Abstract

Matching (or job-matching) is the process whereby a firm and a worker meet, learn whether their characteristics combine productively and, in light of this information, sequentially contract a wage and decide whether to separate or to continue production. This hypothesis implies that wages rise and the risk of separation declines with seniority, wage changes are unpredictable and have declining variability, and valuable specific human capital is accumulated in the form of knowledge about the quality of the match. These and other observable implications have found strong support in available empirical evidence, and make job-matching a central theory of worker turnover.

Access provided by CONRICYT-eBooks. Download reference work entry PDF

Similar content being viewed by others

Keywords

- Bellman equation

- Job-matching hypothesis

- Labour-market contracts

- Matching

- Matching markets

- Returns to tenure

- Roy model

- Selection

- Wage distribution

- Worker turnover

JEL Classifications

Matching (or job-matching) is the process whereby a firm and a worker meet, learn whether their characteristics combine productively and, in light of this information, sequentially contract a wage and decide whether to separate or to continue production.

In many respects, a job is like a marriage. Two parties (a firm and a worker) engage in a long-run relationship, whose success depends on a myriad of factors, all quite difficult to describe. Only the actual outcome of the match can reveal the underlying ‘fit’. If the match works, it continues; otherwise it is scrapped and the partners try their luck elsewhere.

Jovanovic (1979a) formalizes the job-matching hypothesis in a dynamic, rational-expectations context. This hypothesis hinges on two pivotal ideas: learning and selection. The emphasis on selection follows the tradition of equilibrium sorting in labour markets going back to the static Roy model (1951). Now, dynamics and imperfect information take centre stage. A job is viewed as an ‘inspection’ as well as an ‘experience’ good. The worker and the firm have to ‘taste’ the match to decide its value, just like two people first date (to ‘inspect’ the match) then possibly get married (to ‘experience’ the match), with varying degrees of success. Unlike in marriage markets, utility is typically transferable through the wage. The fit between firm and worker characteristics is modelled as a match-specific productivity component, a parameter of the output process, summarizing how well the innumerable relevant characteristics of the worker and of the task actually dovetail. Random noise in production creates a signal extraction problem. The firm and/or the worker continuously observe the output performance of the match, incorporate this information in wages, and reassess it against alternative opportunities offered by the market.

A Job-Matching Model

Output yt is produced at time t = 1, 2… by a firm and a worker with a 1:1 Leontief technology:

There is no hours or effort choice. θ is average productivity or ‘match quality’, drawn by nature, unobserved by firm and worker, at the beginning of the match from θ: N(m−1, 1/h−1), which are also parties’ prior beliefs. εt : N(0, 1/pε) is white noise, i.i.d. and independent of θ. Therefore, risk-neutral firm and worker are interested in the permanent component θ. Following the bulk of the literature, assume that firm and worker are symmetrically informed. This is not a crucial assumption: all that matters is that some learning drives match selection.

Upon matching at time 0, parties inspect the match and observe a signal

where η: N(0, 1/pη) independent of θ. By Bayes’ rule, θ|x: N(m0, 1/h0), where h0 = h−1 + pη and h0m0 = m−1h−1 + xpη. If the match begins and output is produced at t = 1, 2…, posterior beliefs about match quality conditional on the worker’s track record are recursively updated as follows:

That is, mt and ht are the mean and precision of the normal posterior distribution of θ, conditional on all information available to date t. After solving backward, mt is an average of the prior expectation m−1, the initial signal x and the history of output \( {\sum}_{s=1}^t{y}_s \), weighted by their respective precisions. Given the model’s parameters, history and beliefs are summarized by expected productivity mt and by tenure t, which jointly measure the specific human capital accumulated in the relationship.

With no uncertainty and perfect information (h−1 = ∞ and/or pη = ∞), workers and firms would immediately discard unpromising matches and keep drawing better and better outcomes. With imperfect information, equilibrium behaviour is ‘sequential’ and non-trivial. Equilibrium cannot be perfectly competitive, due to the specificity of match quality and consequently of human capital. Nonetheless, with free entry, no mobility and no capital costs, there is a contracting equilibrium where the wage offered by the firm to the worker equals the worker’s expected (marginal) productivity mt, and firms break even. The worker captures the entire option value of learning. By Bayes’s rule, the distribution of the future wage mt+1, unconditional on unknown match quality θ but conditional on current beliefs {mt, t}, is normal with

The worker’s value of employment solves the Bellman equation

for some discount factor β ∈ [0,1]. At each point in time, including t = 0 right after observing the initial signal x and before starting production, the worker decides whether to quit this match at once and to inspect another one next period (expected value \( E\left[V\left({\tilde{m}}_0,0\right)\right] \), independent of {mt, t} because θ is match-specific) or to accept the wage mt, produce, observe the output realization yt, update beliefs to {mt+1, t + 1}, and decide again.

The worker’s employment value V(m, t) is increasing in expected match quality m and decreasing in tenure t. The first effect is obvious. Formally, an increase in mt raises the right-hand side of (2) directly and, by (1), the normal distribution of future wages in a first-order stochastic dominance sense. Standard dynamic programming arguments establish monotonicity of V. To see why the value V is also decreasing in tenure t, consider the following thought experiment. Before deciding whether to quit or to produce yt+1, the worker is provided with a free signal υ which has the same distribution as yt+1, and is then informative about match quality. After observing this signal, the worker cannot do worse, because he or she can always ignore it. So, before observing υ, she must value this additional information:

where the equality follows from υ : yt+1 and then Eυ[E[mt+1|mt, t, υ]] = E[mt+1|mt,t] = mt. The inequality implies that V is convex in m. Since tenure t reduces the variance of m from (1), it follows from Jensen’s inequality that V(m,t) declines in t for given m. Intuitively, a match of equally expected but more uncertain productivity is more valuable: there is some chance it will turn out to be great, otherwise it can always be scrapped.

Testable Implications and Empirical Evidence

The key implications of the model derive from selection and learning, and those implications that are testable have indeed found strong empirical support.

Selection

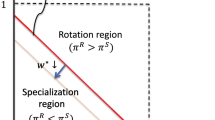

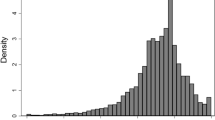

Given the properties of V, the worker quits as soon as the wage falls short of a reservation wage, which is increasing in tenure. As the option value of learning is consumed, a given expected match quality is no longer sufficient to support the match. Reservation wages are not directly observable, but the resulting selection does have indirect, testable implications. Only promising matches survive, so the average mt (wage) in continuing jobs increases (cross-sectionally) with tenure t. Indeed, seniority has modest but consistently positive wage returns (Altonji and Williams 2005). As better matches are less likely to end, the hazard rate of separation, after an initial ‘discovery’ phase, declines with tenure, a very robust stylized fact (Farber 1994). Finally, censoring bad matches skews the distribution of wage residuals, conditional on observable worker and firm exogenous characteristics: a symmetric and thin-tailed Gaussian distribution of output turns into a distribution of ‘unexplained’ wages with a thick Pareto upper tail (Moscarini 2005), as in a typical empirical wage distribution.

Learning

From (1), unconditional on the unobserved quality of the match, the wage mt is a martingale, with variance of innovations declining with tenure t. Beliefs updated in a Bayesian fashion cannot be expected to drift in any direction, for the same reason that asset prices are a random walk in efficient financial markets. Thus, unconditionally on tenure, within-job wage changes are uncorrelated and, as uncertainty about match quality is resolved, have declining variance (Mortensen 1988). Wage growth slows down over the course of a career. Indeed, the search for serial correlation in wage changes has been inconclusive, but the slowdown of wage growth is prevalent (Topel and Ward 1992). The wages of a cohort of workers ‘fan out’, as some workers are luckier than others and find earlier a good match that pays a high wage, and as commonly observed empirically. When a match separates due to an exogenous layoff (not modelled here, but easy to accommodate), the worker loses the entire match-specific human capital, so she suffers a persistent wage loss. This fully agrees with the available evidence (Jacobson et al. 1993). More problematic is the prediction (Mortensen 1988) that, as V(m,t) falls with t, separation rises with tenure given the wage: empirical evidence (Topel and Ward 1992) suggests the opposite.

Alternative Hypotheses About Worker Turnover

In light of its intuitive appeal and empirical success, job-matching has become the benchmark model of worker turnover. It has in part inspired the canonical search- and-matching model of the labour market (Mortensen and Pissarides 1994), where ex post idiosyncratic uncertainty drives job flows while search frictions account for involuntary unemployment. But, despite its vast influence, the job-matching approach still faces alternative and competing views of worker turnover, which provide conceptually quite different explanations for the same set of stylized facts. The starker contrast is with pure search models, which may dispose of heterogeneity altogether. In the search literature, wage dispersion and dynamics originate from firms’ power of monopsony and commitment to contracts, due to purely strategic considerations. Retention concerns and counter-offers (Burdett and Mortensen 1998; Burdett and Coles 2003) explain returns to seniority, declining separations rate and so forth. Closer to the job-matching approach is a class of models that retain heterogeneity and selection, but allow for the quality of the job to change physically over time, while in the job-matching model everything is predetermined, and parties only have to learn their fate. Notable examples are firm-specific training (Jovanovic 1979b) and learning-by-doing, as well as stochastic match-specific productivity shocks (Mortensen and Pissarides 1994). In these models, general properties of Bayesian learning, like the declining variance of innovations, must be assumed as ad hoc properties of the productivity process. Nonetheless, this lack of identification poses a formidable challenge, and motivates an ongoing research effort.

Bibliography

Altonji, J., and N. Williams. 2005. Do wages rise with job seniority? A reassessment. Industrial and Labor Relations Review 58: 370–397.

Burdett, K., and M. Coles. 2003. Equilibrium wage-tenure contracts. Econometrica 71: 1377–1404.

Burdett, K., and D. Mortensen. 1998. Wage differentials, employer size, and unemployment. International Economic Review 39: 257–273.

Farber, H. 1994. The analysis of interfirm worker mobility. Journal of Labor Economics 12: 554–593.

Jacobson, L., R. Lalonde, and D. Sullivan. 1993. Earnings losses of displaced workers. American Economic Review 83: 685–709.

Jovanovic, B. 1979a. Job matching and the theory of turnover. Journal of Political Economy 87: 972–990.

Jovanovic, B. 1979b. Firm-specific capital and turnover. Journal of Political Economy 87: 1246–1260.

Mortensen, D. 1988. Wages, separations, and job tenure: On-the-job specific training or matching? Journal of Labor Economics 6: 445–471.

Mortensen, D., and C. Pissarides. 1994. Job creation and job destruction in the theory of unemployment. Review of Economic Studies 61: 397–415.

Moscarini, G. 2005. Job matching and the wage distribution. Econometrica 73: 481–516.

Roy, A. 1951. Some thoughts on the distribution of earnings. Oxford Economic Papers 3: 135–146.

Topel, R., and M. Ward. 1992. Job mobility and the careers of young men. Quarterly Journal of Economics 107: 439–479.

Author information

Authors and Affiliations

Editor information

Copyright information

© 2018 Macmillan Publishers Ltd.

About this entry

Cite this entry

Moscarini, G. (2018). Matching. In: The New Palgrave Dictionary of Economics. Palgrave Macmillan, London. https://doi.org/10.1057/978-1-349-95189-5_2197

Download citation

DOI: https://doi.org/10.1057/978-1-349-95189-5_2197

Published:

Publisher Name: Palgrave Macmillan, London

Print ISBN: 978-1-349-95188-8

Online ISBN: 978-1-349-95189-5

eBook Packages: Economics and FinanceReference Module Humanities and Social SciencesReference Module Business, Economics and Social Sciences