Abstract

Over the last 20 years, the global production of dimension stones has grown rapidly. Today, seven countries—China, India, Turkey, Iran, Italy, Brazil, and Spain—account for around two-thirds of the world's output of dimension stones. Each one has annual production levels of nine to over twenty-two million tons. Mining operation in general is one of the most hazardous fields of engineering. A large amount of dimensional stone quarries require a special scheme of risk assessment. Risk Breakdown Structure is one of the major stages of risk assessment. In this paper, a detailed structure of risks of the dimension stone quarrying is formed, and divided into 17 main levels and 128 sublevels. The complexity of identifying different parameters made it requisite to use multi-attribute decision-making methods for prioritizing associated risks. As a case study, the main risks of the Ghasre Dasht marble mine are evaluated using the VIKOR method considering 10 major parameters under a Fuzzy environment. The results showed that the economic, Management, and Schedule risks are the most threatening risks of dimensional stone quarrying.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Introduction

Investment decisions in dimension stone projects are highly susceptible to risks, making effective risk management essential. As the Project Management Institute's (PMI) Guide to the Project Management Body of Knowledge (PMBOK) defines, risk is inherently uncertain, potentially leading to adverse impacts like safety hazards and financial losses1. Additionally, risk encompasses any event or condition, positive or negative, that can affect project goals, including both threats and opportunities2,3.

Therefore, robust risk management practices are crucial for maximizing the impact of positive events while minimizing the likelihood and severity of detrimental occurrences. Following the PMBOK standard, risk management involves six key steps: planning, identification, qualitative analysis, quantitative analysis, response planning, and monitoring4.

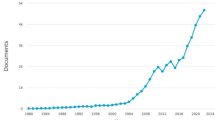

The global production of dimension stone, particularly for building projects, has witnessed significant growth over the past two decades. Architects increasingly leverage the diverse colors, textures, and finishes natural stone offers. Consequently, seven countries—China, India, Turkey, Iran, Italy, Brazil, and Spain—now contribute approximately two-thirds of global dimension stone output, with individual annual production exceeding 9 million and reaching up to 22 million tons. Mining operations, in general, represent some of the most risk-intensive engineering projects throughout both the design and implementation stages, demanding meticulous attention to risk management. The high volume of dimensional stone quarrying necessitates a specific risk analysis approach. Identifying risk factors, understanding their potential impact, and prioritizing them are fundamental steps. Doing so allows for timely decision-making, implementation of appropriate responses to potential risks, and ultimately, the reduction of negative consequences. Notably, various studies have explored risk assessment and management in the context of open-pit and underground mining operations5,6,7,8,9,10,11,12,13,14,15,16,17. Machine learning algorithms have shown promising results in risk assessment modeling e.g.18,19,20,21,22,23,24,25,26,27,28.

In 2011, Careddu and Siotto, by implementing 3-dimensional topographic models, analyzed environmental effects and consequent challenges of these factors such as noise, vibration, fumes, dust, and vehicle traffic on a Marble quarrying in Orosei industrial area29.

Yarahmadi et al.30 selected risks of dimensional quarries are considered for calculating safety risks in this field. Machinery or man falls from bench crest and rock falls were the most influential incidents reported by researchers.

Yari et al.31 presented a comprehensive method for evaluating 19 active mines of the Pyrtak Company in Lorestan province, Iran, considering safety parameters.

The efficiency of dimensional stone quarries was processed by Esmailzadeh et al.32. Based on this research selected factors of gross income, safety, desirability, reduction of environmental impacts, waste and reduction of extracting time are implemented for determining a suitable method to extract the dimensional stone to achieve a more efficiency. As a result, extraction of dimensional stone using diamond wire presented as more efficient method considering the mentioned factors.

Khalilabad et al.33 provided a model to analyze the safety risk of dimension stone mines. In the mentioned study, fault tree analysis under the fuzzy environment was used to analyze hazards related to the wire-cutting machine in a quarry mine in Iran.

Marras and Careddu34 studied the work-related injuries and fatal accidents in the dimension stone mines of the Italian industry from 2012 to 2019. The role of human behavioral factors, the competence of safety measures, and the identification of unambiguous regulations are reported as the most important factors in preventing quarry accidents.

Yari et al.35 determined and ranked the main hazards of decorative stone quarrying by implementing the ‘Preference Ranking Organization Method for Enrichment Evaluation’ (PROMETHEE) technique.

Melodi et al.36 studied the risk management analysis for labor and equipment in quarry mines in three states of Nigeria. In this study, the level of risks and the likelihood of occurrence of potential hazards were identified and analyzed.

Rasti et al.37 investigated research for decreasing financial risk by considering all affecting factors on extraction direction. They recommended determining discontinuities and rock blocks and evaluating the typical geometry of a rock block, counting the shape and size, before mining the benches to maximize mining exploitation efficiency and minimize waste ore production.

The study was presented by Wangela and Shah38 which processed quarrying operations in the Ndarugo area of Kiambu County and concluded that these activities both positive and negative impacts. This study indicates that quarrying companies should consider all environmental, health, and education safety factors to approach sustainable mining.

Esmaeilzadeh et al.39 used the failure modes and effect analysis (FMEA) method for the safety risk assessment of quarry mines. In this research, the main causes of risks in the West Azerbaijan quarry mines of Iran were identified and studied.

A user-friendly decision-making program was developed by Hazrathosseini40 using a combination of the AHP and Folchi methods to select the most appropriate method for the identification and assessment of hazards. The suggested model was evaluated in two decorative quarries.

Mikaeil et al.41 identified the safety and economic hazards of 10 dimensional stone mines in West Azerbaijan province in Iran. Then, the risk severity, probability of occurrence, and probability of risk were assessed by completing a questionnaire. Finally, the risk scores of each risk were determined using the FMEA risk assessment method.

Rahimdel42, evaluated the safety risk of incidents in dimension stone mines in Iran using the fuzzy inference system. The fuzzy analytical hierarchy process is used to identify the importance degree of each incidence and then, the overall risk priority number is calculated based on the fuzzy inference process.

The background of research in the field of the risks of the dimensional stone quarries is summarized in Table 1. As seen, there is extensive research on risk assessment and management in dimension stone quarrying, primarily focusing on safety but also addressing efficiency and environmental sustainability. Different methodologies are employed, with FMEA and fuzzy logic being popular choices. The previous research often employs comprehensive methods that fail to capture the full spectrum of potential risks. Typically, specific risks are addressed through case-by-case analyses, neglecting a holistic approach. Moreover, most studies rely solely on "consequence" and "probability" as key risk assessment factors, leading to concerns about the reliability of these methods17,43. A critical limitation is the equal weighting given to risks with low probability but high consequence and those with high probability but low consequence44.

A grading system for water inrush risk is developed based on the amount of simultaneous anomalous data instances found inside a borehole group45. A study conducted by Xiao et al.46provides a theoretical foundation for policymakers and engineers to develop hot dry rock resources utilizing closed-loop geothermal systems. Guo et al.47 developed mathematical model to provide theoretical direction for the investigation of stress wave energy transformation and fracture propagation during rock blasting and mineral mining. The influence of cyclic weak disturbance on the stress relaxation of rock under different confining pressures was studied by Yu et al.48. For effective risk prioritization and ranking, the multi-attribute decision-making (MADM) method based on expert opinions offers a valuable approach49,50. This method has been successfully implemented in previous studies about risk assessment for example in the tunnel projects, as demonstrated in Sayadi Anari, et al.17. There are many MADM methods; selecting the appropriate methods depend on matching methods with the problems.

This study aims to rank various risks associated with dimensional stone quarries based on their non-commensurable and conflicting nature. Given these characteristics, the VIKOR method emerges as the appropriate choice for this research. For this purpose, in the first stage, all influencing factors of risks are determined considering the published research on this topic and the authors’ expertise in Risk Breakdown Structure (RBS) in Dimensional Stone Quarries in 17 major levels and 128 sublevels. In the next step, the weights of assessment factors are evaluated using Fuzzy-Analytical Hierarchy Processes (Fuzzy-AHP), Finally, all defined risks are prioritized using the Fuzzy-VIKOR method, and the most threatening risks are determined associated with the Ghasre Dasht Mine.

Methods

Risk breakdown structure

Since this definition of Risk Breakdown Structure (RBS) by Hillson51, this structure has been used as an efficient and effective tool for risk management in prominent standards such as PMBOK. The definition of RBS generally is similar to the Work Breakdown Structure (WBS). RBS is a hierarchy structure of potential risks that can help managers determine further risks of the project. In the sublevel of the risk breakdown structure, more detailed risk factors are presented.

A comprehensive RBS can be useful for the identification of risks of a Project but does not necessarily comprise all risks of every project. Therefore, an appropriate RBS should be prepared for each project according to its specific characteristics. The risks associated with mining projects generally divided into internal and external risks. Internal risks are about storage and mine conditions and external risks are caused by external conditions such as business and market conditions52.

Fuentes classifies risks in the mining industry as follows: geological risks, geotechnical risks, project risks, operational risks, environmental risks, marketing risks, macroeconomic risks, political risks, and transaction risks15. Critical risks of mining industry in Mongolia have been expressed by Chinbat and Takakuwa as follows53: Owners' financial problems, Poor management, Technical problems, Government bureaucracy certificate, Wrong evaluation of reserve, Workers irresponsibility, Rail transport delays, Shortage of experts (skilled worker), Delivery delay of machines, Government inspectors’ pressure, Changes in laws and regulations, Fuel shortage in the country, Unexpected environmental accidents, Insufficient investment, Organization/Human Resistance, Accidents during production operations.

Evaluating attributes for risk assessment

Due to the disadvantages of the conventional method mentioned in the introduction for risk assessment and ranking (using only two parameters: probability and consequence), in this research, after comprehensive analysis, 10 attributes were identified for risk assessment (Table 2).

Multi-attribute decision-making methods

Multi-Attribute Decision Making (MADM) presents a process for decision making such as evaluation, prioritization, and selection of the best available alternatives. In MADM problems, some alternatives should be ranked. Every problem has also several attributes that would specify alternatives and decision-making to define problems accurately54. The attributes in a decision matrix are different from each other in terms of scale and units. Sometimes, attributes have a positive aspect and sometimes, they have negative features. Therefore, proper alternatives will provide the best state of each attribute54.

Fuzzy-AHP method

Decision-making problems have several attributes with different degrees of importance. Therefore, each attribute is given weight, and the preference for each index over other attributes is determined using these “weights”. There are different methods for measuring the weights of the attributes. In this study, considering the broad application, the Fuzzy-AHP method has been used.

Fuzzy-AHP methods are applied in the calculation of attributes with comparative priority. Comparative priority is obtained from taking pairs of comparison matrices while overall priorities are the final rank of alternatives. Here, only the calculation of the weights of the attributes is the main goal of using the AHP method55.

The Fuzzy-AHP technique can be viewed as an advanced analytical method developed from the traditional AHP. The process, depending on this hierarchy, using the method of Chang’s56 analysis, consists of the following steps:

-

Step 1. Break down the complex problem into a hierarchical structure form.

-

Step 2. Form a pair of comparisons of matrices (with n rows and m columns):

$$\left[ {\begin{array}{*{20}c} {\tilde{1}} & {\tilde{a}_{12} } & {\tilde{a}_{13} } & {...} & {\tilde{a}_{1n} } \\ {1/\tilde{a}_{12} } & {\tilde{1}} & {...} & {...} & {...} \\ {1/\tilde{a}_{13} } & {...} & {\tilde{1}} & {...} & {...} \\ {...} & {...} & {...} & {...} & {...} \\ {1/\tilde{a}_{1n} } & {1/\tilde{a}_{2n} } & {...} & {...} & {\tilde{1}} \\ \end{array} } \right]$$(1)where

$$\tilde{a}_{ij} = \left\{ {\begin{array}{*{20}l} 1 \hfill & {i = j} \hfill \\ {\tilde{1},\tilde{3},\tilde{5},\tilde{7},\tilde{9}\;{\text{or}}\;\tilde{1}^{ - 1} ,\tilde{3}^{ - 1} ,\tilde{5}^{ - 1} ,\tilde{7}^{ - 1} ,\tilde{9}^{ - 1} } \hfill & {i \ne j} \hfill \\ \end{array} } \right.$$ -

Step 3. Calculating fuzzy synthetic extent value \(S_{i}\) for rows of pair-wise comparison matrix as follows:

$$S_{i} = \sum\limits_{j = 1}^{m} {M_{{g_{i} }}^{j} \otimes \left[ {\sum\limits_{i = 1}^{n} {\sum\limits_{j = 1}^{m} {M_{{g_{i} }}^{j} } } } \right]}^{ - 1}$$(2)where \(M_{{g_{i} }}^{j}\) are Triangular Fuzzy Numbers (TFNs). To obtain \(\sum\nolimits_{j = 1}^{m} {M_{{g_{i} }}^{j} }\) perform the “fuzzy addition operation” of m extent analysis values for a particular matrix given below:

$$\sum\limits_{j = 1}^{m} {M_{{g_{i} }}^{j} } = \left( {\sum\limits_{j = 1}^{m} {l_{j} } ,\,\sum\limits_{j = 1}^{m} {m_{j} } ,\,\sum\limits_{j = 1}^{m} {u_{j} } } \right)$$(3)where l is the lower limit value, m is the most promising value and u is the upper limit value. To obtain \(\sum\nolimits_{i = 1}^{n} {\sum\nolimits_{j = 1}^{m} {M_{{g_{i} }}^{j} } }\) perform the “fuzzy addition operation” of \(M_{{g_{i} }}^{j}\) (\(j \, = \, 1, \, 2, \ldots , \, m\)) values give as:

$$\sum\limits_{i = 1}^{n} {\sum\limits_{j = 1}^{m} {M_{{g_{i} }}^{j} } } = \left( {\sum\limits_{i = 1}^{n} {l_{i} } ,\,\sum\limits_{i = 1}^{n} {m_{i} } ,\,\sum\limits_{i = 1}^{n} {u_{i} } } \right)$$(4)and then compute the inverse of the vector:

$$\left[ {\sum\limits_{i = 1}^{n} {\sum\limits_{j = 1}^{m} {M_{{g_{i} }}^{j} } } } \right]^{ - 1} = \left( {1/\sum\limits_{i = 1}^{n} {u_{i} } ,\;1/\sum\limits_{i = 1}^{n} {m_{i} } ,\;1/\sum\limits_{i = 1}^{n} {l_{i} } } \right)$$(5) -

Step 4. The degree of possibility of \(M_{2} = \left( {l_{2} ,m_{2} ,u_{2} } \right) \ge \,M_{1} = \left( {l_{1} ,m_{1} ,u_{1} } \right)\) is defined as57 (see Fig. 1):

$$V\left( {M_{2} \ge \,M_{1} } \right) = \left\{ {\begin{array}{*{20}l} 1 \hfill & {if\,m_{2} \ge m_{1} } \hfill \\ 0 \hfill & {if\,l_{1} \ge u_{2} } \hfill \\ {{{\left( {l_{1} - u_{2} } \right)} \mathord{\left/ {\vphantom {{\left( {l_{1} - u_{2} } \right)} {\left( {m_{2} - u_{2} } \right) - \left( {m_{1} - l_{1} } \right)}}} \right. \kern-0pt} {\left( {m_{2} - u_{2} } \right) - \left( {m_{1} - l_{1} } \right)}}} \hfill & {otherwise} \hfill \\ \end{array} } \right.$$(6)The degree of possibility for a convex fuzzy number to be greater than k convex fuzzy numbers \(M_{i}\)(\(i \, = \, 1, \, 2,..., \, k\)) can be defined as follows:

$$\begin{aligned} & V\left( {M \ge \,M_{1} ,M_{2} , \ldots ,M_{k} } \right) = V\left[ {\left( {M \ge \,M_{1} } \right)\;and\,\left( {M \ge \,M_{2} } \right)\;and\,\left( {M \ge \,M_{k} } \right)} \right] = \,\min \;V\left( {M \ge \,M_{i} } \right) \\ & \quad i = 1,2, \ldots ,k \\ \end{aligned}$$(7) -

Step 5. Calculating the weights of attributes in pair-wise comparisons matrix:

$$d^{\prime } \left( {A_{i} } \right) = \min \;V\left( {S_{i} \ge S_{k} } \right),\quad k = 1,2, \ldots ,n,\quad k \ne i$$(8)Then the weight vector is given by:

$$W^{\prime } = \left( {d^{\prime } \left( {A_{1} } \right),d^{\prime } \left( {A_{2} } \right), \ldots ,d^{\prime } \left( {A_{n} } \right)} \right)^{T}$$(9)where \(A_{i} \,(i = 1,2, \ldots ...,n)\) are n attributes.

-

Step 6. Via normalization, the normalized weight vectors are given:

$$W = \left( {d\left( {A_{1} } \right),d\left( {A_{2} } \right), \ldots ,d\left( {A_{n} } \right)} \right)^{T}$$(10)where \(W\) is a non-fuzzy number. To evaluate the risks, experts only select the related linguistic variable, then for calculations, they are converted into the scale including triangular fuzzy numbers developed58 and are specified as given in Table 3.

Table 3 Fuzzy number of linguistic variables.

Fuzzy VIKOR Method

VIKOR is an abbreviation of the Serbian name ‘VlseKriterijumska Optimizacija I Kompromisno Resenje’, which means multi-criteria optimization and compromise solution. This method was developed by Opricovic in late 199859. The VIKOR method which is a multi-conflicting criteria decision-making method concentrates on ranking and selecting the best alternative from a set of alternatives, by finding the compromise solution (closest to the ideal) of a problem. The basic principle of VIKOR is defining the positive-ideal solution and the negative-ideal solution in the first step60. The positive and negative-ideal solutions are respectively the best value and the worst value of alternatives under the measurement criteria. In the end, the alternatives are arranged based on the proximity to the calculated ideal value. Therefore, the VIKOR method is generally known as a multi-attribute decision-making method based on the ideal point technique61.

VIKOR uses the following adopted form of LP-metric aggregate function for compromise ranking of multi-criteria measurement62:

where, \(1 \le P \le \infty\); \(j = 1, \, ... \, ,\,n\), is the number of the attributes; \(i = 1, \, ... \, ,\,m\), respect to alternatives such as \(A_{1} ,\,A_{2} ,...,A_{m}\); \(f_{ij}\) is the evaluated value of the \(jth\) criterion for the alternative \(A_{i}\); \(n\) is the number of criteria.

The measured \(L_{Pi}\) shows the distance between the alternative \(A_{i}\) and the positive-ideal solution. Within the VIKOR method \(L_{1i}\)(as \(S_{i}\) in Eq. 20) and \(L_{\infty i}\)(as \(R_{i}\) in Eq. 21) have been used to formulate the ranking calculation.

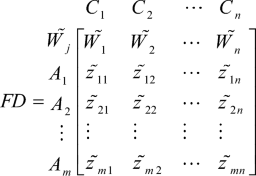

In this paper, the fuzzy-VIKOR method has been used to evaluate the most threatening risk under the group multi-criteria decision-making based on the concept of fuzzy set theory and VIKOR method. Generally, decision-making problems deal with some alternatives which can be ranked, concerning different criteria. Ratings of the alternatives and the weights of each criterion are the two most important factors that can affect the results of decision-making problems. Therefore, this methodology has been used in this research, to calculate the weights of criteria and prioritize the risks. In this paper, the important weights of various criteria and ratings of qualitative criteria are measured as linguistic variables. Linear triangular fuzzy numbers are considered for capturing the vagueness of these linguistic assessments because linguistic assessment can only have the capability to approximate the subjective judgment through a decision maker’s opinion. It should be supposed, that there are k experts with different weights of opinions who are responsible for judging m alternatives (\(A_{i}\),\(i = 1, \, ... \, ,\,m\)), regarding the importance of each of the \(n\) criteria, (\(C_{j}\),\(j = 1, \, ... \, ,\,n\))63.

The compromise ranking algorithm of the fuzzy VIKOR method consists of the following steps64:

-

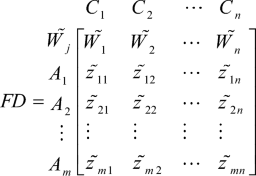

Step 1. Defining appropriate linguistic variables and their positive triangular fuzzy numbers and forming Experts’ opinions-criteria matrix:

$$\begin{gathered} \begin{array}{*{20}l} {} \hfill & {D_{1} } \hfill & {D_{2} } \hfill & \cdots \hfill & {D_{k} } \hfill & {\tilde{W}_{j} } \hfill \\ \end{array} \hfill \\ \begin{array}{*{20}l} {C_{1} } \hfill \\ {C_{2} } \hfill \\ \vdots \hfill \\ {C_{n} } \hfill \\ \end{array} \left[ {\begin{array}{*{20}l} {\tilde{x}_{11} } \hfill & {\tilde{x}_{12} } \hfill & \cdots \hfill & {\tilde{x}_{1k} } \hfill & {\tilde{W}_{1} } \hfill \\ {\tilde{x}_{21} } \hfill & {\tilde{x}_{22} } \hfill & \cdots \hfill & {\tilde{x}_{2k} } \hfill & {\tilde{W}_{2} } \hfill \\ \vdots \hfill & \vdots \hfill & \vdots \hfill & \vdots \hfill & \vdots \hfill \\ {\tilde{x}_{n1} } \hfill & {\tilde{x}_{n2} } \hfill & \cdots \hfill & {\tilde{x}_{nk} } \hfill & {\tilde{W}_{n} } \hfill \\ \end{array} } \right] \hfill \\ \end{gathered}$$(12)where, for example, \(\tilde{x}_{12}\) is a fuzzy number that shows the importance of \(1th\) criterion with respect to \(2th\) expert opinion and \(\tilde{W}_{j}\) is the average fuzzy weighted of each criterion. If \(\omega_{t} \in \left[ {0,1} \right]\) be expert’s opinion weights (where \(\sum\nolimits_{t = 1}^{k} {\omega_{t} } = 1\)), then \(\tilde{W}_{j}\) can be calculated as:

$$\begin{aligned} & \tilde{W}_{j} = \left( {W_{j}^{L} ,W_{j}^{m} ,W_{j}^{u} } \right) \\ & \quad = \left( {\min \left\{ {x_{j1}^{L} ,x_{j2}^{L} , \cdots ,x_{jk}^{L} } \right\},\omega_{1} x_{j1}^{m} + \omega_{2} x_{j2}^{m} + \cdots + \omega_{k} x_{jk}^{m} ,\max \left\{ {x_{j1}^{u} ,x_{j2}^{u} , \ldots ,x_{jk}^{u} } \right\}} \right) \\ \end{aligned}$$(13)Linguistic variables are used to calculate the important weights of criteria and the ratings of the alternatives concerning criteria. In this paper, linguistic variables are defined by a triangular fuzzy number as presented in Table 2.

-

Step 2. Forming a fuzzy alternatives-criteria matrix for each decision maker:

(14)

(14) -

Step 3. Forming a fuzzy decision matrix by pulling all of the experts’ opinions.

(15)

(15)where \(\tilde{z}_{ij}\) is calculated by the following equation:

$$\tilde{z}_{ij} = \left( {z_{j}^{L} ,z_{j}^{m} ,z_{j}^{u} } \right) = \left( {\mathop {\min }\limits_{t = 1,2, \ldots ,k} \tilde{y}^{L}_{ijt} ,\sum\nolimits_{t = 1}^{k} {\omega_{t} \tilde{y}^{m}_{ijt} } ,\;\mathop {\max }\limits_{t = 1,2, \ldots ,k} \tilde{y}^{u}_{ijt} } \right)$$(16) -

Step 4. Defuzzification of the fuzzy decision matrix and fuzzy weight of each criterion:

(17)

(17) -

Step 5. Computing the positive-ideal solutions value (\(f_{j}^{ * }\)) and negative-ideal solutions value (\(f_{j}^{ - }\)) for all criterion ratings:

$$f_{j}^{*} = \left\{ {\begin{array}{*{20}l} {\mathop {\max }\limits_{i = 1,2, \ldots ,m} {\mkern 1mu} f_{ij} ,\;f_{j} \in C_{1} } \hfill \\ {\mathop {\min }\limits_{i = 1,2, \ldots ,m} {\mkern 1mu} f_{ij} ,\;f_{j} \in C_{2} } \hfill \\ \end{array} } \right.$$(18)$$f_{j}^{ - } = \left\{ {\begin{array}{*{20}l} {\mathop {\min }\limits_{i = 1,2, \ldots ,m} f_{ij} ,\;\;f_{j} \in C_{1} } \hfill \\ {\mathop {\max }\limits_{i = 1,2, \ldots ,m} f_{ij} ,\;\;f_{j} \in C_{2} } \hfill \\ \end{array} } \right.$$(19)where, \(j = 1, \, ... \, ,\,n\) and \(C_{1}\) is a benefit type criteria set, \(C_{2}\) is a cost type criteria set.

-

Step 6. Computing the values of \(S_{i}\), \(R_{i}\), (\(i = 1,2, \ldots ,m\)), by using the relations:

$$S_{i} = \sum\limits_{j = 1}^{n} {{{W_{j} \left( {f_{j}^{*} - f_{ij} } \right)} \mathord{\left/ {\vphantom {{W_{j} \left( {f_{j}^{*} - f_{ij} } \right)} {\left( {f_{j}^{*} - f_{j}^{ - } } \right)}}} \right. \kern-0pt} {\left( {f_{j}^{*} - f_{j}^{ - } } \right)}}}$$(20)$$R_{i} = \mathop {\max }\limits_{j = 1,2, \cdots ,n} \left[ {{{W_{j} \left( {f_{j}^{*} - f_{ij} } \right)} \mathord{\left/ {\vphantom {{W_{j} \left( {f_{j}^{*} - f_{ij} } \right)} {\left( {f_{j}^{*} - f_{j}^{ - } } \right)}}} \right. \kern-0pt} {\left( {f_{j}^{*} - f_{j}^{ - } } \right)}}} \right]$$(21)where, \(S_{i}\) is the aggregated value of \(ith\) alternatives with a maximum group utility, and \(R_{i}\) is the aggregated value of \(ith\) alternatives with a minimum individual regret of ‘opponent’. \(W_{j}\) is the average weight of each criterion.

-

Step 7. Computing \(Q_{i}\) by using the following equation:

$$Q_{i} = v\left[ {\left( {S_{i} - S^{*} } \right)/\left( {S^{ - } - S^{*} } \right)} \right] + \left( {1 - v} \right)\left[ {\left( {R_{i} - R^{*} } \right)/\left( {R^{ - } - R^{*} } \right)} \right]$$(22)where, \(S^{*} = \min_{i = 1,2, \ldots ,m} S_{i}\), \(S^{ - } = \max_{i = 1,2, \ldots ,m} S_{i}\), \(R^{*} = \min_{i = 1,2, \ldots ,m} R_{i}\), \(R^{ - } = \max_{i = 1,2, \ldots ,m} R_{i}\) and \(v\) is a weight for the strategy of maximum group utility, and \(v = 0.5\) whereas \(1 - v\) is the weight of individual regret. The compromise can be selected with ‘voting by the majority’ (\(v > 0.5\)), with ‘consensus’ (\(v = 0.5\)), with ‘veto’ (\(v < 0.5\)).

-

Step 8. Ranking of the alternatives by sorting each \(S\), \(R\) and \(Q\) values in ascending order.

-

Step 9. Selecting the best alternative by choosing \(Q\left( {A^{\left( m \right)} } \right)\) as the best compromise solution with the minimum value of \(Q_{i}\) and must have to satisfy the below conditions64:

Condition 1

The alternative \(Q\left( {A^{\left( 1 \right)} } \right)\) has an acceptable benefit; in other words,

where \(A^{\left( 2 \right)}\) is the alternative with the second position in the ranking list by and \(m\) is the number of alternatives.

Condition 2

The alternative \(Q\left( {A^{\left( 1 \right)} } \right)\) is stable within the decision-making process; in other words, it is also best ranked in \(S_{i}\) and \(R_{i}\).

If condition 1 is not satisfied, that means \(Q\left( {A^{\left( m \right)} } \right) - Q\left( {A^{\left( 1 \right)} } \right) \ge {1 \mathord{\left/ {\vphantom {1 {\left( {m - 1} \right)}}} \right. \kern-0pt} {\left( {m - 1} \right)}}\), then alternatives \(A^{\left( 1 \right)} ,A^{\left( 2 \right)} , \cdots ,A^{\left( m \right)}\) all are the same compromise solution and there is no comparative advantage of \(A^{\left( 1 \right)}\) from others. But for the case of maximum value, the corresponding alternative is the compromise (proximity) solution. If condition 2 is not satisfied, the stability in decision-making is deficient while it has \(A^{\left( 1 \right)}\) a comparative advantage. Therefore, \(A^{\left( 1 \right)}\) and \(A^{\left( 2 \right)}\) has the same compromise solution.

Results and discussion

The mentioned studies indicate that the classifications of risk factors in mines have not enough integrity and only some of the risk factors are considered by authors. The large variety of risks that can occur in the mining process, without any systematic procedure for identifying and managing risks, makes quarrying projects more hazardous. RBS presents an effective and targeted tool for the identification and classification of risks17,65. The present study provides a comprehensive structure of risks for Dimensional Stone Quarries in the two general categories of internal risks (11 main categories and 79 sublevels) and external risks (6 main categories and 49 sublevels).

Figures 2 and 3 show Risk Breakdown Structures for internal and external sources of risk in Dimensional stone quarries respectively.

Case study

The Ghasre Dasht Marble Quarry is a building stone quarry with a high production rate. This quarry is located in the northeast of Fars Province, Iran. The quarry primarily extracts marble, characterized by its northwest-southeast orientation and association with the Bangestan Group marls. Figure 4 provide a general overview of the Ghasre Dasht quarry.

This case study presents risk assessment at Ghasre Dasht, leveraging the insights of 18 experts. These 18 experts included 14 PhDs, 3 MSc holders, and 1 BSc graduate person spanning diverse fields of mining engineering and geology. The group of experts possesses an average of 15 years of academic experience as a teacher, and 10 years of industry expertise. Two questionnaires were distributed: The first questionnaire for determining the important weights of 10 attributes using Fuzzy-AHP; and another questionnaire to form a decision matrix to evaluate and rank the risks using the Fuzzy-VIKOR method. The decision matrix has 17 rows and 10 columns: the rows are risks, and the columns are attributes. In this research, in the first stage, the opinions of the 18 experts are collected as linguistic variables for the weight of attributes and risk scores in relation to each attribute. In the next stage, the weights of attributes are calculated using the Fuzzy-AHP method based on experts’ opinions. Fuzzy weights of attributes are presented in Table 4 and fuzziness weights of them are shown in Fig. 5.

After evaluating the weight of attributes and applying all mentioned stages of the Fuzzy-VIKOR method, the ranking process of risks is conducted according to section “Conclusions”. The hierarchical structure of the problem is shown in Fig. 6. The presented results in Table 5 showed that social risks fall as the lowest-threat risks. Located quarry far from the city, with limited community connection and a small workforce, social risks naturally rank lowest. Conversely, economic risk is the most threatening risk for the Ghasre Dasht quarry, and management and Schedule risks are ranked next.

Economic risks, identified in the RBS of external risks of the Ghasre Dasht quarry (Fig. 3), encompass more than ten sublevel risks, including Marketing Conditions, Price fluctuations, Interest rates, Inflation rate, Economic policies of the government, Financing terms, Taxes, tolls and customs duties, and more. These risks can significantly impact various project aspects, such as time, quality, cost, and overall performance.

Economic downturns, inflation, or currency fluctuations can lead to material shortages, resource limitations, and funding delays, potentially slowing down or stalling project activities and extending the timeline. Consequently, the economic risks negatively affect project time (with a relative weight of 16%). Furthermore, economic risks can significantly increase project costs due to inflation, higher material costs, and resource scarcity. Additionally, economic instability can drive up financing costs and interest rates. Economic fluctuations can lead to unpredictable costs, such as currency exchange rate variations or higher insurance premiums. Therefore, economic risks also negatively affect project costs (with a relative weight of 11%). In response to economic pressure, project managers may implement cost-cutting measures that compromise on materials, labor, or quality control. This can lead to reduced functionality, durability, or safety in the final product. Furthermore, project scope might be reduced to stay within budget, potentially sacrificing desired features or functionalities. The economic risks likewise have a negative effect on the project quality (with a relative weight of 10%). Project performance (with a relative weight of 8%) is also impacted by economic risks. Delays, reduced quality, and cost overruns lead to reduced stakeholder satisfaction. Failure to meet deadlines and budgets can damage the project's reputation and credibility, potentially affecting future funding opportunities.

On the other hand, the economic risks for the Ghasre Dasht quarry have high values in terms of probability of occurrence, proximity, and repeatability. The nature of these economic risks in the mentioned mine makes them difficult to manage and predict. Considering these factors, it is understandable why economic risks is ranked as the most threatening risk of the Ghasre Dasht quarry.

A more comprehensive analysis of risk classification results reveals a significant trend: 70% of the top ten most threatening risks plaguing Ghasre Dasht quarry stem from internal sources. While external risks present greater challenges in identification and management, mining experts prioritize controlling internal risks due to their greater influence. Many of these top internal risks are human-made and labor-related, such as management risks, Schedule risks, planning risks, that leading to operational problems causing low productivity, low efficiency, more delays and safety hazards. The results resembles the results presented in regard to the previous studies in the field of risks assessment of dimensional stone quarries as reported in34,35, 38, 39, 41. Considering the importance of personnel's role in these risks, owners of Ghasre Dasht quarry can control and limit the resulting risks by employing an experienced and skilled team for management and technical positions.

Conclusions

The mining process as one of the hazardous fields of engineering requires additional consideration of risk assessment. Risk Breakdown Structure as one of the major stages of risk assessment is formed for dimension stone quarrying and divided into 17 main levels and 128 sublevels. In the next, the main risks of the Ghasre Dasht marble quarry are evaluated using the ‘VlseKriterijumska Optimizacija I Kompromisno Resenje’ (VIKOR) method considering 10 major parameters under a fuzzy environment. Finally, after analyzing 18 experts’ opinions and sorting the main risks, the economic, management, and schedule risks are presented as the most threatening risks of dimensional stone quarrying.

It should be noted that this research focuses on the initial steps of risk management, specifically the identification and qualitative analysis of risks associated with dimensional stone quarries, to uncover the most threatening risks. The next stages of the research will involve the quantitative analysis, management, and control of consequences, as well as the monitoring of risks associated with dimensional stone quarries. Additionally, the authors are currently developing the same procedure for identification, qualitative analysis, and ranking of risks of other types of mines, including coal mines, open-cast metallic mines, underground mines, and more.

Data availability

The datasets used and/or analyzed during the current study available from the corresponding author on reasonable request.

References

Guide, A. in Project Management Institute (2001).

Pinto, J. K. & Ireland, L. Project Management Handbook. (Jossey-Bass Publishers, 1998).

Dai, Z., Li, X. & Lan, B. Three-dimensional modeling of tsunami waves triggered by submarine landslides based on the smoothed particle hydrodynamics method. J. Mar. Sci. Eng. 11, 2015 (2023).

Institute, P. M. (Project Management Institute, 2008).

Steffen, O. Planning of open pit mines on a risk basis. J South Afr Inst Min Metall 97, 47–56 (1997).

Joy, J. Occupational safety risk management in Australian mining. J. Occup. Med. 54, 311–315 (2004).

Arends, G. et al. Risk budget management in progressing underground works: International Society for Trenchless Technology (ISTT) and International Tunnelling Association (ITA) Joint Working Group Report. Tunn. Undergr. Space Technol. 19, 29–33 (2004).

Duzgun, H. & Einstein, H. Assessment and management of roof fall risks in underground coal mines. Saf. Sci. 42, 23–41 (2004).

Heuberger, R. Risk analysis in the mining industry. J. South. Afr. Inst. Min. Metall. 105, 75–80 (2005).

Soons, C., Bosch, J., Arends, G. & van Gelder, P. Framework of a quantitative risk analysis for the fire safety in metro systems. Tunn. Undergr. Space Technol. 21, 281–281 (2006).

Reilly, J. & Brown, J. Management and control of cost and risk for tunneling and infrastructure projects. Tunn Undergr Space Technol. 19, 330 (2004).

Reilly, J. & Parker, H. in AITES-ITA World Tunnel Congress, Prague Vol. 1 679–684 (2007).

Evans, R., Brereton, D. & Joy, J. Risk assessment as a tool to explore sustainable development issues: lessons from the Australian coal industry. Int. J. Risk Assess. Manage. 7, 607–619 (2007).

Wang, L.-G., Miao, X.-X., Dong, X. & Wu, Y. Application of quantification theory in risk assessment of mine flooding. J. China Univ. Min. Technol. 18, 38–41 (2008).

Fuentes, J. E., George, T. & Whittaker, J. (Marzo, 2008).

Dehghani, H. & Ataee-pour, M. Determination of the effect of operating cost uncertainty on mining project evaluation. Resour. Policy 37, 109–117 (2012).

Sayadi Anari, A. R., Monjezi, M., Heidari, M. & Vahidi, M. Economic evaluation and risk analysis of sungun copper mine. IRJME (2007).

Ahmad, M. et al. Application of machine learning algorithms for the evaluation of seismic soil liquefaction potential. Front. Struct. Civil Eng. 15, 490–505 (2021).

Ahmad, M. et al. Prediction of liquefaction-induced lateral displacements using Gaussian process regression. Appl. Sci. 12, 1977 (2022).

Ahmad, F. et al. Prediction of slope stability using tree augmented Naïve–Bayes classifier: Modeling and performance evaluation. Math. Biosci. Eng 19, 4526–4546 (2022).

Ahmad, F., Tang, X., Hu, J., Ahmad, M., Gordan, B. Improved prediction of slope stability under static and dynamic conditions using tree-based models. 1, 3 (2023).

Ahmad, F. et al. Stability risk assessment of slopes using logistic model tree based on updated case histories. 20, 21229–21245 (2023).

Ahmad, M. et al. Unconfined compressive strength prediction of stabilized expansive clay soil using machine learning techniques. 1–15 (2023).

Barkhordari, M. S., Barkhordari, M. M., Armaghani, D. J., Mohamad, E. T. & Gordan, B. Straightforward slope stability prediction under seismic conditions using machine learning algorithms. (2023).

Asteris, P. G. et al. Slope stability classification under seismic conditions using several tree-based intelligent techniques. Appl. Sci. 12, 1753 (2022).

Li, D., Liu, Z., Armaghani, D. J., Xiao, P. & Zhou, J. J. M. Novel ensemble tree solution for rockburst prediction using deep forest. Mathematics 10, 787 (2022).

Armaghani, D. J., Hajihassani, M., Mohamad, E. T., Marto, A. & Noorani, S. A. Blasting-induced flyrock and ground vibration prediction through an expert artificial neural network based on particle swarm optimization. Arab. J. Geosci. 7, 5383–5396 (2014).

Armaghani, D. J. et al. Development of hybrid intelligent models for predicting TBM penetration rate in hard rock condition. Tunn. Undergr. Space Technol. 63, 29–43 (2017).

Careddu, N. & Siotto, G. Promoting ecological sustainable planning for natural stone quarrying: The case of the Orosei Marble Producing Area in Eastern Sardinia. Resour. Policy 36, 304–314 (2011).

Yarahmadi, R., Bagherpour, R. & Khademian, A. Safety risk assessment of Iran’s dimension stone quarries (exploited by diamond wire cutting method). Saf. Sci. 63, 146–150 (2014).

Yari, M., Bagherpour, R. & Almasi, N. An approach to the evaluation and classification of dimensional stone quarries with an emphasis on safety parameters. Rud.-Geol.-Naftni Zb. 31, 15–26 (2016).

Esmailzadeh, A., Mikaeil, R., Sadegheslam, G., Aryafar, A. & Hosseinzadeh Gharehgheshlagh, H. Selection of an appropriate method to extract the dimensional stones using FDAHP and TOPSIS techniques. J. Soft Comput. Civ. Eng. 2, 101–116 (2018).

Nakhaei Khalilabad, Z., Khalo Kakaie, R. & Basirnezhad, M. Application of fuzzy fault tree analysis on risk assessment of wire cutting machine in Kowsar stone mines of Isfahan. J. Min. Eng. 13, 43–53 (2018).

Marras, G. & Careddu, N. Overview: Health and Safety in the Italian dimension stone quarrying industry. Transportation 2, 0–08 (2018).

Yari, M., Bagherpour, R., Khoshouei, M. & Pedram, H. Investigating a comprehensive model for evaluating occupational and environmental risks of dimensional stone mining. Rudarsko-geološko-naftni zbornik 35 (2020).

Melodi, M. M., Adeyemo, A. & Oluwafemi, V. I. Risk management assessment of production in granite stone: A case study of quarries in Ondo, Ogun and Oyo States, Nigeria. ABUAD J. Eng. Res. Dev. 3, 1–7 (2020).

Rasti, A., Ebrahimi, N., Tabaei, M. & Adarmanabadi, H. R. Maximize mining exploitation efficiency of the quarry: A case study. Rud.-Geol.-Naftni Zb. 36 (2021).

Wangela, S. & Shah, P. Environmental effects of dimension stone quarrying activities in Ndarugo area of Kiambu county, Kenya. IJSSME 5 (2021).

Esmaeilzadeh, A. et al. Risk assessment in quarries using failure modes and effects analysis method (case study: West-Azerbaijan Mines). J. Min. Environ. 13, 715–725 (2022).

Hazrathosseini, A. Selection of the most compatible safety risk analysis technique with the nature, requirements and resources of mining projects using an integrated Folchi-AHP method. Rudarsko-geološko-naftni zbornik 37 (2022).

Mikaeil, R., Soltani, B., Alipour, A. & Jafarpour, A. Evaluating of safety and economic challenges in dimensional stone quarries of Western-Azerbaijan Province using FMEA method. J. Eng. Geol 14 (2022).

Rahimdel, M. Fuzzy approach for the safety risk assessment in dimension stone mining. Earth Sci. Res. J. 27, 37–45 (2023).

Chapman, C. & Ward, S. Project Risk Management: Processes, Techniques And insights. (John Wiley, 1996).

Pipattanapiwong, J. Development of Multi-party Risk and Uncertainty Management Process for an Infrastructure Project, Kochi University (2004).

Yin, H. et al. Predicting mine water inrush accidents based on water level anomalies of borehole groups using long short-term memory and isolation forest. J. Hydrol. 616, 128813 (2023).

Xiao, D. et al. Model for economic evaluation of closed-loop geothermal systems based on net present value. Appl. Therm. Eng. 231, 121008 (2023).

Guo, X., Ding, C., Wei, P. & Yang, R. Theoretical analysis of the interaction between blasting stress wave and linear interface crack under high in-situ stress in deep rock mass. Int. J. Rock Mech. Min. Sci. 176, 105723 (2024).

Yu, J. et al. Stress relaxation behaviour of marble under cyclic weak disturbance and confining pressures. Measurement 182, 109777 (2021).

Shirland, L. E., Jesse, R. R., Thompson, R. L. & Iacovou, C. L. Determining attribute weights using mathematical programming. Omega 31, 423–437 (2003).

Pomerol, J.-C. & Barba-Romero, S. Multicriterion Decision in Management: Principles and Practice. Vol. 25 (Springer, 2000).

Iranmanesh, H., Jalili, M. & Pirmoradi, Z. in International Conference on Industrial Engineering and Engineering Management 999–1003 (IEEE, 2007).

Hillson, D. Using a risk breakdown structure in project management. J Facs Manag 2, 85–97 (2003).

Chinbat, U. & Takakuwa, S. in Simulation Conference (WSC), 2612-2623 (IEEE, USA, TX, Austin, 2009).

Hwang, C. L. & Yoon, K. Multiple Attribute Decision Making: Methods and Applications: a State-of-the-Art Survey. Vol. 13 (Springer, 1981).

Saaty, T. L. & Vargas, L. G. Models, Methods, Concepts & Applications of the Analytic Hierarchy Process. Vol. 34 (Springer, 2001).

Özdağoğlu, A. & Özdağoğlu, G. Comparison of AHP and fuzzy AHP for the multi-criteria decision making processes with linguistic evaluations. Istanb Ticaret Üniversitesi Fen derg 6, 65–85 (2007).

Zhu, K.-J., Jing, Y. & Chang, D.-Y. A discussion on extent analysis method and applications of fuzzy AHP. Eur J Oper Res 116, 450–456 (1999).

Chang, D. Y. Applications of the extent analysis method on fuzzy AHP. Eur. J. Oper. Res. 95(3), 649–655 (1996).

Opricovic, S. & Tzeng, G.-H. Compromise solution by MCDM methods: A comparative analysis of VIKOR and TOPSIS. Eur J Oper Res 156, 445–455 (2004).

Wu, M. & Liu, Z. The supplier selection application based on two methods: VIKOR algorithm with entropy method and Fuzzy TOPSIS with vague sets method. Int. J. Manag. Sci. Eng. Manag. 6, 109–115 (2011).

Opricovic, S. & Tzeng, G.-H. Extended VIKOR method in comparison with outranking methods. Eur J Oper Res 178, 514–529 (2007).

Yu, P.-L. A class of solutions for group decision problems. Manag. Sci. 19, 936–946 (1973).

Bashiri, M. & Badri, H. A group decision making procedure for fuzzy interactive linear assignment programming. Expert Syst. Appl. 38, 5561–5568 (2011).

Park, J. H., Cho, H. J. & Kwun, Y. C. Extension of the VIKOR method for group decision making with interval-valued intuitionistic fuzzy information. Fuzzy Optim. Dec. Making 10, 233–253 (2011).

MacDermott, R. E., Mikulak, R. J. & Beauregard, M. R. The Basics of FMEA. (Productivity Press, 1996).

Acknowledgements

The authors are thankful to the Deanship of Graduate Studies and Scientific Research at Najran University for funding this work under the Growth Funding Program grant code (NU/GP/SERC/13/34-1).

Funding

This work is funded and supported by the Deanship of Graduate Studies and Scientific Research at Najran University under the Growth Funding Program grant code (NU/GP/SERC/13/34-1). Furthermore, the open access funding provided by Luleå University of Technology Sweden.

Author information

Authors and Affiliations

Contributions

Mojtaba Yari: Conceptualization, Methodology, Software, Validation, Writing the original draft, Writing, editing and review. Saeed Jamali: Data curation, Writing the original draft, Analysis, editing and review. Gamil M. S. Abdullah, Mahmood Ahmad, Muhammad Usman Badshah, and Taoufik Najeh: Investigation, Analysis, Validation, Writing, editing and review.

Corresponding authors

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Yari, M., Jamali, S., Abdullah, G.M.S. et al. Development a risk assessment method for dimensional stone quarries. Sci Rep 14, 21582 (2024). https://doi.org/10.1038/s41598-024-64276-1

Received:

Accepted:

Published:

DOI: https://doi.org/10.1038/s41598-024-64276-1

- Springer Nature Limited