Abstract

In a game of incomplete information some of the players possess private information which may be relevant to the strategic interaction. Private information is modelled by a type space, in which every type of each player is associated with a belief about the basic issues of uncertainty (like payoffs) and about the other players’ types. At a Bayesian equilibrium each type chooses a strategy which maximizes its expected payoff given the choice of strategies by the other players’ types. Bayesian equilibrium payoffs are often inefficient relative to the equilibrium payoffs that would result had the players been fully informed.

Access provided by CONRICYT-eBooks. Download reference work entry PDF

Similar content being viewed by others

Keywords

- Bayesian equilibrium

- Bayesian strategies

- Common knowledge

- Epistemic game theory: incomplete information

- Games with incomplete information

- Private information

JEL Classifications

A game of incomplete information is a game in which at least some of the players possess private information which may be relevant to the strategic interaction. The private information of a player may be about the payoff functions in the game, as well as about some exogenous, payoff-irrelevant events. The player may also form beliefs about other players’ beliefs about payoffs and exogenous events, about their beliefs about the beliefs of others, and so forth.

Harsanyi (1967–8) introduced the idea that such a state of affairs can be succinctly described by a type space. With this formulation, Ti denotes the set of player i’s types. Each type ti ∈ Ti is associated with a belief λi(ti) ∈ Δ(K × T−i) about some basic space of uncertainty, K, and the combination T−i of the other players’ types. The basic space of uncertainty K is called the space of states of nature, and Ω = K × Πi ∈ ITi, where I is the set of players, is called the space of states of the world.

A type space models a game of incomplete information once each state of nature k ∈ K is associated with a payoff matrix of the game, or, more generally, with a payoff function \( {u}_i^k \) for each player i ∈ I. This payoff function specifies the player’s payoff \( {u}_i^k(s) \) for each combination of strategies s = (si)i ∈ I ∈ S = Πi ∈ ISi of the players. (In the particular case in which k is associated with a payoff matrix, that is, the game is such that each player has finitely many strategies, the payoffs \( {u}_i^k(s) \) to the players i ∈ I appear in the entry of the matrix corresponding to the combination of strategies s = (si)i ∈ I . ) As usual, the set of strategies Si of player i ∈ I may be a complex object by itself. For instance, it may be the set of mixed strategies over some set of pure strategies \( {S}_i^0 \). The payoff function of player i in the state of nature k is \( {u}_i^k:S\to \mathrm{\mathbb{R}} \).

Obviously, different types of a player may want to choose different strategies. Thus, a Bayesian strategy of player i in a game of incomplete information specifies the strategy σi(ti) ∈ Si that the player chooses given each one of her typesti ∈ Ti.

Given a profile of Bayesian strategies σ = (σj : Tj → Sj)j ∈ I of the players, the expected payoff of player i of type ti is

where σ−i(t−i) = (σj(tj))j ≠ i. If there is a continuum of states of nature and types, the sum becomes an integral:

(In this case, the expected payoff function Ui(σ, ti) is well defined if the Bayesian strategies σj : Tj → Sj are measurable functions and if the payoff function \( {u}_i^{\cdot }:K\times S\to R \) is measurable as well; we omit the details of this technical requirement).

We assume that the players are expected payoff maximizers. Thus, player i prefers the Bayesian strategy σ over σ′ if and only if Ui(σ, ti) ≥ Ui(σ′, ti) for each of her types ti ∈ Ti . It follows that given a Bayesian strategy profile σ−i of the other players, the Bayesian strategy σi is a best reply of player i if for any other strategy σ′ of hers, Ui((σi, σ−i), ti) ≥ Ui((σ′, σ−i), ti) for each of her types ti ∈ Ti . A Bayes–Nash equilibrium or a Bayesian equilibrium is a profile of Bayesian strategies σ∗ = (σi∗)i ∈ I such that σi∗ is a best reply against σ−i∗ for every playeri ∈ I .

A simple, discrete variant of an example by Gale (1996) may clarify these abstract definitions. There are two investors i = 1, 2 and three possible states of nature k ∈ K = {−1, 0, 1} . Each investor i only knows her own type

Every type ti of investor i believes that all of the other investor’s types tj ∈ Tj , j ≠ i , are equally likely, so that each of them has probability \( \frac{1}{6} \). Moreover, every type ti believes that the state of nature is k = 1 when ti + tj > 0 ; that the state of nature is k = 0 whenti + tj = 0; and that the state of nature is k = − 1 whenti + tj < 0 . Formally, the belief λi(ti) of type ti ∈ Ti is defined by

The investors cannot communicate their types to one another. They can invest in at most one of two available investment periods. Each investor has three relevant strategies: invest immediately, in the first period; wait to the second period and invest only if the other investor has invested in the first period; or never invest. The payoff of each of the investors depends on the state of nature k ∈ K = {−1, 0, 1} and on her own investment strategy, but not on the investment strategy of the other investor. The payoffs are as follows:

Investing immediately when the state of nature is k yields investor i a payoff of k

$$ {u}_i^k\left({}^{`}{immediately}^{'},\cdotp \right)=k $$

(The · stands for the investment decision of the other investor j ≠ i , which, as we said, does not effect the payoff of investor i.)

If investor i chooses to wait to the second period and invest only if the other investor has invested in the first period, investor i’s payoff in the state of nature k is

$$ {u}_i^k\left({}^{`}{wait}^{'},\cdotp \right)=-\frac{3}{4}k. $$If the investor never invests, her payoff is 0 irrespective of the state of nature:

$$ {u}_i^k\left({}^{`}{never}^{'},\cdotp \right)=0. $$

How will the different types behave at a Bayesian equilibrium? The type ti = 10 assesses that by investing immediately her expected payoff is

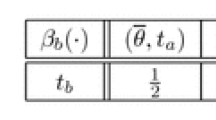

(immediate investment yields 0 in case tj = −10, and yields 1 in case tj = − 6, − 2, 2, 6, 10). This is higher than \( \frac{3}{4} \), the maximum payoff she could possibly get by waiting for the second period, and higher than the payoff 0 of never investing. So at a Bayesian equilibrium

Next, the expected payoff to the type ti = 6 from immediate investment is

(immediate investment yields 1 unless tj = − 10, in which case the payoff is − 1, or tj = − 6, in which case the payoff is 0). So investing immediately is preferred for her over never investing. But how about waiting until the second period? That’s an inferior option as well, since the types tj = − 10, − 6, − 2 will never invest in the first period (this would yield them a negative expected payoff). So only the positive types tj = 2,6,10 could conceivably invest immediately, with overall probability reaching at most \( \frac{3}{6} \). So waiting to see if they invest yields to the type ti = 6 an expected payoff not higher \( \frac{3}{6}\times \frac{3}{4}=\frac{3}{8} \), which is smaller than \( \frac{1}{2} \). We conclude that the preferable strategy of ti = 6 at equilibrium is

What about ti = 2? Immediate investment yields her

(− 1 is the payoff when tj = − 10, − 6; 0 is the payoff when tj = − 2; the payoff is 1 otherwise). However, given that the types tj = 6,10 invest immediately at equilibrium, and that the negative types tj = − 10, − 6, − 2 do not invest immediately, the type ti = 2 figures out that by waiting and investing only if the other investor has invested first would yield her an expected payoff

(\( \frac{2}{6} \) is the probability assigned by ti = 2 to the event that tj ∈ {6, 10} and hence j invests immediately, and \( \frac{3}{4} \) is the payoff from the second period investment). Thepreferred strategy of ti = 2 at equilibrium is therefore

We can now compute inductively, in a similar way, that also

and that

Notice that the equilibrium in the example is inefficient. For instance, when the pair of types is (t1,t2) = (2, 2) the investment is profitable, but both investors wait to see if the other one invests, and thus end up not investing at all. In this case, behaviour would become efficient if the investors could communicate their types to each other. Indeed, they would have been happy to do so, because their interests are aligned.

Obviously, there are other strategic situations with incomplete information in which the interests of the players are not completely aligned. For example, a potential seller of an object would like to strike a deal with a potential buyer at a price which is as high as possible, while the potential buyer would like the price to be as low as possible. That’s why the traders might not volunteer to communicate honestly their private valuations of the object, even if they are technically able to do so. Still, in case the buyer values the object more than the seller, they would both prefer to trade at some price in-between their valuations rather than forgoing trade altogether. Therefore, the traders would nevertheless like to avoid a complete lack of communication. Myerson and Satterthwaite (1983) phrase general conditions under which no Bayesian equilibrium of any trade mechanism is ever fully efficient due to this tension between interests alignment and interests mismatch. Under these conditions, even if the traders are able to communicate their private information, at no Bayesian equilibrium does trade take place in all instances in which there exist gains from trade.

In the above variant of Gale’s example we were able to find the unique Bayesian equilibrium using iterative dominance arguments. We have iteratively crossed out strategies that are inferior for some types, which enabled us to eliminate inferior strategies for other types, and so forth. As in games of complete information, this technique is not applicable in general, and there are games with incomplete information in which a Bayesian equilibrium is not the outcome of any process of iterative elimination of dominated strategies (Battigalli and Siniscalchi 2003; Dekel et al. 2007).

Games with incomplete information are discussed in many game theory textbooks (for example, Dutta 1999; Gibbons 1992; Myerson 1991; Osborne 2003; Rasmusen 1989; Watson 2002). Aumann and Heifetz (2002), Battigalli and Bonanno (1999) and Dekel and Gul (1997) are advanced surveys.

Bibliography

Aumann, R.J., and A. Heifetz. 2002. Incomplete information. In Handbook of game theory, ed. R.J. Aumann and S. Hart, Vol. 3. Amsterdam: North-Holland.

Battigalli, P., and G. Bonanno. 1999. Recent results on belief, knowledge and the epistemic foundations of game theory. Research in Economics 53: 149–225.

Battigalli, P., and M. Siniscalchi. 2003. Rationalization with incomplete information. Advances in Theoretical Economics 3(1), article 3. Online. Available at http://www.bepress.com/bejte/advances/vol3/iss1/art3. Accessed 25 Apr 2007.

Dekel, E., D. Fudenberg, and S. Morris. 2007. Interim correlated rationalizability. Theoretical Economics 2: 15–40.

Dekel, E., and F. Gul. 1997. Rationality and knowledge in game theory. In Advances in economics and econometrics, ed. D. Kreps and K. Wallis. Cambridge, UK: Cambridge University Press.

Dutta, P.K. 1999. Strategies and games: Theory and practice. Cambridge, MA: MIT Press.

Gale, D. 1996. What have we learned from social learning. European Economic Review 40: 617–628.

Gibbons, R. 1992. Game theory for applied economists. Princeton: Princeton University Press.

Harsanyi, J.C. 1967–8. Games with incomplete information played by Bayesian players, parts I–III. Management Science 14: 159–182, 320–334, 486–502.

Myerson, R. 1991. Game theory: Analysis of conflict. Cambridge, MA: Harvard University Press.

Myerson, R., and M. Satterthwaite. 1983. Efficient mechanisms for bilateral trading. Journal of Economic Theory 29: 265–281.

Osborne, M. 2003. Introduction to game theory. Oxford: Oxford University Press.

Rasmusen, E. 1989. Games and information: An introduction to game theory. Oxford: Basil Blackwell.

Watson, J. 2002. Strategy: An introduction to game theory. New York: W.W. Norton.

Author information

Authors and Affiliations

Editor information

Copyright information

© 2018 Macmillan Publishers Ltd.

About this entry

Cite this entry

Heifetz, A. (2018). Epistemic Game Theory: Incomplete Information. In: The New Palgrave Dictionary of Economics. Palgrave Macmillan, London. https://doi.org/10.1057/978-1-349-95189-5_2663

Download citation

DOI: https://doi.org/10.1057/978-1-349-95189-5_2663

Published:

Publisher Name: Palgrave Macmillan, London

Print ISBN: 978-1-349-95188-8

Online ISBN: 978-1-349-95189-5

eBook Packages: Economics and FinanceReference Module Humanities and Social SciencesReference Module Business, Economics and Social Sciences