Abstract

Based on the ARDL and error correction modelling, we investigate the impacts of financial risk factors on Saudi government bond market over the period 1990–2020. The results indicate that foreign debt stability, debt service stability, and international liquidity stability negatively affected public bond market capitalization (PBMC) in the short run. However, in the long run international liquidity stability does not appear to play a major role in the development of Saudi public bond market, while foreign debt stability constitutes an important factor encouraging government to issue bonds. Moreover, current account and exchange rate stability is positively correlated to PBMC in the long run, highlighting that stable current account and less volatile exchange rates are generally associated with larger local-currency bond markets. Based on these results, the study suggests that multiplying efforts toward new policies in managing financial risk aspects of bonds, mainly those related to international liquidity and debt service, are likely to enhance financial stability, thereby contributing to a greater and deeper domestic bond market.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Although the growth of local currency bond markets (LCBMs) in many developed and developing (emerging) economies in the last years, considerable potential and serious interest exist to further develop not only domestic but also regional bond markets. This interest was motivated mainly by the recurrent economic crises, due to the overreliance on the banking system. Given the varying needs of each country, there is no standard “recipe” for implementing and developing a LCBM, but this requires multiple and interdependent policy measures. Macroeconomic and financial stability need to be rigorously considered along the way (Burger and Warnock 2006; Bank for International Settlements 2007; Jeanneau and Tovar 2008; Park and Shin 2023).

Financial stability has become an increasingly important objective in economic policymaking. It is paramount for economic growth, as most transactions in the real economy are made through the financial system. Thus, many central banks have a clear order to promote financial stability. Since the occurrence of the 1997–1998 Asian financial crisis, the importance of financial stability as one of the determinants of growth quality has been stressed. Financial instability therefore leads to economic uncertainty, increases the cost of capital and can have a negative impact on the long-term investments and growth (Carbó-Valverde and Sánchez 2013).

Besides, as shown by Herring and Chatusripitak (2000), in the absence of corporate bond markets (CBMs), a significant share of corporate debt financing would come from the banking system. However, by providing credits to companies, banking institutions face considerable risk due to maturity disparity between short-run liquid assets (deposits) and relatively illiquid long-run credits (loans). Credit risk is the possibility of a loss resulting from a borrower's failure to repay a loan or meet contractual obligations. Improper credit risk management reduces the bank profitability, affects the quality of its assets, and increase loan losses and non-performing loan which may eventually lead to financial distress. LCBMs can thus promote financial stability while contributing to more diversified financial systems.

The 2008 profound crisis has renewed concerns about financial stability. The Lehman Brothers bankruptcy (September 15, 2008) marks a major turning point in the crisis, after which the tensions in financial markets have reached their peak. It has indeed triggered a deep crisis of confidence in financial institutions' solvency and a general mistrust climate on all financial markets, characterized by a sharp increase in volatility, high-risk aversion, and blocking on monetary markets. Thus, in this context, we emphasize the presence of a strong investor preference for government bonds. Risk premiums have reached high records, stock prices have plunged and volatility has increased in all segments, reflecting extreme stress in financial markets. Government bond yields fell, while increasingly, fears of recession and the search for jobs have prevailed over the anticipation of widening budget deficits (Bank for International Settlements 2007).

During the same financial crisis, CBMs are regarded as providing alternative financing to Asian firms when banking systems do not fully play their financing role and compensate for the decline in lending from European and US financial institutions. CBMs may be a substitute for bank lending making the financial system more resistant to crises. The spare tireFootnote 1 role played by CBMs was one of the main motives of various government initiatives to boost LCBMs after the Asian financial crisis (Bank for International Settlements 2016).

LCBMs can promote financial stability in emerging Asian economies by helping to mitigate the maturity and currency mismatchesFootnote 2 widely viewed as the main sources of financial vulnerabilities (Eichengreen and Hausman 1999; Eichengreen et al. 2006). Moreover, they help generating market-determined interest rates that reflect the opportunity costs of funds at different maturities which can enhance economic efficiency (Bank for International Settlements 2007). In economies with underdeveloped LCBMs, long-term interest rates may not be competitively determined which may not reflect the true cost of funds. In this case, banks will find it hard to price long-term lending, and borrowers will lack a market reference in judging borrowing costs. In many cases, long-term debt contracts denominated in the local currency may simply not exist.

The absence of such markets can lead borrowers to take risky financing decisions maybe creating balance sheet vulnerabilities and thereby increasing the risk of default. For instance, issuing foreign currency debt to fund investments that yield local currency earnings leads to currency mismatches: exchange rate changes can therefore have significant effects on the balance sheet and the debt payments of the borrower, often compromising creditworthiness. That is, in other words, currency mismatch occurs when financial liabilities of a country are denominated in foreign currencies, but its financial assets are in domestic currency. In this case, the depreciation of the domestic currency damages the country’s balance sheet, thereby destabilizing the financial system and the economy. Alternatively, using short-term local currency instruments to fund long-term projects entails interest rate and refinancing risks. Better still, the inflow of foreign capital into exclusively short-term paper threatens monetary regulation and, thereby the financial system’s stability. As for the maturity mismatch, it happens when the maturity of financial liabilities is shorter than that of assets. In such a case, the probability of crisis occurrence further increases. The maturity and currency mismatches were the most influencing and contributing factors behind the 1997–1998 overwhelming Asian financial crisis.

In the absence of long-term bond markets macroeconomic policy instruments are more and more limited. So, without extensive LCBMs, countries lack a non-inflationary domestic source of money for the public sector, thereby limiting monetary financing. Active and resilient LCBMs help to support effective monetary policy and thereby providing important information for policymakers. By delivering risk-free benchmark rates, they serve as the cornerstone of well-developed domestic financial markets, which become more stable and less risky sources of funding, promoting financial stability.

Finally, a growing body of evidence shows that more developed LCBMs bring a kind of discipline to both banking and financial systems (Flannery and Sorescu 1996; Morgan and Stiroh 2000; Manganelli and Wolswijk 2007; Han et al. 2016; Elyasiani and Keegan 2017; Anwar and Suhendra 2020; etc.). Flannery and Sorescu (1996) supported the idea that, despite their disciplinary role for the banking system, the debt markets, in particular bond debt, do not entirely replace the government in supervising banking risks. Moreover, Gropp et al. (2002) empirically investigated the use of bond market indicators compared to stock market ones, as detectors of banking fragility. In a nutshell, “encouraging the development of LCBMs would be one way of reducing the global financial system’s instability” (Warnock 2009). More sizeable LCBMs should help mitigate important sources of vulnerabilities and risks by reducing both systemic instability and risks concentration in the banking sector improving thereby the efficiency and the diversification of financial intermediation (Bank for International Settlements 2007). Despite the importance of the arguments in favour of the nexus between developed bond markets and financial stability, it is not clear how financial risks impede the development of LCBMs, and what are the main compounds likely to be the more influent.

This question is an interesting one for at least three reasons. First, the existence of many types of risks generally associated with both government and corporate bonds (market risk, credit risk, interest rate risk, inflation risk, etc.). Second, the lack of consistent empirical validations of causal relationships between bond markets and financial risks. Last and not least, the close attention paid by policymakers to both financial risk management and bond market development strategies in developed, developing and emerging countries mainly in post-crisis Asia (Asia–Pacific Economic Cooperation 1999; ADB Institute 2001; Asian Policy Forum 2001; Fabella and Madhur 2003; Eichengreen et al. 2008; Park and Shin 2023).

Even better, the question about the contribution of viable and deep bond markets to promote financial stability has been raised several times, but the question of how financial risk measures affect bond markets has rarely been asked. In fact, Aronovich (1999) and Nhlapho and Muzindutsi (2020) have the merit to explore the impacts the country risk (premium) likely has on asset returns as important issue for international investors looking for diversification opportunities particularly in emerging and developing countries. Also, Muzindutsi and Obalade (2020) support the idea that country risk can significantly impact investment flow within a country. LCBMs are particularly vulnerable to country risk shocks since these risks affect lending rates and government borrowing countries.

Besides, the main object of this paper is to fill this gap in the existing literature. It aims to clarify the potential effect that financial risk could have on bond markets. By specifying financial risk factors as presented by the ICRG methodology, the central question consists empirically at testing the factors likely to contribute to (or to handicap) the development of the Saudi government bond market over the period 1990–2020. We assume consequently that financial risk factors impact public bond market capitalization in Saudi Arabia.

The remainder of this paper proceeds as follows. Sect. "Literature review" presents the related literature review. Sect. "Data and methodology" considers the data and the empirical methodology. Sect. "Results and discussion" discusses the main findings. Finally, Sect. "Conclusion" offers some concluding remarks.

Literature review

It should be noted that the empirical studies investigating the determinants of BMD are limited in scope. They either emphasized the importance of macroeconomic, financial and institutional factors driving BMD, or focused more on the contribution of well-functioning bond markets in promoting macroeconomic and financial stability (Park and Shenoy 2002; Korajczyk and Levy 2003; Eichengreen and Luengnaruemitchai 2004; Bondt 2005; Burger and Warnock 2007; Eichengreen et al. 2008; Boukhatem 2012; Bhattacharyay 2013; Mu et al. 2013; Boukhatem et al. 2021; Prakash and Sethi 2021).

This study extends the existing research and considers financial risk (instability) factors that may influence the development of bond markets. Accurately, we present in this section the main studies on the relationship between financial stability and government BMD. Although not exhaustive, this literature review is still representative.

The study of Burger and Warnock (2006) is considered among the first ones to address the factors associated with 49 LCBMs. The main results show that strong creditor rights and stable inflation are positively associated with developed LCBMs, letting the countries relying less on foreign currency-denominated bonds. Moreover, according to the authors emerging economies are not basically dependent on foreign currency debt. Slightly, more strengthened institutions and more performant policies may develop LCBMs, reduce currency mismatch, and reduce the probability of crises outbreak.

Jeanneau and Tovar (2008) show that LCBMs have made considerable development in Latin American countries in order to improve the efficiency of financial intermediation, reduce the concentration of risks in the banking sector, and finance fiscal deficits in a non-inflationary manner. Moreover, more developed LCBMs should help mitigate important risks and sources of vulnerabilities, by reducing systemic instability related to maturity and currency mismatches. Empirical evidence shows positive links between the development of BMs and financial stability in emerging market economies.

Burger et al. (2009) emphasized that the development of LCBMs has considerably participated in ameliorating the 1990s emerging market crises and the 2008 financial crisis. Also, they showed that the surge in the development of emerging LCBM has substantially reduced currency mismatches.

Besides, the paper of Boukhatem (2012) deals with the question of knowing if countries with bank-based financial systems face more expensive crises than those with broad and more developed bond markets. The results on a panel of emerging countries show that bank-based financial systems are associated with crises slightly more expensive, whereas the relationship between bond markets and crises’ costs is fragile. Moreover, the economies where bond markets play important roles in financing investment are associated with higher economic growth, and this, independently of the presence or not of crises.

Hmida and Brahim (2016) empirically investigated the links between BMD and financial stability on a panel of nine Asian countries over the period 1997–2009. Specific aspects of BMD and financial stability indicators are covered. Capital adequacy, asset quality and profitability are the main indicators of financial stability used in the empirical tests. The main findings confirm the dynamic relationship between bond markets and financial stability, thereby revealing the significant role that domestic bond markets play in reducing financial vulnerability of the region.

Kowalewski and Pisany (2019), investigated the development of CBMs in ten Asian countries over the period 1995–2014. The main results show that institutional and macroeconomic factors are significantly associated with CBMs depth. Thus, domestic credit and creditor rights, seem to be positively associated with the size of CBMs. Moreover, the results indicate that CBMs have contributed to the alleviation of the 2008 global financial crisis costs in Asian countries.

Using a variety of GARCH models over the period 2006:07–2019:12, the empirical study of Trinh et al. (2020) aims to identify the fiscal, financial and macroeconomic determinants of government bond yields volatility in Vietnam. The main findings show the existence of significant relationships between a set macroeconomic factors and bond risk. Indeed, basic interest rate, foreign interest rate, world oil return, stock return, public debt, fiscal deficit, and current account balance seem to be the main determinants of bond yields volatility, while no relationship has been detected between inflation rate and bond risk.

Besides, the study of Boukhatem (2021) empirically determine the factors related to the development of LCBM in Saudi Arabia over the period 1990–2019. Using ARDL modelling, the results reveal long-run cointegrating relationships between LCBM capitalization and macroeconomic, institutional, and financial factors. However, financial factors seem to matter more in developing LCBM in the short run.

Park et al. (2021) empirically tested the stabilizing effect of LCBMs in emerging countries by analyzing and comparing their financial vulnerability during two episodes of financial stress—the global financial crisis and taper tantrum. The main findings show a negative relationship between the growth of LCBMs and both the depreciation of exchange rates and bank loans, thereby indicating a stabilizing effect of both LCBMs and banking credits. However, no evidence has been found between stock market development and financial stability.

Aman et al. (2023) used panel data analysis to investigate financial and macroeconomic determinants of bond market development (BMD). The results show that financial system and several macroeconomic factors positively and significantly affect BMD. However, the stage of economic development is negatively related to BM capitalization. Policymakers need to improve financial system efficiency and macroeconomic fundamentals to provide reasonable support to the development of BMs.

Finally, Park and Shin (2023) investigated the relationship between the uncovered interest parity (UIP) and LCBMs. They find that deviations in UIP decrease as LCBMs develop. Furthermore, with more developed emerging LCBMs, capital flows respond more sensitively to the UIP premium. These results do not inevitably imply that emerging economies with more developed LCBMs are less vulnerable to large depreciations of the local currency. The authors also find strong evidence of the so-called original sin redux hypothesis, in both emerging and advanced economies.

Another stand of literature focuses on the effects the country risk factors may have on LCBMs. Aronovich (1999) investigates the determinants of the country risk premium behavior for Argentina, Brazil and Mexico over the period spanning from June 1997 to September 1998. The author shows that bond market structure is considered among the most important factors determining the level of the country risk premium. All other things remaining the same, country risk yield spreads overreacted to changes in the US dollar interest rates.

Muzindutsi and Obalade (2020) analyzed the effect of country risk components on the performance and stability of South African bond market under different market regimes. To test the effects of country risk components on bond market return and yield spreads, the authors used two-stage Markov switching models with monthly data (January 1995–December 2018) covering the shift towards democracy in post 1994. The results showed that both returns and spread follow a longer upward trend. Also, bond returns seem to decrease (increase) with a change in financial (political and economic) risk(s). Moreover, no significant impacts have been found of country risk components on yield spreads in different regimes. The authors conclude toward providing evidence to the adaptive market hypothesis in the South African bond market, thereby signifying that the response of BM performance to country risk shocks is influenced by market cycles.

Using a non-linear autoregressive distributed lag (NARDL) model, Nhlapho and Muzindutsi (2020) analyze the time-varying dynamic relationship between the political, economic and financial components of country risk and bond and stock returns for 15 years monthly data. The main findings show asymmetric relationships between country risk and asset returns in both stock and bond markets. However, while economic risk only has short-run effects on bond returns, political risk has short- and long-run implications on both stock and bond returns. These results highlight the importance the domestic and international investors should carefully give to the different components of country risk when seeking diversification opportunities.

In conclusion, this stream of literature studies the role of macroeconomic, institutional and financial factors in bond market development. Regarding the financial factors, the main focus of these studies is to examine the impacts of banking system and stock markets and have missed the eventual effects of financial risk measures. Moreover, it has been established that aggregate financial risk affects LCBMs, but the effects of disaggregated financial risks have not been studied mainly in the (Saudi) context. So, one can notice the hiatus existing in empirical literature exploring how financial risk components affect the development of LCBMs. This need has become especially relevant given the current period of increasing financial risk in Saudi Arabia, particularly since increased financial risk have had broad-based market effects.

Data and methodology

Hypothesis and data

In this paper, it is hypothesised that financial risk components influence the development of Saudi bond market (SBM). For this purpose, we collect data on five financial risk indicators over the period 1990–2020. According to the international country risk guide (ICRG) methodology, the objective of these factors consists at providing the means to assess a country’s ability to pay its financial obligations. In another ways, it can be considered as a country’s likelihood of being financially stable or having a financial crisis in the future. Basically, the ICRG methodology defined five indicators around debt, budget, liquidity, and exchange rate fluctuations—assigned with different weights:

-

(a)

foreign debt to GDP (max 10 points).

-

(b)

foreign debt service to exports of goods and services (max 10 points).

-

(c)

net international liquidity position measured as months of import cover (max 5 points).

-

(d)

current account to exports of goods and services (max15 points).

-

(e)

country’s exchange rate stability (max 10 points).

For each component, the higher the overall score the lower the risk, and the higher the stability.Footnote 3

It should be noted that these abovementioned factors have been widely used in several studies related to the different dimensions of country risk, and/or their implications with macroeconomic and financial considerations. These works include, but are not limited to, Erb et al. (1996), Dellas and Hess (2005), Hoti and McAleer (2005), Hoti et al. (2005), Sulastri et al. (2016), Álvarez-Díez et al. (2016), Perdana et al. (2019), Bonatti et al. (2021), Nobanee et al. (2022), and Athari et al. (2023).

Data on domestic bond market capitalization come essentially from the Global Financial Development Database (GFDD) of the World Bank. The statistics on this variable are available only from 1990. Table 1 presents the definitions and sources of the variables.

Model specification

To investigate the effect of financial stability measures on the BMD, the empirical model is presented as follows:

where\(PBMC\), \(FD\), \(DS\), \(IL\), \(CA\), and \(ER\) are defined previously in Table 1. \({\varepsilon }_{t}\) denotes the error term. \({\alpha }_{0}\) represents the intercept, and \({\beta }_{i} , i=1,\dots ,5\) represent the coefficients of independent variables.

Empirical methodology

This paper uses the autoregressive distributed lag (ARDL) approach to model the dynamics of bond market development (PBMC). The ARDL model was firstly developed by Pesaran and Shin (1999) and Pesaran et al. (2001) to analyze the long-run relationship between variables in a multivariate framework. The ARDL specification is appropriate to simultaneously overcome both serial correlation and endogeneity problem among the variables (Pesaran and Shin 1999). It is suitable with small-size samples, and permits a combination of different stationary variables (I(0) and I(1)).

The econometric form of the model relating to the impact of financial stability indicators on the \(PBMC\), once stationarity or cointegration are verified, is as follows:

where \(\Delta PBMC\) is the change in the natural logarithm of variable \(PBMC\). \({u}_{t}\) the error terms that is white noise, and \(\Delta\) represents the difference operator. \({c}_{1},\dots ,{c}_{6}\), and \({d}_{1},\dots ,{d}_{6}\) represent short-run and long-run coefficients respectively. \(\theta\) is the coefficient of the error correction term (\(ECT\)), and \({ECT}_{t-1}\) symbolizes the one-period lagged \(ECT\).

In order to check the long-run relationships among the variables, bounds test, based on Pesaran et al. (2001), are deployed. So, the null hypothesis of no long-run relationship is tested against the alternative one, as follows:

Conclusions about the existence of long run cointegration are made using the two critical bounds, the upper and lower bounds. When the F-statistics is greater than the upper critical bound I(1), there exists a long-run cointegration relationship and when it is less than the lower bound critical value I(0), no cointegration is presumed. Finally, the long-run equilibrium relationship and multivariate short-run dynamic error correction model are estimated, thereby allowing to testify the relationships between PBMC and financial stability indicators in both the long- and the short-run.

Results and discussion

Unit root test results and optimal lag selection

The stationarity properties of the variables are established by executing the Augmented Dickey–Fuller (ADF) and the Phillips–Perron (PP) tests. They are executed on levels and first differences forms for each variable.

Table 2 shows the unit root test results. It seems that all the variables, except DS, are non-stationary at levels but stationary at first difference. The variables are a mix of both I(0) and I(1), and none of them is I(2). The unit root properties of the time series data support the appropriate choice of the ARDL modelling to investigate the impact of financial stability measures on the development of the Saudi public bond market.

Before running the cointegration test, we should select the optimum lag order by estimating a VAR Model. Based on Akaike information Criterion (AIC), the optimal lags suggested is 4 (Table 3).

Bounds test for cointegration

Table 4 shows the calculated and critical values of the F-statistic based on the bounds test of the ARDL specification. It seems that the calculated F-statistic is higher than the upper critical bound value at 1% significance level. These results confirm the long- and short-run cointegration relationship between the variables. Henceforward, we can continue to the regression results as all prerequisites to apply ARDL approach are achieved. We estimate the long- and short-run relationships between the financial stability indicators and the public bond market capitalization (%GDP) relying on the Akaike Information Criterion (AIC).

Short- and long-run estimates

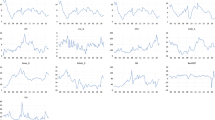

Finally, the results of long-run and short-run with error correction term based on ARDL are reported in Table 5. The optimal lag-lengths indicated by the AIC are (4,4,4,4,3,4). A graphical representation of the overall results is available in Fig. 1.

The top section is about short-run dynamics estimates with the error correction term and the bottom section displays estimates for the long-run. The coefficient assigned for the error correction term (\({ECT}_{t-1}\)) is significant at 1% with a negative value of 0.332, supporting that 33% of the disequilibria caused by shocks on the short term are corrected within a span of one year. Therefore, it takes approximately about 4 years to restore the long-run equilibrium.

The short-run estimations show how financial risk measures have played a major role in helping or hindering the development of the Saudi public bond market. In fact, each component influences public bond market capitalization (PBMC). Foreign debt (FD) stability, debt service (DS) stability, and international liquidity (IL) stability reduce PBMC by 0.21%, 1.06%, and 0.12% respectively. However, in the long run, international liquidity (IL) does not appear to play a major role in the development of the Saudi public bond market. This result corroborates with that of Feyen et al. (2015) in the context of developing and emerging economies. Furthermore, FD is significant, and it affects PBMC positively in the long run. FD stability constitutes an important factor encouraging the government to finance their deficits by bond issuance. This result is aligned with the study of Krugman (2015).

From another side, a 1% increase in the current account to exports of goods and services ratio leads to a 0.06% decrease in PBMC in the short run. Although the negative effect of the current account is noticeable on PBMC, it turns to a positive effect in the long run. This result is expected and corroborates those of Eichengreen (2006), Mu et al. (2013), and Boukhatem (2021) according to which current account balance is positively associated with trade openness, thereby leading to the development of the public bond market.

Conversely, what is unexpected is the negative effect of exchange rate stability (ERS) on PBMC by 0.59% in the short run, as it contradicts the literature. Probably this result explains how the strategic choice of the Saudi Central Bank in terms of exchange rate policy pegging the Saudi riyal to the US dollar. Then, in the long run, this effect becomes positive. The higher the stability of a country’s exchange rate, the higher is the development of its bond market. This result seems to be in line with those of Boukhatem (2021), Boukhatem et al. (2021), Smaoui and Khawaja (2017), Boukhatem (2009), and Eichengreen and Hausmann (1999), according to which countries with less volatile exchange rates generally experience larger domestic bond markets.

Diagnostic tests

Diagnostic tests are implemented to assess misspecifications, heteroscedasticity, and autocorrelations. We applied the LM Breusch-Pagan test for heteroscedasticity, LM Breusch-Godfrey Lagrange multiplier test for autocorrelation, Jarque–Bera test for normality, and Ramsey RESET test to check for omitted variables. The results are shown in Table 6 below.

The results show that the p-values are higher than 0.10 for the four tests. This implies that the null hypotheses of homoscedasticity and no autocorrelation cannot be rejected. Moreover, the null hypothesis of omitted-variable bias or misspecification of the functional form cannot be rejected, thereby suggesting that additional variables are not required in the model. Finally, the null hypothesis that the residuals are normally distributed cannot be rejected, concluding toward no violation of the error term’s normal distribution.

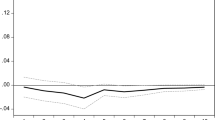

Alternatively, the cumulative sum (CUSUM) of recursive residuals and the cumulative sum of squares (CUSUMSQ) of recursive residuals are employed to investigate the stability of the estimated coefficients. Figures 2 and 3 plot the recursive CUSUM and the cumulative of squared residuals (CUSUMSQ) to detect for the presence of any signs of structural break. We show that CUSUM and CUSUMSQ statistics are within the 95% confidence bands, implying the absence of evidence for any statistically significant breaks and confirming consequently the stability of the ARDL estimated model at a 5% significance level.

Conclusion

The aim of this paper was to elucidate the eventual impacts of financial risk measures on the Saudi government bond market. We pay special attention to the different types of financial risk discussed in the ICRG dataset. We then use ARDL modelling over the period 1990–2020 to show which factors played a major role in helping or hindering the development of the Saudi government bond market.

The main results show that, in the short run, foreign debt stability, debt service stability, and international liquidity stability negatively impacted PBMC. However, in the long run, international liquidity stability does not appear to play a major role in the development of the Saudi public bond market, while foreign debt stability positively affects PBMC, therefore constituting an important factor encouraging the government to finance their deficits by bond issuance.

Moreover, current account stability and exchange rate stability have negative impacts on PBMC in the short run, but in the long run these impacts are positive. These results are expected as current account balance is positively associated with trade openness, thereby leading to the development of the public bond market, and likewise, the stability of a country’s exchange rate contributes to the development of its bond market as less volatile exchange rates generally experience larger domestic bond markets.

Some implications are arising from these findings. From a policy viewpoint, Saudi policymakers and competent authorities should multiply the efforts to design new policies in managing financial risk aspects of bonds, mainly those related to international liquidity and debt service, in order to strengthen financial stability, a sine qua non condition to greater, deeper, and more liquid LCBM which contributes to a well-developed financial system, in turn absorbing internal and external shocks. Furthermore, a more sizable LCBM plays important roles in improving the efficiency of financial intermediation process and reducing the risk concentration in the banking sector. It also constitutes a real contribution to the fiscal deficits financing in a non-inflationary manner thereby mitigating important risks and vulnerabilities sources such as those associated to maturity and currency mismatches.

Data availability

Data will be available only on reasonable request from the authors.

Notes

The term “spare tire” is due to Alan Greenspan (1999) in a well-known speech where he evokes an alternative for corporations to the bank lending.

The maturity and currency mismatches were seen as the direct consequence of the "original sin" of emerging market economies (EMEs). According to Eichengreen et al. (2003), due to EMEs’ structural weaknesses and lack of market credibility foreign investors tend to lend to EMEs only in foreign currencies.

A summarizing detailed guide of names and definitions of the different variables used in measuring financial risk components are available in the ICRG guide to data variables document (https://www.prsgroup.com/wp-content/uploads/2014/08/icrgmethodology.pdf).

References

ADB Institute (2001) Development of capital markets. ADBI Executive Summary Series No. S56/ 02

Álvarez-Díez S, Alfaro-Cid E, Fernández-Blanco MO (2016) Hedging foreign exchange rate risk: multicurrency diversification. Eur J Manag Bus Econ 25(1):2–7

Aman A, Isa MY, Naim AM (2023) The role of macroeconomic and financial factors in bond market development in selected countries. Glob Bus Rev 24(4):626–641

Anwar CJ, Suhendra I (2020) Monetary policy independence and bond yield in developing countries. J Asian Finance Econ Business 7(11):23–31

Aronovich S (1999) Country risk premium: theoretical determinants and empirical evidence for Latin American countries. Rev Bras Econ 53(4):463–498

Asian Policy Forum (2001) Designing a New and balanced financial markets in Postcrisis Asia: proposals on how to foster bond markets through strengthening of the banking sector. Asian Development Bank Institute, Tokyo, Japan.

Asia-Pacific Economic Cooperation (1999) Compendium of Sound practices: guidelines to facilitate the development of domestic bond markets in APEC Member Countries. http://www.apecsec.org.sg/loadall.htm?http://www.apecsec.org.sg/fora/activity_group/fin_minister_process/finance_process.html

Athari SA, Irani F, AlAl HA (2023) Country risk factors and banking sector stability: Do countries’ income and risk-level matter? Evid Global Study Heliyon 9(10):1–22

Bank for International Settlements (2007) Financial stability and local currency bond markets. BIS Papers No. 28

Bank for International settlements (2016) A spare tire for capital markets: fostering corporate bond markets in Asia. BIS Papers 85

Bhattacharyay BN (2013) Determinants of bond market development in Asia. J Asian Econ 24(1):124–137

Bonatti G, Ciacci A, Ivaldi E (2021) Different measures of country risk: an application to european countries. J Risk Financial Manage 14(1):1–16

Bondt GD (2005) Determinants of corporate debt securities in the euro area. Eur J Finance 11(6):493–509

Boukhatem J (2012) Bond markets and banking crises in emerging market economies: the role of institutions. Panoeconomicus 59(5):625–646

Boukhatem J (2021) What drives local currency bond market development in Saudi Arabia: do macroeconomic and institutional factors matter? Fut Business J 7(65):1–18

Boukhatem J, Ftiti Z, Sahut JM (2021) Bond market and macroeconomic stability in East Asia: a nonlinear causality analysis. Ann Oper Res 297(1):53–76

Boukhatem J (2009) Essai sur les déterminants empiriques de développement des marchés obligataires. EconomiX Working Papers 2009–2032

Burger JD, Warnock FE (2006) Local-currency bond markets. NBER Working Paper 12552

Burger JD, Warnock FE, Warnock VC (2009) Global financial stability and local currency bond markets. University of Virginia Darden School of Business. Unpublished manuscript

Burger JD, Warnock FE (2007) Foreign participation in local currency bond markets. Rev Financial Econ 16(3):291–304

Carbó-Valverde S, Sánchez LP (2013) Financial stability and economic growth. In: De Guevara Radoselovics JF, Monsálvez JMP (eds) Crisis, risk and stability in financial markets. Palgrave Macmillan Studies in Banking and Financial Institutions. Palgrave Macmillan, London, UK, pp 8–23

Dellas H, Hess M (2005) Financial development and stock returns: a cross-country analysis. J Int Money Financ 24(6):891–912

Eichengreen B (2006) The development of Asian bond markets. BIS Papers 30

Eichengreen B, Panizza U, Borensztein E (2008) Prospects for Latin American bond markets: a cross-country view. In: Borensztein E, Cowan K, Eichengreen B, Panizza U (eds) Bond markets in Latin America: on the verge of a big bang? The MIT Press, USA, pp 247–290

Eichengreen B, Hausmann R (1999) Exchange rates and financial fragility. NBER Working Papers 7418

Eichengreen B, Luengnaruemitchai P (2004) Why doesn’t Asia have bigger bond markets? NBER Working Paper 10576

Eichengreen B, Hausmann R, Panizza U (2003) Currency mismatches, debt intolerance and original sin: why they are not the same and why it matters. NBER Working Paper 10036

Eichengreen B, Borensztein E, Panizza U (2006) Bond market development in East Asia and Latin America. Mimeo IDB and UC Berkeley

Elyasiani E, Keegan J (2017) Market discipline in the secondary bond market: the case of systemically important banks. Federal Reserve Bank of Philadelphia Working Papers, pp 17–5

Erb CB, Harvey Campbell R, Viskanta T (1996) Political risk, economic risk and financial risk. Financ Anal J 52(6):29–46

Fabella R, Madhur S (2003) Bond market development in East Asia: Issues and challenges. ERD Working Paper Series 35.

Feyen E, Ghosh S, Kibuuka K, Farazi S (2015) Global liquidity and external bond issuance in emerging markets and developing economies. World Bank Policy Research Working Paper 7363

Flannery M, Sorescu SM (1996) Evidence of bank market discipline in subordinated debenture yields. J Finance 51(4):1347–1377

Greenspan A (1999) Do efficient financial markets mitigate financial crisis? Speech given in Sea Island, Gerorgia

Gropp R, Vesala J, Vulpes G (2002) Equity and bond market signals as leading indicators on bank fragility in Europe. European Central Bank Working Paper Series 150

Han SH, Kang K, Shin YS (2016) Bond ratings, corporate governance, and cost of debt: the case of Korea. J Asian Finance Econom Business 3(3):5–15

Herring RJ, Chatusripitak N (2000) The Case of the missing market: the bond market and why it matters for financial development. ADB Institute Working Paper No 11

Hmida M, Brahmi MB (2016) Bond markets and financial stability: evidence from the Asian experience. Int J Econom Financial Manage 4(1):17–28

Hoti S, McAleer M (2005) Modelling the riskiness in country risk ratings. Contrib Econom Anal 273:1–8

Hoti S, McAleer M, Shareef R (2005) Modelling country risk and uncertainty in small Island tourism economies. Tour Econ 11(2):159–183

Jeanneau S, Tovar Camilo E (2008) Financial stability implications of local currency bond markets: an overview of the risks. BIS Papers No 36

Korajczyk RA, Levy A (2003) Capital structure choice: macroeconomic conditions and financial constraints. J Financ Econ 68(1):75–109

Kowalewski O, Pisany P (2019) What drove the growth of the corporate bond markets in Asia? Res Int Bus Financ 48:365–380

Krugman PR, Obstfeld M, Melitz M (2015) International trade: theory and policy, 10th edn. Pearson Education, UK

Manganelli S, Wolswijk G (2007) Market discipline, financial integration and fiscal rules: what drives spreads in the Euro area government bond market? ECB Working Paper 745

Morgan DP, Stiroh KJ (2000) Bond market discipline of banks: Is the market tough enough? Federal Reserve Bank of New York Staff Report 95

Mu Y, Phelps P, Stotsky J (2013) Bond markets in Africa. IMF Working Papers No 12

Muzindutsi PF, Obalade AA (2020) Effects of country risk shocks on the South African bond market performance under changing regimes. Global Business Rev 0(0): 1–13

Nhlapho R, Muzindutsi PF (2020) The impact of disaggregated country risk on the South African equity and bond market. Int J Econ Finance Stud 12(1):189–203

Nobanee H, Shanti HZ, Dilshad MN, Alzaabi F, Alkindi S, Alhammadi J, Alnaqbi M (2022) Bibliometric analysis of foreign exchange risk. J Governance Regul 11(1):86–99

Park J, Shenoy C (2002) An examination of the dynamic behavior of aggregate bond and stock issues. Int Rev Econ Financ 11(2):175–189

Park D, Shin K, Tian S (2021) Do local currency bond markets enhance financial stability? Some empirical evidence. Emerg Mark Financ Trade 57(2):562–590

Park D, Shin Y (2023) The development of local currency bond markets and uncovered Interest Rate Parity. ADB Economics Working Paper Series No 677.

Perdana GR, Sulastri S, Adam M, Widiyanti M (2019) The influence of business risk, financial risk and market risk towards LQ 45 stock performance. The Manager Rev 1(2):151–165

Pesaran MH, Shin Y (1999) An autoregressive distributed lag modelling approach to cointegration analysis. In: Strom S (ed) Econometrics and economic theory in the 20th century: The Ragnar Frisch Centennial Symposium. Cambridge University Press, Cambridge, UK, pp 371–413

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Economet 16(3):289–326

Prakash N, Sethi M (2021) Green bonds driving sustainable transition in Asian economies: the case of India. J Asian Finance Econ Business 8(1):723–732

Sulastri S, Adam M, Isnurhadi I, Muthia F (2016) Diversification strategy and risk reduction. Int J Appl Bus Econ Res 14(13):8931–8952

Trinh QT, Nguyen AP, Nguyen HA, Ngo PT (2020) Determinants of Vietnam government bond yield volatility: a GARCH approach. J Asian Finance Econom Business 7(7):15–25

Warnock F (2009) Reducing the currency mismatch: local currency bond markets and financial stability. https://voxeu.org/article/local-currency-bond-markets-and-financial-stability

Funding

No external funding.

Author information

Authors and Affiliations

Contributions

The corresponding author is the sole author.

Corresponding author

Ethics declarations

Conflict of interest

No conflict of interest to declare. The author alone is responsible for the content and writing of the paper.

Ethical approval

This article does not contain any studies with human participants or animals performed by the author.

Consent to participate

Not applicable.

Consent for publication

Author consents to publication.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Boukhatem, J. The effects of financial risk components on local-currency bond markets: theory and empirical evidence. SN Bus Econ 4, 41 (2024). https://doi.org/10.1007/s43546-024-00642-5

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s43546-024-00642-5