Abstract

The evolution of marketing channel management and the integration of digital technologies in the overall marketing architecture have been deeply examined in the SME literature. Even if in academia the opportunities of digital in terms of performance, growth, and competitiveness are well recognized, in practice, SMEs are not always ready to fully exploit the potential of new technologies, reshaping their channels’ structure and strategies. In this paper, we display insights into the transformation and management of marketing channels for Italian manufacturing medium-sized enterprises. The study explores if and how “Made in Italy” companies are introducing digital channels in their market strategy, aiming at an omnichannel management perspective. We conduct a two-stage research design involving manufacturing medium-sized enterprises acting in the typical “Made in Italy” sectors: a Grounded Delphi Method with semi-structured interviews and the collection of data by a survey. We contribute to extending prior literature by presenting the enablers and barriers of specific marketing channels in the overall architecture and the main reasons for improving an omnichannel perspective in the perspective of the near future. In particular, the research identifies that Made in Italy medium-sized enterprises rest on decisions about adopting and managing specific channels and developing an omnichannel perspective on firm-specific and owner-managerial factors, while resource-related and environmental factors can be overcome, in particular, thanks to new partners. Based on this analysis, we then recommend specific research avenues to stimulate and advance further investigations.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

The development and fast spread of digital technologies have considerable repercussions on the business context. Companies face the challenges of digital transformation, and marketing channels are not exempt from this transformation path. Indeed, since the 2000s, marketing channels have been rethought and managed by companies to leverage the opportunities offered by digitization. In this regard, marketing channels’ literature and, in particular, literature dealing with multichannel and omnichannel marketing strategies, is quite extensive (Berman & Thelen, 2018; Cicea et al., 2023; Vaishnav & Ray, 2023; Verhoef et al., 2015; Weinberg et al., 2007). It is shared that digital channels have emerged as an unavoidable opportunity to expand, get stronger connections with the market, and improve the business (Amiri et al., 2023).

Companies have thus managed the integration of digital channels into their overall marketing channel architecture, adopting a multichannel or omnichannel perspective. The former is a marketing strategy where different customers can use different parallel channels to interact with a company (Weinberg et al., 2007). The latter is identified as the marketing strategy that allows the management of all marketing channels under a synergic and integrated vision, where customers can choose among different possible channels in an interchangeable way (Verhoef et al., 2015). The integration and management of different channels enhances the customer experience, providing positive customers’ responses to interactions with a company’s multiple touch points (Payne et al., 2017). Literature highlights the advantages of an omnichannel strategy (Berman & Thelen, 2018). The main challenges that companies have to manage in order to implement an omnichannel strategy, overcoming the multichannel perspective, are sharing information, activities, and resources between different channels (Lewis et al., 2014): direct, indirect, physical, and digital channels.

Notwithstanding, many contributions highlight the difficulties of small and medium-sized enterprises (SMEs) in integrating and managing different channels. In fact, if on the one hand the introduction of the digital channel brings opportunities in terms of performance, growth, and competitiveness (Liao et al., 2023; Taiminen & Karjaluoto, 2015), on the other hand, SMEs don’t fully use or are not able to fully exploit the potential of new technologies and reshape effectively and efficiently new channels’ structure and strategies (Gilmore et al., 2013; Taiminen & Karjaluoto, 2015).

For this reason, the main focus of this research is the exploration of how Italian SMEs are approaching their marketing channels’ transformation, focusing the attention on mid-sized companies due to the low capability of small enterprises to fully exploit the potential of new technologies, leveraging on limited resources. This is an important issue, especially for Italy and those countries whose industrial structure is mainly based on SMEs. In Italy, in particular, SMEs represent 99.9% of all the businesses (PMI.IT, 2021). Thus, our research focuses on the mid-sized enterprises that belong to the four traditional Made in Italy sectors: food, furniture, automation/mechanics and fashion.

Hence, our study contributes to the understanding of the ongoing transformation of marketing channels for Made in Italy SMEs, identifying enablers and barriers. In particular, our research aims to explore if and how “Made in Italy” SMEs are introducing and managing digital marketing channels and adopting an omnichannel management strategy, focusing the attention on mid-sized enterprises.

The present study is structured as follows. Firstly, a review of the literature on the impact of digitalization on marketing channels and their transformation in SMEs is presented. Secondly, the research design and methodology are presented; thirdly, we present the findings of our research; and finally, we discuss the findings and their managerial and theoretical implications. Finally, limitations and future lines of research are presented.

2 Literature background

2.1 Impact of digital on marketing channels

Digital innovation has modified the way in which companies do business (Rothberg & Erickson, 2017), having an impact on their business models (Rundh, 2003; Volberda et al., 2017), value propositions, relationships, and competitive landscape (Bouwman et al., 2018). In the new business landscape, customers show more demanding expectations and search for more involving experiences (Labrecque et al., 2013). In this complex scenario, the Covid-19 pandemic accelerated the evolving process toward the inclusion of digital technologies on both the demand and supply side. Despite the costs and difficulties, companies had to invest in new digital technologies, facing the challenges of a better understanding of how to manage the transformation affecting structures and processes.

Digitalization has started to permeate the daily business of every company and their relationships with all their stakeholders, especially customers (Soto-Acosta, 2020).

Marketing channels have been among the first affected by a digital transformation (Vesci et al., 2022) resulting in a process of hybridization (Cantù et al., 2022).

We assume the definition of a marketing channel as “a set of interdependent organizations involved in the process of making a product or service available for use or consumption” (Palmatier et al., 2014, p. 3). Following Peterson et al. (1997) we identify marketing channels as distribution channels, transactional channels, and communication channels. Nowadays, marketing channels tend to assume all three functions simultaneously (Cui et al., 2021).

The first studies of marketing channels were focused on general aspects concerning the overall marketing channel architecture of the company and explored separately the specific typology of actors and marketing intermediaries (e.g., retail actors) (Sharma & Dominguez, 1992). Then, due to the increasing complexity of businesses and market contexts and the proliferation of customers’ digital and physical touchpoints, literature has mostly addressed the management of channels’ interaction and integration (Dimitrova et al., 2020).

Literature on multichannel management strategy has underlined the use and management of different channels in a parallel way, without tight integration and sharing of information and resources among different channels (Vaishnav & Ray, 2023).

Starting with the introduction of e-commerce and digital channels in their marketing strategies, companies have gradually moved towards an effective and efficient omnichannel strategy, as it has been extensively suggested and studied in the literature (Bijmolt et al., 2021; Cuesta-Valiño, 2023). The omnichannel perspective is a specific approach aligned with technological development and more demanding customers’ needs, and it has been defined as “the synergetic management of the numerous available channels and customer touchpoints in such a way that the customer experience across channels and the performance over channels is optimized” (Verhoef et al., 2015, p.7).

In order to enhance both multichannel and omnichannel strategies, companies have to invest considerably in new resources and competencies. Such investments are particularly critical and challenging for SMEs.

In literature, it has been fully argued that the way in which SMEs and large companies approach digital transformation is different (Amiri et al., 2023). Large companies are usually more inclined to invest in digital technologies and face processes of digital transformation due to their business dimension, structure, and available resources; SMEs, on their part, have much more difficulties in modifying their existing business and organization (Gallego et al., 2013; Penco et al., 2023) for their limited resources (e.g., financial and human resources), which represent a constraint to digital transformation (Kim et al., 2021).

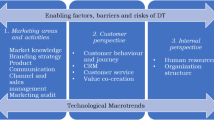

Karjaluoto and Huhtamäki (2010) have classified the reasons to adopt and manage digital marketing into three main categories: firm-specific and owner-managerial, resource-related, and environmental. This classification is used in our research as a starting point to understand the main enablers and barriers for the adoption and management of specific marketing channels (Table 1).

Concerning the firm-specific and owner-managerial factors, they refer to the strategic decision of the top management to transform the company and get the most from this transformation (Dholakia & Kshetri, 2004; Karjaluoto & Huhtamäki, 2010). The decision to invest in digital marketing channels can thus be related to the recognition of the necessity and benefits coming from them. Such recognition can also be linked to the technological knowledge of the company’s owner or manager (Chao & Chandra, 2012), to his or her understanding of the importance of IT solutions, and to the focus on creating and maintaining long-term valuable relationships with customers (Cui et al., 2021).

Regarding resource-related factors, they are classified into three main clusters (Karjaluoto & Huhtamäki, 2010): financial, technological, and human. The availability or limited access to financial resources influences SMEs’ decisions to innovate marketing channels (Gilbert et al., 2006; Kim et al., 2021). The technological resources refer to the IT technology owned by the SMEs that can enhance or limit the adoption of digital channels (Penco et al., 2023). The human resources, instead, are based on the possibility for SMEs to leverage the skills and competencies already available in the company. The lack of knowledge or time to improve the adoption of digital channels can be a barrier (Gabrielli & Balboni, 2010; Gilmore et al., 2007).

As concerns the environmental factors influencing the adoption of digital channels, they are related to changes affecting the competitive environment (Karjaluoto & Huhtamäki, 2010), the changes in the customer preferences (Kaynak et al., 2005), and the industrial sector. All these determinants are not based on company strategic decisions or internal availability of resources, but they are totally independent from the activities of the SMEs. For this reason, they must be considered by SMEs to successfully manage marketing channels’ transformation.

2.2 Marketing channels’ transformation in SMEs

Literature has fully exploited the development and management of digital technologies in big companies (Cenamor et al., 2019) or in innovative companies (e.g., high-tech or digital startups and giants) (Ghezzi & Cavallo, 2020), while there is a paucity of contributions focused on SMEs operating in traditional industries (Soto-Acosta, 2020). Bocconcelli et al. (2018), through an extensive literature review on SMEs, have highlighted that the majority of the studies they have reviewed stress the changes occurring in distribution and marketing underlying both the usage of e-commerce and export strategies. The authors observe that only a few contributions focus on marketing channel management and organization “per se”. For this reason, we have conducted our research to deeply enter into the analysis of the transformation of SMEs’ marketing channels.

Literature observes that the multichannel approach can be useful for SMEs if they are not ready to manage different channels in a coordinated way or if they are not able to integrate activities and resources. In fact, a multichannel strategy allows companies to focus their attention only on the separate optimization of the performance of each channel (Cui et al., 2021). The multichannel strategy can be a successful approach to managing marketing channels even when the SME owns a few diverse channels through which they start or maintain relationships with specific customers. In addition, the customer can self-select the preferred channel during their specific buying journey (Cui et al., 2021). Multichannel strategy is particularly interesting for manufacturing SMEs because they make extensive use of indirect channels for commercializing products, and, implementing a multichannel strategy based on direct or indirect channels, digital or traditional ones, can be a solution to decrease the dependence on distributors (Kolbe et al., 2022). The multichannel perspective can even bring some constraints (Mookherjee et al., 2021). One of the main issues refers to the fact that the presence of different channels can be a source of confusion for the customer when it looks for information and the information provided is contrasting; moreover, it is quite difficult for companies to achieve a complete and integrated acquisition and management of all the information coming from the market for forecasting activities and the resources’ optimization for further investments (Yan & Pei, 2011). The presence of different channels can induce duplication of activities and even cause waste of resources if they are not shared among all channels. In particular, critical aspects to be considered are the employees’ commitment and training, which are fundamental key elements for reaching improvements in channels’ performance (Kolbe et al., 2022).

Because of the drawbacks of the multichannel approach, SMEs are suggested to implement an omnichannel management strategy, where all the different marketing channels are integrated and managed under a unique vision and a seamless experience for the customer (Hasbolah et al., 2022). In literature, several contributions have tried to explore in detail the omnichannel concept due to its importance for companies. For example, Saghiri et al. (2017) developed a conceptual framework for omnichannel systems, configured by the three dimensions of channel stage, channel type, and channel agent, to support companies during the implementation of this strategy.

The omnichannel strategy can help SMEs to extend their current audience, provide integrated and coherent information among diverse marketing channels (Dimitrova et al., 2020), and reduce their efforts in managing different information in parallel. The consequence is the improvement of customer satisfaction, loyalty, and retention (Lewis et al., 2014). As a result, SMEs can increase their competitiveness and improve their performance. SMEs that integrate the digital channel into their channel architecture towards an omnichannel strategy can acquire an abundance of useful and valuable data through, for example, website analytics, social media metrics, and email campaign statistics. The introduction of digital channels even carries some benefits, such as low cost, ease of use, interactivity, and visibility, providing an opportunity for SMEs to respond proactively with limited resources (O’dwyer et al., 2009). In addition, the integrated management of the different digital and traditional channels can bring some advantages in terms of better performance measurement of these channels and help SMEs to understand their customers better (Hasbolah et al., 2022).

The integrated management of all the different channels (digital, physical, direct, and indirect) can bring some complexities (Bijmolt et al., 2021). Indeed, the omnichannel strategy can sometimes be difficult for SMEs to apply due to limited financial, human, material, and informational resources (Shrader et al., 1989). During the search and purchase process, channels are interchangeably and seamlessly used by customers, and sometimes it is difficult for the company to manage this complexity (Cui et al., 2021). Moreover, the omnichannel strategy requires specific know-how and managerial abilities, as well as investments in IT infrastructure that can support the integration and operability of all the diverse activities (Spinelli et al., 2013).

The determinants of the adoption by SMEs of the omnichannel strategy are further explored in this study. Our research doesn’t aim to identify a unique model of marketing channels’ transformation for all SMEs, but instead it has the purpose of highlighting the main enablers and barriers related to the introduction of digital channels and the implementation of an effective omnichannel management strategy.

3 Research design and methodology

This study discusses whether and how “Made in Italy” SMEs are introducing digital channels into their market strategies, aiming for an omnichannel management strategy. We have conducted two-steps research (Taiminen & Karjaluoto, 2015).

The first phase was conducted through a qualitative methodology with 12 semi-structured theme interviews. This exploratory research was carried out in 2020 and 2021 through a Grounded Delphi Method (GDM) (Cantù et al., 2022). This approach is particularly useful when it is necessary to conduct an exploratory study about a specific phenomenon not already explored in detail (Yin, 2011). The main goal was not to generalize issues but to obtain in-depth knowledge of the topic under analysis, i.e., the ongoing changes affecting the Italian SMEs’ marketing channels. In this initial phase, a panel of 12 experts was selected to ensure the validity of the results (Kembro et al., 2017), in alignment with previous research considering expert panels of between 5 and 20 members (Forsyth, 2009). The experts possessed specific knowledge on the topic and represented a variety of points of view (Murry & Hammons, 1995) as highlighted in Table 2.

Moreover, the experts were included according to some criteria (Rowe et al., 1991, p. 324): willingness to be interviewed; job experience related to Italian SMEs in the Made in Italy manufacturing sectors; knowledge about the analysed topics.

The interviews lasted on average 60 min, and the collected data were processed in categories aimed at generating consensus on some fundamental aspects (Brady, 2015). The main topics covered during the interviews were related to: interviewee’s profile, business context (main transformation processes in the structure and strategy inherent in marketing channels), process of transformation of indirect marketing channels and direct marketing channels (exploring pros and cons), level of interest and adoption of digital platforms (proprietary e-commerce, third-party digital platforms, other digital channel actors), integration of digital channel (main inhibitors and benefits related to the integration with the company’s offline channels).

The GDM allowed the identification of how direct and indirect marketing channels are impacted by new technologies in terms of their main benefits and criticalities. In detail, the analysis highlights which new technologies will influence the transformation of marketing channels for Italian medium-sized enterprises, operating in the typical manufacturing sectors of Made in Italy. The results were then graphically represented, according to Kembro etal. (2017). To strengthen the reliability and validity of our research, we triangulated the data using Patton (2002) and Golafshani (2003) criteria and we used different sources of data (e.g., informal conversations and secondary data) (Yin, 2003).

The first phase of our research has established the basis for the second step of the study, which has been conducted through a structured survey (McCann & Barlow, 2015; Taiminen & Karjaluoto, 2015). The research methodology has thus followed four main phases: structure; sample and inclusion criteria; pretesting; data collection and analysis. The first two phases have taken place in parallel, while the remaining ones are in succession. In the next paragraphs each stage is presented.

3.1 Structure

According to the aim of the research, our online survey has been made up of 23 closed-ended questions with a Likert scale, assigning a distinct and gradual weight from 1 to 7 to the alternatives offered, divided into four sections. The first section concerns the profiling of the interviewee and of the company (role of the interviewee, reference product sector, and type of customer). The second section is devoted to identifying which channels are used and managed today by the company enterprise and, in the following section, which channels are expected to be used in the next 3–5 years (traditional direct, digital direct, traditional indirect, and digital indirect). Based on the choice made regarding this last question, the interviewee will see the corresponding areas:

-

Traditional direct channels (direct sales);

-

Direct digital channels (proprietary e-commerce);

-

Traditional indirect channels (wholesaler, retailer, agents, importers, other);

-

Indirect digital channels: horizontal marketplaces (generalists such as Amazon, Alibaba) and vertical marketplaces (specialized by products/sectors).

In each of the previous 4 areas, the reasons that will determine or limit its use in the next 3–5 years have been investigated.

The last section concerns the theme of omnichannel as an integration between physical and digital channels aimed at allowing customers to use marketing channels in a uniform and interchangeable way.

3.2 Sample and inclusion criteria

As concerns the respondents to the survey we have focused our attention on SMEs that manufacture typical Made in Italy products, thus those companies operating in the textile, food, mechanical, and furniture sectors. The Italian country represents an interesting research laboratory for our research. In fact, Italian SMEs are the basis of the Italian economy (Muller & Sessini, 2021). They are 99.9% of all companies, creating over 70% of the country’s turnover and employing more than 81% of workers (PMI.IT, 2021).

According to the European Commission’s 2022 DESI report, which monitors the digital progress made by the members of the European Union, Italy ranks 18th among the 27 countries, with a score of 49.3 compared to the average of 52.3 (Confindustria Emilia, 2022).

The 2021 Istat report highlights that 60.3% of Italian SMEs have reached at least a basic level of digital intensity—a structured metric on the Digital Intensity Index—effectively exceeding the European average (56%). The basic level concerns the usage of at least four of the twelve digital technologies (e.g., AI technology, e-commerce, IoT, social media, CRM, etc.). The Italian goal is to reach 90% by 2030, improving the competitiveness and economic resilience of businesses (Confindustria Emilia, 2022). In addition, the pandemic has pushed SMEs to increase the adoption of e-commerce platforms, for example. In fact, there was a growth of + 50% compared to the pre-pandemic period.

Among the SMEs companies, we decided to explore in detail mid-sized enterprises operating in the main sectors represented by the “Made in Italy”: food, furniture, automation/mechanics and fashion. The relevance of this analysis relies on two main aspects. Firstly, the decision of focusing the attention on medium-sized enterprises is driven by the tendency of researchers to examine SMEs as a homogeneous category, infrequently distinguishing between ‘small’ and ‘medium’ size (Gilmore et al., 2013). In fact, Bocconcelli et al. (2018) highlight how this stream of research should be enhanced. Few are the contributions -especially European studies- that try to consider medium-sized enterprises as an object of analysis (Coltorti et al., 2013; Muzyka et al., 1997). In addition, the main obstacles for digital integration in SMEs are related to time/cost aspects, limited skills and low capability to fully exploit the potential of new technologies in order to reshape effectively and efficiently new channels’ structure and strategies (Gilmore et al., 2013; Taiminen & Karjaluoto, 2015). For this reason, we decided to focus the attention on mid-sized enterprises, which can leverage on broader financial and human resources. Secondly, the significance of this analysis depends on the fact that the “Made in Italy” brand has a considerable impact on the intentions of Italian customers to purchase a product again (Matarazzo et al., 2021) and on the willingness of international customers to buy Italian products (Bertoli & Resciniti, 2013; Matarazzo et al., 2018). In fact, “Made in Italy” is seen as a universal standard of excellence (Penco et al., 2021), assuming peerless importance (Fortis, 2005) and giving more value to the associated products.

The companies to be analysed have been identified through the use of the 2021 report “The main Italian companies” produced by the Mediobanca Study Area (Area Studi Mediobanca, 2021). The report is the 56th edition of the main Italian Companies study, whose roots go back to 1946, when Mediobanca began making data processing and analysis available to private and institutional investors with the intent of contributing to financial market transparency. Among the list of companies presented in the report, we have selected all the medium-sized Italian companies, 360 companies, that meet the following three inclusion criteria (Phillips, 1981):

-

i.

Employees: between 50 and 499 units;

-

ii.

Turnover: between 15 and 330 million euros;

-

iii.

Sector: operating in one of the four typical Made in Italy sectors of food, furniture, automation/mechanics and fashion.

Finally, the link was sent to specific internal professional figures within the companies’ marketing departments, such as marketing managers, digital marketing specialists, digital strategists and directors of digital marketing.

3.3 Pre-testing

To increase the response rate, a pre-test of the survey was carried out, finalized at refining the structure and identifying errors or critical points (Reynolds et al., 1993). In fact, the pretesting (or pilot-testing) is a specific stage in the development of a questionnaire that implements the effectiveness of the answers’ collection. The importance of this step is stressed by the literature (Reynolds et al., 1993). Thus, the questionnaire was submitted to two medium-sized Italian enterprises willing to answer the questions, giving feedback both on the structure and on the individual questions. In detail, we have improved the clarity and readability of four questions, we have modified a question related to digital partners by focusing on the areas in which they are involved, and we have better structured a question related to logistics in terms of possible answers. The pre-testing was conducted three weeks before the official submission of the survey to the final sample and it was presented through a specific editable document on which the companies were able to add comments and suggestions. Through this phase, the questionnaire was streamlined and easier to read.

3.4 Data collection and analysis

The survey was submitted online between the end of June and January 2023, giving priority to sending the link via direct email. Not all the emails identified had a return in terms of response, and there were situations of impossibility to reach the contact (e.g., undeliverable email or automatic email for holidays) and of decline of the request (e.g., declaration by the contact of unwillingness to participate in the research) (Hulland et al., 2018). With regard to the impossibility of reaching contact, alternative forms of sending were sought (e.g., filling out online forms on the company website or contacting them via social networks). A week later, a reminder was sent.

The data collection and analysis took place two weeks after the reminder in order to allow those who had started responding to complete the survey. A total of 50 usable questionnaires have been obtained (Table 3), resulting in a response rate of 13.9 percent.

4 Findings

4.1 Marketing channels’ architecture

Our analysis is based on 50 respondents. As far as the structure of the marketing channels used by the companies is concerned, we have distinguished between traditional or digital and direct or indirect channels. The traditional direct channels consider zero-channel sales when essentially the company communicates, delivers value, and supplies directly products to the final customers through one-to-one product demonstrations, face-to-face visits, owned physical stores, and other ways of personal selling. The digital direct channels comprehend the use of proprietary e-commerce, a specific online platform dedicated to providing information, delivering value, selling, and eventually delivering products directly to the final customers. Traditional indirect channels are managed by companies to communicate, deliver value and sell their products through the intermediation of third parties. If correctly managed, the indirect channel can be relevant for the internationalization strategy of SMEs. We consider intermediaries, those business partners such as wholesalers, retailers, agents, importers, etc. According to the number of actors involved, the channel can move from one-level to two-level. For example, a product that moves from the manufacturer to a wholesaler and then to a retailer is considered a two-level channel. Finally, the digital indirect channels are those third-party digital platforms for sustaining companies in their communicating, and delivering value and selling processes. The owners of these marketplaces are digital players that provide various “general” services to support commercial interaction between companies and final customers. Digital marketplaces can be defined as those neutral internet-based places where it is possible to share information, products, services, and payments between buyers and suppliers virtually. They can be classified into horizontal and vertical marketplaces. The former concerns generalist providers such as Amazon, Alibaba, etc. The horizontal marketplaces involve actors belonging to heterogeneous industries to reach the widest audience possible. They are a digital one-stop shop where customers and business clients can purchase anything they need in one place, combining various market segments to reach broader coverage. The latter, vertical marketplaces, include those third-party digital platforms specialized by products or sectors, such as Etzy, TaskRabbit, Metro Market, etc. This vertical business model is focused on providing the best services in one specific category. Typically, vertical marketplaces aim to be the best in their domain due to the limitation of their target audience

Based on the analysis of the results, we can report that the majority of the interviewed companies built their marketing channels’ architecture on direct and indirect channels. In fact, 88% of the companies use and manage traditional indirect channels such as wholesalers, retailers and business partners; while 60% of the respondents affirm that they sell their products through traditional direct channels. Digital channels are used, but less diffused among respondents. 28% of companies adopt and manage direct digital channels, such as proprietary e-commerce, and the same percentage of companies use indirect digital channels, for example, vertical or horizontal marketplaces.

A part of our survey was finalized to understand the expectations about the future of marketing channels in the next 3–5 years.

What emerges is that companies do not expect big changes, even if the usage of digital channels will increase by an average of 70% (Fig. 1).

According to our respondents, the traditional direct and indirect channels will be the most important. The adoption of traditional indirect channels will decrease by 9% and this contraction is linked to the difficulties companies face in managing these channels and intermediaries. As described later, two are the key limitations of the diffusion of traditional indirect channels highlighted by the majority of companies in the next 3–5 years. The first is represented by the main company’s limited control of this specific channel, while the second constraint is envisaged in the resistance to the change of intermediary partners.

4.2 Enablers and barriers of adopting different marketing channels

Based on the choices made by companies regarding the usage of the different channels in the next 3–5 years, our survey has investigated the three main reasons that will determine or limit the adoption and management of each channel.

The main reasons that underpin the use of traditional direct channels are based on the relationship theme. First of all, maintaining personal relationships over time is the most relevant advantage recognized by companies for justifying the importance of this specific channel in the overall marketing channel’s architecture. Secondly, companies place fundamental importance on maintaining access to customer information. In fact, traditional direct channels are owned by the company, which has a complete view of all data and information provided by the customers during their buying process. The last aspect, included as a main reason that drives the adoption of the traditional direct channel, is the possibility for the company to create effective storytelling. Storytelling is part of the content creation process managed by the company to establish a relationship with its business and final customers. However, companies identify some critical issues that can inhibit the decision to manage traditional direct channels. First of all, the most important issue is structural costs. The costs borne by the company for creating and maintaining this channel are significant. Secondly, linked to the previous aspect, companies identify limited internal resources as a relevant constraint. Investments in human, technological, and financial resources are necessary to effectively manage the traditional direct channel. The last limit of adoption is envisaged in the difficulties in collecting and elaborating data. Data are fundamental, previously included as an enabler for the management of this specific channel.

Over the next 3–5 years, the motivations that will drive the usage and management of digital direct channels will be different. The greatest advantage of the adoption of digital direct channels is the strengthening of brand positioning. Companies recognize the importance of being correctly perceived by business and final customers. Then, increasing the online presence is the second enabler for using proprietary e-commerce. Digital is seen by companies as a useful option to promote their brands and solutions to their target audience. Finally, the possibility of creating a direct relationship with customers is another benefit that justifies the willingness of companies to use the digital direct channel. The major constraints are identified in several barriers, such as the limited impact on turnover, the necessity of new competencies, and revisions to logistics processes. The first aspect is related to the investments made. The decision to buy or create its own digital platform for delivering value and selling its products or services implies relevant financial resources. Even investments in human resources, such as the establishment of a dedicated team of experts, and in technological assets, for example, the acquisition of software and hardware to manage processes, are fundamental. The second limit of adoption in the next 3–5 years of digital direct channels is the necessity of new competencies. As anticipated, these digital direct channels require specific competences and skills that usually cannot already be present in SMEs. Experts in coding, digital marketing, and software development are necessary for managing these channels. The last constraint is the revision of logistics processes. It has to be considered that the integration of logistics behind the digital and physical channels is not always put into practice. In fact, usually companies manage the digital and physical channels with two different warehouses and inventories because the implications in terms of alignment of marketing strategies, shared information, technological software and hardware, competencies, and skills are significant for SMEs.

Furthermore, what emerges from our research is that the use of proprietary e-commerce has not been decisive in the last two years, and in the next three years, approximately the majority of companies will invest less than 5% of their turnover in the use of proprietary e-commerce (Fig. 2).

As far as the use of traditional indirect channels in the next 3–5 years, the interviewed companies still consider relying on the relationships actors (such as wholesalers, retailers, agents, importers, etc.) relevant. This occurs first because of the geographical diffusion of customers, and the intermediaries enhance the possibility for a company to contact customers and business clients who are physically located in different places. Secondly, intermediaries are important sources of data. As already underlined, data is fundamental nowadays for gaining knowledge of a company’s customers, and the integration of information with partners can strengthen the ability of actors involved in the network to better manage all business processes. Although, the adoption of traditional indirect channels is impeded by some barriers. First of all, the limited control of the channel is a constraint based on the structure of the channel itself. In fact, the presence of a long channel can create problems concerning the message and information supplied to the audience by third parties. Secondly, the resistance to change by intermediary partners is another barrier to the adoption and management of these channels. New solutions, activities, and technologies are not always accepted by intermediaries. Finally, linked to the previous constraint, the misalignment of operations and tools used can create difficulties in managing and exchanging data and information. Marketing is the process by which companies create value and build strong relationships with customers to capture value from them in return. However, if the actors involved in marketing channels’ architecture decide to adopt and manage different technological tools than those of the company, their procedures for sharing insights emerging from the market are not aligned with the company’s, and problems can arise, such as loss and waste of resources provided for business operations.

Regarding the digital indirect channels, horizontal and vertical marketplaces are analysed.

Interviewed companies say that in the future, the adoption and management of horizontal marketplaces will be strengthened for some main reasons. The first aspect is reaching a new market. Generalist providers, such as Amazon, Alibaba, etc., are marketplaces that involve actors belonging to heterogeneous industries and are used especially for reaching the widest audience possible. SMEs are usually not able to enter new markets due to their limited financial, human, and technological resources. Horizontal marketplaces can thus provide this kind of support. The second advantage of adopting and managing these channels is reinforcing the brand positioning. The horizontal marketplaces are a digital one-stop shop where customers and business clients can purchase anything they need in one place. These digital environments allow the comparison of different solutions because they combine various market segments to reach broader coverage, giving the audience the possibility to understand exactly the SME’s brand and its offer. The last benefit that can be achieved by companies in using horizontal marketplaces is increasing their ability to follow new buying behaviors by customers. The digital context opens them to new potential customers, who can have new buying behaviors. They can be intercepted and then managed by the company digitally, providing the right customer service, personalizing the solution, or the delivery process. Even for this typology of indirect channel, the main limit is seen in the limited control of the channel. In fact, several problems can arise as the digital platform is not directly managed by the company. For example, inadequate integration of information between the platform and the company, constraints linked to the structure of the platform, or costs related to the usage of the platform itself can inhibit the adoption of the channel. Another barrier is the need for new internal skills in companies. They are usually characterized by limited resources, and the absence of technological tools or human resources dedicated to controlling all the activities conducted digitally can be a source of loss in terms of customer satisfaction, loyalty, and profits. Finally, companies highlight an important aspect that can inhibit the application and management of these channels, which is an unsuitable result for the investment. Their ability to measure results on investments concerning the usage of specific channels is fundamental for planning an effective marketing channel’s architecture.

In the next 3–5 years, the main reason that can enhance the usage of vertical marketplaces is the growth in competitiveness of specialized marketplaces. These particular channels are increasing in terms of importance and online diffusion. They have a specific vertical business model focused on providing the best services in one specific category, and their competitiveness among brands is high. The second aspect that boosts the usage of vertical marketplaces by SMEs is the possibility of increasing corporate brand awareness. This advantage is rooted in the specificity of the digital component. These third-party digital platforms, specialized by products or sectors give companies the possibility to reach a broader audience not attainable through traditional channels. The last enabler is increasing the efficacy of customer care. Digital platforms, if correctly managed, can help companies follow customers in their specific buying processes, providing real-time customized solutions. As with the other channels analysed, even the adoption of vertical marketplaces can be confined due to some barriers. The limited visibility of the marketplace can be a possible constraint. In fact, the analysed companies are dependent on the visibility reached by the provider of the platform. If on the one hand, vertical marketplaces aim to be the best in their domain due to a restricted target audience; on the other hand, this aspect can be a source of problems in terms of diffusion. Another issue highlighted by respondents is the possibility of using these channels only in a preliminary phase. If the company aims to expand its activity or brand awareness, vertical marketplaces can be used as part of the overall marketing channels’ architecture due to their target audience limitations. Even for these channels, a main barrier is the need for new skills by SMEs.

In general, the results underline that both marketplaces—horizontal and vertical ones—have had little significance in terms of sales in the last two years. More than 74% of companies that declare that they will use and manage digital indirect channels in the next three years will invest less than 5% of their turnover in using these channels (Fig. 3).

4.3 Omnichannel strategy

All the companies involved in the study have been asked to focus their attention on the adoption of an omnichannel strategy. 30 companies have recognized a positive experience in managing integration among digital and traditional channels. Digital channels include direct channels, such as proprietary e-commerce platforms, and indirect channels, such as horizontal and vertical marketplaces. Traditional channels are both direct (zero-channel sales) and indirect (those actors considered as intermediary partners).

The main advantages that these companies underline in the adoption of an omnichannel strategy are three. First of all, greater customer profiling and the possibility of merging different information coming from a plurality of sources are important. In fact, the omnichannel strategy can enhance the ability of companies to acquire an abundance of useful and valuable data through, for example, website analytics, social media metrics, and email campaign statistics. The second aspect that is observed by companies during the adoption of an omnichannel strategy is the possibility of aligning messages. Through this strategy, they have observed that they can manage different marketing channels in an integrated way with a unique vision and a seamless experience for the customer. Thanks to the omnichannel strategies, they reduce efforts in managing different communications in parallel and improve customer satisfaction, loyalty, and retention. The last advantage recognized by companies is the possibility of accompanying customers along their customer journey. In fact, the integration of different channels helps them better understand customers, not only thanks to the alignment of information but even by fostering the performance measurement of each channel in order to understand where control and adjustment measures can be applied.

Our research, however, also highlights that companies even find some problems during the adoption and management of an omnichannel strategy. The first aspect is the complexity of integrating the data collected from the various channels. During the search and purchase processes, channels are interchangeably and seamlessly used by customers. This complexity can sometimes be difficult to manage as the analysed companies are characterized by limited resources. The second issue is the difficulty of the needed technological integration. In fact, the omnichannel strategy requires specific know-how to foster channels’ integration and investments in IT infrastructure that can support the integration and operability of all the diverse activities implemented through the various channels. The technological integration is fundamental to achieving a complete and aligned acquisition of all information coming from the market through the different channels. Such information are also necessary to forecast the needed activities and resources for further investments. Finally, respondent companies find difficulties in logistics activities that have to be improved when an omnichannel strategy is implemented. Channels’ integration must be connected to logistics’ integration, which demands employees’ commitment and training.

In the last phase of the study, respondents have been asked to explain which new actors are necessary for the channels. Companies highlight three main areas where new professional profiles are particularly important. Firstly, data analysis is the most significant field where new actors are necessary. As previously underlined, data and information are essential nowadays in order, not only to deliver value and exactly comprehend the final customer or business client, but even to capture value in return from the market. For this reason, new partners are fundamental to supporting the companies that are usually characterized by a paucity of technological, human, and financial resources. Secondly, companies consider particularly relevant the presence of new partners for communication and storytelling. Activities supporting and managing the creation and nurturing of relationships with stakeholders are key aspects that have to be included in the overall processes and marketing channels’ architecture. According to the respondents, the third area that requires new partners is logistics. Companies can decide if to manage the logistics operations internally or outsource them. In both the cases, they can optimize the investments in resources by sharing the logistics and warehouse operations between all channels with the help and support of external experts.

5 Discussion

In this section, we want to apply the classification of the factors influencing the adoption of digital marketing strategies suggested by Karjaluoto and Huhtamaki (2010) firm and owner or manager-specific, resource-related, and environmental to the adoption of different marketing channels by Italian mid-sized companies in the next 3–5 years.

Table 4 highlights the main enablers and barriers linked to the decision to adopt and manage traditional or digital channels. In detail, we present the main facilitators and inhibitors for companies that are currently managing only traditional channels and those that are approaching or using digital channels.

For traditional channels, firm-specific and owner-managerial factors that enable the decision to adopt and manage them include achieving strong and personal direct relationships with customers and intermediaries, gathering useful information, strengthening relationships, sharing data, and boosting brand awareness. The main barriers focus on the ability to manage data for decision-making and the capability of the company to integrate different data sources (direct or indirect traditional channels). Another limitation is the possibility of sharing data with customers and partners. Direct and indirect channels imply using different tools for data collection, which can be a constraint if there isn’t alignment between partners.

Resource-related factors can be analysed according to financial, human, and technological resources. The lack of necessary resources in the company can often be a barrier to adopting a specific channel, which can be overcome with the support of external partners. Even if financial investments in traditional channels are usually well-known and can be forecasted, traditional channels have high structural costs that need to be managed and maintained. This implies a successful alignment among all activities, preventing losses and wasted investments (e.g., duplications or overlapping of tasks). Adopting traditional channels requires a team of experts with recognized expertise, which can be limited by internal competencies and investments in training and skill development. Technological resources are fundamental; data sharing is essential to manage all processes better, and partner support can be key in implementing traditional specific processes. Despite clear enablers, several barriers exist: coordination issues with compatible tools, limited control over long channels due to different actors involved, and difficulties related to specific processes.

Lastly, environmental factors facilitating the adoption of traditional channels include the willingness to geographically cover customer diffusion and enhance physical presence. These factors imply difficulties such as managing the physical presence through diverse traditional channels (direct or indirect), which might not have the same strategy or approach.

For digital channels, firm-specific and owner-managerial factors that enhance adoption include the ability to valorize brand positioning, increase brand and solution promotion, enable corporate brand awareness, improve competitiveness, expand market entry possibilities, and create direct relationships with customers. These strong and personal direct relationships also lead to higher levels of product customization and close market interaction, which is especially important for Made in Italy companies characterized by internationally recognized craftsmanship and quality (Runfola et al., 2024). On the other hand, barriers can inhibit digital channel adoption, such as the limited technological knowledge of the company’s owner and the ability to forecast results.

Regarding resource-related factors, financial enablers involve the company’s ability to invest internally or outsource processes and activities, including external partners. Constraints include the low impact on turnover, inability to measure return on investment, and costs linked to acquiring or using digital tools. Human resources must be implemented to manage digital technologies correctly, with training and refresher courses essential for gaining a competitive advantage in a highly competitive business environment. Well-trained and updated human resources are crucial for Made in Italy companies to improve brand awareness through the right channels, as the Made in Italy brand is seen as a universal standard of excellence (Penco et al., 2021). Technological resources face challenges in technology compatibility, limited control of the channel, data integration among diverse software (e.g., inventory and warehouses used in traditional/digital and direct/indirect channels), and specific new processes to be managed (e.g., logistics, collection, and elaboration of big data). Companies should integrate different activities and processes into a coherent business strategy, which Made in Italy companies, characterized by high flexibility, can handle successfully (Gistri & Corciolani, 2020).

As far as environmental factors, Italian mid-sized companies highlight that key enablers for adopting digital channels include higher audience coverage, digitalization of customers and business clients, and the ability to satisfy customer needs (personalization and different purchasing options). These aspects are fundamental, especially for Made in Italy companies, as the brand significantly impacts Italian customers’ intentions to repurchase products (Matarazzo et al., 2021) and international customers’ willingness to buy Italian products (Bertoli & Resciniti, 2013; Matarazzo et al., 2018). However, barriers that discourage the use of digital channels include limited visibility of the channel by the final market (e.g., visibility depends on marketing activities done by the solution provider), low effective adoption of the channel by the market, and resistance to change by partners. These aspects are linked to external variables that cannot be managed by the company itself but should be considered to face the complexity of the business environment.

Moving on to analyse the answers related to the companies’ adoption of the omnichannel strategy, the main enablers stressed by the respondents as enhancing the adoption and management of an omnichannel strategy are firm-specific and owner-managerial factors. Long-term relationships with customers are the strategic purpose of all the companies involved. It emerges as a clear necessity to share information with customers to accompany them along a personalized customer journey, which is only possible through direct communication and better customer profiling. These goals can be reached through the correct application of an omnichannel strategy. The main issue is the lack of knowledge by owners or managers of the efficacy and effectiveness of the omnichannel strategy (Amiri et al., 2023).

However, the main barriers for companies that aim to improve an omnichannel strategy are linked to resource-related factors. In particular, companies highlight, as key constraints for an integrated management of digital and traditional channels, technological resources. For example, the complexity of merging data, technologies, and processes is a fundamental aspect that requires particular attention. This consideration is connected to the difficulty of respondent companies in managing the complexity that arises when there is a coexistence of different channels that have to be managed in an integrated way (Cui et al., 2021). Omnichannel strategy also demands logistics and communication abilities that require specialized skills and human resource abilities that are still missing in many of the interviewed companies.

6 Conclusion

This study aimed to explore if and how “Made in Italy” SMEs are introducing and managing digital marketing channels, aiming for an omnichannel management strategy. To answer the main aim of the research, we focused the attention on medium-sized companies and a two-phases research design has been applied: the first phase was conducted through a qualitative methodology with 12 semi-structured interviews carried out in 2020 and 2021 through a grounded Delphi method, while the second phase was based on the administration of a survey. The results of our analysis have underlined the main enablers and barriers for adopting and managing different types of channels (traditional or digital) and the benefits and drawbacks related to an omnichannel management strategy.

Factors affecting channels’ decisions are influenced by firm-specific and owner-managerial factors and by resource-related and environmental factors. Through this analysis, our study offers theoretical and managerial implications, which we present in the following subsections.

6.1 Theoretical implications

The theoretical contribution of our study is fourfold.

First, our research contributes to the literature by providing insights into the different approaches SMEs take toward the management of marketing channels. The study delves deeply into the analysis of the transformation of SMEs’ marketing channels, addressing the paucity of research focused on SMEs operating in traditional industries (Soto-Acosta, 2020). In fact, the paper aims to emphasize and satisfy the need for further knowledge on marketing channel management, as highlighted by several authors (Bocconcelli et al., 2018).

Second, the study confirms the attention of medium-sized companies concerning the inclusion of digital channels (Vesci et al., 2022), but it even highlights that the introduction of the digital channel does not cannibalize the role and activities connected to more traditional channels, direct and indirect. Even the transformation underway among the traditional players of the indirect channel, namely intermediaries or third parties, does not yet appear clear in its evolution or the impact it could have on the sales strategies of companies. Similarly, the reference to digital platforms, still considered an important counterpart, is triggered in a context with outlines that are still undefined. The transition toward an omnichannel strategy is followed by medium-sized companies due to the main acknowledged benefits (e.g., the possibility of a SME extending the actual audience and providing integrated and coherent information among diverse marketing channels) (Dimitrova et al., 2020; Hasbolah et al., 2022), but it is not fully applied. This insight confirms previous studies that highlight the main advantages of an omnichannel strategy for SMEs in terms of performance, growth, and competitiveness (Hasbolah et al., 2022; Lewis et al., 2014; Liao et al., 2023; O’Dwyer et al., 2009). However, it also supports the considerations about the main disadvantages, such as the difficulty SMEs face in managing this complexity. SMEs often struggle to fully exploit the potential of new technologies and to effectively and efficiently reshape new channels’ structures and strategies (Cui et al., 2021; Gilmore et al., 2013; Taiminen & Karjaluoto, 2015). In fact, an omnichannel strategy requires specific know-how and managerial abilities to support the integration and operability of all the diverse activities (Spinelli et al., 2013).

Third, our study contributes to the theory by including specific considerations concerning the main categories identified by previous authors (Karjaluoto & Huhtamäki, 2010) to classify the determinants of the adoption of specific channels. In detail, we have improved the identification of the main enablers and barriers for each category of factors, presenting and explaining them through specific elements that have a positive or negative impact on the adoption of traditional and digital channels. Moreover, the financial, human, and technological resources that were generally considered as facilitators and inhibitors of resource-related factors in the previous framework (Table 1) are, in Table 4, part of the classification of the main typologies of resource-related factors. Each of the three clusters (financial, human, and technological resources) is then deeply explored, presenting the key and specific enablers and barriers for the adoption of a particular channel. In addition, it is interesting how, for medium-sized companies, firm-specific and owner-managerial factors are the main enablers for taking decisions according to the specific channel to be used and managed. As confirmed by literature, the main discriminators for the choice and management of the correct marketing channels’ architecture are resource-related and environmental factors. This is aligned with the main difficulties of SMEs, represented by the company dimension and the limited available resources that can be compensated for by external new partners (Gilbert et al., 2006; Kim et al., 2021; Shrader et al., 1989).

Lastly, our results confirm the attention of SMEs, especially medium-sized companies, toward the relationship with their customers and partners (Soto-Acosta, 2020). It is interesting to note that despite the recognized strategic importance of e-commerce, there is still a strong uncertainty regarding the use of third-party platforms (vertical and horizontal marketplaces) and, in any case, the effectiveness of digital tools to trigger and maintain long-term relationships with customers. The digital channel is now considered to be used to sell products, communicate, share information, provide services, share content, and, more generally, interact with customers to create a win–win relationship. Although traditional channels (direct and indirect) are still important for creating and maintaining relationships with actors belonging to the same network.

6.2 Managerial implications

The adoption of specific marketing channels by the interviewed companies is based on the recognition of the strategic role of marketing channels themselves. However, the effective creation of a successful marketing channel’s architecture depends on the internal resources already available in the companies (eventually integrated with external ones) and environmental factors that are not under the control of the companies themselves. These two latter aspects are the main barriers that can limit the execution and management of the strategic planning of the marketing channels. Additionally, the research is grounded in the Italian context, characterized by its predominant industrial structure centered around SMEs. However, this focus does not constrain the broader applicability of the recommendations, which are developed from a well-established framework and informed by insights from mid-sized enterprises. This approach acknowledges the challenges faced by small enterprises in fully harnessing the potential of new technologies, often due to resource constraints.

Our research suggests that, as the business environment becomes more complex and uncertain, SMEs need long-term relationships with market actors. Managers should pay particular attention to the value of such relationships in a context that is characterized by more demanding, informed, and unfaithful customers and, also, intermediaries. Partners are key actors that have to be considered and included in the overall activities of SMEs, as they are can provide resources (human, technological, and financial) when the company is not able to. For this reason, the presented framework can serve as a useful guideline for practitioners aiming to assess whether an SME is capable of adopting traditional and/or digital channels. The comprehensive list of enablers and barriers can be applied as a practical checklist, helping to identify areas where the SME can leverage existing facilitators and effectively manage internal barriers. This checklist enables practitioners to systematically address each aspect of the adoption process, ensuring that no critical factor is overlooked. Furthermore, this framework can assist in determining when it is necessary to involve external partners to overcome significant constraints that the SME might face. By engaging with external partners, SMEs can access additional resources, expertise, and technologies that may not be available internally. This collaborative approach can significantly enhance the SME’s ability to navigate the complexities of channel adoption and integration. Ultimately, by systematically addressing these factors, SMEs can improve their strategic approach, ensuring a smoother transition and more effective utilization of new marketing channels.

We recommend business managers and entrepreneurs consider the omnichannel perspective as a possible approach that can be used to manage the marketing channels’ architecture, but its application is not mandatory. In fact, medium-sized companies that are not able to face the key barriers of adoption and management of a specific channel can even decide to keep a multichannel approach. Omnichannel emerges as a possibility, not a necessity, in order to be successful. This consideration emphasizes the critical need for managers to prioritize expanding and enhancing their knowledge, expertise, and managerial skills to effectively integrate diverse activities within their organization. Practitioners must thoroughly assess the feasibility of fully leveraging new technologies and understand how implementing unified management of digital and physical channels can influence their company’s current operations. Achieving this requires a deep understanding of the primary factors that facilitate or hinder integration across various channels, which in turn shapes the overall architecture and strategic approach of these channels. By addressing these enablers and barriers comprehensively, managers can strategically reshape their company’s channel strategies, ensuring alignment with evolving market dynamics and enhancing operational efficiency and effectiveness.

6.3 Limitations and future research

While our research yields new insights, it also has some limitations.

The data collected refers to 50 medium-sized companies, and the sample could be potentially improved, even including a focus on small businesses. Not only, the sample of two specific sectors (Furniture and Clothing & fashion) could be extended. It could be even more interesting to identify benchmark companies to analyse their successful process of marketing channel transformation to an omnichannel structure and strategy. This further exploration could be conducted through a multiple case study approach, and it could provide additional insights that, in the actual research, do not emerge. An in-depth analysis of the process could be helpful to delve more deeply into the details of the most important enablers and barriers. Interviews should be done with different actors inside the company as well as with the company’s counterparts, mostly digital platforms and third parties. The last academic contributions consider even the concept of “ecosystem”, which in the present study was not explored as potentially too demanding for Italian SMEs. In fact, digital technologies enable the network of actors to act as a fully integrated ecosystem, with transparent information for all the channel partners, from raw material suppliers to logistics providers to manufacturers. Further studies could be focused on this specific approach in order to identify possible applications in the Italian contest.

References

Amiri, A. M., Kushwaha, B. P. & Singh, R. (2023). Visualisation of global research trends and future research directions of digital marketing in small and medium enterprises using bibliometric analysis. Journal of Small Business and Enterprise Development, (ahead-of-print).

Area Studi Mediobanca. (2021). Le Principali società italiane. [online] https://www.areastudimediobanca.com/it/product/le-principali-societa-italiane-2021 (Accessed 3 Feb 2021)

Berman, B., & Thelen, S. (2018). Planning and implementing an effective omnichannel marketing program. International Journal of Retail & Distribution Management, 46(7), 598–614.

Bertoli, G., & Resciniti, R. (Eds.). (2013). International marketing and the country of origin effect: The global impact of ‘Made in Italy.’ Edward Elgar Publishing.

Bijmolt, T. H., Broekhuis, M., De Leeuw, S., Hirche, C., Rooderkerk, R. P., Sousa, R., & Zhu, S. X. (2021). Challenges at the marketing–operations interface in omni-channel retail environments. Journal of Business Research, 122, 864–874.

Bocconcelli, R., Cioppi, M., Fortezza, F., Francioni, B., Pagano, A., Savelli, E., & Splendiani, S. (2018). SMEs and marketing: A systematic literature review. International Journal of Management Reviews, 20(2), 227–254.

Bouwman, H., Nikou, S., Molina-Castillo, F. J., & De Reuver, M. (2018). The impact of digitalization on business models. Digital Policy, Regulation and Governance, 20(2), 105–124.

Brady, S. R. (2015). Utilizing and adapting the Delphi method for use in qualitative research. International Journal of Qualitative Method, 14(5), 1609406915621381.

Cantù, C., Martinelli, E. M., & Tunisini, A. (2022). Marketing channel transformation in Italian SMEs. International Journal of Globalisation and Small Business, 13(2), 147–163.

Cenamor, J., Parida, V., & Wincent, J. (2019). How entrepreneurial SMEs compete through digital platforms: The roles of digital platform capability, network capability and ambidexterity. Journal of Business Research, 100, 196–206.

Chao, C. A., & Chandra, A. (2012). Impact of owner’s knowledge of information technology (IT) on strategic alignment and IT adoption in US small firms. Journal of Small Business and Enterprise Development, 19(1), 114–131.

Cicea, C., Marinescu, C., & Banacu, C. S. (2023). Multi-channel and omni-channel retailing in the scientific literature: A text mining approach. Journal of Theoretical and Applied Electronic Commerce Research, 18(1), 19–36.

Coltorti, F., Resciniti, R., Tunisini, A., & Varaldo, R. (Eds.). (2013). Mid-sized manufacturing companies: The new driver of Italian competitiveness. Springer Science & Business Media.

Cuesta-Valiño, P., Gutiérrez-Rodríguez, P., Núnez-Barriopedro, E., & García-Henche, B. (2023). Strategic orientation towards digitization to improve supermarket loyalty in an omnichannel context. Journal of Business Research, 156, 113475.

Cui, T. H., Ghose, A., Halaburda, H., Iyengar, R., Pauwels, K., Sriram, S., & Venkataraman, S. (2021). Informational challenges in omnichannel marketing: remedies and future research. Journal of Marketing, 85(1), 103–120.

Dholakia, R. R., & Kshetri, N. (2004). Factors impacting the adoption of the Internet among SMEs”. Small Business Economics, 23, 311–322.

Dimitrova, B. V., Smith, B., & Andras, T. L. (2020). Marketing channel evolution: From contactual efficiency to brand value co-creation and appropriation within the platform enterprise. Journal of Marketing Channels, 26(1), 60–71.

Emilia, C. (2022). Digitalizzazione imprese italiane: a che punto siamo? [online] 22 December 2022 https://www.confindustriaemilia.it/digitalizzazione-italia-report-desi2022-istat (Accessed 6 Jan 2023)

Forsyth, D. (2009). Delphi technique. In J. Levine & M. Hogg (Eds.), Encyclopedia of Group Processes and Intergroup Relations (pp. 195–197). Thousand Oaks, CA: Sage Publications Inc.

Fortis, M. (2005). Le due sfide del made in Italy: globalizzazione e innovazione. Bologna, Il Mulino

Gabrielli, V., & Balboni, B. (2010). SME practice towards integrated marketing communications. Marketing Intelligence & Planning, 28(3), 275–290.

Gallego, J., Rubalcaba, L., & Hipp, C. (2013). Organizational innovation in small European firms: A multidimensional approach. International Small Business Journal, 31(5), 563–579.

Ghezzi, A., & Cavallo, A. (2020). Agile business model innovation in digital entrepreneurship: Lean startup approaches. Journal of Business Research, 110, 519–537.

Gilbert, B., McDougall, P., & Audretsch, D. (2006). New venture growth: a review and extension. Journal of Management, 32(6), 926–950.

Gilmore, A., Callagher, D., & Henry, S. (2007). E-marketing and SMEs: Operational lessons for the future. European Business Review, 19(3), 234–247.

Gilmore, A., McAuley, A., Gallagher, D., Massiera, P., & Gamble, J. (2013). Researching SME/entrepreneurial research: A study of journal of research in marketing and entrepreneurship. Journal of Research in Marketing and Entrepreneurship, 15, 87–100.

Gistri, G., & Corciolani, M. (2020). Towards a better understanding of practitioners’ ideas about product placement: An empirical analysis in the Italian context. Italian Journal of Marketing, 2020(4), 261–288.

Golafshani, N. (2003). Understanding reliability and validity in qualitative research. The Qualitative Report, 8(4), 597–607.

Hasbolah, H., Rosdi, N. M., Sidek, S., Abdullah, F. A., Daud, R. R. R., & Khadri, N. A. M. (2022). The digital marketing practices towards Sme’s performance in cyber entrepreneurship. Journal of Information System and Technology Management, 7, 289.

Hulland, J., Baumgartner, H., & Smith, K. M. (2018). Marketing survey research best practices: Evidence and recommendations from a review of JAMS articles. Journal of the Academy of Marketing Science, 46, 92–108.

Karjaluoto, H., & Huhtamäki, M. (2010). The role of electronic channels in micro-sized brick-and-mortar firms. Journal of Small Business & Entrepreneurship, 23(1), 17–38.

Kaynak, E., Tatoglu, E., & Kula, V. (2005). An analysis of the factors affecting the adoption of electronic commerce by SMEs: Evidence from an emerging market. International Marketing Review, 22, 623.

Kembro, J., Naslund, D., & Olhager, J. (2017). Information sharing across multiple supply chain tiers: A Delphi study on antecedents. International Journal of Production Economics, 195, 77–86.

Kim, S., Choi, B., & Lew, Y. K. (2021). Where is the age of digitalization heading? The meaning, characteristics, and implications of contemporary digital transformation. Sustainability, 13(16), 8909.

Kolbe, D., Calderon, H., & Frasquet, M. (2022). Multichannel integration through innovation capability in manufacturing SMEs and its impact on performance. Journal of Business & Industrial Marketing, 37(1), 115–127.

Labrecque, L. I., Vor Dem Esche, J., Mathwick, C., Novak, T. P., & Hofacker, C. F. (2013). Consumer power: Evolution in the digital age. Journal of Interactive Marketing, 27(4), 257–269.

Lewis, J., Whysall, P., & Foster, C. (2014). Drivers and technology-related obstacles in moving to multichannel retailing. International Journal of Electronic Commerce, 18(4), 43–68.

Liao, M., Fang, J., Han, L., Wen, L., Zheng, Q., & Xia, G. (2023). Boosting eCommerce sales with livestreaming in B2B marketplace: A perspective on live streamers’ competencies. Journal of Business Research, 167, 114167.

Matarazzo, M., Lanzilli, G., & Resciniti, R. (2018). Acquirer’s corporate reputation in cross-border acquisitions: The moderating effect of country image. Journal of Product & Brand Management, 27(7), 858–870.

Matarazzo, M., Penco, L., Profumo, G., & Quaglia, R. (2021). Digital transformation and customer value creation in Made in Italy SMEs: A dynamic capabilities perspective. Journal of Business Research, 123, 642–656.

McCann, M., & Barlow, A. (2015). Use and measurement of social media for SMEs. Journal of Small Business and Enterprise Development, 22(2), 273–287.

Mookherjee, S., Lee, J. J., & Sung, B. (2021). Multichannel presence, boon or curse?: A comparison in price, loyalty, regret, and disappointment. Journal of Business Research, 132, 429–440.

Mueller, A., & Sensini, L. (2021). Determinants of financing decisions of SMEs: Evidence from hotel industry. International Journal of Business and Management, 16(3), 117–127.

Murry, J. W., Jr., & Hammons, J. O. (1995). Delphi: A versatile methodology for conducting qualitative research. The Review of Higher Education, 18(4), 423–436.

Muzyka, D., Breuninger, H., & Rossell, G. (1997). The secret of new growth in old German ‘Mittelstand’companies. European Management Journal, 15(2), 147–157.

O’dwyer, M., Gilmore, A. & Carson, D. (2009). Innovative marketing in SMEs. European Journal of Marketing.

Palmatier, R. W., Stern, L. W., & El Ansary, A. I. (2014). Marketing Channel Strategy (8th ed.). Prentice Hall.

Patton, M. Q. (2002). Qualitative research & evaluation methods. Los Angeles: Sage.

Payne, E. M., Peltier, J. W., & Barger, V. A. (2017). Omni-channel marketing, integrated marketing communications and consumer engagement: A research agenda. Journal of Research in Interactive Marketing, 11, 185.

Penco, L., Profumo, G., Serravalle, F., & Viassone, M. (2023). Has COVID-19 pushed digitalisation in SMEs? The role of entrepreneurial orientation. Journal of Small Business and Enterprise Development, 30(2), 311–341. https://doi.org/10.1108/JSBED-10-2021-0423

Penco, L., Serravalle, F., Profumo, G., & Viassone, M. (2021). Mobile augmented reality as an internationalization tool in the “Made In Italy” food and beverage industry. Journal of Management and Governance, 25, 1179–1209.

Peterson, R. A., Balasubramanian, S., & Bronnenberg, B. J. (1997). Exploring the implications of the Internet for consumer marketing. Journal of the Academy of Marketing Science, 25, 329–346.

Phillips, L. W. (1981). Assessing measurement error in key informant reports: A methodological note on organizational analysis in marketing. Journal of Marketing Research, 18(4), 395–415.