Abstract

The dynamics of return and volatility spillover indices were investigated to reveal the strength and direction of transmission that occurred during a financial crisis. The focus of this study was especially placed on the 2007 US subprime mortgage crisis, the global financial crisis, the European sovereign debt crisis, and the dramatic collapse of oil prices since 2014. The paper uses the Diebold and Yilmaz (Economic Journal 119(534): 158–171, 2009, International Journal of Forecasting 28(1): 57–66, 2012) spillover index behavior. Assuming one structural break, return and volatility linkages for Islamic banks in the GCC were stronger than for conventional banks. When multiple breaks were allowed, the spillover index was found to be highly sensitive to various economic events. Overall, the findings of this study provide new insights into the behavior of the Islamic and conventional banks stock returns and volatility spillovers, which may improve investment decisions and the trading strategies portfolio of investors.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Recently, various events such as the 2007 United States (US) subprime mortgage crisis, the global financial crisis (GFC) during 2008–2010, the European sovereign debt crisis (ESDC) during 2010–2012, and the dramatic collapse of oil prices since 2014 have severely affected the conventional banking systems around the world, resulting in many bank failures and an increased interest in the Islamic banking system. For example, between January 2008 and December 2011, a period of economic downturn leads to the failure of 414-insured US banks.Footnote 1 (The number of failed banks was 25, 140, 157, and 92 from 2008 to 2011, respectively.) In 2008, according to the report published by the European Commission,Footnote 2 the write-downs of banks were estimated to be over 300 billion USD in the UK (over 10% of their GDP) and in a range of 500–800 billion EUR in the European area. This renewed interest in the Islamic bank system has been directly reflected by an increase in the theoretical and empirical literature. In this prospect, a number of special issues on Islamic banking were published in various journals, including the Journal of Economic Behavior and Organization (Vol. 103, July 2014), the Pacific-Basin Finance Journal (Vol. 34, June 2015), and the Managerial Finance (Vol. 44, 2018) among others.

The main challenge of Islamic banking research is the deficiency of time series concerning previous historical data (Narayan et al. 2016). For this reason, the empirical studies exploiting data from time series at the stock level are limited. Moreover, most of the existing research questions using data at the stock level were performed at a margin that used the Islamic index individually and applied univariate statistical or econometric models to investigate the return or volatility behavior of such stocks, see, for instance, Fahlenbrach and Stulz (2011), Beltratti and Stulz (2012), Fahlenbrach et al. (2012), Berger and Bouwman (2013), and Irresberger et al. (2015). All these empirical studies mainly focused on the impact of the financial crisis and used the marginal behavior of stock bank returns during (short-run) and after (long-run) the financial crisis. As a result, their methodology paid little attention to the possible correlation and dependence potentially existing between different banks coexisting in the market. Then, the coexistence of a number of Islamic and conventional stocks in one market or portfolio raises the question of the presence of spillovers between their returns and volatilities. The presence of spillover effects causes the increase in requirements for bankers, traders, portfolio risk managers, investors, and policymakers to apprehend the dynamics of bank stock prices better. The spillover phenomenon implies that one large shock increases the correlation or volatilities of returns and not just in their own market or asset but also in other ones. This effect might intensify during financial and economic crises, adding an implication in which both volatility and correlation will persistently move together over time (Silvennoinen and Thorp 2013; Sensoy et al. 2015; Ewing and Malik 2016).

Our study aims to fill the gap in the literature by focusing on the coexistence of both banking systems and their impact on financial stability. Furthermore, we investigated the stability of banks using dependence and spillover rather than using margins. The impact of shocks or bad news on the interdependence behavior of banks was specifically investigated by analyzing the dynamic spillover between stock returns and stock volatilities. Finally, we also compared the dependence behavior among a set of Islamic and conventional banks operating in the Gulf Cooperation Council (GCC) area.

Prior empirical studies focusing on the dependence and spillover among financial markets or between assets are generally divided into two clusters: short-run and long-run. One of the most frequently used approaches to investigate the short-run interdependence between markets or assets is the implementation of multivariate autoregressive conditional heteroscedasticity models (Longin and Solnik 1995; Chiang et al. 2013; Bekiros 2014). However, to explore the long-run interdependence between financial time series, the preferred method is to employ cointegration tests (Onour 2010; Alagidede et al. 2011; Gil-Alana 2010). Previous studies using these models and tests regarding bank interdependence have demonstrated that these approaches have certain limitations. For instance, the cointegration approach is suitable to explore long-run relationships but is inappropriate for describing the short-run relationship and the dynamic characteristics of a possible dependence or spillover. Conversely, the multivariate GARCH approach can estimate the complicated dynamics of spillovers; only a maximum of two or three time series can be employed with the multivariate generalized autoregressive conditional heteroscedasticity (MGARCH) to accomplish a numerical conversion in the estimation.

Several studies have underlined a number of empirical benefits of the Diebold and Yilmaz’s spillover method (Awartani and Maghyereh 2013; Zhang and Wang 2014; Antonakakis and Kizys 2015). First, as it requires aggregating and offsetting invariant forecast-error variance decomposition, it does not depend on the Cholesky factor identification of vector autoregressive regression (VAR). Hence, the results of the variance decomposition do not hinge on the ordering of variables. Second, the Diebold and Yilmaz’s method enables the measurement of spillovers in returns and volatilities over time and across multiple individual assets, classes of assets, and markets. Third, the dynamics of the spillover measure, generated by a rolling window approach, facilitates both crisis and non-crisis events, including trends and bursts in spillovers. Finally, and most importantly, the method measures spillovers from one market to any other market as well as allowing net spillovers and the to-be-calculated direction. These distinctive features provide more information about dynamic directional spillovers than the significance measurement of a parameter, which is estimated under a variance–covariance matrix framework similar to the MGARCH models (Zhou et al. 2012).

We determined in our study that a strong bidirectional return spillover existed between the conventional banks and that an extremely weak spillover occurred from the Islamic banks to the conventional banks, which indicates that the transmission of shocks from the Islamic banks to the conventional banks was reduced. We also determined that the dependence between stock returns in an Islamic bank market structure was strongly affected by the financial crisis when compared to a conventional bank market. Furthermore, the volatility linkage was found to be more affected by a financial crisis in an Islamic context than it would be for a conventional bank system. Finally, the time-varying investigation highlights that the spillover index is highly sensitive to financial shocks or disturbing economic events. More precisely, the interrelationship between the bank stock returns becomes high during a period of high financial market volatilities. This result maintained for the Islamic and conventional banks in the area studied.

The findings of this empirical study will hopefully offer some valuable insights to government policymakers, bankers, and investors. Generally, governments seek to create a more equitable and efficient financial system. However, the principal question becomes whether they should intervene in markets or that the markets themselves should find a solution to the financial institutions in crises periods. For instance, the recent financial crisis showed that the governments played a substantial role in its recovery. Knowing the principal causes of a financial crisis, such as leverage, asset liability mismatch, regulatory failure, fraud, corruption and greed, contagion, and money supply, governments have a great role in establishing an efficient financial system. Governments that authorize the coexistence of conventional and Islamic banks in a global financial system will provide a system that reduces the impact from a financial crisis. For instance, Islamic banks in GCC countries finance in the first-rank individual customers and in the second rank the companies. Contrariwise, the conventional banks are more oriented to offer loans to companies first and as the second rank personal loans. Loan companies are riskier than personal loans at any time. The weights of portfolio credits (the percentage of credits to companies and the percentage credits to individual personal loans) for Islamic banks are different from conventional banks, which partly explains the difference in financial performance of the two during financial crisis periods. At the end of 2015, following the Saudi Arabia financial market capitalization, the National Commercial Bank (the largest conventional bank in KSA) was ranked at the third position with a proportion of 6.55% and the Rajhi Bank (the largest Islamic bank) was ranked at the fourth position with a proportion of 5.42%. By the end of 2016, the National Commercial Bank had lost its position (became the fifth with a proportion of 5.06%) to the Rajhi Bank, which became third with a proportion of 6.10%. This can be explained by the types of portfolio loans, where the Rajhi Bank was more oriented toward personal credit rather than corporate credit compared to the National Commercial Bank. In our point of view, it is currently not advisable to swing to the entire Islamic banking system, because until today, the Islamic bank system does not offer sufficient financial products to finance the financial needs of all companies.

Our findings are also captivating regarding the perspective of investors. The coexistence of the conventional and Islamic bank systems will allow investors to obtain a more efficient strategy of portfolio diversification by reducing the default risk. Because during a financial crisis period, Islamic banks perform better than conventional banks and provide higher stability of portfolio returns.

This paper is organized as follows: “Literature review” section briefly reviews the literature focusing on the comparison between conventional and Islamic banks; “Estimation methodology” section presents the approach of Diebold and Yilmaz (2012) to estimate the spillover index, which is evaluated in this article; “Empirical results” section focuses on the description of the data; “Discussion of the spillover index results” section reports and discusses the main empirical findings; and “Conclusions” section presents the study’s conclusions.

Literature review

Subsequent literature of empirical and theoretical studies was used to compare the conventional and Islamic banks. There are two main categories regarding recent economic financial literature on the comparison between conventional and Islamic banking.

The first category of the literature compares the performance and risk profiles of conventional and Islamic banks (Abedifar et al. 2013; Johnes et al. 2014; Khediri et al. 2015; Pappas et al. 2016; Abdelsalam et al. 2016; Sorwar et al. 2016). These empirical studies mainly highlight that Islamic banks are more efficient and less exposed to credit risk than their conventional counterparts. Johnes et al. (2014) use data envelopment analysis and meta-frontier analysis to compare the efficiency of Islamic and conventional banks of the 2004–2009 period. Their findings show that Islamic banks were typically on a par with the conventional ones in terms of gross efficiency, significantly higher on net efficiency, and significantly lower on type efficiency. Furthermore, they also described that the low type efficiency of Islamic banks is due to the lack of product standardization and that the high net efficiency reflects high managerial capability in Islamic banks. Next, Ben Khediria et al. (2015) investigated the characteristics of Islamic and conventional banks located in the Gulf Cooperation Council countries of the 2003–2010 period. In that study, they used parametric and nonparametric classification models to examine whether financial ratios could be used to compare Islamic and conventional banks. Their results indicated that Islamic banks were on average more profitable, more liquid, better capitalized, and had a lower credit risk than the conventional banks. They also showed that Islamic banks were less involved on average in off-balance sheet activities and had stronger operating leverage than their conventional peers. In another study, Abdelsalam et al. (2016) investigated the impact of organizational religiosity on the quality of earnings of listed banks in the Middle East and the North Africa region. They compared Islamic banking institutions with their conventional counterparts of the 2008–2013 period. Their results show that Islamic banks were less likely to manage earnings and that they adapted more conservative accounting policies. Abdelsalam et al. (2016) also argued that in these organizations religious norms and moral accountability constraints had a significant impact on financial reporting quality and agency costs, which had implications for both regulators and market participants. Finally, Sorwar et al. (2016) explored two sets of conventional and Islamic banks, which were taken from the same geographical location of the 2000–2013 period. They estimated a value-at-risk and expected a shortfall of three time periods: before, during, and after the financial crisis. Their univariate analysis did not find any significant differences between the Islamic and conventional banks. However, dynamic correlations highlighted Islamic banks for being less risky compared to their conventional counterparts.

The second category of the literature compares the conventional and Islamic banks with the focus on their stability and resilience to financial and economic shocks (Hasan and Dridi 2011; Beck et al. 2013; Bourkhis and Nabi 2013; Farooq and Zaheer 2015). According to Hasan and Dridi’s (2011) investigation, Islamic banks performed better than conventional banks during 2008 and 2009. These scholars determined that Islamic banks had on average stronger resilience during the GFC period. The result of this study was notable as it recognized Islamic banking as an ideal banking model because it avoids interest and interest-based assets. In addition, Islamic modes of financing are based on profit and loss sharing investments. Recently, Islamic banks have contributed to financial innovations as they have actively contributed to capital markets and securitization and thereby restricted speculation (Hassan and Lewis 2007). However, Hasan and Dridi (2010) determined that Islamic banks incurred larger losses than conventional banks after the financial crisis spread to the real economy. Then, in a study by Bourkhis and Nabi (2013), the Z-score was used as an indicator of bank stability to investigate the impact of the 2007 and 2008 financial crisis on the stability of Islamic banks and their conventional counterparts. The results showed that there was no significant difference in terms of the effect of the financial crisis on the stability of IBs and CBs. In another study, Beck et al. (2013) used the data of 22 countries from 1995 to 2009, including 510 banks (with 88 Islamic banks), and demonstrated that Islamic banks were less cost-effective but had a higher intermediation ratio, higher asset quality, were better capitalized, and less likely to disintermediate during crisis periods. These scholars also noted relatively improved stock market performance of Islamic banks during 2008 and 2009. However, the performance of Islamic banks was not universally superior because of a significant size effect. In another study, by Farooq and Zaheer (2015), a dataset from Pakistan was used, where Islamic and conventional banks coexist. These scholars compared the behavior of Islamic and conventional banks during a financial panic and demonstrated that Islamic bank branches (banks that have both Islamic and conventional operations) were less prone to deposit withdrawals during financial panic. The Islamic bank branches tended to attract deposits during a financial panic. In addition, Farooq and Zaheer (2015) determined that Islamic bank branches granted more credits during financial crisis and that their lending decisions were less sensitive to changes in deposits.

Although the first category of the literature—the comparison of conventional banks to their Islamic counterparts in terms of risk and performance—shows obvious mutual implications and sometimes meets, there are a significant number of non-conclusive results regarding the resilience of banks to a crisis. Overall, the results of the related literature indicate certain supremacy of Islamic banks compared to their conventional peers in terms of performance and risk. This supremacy is mainly argued by the fact that the capital guidelines provided by the Islamic Financial Services BoardFootnote 3 (IFSB) are more effective in increasing the performance of Islamic banks than those provided by the Basel Committee on Banking and Supervision. Moreover, as the mechanisms of Islamic banks comply by Islamic Sharia’a law, they demonstrated better flexibility against speculation, which immensely affected the conventional banks.

The existing literature that compares Islamic banks to their conventional counterparts in terms of resilience to exogenous shocks (economic or financial crisis) is not yet conclusive and provides mixed results. As we pointed out in this literature review, some empirical studies show a higher degree of resilience to the financial crisis for the Islamic banks than their conventional counterparts (Hasan and Dridi 2011; Beck et al. 2013), while others highlight that there is no significant difference (Bourkhis and Nabi 2013). Furthermore, the existing literature focuses only on the impact of the GFC (2008–2010). Accordingly, a principal aim of this paper is to further complete the existing literature by exploring the impact of multiple financial events (instead of one) regarding the spillover between bank stock returns and volatilities in the GCC area. As such, this is the first study (to our best knowledge) that compares the stability of conventional banks to Islamic ones by using more than one financial event: the 2007 US subprime mortgage crisis, GFC, ESDC, and the dramatic collapse of oil prices since 2014.

Estimation methodology

In an initial paper, Diebold and Yilmaz (2009) introduced spillover measures based on forecast-error variance decompositions from the earlier orthogonalized impulse response functions. This approach can simultaneously investigate a large number of time series and allows the exploration of spillovers’ various dynamic features. However, this method relies on Cholesky factor identification of VARs; consequently, the resulting variance decompositions can be dependent on variable ordering. In this paper, we will use this first methodology to calculate the total spillover index.

Accurately, the measurement of the direction of spillovers proposed by Diebold and Yilmaz (2012) overcomes limitations associated with Diebold and Yilmaz (2009). This novel methodology is mainly used to measure the directional spillovers between markets and the net spillover effects as well. In this paper, we briefly present the methodology proposed by Diebold and Yilmaz (2012).

Diebold and Yilmaz (2012) proposed a new spillover index to analyze the interdependence effects across major stock markets around the world. A higher index value indicates that a larger proportion of the shocks in bank sectors (Islamic and conventional) can be observed by cross-variable shocks rather than own-variable shocks.

Following Diebold and Yilmaz (2012), we assume a covariance stationary n-variables \({\text{VAR}}(P)\):

where \(y_{t}\) is the \(n \times n\) autoregressive coefficient matrices and \(\varepsilon_{t}\) is a vector of error terms assumed to be serially uncorrelated.

The moving average representation of formula (1), under the condition of the covariance stationary, is written as \(y_{t} = \sum\nolimits_{j = 1}^{\infty } {A_{j} } \varepsilon_{t}\), where the \(n \times n\) coefficient matrix \(A_{j}\) follows a recursion of the form \(A_{j} =\Phi _{1} A_{j - 1} +\Phi _{2} A_{j - 2} + \cdots +\Phi _{p} A_{j - p}\), with \(A_{0}\) an \(n \times n\) identity matrix and \(A_{j} = 0\) for \(j < 0\).

The generalized forecast-error variance decompositions of the moving average representation of the VAR model allow generating the total, the directional, and net spillovers. The generalized variance decompositions structure eliminates any dependence of the results on the ordering of the variables.

The H-step-ahead generalized forecast-error variance decomposition as proposed by Koop et al. (1996) and Pesaran and Shin (1998) can be written as follows:

where \(\sum {}\) is the variance matrix of the vector of error \(\varepsilon\) and \(\sigma_{jj}\) is the standard deviation of the error term of the \(j{\text{th}}\) equation. In this presentation, \(e_{i}\) is a selection vector with a value of 1 for \(i{\text{th}}\) element, and 0 otherwise.

The elements of \(n \times n\) matrix \(\theta \left( H \right) = \left[ {\theta_{ij} \left( H \right)} \right]\) provide the contribution of variable \(j\) to the forecast-error variance of variable \(i\). Diebold and Yilmaz (2009) define the “own variance” and the “cross-variance” referred to as the spillover effect. The own-variable and cross-variable contributions are contained in the main diagonal and the off-diagonal elements of \(\theta \left( H \right)\) matrix, respectively.

Finally, each entry of the variance decomposition matrix is normalized by its row sum to insure that the own and cross-variable variance sum shares become equal to 1 and then we can write:

with \(\sum\nolimits_{j = 1}^{N} {\tilde{\theta }_{ij} } \left( H \right) = 1\) and \(\sum\nolimits_{j = 1}^{N} {\tilde{\theta }_{ij} } \left( H \right) = N\).

The total spillover (TS) index is then expressed as:

This total spillover index measures the average contribution of spillovers from shocks to all (other) banks to the total forecast-error variance.Likewise, the directional spillover (DS) received by market or bank \(i\) to all other markets or banks \(j\), is given, respectively, by:

Finally, we compute the net volatility spillovers from each bank or market by subtracting Eq. (5) from Eq. (6). The net volatility spillovers can be written as follows:

The net spillovers indicate whether a market is source or receiver of spillovers in net term.

Empirical results

This section presents the data and discusses its stochastic proprieties along with the estimated spillover index of Diebold and Yilmaz. “Data and preliminary analysis” section presents the data and describes its proprieties in terms of mean, minimum, maximum, standard deviation, skewness, kurtosis, Jarque–Bera, Ljung–Box, and Phillips–Perron (PP) unit root test.

Data and preliminary analysis

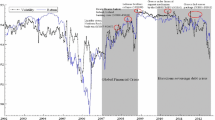

We investigate the period from December 30, 2004, to May 28, 2015. This period covers major global financial events, principally, the 2007 US subprime mortgage crisis, the global financial crisis (GFC) (2008–2010), the European sovereign debt crisis (ESDC) (2010–2012), and the dramatic collapse in the oil prices since 2014, with bank stock prices evidencing an upward trend in prices, on average, and high levels volatility around the trend (see Fig. 1a, b). We used daily return data for Islamic and conventional banks that operated in Gulf Cooperation Council (GCC) countries. Data indicated that 24 Islamic banks and 20 conventional banks operated in GCC financial markets; however, only 29 banks (13 Islamic and 16 conventional) were considered in the sample due to the data availability for 2005.

Figure 1a, b displays the daily dynamic behavior between 2004 and 2015 for the prices for conventional and Islamic bank stocks, respectively. All time series indicate an important variability. The bank stock prices increased substantially in the period between 2007 and 2009.

Additionally, for the majority of the studied time series we observe a dramatic drop of the bank stock prices by the end of 2009.

We calculate the daily returns using the formula as follows:

where \(r_{i,t}\) denotes the continuously compounded percentage returns and \(P_{i,t}\) denotes the price level of stock bank \(i\) at time \(t\).

We also use the squared daily returns as a volatility proxy. Formally \(E_{t - 1} [r^{2} ] = \sigma_{t}^{2}\). Considering the squared daily returns as volatility proxy satisfies the necessary condition for robustness (Hansen and Lunde 2006; Patton 2011).

Table 1 reports the basic properties of mean, standard deviation, and Jarque–Bera for the studied return time series of conventional and Islamic banks. The daily average returns for most of the banks were positive between 2005 and 2014. Over the available sample periods, we determined that the Albilad Bank (listed on the Saudi Arabia Stock Market) provided the lowest return and the Adib Bank (listed on the Abu Dhabi Stock market) provided the highest returns; both were Islamic banks. The descriptive statistics indicated that the standard deviation of the Islamic banks’ returns was relatively higher than for the conventional banks. The conventional National Bank of Kuwait (NBKK.KW) exhibited the lowest sample volatility, and the Bahrain Islamic Bank (BISB.BH) was the most volatile. The empirical distribution of the daily return diverged from the normal distribution. Banks showed significant negative or positive skewness and large kurtosis, which indicated that the return distribution was fat-tailed. Skewness and kurtosis rates satisfied the Jarque–Bera tests for normality which was rejected. We used the Phillips–Perron (PP) test (Phillips and Perron 1988) for the time-series analysis to test the null hypothesis that a time series was integrated of order 1. This unit root test allowed us to confirm that the returns were stationary. The investigation of the stationary of time series is highly important because the Diebold Yilmaz approach that was used in this study required that all variable input was stationary.

Discussion of the spillover index results

Total spillover results

Table 2 reports the spillover matrix for the Saudi Arabia bank market. The results of the total spillover index of the remaining GCC countries are illustrated in Fig. 2. Each graph reports the total spillover index, the forecast-error variance (one bank exports to all other banks), and the forecast-error variance (one bank imports from the other banks).

To analyze the dependence between stock returns and the volatility of conventional and Islamic banks, we investigated the decomposition of the spillover index termed ijth into all the forecast-error variance components for bank \(i\) coming from shocks to bank \(j\) and for all banks \(i\) and \(j\). The initial results show that the value of the total return spillover index in Table 2 was 35.92%, indicating a great interdependence among banks in Saudi Arabia. The Arab National Bank (ANB: a conventional bank) reports the greatest spillover to (168.95%) and the lowest from (1.78%). The results in Table 3 show that innovations of Islamic stock bank return in the Saudi Arabia market are responsible for 0.354% (0.11 + 0.058 + 0.186) of the error variance of the first conventional bank returns (ANB). The remaining error variance of this bank (1.423%) was attributable to the innovations of the other conventional banks. The innovations of the ANB’s returns were responsible for 33.30% and 32.84% of the error of variance in forecasting for the Riyad Bank (RBS) and the Rajhi Bank (Rajhi), respectively, but only 19.86% of the error of variance in forecasting for the Albilad bank (Albilad) returns. The innovations of the Rajhi Bank returns (the greater market capitalization in the Saudi bank sector) were responsible for 11.89% and 11.21% of the error of variance in forecasting for Albilad and Aljazira, respectively; however, conventional banks made no contribution to the error of variance in forecasting returns. Furthermore, Aljazira could be seen to impart great spillover from (44.7%) and very weak to (5.63%), and similar results were observed for Albilad, with a from spillover of 46.31% and a to of 0.81%.

Next, Tables 4, 5, 6, 7 and 8 (first column) remarkably show that the market share of a bank played an important role in the degree of interaction between returns in the bank sector. Here, a large bidirectional spillover was found between conventional banks themselves and from conventional banks to Islamic banks—with the exception of the Saudi British Bank (SBB). A spillover effect was also observed from the Rajhi Bank to other Islamic banks but was feeble to conventional banks. These results show that the spillover index of the Saudi bank market was mainly composed of the variance errors of conventional bank stock returns. This is crucial in the sense that it permits a possible successful diversification and reduced risk when conventional and Islamic banks would be combined into a single portfolio.

A small part of the variance, explained by the Islamic banks, is also provided for all the conventional banks. However, the share of the error variance of the Islamic stock bank returns, explained by the innovations to the conventional bank stock returns, seemed important.

The analysis of the spillover matrices highlights a similar feature for the other GCC countries (Fig. 2), principally for the UAE, Qatar, and Kuwait. Moreover, there was no spillover detected for the Bahrain market, which had a spillover index of less than 1%. The values of the total return spillover index as indicated in Tables 4, 5, 6, 7 and 8 were essential and equal of 21.05% for UAE, 33.09% for Qatar, and with a less important spillover of 14.2% for Kuwait. For these markets, we found a strong bidirectional interaction between conventional banks and strong unidirectional effects from conventional to Islamic banks. Also, the bidirectional spillovers between Islamic banks were less important than the bidirectional spillovers between conventional banks.

A similar analysis of the variance spillover table for the full sample indicated that the behavior of the volatilities indexes follows the spillover for returns (see “Appendix B”). Here, the total volatilities spillover indexes values were found high for Saudi Arabia, the UAE, and Qatar at 33.88, 18.29, and 24.1%, respectively. However, it was relatively small for Kuwait at 16.11%. For Bahrain, the value of the volatility spillover index was less than 2%, indicating a very weak interdependence between banks. The directional “to” for conventional banks was found higher than the one for Islamic banks. The ANB was crucial in the Saudi stock market, where the ANB’s volatility imparts strong shocks: estimated at 34.34% and 27.44% spillovers to the RBS and the Rajhi Bank, respectively. Nevertheless, ANB received only a 4.2% spillover from the rest of the Saudi banks. The Rajhi Bank’s volatility imparted the shocks to other Islamic banks, but it had no impact on conventional banks.

For the UAE bank sector, the total volatility spillover was found lower than in the Saudi bank sector. The Abu Dhabi Commercial Bank (a conventional bank) seemed to play the most important role regarding shock transmission: It imparted 73.61% to other banks but received a very weak spillover from them. The Islamic banks imparted less than 1% volatility spillover to conventional banks; however, there were some volatility spillovers between the Islamic banks. In contrast, similar results were observed for the Qatar and Kuwait bank sectors. Finally, the spillover impact in Bahrain bank sectors was not significant.

Spillovers with one break

To investigate the impact of one break on the spillovers between stock returns, we propose to study the impact of the GFC empirically.

Because of the large volume of data that we summarize in Table 3, the calculated spillover indices were applied to returns and volatilities for different banks relative to the five studied GCC countries in different time periods (before and after a crisis).

Table 3 shows that the volatility of conventional banks was significantly lower before the crisis than the volatility of the Islamic banks, and therefore, it is possible to advance the hypothesis that those conventional banks manage their risk better than the Islamic banks. Several conventional banks had more professional management thanks to their affiliation with conventional European banks and the Arab Bank (Jordan), which started around 1977–1978 where European banks and the Arab Bank sent several CEOs and MDs to GCC countries. For example, the majority of Saudi conventional banks, except the National Commercial Bank, are affiliated with European/Global banks: Saudi British is affiliated with HSBC, Saudi Fransi is affiliated with Credit Agricole, ANB is affiliated with Arab Bank (Jordan), Saudi American Bank is affiliated with Citicorp, and Saudi Hollandi is affiliated with ABN AMRO.

The results also indicate that for the majority of the studied banks, the spillover index measures on returns and volatilities decreased after the financial crisis, and the variation of the index spillover was significantly higher for the Islamic bank sector than for the conventional bank system. However, when considering a mixed market composed of conventional and Islamic banks, the variation of the spillover index was lower than the two previous structures. These results are emphasized for the five GCC countries. Overall, we conclude that the spillover between stock returns of the Islamic bank market structure was more affected by the financial crisis than for the conventional bank markets. Furthermore, the volatility linkage was more affected by the crisis in an Islamic context than for a conventional bank system context. To clarify, in an Islamic bank system, the volatility of one stock bank highly affected the volatility of another stock bank’s return because of exogenous events. In a mixed system, the volatility linkage between bank stock returns was less affected by exogenous bad news than for a market that consisted of solely Islamic or conventional banks. These results reveal that the shock induced by the recent financial crisis rapidly impacted relationships among the Islamic banks.

Rolling-sample spillover analysis

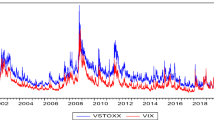

Transmission or spillover has been shown to change over time and that the dependence between assets or markets may consequently decrease or increase under conditions of uncertainty dependent on the presence of bad or good news. More accurately, the static spillover index investigated previously might ignore the price and volatility jumps typically associated with various economic and financial events such as the US subprime mortgage crisis, the GFC, and the ESDC. These events occurred within the sample period and may have impacted the strength and direction of the dependence between bank stock returns and volatilities. Accordingly, we examined the time-varying returns and volatility spillovers among the considered Islamic and conventional bank stocks.

Next, Fig. 3 shows the total volatility spillover index between December 30, 2004, and May 28, 2015. In this figure, the gray-shaded areas mark the four considered global financial events: the 2007 US subprime mortgage crisis, the GFC (2008–2010), the ESDC (2010–2012), and the dramatic collapse of oil prices (2014–2015).

For the entire investigated bank stock markets operating in GCC, there were four significant spikes in volatility spillover index observed. The first spike was detected for the period between January 01, 2008, and June 17, 2008. This period can be considered as the timing of response of the GCC banking sector to the subprime mortgage crisis. In this particular period, the average total spillover for all the countries was significantly high with 64.96% for Saudi Arabia, 35.72% for Qatar, and 46.06% for UAE. The second spike was identified in the period between October 03, 2008, and May 18, 2009. The level of volatility spillovers was much higher in the GFC period compared to the subprime mortgage crisis period: Saudi Arabia 66.17% versus 64.96%, Qatar 59.07% versus 35.72%, and UAE 59.35% versus 46.06%, respectively. Next, the period between January 10, 2011, and February 15, 2011, was also characterized by a spike in the maximum level of spillover index: 75.40% for Saudi Arabia, 43.53% for Qatar, and 41.33 for UAE. In the same period, relative to the GCC, the response to the ESDC was also characterized by a high average of total spillover for all the mentioned countries: 71.39% for Saudi Arabia, 39.08% for Qatar, and 39.58% for UAE. The last spike was detected in the period between July 15, 2014, and May 15, 2015, which is related to the dramatic drop in oil prices and directly affected the economies of the GCC countries. In this period, the total spillover index reached extreme values, particularly for Saudi Arabia with 76.79% and for UAE with 66.16%. Moreover, the two countries reached the highest average total spillovers throughout the studied period. Our results also show that the higher spillover index is highlighted for the Saudi Arabia bank market as the high level of the Saudi spillover index was observed for the entire period.

Figure 4 shows the total volatility spillover index between December 30, 2004, and May 28, 2015, by type of bank and by country. This graphic allows a spillover index comparison between the different GCC countries. First, the figure indicates that the total spillover index for the GCC counties is time varying and moves in the same direction. Specifically, when the index increases for one country, it rises also for the other GCC countries. It is also noticed that the spillover index increases in the period of financial crisis for all the studied GCC banks regardless of whether they are Islamic or conventional. Secondly, while the Saudi index spillover is significantly higher compared to the remaining GCC countries, the lowest total spillover index is observed for Bahrain. This feature is observed for the entire studied period and for both Islamic and conventional banks. Moreover, the Saudi spillover index seems to be more sensitive to financial and economic chocks than the index of the remaining GCC countries.

Figure 5 shows the total volatility spillover index between December 30, 2004, and May 28, 2015, by type of bank in each GCC country. It shows also that, except for the Saudi Arabia, the spillover index for conventional bank is higher than that for Islamic bank. In crises periods, the spillover index tends to increase for all banks regardless of whether they are Islamic or conventional. However, in average, the spillover index for the conventional banks is likely to be more sensitive to financial and economic crisis than that for Islamic banks. Furthermore, the sensitivity of the spillover index seems to be more pronounced in the period 2014 to 2015 related to the drop in oil prices.

Robustness check

To assess the sensitivity of the empirical results, we employed three strategies: (1) an alternative m-week rolling window was estimated, (2) an alternative H-step-ahead forecast-error variance decomposition was used, and (3) the total spillover index with a different ordered VAR was used.

A critical concern that arises when employing the rolling-sample technique is the potential sensitivity of the empirical results to the chosen window size. This possibility can arise particularly when the dataset is characterized by numerous breaks. Accordingly, it was evidently found that smaller rolling windows are more reliable and provide more robust results for series that are subject to many shocks or breaks. As such, smaller window sizes allow for better valuation of the significance of these shocks on the parameters than larger window sizes. This can be explained by the fact that empirical results obtained from large window sizes are more influenced by the presence of breaks than results obtained from smaller window sizes.

Previous rolling window studies generally implemented window sizes between one and two years, and the empirical results were generally not highly sensitive to small changes in the window size (see Aloui et al. 2013; Charfeddine and Benlagha 2016). In this study, to investigate whether the results were window size dependent, two alternative window sizes were used: T = 75 weeks (approximately 375 trading days) and T = 125 weeks (approximately 625 trading days). Here, the results show that overall, no significant differences were present compared to the results that use a window size of T = 150 weeks. In the cases of both observations of T = 75 and T = 125 weeks, strong evidence for the time-varying behavior of the estimated parameter of dependence was observed.

Secondly, as proceeded by Diebold and Yilmaz (2009), we estimated a rolling window model with two variance decomposition forecast horizons (h) rather than ten. The total spillover plot using h = 2 is likely to be the same as the obtained plot that uses h = 10. More interestingly, the periods of peaks in the total spillover index remained unchanged.

Finally, plotting the maximum and minimum volatility spillovers across a variety of alternative VAR orderings using a 150-week rolling window as the estimation showed evidently the same patterns.

Conclusions

This study investigated the spillover effects between the returns and volatilities of stocks related to the Islamic and conventional banks in GCC using the index measurement approach of Diebold and Yilmaz (2012). The sample of our study included 29 banks: 13 Islamic and 16 conventional ones that were listed in the GCC financial markets during 2005–2014.

The first segment of this study determined and explained the returns and volatility spillovers between conventional and Islamic banks for all GCC countries, with the exception of Oman because of a lack of available data since 2005. The primary finding of our research illustrates that a strong bidirectional return spillover existed between conventional banks and that a very weak spillover existed from Islamic banks to conventional banks; the transmission of shocks from Islamic banks to conventional banks was reduced. This result has an important impact on portfolio diversification when combining conventional and Islamic banks in it. The behavior of the volatility indices also followed spillover for returns. Furthermore, we determined that the total volatilities spillover indices were lower than the return spillover indices for Saudi Arabia, UAE, and Qatar; however, contrary results were indicated for the Kuwait market. The volatilities spillover and returns spillover were not notable for the Bahrain banks sector.

The second segment of this study tested bank resilience to shocks that were induced by a financial crisis. We determined that the dependence between stock returns in an Islamic bank market structure was strongly affected by the GFC compared to the conventional bank market. Moreover, the volatility linkage was more affected by the crisis in the Islamic context than that for the conventional bank system index.

The third segment of this study improved the results of Diebold and Yilmaz’s approach by introducing a rolling window spillover estimation. The main finding of this segment shows that the spillover index is highly sensitive to financial shocks or events on stock markets. More precisely, the interrelationship of bank stock returns became high during the period of high financial market volatilities. This result is similar for the Islamic and conventional banks in the studied area. Moreover, the sensitivity of the spillover index seems to be more pronounced in the period between 2014 and 2015, which was related to the dropping oil prices. This result reveals the importance of the oil price and its impact on the stability of the bank stock market returns and volatilities. As such, the results clearly highlight the existence of significant effects from oil price shocks on stocks returns and that these results corroborate those obtained from the existing literature (See Hamilton 1983; Huang et al. 1996; Narayan and Bannigidadmath 2017; among others).

Notes

United States Government Accountability Office; Report to Congressional Committees (January 2013).

European Commission, Economic Crisis in Europe: Causes, Consequences, and Responses (2009).

The Islamic Financial Services Board (IFSB) is an international regulatory organization that promotes the stability and performance of Islamic financial institutions with the rest of the financial system.

References

Abdelsalam, O., P. Dimitropoulos, M. Elnahass, and S. Leventis. 2016. Earnings management behaviors under different monitoring mechanisms: The case of Islamic and conventional banks. Journal of Economic Behavior & Organization 132: 155–173.

Abedifar, P., P. Molyneux, and A. Tarazi. 2013. Risk in Islamic banking. Review of Finance 17 (6): 2035–2096. https://doi.org/10.1093/rof/rfs041.

Alagidede, P., T. Panagiotidis, and X. Zhang. 2011. Causal relationship between stock prices and exchange rates. Journal of International Trade and Economic Development 20 (1): 67–86. https://doi.org/10.1080/09638199.2011.538186.

Aloui, R., S. Hammoudeh, and D.K. Nguen. 2013. A time-varying copula approach to oil and stock market dependence: the case of transition economies. Energy Economics 39: 208–221.

Antonakakis, N., and R. Kizys. 2015. Dynamic spillovers between commodity and currency markets. International Review of Financial Analysis 41: 303–319. https://doi.org/10.1016/j.irfa.2015.01.016.

Awartani, B., and A.I. Maghyereh. 2013. Dynamic spillovers between oil and stock markets in the Gulf Cooperation Council Countries. Energy Economics 36: 28–42. https://doi.org/10.1016/j.eneco.2012.11.024.

Beck, T., A. Demirgüç-Kunt, and O. Merrouche. 2013. Islamic vs. conventional banking: Business model, efficiency and stability. Journal of Banking & Finance 37 (2): 433–447. https://doi.org/10.1016/j.jbankfin.2012.09.016.

Bekiros, S.D. 2014. Contagion, decoupling and the spillover effects of the US financial crisis: Evidence from the BRIC markets. International Review of Financial Analysis 33: 58–69. https://doi.org/10.1016/j.irfa.2013.07.007.

Beltratti, A., and R.M. Stulz. 2012. The credit crisis around the globe: Why did some banks perform better? Journal of Financial Economics 105 (1): 1–17. https://doi.org/10.1016/j.jfineco.2011.12.005.

Berger, A.N., and C.H.S. Bouwman. 2013. How does capital affect bank performance during financial crises? Journal of Financial Economics 109 (1): 146–176. https://doi.org/10.1016/j.jfineco.2013.02.008.

Bourkhis, K., and M.S. Nabi. 2013. Islamic and conventional banks’ soundness during the 2007–2008 financial crisis. Review of Financial Economics 22 (2): 68–77. https://doi.org/10.1016/j.rfe.2013.01.001.

Charfeddine, L., and N. Benlagha. 2016. A time-varying copula approach for modelling dependency: New evidence from commodity and stock markets. Journal of Multinational Financial Management 37–38: 168–189.

Chiang, S.M., H.F. Chen, and C.T. Lin. 2013. The spillover effects of the sub-prime mortgage crisis and optimum asset allocation in the BRICV stock markets. Global Finance Journal 24 (1): 30–43. https://doi.org/10.1016/j.gfj.2013.03.001.

Diebold, F.X., and K. Yilmaz. 2009. Measuring financial asset return and volatility spillovers, with application to global equity markets. Economic Journal 119 (534): 158–171. https://doi.org/10.1111/j.1468-0297.2008.02208.x.

Diebold, F.X., and K. Yilmaz. 2012. Better to give than to receive: Predictive directional measurement of volatility spillovers. International Journal of Forecasting 28 (1): 57–66. https://doi.org/10.1016/j.ijforecast.2011.02.006.

Ewing, B.T., and F. Malik. 2016. Volatility spillovers between oil prices and the stock market under structural breaks. Global Finance Journal 29: 12–23. https://doi.org/10.1016/j.gfj.2015.04.008.

Fahlenbrach, R., R. Prilmeier, and R.M. Stulz. 2012. This time is the same: Using bank performance in 1998 to explain bank performance during the recent financial crisis. Journal of Finance 67 (6): 2139–2185. https://doi.org/10.1111/j.1540-6261.2012.01783.x.

Fahlenbrach, R., and R.M. Stulz. 2011. Bank CEO incentives and the credit crisis. Journal of Financial Economics 99 (1): 11–26. https://doi.org/10.1016/j.jfineco.2010.08.010.

Farooq, M., and S. Zaheer. 2015. Are Islamic banks more resilient during financial panics? Pacific Economic Review 20 (1): 101–124. https://doi.org/10.1111/1468-0106.12096.

Gil-alana, L.A. 2010. Inflation in South Africa: A time-series view across sectors using long-range dependence. South African Journal of Economics 78 (4): 325–343.

Hamilton, J. 1983. Oil and the Macroeconomy since World War II. Journal of Political Economy. 91 (2): 228–248.

Hansen, P.R., and A. Lunde. 2006. Consistent ranking of volatility models. Journal of Econometrics 131: 97–121. https://doi.org/10.1016/j.jeconom.2005.01.005.

Hasan, M., and Dridi, J. 2010. The effects of the global crisis on Islamic and conventional banks: A comparative study. IMF Working Paper 10/201: International Monetary Fund.

Hasan, M., and J. Dridi. 2011. The effects of the global crisis on Islamic and conventional banks: A comparative study. Journal of International Commerce, Economics and Policy 2 (2): 163–200. https://doi.org/10.1142/S1793993311000270.

Hassan, M.K., and M.K. Lewis. 2007. Islamic banking: An introduction and overview. Cheltenham: Edward Elgar publishing limited.

Huang, R.D., R.W. Masulis, and H.R. Stoll. 1996. Energy shocks and financial markets. Journal of Futures Markets 16 (1): 1–27.

Irresberger, F., J. Mühlnickel, and G.N.F. Weiß. 2015. Explaining bank stock performance with crisis sentiment. Journal of Banking & Finance 59: 311–329. https://doi.org/10.1016/j.jbankfin.2015.06.001.

Johnes, J., M. Izzeldin, and V. Pappas. 2014. A comparison of performance of Islamic and conventional banks 2004–2009. Journal of Economic Behavior & Organization 103: S93–S107. https://doi.org/10.1016/j.jebo.2013.07.016.

Khediri, K.B., L. Charfeddine, and S. Ben Youssef. 2015. Islamic versus conventional banks in the GCC countries: A comparative study using classification techniques. Research in International Business and Finance 33: 75–98. https://doi.org/10.1016/j.ribaf.2014.07.002.

Koop, G., M.H. Pesaran, and S.M. Potter. 1996. Impulse response analysis in nonlinear multivariate models. Journal of Econometrics 74 (1): 119–147. https://doi.org/10.1016/0304-4076(95)01753-4.

Longin, F., and B. Solnik. 1995. Is the correlation in international equity returns constant: 1960–1990? Journal of International Money and Finance 14 (1): 3–26. https://doi.org/10.1016/0261-5606(94)00001-H.

Narayan, P.K., and D. Bannigidadmath. 2015. Are Indian stock returns predictable? Journal of Banking & Finance 58: 506–531.

Narayan, P.K., D.H.B. Phan, S.S. Sharma, and J. Westerlund. 2016. Are Islamic stock returns predictable? A global perspective. Pacific Basin Finance Journal 40: 210–223. https://doi.org/10.1016/j.pacfin.2016.08.008.

Onour, I.A. 2010. Analysis of portfolio diversifications efficiency in emerging African stock markets. International Research Journal of Finance and Economics 40: 30–37.

Pappas, V., S. Ongena, M. Izzeldin, and A.M. Fuertes. 2016. A survival analysis of Islamic and conventional banks. Journal of Financial Services Research 51 (2): 221–256. https://doi.org/10.1007/s10693-016-0239-0.

Patton, A.J. 2011. Volatility forecast comparison using imperfect volatility proxies. Journal of Econometrics 160: 246–256. https://doi.org/10.1016/j.jeconom.2010.03.034.

Pesaran, H.H., and Y. Shin. 1998. Generalized impulse response analysis in linear multivariate models. Economics Letters 58 (1): 17–29. https://doi.org/10.1016/S0165-1765(97)00214-0.

Phillips, P.C.B., and P. Perron. 1988. Testing for a unit root in time series regression. Biometrika 75 (2): 335–346. https://doi.org/10.1093/biomet/75.2.335.

Sensoy, A., G. Aras, and E. Hacihasanoglu. 2015. Predictability dynamics of Islamic and conventional equity markets. North American Journal of Economics and Finance 31: 222–248. https://doi.org/10.1016/j.najef.2014.12.001.

Silvennoinen, A., and S. Thorp. 2013. Financialization, crisis and commodity correlation dynamics. Journal of International Financial Markets, Institutions and Money 24 (1): 42–65. https://doi.org/10.1016/j.intfin.2012.11.007.

Sorwar, G., V. Pappas, J. Pereira, and M. Nurullah. 2016. To debt or not to debt: Are Islamic banks less risky than conventional banks? Journal of Economic Behavior & Organization 132: 113–126. https://doi.org/10.1016/j.jebo.2016.10.012.

Zhang, B., and P. Wang. 2014. Return and volatility spillovers between china and world oil markets. Economic Modelling 42: 413–420. https://doi.org/10.1016/j.econmod.2014.07.013.

Zhou, X., W. Zhang, and J. Zhang. 2012. Volatility spillovers between the Chinese and world equity markets. Pacific Basin Finance Journal 20 (2): 247–270. https://doi.org/10.1016/j.pacfin.2011.08.002.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: Conventional and Islamic banks in GCC countries

Conventional banks | Islamic banks | ||

|---|---|---|---|

Saudi Arabia | |||

Arab National Bank | ANB.SE | Al Rajhi Banking and Investment Corp SJSC | Rajhi.SE |

Riyad Bank SJSC | RBS.SE | Bank Aljazira JSC | ALJAZIRA.SE |

Samba Financial Group SJSC | SFG.SE | Bank Albilad SJSC | Albilad.SE |

Saudi British Bank SJSC | SBB.SE | ||

UAE | |||

Abu Dhabi Commercial Bank PJSC | ADCB.AD | Abu Dhabi Islamic Bank PJSC | ADIB.AD |

Emirates NBD Bank PJSC | ENBD.DU | Dubai Islamic Bank PJSC | DISB.DU |

First Gulf Bank PJSC | FGB.AD | Sharjah Islamic Bank PJSC | SIB.AD |

National Bank of Abu Dhabi PJSC | NBAD.AD | ||

Qatar | |||

Commercial Bank of Qatar QSC | COMB.QA | Qatar International Islamic Bank QSC | QIIB.QA |

Doha Bank QSC | DOBK.QA | Qatar Islamic Bank SAQ | QISB.QA |

Qatar National Bank SAQ | QNBK.QA | ||

Kuwait | |||

Burgan Bank SAKP | BURG.KW | Ahli United Bank KSCP | BKME.KW |

Commercial Bank of Kuwait KSC | CBKK.KW | Kuwait Finance House KSCP | KFIN.KW |

National Bank of Kuwait SAK | NBKK.KW | Kuwait International Bank KSC | KIBK.KW |

Bahrain | |||

BBK BSC | BBKB.BH | Bahrain Islamic Bank BSC | BISB.BH |

National Bank of Bahrain BSC | NATB.BH | Ithmaar Bank BSC | ITHMR.BH |

Appendix B: Spillovers volatilities

Rights and permissions

About this article

Cite this article

Benlagha, N., Mseddi, S. Return and volatility spillovers in the presence of structural breaks: evidence from GCC Islamic and conventional banks. J Asset Manag 20, 72–90 (2019). https://doi.org/10.1057/s41260-018-00107-z

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41260-018-00107-z