Abstract

This study considers a duopoly model in which both a consumer-friendly (CF) firm and a for-profit (FP) firm undertake cost-reducing R&D investments in an endogenous R&D timing game and then play Cournot output competition. When the CF firm chooses its profit-oriented consumer-friendliness, we show that the consumer-friendliness is non-monotone in spillovers under both simultaneous move and sequential move with FP firm’s leadership while it is decreasing under sequential move with CF firm’s leadership. We also show that a simultaneous-move outcome is a unique equilibrium when the spillovers are low and the CF firm invests higher R&D and obtains higher profits. When the spillovers are not low, two sequential-move outcomes appear and the CF firm might obtain lower profits with higher spillovers under the CF firm leadership.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Since the last generation, due to the explosive expansion of corporate social responsibility (CSR) in the world,Footnote 1 CSR activities have become the most popular and imperative business practices. Nowadays, many oligopolistic industries where a few significant firms compete are characterized by different organizational structures with the coexistence of for-profit firms and not-for-profit firms. As a result, the heterogeneity of objectives among the firms emerges as an essential research topic in recent literature.Footnote 2

The recent topic on CSR has received increasing attention from broad research in both empirical and theoretical economics.Footnote 3 From the theoretical approach of applied microeconomics, many studies have analyzed different competition models of oligopolies where profit-maximizing firms compete with their rival firms that might adopt CSR activities. In particular, they utilized a model in which the firm adopts consumer surplus as a proxy of its CSR concerns. That is, a CSR initiative includes both profitability and consumer surplus, and thus, the objective of CSR firm is a combination of consumers surplus and its profits. Then, the firms put a higher weight on output in productions competition, which induces rivals to reduce their outputs under strategic substitutes relationship and thus profits can be higher for a firm which adopts CSR activities.Footnote 4

Though plentiful, the literature on CSR often ignores the importance of R&D investments, which are significant in the R&D-intensive industries such as health-care, medical, energy, and biotechnology. As well as empirically relevant, the study of R&D activities is becoming increasingly popular from a theoretical perspective. In particular, one important feature is whether R&D findings are perfectly appropriated by the innovating firm or not.Footnote 5 Hence, the analysis of the relationship between CSR initiatives and R&D spillovers is one of the key factors in understanding the market equilibrium under the heterogeneity of objectives among the firms.

In this paper, we consider a Cournot duopoly model in output competition in which a consumer-friendly (CF) firm competes with a for-profit (FP) firm not only in output productions but also in R&D investments for cost-reducing (process) innovation in the presence of spillovers. The main aim of this paper is to examine whether the sequential move can be more appropriate than a simultaneous move in modeling the R&D phase of the endogenous R&D timing game. We then provide the conditions where the consumer-friendliness can be more profitable to the CF firm than the FP firm in modeling the R&D choices. Based on the previous findings in Lambertini and Tampieri (2015) and Garcia et al. (2019b) that the CF firm expands its outputs and obtains higher profits than the FP firm, we keep Cournot competition in the last period on output decisions so that we can eliminate the first-mover advantage position in the timing of output choices. We then raise a question of sequencing R&D decisions which characterize the R&D leader and follower. Hence, we can compare simultaneous move versus sequential move in R&D decisions with spillovers and identify the profitable conditions of consumer-friendliness.

In the analysis, we assume that the CF firm can strategically choose its profit-oriented consumer-friendliness and then examine the endogenous R&D timing game in which both firms decides R&D investments sequentially or simultaneously. The main findings are as follows: On the one hand, we show that the CF firm always produces higher outputs than the FP firm irrespective of spillovers. But, the consumer-friendliness is non-monotone in spillovers under the simultaneous move and sequential move with FP firm’s leadership in R&D, while it is decreasing under the sequential move with CF firm’s leadership.

On the other hand, we show that R&D spillovers are crucial factors in determining the equilibrium of endogenous timing game. When the spillovers are low, a simultaneous-move outcome is a unique equilibrium and the CF firm invest higher R&D and obtain higher profits. When the spillovers are not low, however, two sequential-move outcomes appear. In particular, the CF firm can always obtain higher profits under the FP firm leadership, while it might obtain lower profits with higher spillovers under the CF firm leadership. It implies that being a CF firm under the CF firm leadership is profitable only when the spillovers are not so high. Hence, we can conclude that the firm may strategically use CSR initiative as a credible commitment to obtain higher profits than its profit-seeking competitors only when the spillovers are not so high.

The remainder of this paper is organized as follows. In Sect. 2, we formulate a duopoly model with a CF firm and an FP firm investing cost-reducing R&D activities. We analyze the simultaneous and sequential movements in Sect. 3 and compare the outcomes to find an endogenous timing in choosing R&D decisions in Sect. 4. Final section concludes the paper.

2 Model

We consider a homogeneous goods duopoly in an R&D and then quantity-setting game. One of the firms is a consumer-friendly (CF) firm (hereafter referred to as firm 0) that cares for not only its profits but also consumers surplus. The other is a for-profit (FP) firm (hereafter referred to as firm 1) that maximizes only its profits. Firms sell their output \(q_0>0\) and \(q_1>0\), respectively, at the market clearing price \(p(Q)=a-Q\) where \(Q=q_0+q_1\).

We consider a (convex) production cost function of each firm. Firms invest in R&D to reduce the initial production costs. In particular, adopting the approach suggested by D’Aspremont and Jacquemin (1988), we assume that reducing production costs by \(x_i\) units requires \(\frac{x_i^2}{2}\) as R&D expenditures.Footnote 6 However, the appropriability of research knowledge is imperfect and its leakages benefit the competitor, i.e., there exist R&D spillovers. Then, taking R&D activities and associated spillovers into consideration, the production costs are reduced to

where \(\beta \in [0,1]\) is the research spillovers rate: R&D findings are perfectly appropriated if \(\beta =0\) while research rewards perfectly spill over to the rival or are shared between firms if \(\beta =1\). It is assumed that \(a> c>x_i + \beta x_j\) for an interior solution.

Firms’ profits are given by

We assume that the CF firm is in a managerial delegation contract in which R&D and production decisions are delegated to a manager. That is, to maximize the profits, the owner of the firm 0 specifies a degree of consumer-friendliness as an incentive contract with the manager.Footnote 7 Then, the manager is assumed to maximize the profit of the firm 0 plus a fraction of consumer surplus (CS) in production. Thus, the objective function of the manager of the firm 0 is given by:

where \(CS=\frac{Q^2}{2}\). The parameter \(\theta \in [0,1]\) represents the extent to which firm 0 concerns with CSR specified in the incentive contract.

The setting is a multi-stage game. In the first stage, the CF firm sets up the managerial incentive scheme, \(\theta\) to maximize its profits. In the second stage, firms compete with R&D: the manager of the firm 0 chooses R&D investment given \(\theta\) prescribed in the first stage to maximize his objective function, while firm 1 chooses its R&D investment to maximize its profits. In this stage, we have an either simultaneous or sequential choice. Finally, firms compete with outputs in the last stage. We solve this game by backward induction and find a subgame perfect Nash equilibrium.

3 The analysis

3.1 Output decisions

In the last stage, the first-order conditions of the CF firm and the FP firm are as follows, respectively:

Solving these conditions yield the equilibrium outputs of the CF and FP firms as

The relationships between outputs and R&D are

A few remarks are in order. First, the effect of each firm’s R&D on its output is positive, but it is weakened as spillovers increase. In particular, a firm’s own R&D contributes more to its output than its rival’s R&D does, i.e., \(\frac{\partial q_i}{\partial x_i}\ge \frac{\partial q_i}{\partial x_j}\). Second, a firm’s R&D has two countervailing spillovers effect on rival’s performance: one is a positive business augmenting effect and the other a negative business stealing effect. These strategic effects are dissimilar across firms. In particular, the strategic effects from the FP firm’s R&D to the CF firm depend on \(\beta \frac{>}{<}\frac{1-\theta }{4}\), while those from the CF firm’s R&D to the FP firm depend on \(\beta \frac{>}{<}\frac{1}{4-\theta }\): (i) if spillovers rate is small, i.e., \(0 \le \beta < \frac{1-\theta }{4}\), both firms’ R&D has negative effects (ii) if spillovers rate is intermediate, i.e., \(\frac{1-\theta }{4}<\beta < \frac{1}{4-\theta }\), FP’s R&D provides positive effects while CF’s R&D provides negative effects (iii) if the spillovers rate is high, i.e., \(\frac{1}{4-\theta } < \beta \le 1\), both firms’ R&D has positive effects.

3.2 R&D decisions and strategic CSR

In the second stage, the FP is a pure profit-maximizing firm in determining R&D. However, CF is in a managerial delegation mode in which manager determines R&D investments to maximize the objective function; while the owner determines its degree of strategic CSR in the first stage of the game.

We will analyze three scenarios: simultaneous choice, and sequential choice with FP leadership and with CF leadership.

3.2.1 Simultaneous scenario

The CF firm’s manager determines R&D to maximize (2), while the FP firm chooses its R&D investment that maximizes its profit. The following are its R&D choices, respectivelyFootnote 8:

From Eq. (5), we have the following lemma.Footnote 9

Lemma 1

\(x_0\ge x_1\) for any \(\theta \in [0,1]\) and \(\beta \in [0,1]\). Also, \(x_0\) increases with \(\theta\) whereas \(x_1\) decreases with \(\theta\).

This represents that the CF firm will take higher investment, which is increasing in consumer-friendliness, irrespective of spillovers under simultaneous game. This is because, as mentioned in Lambertini and Tampieri (2015) and Garcia et al. (2019b), the CF firm expands more outputs in output production game and this position encourages more R&D investment to reduce its output production cost in a simultaneous game.

In the first stage of the game, the owner of CF firm chooses parameter \(\theta\) to maximize (1). Solving it, we obtain very complicated outcomes and thus we simply report the following results: Let \(\theta ^{sm}\) satisfies \(\frac{\partial \pi _0}{\partial \theta }=0\). Then, we have the following relationships in a simultaneous R&D equilibrium:

Proposition 1

Under a simultaneous R&D competition, we have that

-

(a)

\(\theta ^{sm}\) is a convex function of \(\beta\), which first decreases and then increases at \(\beta \approx 0.786\).

-

(b)

\(q_0^{sm}>q_1^{sm}\) for any \(\beta \in [0,1]\); \(q_0^{sm}\) is a convex function of \(\beta\); whereas \(q_1^{sm}\) is a concave function of \(\beta\).

-

(c)

\(x_0^{sm}>x_1^{sm}\) for any \(\beta \in [0,1]\); \(x_0^{sm}\) monotonically decreases with \(\beta\) whereas \(x_1^{sm}\) is a concave function of \(\beta\).

-

(d)

\(\pi _0^{sm}>\pi _1^{sm}\) if and only if \(\beta <{\bar{\beta }}_1\approx 0.8198\); firm’s profit increases with \(\beta\).

This proposition states that in a simultaneous R&D competition, CF firm invests and produces more than FP firm with strategic consumer-friendliness, which decreases if spillovers rate is not so high but increases when the spillovers rate is so high. Thus, spillovers have a detrimental effect on the choice of consumer-friendliness of the CF firm. However, both firms get higher profit as spillovers rate increases and CF firm can get a higher profit than that of FP firm only when spillovers rate is not so high. Hence, when the spillovers rate is so high, a larger production of the CF firm in output competition will provide a negative effect on its profit.

3.2.2 Sequential scenario with FP leadership

We further address the Stackelberg situation, in which the FP firm plays the leading position, while the CF firm responds. Using backward induction, the CF firm’s manager chooses the R&D investment that maximizes Eq. (2), that is, according to \(\frac{\partial V_0}{\partial x_0}=0\), we have

By inserting \(x_0(x_1)\) into the FP firm’s profits and using \(\frac{\partial \pi _1}{\partial x_1}=0\), we get the equilibrium R&D efforts as follows:

From Eq. (6), we have the following lemma:

Lemma 2

\(x_0\ge x_1\) if and only if \({\hat{\theta }}(\beta )\le \theta \le 1\), where \({\hat{\theta }}\) satisfies \(x_0= x_1\). Also, \(x_0\) increases with \(\theta\) whereas \(x_1\) decreases (increases) with \(\theta\) if \(\beta\) is low enough (high enough).

This represents that the CF firm will take higher (lower) investment with a lower (higher) degree of spillovers under sequential game with FP leadership even though the CF firm will expand more outputs in the production game.

Now regarding the first stage of the game, when solving it, we obtain the following results: Let \(\theta ^{fp}\) satisfies \(\frac{\partial \pi _0}{\partial \theta }=0\). Then, we have the following relationships in a sequential R&D equilibrium where FP firm acts as the leader:

Proposition 2

Under a sequential R&D competition where FP firm acts as the leader, we have that

-

(a)

\(\theta ^{fp}\) is a convex function of \(\beta\), which first decreases and then increases at \(\beta \approx 0.5694\).

-

(b)

\(q_0^{fp}>q_1^{fp}\) for any \(\beta \in [0,1]\); \(q_0^{fp}\) is a convex function of \(\beta\); whereas \(q_1^{fp}\) monotonically increases with \(\beta\).

-

(c)

\(x_0^{fp}>x_1^{fp}\) if and only if \(\beta <{\bar{\beta }}_2\approx 0.662\); each firm’s investment in R&D, \(x_i^{fp}\), is a convex function of \(\beta\).

-

(d)

\(\pi _0^{fp}>\pi _1^{fp}\) for any \(\beta \in [0,1]\); firm’s profit increases with \(\beta\).

This proposition states that in a sequential R&D competition with FP firm’s leadership, CF firm invests more than FP firm only when the spillovers rate is not so high. Also, strategic consumer-friendliness decreases if spillovers rate is not so high but increases when the spillovers rate is high. Thus, spillovers have a detrimental effect on the choice of consumer-friendliness of the CF firm. But, CF firm always gets a higher profit than that of FP firm irrespective of spillovers rate. Hence, under a sequential R&D competition where FP firm acts as the leader, regardless of spillovers rate, a larger production of the CF firm in output competition will always provide a positive effect to its profit.

3.2.3 Sequential scenario with CF leadership

We finally address another situation, in which the CF firm acts as the leader, while the FP firm responds. Similarly, according to \(\frac{\partial \pi _1}{\partial x_1}=0\), we have

By inserting \(x_1(x_0)\) into the CF firm manager’s objective function and using \(\frac{\partial V_0}{\partial x_0}=0\), we get the equilibrium R&D efforts as follows:

From Eq. (7), we have the following lemma:

Lemma 3

\(x_0\ge x_1\) for any \(\theta \in [0,1]\) and \(\beta \in [0,1]\). Also, \(x_0\) increases with \(\theta\) whereas \(x_1\) decreases with \(\theta\).

This also represents that the CF firm will take higher investment, which is also increasing in consumer-friendliness, irrespective of spillovers under sequential game with CF leadership. Thus, the fact that the CF firm can expand more outputs in production game requires higher output production to the CF firm when it acts as a leader in R&D competition.

Similarly according to the first stage of the game, when solving it, we obtain the following results: Let \(\theta ^{cf}\) satisfies \(\frac{\partial \pi _0}{\partial \theta }=0\). Then, we have the following relationships in a sequential R&D equilibrium where CF firm plays the leading position:

Proposition 3

Under a sequential R&D competition where CF firm plays the leading position, we have that

-

(a)

\(\theta ^{cf}\) decreases with \(\beta\) and, in the vicinity of \(\beta \approx 0.7364\) the CSR becomes null.

-

(b)

\(q_0^{cf}\ge q_1^{cf}\) for any \(\beta \in [0,1]\); \(q_0^{cf}\) is a convex function of \(\beta\) whereas \(q_1^{cf}\) monotonically increases with \(\beta\).

-

(c)

\(x_0^{cf}>x_1^{cf}\) for any \(\beta \in [0,1]\); \(x_0^{cf}\) is a convex function of \(\beta\) whereas \(x_1^{cf}\) is a concave function of \(\beta\).

-

(d)

\(\pi _0^{cf}>\pi _1^{cf}\) if and only if \(\beta <{\bar{\beta }}_3\approx 0.534\); firm’s profit increases with \(\beta\).

This proposition states that in a sequential R&D competition with CF firm’s leadership, CF firm invests and produces more than FP firm, but the strategic consumer-friendliness is non-increasing with spillovers rate. In particular, if the spillovers rate is so high, CF firm chooses non-commitment on consumer-friendliness and thus, both firms become the same profit-maximizing firms when the spillovers rate is so high. However, both firms get higher profit as spillovers rate increases and CF firm can get a higher profit than that of FP firm only when it adopts positive CSR where spillovers rate is not so high. Hence, when the spillovers rate is not so high, a larger production of the CF firm in output competition will induce a higher R&D and higher profit.

4 Endogenous R&D timing

We examine the modified format of endogenous timing game where both firms choose its timing to move between “early” \((t = 1)\) and “late” \((t = 2)\) in determining R&D decisions.Footnote 10 If both firms choose the same period, the equilibrium is a simultaneous-move game. Otherwise, the equilibrium is a sequential move game. Table 1 provides the payoff matrix of the observable delay game.

To find the equilibrium of the endogenous timing R&D game, we will compare the firms’ profits under each scenario, which gives us the following results:

Lemma 4

Comparing profits provides the following relationships:

-

(a)

\(\pi _{0}^{sm}\ge \pi _{0}^{cf}\) if \(\beta \in [0,0.199]\). Otherwise, \(\pi _{0}^{sm}<\pi _{0}^{cf}\)

-

(b)

\(\pi _{0}^{sm}\ge \pi _{0}^{fp}\) if \(\beta \in [0,0.225]\). Otherwise, \(\pi _{0}^{sm}<\pi _{0}^{fp}\)

-

(c)

\(\pi _{1}^{sm}\ge \pi _{1}^{fp}\) if \(\beta \in [0,0.25]\). Otherwise, \(\pi _{1}^{sm}<\pi _{1}^{fp}\)

-

(d)

\(\pi _{1}^{sm}\ge \pi _{1}^{cf}\) if \(\beta \in [0,0.259]\). Otherwise, \(\pi _{1}^{sm}<\pi _{1}^{cf}\).

Using this lemma, we have the following result:

Proposition 4

The equilibrium of endogenous R&D timing game is as follows:

-

(a)

If \(\beta \in [0,0.199]\), then either (\(t_0,t_1\))=(1, 1) or (\(t_0,t_1\))=(2, 2), is equilibrium outcome.

-

(b)

If \(\beta \in (0.199,0.225]\), then the only equilibrium of the game is the simultaneous movement, (\(t_0,t_1\)) = (1, 1);

-

(c)

If \(\beta \in (0.225,0.25]\), then no equilibrium outcome exists.

-

(d)

If \(\beta \in (0.25,0.259]\), then the only equilibrium is the sequential-move outcome, (\(t_0,t_1\)) = (2, 1), in which the FP firm acts as the leader.

-

(e)

If \(\beta \in (0.259,1]\), then either the CF or FP firm can be the Stackelberg leader. That is, (\(t_0,t_1\)) = (1,2) and (\(t_0,t_1\)) = (2,1), are equilibrium outcomes.

Propositions 4 states that the degree of spillovers affects the sequencing R&D. In particular, simultaneous choice of R&D appears when spillovers rate is low, while the sequential choice of R&D appears when spillovers rate is high. Furthermore, if \(\beta \in (0.25,0.259]\), the only equilibrium is the sequential-move outcome where the FP firm acts as the leader. It also implies that simultaneous R&D game is appropriate when spillovers rate is low while simultaneous R&D game is problematic when spillovers rate is high. Finally, it is noteworthy that at the equilibrium of endogenous R&D timing game, CF firm always chooses higher output productions regardless of spillovers rate, and gets higher profits than FP firm if spillovers rate is small.

Finally, we provide two remarks which show that our findings are robust in different context:

Remark 1

If comparing the case where both firms are pure profit-maximizing firms, the strategic consumer-friendliness of the CF firm might change the equilibrium of endogenous R&D timing game only when the spillovers are intermediate.Footnote 11

Remark 2

Instead of the manager, if the owner chooses R&D, simultaneous move game is the only equilibrium outcome of endogenous R&D timing game when \(\beta \in [0, 0.25]\).Footnote 12

5 Concluding remarks

This paper considers an endogenous R&D timing game in which a CF firm competes with an FP firm in R&D investments in the presence of spillovers, and then play Cournot output competition. We compare simultaneous versus sequential move in R&D decisions and then provide the conditions on spillovers where the consumer-friendliness can be more profitable to the CF firm than the FP firm. In the endogenous R&D timing game, we found that the CF firm always produces higher outputs than the FP firm irrespective of spillovers. But, the consumer-friendliness is non-monotone in spillovers under the simultaneous move and sequential move with FP firm’s leadership in R&D, while it is decreasing under the sequential move with CF firm’s leadership. We also found that R&D spillovers are crucial factors in determining the equilibrium of endogenous timing game. When the spillovers are low, a simultaneous-move outcome is a unique equilibrium and the CF firm invest higher R&D and obtain higher profits. When the spillovers are not low, however, two sequential-move outcomes appear. In particular, the CF firm can always obtain higher profits under the FP firm leadership, while it might obtain lower profits with higher spillovers under the CF firm leadership. We can conclude that the firm may strategically use CSR initiative as a credible commitment to obtain higher profits than its profit-seeking competitors only when the spillovers are not so high.

Our analysis has limitations because of simple duopoly modeling with linear demand and quadratic cost functions. It should be extended into more general settings such as differentiated products in oligopoly competition. It is also important to investigate real-world evidence of CSR behaviors and R&D decisions to analyze governmental role on the firm’s CSR initiatives.Footnote 13 Finally, further strategic avenues of the firms should include cooperative managerial delegation or endogenous equilibrium choice in a strategic delegation game. These are challenging future research.

Notes

According to KPMG (2015) survey on the top 100 firms in 45 countries, 73% of them declared the accomplishment of corporate social responsibility (CSR) activities in their financial reports. Moreover, the Global Fortune Index, which includes the world’s 250 largest firms, has declared more than 92%.

Numerous studies have formulated theoretical approaches on the CSR in the field of applied microeconomic theory such as public economics and the theory of industrial organization. For example, see Goering (2012, 2014), Kopel and Brand (2012), Brand and Grothe (2013, 2015), Kopel (2015), Liu et al. (2015), Xu et al. (2016), Leal et al. (2018) and Garcia et al. (2019b) among others. Regarding empirical works, see Flammer (2013, 2015), Chen et al. (2016) and Nishitani et al. (2017).

The approach that CSR concerns account for consumer surplus is very closely related to the literature on strategic delegation and sales targets for managers in oligopolies. Since Fershtman and Judd (1987) and Vickers (1985) suggested the managerial delegation model, it is well known that owners in an oligopoly may choose non-profit maximization as the optimal managerial incentives and include sales to commit the managers to more aggressive behavior in the output market. As for extensive works with strategic motives for CSR, Fanti and Buccella (2016) examined the network effects while (Lambertini and Tampieri 2015; Liu et al. 2015; Hirose et al. 2017; Lee and Park 2019) incorporated environmental concern. See also Fanti and Buccella (2017) and Kim et al. (2019) for more literature on the strategic approaches on CSR.

A sizeable literature on the choice of R&D in the strategic delegation has been emerged recently. See, for example, Zhang and Zhang (1997), Kräkel (2004), Kopel and Riegler (2006) and Pal (2010). As empirical works, Acemoglu et al. (2007) and Kastl et al. (2013) documented a positive correlation between delegation and innovation.

In the R&D literature, there are two ways of modeling cost-reducing R&D investments with spillovers across firms in an oligopoly context. Kamien et al. (1992) position the spillover effect on the R&D input while D’Aspremont and Jacquemin (1988) position the spillover effect on the final cost reduction. We adopted the latter approach, in which convex cost function is generally assumed. As related works in the context of mixed oligopoly where private firms compete with non-profit firms in R&D investemnts, see Gil-Moltó et al. (2011), Kesavayuth and Zikos (2013), Lee and Tomaru (2017) and Lee et al. (2017).

In the managerial delegation contract, the firm may strategically use CSR initiative as a commitment device to expand the outputs and thus, the firm that adopts CSR obtains higher profits than its profit-seeking competitors. For recent discussion on the theoretical relation between managerial delegation and CSR, see Lambertini and Tampieri (2015), Hirose et al. (2017), Lee and Park (2019) and Garcia et al. (2019a).

For expositional convenience, we provide \(\Delta _i\) and \(\nu _i\) (\(i=1,2,3\)) in Appendix B.

The Proof of lemmas and propositions in this section will be provided in Appendix A.

In specific, if \(\beta \in (0.25, 0.259]\), the equilibrium is sequential move with either of the firms acting as a leader when both firms are pure profit-maximizing firms. Rigorous proofs on the remarks will be provided by authors upon request.

It is not clear to identify whether the R&D decision in the long-run process will be delegated to the manager in the context of business strategy planning. It is also noted that the characteristics of R&D will be classified between irreversible R&D and flexible R&D, depending on the contractual scopes and risk expenditures. The latter refers R&D decisions in the short-term contract (such as decisions on new auto-machines and cost-reducing material purchases), which can be usually delegated to the manager, while the former refers R&D decisions in the long-term contract (such as decisions on relocation, research joint venture and cost-reducing M&A), which are counted as high risk expenditures.

The promotion of CSR has become a top priority in the global policy agenda such as EU and UN. This calls for the government to realize the full benefits that CSR can bring. For more descriptions, see Xu and Lee (2019).

References

Acemoglu, D., Aghion, P., Lelarge, C., Van Reenen, J., & Zilibotti, F. (2007). Technology, information, and the decentralization of the firm. Quarterly Journal of Economics, 122, 1759–1799.

Brand, B., & Grothe, M. (2013). A note on ’corporate social responsibility and marketing channel coordination’. Research in Economics, 67, 324–327.

Brand, B., & Grothe, M. (2015). Social responsibility in a bilateral monopoly. Journal of Economics, 115, 275–289.

Chen, Y. H., Wen, X. W., & Luo, M. Z. (2016). Corporate social responsibility spillover and competition effects on the food industry. Australian Economic Papers, 55, 1–13. https://doi.org/10.1111/1467-8454.12058.

Chirco, A., Colombo, C., & Scrimitore, M. (2013). Quantity competition, endogenous motives and behavioral heterogeneity. Theory and Decision, 74, 55–74.

Cho, S., & Lee, S. H. (2017). Subsidization policy on the social enterprise for the underprivileged. Korean Economic Review, 33, 153–178.

D’Aspremont, C., & Jacquemin, A. (1988). Cooperative and noncooperative r&d in duopoly with spillovers. American Economic Review, 78, 1133–1137.

Fanti, L., & Buccella, D. (2016). Network externalities and corporate social responsibility. Economics Bulletin, 36, 2043–2050.

Fanti, L., & Buccella, D. (2017). Corporate social responsibility, profits and welfare with managerial firms. International Review of Economics, 64, 341–356.

Fershtman, C., & Judd, K. L. (1987). Equilibrium incentives in oligopoly. American Economic Review, 77, 927.

Flammer, C. (2013). Corporate social responsibility and shareholder reaction: The environmental awareness of investors. Academy of Management Journal, 56, 758–781. https://doi.org/10.5465/amj.2011.0744.

Flammer, C. (2015). Does corporate social responsibility lead to superior financial performance? A regression discontinuity approach. Management Science, 61, 2549–2568. https://doi.org/10.1287/mnsc.2014.2038.

Flores, D., & García, A. (2016). On the output and welfare effects of a non-profit firm in a mixed duopoly: A generalization. Economic Systems, 40, 631–637.

Garcia, A., Leal, M., & Lee, S.H. (2019a). Cooperation with a multiproduct corporation in a strategic managerial delegation. Managerial and Decision Economics Article in Press.

Garcia, A., Leal, M., & Lee, S. H. (2019b). Endogenous timing with a socially responsible firm. Korean Economic Review, 35, 345–370.

Gil-Moltó, M., Poyago-Theotoky, J., & Zikos, V. (2011). R&d subsidies, spillovers, and privatization in mixed markets. Southern Economic Journal, 78, 233–255.

Goering, G. E. (2012). Corporate social responsibility and marketing channel coordination. Research in Economics, 66, 142–148.

Goering, G. E. (2014). The profit-maximizing case for corporate social responsibility in a bilateral monopoly. Managerial and Decision Economics, 35, 493–499.

Hamilton, J. H., & Slutsky, S. M. (1990). Endogenous timing in duopoly games: Stackelberg or cournot equilibria. Games and Economic Behavior, 2, 29–46.

Hirose, K., Lee, S. H., & Matsumura, T. (2017). Environmental corporate social responsibility: A note on the first-mover advantage under price competition. Economics Bulletin, 37, 214–221.

Kamien, M. I., Muller, E., & Zang, I. (1992). Research joint ventures and r&d cartels. The American Economic Review, 82, 1293–1306.

Kastl, J., Martimort, D., & Piccolo, S. (2013). Delegation, ownership concentration and r&d spending: Evidence from italy. Journal of Industrial Economics, 61, 84–107.

Kesavayuth, D., & Zikos, V. (2013). R&d versus output subsidies in mixed markets. Economics Letters, 118, 293–296.

Kim, S. L., Lee, S. H., & Matsumura, T. (2019). Corporate social responsibility and privatization policy in a mixed oligopoly. Journal of Economics, 128, 67–89. https://doi.org/10.1007/s00712-018-00651-7.

Kopel, M. (2015). Price and quantity contracts in a mixed duopoly with a socially concerned firm. Managerial and Decision Economics, 36, 559–566.

Kopel, M., & Brand, B. (2012). Socially responsible firms and endogenous choice of strategic incentives. Economic Modelling, 29, 982–989.

Kopel, M., & Riegler, C. (2006). R&d in a strategic delegation game revisited: A note. Managerial and Decision Economics, 27, 605–612.

Kräkel, M. (2004). R&d spillovers and strategic delegation in oligopolistic contests. Managerial and Decision Economics, 25, 147–156.

Lambertini, L., & Tampieri, A. (2015). Incentives, performance and desirability of socially responsible firms in a cournot oligopoly. Economic Modelling, 50, 40–48.

Leal, M., García, A., & Lee, S. H. (2018). The timing of environmental tax policy with a consumer-friendly firm. Hitotsubashi Journal of Economics, 59, 25–43.

Lee, S. H., Muminov, T., & Tomaru, Y. (2017). Partial privatization and subsidization in a mixed duopoly: R&d versus output subsidies. Hitotsubashi Journal of Economics, 58, 163–177.

Lee, S.H., & Park, C.H., (2019) Eco-firms and the sequential adoption of environmental corporate social responsibility in the managerial delegation. B.E. Journal of Theoretical Economics 19.

Lee, S. H., & Tomaru, Y. (2017). Output and r&d subsidies in a mixed oligopoly. Operations Research Letters, 45, 238–241.

Liu, C. C., Wang, L., & Lee, S. H. (2015). Strategic environmental corporate social responsibility in a differentiated duopoly market. Economics Letters, 129, 108–111.

Matsumura, T., & Ogawa, A. (2014). Corporate social responsibility or payoff asymmetry? A study of an endogenous timing game. Southern Economic Journal, 81, 457–473.

Nishitani, K., Jannah, N., Kaneko, S., & Hardinsyah, (2017). Does corporate environmental performance enhance financial performance? An empirical study of indonesian firms. Environmental Development, 23, 10–21. https://doi.org/10.1016/j.envdev.2017.06.003.

Pal, R. (2010). Cooperative managerial delegation, R&D and collusion. Bulletin of Economic Research, 62, 155–169.

Vickers, J. (1985). Delegation and the theory of the firm. Economic Journal, 95, 138–147.

Xu, L., Cho, S., & Lee, S. H. (2016). Emission tax and optimal privatization in cournot-bertrand comparison. Economic Modelling, 55, 73–82.

Xu, L., & Lee, S. H. (2019). Tariffs and privatization policy in a bilateral trade with corporate social responsibility. Economic Modelling, 80, 339–351.

Zhang, J., & Zhang, Z. (1997). R&D in a strategic delegation game. Managerial and Decision Economics, 18, 391–398.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A. Simultaneous and sequential R&D competition

Proof of Lemma 1

where

and

\(\square\)

Proof of Proposition 1

\(\frac{\partial ^2 \pi _0}{\partial \theta ^2}<0\) for any \(\theta \in [0,1]\) and \(\beta \in [0,1]\). Now \(\frac{\partial \pi _0}{\partial \theta }\big |_{\theta \rightarrow 0}=\frac{30 (a-c)^2 \left( 2871-4256 \beta +816 \beta ^2+2784 \beta ^3-784 \beta ^4\right) }{\left( 29+20 \beta -4 \beta ^2\right) \left( 59-12 \beta +4 \beta ^2\right) ^3}>0\) for any \(\beta \in [0,1]\) and \(\frac{\partial \pi _0}{\partial \theta }\big |_{\theta \rightarrow 1}=-\frac{(a-c)^2 \left( 157197+399959 \beta +259650 \beta ^2-33382 \beta ^3-37981 \beta ^4+17615 \beta ^5+1512 \beta ^6-2240 \beta ^7+294 \beta ^8\right) }{3 \left( 71+26 \beta -25 \beta ^2+4 \beta ^3\right) ^3}<0\) for any \(\beta \in [0,1]\). The fact that \(\frac{\partial \pi _0}{\partial \theta }\big |_{\theta \rightarrow 0} >0\) and \(\frac{\partial \pi _0}{\partial \theta }\big |_{\theta \rightarrow 1}<0\) implies the existence of \(\theta ^{sm}\in (0,1)\) such that \(\frac{\partial \pi _0}{\partial \theta }=0\).

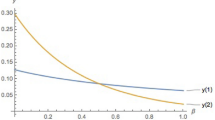

By substituting \(\theta ^{sm}\) into \(q_i\), \(x_i\) and \(\pi _i\) we obtain the Fig. 1. \(\square\)

Proof of Lemma 2

where \(\epsilon _3\equiv 192-4925 \theta +3402 \theta ^2-798 \theta ^3+63 \theta ^4+\beta ^3 \left( -768+1292 \theta -543 \theta ^2+75 \theta ^3-2 \theta ^4\right) +3 \beta \big (-528-801 \theta +906 \theta ^2-268 \theta ^3+25 \theta ^4\big )+\beta ^2 \big (3456-3036 \theta +1443 \theta ^2-369 \theta ^3+36 \theta ^4\big )<0\) iff \({\hat{\theta }}<\theta \le 1\) for any \(\beta \in [0,1]\). \(\square\)

Regarding \(\frac{\partial x_0}{\partial \theta }\) and \(\frac{\partial x_1}{\partial \theta }\) we show the following contour-plots: See Fig. 2

Proof of Proposition 2

Let \(\mu _1\equiv \scriptstyle 44627383183+27162552896 \beta -97878998532 \beta ^2+16174246080 \beta ^3+137506521008 \beta ^4+78638538496 \beta ^5+70604951232 \beta ^6-4968843264 \beta ^7-4994814720 \beta ^8+8267472896 \beta ^9-5900045312 \beta ^{10}+1783873536 \beta ^{11}-395538432 \beta ^{12}+70451200 \beta ^{13}-5619712 \beta ^{14}>0\) and \(\mu _2\equiv \scriptstyle 44267381717+131915016701 \beta +70664147757 \beta ^2-64122805393 \beta ^3-15190851132 \beta ^4+16292528946 \beta ^5-14273759238 \beta ^6+8826622830 \beta ^7 +115135101 \beta ^8-2259056223 \beta ^9+625964841 \beta ^{10}-15435117 \beta ^{11}-12286566 \beta ^{12}-419904 \beta ^{13}>0\). Then,

\(\frac{\partial ^2 \pi _0}{\partial \theta ^2}<0\) for any \(\theta \in [0,1]\) and \(\beta \in [0,1]\). Now \(\frac{\partial \pi _0}{\partial \theta }\big |_{\theta \rightarrow 0}=\frac{2 (a-c)^2 \mu _1}{\left( 73+54 \beta -36 \beta ^2+8 \beta ^3\right) ^3 \left( 249+10 \beta +28 \beta ^2-8 \beta ^3\right) ^3}>0\) for any \(\beta \in [0,1]\) and \(\frac{\partial \pi _0}{\partial \theta }\big |_{\theta \rightarrow 1}=-\frac{(a-c)^2 \mu _2}{\left( 143-18 \beta +15 \beta ^2\right) ^3 \left( 47+30 \beta -33 \beta ^2\right) ^3}<0\) for any \(\beta \in [0,1]\). The fact that \(\frac{\partial \pi _0}{\partial \theta }\big |_{\theta \rightarrow 0} >0\) and \(\frac{\partial \pi _0}{\partial \theta }\big |_{\theta \rightarrow 1}<0\) implies the existence of \(\theta ^{fp}\in (0,1)\) such that \(\frac{\partial \pi _0}{\partial \theta }=0\).

By substituting \(\theta ^{fp}\) into \(q_i\), \(x_i\) and \(\pi _i\) we obtain the Fig. 3. \(\square\)

Proof of Lemma 3

where \(\epsilon _4\equiv 192+4253 \theta -2637 \theta ^2+531 \theta ^3-35 \theta ^4+\beta ^3 \left( -768+100 \theta +72 \theta ^2-12 \theta ^3\right) +\beta \big (-1584+6111 \theta -3435 \theta ^2 +681 \theta ^3-45 \theta ^4\big )-12 \beta ^2 \left( -288+116 \theta +13 \theta ^2-10 \theta ^3+\theta ^4\right) \ge 0\). \(\square\)

Regarding \(\frac{\partial x_0}{\partial \theta }\) and \(\frac{\partial x_1}{\partial \theta }\) we show the following contour-plots: See Fig. 4

Proof of Proposition 3

Let \(\scriptstyle \mu _3\equiv 2230767+898952 \beta -4288472 \beta ^2-1749792 \beta ^3+669920 \beta ^4-324608 \beta ^5+8832 \beta ^6+32768 \beta ^7-4352 \beta ^8>0\) iff \(\beta <0.7364\); and \(\scriptstyle \mu _4\equiv 61252038+207486522 \beta +222060609 \beta ^2+74691882 \beta ^3+3472929 \beta ^4-9569790 \beta ^5-8218953 \beta ^6+4566642 \beta ^7-2702812 \beta ^8+967840 \beta ^9-74729 \beta ^{10} -9340 \beta ^{11}-6715 \beta ^{12}+2564 \beta ^{13}-223 \beta ^{14}>0\). Then,

\(\frac{\partial ^2 \pi _0}{\partial \theta ^2}<0\) for any \(\theta \in [0,1]\) and \(\beta \in [0,1]\). Now \(\frac{\partial \pi _0}{\partial \theta }\big |_{\theta \rightarrow 0}=\frac{2 (a-c)^2 \mu _3}{\left( 18177+14176 \beta -6380 \beta ^2+2560 \beta ^3-1360 \beta ^4+512 \beta ^5-64 \beta ^6\right) ^2}>0\) iff \(\beta <0.7364\) and \(\frac{\partial \pi _0}{\partial \theta }\big |_{\theta \rightarrow 1}=-\frac{(a-c)^2 \mu _4}{4 \left( 477+324 \beta -264 \beta ^2+24 \beta ^3-20 \beta ^4+18 \beta ^5-3 \beta ^6\right) ^3}<0\) for any \(\beta \in [0,1]\). The fact that \(\frac{\partial \pi _0}{\partial \theta }\big |_{\theta \rightarrow 0} >0\) and \(\frac{\partial \pi _0}{\partial \theta }\big |_{\theta \rightarrow 1}<0\) implies the existence of \(\theta ^{cf}\in (0,1)\) such that \(\frac{\partial \pi _0}{\partial \theta }=0\).

By substituting \(\theta ^{cf}\) into \(q_i\), \(x_i\) and \(\pi _i\) we obtain the Fig. 5. \(\square\)

Appendix B. Values of \(\Delta _i\) and \(\nu _i\)

Rights and permissions

About this article

Cite this article

Leal, M., García, A. & Lee, SH. Sequencing R&D decisions with a consumer-friendly firm and spillovers. JER 72, 243–260 (2021). https://doi.org/10.1007/s42973-019-00028-5

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s42973-019-00028-5