Abstract

Despite the growing importance of CEOs’ international experience (IE), we have yet to gain sufficient insights into its conceptualization and effect on firm outcomes. Based on prior research and work experience models, we suggest a new framework for measuring IE, including three components: length of time, number of countries, and cultural distance, along with their interactions. Drawing upon social and cognitive learning theories, we explore the impact of CEOs’ IE on two outcomes: strategic change and firm performance. We argue that IE components affect the two outcomes by enhancing executives’ international knowledge and general competencies. While international knowledge may affect firm performance directly, general competencies may affect firm performance both directly and indirectly through strategic change. Using a sample of 387 new CEOs, we found that time abroad had a positive effect on strategic change and firm performance, while number of countries and cultural distance positively moderated these relationships. Additionally, we also found that these components affected firm performance both directly and mediated through strategic change. Our findings have important theoretical implications for the conceptualization and impact of CEOs’ IE and practical implications for executive development and promotion.

Résumé

En dépit de l’importance croissante de l’expérience internationale (EI) des PDG, nous avons besoin de mieux cerner sa conceptualisation et son effet sur les résultats des entreprises. En nous appuyant sur des recherches précédentes et les modèles de l’expérience du travail, nous suggérons un nouveau cadre conceptuel, intégrant trois composantes, qui permet de mesurer l’EI: la longueur de temps, le nombre de pays et la distance culturelle ainsi que leurs interactions. A partir des théories d’apprentissage social et cognitif, nous étudions l’impact de l’EI des PDG sur deux résultats: le changement stratégique et la performance de la firme. Nous considérons que les composantes de l’EI influencent les deux résultats en améliorant les connaissances internationales et les compétences générales des dirigeants. Si les connaissances internationales peuvent directement affecter la performance de la firme, les compétences générales peuvent affecter la performance de la firme à la fois de manière directe et indirecte par le changement stratégique. En utilisant un échantillon de 387 nouveaux PDG, nous avons trouvé que le temps passé à l’étranger avait un effet positif sur le changement stratégique et la performance de la firme, tandis que le nombre de pays et la distance culturelle ont modéré positivement ces relations. Par ailleurs, nous avons constaté que ces composantes avaient affecté la performance de la firme à la fois de manière directe et arbitrée par le changement stratégique. Nos résultats ont des implications théoriques importantes pour la conceptualisation et l’impact de l’IE des PDG, et des implications pratiques pour le développement et la promotion des dirigeants.

Resumen

Pese a la importancia de la experiencia internacional (EI) de los CEOs, todavía tenemos que obtener suficiente entendimiento de su conceptualización y los efectos en los resultados de la empresa. Con base en investigación anterior y modelos de experiencia laboral, sugerimos un nuevo marco para medir la EI, incluyendo tres componentes: duración en tiempo, número de países, y distancia cultural, junto con sus interacciones. Aprovechando las teorías del aprendizaje social y cognitivo, exploramos el impacto de la EI de los CEOs sobre dos resultados: el cambio estratégico y el rendimiento de la empresa. Discutimos que los componentes de la EI afectan los dos resultados al mejorar el conocimiento internacional de los ejecutivos y las competencias generales. Mientras que el conocimiento internacional puede afectar el rendimiento de la empresa de manera directa, las competencias generales pueden afectar el rendimiento de la empresa tanto de manera directa como indirecta mediante un cambio estratégico. Utilizamos una muestra de 387 nuevos CEOs, encontramos que el tiempo en el extranjero tuvo un efecto positivo en el cambio estratégico y el rendimiento de la empresa, mientras que el número de países, y la distancia cultural moderó positivamente estas relaciones. Adicionalmente, encontramos que estos componentes afectaron el rendimiento de la empresa tanto directamente como mediado a través de cambios estratégicos. Nuestros hallazgos tienen implicaciones teóricas importantes para la conceptualización y el impacto de la IE de los CEOs y las implicaciones prácticas para el desarrollo y promoción de los ejecutivos.

Resumo

Apesar da crescente importância da experiência internacional dos CEOs (IE), ainda temos de obter insights apropriados sobre sua conceituação e efeito sobre os resultados da empresa. Com base em pesquisas anteriores e em modelos de experiência de trabalho, sugerimos uma nova estrutura para a mensuração da IE incluindo três componentes: duração do tempo, número de países e distância cultural, juntamente com suas interações. Baseados nas teorias de aprendizagem social e cognitiva, exploramos o impacto da IE dos CEOs em dois resultados: mudança estratégica e desempenho da empresa. Argumentamos que os componentes da IE afetam os dois resultados aumentando o conhecimento internacional e as competências gerais dos executivos. Enquanto o conhecimento internacional afeta diretamente o desempenho da empresa, as competências gerais podem afetar o desempenho da empresa tanto direta quanto indiretamente, por meio de mudanças estratégicas. Usando uma amostra de 387 novos CEOs, descobrimos que o tempo no exterior teve um efeito positivo sobre a mudança estratégica e o desempenho da empresa, enquanto o número de países e a distância cultural moderaram positivamente essas relações. Além disso, constatamos que esses componentes afetaram o desempenho da empresa tanto diretamente quanto mediados por meio de mudanças estratégicas. Nossas descobertas têm importantes implicações teóricas para a conceituação e impacto da IE dos CEOs e implicações práticas para o desenvolvimento e promoção de executivos.

概要

尽管CEO的国际经验(IE)日益重要,我们还有待获得对其概念化和它对企业业绩影响的充分的领悟。基于先前的研究和工作经验模型,我们提出了一个测量IE的新框架,包括三个部分:时间长度,国家数量和文化距离,以及它们的相互作用。借鉴社会和认知学习理论,我们探索CEO的IE对两个结果的影响:战略变化和企业绩效。我们认为,IE要素通过提升高管的国际知识和通用能力来影响这两个结果。虽然国际知识可能直接影响企业绩效,但通用能力可能通过战略变化直接和间接地影响企业绩效。使用387名新CEO的样本,我们发现国外的时间对战略变化和企业绩效有积极的影响,而国家数量和文化距离对这些关系有积极的调节。此外,我们发现这些要素直接地和通过调整战略变化来影响企业绩效。我们的研究结果对CEO的IE概念化及影响有重要的理论启示,同时对业务发展和推广有实际启示。

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Executives’ international experience (IE) has been recognized as a valuable resource as firms compete in increasingly globalized markets (Caligiuri & Di Santo, 2001; Carpenter, Sanders, & Gregersen, 2001; Daily, Certo, & Dalton, 2000; Morris, Snell, & Björkman, 2016). Prior research has shown that by endowing executives with host countries’ knowledge and networks, IE contributes to the internationalization of a firm and enhances its competitive advantage and performance (e.g., Carpenter & Fredrickson, 2001; Hsu, Chen, & Cheng, 2013; Kim, Pathak, & Werner, 2015). Executives’ IE has received considerable scholarly attention and become an item of interest relative to executive recruitment and promotion (Carpenter et al., 2001; Sanders & Carpenter, 1998).

Despite considerable research, there are still some gaps in the literature that need to be addressed in order to advance our understanding of IE and its effect on executive and organizational performance. First, although time-based or quantitative measures, such as the length of time, have been often used in prior research, they are insufficient to capture the multifaceted construct of IE (Takeuchi, Wang, & Marinova, 2005). Researchers have long suggested that work experience consists of various components beyond simply time spent, and firm outcomes are determined not only by individual components, but also the interactions between those components (e.g., Quińones, Ford, & Teachout, 1995; Tesluk & Jacobs, 1998). Recent studies have attempted to enrich the conceptualization and operationalization of IE by taking into account its other aspects, such as cultural distance, experience in different regions, and breadth and depth of experience (e.g., Dragoni et al., 2014; Godart, Maddux, Shipilov, & Galinsky, 2015; Selmer, 2002; Takeuchi et al., 2005; Zhu, Wanberg, Harrison, & Diehn, 2016). Yet further research on this issue is warranted (Dragoni et al., 2014; Takeuchi et al., 2005).

Second, most previous studies of the consequences of IE have largely focused on its internationalization-related outcomes, such as firm internationalization, modes of entry, and international acquisitions (e.g., Daily et al., 2000; Holm, Eriksson, & Johanson, 1996). According to learning theorists (e.g., Endicott, Bock, & Narvaez, 2003; Fee, Gray, & Lu, 2013; Suutari & Mäkelä, 2007), experience in a particular field might not only enhance domain-specific knowledge and skills in that field, but also result in general personal and professional development. This raises the question of whether IE augments executives’ general competencies and firm outcomes in ways that go beyond specific international knowledge and internationalization-related outcomes. This question has not been adequately addressed in the extant literature (Dragoni et al., 2014). Another related gap in the literature is a lack of understanding of specific processes through which IE affects firm performance, although it has been established in the strategic management literature (e.g., Carpenter et al., 2001; Daily et al., 2000) that IE has a positive impact on firm performance.

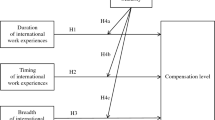

This article seeks to address the above gaps in the literature by examining how substantial IE shapes CEOs’ influence on strategic change and firm performance. We define substantial IE as the experience an executive gains from working in a foreign country for at least one year (Carpenter et al., 2001). Based on the work experience models by Quińones et al. (1995) and Tesluk and Jacobs (1998), we develop a framework for differentiating the elements of CEO IE, which include three main components: the length of time of international experience (hereafter referred to as length of time IE), the number of countries in which international experience is gained (hereafter referred to as number of countries IE), and the cultural distance of host countries from CEOs’ home countries (hereafter referred to as cultural distance IE) as well as their interactions. In our framework, the effect of CEO length of time is considered first, followed by the augmenting effect of number of countries IE and cultural distance IE. In order to explain how the components and their interactions affect strategic change and firm performance, we draw on the insights of the social and cognitive learning literature (Bandura, 1977; Endicott et al., 2003; Kolb, 1984; Piaget, 1955). We posit that foreign countries’ environments render stimuli that create cognitive dissonance between an individual’s cognitive schemas and structure and the environment, thus stimulating learning in domain-specific knowledge and/or general cognitive competencies. While both of the learning outcomes may have a direct effect on firm performance, general cognitive competencies may also have an indirect effect in that they may influence immediate outcomes. Thus, we investigate both the direct effect of CEO IE on firm performance and its indirect effect through an immediate outcome, that being strategic change.

We examine strategic change as it has been found to be an important determinant of CEOs’ influence on firm performance in the strategic management literature (Wiersema & Bantel, 1992; Zhang & Rajagopalan, 2010). Timely strategic change reflects the ability of a firm to anticipate and respond to environmental changes (Wiersema & Bantel, 1992). As today’s environment changes constantly, the ability to effect strategic change is vital for firms to stay relevant and competitive (Kraatz & Zajac, 2001). Following the strategic management tradition (e.g., Carpenter, 2000; Finkelstein & Hambrick, 1990; Quigley & Hambrick, 2012; Zhang, 2006), we measure strategic change as change in resource allocations. We test our hypotheses using a sample of 387 newly appointed CEOs from US corporations listed in the S&P Industrials and S&P MidCap indices during the period 2000 to 2007. We focus on new CEOs as greater strategic change may be observed in the earlier, rather than the later years of a CEO’s tenure (Henderson, Miller, & Hambrick, 2006).

Our study offers a number of contributions to the international business and strategic management literature. First, our study contributes to the literature addressing the conceptualization and operationalization of IE (e.g., Caligiuri & Tarique, 2012; Dragoni et al., 2014; Godart et al., 2015; Selmer, 2002; Takeuchi et al., 2005; Zhu et al., 2016) by differentiating the important components of IE in order to assess their individual and interactive effects on firm outcomes. We show that CEO length of time and its interactions with number of countries and cultural distance capture the multifaceted construct of IE more fully than length of time or number of countries alone. Second, our study extends the line of research on the impact of IE on firm performance (Carpenter et al., 2001; Daily et al., 2000) by finding evidence that such impact is greater when a richer conceptualization of IE is used. Finally, we provide insights into the immediate outcomes of IE (Caligiuri & Tarique, 2012; Dragoni et al., 2014, Lisak et al., 2016). Our results show that CEO IE has a positive effect on strategic change. This is attributable to the greater international knowledge and general competences that the CEO developed from IE.

Theoretical Background and Hypotheses

As with other types of work experience, IE is complex and multidimensional. Indeed, the literature has been inconsistent as to how to even measure IE (Takeuchi et al., 2005). Although length of time and number of countries have been the most frequently used measures, they do not fully capture the nature and the importance of IE (Dragoni et al., 2014; Godart et al., 2015; Selmer, 2002). In order to measure the effect of CEO IE on strategic change and firm performance, we draw upon the work experience models by Quińones et al. (1995) and Tesluk and Jacobs (1998).

Quińones et al. (1995) suggest a framework of work experience measures, which includes three measurement modes of experience: time (on the job), amount (numerical counts such as number of jobs held), and type (qualitative aspects such as job difficulty and complexity). Building on Quińones et al. (1995), Tesluk and Jacobs (1998) propose three components of work experience, including quantitative components, qualitative components, and interactive components. Their quantitative components include both time and amount, while their qualitative component is similar to type in Quińones et al.’s (1995) model. Tesluk and Jacobs (1998) particularly emphasize the importance of the interaction between quantitative and qualitative measures. There are two important points that we draw from these two models. First, although time and amount are both quantitative components, they are different in important ways and should be addressed separately. Quińones et al. (1995: 983) emphasize this point by indicating that “individuals may spend the same amount of time performing a task but differ in the number of times they perform the task within that time.” Thus, time, amount, and type are the major measures of experience. Second, it is important to not only examine the effect of these individual components, but also their interactions. Both Quińones et al. (1995) and Tesluk and Jacobs (1998) imply that researchers should consider the effect of the length of time on an outcome first and then the augmenting effects of other measures. Specifically, Tesluk and Jacobs (1998) suggest that in order to explain the effect of experience, researchers should consider quantitative measures such as the length of time first, and then the qualitative measures. Additionally, in both research and practice, length of time is the most popular measure of experience (Quińones et al., 1995). Thus, length of time should be used as the starting point in examining the effect of experience. Previous studies that focus on different aspects of IE also start with the length of time as the main effect and then add other experience measures as moderators (e.g., Dragoni et al., 2014).

With regard to international experience, “time” can be conceptualized as the length of time that an executive stayed abroad (length of time IE); “amount” may be conceptualized as the number of countries in which an executive worked (number of countries IE); and “type” may be viewed as the cultural distance between the home and the host country (cultural distance IE) as it reflects the complexity of IE. The three components of IE are also the most common measures of IE in the extant literature (e.g., Godart et al., 2015; Selmer, 2002; Takeuchi et al., 2005). Thus, in this article, we use the three components of IE to capture its effect on strategic change and firm performance. To examine its effect on outcomes, we consider the effect of length of time first, followed by the augmenting effect of number of countries and cultural distance.

Learning theories are often used to explain the outcomes of IE (e.g., Caligiuri & Tarique, 2009; Fee et al., 2013; Li, Mobley, & Kelly, 2013). Piaget’s (1955) concept of learning as a process of equilibration provides the foundation for contemporary learning theories, notably social learning theory (Bandura, 1977) and experiential learning theory (Kolb, 1984). This concept suggests that individuals are motivated to learn when they experience cognitive dissonance between themselves and the environment. Cognitive dissonance occurs when individuals encounter new, meaningful, critical, and/or contradictory behaviors (Bandura, 1977) and experiences (Kolb, 1984) that cannot be understood within the context of their existing knowledge or beliefs (Endicott et al., 2003). Cognitive dissonance creates the sense of arousal, uncertainty, stress, and emotional ambivalence in individuals. This psychological state heightens learning so as to diminish dissonance and adapt to the environment (DeRue & Wellman, 2009; Kolb, 1984; Piaget, 1955). Learning occurs in two distinct learning processes: assimilation and accommodation (Fee et al., 2013; Piaget, 1955). Assimilation involves the addition to existing schemas (knowledge, beliefs, and other memories). Accommodation involves the development of sophisticated schemas and fundamental changes in cognitive structure (Fee et al., 2013; Piaget, 1955). While the former results in greater domain-specific knowledge, the latter results in greater general cognitive competencies (Endicott, et al., 2003). In order words, the former brings about quantitative changes, while the latter brings about qualitative changes in individuals’ knowledge base (Lord & Hall, 2005). Domain-specific knowledge is knowledge that is specific to and can be used only in a certain arena; general cognitive competencies include creativity, problem solving, leadership, information processing, and other competencies that can be used in different arenas (Endicott et al., 2003; Godart et al., 2015). Although the two learning processes are distinct, they can intertwine in that additions to existing schemas may lead to fundamental changes in cognitive structure (Endicott et al., 2003; Fee et al., 2013).

Foreign countries provide stimuli that create dissonance between an individual’s cognitive schemas and structures and the environment, or between what they know and believe and what they observe in foreign countries. The resulting dissonance stimulates learning that brings about greater domain-specific knowledge and general cognitive competencies (Endicott et al., 2003; Fee et al., 2013; Suutari & Mäkelä, 2007). With regard to CEO IE, domain-specific knowledge is international and intercultural knowledge, such as knowledge of international markets, global networks, and intercultural communication; general cognitive competencies are reflected in the general ability to process information, make creative decisions, and interact with diverse people. Previous studies have identified some forms of general competencies gained through IE such as creativity (Leung et al., 2008), managers’ end-state competencies (Dragoni et al., 2009), strategic thinking competencies (Dragoni et al., 2014), and global leadership effectiveness (Caligiuri & Tarique, 2009). In the next section, we will apply the above theoretical insights to investigate how IE measured as CEO length of time and its interactions with number of countries and cultural distance shapes CEOs’ influence on strategic change and firm performance.

Effect of CEO IE on Firm Performance

Following the upper echelons tradition (Hambrick & Mason, 1984) and adopting the resource-based view (Barney, 1992), strategic management researchers (e.g., Carpenter et al., 2001; Daily et al., 2000; Roth, 1995; Suutari & Mäkelä, 2007) have established a positive relationship between executives’ IE and firm performance. These studies indicate that CEO IE helps develop skills, distinctive worldviews, and global networks as well as the ability to process complex and dynamic information. These skills and competencies can be a source of competitive advantage and superior firm performance because they can be valuable, rare, and inimitable (Carpenter et al., 2001; Daily et al., 2000). Specifically, CEOs with substantial IE can identify opportunities in foreign markets, develop unique international strategies, and manage and coordinate international operations effectively, resulting in superior firm performance (Carpenter et al., 2001; Daily et al., 2000; Ricks, Toyne, & Martinez, 1990). Our article contributes to this line of research using a more fine-grained conceptualization and operationalization of CEO IE. We argue that the effect of IE on firm performance is greater when its important components (i.e., length of time, number of countries, and cultural distance) and their interactions are considered (Quińones et al., 1995; Tesluk & Jacobs, 1998). We also attempt to provide a more micro-level explanation of how these components affect CEOs’ influence on firm performance.

Foreign countries provide executives with unique learning experiences that cannot be acquired by working in their home country (Roth, 1995). Individuals tend to slow down their social learning when they are familiar with and develop structured and routinized responses to the environment (Bandura, 1977). While adults may not learn much from the environment in which they have grown up, they may learn a great deal when they live and work in foreign environments (Leung et al., 2008). Countries are very different from one another with regard to cultures, institutional environments, economic development, and business practices (Hofstede, 1980). Although the differences induce culture shocks and create difficulties for executives to adjust and work in a foreign country, they stimulate learning (Black, Morrison & Gregersen, 1999; Li et al., 2013). As foreign environments present stimuli that are new and different, they create a sense of dissonance. The resulting dissonance activates individuals’ learning in either or both assimilation and association processes (Endicott et al., 2003; Fee et al., 2013). Through the assimilation process, executives enlarge their domain-specific knowledge relating to international business, such as products, markets, customers, cultures, and institutional environments. Foreign environments may present stimuli which are incongruent with executives’ existing knowledge. Such stimuli provoke fundamental changes in their cognitive structures, resulting in greater general cognitive competencies. As we discussed previously, CEOs’ international knowledge and general competencies can provide tacit knowledge and a source of competitive advantage (Barney, 1992). Thus, CEO IE may have a positive impact on firm performance (Carpenter et al., 2001; Daily et al., 2000).

The impact of IE on firm performance is to some degree determined by length of time as it takes time for an executive to understand and learn from a new culture. First, expatriates need to overcome an initial adjustment period, in which they have a culture shock and tend to use their home-country cultural values and beliefs to give meaning to what they observe in the host countries (Black & Mendenhall, 1991). Executives do not start learning from the host countries’ environments until they work through this adjustment period (Black et al., 1999; Godart et al., 2015). Second, foreign countries’ national cultures are complex with multiple layers ranging from behaviors at the outer layers, values and norms which form the middle layers, while critical assumptions lie at the core (Crowne, 2008; Trompenaars & Hampden-Turner, 1997). It is easy to observe the surface layer of a national culture, but it requires considerable time and exposure to understand the deeper layers of a culture. Finally, social learning is a gradual process, in which individuals experience concrete stimuli, reflect on them, conceptualize new knowledge and behaviors, and experiment with the new knowledge and behaviors (Kolb, 1984). The longer the executives live in a foreign country, the greater the number of stimuli they experience and the greater the knowledge they can acquire (Godart et al., 2015). Executives need to immerse themselves in the host country’s culture for a substantial period of time to acquire tacit domain-specific knowledge and enhance their general cognitive competencies (Maddux & Galinsky, 2009). Thus, we expect that CEOs’ length of time IE will have a positive impact on firm performance.

Hypothesis 1a:

During the first three years of their tenure, CEOs’ length of time IE will be positively associated with firm performance.

We posit that given the same length of time abroad, CEOs living and working in a greater number of countries will develop greater domain-specific knowledge and general cognitive competencies, thus having a greater impact on firm performance. First, working in more countries provides CEOs with a broader array of stimuli, thus resulting in greater international knowledge and general competencies than working in fewer countries (Godart et al., 2015). Second, international knowledge and competencies obtained from more countries are more valuable than those obtained from fewer countries. As the knowledge and competencies are drawn from multiple countries, they involve a greater level of causal ambiguity and social complexity (Leung et al., 2008). International knowledge and competencies obtained from multiple countries are also more global and can be used across different countries rather than a single country (Cappellen & Janssens, 2005). Finally, multi-country experiences expose executives to various worldviews, value systems, ideas, and conceptions. Such exposure not only enlarges their repertoire of international knowledge but also enhances general competencies. When executives experience a host country’s culture, they encounter dissonance, thus engaging in an accommodation process. When they move to another country, they have to do so again. This means that they have to undergo multiple accommodation processes. As a result, their general cognitive competencies, such as tolerance for ambiguity, multiple worldviews, creativity, and flexibility are deeply enriched (Caligiuri & Tarique, 2012; Crowne, 2008; Leung et al., 2008; Maddux & Galinsky, 2009; Ng, Van Dyne, & Ang, 2009). The multi-country accommodation process is more complex and results in greater cognitive expansion than a single-country accommodation process (Leung et al., 2008). It is noteworthy that the effect of multi-country experiences requires a substantial amount of time in which executives stay in each of the countries (Black et al., 1999; Maddux & Galinsky, 2009). Thus, we expect that the interaction between CEOs’ length of IE and number of countries IE has a positive impact on firm performance.

Hypothesis 1b:

During the first three years of their tenure, CEOs’ number of countries IE will positively moderate the relationship between CEOs’ length of time IE and firm performance.

In the same vein, we argue that, given the same length of time abroad, executives living and working in countries with greater cultural distance from their own will acquire greater international knowledge and general competencies, thus having a greater impact on firm performance. National cultural distance can be defined as the extent to which the shared norms and values of one country differ from those of another country (Chen & Hu, 2002; Hofstede, 2001; Kogut & Singh, 1988). Bi-national cultural distance is low when two countries share similar values, assumptions, and taken-for-granted norms and behaviors (Hofstede, 1980). Foreign countries with greater cultural distance provide stimuli with a greater level of novelty, difference, and even conflict with expatriates’ deep-level beliefs and assumptions (Chen & Hu, 2002; Cuypers, Ertug, & Hennart, 2015). The stronger the stimuli are, the more intense the cognitive dissonance is. The heightened dissonance in turn stimulates deep learning (Maddux, Adam, & Galinsky, 2010). Specifically, new and different ideas, concepts, and behaviors in culturally distant countries create a heightened sense of dissonance, thus motivating executives to engage in the assimilation process. As a result, they enlarge their repertoire of international knowledge. Cultural distance has a particularly strong impact on accommodation learning. Exposure to different, even conflicting value systems and worldviews of culturally distant countries over a substantial period of time arouses the accommodation learning process in individuals (Endicott et al., 2003; Fee et al., 2013). Their cognitive structures gradually change such that they can accommodate different worldviews. The process results in greater cognitive complexity (e.g., Caligiuri & Tarique, 2012; Earley & Peterson, 2004; Ng et al., 2009). The effect of cultural distance does not occur without a substantial period of time being spent in a foreign country. This is because it takes time for an executive to comprehend and learn from a national culture, especially its deep-level layer (Godart et al., 2015). Thus, we suggest that the interaction between CEOs’ length of time IE and cultural distance IE will have a positive impact on firm performance.

Hypothesis 1c:

During the first three years of their tenure, CEOs’ cultural distance IE will positively moderate the relationship between CEOs’ length of time IE and firm performance.

Effect of CEO International Experience on Strategic Change

Although the direct and positive impact of CEO IE on firm performance has been established, two questions regarding the outcomes of IE are under-researched (Caligiuri & Tarique, 2009; Dragoni et al., 2009; Slater & Dixon-Fowler, 2009; Suutari, 2003). First, what are the immediate outcomes of IE, or what are the specific processes through which CEO IE affects firm performance? Second, can international experiences bring about outcomes that are not directly related to internationalization? To address these under-researched questions, we examine strategic change as an immediate outcome of CEO IE. As today’s environment changes constantly, firms must make timely changes in their strategic directions and operations to stay relevant and competitive (Kraatz & Zajac, 2001). CEOs and top management teams play a central role in making strategic changes (Wiersema & Bantel, 1992; Zhang & Rajagopalan, 2010).

In order to effectively influence strategic change, CEOs should be able to anticipate and envision, maintain flexibility, think strategically, and work with others effectively (Ireland & Hitt, 2005; Wiersema & Bantel, 1992; Zhang & Rajagopalan, 2010). Specifically, CEOs should be able to understand the external and internal environments, identify opportunities, develop strategic initiatives, and work with people to formulate and execute strategic change (Crossland et al., 2014; Hambrick & Mason, 1984). We posit that IE helps develop the knowledge and competencies necessary for successfully initiating and managing strategic change. Domain-specific knowledge gained from IE aids the initiation and implementation of strategic change in several ways. First, international knowledge helps CEOs to understand foreign markets, customers, products, and networks. Such knowledge is useful for CEOs to see more opportunities in foreign countries in terms of market expansion, resource acquisition, and collaboration (Carpenter et al., 2001; Daily et al., 2000). Second, greater domain-specific knowledge provides a broader repertoire of ideas and concepts regarding foreign markets, customers, products, and technologies, which can be used as inputs for developing strategic initiatives (Godart et al., 2015). Third, CEOs with substantial international knowledge likely internalize multiple worldviews. This enables them to approach a problem from different perspectives and become more creative in formulating novel strategic initiatives (Leung et al., 2008; Maddux & Galinsky, 2009). Finally, CEO domain-specific knowledge, such as intercultural skills and global networks, can aid in the execution of strategic change (Godart et al., 2015). In sum, CEO domain-specific knowledge gained from IE enables them to identify more opportunities and initiatives for strategic change.

CEOs’ general competencies gained from IE can also influence strategic change as they involve information processing, problem solving, and strategic decision-making in general. IE enhances executives’ general competences to act effectively in complex and uncertain environments and process complex and dynamic information (Suutari & Mäkelä, 2007). These competences are important for making effective strategic change as they enable CEOs to anticipate changes and trends in the environment (Ireland & Hitt, 2005). Working abroad, executives develop the ability to use multiple frameworks in an integrated way for making sense of the environment (Townsend & Cairns, 2003). Such ability enables them to see trends and opportunities from various unrelated origins (Dragoni et al., 2014). It also enables them to form novel and creative initiatives to exploit opportunities (Leung et al., 2008). As executives have to constantly develop new solutions or responses to stimuli in foreign countries rather than using their routinized responses as in their home country, they become more mindful and creative, thus enhancing their ability to generate new ideas for strategic initiation and implementation. Finally, CEO IE has been found to enhance flexibility, receptivity, and adaptability (Li et al., 2013; Rhinesmith, 1995). These attributes enable CEOs to identify and adopt ideas from different sources, listen to critical feedback, and adapt to changes effectively (Caligiuri & Tarique, 2012; Crowne, 2008; Earley & Peterson, 2004). In sum, general competencies can help CEOs identify more opportunities and come up with more strategic initiatives, thus leading to greater strategic change in their firm.

As discussed earlier, length of time IE has a positive impact on CEOs’ domain-specific knowledge and general competencies. The number of countries IE and cultural distance IE augment the effect of length of time IE. Therefore, we propose that CEOs’ length of time IE has a positive effect on strategic change and this effect is further strengthened by the number of countries IE and cultural distance IE.

Hypothesis 2a:

New CEOs’ length of time IE will be positively associated with strategic change.

Hypothesis 2b:

New CEOs’ number of countries IE will moderate the relationship between the length of time IE and strategic change such that the positive relationship will be strengthened when new CEOs have greater number of countries IE.

Hypothesis 2c:

New CEOs’ cultural distance IE will moderate the relationship between the length of time IE and strategic change such that the positive relationship will be strengthened when new CEOs have greater cultural distance IE.

Mediating Effect of Strategic Change on the CEO IE–Firm Performance Relationship

If our expectations are realized, and new, more internationally grounded CEOs more aggressively pursue strategic change, the obvious question becomes whether performance also improves as well. The relationship between CEO succession, strategic change, and firm performance has received considerable attention. Many studies have focused on the nature of CEO succession (routine vs. non-routine) to explain the relationship (e.g., Bonnier & Bruner, 1989; Khanna & Poulsen, 1995). Other studies have examined the contingencies of the relationship, such as the dynamism of the external environment (e.g., Henderson et al., 2006) and governance structures (e.g., Quigley & Hambrick, 2012). Recent research focused on this area has begun to examine the influence of CEO experience and cognitive ability on strategic change and firm performance (Crossland et al., 2014; Hutzschenreuter, Kleindienst, & Greder, 2012). The literature has revealed the double-edged sword effect of strategic change on firm performance (Herrmann & Nadkarni, 2014). Some studies argue that strategic change is indicative of effective adaptation and innovation, thus enhancing firm performance (Zajac & Kraatz, 1993), while other studies suggest that strategic change leads to disruption and inefficient use of resources, thus hampering firm performance (Naranjo-Gil, Hartmann, & Maas, 2008). Upper echelons theory has long held the strategic direction provided by CEOs and top executives and disproportionately impacts firm outcomes (Hambrick & Mason, 1984). However, the impact of new CEOs on the effectiveness of strategic change has been found to be equivocal because while new CEOs can bring a fresh perspective, they often lack strategic firm-specific knowledge (Miller, 1991; Virany, Tushman, & Romanelli, 1992).

We posit that strategic change in firms with new CEOs who have greater IE will lead to better firm performance. As discussed earlier, these CEOs have valuable knowledge of international markets and complex general competencies. With greater international knowledge and networks, CEOs are able to identify opportunities in the global market. They can draw from a broader repertoire of ideas and concepts that they gained from IE to formulate effective strategies to exploit those opportunities. They can use their global networks to form partnerships with foreign partners to execute strategic change. Thus, strategic change in firms with new, more internationally grounded CEOs may be more timely and more effectively planned and executed. Such strategic change likely engenders better firm performance (Ireland & Hitt, 2005; Wiersema & Bantel, 1992; Zhang & Rajagopalan, 2010). As we indicated earlier, CEOs’ general competencies gained from IE include the ability to process complex and uncertain information, identify trends and patterns from unrelated sources, generate novel solutions, adapt to the environment, and work effectively with diverse people. These competencies help CEOs understand the need for change, develop innovative change initiatives, and work effectively with diverse employees to execute strategic change. As a result, strategic change is timely and effective, thus having a positive effect on firm performance.

We have reasoned that strategic change in firms with new CEOs who have substantial IE will result in better firm performance. In other words, CEO IE leads to greater and more effective strategic change which enhances firm performance. In the previous sections, we have argued that length of time IE has a positive effect on firm performance and this effect is strengthened with number of countries IE and cultural distance IE; we have also reasoned that CEO length of time IE and its interactions with number of countries IE and cultural distance IE have a positive effect on strategic change. Taken together, these arguments capture the dynamics of the IE–strategic change–firm performance relationship in that length of time IE and its interaction with number of countries IE and cultural distance IE affect firm performance both directly and through strategic change. In effect, we envision CEO IE positively influencing firm performance as a result of greater, more effective strategic change. We also anticipate CEO IE directly improving firm performance as it strengthens CEOs’ capacity to manage the firm and implement strategic change. Thus, we propose our last three hypotheses which explore the impact of CEOs’ length of time IE on firm performance as mediated through strategic change as well as its direct impact on performance.

Hypothesis 3a:

There will be a positive relationship between CEOs’ length of time IE and firm performance, both directly and mediated through the greater strategic change fostered by these CEOs.

Hypothesis 3b:

The interaction between CEOs’ length of time IE and number of countries IE will be positively associated with firm performance, both directly and mediated through the greater strategic change fostered by these CEOs.

Hypothesis 3c:

The interaction between CEOs’ length of time IE and cultural distance IE will be positively associated with firm performance, both directly and mediated through the greater strategic change fostered by these CEOs.

Sample and Methods

Sample and Data Sources

Our initial sample was obtained from the ExecuComp database, including 499 newly appointed American CEOs of US firms listed in the S&P Industrials Index and the S&P MidCap Index, who were appointed between 2000 and 2007. This population of firms has been previously used (e.g., Carpenter & Fredrickson, 2001) as it is representative of a wide array of major US industrial corporations. CEO demographic data and experience were acquired from Capital IQ, Who’s Who in Leadership and Business 2009–2010, corporate proxies, company websites, and third party executive information directories. As we focused on American CEOs and US firms, we excluded 49 foreign-born CEOs from our sample. We also excluded 56 CEOs who remained for less than two years following their initial appointment as two years is not sufficient time to assess their impact on subsequent strategic change. Owing to 7 firms for which data could not be secured, our final sample included 387 newly appointed CEOs. The firms dropped did not differ materially from those remaining in terms of size, performance, or financial leverage, while CEO demographics (e.g., age and education) were also comparable.

Independent and Moderator Variables

CEO length of time IE was represented as the number of years that the CEO resided and worked overseas prior to her/his CEO appointment. Our number of countries IE variable refers to the number of countries in which the CEO resided and worked before her/his CEO appointment. If the CEO never served outside the US, then this variable was scored as 0. To calculate our cultural distance IE variable, we followed the procedure developed by Kogut and Singh (1988) and used Hofstede’s (2001) four cultural dimension scores (uncertainty avoidance, individualism, masculinity, and power distance). Algebraically, the formula is as follows.

We first calculated the differences between the host country’s individual item scores (I j) and the US scores (I u) for each of the four cultural dimensions (i). We next squared the resulting differences and divided by the variance of that dimension (Vi). We then summed the resulting values for all four dimensions and divided by 4 in order to estimate an average cultural distance score (CDj).

Mediator Variable: Strategic Change

Our mediator variable is strategic change. Our measure of strategic change is defined as the overall change in a firm’s pattern of resource allocations in multiple key strategic dimensions. This approach has been widely used in previous studies (e.g., Carpenter, 2000; Finkelstein & Hambrick, 1990; Quigley & Hambrick, 2012; Zhang, 2006). As with previous studies, we used resource allocation changes as our measure of strategic change. Specifically, we included changes in six key strategic allocations: (1) advertising intensity (advertising/sales), (2) research and development intensity (R&D/sales), (3) plant and equipment newness (net P&E/gross P&E), (4) non-production overhead (selling, general, and administrative [SGA] expenses/sales), (5) inventory levels (inventories/sales), and (6) financial leverage (debt/equity). We collected our strategic dimension data from the Compustat database. First, we calculated the differences in the ratios between the current and prior years. Then, we accounted for industry effects by subtracting the industry median changes in these ratios. The relevant industry was defined as the focal firm’s primary four-digit industry, and the focal firm was excluded in calculating industry median values (Huson, Malatesta, & Parrino, 2004). Next, we calculated the absolute values of the industry-adjusted changes in these ratios and standardized the absolute values within the sample (mean = 0, standard deviation = 1). Following prior studies (e.g., Zhang and Rajagopalan, 2010), we then used the average of the six standardized values as our strategic change measure. With regard to the time period for which we measure strategic change, if we define the year in which the CEO is replaced as year “t,” we measure strategic change across years t + 1 and t + 2. Our logic is that in the year of succession the new CEO assesses the current state of the firm; in year t + 1 the CEO formulates new strategies, seeks support from various stakeholders, and begins implementation; and in year t + 2 the new strategies are fully rolled out and stakeholders (most notably investors) gain greater clarity as to where the CEO is taking the firm.

Control Variables

Firm size has previously been associated with both the direction and magnitude of strategic change, as well as firm performance. Simply put, it is typically easier to materially alter the direction of a smaller, versus larger firm (Zhang & Rajagopalan, 2010). We therefore included firm size as a control variable in models seeking to predict strategic change. Firm size has also been found to variously influence firm performance (Atinc, Simmering, & Kroll, 2011), so we included firm size as a control variable when firm performance is the dependent variable. Firm size was operationalized as the natural logarithm of the average number of employees in the three years prior to succession (Dalton & Kesner, 1983). We controlled for pre-succession firm performance as it likely affects CEOs’ inclinations to change direction at their firms, with poor prior performance being an antecedent for new strategic direction (Datta & Rajagopalan, 1998; Boeker, 1997; Zajac & Kraatz, 1993). We also include it as a control variable when firm performance is the dependent variable, as prior performance can be predictive of subsequent firm performance. This variable was operationalized as industry-adjusted, average total returns to shareholders for the three years prior to the succession.

In our models addressing strategic change, we controlled for CEO firm tenure as the longer the CEO worked in the firm prior to his/her CEO appointment, the more she/he may feel vested in current strategies and less likely to make dramatic strategic changes. Conversely, a CEO with no prior history with the firm may feel little commitment to past strategies. We measured this variable as the years the CEO was employed by the firm prior to the year of succession (Singh & Harianto, 1989). When modeling strategic change, we controlled for outside/inside CEO succession as different types of succession have different effects on strategic change. Outsiders have been found to be inclined to depart from the status quo and change firm direction, and in fact feel a mandate to make changes (Herrmann & Datta, 2002). We coded this dummy variable as 0 for inside succession and 1 for outside succession. We controlled for macroeconomic conditions by including dummy variables for the various calendar years for which the data were collected (labeled: year). It is of course possible that strategic change may be accelerated or slowed owing to macroeconomic conditions, and resultant improving or declining returns. We controlled for industry conditions by including dummy variables representing the first-digit SIC codes present in the sample (labeled: industry) in both strategic change and firm performance models.

Dependent Variable: Firm Performance

In order to measure our dependent variable, firm performance, we employed the lagged, industry-adjusted total returns to shareholders for the three years following the year of CEO succession, including the years for which we measured strategic change. Assuming that the CEO succession occurred in year t, and we measured change across years t + 1 and t + 2, our performance measure represents returns to shareholders in years t + 1, t + 2, and t + 3. We employ what is essentially a contemporaneous performance measure as the efficient markets hypothesis would anticipate that as the new CEO announces and launches strategic changes, investors will simultaneously adjust firm stock prices (Busse & Green, 2002). Total returns to shareholders, from the Compustat database, consist of share appreciation plus dividends for a year. These values were industry adjusted by dividing each firm’s total returns by the corresponding four-digit industry average total returns. We employ a market-based performance measure rather than an accounting measure such as ROA as both boards and institutional investors that control the great majority of shares outstanding are quite sensitive to a firm’s relative market performance, and management changes appear to be presaged by poor relative share price performance rather than accounting performance (Huson et al., 2004; Kang & Shivdasani, 1995; Parrino, Sias, & Starks, 2003).

Methods

As we employ cross-sectional data with a single observation for each sample firm, in order to test our hypotheses we employ variants of ordinary least squares. Below we describe our approaches to testing our various hypotheses.

As Hypothesis 1a anticipates a simple, linear relationship between length of time IE and firm performance, we begin our analysis by regressing our length of time IE variable and our control variables on our firm performance measure, total returns to shareholders. The expectation is obviously that the relationship will prove to be positive and significant. Hypotheses 1b and 1c anticipate that two different moderator variables will interact with our length of time IE variable to, in effect, strengthen the length of time IE–total returns to shareholders relationship. Specifically, the CEO having greater number of countries IE (i.e., H1b), and the CEO experiencing greater cultural distance IE (i.e., H1c) will result in length of time IE bringing about even better firm performance. The following conceptual model illustrates our expectations for the first of these moderated relationships (i.e., number of countries IE):

Adopting Hayes’s (2013) graphic representation of a test of moderation, we will estimate the following model in order to examine the moderating effect of number of country IE:

We will estimate the same model for our other moderator, cultural distance IE (i.e., H1c). In order for H1b and H1c to be supported, the coefficients for the interactive terms (i.e., b3) should each prove to be positive and significant. Additionally, following Aiken and West (1991), we graph the simple regression slopes over the relevant range of length of time IE, and the simple regression slopes for length of time IE at relatively high levels of the two moderators should be associated with materially better firm performance than is the case at low levels of the moderator variables.

As Hypothesis 2a anticipates a simple, linear relationship between length of time IE and strategic change, we regressed our length of time IE variable, along with our moderator and control variables, on our strategic change measure. Our expectation is that the length of time IE–strategic change relationship will prove to be positive and significant.

Hypotheses 2b and 2c anticipate that our number of countries IE variable and our cultural distance IE variable will positively moderate the relationship between length of time IE and strategic change. We will therefore follow the same steps in testing 2b and 2c as we employ in testing Hypotheses 1c and 1b, though the dependent variable will be strategic change. If the interactive terms prove significant, we will again examine the nature of the interactions by graphing the simple regression slopes over the relevant range of length of time IE. The simple slopes for length of time IE at relatively high levels of the two moderators should be associated with materially greater strategic change than is the case at low levels of the moderator variables.

Hypothesis 3a anticipates a positive relationship between length of time IE and our performance measure, total returns to shareholders that is mediated through strategic change. In effect, it proposes length of time IE to positively impact firm performance, but that impact is brought about in large measure through strategic changes. Graphically, the hypothesized relationship may be portrayed as follows (Hayes, 2013):

In order to test the hypothesized relationships depicted above, we will estimate two regression models which provide the coefficients in the diagram (i.e., b 1, b 2, and b 3) using the PROCESS procedure, a macro developed by Hayes (2013) for the SAS System. The resulting coefficients will provide indications of the influence that length of time IE has on our mediator, strategic change (as represented in the first equation below), and the combined influence length of time IE and strategic change have on the dependent variable, firm performance (as represented in the second equation below):

In order for Hypothesis 3a to be supported, the total effect of length of IE on firm performance (i.e., the combined direct effect [b 3] and indirect effect [b 1 × b 2]) must be significant. The significance of the direct effect of length of time IE on firm performance may be determined with standard probability values. In order to assess the indirect effect, the PROCESS procedure provides 95% bootstrap confidence intervals to test for significance.

Hypotheses 3b and 3c essentially explore the possibility that the mediated relationship just described in Hypothesis 3a is moderated by the two moderators examined earlier—specifically, number of countries IE and cultural distance IE. It will be recalled that we anticipate the two moderators also influence the relationship between CEO length of IE and firm performance (please see Hypotheses 1b and 1c). The diagram below depicts the moderated-mediated relationships:

Again following Hayes (2013), we test H3b and H3c by estimating the following model using the PROCESS SAS macro:

The above model, depicting the mediated length of time IE–strategic change– firm performance relationship as moderated by number of countries IE and cultural distance IE, as well as the direct effect of length of time IE on firm performance, as moderated by number of countries IE and cultural distance IE, requires estimating the following equations:

As illustrated in the diagram above, there are two separate effects for which significance levels must be determined, the direct effect of length of IE on firm performance, and the indirect effect the length of time IE–strategic change relationship, as moderated by our two moderators, has on firm performance. The significance of the direct effect of length of time IE on firm performance as moderated by the interactive term may be assessed using customary t values. To assess the significance of the indirect effect, we will again estimate bootstrap confidence intervals in order to determine whether the interactive effects of each moderator × length of time IE, as mediated through strategic change, impact firm performance in a statistically significant way.

Results

Table 1 provides descriptive statistics and correlations. Some of the correlations between our various control variables are statistically significant, suggesting possible multicollinearity issues in our subsequent analysis. We thus estimated variance inflation factor statistics for our various regression models. None of these values exceeded 4.0, which is well below 10, a level at which multicollinearity is thought to become an issue. Additionally, the relevant correlation coefficients are all well below 0.70, the threshold at which multicollinearity is likely to be problematic (Kennedy, 2003).

Test of Hypothesis 1a

As described earlier, Hypothesis 1a anticipates that greater length of time IE is associated with better firm performance. Table 2 presents a series of models which include a test of Hypothesis 1a. Model 1 of Table 2 presents the regression of our various control variables on our three-year total returns to shareholders performance measure. One of our control variables, prior firm performance, proved to be significantly and positively related to firm performance. In Model 2 of Table 2, we regress our independent variable length of time IE, along with our two moderators, CEO number of countries IE and cultural distance IE on firm performance. As may be observed, and in line with Hypothesis 1a’s expectations, longer length of time IE is positively and significantly related to firm performance.

Tests of Hypotheses 1b and 1c

Hypotheses 1b and 1c explore the potential for number of countries IE and cultural distance IE to cause the positive relationship between length of time IE and firm performance to be further strengthened. Model 3 of Table 2 provides a test of Hypothesis 1b as it includes the interactive term length of time IE × CEO number of countries IE. Please note that the coefficient of the interactive term is positive and significant, suggesting support for our hypothesis. In order to more completely understand the influence CEO experience gained in more countries has on the relationship between CEO IE and firm performance, we graph the simple regression slopes reflected in Model 3, following Aiken and West (1991). Figure 1 portrays the simple slopes reflecting the relationship between CEO IE and firm performance when that IE is gained in more versus fewer countries. Please observe that the line associated with “more countries” is statistically significantly (p < .05) positively sloped, while the line associated with “fewer countries” is not significantly different from zero. Clearly, a CEO who gains his/her IE in multiple countries benefits more from the experience and is able to improve firm performance as a result.

Model 4 of Table 2 provides a test of Hypothesis 1c as it includes the interactive term length of time IE × cultural distance IE. As is apparent from the results, the interactive term coefficient is, as anticipated, positive and significant, suggesting support for Hypothesis 1c. Figure 2 portrays the simple slopes reflecting the relationship between CEO IE and firm performance when said IE is gained in more versus less culturally diverse settings. As was the case in Figure 1, the line associated with more culturally diverse IE is positively and significantly sloped (p < .05), suggesting that more CEO IE positively impacts firm performance especially when it is gained in more culturally diverse societies from that of the CEO’s home country. For robustness, we include both interactive terms in a single model (Model 5 of Table 2) and find that both interactive terms remain significant at the 0.05 level.

Test of Hypothesis 2a

Hypothesis 2a anticipates a positive linear relationship between length of time IE and strategic change. In Table 3, we present models intended to test Hypotheses 2a, 2b, and 2c. In Model 1 of Table 2, we include our various control variables which are thought to influence strategic change. In Model 2 of Table 3, we include our measure of CEO IE, along with our two moderator variables number of countries IE and cultural distance IE. As our results indicate, CEO length of time IE proved to be positively and significantly related to strategic change, providing support for Hypothesis 2a.

Tests of Hypotheses 2b and 2c

Please recall that Hypothesis 2b proposes that our number of countries IE variable positively moderates or strengthens the positive association between CEO IE and strategic change. Hypothesis 2c anticipates that our cultural distance IE variable will likewise positively moderate the CEO IE–strategic change relationship. Table 3 also reports the results of the tests of Hypotheses 2b and 2c. In Model 3 of Table 3, we enter the interactive term length of time IE × CEO number of countries IE. As may be observed, the interactive term’s coefficient proved to be positive and significant (p < .05), offering support for Hypothesis 2b. Model 4 of Table 3 presents the results of our inclusion of the interactive term length of time IE × cultural distance IE, which is intended to test Hypothesis 2c. The interactive term’s coefficient proved to be positively and significantly related to strategic change, offering support for Hypothesis 2c. In order to more fully examine these moderated relationships, we graph the simple regression slopes of the coefficients presented in Models 3 and 4 of Table 3. Figure 3 portrays the simple slopes of the relationship between length of time IE and strategic change given CEOs’ exposure to more versus fewer countries. As is apparent from the figure, at all levels of length of IE, exposure to more countries is associated with greater strategic change. Similarly, as portrayed in Figure 4, the association between length of time IE and strategic change is clearly stronger when that experience is garnered in countries that are culturally distant from the CEO’s home country. Again, for robustness we include a model containing both interactive terms (please see Model 5 of Table 3) simultaneously. As is apparent, inclusion of the two interactive terms in a single model does not materially change our results.

Test of Hypothesis 3a

Please recall that Hypothesis 3a anticipates that while length of time IE positively influences firm performance, that positive influence will be, at least in part, mediated through the level of strategic change the new CEO undertakes. As described earlier, in order to test mediated relationships the PROCESS system estimates the two regression models required to measure the direct and indirect or mediated effect of length of IE on firm performance (Hayes, 2013). In Model 1 of Table 4, length of time IE is regressed on strategic change in order to estimate b

1. As reported earlier, CEO length of time IE has a positive and significant impact upon strategic change (b

1 = 0.868, p < 0.05). In Model 2 of Table 4, both strategic change and length of time IE are regressed on firm performance. The coefficient reflecting the influence of strategic change on firm performance is also positive and significant (b

2 = 0.007, p < 0.05), while the direct effect of length of time IE is likewise positive and significant (b

3 = 0.023, p < 0.05). In order to illustrate these relationships, we recreate the figure portraying a mediated relationship found in our “Methods” section. In the diagram below, we provide the actual coefficients and their significance.

We assess the significance of the indirect effect (b 1 × b 2, or 0.868 × 0.007 = 0.006) using a bootstrap-estimated 95% confidence interval with a lower bound of 0.0024 and an upper bound of 0.0093. As our 95% confidence interval does not contain 0, we appear to have evidence of a significant indirect or mediated effect. In terms of total effect, which is equal to the sum of b 3 + (b 1 × b 2) or 0.029, the 95% confidence interval is defined by a lower bound of 0.015 and an upper bound of 0.047. As the confidence interval falls above 0, we again have support for the belief that the combined direct and indirect effects of length of time IE, as mediated through strategic change, on performance is positive and significant.

Test of Hypothesis 3b and 3c

Hypotheses 3b and 3c explore the same mediated relationship as Hypothesis 3a, while simultaneously assessing the impact our number of countries IE and cultural distance IE variables have on the relationship between length of time IE and strategic change, as well as the length of time IE–firm performance relationship. In effect, we test a moderated, mediated regression model (Hayes, 2013). We provide the results of the analysis in Table 4, Models 3 and 4. In order to portray our results, we reproduce the diagram earlier provided in the “Methods” section and include the various coefficients, along with their probability values.

As is apparent from the results presented in the diagram, all of the critical relationships in the model are, as hypothesized, positive and significant. In order to more fully understand the conditional indirect effect of length of time IE on total returns to shareholders when mediated through its moderated relationship with strategic change, we will look at the significance of the length of time IE–strategic change–total returns to shareholders linkage when the values of the moderators, number of countries IE and cultural distance IE, are set relatively low (−1 standard deviation), at mid-point (at the mean), and relatively high (+1 standard deviation). In order to do so, we made our assessments using the PROCESS-program-generated bootstrap confidence intervals at the 95% confidence level. These values are provided in Table 5.

As may be observed in Table 5, at low levels of both number of countries IE and cultural distance IE, the indirect or mediated effect of length of time IE on firm performance is muted with an indirect effect coefficient of 0.0085, while the 95% confidence band contains 0, suggesting that at low levels of both number of countries IE and cultural distance IE, length of time IE has only a modest impact on firm performance as mediated through strategic change. The other instance in which the indirect effect of length of time IE on firm performance proves to be insignificant occurs when number of countries IE is set at its mean and cultural distance IE is quite low. Both of these instances suggest that CEO length of time abroad is more likely to result in material strategic change that leads to enhanced performance when that time abroad is a truly enriching experience involving meaningful exposure to diverse cultures in various countries. It does not appear that CEO time abroad enhances the mediated relationship of length of time IE–strategic change–total returns to shareholders when that time abroad is spent in perhaps one country that is very similar to the CEO’s own country.

Collectively, our results suggest the presence of a material relationship between the length of CEOs’ IE and firm performance that is moderated by the number of countries in which the CEO gains his/her IE, and the cultural distance between those countries and the CEO’s own country, and this effect is mediated through the strategic change they undertake. Our findings provide support for both Hypotheses 3b and 3c.

Tests for Robustness

As will be recalled, we employed lagged three-year total returns to shareholders as our performance measure in testing hypotheses involving firm performance, as it was anticipated stock prices would change as strategic changes took place following CEO succession. Assuming that the efficient markets hypothesis is correct, we anticipate that investors adjust stock prices contemporaneously with strategic changes made by the firm (Busse & Green, 2002). It is also possible that given more time to evaluate the strategic changes the firm has undertaken, the results might be different. We therefore replicated our mediation and moderated, mediation analysis (tests of Hypotheses 3a, 3b, and 3c) using two-year lagged total returns to shareholder data (i.e., years t + 2, t + 3, and t + 4). Although not presented for the sake of parsimony, the results were qualitatively the same as those for the one-year lagged results reported above. These results are interesting in that they suggest investors do recognize the merits of the strategic changes the new CEOs make, as they make them. However, the post hoc analysis using a two-year lagged performance measure suggests that investors continue to reward the firm with higher stock prices as the strategic changes actually bear fruit.

Discussion

The purpose of this study is to investigate the effect of CEO IE on strategic change and firm performance using a new framework for conceptualizing and operationalizing CEO IE. The results suggested that the length of time an executive spent abroad had a positive effect on performance, while the number of countries she/he worked in and cultural distance she/he was exposed to strengthened this effect. The results also showed that length of time and its interactions with number of countries and cultural distance enhanced strategic change. Finally, the results showed that length of time and its interactions with number of countries and cultural distance positively affected firm performance both directly and through strategic change. The findings offer several theoretical and practical implications as discussed below.

Theoretical Implications

Our study offers a number of contributions to the international and strategic management literature. First, our study contributes to the literature on the conceptualization and operationalization of executives’ IE (e.g., Caligiuri & Tarique, 2009; Carpenter et al., 2001; Daily et al., 2000; Dragoni et al., 2014; Selmer, 2002; Takeuchi et al., 2005; Zhu et al., 2016). Work experience literature indicates that in order to fully capture the nature and importance of experience, we should take into account different components of experience and their interactions (Tesluk & Jacobs, 1998). In this light, we developed a framework for the conceptualization and operationalization of CEO IE based on the work experience models developed by Quińones et al. (1995) and Tesluk and Jacobs (1998) as well as previous studies’ measurement of IE (e.g., Caligiuri & Tarique, 2009; Carpenter et al., 2001; Daily et al., 2000; Dragoni et al., 2014; Zhu et al., 2016). We suggested that the three main measures of executives’ IE are the length of time executives spend abroad, the number of countries they work in, and the cultural distance of the host country from their own. They represent time, amount, and type, which are the measurement modes in the work model by Quińones et al. (1995). Operationally, we suggested that length of time may be considered the independent variable which interacts with number of countries and cultural distance. Our results showed that both the main and interaction effects of CEO length of time, number of countries, and cultural distance were significantly and positively related to strategic change and firm performance. Thus, our paper provides empirical evidence consistent with the argument by Tesluk and Jacobs (1998) that experience should be measured using both quantitative and qualitative components as well as their interactions.

Another contribution to the IE literature involves our theoretical argument regarding how the components of IE affect individual and firm outcomes based on the social learning literature (Bandura, 1977; Endicott et al., 2003; Fee et al., 2013; Kolb, 1984; Piaget, 1955). As prior research on executives’ IE overlooks how individuals learn from their IE, our understanding of how executives develop during their international stay leaves much to be desired (Suutari, 2003). Some recent studies (e.g., Caligiuri & Tarique, 2009; Dragoni et al., 2014, Lisak et al., 2016) have addressed this gap in the literature. Our article contributes to this line of research by providing a micro-level explanation regarding how the components of IE and their interactions affect executives’ knowledge and general cognitive competencies. We posit that the components of IE and their interactions expose executives to certain stimuli and arouse cognitive dissonance, thus activating a certain level of learning through either or both assimilation and accommodation processes. The learning results are either or both domain-specific knowledge and general competencies, respectively. For example, given the same length of time abroad, an executive encounters a greater number of critical stimuli in a country with greater cultural distance from the executive’s home country than she/he will in a country with less cultural distance. This arouses greater dissonance, thus resulting in greater learning. By theoretically distinguishing the two types of learning (i.e., assimilation and accommodation) and two types of knowledge gained from IE (domain-specific knowledge and general competencies), we lay out the foundation for investigating different types of outcomes of IE (i.e., direct and indirect effects on firm performance). Domain-specific knowledge has a direct impact on firm performance while general competencies may affect performance both directly and indirectly.

Second, our study contributes to the strategic management literature addressing the impact of IE on firm performance. Strategic management researchers (e.g., Carpenter et al., 2001; Daily et al., 2000; Kim et al., 2015; Morris et al., 2016) have considered executives’ IE as an important background characteristic and demonstrated a positive relationship between executives’ IE on firm performance. Such insights are significant because they shed light on the role of executives’ IE in the strategic management literature. However, there are two issues that still need attention. First, as previous studies only use length of time and number of countries to measure IE, they might not capture the full effect of IE on firm performance. Second, they do not directly examine the processes through which IE enhances executives’ knowledge and competencies. The results of our study show that the effect of IE on firm performance is greater when using all three measurement modes of IE and their interactions. Our study also extends previous work by indicating that IE affects firm performance both directly and through strategic change.

Third, by investigating strategic change as an immediate outcome of executives’ IE, our study contributes to both the international and strategic management literature. While much prior research, especially in strategic management, examines the secondary outcomes of executives’ IE, such as firm performance, international acquisitions, and entry modes, little research has focused on its immediate outcomes. Some researchers (e.g., Caligiuri & Tarique, 2009; Dragoni et al., 2014; Tesluk & Jacobs, 1998) emphasize the need to identify and examine the immediate outcomes of experience as this will help us understand how executives’ experience affects secondary outcomes. Our article addresses this gap by providing a theoretical explanation and empirical evidence that IE has a positive effect on strategic change, which we conceptualize as an immediate outcome of IE.

By examining strategic change as a consequence of IE, our article contributes to the strategic management literature regarding the determinants and effectiveness of strategic change (e.g., Carpenter, 2000; Finkelstein & Hambrick, 1990). The upper echelons view suggests that top managers play a central role in shaping the firm’s strategic direction (Hambrick & Mason, 1984). This research stream has explored various executive characteristics as determinants of strategic change, such as TMT tenure, heterogeneity, and succession (Boeker, 1997; Wiersema & Bantel, 1992), board capital (Haynes & Hillman, 2010), and executive migration (Boeker, 1997). Our article adds to this literature by providing evidence that CEOs’ IE is positively related to strategic change. In other words, CEOs’ IE may be viewed as a determinant of strategic change. While researchers have recognized the importance of CEOs and TMTs in initiating and implementing strategic change (Hambrick & Mason, 1984), studies to date have reported mixed findings regarding the effect of strategic change on firm performance (e.g., Herrmann & Nadkarni, 2014; Naranjo-Gil et al., 2008; Virany et al., 1992). In response, a growing body of literature has focused on how CEOs influence strategic change (e.g., Herrmann & Nadkarni, 2014). The significant and positive relationships between CEO IE, strategic change, and firm performance found in our paper indicate that CEO IE helps enhance the effectiveness of strategic change.

Finally, our article contributes to the research examining a CEO succession’s impact on firm performance. Earlier findings regarding the relationship between CEO turnover and firm performance (most of which has focused on forced turnover) has been inconclusive (Bonnier & Bruner, 1989; Khanna & Poulsen, 1995). Some studies find no evidence of an improvement in performance following CEO turnovers (e.g., Denis & Denis, 1995), while other studies report a positive relationship between CEO turnover and performance (e.g., Huson et al., 2004). Our findings show that new CEOs with rich IE enhance strategic change which improves firm performance. The implication is that new CEOs’ IE should be taken into account when evaluating the relationship between CEO succession and performance.

Practical Implications