Abstract

This study's goal is to review the body of research regarding financial inclusion. The bibliometric analysis of the subject under consideration was conducted using the Scopus database. The PRISMA technique was used to carry out the sampling process. Software called VOSviewer was used to examine 891 publications. This revealed the network’s expansion, the most contributors, the intellectual structure’s background, the most popular subjects, and the research gap for future studies. We discovered that the Scopus database started accepting articles about financial inclusion research in 2005. The terms "financial inclusion,” “financial development,” and “microfinance” have appeared frequently since 2005. Financial inclusion, fintech, microfinance, economic growth, financial literacy, mobile money, and remittances are some of the recent themes that are shown in the density map. However, research gaps have been identified due to the words' recentness and the frequency of their persistence in the current sub-period. The results will inform researchers about the implications for the past, present, and future, as well as the gaps in their understanding.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Financial inclusion is a socioeconomic activity that is dependent on a variety of other activities, including the credit ecosystem (Urrea & Maldonado 2011), social banking (Arun & Kamath 2015), the promotion of microenterprises (Trevinyo-Rodríguez & Chamiec-Case 2012), understanding of banking products (Thoene & Turriago-Hoyos 2017), and institutional investment (Bongomin et al. 2016). On the supply side, institutional frameworks may be responsible for financial inclusion (Bongomin et al. 2016), demonetization (Daya & Mader 2018), remittance facilities (Anzoategui et al. 2014), improving rural participation (S. Ghosh 2019), the financial stability of banks (Ahamed & Mallick 2016), enhancement of women's participation (Beck et al. 2015), and the government's socially inclusive policy (Fuller et al. 2006).

Policy changes and reforms are the catalysts for financial inclusion (Esnard-Flavius & Aziz 2011). The specific policies targeting financial inclusion are social inclusion policies (Arun & Kamath 2015), poverty alleviation (Deepika & Sigi 2014), inclusive banking (Esnard-Flavius & Aziz 2011), and monetary policy (Anarfo et al. 2019). Banks are developing different strategies for cost reduction that also ensure financial inclusion in the long run (Abor et al. 2018). The effective strategies and channels designed by banks that have impacted financial inclusion are microfinance (J. Ghosh 2013); mobile money and mobile banking (Abor et al. 2018); digitalization in the Fintech era (Gabor & Brooks 2017); and technological innovation in banking (Arner et al. 2020). On the demand side, financial literacy (Schuetz & Venkatesh 2020) and women's empowerment (Mia et al. 2019) significantly affect financial inclusion.

Financial literacy improves investment and saving behavior as well as social capital development (Okello Candiya Bongomin et al. 2016), which improves financial inclusion. Economic empowerment of women (Hendriks 2019), through microfinance (Mia et al. 2019), minimization of both the gender gap and gender violence (S. Ghosh & Günther 2018), and shifting from microfinance to microenterprise (Mader & Sabrow 2019), have a positive impact on financial inclusion.

Therefore, financial inclusion has gained momentum in recent years due to its significance in promoting economic empowerment. Governments create policy frameworks for microfinance, microcredit, and other supporting institutions. However, many developing nations have yet to fully appreciate the advantages of financial inclusion and have, thus, avoided discussing this kind of economic empowerment tool (Chhatoi et al. 2021). In this case, the focus is now more on addressing inclusive economic policies, whereby numerous programs have been developed with the goals of increasing household income, promoting equitable development, and alleviating poverty (Chhatoi et al. 2021). Then, in response to the financial market's growing complexity, the system underwent significant modifications by implementing artificial intelligence and developing digital platforms (Cao et al. 2020). For instance, the items include financial digitalization (Okello Candiya Bongomin et al. 2019), Internet lending platforms (Gruin & Knaack 2020), and so on. To gather and assess the state of research, not much has been done. The characteristics of recent papers on the subject of financial inclusion must be thoroughly analyzed. According to Han et al. (2020), bibliometrics, a relatively developed and significant subfield of intelligence research, may study the literature and analyze financial inclusion theory and implementation. Additionally, it considers all financial inclusion-related materials, looks into current research hot issues, and forecasts potential development patterns. Examples include the presentation of the research concentrations, development experiences, and prolific documents, among others (Laengle et al. 2017).

Our work is a review of papers related to financial inclusion. It is based on bibliometric variables that collect all peer-reviewed articles from the Scopus database, examine the compliance foundation aspects, and then detect the dynamic trend in various sub-periods, all while taking the benefits and established bibliometric technologies into account. Therefore, VOSviewer (Stopar & Bartol 2019) was chosen to visualize the key networks, including the cooperation network of countries, the co-occurrence network of authors' keywords, the co-citation networks, and timeline visualizations. The following is a list of the contributions to this review paper:

(1) To explain the current status, including the perspectives of types and research directions and significant indicators at the levels of countries, authors, documents, and journals, a general analysis and basic features are provided; (2) To show corresponding networks by analyzing authors’ linkage; (3) To help scholars’ comprehension of the hotspots and concentrate, the themes of all publications and the most prestigious journals are compiled based on author-keyword analyses and citations. (4) To help scholars comprehend the trend of numerous topics and make it easier to find the relevant research; (5) Based on all analyses and visualization mapping, it will be helpful to explain the past, present, and future. All these will be accomplished using bibliometric analysis.

According to De Moya-Anegón et al. (2007), "bibliometric analysis is a statistical analysis of published books, scientific articles, or book chapters and is an effective technique to measure the influence of publishing in the scientific community." Examining all of the papers on a certain topic or area is a scientific computer-assisted review procedure that aims to identify significant authors or core research, as well as their relationships (Han et al. 2020).

Bibliometric evaluations, when used in conjunction with social network analysis tools, can statistically explain formal scholarly networks and reveal cross-national, collaborative, citation and co-citation, keyword, and existing comparisons among academic fields, for instance in the form of clusters and networks. Given this, a careful analysis of the research's development will help to provide a better fundamental understanding of the topic and shed light on the state of the field by offering a selective appraisal of the various aspects of the financial inclusion debate globally.

It is not yet apparent, though, how the research will prioritize the financial inclusion trend. Furthermore, it is unclear who the primary authors and contributors are to the research that receives the most citations and is the most widely read publication on financial inclusion. The goals of this bibliometric review are to help academics better understand past, present, and future trends and to suggest potential study topics for the future. We, therefore, undertook a bibliometric analysis of financial inclusion studies using a science-mapping methodology, with a primary focus on the following research issues:

-

RQ1: What is the research growth trend in the area of financial inclusion?

-

RQ2: What are the authors and documents that had the greatest knowledge contributions in the area of financial inclusion?

-

RQ3: What is the context of the intellectual structure of the literature on financial inclusion?

-

RQ4: What are the most studied topics in the area of financial inclusion, and what is research gap?

This review of the literature uses bibliometric analysis, which is the most effective technique for examining the conceptual framework of the research topic, to analyze the corpus of research on financial inclusion with the goal of creating a viable knowledge base (Kumar et al. 2019).

Methodology

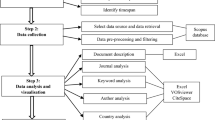

In their bibliometric analyses of the literature, Cisneros et al. (2018) and Kumar et al. (2019) used techniques like co-occurrence analysis, citation analysis, co-authorship analysis, and co-citation analysis. The literature uses VOSviewer software for bibliometric analysis (Eck & Waltman 2010). Because of its versatility, we selected VOSviewer software. VOSviewer, in contrast to most software, can provide a detailed graphical representation of bibliometric maps (Eck & Waltman 2010). In order to gain a current picture of the study field and build a list of the terms that are most frequently used, we started analyzing the financial inclusion literature on September 19, 2022.

We defined our inclusion criteria in accordance with the PRISMA protocol prior to starting the data collection process (Moher et al. 2009). PRISMA (Preferred Reporting Items for Systematic Reviews and Meta-Analyses) is a minimal set of items that are evidence-based and designed to help scientific authors when reporting a diverse range of systematic reviews and meta-analyses, which are largely used to assess the benefits and drawbacks of a healthcare intervention. PRISMA focuses on techniques authors can use to ensure that their studies are completely and openly reported (Gough et al. 2012).

Identifying sources for the review

Because empirical investigations have shown that Scopus provides more comprehensive coverage of publications than Web of Science sources for the social sciences, Scopus was chosen as the source of material for exploring and obtaining papers (Mongeon & Paul-Hus 2016). Although it is plausible to argue that the Web of Science has a database of higher-quality sources as a result of its more constrained coverage, the authors contend that this is a field-specific assertion that has to be empirically proven (Hallinger & Kovačević, 2019). As a result, we consulted an earlier study in the multidisciplinary area and found that Scopus and Web of Science publications and citations were significantly related (Archambault et al. 2009).

Search delimiting criteria

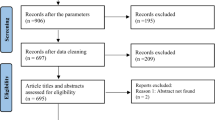

On September 19, 2022, the "Scopus" database was first searched with the predetermined search string. The inclusion and exclusion criteria are as defined in Fig. 1 (the PRISMA approach). The query was done in the Scopus Database using the operator "TITLE-ABS-KEY," which performs full-text searches on titles, abstracts, and authors' keywords. The search is restricted to "final peer-reviewed papers" published in English in all journals. The documents published in the period since the start of Scopus publishing up to September 19, 2022, were transparently chosen. The articles from the fields of social science, business management, and economics are selected subject to specific keywords as provided in the manuscript methodology section. The inclusion and exclusion criteria are used due to the fact that any form of research that investigates the characteristics of a certain subset of a population must define inclusion and exclusion criteria. This aids in the constant, trustworthy, and impartial identification of the study population by researchers. The selected sample in the study is therefore more likely to possess the qualities necessary to adequately address the research issue (Meline 2006). Therefore, using a set of exclusion and inclusion parameters, our result was narrowed down (Fig. 1).

The PRISMA flow diagram explaining steps in the identification and screening of data (Moher et al. 2009)

The search for documents was guided by the PRISMA approach (Moher et al. 2009). Parentheses customize the results for accuracy. The question mark “?” and “*,” for inclusion purposes, and Boolean operators (OR, AND), are used to widen and narrow the search, respectively, to specify the search key words. The search terms ("Effect*" OR "impact*" OR "influence*") AND ("financial inclusion" OR "mobile banking" OR "POS" OR "banking penetration") AND ("family firm growth" OR "cottage growth" OR "growth"), were used in a Scopus database. There were 3,220 documents found in this search. After screening and eligibility checking, 2,329 documents were removed due to the removal of unwanted specifications and documents of insufficient significance (Fig. 1).

Results and discussion of findings

Bibliographic information for the 891 papers, including authors, titles, abstracts, keywords, and citations, was exported and preserved for further data analysis. Comprehensive bibliometric research included author co-citation and keyword co-occurrence analysis, as well as citation and co-citation analysis and "visualization of similarities" (Eck & Waltman 2017). Excel and Scopus analytical tools were used by VOSviewer analysis in the bibliometric investigations (Eck & Waltman 2017). This section presents the findings from the bibliometric examination of the financial inclusion knowledge base. The following are the responses to the four research questions.

Descriptive trends in financial inclusion knowledge base

The study aids in describing the growth of the context of financial inclusion's knowledge base. This review's initial source was a 2005 article. The frequency of publications began to rise in 2013, which is when scholarly interest began to take off (Fig. 1). The most tremendous increase was in the year 2022, when the number of publications rose to a maximum of 219 (Fig. 2). Several significant elements in this sub-period are suggested by the analysis of the co-occurrence keywords, namely financial inclusion, fintech, economic growth, financial development, and microfinance. It is important to note that fintech, financial literacy, and digital finance are the newly emerging terms that were absent from earlier sub-periods (Table 1).

The chronological evolution has been explored by taking into account the keyword timelines, and the frequencies have been standardized by the total number of keywords in each sub-period (Agramunt et al. 2020). Table 1 shows the development of the keywords during the full period and its three sub-periods. The beginning phase is considered to be the first sub-period, which runs from 2005 to 2010. Only an average of two publications were published annually during this time. In this period, the five keywords with the highest co-occurrence were financial inclusion, financial development, financial exclusion, microfinance, and access to finance, which accounted for more than 11 percent of all occurrences.

The second sub-period, which spans 2011–2016, is known as the "take-off phase" because it was during this time that the number of articles gradually increased. On average, more than 13 papers were published per year. Financial inclusion, financial development, microfinance, economic growth, and financial exclusion were the five most frequently occurring terms, accounting for more than 12 percent of total occurrences during the sub-period. In this sub-period, fintech, digital finance, financial stability, financial literacy, and sustainable development started to attract researchers' attention as a driving force behind financial inclusion (Table 1).

The current phase, which spans 2017–2022, is the third sub-period. The average number of articles in this sub-period is around 135 per year, and the heavy increase started in this phase. The driving themes are financial inclusion, microfinance, financial literacy, and financial services, which are depicted in green. Financial inclusion could be thought of as a concentrated term that exists in all sub-periods and is the most often cited keyword. The term "fintech" contains fundamental concerns relating to financial inclusion. The terms “sustainable development,” “household income,” “banking,” “mobile banking,” and “credit provision” are the most frequently occurring terms across all sub-periods (2005–2022).

The financial inclusion in the first sub-period had the highest growth of about 6 percent, the highest of the occurrences. In the second sub-period, the growth rate decreased to 5.76 percent in occurrence. However, it increased to more than 9 percent of occurrences in the third sub-period. On average, financial inclusion had the highest growth, reaching about 26 percent of the occurrences (Table 1). The fast growth of research in the field of financial inclusion is caused by the field's assumed growing importance in establishing policy frameworks for microcredit and microfinance as well as similar lending institutions (Bongomin et al. 2016). Since the topic is still hot, researchers are advised to keep on studying it, as it is still not known to a larger population on the globe. Concentration should also be maintained in developing countries due to the obvious benefits of economic growth.

Fintech is a new term that occurred in the third sub-period. It is a hot topic, and so is the direction for research in the financial inclusion domain. In its first occurrence, it had a growth rate of 3.3 percent. Fintech had the second highest growth rate on average, accounting for approximately 8.5 percent of all occurrences (Table 1). As long as a topic is newly introduced, it is still unknown to most stakeholders. It has attracted wide attention because of the following advantages: improving the efficiency of operations, reducing operating costs effectively, disrupting the existing industry structures, blurring industry boundaries, facilitating strategic disintermediation, providing new gateways for entrepreneurship, and democratizing access to financial services (Agarwal & Zhang 2020; Suryono et al. 2020). The key technologies of FinTech work with internet technology such as the Internet and the Web of Things (Ruan et al. 2019), big data (Gai et al. 2018), artificial intelligence (Belanche et al. 2019), distributed technology like blockchain and cloud computing (Belanche et al. 2019; Miau & Yang 2018); and security technology like biometric technology (Gai et al. 2018). Under the influence of these technologies, the traditional development model of financial technology has changed. Fintech research in developing economies is limited due to the region's infrastructure, so its impact on those economies' economic growth remains unknown. Therefore, the research should be done in developing countries, where most of the areas have poor technologies. The impact that can be seen in emerging and developed countries may be due to the high technology they have.

Microfinance started being researched in the first sub-period, with a growth rate of about 2 percent. In the second sub-period, it increased its growth rate to about 3 percent of occurrences. It faced a decline in growth to about 2 percent of occurrences in the third sub-period. Microfinance had the third highest growth rate, accounting for more than 6 percent of all occurrences (Table 1). Several elements, all of which are structural aspects of the recent rise of microfinance, were the most crucial. Among them are multiple borrowing, intense market competition, overburdened management systems, and deterioration of lending discipline (J. Ghosh 2013). However, the area has had little research so far, as the main theme of "financial inclusion" is still too young to have many publications available in the Scopus database between 2005 and 2022. For instance, for all the sub-periods, it seems to have slow growth, meaning that researchers are not motivated to do research in the area, and this creates a gap.

The term "poverty" in the first sub-period had a growth rate of 1 percent of the occurrences. It maintained its 1 percent occurrence growth rate in the second sub-period. In the third sub-period, the growth rate increased to about 2 percent in occurrence. On average, the term "poverty" had a growth rate of just 2 percent of the occurrences (Table 1). The contribution of financial inclusion to poverty reduction is still unknown due to the fact that different economies have different characteristics. For instance, it is shown that most of the research in this domain was done in the developed and emerging countries, while the developing countries were left out (Fig. 3). Research in developing countries where poverty is high could be relevant in this area.

The term "financial literacy" in the first sub-period had a growth rate of 0.7 percent of the occurrences. It increased the occurrence rate to 0.8 percent in the second sub-period. However, in both sub-periods, it has not entered the top ten most frequent keywords. In the third sub-period, the growth rate rose to 1.35 percent in occurrences, and so it managed to enter the ten top-most keywords with high occurrences. On average, the term "financial literacy" had a growth rate of about 4 percent of the occurrences (Table 1). The topic is growing, though not at a fast pace. The reason is that the effects of financial literacy impel better financial inclusion, the benefits of which extend to the real economy (Grohmann et al. 2018). The combined effect of financial literacy and financial inclusion brings about financial capability, which means "ability to act" as well as "opportunity to act" (Sherraden et al. 2015). So, it needs to be researched, as the little research done on financial literacy has shown that it is one of the factors to be considered in financial inclusion. As it has started growing at a high speed in sub-period 3, we do expect higher growth in the future.

The geographical location of authors was investigated in order to determine where scholarly interest in financial inclusion research has been concentrated. This corpus of work was written in 105 different countries throughout the world, demonstrating a global interest in the subject (Fig. 3). However, researchers concentrated mostly in developed and emerging countries, as can be seen in Fig. 3. More than 75 percent of the knowledge base on financial inclusion collected for this review came from scholars connected to these twenty countries. Therefore, there is a gap for this research in developing countries as long as their contribution to the global economy is material.

Analysis of influential authors and documents

This analysis helps to understand the contribution of researchers and their studies in the domain. Table 2 exhibits the most dominant researchers in the financial inclusion literature with substantial authors' citation effects. However, we have not considered the h-index because the Scopus h-index considers each author's whole corpus of scholarly work that extends beyond the financial inclusion discipline. Therefore, the citations in Table 2 are exclusively based on citations from each author's articles on financial inclusion.

Table 3 shows the most cited documents in financial inclusion research as determined by total Scopus citations. More than 5,342 citations were found in twenty documents. These citations are within a reasonable range, given the recent nature of the financial inclusion literature.

Allen et al. (2016), seeking to identify what characteristics were connected with the usage of financial inclusion and what policies were particularly effective, have 257 citations, making them the most popular authors. Their motive for this research was due to the fact that financial inclusion could boost people's welfare in a variety of ways, though little was known about the factors influencing financial inclusion. They discovered that increased financial inclusion was linked to a better environment that makes it easier to use financial services, like lower banking fees and closer access to branches. Political stability and expanded legal rights were also important for inclusion. However, depending on the qualities of the individuals under consideration, measures that encourage inclusion seem subjective.

They discovered that policies generally seem to have less success in encouraging women and young people to open accounts and benefit from financial inclusion. In this case, they advised governments to create friendly environments for financial inclusion so that people get access to financial services as a means to benefit from financial inclusion. Also, they studied the elements that financially excluded individuals perceive as impediments to account use. They found that the main obstacles were the higher account fees and lower financial service providers’ penetration. Their advice was for the government to review its policies to enable an environment that favors the financial service providers to increase their penetration in a way that increases the number of service users.

Ozili (2018) distinguished financial data inclusion from financial inclusion and has 231 citations, making him among the most popular authors. He explained that financial inclusion entails expanding the number of people who have access to formal financial services, primarily through having formal bank accounts. In contrast, financial data inclusion entails combining individuals' biometric information with their bank accounts to enable financial transactions that can be verified and traced to the individual or firm. Despite the advantages of digital financial services, many developing nations still have significant difficulties getting merchant acceptance of digital payments (Ozili 2018). Some of the narrated reasons were the high bank charges and high initial costs, and most of the small companies in urban and rural parts of developing countries do not accept cashless transactions.

The author cited the customers' lack of trust in digital finance channels as having a detrimental impact on programs for financial inclusion in developing and emerging economies. The result is that if people do not trust digital channels, having more financial data included does not necessarily improve access to finance for those who are poor. In general, a program for financial inclusion that is driven by digital finance may have the unintended result of increasing financial data inclusion but not financial inclusion itself.

Tchamyou et al. (2018), who studied the impact of ICT on income inequality through the lens of financial development dynamics of depth, efficiency, and financial activity, have 223 citations, making them among the most popular authors. Their results demonstrate that ICT reduces inequality through the development and formalization of the formal financial sector as opposed to the development and informalization of the informal financial sector.

The authors recommended that policymakers use ICT to lessen inequality by using ICT for financial access due to the fact that it gives users access to data about their bank accounts and the ability to store money. Particularly in nations where mobile financial services are gaining traction, the rise of mobile phones is solidifying the influence of financial inclusion on economic growth. In essence, whereas mobile banking is linked to actual bank accounts in the formal financial sector, this is not the case in the unregulated informal financial sector, which is not distinguished by bank accounts. The authors suggested that the availability of financial service providers near consumers enables consumers to use the services even during an emergency. Apart from adding to the body of current literature, the study uncovers the viability of the established link between information sharing and financial inclusion, provided that both can use the same ICT.

Haddad & Hornuf (2018), researching on the economic and technological factors that propel businesspeople to launch fintech projects, have 161 citations, making them among the most popular. They found that nations with adaptable market rules, strong economies, and accessible supporting infrastructure have a higher number of fintech start-up establishments. M-Pesa serves as an illustration of how fintech may successfully address issues affecting people in developing nations. Therefore, it is essential to provide the necessary infrastructure, including sustainable technology and accessibility, to enable financial inclusion, particularly with regard to fintech services. They concluded that policymakers may be guided by these research results as they choose how to support this emerging domain. So, the establishment of fintech start-ups should not be left to chance and may instead be influenced by proactive policies.

To stimulate researchers in this domain, the authors recommended conducting empirical research to determine whether fintech companies offer services that are more effective than those of established financial institutions or not. They also found a knowledge gap on whether fintech will not ultimately lead to the creation of new systemic dangers that require regulation.

Anagnostopoulos (2018), who studied the impact of FinTech development on the larger financial technology environment, has 129 citations, making him among the most popular. This was grounded in the fact that it was not new for banks and fintech companies to compete for customer loyalty. He found that developments in technology and sophisticated regulatory mechanisms indicate a change in favor of alliances. Direct collaboration throughout the fintech ecosystem seems to have already replaced competitive relationships between banks and challengers. However, a number of significant obstacles were reported to prevent them from doing business together. According to the author, new competitors lack regulatory certainty and IT security that complies with regulations. The tensions, as seen from the perspective of fintech, were caused by variations in operational procedures and cultural practices.

He went on to say that fintech owns agility, innovation, and a future client base, while banks possess legacy, financial expertise, infrastructure, and a stable customer base. Banks may profit from considering "fintech" as partners rather than competitors. To stimulate researchers in the domain, the author called attention to possible regulatory hotspots, prospective solutions, upcoming research, or newly emerging problems that demand more investigation.

Intellectual structure of the financial inclusion knowledge base

Researchers can find the most researched topics and unresearched areas in the subject of financial inclusion by looking at the intellectual structure. Academics used scientific mapping and review approaches to investigate the "intellectual structure" of various academic disciplines (Nerur et al. 2008). Intellectual structure refers to the main theoretical and empirical paths of inquiry, or "schools of thought," that characterize a field of study. We created a network map in VOSviewer that illustrates the conceptual organization of the financial inclusion knowledge base using author co-citation analysis.

According to researchers who employ co-citation analysis, authors who are frequently co-cited by other authors have related scholarly philosophies (Hallinger & Kovačević, 2019). Furthermore, by analyzing the frequency of "author co-citations," VOSviewer software may produce a network map that "visualizes commonalities" among the authors cited in our financial inclusion database (Eck & Waltman 2017).

The co-citation map for VOSviewer displayed 891 academics since the requirement was set to at least 20 co-citations from authors (Fig. 4). According to the frequency of co-citations, the larger bubbles in Figure 4 represent important researchers. The vibrant clusters categorize researchers into different study topics based on co-citation relationships.

Topical concentrations of the financial inclusion knowledge base

Understanding the topical focus of financial inclusion can help identify relevant research gaps for future studies. Utilizing keyword analysis, the themes discussed in the financial inclusion literature were examined. To begin, we used the Scopus analysis tool to identify the most popular phrases (Fig. 5). Financial inclusion was the keyword that appeared the most often, according to the funnel chart (Fig. 5), with 264 occurrences.

A "chronological keyword map" in VOSviewer was made with a threshold of at least 20 co-occurrences (Fig. 6) (Eck & Waltman 2017). The chronological co-word analysis examines the distribution of keywords across time based on the publication date of the document.

We also used author-keyword analysis to ascertain the direction of research in the domain of financial inclusion. The author keywords were first retrieved from our collection of 891 relevant articles, and then, using VOSviewer software, an author-keyword network was built. To gather analytical data, we specified a requirement of five minimum co-occurrences of terms. For keywords that co-occurred more than five times in the collection of 891 papers, an author's keyword co-occurrence network was apparent. Out of 2,224 key words, 102 met our criteria. Financial inclusion was found to be the keyword that occurred the most, 264 times.

Conclusion, research gap, and limitations

Conclusion

The study is an initial attempt to compile and make sense of the body of knowledge on financial inclusion. This has been accomplished through a number of quantitative bibliometric assessments that rely on software and computational techniques that allow participation in the activity of the flow of knowledge generation across time. By doing so, we were able to provide a thorough assessment of the body of knowledge on financial inclusion, to suggest some possible research trajectories, and to provide an analytical framework that takes into consideration the dynamic evolution of the field. Therefore, the study clarifies the information gap and knowledge map.

Asongu S. A. is the most well-known author in the area of financial inclusion, with 647 citations from 22 documents. The 219 most recent documents are all about 2022. As far as geography is concerned, the United Kingdom, with 138 publications, has devoted itself to being the leading contributor in the financial inclusion domain. The study has differentiated fintech, financial literacy, digital finance, and financial inclusion themes from the normal topics, so they deserve to be future research targets.

Theoretically, this study contributes to the corpus of knowledge on financial inclusion. It might enable researchers to gain a comprehensive understanding of a subject. By highlighting the financial inclusion topics that have received the greatest attention, as well as emerging trends and evolutionary orientations, this can help academics increase the subjects' body of knowledge.

Research gaps

First, in the last sub-period (2017–2022), three terms appeared for the first time in the ten top-most keywords. These are "fintech," "financial literacy," and "digital finance." Since the terms are new, they need more research (Table 1).

Second, financial inclusion grew the fastest, accounting for approximately 26 percent of all occurrences (Table 1). The topic is still of interest to researchers because it is unknown to a larger population around the world.

Third, fintech is a new term that occurred in the third sub-period (2017–2022). It is a hot topic, and so is the direction for financial inclusion domain research. Fintech grew at the second-fastest average rate, accounting for roughly 8.5 percent of all occurrences (Table 1). As long as a topic is newly introduced, it is still unknown to most stakeholders.

Fourth, developed and emerging economies monopolize financial inclusion research, leaving developing economies in the dark (Fig. 2). For instance, due to most countries in developing nations having poor technology, the application of fintech and digital financing in particular is a challenge. As a result, the impact of the themes seen in emerging and developed countries may differ from that seen in developing economies. In this case, the impact of fintech on the economic growth of developing countries is still unknown.

Fifth, microfinance grew at the third fastest rate, accounting for more than 6 percent of all occurrences (Table 1). The area has little research so far as the main theme of "financial inclusion" is still young for publications available in the Scopus database (2005–2022). Nevertheless, for all the sub-periods, it seems to have slow growth, meaning that researchers are not motivated to do research in the area, and this creates a gap.

Limitations

The limitations of the bibliometric approaches that are relevant to this study are not excluded. First off, despite the advantages of using the Scopus database, it's probable that other important papers that can only be accessed through other databases (such as the Web of Sciences, ABI, and Inform/ProQuest) have gone unnoticed. This is a consistent problem across all bibliometric investigations, as is obvious (Jacsó, 2008). Second, this search approach excludes materials like national journals, conference proceedings, and editorial content, despite their potential importance in financial inclusion research (Casado-Belmonte et al. 2021). Finally, our study used key word analysis, co-occurrence analysis, and co-citation analysis (Tiberius et al. 2020). Our findings might benefit from the use of different bibliometric techniques like bibliographic coupling. In any case, the aforementioned constraints offer recommendations for strengthening or improving bibliometric research going forward. Due to the above limitations, the findings of this study cannot be generalized to both published and unpublished work outside of the framework described in the methodology section.

Data availability

The datasets generated and analyzed during the current study is attached to the submission portal as csv file.

References

Abor JY, Amidu M, Issahaku H (2018) Mobile telephony, financial inclusion and inclusive growth. J Afr Bus 19(3):430–453. https://doi.org/10.1080/15228916.2017.1419332

Agarwal S, Zhang J (2020) fintech, lending and payment innovation: a review. Asia Pac J Financ Stud 49(3):353–367. https://doi.org/10.1111/ajfs.12294

Agramunt LF, Berbel-Pineda JM, Capobianco-Uriarte MM, Casado-Belmonte MP (2020) Review on the relationship of absorptive capacity with interorganizational networks and the internationalization process. Complexity. https://doi.org/10.1155/2020/7604579

Ahamed MM, Mallick S (2016) Is financial inclusion good for bank stability? international evidence by m mostak ahamed 1,2 and sushanta. Mallick. 44:1–65

Allen F, Demirguc-Kunt A, Klapper L, Martinez Peria MS (2016) The foundations of financial inclusion: understanding ownership and use of formal accounts. J Fin Intermed 27(2016):1–30. https://doi.org/10.1016/j.jfi.2015.12.003

Anagnostopoulos I (2018) Fintech and regtech: Impact on regulators and banks. J Econ Bus 100:7–25. https://doi.org/10.1016/j.jeconbus.2018.07.003

Anarfo EB, Abor JY, Osei KA, Gyeke-Dako A (2019) Monetary policy and financial inclusion in sub-sahara africa: a panel var approach. J Afr Bus 20(4):549–572. https://doi.org/10.1080/15228916.2019.1580998

Anzoategui D, Demirgüç-Kunt A, Martínez Pería MS (2014) Remittances and financial inclusion: evidence from el salvador. World Dev 54:338–349. https://doi.org/10.1016/j.worlddev.2013.10.006

Archambault É, Campbell D, Gingras Y, Larivière V (2009) Comparing bibliometric statistics obtained from the web of science and scopus. J Am Soc Inform Sci Technol 60(7):1320–1326. https://doi.org/10.1002/asi.21062

Arner DW, Buckley RP, Zetzsche DA, Veidt R (2020) Sustainability, FinTech and Financial Inclusion. Euro Bus Organ Law Review 21(1):7–35. https://doi.org/10.1007/s40804-020-00183-y

Arun T, Kamath R (2015) Financial inclusion: Policies and practices. IIMB Manag Rev 27(4):267–287. https://doi.org/10.1016/j.iimb.2015.09.004

Beck T, Senbet L, Simbanegavi W (2015) Financial inclusion and innovation in africa: an overview. J Afr Econ 24:i3–i11. https://doi.org/10.1093/jae/eju031

Belanche D, Casaló LV, Flavián C (2019) Artificial Intelligence in FinTech: understanding robo-advisors adoption among customers. Ind Manag Data Syst 119(7):1411–1430. https://doi.org/10.1108/IMDS-08-2018-0368

Bongomin GOC, Ntayi JM, Munene J (2016) Institutional frames for financial inclusion of poor households in Sub-Saharan Africa evidence from rural Uganda. Int J Soc Econ 43(11):1096–1114. https://doi.org/10.1108/IJSE-06-2014-0110

Bongomin GOC, Yourougou P, Munene JC (2019) Digital financial innovations in the twenty-first century. J Eco Admin Sci 36(3):185–203. https://doi.org/10.1108/jeas-01-2019-0007

Candiya BG, Ntayi JM, Munene JC, NkoteNabeta I (2016) Social capital: mediator of financial literacy and financial inclusion in rural Uganda. Review Inter Bus Strategy 26(2):291–312. https://doi.org/10.1108/RIBS-06-2014-0072

Cao L, Yuan G, Leung T, Zhang W (2020) Special ahead. IEEE Intell Syst 35(2):3–6. https://doi.org/10.1109/MIS.2020.2983494

Casado-Belmonte, M. del P., Capobianco-Uriarte, M. de las M., Martínez-Alonso, R., & Martínez-Romero, M. J. (2021). Delineating the Path of Family Firm Innovation: In Din M (eds) Mapping the Scientific Structure. Review of Managerial Science. Springer Berlin Heidelberg

Chhatoi BP, Sahoo SP, Nayak DP (2021) Assessing the academic journey of “financial inclusion” from 2000 to 2020 through bibliometric analysis. J Sci Res 10(2):148–159. https://doi.org/10.5530/JSCIRES.10.2.29

Cisneros, L., Ibanescu, M., Keen, C., Lobato-Calleros, O., & Niebla-Zatarain, J. (2018). Bibliometric study of family business succession between 1939 and 2017: mapping and analyzing authors’ networks. In Scientometrics (Vol. 117, Issue 2). Springer International Publishing. https://doi.org/10.1007/s11192-018-2889-1

Daya H, Mader P (2018) Did demonetisation accelerate financial inclusion? Econ Pol Wkly 53(45):17–20

De Moya-Anegón F, Chinchilla-Rodríguez Z, Vargas-Quesada B, Corera-Álvarez E, Muñoz-Fernández FJ, González-Molina A, Herrero-Solana V (2007) Coverage analysis of Scopus: A journal metric approach. Scientometrics 73(1):53–78. https://doi.org/10.1007/s11192-007-1681-4

Deepika MG, Sigi MD (2014) Financial inclusion and poverty alleviation: The alternative state-led microfinance model of Kudumbashree in Kerala. India Enter Develop Microfin 25(4):327–340. https://doi.org/10.3362/1755-1986.2014.030

Esnard-Flavius T, Aziz Z (2011) Microcredit, microenterprises and social welfare of the rural poor in North-Eastern Trinidad: An evaluation of “Hope.” Asian Acad Manage J 16(1):95–118

Fuller D, Mellor M, Dodds L, Affleck A (2006) Consulting the community: Advancing financial inclusion in Newcastle upon Tyne, UK. Int J Sociol Soc Policy 26(5–6):255–271. https://doi.org/10.1108/01443330610674297

Gabor D, Brooks S (2017) The digital revolution in financial inclusion: international development in the fintech era. New Pol Eco 22(4):423–436. https://doi.org/10.1080/13563467.2017.1259298

Gai K, Qiu M, Zhao H (2018) Energy-aware task assignment for mobile cyber-enabled applications in heterogeneous cloud computing. J Para Distribut Comput 111:126–135. https://doi.org/10.1016/j.jpdc.2017.08.001

Ghosh J (2013) Microfinance and the challenge of financial inclusion for development. Camb J Econ 37(6):1203–1219. https://doi.org/10.1093/cje/bet042

Ghosh S (2019) Retracted Article: Biometric identification, financial inclusion and economic growth in India: does mobile penetration matter? Inf Technol Dev 25:4

Ghosh S, Günther MK (2018) Financial Inclusion Through Public Works Program: Does Gender-Based Violence Make a Difference? In Gender Issues. https://doi.org/10.1007/s12147-017-9202-0

Gough, D., Oliver, S., & Thomas, J. (2012). An introduction to Systematic Reviews. In SAGE Publications Ltd. SAGE Publications Ltd. https://b-ok.asia/book/2718381/a08a63

Grohmann A, Klühs T, Menkhoff L (2018) Does financial literacy improve financial inclusion? cross country evidence. World Dev 111:84–96. https://doi.org/10.1016/j.worlddev.2018.06.020

Gruin J, Knaack P (2020) Not just another shadow bank: chinese authoritarian capitalism and the ‘developmental’ promise of digital financial innovation. New Political Eco 25(3):370–387. https://doi.org/10.1080/13563467.2018.1562437

Haddad C, Hornuf L (2018) The emergence of the global fintech market : economic and technological determinants. Small Bus Econ 53(1):81–105

Hallinger P, Kovačević J (2019) A bibliometric review of research on educational administration: science mapping the literature, 1960 to 2018. Rev Educ Res 89(3):335–369. https://doi.org/10.3102/0034654319830380

Han J, Kang HJ, Kim M, Kwon GH (2020) Mapping the intellectual structure of research on surgery with mixed reality: Bibliometric network analysis (2000–2019). J Biomed Inform 109:103516. https://doi.org/10.1016/j.jbi.2020.103516

Hendriks S (2019) The role of financial inclusion in driving women’s economic empowerment. Dev Pract 29(8):1029–1038. https://doi.org/10.1080/09614524.2019.1660308

Jacsó P (2008) The pros and cons of computing the h-index using Web of Science. Online Inf Rev 32(5):673–688. https://doi.org/10.1108/14684520810914043

Kumar, S., Sureka, R., & Colombage, S. (2019). Capital structure of SMEs: a systematic literature review and bibliometric analysis. In Management Review Quarterly (Vol. 70, Issue 4). Springer International Publishing. https://doi.org/10.1007/s11301-019-00175-4

Laengle S, Merigó JM, Miranda J, Słowiński R, Bomze I, Borgonovo E, Dyson RG, Oliveira JF, Teunter R (2017) Forty years of the european journal of operational research: a bibliometric overview. Eur J Oper Res 262(3):803–816. https://doi.org/10.1016/j.ejor.2017.04.027

Mader P, Sabrow S (2019) All Myth and Ceremony? examining the causes and logic of the mission shift in microfinance from microenterprise credit to financial inclusion. Forum Social Eco 48(1):22–48. https://doi.org/10.1080/07360932.2015.1056204

Meline T (2006) Selecting Studies for Systemic Review: Inclusion and Exclusion Criteria. Contemp Issues Commun Sci Disorder 33(Spring):21–27. https://doi.org/10.1044/cicsd_33_s_21

Mia MA, Dalla Pellegrina L, Van Damme P, Wijesiri M (2019) Financial inclusion, deepening and efficiency in microfinance programs: evidence from bangladesh. Eur J Dev Res 31(4):809–835. https://doi.org/10.1057/s41287-018-0188-6

Miau S, Yang JM (2018) Bibliometrics-based evaluation of the Blockchain research trend: 2008–March 2017. Technol Anal Strat Manage 30(9):1029–1045. https://doi.org/10.1080/09537325.2018.1434138

Moher D, Liberati A, Tetzlaff J, Altman DG (2009) Academia and Clinic Annals of Internal Medicine Preferred Reporting Items for Systematic Reviews and Meta-Analyses. Ann Intern Med 151(4):264–269

Mongeon P, Paul-Hus A (2016) The journal coverage of Web of Science, and Scopus: A comparative analysis. Scientometrics 126(6):5113–5142. https://doi.org/10.1007/s11192-021-03948-5

Nerur SP, Rasheed AA, Natarajan V (2008) The intellectual structure of the strategic management field: An author co-citation analysis. Strateg Manag J 29(3):319–336. https://doi.org/10.1002/smj.659

Ozili PK (2018) Impact of digital finance on financial inclusion and stability. Borsa Istanbul Rev 18(4):329–340. https://doi.org/10.1016/j.bir.2017.12.003

Ruan J, Wang Y, Chan FTS, Hu X, Zhao M, Zhu F, Shi B, Shi Y, Lin F (2019) A Life Cycle Framework of Green IoT-Based Agriculture and Its Finance, Operation, and Management Issues. IEEE Commun Mag 57(3):90–96. https://doi.org/10.1109/MCOM.2019.1800332

Schuetz S, Venkatesh V (2020) Blockchain, adoption, and financial inclusion in India: Research opportunities. Int J Inf Manage 52:1–8. https://doi.org/10.1016/j.ijinfomgt.2019.04.009

Sherraden MS, Huang J, Johnson Frey JJ, Birkenmaier J, Callahan C, Clancy MM, Sherraden M (2015) Building financial capability and assets for all. Grand Chal Social Work Society. https://doi.org/10.1093/oso/9780197608043.003.0023

Stopar K, Bartol T (2019) Digital competences, computer skills and information literacy in secondary education: mapping and visualization of trends and concepts. Scientometrics 118(2):479–498. https://doi.org/10.1007/s11192-018-2990-5

Suryono RR, Budi I, Purwandari B (2020) Challenges and trends of financial technology (Fintech): a systematic literature review. Information 11(12):1–20. https://doi.org/10.3390/info11120590

Tchamyou VS, Erreygers G, Cassimon D (2018) Inequality, ICT and financial access in Africa. Technol Forecast Soc Chang 139:169–184. https://doi.org/10.1016/j.techfore.2018.11.004

Thoene U, Turriago-Hoyos Á (2017) Financial inclusion in Colombia: A scoping literature review. Intangible Capital 13(3):582–614. https://doi.org/10.3926/ic.946

Tiberius V, Schwarzer H, Roig-Dobón S (2020) Radical innovations: Between established knowledge and future research opportunities. J Innov Knowl 6(3):145–153. https://doi.org/10.1016/j.jik.2020.09.001

Trevinyo-Rodríguez RN, Chamiec-Case L (2012) Pursuing financial inclusion of family firms at the base of the pyramid (bop): the case of convenience stores and microenterprises in nuevo león, mexico. J Small Bus Entrep 25(2):231–248. https://doi.org/10.1080/08276331.2012.10593571

Urrea MA, Maldonado JH (2011) Vulnerability and risk management: The importance of financial inclusion for beneficiaries of conditional transfers in Colombia. Canad J Develop Stud 32(4):381–398. https://doi.org/10.1080/02255189.2011.647442

Van Eck NJ, Waltman L (2010) Software survey: VOSviewer, a computer program for bibliometric mapping. Scientometrics 84(2):523–538. https://doi.org/10.1007/s11192-009-0146-3

Van Eck NJ, Waltman L (2017) Citation-based clustering of publications using citnetexplorer and vosviewer. Scientometrics 111(2):1053–1070. https://doi.org/10.1007/s11192-017-2300-7

Acknowledgements

We would like to thank our Almighty God for keeping us healthy so that we managed to complete this research. Our heartfelt thanks to the Post-Graduate Department of Business Management Sardar Patel University (India) management, The Local Government Training Institute (Tanzania), and Indian Commission for Cultural Relations for their material and moral support. We alone remain responsible for any errors © 2023 by Prof. (Dr.) P. K. Priyan, Wakara Ibrahimu Nyabakora, and Geofrey Rwezimula.

Funding

The authors received no financial support for the research, authorship, and/or publication.

Author information

Authors and Affiliations

Contributions

All authors contributed to the study's conception and design. Material preparation, data collection, and analysis were performed by WIN, PKP, and GR. The first draft of the manuscript was written by WIN. Editing of the manuscript was done by PKP and all authors commented on the versions of the manuscript, read and approved the final manuscript for publication.

Corresponding author

Ethics declarations

Conflict of interest

We, the authors, declare that there is no potential conflict of interest regarding this research and its publication.

Ethics approval and consent to participate

This article does not contain any studies with human participants performed by any of the authors.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Priyan, P.K., Nyabakora, W.I. & Rwezimula, G. A bibliometric review of the knowledge base on financial inclusion. SN Bus Econ 3, 58 (2023). https://doi.org/10.1007/s43546-023-00441-4

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s43546-023-00441-4