Abstract

The purpose of this chapter is to shed light on how start-ups deal with the complex task of commercializing science. While the linear “spin-out funnel” model (Clarysse, Wright, Lockett, Van de Velde, & Vohora, 2005) views commercialization simply as a bridge between technology and the market, the process of connecting science to industrial or societal needs is more complex and transforms the original science into something else (Pavitt, 2004; Grandin, Wormbs, & Widmalm, 2004) rather than simply transferring it over a bridge. This “something else” is often “downgraded” because the most cutting-edge discoveries are too advanced and clash with established investments and the other technologies already in place (Håkansson & Waluszewski, 2007, pp. 6–10). Therefore, most scientific knowledge is used in the business world, after it has already been embedded in a complex socio-technical network through several connections created with surrounding technologies, actors and organizations (Håkansson & Waluszewski, 2007, pp. 6–7). Following this approach towards the commercialization of science and the adoption of a network perspective (Håkansson & Snehota, 1995) means “the real challenge in commercializing science is making it fit in the established socio-technical structures of producers and users” (Håkansson & Waluszewski, 2007, p. 10).

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

7.1 Introduction

The purpose of this chapter is to shed light on how start ups deal with the complex task of commercializing science. While the linear “spin-out funnel” model (Clarysse, Wright, Lockett, Van de Velde, & Vohora, 2005) views commercialization simply as a bridge between technology and the market, the process of connecting science to industrial or societal needs is more complex and transforms the original science into something else (Pavitt, 2004; Grandin, Wormbs, & Widmalm, 2004) rather than simply transferring it over a bridge. This “something else” is often “downgraded” because the most cutting-edge discoveries are too advanced and clash with established investments and the other technologies already in place (Håkansson & Waluszewski, 2007, pp. 6–10). Therefore, most scientific knowledge is used in the business world, after it has already been embedded in a complex socio-technical network through several connections created with surrounding technologies, actors and organizations (Håkansson & Waluszewski, 2007, pp. 6–7). Following this approach towards the commercialization of science and the adoption of a network perspective (Håkansson & Snehota, 1995) means “the real challenge in commercializing science is making it fit in the established socio-technical structures of producers and users” (Håkansson & Waluszewski, 2007, p. 10).

This challenge is even more compelling when, as shown in previous studies (Aaboen, Dubois, & Lind, 2011), we consider that the efforts of new ventures to commercialize their offer depend on some initial and key business relationships—specifically customer relationships—as well as particular conditions that affect, at a network level, the new venture’s development. Therefore, we take the perspective of a new venture facing a business network, and we refer to science as the object of a commercialization process, whereby a complex set of relationships transforms science into something else of commercial value. Because start ups are small companies and have minimal network connections, the first relationships they establish play a pivotal role in the new venture’s development. Accordingly, we call them “key relationships”.

Against this background, the purpose of this chapter is to illustrate how initial key relationships influence the way in which a start up commercializes science. The first part of the chapter offers theoretical insights into the critical role that business relationships play in supporting or limiting the efforts that new business ventures make to commercialize science. The second part of the chapter focuses on the particular case of an academic spin-off, Nautes, established at the Universita’ Politecnica delle Marche, Italy, and its first customer relationship. By means of this empirical study, we emphasize how business ventures are shaped and strongly affected by their initial and key business relationships, which can play two different roles: as facilitators or inhibitors of the commercialization process. The chapter ends with a discussion of how new business ventures may overcome the barriers created by the first business relationships and exploit the opportunities related to their initial and key customer relationships. More specifically, by looking at the academic spin-off as a central actor, we focus on how this new venture, managed by researchers with limited experience commercializing their innovation, engaged with a large customer and learnt, albeit in a turbulent way, how to take its business forward.

The main contribution of this chapter is its explanation of the commercialization process of science by taking an inter-organizational perspective. Secondly, we investigate the complex nature of relationships between new and established companies. Thirdly, we examine the embedding process of science over time by describing several adaptations between the new solution and the surrounding context (Akrich, Callon, & Latour, 2002, p. 209; Van de Ven, Polley, Garud, & Venkataraman, 1999), starting from the first customer and continuing with subsequent customer relationships.

7.2 Theoretical Background

New business ventures creation and development have attracted the attention of many researchers, and the debate in academia is still blooming. Within the domain of entrepreneurship studies , how, why, when and under which conditions new companies develop has been an important research area for a long time (Shane & Venkataraman, 2000). As pointed out by Jones and Holt (2008), it appears that this phenomenon is not yet clear enough. Considering its relevance from both a managerial and scientific perspective, it deserves additional study. In other words, it would be interesting and intriguing to shed more light on the “chaotic and complex” process of new business creation and development (Aldrich, 1999).

The role that business relationships play in supporting a company’s development is widely recognized within the Industrial Marketing and Purchasing (IMP) tradition (Ford, Gadde, Håkansson, & Snehota, 2003, 2006; Håkansson & Snehota, 1995). Developing new products with counterparts, entering a new business and expanding the business operations abroad typically require the creation and development of business relationships. But establishing business relationships is a complex task for both established and new ventures (Gadde, Hjelmgren, & Skarp, 2012; Håkansson & Ford, 2002; La Rocca, Ford, & Snehota, 2013): “the development of a customer relationship requires coordination of the interactions between a customer and a supplier. This coordination entails costs and problems for both companies and it limits their freedom to coordinate with others” (Ford, Gadde, Håkansson, & Snehota, 2011, p. 53).

In the past few years, specific studies have investigated the impact of business relationships on the creation and development of new business ventures (Ciabuschi, Perna, & Snehota, 2012; Snehota, 2011). One challenging aspect identified is the specificity of the early business relationships in enhancing or hindering the new venture’s growth.

The key role of relationships for new business development is even more pivotal when we refer to science as the “product” of a new venture, since the production and using setting will require significant changes and adaptations in the science being commercialized, so as to make it more “productified”, reproducible and reliable. In particular, providing an embedded view of commercialization, Baraldi and Launberg (2013) stress that “the ‘embedding process’ of science [into pre-existing networks consists of] the emergence of interfaces between a focal scientific discovery and the other material and immaterial resources necessary for developing, producing and utilizing it, so to turn that science into an innovation…”

The “resource interaction perspective” (Baraldi, Gressetvold, & Harrison, 2012) provides a useful toolbox to investigate the way in which key relationships affect start up development: by focusing on particular types of resource interfaces and how they change over time, this perspective helps to map the process of the commercialization of science and how it is affected by key relationships. Therefore, the analysis in this chapter revolves around the key relationship that influences the development of a new business venture in parallel with the commercialization of its science, namely the process that transforms science into a product/service valuable for new users.

Some IMP studies have been carried out with the specific purpose of illuminating such issues: for instance, Aaboen et al. (2011) analyse how start ups develop their initial customer relationships. These authors clearly show that the product offered by the new venture has to fit with the customer’s resource structure, and there is an important implication: by interacting with the customer, the start ups learn with whom they can develop future relationships (ibid., p. 56).

Besides the positive effects that the initial relationships have, new ventures also face several problems when interacting with counterparts for the first time (La Rocca et al., 2013). The product might still be partially incomplete or the organizational form under development: accordingly, the early relationships look undeveloped, unstructured and uncoordinated (ibid., p. 1026). Moreover, as shown by Johnsen and Ford (2007), because new ventures lack the experience to manage initial relationships, they are likely to be greatly influenced by their counterpart at this stage.

Therefore, the influence of the initial key relationships on start up development may turn out to be positive as well as negative. Håkansson and Snehota (2002) point out that business relationships always have a certain burden. The authors discuss several reasons, motivations and factors negatively affecting the development of business relationships. For instance, the more the company is dependent on few relationships, the higher the burden of those relationships will be (ibid., p. 92). Because they are not yet established within the business network, new business ventures depend on the few other counterparts they have started building relationships with: consequently, the termination of a key business relationship may have overwhelmingly negative effects for the start up at this early stage.

This overview of the literature has introduced the impact of key business relationships on the commercialization of science and hence on the development of academic start ups. Our theoretical background dealt with both the positive and the negative side of building business relationships from the new business venture’s point of view.

7.3 Methodology

This chapter relies on a case study focusing on 14 years (2001–2015) of the operation of a high-tech company, Nautes S.p.A. (Nautes), an Italian university spin-off from the Universita’ Politecnica delle Marche (UNIVPM). The case was chosen because it represents an intriguing example of a spin-off that during its early development was mostly affected by one initial customer relationship. Moreover, it can be considered the first academic spin-off from UNIVPM, and this “mother organization” is an actor that played a complex role in Nautes’s development. In order to investigate the pivotal role that these two key business relationships played for Nautes, we adopt a qualitative case study method (Yin, 2003). The empirical material was collected between January 2014 and June 2015 by using two different and complementary strategies (Stake, 2005, p. 443): data collection was handled via in-depth interviews and public or internal document analysis. Interviews were collected through a typical cumulative approach, by interviewing new informants as they were mentioned as “bearer[s] of specific knowledge and useful to reconstruct the facts” by other informants, while documents were double-checked with key informants to evaluate their internal validity.

Eight face-to-face interviews were conducted, recorded, transcribed and jointly analysed by the researchers using a protocol of content analysis preliminarily shared among the authors in order to deduct a “meaning of the meanings”. The people interviewed were one full professor at UNIVPM (Prof. D.I.—fictitious name) responsible for the “Liaison Office” at the time of Nautes’s founding, one manager at the UNIVPM (Mr. A.I.—fictitious name) responsible for the “Liaison Office” today, two current representatives from Nautes (Mr. Gialletti, CEO and founder, and Mr. Massimo Manzi, sales manager) and one former representative from Nautes (Mr. M.D.G.—fictitious name, board member of Nautes).

The case analysis was developed using an abductive approach (Alvesson & Sköldberg, 2009, p. 7), which, according to Mayan (2009), aims to generate interpretations that ask for new data collection in a kind of snowball path. In other words, we opted for “systematic combining” (Dubois & Gadde, 2002): an iterative process was used to analyse collected data in the light of an emergent theoretical frame.

The collected data are solid enough to describe the phenomenon accurately and to reflect on the possibility of refining and developing the existing understanding of new venture development and commercialization of science as viewed from a network perspective.

7.4 Case Study

7.4.1 Overview of Nautes in 2014

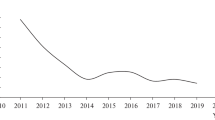

Nautes S.p.A. (Nautes) is an Italian firm focusing on the design and development of software for social and project management, learning management and troubleshooting. In 2014, the company’s turnover was €1.5 million (Gialletti, 2015). It had reached €1 million in 2008, representing a steady yearly average growth of 25 % since 2001, the year it was established, and then increasing at a yearly average of 10 % until 2012 (Gialletti, 2015). Nautes currently employs 30 people.

Nautes develops and produces solutions for midsized and large Italian companies such as Indesit (one of the largest home appliances producers in Europe), Maserati (producer of luxury cars, which belongs to the Fiat Automobile Group) and CheBanca (an Italian bank). In 2015, the consolidated portfolio included more than 60 customers operating in several industries, including banking, pharmaceuticals, manufacturing and services. The customer retention rate over time is more than 30 %, and around 20 clients make up 70 % of the total turnover (Gialletti, 2015).

Currently, Nautes offers three products: Nautes SM (a social/project management system), Nautes LM (a learning management system) and Nautes TS (a customer support system). Nautes SM is a software platform aimed at reducing time to market for innovators through a high involvement of human resources and a shared goal approach. Nautes LM is a tool for managing corporate learning through offline, online and blended courses. Nautes TS is a problem-solving system that optimizes the use of resources for customer support. Moreover, the company provides co-development services to customers in need of customized features for complex projects.

7.4.2 2000: The Origin of Nautes’s Business Idea

In 2000, the Departments of Civil and Building Engineering and Architecture of the Universita’ Politecnica delle Marche (UNIVPM) located in Ancona, Italy, took part in an international consortiuminvolving several European universities and companies. The consortium was formed around “W.I.N.D.S.”,Footnote 1 a research project whose aim was to define a set of requirements for advanced design learning environments. One of the main goals of this project was the creation of a Web-based intelligent design tutoring system. Because of the need of digital technology, the W.I.N.D.S. project involved three Ph.D. students from the Computer Science Department at UNIVPM. These young researchers (Marco Gialletti, Marco Giretti and Gianluca Trombin) had enough skills in the field of computer science to guarantee the successful implementation of the tutoring system.

The W.I.N.D.S. project was important for at least two reasons. Primarily, Gialletti, Giretti and Trombin had the chance to work together, as a team, on a concrete project aimed at developing an innovative technological solution. Secondly, through this experience, they understood the relevance of exploiting the experience of end-users in software development. Marco Gialletti recognized that users, with their own cognitive processes and behaviours, should influence software features during its creation process, even at the very early stages of development. He also realized that “ergonomics” was a key success factor in the development of software, especially for knowledge management and learning platforms. The early works within W.I.N.D.S. would therefore give an important imprint to Nautes, the company that would soon be involved in the development of digital learning environments focused on simplicity and usability.

7.4.3 2001: Request for Financial Support Following a Business Plan Competition

The success of the W.I.N.D.S. project inspired the three Ph.D. students to take part in eCapital, a business plan competition that funds innovative ventures.Footnote 2 This competition is still supported by public institutions such as the regional government of Marche and UNIVPM, and its first edition was organized in 2001. Participants have to present a business plan that is assessed and evaluated by a scientific committee (comprising researchers from several universities from the Marche region). The best idea is awarded a financial grant. Although Giretti and Trombin were involved from the beginning, Gialletti was the main promoter of the new venture initiative, and together they received a grant to set up a new business venture: Thus, Nautes was born on June 28, 2001.

7.4.4 Nautes as a Quasi-Spin-Off

The initial capital investment in the company was €15,000, which was the entire value of the grant received from eCapital. From the very beginning, Nautes’s founders aimed to commercialize some form of Web-based software to support learning and tutoring.

“Nautes was funded under the impulse of the vision of its founders. In 2001, we strongly believed that the knowledge management software industry could be vigorously innovated by simplifying interfaces and processes, and just because of this idea we started our business. Once we received the winning prize from eCapital, we set up our offices in Jesi, our hometown, and we started working on a new software idea” (Marco Gialletti, Nautes’s CEO).

At the time, Nautes had no direct or formal connection with UNIVPM. The only link with the university was indirect and informal: the company founders had their scientific affiliation there. Nevertheless, the university’s management and faculty greatly appreciated the efforts of Gialletti and his colleagues in setting up a company starting from a project that was born in a university department. Very soon, Nautes was framed—at least informally and internally—as the first university spin-off of UNIVPM. Moreover, at a time when there was a great expectation about the role that universities could play as an innovation actor, Nautes was seen as an important test bench of the spin-out process for the entire university.

“In 2001, when Nautes was funded, UNIVPM was working on the development of a set of rules for the regulation of academic spin-offs. Nautes was therefore seen by UNIVPM as an ‘archetype’ of what ‘transferring knowledge’ would mean in the following years. There was a great deal of attention and a lot of interest about what was going on with Nautes. The W.I.N.D.S. Project Director (Prof. Grassi), and the Rector himself were enthusiastic about the initiative of Nautes, and they emphasized its value—even if symbolic—on several official occasions” (A.I., UNIVPM International Liaison Office).

When UNIVPM eventually finalized the regulation of academic spin-offs in 2001, Nautes was the first company to be formally named as an academic spin-off by this university.

7.4.5 UNIVPM and the Development of the Initial Business Relationship

Historically, UNIVPM initiated collaborations and developed joint research projects with private companies from the area around Ancona. Those collaborations led UNIVPM to gain trust among these companies and to be recognized as a valuable partner of these companies in new technology scouting.

Among these collaborations, the relation between UNIVPM and a leading Italian company operating in the lighting business, “IGU” (fictitious name), was particularly strong. IGU was established about 50 km from Ancona in 1959. The company currently employs more than 1,000 people, and the turnover in 2014 was €184 million (IGU, 2015). IGU operates internationally with a number of owned retailers across Europe, Asia and the Americas. Historically, IGU has worked with the Department of Civil Engineering at UNIVPM to develop and test new products. Fresh graduate engineers from UNIVPM are also regularly recruited by the company. Even if IGU was not directly involved in the W.I.N.D.S project, its managers heard about the Nautes experiment and were interested to understand how to use its technology to improve its own processes.

According to Gialletti, the “Nautes experiment” caught the attention of several key actors related to UNIVPM, but IGU was the first to understand its potential and to start looking for a concrete way to introduce the Nautes’s approach into its own processes.

7.4.6 The First Customer

In October 2001, IGU put the first-ever order to Nautes: it asked for the development of “LC”, a new e-learning platform that would be used to train its customers (installers and architects) all over the world. What made it possible for a totally new company like Nautes, without a prototype or a pilot installation of its product, even to be considered as a reliable supplier by a big company like IGU?

According to Professor D.I., one of the promoters of UNIVPM’s first spin-offs regulation, the exchange of information between UNIVPM and IGU was a preliminary condition that made the latter interested in Nautes as a potential supplier. Moreover, the W.I.N.D.S. project was a catalyst of relationships for at least two main reasons. Firstly, thanks to this experience, IGU had the chance to get to know Nautes’ scientific background and genesis. Secondly, Professor D.G. (fictitious name), the formal supervisor of the W.I.N.D.S. project, endorsed the Nautes team based on his direct work experience with its members. Moreover, the role played by Professor D.G. was essential in putting Nautes and IGU in contact with each other: as stated by Professor D.I., “the role of D.G. was essential to guarantee the trust needed to obtain the first order by a worldwide player on the international market of lighting design” (D.I., Department of Information Engineering, UNIVPM).

The business relationship between IGU and Nautes turned out to be fruitful from the start: IGU found a reliable IT partner that was able to provide knowledge management solutions, while Nautes got an excellent chance to commercialize its technology despite having limited experience in sales. While Nautes handled some technical issues related to the complexity of the project, the interaction developed over time: the main effect of this increasing complexity was reflected in the negotiation of the price of the solution provided by Nautes. Since the technology was offered to IGU at a very convenient price, no particular problems arose in this regard for the first few years. Gialletti was very willing to establish the business relationship with IGU, mostly with the goal of learning as much as possible from it.

In 2002, IGU’s commitment to its business relationship with Nautes grew stronger in response to the high quality of technology offered, as well as the strong commitment demonstrated from Nautes’s side. Consequently, IGU decided to buy a stake corresponding to 30 % of Nautes’s capital. Thanks to this operation, IGU also acquired a place on the board of Nautes.

For six years, between 2002 and 2008, IGU was Nautes’s main (indeed, dominant) customer. With a total turnover of nearly €5 million over the years, IGU regularly accounted for about 80 % of Nautes’s turnover. Minor deals were struck with other clients, but IGU always influenced these new business relationships: moreover, these “minor” clients were often business partners of IGU or located in the Ancona area.

The importance of the business relationship with IGU has been well pointed out by Gialletti: “The business relationship with IGU was essential for our development. Its international and complex profile encouraged the continuous improvement of our software and gave us the chance to learn from the best players, not only regarding products but also managerial practices” (Marco Gialletti, Nautes’s CEO).

IGU had provided Nautes with commercial opportunities and was fully engaged in supporting its R&D activities. It was clear that IGU considered Nautes its own “spin-off” more than a university spin-off.

7.4.7 Conflict with IGU

Over time, Gialletti and his colleagues realized that the business relationship with IGU could potentially lead to problems. Although IGU provided most of the turnover, it often constrained Nautes with respect to the development of new customer relationships: it believed that the strength of Nautes’ solutions mainly derived from the definition of the requirements made by the staff of IGU. Additionally, IGU considered Nautes an internal IT department aimed at developing a learning management solution for the company. Nautes was too focused on creating customized features on LC and was not capable of creating general, resalable and scalable products. In 2008, tension between Nautes and IGU emerged when IGU’s representative on Nautes’ board tried to hinder Gialletti’s attempts to develop new customer relationships. While Gialletti was focused on pushing the firm’s technology onto the market by offering it to new potential customers, IGU was not open to sharing it with others.

In 2009, as a result of this tension, IGU sold its shares and exited from Nautes. The company also stopped making purchases from Nautes. Of course, this action caused a major financial problem as Nautes’ turnover was dramatically reduced: in the 2003–2008 period, IGU’s weight on the total turnover had been around 43 %, while in 2009 it was only 20 %, and in 2010 less than 5 %.

In order to avoid a fatal crisis, Nautes had to start looking for new potential customers immediately, as Gialletti described in an interview: “A new high-tech venture, especially when it’s an academic spin-off, is based on big innovation. This kind of company is often mostly involved in the technical details of product development, and it risks neglecting the importance of understanding the deep needs of customers and competitors’ offerings. After IGU’s exit, we had to systematically identify our unique selling proposition, while creating a sustainable business model and reinforcing our [other] business relationships” (Marco Gialletti, Nautes’s CEO).

7.4.8 “Recovering” from IGU: Searching for a New Customer

In 2009, in order to create and develop new customer relationships, the Nautes management team was focused on two main activities. Firstly, it was looking for experienced salesmen who could relate Nautes to new customers and introduce its technology into its processes. Gialletti met a university schoolmate who had resigned from a large consulting company in the Milan area. This person accepted to introduce Nautes to some companies with which he had developed projects in the past: in 2009, Nautes developed and then sold a customized solution for learning management to “Che Banca” (retail bank of the Mediobanca Financial Group). This new customer balanced the losses caused by IGU’s exit and prevented a huge reduction in sales.

Secondly, Nautes engineers started to redesign the software that had originally been developed for IGU. The new product design was “market-driven”, meaning that Nautes, for the first time since its inception, applied a systematic review of potential customers’ needs and competitors’ offerings. Because of this analysis, a completely redesigned software interface was introduced, and the entire software suite was made accessible online through browsers or mobile devices.

During this phase, UNIVPM played an important role—like at the beginning, when it connected the company to IGU—in facilitating the creation of relationships with new customers. In particular, after IGU’s exit from Nautes, UNIVPM’s management board mentioned Nautes during workshops and conferences as a successful knowledge-transfer experience, which contributed to building a positive reputation for Nautes.

7.4.9 The Further Development of New Customer Relationships

Starting in 2010, Nautes created commercial partnerships with companies that were operating in complementary sectors, such as consultancy or IT firms. Massimo Manzi, the sales manager at Nautes, frames these partners as different “channels” through which Nautes’ technology reaches various customers. Owing to the peculiarity and the characteristics of the firm’s products, third parties like independent agents cannot sell them autonomously. In other words, Nautes is still not in the phase of selling its solutions by delegating the entire commercialization process to a direct or an indirect sales force. However, Nautes has been shifting from the “special project paradigm”—whereby it created a unique, customized solution for each customer, sharing just the same software core with other projects—to the “customized product” paradigm—whereby each customer receives a parameterized version of Nautes’ product, with some lines of specially developed code provided on a case-by-case basis. This paradigm shift is also witnessed by the composition of Nautes’s revenue sources over the years: until 2012, the value of revenues from software licences and customizations had been only 30 % of special projects revenues, while in 2014 it was more than 60 %.

7.5 Discussion

The case of Nautes sheds light on how start ups deal with the complex task of commercializing technologies, especially science-based ones, by building initial key business relationships. Furthermore, this case is useful in defining the concept of commercialization itself, by conceiving it as a process of development of business relationships more than simply as a bridge between technology and the market.

In particular, our discussion addresses how key business relationships affect start ups’ development. We analyse the process through which Nautes commercialized its technology by emphasizing three main aspects: (1) with which particular actor the key business relationship was initiated, considering the characteristics of both the customer and other actors involved; (2) the particular type of support Nautes received from these actors (e.g., mediating, financing, learning effects); and (3) the power and dependency between these organizations and the start up, Nautes, as a potential source of negative effects on the venture’s development. In order to illuminate the development process of this venture, we introduce the metaphor of “imprinting”, which stresses the influence that significant other interaction partners in the surrounding network exert on the activity, resource and actor dimensions (Håkansson & Snehota, 1995) of a new venture (La Rocca & Perna, 2014).

7.5.1 Phase 1: Nautes as a University Spin-Off Imprinted by UNIVPM and IGU

Once Nautes was established in 2001, the company may well have brought together the competences and experience of some academic researchers, but by and large it was very much like a blank slate in terms of activities, resources and identity. The technology and the business idea were also only at an embryonic stage. It was at this very early stage of its life that Nautes received a clear imprint from UNIVPM. This imprinting concerned especially the actor dimension of Nautes, as UNIVPM assigned it a clear identity: that of being its first-ever academic spin-off. In turn, this identity further contributed to creating legitimacy, also in relation to other actors because of the connection with a well-established institution.

However, a first problem for Nautes was to find a suitable customer interested in using its technology. In this phase, Nautes was primarily committed to finding an organization with which to develop a new solution starting from its approach to software design. In the early stages of Nautes’s life, “commercializing” simply meant creating an initial customer relationship that was strong enough to keep the company alive with a stream of revenues sufficient to cover its costs.

A couple of aspects of the actor-level imprinting from UNIVPM became relevant at this point: the W.I.N.D.S. project at UNIVPM was relevant to Nautes for at least two reasons. Firstly, it allowed the founders to be aware of the opportunities of developing a new and innovative solution. Secondly, the project was the spark to make Nautes reliable for established companies like IGU: even after winning the eCapital prize, Nautes did not know how to get its first customer, and it was mainly thanks to its relationship with UNIVPM, as well as the favourable connection to the W.I.N.D.S. project, that the spin-off was able to link up with IGU.

According to all the informants, UNIVPM played a crucial role in supporting Nautes—not so much in financial terms, but in a different form. UNIVPM already had a significant relationship with IGU and acted as a mediator to enable the establishment of the business relationship between the two companies. Since Nautes had never done business with IGU before, UNIVPM clearly had a positive influence over the development of the new venture by providing a suitable commercial opportunity. Such a role in the development of a university spin-off company is similar to the mediating function that incubators play (Bergek & Norrman, 2008, pp. 24–25; Ahmad & Ingle, 2011).

The start of the relationships between Nautes and IGU signalled another type of imprinting for the new venture—this time, more at the level of its resources and activities, all of which were now explicitly oriented and adapted (Håkansson & Snehota, 1995) to fit the customer’s requests. In particular, the initial configuration of Nautes’s business relationships, in which there was only one main customer who, after a year, also became a shareholder, emphasizes the double-edged sword nature of key relationships, which can create overdependence, especially at the very beginning of a new venture. How then did Nautes act and react to the imprinting from IGU?

Clearly, IGU affected Nautes’s development in a positive manner, at least up to a point. Nautes’s survival and growth in the earliest stages of its life have been made possible by the financial contribution of the first deal with IGU. Nautes also learnt how to negotiate with external partners, thanks in large part to its interactions with IGU: it is important to stress here that Nautes was a much smaller firm than IGU, and therefore any occasion for negotiations and discussions offered Nautes important learning opportunities. Finally, this relationship also provided an important opportunity to connect with and then exploit significant resources held by IGU once the relationship was established: for instance, IGU’s managerial competences, processes and needs were exploited by Nautes in order to further develop and test its software solutions. The imprinting by IGU clearly marked Nautes in terms of its new R&D activities as well as financial and technical resources gained thanks to this customer relationship (Håkansson & Snehota, 1995).

However, interacting with such a large and dominant customer also has disadvantages for the further development of the start up. Being the main customer of Nautes, IGU is perceived (at least at the very beginning) as the most promising way for Nautes to commercialize its technology. The commitment of Nautes to this relationship is therefore absolute and complete and, as a result, reduces the bargaining power of Nautes and allows IGU to have a strong influence in product configuration. This business relationship is like a cocoon that allows Nautes to survive during the first stages of its life, but it simultaneously traps Nautes and prevents it from growing freely, thus becoming a crystal cage. The initial advantage of IGU’s imprinting disappears or, better, is transformed into a strong dependence on IGU that soon locks Nautes into the structure of IGU, with its resources and activities all oriented in a single, unilateral way that limits their heterogeneity (Håkansson & Waluszewski, 2002; Penrose, 1959), that is, the possibility of being recombined in new ways with other resources, ideally with other actors in the network (Baraldi et al., 2012).

This is why tensions and conflicts appear over time as the key relationship with IGU develops. When it was no longer a vital opportunity, the relationship with IGU became a clear problem. After the decision to increase its control of the relationship by acquiring Nautes shares, IGU even had the formal power to limit the freedom of Nautes to expand its network horizon (Ford et al., 2011) by finding new customers. Without a doubt, Nautes made business out of the relationship with IGU, but from a certain point on, IGU acted more as a hindrance to the development of Nautes. Without any reaction to the imprinting received from IGU, the tangible risk for Nautes would be to limit its development (Håkansson & Ford, 2002).

In summary, the development of Nautes has been both positively and negatively affected by the key relationship with its first main customer.

7.5.2 Phase 2: Nautes Connects to Others Within the Business Network

When Nautes decided to take measures to leave its first key customer relationship, it had to reorganize its internal resources in order to grow by finding new customers. The imprinting from IGU meant, for instance, that Nautes had not developed any real marketing function. Therefore, first of all, the marketing and sales department gained importance over the technical one. This shift was due to an evolution in the very meaning of commercialization, which the Nautes management teams developed internally thanks to—or even as a reaction to—the business relationship with IGU. Commercialization moved from being viewed as “the process of understanding the needs of a customer and translating them into a bundle of software features” to “the process of relating to a business network”. This shift basically amounted to opening Nautes to the imprinting coming from many more actors than just a dominant one.

Nautes understood the importance of acquiring and connecting with new resources capable of introducing the firm’s technology to other customers. After acquiring additional customers from a former consultant in the Milan area, Nautes started to develop repeatable and scalable patterns to find sales partners with whom to develop new projects (something they called “channels”).

Nautes did not have a stand-alone “product” yet, but rather than being totally dependent on a single special project with only one customer, Nautes started repeating the “special project paradigm” through several new business relationships being developed (the Nautes team labels this approach “customized products”). Nautes is therefore still an IT service company capable of partnering with other companies (namely consultancy firms) that pass its technology on to final customers. In fact, since 2010, only 35 % of Nautes’s whole lead generation has come from the company’s own sales force. The reconfiguration of actors, resources and activities in this phase is totally oriented towards reducing dependence on a single customer and a single “channel”. Thus, the development we observed goes from being imprinted by one or just a few dominant actors to becoming open to the influence of several actors in its network.

7.6 Concluding Remarks

This study adopted the IMP perspective to investigate the impact of key relationships on the development of new ventures, focusing empirically on an Italian university start up that soon after its founding commercialized a knowledge management IT software. This case study explored how the new business venture has been affected by two main business relationships that left clear imprints at the levels of its activity, resource and actor dimensions (Håkansson & Snehota, 1995). For instance, one of these relationships, the one with the customer, ended up exerting a positive effect at the beginning before subsequently blocking the company’s development.

These dynamics make visible what many IMP studies have shown in terms of the “burden of relationships” (Håkansson & Snehota, 2002), especially when new companies are struggling to become more established (La Rocca & Perna, 2014). Our contribution rests in showing that such burdens also hold for newly started companies, and thus for relatively new relationships, rather than long-term, established and hence institutionalized relationships, which are those typically mentioned as burdens for the particular companies (Håkansson & Snehota, 1995, p. 10).

The case suggests that besides the duration of a relationship, the power/dependence imbalance in a relationship between a small new firm and an established large one can also be a source of problems, as it creates a burden at least for the less powerful party. The smaller and younger firm needs not only stability and certainty, which a larger and more established counterpart can offer, but also the freedom to develop and broaden its repertoire of experiences.

On the other hand, the very same “burdening” relationship can also have positive impacts on the small party: as we observed, Nautes learnt several things by interacting with the same larger counterpart, such as how to negotiate and how to exploit its technical knowledge. In some way, despite the tensions and the break caused by the power/dependence imbalance, the very same relationship can also prepare the ground for further developments of the new venture. There is, however, in the background also another relationship, which, although probably not directly involved in daily operations, can be activated when needed, namely the one with the “mother” university, which acts as a bridge to other relationships.

Thus, the relationships with both UNIVPM and IGU have clearly influenced how Nautes has sought and cultivated other new business relationships in order to overcome the crisis with IGU. Therefore, both the internal learning process based on substantive interactions with key partners and the dynamics of single relationships affect and shape the pattern of future business relationships developed by the start up.

To sum up, this case study shows the importance of the key business relationships in “shaping” the next development of new relationships, particularly when the actor has limited resources available and is new to a network. In line with Ford et al. (2011), the understanding of interactive behaviours in one or more business relationships represents an important step in explaining how other business relationships develop.

As for further research avenues, we stress the need to develop a dynamic model focused on understanding how new ventures, such as university spin-offs, balance the effects of the imprinting derived from initial relationships with the independence that seems necessary to let the company embrace “others” within the business network. Our empirical case clearly confirms the relevance of coping with these issues: imprinting and independence can be viewed as two opposite forces that frame new venture development from an interactive point of view.

Notes

- 1.

As the official project’s brief explains, W.I.N.D.S. involves the analysis of a number of students’ design review sessions in regular university classrooms, in order to point out the relationships occurring between the different forms of designers’ cognitive involvement (conceptual, visual, social, emotional, etc.) in design. http://www.dicea-bc.univpm.it/index.php/deisgnstudies/web-based-intelligent-design-tutoring-system-winds

- 2.

References

Aaboen, L., Dubois, A., & Lind, F. (2011). Start-ups starting up—Firms looking for a network. The IMP Journal, 5(1), 42–58.

Ahmad, A. J., & Ingle, S. (2011). Relationships matter: Case study of a university campus incubator. International Journal of Entrepreneurial Behaviour & Research, 17(6), 626–644.

Akrich, M., Callon, M., & Latour, B. (2002). The key to success in innovation PART II: The art of choosing good spokespersons. International Journal of Innovation Management, 6(2), 207–225.

Aldrich, H. (1999). Organizations evolving. Thousand Oaks, CA: Sage Publications.

Alvesson, M., & Sköldberg, K. (2009). Reflexive methodology: New vistas for qualitative research. Thousand Oaks, CA: Sage.

Baraldi, E., Gressetvold, E., & Harrison, D. (2012). Resource interaction in inter-organizational networks: Foundations, comparison, and a research agenda. Journal of Business Research, 65(2), 266–276.

Baraldi, E., & Launberg, A., 2013, The commercialisation of science as an embedding process: The case of PET radiotracers at Uppsala University. Paper presented at the 29th IMP Conference, Atlanta.

Bergek, A., & Norrman, C. (2008). Incubator best practice: A framework. Technovation, 28, 20–28.

Ciabuschi, F., Perna, A., & Snehota, I. (2012). Assembling resources in the formation of a new business. Journal of Business Research, 65(2), 220–229.

Clarysse, B., Wright, M., Lockett, A., Van de Velde, E., & Vohora, A. (2005). Spinning out new ventures: A typology of incubation strategies from European research institutions. Journal of Business Venturing, 20, 183–216.

Dubois, A., & Gadde, L.-E. (2002). Systematic combining: An abductive approach to case research. Journal of Business Research, 55, 553–560.

Ford, D., Gadde, L.-E., Håkansson, H., & Snehota, I. (2003). Managing business relationships (1st ed.). Chichester: Wiley.

Ford, D., Gadde, L.-E., Håkansson, H., & Snehota, I. (2006). The business marketing course. Managing in complex networks (2nd ed.). Chichester: Wiley.

Ford, D., Gadde, L.-E., Håkansson, H., & Snehota, I. (2011). Managing business relationships (3rd ed.). Chichester: John Wiley & Sons.

Gadde, L. E., Hjelmgren, D., & Skarp, F. (2012). Interactive resource development in new business relationships. Journal of Business Research, 65, 210–217.

Gialletti, M. (2015). Report on statistics of Nautes. Company’s internal records.

Grandin, K., Wormbs, N., & Widmalm, S. (Eds.). (2004). The Science-Industry Nexus. History, Policy, Implications, Science History Publications: Sagamore Beach, MA.

Håkansson, H., & Ford, D. (2002). How should company interact in business networks? Journal of Business Research, 55(2), 133–139.

Håkansson, H., & Snehota, I. (Eds.). (1995). Developing relationships in business networks. London: Routledge.

Håkansson, H., & Snehota, I. (2002). The burden of relationships or who’s next? In D. Ford (Ed.), Understanding business markets (pp. 88–94). London: Thompson Learning.

Håkansson, H., & Waluszewski, A. (2002). Managing technological development. IKEA, the environment and technology. London: Routledge.

Håkansson, H., & Waluszewski, A. (Eds.). (2007). Knowledge and innovation in business and industry. The importance of using others. London: Routledge.

IGU. (2015). 2015 Company’s report.

Johnsen, T., & Ford, D. (2007). Customer approaches to product development with suppliers. Industrial Marketing Management, 36(3), 300–308.

Jones, O., & Holt, R. (2008). The creation and evolution of new business ventures: An activity theory perspective. Journal of Small Business and Enterprise Development, 15(1), 51–73.

La Rocca, A., Ford, D., & Snehota, I. (2013). Initial relationship development in new business ventures. Industrial Marketing Management, 42, 1025–1032.

La Rocca, A., & Perna, A. (2014). New venture acquiring position in an existing network. The IMP Journal, 2(8), 64–73.

Mayan, M. J. (2009). Essentials of qualitative inquiry. Walnut Creek, CA: Left Coast Press.

Pavitt, K. (2004). Changing patterns of usefulness of university research. Opportunities and dangers. In Grandin et al. (Eds.), The science-industry nexus. History, policy, implications (pp. 119–131). Sagamore Beach, MA: Science History Publications.

Penrose, E. (1959). The theory of the growth of the firm, Reprint 1995. New York: Oxford University Press.

Shane, S., & Venkataraman, S. (2000). The promise of entrepreneurship as a field of research. Academy of Management Review, 25(1), 217–226.

Snehota, I. (2011). New business formation in business networks. The IMP Journal, 5(1), 1–9.

Stake, R. E. (2005). Qualitative case studies. In N. K. Denzin & Y. S. Lincoln (Eds.), The Sage handbook of qualitative research (pp. 443–466). Thousand Oaks, CA: Sage.

Van de Ven, A., Polley, D., Garud, R., & Venkataraman, S. (1999). The innovation journey. New York: Oxford University Press.

Yin, R. K. (2003). Case study research: Design and methods (3rd ed.). Thousand Oaks, CA: Sage Publications.

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Copyright information

© 2017 The Author(s)

About this chapter

Cite this chapter

Baraldi, E., Perna, A., Fraticelli, F., Gregori, G.L. (2017). 7 The Impact of a Start Up’s Key Business Relationships on the Commercialization of Science: The Case of Nautes. In: Aaboen, L., La Rocca, A., Lind, F., Perna, A., Shih, T. (eds) Starting Up in Business Networks. Palgrave Macmillan, London. https://doi.org/10.1057/978-1-137-52719-6_8

Download citation

DOI: https://doi.org/10.1057/978-1-137-52719-6_8

Published:

Publisher Name: Palgrave Macmillan, London

Print ISBN: 978-1-137-52714-1

Online ISBN: 978-1-137-52719-6

eBook Packages: Business and ManagementBusiness and Management (R0)