Abstract

Understanding trends in regional house prices and whether they converge to a single steady state or form clusters are important issues. These trends have been studied at length in respect to advanced and emerging market economies (EMEs). However, the trends are not understood well in the context of a major and populous EME such as India, which can offer vital policy insights for other countries. Using residential house price data for fifty cities, this study showed that house prices do not converge to a single steady state in India. Rather these prices form three clusters wherein they converged to their respective steady-state paths and displayed conditional convergence. Higher initial house price, home loan, rent, population density and literacy were associated with an increased probability of higher house price club. City inflation, on the contrary, increased the chances of association with lower-price clubs. Similar dynamics of housing clusters can enable policymakers to probe the common driving factors and accordingly devise cluster-specific policy measures. There is no study, so far, on club convergence of house prices for India; so this study contributes to this gap in the literature.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Housing forms one of the core needs (food, cloth and shelter) of human beings. It also constitutes an important form of asset for house-owning households. This notion of housing as a wealth stock for households binds this sector intricately with economic activity. Changes in house prices are believed to influence the spending behaviour of households through the ‘wealth effect’.Footnote 1 In addition, the housing sector remains inter-linked with other sectors of the economy in a significant way. As the housing sector constitutes a significant chunk of the gross domestic product (GDP), a boom or bust in house prices could significantly influence economic activity. Sharper change in prices in the housing market could also become a source of vulnerability or crisis. The Great Recession, which essentially originated in the subprime mortgage market, is a case in point.

Furthermore, as housing forms a core component of retail inflation, changes in house prices have a bearing on inflation in the economy. Hence, policymakers attach high importance to monitoring house price movements. Besides, the financial stability and inflation concerns, maintaining house affordability for first-home buyers has also recently engaged the attention of policymakers for monitoring house price movements. In the case of New Zealand, the Monetary Policy Committee of its Central BankFootnote 2 considers house prices while making monetary policy decisions since early 2021.

House prices at the sub-national level are characterised by marked heterogeneity. Under perfect factor mobility condition over time, ceteris paribus, regional house prices are expected to converge to a long-run steady state. But, the presence of several rigidities may constrain the possibility of achievement of such a steady state. Notwithstanding this, the city house prices across regions may, however, in some way display a similar trend over time and converge to a particular steady state. This could be driven, inter alia, by initial conditions, migration, population pressure, etc. For a country, understanding regional differences in house prices and the associated dynamics may offer significant policy insights. Differences in house price behaviour across cities may also reflect regional income disparities (Apergis et al. 2015).

Several studies in the context of both advanced and emerging market economies have established the existence of club convergence in the mortgage markets. Club convergence implies that regional house prices form clusters within which they achieve convergence. In simple terms, within each club the dispersion of house prices declines over time.

An in-depth understanding of the differential behaviour of mortgage markets at the sub-national level can be significant to policymakers in devising targeted policy interventions.Footnote 3 Recognition of the fact that a group of sub-national mortgage markets may witness similar dynamics could enable policymakers in deciphering the underlying common driving factors and accordingly institute apposite policy measures. For a large country like India,Footnote 4 given the acute shortage of housing and its affordability, grouping cities based on price trends could enable policy authorities in making apposite demand and supply-side interventions. In addition, given the heterogeneity of regional mortgage markets in large countries, identification of similarly behaving clusters could guide policymakers better in stabilizing localized house price shocks through regionally differentiated policies. In this regard, Funke et al. (2021)Footnote 5 specifically highlighted the efficacy of sub-national macro-prudential policies (such as loan-to-value ratio) in stabilising house prices if they are region-specific and originate on the demand side. Information about housing club convergence could also be useful for financial stability (Matysiak and Olszewski 2019).

The evidence of club convergence behaviour of sub-national mortgage markets could also be useful for real estate investors, especially real estate investment trusts and other real estate fund houses. Identification of clubs could enable them in designing better fund diversification strategies. Furthermore, understanding and awareness of house club convergence at the regional level could also save modelling and forecasting efforts of the forecasters as the groups could be studied together. Such an analysis becomes all the more relevant for sheer-sized countries with a larger number of sub-national mortgage markets. Despite the significant merits of understanding club convergence behaviour of sub-national house prices for policy formulation, it has remained a less explored area, especially in the context of a large number of emerging market economies (EMEs), including India.

To the best of knowledge, there is no study, so far, on club convergence of house prices for India. This study, therefore, contributes to this literature gap. The present study attempts to investigate empirically if the housing market in India is characterised by a long-run equilibrium to which individual city house prices converge. If not, whether there are convergence clubs wherein the sub-groups with common trend converge to their steady states. In the process, the study also seeks to unravel the underlying factors that could be driving this behaviour.

Against this backdrop, this paper analyses the quarterly sub-national residential house prices data for 50 cities in India and implements log(t) test and clustering algorithm as suggested by Phillips and Sul (2007) and (2009). Findings suggest that sub-national house prices in India do not converge to a single steady state. Of the 50 cities, residential house prices of 48 cities form three distinct convergence clubs and the remaining two cities form a divergent group. The transition path of cities within a club may be quite distinct from one another. However, they display catching-up to the average transition path.

This paper is organised as follows. Section 2 lays down a synoptic literature review in this area. Data and methodological discussions are covered in Sect. 3. Characteristics and recent trends in house prices in India are covered in Sect. 4. Empirical estimation and relevant discussions constitute Sect. 5, and lastly Sect. 6 concludes.

2 Literature review

The regional house prices could, inter alia, be also influenced by the ripple effect of one region on other area(s). A large number of studies have investigated the dynamics of regional house prices. Earlier convergence studies used techniques such as unit root, cointegration, beta, sigma, dynamic panel data methods, etc. The heterogeneous transitional dynamics, nevertheless, may not get adequately captured through these conventional convergence tests. These conventional convergence methods do not perform well in the presence of heterogeneous transitional behaviour of cross-sections. The convergence methodology proposed by Phillips and Sul (2007) takes into account individual heterogeneity and transitional dynamics. This methodology is popular given its better performance vis-à-vis other conventional methods and accordingly has been used widely for studying house price convergence.

A number of studies have examined the issues of house price convergence across various economies. Akin to the convergence of house prices, few studies have also been undertaken in the context of understanding convergence in housing rentalsFootnote 6 at the sub-national level in respect of Poland and Germany. The club convergence of house prices has been studied extensively in respect of a number of advanced and EMEs; notably in respect of Eurozone countries, UK, USA, South Africa, Poland, Spain, China, Turkey, Australia, etc. [Apergis and Payne (2012); Kim and Rous (2012); and Apergis and Payne (2020); Holmes and Grime (2005); Montagnoli et al. (2015); Churchill et al. (2018); Bashar (2021); Blanco et al. (2016); Matysiak and Olszewski (2019); Maynou et al. (2020); Miles (2020); Maynou et al. (2021); Trojanek (2021); Tsai (2018); Kim (2011); Meng et al. (2015); Apergis et al. (2015); Ganioglu and Seven (2019); Ganioglu and Seven (2021); and Gunduz and Yilmaz (2021)].

Few notable studies examining club convergence of house prices in the case of the United States are that by Apergis and Payne (2012); Kim and Rous (2012); and Apergis and Payne (2020). Using quarterly house prices data for 1975q1 to 2010q4, Apergis and Payne (2012) reported three convergence clubs. Clubs I, II, and III consisted of 29, 19, and two states, respectively. Kim and Rous, op. cit. reported strong evidence of multiple convergence clubs. They also examined the general characteristics of the various convergent and divergent sub-groups as well as some important driving forces of convergence clubs. They found that housing supply regulation together with climate remained important determinants. Apergis and Payne (2020) explored the regional housing prices across 21 metropolitan areas of Florida (USA). Using quarterly house price data for 1987q2 to 2017q3, they report four convergence clubs.

In the case of the United Kingdom, Holmes and Grime (2005); and Montagnoli et al. (2015) examined the clustering behavior of UK cities. Holmes and Grime, op. cit. analysed the regional house price convergence for the thirteen regions using quarterly data for 1973q4 to 2005q1. They derived the largest principal component from regional house price differentials. This was found stationary suggesting a common stochastic trend driving regional house prices, which could be regarded as exhibiting strong long-run convergence. They observed a higher level of persistence in regional house price differentials. Montagnoli et al. (2015) analysed the quarterly house prices for 1983q1 to 2012q4 across twelve different regions of the United Kingdom and found that regions could be grouped into four clusters.

For Australia, Churchill et al. (2018) and Bashar (2021) analysed the clustering behavior of house prices across Australian cities. Churchill, op. cit. examined the issue of convergence in the residential property price index across the eight Australian cities from 2003q3 to 2017q4. They identified two convergence groups and one non-divergent group. Bashar, op. cit. examined convergence of regional house prices across 300 odd suburbs of the Melbourne metropolitan area in Australia. They found evidence for conditional convergence in presence of spatial effects as also population, employment, crime rate, and education.

A number of studies [Blanco et al. (2016); Matysiak and Olszewski (2019); Maynou et al. (2020); Miles (2020); Maynou et al. (2021); Trojanek (2021)] have been carried out in respect of clustering behavior of house prices across European countries. Blanco et al. (2016) attempted to identify convergence clubs in house prices among Spanish regions over the period 1995q1 to 2007q4 and investigated determinants. They found four groups for club convergence, which were influenced by initial house supply, population growth, size of the rental market, and geographical situation.

Matysiak and Olszewski (2019) investigated the evolution of residential property prices in sixteen major cities of Poland over the period 2007q1 to 2018q4 and found evidence for three convergence clubs. They also established that few demand and supply factors, in conjunction with initial price conditions, accounted for the club groupings.

Maynou et al. (2020) analysed the issue of house price convergence across the European countries, both members and non-members of Eurozone. They reported five convergence clubs for Europe, which, in turn, were driven by private debt, unemployment, and long-term government interest rate. Miles (2020) applied probabilistic pairwise approach for analyzing convergence across eurozone housing markets. They do not find strong evidence for house market convergence for eurozone countries. Maynou et al. (2021) examined the issue of convergence in house prices across the Eurozone countries using quarterly data for 2004q2 to 2016q3. They found evidence for five convergence clubs. They attribute unemployment and fiscal policy as the drivers of this clustering. Trojanek (2021) analysed 18 regional housing market for Poland. The study identified two house price convergence clubs in Poland for the period 2000q1 to 2019q4. However, in the split sample analysis for pre and post-Great Recession periods, the study identified four convergence clubs along with a number of divergent housing markets.

In contrast to the above studies for European countries, which established club convergence across the countries, Tsai (2018) reported the contrary. Tsai, op. cit. examined if the adoption of the Euro increased house price convergence amongst European countries. Using quarterly data for 1984q1 to 2015q1, for select EU and non-EU countries, Tsai, op. cit. reported that before the implementation of the Maastricht Treaty in 1992, house prices in European countries remained non-convergent, nevertheless, after 1992, it converged.

The clustering behavior of house prices has also been examined in the case of several emerging market economies as well. In the case of Korea, Kim (2011) established the existence of multiple convergence clubs for house prices. Meng et al. (2015) used monthly house price data for ten key cities in China (for the period from January 2005 to November 2013) and found evidence for four convergence clubs. In the case of South Africa, Apergis et al. (2015) examined the issue of the law of one price across the residential markets of nine provinces. They found that house prices in nine provinces did not converge to a single steady state, rather they formed three convergence clubs.

In the case of Turkey, notable work has been done by Ganioglu and Seven (2019) and Ganioglu and Seven (2021). Employing quarterly nominal house price data for 26 Turkish cities for the period 2010 to 2018 to see if the prices converged, Ganioglu and Seven (2019) reported prevalent heterogeneity in Turkey’s housing market. They reported the existence of seven convergence clubs and one divergent club. In a similar analysis, Ganioglu and Seven (2021) contended that income, population, education, refugees, earthquake zone, and unemployment explained the cluster behavior of the cities. Gunduz and Yilmaz (2021) analysed house price convergence across 55 major cities in Turkey for the period 2010q1 to 2018q4. They reported the role of population density, climate, employment rate, and metropolitan municipality in influencing convergence club membership.

On the whole, these studies have established the existence of club convergence in the sub-national housing markets of both the advanced and emerging market countries. Most of these studies have also suggested the determinants of such club convergence behavior of house prices, which could vary from one country to another. These studies have established several factors for club convergence of house prices, which could be listed inter alia as supply and demand factors, initial prices, housing supply, climate, private debt, unemployment, long-term government interest rate, population growth, size of the rental market, geographical situation, income, education, earthquake zone, and refugees.

In the context of housing study in India, available literature have, by and large, discussed, various aspects such as housing prices and its interaction with interest, income, bank credit, regulatory guidelines, monetary policy shocks, and macro-prudential regulation. Joshi (2006),Footnote 7 and Mahalik and Mallick (2011)Footnote 8 examined the influence of interest rates, income level, and bank credit on house prices in India. The influence of monetary policy on house prices has been examined by Singh and Pattanaik (2012)Footnote 9; Singh and Nadkarni (2017)Footnote 10; and Naikoo et al. (2021).Footnote 11 The response of house prices to macro-prudential regulation has been examined by Singh (2020) who reported that macro-prudential indicators such as loan-to-value (LTV) ratio, risk weights, and provisioning requirements also had a binding influence on housing price movements in India.

The literature on housing price convergence in the Indian context, nevertheless, is all the more scanty. The only available study is that by Aye et al. (2012) who used a panel unit root test on house prices (for the period 2007 to 2011) for 15 bigger cities reported that house prices did not converge in India. Nevertheless, there is no study, so far, in the Indian context, which has highlighted this issue of the club convergence behavior of regional house prices. This study, hence, contributes and fills this void in the literature. Besides establishing the club convergence of regional house prices, the study also unravels the factors influencing this.

3 Data and methodology

3.1 Data

Currently, two public sector agencies, viz., National Housing Bank (NHB) and the Reserve Bank of India (RBI) are involved in the release of housing price data in India. The housing price index released by the NHB is called the RESIDEX. Comparatively,Footnote 12 the NHB RESIDEX has wider geographical coverage of 50 cities (of which 33 are smart cities) located across 21 states.Footnote 13 Based on the wider coverage of data for a large number of cities, NHB data has been used in this study.

Ipso facto, the first official statistics on house prices in India was released by the NHB in 2007.Footnote 14 Since its launch, the NHB has updated the base year four times—the current base year being 2017–18 since June 2018.Footnote 15 The NHB house price index is computed using the base year quantity using the Laspeyres’ index method. The city-wise house price index (HPI), calculated for the 50 cities, is weighted, based on 2011 census population, to derive the composite HPI.

The NHB releases two house price indices. Assessment price of ready residential properties is based on valuation data as received from the banks and housing finance companies, while the market price for under-construction properties derives from the market survey of project financing details of the banks and HFCs for collecting data in respect of unsold stock. Besides the house price indices, the NHB also releases four-quarter moving average city-wise house assessment prices—INR per square foot. The city-wise assessment price was used in the study. For empirical estimation, the nominal house price data was deflated by city inflationFootnote 16 derived from the Government of India. Mortgage loan from the banks were sourced from the RBI, which was then deflated by a number of loan accounts. Data on population density, literacy and house rentFootnote 17 were sourced from the Government of India (Table 1).

3.2 Methodology

The heterogeneous transitional dynamics may not get adequately captured through conventional convergence tests such as unit root, cointegration, beta, sigma, dynamic panel data methods, etc. These conventional convergence methods do not perform well in the presence of heterogeneous transitional behaviour of cross-sections. The convergence methodology proposed by Phillips and Sul (2007) is a non-linear time-varying factor model that accounts for individual heterogeneity and transitional dynamics. It involves a one-sided t-test in which the null hypothesis of convergence is considered against the alternate hypotheses of partial convergence amongst sub-groups or divergence [Phillips and Sul (2009)]. Given its inherent advantages and better performance, this method has been widely used in a number of related studies as stated earlier.

A panel data series Xit may be decomposed into a permanent (git) and a transitory component (ait) as follows:

Hodrick and Prescott (HP) (1997) has been one of the most popular and widely used filters for extracting trend and cyclical components from time series data. Over time, there have been several discussions on its pros and cons. Phillips and Shi (2021) highlight that the conventional HP-fitted trend generates a residual trend, which contaminates the cyclical component. They proposed an iterative and easy-to-implement modification of the HP filter (based on machine learning), which makes it more effective in fitting and elimination of trend components. This method enhances the efficacy of the HP filter and is called as boosted HP filter.Footnote 18 Phillips and Shi, op. cit. contend that as the filtered cyclical components (obtained from the conventional HP filter) may retain trend elements, the data is fed into the filter again for cleaning the leftover elements. The process is repeated until the trend elements are completely removed. As per convention, the smoothing parameter, λ, was set at 1600 for quarterly data.

Since both the said components have a common factor (µt), Eq. (1) could be rewritten as:

where δit is a time-varying idiosyncratic element, which captures the deviation of series i from the common component (µt), which is common (say a technological development available to all) across cross-sections. δit are individual transition factors measuring as to how the cross-sections relate to µt over time.

In this framework, the panel entities are expected to converge (either in the full sample or in some clusters) to a steady state at some future point if \(\underset{k\to \infty }{\mathrm{lim}}{\delta }_{it+k}= \delta\) for all i = 1,2,….., N. The transition paths of different panels could be significantly different. Since δit cannot be estimated directly from Eq. 2, the common component µt is eliminated through rescaling by the cross-sectional average:

where hit in the above equation is relative transition parameter. It measures the relative share of the factor loading, δit, in respect of individual cross-section at time ‘t’ and captures the transition path with respect to the panel average.

Furthermore, cross-sectional variance of hit is measured as Ht, which is defined as follows:

For the convergence, the following semi-parametric form of δit is assumed:

where \({\sigma }_{it}= \frac{{\sigma }_{i}}{L(t){t}^{\alpha }}\) ; σi > 0, t ≥ 0, and εit is weakly dependent over t.

L(t) is a slowly varying function like log(t). And, L(t) → ∞ as t → ∞.

The average difference between δit and δi is expected to decline overtime. This decline occurs at a proportional rate of the inverse of tαL(t).

Under the above specific form of δit, convergence is ensured if δi = δ. In the event of δi = δ, hit converges to 1 and Ht tends to 0.

The convergence can be tested in the framework of the following log t regression:

The convergence hypothesis can be tested by the null hypothesis of b = 0 in the equation above. Rejection of the null hypothesis of Eq. (6) above implies non-convergence or divergence. As such, there could be clusters within which a few entities could be converging and also some divergent members in the panel. Absolute (level) convergence is achieved if b ≥ 2. Relative (conditional) convergence is achieved if 0 < b < 2.

After testing the null hypothesis (considering entire panel), clustering algorithm as proposed by Phillips and Sul (2007 and 2009) is implemented following the suggested four steps:

-

(a)

Step 1 involves ordering the cross-section based either on the basis of last observation of the average of the second half of the observations.

-

(b)

Step 2 implicates forming a core group from the cross-sections such that they form a sub-group for 2 ≤ k ≤ N and tested using the log t regression for that sub-group. The core group size is chosen by maximising tk over k subject to min {tk} >—1.65.

-

(c)

Step 3 is associated with sieving the data for new club members by adding one cross-section at a time to the core group so formed and running log t regression again. Keep adding new cross-sections if the associated t-statistics exceed the critical value.

-

(d)

Step 4 is about the recursion and stopping rule. From the cross-section not selected in Step 3 constitute a sub-group and run the log t regression for this sub-group to see if it satisfies the convergence test. In case it satisfies the convergence condition, then conclude that there are two convergence clusters. Otherwise, replicate steps 1–3 to see if the second group itself can be divided into sub-groups. In case there is no core group in Step 2, then the remaining cross-sections are deemed to diverge.

4 House prices in India—characteristics and recent trends

In India, the real estate sector accounted for 6.7 percent of the GDP in FY 2021. Owing to its significant interlinkages with manufacturing, construction, financial services and other sectors, it is the second largest employment-generating sector (around 55 million jobs), next to agriculture, in the country. Given its larger economic significance, understanding the dynamics of this sector can offer vital policy lessons. Another compelling reason for studying the Indian residential house market is the fact that the country accounts for six of the world’s top twenty most populated cities (Fig. 1). Hence, a study of the Indian property market could help better understand the influence that population pressure could have on house prices in a larger economic setting. Another dimension that makes the study of the Indian real estate market topical is the fact that one of its cities, Mumbai,Footnote 19 is portrayed as one of the most expensive real estate markets in the world. Mumbai, having the most expensive real estate market, remains an outlier in the country. As such, this study enables a better understanding of the convergence dynamics of sub-national house prices in presence of outlier cities.

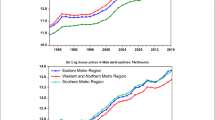

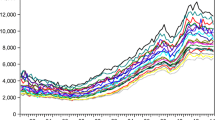

The sub-national Indian housing market is characterised by significant heterogeneity. This heterogeneity could emanate from socio-economic, locational, climatic, and other factors. The residential property prices in metro cities in India remain higher than those in non-metro cities (Fig. 2). Mann–Whitney test validates the significant difference in house prices across metro and non-metro cities in India.Footnote 20 There also remains significant variation in property prices across various regions of the country (Fig. 3). Kruskal–WallisFootnote 21 test validates significant differences in residential property prices across the regions. The Western region has the highest median house prices, while the Central region has the lowest median. In addition, residential property prices across 50 cities depict distinct trends (Fig. 4).

Besides, there remains a significant disparity in the sub-national residential house prices in the country. Amongst the 50 cities, average house prices remained the highest in Mumbai and the lowest in Meerut; with the price in the former being roughly seven-times the latter (Fig. 5). Furthermore, the house prices in Mumbai remained one-and-a-half times that of Thane, the city with the second highest house prices. In addition, many cities in India are characterized by lower residential house prices than the national average. Average house prices (for the period 2013q2 to 2021q3) in only 13 cities remained higher than the national average. There also remains a significant disparity in residential house prices across metro cities. Residential house prices in three metro cities such as Kolkata, Hyderabad and Ahmedabad, remained even lower than the national average (see Fig. 5).

The heterogeneous behavior of sub-national residential property prices in India was very much evident even during the covid-19 pandemic, which can be considered as a common shock. Asymmetric quarter-on-quarter and year-on-year changes in residential house prices across cities in 2020q3 (just the quarter following the covid-19 lockdownFootnote 22) was observed. While house prices increased in some cities, it declined in others (Figs. 6 and 7).

Moving away from a heterogeneity of housing prices at a sub-national level, we now discuss the trend in house prices in India in the last couple of years. The residential property market in India has been lacking traction in the last couple of years. The residential housing market, in India, lacked significant activity even before the pandemic in line, inter alia, with lackluster growth in the last couple of years and a huge stock of unsold residential house inventories. Hence, house prices in India have witnessed significant correction. In real terms, house prices in IndiaFootnote 23 have continued the slump even after the outbreak of covid-19. This experience of the residential house market of India stands in contrast with many of the advanced economies wherein the residential housing segment boomed during the covid-19 pandemic (Fig. 8).

The correction in property prices in India in recent years has helped improve residential house affordabilityFootnote 24 across many cities (Fig. 9). Karmali and Weng (2022)Footnote 25 also highlight the improvement in house affordability in India. The improvement in house affordability is good given the significant urban housing shortagesFootnote 26 in the country (Fig. 10). The affordability could have benefitted, inter alia, from near stagnant or correction in residential house prices, softer interest rate regime, and higher disposable income, especially in the pandemic period. Nevertheless, Mumbai remains unaffordable despite marked improvement in affordability statistics.Footnote 27

Source: Government of India (2013)

Urban housing shortage in India (2012) (in millions).

5 Empirical estimation

Descriptive summary of the variables used in the estimation is as follows (Table 2). As discussed in the preceding sections, Phillips and Sul (2007) log(t) convergence test was undertaken.Footnote 28 This suggests the rejection of the null hypothesis of the convergence of residential prices of the cities to a single price levelFootnote 29 (Table 3). Rejection of the null hypothesis of convergence, however, does not rule out the convergence of sub-groups or divergent members in the full panel [Phillips and Sul (2007)]. Further, the possibility of convergence to respective steady states at the sub-groups level was explored.

Initially, cluster analysis suggested the existence of five clubs (Table 4). The regression coefficients for all five clubs are found significantly positive suggesting support for club classification. Following the clustering procedure, further possibilities were explored if the proximate clubs could be merged to form larger convergence clubs. Merger analysis suggests that clubs (1 and 2) and clubs (3 and 4), could be merged, respectively (Table 5). In both the club classifications, Mumbai and Thane (having the most expensive real estate market in the country) form a divergent group.

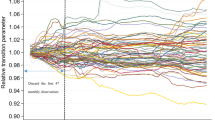

The cities, finally, have been categorised into three different clubs as per the trend in house prices (Table 6 and Figure A1). Club 3 exhibits a higher speed of convergence followed by club 2 and club 1. It is noteworthy that the club of cities so formed do not share contiguous geographical location—as one would expect that cities located closer to each other (say within a state) would witness similar price dynamics. Nevertheless, evidence from studies across different countries suggests that club membership in cities or regions need not necessarily be driven by geographical neighbourhood. In this regard, Kim and Rous (2012) contend that usual concepts of economic areas (say, census region) may not be best suited to study regional differences in house prices. Gunduz and Yilmaz, op. cit. also highlighted the non-conformity of convergence clubs to conventional geographical regions of the country.

The divergent group is characterised by the highest level of residential prices (Fig. 11). Club 1 comprising of the metro cities, barring Mumbai, displays the highest level of residential prices followed by club 2 and club 3, respectively.

Figures 12a–c display the transition paths of city residential prices in the respective clubs. City-house prices within the clubs may display distinct transition paths. But, they display a tendency of catching-up to the average transition path and convergence within the respective clubs. Figure 12d shows the average transition paths of respective clubs.

Having explored the club convergence of the cities, we now examine the factors that could drive this. Initial situation, the evolving conditions and dynamics in the cities could provide push and pull factors in such club formation. Based on data availability, we focus on six factors that could contribute to the club formation of the cities. Initial residential price of the city, house rent, home loans, population density, literacy and city inflation were considered to gauge if they had a binding influence on the club formation. All the said variables, barring the city inflation, were found to be the highest for club 1 followed by clubs 2 and 3 (Table 7).

For exploring the determinants of club formation, ordered probit model was estimated. The clubs were ranked based on the average prices for the said period in ascending order (club 1 having the least price). A set of variables such as initial house price, house loans, rent, population density, literacy and inflation were considered. A city with higher initial prices, ceteris paribus, is expected to have an inertial higher price and accordingly qualify into a higher price club. Larger quantum of house loan is expected to fund home buying in a city having relatively higher real estate prices. A city in a higher price residential club is expected to have higher rental levels. This is corroborated in the Indian case wherein residential rentals in select cities were found to be positively associated with house prices (Fig. 13). Increased population pressure is expected to create higher demand for housing and, thereby, higher house prices. Higher literacy is positively associated with income, which improves house affordability. Hence, increased literacy is expected to have a salutary influence on house prices. City inflation in the club of cities with a higher level of house prices was found to be relatively lower than that of the club with lower house prices (see Table 7). Hence, higher city inflation increases the probability of membership in cities with relatively lower prices. The estimation result is produced in Table 8, which is on the expected lines.

The estimated marginal effects show the impact of each variable on the change in the probability of belonging to a club. These are also on the expected lines. Increase in initial price increases the probability of higher residential price club membership while decreasing the probability of lower residential price clubs membership (Table 9). The same logic applies in the cases of loan, rent, population density, and literacy wherein any increase in the explanatory variables is associated with a rise in the probability of higher house price club membership. On the contrary, as expected, an increase in city inflation is found to have a higher chance of being associated with lower-price clubs.

6 Concluding observations

While studies on regional house price convergence have been undertaken in respect of advanced economies and a few emerging market countries, literature remains scarce in respect of some significant and large EMEs like India. This study seeks to bridge this gap. In the present study, an analysis of house prices in 50 cities in India was undertaken. It was found that the city residential house prices across the country do not share homogenous movements. As such, they do not converge to a unique steady state. Rather, we found evidence that the cities form distinct clubs wherein they exhibit a tendency for conditional convergence.

Of the fifty cities, 48 cities were found to form three distinct clubs wherein the house prices converged to their respective steady-state paths. Two cities, with the highest level of residential house prices, were found to form a divergent group. The convergence club of cities (based on residential prices) are not found to share geographical contiguity. The transition path of cities within the clubs are quite distinct from one another, nevertheless, they display catching up to the average transition path.

To explain the drivers of club formation of cities, an ordered probit model was estimated. Initial residential price of the city, house rent, home loans, population density, literacy and city inflation were found to be the determinants facilitating club formation. An increase in initial house price, home loan, rent, population density, and literacy was found to be associated with an increased probability of higher house price club membership. City inflation, on the contrary, was found to have increased chances of being associated with lower-price clubs.

The findings relating to diverse behaviour of house prices at sub-national level and recognition of the fact that within cluster(s) the regional house prices may witness similar dynamics could enable policymakers in probing the common driving factors and accordingly devising apposite policies. An important policy implication arising from this study is that given significant heterogeneity of house price trends at the sub-national level, the regional house prices could be at variance from one another as also against the national trend. Hence, implementation of nation-wide uniform regulatory policy may not be apposite, especially in the context of geographically large-sized countries. In this regard, the identification of housing clusters could guide policymakers better in stabilizing demand-driven localized house price shocks through regionally differentiated policies. Funke, op. cit. estimated a two-region dynamic stochastic general equilibrium (DSGE) model and highlighted the efficacy of sub-national macro-prudential policies in reducing the variance of house prices in the case of the United Kingdom.

This study of the residential house market of a large emerging market like India could offer several insights for other economies. From the sub-national housing price dynamics in a large and populous county like India, one can appreciate better the influence of population pressure on mortgage prices. Furthermore, for a large country such as India, given the acute shortage of housing and concerns relating to affordability, grouping cities based on price trends could enable policymakers to devise apposite policy interventions.

The study considered select variables (based on the availability of reliable data) for understanding the determinants of sub-national house price convergence in the Indian context. Housing inventory also has a significant influence on house prices. Nevertheless, owing to the unavailability of credible (official) data on housing stock, it could not be included in the present analysis. Future studies may be undertaken to bridge this gap when such reliable data is available. Furthermore, given the paucity of literature in the area, it is also important that more studies as this are undertaken for India on different aspects of housing dynamics.

Data availability

All the data used in this study is available in the public domain. The individual sources of data availability is mentioned in data section and Table 1.

Notes

A behaviourial theory suggesting that higher house prices cause a rise in value of people’s asset holdings (wealth) and, in turn, encourage them to spend more, which boosts economic activity and growth.

Since March 2021, as per the Government’s direction, the Monetary Policy Committee of the Reserve Bank of New Zealand (RBNZ) is required to assess how its interest rate decisions and other policy instruments (at its disposal) affect the government’s objective of house price sustainability. Furthermore, the RBNZ has also been directed to dampen investor demand so as to improve house affordability of first-home buyers. (See https://www.rbnz.govt.nz/).

See Matysiak and Olszewski (2019).

As per the World Bank data, India has the second largest urban population in the world, after China. There remains a significant shortage of housing in urban areas in the country. As per the Government of India (2013), 14.99 million households in urban areas lived in congested houses requiring new houses. Furthermore, another 3.79 million urban households either did not have any house or they lived-in houses, which were inhabitable or obsolete.

They analysed sub-national house price dynamics in a multi-regional DSGE model for the UK economy. Their findings suggest that given significant regional house price differences in the Great Britain, regionally differentiated macro-prudential policies achieve better policy outcome than the ‘one-size fits-all’ national policy.

He estimated a structural VAR model and found that interest rate and non-food credit accounted for more than two-thirds of forecast variance in house prices in India, which remained more important than income.

They estimated a vector error correction model and found that while income had positive influence on house prices in India, real non-food bank credit had an adverse impact.

They investigated asset prices and monetary policy interactions and reported interest sensitivity of housing credit demand in India.

They found that monetary policy and bank credit shocks had a dominant role in influencing stock and house prices, respectively.

He found that monetary policy shocks did not have a significant impact on house prices in India.

The housing data published by the RBI covers just 10 bigger cities.

NHB (2020).

In 2005, the NHB first conducted a pilot study in Mumbai, Delhi, Bangalore, Bhopal and Kolkata before officially launching the NHB residex based on the house price data for these five cities on half-yearly basis, to begin with. Subsequently the coverage of NHB residex was widened to 26 cities and 2007 base year chosen. Since 2017, when the base year was shifted to 2012–13, the NHB has been publishing house price data in respect of 50 cities.

Previous base years have been 2001, 2007, and 2012–13.

In case of unavailability of inflation data for few cities, the inflation of proximate city was considered.

House rent data was not available for 2020q2 owing to data collection issues during the lockdown.

As per Knight Frank’s Prime International Residential Index, as in December 2018, Mumbai remained the 16th most expensive prime residential property market in the world.

p-value = 0.00.

Chi2 = 281.5 (p-value = 0.0001).

Nation-wide lockdown was enforced in India in four phases from March 25, 2020 to May 31, 2020 for preventing the spread of covid-19 pandemic in the country. Subsequently, unlocking of economy was undertaken in a phased manner, which lasted for a year or so.

Owing to different base years, etc. y–o-y growth figures reported by the BIS could differ from that of the RBI and the NHB.

This is based on Knight Frank Affordability Index. The index indicates the proportion of household income that would be required to fund the equated monthly instalment (EMI) of a house purchased through mortgage loan.

They find that income elasticity of house demand is high in India and therefore advocate that public policy interventions should essentially be more on the supply side rather than demand side. Supply-side interventions could aim at increased level of housing supply through better service infrastructure and amenities such as water, sanitation, and connectivity.

A Technical Group constituted by the Ministry of Housing and Urban Poverty Alleviation had estimated urban housing shortage in the country on the number of households, available housing stock, acceptable housing stock, overcrowding/congestion in the existing dwelling units and obsolescence factor by using the Census 2011 data.

Beyond the threshold of 50 percent, EMI to income ratio is considered unaffordable. This, broadly, remains the limit adhered to by the banks in the loan process (Knight Frank 2021).

As suggested by Phillips and Sul (2007), a small fraction of data (r = 0.3) to be discarded was considered in the algorithm.

The log(t) test results are similar, both with the conventional HP and booster HP filtered house price data.

References

Apergis N, Payne JE (2012) Convergence in US house prices by state: evidence from the club convergence and clustering procedure. Lett Spat Res Sci 5(2):103–111

Apergis N, Payne JE (2020) Florida metropolitan housing markets: examining club convergence and geographical market segmentation. J Hous Res 28(2):145–163

Apergis N, Simo-Kengne BD, Gupta R (2015) Convergence in provincial level South African house prices: evidence from the club convergence and clustering procedure. Rev Urban Reg Dev Stud 27(1):2–17

Aye, Goodness C.; Samrat Goswami; and Rangan Gupta (2012). Metropolitan house prices in India: Do they converge?, University of Pretoria Department of Economics Working Paper Series, 2012–20, June.

Bashar OHMN (2021) An intra-city analysis of house price convergence and spatial dependence. J Real Estate Financ Econ 63(4):525–546

Blanco F, Martin V, Vazquez G (2016) Regional house price convergence in Spain during the housing boom. Urban Stud 53(4):775–798

Churchill SA, Inekwe J, Ivanovski K (2018) House price convergence: Evidence from Australian cities. Econ Lett 170:88–90

Knight Frank (2021). India Real Estate, July-December.

Funke M, Mihaylovski P, Wende A (2021) Out of sync sub-national housing markets and macro-prudential policies in the UK. De Econ 2021(169):445–467

Ganioglu, Aytul; and Unal Seven (2019). Convergence in house prices: Cross-regional evidence for Turkey, Central Bank of the Republic of Turkey Working Paper No: 19/14, May.

Ganioglu A, Seven U (2021) Do regional house prices converge? evidence from a major developing economy. Cent Bank Rev 21(2021):17–24

Government of India (2013). State of Housing in India: A Statistical Compendium, Ministry of Housing and Urban Poverty Alleviation.

Gunduz L, Yilmaz MK (2021) Club convergence and drivers of house prices across Turkish cities. Int J Emerg Mark. https://doi.org/10.1108/IJOEM-10-2020-1157

Himanshu J (2006) Identifying asset price bubbles in the housing market in India-Preliminary evidence. Reserv Bank India Occas 27(1):73–88

Hodrick RJ, Prescott EC (1997) Post-war US business cycles: an empirical investigation. J Money Credit Bank. https://doi.org/10.2307/2953682

Holmes, Mark J.; and Arthur Grimes (2005). Is there long-run convergence of regional house prices in the UK?, Motu Working Paper 05–11, August.

Karmali, Nadeem M.; and Xinyu Weng (2022). Housing demand and affordability in India: Implications for housing policy, Policy Research Working Paper 10031, World Bank.

Kim YS (2011) Housing price convergence in Korea: Do purchase price and jeonse price have in common? J Korean Econ 12(1):211–238

Kim Y, Se; and Jeffrey J. Rous, (2012) House price convergence: evidence from US state and metropolitan area panels. J Hous Econ 21(2012):169–186

Laia M, Monfort M, Morle B, Ordonez J (2021) Club convergence in European housing prices: The role of macroeconomic and housing market fundamentals. Econ Model 103:105595

Mahalik M, Mallick H (2011) What causes asset price bubble in an emerging economy? Some empirical evidence in the housing sector of India. Int Econ J 25(2):215–237

Matysiak, George A.; and Krzysztof Olszewski (2019). Panel analysis of Polish regional cities: Residential price convergence in the primary market, National Bank of Poland Working Paper, July.

Maynou, Laia; Mercedes Monfort; Bruce Morley; and Javier Ordonez (2020). House price convergence across Europe, Universitat Jaume I Working Papers No. 2020/7, Castellon (Spain).

Meng H, Xie WJ, Zhou WX (2015) Club convergence of house prices: evidence from China’s ten key cities. Int J Modern Phys B 29(24):1550181

Miles W (2020) House price convergence in the euro zone: A pairwise approach. Econ Syst 44(3):100782

Montagnoli A, Nagayasu J (2015) UK house price convergence clubs and spillovers. J Hous Econ 30:50–58

Naiikoo MW, Peer AH, Ahmed F, Ishtiaq M (2021) Monetary policy and housing prices dynamics in India. Eurasian J Bus Econ 14(27):47–61

NHB (2020). White Paper on NHB RESIDEX Methodology, National Housing Bank (NHB).

Phillips PCB, Shi Z (2021) Boosting: why you can use the HP filter. Int Econ Rev 62(2):521–570

Phillips PCB, Sul D (2007) Transition modeling and econometric convergence tests. Econometrica 75(6):1771–1855

Phillips PCB, Sul D (2009) Economic transition and growth. J Appl Econ 24:1153–1185

Semerikova E, Nastansky A, Blokhina A (2022) Convergence in German regional housing markets. High Sch Econ Econ J 26(1):120–144

Singh, Bhupal; and Avadhoot R. Nadkarni (2017). How asset prices interact with bank credit and monetary policy? Evidence from emerging market and developing economies, RBI Working Paper Series, WPS (DEPR): 01/2017.

Singh B, Pattanaik S (2012) Monetary policy and asset price interactions in India: should financial stability concerns from asset prices be addressed through monetary policy? J Econ Integr 27(1):167–194

Tomal M (2021) Testing for overall and cluster convergence of housing rents using robust methodology: evidence from Polish provincial capitals. Empir Econ 62:2023–2055

Trojanek R (2021) Housing price cycles in poland – the case of 18 provincial capital cities in 2000–2020. Int J Strateg Prop Manag 25(4):332–345

Trojanek R, Gluszak M, Kufel P, Tanas J, Tojanek M (2022) Pre and post-financial crisis convergence of metropolitan housing markets in Poland. J Hous Built Environ. https://doi.org/10.1007/s10901-022-09953-1

Tsai IC (2018) House price convergence in euro zone and non-euro zone countries. Econ Syst 42:269–281

Acknowledgements

We are especially grateful to Unal Seven (The Central Bank of the Republic of Turkey) for discussing this paper in a research seminar organized by the Banque de France. Authors are also thankful for comments in the DGSEI seminar at the Banque de France. Comments from Remy Lecat are also acknowledged. Views of authors are personal and not that of their affiliated institutions.

Funding

This is to certify that no funding has been received by the authors for this paper.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no conflicts of interest to declare.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

DGSEI, Banque de France: On secondment from the Reserve Bank of India, India.

Supplementary Information

Below is the link to the electronic supplementary material.

About this article

Cite this article

Rajesh, R., Rath, D.P. House price convergence: evidence from India. Asia-Pac J Reg Sci 7, 721–747 (2023). https://doi.org/10.1007/s41685-023-00285-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41685-023-00285-8