Abstract

The pricing mechanisms that lay behind the momentum risk premium, which is seen as one of the most important alternative risk premia alongside the carry premium, seem not well understood. In the finance literature, there is no consensus on whether a momentum investment gears towards asset selection (alpha) or rather towards a systematic exposure to risk (beta). Does selecting the trending assets within a market introduce a skew or convexity into the expected return distribution? Does it modify the price correlation relationships with respect to other positions that are taken in a portfolio? The goal of this paper is to address these questions and define what momentum investing stands for. What characterises momentum investing is to us its capacity to diversify which is particularly pronounced in stressed markets. This market-timing aspect we observe is of interest for long investors, as the price decorrelation that is provoked comes when it is most needed. We make evident that the diversification asymmetry is less relevant for a long–short absolute-return investment.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Momentum investing is a well-established and popular trading strategy in the investment community. It refers back to the basic Turtle Trading RulesFootnote 1 that Richard Dennis and William Eckhardt had set out in the 1980s. It constitutes in essence the performance engine of commodity trading advisors (CTAs) and of managed futures (MFs) that are highly popular in the hedge fund industry. It explains the pricing mechanism of certain structured products as well which depends on a relation between the prices of derivative instruments and those of the underlying assets. And momentum investing is common among traditional fund managers. Carhart (1997) has made this apparent when he introduced the four-factor equity risk model, which is since a standard approach for analysing the performance of equity fund managers.

Momentum investing is often opposed to the contrarian investment style. In the first approach the investor follows the price trends of assets; it is why we also speak of trend-following strategies. In the second approach, the investor goes against market trends, betting thus on the normalisation or reversal of price levels. Contrarian investors belief that market participants have a tendency to overreact and that this crowd behaviour leads to asset mispricing. For that matter, value investing is generally classified as a contrarian strategy. A value investor estimates the fundamental (or fair) value of a security, compares it with the intrinsic value, and buys (or sells) the security if it is under-priced (or overpriced).

Between the two investment styles, momentum investors are generally seen as lazy investors that move in herds, while value investors are perceived as smart people that think “out of the box”. It is striking that Graham (1949) called his leading book on value investing “The Intelligent Investor”. Probably due to a sense of inferiority, fewer funds are labelled momentum-investment funds than one would expect. Grinblatt et al. (1995) found evidence of this. Judging on quarterly portfolio holdings, they found that, out of 155 equity mutual funds managed between 1974 and 1984, as many as 77% were in fact momentum investors. And indeed, capital markets would simply not function if all participants were momentum investors.

Nevertheless, momentum investors were given credit in a publication by Fung and Hsieh (2001), and their reputation is more or less restored since Richard Thaler, seen as the father of behavioural finance, won the Nobel Prize in 2017. In his work, for example with Barberis or De Bondt (Barberis and Thaler 2003; De Bondt and Thaler 1985), he explains how a cautious attitude of investors can give rise to a situation where current winners can continue to outperform current losers.

A distinction is usually made between two generic momentum strategies, namely the time-series and the cross-sectional strategy. In the first, the investment portfolio is long on the asset class as a whole if it is trending upwards and short if it is trending downwards. The net exposure is not nil. Conversely the second case, zero-sum portfolios are built that are long on assets that have outperformed and short on assets that have underperformed. Time-series momentum is also called trend-following or trend-continuation strategies; cross-sectional momentum tends to be referred to as winner-minus-losers strategies. The time-series momentum suits CTAs that are implemented in a multi-asset universe covering equities, bonds, currencies and commodity futures contracts usually. Cross-sectional momentum is one of the pillars in an equity multi-factor investment approach, whereby size, value, momentum, low risk and quality factors are mixed. In the sequel, when the type of strategy is not specified, we systematically refer to the time-series momentum.

This article is organised as follows. In Sect. 2, we discuss the renewed interest in the momentum risk premium that institutional investors pay these last years. Section 3 presents a theoretical model for analysing the risk-return analysis of trend-following strategies. The analytical approach allows to understand the difference between time-series and cross-sectional momentum in Sect. 4. Section 5 deals with the hidden risk of momentum strategies. In Sect. 6, we present the empirical results of the model and discuss the relation between momentum strategies and traditional risk premia. Finally, Sect. 6 concludes that the main interest of momentum investing is not the standalone performance of trend-following portfolios, but their diversification power.

Why do investors pay so much attention to momentum risk premia?

As large institutional investors such as pension funds and sovereign wealth funds are rethinking their methodology of how to build up strategic asset allocations, the momentum-investment strategy is gaining steam. The hitherto predominant constant-mix philosophy, which is by construction a contrarian investment strategy, is being replaced, so it seems, by a alternative approach whereby strategic investment decisions are structured around risk factors that bear alternative risk premia. Roncalli (2017) supports the view that carry and momentum are the most pertinent alternative risk premia since they are present across different asset classes, and should therefore be taken into account in the strategic allocation.

The Alternative Risk Premia (ARP) approach challenges the portfolio management profession in two directions. First it challenges the way the investment universe is defined. Strategic asset allocation is up to date intimately related to the concept of asset classes. The idea is to group individual securities into homogenous groups with a common price behaviour. As such the universe is broadly divided into stocks, bonds, currencies and commodities, and more specifically into US equities, European equities, Japanese equities, EM equities, etc. This approach is constructive for building the strategic allocation, but limits the scope for security selection for the fact that asset groups are based on the capitalisation weights.

Second, the ARP approach challenges the framework in which asset allocations are made. Individual securities are grouped together in a different manner in the purpose to capture new risk factors (Ang 2014). That gives scope to extend the building blocks of the strategic allocation and complete the investment universe with factor strategies. The introduction of new risk factors forces the investor to change the asset-allocation framework. For many decades, the risk factors were extensively used by hedge funds and active managers under the name “absolute return” or alpha strategies. This connotation leads to believe that the factors are independent from the traditional asset classes. Under this supposition, asset allocation consists of building two portfolios, a beta- and an alpha portfolio, and mixing them in order to benefit from the respective diversification-versus performance potential.

This magic formula has been put under pressure during the Global Financial Crisis in 2008 and thereafter, when the supposedly independent risk factors were seen to correlate with the traditional asset classes. It turned out that most absolute-return strategies were in fact beta strategies, in the sense that their performance also depends on the performance of the market. If alternative risk premia are beta—not alpha—strategies, the traditional diversification approach is not appropriate. As we argue in Burgues et al. (2017), it must in that case be replaced by one that focuses on the pay-out of investments rather than on price return. We give two arguments. First, return volatility is not a pertinent risk measure for long-term investors in the first place. In a long-term vision, one is more sensitive to expected drawdowns. To say it in other words, return volatility is a tactical as opposed to a strategic asset-allocation decision, whereas skewness risk is what matters in the long run. Second, relationships between risk premia tend to be nonlinear. Since relations are time-varying, correlation measures can only be interpreted correctly if the state of the market is taken into account.

Since the main objective of the ARP approach is to build a better diversification into the portfolio compared to the traditional stock-bond constant-mix policy, it is not directly intuitive to understand how momentum fits into that. At first sight momentum may seem to provoke the contrary as it sets up the investor to follow the market trend. We undo this misconception. By differentiating convexity and concavity in the portfolio, alternative risk premia reshuffle the notion of “bad” and “good” diversification. A bad diversification comes from an asset that will help in bad times, but that will also destroy performance in good times, eventually ending up with a non- or low-performing portfolio. This may occur for example when systematically buying put options. This type of behaviour is contrary to the long-run investment mind-set, because it assumes that there are no positive risk premia in the long-term. A good diversification comes from an asset that will help in bad times without compromising the long-run performance. This can only be achieved with a risk premium strategy that exhibits a time-varying beta, more specifically a positive beta in good times and a negative beta in bad times, and this is exactly the beta profile of momentum risk premia.

In ARP portfolios momentum is often combined with carry strategies. The rationale is that the momentum profile, which is convex, offsets the risks engendered by the carry strategies, which produce concave pay-outs in that they look like short put options. The motivation behind a carry strategy is to improve the performance of traditional risk premia, or more generally, to generate income. Accumulating only concave pay-outs or short put pay-outs, would be too risky. A momentum strategy is therefore helpful as it is one of the few convex strategies that can mitigate the risks in the portfolio stemming from carry and also from the traditional risk premia.

Risk-return analysis of trend-following strategies

A model for trend-following

We consider a universe of n risky assets, the price dynamics of which St is specified by a multidimensional stochastic differential equation:

where St, μt, σ and \(\sigma^{{ \star }}\) are four n × 1 vectors, μt is the vector of stochastic trends, σ is the vector of asset volatilities and \(\sigma^{{ \star }}\) is the vector of trend volatilities. Wt and \(W_{t}^{{ \star }}\) are two independent vector Brownian motions with \({\mathbb{E}}\left[ {W_{t} W_{t}^{{ \intercal }} } \right] = C\, {\text{d}}t\) and \({\mathbb{E}}\left[ {W_{t} W_{t}^{{ \intercal }} } \right] = C^{{ \star }} \, {\text{d}}t\). We denote by \(\varSigma\) and \(\varGamma\) the covariance matrix of asset returns and stochastic trends. We assume that the portfolio is continuously rebalanced. In this case, the portfolio value Vt satisfies the following equation:

where et is the allocation policy. In the case of a momentum strategy, we have \(e_{t} = A\hat{\mu }_{t}\) where A is the allocation matrix and \(\hat{\mu }_{t}\) is the vector of estimated trends.

Using Kalman-Bucy filtering, we found (Jusselin et al. 2017) that the optimal estimator for the price trend is:

where \(R_{t} = {\text{d}}S_{t} /S_{t}\) is the vector of asset returns and \(\varLambda\) is a matrix that depends on the covariance matrices \(\varSigma\) and \(\varGamma\).

It is remarkable that the optimal estimator is an exponentially-weighted moving average. This result allows to find the expression of the P&L of the trend-following strategy. Indeed, we showed in Jusselin et al. (2017) that the P&L is the sum of an option profile GT and a trading impact \(\mathop \smallint \limits_{0}^{T} g_{t} \, {\text{d}}t\). More precisely, we have:

This result is interesting since it decomposes the P&L in a similar way as the robustness formula of the Black–Scholes model (El Karoui et al. 1998). The first term is the payoff of the momentum risk premium, and the second term represents the gamma costs of the trend-following strategy.

Using the previous equation of the P&L, Jusselin et al. (2017) derive the probability density function, the first four moments, the Sharpe ratio and the expected drawdown of the trend-following strategy with respect to the model parameters. We do not reprint the mathematical expressions in this article, as they are a little daunting, but prefer to focus on the theoretical implications of the model. Even if the model of asset returns is not very realistic—a mean-reverting trend would be more convincing—the theoretical stylised facts are close to the empirical observations.

Main results

We give demonstration, in Jusselin et al. (2017), that the payoff of the trend-following strategy is convex and is similar to a long exposure on a straddle option (see Fig. 1). This result was also derived by Fung and Hsieh (2001), Bruder and Gaussel (2011) and Dao et al. (2017).

The convexity of the payoff implies that the strategy has a positive skewness. Roncalli (2017) classifies alternative risk premia into two families:

-

1.

Skewness-risk premia: the investor is rewarded in good times for taking a skewness risk in bad times;

-

2.

Market anomalies: they correspond to trading strategies that have delivered good performance in the past, but their performance cannot be explained by the existence of a systematic risk in bad times; their performance can only be explained by behavioural theories.

A convex pay-out implies that the strategy has a positively skewed return distribution. The cumulative distribution function is depicted in Fig. 2. It can be noted that the loss is bounded, but the gain may be infinite in principle, even if the underlying assets bears no structural risk premium (zero Sharpe ratio). From this we may conclude, as does Roncalli (2017), that trend-following strategies can only be market anomalies.

The effect of the time-window is interesting. We note that the profit and loss of short-term trend-following strategies is more volatile than that of long-term trending strategies. That seems counterintuitive at first sight, as the risks of short-term trading may seem easier to manage than those of long-term trading; however, the reason is that short-term trends are more difficult to estimate. The broader dispersion of returns that can be observed between short-term and long-term CTAs is a confirmation of that. It also explains why short-term trend-following strategies tend to rely more heavily on proprietary models and on the empirical know-how of the trading teams.

The degree of convexity in the pay-out depends on the risk-adjusted return level that is expected for the underlying assets. To be precise, it depends on their absolute values irrespective of the sign. That fact introduces a symmetry; to choose for a momentum strategy, an investor needs to be convinced that asset prices will exhibit trends whatever the direction. Conversely, when building a long-only portfolio the investor needs to be convinced that expected return is positive. It explains why the investment universe of a constant-mix portfolio is composed of stocks and bonds, whereas the universe of a momentum portfolio generally also includes currencies and commodities that do not necessarily bear positive risk premia. In order to perform well, momentum strategies require significant price trends compared to the volatility levels. We argue that momentum strategies have a negative vega, meaning that the investor pays a premium for being systematically short on the short-term volatility. This exposure explains why momentum strategies tend to be disrupted by volatility spikes. It is important to compare the strength of a trend with its volatility level. A strong trend with high volatility is not necessarily better than a medium trend with low volatility. In Fig. 1, an area is indicated that corresponds to negative P & L. In that area, the trend is too weak to generate sufficient return that will offset the volatility trading costs.

As holds in the theory of options, the success of a momentum strategy is based on several trade-offs: trend versus volatility, delta gain versus gamma cost, long-term volatility versus short-term volatility. The trade-off between gain versus loss is particularly interesting. Trend-followers lose more often than they gain, as shown by Potters and Bouchaud (2006). This is due to the fact that big trends are not very frequent in the financial markets. Most of the time, gamma costs dominate implying that the performance of the momentum strategy is poor, but sometimes there is a big trend and the momentum strategy posts an outstanding performance.

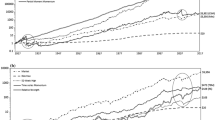

While comparing momentum with long-only (buy-and-hold or constant-mix) strategies, Jusselin et al. (2017) find that momentum strategies are set to produce superior risk-adjusted returns when the Sharpe ratio of the underlying asset is lower than 0.35. In that situation, even short-lived trends up or down will generate return that exceeds the risk premium. Interestingly, in a simulation of the Geometric Brownian motion with a zero-return expectation, trends that are statistically significant are frequent. An illustration is given in Fig. 3, displaying four simulated paths. The maximum trend of each simulation is equal to + 84, + 73, − 56 and − 48% respectively.

On the contrary, when the Sharpe ratio is sufficiently high, the long portfolio does a better job than the momentum portfolio, because the performance of the former is not impacted by the gamma trading costs.

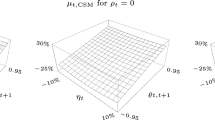

Concerning the correlation between assets, the third parameter determining the outcome of a momentum strategy, Jusselin et al. (2017) find an intriguing result. In case the expected return of the underlying asset is nil, the P&L of the trend-following strategy does not depend on the sign of the correlation. As shown in Fig. 4, a correlation of – 80% has the same impact as a correlation of + 80%. This finding contrasts with the traditional long-only investment setting, where the opportunity to diversify risk is greatest when assets are negatively correlated. The predominantly negative correlation between stocks and bonds we have seen over the last decades may explain why the stock-bond asset mix has been so popular over this period.

For a long-short investment portfolio, incurring negative or positive correlation is equivalent. To see this consider two extreme cases, namely perfect correlation and perfect anti-correlation. In the latter case, a positive trend on one asset implies a negative trend another asset. Therefore, the portfolio will be long on the first- and short on the second asset; however, risks are not diversified since it concerns essentially the same trend. The best diversification opportunity is created when correlation is nil, when trends are independent of each other.

Time-series versus cross-sectional momentum

In the previous section, results are given for the more-common time-series momentum strategies. In this section, we look at cross-sectional momentum. Figure 5 depicts the cumulative return distribution of a trend-following strategy applied over assets that are cross-correlated. In the Figure, cross-correlation is equal to 0.8 and the number of assets in the investment universe mounts from 1 up to 25. It can be noticed that the diversification gain is limited as soon as the number of assets exceeds 3. It shows that a high cross-correlation (positive or negative) hinders a time-series momentum strategy.

The situation is different for cross-sectional momentum. In Fig. 6, the risk-adjusted return is depicted for this strategy against the correlation level between asset returns. It shows that return increases with correlation. How can this be? It was shown in previous section that time-series momentum is essentially a beta strategy, whereby the dependence between the strategy return and the asset return increases with the magnitude of the trend. Zero correlation helps to reduce the volatility of this strategy. For cross-sectional momentum, the return of the strategy depends on the relative differences in asset trends. If assets are weakly correlated, the dispersion of the P&L is high and the outcome of the strategy uncertain.

We make an analogy to the distinction that is usually made for hedge funds between long/short matching and long/short managing. In an equity market-neutral strategy, for example, the aim is to build a short exposure that is correlated with the long exposure, particularly so when the fund manager engages in pair trading. In that case, the performance is expected to come from long/short matching. A pair is seen as a single investment bet, not two bets. The same holds for cross-sectional momentum investing. The investor expects the performance to come from long/short matching. In a time-series momentum investment, the performance is expected to come from both the short and long exposures. Thus, cross-sectional momentum can be considered a relative value (or an alpha) strategy whereas time-series momentum is typically a beta strategy.

The difference in profile has major implications when designing a strategy. Time-series momentum makes sense for a multi-asset universe, including equity, fixed-income, currency and commodity futures contracts, as it builds in diversification opportunity. Cross-sectional momentum makes sense for a universe of homogeneous securities, for instance for the stocks of an equity index that are of the same country or region. For commodities, it is better, we argue, to implement time-series momentum at the global level and cross-sectional momentum at the category level (agricultural, energy, livestock, metals, etc.).

Hidden risks of momentum strategies

The concept of an “all-weather fund” is a marketing idea that is difficult to achieve in practice. It is a bit different from the concept of an absolute-return investment. The two investment styles have an objective in common, namely to perform well during both good and bad times. However, their approach is fundamentally different. Absolute-return portfolios are based on alpha strategies that are weakly correlated with the traditional risk premia, while all-weather portfolios are based on beta exposures, diversification being the main driving force to achieve good performance in bad times. It is extremely difficult, we reckon, to put this diversification engine together, since the behaviour of a diversified portfolio in bad times is not easy to predict. We think it is illusory that diversification will protect the investor entirely from bad times. As explained by Ang (2014), each risk premium, traditional or alternative, has their own bad times. Of course, diversification helps to mitigate drawdown risks, but we do not think it can eliminate them.

Momentum investing has its limits as well. It was asserted in Sect. 3 that the loss is bounded; however, this is true only if two conditions hold. Firstly, the portfolio leverage must remain between bounds of course. Moreover, it would be wrong to think that leverage only sets the magnitude of the long/short exposures, implicitly assuming a linear relationship between leverage, return and portfolio volatility. Excessive loss may be induced by gamma trading, which are nonlinear with respect to leverage. Secondly, loss is bounded only in the absence of jumps or discontinuity in asset prices. Without this assumption, the pay-out is not necessarily convex and the loss not bounded.

We think that there is a misconception about CTAs. Many people consider CTAs to be good strategies for hedging out the skewness risk in the stock market. We are convinced that they are more effective for hedging against drawdowns. According to us CTAs did a good job in 2008, for the fact that the Global Financial Crisis was a high-volatility event more than a skewness-risk event. It is not obvious that CTAs will post similar performances when facing skewness events. The disappointing performance of CTAs during the Eurozone crisis in 2011 and the Swiss CHF chaos in January 2015 may be explained by that. In Fig. 7, the cumulative performances are reported of the trend-following strategy applied on the Swiss franc-US dollar spot rate (CHF/USD). On January 15, 2015, a large drawdown can be observed. The illustration shows that time-series momentum may suffer in case of market discontinuities.

Another hidden risk concerns trend reversals. Daniel and Moskowitz (2016) make the point, showing that investors may face momentum crashes especially when pursuing cross-sectional momentum strategies. Their findings verify that, eventually, there is no free lunch in finance. If cross-sectional momentum is implemented onto securities (stocks or bonds), the investor also faces a transaction cost risk. Indeed, the turnover of cross-sectional momentum is much higher than that of other risk factors such as value or quality. More generally, we make note that the liquidity of the asset universe is a key parameter when considering momentum strategies.

How do momentum strategies benefit from traditional risk premia?

Trend-following portfolios tend to be net long, particularly so for strategies that are applied onto equities and bonds. Jusselin et al. (2017) find that the average exposure for a trend-following strategy whose volatility is matched with that of the underlying asset, is as high as 58% when applied to bonds, 52% when applied to equities, compared to 23% for commodities and 10% for currencies. They derive that the net-long exposure is largely explained by the positive risk premium on equities and bonds. For strategies applied onto commodities and currencies the net-long bias stems from the trend patterns, they find.

Jusselin et al. (2017) find that over the observation period, the long exposures in equity momentum strategies are on average twice larger than the short exposures. It demonstrates that the momentum risk premium comes also from the capacity to leverage or deleverage traditional risk premia. Within that, it is not obvious whether short-selling contributes more than levering up. For that matter, we go against another myth about CTA strategies. It is widely believed that the good performance of CTAs in 2008 is due to their short equity exposure; however, in reality CTAs were only 15% net short on equities on average in 2008. The deleveraging was small because it is extremely difficult to go farther when the market volatility is so high.Footnote 2 It is the reason why CTAs have more difficulties to be short on equities than long, because negative trends are associated with high-volatility regimes, while positive trends are observed in low-volatility regimes.

If it is not the short-selling, how to explain the good performance of CTAs in 2008? Apart from their effectiveness to hedge against drawdown, mentioned earlier, we see the negative stock/bond correlation as another reason. We remind that negative correlation has the same impact as positive correlation for long/short portfolios, as it constitutes essentially the same bet. This being said, this assumes that the market volatility is stable over normal and stressed periods. If two assets are highly negatively correlated, and if we observe a negative price trend in the first asset, the trend-follower has the choice between being short on the first- and/or long on the second asset. In 2008, the negative price trend observed in equities has been primarily implemented by trend-followers by means of a big long exposure on bonds, and a small short exposure on equities.

To trend is to diversify

In their study on the diversification capacity of trend-following strategies, Burgues et al. (2017) make a distinction between “correlation diversification” and “pay-out diversification”. In Fig. 8, the pay-out function is depicted of several asset classes by considering that the reference asset is the S&P 500 index. It is estimated over the period from January 2000 to December 2016 assuming correlations constant.

The pay-outs of the equity asset classes are an increasing affine function, because of their high correlation with the S&P. The pay-outs of bond asset classes are decreasing for their negative correlation. It is interesting that the lines cross in the top right quadrant. It shows that combining stocks and bonds produces “good” diversification. Bonds diversify equities in bad times, and they contribute to the return performance in good times. A situation of “bad” diversification would occur when the good return of one asset would be offset by the bad return of the other asset, as shown in Fig. 9.

In Fig. 10 we compare the generic pay-outs of four investment strategies: diversified risk parity (Roncalli 2013), alpha, carry (Koijen et al. 2018) and momentum. By construction, an alpha or absolute-return strategy is uncorrelated to the traditional asset classes. Taking uncorrelated bets helps to improve the risk/return profile of a diversified fund, yet the diversification power is limited. A carry strategy may suffer in bad times. Therefore, carry may diversify at a high-frequency time scale (daily or weekly), but its diversification power is limited at a lower frequency time scale (yearly or beyond). The case of the momentum strategy is more interesting. As explained by Burgues et al. (2017), momentum helps to mitigate risk in bad times, however, its pay-out is very different from a long exposure on bonds (see Figs. 8 and 10). And like bonds, the worst diversification case is avoided because of the convexity. Indeed, momentum strategies also generate performance in good times, even if they drag compared to a constant-mix portfolio.

In this respect momentum investing cannot be motivated by the search for alpha; it is a beta strategy, or more precisely, it is a time-varying beta strategy. It is not evident how to build an investment portfolio set to seize the alternative risk premia, or a portfolio that combines traditional and alternative investment strategies. The problem is that in the long run, the return correlation between momentum strategies and traditional diversified portfolios is close to zero. As such in a standard mean-variance portfolio optimisation, momentum is given the same place as an alpha strategy; it is selected in the purpose to reduce volatility. In the short run it leads to two awkward situations. After good times, momentum is not selected in the portfolio optimisation, because of its high beta with the underlying asset, which is lower than that of a simple constant-mix strategy. After bad times, momentum strategies get over-weighted because of its good performance. Mean-variance portfolio optimisation is therefore not adapted, we argue, when allocating between alternative risk premia, as it is oblivious to convexity and concavity.

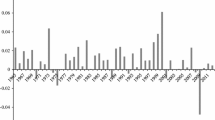

To illustrate why the purpose of diversification cannot be reduced to volatility mitigation alone, we display, in Fig. 11, the correlation levels between risk parity, momentum and carry strategiesFootnote 3 measured over a rolling time-window. The long-term correlation levels, measured over the entire period, are 50% between risk parity and momentum, 50% between risk parity and carry, and 30% between carry and momentum. Positive correlations are as expected for they are all beta strategies. As correlations are positive, we may think that the diversification opportunity is limited. However, they serve the purpose of generating long-term performance. Negative long-term correlation would have given undesired “bad” diversification. Further, it is interesting that the short-term correlation varies over time, and may even become negative in bad times. This is beneficial, because investors do not need diversification at all times. They need diversification in bad times, and particularly when they invest in beta strategies like alternative risk premia.

Notes

The VIX index peaked at 80% in October 2008.

Risk parity corresponds here to an Equal Risk Contribution (ERC) portfolio between equities and bonds; momentum is implemented on a universe of bonds, equities and currencies; the carry strategy we have deployed is a mix of three portfolios: fixed-income “roll-down", currency “forward rate bias" and volatility carry.

References

Ang, A. 2014. Asset Management—A Systematic Approach to Factor Investing. Oxford: Oxford University Press.

Barberis, N., and R.H. Thaler. 2003. A Survey of Behavioral Finance. In Handbook of the Economics of Finance, vol. 1(B), ed. G.M. Constantinides, M. Harris, and R.M. Stulz, 1053–1128. New York: Elsevier.

Bruder, B., and N. Gaussel. 2011. Risk-Return Analysis of Dynamic Investment Strategies. SSRN. www.ssrn.com/abstract=2465623. Accessed 15 June 2018.

Burgues, A., A. Knockaert, E. Lezmi, H. Malongo, T. Roncalli, and R. Sobotka. 2017. The Quest for Diversification—Why Does It Make Sense to Mix Risk Parity, Carry and Momentum Risk Premia? Amundi Discussion Paper, 25.

Carhart, M.M. 1997. On Persistence in Mutual Fund Performance. Journal of Finance 52 (1): 57–82.

Daniel, K.D., and T.J. Moskowitz. 2016. Momentum Crashes. Journal of Financial Economics 122 (2): 221–247.

Dao, T.-L., T.T. Nguyen, C. Deremble, Y. Lempérière, J.-P. Bouchaud, and M. Potters. 2017. Tail Protection for Long Investors: Trend Convexity at Work. Journal of Investment Strategies 7 (1): 61–84.

De Bondt, W.F., and R. Thaler. 1985. Does The Stock Market Overreact? Journal of Finance 40 (3): 793–805.

El Karoui, N., M. Jeanblanc, and S.E. Shreve. 1998. Robustness of the Black and Scholes Formula. Mathematical Finance 8 (2): 93–126.

Fung, W., and D.A. Hsieh. 2001. The Risk in Hedge Fund Strategies: Theory and Evidence from Trend Followers. Review of Financial studies 14 (2): 313–341.

Graham, B. 2006. The Intelligent Investor, Revised Edition, Harper Business (First Edition published in 1949).

Grinblatt, M., S. Titman, and R. Wermers. 1995. Momentum Investment Strategies, Portfolio Performance, and Herding: A Study of Mutual Fund Behavior. American Economic Review 85 (5): 1088–1105.

Jusselin, P., E. Lezmi, H. Malongo, C. Masselin, T. Roncalli, and T.-L. Dao. 2017. Understanding the Momentum Risk premium: An In-Depth Journey Through Trend-Following Strategies. SSRN. www.ssrn.com/abstract=3042173. Accessed 15 June 2018.

Koijen, R.S.J., T.J. Moskowitz, L.H. Pedersen, and E.B. Vrugt. 2018. Carry. Journal of Financial Economics 127 (2): 197–225.

Potters, M., and J.-P. Bouchaud. 2006. Trend Followers Lose More Often Than They Gain. Wilmott Magazine 26: 58–63.

Roncalli, T. 2013. Introduction to Risk Parity and Budgeting. Boca Raton: Chapman & Hall/CRC Financial Mathematics Series.

Roncalli, T. 2017. Alternative Risk Premia: What Do We Know? In Factor Investing and Alternative Risk Premia, ed. E. Jurczenko. New York: Elsevier.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Roncalli, T. Keep up the momentum. J Asset Manag 19, 351–361 (2018). https://doi.org/10.1057/s41260-018-0078-7

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41260-018-0078-7