Abstract

A simple life insurance contract can be of two forms: (i) annuities paying specified amounts on fixed dates, provided that the insured is alive; or (ii) life insurances paying a specified amount at the death of the insured. All life insurance contracts can be built up as combinations of these two basic components.

Access provided by CONRICYT-eBooks. Download reference work entry PDF

Similar content being viewed by others

A simple life insurance contract can be of two forms: (i) annuities paying specified amounts on fixed dates, provided that the insured is alive; or (ii) life insurances paying a specified amount at the death of the insured. All life insurance contracts can be built up as combinations of these two basic components.

The actuarial calculations in life insurance are based on the ‘principle of equivalence’, which requires that the expected present values of the payments made by the insured and by the insurer must be equal. If the administrative expenses of the insurer are ignored, the expected present value of his payments will be equal to that of the receipts of the insured.

The expectations are calculated from a mortality law, described by the death rate qx, which can be interpreted as the probability that a person of age x will die before he reaches the age x + 1. From the death rates one calculates, usually after some graduation, the mortality table lx by the formula

The ratio

can be interpreted as the probability that a person of age x will still be alive after a time t. Table 1 gives the values of qx under some widely used mortality tables.

If the function π(t) is continuous it is convenient to write

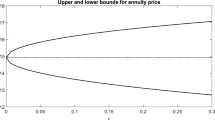

where μx is the ‘force of mortality’. The single premium for the pure endowment can then be written

From (1) it follows that the premium is less than the present value of a unit payable with certainty at time t, because the discounting is done at a higher and increasing rate of interest.

A life-long annuity is a sum of pure endowments, and hence the single premium is

In theoretical work it is often advantageous to assume that the annuity is paid as a continuous stream, and write

for the single premium.

Under a typical pension plan the insured will pay a constant or ‘level’ premium P up to the time n, and from then on he will receive an annuity B as long as he lives. The principle of equivalence gives the following relationship between premium and benefits:

or in the standard actuarial notation

As π(t) is non-increasing, π(0) = 1 and π(∞) = 0, it follows that F(t) = 1 − π(t) has the properties of a cumulative probability distribution. Hence F′(t) = 1 − π′(t) can be interpreted as the probability density of the event that the person will die at time t. The present value of a unit payable then is e−δt. From the principle of equivalence it follows that the single premium for an insurance contract paying a unit at the time of the death of the insured is

or

The continuous level premium, for the whole duration of this insurance contract is determined by

or

The contract described, called whole-life insurance, remains in force until the insured dies. Two other insurance contracts in general use are:

Term insurance. The single premium is

Under this contract the sum insured is paid only if the insured dies before the time n.

Endowment insurance with a single premium

Under this contract the unit sum is paid after a time n, or at earlier death. The contract is clearly the sum of a pure endowment and a term insurance. Most life insurance contracts contain an important element of saving. For the pension plan described by (2) this is obvious, and it holds also for the whole life insurance with a level premium determined by (1). At a time t after a contract of this kind was concluded, the insured will have reached the age x + t. He will then have accumulated savings amounting to

It can be shown that this equation also can be written in the form

In (2) the first term is the expected present value, at time t, of a unit payable at the death of the insured. The second term is the expected present value of the premiums which the insured according to the contract has undertaken to pay as long as he lives. The difference between the two represents the net expected present value of the insurer's obligations under the insurance contract at time t.

The first term in braces in (3) is the expected present value at time 0, of the premiums paid by the insured up to time t, and the second term is the value of the insurance cover he has received. The difference, compounded up to time t, at the rate of interest defined by (1), gives the accumulated saving of the insured at time t.

The common left-hand side of (2) and (3) is usually called the ‘premium reserve’, since it represents that part of premiums received which the insurer must keep in reserve to meet his expected future obligations.

The premium reserve can also be interpreted as the accumulated savings of the insured at time t. Often he will have the right at any time to cancel the contract and receive the ‘surrender value’ of his policy in cash. The surrender value will usually be equal to the premium reserve, less a deduction for expenses incurred by the insurer.

An insurance contract can be of very long duration, and once the contract is concluded the insurer can usually not change the term. When he quotes a premium, the quotation must be based on forecasts of interest and mortality rates several decades into the future. It is natural, and indeed necessary, that these forecasts should include considerable safety margins. This means, however, that the insurance contract can be expected to yield a substantial ‘surplus’, or profit to the insurer. Under most life insurance contracts this surplus is paid back to the insured, once it has been realized.

Conventionally the theory of life insurance is formulated in terms of probabilities, although this is not really necessary. If sufficient safety margins are included in the assumptions about future interest and mortality, there is a high probability that surplus will arise. This surplus, if it materializes, is distributed to the policy-holders by methods closely related to those of cost accounting. Essentially the actual cost to the insurer is calculated for a group of similar contracts, and the excess of premiums paid over costs is refunded to the policy holders in the group.

In older insurance policies the sum payable at death was usually the same during the whole duration of the contract, and the premium was constant over the same or a shorter period. The only flexibility was that the insured could buy and surrender any combination of term and endowment contracts, as his needs changed.

A more general insurance contract consists of the two elements: (i) C(t) = the amount payable at death, if death occurs at time t; (ii) P(t) dt = the premium paid by the insured in the time interval (t, t + dt). P(t) may be negative for some values of t, as in a pension plan.

The principle of equivalence requires that

Any pair of functions satisfying this condition represents a feasible insurance contract. In practice one will require however that the premium reserve always be non-negative.

A generalization of (3) gives the premium reserve at time t for this contract as

Hence any insurance contract which satisfies (4) is possible, provided that xVt ≥ 0 for all t, and the insured can change the contract at any time, provided that the two conditions are not violated. To avoid adverse selection there must, however, be restrictions on how the insured can increase the death benefit C(t) in the contract period.

General contracts of this form have been introduced in most countries during recent decades, and they have made life insurance a very flexible instrument of saving.

The conventional insurance contract is expressed in nominal units of money, and this may lead the insurers to invest the funds in fixed interest securities. In times of inflation such investments are not very attractive, since the real rate of interest may well be negative. To meet competition from other forms of savings, insurance companies in some countries have introduced different types of ‘equity-linked’ insurance contracts. One way of doing this is to express the benefits to the insured in terms of units in an investment fund. This makes it possible to construct insurance contracts representing any combination of risk-free investment and the higher return associated with risky investment.

History

The history of life insurance can be traced back at least to the days of the Roman Empire. In the Middle Ages the guilds imposed special dues on their members, and the amounts collected were paid to the dependents of the members who had died during the past year. The sums involved were usually modest, and the main objective seems to have been to secure a decent funeral for the departed member.

In the 17th century mutuals or ‘friendly societies’ were formed in several European countries. These societies, which offered life insurance for modest amounts on principles similar to those used by the medieval guilds, often operated on a shaky technical basis. It is generally agreed (cf. Ogborn 1962) that modern life insurance began in 1762 with the formation of the Equitable Society in London. This society, which is still in operation, introduced the correct scientific methods in the calculation of its premiums and reserves.

From the 16th to the 18th century the sale of life annuities or pensions was an important element in government borrowing. Governments usually found it difficult to repay their debts on schedule, and some loans were floated without any redemption plan, such as the consols in Britain. In such cases the interest payments became a perpetual annuity. If it was agreed that payments should cease with the death of the lender, the loan would automatically be liquidated, although annual payments would be higher.

The correct formula for the expected present value of a life-long annuity was presented by Jan de Witt in 1671, in a report: De Vardy van de Lifrenten (The Value of Life Annuities) to the States General of the Netherlands. According to Neuburger (1974), de Witt argued that a life-long annuity to a child of 3 years should be priced at 16 times the annual payment. He was, however, overruled by the politicians, who decided that the price should be 14.

A special form of borrowing was the ‘tontine’, named after Lorenzo Tonti who proposed the scheme to Cardinal Mazarin. Under a tontine a large number of tickets or bonds were sold to buyers who were divided into age-groups. The government paid the agreed interest on the total amount raised by each group, and the interest was divided among the surviving members. When all members of the group had died, payments ceased, and the debt was liquidated. The tontine brought an element of gambling into the purchase of life annuities, and this seems to have been appreciated by investors at the time (cf. Jennings and Trout 1982).

The early life insurance companies were often founded by idealists who wanted to make safe life insurance available to those who wanted to provide for their old age, or for dependents in case of early death. Growth was slow, until the active selling of life insurance began in the second half of the 19th century. Since then growth has been rapid, and in the industrialized Western countries 2–4 per cent of GNP is spent on life insurance premiums.

See Also

Bibliography

Jennings, R.M., and A.P. Trout. 1982. The tontine: From the reign of Louis XIV to the French revolutionary era. Homewood: Richard D. Irwin.

Neil, A. 1977. Life contingencies. London: William Heinemann.

Neuburger, E. 1974. Die Versicherungsmathematik von vorgestern bis heute. Zeitschrift für die gesamte Versicherungswissenschaft 63: 107–124.

Ogborn, M. 1962. Equitable assurances, the story of a life assurance society. London: Allen & Unwin.

Author information

Authors and Affiliations

Editor information

Copyright information

© 2018 Macmillan Publishers Ltd.

About this entry

Cite this entry

Borch, K.H. (2018). Life Insurance. In: The New Palgrave Dictionary of Economics. Palgrave Macmillan, London. https://doi.org/10.1057/978-1-349-95189-5_1186

Download citation

DOI: https://doi.org/10.1057/978-1-349-95189-5_1186

Published:

Publisher Name: Palgrave Macmillan, London

Print ISBN: 978-1-349-95188-8

Online ISBN: 978-1-349-95189-5

eBook Packages: Economics and FinanceReference Module Humanities and Social SciencesReference Module Business, Economics and Social Sciences