Abstract

Revenue in the recording music industry is driven by exogenous technology inputs and revisions to the Copyright Act. Each new technology and regulatory change had a financial impact that altered the life cycle patterns in the industry, that in turn led to innovative marketing applications that transformed the production, sale, and distribution of music. The premise that technological change follows exactly the theoretical S-curve in all cases may be misleading and this paper provides an alternative measure. We analyze the life cycle effects of technology on revenue in the music industry using an unbalanced panel instead of a logistic growth model when life cycle curves may be ‘irregular’ and the mathematical approximation is often difficult. When the error terms are corrected for heteroscedasticity and serial correlation, the model measures the increased marginal effects of digital technologies (physical, downloads, digital subscriptions, streaming, and synchronization) on music industry revenue for the years 1973–2017. This paper adds to the growing literature of advanced econometric modeling, machine learning, and artificial intelligence analysis in the music and creative industries.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The recorded music industry has passed the mature stage in its life cycle. Traditional revenue streams from the physical segment (vinyl and CDs) and permanent digital downloads (singles and albums) have collapsed or in decline. The industry is now being transformed and a new life cycle is taking shape due in part by the creation of digital technologies such as MP3, broadband, satellite, mobile devices, and apps. The Internet and mobile apps are now the primary media platforms for the sale and distribution of music, and this is expected to drive future industry growth and revenue.

Record labels must now rely on licensing to music users such as (Amazon Music, iTunes, Pandora, and Spotify) to monetize digital sound recordings to offset the collapse of CD sales in the physical segment. The shift toward digital subscription and streaming services created new revenue streams for record labels and music publishers; however, the monetization of these new digital services has not produced the same amount of revenue that the industry once earned from CD sales and other products.

The introduction of new innovations in music technology meant a greater increase in digital music consumption for recorded music (as the speed of adoption skyrocketed), but the status-quo media landscape (radio, film, and television), copyright laws, licensing, and business models were slow to adapt the new technologies. Music industry unit sales and revenue in certain segments would increase with the introduction of the latest technology (for example, CDs), while the sales of the older technology (vinyl and cassette tapes) would decline.

Despite the decline in revenue in certain segments, the industry is uniquely profitable because of the following reasons. First, the marginal costs of reproducing a new copy of a musical work once the song has been digitally mastered are practically zero.

Second, the introduction of new media platforms meant that consumers were replacing the same music in their libraries in the newer format. Finally, the same digital song can then be licensed an infinite number of times to an infinite number of music users. Interestingly, most of the new technology platforms in music (MP3, computers, smart phones, satellite, and broadband) are often considered exogenous; that is, they were created outside the music industry without the music industry contributing financial resources.

From the beginning of our study in 1973 to today, the music industry has been in a constant state of flux where streaming and social media are now the dominant forces in determining success for both new and existing songwriters. Pitt (2010, 2013) analyzed performance royalty income and the so-called ‘superstar or winner-take-all effect’ in music in which a small number of songwriters and composers earned the lion’s share of music royalties and concluded that the number of ‘hits’ in a songwriters’ repertoire was the one of the causes of this effect. A large number of hits increased the likelihood that a number of songs would be performed more often on radio and television.

Cameron (2016) provides an excellent survey of the literature in this special issue on the economics of music research, something that is not repeated here due to space limitations. Among other things, he found that new empirical research in the field of music requires grappling with issues that still trouble the core of mainstream economics—supply and demand—while coming to terms with the shift from physical production (vinyl and CDs) to streaming, social media, and a knowledge-based economy.

Most of the economic studies are on the demand side, because that is the only limited data that is made public. Outside of statutory requirements, supply side pricing data such as the bundling of blanket licensing transactions, songwriter’s contracts, and PRO royalty payments to composers and publishers, and other input costs (overhead and legal fees) are obscured or hidden in confidentiality agreements, so there is no price discovery that you would find in the supply and demand economics literature outside of music that would expose administrative inefficiencies. These agreements hide the asymmetrical information that is known only to music publishers/PROs and individual songwriters, prohibiting a cross comparison of royalty payments among all songwriters, and the proper economic evaluation of what a musical performance is worth across all media platforms or even across all PROs (Pitt 2015, Chapter 2).

Krueger (2019, pp. 6–10) describes seven economic lessons that constantly resonate in a more recent study of the music industry. He found economies of scales, a timely and unique product, luck, and a passion for music enable superstars to dominate certain music markets, among other things. He also notes that from vinyl records to digital music and streaming, the industry will continue to evolve with lots of winners and losers determined by the economic forces of supply and demand. Disruptive technologies caused the income of some artists to decline, while the same technology created economic windfall for others through economies of scale. This has deepened the fundamental divide between artists and consumers as recorded music became more ubiquitous and easier to distribute; it became harder to prevent piracy. As a result, unauthorized (unpaid) use of music decreased royalty income from album sales for some musicians. With the economic analysis of all of these factors, economists can learn new insights about how disruptive technologies (creative destruction in real time) can affect both the music industry and consumer behavior.

The aim of this economic study is to provide some insight into where the industry has been and where the industry is likely headed as new musical genres are created. We analyze the life cycle of the recorded music industry by marketing segments, technology, and revenue using two methods and Recording Industry Association of America (RIAA) revenue data for the years 1973–2017.

We use a graphical approach and an econometric model to measure the marginal effects of technologies (vinyl, cassettes, CDs, video, digital downloads, digital subscriptions, digital streaming, and royalties) that were introduced at various stages in the life cycle of the music industry. The econometric model uses data from the (RIAA), that is broken down by marketing segment, technology (media platform), and revenue. RIAA revenue data are wherever possible tabulated at retail value, and, in most cases, include both the record label and publisher shares for those formats in revenue estimates.

This paper makes a distinction between the recording industry segment of the music industry and the music publisher. We do this to separate the functions of record labels whose responsibilities include coordinating the movement of physical records from manufacturing to retail outlets and the digital distribution of music, among other things.

The paper is organized as follows. The section “Introduction” contains introductory material. The section “How technology, innovation and competition changed music” takes a look at the classification periods in the life cycle of the recording industry. The section “Sound recording life cycle by segment, technology and year” walks us through the life cycle analysis and estimation techniques, including S-curves, logistic growth, and pooled time-series cross-section modeling. The section “Life cycle analysis estimation techniques” describes our data. The section “Data” presents the results from our econometric model and the section “Results” contains concluding remarks.

How technology, innovation, and competition changed music

The music industry was one of the first sectors in the entertainment industry to confront the technological shift—as bandwidth capacity increased dramatically—to music consumption using digital products and services and the adverse effects of what is called ‘piracy’, the unauthorized use of copyrighted music.

In their futile fight to outlaw piracy, music publishers and record labels failed to meet the unmet demand caused by piracy. Their copyright infringement lawsuits, obsolete business models, and redundant-self preservation management only delayed the rapid transition to new digital services. Book publishers, movie, and video producers faced the same technological issues as the music industry, but had the lead time to avoid the costly mistakes made in the music industry (Pitt 2015, Chapter 7, pp. 169–217).

Nearly every major technological innovation in music delivery—from player pianos to record players, to juke-boxes, to broadcast and cable television, to satellite transmissions, to the Internet, and to wireless phones—led to amendments in the Copyright Act, if only as an initial knee–jerk reaction to protect the fading status-quo business models of incumbent PROs, music publishers, and record labels (Cardi 2007; Patry 2011; Pitt 2015).

No other RIAA product matched the impressive revenue numbers from CD sales of $63,078 billion in the years 1998–2002 that is shown in Table 4. The share of revenue from CDs sales reached its historic peak in 2000 with a revenue market share of 93.25%, as shown in Table 1. So far, none of the digital products have achieved a similar market penetration as CDs. When CDs began a steep decline in sales, it signaled the mature stage in the life cycle of the music recording industry and its eventual new transformation into digital products.

The music industry can thus be divided into two categories: pre-and-post CDs. Digital technologies redefined the what, how, and when the method of distribution (in some cases free) for consumer entertainment, and in the process diminished the gatekeeping roles of incumbent PROs, record labels, and music publishers. Marketing innovations in the music industry were often the result of both exogenous technological invention (MP3s for example) and later clever marketing insight (such as turning Napster into iTunes or Spotify).

For example, Apple’s inventions such as the iPod and iPhone took their innovations into areas of music applications such as iTunes for downloading, purchasing, and streaming musical content and videos, but made a fortune from selling the media players. The Internet made the distribution of music easier, cheaper, and more efficient than brick and mortar retailers.

Apple’s iTunes was something that the music industry would not have thought of or had the desire to implement for several reasons. First, the incumbent record labels, music publishers, and PROs were always reluctant to introduce new technologies if the new technologies altered the status-quo. New delivery technologies were often considered a threat to existing business models rather than an unimagined opportunity for new media innovations. It was difficult to contemplate the virtual concept of a turnkey solution such as iTunes—which aggregated the individual music catalogs of all publishers—in a digital marketplace which offered digital downloads for 99 cents and albums for $9.99 when the record labels enjoyed a $10–$12 profit margin on each CD sold.

Infighting and inertia among music publishers meant that any digital market place service would have been limited to only the individual repertoire of each publisher, requiring consumers to purchase each service separately to obtain a wide variety of music.

Apple (thanks in part to the pioneering Napster) shifted the standard unit of commerce—the vinyl or CD album—to single downloads and established the process of selling tens of millions of songs, iPods and iPhones, a strong indication that some consumers were still willing to pay for music that they wanted.

Later, as streaming became more popular than downloads, consumers were willing to pay a subscription fee for access to all of the recorded music in history. Even though the record labels received about 67 cents for each digital download, it was not enough to offset the decline in CD sales. To make up for the income loss from declining album sales, artists turned to touring where the money was in ticket sales and merchandising (Seabrook 2016, pp. 196–194).

As iTunes’ downloaded-singles pricing model became more popular with consumers, physical album sales mattered less for some successful artists in the digital era. Hit singles—not attached to an album, the norm for vinyl, and CD recordings in the rock era—meant that artists had only a few minutes on a recording to define their distinctive sound, vocal range, personality, style, presence, artistic vision, and other intangibles that grabbed listeners’ attention, instead of the 10–12 songs on an album.

Hit singles would change dramatically the division of labor in how music is composed (cheaper and efficiently) in the digital era with unintended consequences for copyright law protection and why there may need to be a revision to those outdated laws. Track-and-hook has largely replaced the well-defined and older melody-and-lyrics approach of Tin Pan Alley songwriters and composers. For example, in the melody-and-lyrics approach to music composition, the melody and lyrics were fleshed out first sitting at a piano and then production followed. Today, you would hardly hear anyone say, ‘melody by composer A and lyrics by songwriter B’. It is the reverse with track-and-hook in which production comes first in a factory-style production system and the producer or a popular DJ has taken control of the song-making process.

With track-and-hook, producers create batches of tracks (technically, parts of both the musical composition and sound recording of a song that are copyright protected) all at one time and those tracks are submitted to topliners—competing music specialists such as verse writers, hook smiths, bridge makers, and lyricists—for song completion, eliminating the need for session musicians.

It is the topliners’ job to create or augment the melodies and lyrics that will be placed on top of the producer’s tracks. A single melody is often created by a team of multiple songwriters and composers and the producer will often chose the best melody from submitted works. It is the reason why so many songwriters and composers often appear as copyright owners—having to split meager royalties among themselves—on recent song-title registrations and many of the top hits have a formulaic sound to them.

The topliners and producers split the publishing royalties 50–50. However, producers are paid for the time spent in studio and regardless of whether a hit is produced, whereas the topliners are only paid if the song is recorded and put on sale. Producers may also receive a cut of record sales and other income, while topliners do not.

By submitting tracks to dozens of competing topliners, producers maximize their chances that the process might result in a salable song, but for the songwriters whose material were not chosen, they may have squandered a melody on nothing and were unpaid for their writing efforts (Seabrook 2016, 198–207).

This is in sharp contrast to the older works-for-hire agreements (often unethical and a legal grey area) used in Tin Pan Alley where songwriters and composers were employed to churn out music, but the copyright ownership (melody and lyrics) was transferred to the music publisher. In this case, the songwriters may not have been publicly credited at all and received no future residual royalties beyond what was specified in the agreement.Footnote 1

It is beyond the scope of this article to discuss the unintended consequences of how the track-and-hook industrial process blurred the lines of creativity in songwriting, artist development, music production, copyright ownership, and protection with the producer controlling the process by performing (and sharing the royalties as well) the music executive, A&R, sound recording, music publisher, composer, songwriter, and vocalist roles, a subject that we will explore in a follow-up article.

The RIAA was notorious for filing infringement (piracy) lawsuits, that invariably, backfired when litigation failed to stop consumer preference for the new technology or there were no means to block innovations such as bit torrent.Footnote 2

It was hard to quantify the real threats and opportunities that piracy and the disruption associated with digital technology presented—except for attorney fees—because some ‘pirates’ eventually spent money on other music content, merchandise, concert tickets, or media platforms after discovering new music through piracy. ‘Pirates’ could use their iPods to play both pirated and legally acquired music.Footnote 3

Still, others may have downloaded the pirated content, because it was readily or easily available, but they had no intention of purchasing anything, because it was too expensive to obtain it legitimately.

Price-sensitive consumers were not interested in purchasing a music CD—the most lucrative revenue generator in the music industry because music fans replaced music that they already owned on vinyl with CDs—with just one or two good songs and the rest mostly filler for $19.99, almost double the retail price of a vinyl album, even though the manufacturing costs of CDs were soon to be lower than vinyl records.

Second, the incumbent record labels, music publishers, and PROs had a vested interested in existing technologies, because senior executives built their careers on the older technology, and the new technologies (the foundation of their businesses) would have threatened their perks, benefits, and the career paths of some rising managers. Hit albums on CDs soon outpaced the sales of hit albums on vinyl records by a wide margin, and the record labels repackaged their catalogs of songs that were no longer in vinyl production onto CDs. As the CD market grew steadily, ‘CDs spawned a generation of record executives whose skill was in putting together compilations of existing music rather than in discovering new artists’ (Seabrook 2016, p. 25).

Finally, as we demonstrate, new technologies often cannibalized the sales of existing technologies and required new business models. The piracy argument would later strain credulity as technology; competition; innovation; economic and financial conditions; and consumer preferences exposed the structural problems in the music industry that led to the overall decline in industry revenue, but growth in certain segments.

Legitimate music and video services such as iTunes, Netflix, and Spotify would later demonstrate that some of the best methods to combat piracy—and its associated unmet consumer demand—was not copyright infringement lawsuits, but the right combination of price (singles versus bundles; basic, standard or premium), aggregated inventory (combined music and video catalogs of copyright owners), technology (higher-quality streaming, smart phones, tablets and personal computers), and convenience (content available anytime or anyplace and binge-viewing) (Pitt 2015, pp. 74–75).

Spotify resurrected the concept of an ‘interactive streaming album’ by creating curated playlists that combined different titles and genres that were designed by Spotify’s editors and subscribers using song analytics and valuable subscriber data (social media, tastes, mood, time, weather, and location).

One big question in the music industry is how the streaming model pioneered by Spotify could be disrupted by increased competition and new business models? For example, would the base of built-in iPhone purchasers prefer Apple if Apple Music came already pre-installed on its iPhones devices and included the price of a subscription or should Amazon include the price of a music subscription in its Amazon Prime package impact churn or subscriber growth for Spotify?

With all of these music services having the same access to the music catalogs of all music publishers (with some having an equity stake in Spotify), the defining competitive advantage appears to be the built-in base of valuable subscriber data collected by each streaming service.

Amazon eclipses the other competitors with its database of consumer purchases at its website and Apple makes it money from hardware devices, so it is not hard to see how either could discount their services by decreasing the price of a subscription and undermine Spotify.

Sound-recording life cycle by segment, technology, and year

Table1 looks at the recording industry’s life cycle broken down by five segments (physical, digital permanent downloads, digital subscriptions, digital streaming, and royalty); the associated technology platforms; the year and distribution channels, along with their life cycle phase. For example, the table shows that the technologies or products in the RIAA’s defined physical segment in music recording, all had reached peak revenue by 2005, and are in rapid decline or have been extinguished. There has been no recorded revenue for cassettes since 2009, similar to 8-track tapes that were extinguished in 1983. The death of vinyl was prematurely announced and it appears as though this product is recovering.

The digital permanent download segment has also peaked and is now in decline. Digital subscriptions, digital streaming, and synchronization are in the growth stages in the life cycle of music recording. The status of digital performance royalties collected by SoundExchange is undetermined, even though it appears to have peaked. There is one thing that is surprising about the life cycle of music, as shown in Table 1, and that is the shortened time span from introduction to decline for digital permanent downloads. On average, the time span is around 4 years for the segment, while it is around 21 years when compared to the time span from introduction to peak for the physical segment. Revenue—as recorded by the RIAA—began in 2004 for the segment, and by 2010 in some cases, the revenue had began a steep decline as other products were being substituted.

When the data are disaggregated, downloaded singles outsold albums as consumers rebuilt their personal music libraries with the musical selections that they preferred. The industry’s marketing concept of (high-priced) bundled CDs with one or two good songs and the rest as filler was destroyed. In this article, we are going to limit our focus to the life cycle associated with the sale and distribution of both the physical and digital sound/audio recording that has occurred in the years 1973–2017.

Music industry transformation: digital subscriptions and streaming

Digital subscriptions (including paid and limited tier paid services) and advertising-supported streaming are two areas that are growing in the music industry. The record labels’ revenue is derived from licensing music in their catalogs to music services such as Spotify and Pandora, and digital stores such as iTunes. The cost to license music that has already been created and mastered is practically zero and that leaves an almost 100 profit margin for the record labels. The record labels are able to recoup their research and development costs by re-licensing works that have already been recreated, over and over again (Gordon 2011, p. 312).

Table 2 shows how the music industry has transformed itself in the digital era with an entirely new distribution model. The table shows the growing preferred methods for consuming music that include paid subscriptions and streaming. All of the music services have aggregated millions of licensed songs in the music libraries of the individual music publishers, and may have required the approval of both music publishers and the record labels. Individual music publishers did try to create digital subscription models, but failed because of the limited number of songs in their distinctive libraries and music restrictions by artists. It would have meant that consumers would have needed multiple subscriptions from multiple publishers to enjoy music.

Some consumers are no longer interested in owning physical copies of music and they may prefer subscribing to music services that offer different tiers of services, advertising, and ad-free supported services. For example, the price for a subscription varies from free tiers to $19.99 a month. Amazon music does not offer a free tier and customers must be ‘Prime’ members to get a discount. Google, Pandora, and Spotify offer a free tier, but it contains advertising. On-demand and advertising free services cost more for consumers.

Table 3 shows the growth in annual average number of subscription units and excludes limited tier subscriptions in data reported by the RIAA. The digital subscription segment is one of the growth areas in recorded music in terms of both units and revenue. As the music industry recovered from the slump caused by 2008–2009 economic crisis, the industry increased paid subscriptions by the double digits starting in 2010. By 2017, the industry recorded over 35 million paid subscriptions for the various pricing packages offered by music services.

Netflix started as a DVD (physical) subscription service and its life cycle evolved to become the world’s leader in digital—subscription streaming and distribution of licensed video content worldwide; due in part to the rapidly evolving mobile technology and increased Internet bandwidth speeds. Like Apple’s iTunes, Netflix was able to aggregate the video content of various copyright holders into a seamless product that each content holder could not do on their own due to limited content or capabilities.

Netflix has estimated 118 million memberships in over 190 countries who can watch TV shows, documentaries, and feature films across a wide variety of genres and languages anywhere and on any Internet-connected (laptop, TV, phone, and tablet) screen. Members can binge watch as much as they want, anytime, and can pause and resume watching, all without commercials.

Netflix secures its exclusive and non-exclusive content through negotiated licensing agreements with TV networks, independent filmmakers, movie studios, and other content owners for either a set period or in perpetuity. There is a premium cost to Netflix for exclusive licensing agreements because of the potential to increase the number of subscribers over time with its content that is not available elsewhere.

Life cycle analysis estimation techniques

Logistic growth is the tendency of growth patterns to steadily decline as the size of an enterprise or product penetration approaches its mature level or capacity. The mathematical representation used to model S-curves is a logistic regression. Schumpeter (1939); Fisher and Pry (1971); Foster (1985, 1986); Christensen (1997); Kucharavy and DeGuio (2007) found that there was a cyclical pattern to technology diffusion and substitution, and that pattern can be represent by an S-curve. S-shaped curves have been used in a wide variety of industries for analyzing the cumulative progress of construction projects; the transition and performance of competing technologies; population growth rates; market penetration; value investing; and biological growth rates in laboratory experiments. For example, Wanga et al. (2015) demonstrated the use of S-curves in the optical disc industry. They showed that the “rapid advancement of the global optical disc industry results from systematic changes during the product life cycles of digital audio-visual technology”. Compact discs (CD) and digital versatile disc (DVD) sales peaked in 2004 and 2006, respectively, and the markets began to shrink as older technology (CDs and DVDs) entered the mature stage of development with the introduction of Blu-ray disc technology.

The life cycle of the music recording industry is said to follow the growth patterns in the following stages: introduction, growth, maturity, decline, and transformation that is depicted in Fig. 1.Footnote 4

At a certain time interval, a new technology is introduced and early business models are developed for new revenue exploitation for copyright owners. Following the introduction of new technology, there is widespread adoption of the technology and growth in sales and revenue until the next round of innovation is introduced and the older technology matures.

Following maturity, the enterprise may go through a phase where there is a steep decline in revenue and the product is extinguished. Both enterprise and the industry go through a transformation that begins a new life cycle with a new product replacement, challenging the status-quo. As new technology is adopted, music consumption follows a distinct pattern in which consumers upgrade the same music in their personal libraries that they already own repeatedly with the latest technology. It is not usual for consumers to own music on CDs, but also have a vinyl and digital copies. Each new wave of technological innovation brings increased music consumption.

S-curve descriptive method

S-curve theory can be used in a descriptive manner, as shown in Figs. 2 and 3, and discussed in (Rogers 2003). Data used in the figures are summarized in Table1. The horizontal axis in the figures depicts the period (1973–2017), depending on the introduction of new technology, platform, or a change in copyright law. The vertical axis shows the revenue share in percentages that the particular technology or platform contributed to the recording music industry. The industry plot shows annual revenue instead of revenue shares

The non-linear plots illustrate that as one technology was displaced, another new technology was substituted in its place, particularly for the years 1973–2017. Each plot shows the life cycle functional form of each technology—the upper limit or the maximum market share (%) that the specific technology achieved at maturity and the inflection point (year) in which revenue shares for each product began its decline and the years that followed. The upper limits and inflection points are shown in Table 1 for each technology.

After each technology reached its inflection point, the possibility for future growth declined, with the rare exception of vinyl records that is making a comeback. The newly introduced technology transformed the industry. For example, Fig. 2 plots (a–c) show that cassettes displaced vinyl records and 8-track tapes by 1973. Figure 2d shows that the upper limit for CDs’ market share reached 93.25% and the infliction year was 2000. Cassettes (4.40%), vinyl (0.38%), and music videos (1.97%) made up the remaining market share for physical products in the music industry. CDs were eventually displaced by digital downloaded singles and albums, as shown in Fig. 3, plots (a) and (b). Digital technologies transformed the industry in two stages. First, there were downloaded singles and albums that were purchased from digital stores such as iTunes. Second, streaming music services with on-demand features were replacing downloaded music, as shown in Table 2.

Figure 3, plot (a) shows that downloaded singles and albums’ market share infliction point was in year in 2012 and its upper limited peaked at 40.61% share of industry revenue. The time span from intro to peak for digital products is much shorter than that of previous physical products, and none so far have appeared to match the dominance of CD revenue.

Figure 3, plots (e) and (f) show that digital subscriptions and streaming revenue have not reach an infliction year nor upper limit in market share and have the potential for future growth. The growth pattern for royalty revenue from SoundExchange shows what could be a one-off year in licensing fee collection, and it may be too soon to determine if an infliction point has been reached. Figure 3, plot (i) shows that, overall, the music recording industry revenue peaked at about the same time as CDs and the industry is now beyond its mature stage.

It is worth noting that the shapes of the S-curves shown here are somewhat ‘irregular’ looking and appear to show other dimensions of innovation and technological change. The premise that technological change follows exactly the theoretical S-curve in all cases may be misleading and this paper provides an alternative measure. For example, Sood and Tellis (2005) found that ‘technologies do not show evidence of a single S-shaped curve of performance improvement. Rather, they evolve through an irregular step function with long periods of no growth in performance interspersed with performance jumps. A jump in performance appears to be largest after a long plateau of no improvement.’

Logistic growth method

S-curves can also be used for estimation and prediction purposes. A logistic growth model is often used, when data follow a non-linear pattern of rapid growth, followed by a plateau and then a gradual decline. Different mathematical S-curve formulas for logistic growth functions are fitted for estimation, depending on the industry or scientific discipline. For example, the growth rate of bacteria in a petri dish differs from the population growth of the United States and would be estimated with different mathematical equations. A cubic polynomial function (combined with neural networks) is often used to generalize S-curves (Chao and Chien 2009). The logistic growth model requires an iterative procedure to obtain ‘reasonable’ estimates of asymptotic values and growth rate (scale) parameters as starting values prior to estimation. The estimates can be either user supplied (best guesses) or self-starting (machine generated). The choice of such estimates can only add subjectivity to computational difficulty and can make a big difference in predictions when one parameterization works, while another one fails (Fox and Weisberg 2011).

Pooled time-series cross-section estimation

To avoid some of the issues associated with logistic growth functions discussed above, a pooled time-series cross-section model can also be used to analyze the marginal contributions of each technology over time in the music recording industry. In our RIAA data, the information provided by logistic growth models (the upper limit asymptotes and the maximum market share slope—for physical products and digital permanent downloads segments) is already known. At best, logistic growth models may be used to measure the growth patterns in the digital subscriptions and streaming, but the data are limited.

A pooled time-series cross-section model—sometimes referred to as a panel data model—is a hierarchical data set in which the behavior of panels (cross-section) is observed over time. These cross-sections could be companies, individuals, counties, states, countries, or the various technologies and music platforms that are used in this study. Panels can be balanced or unbalanced. In a balanced panel, the number of time-periods is the same for all individual cross-section, while an unbalanced panel contains unequal time-periods, as in our RIAA data set. Figures 2 and 3 explored the functional forms of the panels that are used in our model.

Three techniques—pooled, random, and fixed effects models—are used to estimate panel data when OLS regression techniques are not applicable, because heterogeneity across groups or time is not considered. Pooled, fixed, and random effects models are distinguished by their error structures (Baltagi 2005b).

The pooled model

A pooled model is one where data on different individuals, sections, or firms are pooled together with no provision for individual differences. In other words, pooled models do not allow for intercept or slope difference among cross-sections and are similar to an OLS/ANOVA estimation in which individual and/or time effects are not considered.

Random effects model

The random effect model is a more elaborate FE model that assumes that the variation across panels is random rather than fixed. In the random effects model, all individual differences are captured by the intercept parameters, but individuals could be randomly selected. The pooled model is often estimated along with the fixed effect model to determine if individual and/or time effects based on the comparison are necessary. In most studies, it comes down to either selecting an FE or a random model for analysis (Hsiao 2003; Baltagi 2005a; Wooldridge 2010b).

Fixed effects model

Fixed effects models are sometimes referred to as ‘within’ models in the literature. All behavioral differences between individuals, referred to as individual heterogeneity, are assumed to be captured by the intercept. Individual intercepts are included to “control” for individual-specific, time-invariant characteristics, but with the same error structure, so that the estimated coefficients cannot be biased because of omitted time-invariant characteristics (Hill et al. 2011).

We will use the fixed effects (FE) model with technology specific indicator or dummy variables for three reasons. First, we are interested in analyzing how music technologies have influenced market share revenue in the music industry over time. This study is designed to study the causes of changes within cross-section or panel. Second, the FE model assumes that something within each individual panel may affect revenue and we need to control for this. Finally, the FE model assumes that time-invariant and unknown characteristics are unique to each cross-section.

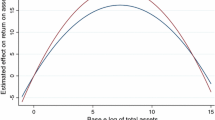

Each panel is different and therefore the panel’s error term and the (which captures individual characteristics) should not be correlated with the others. The equation for the FE model is given by:

where \(y_{it}\) is a dependent variable, \(\beta _{1i}\) is a constant term for each panel, \(\beta _{2i}\) for \((i=1 \ldots n)\) are estimated coefficients for each panel, \(x_{2it}\) for \((i,t=1 \ldots n)\) are independent variables, and \(\epsilon _{it}\) is the error term.

Data

The model in Eq. 1 is estimated using an unbalanced panel. The model is unbalanced, because we have 14 cross-sections that are observed over varying time-periods.(Baltagi 2005b). The dependent variable \(y_{it}\) is the percent share of RIAA annual revenue that was tabulated from the data shown in summarized form in Table 4. In some cases, annual revenue has been aggregated by technology cross-sections. Table 5 shows how RIAA annual revenue data were aggregated. For example, the table shows that within the physical segment in music recording, vinyl technology revenue data have been aggregated into a single category called ‘Vinyl’ and that includes revenue from singles, LPs, and EPs. The coefficient name given to vinyl technology cross-section is vinyl. Vinyl has 45 years of revenue data or observations and that represents 16.79% out of the total number of observations of 268 in our unbalanced panel. Similarly, newer services that were introduced recently such as digital streaming have few years of revenue and observations; a total 7 and that represents 2.61% of the total number of observations.

It was not necessary to aggregate revenue from royalty cross-sections such as SoundExchange, synchronization, and other categories. The dependent variable \(y_{it}\) has also been normalized (indexed) to Year \(2000=1\) and the CDs’ cross-section, as a reference point for the following reason. The year 2000 was the year that CD sales had reached its peak and has been in decline ever since. No other music product has been able to surpass the revenue of CD sales as yet. Based on the strength of CD sales, the recording industry enjoyed its most profitable years in its history. This was due in part to the efficiency gains in the CD manufacturing process in which the per-unit cost of a CD was less than a dollar, savings that were not passed on to consumers (Witt 2015, p. 79). For practical purposes, the music industry benchmark is now pre-and-post CD era.Footnote 5 (Witt 2015, pp. 114–116).

The estimated coefficients are given by \(\beta _{2i}\). The independent variables \(x_{2it}\) in our model are all indicator variables representing each technology and are labeled Vinyl, Cassettes, CDs, MusVid, DVDAudVid, DPGSingleAlbums, SoundEx, DPGMusVid, DSubTiers, DPGKiosk, DPGRing, Track8Other, Synchronization, and Dstream, as shown in Table 5:

For example, Vinyl = 1, if the cross-section is Vinyl, otherwise 0, and so on. The omitted indicator category is CDs. The models and statistical tests were estimated in the R language using the plm package (Croissant and Millo 2008; Millo 2017).

Results

Attempts to model panel data (cross-sectional units over several periods) rely on the choice of a pooled, random, or fixed effects functional form. The estimation is guided by the characteristics of the panel data and, in some cases, the study objectives (Baltagi 2005b). We made an a-priori assumption to use the fixed effects model for various reasons cited above. To decide between the two models, a Hausman test is conducted where the null hypothesis is that the preferred model is the pooled effects versus the alternative fixed effects model. Our fixed effect model selection is confirmed by a Hausman test (chisq = 38.861, df = 12, p value = 0.0001) in which we can conclude that the pooled model is inconsistent with our data.

Further specification testing in panel models involves testing for serial correlation, and for individual or unobserved effects. The Breusch–Pagan (cross-section dependence) and Breusch–Godfrey/Wooldridge (serial correlation) methods were used, because they are suited for unbalanced panel as suggested by Breusch and Pagan (1980); Baltagi and Li (1990); Croissant and Millo (2008), and Wooldridge (2010a); Millo (2017).

Table 6 shows the results of these two tests. The was data shown to exhibit heteroskedastic and autocorrelation significant effects by their p values, as you would expect in a pooled time-series cross-section model.

Fixed effects models are usually estimated without a constant term. Croissant and Millo (2008); Millo (2017) consider estimating a fixed effects model with an intercept to be somewhat artificial, because it is assumed that fixed effects models have different intercepts and they can vary within each group, over time or both. We do not add an intercept term in our fixed effects estimated model. When a constant term is estimated in the fixed effect model, it can be considered an overall intercept in the within model framework and is the weighted mean of the fixed effects (Greene 2012).

To correct for significant effects, a heteroskedasticity and autocorrelation consistent (HAC) robust coefficient covariance estimation was performed as discussed in (Arellano 1987; Newey and West 1987; Arellano and Bond 1991; Millo 2017).

Table 7 shows the results of both the pooled model and the fixed effects model with robust standard errors. In interpreting the estimated beta coefficients, we can say that for a given technology, as \(x_{2it}\) varies across time on average, the percentage share of revenue \(y_{it}\) increased or decreased by \(\beta _{2i}\) units.

In the fixed effects model with robust errors, all of the coefficients are negative, as expected, because it is compared to the omitted base of physical segment—CD technology—year 2000. For example, in Table 7, the Fixed Effects Model with Robust Errors show that when compared to CD technology in the physical segment and the year 2000—the category that was omitted—all of the associated older technologies in descending order such as Track8Other (\(-0.3678\)), MusVid (\(-0.3613\)), DVDAudVid (\(-0.3284\)), Vinyl (\(-0.3247\)), and Cassettes (\(-0.2991\)) had the biggest unit decline. Dstream (\(-0.2501\)), DSubTiers (\(-0.2321\)), and DPGSingleAlbums (\(-0.1705\)) showed the smallest unit decline, because these are new digital technologies and they are growing.

The p values shown in Table 7 test the null hypothesis on whether each coefficient is different from 0. The p values for each coefficient in the fixed effects model with robust standard errors are less than 0.05; therefore, we can reject the null hypothesis. The same conclusions can be made for the overall fixed effects model that uses a F test. The F-statistic shown in the footnotes of Table 7, F-statistic: 13.0811, DF (12, 211), and p value: 0.0000) suggests the alternative hypothesis conclusion for the overall model.

It is interesting to contrast the difference in estimation techniques when a pooled and a fixed effects model with robust standard errors are estimated to check for specification errors. Table 8 shows the difference in marginal effects and standard errors when the error terms are corrected between the pooled and fixed effects models.

When the error terms are corrected for heteroscedasticity and serial correlation—with the exception of DVDAudVid (6.77%)—older technologies such as Track8Other (\(-18.60\%\)), Cassettes (\(-21.37\%\)), and MusVid (\(-8.32\%\)) show the biggest decline in marginal effects when the corrections are made. Digital technologies such as DPGSingleAlbums (22.87%), DPGRing (17.58%) DPGMusVid (16.19%), DPGKiosk (16.14%), DSubTiers (19.67%), Dstream (22.86%), and Royalty (15.53%) all showed an increase in marginal effects after the error corrections are made.

Similarly, with the exception of Vinyl (0.14%), Track8Other (8.35%), MusVid (2.84%), and DVDAudVid (5.16%), the standard errors of the Fixed Effects Model with Robust Error for Cassettes (\(-0.16\%\)), DPGSingleAlbums (\(-0.17\%\)), DPGRing (\(-10.21\%\)), DPGMusVid (\(-7.75\%\)), DPGKiosk (\(-7.71\%\)), DSubTiers (\(-3.23\%\)), Dstream (\(-18.50\%\)), and Royalty (\(-2.41\%\)) are smaller than in the pooled model. The fixed effects model is a better specification choice for modeling the life cycle in the music recording industry.

Conclusions

The major conclusion from this study is that a pooled time-series cross-section model, specifically a fixed effects model with robust standard errors, can be used as an alternative to the logistic growth model to measure the marginal contributions of technology over time in the music industry when model specification for ‘irregular’ life cycle curves may be problematic using another method.

The study is limited in scope, because the model did not include other sources of revenue in the music industry. We do not include the music publishing (in which the record label is often a subsidiary) revenue that would include revenue from non-dramatic public performances, lyrics, a portion of synchronization, and other negotiated licensing agreements. Revenue from live concerts and touring; merchandise; ASCAP, BMI, and SESAC performances; and fan club segments are not included here.

It is a safe bet to say that the music industry will be in a state of constant change for the foreseeable future as analysts predict what comes next after streaming has matured. Predicting the future in a constantly changing industry—as Apple, Amazon, and Google and Spotify are now competitors in the on-demand streaming market—and fickle consumer tastes is often very tricky.

Over the course of the next decade, (Aziz 2019) envisions a music world with the following challenges and opportunities: (1) physical records are long gone (even with the recent tiny rebirth), (2) records labels whose primary functions used to be A&R, marketing, and distribution will be extinct like Tower Records, (3) hit songs will have longer staying power due to social media and streaming, (4) ‘virtual reality’ headsets will be packaged with records and apps, so that fans can have an ‘augmented immersive experience’ from remote locations, while artists are performing in another, (5) music creation is expected to become even more automated beyond the realm of Auto-Tune with artificial intelligence (AI) replacing expensive, time-consuming, and complicated processes in music composition, songwriting, and distribution, (6) artists will rely less on an album sales model and pursue more of the so-called ‘360’ deals that involve marketing, merchandising, touring, film, and TV as a means to build their bank accounts, (7) new music genres are expected to emerge that will fuse together existing genres such as hip=hop and country music, and (8) fans will be able to soundtrack their own shows while watching Netflix on smart devices.

Regardless of the constant change in music, machine learning is likely to become a big factor as the industry adopts a unified database standard for the storage and exchange of all music industry (supply and demand) data, an undertaking that is long overdue. The future looks bright for students with advanced econometric modeling, machine learning, and AI analysis skills. Every bit of digitized music big-data (song production input costs, song-title registration (PRO), copyright ownership (composition and sound-recording), distribution (record label, streaming service), music sales, radio airplay and charting (Billboard), terrestrial and digital public performances (broadcast and cable TV and YouTube), touring (Pollstar), and playlist recommendations based on mood, preference, or local market (streaming service) will be transformed into metadata files in which machine learning algorithms will make it simpler and cost effective for sharing and analysis. Data and insights for subscriber acquisition, retention and loyalty models, content search, content curation, user experience, and subscriber behavior are expected to grow exponentially for streaming service providers.

The transition period from old to new technology in music has always generated a lot of political and social debate on the impact of the new technology during the transition period on such issues as (1) how does the new technology work; (2) how will the rate of adoption affect creativity in the short and long term? (3) how will the equitable distribution of royalty payments for songwriters and composers change under the new system or model when there is a ‘winner-take-all’ attitude in the music industry? (4) how will the competing agendas and conflicts of interest among allies in the music industry organizations (record labels, music publishers, and PROs) resolve itself? (5) how will the industry be transformed when there is internal, external, legal, and accounting resistance to reforms? and (6) what are the human (panic and fear of no or little work) and financial costs (often very high) of the new innovations when certain routine and standardized tasks are automated with AI and those jobs vanish or replaced with new jobs that require different skill sets in new locations? (7) Covid 2020 Pandemic has made virtual reality in music more relevant than ever due to social distancing requirements that caused the cancellation of touring and music performances at small and large arenas. What will be the economic impact of revenue, profits, and royalty income from lost ticket sales in the music industry?

Some of the issues caused by technology innovations will be resolved when consumers, artists, and music executives are educated on what it all means for the future through public policy and institutional reforms.

Availability of data and material

The frequently updated data used in this study can be obtained from the RIAA by request.

Change history

08 February 2021

A Correction to this paper has been published: https://doi.org/10.1007/s43546-020-00025-6

Notes

Napster at its popular peak had tens of millions of users on college campuses, but the record labels missed an early opportunity to monetize this segment, because they had no interest in the Internet distribution of music at the time. See Gordon (2011, pp. 119–126) for a review of the major RIAA lawsuits; Gordon (2014) for the direct licensing controversy in which publishers are looking to bypass intermediate licensing agencies and Witt (2015) for the story on how MP3s audio quality transformed the music industry.

See RIAA Spent $64M to Win $1.4M From Pirates Between ’06 and ’08 available here: http://www.dailytech.com/RIAA+Spent+64M+to+Win+14M+From+Pirates+Between+06+and+08/article19034.htm.

Miles (2017) is the source of the diagram who applied S-curves to investing.

Shawn Fanning invented Napster in June of 1999 and this was a possible year to use as an index, because pirated mp3 songs later led to new innovations in the iPod and smart phone markets. However, the free software innovation did not reach a critical mass of 20 million users until early 2000, and by summer, over 14,000 songs were being downloaded a minute. More importantly, it was not until early 2000 that the RIAA began to understand the economic significance of peer-to-peer technology. It was in late 2000 that Bertelsmann announced a joint venture with Napster to develop paid legal channels using the technology

References

Arellano M (1987) Computing robust standard errors for within group estimators. Oxf Bull Econ Stat 49(4):431–434

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte carlo evidence and an application to employment equations. Rev Econ Stud 58:277–297

Aziz A (2019) 10 ways the music industry will change in 10 years. Vibe. https://www.vibe.com/photos/10-ways-music-industry-changes-10-years. Accessed 29 Mar

Baltagi B (2005a) Econometric analysis of panel data, 3rd edn. Wiley, New York

Baltagi B (2005b) Unbalanced panel data models (Chap. 9). In: Econometric analysis of panel data, 3rd edn. Wiley, New York, pp 165–186

Baltagi B, Li Q (1990) A lagrange multiplier test for the error components model with incomplete panels. Econ Rev 9:103–107

Breusch T, Pagan A (1980) The Lagrange multiplier test and its applications to model specification in econometrics. Rev Econ Stud 47:239–253

Cameron S (2016) Past, present and future: music economics at the crossroads. J Cult Econ 40:1–12

Cardi WJ (2007) Über-middleman: reshaping the broken landscape of copyright music. Iowa Law Rev 92:835–890

Chao L, Chien C (2009) Estimating project s-curves using polynomial function and neural networks. J Constr Eng Manag 135:169–177

Christensen C (1997) The innovator’s dilemma: when new technologies cause great firms to fail. Harvard Business School Press, Boston

Croissant Y, Millo G (2008) Panel data econometrics in R: the plm package. J Stat Softw 27(2):1–52

Fisher J, Pry R (1971) A simple substitution model of technological change. Technol Forecast Soc Change 3:75–88

Foster R (1985) Timing technological transitions. Technol Soc 7:127–141

Foster RN (1986) The s curve: a new forecasting tool (Chap. 4). In: Innovation: the attacker’s advantage. Simon and Schuster, New York, pp 88–111

Fox J, Weisberg S (2011) An R companion to applied regression, 2nd edn. Sage, Thousand Oaks

Gordon S (2011) The future of the music business, third edn. Hal Leonard, Milwaukee

Gordon S (2014) direct licensing controversy: will publishers be able to license public performing rights to digital music services directly (instead of through the PROs) and what are the consequences for songwriters? Future of the music business. http://www.futureofthemusicbusiness.biz/2014/05/direct-licensing-controversy-will.html. Accessed May 27

Greene W (2012) Models for panel data (Chap. 11). In: Econometric analysis, 7 edn. Pearson Prentice Hall, New York, pp 383–466

Hill RC, Griffiths WE, Lim GC (2011) Panel data models. In: Principles of econometrics, 4 edn, chapter 15. Wiley, pp 537–584

Hsiao C (2003) Analysis of panel data. Cambridge University Press, Cambridge

Krueger A (2019) Rockonomics: a backstage tour of what the music industry can teach us about economics and life. Currency Books, New York

Kucharavy D, De Guio R (2007) Application of S-shaped curves. TRIZ-future conference: current scientific and industrial reality, November, Frankfurt, Germany, pp 81–88

Miles H (2017) Baseball, S-curves, and forecasting. https://seekingalpha.com/article/4063168-baseball-s-curves-forecasting. Accessed May 2018

Millo G (2017) Robust standard error estimators for panel models: a unifying approach. J Stat Softw 82(3):1–27

Newey W, West K (1987) A simple, positive semi-definite, heteroskedasticity and autocorrelation consistent covariance matrix. Econometrica 55:703–708

Patry W (2011) How to fix copyright. Oxford University Press, New York

Pitt IL (2010) Economic analysis of music copyright: income, media and performances. Springer, New York. http://www.amazon.com/Economic-Analysis-Music-Copyright-Performances/dp/1441963170/ref=sr_1_1?s=books&ie=UTF8&qid=1417266944&sr=1-1&keywords=economic+analysis+of+music+copyright. Accessed Dec 2010

Pitt IL (2013) Power laws and skew distributions: an application to performance royalty income. J Income Distrib 22:148–159

Pitt IL (2015) Direct licensing and the music industry: how technology. In: Innovation and competition reshaped copyright licensing. Springer

Rogers EM (2003) Diffusion of innovations, 5th edn. Simon & Schuster, Noida

Schumpeter J (1939) Business cycles: a theoretical, historical and statistical analysis of the capitalist process. McGraw Hill, New York

Scorpio Music S.A. vs. Willis (2011) No: 11cv1557 BTM(RBB), S.D.C.A. http://archive.org/details/gov.uscourts.casd.357493, pp 1–29. Accessed July

Scorpio Music S.A. vs. Willis (2012) No: 11cv1557 BTM(RBB), S.D.C.A. http://ia600708.us.archive.org/26/items/gov.uscourts.casd.357493/gov.uscourts.casd.357493.30.0.pdf, pp 1–10. Accessed May

Seabrook J (2016) The song machine: inside the hit factory. W. W. Norton & Company, New York

Sood A, Tellis GJ (2005) Technological evolution and radical innovation. J Mark 69:152–168

Wanga Y, Trappey A, Trappey C (2015) Life cycle analysis of the optical disc industry market innovation and development. Innov Manag Policy Pract 17(2):196–216

Witt S (2015) How music got free: the end of an industry, the turn of the century, and the patient zero of piracy. Penguin Random House, New York

Wooldridge J (2010a) Basic linear unobserved effects in panel data models. In: Econometric analysis of cross section and panel data, 2nd edn. MIT Press, Boston, pp 281–334

Wooldridge J (2010b) Econometric analysis of cross section and panel data, 2nd edn. MIT Press, Boston

Funding

This study was NOT funded by any grants, payments, or pro quid quo by the RIAA.

Author information

Authors and Affiliations

Contributions

I am the sole author of this paper.

Corresponding author

Ethics declarations

Conflict of Interest

There is no conflict of interest. I have never worked at the RIAA and I do not know anyone there.

Code availability

This study was conducted using the R software that is freely available.

Music industry

The author did not receive any financial or non-financial assistance from the RIAA or any other group within or outside the music industry.

Informed consent

Informed consent was not needed in this study, because it is strictly a numerical exercise that did not involve experiments using humans or animals.

Rights and permissions

About this article

Cite this article

Pitt, I.L. Life cycle effects of technology on revenue in the music recording industry 1973–2017. SN Bus Econ 1, 9 (2021). https://doi.org/10.1007/s43546-020-00004-x

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s43546-020-00004-x

Keywords

- Life cycle of music

- Physical music segment

- Digital permanent downloads

- Digital subscriptions

- Digital streaming

- Digital performance royalty

- Pooled time-series cross-section model and RIAA data