Abstract

The loan recovery strategy model for banks in India is based on a two-pronged strategy with dual dimensions: (1) preventive strategy and (2) curative strategy. This paper presents a conceptual two-pronged loan recovery model for Indian banks. The study has proposed a novel model for the analysis of the recovery efforts and recovery strategy of the banks and empirically tested the model through panel GLS regression, a GMM-SYS model, and further through structural equation models (SEM). The objective of the study is to discern if the two-pronged strategic responses (preventive and curative loan recovery strategies) of the bank groups in India have any significant difference, i.e., do the loan recovery strategies of the bank groups have discerning or divergent effects on bad loan management? Through the lens of the proposed model, the study provides a comparative insight into the loan recovery efforts of various bank groups in the Indian banking sector. The insights gained from this study have important implications for bank groups in the evaluation, formulation, and execution of an effective loan recovery strategy. The paper also uses structural equation models to demonstrate the dynamics of the novel model. We empirically determine that gross slippage ratio, cost of funds, return on equity, and return on assets have significant effects on gross non-performing assets, with higher slippage ratios and costs of funds associated with increased non-performing assets and higher return on equity and assets associated with decreased non-performing assets. The research has a future orientation in the sense that it provides the necessary pedestal for banks to analyse and find out what they can do better and how they can formulate loan recovery strategies based on their strengths and competitive advantages. Our proposed model is a significant addition to the scholarship of loan recovery and NPA management globally.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Recovery of loans is central to the management of non-performing assets in commercial banks. Effective management of loan recovery has a twofold character. One is ex-ante management, which deals with the resolution and recovery of assets under stress and with the possibility of default, and another is ex-post management of NPAs, which deals with the resolution and recovery of assets that are already in default. Ex-ante management relates to controlling and arresting new loan defaults, while ex-post management relates to the management of loan delinquencies and NPAs in a manner so as to maximise recovery. Ex-ante management deals with formulating, building, and finally implementing strategies and policies to prevent the credit risk from culminating beforehand. Any strategy for good recovery should be considered, taking into account the effectiveness of loan appraisal and credit delivery systems (Pati 2010). Ex-post NPA management is concerned with strategizing ways and means to handle NPAs effectively and efficiently recover defaulted loans. Individual banks may have bank-specific goals and objectives to manage problem loans, and in general, banks make efforts to keep NPAs in check. A low level of NPA is desirable for banks, as good asset quality is an indicator of the bank's health. Weak asset quality may not go very well with customers and shareholders.

This paper proposes a novel loan recovery model for banks in India that has dual dimensions of preventive and curative strategies. The highlight of this paper is the development of this model, which is empirically tested through panel GLS regression and structural equation models. The objective of this study is to evaluate if the two-pronged strategic responses of bank groups in India have significant differences in their effects on bad loan management. The study provides a comparative analysis of the loan recovery efforts of various bank groups in the Indian banking sector and offers insights for the evaluation, formulation, and execution of an effective loan recovery strategy. The paper also highlights the significant effects of gross slippage ratio, cost of funds, return on equity, and return on assets on gross non-performing assets. The remainder of the paper is organised as follows: Section 2 is the Literature Review and Conceptual Framework. Section 3 covers research gaps and methodology. Section 4 is Analysis and Discussion of Results. Section 5 concludes with recommendations and policy implications.

Literature review

Berger and Humphrey (1992), in their seminal work on efficiency measurement in commercial banking, define banking efficiency in the light of banks’ financial intermediation functions. Banks work as intermediaries between savers and investors. Banks provide intermediation services through the collection of deposits and other liabilities and their application to interest-earning assets such as loans. This approach includes both operating and interest expenses as inputs, whereas earnings from loans and other major assets count as outputs. Thus, if an asset is not generating returns for a bank and becomes non-performing, it results in reduced efficiency for that particular bank. A bank’s asset quality therefore does not only characterise the performance of a bank’s asset portfolio but also defines the efficiency with which a bank is performing.

The determinants of the performance of a bank’s asset portfolio should not be sought exclusively in macroeconomic factors, which are viewed as exogenous forces influencing the banking industry. On the contrary, the distinctive features of the banking sector and the strategic and policy choices of each particular bank with respect to their efforts for maximum efficiency and improvements in their risk management are expected to exert a decisive influence on the performance of their asset portfolio and the evolution of NPAs in their balance sheets. A strand in the literature has examined the connection between bank-specific factors and asset portfolio performance. The synthesis of the aforementioned discussion on the literature, which focuses on the connection between bank-specific factors and asset portfolio performance, strengthens the premise that ‘bad management’ leads to bad loans (non-performing loans) and reduced efficiency in a bank. The gist of the above discussion therefore solicits an understanding of what constitutes ‘good management’ with regard to maintaining and improving the quality of an asset portfolio for a bank. The next section attempts to explain the bank-specific reasons for poor asset quality in banks.

Mora (2012) argues that an important component of a strong risk management system is a bank’s ability to assess the potential losses on its investments. One factor that determines the extent of losses is the recovery of assets that are in default. Loan recovery measures the extent to which the creditor recovers the principal and accrued interest due on a defaulted debt. Building on the premise suggested by Mora (2012), Misra and Rajmal (2016) describe that there are two dimensions to loan recovery. One measures the extent to which a creditor recovers the principal and accrued interest on a loan. Another dimension of loan recovery measures the extent to which the creditor recovers the principal and accrued interest due on a defaulted debt. The authors further argue that a proper assessment of both of these dimensions of loan recovery is a crucial part of the overall risk management strategy of banks. Mora (2012) underscores the premise that the goal of risk management is to reduce the risk of loan losses and increase a bank’s resilience to loan losses. The first dimension of loan recovery, as argued by Misra and Rajmal (2016), analyses the extent to which the loan portfolio of a bank is performing and the reasons why a performing asset converts into a non-performing asset. This dimension has therefore led to studies that have focused on the determinants of non-performing assets and methods to deal with the problem of non-performing assets.

Gandhi (2015) discusses the preventive and curative loan recovery and NPA management strategies in detail in his lecture titled ‘Asset Reconstruction and NPA Management in India’. Discussing preventive strategies, the author discourses that the strategy should encompass: (1) measurement of risk through credit rating and scoring; (2) quantification of risk through estimating expected and unexpected loan losses; (3) risk pricing on a scientific basis; and (4) controlling the risk through effective loan review mechanisms and portfolio management. Discussing the curative and remedial loan recovery strategies, the author suggests that despite proper credit appraisal and proper structuring of loans, slippages in asset quality may not be unavoidable, especially when the economic cycles turn worse.

Batrancea (2021) analyses the performance of banks in Europe, Israel, the United States, and Canada and examines the relationship between bank performance, their assets, and liabilities. The results show that bank performance is positively associated with bank assets and negatively associated with bank liabilities. The authors suggest that banks should maintain a balanced portfolio of assets and liabilities to improve their performance. In another study, Batrancea et al. (2022) used panel data analysis to investigate the factors that influence economic growth in seven non-Basel Committee on Banking Supervision (BCBS) countries. The study finds that human capital, financial development, and trade openness have a positive impact on economic growth, while corruption has a negative impact. The authors also suggest that policymakers should focus on increasing human capital, financial development, and trade openness to promote economic growth.

In the US, a study by Bodenhorn et al. (2016) found that banks with better credit risk management practises tend to have lower non-performing loan ratios. They argued that credit risk management practises, such as rigorous credit analysis and monitoring, can help banks identify potential defaulters and take proactive measures to recover loans before they become non-performing assets.

Similarly, a study by Vithessonthi and Tongurai (2018) examined the impact of bank-specific and macroeconomic factors on the loan recovery rates of banks in Europe. They found that bank-specific factors, such as capital adequacy and asset quality, have a significant impact on loan recovery rates. They also observed that macroeconomic factors, such as GDP growth and inflation, can affect the loan recovery rates of banks in Europe.

Moreover, a study by Beltratti and Stulz (2015) examined the role of loan loss provisions in loan recovery. They found that banks with higher levels of loan loss provisions tend to have better loan recovery rates. They argued that loan loss provisions act as a signal to borrowers that banks are serious about recovering their loans.

Identification of variables

-

A.

Loan Recovery Strategy of Banks (Presumed Cause).

-

B.

Gross Non Performing Assets Ratio, Slippage Ratio and Slippage to Recovery Ratio (Presumed Effects).

According to the glossary of important terms on the RBI website, "slippages" (gross slippage ratio) refer to the fresh accretion of NPAs during the year divided by the total standard assets at the beginning of the year. This ratio is a better metric for assessing the credit management and credit administration systems in banks (Chakrabarty 2013). Several previous studies have extensively used this ratio to evaluate credit administration and credit appraisal in banks (Chakrabarty 2013; Ghosh 2014). A lower ratio indicates better loan recovery (preventive) efforts by banks.

The effectiveness of the recovery efforts made by banks is often measured by the ratio of slippages to recovery. This ratio indicates the extent to which banks have been successful in reducing their NPAs through recovery efforts (Chakrabarty 2013). Many previous studies have extensively used this ratio as an indicator of the effectiveness of NPA management efforts by banks (Chakrabarty 2013; Ghosh 2014). A lower ratio indicates better recovery (curative) efforts by banks (see Fig. 1).

The banking sector's curative loan recovery strategy refers to the process of recovering non-performing loans. This process involves taking legal action against the borrower, selling the collateral put up against the loan, and negotiating with the borrower to reach a settlement. On the other hand, a preventive loan recovery strategy aims to prevent loans from becoming non-performing in the first place. This involves conducting thorough due diligence on the borrower before granting the loan, implementing robust risk management processes, monitoring the borrower's financial health throughout the loan period, and proactively addressing any issues that may arise. Adekunle and Adesina (2015) define the two strategies. Curative loan recovery strategies include litigation, loan restructuring, and loan write-offs, as well as negotiations with clients for a settlement. Conversely, preventive strategies comprise enhanced credit risk assessment, credit monitoring, and loan portfolio diversification to reduce the likelihood of default.

Research gaps

This study's review of related literature and conceptual framework for Loan Recovery Strategy and Measures of Bank Asset Quality proposes a model to scrutinize and attribute differences in Banks' Asset Quality indicators to the Loan Recovery Strategy adopted by the banks. Additionally, a model to compare the effectiveness of Loan Recovery Strategy amongst bank groups is necessary. To address these gaps, this study adopts a novel approach and model to test the differences in asset quality indicators among banks and attribute them to their recovery strategies. Therefore, the objective of this study is to compare the effectiveness of loan recovery strategies among bank groups in India.

Methodology

The Indian banking sector categorizes scheduled commercial banks into four groups for comparison purposes, namely: (1) SBI & Associates, (2) Public Sector Banks (PSBs), (3) Private Sector Banks, and (4) Foreign Banks operating in India. The classification of Indian banks into these groups is based on ownership and control. Misra and Varma (2018) provide a definition of this classification. The State Bank of India (SBI) is the largest commercial bank in India, and its associates were merged with it over time. These banks are owned by the Indian government and offer various banking products and services. PSBs are also owned by the Indian government and have a significant presence in rural and semi-urban areas, providing a broad range of banking services. Private Sector Banks are owned and controlled by private shareholders, known for their customer-centric approach and innovative products and services. Foreign Banks operating in India are owned by foreign entities and offer banking products and services to both retail and corporate customers.

To determine which bank group's loan recovery strategy is more effective, a comparison of the Slippage Ratio and Slippage to Recovery Ratio has been conducted among the various bank groups. The data used for comparison is computed from data collected from the Reserve Bank of India website for the period 2005–06 to 2017–18. The study uses Panel GLS Regression to empirically analyze the effectiveness of the loan recovery strategy of the four bank groups in the Indian banking sector, using time dummies (Certo and Semadeni 2006). The paper also uses SEM tools (Structural Equation Models) to graphically demonstrate the dynamics between the variables used in the study. In addition to the Panel GLS Regression, the current study has also employed a Dynamic Panel Data Model Using Generalized Method of Moments (GMM) to model Gross NPA. The one-step panel System GMM (GMM-SYS) includes several explanatory variables such as the Slippage Ratio, Slippage to Recovery Ratio, Net Interest Margin (NIM), Return on Assets (ROA), Return on Equity (ROE), Cost of Funds, bank groups, and time dummies. The GMM approach is particularly suitable for handling endogeneity issues and dynamic panel data models. The model allows for the estimation of the long-run and short-run effects of the explanatory variables on the Gross NPA of the four bank groups in the Indian Banking sector.

Panel GLS model

The study uses the panel data random effects generalized least square model, which regresses the dependent variable (Model 01: Gross NPA Ratio; Model 02: Gross Slippage Ratio; Model 03: Slippages to Recovery Ratio) upon the independent Variables- The Bank Groups and the Time Dummies.

where i = 0–4, for four bank groups and t = 1–13 for the financial years from 2006 to 2018 and e represents the random error.

The table above summarizes the descriptive statistics for four categories of banks, namely Foreign Banks (FBS), Public Sector Banks (PSB), Private Banks (PVT), and State Bank of India (SBI), across three variables—Gross Non-Performing Assets (GNPA), Gross Advances (GSR), and Slippage Ratio (Slip_to_Recov). For each category of banks, the table presents the mean, standard deviation (SD), standard error of the mean (SE), skewness, kurtosis, and median (p50) of the three variables. On average, PSBs have the highest GNPA (5.66), followed by FBS (3.32), SBI (4.75), and PVT (2.68). In terms of gross advances, FBS has the lowest average (2.79), while PSBs have the highest (4.06). The slippage ratio is the highest for PVT (2.49) and FBS (2.34) and the lowest for SBI (2.23). The measures of skewness and kurtosis suggest that the distributions of the three variables for each category of banks are not perfectly symmetrical and have varying degrees of peakedness. The standard errors of the mean are relatively small, indicating that the sample means are fairly precise estimates of the true population means.

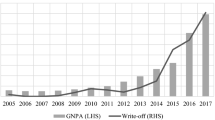

The overlapping graph Fig. 2 shows the movement of the Gross Non-Performing Assets Ratio for the four bank groups in India for the time frame starting from FY 2006 to FY 2018. A period of 13 years. The graph shows the elevated levels of the GNPA Ratio for the PSBs and SBI Group for the latter period of the time frame.

The results of the Panel Random Effects GLS Regression with GNPA as the dependent variable and Bank Groups (categorical dummies) and the Time in Year (time dummies) as the independent variables is presented in Table 1. The Coefficient for SBI Group is significant at p < 0.1 level, while for PBSs the coefficient is significant at p < 0.05 level. The regressions coefficients for PVTS is not significant. The time dummies have significant negative coefficients from FY 2006 until FY 2015, afterwards i.e. from FY 2016 the time dummies cease to have a significant coefficient. The regression results for the SBI Group and Public Sector Banks are significant with strong positive coefficients suggesting that the SBI Group and the Public Sector Banks are blemished with the high non-performing assets particularly in the latter period of the time-frame under study. The use of time dummies serves dual purposes of factoring in and negating exogenous externalities thus making the model more robust. The time dummies’ coefficients are negatively significant with higher magnitude in the former period of the time-frame under study and subsequently begin to shrink and turns to be non-significant at the tail period of the time-frame under study suggesting that the impact of the exogenous externalities in the latter period of the study has shrank rapidly and that the GNPA Ratio represented is attributable to much of the efforts/internalities of the Bank Groups. Evidence of heteroscedasticity is found in the model following the Breusch-Pagan test for heteroscedasticity (chi2 = 38.58; p = 0.000).

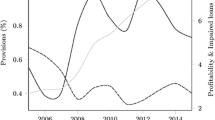

The overlapping graph Fig. 3 shows the movement of the Gross Slippages Ratio for the four bank groups in India for the time frame starting from FY 2006 to FY 2018.. The graph shows the elevated levels of the ratio for the PSBs and SBI Group for the latter period of the time frame while the Slippages were higher for the Private Banks and the Foreign Banks in the former period of the time frame.

The regression results with Gross Slippage Ratio as the dependent variable with the time dummies and Bank Groups are presented in Table 2. The coefficients of the Bank Groups are not significant for any of the bank groups while that for the time dummies are significant in the former part of the time-frame, while the latter years towards the end of the time period show insignificant results. Evidence of heteroscedasticity is found in the model following the Breusch-Pagan test for heteroscedasticity (chi2 = 15.20; p = 0.000).

The overlapping graph Fig. 4 shows the movement of the Slippages to Recovery Ratio for the four bank groups in India for the time frame starting from FY 2006 to FY 2018.. The graph shows the elevated levels of the ratio for the PSBs and SBI Group for the latter period of the time frame whereas for the majority of the time frame the ratio has been non-discerningly overlapping implying that the efforts of recovery across the bank groups have been homogeneous.

The regression results with Slippage to Recovery Ratio as the dependent variable and Time dummies and Bank Groups are presented in Table 3. The coefficients of the Bank Groups are not significant for any of the bank groups while that for the time dummies are significant in the former part of the time-frame, while the latter years towards the end of the time period show insignificant results. Evidence of heteroscedasticity is found in the model following the Breusch-Pagan test for heteroscedasticity (chi2 = 20.19; p = 0.000) (see Table 4).

Analysis through structural equation modelling

The equations for the specified structural equation model (SEM) with coefficients are:

1. For Group 1: SBI

2. For Group 2:PSB

3. For Group 3:PVT

4. For Group 4:FBS

5. For Entire Sector-

where GNPA is the endogenous variable, SlipTRecov and GSR are the exogenous variables, and e.GNPA is the error term. SBI-State Bank of India Group, PSB-Public Sector Banks in India, PVT-Private Banks in India, FBS-Foreign Banks Operating in India. GNPA-Gross Nonperforming Assets,GSR-Gross Slippage Ratio, SlipTRecov-Slippages to Recovery Ratio (see Table 5).

The results in table above show the coefficients and standard errors of the SEM analysis with GNPA as the dependent variable and SlipTRecov and GSR as the independent variables. The data is also broken down into four groups: SBI, PSB, PVT, and FBS. For each group, the coefficients and standard errors of the independent variables are presented. In Group 1 (SBI), both SlipTRecov and GSR have positive coefficients, with GSR having a statistically significant coefficient at the 5% level. In Group 2 (PSB), SlipTRecov has a negative coefficient and GSR has a positive coefficient, with GSR having a statistically significant coefficient at the 1% level. In Group 3 (PVT), SlipTRecov has a negative coefficient and GSR has a positive coefficient, with both coefficients statistically significant at the 1% level. In Group 4 (FBS), SlipTRecov has a positive coefficient that is statistically significant at the 5% level, while GSR has a non-statistically significant positive coefficient. For the entire sector, the coefficient for SlipTRecov is negative but not statistically significant, while the coefficient for GSR is positive and statistically significant at the 1% level. The results suggest that GSR has a positive and statistically significant association with GNPA, while the association between SlipTRecov and GNPA varies by group and is not statistically significant for the entire sector (see Fig. 5).

The SEM Model as represented in Fig. 1 shows the ungrouped model for the variables GNPA (Gross Non Performing Assets Ratio), GSR (Gross Slippage Ratio) and Slippage to Recovery Ratio. The model shows the dynamics between these three variables. The models shows that that higher the GSR, higher will be the GNPA. In the instant case the coefficient of GSR is 1.3 and that of Slippages to Recovery is -0.88. The inverse relationship between GNPA and Slippage to Recovery Ratio has been established. The Covariance between the GSR and Slippages to Recovery Ratio for the model is computed as 1.6; inferring that there is propensity for the two variables to move together (see Fig. 6).

The SEM Model as represented in Fig. 2 shows the model for Group 1 i.e. State Bank of India Group for the variables GNPA (Gross Non Performing Assets Ratio), GSR (Gross Slippage Ratio) and Slippage to Recovery Ratio. The Covariance between the GSR and Slippages to Recovery Ratio for the model is computed as 1.5; inferring that there is propensity for the two variables to move together, although this propensity is marginally lower than the ungrouped model. The coefficients for the GSR and Slippages to Recovery are near to 01 and 0.8 respectively, suggesting that the both the variables are contributing positively in the computation of the GNPA (see Fig. 7).

The SEM Model as represented in Fig. 3 shows the model for Group 2 i.e. Public Sector Banks for the variables GNPA (Gross Non Performing Assets Ratio), GSR (Gross Slippage Ratio) and Slippage to Recovery Ratio. The Covariance between the GSR and Slippages to Recovery Ratio for the model is computed as 3.4; inferring that there is propensity for the two variables to move together, this propensity is markedly higher than the ungrouped model. The coefficients for the GSR and Slippages to Recovery are 1.8 and -0.81 respectively, suggesting that the GSR is contributing positively in the computation of the GNPA while Slippages to Recovery Ratio is pulling the GNPA downwards (see Fig. 8).

The SEM Model as represented in Fig. 4 shows the model for Group 3 i.e. Private Sector Banks for the variables GNPA (Gross Non Performing Assets Ratio), GSR (Gross Slippage Ratio) and Slippage to Recovery Ratio. The Covariance between the GSR and Slippages to Recovery Ratio for the model is computed as 0.7; inferring that there is propensity for the two variables to move together, this propensity is almost half as compared to the ungrouped model. The coefficients for the GSR and Slippages to Recovery are 0.8 and -0.11 respectively, suggesting that the GSR is contributing positively in the computation of the GNPA while Slippages to Recovery Ratio is pulling the GNPA downwards; however these coefficients are markedly lower than the Public Sector Banks; suggesting that though the PSBs may be having higher slippages but there recovery efforts are higher than those of Private peers (see Fig. 9).

The SEM Model as represented in Fig. 5 shows the model for Group 4 i.e. Foreign Banks for the variables GNPA (Gross Non Performing Assets Ratio), GSR (Gross Slippage Ratio) and Slippage to Recovery Ratio. The Covariance between the GSR and Slippages to Recovery Ratio for the model is computed as 0.8; inferring that there is propensity for the two variables to move together, this propensity is almost half as compared to the ungrouped model. The coefficients for the GSR and Slippages to Recovery are 0.18 and 0.43 respectively, suggesting that the GSR and the Slippages to Recovery Ratio both are contributing positively in the computation of the GNPA.

Dynamic panel data model using generalized method of moments (GMM) (System GMM Model)

A dynamic panel data model with one-step lags (System GMM) is run to control for unobserved heterogeneity and endogeneity in panel data analysis. In panel data analysis, we observe the same individuals (e.g., firms or individuals) over time, which may lead to unobserved heterogeneity that affects the relationship between variables of interest. Additionally, endogeneity arises when variables of interest are correlated with error terms in the regression model. Both unobserved heterogeneity and endogeneity can lead to biased and inconsistent estimates in panel data analysis. Subsequently we develop the econometric model as under:-

where, ΔGNPAit: Gross Non-Performing Assets (GNPA) of bank i in time period t, α: Coefficient of lagged dependent variable (GNPA) i.e. speed of adjustment towards equilibrium, ΔGNPAit-1: GNPA of bank i in the previous time period t-1, β, γ, δ, ε, η, κ, λ, θ: Coefficients of the explanatory variables SlipTRecov, GSR, COF, ROE, ROA, NIM, BnkGrp and Year respectively and C is the constant, εt: Error term for the individual bank i in time period t, GNPA Gross Nonperforming Assets, GSR Gross Slippage Ratio, Slip_to_Recov Slippages to Recovery Ratio, NIM Net Interest Margin, ROA Return on Assets, ROE Return on Equity, COF-Cost of Funds.

The lagged values of the variables "SlipTRecov", "GSR", "COF", "ROE", "ROA", "NIM", and the group variables "BnkGrp1", "BnkGrp2", "BnkGrp3", and "yr*" are included in the instrument matrix. The model includes one lag of each endogenous variable in the instrument matrix. The instruments are in levels rather than differences. A system GMM approach is opted to account for the dynamic nature of the data and to address potential endogeneity and autocorrelation issues (Vota 2022) (see Fig. 10) (see Table 6).

The table above shows the regression results of model, investigating the relationship between Gross Non-Performing Assets (GNPA) and the independent variables. We employ a one-step system GMM (GMM-SYS) model to estimate the empirical model, using two lags of the GNPA as dependent variables to capture the dynamic effects of the dependent variable. System GMM is particularly suitable for capturing these dynamic effects by including lagged variables in the model (Vota 2022). The coefficient of the first lagged value (L1.GNPA) is positive and significant at the 1% level, implying that past levels of GNPA have a strong and positive impact on current levels of GNPA. The coefficient of the second lagged value (L2.GNPA) is negative and insignificant, indicating that the impact of two periods ago GNPA levels is not statistically significant in explaining current GNPA levels. Although the coefficient estimate for the variable L2.GNPA is not statistically significant, our supposition that the lagged effect of GNPA on the dependent variable is better captured by including two lags rather than just one requires us to display the output with two lags.

In the given regression results, the independent variables GSR, COF, ROE, and ROA have significant effects on the dependent variable GNPA. Specifically, GSR has a positive effect on GNPA with a coefficient of 0.550334, which means that an increase in GSR is associated with an increase in GNPA. COF also has a positive effect on GNPA, with a coefficient of 0.888502, suggesting that an increase in COF is associated with an increase in GNPA. On the other hand, both ROE and ROA have negative effects on GNPA, with coefficients of -0.24136 and 2.925233, respectively, implying that an increase in ROE and ROA is associated with a decrease in GNPA.

In the given output, BnkGrp1, BnkGrp2, and BnkGrp3 are categorical predictor variables representing three different banking groups. The coefficients associated with each variable indicate the impact on the dependent variable (GNPA) compared to the baseline group (BnkGrp4 which omitted due to collinearity). The coefficient for BnkGrp1 is – 1.29825 with a p-value of 0.298, indicating that this group is not statistically significantly different from the baseline group with respect to their effect on GNPA. The coefficient for BnkGrp2 is – 0.37261 with a p-value of 0.14, indicating that this group is also not statistically significantly different from the baseline group with respect to their effect on GNPA. The coefficient for BnkGrp3 is – 1.98766 with a p-value of 0.001, indicating that this group is statistically significantly different from the baseline group in terms of their effect on GNPA. Specifically, the negative coefficient suggests that being part of BnkGrp3 is associated with a decrease in GNPA compared to the baseline group. The confidence interval for BnkGrp3 does not include zero, indicating that this result is statistically significant at a 95% confidence level.

We perform post-hoc diagnostic tests for robustness of the GMM Estimators. The study conducted Arellano-Bond tests for autocorrelation of order 1 and 2 in the first differences of the data. The results suggest that there is no significant evidence of autocorrelation of order 2, but there is evidence of autocorrelation of order 1 in the first differences of the data. These tests are commonly used in the context of system GMM estimation to check for the presence of serial correlation in the differenced data. Moreover, the Sargan test indicates that the regression test is not weakened by the presence of many instruments (see Table 7).

Subsequently, the results of the Difference-in-Sargan tests are discussed, which evaluate the exogeneity of various instrument subsets. The initial subset employs GMM instruments for levels, with a Sargan test excluding group exhibiting a statistically significant chi-square statistic of 38.09 and a probability less than 0.000, indicating rejection of the null hypothesis of no over-identifying restrictions. Nonetheless, the Difference test for this subset indicates an insignificant chi-square statistic of -0.00 with a probability greater than 1.000, failing to reject the null hypothesis of exogeneity. The second subset consists of various instrumental variables and bank group dummies for years 1–12. The Sargan test excluding group indicates a statistically significant chi-square statistic of 38.09 with a probability less than 0.000, demonstrating rejection of the null hypothesis of no over-identifying restrictions. However, the Difference test for this subset reveals an insignificant chi-square statistic of -0.00 with a probability greater than 1.000, failing to reject the null hypothesis of exogeneity. The results provided suggest that the data does not suffer from weak instrument bias (see Fig. 11).

Conclusion

The study proposes a novel and robust model for analyzing the recovery efforts and strategies of banks and empirically tests the model using panel GLS regression, panel GMM model and SEM models. The GLS regression model confirms the academic and regulatory literature that Public Banks in India have been plagued with the problem of bad loans for the time period under study. However, the objective of the study is not to underline the already known occurrence of a higher degree of bad loans in Public Banks in India or to describe the structural reasons for its existence. Instead, the objective is to determine if there are any significant differences in the two-pronged strategic responses (preventive and curative loan recovery strategies) of bank groups in India, i.e., whether the loan recovery strategies of bank groups have discerning or divergent effects on bad loan management. To that end, the study concludes that for the time period under study, there is no conclusive evidence from the econometric model deployed in this study that any of the four bank groups in the Indian Banking sector has a superior (inferior) or better ex-ante (preventive) and ex-post (curative) strategy than any other bank group. Implicit in this conclusion is the view that since no bank group has a superior strategy than another, and given the higher magnitude of bad loans on the books of public banks, it is discernible that the magnitude of bad loan recovery is leaning in favor of public banks. Any perception or policy decisions made solely on the basis of the magnitude of bad loans do not provide a complete picture of the effectiveness of bad loan management and loan recovery in the banking space.

Based on the results of the panel GMM regression analysis, we conclude that Gross Slippage Ratio and Cost of Funds have a positive relationship with Gross Non-Performing Assets, while Return on Equity and Return on Assets have a negative relationship with Gross Non-Performing Assets. This suggests that an increase in Gross Slippage Ratio and Cost of Funds is associated with an increase in Gross Non-Performing Assets, while an increase in Return on Equity and Return on Assets is associated with a decrease in Gross Non-Performing Assets. While it is clear that an increase in slippages will directly impact the level of bad loans, we conjecture that a rise in the cost of funds could also contribute to this issue. Our reasoning is that when the cost of funds increases, lending rates are likely to rise as well. This could put additional strain on already strained assets, potentially leading to an exacerbation of slippages.

This study contributes to the existing literature on bad loan management and recovery in the banking sector. The novel model introduced in this research could serve as a useful tool for future studies on this topic. Additionally, the findings of this study could inform future research and help academics develop a deeper understanding of the factors that influence bad loan management and recovery.

Data availability

The datasets generated during and/or analyzed during the current study are available in the website dbie.rbi.org.in/DBIE/dbie.rbi?site = home.

References

Adekunle S, Adesina K (2015) An evaluation of loan recovery strategies in Nigerian Banks. J Appl Finance Bank 5(6):109–123

Batrancea LM (2021) An econometric approach on performance, assets, and liabilities in a sample of banks from Europe, Israel, United States of America, and Canada. Mathematics 9(24):3178

Batrancea L, Rathnaswamy MK, Batrancea I (2022) A panel data analysis on determinants of economic growth in seven non-BCBS Countries. J Knowl Econ 13(2):1651–1665

Beltratti A, Stulz RM (2015) The credit crisis around the globe: Why did some banks perform better? J Financ Econ 105(1):1–17

Berger AN, Humphrey DB (1992) Measurement and efficiency issues in commercial banking: output measurement in the service sectors. University of Chicago Press, pp 245–300

Bodenhorn H, Landon-Lane J, Rockoff H (2016) Keeping it in the family: lineage, tenure, and loan officer effectiveness. J Bank Finance 72:S57–S70

Certo ST, Semadeni M (2006) Strategy research and panel data: evidence and implications. J Manag 32(3):449–471

Chakrabarty KC (2013) Two decades of credit management in banks: looking back and moving ahead (Address by Dr. K. C. Chakrabarty, Deputy Governor, Reserve Bank of India at BANCON 2013)

Gandhi R (2015) Asset Reconstruction and NPA Management in India. (Shri R. Gandhi, Deputy Governor – September 15, 2015 – ReModel in India – Assets Reconstruction and NPA Management Summit organized by Economic Times, Mumbai)

Ghosh A (2014) Asset quality of banks: evidence from India. Macro Research 2013–14. Indian Institute of Banking & Finance

Misra R, Rajmal RV (2016) Determinants of recovery of stressed assets in India. Econ Pol Wkly 51(43):63

Misra B, Varma S (2018) Indian banking: performance, growth and technological progress. J Appl Finance Bank 8(3):7–18

Mora N (2012) What determines creditor recovery rates? Fed Reserve Bank Kansas City Econ Rev 97:79–109

Pati AP (2010) A study on the viability of RRBs as rural financial institutions in the liberalized environment. Available at SSRN: https://ssrn.com/abstract=1630104 or https://doi.org/10.2139/ssrn.1630104.

Vithessonthi C, Tongurai J (2018) What drives bank loan recovery rates? Evidence from Europe. J Financ Stab 36:240–257

Vota L (2022) Employment impact of firms’ innovation: what is the role of regional institutions? Evidence from Italy. Reg Sci Inq J 14(2):11–24

Funding

There are currently no Funding Sources in the list.

Author information

Authors and Affiliations

Contributions

The authors declare that we have all contributed intellectually and operationally in the construction of this research article.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Consent for publication

The authors give our consent for the publication of this research article, including all the details within the text and within the document.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Thomas, R. Modelling the effectiveness of the loan recovery strategy of Indian banks. SN Bus Econ 3, 174 (2023). https://doi.org/10.1007/s43546-023-00548-8

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s43546-023-00548-8