Abstract

This research investigates the time-varying correlation as well as long-run cointegration relationship between the carbon prices of the European market and the China market during the period 2013–2020. We adopt the Lagrange Multiplier (LM) unit root and cointegration test based on the univariate unit root test with one structural break and wavelet coherency analysis in the time–frequency domain. Overall, we validate a long-run cointegration among carbon prices of different markets when considering structural breaks. Additionally, there is a significant correlation among the carbon prices in the long term, but a weaker correlation in the short term, as presented by wavelet coherency. Hence, there is a solid foundation for the integration of China’s carbon market with the global carbon market.

Article Highlights

-

We investigate the carbon prices of the Europe market and the China market during the period 2013–2020.

-

We find long-run cointegration among carbon prices of different markets when considering structural breaks.

-

There a significant correlation among the carbon prices in the long term.

-

China government should continue to integrate national carbon market.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

To cope with the continuing climate change and potential deterioration of humans’ living environment, governments are collaborating on schemes to develop low-carbon economies and reducing greenhouse gas (GHG) globally. Among mechanisms designed for reducing GHG emissions, the core is the allocation of carbon emission allowances and a market mechanism for the trading of allowances that facilitates a price formulation procedure for the carbon market and provides motivation for spontaneous de-carbonization in the profit-maximizing private sectors. The European Emissions Trading System (EU ETS), formally launched in 2005, has already been run successfully. EU ETS is a ‘cap and trade’ system, of which the total emission amount is declining, so that total emissions fall over time.Footnote 1 More than 11,000 heavy energy-using installations and airlines covered by EU ETS need to receive or buy emission allowances. Total emissions have so far fallen by about 35% between 2005 and 2019.

Along with EU ETS, other countries have set-up emission trading systems as well. For example, the New South Wales GHG trading system was launched in 2003 as Australia’s own trading system. Japan’s Kyoto cap-and-trade system was launched in April 2010 as the first carbon trading system in Asia. Through April 2019, there are 28 carbon trading centers and 29 carbon taxations, covering 46 countries, 28 regions, and 11 billion tons of carbon emissions traded yearly, accounting for 20% of the world’s total emissions.

As the country with largest carbon emissions, China in 2011 set-up pilot projects for carbon trading in seven regions: Beijing, Shanghai, Tianjin, Chongqing, Hubei, Shenzhen, and Guangzhou (Zhang et al. 2014). A small percentage of carbon emissions is also auctioned in Guangdong, Shenzhen, and Hubei. Moreover, all seven pilot projects allocate allowances free of charge (Dong et al. 2016; Duan et al. 2014). If the firms generate certified emission reductions outside the pilot regions, then they could offset the quota for carbon emissions. The pilot projects also demonstrate features of allowance reserves, buy-back of surplus allowances, and auctions triggered by price ceilings (Pang and Duan 2016).

EU ETS is open to other mechanisms, including certified emission reduction (CER) generated by the clean development mechanism (CDM) and emission reduction unit (ERU) generated by joint implementation (JI). The entities covered by EU ETS are allowed to use the credits up to a certain level to meet their obligations. Since the carbon markets around the world are interconnected, there is widespread evidence that they have influences over one another (Nazifi 2013; Koch et al. 2014; Wu et al. 2020; Colla et al. 2020; Wen et al. 2021). Berghmans and Alberola (2013) estimate that the power sector offsets around 65% of its shortfall of EUAs using Kyoto credits. Even when the carbon products are not directly fungible, the carbon markets are still linked, because the following reasons will cause the spillover effect. The corporations are able to set-up plants globally. Hence, a high price of emission allowances in one carbon market will motivate the polluting corporations to manufacture in a country with lower carbon costs, whose carbon emissions will drive up local carbon prices.

The reason why we choose the relationship between the prices of China’s and the EU’s carbon markets goes as follows. First, China is enhancing its partner relationship with the EU in many aspects like the China–EU Investment Agreement,Footnote 2 which facilitates bilateral investment in all areas, and the spillover effect of the two carbon markets has now become clearer (Dhamija et al. 2018). Manufacturers in the EU are able to select sites for their factories, especially those with huge carbon emissions. If they deem that the cost of carbon emissions is lower in China—that is, the carbon price in China is lower than that of EU—then the manufacturers will establish factories in China, thus driving up the need for quotas on carbon emissions and leading to an increase in carbon price in China (Wang et al. 2017). Hence, when the EUA price is high, the price of China’s carbon market is expected to go up, and vice versa. The lead–lag relationship between the prices of the two carbon markets requires further research (Chang and Lee 2015).

In addition, the assertion made by Chinese government to achieve “carbon peak” by 2030 and “carbon neutral” by 2060 at the 75th session of the United Nations General Assembly in 2020 has accelerated the progress of carbon trading. In 2021, the National People’s Congress and the Chinese Political Consultative Conference (NPC&CPPCC) has formally added the “2030” and “2060” goals into the government work report, together with measures to achieve the goals. A carbon emission trading scheme has been proved to be effective towards carbon reduction (Hu et al. 2020; Zhang et al. 2019; Chen et al. 2020; Zhang 2015). Hence, to achieve the “2030” and “2060” goals, development of the carbon market is an indispensable and practical measure for China.

During the 14th 5-year plan, it is expected that eight key energy-consumption industries will be included in the carbon market. At that time, about 5 billion tons of quotas will be issued, making it the largest carbon emission trading market in the world.Footnote 3 China has put the integration of the carbon market onto its main agenda. After the launch of the national carbon market, China will issue the largest amount of carbon quotas in the world and is likely to become the world’s largest spot trading market, which will have a great impact on the international market. Currently, the European carbon market is the world’s leading carbon market. Although the price of China’s carbon price is unlikely to lead EUA in the short term since EUA plays a leading role in the global carbon market, China’s carbon exchange will become one of the largest carbon exchanges in the world. Hence, it is meaningful and interesting to look into the historical data and make a reflection on the relationship between the two markets.

Furthermore, there is also a top-level policy to build a unified carbon trading market. The Paris Climate Agreement has established a framework for international collaboration on emission reduction through reinforcement of targets, transparency, and accountability. Research into the relationship between the carbon price in different carbon markets is helpful for the mechanism design of a worldwide carbon market. For example, although EUA and CER are quotas from different markets, the European Commission allows the energy consuming sectors covered by EU ETS to use up to 13.4% of the total allowance with CER (Bataller et al. 2011). Moreover, although the European and Chinese carbon markets are not inter-linked directly, they have common factors such as energy price, weather, and global policies that influence both markets, causing a pattern of co-movement. It is interesting to research into the price relationship between the two markets, and the research question is to find the relationship between the carbon price of the pilot schemes of China and the relationship between China’s and EU’s carbon price so as to illustrate how the markets are interconnected with each other.

As for the methods adopted, we used cointegration with structural breaks and wavelet analysis to research into the question because the two methods are appropriate for the research question.Footnote 4 As we can see, the carbon market is affected by large external shocks. For example, the scheme of EU ETS changes every several years, and correspondingly the price of ETS has varied substantially during the transition (Koch et al. 2014). United States President Donald Trump shocked the market by withdrawing from Paris Climate Agreement in June 2017 (Böhringer and Rutherford 2017). Ignoring such structural breaks will lead to biased results, which may cause policy makers to misunderstand the true situation (Chang and Lee 2008; Hu et al. 2019; Chang et al. 2021; Chen et al. 2021; Feng et al. 2021). Moreover, the behavior of investors and consumers will also be biased due to any misinterpretation (Linn and Muehlenbachsn 2018; Shahbaz et al. 2014). Hence, we choose the cointegration test with structural breaks—namely, the Gregory and Hansen (GH) cointegration test—to find the long-term co-movement of carbon prices. For the time series data of carbon prices, the cointegration test with structural breaks is able to find the cointegration relationship between the time series even when there are critical incidents that lead to breaks in the time series data.

There are many factors influencing the carbon market, such as long-term economic prospects, global policies on the carbon market and green development, and price movements in other markets. Some of the factors are long term, such as economic prospects and policies, while some are short term, such as price movements in the stock market, oil market, etc. A deviation in the time scale of factors leads to differing characteristics of price movement under various time scales. Thus, an important feature of the carbon price movement will be neglected if we only focus on the time domain, and hence we need to consider data frequency carefully before reaching any conclusions (Zhuang et al. 2014; Sui et al. 2021; Wang et al. 2020, 2021). Wavelet analysis is a perfect tool for research into co-movements with respect to different time scales, because it is able to capture both time- and frequency-varying features of the time series data and can find the relationship between carbon markets with different maturities by considering the different trading entities in these markets. The advantage of wavelet analysis is that it can decompose the time-varying co-movements into different horizons so that the effects of various factors with different horizons can be observed (Graham et al. 2012).

The innovation of our paper is threefold. First, there is no previous literature on the relationship between the carbon prices of the two markets in China and Europe as well as the relationship between the carbon prices of different carbon pilot schemes in China. The topic is very interesting and important, because the integration of China’s carbon market will make it the largest one in the world. Second, the technique of wavelet analysis has not been applied to this issue. Wavelet analysis is an innovative analytic tool that enables one to find the relationship among time series from both the time domain and frequency domain. Third, from our research result we are able to find a long-run cointegration relationship as well as the feature of structural breaks and a causal relationship between the markets, which offer policy implications for governments and participants in these markets.

The rest of the paper runs as follows. The section “Literature Review” conducts a literature review on carbon prices and relevant statistical methods. The section “Methodology” briefly introduces the Lagrange Multiplier (LM), the Gregory and Hansen (GH) cointegration test, and wavelet coherency analysis. Section “Data Description” demonstrates the data sources and the basic pattern of carbon prices. Section “Result Analysis” discusses the model result and its policy implications. Section “Conclusion” summarizes.

Literature Review

To have a better understanding of the relationship between the carbon prices of the two markets in China and Europe, it is critical to summarize the pattern of carbon price movement in the EU market. Liu et al. (2021) find the existence of a mean spillover relationship between EUA spot and futures through non-linear methods of Granger causality. Rabe et al. (2019) forecast EUA prices for the years 2019–2030 and utilize the result in regional power system planning. Sun et al. (2020) discover the long-term memory feature of the EUA prices and deem that the EUA market is more efficient than China’s carbon market. Huang et al. (2021) apply the VMD-GARCH/ LSTM-LSTM model to forecast the EUA price movement and provide a better forecast with smaller errors than other models. Jianwei et al. 2021 adopt a hybrid model of ESMD, KICA, and LSSVR to predict the carbon price and prove the superiority of the method from the perspective of statistical performance criteria. The current literature tries to decompose the price movement of EUA with hybrid models, but the studies neglect the price movement in the frequency domain.

The topic on carbon prices between different markets has been researched from different angles with different methods. For research results, the focus is on EUAs and sCERs, which are valid under EU ETS and Kyoto Protocol’s CDM, respectively (Nazifi 2013; Bataller et al. 2011). There is evidence that the price difference between the two carbon markets can generate arbitrage opportunities for investors and firms (Bataller et al. 2011). For investors, it is crucial to understand the factors influencing the price spread between EUAs and CERs so as to take advantage of any arbitrage opportunities, and many studies in the literature have contributed to the issue (Nazifi 2013; Koch et al. 2014; Bataller et al. 2011). Koch et al. (2014) researches the weak performance of EUAs and finds that negative demand shocks are not the main cause of a weak carbon price, and issued CERs, among other factors, have influence over the price of EUAs. Bataller et al. (2011) argue that the spread between EUAs and sCERs is mainly driven by EUA prices and market microstructure variables and less importantly by emissions-related fundamental drivers. However, there is scant research on the link between other pairs of carbon products, especially carbon price in the EU and China markets.

As for the analysis techniques on relationships, Yu et al. (2015) investigate the lead–lag relationship between carbon emissions and crude oil in terms of price, using a multi-scale analysis approach that utilizes a decomposition of the time series of market returns into different scales of frequency. They find no correlation on a small time scale, but present a linear relationship on a long-term scale. Moreover, wavelet analysis is a useful tool to analyze the time–frequency domain. Aguiar-Conraria and Soares (2011) conduct research on the US economy for the relationship between crude oil prices and economic indicators. Chang and Lee (2015) analyze the co-movement of oil spot and futures prices and generate implications on investment strategies from the angle of risk diversification. Wavelet analysis enables us to understand how co-movement between carbon prices differs across various frequencies via wavelet coherency. Phase analysis allows us to observe the feature of synchronization of two time series in the frequency domain. Hence, the high-frequency and low-frequency relationships between carbon prices can be revealed.

As for the factors influencing the price movement of carbon markets, there are plenty of research works on the EUA price. Dutta et al. (2019) adopt the symmetric GARCH model to examine the conditional variance of EUA prices. They find that accounting for structural breaks improves the forecast performance of GARCH models, proving that the price movement of EUA has a pattern of structural breaks. Li et al. (2020) establish a back propagation neural network model and facilitate the mean impact value method to find those factors influencing the EUA price. They find that economic development (Stoxx600, Stoxx50, FTSE, CAC40, and DAX)), black energy (coal and Brent crude), and clean energy development (gas, PV Crystalox Solar, and Nordex) have impacts on the movement of the EUA price. Dhamija et al. (2018) research into the volatility co-movement between the EUA market and the energy markets with the Multivariate GARCH (BEKK-MGARCH) model. Their results show a high degree of volatility co-movement between the markets and a small but significant volatility spillover effect from the energy markets into the EUA price. Lu and Yin (2012) apply the Vector Error Correction Model (VECM) and find a long-run equilibrium between the prices of natural gas, EUA, coal, and electricity futures. Wen et al. (2017) adopt both static and generalized autoregressive score dynamic copulas to model the dependence between the EUA’s and the four energy commodity futures prices. Moreover, they investigate the performance of diversified portfolios and hedged portfolios and find that diversified portfolios are superior at reducing the variance and downside risks of carbon assets. Zhang et al. (2018) propose a hybrid model combined with CEEMD, CIM, GARCH, and GNN optimized by the ant colony algorithm and find that the model performs better than other models in the prediction of the EUA price.

Finally, on the necessity of a well-functioning price mechanism in the China carbon market, many researchers have found carbon mitigation effects of the trading mechanism (Hu et al. 2020; Zhang et al. 2019; Chen et al. 2020). Hu et al. (2020) use the DID model to compare the CO2 emissions of pilot and non-pilot areas and find significant emission reduction effects. Zhang et al. (2019) and Chen et al. (2020)’s research supports the carbon mitigation effects of the trading mechanism and reveals the importance of energy efficiency and high-quality innovation, respectively. As a whole, the trading mechanism has been proved to be effective, but few have looked into the difference between the pilot schemes and analyzed whether China can build up an integrated carbon market by considering the varying economic features across the country. A comparison between the different pilot schemes has only been researched qualitatively. Zhang et al. (2014), Dong et al. (2016), and Duan et al. (2014) compare the different mechanism designs of the pilot schemes in China, but they do not conduct a numerical analysis on the pattern of carbon price movement of the schemes and hence offer little implication on the feasibility of an integrated carbon market for China.

This research contributes to the current literature as follows. First, the topic has not been discussed under the trend of integration within China’s national carbon market. Second, the paper adopts the method of cointegration with structural break to reflect the influence of a large external shock to the prices of carbon markets and hence achieves a more accurate measurement of the long-term relationship between the time series. Third, the paper adopts wavelet analysis so as to obtain data correlation in different time–frequency domains and provides more robust evidence on the integration of China’s national carbon market.

Methodology

Unit Root and Cointegration Tests with Structural Breaks

We present the test for unit root with structural breaks from the method proposed by Lee and Strazicich (2013), who endogenously determine a structural break in intercept and trend. After that, we investigate the cointegration relationships of the variables.

where \(Y\) denotes the carbon price of different trading markets at time \(t\) and type i; \(X\) implies the carbon price of Beijing; and \(\nu\) represents the error term.

This study utilizes the cointegration test with structural breaks for time series, which is proposed by Gregory and Hansen (1996), to find the relationship between carbon prices. In Gregory and Hansen (1996), the null hypothesis is no cointegration among the time series, and then their study applies \({\text{ADF}}\), \(Z_{\alpha }\), and \(Z_{t}\) tests to determine whether there is level shift or regime shift. Overall, Gregory and Hansen (1996) propose three models and three abbreviations for the models accordingly: C for level shift, C/T for level shift with trend, and C/S for regime shift model. For a possible regime shift at time \(\tau \in T\), the three models of cointegration are tested. Among all possible structural breaks, the break point with the smallest value is the final result.

Wavelet Analysis

Our empirical tests utilize the continuous wavelet transform presented by Aguiar-Conraria et al. (2012), which is based on Aguiar-Conraria and Soares (2011). Aguiar-Conraria et al. (2012) demonstrate that the wavelet function just presents itself as a small wave losing its strength as the distance from the center becomes greater, meaning that the wavelet move towards 0, which is different from Fourier transform. With this characteristic, the wavelet analysis is more effective on localization in the time and frequency domains.

Let \(\chi (t)\) denote the time series and \(W_{\chi } (\alpha ,\beta )\) represent the continuous wavelet transform for a wavelet function \(\xi\), where the latter is a function of two variables:

where \(\alpha\) and \(\beta\) indicate the parameters for scale and location, respectively. Scale implies wavelet length, location denotes where the wavelet is centered, and \(\xi\)* indicates the complex conjugate. There is an inverse nexus between scale and frequency, where a more (less) compressed wavelet is implied by a higher (lower) wavelet. Hence, scale is able to reveal the feature of time series with lower (higher) frequency. The term \(W_{\chi }\) is composed of: \(R(W_{\chi } )\) as a real part, \(I(W_{\chi } )\) as an imaginary part, amplitude, \(\left| {W_{\chi } } \right|\), and phase, \(\tan^{ - 1} \left[ {\frac{{I(W_{\chi } )}}{{R(W_{\chi } )}}} \right]\), which is parameterized in radians, ranging from \(- \beta\) to \(\beta\). Hence, the time series data are divided according to the wavelet power spectrum.

The continuous wavelet transform has a mother wavelet with the following feature: \(\xi (t)\) is a square integrable function with the condition of \(\int_{ - \infty }^{\infty } {\frac{{\left| {\xi (f)} \right|}}{f}} {\text{d}}f < \infty\), where \(\xi (f)\) is the Fourier transform of \(\xi\) under the condition of \(\int_{ - \infty }^{\infty } {\xi (t)} {\text{d}}t = 0\), leading \(\xi\) to wiggle up and down the t-axis as a wave. Moreover, the accuracy property of wavelet analysis is highlighted by Aguiar-Conraria and Soares (2011), and \(e_{t} = \int_{ - \infty }^{\infty } {t\left| {\xi (t)} \right|}^{2} {\text{d}}t\) and \(\rho_{t}^{2} = \int_{ - \infty }^{\infty } {(t - e_{t} )^{2} \left| {\xi (t)} \right|}^{2} {\text{d}}t\) show the center and variance of wavelet analysis \(\xi\), respectively. Thus, we define the Morlet wavelet as:

Here, the wavelet value attains the lower bound of \(\rho_{t} \rho_{f} = \frac{1}{4\pi }\), and \(w0 = 6\).

We present the wavelet transform between the series as follows and design the Monte Carlo simulations according to Schreiber and Schmitz (1996) by adopting the amplitude-adjusted Fourier transform. The analysis offers the ratio of the cross-spectrum for the carbon price of the spectrum series with time frequencies.

where \(S\) represents the smoothing operator both with time and scale. Since we cannot obtain the accurate distribution of the wavelet analysis (Vacha and Barunik, 2012), we next examine the statistical significance based on the Monte Carlo model, which is proposed by Schreiber and Schmitz (1996) and further developed by Aguiar-Conraria and Soares (2011).

Let \(\eta_{x,y}\) denote the phase-difference with series \(x(t)\) and \(y(t)\), where \(\eta_{x,y}\) is:

When the time series moves in the same direction, which means that the time series are positively correlated, and \(\eta_{x,y} \in \left( {{0,}\;{\raise0.7ex\hbox{$\pi $} \!\mathord{\left/ {\vphantom {\pi {2}}}\right.\kern-\nulldelimiterspace} \!\lower0.7ex\hbox{${2}$}}} \right)\), which means series \(y(t)\) leads \(x(t)\); while for \(\eta_{x,y} \in \left( { - {\raise0.7ex\hbox{$\pi $} \!\mathord{\left/ {\vphantom {\pi {2}}}\right.\kern-\nulldelimiterspace} \!\lower0.7ex\hbox{${2}$}}{,}\;{0}} \right)\), \(x(t)\) plays the role of a leader. When the phase-difference is \(\pi\) or \({ - }\pi\), the time series moves in the opposite direction, which means that the time series are negatively correlated. With a phase-difference of \(\eta_{x,y} \in \left( {{\raise0.7ex\hbox{$\pi $} \!\mathord{\left/ {\vphantom {\pi {2}}}\right.\kern-\nulldelimiterspace} \!\lower0.7ex\hbox{${2}$}},\;\pi } \right)\), series \(x(t)\) leads \(y(t)\). Furthermore, when \(\eta_{x,y} \in \left( { - \;\pi ,\; - \;{\raise0.7ex\hbox{$\pi $} \!\mathord{\left/ {\vphantom {\pi {2}}}\right.\kern-\nulldelimiterspace} \!\lower0.7ex\hbox{${2}$}}} \right)\), \(y(t)\) occupies the leading position. Therefore, we adopt wavelets to examine the co-movement between carbon prices, mainly on the interconnection among China’s carbon trading markets.

Data Description

We adopt monthly data of the EUA spot price, obtained from ECX, and monthly data of carbon trading prices in China, obtained from the Wind database. Due to the fact that the seven carbon trading markets of China were established from 2013, we correspondingly choose data over the same period from the EUA spot price. However, we observe breakpoints in the data of China’s markets, because the trading volume can be low in newly set-up markets, and sometimes the volume may even drop to 0. To guarantee data continuity, we choose the longest continuous data variable from each dataset. Thus, the starting and ending times of all variables are not the same. In the cointegration test and wavelet analysis, we choose the overlap part from the pair of variables. We depict the main feature of carbon prices in Table 1 with descriptive statistics.

We have a total of 61 datapoints of EUA from November 2013 (201,311) to November 2018 (201,811), 76 datapoints of the Beijing market from 201,311 to 202,001, 71 datapoints of the Guangdong market from 201,403 to 202,001, 70 datapoints of the Hubei market from 201,404 to 202,001, 34 datapoints of the Tianjin market from 201,312 to 201,609, and 41 datapoints of the Shenzhen market from 201,609 to 202,001. We define EUA as type 1, Guangdong as 2, Hubei as 3, Tianjin as 4, and Shenzhen as 5. Figure 1 further depicts the trend of price movements of these markets. We see that their price movements can mostly be divided into two phases: one is a stable period where the price fluctuates around a center; the other is a period where a trend can be observed. From this observation, we infer that a breakpoint exists in the variables.

Result Analysis

Engle and Granger Residual Test

We first conduct the Engle and Granger residual test on the data to look into the relationships of cointegration among the data. The Engle and Granger residual test is a two-step test whereby we first regress the dependent variable and the independent variable and then conduct an ADF test on the residuals of the regression to test for the stationarity of the residuals. Table 2 lists the ADF results obtained from the regressions. From the table, we are able to see that several regressions do not pass the ADF test, meaning that the variables are not cointegrated. The result reveals that there could exist structural breaks in the data, which have affected the overall cointegration relationship.

Evidence from Unit Root and Cointegration Tests with Structural Breaks

To test the stationary property of the variables, we adopt the Lee and Strazicich (2013) test with one structural break. Table 3 reports Model C’s results, where we notice that the breakpoints of the variables do not show a stable pattern. The results suggest that the reactions of the trading markets differ according to the type of shocks. One reason behind this is that under different trading markets of China, local firms vary in terms of industry, as the provinces emphasize the construction of provincial characteristics.

Based on the unit root tests of stationarity evidence, we next investigate the carbon prices of Beijing and other trading centers for a cointegration relationship. As has been mentioned, we utilize the GH (1996) cointegration test with structural breaks, and the results are displayed in Table 4. The \({\text{ADF}}^{*}\), \(Z_{t}^{*}\), and \(Z_{\alpha }^{*}\) tests are conducted to test whether there is one structural break in the time series. From the results, we see that the null hypothesis of no cointegration relationship can be almost rejected with one of the three models. To be specific, there is strong evidence from the results of C/T, which represents the level shift with trend model, for the existence of cointegration with structural break, meaning the test supports the long-run stationary correlation of the variables.

Evidence from Wavelet Analysis

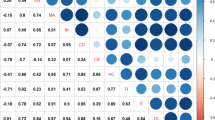

Figures 2, 3, 4, 5, 6, 7 and 8 illustrate the wavelet coherencies and phase-differences between the carbon prices of different trading centers. In wavelet analysis the cone of influence is presented as a black line, which is similar to a “region”. The contour within the one of influence is significant at the 5% confidence level. The left graphs in each figure denote the results of wavelet coherency, and the right graphs show the phase-differences results. In the left graphs, the vertical axis means the frequency converted to a time unit (month), while the horizontal axis refers to the sample period. Due to the difference in the length of data, the period reflected by the horizontal axis is different in each graph. Coherency ranges from red, implying a low level of coherency, to blue, meaning a high level of coherency. Hence, as an example, if the graph shows a blue area at the top (bottom), then there is strong co-movement at high (low) frequencies. The location of the blue area in the horizontal level reflects the corresponding time period when the co-movement occurs. Similarly, a red area at the top (bottom) suggests a low level of co-movement at high (low) frequencies. For phase-difference graphs on the right-hand side, the vertical axis implies the phase-difference between the variables, while time is presented in the horizontal axis. We select the frequency band of 3–8 months to perform wavelet analysis, due to the restriction of the sample scale.

Wavelet analysis on carbon prices of Beijing and EUA. Notes: On the left is wavelet coherency. The cone of influence is presented as a black line, and the contour within the one of influence is significant at the 5% confidence level. Blue (red) color reflects low (high) degree of dependence between the pair of time series. The vertical axis refers to the level of frequency; the horizontal axis refers to the time period. Phase-difference line is displayed on the right graph

Figure 2 displays the result of wavelet analysis on the carbon prices of Beijing and EUA. From the figure, we find a large area of blue color on the bottom, indicating that the carbon prices of Beijing and EUA correlate in the low-frequency domain, and there is a relationship of co-movement on a longer time scale. This result supports our idea that the carbon markets of the world are interconnected. The trading price of China’s carbon emission allowances may be linked more to its domestic market and policy, but the two are certainly not isolated from the global market. For the carbon trading centers in China, we find that they exhibit price co-movement in the medium to long-term scales.

When modelling the price spread between EUA and CER carbon prices, Nazifi (2013) does not find price convergence with the convergence test and Kalman filter test and hence fails to see a co-movement of carbon prices between different carbon markets. Zeng et al. (2020) find the existence of an asymmetric volatility spillover effect between the EUA and CER markets, corresponding to the long-term co-movement relationship between the China and EU carbon markets. They reach the conclusion that the EUA market has led the CER market in terms of information and spillover effects.

From Figs. 3, 4, 5, 6, 7 and 8, consistent with earlier findings, we find that there are medium- to long-term co-movement among the carbon prices of different trading centers when they are compared with Beijing, which is at the core in the integration of carbon markets, except that there is no co-movement relationship in the long-term scale of carbon prices of Guangdong and Tianjin in the first half of the period. It may because of the facts that the long distance and the irrelevance of representative industries between the two cities have led to inconsistency of the carbon prices. We see from Fig. 8 that the two prices exhibit co-movement after the trading mechanism runs for half of the period.

Since wavelet coherency cannot distinguish whether the time series have positive or negative co-movements, we subsequently adopt phase-difference analysis to examine the lead–lag relation between carbon prices, which is illustrated in the right half of Figs. 2, 3, 4, 5, 6, 7 and 8. We find a clear lead–lag relationship between Beijing and Tianjin from Fig. 6, as the phase-difference is in the domain of (0, π/2), and thus Tianjin leads Beijing. Given that the pilot scheme of Beijing and Tianjin covers different industries, the lead–lag relationship is easy to understand. When the oil and gas exploration sector covered by the Tianjin pilot scheme moves towards prosperity, the petrochemical sector covered by the Beijing pilot scheme will be affected. Hence, higher carbon emissions in Tianjin, which drive up the carbon price, also increase the carbon emission in Beijing and hence the carbon price of Beijing. Thus, there is a lead–lag relationship between the two markets that is discovered by wavelet analysis.

As we see from the figures, for other trading centers there is no consistent lead–lag relationship. Figure 2 shows that the phase-difference domain of Beijing and EUA mostly moves around 0, while Beijing leads Hubei most of the time since the phase-difference domain is generally located in (− π/2, 0), which is shown in Fig. 4. From Fig. 7, Tianjin leads Guangdong most of the time according to the location of the phase-difference domain. As shown in Fig. 3, the relationship between Beijing and Guangdong is much more complex, and their lead–lag role switches frequently.

Considering the different locations of the pilot schemes and the different mechanisms of allocation and trading, the lead–lag relationship between the pilot schemes is not very clear for some of them. Overall, it is surprising for us to find a long-term co-movement relationship between the pilot schemes. As a matter of fact, the barrier for China to establish a national carbon emission exchange is on the potential conflict between the regions covered by the trade scheme, since the development of some regions relies on traditional heavy energy-consumption industries. Hence, there may be structural disorder given the different characteristics of the regions. Although at the high-frequency level the trading behavior of hedgers and speculators results in no clear co-movement, there is indeed a long-term co-movement relationship between the pilot schemes, and hence there is stable mechanism underlying the different pilot schemes.

To utilize the feature of carbon markets of different pilot schemes towards the “2030” and “2060” goals, the China government should give the integration of the national carbon market a first priority. Since there exists a lead–lag relationship between different pilot schemes, an integrated carbon market may display a price movement of periodic ups and downs. Instability in the price movement may cause unpredictable carbon emission costs to firms in different regions and hence an increased risk to the financial status of firms and economic development of the whole region. Therefore, a crucial measure for risk management is to introduce futures on carbon emissions, which will perform a function of price discovery so as to make the pricing of carbon emissions more reasonable and provide a tool of risk management for firms.

Conclusion

The paper overall applies the technique of both cointegration with structural breaks and wavelet analysis to the price data of EUA and Chinese carbon markets and finds interesting results. From the long-run cointegration with structural breaks and the pattern of long-term co-movement verified by wavelet analysis, we are able to offer some policy implications. When external shocks cause structural breaks to the market, the government does not need to take any action, because the market mechanism will drive the price to equilibrium due to the long-term equilibrium between the two markets. For participants in the carbon exchange, given that the price movement of the two markets will converge to the long-term equilibrium in the future, the implication is that when there may be fluctuations caused by shocks to the market, they should not make irrational investment decisions by speculating on the direction of price movement. When participants of one carbon exchange are making investment decisions, whether the decisions are financial or tangible, they should look for price signals in the other exchange since the prices of the two exchanges will influence each other.

With the Paris Climate Agreement setting out the goal for global integration of carbon markets and China moving towards national integration of its domestic carbon markets, we investigate the co-movement of carbon prices within different markets. The investigation gives us a better understanding of carbon prices from the perspective of companies and investors. Our data mainly cover the period from 2013 to 2020, as China’s carbon markets began transacting in 2013.

The cointegration tests show a long-run relationship between the carbon prices of different carbon markets. We then adopt wavelet analysis to research features of the prices from the domains of time and frequency. In conclusion, we find co-movement in the long-run and a complex lead–lag relationship between the variables. Our conclusions provide important implications for governments, companies, and investors as follows.

First, the results indicate that a long-run equilibrium exists among carbon prices, which mean the variables maintain an interactive relationship, and that integration of carbon markets is feasible. The conclusion builds a solid basis for the China government to consider a national carbon trading mechanism, and we suggest that China take steps to construct a national carbon market so as to improve the efficiency towards carbon reduction and increase its pricing power in the global carbon market. However, many considerations need to be taken into account aside from the long-term co-movement of carbon prices. For example, different industries and different economic conditions may affect equity and efficiency between different regions. In this way, the differences in pilot schemes provide abundant evidence for policymakers to decide on the eventual trading scheme of the national exchange.

Second, firms can now understand the movement of carbon prices so as to save emission costs by setting up factories in places where the carbon price is low, thus benefitting the pace of manufacturing. For example, we know that the carbon price of Tianjin leads Beijing. If we observe a trend of reduction in Tianjin, then firms in Beijing can wait for a larger scale of production when the carbon price of Beijing goes down.

Third and finally, the co-movement and lead–lag relationship among carbon prices provide useful information to make predictions on the carbon price.

Limitation and Prospect of Research

First of all, due to discontinuity of the market data of different pilot schemes in China, we choose the longest continuous data, but this causes the amount of available data to be limited. Therefore, some pattern of carbon price movement may be overlooked. One possible solution to the limitation is to adopt an analyzing technique that is capable of dealing with discontinuous data. Second, there are several important carbon emission trading schemes globally, among which EU ETS is the most important one. We choose to research the relationship between the carbon price movement of EU and China, while neglecting any possible influence of other carbon markets. Hence, future research can focus on the carbon price movement of China and other countries.

Notes

“Cap and trade” is a common term for a government regulatory program designed to limit, or cap, the total level of emissions of certain chemicals, particularly carbon dioxide, as a result of industrial activity. The government issues a set amount of permits to companies that comprise a cap on allowed carbon dioxide emissions. The total limit (or cap) on pollution credits declines over time, giving corporations an incentive to find cheaper alternatives.

Department of International Organizations and Conference, “EU: The China–EU Investment Agreement will bring more certainty to European companies investing in China”; https://www.ndrc.gov.cn/fggz/gjhz/zywj/202103/t20210322_1270032_ext.html

Economic Information Daily, “A national carbon market is expected to be put into operation next year”; http://www.sasac.gov.cn/n2588025/n2588139/c16277408/content.html

The paper makes use of technical tools for exploring long-term relationships with cointegration with structural breaks and wavelet analysis since the tools analyze the price movement of the carbon markets and bring up relevant research conclusions. Instead, market tools are more concerned on the intrinsic value of the product, so that market tools adopt fundamental aspects such as economic conditions, etc. to infer the carbon price. As a result, the difference between China and EU's economy and the difference between China's different pilot schemes will cause fundamental analysis to be malfunctioned and unable to discover the relationship between the carbon prices. In the paper, we are interested about the long-term comovement between the carbon markets, so that a technical tool focusing on the price movement is more appropriate, as technical tools enable us to find the pattern of price movement and draw up conclusions on the comovement relationship.

References

Aguiar-Conraria L, Soares MJ (2011) Oil and the macroeconomy: using wavelets to analyze old issues. Empir Econ 40(3):645–655

Aguiar-Conraria L, Magalhâes P, Soares MJ (2012) Cycles in politics: wavelet analysis of political time series. Am J Polit Sci 56(2):500–518

Bataller MM, Chevallier J, Mignucci MH, Alberola E (2011) EUAand sCER phase II price drivers: Unveiling the reasons for the existence of theEUA–sCER spread. Energy Policy 39(3):1056–1069. https://doi.org/10.1016/j.enpol.2010.10.047

Böhringer C, Thomas FR (2017) US withdrawal from the Paris Agreement: economic implications of carbon-tariff conflicts. In: Discussion Paper 2017–89. Cambridge, Mass: Harvard Project on Climate Agreements

Chang CP, Lee CC (2008) Are per capita carbon dioxide emissions converging among industrialized countries? New time series evidence with structural breaks. Environ Dev Econ 13(4):497–515

Chang CP, Lee CC (2015) Do oils pot and futures prices move together? Energy Econ 50:379–390

Chang CP, Feng GF, Zheng M (2021) Government fighting pandemic, stock market return and COVID-19 virus outbreak. Emerg Markets Finance Trade. https://doi.org/10.1080/1540496X.2021.1873129

Chen S, Shi A, Wang X (2020) Carbon emission curbing effects and influencing mechanisms of China’s emission trading scheme: the mediating roles of technique effect, composition effect and allocation effect. J Clean Prod 264:121700

Chen YE, Li C, Chang CP, Zheng M (2021) Identifying the influence of natural disasters on technological innovation. Econ Anal Policy 70:22–36. https://doi.org/10.1016/j.eap.2021.01.016

Colla P, Germain M, Van Steenberghe V (2012) Environmental policy and speculation on markets for emission permits. Economica 79(313):152–182

Dhamija AK, Yadav SS, Jain PK (2018) Volatility spillover of energy markets into EUA markets under EU ETS: a multi-phase study. Environ Econ Policy Stud 20(3):561–591

Dong J, Ma Y, Sun H (2016) From pilot to the national emissions trading scheme in China: international practice and domestic experiences. Sustainability 8(6):522

Duan M, Pang T, Zhang X (2014) Review of carbon emissions trading pilots in China. Energy Environ 25(3–4):527–549

Dutta A, Jalkh N, Bouri E, Dutta P (2019) Assessing the risk of the European Union carbon allowance market: structural breaks and forecasting performance. Int J Manag Finance 16(1):49–60. https://doi.org/10.1108/IJMF-01-2019-0045

Feng GF, Yang HC, Gong Q, Chang CP (2021) What is the exchange rate volatility response to COVID-19 and government interventions? Econ Anal Policy 69:705–719. https://doi.org/10.1016/j.eap.2021.01.018

Graham M, Kiviaho J, Nikkinen J (2012) Integration of 22 emerging stock markets: a three-dimensional analysis. Glob Financ J 23:34–47

Gregory AW, Hansen BE (1996) Residual-based tests for cointegration in models with regime shifts. J Econ 70:99–126

Hu HQ, Wei W, Chang CP (2019) Do shale gas and oil productions move in convergence? An investigation using unit root tests with structural breaks. Econ Model 77(3):21–33

Hu Y, Ren S, Wang Y, Chen X (2020) Can carbon emission trading scheme achieve energy conservation and emission reduction? Evidence from the industrial sector in China. Energy Econ 85(C):104590

Huang Y, Dai X, Wang Q, Zhou D (2021) A hybrid model for carbon price forecastingusing GARCH and long short-term memory network. Appl Energy 285:116485

Jianwei E, Ye J, He L, Jin H (2021) A denoising carbon price forecasting method based on the integration of kernel independent component analysis and least squares support vector regression. Neurocomputing 434:67–79

Koch N, Fuss S, Grosjean G, Edenhofer O (2014) Causes of the EU ETS price drop: recession, CDM, renewable policies or a bit of everything? New evidence. Energy Policy 73:676–685

Lee J, Strazicich MC (2013) Minimum lm unit root test with one structural break. Econ Bull 33(4):2483–2492

Li ZP, Yang L, Li SR, Yuan X (2020) The long-term trend analysis and scenario simulation of the carbon price based on the energy-economic regulation. Int J Clim Change Strateg Manag 12(5):653–668. https://doi.org/10.1108/IJCCSM-02-2020-0020

Linn J, Muehlenbachsn L (2018) The heterogeneous impacts of low natural gas prices on consumers and the environment. J Environ Econ Manag 89:1–28

Liu J, Tang S, Chang CP (2021) Spillover effect between carbon spot and futures market: evidence from EU ETS. Environ Sci Pollut Res 28:15223–15235. https://doi.org/10.1007/s11356-020-11653-8

Lu W, Yin H (2012) An empirical study on the interaction between EUA futures, coal, natural gas and electricity. Int J Green Econ 6(1):1–16

MacKinnon JG (1996) Numerical distribution functions for unit root andcointegration tests. J Appl Econometrics 11(6):601–618

Meng B, Xue J, Feng K, Guan D, Fu X (2013) China’s inter-regional spillover of carbon emissions and domestic supply chains. Energy Policy 61:1305–1321

Nazifi F (2013) Modelling the price spread between EUA and CER carbon prices. Energy Policy 56(3):434–445

Pang T, Duan M (2016) Cap setting and allowance allocation in China’s emissions trading pilot programmes: Special issues and innovative solutions. Clim Policy 16(7):815–835

Rabe M, Streimikiene D, Bilan Y (2019) EU Carbon emissions market development and its impact on penetration of renewables in the power sector. Energies 12(15):2961. https://doi.org/10.3390/en12152961

Schreiber T, Schmitz A (1996) Improved surrogate data for nonlinearity tests. Phys Rev Lett 77(4):635–638

Shahbaz M, Khraief N, Mahalik MK, Zaman KU (2014) Are fluctuations in natural gas consumption per capita transitory? Evidence from time series and panel unit root tests. Energy 78(2):183–195

Sheng C, Wang G, Geng Y, Chen L (2020) The correlation analysis of futures pricing mechanism in china’s carbon financial market. Sustainability 12:7317. https://doi.org/10.3390/su12187317

Sui B, Chang CP, Jang CL, Gong Q (2021) Analyzing causality between epidemics and oil prices: role of the stock market. Econ Anal Policy. https://doi.org/10.1016/j.eap.2021.02.004

Sun L, Xiang M, Shen Q (2020) A comparative study on the volatility of EU and China’s carbon emission permits trading markets. Phys A Stat Mech Appl 560:125037

Vacha L, Barunik J (2012) Energy economics co-movement of energy commodities revisited: evidence from wavelet coherence analysis. Energy Econ 34:241–247

Wang Y, Chen W, Liu B (2017) Manufacturing/remanufacturing decisions for a capital-constrained manufacturer considering carbon emission cap and trade. J Clean Prod 140:1118–1128

Wang QJ, Chen D, Chang CP (2020) The impact of COVID-19 on stock prices of solar enterprises: a comprehensive evidence based on the government response and confirmed cases. Int J Green Energy. https://doi.org/10.1080/15435075.2020.1865367

Wang YW, Wang K, Wang QJ (2021) The Comovement between epidemics and atmospheric quality in emerging countries. Emerg Markets Finance Trade. https://doi.org/10.1080/1540496X.2021.1877133

Wen X, Bouri E, Roubaud D (2017) Can energy commodity futures add value to the carbon emission market. Econ Model 62:194–206

Wen J, Zhao XX, Chang CP (2021) The impact of extreme events on energy price risk. Energy Econ 2021:105308

Wu Y, Zhang C, Yang Y, Yang X, Yun P, Cao W (2020) What happened to the CER market? A dynamic linkage effect analysis. IEEE Access 8:62322–62333

Yu, L., Li, J. J., & Tang, L. (2015) Dynamic volatility spillover effect analysis between carbon market and crude oil market: A DCC-ICSS approach. Int J Glob Energy Issues 38(4/5/6):242–256

Zeng S, Jia J, Su B, Jiang C, Zeng G (2020) The volatility spillover effect of the European Union (EU) carbon financial market. J Clean Prod. https://doi.org/10.1016/j.jclepro.2020.124394

Zhang Z (2015) Carbon emissions trading in China: the evolution from pilots to a nationwide scheme. Clim Policy 15(supp. 1):104–126

Zhang D, Karplus VJ, Cassisa C, Zhang X (2014) Emissions trading in China: progress and prospects. Energy Policy 75:9–16

Zhang J, Li D, Hao Y, Tan Z (2018) A hybrid model using signal processing technology, econometric models and neural network for carbon spot price forecasting. J Clean Prod 204:958–964

Zhang W, Zhang N, Yu Y (2019) Carbon mitigation effects and potential cost savings from carbon emissions trading in China’s regional industry. Technol Forecast Soc Chang 141:1–11

Zhuang X, Wei Y, Zhang B (2014) Multifractal detrended cross-correlation analysis of carbon and crude oil markets. Phys A 399:113–125

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Rights and permissions

About this article

Cite this article

Wang, Y., Fu, Q. & Chang, CP. The Integration of Carbon Price Between European and Chinese Markets: What are the Implications?. Int J Environ Res 15, 667–680 (2021). https://doi.org/10.1007/s41742-021-00342-0

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41742-021-00342-0