 2014). This increases our confidence in the interpretations provided in this article.

-

(ii) Cluster definition. We detected clusters using three cut-off criteria with respect to LQs, employment, and number of establishments. Clusters were defined in such a way that a group of related local industries had to meet all three criteria. The detected clusters entered our model in decisive ways via the dependent variable Investment in clusters and the independent variable Cluster origin that were both defined as binary variables. Since these are key variables in our model, it is important to check the stability of the results using alternative criteria to identify clusters. We used two alternative approaches to detect clusters. First, we applied more rigid cut-off values for employment and establishment LQs (LQs > 1.5; LQs > 2), together with the same minimum-size criteria for employment and number of establishments as before. Second, we used LQs as a continuous measure of agglomeration to distinguish different degrees of clustering.10 Applying both alternative approaches, the results of our analysis remained largely consistent with the prior findings (Table 5).

Table 5 Robustness checks (dependent variable: Investment in clusters) -

(iii) Outliers. In our regression models, all variables are binary except for Firm age and Subsidiary network size, which are both discrete and may be influenced by few very large values. To make sure that the results are stable for the two variables, we tested multiple specifications and categorized them based on different percentiles. With the smallest percentile as the base group, Firm age variables consistently showed a positive sign, while Subsidiary network size variables had a negative coefficient, with all other variables remaining the same as in the main models.11 These results suggest that our findings are robust to potential outliers of these two variables (Table 5).

Conclusions

Exploring knowledge networks in local and global settings is an increasingly important topic in economic geography and international business studies. In economic geography, a localized understanding of the innovation process has dominated much of the literature, especially investigations about industrial clusters and other agglomerations. Based on case studies of innovative regions, different concepts have been developed to explain the social conditions that support localized learning in communities and clusters. In the past decade, however, it has been increasingly emphasized that local knowledge pools are not sufficient for innovation in the globalizing knowledge economy and that firms need to tap into distant reservoirs of ideas and technologies both nationally and internationally (e.g., Bathelt et al., 2004). Although there are some interesting case studies showing that firms from clusters invest in other, similarly structured cluster areas (e.g., Saxenian, 2006; Scott & Pope, 2007; Oliver et al., 2008; Lan, 2015), broader statistical evidence to support the conceptualization of cluster networks is still lacking. In international business studies, it is well established that multinational corporations invest globally not only to achieve low-cost production or better market penetration but also to acquire important knowledge. Due to data limitations, the exploration of global networks of multinational enterprises in this literature is often restricted to the continent, country, or state/provincial level. Only recently have locational choices of foreign investment decisions also been investigated at the metropolitan scale – an approach that is more capable of capturing agglomeration economies and knowledge spillover effects (Chung & Alcácer, 2002; Alcácer & Chung, 2014).

In this article, we aim to bridge the two fields in the context of global networks that evolve from localized innovation systems. To extend case studies of clusters in economic geography, we developed a comparative method to detect clusters in an international context and identified an overall pattern of investment networks across clusters. We provided strong statistical evidence that broadens anecdotal case study findings about cross-cluster linkages. With respect to international business studies, our research contributes to extending the exploration of location strategies of multinational firms to the metropolitan and cluster levels both in the origin and destination countries. We also provide evidence supporting the idea that knowledge seeking and combination play an important role in understanding locational choices of firms in international as well as national settings.

This research was designed to provide more clarity regarding the role of clusters, cluster networks, and knowledge flows in national and international investment decisions of firms. The results derived from analyzing Canadian and Chinese investment cases are generally consistent with arguments about the role of localized and globalized learning processes in the knowledge economy. Our analysis revealed that the home cluster effect is much more important than the home country effect in directing investments to cluster locations. This finding suggests that previous investigations in international business studies may overestimate the country-of-origin effect by not zooming into the metropolitan and cluster scales.

By examining locational choices in investment decisions at the metropolitan level, our research finds strong evidence that firms from clusters are more likely than non-cluster firms to invest in clusters – more precisely in clusters with similar specialization. This result substantiates the framework of global cluster networks, which proposes that patterns of knowledge circulation and generation develop across clusters that are specialized in the same or similar industries (Bathelt & Li, 2014). Within economic geography, cluster networks are a new spatial configuration of knowledge generation that has not yet received much attention. The formation of such cluster networks suggests that there is an important, perhaps increasingly significant, global dimension of learning activities within and across clusters. When such global connections become significant, local institutions and interactions can only provide a partial understanding of innovation successes, thus demanding a broader trans-local and international analytical focus. Another implication of global cluster networks is that clusters, as well as other regions, which are not embedded in such high-level networks, might systematically fall behind in terms of knowledge generation and innovation with potentially negative competitive, economic, and social effects in the respective regions.

In the context of international business studies, our findings imply that there are important investment patterns at the cluster level which have not yet been revealed but have a strong impact on the locational choices and knowledge strategies of multinational corporations. In other words, theorizations at the country level may no longer suffice to explain corporate knowledge creation processes in the globalizing knowledge economy. When considering that the likelihood of clusters being connected through investment decisions is particularly strong if firms are experienced and operate in knowledge-intensive environments, we should expect that knowledge-creating multinational enterprises play a major role in constructing global cluster networks – a role that can best be explored by combining the research traditions in international business studies and economic geography.