Abstract

This paper examines the role of housing in predicting macroeconomic outcomes. We do so by incorporating real-estate loans securitization, an important housing-related variable, in our investigation. Our in-and out-of-sample results show that (1) securitized real-estate loans contain leading information about the real economy after accounting for other predictors such as residential investment; (2) securitized real-estate loans significantly improve corporate bond credit spreads’ ability to forecast economic indicators; (3) while house prices lead the economy, after accounting for securitized real-estate loans and residential investment, the predictability appears to be more about economic contractions than expansions; (4) shocks to securitized real-estate loans have sustained economically significant effects on economic growth.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Investigating the impact of housing and credit supply on the business cycles is important for policymakers and investors. In this study, we examine whether securitized real-estate loans contain leading information about the real economy after accounting for house prices, residential investment, and other variables that are known to forecast economic growth.

Our investigation of real-estate loans securitization as a predictor of the real economy is motivated by the securitization process. Financial intermediaries securitize pools of illiquid assets such as real-estate loans by creating marketable liquid assets, such as mortgage-backed securities, which are sold to capital market investors.Footnote 1 Special purpose vehicles (SPVs) with their own balance sheet are created and entrusted with the securitization process.Footnote 2 One of the attractive features of securitization is that even though securitization by itself does not change the cashflows of the underlying pools of assets, it creates new sources of funds for intermediaries. The newly created funds are then used to underwrite additional loans. Thus, by holding everything else to be equal, securitization should promote economic growth. Indeed, Estrella (2002), among others, argues that asset securitization changes economic output by providing the volumes of liquidity in the market or the supply of credit.

The liquidity channel theories (e.g., Kolari et al. 1998) argue that securitization has deepened the credit market. The upshot is that the credit markets are more efficient in the allocation of credit and the additional liquidity in the credit markets reduces imperfections in these markets, and thereby promoting economic growth. In addition, the literature (e.g., Estrella 2002) argues that securitization may affect the volume of credit due to standardization of contracts. Thus, if lending criteria is loosened, it will affect all borrowers including the borrowers whose loans are planned for securitization. As a direct consequence, looser lending criteria would affect a larger pool of borrowers, and hence it may have a larger aggregate supply effect.

However, over-securitization, and hence over-lending to less creditworthy borrowers may lead to economic crises as we have seen during the Great Recession of 2007–2009. The stated crisis has further shown that demand for securitized assets decreased prior to and during the crisis (e.g., Chernenko et al. 2014, among others), and thereby reducing both asset securitization and supply of credit. Even before the above crisis, Estrella (2002) finds that securitization tends to decline during recessions. Thus, we argue that securitization potentially contains leading information about the business cycles.

While there are different types of pools of assets that are securitized, we investigate whether securitization of real-estate loans, one of the most important types of loans, contain information about economic growth. While the existing literature investigates house prices (e.g., Bostic et al. 2009; Miller et al. 2011; Kartashova and Tomlin 2017) and residential investment (e.g., Green 1997; Learner 2007, 2015; Ghent and Owyang 2010) as leading indicators of economic growth, to the best of our knowledge, the existing literature does not analyze whether real-estate loans securitization leads the real economy.

Our empirical findings over the 1975–2019 period are as follows. First, in-sample results show that (1) the correlation between securitized real-estate loans and residential investment is 0.12, and thereby implying that securitized real-estate loans and residential investment have different information; (2) a real GDP growth prediction model with securitized real-estate loans and residential investment as predictors has higher R-squared values than that of a parsimonious model with residential investment as the predictor. This result indicates that while securitization of real-estate loans may lead to residential investment, informationally it is distinct from residential investment, underscoring the importance of securitized real-estate loans; (3) securitized real-estate loans contain leading information about real GDP growth after accounting for a set of predictors including house prices, residential investment, etc. The above results are further robust to the exclusion of National Bureau of Economic Research recession (NBER recessions hereafter) quarters including the 2007–2009 Great recession. Second, the out-of-sample forecast results generally agree with the in-sample results. The out-of-sample results further show that securitized real-estate loans better forecast real GDP growth than house prices and residential investment do.

Finally, the macroeconomic consequences that we investigate in a standard vector-autoregression framework are as follows. The accumulated impacts of one standard deviation positive orthogonalized shocks to real-estate loans securitization, house prices, residential investment, and corporate credit spreads on real GDP growth after ten quarters are approximately 0.38, 0.46, 0.40, and − 0.46 percentage points, respectively. Given that the quarterly mean GDP growth is 0.67% in the sample, these impacts are economically significant. Thus, real-estate loans securitization not only predicts economic growth but also has significant impact on it. These results are robust to the exclusion of the housing-driven crisis period of 2007–2009. Furthermore, among the predictor variables, we examine real-estate loan securitization has the maximum impact on personal consumption. Our results contribute to several strands of the literature as we discuss below.

We contribute to the literature on the relationship between housing and the macroeconomy.Footnote 3 In particular, our results contribute to the housing literature (e.g., Miller et al. 2011; Leamer 2015) that argues that residential investment and house prices are important indicator of the business cycles by showing that real-estate loans securitization better forecasts real GDP growth. Our results also contribute to the literature (e.g., Bluedorn et al. 2016; Christensen et al. 2019) that finds house prices forecast economic recessions by showing that house prices are possibly linked to economic contractions rather than expansions once we account for securitized real estate loans and residential investment.

We further contribute to the literature on the financial accelerator theory (e.g. Bernanke and Gertler 1989; Bernanke et al. 1999; Kiyotaki and Moore 1997; Hall 2011) that shows the relationship between the quality of firm’s balance sheet and their access to external finance. In support of the above theory, the empirical business cycle literature (e.g., Gertler and Lown 1999; Mody and Taylor 2004; Gilchrist et al. 2009; Gilchrist and Zakrajšek 2012; Faust et al. 2013) shows that corporate bond credit spreads, as a proxy for firm’s access to external finance, contain leading information about economic indicators. However, if the financial accelerator theory is correct, household balance sheet, borrowing, spending, and real activity are affected by the housing market (see, e.g., Bernanke 2007). We contribute to the above literature by showing that the most accurate out-of-sample real GDP growth forecasts are obtained for the model that augments the baseline autoregressive model with both securitized real-estate loans and corporate bond credit spreads. However, we find that after accounting for residential investment, securitized real-estate loans rather than corporate bond credit spreads is a better predictor of real GDP growth.

Our results may have policy implications. Since the Great Recession of 2007–2009 substantial research investigates a range of asset securitization issues including how securitization could be made more efficient by designing optimal contracts for asset-backed securities.Footnote 4 We show that securitization, real-estate loans securitization in particular, is an important indicator of economic output. Thus, securitization may have diminished the efficacy of monetary policy as discussed in Estrella (2002), policymakers may be cognizant about the real-estate loans securitization market along with other housing and credit market indicators to gauge the health of the economy. Furthermore, while over-securitization of real-estate assets, and hence over-lending to less credit worthy borrowers may have reduced since 2007–2009 crisis, it remains an important determinant of available credits in the economy.

The remainder of the paper proceeds as follows. “Data sources and characteristics” describes the data sources and data characteristics. In “Empirical results”, we presents the empirical results, and “Concluding remarks” concludes.

Data sources and characteristics

The quarterly sample we investigate dates from the first quarter of 1975 to the fourth quarter of 2019, and this sample contains full five and one partial NBER recession quarters (1975 first quarter). We obtain most of our macroeconomic data, such as real GDP, real personal consumption expenditures (CONS hereafter), real business fixed investment (BINV), NBER recession indicators, industrial production (IP hereafter) and unemployment rates (UNEMP hereafter), securitized real-estate loans (SRL hereafter), real residential property prices (RRPP hereafter), and residential investment (RINV hereafter) etc., from the Federal Reserve Bank website and our data consists of various vintages.

As for the credit spread measures, we obtain excess bond premium (EBP hereafter) and GZ-Spread (GZS hereafter) data from the Board of Governors.Footnote 5 We concentrate on EBP throughout since it is shown to be a better measure since corporate default probability is removed from GZS to obtain EBP (see, Gilchrist and Zakrajšek 2012). We further obtain Moody’s AAA and BAA rated corporate bond yields to compute credit-spread (CS hereafter), the traditional measure of corporate credit spreads defined as the difference in yields between Moody’s AAA and BAA rated bond yields.

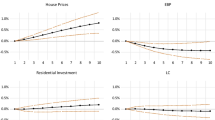

Accumulated responses of real GDP to housing shocks. This figure shows accumulated impulse responses of real GDP to generalized one standard deviation positive shocks for the VAR(1) model with the following endogenous variables: ΔGDP, ΔCONS, ΔBINV, ΔIP, UNEMP, ΔFED, TS, EBP, XMRET, ΔRINV, ΔSRL, and ΔRRPP. The variables are described earlier. Figure 2A and B shows responses of ΔGDP to different shocks for the full sample and 1975–2005 sub-sample. Response functions are plotted for 10 quarters in % points. A Accumulated responses of real GDP growth (full sample). B Accumulated responses of real GDP growth (1975–2005 sub-sample)

In addition to corporate credit spreads, we obtain other indicators that are used in the literature as follows. We obtain the Federal funds rate (FED hereafter) and yields of 10-year and 3-month US Treasuries. We compute the Treasury term-spread (TS hereafter), which is the difference in yields between the 10-year and 3-month US Treasuries. We use FED and TS as per the literature (e.g., Harvey 1988, 1989; Estrella and Hardouvelis 1991; Ang et al. 2006). We obtain stock market excess returns (XMRET hereafter) data from the Kenneth French website since stock market is found to be important for economic growth (see, e.g., Fama 1981; Levine 1991).Footnote 6 Some of the above data are available monthly and we use arithmetic average to compute quarterly data for those variables.

We conduct stationarity tests of variables using both ADF (Augmented Dickey and Fuller 1979) and KPPS (Kwiatkowski et al. 1992) method. To attain stationarity, we transform some of the variables and these variables are shown with the prefix Δ. For instance, ΔGDP and ΔFED are the log difference of real GDP and the first difference of FED, respectively. The housing-related predictor variables that we use throughout the paper are as follows. ΔSRL, ΔRRPP and ΔRINV, which are the log differences of SRL, RRPP and RINV, respectively.

Table 1, Panel A presents pairwise-correlation between some of the variables of interests. The correlation analysis shows that while housing variables are positively related to ΔGDP, EBP is negatively related to ΔGDP. Among the housing variables, the lowest correlation of 0.12 is observed between ΔSRL and ΔRINV, thereby indicating ΔSRL and ΔRINV may have different information. Importantly, a very low statistically insignificant correlation between ΔSRL and NBER recessions imply that, while over-securitization of real-estate loans may be one of the precursors to the 2007–2009 recession, the contemporaneous relationship between the two is rather weak considering the five NBER recessions in the sample.

Table 1, panels B and C present the pairwise Granger causality test results for some of the variables. The optimal lag length for the Granger causality tests is chosen to be “one” quarter and is selected in a vector-autoregression framework incorporating both the Schwarz (SIC) and Akike (AIC) information criterion. The pairwise Granger causality in Table 1 panel B shows that ΔSRL, EBP, ΔRRPP and ΔRINV contain leading information about ΔGDP. However, the reverse Granger causalities are absent. In Table 1, panel C shows that both ΔRRPP and ΔRINV Granger causes EBP, while the reverse is not true. Among the housing variables, ΔRRPP Granger cause ΔRINV, while there is no other Granger causality between other variables. While the pairwise Granger causality results show that securitized real-estate loans have leading information about real GDP, we next investigate the relationship in a multivariate setup.

Empirical results

In this section, we investigate the in-sample predictions followed by pseudo-out-of-sample forecasts of economic indicators. The primary goals of the in-sample predictions are (1) to identify indicators that are significantly related to both economic contractions and expansions; (2) whether in-sample results hold if we exclude the housing-driven Great recession of 2007–2009. The pseudo-out-of-sample tests by design cannot identify those indicators since out-of-sample forecasts must include both recessions and expansions. Finally, we investigate the macroeconomic consequences of shocks to the housing and credit markets on the real economy.

For the in-sample prediction, we run the following predictive model:

where one of ΔGDP, ΔCONS, and ΔBINV is the dependent variable, V is a vector of predictive variables. We further control for NBER recessions, which is an indicator variable that takes the value of “1” in NBER recession quarters, “0” otherwise, in some of our specifications.

First, we test the results reported in the existing literature (e.g., Leamer 2015) that ΔRINV predicts ΔGDP. This step also ensures that we control for residential investment to test the predictive power of securitized real-estate loans, since proceeds from securitization could be used for real-estate lending/investments. Next, we investigate whether ΔSRL add to the forecasting power after controlling for ΔRINV. Finally, we account for a number of variables in the successive models to test whether ΔSRL predicts ΔGDP, ΔCONS, and ΔBINV. The corresponding results are presented in Table 2.

Looking from the left at Model 1 in Table 2, where we test whether ΔRINV contains leading information about ΔGDP, we find that the coefficient of ΔRINV is statistically significant at the 1% level, and it is positive, and hence, it shows that higher ΔRINV leads to higher ΔGDP. The corresponding adjusted R-squared value is 19%. Looking next at Model 2, where we include ΔSRL as another predictor variable, we observe that both ΔSRL and ΔRINV predict ΔGDP. The signs of the coefficient show that a rise in ΔSRL indicates future economic expansions. The corresponding adjusted R-squared value is 23%. Thus, we find some evidence that ΔSRL contains information about real GDP growth that is not captured in ΔRINV. The above results are further consistent with the pairwise Granger causality results that both ΔSRL and ΔRINV contain predictive information about ΔGDP.Footnote 7

Looking next at Model 3, where we include a number of other predictor variables, we find that ΔSRL continues to predict ΔGDP. Looking at the sign and the statistical significance of ΔRRPP and EBP, we find that a rise in house prices and a fall in EBP signal economic growth. The results are consistent with the existing literature that shows that ΔRRPP (e.g., Miller et al. 2011) and EBP (e.g., Gilchrist and Zakrajšek 2012) have leading information about ΔGDP. We further find that TS and XMRET predict ΔGDP, and the results are also consistent with the literature (e.g., Harvey 1988, 1989) that those variables are important indicators of economic growth. Overall, we find that ΔSRL maintains its predictive power for ΔGDP after controlling for indicators that are known to predict economic growth.

Looking next at Model 4, where we include NBER recessions as a control variable, we find that ΔSRL, ΔRINV, and XMRET are the only variables that predict ΔGDP. Thus, the results imply ΔRRPP an EBP are potentially related to recessions rather than economic expansions. The results are consistent with the literature that house prices (e.g., Bluedorn et al. 2016; Christensen et al. 2019) and EBP (e.g., Favara et al. 2016) are important indicators of recessions. We further find that TS contains no information about ΔGDP after accounting for recessions and this is consistent with the literature (e.g., Estrella and Hardouvelis 1991) that finds that TS is a robust predictor of recessions. Looking next at the coefficient of ΔFED, we find that it is unrelated to ΔGDP, and the result finds some support for the arguments made in Estrella (2002) that monetary policy to influence economic growth became less effective because of securitization. In summary, we find that after accounting for NBER recessions along with a number of predictors, securitized real-estate loans have leading information about economic growth.

In Models 5 through 8, we investigate how ΔSRL is informationally related to ΔCONS and ΔBINV. We observe that after controlling for NBER recessions, ΔSRL is the only variable that contain leading information about both ΔCONS and ΔBINV, while ΔRINV and EBP lead ΔBINV. ΔFED is another variable that predicts both ΔCONS and ΔBINV, and it shows that higher ΔFED reduces consumption, but increases business investment. Potentially, this is the reason we find that the net effect of monetary policy changes on ΔGDP is insignificant as shown in Models 3 and 4. We further find TS and XMRET contain leading information about ΔBINV, while they have no information about ΔCONS. Overall, the in-sample results show that securitized real-estate loans are a robust predictor of ΔGDP, ΔCONS, and ΔBINV.

Out-of-sample forecasts of real GDP growth

In this section, we perform a number of pseudo-out-of-sample tests to ascertain that the in-sample results hold out-of-sample. First, we present the out-of-sample forecasting methodologies. Next, we present the out-of-sample test results for ΔGDP.

Following the housing literature (e.g., Aastveit et al. 2019), we adopt a recursive τ-step-ahead out-of-sample forecast methodology, where we set τ = 1, 2, 3, and 4 quarters. Since our sample (from 1975 to 2019) includes five NBER recessions, we consider the first quarter of 1975 through the fourth quarter of 1984 for the model estimation. This choice of estimation period includes two NBER recessions, and hence provides realistic coefficient estimates of indicators to forecast the business cycles. Next, we forecast for the dependent variable from the first quarter of 1985 through the fourth quarter of 2019, and these forecasts include three NBER recessions. Since an autoregressive model often contain considerable information about the dependent ΔGDP variable, our baseline model is an AR(1) model as per Eq. (2). The AR(1) term potentially accounts for variables that we do not analyze.

Next, we augment the above baseline AR(1) model with other predictor variables. The performance of the test model relative to the baseline model is measured by out-of-sample root mean squared forecasting error (RMSE) ratios. Since RMSE ratios may be biased, we evaluate the forecast performance based on the test-statistics as follows. If the parsimonious model has the same predictor variables of a larger encompassing model, then the models are nested. In our case, the models we are interested in are all nested, and they include the baseline AR(1) model.Footnote 8 For the nested-models, we evaluate the forecast accuracy of a model relative to others by the MPSE-adjusted-statistics proposed in Clark and West (2007). Suppose there are a candidate predictor variable 1 and a competing predictor variable 2. The forecaster is interested in τ-step-ahead forecasts of the dependent variable y. The period t forecasts of \(y_{t + \tau }\) from two models are denoted by \(\hat{y}_{1t + \tau }\) and \(\hat{y}_{2t + \tau }\). We want to test the null that both have equal predictive accuracy. We define a variable \({\widehat{f}}_{t+\tau }\) as per Eq. (3) and test for equal RMSEs by regressing it on a constant. Then, use the resulting t-statistics for a zero coefficient, and reject the null at 5% level if | MPSE-adjusted |> 1.65.

We investigate a number of models that nest the AR(1) model. In addition to the variables we investigated to far, we also include two additional credit spreads measures GZS and CS in the out-of-sample tests, and they are described in the data section. Table 3 presents the out-of-sample test results. After accounting for the housing and credit spreads variables, we find that other predictors do not add to the forecast accuracy, and hence those are not reported. In particular, we show thirteen different models besides the baseline model since models with other combinations of predictor variables have higher RMSE ratios than the ones we present. Looking from the top for a one-quarter ahead forecasts of ΔGDP, first we present the baseline AR(1) model. Next, we add one of the predictors to the baseline model, and then, we add two predictors, and so on. For parsimony and visual clarity, we only show the statistical significance of the model that has the lowest RMSE ratio relative to the competing models.

Comparing the two-variable forecast models and the baseline model, we find the model that contain AR(1) and EBP has the lowest RMSE ratio of 0.94. Recall that our in-sample results in Table 2 show that EBP does not predict real GDP if we control for NBER recessions. The inclusion of three NBER recessions in the out-of-sample forecasts for the 1985–2019 period may have contributed to the better performance of EBP. Nevertheless, the out-of-sample results indeed show the importance of EBP. The next best two-variable model has AR(1) and ΔSRL terms and it has the RMSE ratio of 0.96. The third best model with the RMSE ratio of 0.98 contains AR(1) and ΔRINV terms. Thus, ΔSRL as a single predictor does better than ΔRINV in predicting ΔGDP.

Looking next at the models with two predictors in addition to the AR(1) term, we observe that the RMSE ratio of 0.88 is the lowest among all the models we present in Table 3, and this model contains three predictors: AR(1) + EBP + ΔSRL. Based on the MPSE-adjusted-statistics, this model is more accurate than the competing three models: (1) AR(1); (2) AR(1) + EBP; (3) AR(1) + ΔSRL. That is, ΔSRL considerably improves the forecast accuracy of the parsimonious model that contain AR(1) and EBP. In contrast, looking at the last two rows, we find that adding more indicators to the three factor AR(1) + EBP + ΔSRL model increases the RMSE ratios of the corresponding larger models. We do not show other possible combinations for brevity, because all of these models have RMSE ratios higher than 0.88.

For two- to four-quarter-ahead forecasts, Table 3 shows that the results are qualitatively similar to those for the one-quarter-ahead forecasts. overall, the out-of-sample results supports the in-sample results that securitized real-estate loans forecasts economic growth. For parsimony, we do not report the results for the pseudo-out-of-sample results for real personal consumption and fixed business investment since these results do not change our primary conclusions, but the results are available on request. However, in “Macroeconomic implications”, we fully explore the impact on these indicators to ΔSRL shocks.

Robustness: out-of-sample tests with alternative baseline model

In this section, we investigate whether an alternative baseline model that includes residential investment and the AR(1) terms changes our results for the following reason. It could be argued that new funds generated through real-estate loans securitization could be invested in the form of residential investment. Thus, forecasters are better off using residential investment as a forecasting variable, and then include securitized real-estate loans to investigate its forecasting ability. Therefore, we alter the baseline model specification as per Eq. (4) and reinvestigate the out-of-sample performance of securitized real-estate loans.

The out-of-sample tests methodology is similar to the methodology in the previous section. However, in this study, we focus on ΔSRL, ΔRRPP, and EBP since these variables perform better than the others as per Table 3 results. The corresponding out-of-sample results are presented in Table 4. For parsimony, we do not present all the possible models since other models are less accurate than the models we show. The RMSE ratios in the above specification would also differ from the ones we presented earlier in Table 3 since the baseline model is different.

Looking at Table 4 from the top, we present the alternative baseline model followed by larger encompassing models with other predictors. The RMSE ratios in the second row are less than “1”, and hence the result shows that augmenting the alternative baseline model with ΔSRL increases the forecast accuracy in all four forecast horizons. Thus, we find another piece of evidence that information content of securitized real-estate loans is different from that of residential investment.

In contrast, looking at the results in the next row, we find that ΔRRPP as a forecasting variable lowers the forecast accuracy of the alternative baseline model in all four forecast horizons. This result indicates that after accounting for residential investment, house prices may not have information about future ΔGDP. Looking next at the results for EBP as a forecasting variable, we find that it adds to the alternative baseline model in terms of forecast accuracy in all forecast horizons. However, the RMSE ratios of this model in all four forecast horizons are higher than those for the model that augments alternative baseline with ΔSRL. That is, after accounting for ΔRINV, ΔSRL is a better predictor of economic growth than EBP.

Looking at the last row that shows the model that contains four predictors: AR(1) + ΔRINV + EBP + ΔSRL, we find that the RMSE ratio of this model is 0.90 and is more accurate than the competing three models: (1) AR(1) + ΔRINV; (2) AR(1) + ΔRINV + EBP; (3) AR(1) + ΔRINV + ΔSRL. The results thus show that ΔSRL adds to the forecasting power of the AR(1) + ΔRINV + EBP or AR(1) + ΔRINV models, and the model accuracy is statistically significant at the 1% level of significance in all four forecast horizons. Overall, we find that an alternative baseline model does not change our main conclusions that ΔSRL is a leading indicator of economic growth.

Macroeconomic implications

While the in-sample and pseudo-out-of-sample forecasts are important, policymakers are also interested in examining the effects on real GDP for shocks to ΔSRL. For this analysis, we use the standard vector autoregression (VAR) method, which is similar to the VAR specification in Gilchrist and Zakrajšek (2012) except that we have included ΔSRL and other housing-related indicators. The VAR specification includes the following endogenous variables: ΔGDP, ΔCONS, ΔBINV, ΔIP, UNEMP, ΔFED, TS, EBP, XMRET, ΔRINV, ΔSRL, and ΔRRPP. Based on both Schwarz information criterion (SIC) and Akike information criterion (AIC), we find that VAR(1) describes the dynamics.

There are diverging views about how the endogenous VAR variables should be ordered. Without supporting or rejecting different views about the ordering of the variables in the literature (e.g., Thorbecke 1997; Christiano et al. 1994, 1999), we examine the generalized impulse response functions (see, e.g., Koop et al. 1996; Pesaran and Shin 1998) where the ordering is not important. The accumulated generalized impulse response functions of ΔGDP to selected shocks are depicted for ten quarters in Fig. 1. We do not report the VAR parameter estimates or show the impulse response functions of ΔGDP to all shocks for parsimony.

In Fig. 1A, where we use the full sample, we find that one standard deviation (s.d.) positive ΔSRL and ΔRINV shocks in the present quarter have an accumulated impact on ΔGDP of approximately 0.38 and 0.46 percentage points, respectively, after ten quarters. For a similar shock to EBP impacts ΔGDP by − 0.46 percentage points. In contrast, for similar shocks to ΔRRPP have accumulated impacts of approximately 0.40 percentage points. Given that the quarterly mean real GDP growth in the sample is approximately 0.67 percent, all of the above impacts are economically significant. In summary, the above impulse responses of real GDP growth supports our earlier conclusions that securitized real-estate loans are important for economic growth.

To ensure robustness of the above results, we use the 1975–2005 sub-sample, and the results are shown in Fig. 1B. This sub-sample analysis allows us to investigate the relationship after excluding the 2007–2009 housing/credit market driven crisis period since it could be argued that our results are driven by the stated crisis. Figure 1B shows that one s.d. positive ΔRINV and ΔSRL shocks have accumulated impacts of approximately 0.40 percentage points on ΔGDP after ten quarters, while a EBP shock impacts ΔGDP by approximately − 0.40 percentage points. Thus, these impacts are qualitatively similar to those we obtain for the full sample. However, the accumulated response of real GDP to similar ΔRRPP shocks is relatively small and this result underlines how house prices had an outsized impact on the economy during the 2007–2009 crisis. Thus, the sub-sample analysis does not change our main conclusions. We next investigate the impacts of different shocks on other business cycle indicators.

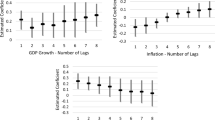

For this analysis, the VAR model is same as before and we use the full 1975–2019 sample. In Fig. 2, we show that the accumulated impulse responses of personal consumption (ΔCONS), business fixed investment (ΔBINV), industrial production (ΔIP) and unemployment (UNEMP) to different shocks. To save space, we show the impulse responses of each indicator to different shocks in the same figure. Thus, we do not show the standard error (s.e.) bands of the response functions for visual clarity.

Accumulated responses of other business cycle indicators to housing shocks. This figure shows accumulated impulse responses of different variables to Generalized one standard deviation positive shocks for the VAR(1) model with the following endogenous variables: ΔGDP, ΔCONS, ΔBINV, ΔIP, UNEMP, ΔFED, TS, EBP, XMRET, ΔRINV, ΔSRL, and ΔRRPP, where ΔIP is changes in industrial production (IP) and UNEMP is unemployment rates, the other variables are described earlier. The figure shows the impulse responses of ΔCONS, ΔBINV, ΔIP, and UNEMP to different shocks for the full sample, where we do not show the standard error (s.e.) bands for visual clarity. Response functions are plotted for 10 quarters in % points

Looking first at the impulse responses of ΔCONS and ΔBINV, we find that for one s.d. positive ΔSRL shocks in the present quarter increase ΔCONS and ΔBINV by approximately 0.32 and 0.69 percentage points, respectively, after ten quarters. A similar shock to ΔRINV increases ΔCONS and ΔBINV by approximately 0.22 and 0.69 percentage points, while those for shocks to ΔRRPP are approximately 0.25 and 1.02 percentage points, respectively. As for similar shocks to EBP, ΔCONS and ΔBINV decrease by approximately − 0.20 and − 0.75 percentage points. In summary, we find that ΔSRL has the highest impact on ΔCONS, while ΔRRPP has the maximum impact on ΔBINV.

Looking next at the impulse responses of ΔIP in Fig. 2, we find that one s.d. positive shocks to ΔSRL increase ΔIP by approximately 0.82 percentage points after ten quarters, while the impacts of shocks to ΔRRPP and ΔRINV are approximately 1.00 and 0.50 percentage points, respectively. In contrast, shocks to EBP in the present quarter reduce ΔIP by approximately − 0.87 percentage points after ten quarters. As for the impulse responses of UNEMP, we find that for similar shocks to ΔSRL, reduce UNEMP by approximately − 0.25 percentage points after ten quarters, while shocks to ΔRRPP and ΔRINV reduce UNEMP by approximately − 1.25 percentage points. For similar shocks to EBP, UNEMP increase by approximately 1.20 percentage points. Overall, the impulse response functions of macroeconomic variables are generally in conformity with the in- and out-of-sample results that securitized real-estate loans are an important indicator of the real economy.

Concluding remarks

This study examines the role of securitized real-estate loans in predicting macroeconomic outcomes. Financial intermediaries securitize different types of loans by creating marketable asset-backed securities that are sold to investors. Essentially, intermediaries create new sources of funds through the asset securitization process, and these newly created funds are then used for underwriting additional loans. Thus, asset securitization should promote economic growth.

The literature (e.g., Estrella 2002) indeed argues that asset securitization changes economic output by providing additional credit. However, the 2007–2009 crisis has shown that over-securitization, and hence lending to less creditworthy borrowers, may lead to economic crises. In such crises, demand for asset-backed securities falls (e.g., Chernenko et al. 2014, among others), and thereby reducing credit to the economy. In another words, asset securitization may lead the business cycles. In this study, we investigate whether real-estate loans securitization, an important housing-related variable, is a leading indicator of economic growth. Our in- and out-of-sample results substantiate that securitized real-estate loans lead real GDP growth. Furthermore, the standard vector-autoregression results show that securitized real-estate loans have sustained economically significant effects on economic growth.

Our findings could be followed up in several ways. First, future research may investigate the term structure of mortgage-backed securities held by different intermediaries and its relationship to the business cycles. Second, future research may examine the effect of financial intermediation on economic growth after accounting for the housing and credit markets. Third, we have not investigated securitization of other types of loans such as consumer or commercial and industrial loans. Future research may investigate whether securitization of other types of loans contains leading information about the real economy.

Data availability

Since some data are obtained on a subscription from CRSP, dataset will be available on request from the author.

Notes

Please see, Gorton and Metrick (2011) for a comprehensive study on securitization.

Please see, Gorton and Souleles (2005) for details on SPV’s role in securitization.

A short list includes Lettau and Ludvigson (2004), Carroll et al. (2011), Adelino et al. (2015), Chaney et al. (2012) and Mian and Sufi (2011). Housing can affect the real economy through different channels. For instance, one strand of the housing literature (e.g., Benjamin et al. 2004; Case et al. 2005; Campbell and Cocco 2007) argues for the wealth effect of housing on the economy. Another strand of the literature (e.g., Favara and Imbs 2015; Gertler and Gilchrist 2018) argues for the balance sheet channel effect of housing on the economy.

Please see the link below Fig. 1 in the paper https://www.federalreserve.gov/econresdata/notes/feds-notes/2016/recession-risk-and-the-excess-bond-premium-20160408.html. These measures are constructed using trading data for a sample of nonfinancial senior unsecured bonds.

We further evaluate the marginal gain in R-square values of ΔSRL relative to other predictor variables. We find that EBP has similar performance as ΔSRL, and other predictors add less in terms of model fitness. We further include other lags of ΔSRL to evaluate whether other lags better predicts ΔGDP and the sign of the coefficient changes for other lags. However, we find that one-lag of ΔSRL has the best performance, and the positive relationship between ΔSRL and ΔGDP persists irrespective of the lags of ΔSRL. These results are available upon request. We thank anonymous referees for this analysis as a robustness test.

We have models that are non-nested. However, for parsimony we do not show the test-statistics for non-nested models since these models have lower RMSE ratios relative to the nested models.

References

Aastveit KA, Anundsen AK, Herstad EI (2019) Residential investment and recession predictability. Int J Forecast 35:1790–1799

Adelino M, Schoar A, Severino F (2015) House prices, collateral, and self-employment. J Financ Econ 117(2):288–306

Ang A, Piazzesi M, Wei M (2006) What does the yield curve tell us about GDP growth? J Econom 131(1–2):359–403

Benjamin JD, Chinloy P, Jud GD (2004) Real estate versus financial wealth in consumption. J Real Estate Finance Econ 29:341–354

Bernanke B (2007) The financial accelerator and credit channel. The credit channel of monetary policy in the twenty-first century conference, Federal Reserve Bank Atlanta, Atlanta, Georgia. The Financial Accelerator and the Credit Channel—Federal Reserve Board

Bernanke B, Mark G (1989) Agency costs, net worth, and business fluctuations. Am Econ Rev 79(1):14–31

Bernanke B, Mark G, Simon G (1999) The financial accelerator in a quantitative business cycle framework. In: Taylor JB, Woodford M (eds) Handbook of macroeconomics, vol 1C. Elsevier Science North-Holland, Amsterdam, pp 1341–1393

Bluedorn JC, Decressin J, Terrones ME (2016) Do asset price drops foreshadow recessions? Int J Forecast 32:518–526

Bostic R, Gabriel S, Painter G (2009) Housing wealth, financial wealth, and consumption: new evidence from micro data. Reg Sci Urban Econ 39:79–89

Campbell JY, Cocco JF (2007) How do house prices affect consumption? Evidence from micro data. J Monet Econ 54:591–621

Campbell JY, Clara N, Cocco JF (2021) Structuring mortgages for macroeconomic stability. J Finance 76:2525–2576

Carroll CD, Otsuka M, Salacalek J (2011) How large are housing and financial wealth effects? A new approach. J Money Credit Bank 43(1):55–79

Case KE, Quigley JM, Shiller RJ (2005) Comparing wealth effects: the stock market versus the housing market. B.E. J Macroecon De Gruyter 5(1):1–34. https://doi.org/10.2202/1534-6013.1235

Chaney T, Sraer D, Thesmar D (2012) The collateral channel: how real estate shocks affect corporate investment. Am Econ Rev 102(6):2381–2409

Chernenko S, Hanson SG, Sunderam A (2014) The rise and fall of demand for securitizations. NBER Working Paper No. w20777. Available at SSRN: https://ssrn.com/abstract=2541553

Christensen C, Eriksen JN, Møller SV (2019) Negative house price co-movements and US recessions. Reg Sci Urban Econ 77:284–328. https://doi.org/10.1016/j.regsciurbeco.2019.06.007

Christiano LJ, Eichenbaum M, Evans C (1994) The effects of monetary policy shocks: some evidence from the flow of funds. National Bureau of Economic Research, Cambridge

Christiano LJ, Eichenbaum M, Evans C (1999) Monetary policy shocks: what have we learned and to what end? Handb Macroecon 1:65–148

Clark T, West K (2007) Approximately normal tests for equal predictive accuracy in nested models. J Econom 138:291–311

Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74:427–431

Eberly J, Krishnamurthy A (2014) Efficient credit policies in a housing debt crisis. Brook Pap Econ Act 45:73–136

Estrella A (2002) Securitization and the efficacy of monetary policy. Econ Policy Rev 8(1):1–13

Estrella A, Hardouvelis GA (1991) The term structure as a predictor of real economic activity. J Financ 46:555–576

Fama EF (1981) Stock returns, real activity, inflation, and money. Am Econ Rev 71(4):545–565

Faust J, Gilchrist S, Wright JH, Zakrajsek E (2013) Credit spreads as predictors of real-time economic activity: a Bayesian model-averaging approach. Rev Econ Stat 95(5):1501–1519

Favara G, Imbs J (2015) Credit supply and the price of housing. Am Econ Rev 105(3):958–992

Favara G, Gilchrist S, Lewis KF, Zakrajsek E (2016) Recession risk and the excess bond premium. Board of Governors of the Federal Reserve System (US)

Gertler M, Cara L (1999) The information content of the high yield bond spread for the business cycle. Oxf Rev Econ Policy 15:132–150

Gertler M, Gilchrist S (2018) What happened: financial factors in the Great Recession (No. w24746). J Econ Perspect 32:3–30

Ghent AC, Owyang MT (2010) Is housing the business cycle? Evidence from US cities. J Urban Econ 67:336–351

Gilchrist S, Zakrajšek E (2012) Credit spreads and business cycle fluctuations. Am Econ Rev 102:1692–1720

Gilchrist S, Yankov V, Zakrajsek E (2009) Credit market shocks and economic fluctuations: evidence from corporate bond and stock markets. J Monet Econ 56(4):471–493

Gorton GB, Metrick A (2011) Securitization. Hand Book Econ Finance. https://doi.org/10.1016/B978-0-44-453594-8.00001-X

Gorton GB, Souleles N (2005) Special Purpose Vehicle and Securitization. NBER working paper 11190. https://doi.org/10.3386/w11190

Green RK (1997) Follow the leader: how changes in residential and nonresidential investment predict changes in GDP. Real Estate Econ 25(2):253–270

Guren AM, Krishnamurty A, Mcquade ANDTJ (2021) Mortgage design in an equilibrium model of the housing market. J Finance 76:113–168

Hall RE (2011) The high sensitivity of economic activity to financial frictions. Econ J 121(552):351–378

Harvey CR (1988) The real term structure and consumption growth. J Financ Econ 22:305–333

Harvey CR (1989) Forecasts of economic growth from the bond and stock markets. Financ Anal J 45:38–45

Kartashova K, Tomlin B (2017) House prices, consumption and the role of non-Mortgage debt. J Bank Finance 83:121–134

Kim Y, Pence K, Stanton R, Walden J, Wallace N (2022) Non-banks and mortgage securitization. Annu Rev Financ Econ 14:137–166 (Forthcoming)

Kiyotaki N, Moore J (1997) Credit cycles. J Political Econ 105(2):211–248

Kolari JW, Fraser DR, Anari A (1998) The effects of securitization on mortgage market yields: a cointegration analysis. Real Estate Econ 26(4):677–693

Koop G, Pesaran MH, Potter SM (1996) Impulse response analysis in nonlinear multivariate models. J Econom 74:119–147. https://doi.org/10.1016/0304-4076(95)01753-4

Kwiatkowski D, Phillips PCB, Schmidt P, Shin Y (1992) Testing the null hypothesis of stationarity against the alternative of a unit root: how sure are we that economic time series have a unit root? J Econom 54:159–178

Leamer EE (2007) Housing is the business cycle. National Bureau of Economic Research, Cambridge

Leamer EE (2015) Housing really is the business cycle: what survives the lessons of 2008–09? J Money Credit Bank 47:43–50

Lettau M, Ludvigson SC (2004) Understanding trend and cycle in asset values: reevaluating the wealth effect on consumption. Am Econ Rev 94:276–299

Levine R (1991) Stock markets, growth, and tax policy. J Finance 46(4):1445–1465

Mian A, and Sufi A (2011) House prices, home equity-based borrowing, and the US household leverage crisis. Am Econ Rev 101(5):2132–2156

Miller N, Peng L, Sklarz M (2011) House prices and economic growth. J Real Estate Finance Econ 42:522–541

Mody A, Taylor MP (2004) Financial predictors of real activity and the financial accelerator. Econ Lett 82:167–172

Pesaran HH, Shin Y (1998) Generalized impulse response analysis in linear multivariate models. Econ Lett 58:17–29

Thorbecke W (1997) On stock market returns and monetary policy. J Financ 52:635–654

Acknowledgements

The author would like to thank the seminar participants the University of Trento, Department of Economics and Management for many insightful comments. We are further grateful to Flavio Bazzana, Ernesto D‘Avanza for the invaluable comments and suggestions.

Funding

N/A.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

There is no conflict of interest.

Ethical approval

N/A.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Chatterjee, U. Predicting economic growth: evidence from real-estate loans securitization. SN Bus Econ 3, 74 (2023). https://doi.org/10.1007/s43546-023-00456-x

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s43546-023-00456-x

Keywords

- Business cycles

- Real-estate loan securitization

- House prices

- Residential investment

- Corporate credit spreads

- Financial accelerator mechanism