Abstract

Political instability, especially when it is of a violent nature, diminishes the productive, as well as the transactional capacities of the economy. This has adverse consequences for investment and thus future economic growth, a situation which in turn creates a fragile socio-political environment. The relationship between political instability and economic growth flows in either direction; political instability resulting in low economic growth (PI → LEG) and low economic growth resulting in political instability (LEG → PI). From the PI → LEG point of view, political instability influences the latter through a number of channels including the tax system, government spending and fiscal deficit, and inflation, all of which affect the level of investment, and thus influence future economic growth rates. From the LEG → PI point of view, low economic growth rates create conditions favourable for political instability. Reviewing economic and political stability data from 52 African countries for the period 1980 to 2013, the analysis demonstrates through some scenarios that higher and relatively more stable long-term (1980–2013) average growth rates correlate with lower levels of political instability in most of the pairwise comparisons of the countries. This is shown to be especially true for less resource-dependent countries. Empirical analyses of the data comprising all the countries under investigation find there to be a strong bi-directional direct relationship between political stability and the level of growth, and it is even more so the case for conflict-affected countries, unlike the non-conflict-affected countries. Further analyses using three-year averages of the data from 1981 to 2013 find that greater fluctuations in the growth rate adversely affect the level of political stability in especially conflict-affected countries, thus indicating a correlation between economic instability and political instability.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Many nations on the African continent have performed poorly in maintaining stable economic growth rates and achieving appreciable levels of economic development. This is despite the abundance of human and material resources that should engender positive economic outcomes for most of the population. To the contrary, many of these countries suffer from abysmally poor levels of development of both human and material resources, with many instances of social discontent and conflict, which further aggravate the state of underdevelopment.

Political instability, especially of a violent nature, destroys the productive capacity of the economy through its adverse impact on human and material resources. Besides, the transactional inefficiencies that result damage the economic prospects further [11], leading to lower investments. There is, consequently, an expectation that the level of economic growth will decline in the future. Furthermore, because political instability, in general, is likely to shorten the horizon of policymakers, there is a greater likelihood towards suboptimal short-term macroeconomic policies and frequent switch of policies that create volatility and thus, negatively affect macroeconomic performance [4].

The literature on the relationship between political instability and economic growth show that this relationship flows in either direction; that is, political instability influences the level of economic growth, on the one hand [30], [14], [7], [18], while the level of economic growth influences the level of political instability, on the other [28]. Additionally, the literature suggest that this relationship flows through other connecting variables such as the level of inflation, fiscal deficits and investment, where, for instance, Guillaumont et al. [22] note that political instabilities, along with other “primary” instabilities, influence Africa’s economic growth through their impact on economic policy as evidenced by the instabilities of investment and of the real exchange rate.

This analysis on the relationship between political instability and economic growth in Africa considers the nature of this phenomenon on the African continent. Being a continent where there have been significant levels of political instability, and where also there is widespread underdevelopment, the African continent presents an important location for the analysis of the relationship between political instability and economic growth. The analysis covers 52 out of the 54 countries in Africa for the period 1980–2013.

The analysis, by applying both static and dynamic methods in ascertaining the relationship, shall seek to determine the how political instability interacts with the level of economic growth. In addition, seeing the unstable performance of economies on the continent, the analysis shall further seek to determine if and what manner of relationship exists between political instability and instability in the economy. While some studies on the relationship between political instability and economic growth in Africa have performed a unidirectional [22] or a bi-directional analysis [21], [23], [25], this analysis shall, in addition to a bi-directional analysis, study the effect that instability of the economic growth rate has on the level of political instability.

In Sect. 2 of this paper, a review of the literature, which includes theoretical and empirical studies on the subject matter, is carried out. Section 3 examines the relationship between political instability and economic growth in a number of countries in Africa. Specification of the research models and analysis of data, using the bi-directional models as well as an analysis of the impact of instability of the economic growth rate on the level of political instability, and a robustness check, are carried out in Sect. 4. Section 5 concludes the paper.

Literature review

The relationship between political instability and economic growth flows in either direction; PI → LEG and LEG → PI. The literature that pertains to this relationship have widely reported an inverse relationship between political instability and economic growth. One strand of the literature from the PI → LEG point of view considers the relationship as flowing through the tax system. This strand considers the design of the tax structure as being based on strategic political considerations [14]. The incumbent government in a politically unstable environment imposes tax on capital, for example, to discourage investment. Additionally, the incumbent increases the level of spending so much that the level of deficit is increased to constrain the fiscal policies of future governments. Because of these political decisions, there is a decline in the future economic growth rates [30], [7], [18].

The influence political instability has on investment, however, does not arise from political decisions alone. Empirical studies have found a significant link between the policy uncertainty that arises from political instability and the level of investment. The studies have shown that investments decline with uncertainty in policies when an “outsider” gets into office or it is imminent that an incumbent would fall [19], [8], [24]. This is so because a new government, unlike a re-elected government, brings with it new or, at least, different policies. The uncertainty about how the new policy directions would affect the economy or certain sectors within it influences investment decisions. This is especially the case when the investment is long-term and/or irreversible, as in the case of sector-specific capital investment, and/or when the investment can be delayed [31], [21]. Investors thus exit the economy in preference for politically stable environments with less policy uncertainty [5]. Moreover, a decline in investment may arise from political instability not only because of the uncertainty created, but may also be the result of a reduction in the return to capital arising from the inhibition of efficient capital allocation caused by political instability [21], [20].

An alternative channel through which political instability leads to lower economic growth is inflation. Weak governments, which are especially characteristic of politically unstable environments, are unable to resist the demand for increased spending, either for patronage or for suppressing dissent. Having ineffective tax systems that generate sufficient tax revenues, the increased government spending is financed by seigniorage—the inflation tax—when revenue from other sources is limited. The increased government spending is inflationary [14], [3].

Acemoglu et al. [2] argue that large budget deficits and high inflation are an indication of weak institutions. It is the weak institutions, which bring about distortionary macroeconomic policies that result not only in slower growth over the long run but also in greater volatility and worse macroeconomic outcomes. Acemoglu et al. [2] further argue that countries that experience high volatility and economic crises are more likely to have inherited more extractive institutions from their colonial past.

These countries, having weak institutions and thus dysfunctional tax systems, depend substantially on extractions from natural resources, especially when they are resource-rich. The result is a rentier state, which is yet another link in the political instability-economic growth nexus. The concentration of economic power in the government, which is common in rentier states, makes the possession of political power highly lucrative and thus attracts human and material resources into the contest for political power. This transfer of resources and skills away from productive employment into the contest for political power represents a significant loss of productive capacity, which results in a decline in economic productivity. This scenario is commonly referred to in the literature as the “resource curse” [26], [12], [16], [10]. In summary, what we have is a connection between political instability, which results from having rentier states with extractive institutions, and lower economic growth, which results from the transfer of resources away from productive ventures occasioned by the rentier situation. Thus, while being resource-rich creates the tendency towards a rentier system that leads to greater political instability, political instability, in turn, weakens administrative structures that are required for efficient tax administration, which leads to dependence on resource rents, with the attendant consequences of the resource curse.

Beside strategic political considerations and beyond political instability arising from the turnover of government, political instability of a violent nature, has been widely reported to also negatively affect the level of economic growth. The channel through which this occurs is the destruction of human and material resources that are required for sustaining economic productivity. Since wars are intrinsically destructive of these resources, as well as, the transactional structures that sustain their productivity, the economic growth rate declines relative to what it would have been had the war not occurred [11]. The decline in the growth rate is, however, reversed post-conflict as the conflict-affected countries tend to grow faster than the non-conflict-affected countries after hostilities have ended [13].

From the contrary point of view, that is, low economic growth leading to political instability (LEG → PI), the literature finds that poor economic performance creates vulnerabilities that increase the risks of political instability. Londregan and Poole [28] find that the probability of government being overthrown is significantly influenced by the level of economic well-being. Consequently, coups are almost non-existent in developed countries because high levels of income and high rates of economic growth significantly inhibit coups and also result in lower levels of politically motivated violence [28], [25]. Because failure represents significant risks to the coup participants, Londregan and Poole [28] add that the participants weight these costs and would, consequently activate their plans only when they expect to succeed. A weak economic environment and high poverty rates create the conditions for the coup to succeed as popular dissatisfaction increases. They [28] find that poverty is a common denominator in all coups.

In the literature concerning Africa, empirical studies have found that political instability, particularly, the instability in regimes, through its adverse influence on investment, accounts for a substantial reduction in the economic growth rate in Sub-Saharan Africa [21], [23]. Considering political instability among a group of “primary” instabilities, including climatic and terms of trade instabilities, Guillaumont et al. [22] state that it leads to stop-and-go policies, which cause instabilities in the rate of investment and the real exchange rate. It is these “intermediate” instabilities that significantly lower Africa’s economic growth rate.

It can thus be deduced from the literature that there is a deep interconnection between economic growth and political instability. While investment and the rate of economic development is reduced by the uncertainty associated with an unstable political environment, poor economic performance, on the other hand, may lead to the government collapse and political unrest [5].

Political instability and economic growth in Africa

Liberia had positive economic growth rates of up to 6% per annum for all, except 2 years (1973 and 1975) of the 1970s. However, following the coup d’état in 1980 in which the incumbent president was assassinated, Liberia consistently had negative growth rates until 1995. The deepest declines in economic growth within this period were in 1989, 1990, 1992, 1993, and 1994 when the GDP growth rates fell to − 27%, − 51%, − 35%, − 33% and − 22%, respectively. 1989 also marks the year of the commencement of the First Liberian Civil War (1989–1997), which led to the assassination of the incumbent president in September 1990. The Liberia situation shows how a continuous decline in the level of economic activity starting from a situation of political instability led to even further political instability in the future. As a matter of fact, between 1980 and 2013, Liberia experienced more years with negative economic growth rates (18 years) than years with positive growth rates (16 years). All the positive GDP growth years occurred towards the end of the war and after the war had ended indicating a rebounding of the economy.

The number of positive economic growth years relative to the negative growth years appears to not be conclusively related the level of political instability, as can be seen in the situations in Kenya and Lesotho. Although both countries had 33 years each of positive economic growth out of the 34 years (1980–2013) covered in this analysis, Kenya is more politically unstable than Lesotho is. Looking further at the average economic growth rates over the period (\(AV\)), as well as, the standard deviations of these growth rates (\(SD\)), Lesotho had only a slightly higher average economic growth rate of 3.77% and even more slightly lower standard deviation of the growth rate at 2.31 in comparison to Kenya’s 3.68% and 2.32, respectively, as shown in Table 1.

Two other countries with 33 years of positive economic growth rates are Botswana and Mauritius. Of the 33 years of positive economic growth in Botswana, only 10 of these years recorded growth rates below 5%, while 6 years recorded growth rates that were greater than 10%, annually. Unlike Botswana, however, 17 of the 33 years of positive economic growth in Mauritius recorded growth rates that were below 5%, while annual growth rates above 10% were not recorded in any of the years. Botswana, with a relatively higher average economic growth rate of 6.85% and higher standard deviation of the growth rate of 4.69, is noted in the literature for being a politically stable country [32], [1]. Mauritius is similarly politically stable, having an average growth rate of 4.47% and standard deviation of 3.26. The coefficients of variation (the standard deviation of GDP growth-to-average GDP growth (\(SD\)—\(AV\)) ratios) for Botswana and Mauritius are, respectively, 0.68 and 0.73, which are close to Kenya’s 0.63 and Lesotho’s 0.61. All four countries, except Kenya, are relatively politically stable when assessed in relation to the Political Stability and Absence of Violence/Terrorism estimate (\(PSE\)) of the World Bank World Governance Indicators (WGI), which captures the perceptions of the likelihood that the government will be destabilized or overthrown by unconstitutional or violent means [27]. Although, both Kenya and Lesotho, unlike Botswana and Mauritius, experienced incidences of conflict, the duration of conflictFootnote 1 in both cases was on the average very short, at about 0.03 month.

Looking further into how the relationship between the average GDP growth rate and the standard deviation of GDP growth rate relate to the level of political instability, we see a sort of pattern as shown in Fig. 1a. In countries where on the average the total tax annually exceeds the total natural resource rents (Group A in Table 1), a lower \(SD\)—\(AV\) ratio on the average, indicating a faster and relatively stable economic growth, is associated with lower levels of political instability. The only exceptions to the rule in these countries, ranging from Tanzania to Zimbabwe on Fig. 1a, are Tanzania and Kenya, where the \(SD\)—\(AV\) growth ratios are low but have quite high levels of political instability. Moreover, the duration of conflict in the countries where on the average the total tax annually exceeds the total natural resource rents, where it occurs, is relatively shorter the smaller the \(SD\)—\(AV\) growth ratio. This may thus suggest that for these countries, the lower the level of political instability, the relatively more stable would be the rate of economic growth, as measured by the standard deviation of the GDP growth rate.

The picture regarding the \(SD\)—\(AV\) growth ratio and the level of political instability, however, seems to be unclear in countries where on the average the total natural resource rents annually exceed the total tax (Group B in Table 1). Here, political instability as measured by the \(PSE\) seems to be unrelated to the \(SD\)—\(AV\) growth ratio. However, converse to what was shown for the higher total tax countries, in these countries, ranging from Guinea to the Central African Republic in Fig. 1b, longer durations of internal conflict are correlated with lower \(SD\)—\(AV\) growth ratios. Additionally, the annual total natural resource rent-to-total tax (\(NRT\)) ratio is directly correlated with the \(SD\)—\(AV\) growth ratio, implying relatively less stable economic growth rates as the \(NRT\) ratio increases. The presence of relatively higher total natural resource rents thus leads to less stable economic growth rates. This would not be unconnected with the instability in prices of natural resources in international markets and suggests a transmission of the effects of instability in commodity prices to the stability in economic growth rates in resource-dependent economies.Footnote 2

The average standard deviation of the economic growth rate in the 22 countries in the group where total natural resource rents exceed total tax is 8.8, with an average growth rate for the period of 4.3%. These are higher than the corresponding values in the 30 countries where the total tax exceeds the total natural resource rents, with the values being 4.22 and 3.71% for the standard deviation of the growth rate and average growth rate, respectively. The average standard deviation of the growth rate in countries where total natural resource rents exceed total tax being more than two times higher than that of countries where the total tax exceeds total natural resource rents, even though the average growth rate is only 1.15 times higher, suggests the influence natural resource rents have on economic growth rates either directly, through the fluctuations in commodity prices, or indirectly, through the greater tendency for political instability in resource-dependent countries and the resulting impact of political instability and war on the level of economic growth.

The foregoing analyses show that not only higher economic growth rates but also relatively more stable growth rates are correlated with lower levels of political instability in less resource-dependent countries. Taking a ratio of the standard deviation of the economic growth rate to the average growth rate thus attaches greater value, and therefore greater importance, to stable growth, especially regarding its relationship with political instability. A lower \(SD\)—\(AV\) growth ratio would thus indicate not just a higher and more stable economic growth rate but also the added benefit of a lower level of political instability.

Parvin [29] noted the importance of a growing income in determining the level of political instability. Since growing per capita incomes indicate the expanding capacity of the economy to meet the growing demands of the society, and therefore create a sense of individual and/or group fulfilment, the sense of disaffection felt by members of the society is removed or minimized. Moreover, Parvin [29] additionally noted that a higher rate of income growth raised the present value of future incomes and therefore raises the level of current employment. This raises the opportunity cost of violence for the individual. Consequently, higher growth rates would coincide with lower levels of political instability because individuals would prefer to maintain their present and future economic status.

When growth rates fluctuate, however, a different effect on expectations is generated. Wide fluctuations in growth rates generate uncertainties about the state of the economy and, thus, adversely affect investments. The effect is that individuals’ perceptions of their future prospects are negatively altered and it would be the case then that their present and future opportunity costs for engaging in violent acts and potentially losing their present economic status for a better one, should the outcome of engaging in violence be in their favour, will be lowered. The level of political instability would then rise. Despres et al. [17:507] relate the relationship between political instability and economic instability, which includes an unsteady growth in production, as well as, mass unemployment and major fluctuations in the price level (Despres et al., [17]:505), thus: “…marked economic instability creates conflicts and hardships, sets group against group and produces dissatisfaction with the existing structure of society.”

Three scenarios can be thought-up from the relationship between the growth of the economy, denoted by the average growth rate (\(AV\)), and stability in the growth of the economy, denoted by the standard deviation of the growth rate (\(SD\)), in relation to the level of political instability.

The first is a scenario where any two countries have the same average growth rate but one of which has a lower standard deviation of the growth rate, thus giving it a lower \(SD\)—\(AV\) growth ratio. Such a country would have the advantage of a more stable political system in comparison to the other. For this scenario, we find that no two countries have the same average growth rates, so comparisons are made for countries whose average growth rate values are very close. Niger and South Africa have average long-term (1980–2013) growth rates of 2.43 and 2.44, respectively. South Africa, however, has a lower standard deviation of 2.34, giving it a lower \(SD\)—\(AV\) ratio of 0.96, compared to Niger’s standard deviation of the growth rate of 5.28 and \(SD\)—\(AV\) ratio of 2.17. South Africa is shown to be more politically stable than Niger, having an average \(PSE\) of − 0.14, which is greater than Niger’s − 0.59, as shown in the comparisons on Table 2. Similar outcomes are found for the comparisons between Tunisia and Morocco, and between Sao Tome and Principe and Swaziland, with the more politically stable country being the country having the lower standard deviation of the growth rate and, therefore, a lower \(SD\)—\(AV\) ratio, as underlined in Table 2. Regarding the other measures of political instability, the frequency of government change (\(FGC\)) seems not to be influential in the political stability-economic growth relationship in two of the three cases (that is, Tunisia-Morocco and Sao Tome and Principe-Swaziland) as the countries with the higher \(FGC\) s in these comparisons turned out to have lower \(SD\)—\(AV\) ratios. Regarding the duration of conflict, the non-occurrence of conflict or the shorter the duration of conflict in two of the three cases (that is, Tunisia-Morocco and Sao Tome and Principe-Swaziland) is shown to coincide with a lower \(SD\)—\(AV\) ratio. All the countries considered under Scenario 1 are in group A (that is, countries where total tax annually exceeds total natural resource rents on the average).

The second scenario is one where two countries have the same standard deviation of the growth rate but in which one country has a higher average growth rate, and thus also has a lower \(SD\)—\(AV\) growth ratio. Here, the risk of political instability reflected in the instability of the economic growth rate would be compensated for by the higher economic growth rate. We make comparisons here between Lesotho and Kenya, Swaziland and Mali, and Mali and Cabo Verde. In all but the Swaziland-Mali cases, relatively higher average economic growth rates, and, therefore, lower \(SD\)—\(AV\) ratios coincide with lower levels of political instability. Moreover, except for the Lesotho-Kenya case, a lower \(FGC\) and the non-occurrence of conflict coincide with a lower \(SD\)—\(AV\) ratio. Like the first scenario, all the countries considered in Scenario 2 are in group A.

The third scenario has two countries with the same \(SD\)—\(AV\) growth ratio among which, one country has a higher average growth rate and, therefore, inevitably has a higher standard deviation of the growth rate. Because the \(SD\)—\(AV\) ratios are the same for both countries, the pairwise comparisons here are not expected to show a clear relationship between \(AV\) and \(SD\) in relation to the level of political stability. For the within-groups (that is, groups A—countries where total tax annually exceeds total natural resource rents on the average—and B—countries where total natural resource rents annually exceed the total tax on the average) comparisons, three sets of cases with (almost) identical \(SD\)—\(AV\) ratios [Djibouti-Togo (Group A), Cameroon-Equatorial Guinea (Group B), and Angola-Chad (Group B)] are compared. In two of the three cases (Djibouti-Togo and Angola-Chad), the countries with the higher average growth rates and, therefore, greater standard deviations in the respective comparisons were more politically unstable. This is, however, reversed with respect to the Cameroon-Equatorial Guinea comparison, where Equatorial Guinea, having an exceptionally high average growth rate, is more politically stable, despite the much higher standard deviation of the growth rate. The country with the lower \(FGC\) in all three comparisons here is the less politically unstable country.

For the across-groups comparisons in Scenario 3, Gabon (from Group B), which has the higher \(AV\) and \(SD\), in the Madagascar-Gabon comparison is less politically unstable than Madagascar. Conversely, Morocco (from Group A), which has the lower AD and \(SD\), in the Morocco-Sudan comparison is the less politically unstable country.

Overall, given the (almost) identical \(SD\)—\(AV\) ratios, the relative influence of the average growth rate and the standard deviation of the growth rate on the level of political stability is not clear for Scenario 3. For the comparisons in Scenario 1 and Scenario 2, however, the size of the standard deviation appears to influence (or be influenced by) the level of political instability the most.

Empirical analysis

Data

The study includes 52 (out of the 54) countries in Africa for the period 1980–2013. Somalia and South Sudan are excluded for reasons of insufficiency of data. Economic and demographic data were sourced from the World Development Indicators of the World Bank.Footnote 3 The data on taxes were retrieved from the International Centre for Tax and Development (ICTD) Government Revenue Dataset. Political stability data, namely, Political Stability and Absence of Violence/Terrorism estimate, which runs from 1996 to 2013 but in which the years 1997, 1998 and 2001 are unreported, were sourced from the World Governance Indicators datasets of the World Bank, while the data on conflict were retrieved from the Uppsala Conflict Data Program/Centre for the Study of Civil Wars, Peace Research Institute Oslo (UCDP/PRIO) Armed Conflict Dataset, Version 4-2015.

The variables, applied variously in the econometric models, are defined as follows. For the set of political or politically determined factors (P), we have

Political instability (\(PSE_{it}\))

For country \(i\) in year \(t\) and indicated by \(PSE_{it}\), which measures the level of political instability on a scale ranging from − 2.5 to 2.5, with lower values indicating higher levels of political instability and higher values indicating lower levels of political instability [27], the level of political instability is expected to have an inverse relationship with the level of economic growth, as a politically unstable environment would not allow for policy consistency as well as a secure economic environment, all of which increase disruptions to economic/business operations. The World Bank WGI aggregates \(PSE\), which has also been used to indicate the level of political instability in [15], from up to nine (9) different sources for countries in Africa [27]. Hence, the indicator provides a broad perspective on the political situation in these countries. Political instability may alternatively be measured by \(FGC\) and the duration of internal conflict measured in months (\(ICM\)).

Total natural resource rent-to-total tax ratio (\(NRT_{it}\))

The \(NRT\) ratio indicates the level of dependence of the economy on natural resources. Resource-dependent countries have a greater tendency towards rent-seeking, which increases the competition for political power by providing an incentive for the opposition (or even rebels) to take over power and, hence, raises the level of political instability. Consequently, an inverse relationship between the \(NRT\) ratio and \(PSE\) is expected. Moreover, rent-seeking causes a transfer of skills and resources away from productive economic activities unto the contest for political power, leading to a decline in the level of economic growth. An inverse relationship is, therefore, expected between the \(NRT\) ratio and the level of economic growth. Although the amount of rents received may be outside the control of the government, taxes are politically determined. As a result, the \(NRT\) ratio is a politically determined variable.

Seigniorage \(\left( {\frac{{\varvec{\pi H}}}{\varvec{Y}}} \right)_{{\varvec{it}}}\)

We expect that there would be an inverse relationship between the level of seigniorage, which is measured as the product of the rate of inflation and high-powered money, and the level of economic growth.

Fiscal deficit (\(FD_{it}\))

Since debt-financed deficits raise the level of interest rates and money-financed deficits are inflationary, it is expected that fiscal deficit would be inversely related to the level of economic growth. It is also expected that fiscal deficit would be inversely related to \(PSE\) as higher levels of political instability force governments to increase spending on security and/or patronage even when government revenues are low. Fiscal deficit is measured here as the inverse of General Government Net Lending/Borrowing as a percentage of GDP.

For the set of domestic economic factors (E), we have

Real GDP growth rate (\(\Delta Y_{it}\))

As mentioned above, an inverse relationship is expected to hold between the rate of economic growth and the level of political instability.

Consumption (\(C_{it}\))

Higher consumption spending implies an increased demand for goods and services and, therefore, more investment, which is expected to raise the level of economic growth.

Domestic credit to the private sector (\(Credit_{it}\))

It is included as a proxy for investment, as well as, a proxy for financial development. It is expected that credit to the private sector would raise the level of economic growth. Zouhaier and Karim [33] used money and quasi-money (\(M2\)) as proxy for financial development. However, in the literature, \(M2\) is often used to indicate money supply and has been in used in this paper to form part of the definition of seigniorage.

For the set of demographic factors (D), we have

Secondary school enrolment (\(SchEnr_{it}\))

School enrolment is taken as an indicator of the level of education, and, therefore, as a quantifier of skill sets available to the economy. A direct relationship between school enrolment and the level of economic growth is, therefore, expected. In addition, school enrolment is expected to have an inverse relationship with the level of political instability.

For the set of external factors (Ex), we have

Foreign direct investment (\(FDI_{it}\))

The flow of foreign resources into a country provide capital, as well as, technology, which are expected to raise the level of economic growth.

Openness of the economy (\(MT_{it}\))

Measured as the ratio of merchant trade to GDP, \(MT_{it}\), it is expected that the greater the openness of the economy, the higher the level of economic growth would be. Moreover, it is expected that the more open an economy is to international trade, the lower would be the level of political instability.

Granger causality test

As a preliminary, to ascertain causality between the variables, a Granger causality test is conducted for respective pairs of the variables.Footnote 4 The summary of the results of the Granger causality test is presented in Table 3. One of the main variables in this research, \(PSE\), is Granger caused by \(FDI\) when one lag of \(PSE\) is included. \(\Delta Y\) is Granger caused by \(FGC\), \(NRT\), \(MT\), \(C\), \(FDI\) and \(FD\). There is two-way causality when two and three lags of \(C\) are included and when one, two and three lags of \(MT\) and \(FDI\), respectively, are included.

Econometric models

Econometric models are specified for political instability and economic growth. Because of the expected endogeneity in the models, dynamic linear models, in particular, the System Generalized Method of Moments (SGMM), are used.

Political instability

The SGMM model for political instability specifies political instability as a function of political instability in the preceding period, the \(NRT\) ratio, fiscal deficit, the growth rate of real GDP, secondary school enrolment, and the indicator for the openness of the economy, which is merchandise trade.

Economic growth

The economic growth SGMM model specifies the economic growth rate as a function of the preceding period’s level of economic growth, the level of political instability, fiscal deficit, domestic credit to the private sector, secondary school enrolment, and merchandise trade, which is the indicator for the openness of the economy.

Empirical results

Political instability

The results of the political instability model are presented in the following tables. Table 4 shows the results of the analysis using SGMM. The analysis includes one lag of the dependent variable (\(PSE\)) with a maximum lag depth of one. The total natural resource rents-to-total tax ratio, general government net lending/borrowing and the GDP growth rate are taken as endogenous, without lags but a maximum of one lag used as instruments.

The two-step SGMM results show, in accordance with a priori expectations, a direct relationship between the GDP growth rate and \(PSE\), implying an inverse relationship between GDP growth and political instability. Consequently, when growth rates decline, the level of political instability rises.

For the other variables, the total natural resource rents-to-total tax ratio, as expected, has an inverse relationship with \(PSE\). This indicates that the more resource-dependent a country is, the higher the level of political instability, as was previously shown in Fig. 1b. School enrolment, on the other hand, is found to be directly related to \(PSE\). Hence, the more educated a society is, the more politically stable it becomes.

The results of the Sargan-Hansen test for overidentifying restrictions [9] for the respective columns are statistically nonsignificant, thus satisfying the hypothesis that the instruments are valid instruments—that is, the instruments are uncorrelated with the error term—and the excluded instruments are correctly excluded from the estimated equation. As expected, the results of the autoregressive (AR) process are statistically significant for AR(1) and nonsignificant for AR(2) and AR(3). First-order serial correlation is expected since the first lag of the dependent variable, political stability, is used as an explanatory variable in the SGMM regression. On the contrary, there is no second- and third-order autocorrelation. The significant Wald Chi squared test results indicate that the explanatory variables in the model are statistically significant.

Table 5 shows the results for the political instability model using the Fixed-Effects method. The results indicate a statistically significant direct relationship between political stability and the economic growth rate (that is, an inverse relationship between the economic growth rate and political instability) at the 5% level of significance. This is shown to be true for the different classifications of the countries (that is, conflict-affected countries and countries with the average long-term (1980–2013) GDP per capita of less than $1000, as well as those with average long-term GDP per capita greater than $1000). Hence, higher levels of economic growth would have a depressing effect on the level of political instability.

The results, however, unlike the case for the conflict-affected countries, are not statistically significant at the 5% level of significance for the non-conflict-affected countries. This would suggest the importance of conflict, or the absence thereof, in the determination of the relationship between the level of economic growth and political instability.

General government net lending/borrowing is found to be directly related to the level of political stability in non-conflict affect countries. This indicates that fiscal deficits (that is, a negative fiscal balance) would be associated with higher levels of political instability.

Economic growth

The results for the economic growth model are presented in Tables 6 and 7. The two-step SGMM results in Table 6 include one lag of the dependent variable (GDP growth) with a maximum lag depth of one. \(PSE\) and general government net lending/borrowing are taken as endogenous, without lags but a maximum of one lag used as instruments. The analysis indicates a direct relationship between \(PSE\) and the economic growth rate, as was earlier found for the political instability model. The result remains true for countries whose average GDP per capita is greater than $300 and for countries which were affected by internal conflict. The results regarding domestic credit to the private sector and school enrolment, however, by respectively having negative values, go against a priori expectations.

As was found for the political instability model, the results of the Sargan-Hansen test for overidentifying restrictions [9] for the respective columns are statistically nonsignificant. Again, similar to the case of the political instability model, the results of the AR processes are statistically significant for AR(1), except in the case of column (P) for all countries, while they are nonsignificant for AR(2) and AR(3). First-order serial correlation is expected due to inclusion of the first lag of economic growth in the SGMM regression, while there is no second- and third-order autocorrelation. Except in the case of column (P) for all countries, again, the significant Wald Chi squared test results indicate that the explanatory variables in the model are statistically significant.

The results in Table 7, analysed using the Fixed-Effects method, include additional variables into the economic growth model. These are seigniorage, final consumption expenditure and foreign direct investments.

Seigniorage, as expected is found to have an inverse relationship with the level of economic growth, while merchandise trade (an indicator for the openness of the economy) has a direct relationship with the level of economic growth. Final consumption expenditure, however, against expectation, is found to be inversely related to the level of economic growth. General government net lending/borrowing is found to be directly related to the level of economic growth, implying that greater fiscal deficits would lower the level of economic growth. Regarding the main variable of interest, however, \(PSE\) is found to be directly related to the level of economic growth in all countries with average per capita GDP less than $1000, and in countries with average GDP per capita less than $1000, which were also affected by conflict during the period of the study.

Stability of the economic growth rate

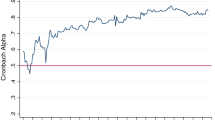

Following the earlier discussion in this paper regarding the relationship between the average (\(AV\)) growth rate and the standard deviation (\(SD\)) of the growth rate, the data is re-analysed by taking 3-year averages of the data. Since the data runs for 34 years (1980–2013), which would result in 11 three-year averages but with 1 year left out, the year 1980 is excluded when computing the 3-year averages. This leaves us with 11 3-year averages from 1981 to 2013. The average (\(AV\)) growth rate and the standard deviation (\(SD\)) of the growth rates, as well as the \(AV\)–\(SD\) ratios for the respective periods 1981–1983, 1984–1986, …, 2011–2013 are computed. However, since \(PSE\) runs only from 1996, this leaves us with six 3-year periods in effect, that is, 1996–1998, 1999–2001, 2002–2004, 2005–2007, 2008–2010, and 2011–2013. These are applied to the political instability and economic growth models, respectively, and analysed using the Fixed-Effects method. The political instability model is modified to become:

Only the \(SD\) is found to have a statistically significant relationship with the level of political stability in the political instability model, the results of which are shown in Table 8. The relationship between \(SD\) and political stability is an inverse relationship, indicating that wide fluctuations in the growth rate are associated with lower levels of political stability, hence political instability rises with wide fluctuations in the economic growth rate. Furthermore, unlike the non-conflict-affected countries, the fluctuations have a significant influence on political stability in conflict-affected countries.

Robustness check

Political instability is multidimensional, comprised of mass civil protests, politically motivated violence and war, instability within the political regime and instability of the political regime, among other forms of instability [25]. To check the robustness of the results found above by a disaggregation of political instability, therefore, the analysis used \(FGC\) and \(ICM\) as alternative indicators of political instability. This follows the argument by Alesina and Perotti [6] that political instability could be measured by the ‘the propensity to observe government changes’ and also by social unrest and political violence that may be marked by mass violence and civil wars. Since from the Granger causality test results (Table 3), \(ICM\) Granger causes \(FGC\), the model is specified below:

The results presented on Table 9 show an inverse relationship between \(FGC\) and the GDP growth rate. This supports the results found earlier on the relationship between political instability and economic growth.

Summary and conclusion

The foregoing analysis investigated the relationship between political instability and economic growth in Africa from 1980 to 2013. Through the review of the literature, the analysis found that the relationship between political instability and economic growth flows in either direction; political instability-affecting-economic growth (PI → LEG) and economic growth-affecting-political instability (LEG → PI). The analysis also reviewed the channels through which political instability is related to the level of economic growth. Several channels including the tax system, government spending and fiscal deficit, and inflation, were found in the literature to link political instability and the level of economic growth.

Reviewing the economic and political stability data on Africa, the study found a case where an initial instance of political instability led to a decline in the economic growth rate, which in turn led to further political instability and war. Further review of the data showed a pattern of relationship between the level of political instability and the average (\(AV\)) long-term economic growth rate, the standard deviation (\(SD\)) of the growth rate, as well as the interaction between the \(AV\) and the \(SD\). Some scenarios were considered using pairwise comparisons of countries to determine how the \(AV\) and the \(SD\) relate to the level of political instability. The scenarios suggested that a relatively higher \(AV\) or a relatively smaller \(SD\) coincided with lower levels of political instability. Thus, higher and relatively more stable economic growth rates are indicated to coincide with higher levels of political stability (or lower levels of political instability) in especially countries that are less dependent on natural resources in relation to total tax collection.

Through econometric analysis of the data, the analysis found there to be a statistically significant direct relationship between political stability and the level of economic growth. This is true for both the political instability model and the economic growth model. Political instability lowers the level of economic growth, on the one hand, while lower levels of economic growth worsened the level of political instability, on the other hand. The relationships were found to be especially true for conflict-affected countries.

Further analysis using 3-year averages of the data from 1981 to 2013 found that greater fluctuations in the economic growth rate negatively affected the level of political stability. This indicates a connection between economic instability and political instability; economic instability leading to political instability. This relationship is found to be especially true for conflict-affected states.

The analysis, therefore, concludes that there is a strong bi-directional direct relationship between political stability and the level of economic growth. Additionally, the analysis also concludes that economic instability is correlated with political instability.

Consequently, any plans to improve economic growth on the African continent would require a lowering of the level of political instability to address the uncertainties generated by it. In a circular manner, addressing economic instability through strong and stable institutions that are properly equipped for policy making and stable administration of policy, including stable tax administration that reduces over-dependence on revenue from natural resources, the instability of which, generates instability in the economy, will be necessary in lowering the level of political instability in countries on the continent.

Notes

The duration of conflict here is measured by Type 3 (internal armed conflict occurring between the government of a state and one or more internal opposition group(s) without intervention from other states) and Type 4 (internationalized internal armed conflict occurring between the government of a state and one or more internal opposition group(s) with intervention from other states (secondary parties) on one or both sides) conflicts in the UCDP/PRIO Armed Conflict Dataset, Version 4-2015 of Uppsala University, Sweden (Themnér, 2015). Since the UCDP/PRIO Armed Conflict Dataset, Version 4-2015 is presented in days, an internal conflict month (\(ICM\)) is defined here as a Type 3 and/or Type 4 conflict in the UCDP/PRIO Armed Conflict Dataset, Version 4-2015 that occurs within a period ranging from 1 day to one calendar month. External conflict is not considered here because its impact on the domestic economy may not be certain.

Figure 1b, additionally, shows a greater density of negative-valued Average \(PSE\) bars in resource-dependent countries denoting higher levels of political instability on the average in these countries as compared to the less resource-dependent countries. There are similarly longer durations of conflict in the resource-dependent countries on the average than is the case in the less resource-dependent countries. Analyses of these relationships are outside the scope of this paper.

There are no cyclically adjusted data in our database. The original data is thus used.

Preceding the Granger causality test, the requirement that the series have to be covariance stationary is ascertained through the panel unit root test, the results of which are shown in Appendix A1. For most of the series, the null hypothesis H0 of non-stationarity is rejected at the 5% level of significance, both at level and at first difference. However, H0 is not rejected for \(SchEnr\) and \(Credit\) at level for all of the tests, while it is rejected at first difference, except for the Breitung t-statistic for \(SchEnr\). H0 is not rejected for \(PSE\), \(NRT\), \(FD\), \(C\), \(FDI\), at level and at first difference for \(C\) using Breitung t-statistic.

References

Acemoglu, D., Johnson, S., & Robinson, J. A. (2003). An African success story: Botswana. In D. Rodrik (Ed.), In search of prosperity: analytical narratives on economic growth (pp. 80–119). Princeton: Princeton University Press.

Acemoglu, D., Johnson, S., & Thaicharoen, Y. (2003). Institutional causes, macroeconomic symptoms: volatility, crises and growth. Journal of Monetary Economics, 50, 49–123. https://doi.org/10.1016/S0304-3932(02)00208-8.

Aisen, A., & Veiga, F. J. (2006). Does political instability lead to higher inflation? A panel data analysis. Journal of Money, Credit and Banking, 38(5), 1379–1389. https://doi.org/10.1353/mcb.2006.0064.

Aisen, A., & Veiga, F. J. (2013). How does political instability affect economic growth? European Journal of Political Economy, 29, 151–167. https://doi.org/10.1016/j.ejpoleco.2012.11.001.

Alesina, A., Özler, S., Roubini, N., & Swagel, P. (1996). Political instability and economic growth. Journal of Economic Growth, 1(2), 189–211.

Alesina, A., & Perotti, R. (1996). Income distribution, political instability, and investment. European Economic Review, 40, 1203–1228. https://doi.org/10.1016/0014-2921(95)00030-5.

Alesina, A., & Tabellini, G. (1990). A positive theory of fiscal deficits and government debt. The Review of Economic Studies, 57(3), 403–414. https://doi.org/10.2307/2298021.

An, H., Chen, Y., Luo, D., & Zhang, T. (2016). Political uncertainty and corporate investment: evidence from China. Journal of Corporate Finance, 36, 174–189. https://doi.org/10.1016/j.jcorpfin.2015.11.003.

Arellano, M., & Bond, S. (1991). Some tests of specification for panel data: monte Carlo evidence and an application to employment equations. The Review of Economic Studies, 58(2), 277–297. https://doi.org/10.2307/2297968.

Bjorvatn, K., & Farzanegan, M. R. (2015). Resource rents, balance of power, and political stability. Journal of Peace Research, 52(6), 758–773. https://doi.org/10.1177/0022343315593992.

Brück, T. (1997). Macroeconomic effects of the war in Mozambique. QEHWPS11. Oxford University IDC, Queen Elizabeth house. http://www3.qeh.ox.ac.uk/RePEc/qeh/qehwps/qehwps11.pdf, Accessed 5.10.2016.

Caselli, F., & Cunningham, T. (2009). Leader behaviour and the natural resource curse. Oxford Economic Papers, 61, 628–650. https://doi.org/10.1093/oep/gpp023.

Collier, P., & Hoeffler, A. (2011). Aid, policy, and growth in post-conflict societies. Conflict, political accountability and aid (pp. 124–146). London: Routledge.

Cukierman, A., Edwards, S., & Tabellini, G. (1992). Seigniorage and political instability. The American Economic Review, 82(3), 537–555. https://doi.org/10.2307/2117320.

d’Agostino, G., Dunne, P. J., & Pieroni, L. (2016). Government spending, corruption and economic growth. World Development, 84, 190–205. https://doi.org/10.1016/j.worlddev.2016.03.011.

Deacon, R. T., & Rode, A. (2012). Rent seeking and the resource curse. http://econ.ucsb.edu/~deacon/RentSeekingResourceCurse%20Sept%2026.pdf. Accessed 3 Dec 2016.

Despres, E., Hart, A. G., Friedman, M., Samuelson, P. A., & Wallace, D. H. (1950). The problem of economic instability. The American Economic Review, 40(4), 501–538. http://www.jstor.org/stable/pdf/1808423.pdf. Accessed 30 Oct 2017.

Devereux, M. B., & Wen, J. F. (1998). Political instability, capital taxation, and growth. European Economic Review, 42, 1635–1651. https://doi.org/10.1016/S0014-2921(97)00100-1.

Feng, Y. (2001). Political freedom, political instability, and policy uncertainty: a study of political institutions and private investment in developing countries. International Studies Quarterly, 45(2), 271–294. https://doi.org/10.1111/0020-8833.00191.

Fielding, D. (2002). Human rights, political instability and investment in South Africa: a note. Journal of Development Economics, 67, 173–180. https://doi.org/10.1016/S0304-3878(01)00182-1.

Fosu, A. K. (1992). Political instability and economic growth: evidence from Sub-Saharan Africa. Economic Development and Cultural Change, 40(4), 829–841. https://doi.org/10.1086/451979.

Guillaumont, P., Guillaumont Jeanneney, S., & Brun, J. F. (1999). How instability lowers African growth. Journal of African Economies, 8(1), 87–107. https://ssrn.com/abstract=915087. Accessed 20 Aug 2018.

Gyimah-Brempong, K., & Traynor, T. L. (1999). Political instability, investment and economic growh in Sub-Saharan Africa. Journal of African Economies, 8(1), 52–86. https://doi.org/10.1093/jae/8.1.52.

Jens, C. E. (2017). Political uncertainty and investment: causal evidence from US gubernatorial elections. Journal of Financial Economics, 124(3), 563–579. https://doi.org/10.1016/j.jfineco.2016.01.034.

Jong-A-Pin, R. (2009). On the measurement of political instability and its impact on economic growth. European Journal of Political Economy, 25, 15–29. https://doi.org/10.1016/j.ejpoleco.2008.09.010.

Karl, T. L. (1997). The Paradox of Plenty: Oil Booms and Petro-States. Berkeley: University of California Press.

Kaufmann, D., Kraay, A., & Mastruzzi, M. (2010). The Worldwide Governance Indicators: Methodology and Analytical Issues. World Bank Policy Research Working Paper No. 5430. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1682130. Accessed 19 Aug 2018.

Londregan, J. B., & Poole, K. T. (1990). Poverty, the coup trap, and the seizure of executive power. World Politics, 42(2), 151–183. https://doi.org/10.2307/2010462.

Parvin, M. (1973). Economic determinants of political unrest: an econometric approach. The Journal of Conflict Resolution, 17(2), 271–296. https://doi.org/10.1177/002200277301700205.

Persson, T., & Svensson, L. E. O. (1989). Why a stubborn conservative would run a deficit: policy with time-inconsistent preferences. The Quarterly Journal of Economics, 104(2), 325–345. https://doi.org/10.2307/2937850.

Pindyck, R. S. (1991). Irreversibility, uncertainty, and investment. Journal of Economic Literature, XXIX(3), 1110–1148.

Wantchekon, L. (2002). Why do resource abundant countries have authoritarian governments? Journal of African Development, 5(2), 145–176.

Zouhaier, H., & Karim, K. M. (2012). Democracy, investment and economic growth. International Journal of Economics and Financial Issues, 2(3), 233–240.

Acknowledgements

The author is grateful to Professor Masayuki Tamaoka for providing invaluable guidance during the study and to Professor Yoshikatsu Tatamitani and Professor Shigeharu Okajima for their helpful comments. I am also grateful to Professor Yuko Arayama and Professor Tsuyoshi Shinozaki, as well as, the other participants at the 16th International Conference of the Japan Economic Policy Association in Okinawa, who made very helpful suggestions aimed at improving the quality of this paper. The very helpful comments of two anonymous referees is acknowledged and appreciated.

Author information

Authors and Affiliations

Corresponding author

Additional information

This paper forms part of the author’s doctoral dissertation on the topic “Economic analysis of political instability in Africa”.

Appendix A1 Panel unit root test results

Appendix A1 Panel unit root test results

Panel unit root test: Summary

Series: POLITICAL_STABILITY_AND_

Date: 12/08/17 Time: 02:37

Sample: 1980 2013

Exogenous variables: Individual effects, individual linear trends

Automatic selection of maximum lags

Automatic lag length selection based on SIC: 0 to 1

Newey-West automatic bandwidth selection and Bartlett kernel

Method | Statistic | Prob.** | Cross-sections | Obs |

|---|---|---|---|---|

Null: unit root (assumes common unit root process) | ||||

Levin, Lin & Chu t* | − 13.1027 | 0.0000 | 53 | 570 |

Breitung t-stat | − 0.13213 | 0.4474 | 53 | 517 |

Null: unit root (assumes individual unit root process) | ||||

Im, Pesaran and Shin W-stat | − 3.79810 | 0.0001 | 53 | 570 |

ADF—Fisher Chi-square | 170.276 | 0.0001 | 53 | 570 |

PP—Fisher Chi-square | 200.452 | 0.0000 | 53 | 583 |

Panel unit root test: Summary

Series: D(POLITICAL_STABILITY_AND_)

Date: 12/08/17 Time: 02:37

Sample: 1980 2013

Exogenous variables: Individual effects, individual linear trends

Automatic selection of maximum lags

Automatic lag length selection based on SIC: 0 to 1

Newey-West automatic bandwidth selection and Bartlett kernel

Method | Statistic | Prob.** | Sections | Obs |

|---|---|---|---|---|

Null: unit root (assumes common unit root process) | ||||

Levin, Lin & Chu t* | − 28.3374 | 0.0000 | 53 | 507 |

Breitung t-stat | − 8.95176 | 0.0000 | 53 | 454 |

Null: unit root (assumes individual unit root process) | ||||

Im, Pesaran and Shin W-stat | − 10.8386 | 0.0000 | 53 | 507 |

ADF—Fisher Chi-square | 352.014 | 0.0000 | 53 | 507 |

PP—Fisher Chi-square | 518.798 | 0.0000 | 53 | 530 |

Panel unit root test: Summary

Series: UPPSALA_INTCONFMONTHS

Date: 12/08/17 Time: 02:39

Sample: 1980 2013

Exogenous variables: Individual effects, individual linear trends

Automatic selection of maximum lags

Automatic lag length selection based on SIC: 0 to 7

Newey-West automatic bandwidth selection and Bartlett kernel

Balanced observations for each test

Method | Statistic | Prob.** | Cross-sections | Obs |

|---|---|---|---|---|

Null: unit root (assumes common unit root process) | ||||

Levin, Lin & Chu t* | − 8.25635 | 0.0000 | 37 | 1258 |

Breitung t-stat | − 1.94383 | 0.0260 | 37 | 1221 |

Null: unit root (assumes individual unit root process | ||||

Im, Pesaran and Shin W-stat | − 8.15020 | 0.0000 | 37 | 1258 |

ADF—Fisher Chi-square | 259.853 | 0.0000 | 37 | 1258 |

PP—Fisher Chi-square | 271.770 | 0.0000 | 37 | 1258 |

Panel unit root test: Summary

Series: D(UPPSALA_INTCONFMONTHS)

Date: 12/08/17 Time: 02:39

Sample: 1980 2013

Exogenous variables: Individual effects, individual linear trends

Automatic selection of maximum lags

Automatic lag length selection based on SIC: 0 to 6

Newey-West automatic bandwidth selection and Bartlett kernel

Balanced observations for each test

Method | Statistic | Prob.** | Cross-sections | Obs |

|---|---|---|---|---|

Null: unit root (assumes common unit root process) | ||||

Levin, Lin & Chu t* | − 24.4864 | 0.0000 | 27 | 918 |

Breitung t-stat | − 9.76984 | 0.0000 | 27 | 891 |

Null: unit root (assumes individual unit root process) | ||||

Im, Pesaran and Shin W-stat | − 26.6501 | 0.0000 | 27 | 918 |

ADF—Fisher Chi-square | 805.937 | 0.0000 | 27 | 918 |

PP—Fisher Chi-square | 2051.28 | 0.0000 | 27 | 918 |

Panel unit root test: Summary

Series: FREQUENCY_OF_GOVERNMENT_

Date: 12/08/17 Time: 02:41

Sample: 1980 2013

Exogenous variables: Individual effects, individual linear trends

Automatic selection of maximum lags

Automatic lag length selection based on SIC: 0 to 3

Newey-West automatic bandwidth selection and Bartlett kernel

Balanced observations for each test

Method | Statistic | Prob.** | Cross-sections | Obs |

|---|---|---|---|---|

Null: unit root (assumes common unit root process) | ||||

Levin, Lin & Chu t* | − 30.5026 | 0.0000 | 52 | 1768 |

Breitung t-stat | − 17.2901 | 0.0000 | 52 | 1716 |

Null: unit root (assumes individual unit root process) | ||||

Im, Pesaran and Shin W-stat | − 30.8561 | 0.0000 | 52 | 1768 |

ADF—Fisher Chi-square | 886.440 | 0.0000 | 52 | 1768 |

PP—Fisher Chi-square | 1914.95 | 0.0000 | 52 | 1768 |

Panel unit root test: Summary

Series: D(FREQUENCY_OF_GOVERNMENT_)

Date: 12/08/17 Time: 02:41

Sample: 1980 2013

Exogenous variables: Individual effects, individual linear trends

Automatic selection of maximum lags

Automatic lag length selection based on SIC: 0 to 6

Newey-West automatic bandwidth selection and Bartlett kernel

Balanced observations for each test

Method | Statistic | Prob.** | Cross-sections | Obs |

|---|---|---|---|---|

Null: unit root (assumes common unit root process) | ||||

Levin, Lin & Chu t* | − 22.6416 | 0.0000 | 46 | 1564 |

Breitung t-stat | − 10.1413 | 0.0000 | 46 | 1518 |

Null: unit root (assumes individual unit root process) | ||||

Im, Pesaran and Shin W-stat | − 42.9844 | 0.0000 | 46 | 1564 |

ADF—Fisher Chi-square | 1546.64 | 0.0000 | 46 | 1564 |

PP—Fisher Chi-square | 10898.4 | 0.0000 | 46 | 1564 |

Panel unit root test: Summary

Series: TOTNATRESRENT_TOTTAX

Date: 12/08/17 Time: 02:42

Sample: 1980 2013

Exogenous variables: Individual effects, individual linear trends

Automatic selection of maximum lags

Automatic lag length selection based on SIC: 0 to 7

Newey-West automatic bandwidth selection and Bartlett kernel

Method | Statistic | Prob.** | Cross-sections | Obs |

|---|---|---|---|---|

Null: unit root (assumes common unit root process) | ||||

Levin, Lin & Chu t* | − 35.8563 | 0.0000 | 53 | 1456 |

Breitung t-stat | − 6.2E-11 | 0.5000 | 53 | 1403 |

Null: unit root (assumes individual unit root process) | ||||

Im, Pesaran and Shin W-stat | − 11.8921 | 0.0000 | 52 | 1454 |

ADF—Fisher Chi-square | 582.842 | 0.0000 | 52 | 1454 |

PP—Fisher Chi-square | 894.210 | 0.0000 | 52 | 1482 |

Panel unit root test: Summary

Series: D(TOTNATRESRENT_TOTTAX)

Date: 12/08/17 Time: 02:42

Sample: 1980 2013

Exogenous variables: Individual effects, individual linear trends

Automatic selection of maximum lags

Automatic lag length selection based on SIC: 0 to 4

Newey-West automatic bandwidth selection and Bartlett kernel

Method | Statistic | Prob.** | Cross-sections | Obs |

|---|---|---|---|---|

Null: unit root (assumes common unit root process) | ||||

Levin, Lin & Chu t* | − 57.1006 | 0.0000 | 52 | 1394 |

Breitung t-stat | − 10.2435 | 0.0000 | 52 | 1342 |

Null: unit root (assumes individual unit root process) | ||||

Im, Pesaran and Shin W-stat | − 41.5836 | 0.0000 | 52 | 1394 |

ADF—Fisher Chi-square | 1391.71 | 0.0000 | 52 | 1394 |

PP—Fisher Chi-square | 3377.63 | 0.0000 | 52 | 1419 |

Panel unit root test: Summary

Series: SEIGNIORAGE__PH_Y_

Date: 12/08/17 Time: 02:43

Sample: 1980 2013

Exogenous variables: Individual effects, individual linear trends

Automatic selection of maximum lags

Automatic lag length selection based on SIC: 0 to 4

Newey-West automatic bandwidth selection and Bartlett kernel

Method | Statistic | Prob.** | Cross-sections | Obs |

|---|---|---|---|---|

Null: unit root (assumes common unit root process) | ||||

Levin, Lin & Chu t* | − 229.482 | 0.0000 | 52 | 1546 |

Breitung t-stat | − 11.6970 | 0.0000 | 52 | 1494 |

Null: unit root (assumes individual unit root process) | ||||

Im, Pesaran and Shin W-stat | − 54.4814 | 0.0000 | 52 | 1546 |

ADF—Fisher Chi-square | 755.431 | 0.0000 | 52 | 1546 |

PP—Fisher Chi-square | 1071.45 | 0.0000 | 52 | 1561 |

Panel unit root test: Summary

Series: D(SEIGNIORAGE__PH_Y_)

Date: 12/08/17 Time: 02:43

Sample: 1980 2013

Exogenous variables: Individual effects, individual linear trends

Automatic selection of maximum lags

Automatic lag length selection based on SIC: 0 to 4

Newey-West automatic bandwidth selection and Bartlett kernel

Method | Statistic | Prob.** | Cross-sections | Obs |

|---|---|---|---|---|

Null: unit root (assumes common unit root process) | ||||

Levin, Lin & Chu t* | − 170.373 | 0.0000 | 52 | 1519 |

Breitung t-stat | − 13.0357 | 0.0000 | 52 | 1467 |

Null: unit root (assumes individual unit root process) | ||||

Im, Pesaran and Shin W-stat | − 68.6987 | 0.0000 | 52 | 1519 |

ADF—Fisher Chi-square | 1611.71 | 0.0000 | 52 | 1519 |

PP—Fisher Chi-square | 8712.81 | 0.0000 | 52 | 1542 |

**Probabilities for Fisher tests are computed using an asymptotic Chi -square distribution. All other tests assume asymptotic normality

Panel unit root test: Summary

Series: GENERAL_GOVERNMENT_NET_L

Date: 12/08/17 Time: 02:44

Sample: 1980 2013

Exogenous variables: Individual effects, individual linear trends

Automatic selection of maximum lags

Automatic lag length selection based on SIC: 0 to 7

Newey-West automatic bandwidth selection and Bartlett kernel

Method | Statistic | Prob.** | Cross-sections | Obs |

|---|---|---|---|---|

Null: unit root (assumes common unit root process) | ||||

Levin, Lin & Chu t* | 27.9124 | 1.0000 | 53 | 1001 |

Breitung t-stat | − 8.6E-12 | 0.5000 | 53 | 948 |

Null: unit root (assumes individual unit root process) | ||||

Im, Pesaran and Shin W-stat | − 7.15731 | 0.0000 | 52 | 999 |

ADF—Fisher Chi-square | 249.698 | 0.0000 | 52 | 999 |

PP—Fisher Chi-square | 210.159 | 0.0000 | 52 | 1035 |

**Probabilities for Fisher tests are computed using an asymptotic Chi -square distribution. All other tests assume asymptotic normality.

Panel unit root test: Summary

Series: D(GENERAL_GOVERNMENT_NET_L)

Date: 12/08/17 Time: 02:45

Sample: 1980 2013

Exogenous variables: Individual effects, individual linear trends

Automatic selection of maximum lags

Automatic lag length selection based on SIC: 0 to 6

Newey-West automatic bandwidth selection and Bartlett kernel

Method | Statistic | Prob.** | Cross-sections | Obs |

|---|---|---|---|---|

Null: unit root (assumes common unit root process) | ||||

Levin, Lin & Chu t* | − 24.7869 | 0.0000 | 52 | 945 |

Breitung t-stat | − 11.4868 | 0.0000 | 52 | 893 |

Null: unit root (assumes individual unit root process) | ||||

Im, Pesaran and Shin W-stat | − 20.0383 | 0.0000 | 52 | 945 |

ADF—Fisher Chi-square | 658.453 | 0.0000 | 52 | 945 |

PP—Fisher Chi-square | 1883.69 | 0.0000 | 52 | 983 |

**Probabilities for Fisher tests are computed using an asymptotic Chi -square distribution. All other tests assume asymptotic normality

Panel unit root test: Summary

Series: GDP_GROWTH__ANNUAL_____N

Date: 12/08/17 Time: 02:46

Sample: 1980 2013

Exogenous variables: Individual effects, individual linear trends

Automatic selection of maximum lags

Automatic lag length selection based on SIC: 0 to 1

Newey-West automatic bandwidth selection and Bartlett kernel

Method | Statistic | Prob.** | Cross-sections | Obs |

|---|---|---|---|---|

Null: unit root (assumes common unit root process) | ||||

Levin, Lin & Chu t* | − 24.5565 | 0.0000 | 54 | 1671 |

Breitung t-stat | − 15.2813 | 0.0000 | 54 | 1617 |

Null: unit root (assumes individual unit root process) | ||||

Im, Pesaran and Shin W-stat | − 22.4071 | 0.0000 | 54 | 1671 |

ADF—Fisher Chi-square | 856.097 | 0.0000 | 54 | 1671 |

PP—Fisher Chi-square | 1257.44 | 0.0000 | 54 | 1672 |

**Probabilities for Fisher tests are computed using an asymptotic Chi -square distribution. All other tests assume asymptotic normality.

Panel unit root test: Summary

Series: D(GDP_GROWTH__ANNUAL_____N)

Date: 12/08/17 Time: 02:46

Sample: 1980 2013

Exogenous variables: Individual effects, individual linear trends

Automatic selection of maximum lags

Automatic lag length selection based on SIC: 0 to 7

Newey-West automatic bandwidth selection and Bartlett kernel

Method | Statistic | Prob.** | Cross-sections | Obs |

|---|---|---|---|---|

Null: unit root (assumes common unit root process) | ||||

Levin, Lin & Chu t* | − 29.1399 | 0.0000 | 53 | 1642 |

Breitung t-stat | − 18.9121 | 0.0000 | 53 | 1589 |

Null: unit root (assumes individual unit root process) | ||||

Im, Pesaran and Shin W-stat | − 41.3238 | 0.0000 | 53 | 1642 |

ADF—Fisher Chi-square | 1594.19 | 0.0000 | 53 | 1642 |

PP—Fisher Chi-square | 9143.74 | 0.0000 | 53 | 1654 |

**Probabilities for Fisher tests are computed using an asymptotic Chi -square distribution. All other tests assume asymptotic normality

Panel unit root test: Summary

Series: FINAL_CONSUMPTION_EXPEND

Date: 12/08/17 Time: 02:47

Sample: 1980 2013

Exogenous variables: Individual effects, individual linear trends

Automatic selection of maximum lags

Automatic lag length selection based on SIC: 0 to 5

Newey-West automatic bandwidth selection and Bartlett kernel

Method | Statistic | Prob.** | Cross-sections | Obs |

|---|---|---|---|---|

Null: unit root (assumes common unit root process) | ||||

Levin, Lin & Chu t* | − 156.150 | 0.0000 | 51 | 1503 |

Breitung t-stat | − 4.1E-11 | 0.5000 | 51 | 1452 |

Null: unit root (assumes individual unit root process) | ||||

Im, Pesaran and Shin W-stat | − 5.36848 | 0.0000 | 50 | 1501 |

ADF—Fisher Chi-square | 228.128 | 0.0000 | 50 | 1501 |

PP—Fisher Chi-square | 222.577 | 0.0000 | 50 | 1506 |

**Probabilities for Fisher tests are computed using an asymptotic Chi -square distribution. All other tests assume asymptotic normality.

Panel unit root test: Summary

Series: D(FINAL_CONSUMPTION_EXPEND)

Date: 12/08/17 Time: 02:48

Sample: 1980 2013

Exogenous variables: Individual effects, individual linear trends

Automatic selection of maximum lags

Automatic lag length selection based on SIC: 0 to 7

Newey-West automatic bandwidth selection and Bartlett kernel

Method | Statistic | Prob.** | Cross-sections | Obs |

|---|---|---|---|---|

Null: unit root (assumes common unit root process) | ||||

Levin, Lin & Chu t* | − 1953.97 | 0.0000 | 51 | 1476 |

Breitung t-stat | − 5.3E-10 | 0.5000 | 51 | 1425 |

Null: unit root (assumes individual unit root process) | ||||

Im, Pesaran and Shin W-stat | − 27.7327 | 0.0000 | 50 | 1474 |

ADF—Fisher Chi-square | 1091.20 | 0.0000 | 50 | 1474 |

PP—Fisher Chi-square | 3325.23 | 0.0000 | 50 | 1487 |

**Probabilities for Fisher tests are computed using an asymptotic Chi -square distribution. All other tests assume asymptotic normality

Panel unit root test: Summary

Series: DOMESTIC_CREDIT_TO_PRIVA

Date: 12/08/17 Time: 02:49

Sample: 1980 2013

Exogenous variables: Individual effects, individual linear trends

Automatic selection of maximum lags

Automatic lag length selection based on SIC: 0 to 7

Newey-West automatic bandwidth selection and Bartlett kernel

Method | Statistic | Prob.** | Cross-sections | Obs |

|---|---|---|---|---|

Null: unit root (assumes common unit root process) | ||||

Levin, Lin & Chu t* | 0.45223 | 0.6744 | 52 | 1554 |

Breitung t-stat | 4.69898 | 1.0000 | 52 | 1502 |

Null: unit root (assumes individual unit root process) | ||||

Im, Pesaran and Shin W-stat | 1.65156 | 0.9507 | 52 | 1554 |

ADF—Fisher Chi-square | 117.533 | 0.1720 | 52 | 1554 |

PP—Fisher Chi-square | 73.7166 | 0.9893 | 52 | 1578 |

**Probabilities for Fisher tests are computed using an asymptotic Chi -square distribution. All other tests assume asymptotic normality.

Panel unit root test: Summary

Series: D(DOMESTIC_CREDIT_TO_PRIVA)

Date: 12/08/17 Time: 02:50

Sample: 1980 2013

Exogenous variables: Individual effects, individual linear trends

Automatic selection of maximum lags

Automatic lag length selection based on SIC: 0 to 5

Newey-West automatic bandwidth selection and Bartlett kernel

Method | Statistic | Prob.** | Cross-sections | Obs |

|---|---|---|---|---|

Null: unit root (assumes common unit root process) | ||||

Levin, Lin & Chu t* | − 23.6658 | 0.0000 | 52 | 1536 |

Breitung t-stat | − 14.8404 | 0.0000 | 52 | 1484 |

Null: unit root (assumes individual unit root process) | ||||

Im, Pesaran and Shin W-stat | − 27.1366 | 0.0000 | 52 | 1536 |

ADF—Fisher Chi-square | 945.741 | 0.0000 | 52 | 1536 |

PP—Fisher Chi-square | 1658.69 | 0.0000 | 52 | 1555 |

**Probabilities for Fisher tests are computed using an asymptotic Chi -square distribution. All other tests assume asymptotic normality.

Panel unit root test: Summary

Series: SCHOOL_ENROLLMENT__SECON

Date: 12/08/17 Time: 02:51

Sample: 1980 2013

Exogenous variables: Individual effects, individual linear trends

Automatic selection of maximum lags

Automatic lag length selection based on SIC: 0 to 3

Newey-West automatic bandwidth selection and Bartlett kernel

Method | Statistic | Prob.** | Cross-sections | Obs |

|---|---|---|---|---|

Null: unit root (assumes common unit root process) | ||||

Levin, Lin & Chu t* | 6.79587 | 1.0000 | 49 | 922 |

Breitung t-stat | 6.35568 | 1.0000 | 49 | 873 |

Null: unit root (assumes individual unit root process) | ||||

Im, Pesaran and Shin W-stat | 7.05368 | 1.0000 | 49 | 922 |

ADF—Fisher Chi-square | 51.2208 | 1.0000 | 49 | 922 |

PP—Fisher Chi-square | 51.8107 | 1.0000 | 49 | 968 |

**Probabilities for Fisher tests are computed using an asymptotic Chi -square distribution. All other tests assume asymptotic normality.

Panel unit root test: Summary

Series: D(SCHOOL_ENROLLMENT__SECON)

Date: 12/08/17 Time: 02:52

Sample: 1980 2013

Exogenous variables: Individual effects, individual linear trends

Automatic selection of maximum lags

Automatic lag length selection based on SIC: 0 to 4

Newey-West automatic bandwidth selection and Bartlett kernel

Method | Statistic | Prob.** | Cross-sections | Obs |

|---|---|---|---|---|

Null: unit root (assumes common unit root process) | ||||

Levin, Lin & Chu t* | − 16.2561 | 0.0000 | 47 | 827 |

Breitung t-stat | 0.83171 | 0.7972 | 47 | 780 |

Null: unit root (assumes individual unit root process) | ||||

Im, Pesaran and Shin W-stat | − 6.65647 | 0.0000 | 47 | 827 |

ADF—Fisher Chi-square | 282.437 | 0.0000 | 47 | 827 |

PP—Fisher Chi-square | 310.728 | 0.0000 | 47 | 864 |

**Probabilities for Fisher tests are computed using an asymptotic Chi -square distribution. All other tests assume asymptotic normality.

Panel unit root test: Summary

Series: FOREIGN_DIRECT_INVESTMEN

Date: 12/08/17 Time: 02:53

Sample: 1980 2013

Exogenous variables: Individual effects, individual linear trends

Automatic selection of maximum lags

Automatic lag length selection based on SIC: 0 to 6

Newey-West automatic bandwidth selection and Bartlett kernel

Method | Statistic | Prob.** | Cross-sections | Obs |

|---|---|---|---|---|

Null: unit root (assumes common unit root process) | ||||

Levin, Lin & Chu t* | − 9.55021 | 0.0000 | 53 | 1606 |

Breitung t-stat | − 0.33925 | 0.3672 | 53 | 1553 |

Null: unit root (assumes individual unit root process) | ||||

Im, Pesaran and Shin W-stat | − 11.1968 | 0.0000 | 53 | 1606 |

ADF—Fisher Chi-square | 378.924 | 0.0000 | 53 | 1606 |

PP—Fisher Chi-square | 415.636 | 0.0000 | 53 | 1621 |

Panel unit root test: Summary

Series: D(FOREIGN_DIRECT_INVESTMEN)

Date: 12/08/17 Time: 02:53

Sample: 1980 2013

Exogenous variables: Individual effects, individual linear trends

Automatic selection of maximum lags

Automatic lag length selection based on SIC: 0 to 7

Newey-West automatic bandwidth selection and Bartlett kernel

Method | Statistic | Prob.** | Cross-sections | Obs |

|---|---|---|---|---|

Null: unit root (assumes common unit root process) | ||||

Levin, Lin & Chu t* | − 30.5802 | 0.0000 | 53 | 1577 |

Breitung t-stat | − 2.37221 | 0.0088 | 53 | 1524 |

Null: unit root (assumes individual unit root process) | ||||

Im, Pesaran and Shin W-stat | − 38.0143 | 0.0000 | 53 | 1577 |

ADF—Fisher Chi-square | 1396.77 | 0.0000 | 53 | 1577 |

PP—Fisher Chi-square | 5819.89 | 0.0000 | 53 | 1600 |

Panel unit root test: Summary

Series: MERCHANDISE_TRADE____OF_

Date: 12/08/17 Time: 02:54