Abstract

With rapidly accelerating real estate prices in China, the government has used changes in deed tax rates to affect demand. Tax rates have been increased for buyers of large or multiple homes to discourage speculative demand. We analyze the effects of deed tax rates on real estate prices over the period 2004–2013, estimating traditional dynamic models and dynamic spatial models. Results indicate that deed tax rate increases have a negative effect on pre-tax prices for both residential units and land use rights. Spatial spillover effects are also found in the residential market, with larger effects in the long term.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

China’s real estate market has experienced booms and busts over the past 2 decades. Widespread economic development and increases in disposable income have fueled increased demand for real estate in general, although the pace of growth has been uneven across regions. Residential units, in particular, have generally experienced unprecedented increases in demand. Real estate prices almost doubled over the 10-year period 2004–2013. According to data from the China Statistical Yearbook, the average real price of real estate units of all types increased from 2778 to 4779 Yuan/m2 in mainland China from 2004 to 2013. Beijing and Shanghai experienced much faster increases in real estate prices than the national average. From 2004 to 2013, prices of real estate units of all types increased from 5053 to 18,544 Yuan/m2 in Beijing and from 5855 to 16,411 Yuan/m2 in Shanghai.Footnote 1

Given the rapidly changing real estate market environment, an important policy tool implemented by the Chinese government to influence the housing market has been changes in deed tax rates. The government has manipulated deed tax rates, to stimulate sales during weak economic times and stabilize prices during periods of fast growth. The changes have also been used differentially across provinces, depending on housing market conditions. The policy intent of increases in the deed tax rate has been to stabilize real estate markets by setting a higher tax rate for buyers of large homes or buyers of more than one home, thereby discouraging speculative demand. Reductions in deed taxes have been intended to boost housing demand during slower economic conditions and regions. Provinces and regions have adopted the following ratesFootnote 2:

Beijing, Tianjin, Shanxi, Inner Mongolia, Shanghai, Zhejiang, Fujian, Shandong, Guangdong, Guangxi, Hainan, Chongqing, Yunnan, Guizhou, Shaanxi, Qinghai, Gansu, Ningxia, Xinjiang: 3%.

Hebei, Jiangsu, Anhui, Jiangxi, Henan, Hubei, Hunan, Sichuan: 4%.

Heilongjiang, Jilin: 5% for commercial houses; 4% for other items.

Liaoning: 4% for commercial houses; 3% for other items.

Tibet: This tax is not levied currently.

In this paper, we compute average deed tax rates by province and year for all classes of real estate and analyze the effect of those rates on real estate prices in China over the 10-year period 2004–2013. Our analysis indicates that increases in the deed tax rate have a negative effect on pre-tax prices in a stock-flow market framework. By estimating dynamic models and the dynamic spatial models, we find that increases in the deed tax rate have a significant negative effect on prices of the pooled real estate units, residential units, and land use rights. We find that deed tax rates significantly affect prices of residential units, but not prices of office-use and business-use types of real estate. The finding is not surprising since all changes in deed tax rates have been applied exclusively to residential transactions. We also find provincial spillover price effects from deed tax rates in the residential market, with larger effects in the long term. Our findings provide evidence that deed tax policy changes have significantly affected real estate prices, and have done so in the intended direction.

1.1 Real estate market background

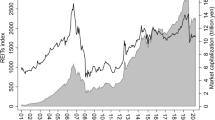

High prices in the real estate market, especially in the residential market, have drawn both Chinese authorities’ and individuals’ attention. The residential market is directly related to home-ownership of households and comprises about 80% of the real estate market in China. Figure 1 shows the real national average residential prices for the 30 provinces and direct-controlled municipalities in mainland China between 2004 and 2013.Footnote 3 Residential prices have been persistently increasing in China, on average. Figure 1 shows real average residential prices for the 30 provinces and direct-controlled municipalities in mainland China over the same 10-year period. Price increases were common in all 30 Chinese regions during that period. Interestingly, the cities of Beijing, Shanghai and Tianjin, and province of Zhejiang experienced notable fluctuations during the period of an increasing trend in housing prices. Those are also the regions with higher housing prices. The downturns of 2008 and 2010–2011 may be attributed to the global recession and the economic slowdown in China, respectively. The persistent increases in housing prices show potential autoregressive patterns over time.

In addition to economic conditions, housing prices in China are also affected by policy changes that affect the real estate market. Down payment requirements, interest rates, restrictions on foreign ownership, and other government policies also influence prices. For our purposes, a notable example is the change in deed tax policy at the end of 2010, which was intended to discourage speculative demand by increasing tax liabilities for buyers of large homes or multiple home units (i.e., apartments or houses).

Figure 2 is a heat map of residential real estate prices in China in 2013. In general, regions on the east coast of China have much higher housing prices than other regions. Cities like Beijing and Shanghai had the highest housing prices among all regions. Tianjin, contiguous to Beijing, also had relatively high housing prices. Shanghai was the central driving force of the high housing prices clustered on the east coast. In Central China, Chongqing is contained in a relatively high housing price cluster compared to the surrounding areas. Simply looking at the heat map, we suspect that there may be spatial correlation in regional housing prices.

1.2 Policy approaches to influence real estate prices

The Chinese central government has attempted to stabilize real estate markets, especially housing prices. The government has manipulated interest rates, down payment requirements, and tax policy, has imposed purchase restrictions, and constructed economically affordable housing to make residential units affordable for low-income individuals.Footnote 4 These attempts have met with mixed success. In the following paragraphs, we provide an overview of the various policy tools that have been used to manipulate the real estate market. We also provide a description of the several forms of real estate taxes in China.

The Chinese central government has used both monetary policy and fiscal policy to help stabilize real estate prices. Our focus is on fiscal policy, and specifically tax policy in the form of the deed tax. This approach has the advantage that tax policy is flexible in the sense that it can vary across regions or individuals under different circumstances. Implementing different tax rates can alter household demand and producer supply in different ways across regions. In addition, tax revenue is an important source of government revenue that can be used to construct economically affordable housing for the low-income households or provide other public services.

Real estate taxes in China are applied in the broad categories of development, transactions, and ownership of the real estate units. Specific taxes include the urban and township land use tax, farm land occupation tax, land appreciation tax, deed tax, and property tax. The urban and township land use tax is imposed on all enterprises, units, individual household businesses and other individuals who use urban and township land for any economic activity. The farm land occupation tax is imposed on all enterprises, units, individual household businesses and other individuals who occupy farm land for building construction or for other non-farm purposes. The land appreciation tax is imposed on income from a disposal or other means of transfer of state-owned land use rights, buildings on the land and their attached facilities. The deed tax is an ad valorem tax paid by the person or organization who receives land or any type of real estate units within the territory of China. The property tax is imposed on owners of property, operational and managerial units of house property, mortgages, custodians and users of house property. Most residential properties owned by individuals for non-business use are exempt from property tax.

The deed tax is not the only tool used by the Chinese government to stabilize real estate markets; other tools include manipulation of down payments, limiting purchases by families, and property tax reforms. The down payment for a home mortgage is 30% for the family’s first purchase and 60% for the second purchase. This down payment policy is intended to discourage speculative demand for residential housing. The other purpose is to avoid underwater mortgage finance positions of households, a problem familiar from the 2008–2010 financial crisis in the United States. Fears that the same thing could happen in the Chinese real estate market if housing values depreciated more than 30% for the first-home purchases or 60% for investment purchases of residential property motivated policy changes.

Another policy attempt to stabilize the housing market is the limited purchase policy which was adopted by 46 cities in China by 2011 but was dropped by many cities during 2014. During September 30–October 5, 2016, some cities restarted the limited purchase policy to discourage speculative housing demand. Under the limited purchase policy, each family is restricted to only purchase a certain maximum amount of residential property within the city where their residential status is located. The specific maximum amount varies among cities. Individuals who do not hold regional residential status own less residential property.Footnote 5

1.3 Deed taxes

The recent policy goal of the Chinese government has been to stabilize real estate markets by setting a higher deed tax rate for buyers of large homes or buyers of more than one home, thereby discouraging speculative demand. For example, a change in the deed tax at the end of 2010 was followed by declines in housing prices in some Chinese regions. We examine the effects of the deed tax rate on real estate prices in China over the 10-year period of 2004–2013.

The deed tax is legislated through the Provisional Regulations Governing Deed Tax Detailed Rules for Its Implementation. This tax code was issued on July 7, 1997 by the State Council of China and came into effect on October 1, 1997. The tax is essentially a tax levied on the transfers of land use rights or all kinds of real estate property and is paid by the person or organization receiving the land or real estate. The tax rate ranges from 3 to 5% for land and real estate transfers. Tax rates differ between regions and are determined at the provincial level by the People’s Government within the stipulated range taking into consideration local conditions. Tax rates adopted at the provincial level are then filed with the Ministry of Finance and the State Administration of Taxation (SAT).Footnote 6 For purchases of real estate units or use rights of state-owned land, the tax liability is a fixed proportion of the transaction price. For transfers of land use rights or residential units as gifts, the tax liability is a proportion of the assessed value as determined by tax collection offices based on the market prices. For exchanges of land use rights or real estate units, the tax liability is a proportion of the difference of the land use rights prices or the real estate prices. Since the tax was established in 1997, changes in deed tax policy have affected transfers of residential units only. Table 1 lists the changes to the residential deed tax rate since its inception. The time span considered in our analysis is 2004–2013, a span that includes two of the rate changes listed in that table.

The changes in deed tax rates affected residential properties in particular; so, we estimate the effects on residential property prices. We also estimate the effects on other classes of real estate which are unaffected by deed tax changes to assure that we are capturing the effects appropriately, expecting no impact in non-residential markets. We measure aggregate deed tax rates at the provincial level by computing total deed tax revenue relative to the total value of real estate units sold by development companies, thereby generating an average effective deed tax rate in each province-year. Consequently, we are not conducting an event study following specific rate changes, but rather we are estimating the effects of average deed tax rates on prices of residential units, office-use units, business-use units, and land use rights.Footnote 7 The empirical frameworks used in this study are dynamic models and dynamic spatial models that are estimated in panel data environments. The latter type of model allows us to investigate spatial correlation in real estate prices across Chinese provinces, as well as spatial spillover effects of economic factors including deed tax rates.

The remainder of the paper is organized as follows. Section 2 reviews related studies. Section 3 provides a theoretical framework of the deed tax effect on real estate prices in general in a stock-flow model framework. Section 4 discusses the empirical strategy and reports the results. Section 5 concludes and provides policy implications.

2 Literature review

An extensive literature is available that assesses the effect of property taxes in real estate markets. Deed taxes, or transfer taxes, have received relatively little attention, however. A deed tax is triggered by the transfer of, or transaction of, land or real estate units. This type of transfer tax is present not only in China but also in the United States, Canada, Australia, the United Kingdom, France and several other countries. The difference between China and the United States with this type of transfer tax is that the deed tax in China is paid by the buyer or receiver of land use rights or real estate units, while the transfer tax in the United States is paid by the seller. Kopczuk and Munroe (2014) study one form of transfer tax, the so-called 1% “mansion tax” in New York and New Jersey. They find that the tax affects the ultimate allocation in the housing search market by increasing price reductions during the search process and bargaining stage, weakening the relationship between listing and sale prices. Slemrod et al. (2016) estimate the behavioral response to housing transfer taxes in Washington D.C. and find evidence of manipulation of the sales price to the lower-tax-rate region around the price notch. Best and Kleven (2015) estimate the effects of property transaction taxes in the U.K. housing market and find that a 1% decrease in the housing transaction tax permanently increases housing sales by about 12%. Few studies have dealt with deed tax effects on the real estate market in China. This paper contributes to the literature by providing a spatial examination of whether deed tax rates affect real estate prices and estimates the magnitude of those effects.

Studies of property taxes and other real estate taxes provide a general framework for studying the effects of taxes in real estate markets. Many studies show that changes in property taxes are capitalized into housing prices. Krantz et al. (1982) find that property taxes have a significantly negative effect on housing prices with approximately 60% of the property taxes being capitalized into local house prices. Capozza et al. (1996) find that removing the property tax deduction on the US income tax would reduce national housing prices by 5–7%. Kuang and Ma (2010) find that property taxes have a negative effect on housing prices in China. Zhang (2009) proposes a theoretical framework based on Poterba’s (1984) asset-market model to address how differently taxes on housing development, housing transactions, and housing ownership would affect the price of housing in China. Zhang (2009) predicts that an increase in housing ownership taxes leads to a larger negative effect on housing prices than does the taxing of housing transactions.

The deed tax rate in China varies by home size, number of homes owned by the buyer before the new purchase, and the buyer’s marital status. However, housing transaction data at the micro-level are not available to the public. Due to that data limitation, the analysis in this paper is based on the average deed tax rate, which is constructed from total deed tax revenue divided by the total transaction value of land use rights and real estate units sold by real estate development companies.Footnote 8 It is not uncommon to use the average tax rate in studies of taxation. Yamarik (2000) uses average tax rates with respect to gross state product and with respect to property to investigate how distortionary taxation affects the growth rate of output. His empirical results generated by those average tax rates are consistent with the predictions of growth theory. In the Altshuler et al. (2000) study of how tax rates in different countries affects US firms’ investment location decisions, they define the average tax rate for controlled foreign corporations abroad of US parent corporations as total income taxes paid divided by total earnings and profits, and they then utilize that average tax rate in their study.

International evidence on spatial correlation of housing prices is substantial. Wang et al. (2014) study quarterly real estate prices in China and find significant and positive diffusion effects of prices both over time and across space in the eastern and middle regions in China. They only observe positive diffusion effects over time for the western regions in China, however. Nanda and Yeh (2014) employ space-time panel models and estimate residential land prices using a panel dataset between 1992 and 2010 for 41 Taipei sub-markets. They find that spatial dependence plays an important role in prices among these regions. They also find that centralized economic development is important in affecting the residential land values of surrounding areas. Cohen et al. (2016) find that US Metropolitan Statistical Areas exhibited significant spatial diffusion patterns in housing price growth rates between 1996 and 2013. They also find greater spatial diffusion in home price growth after the 2008 housing market crisis than over the entire sample period. Oikarinen (2004) estimates vector autoregressive and vector error-correction models for Finnish housing markets between 1987 and 2004. His results confirm the lead–lag relation between housing price movements in the Helsinki Metropolitan Area and the surrounding areas.

3 Stock-flow model

A stock-flow model is used to illustrate the potential for a deed tax to affect real estate prices. The following assumptions are made: (1) the stock of real estate units in the current period is equal to the stock of real estate units carried over from last period plus new construction minus newly purchased and occupied real estate units in the current period; (2) all parameters are non-negative for any time period, (3) there is no tax incurred by either party at in period t − 1, but a unit deed tax in period t is paid by the consumerFootnote 9; (4) the tax-inclusive price elasticity with respect to the amount of newly purchased and occupied real estate is assumed to be negative; (5) the pre-tax price with respect to the amount of newly constructed real estate is assumed to be positive, and (6) the demolition rate of real estate is δ in each period.

In the stock-flow model, we have:

where \( S_{t} \) is the stock of available real estate units at time t, \( {\text{NC}}_{t} \) is the new construction of real estate units at time t, and \( {\text{NP}}_{t} \) is the amount of real estate units purchased and occupied at time t. \( \delta \) is the demolition rate of real estate which is assumed to be constant in this model. The pre-tax price is denoted as pt.

At time t, the consumer pays a unit deed tax, \( \tau_{t} \). The tax-inclusive price faced by the consumer is \( p_{t} + \tau_{t} \). The producer does not pay tax at time t; therefore, the price faced by producer is the pre-tax price. By assumption (3), neither consumers nor producers must pay tax at time t − 1. Therefore, the prices faced by the consumer and producer at time t-1 are equal to the price \( p_{t - 1} \).

Assuming full salience of the deed tax to consumers, they are expected to react to changes in the tax-inclusive price. Therefore, we define the tax-inclusive price elasticity with respect to the amount of newly purchased and occupied real estate units as the percent change in the amount of the newly purchased and occupied real estate units divided by the percent change in the tax-inclusive price. The tax-inclusive price elasticity with respect to the amount of newly purchased and occupied units is

The elasticity is assumed to be negative as lower prices encourage more transactions of real estate units.

Given that producers do not (legally) pay deed taxes, the price faced by the producer is the pre-tax price \( p_{t - 1} \) at time t − 1 and the pre-tax price \( p_{t} \) at time t. In this case, the price elasticity with respect to the new construction of real estate units is:

The elasticity is assumed to be positive, as higher prices create incentives for real estate companies to construct more units for future sales.

Solve Eqs. (2) and (3) for \( {\text{NP}}_{t} \) and \( {\text{NC}}_{t} \), then substitute into Eq. (1) to solve for the pre-tax price \( p_{t} \):

Differentiating Eq. (4) with respect to \( \tau_{t} \), we obtain the effect of the deed tax on the pre-tax price \( p_{t} \):

The effect of the deed tax on pre-tax price depends on the tax-inclusive price elasticity of newly purchased and occupied amounts of real estate units. Given that the price elasticity is reasonably assumed negative and \( {\text{NP}}_{t} \) is non-negative, the deed tax has a negative effect on the pre-tax price \( p_{t} \).Footnote 10 The result of the tax effect on the market prices derived from the stock-flow model is consistent with the result from a demand and supply model in theory.

In the next section, we test the theoretical prediction shown in (5) by estimating reduced-form price models using a panel of 30 provinces and direct-controlled municipalities in mainland China over the period of 2004–2013. Deed tax rates are among the controls included in the models, with increases in deed tax rates expected to reduce real estate prices.

4 Empirical method

The empirical analysis is conducted for the prices of pooled real estate, residential units, office-use units, and business-use units as well as land use rights. Real estate prices may be correlated with their previous values, as shown in Fig. 1. Therefore, a dynamic model for price is used. The model incorporates a lagged price variable along with the average deed tax rate and other control variables. To analyze spatial correlations in real estate prices, we prepare a spatial weights matrix and estimate dynamic spatial models for the prices. In this section, we provide descriptions of the data and variables used in the estimations, explain the empirical strategy in detail and discuss results.

4.1 Data

The panel data span the years of 2004–2013 for 30 regions in mainland China, including four direct-controlled municipalities (Beijing, Tianjin, Shanghai and Chongqing) and 26 provinces (Tibet is omitted due to missing data).Footnote 11 Data for total regional deed tax revenue, prices by types of real estate, transaction amount by types of real estate, transaction value by types of real estate, the amount of land area purchased by real estate development companies, total value of land purchased, the amount of land pending for development, regional GDP, CPI and regional population are collected from the China Statistical Yearbook. The Yearbook does not report data on real estate inventory; therefore, the data on the inventory of real estate units by types are collected from the China Real Estate Statistical Yearbook. The spatial weights matrix used in the dynamic spatial models is based upon population centroids of the 30 regions. Centroids were determined using the populations of the 337 prefecture-level cities from the tabulations in the 2010 Population Census and the geographic coordinates of those cities obtained from Google Maps.

Following is a list of variables used in the empirical analyses and their construction methods. All currency values used in the estimation are in real 2004 Yuan, i.e., controlled for changes in the CPI.

\( {\text{PRICE}}_{i,t} \): the average selling price of commercialized real estate units sold by real estate development companies is used to represent the price of real estate units in a region within a specific year. This variable is measured by Yuan/m2. The average price of land use rights is the ratio of the total value of land purchased to the total area of land purchased by real estate development companies for land use rights.

\( {\text{TRAN}}_{i,t} \): the total area of commercialized real estate units sold by real estate development companies is used to represent the total transaction amount of real estate units in a region within a specific year. This variable is measured by m2. For land use rights, this variable is the total area of land with its use rights obtained by the real estate development companies.

\( {\text{STOCK}}_{i,t} \): the total stock of real estate units in a region within a specific year, measured by m2. This variable is calculated by summing the amount of real estate sold by real estate development companies in a year and real estate inventories at the end of that year. For land use rights, this variable is calculated by summing the area of land purchased by real estate development companies and the area of land pending for development.Footnote 12

\( {\text{DEEDTAX}}_{i,t} \): average deed tax rate in a region within a specific year. The deed tax is collected when the transfer of land use rights or transfer of real estate occurs. It is calculated as the ratio of total deed tax revenue to the sum of land acquisition costs and total value of real estate units sold by real estate development companies.Footnote 13

\( {\text{GDPPC}}_{i,t} \): economic condition is measured by gross product per capita in a region within a year, measured by Yuan. This variable is used to control for business cycles and economic development.

Table 2 presents summary statistics for the variables in levels.

4.2 Empirical models

First, we use a traditional dynamic model without spatial components to investigate time-lagged price effects, deed tax effects and effects from other economic factors. Second, we use a dynamic spatial model to incorporate spatial correlations of prices across regions and spillover effects from the explanatory variables. Finally, we compare results from the two methods to check robustness.

4.2.1 Dynamic model

Real estate prices are expected to be correlated with previous values; so, a lagged price is included in the model:

where \( x_{i,t} \) denotes the vector of explanatory variables including transaction amount, stock amount, average deed tax rate, and per capita GDP. Fixed effects for regions are denoted by μi. The presence of lagged price creates a problem in using ordinary least squares estimation. The estimator is inconsistent because lagged price is correlated with the error term. Therefore, we use the Arellano and Bond (1991) estimator to estimate the dynamic model. The model is estimated in first differences and uses an unbalanced set of lagged regressors as instrumental variables. In the present application, an unbalanced set of lagged prices were used as instrumental variables. The maximum lag used was two, \( \ln p_{i,t - 2} \) and \( \ln p_{i,t - 3} \). Both are uncorrelated with \( \Delta \varepsilon_{i,t} \), the error term of the first-differenced specification. The model includes region fixed effects denoted by \( \mu_{i} \) but they are eliminated when first differences are taken. The model was estimated for pooled real estate types, residential units, office-use units, business-use units and land use rights. The price, transaction, and stock variables were chosen according to the specific real estate type or land use rights under consideration.

4.2.2 Dynamic spatial model

Given the spatial patterns in prices observed in Fig. 2, a dynamic spatial model is adopted to control for correlations of prices over time and across regions. By estimating a dynamic model with spatial elements, we are able to measure the direct and indirect spillover effects on price from the explanatory variables in the short and long terms. We use the spatial autoregressive (SAR) version of the dynamic spatial model:

The contemporaneous spatial autoregressive parameter is ρ, the dynamic spatial autoregressive parameter is ψ, and μi is a region fixed effect. W is a row-normalized inverse distance weight matrix for the 30 regions. Distances between regions were based upon population centroids determined using GPS coordinates of prefecture-level cities and autonomous counties within each region.Footnote 14 The dynamic SAR models are estimated by the bias-corrected quasi-maximum likelihood approach of Yu et al. (2008).

4.3 Empirical results

4.3.1 Dynamic model

In this subsection, we discuss the results from estimating the dynamic model for pooled real estate, separate types of real estate and land use rights. Following that is a discussion of short-term and long-term effects on prices from the deed tax rate and other economic factors. The estimation results are shown in Table 3. All of the coefficients are to be interpreted as elasticities.

In the upper panel of Table 3 reporting short-run elasticities, we find that the deed tax rate has a significant negative effect on the price of pooled real estate, residential real estate, and land use rights. Deed tax rates do not have a significant effect on the prices of office-use or business-use real estate, however. The marginal effect of a 1% increase in the deed tax rate is a decrease in the price of pooled units and residential units by approximately 0.16%. Since the elasticities in residential and pooled markets are virtually identical, the deed tax effect in the residential market appears to be the driving force behind the significant result for pooled units. It is notable that the deed tax rate affects prices of residential units but not office-use or business-use units. Given that deed tax rate changes have only been applied to residential transactions, the lack of an observed effect on non-residential real estate is confirmatory evidence of the impact of deed tax rates in the residential sector. This result is also consistent with the theoretical prediction in Sect. 3.

Increases in the deed tax rate also have a significant negative effect on the price of land use rights. A 1% increase in the average deed tax rate decreases the price of land use rights by about 0.25%. Changes in the deed tax rate on the transfers of residential units affect prices of land use rights through the derived demand for land. Even though the deed tax rates have been constant for the transfer of land use rights over the sample period for each region, the price of land use rights is affected by the increase in the deed tax rate applied to residential units. Given that land is an input for constructing residential buildings, a decrease in residential prices may reduce demand for land, thereby decreasing the price of land use rights.

Lagged prices have a positive effect on the prices of pooled real estate, residential units and land use rights while having no effect on office-use units and business-use units. This indicates that prices of office-use units and business-use units are more volatile, while the prices of residential units and land use rights tend to depend on their previous values. The negative relationship between transaction amounts and prices of land use rights is consistent with the law of demand. The positive relationship between transaction amounts and prices of residential units, although weakly significant, could be attributed to speculative demand for residential property. The real estate stock variable does not have a significant effect on prices in any of the real estate markets. This result reflects opposing forces at work in the Chinese real estate markets. While an increase in the real estate stock, reflecting a shift in supply, would be expected to lower prices other things equal, in this case there is apparently a shift in demand also taking place that offsets the price effect. To stabilize the real estate market and avoid crises in the financial market, the Chinese government has been reluctant to allow real estate prices to decline significantly. With the expectation that prices will continually increase in the future, Chinese citizens consider real estate properties as a safer investment than purchasing stocks. The associated speculative motive shifts the demand curve outward, which when combined with increasing supply managed by Chinese local governments yields the result observed. Regional GDP per capita is positively related to the prices of all types of real estate and land use rights. This result reflects the role of GDP per capita as a demand shifter with prices significantly related to regional economic development.

The dynamic nature of the price model provides an opportunity to determine long-term elasticities from the estimated coefficients. These are reported in the lower panel of Table 3. Based on the notation in model (6), the long-run tax price elasticity is \( \alpha /(1 - \theta ) \). The estimated parameters α and θ are significant only in the models for pooled real estate, residential units and land use rights. Accordingly, significant long-term deed tax effects are found only in pooled real estate, residential units and land use rights. The effects get larger over time due to the positive autoregression in prices. The effect on prices from a change in the deed tax rate is amplified in following years through the positive effect of the previous prices on current prices. The amplified effect diminishes year after year and converges to zero eventually. Thus, a 1% increase in the deed tax rate engenders an infinite, though summable, series of decreases in prices. Following the same logic, per capita GDP also has a larger positive effect on prices in the long term than in the short term.

For assessing model fit, we report the squared correlations between actual values of the dependent variables and predicted values. The models for prices of pooled real estate and residential units show relatively high degrees of fit. The other three models show more modest but satisfactory levels of fit.

4.3.2 Dynamic spatial model

Table 4 reports results from estimating the dynamic SAR models for the prices of each type of real estate. After controlling for the time-lagged price effect, the spatial-lagged price effect, and the cross-product term reflecting spatial-lagged effects at a 1-year lag, the effects of the deed tax rate on prices remain significant and negative in the models for pooled real estate, residential units and the land use rights. Hence, the deed tax effects on prices are robust across the non-spatial and spatial frameworks.Footnote 15

The sizes of the coefficients on the deed tax rate are smaller than the corresponding coefficients obtained from the dynamic model without spatial components, however. To frame the magnitude of the effect of deed tax rates on the residential prices in levels, we illustrate with deviations from the mean deed tax rate and mean residential prices in the sample. For example, if the deed tax rate is increased from 3.5 to 4%, that is a 14% increase in the deed tax rate, then it leads to a (14%) × (0.10) = 1.4% decrease in price. Given that the sample mean of residential prices is about 3500 Yuan/m2, a 1.4% decrease in price holding all other influences constant makes the new price 3451 Yuan/m2. This result has implications regarding the tax incidence on Chinese residential real estate units. The evidence indicates over-shifting of deed tax increases. That is, the price rises by more than the increase in the deed tax. When the deed tax burden goes up by 0.5% × 3500 = 17.5 Yuan, the pre-tax price falls by 1.4% × 3500 = 49 Yuan.

A number of studies have found over-shifting of excise tax increases, for example, in the context of the markets for cigarettes and alcohol (see, for example, Hanson and Sullivan 2009; Sullivan and Dutkowsky 2012; Young and Bielinska-Kwapisz 2002). Dutkowsky and Sullivan (2014) argue that over-shifting phenomena are usually found in imperfectly competitive markets and find evidence of that in the cigarette market. More specifically, the theory of tax incidence suggests that over-shifting occurs in imperfectly competitive market conditions where the elasticity of the slope of the inverse demand function, known as Seade’s E, exceeds one.Footnote 16 Given the role of the state in market for residential real estate units in China, that market is certainly imperfectly competitive. Hence, the over-shifting result is consistent with market conditions.

Time-lagged prices have a significant positive effect on current prices. This result is also consistent with those from the dynamic model and supports the necessity of including lagged prices in the models. As for other control variables, the transaction amount and stock of real estate units do not affect prices significantly, except for prices in the land market where the increase in the transaction amount of land use rights is associated with a decrease in land prices. Real GDP per capita tends to positively affect prices of all types of real estate but does not have a significant effect on prices of land use rights. The land market in China is not totally a free market. A significant amount of government intervention could influence land prices and weaken links between land prices and general economic conditions.

As for the spatial character of the Chinese real estate markets, positive spatial correlations are observed in the prices of pooled units, residential units and business-use units. An increase in prices in one region will exert a positive influence on prices in surrounding regions in the same period. When price increases in a region, some buyers may choose to buy homes in a nearby region, contributing to an increase in prices there as well. Another explanation of the positive spatial correlations in prices could be the presence of common factors that cause housing prices in proximate regions to increase together. For example, consider the east coast of China. The location benefits of cities on the coast, rapid economic development in the coastal regions, and large populations of coastal cities all contribute to co-movements of real estate prices.

It also appears that time-lagged prices from neighboring regions have a negative effect on current local prices. This pattern is consistent with Myrdal’s backwash effect (Myrdal 1957) and the use of real estate investment for speculation. The backwash effect describes a situation where economic growth in a core region attracts resources from surrounding regions. In the case of the Chinese real estate market, an increase in a core region’s prices of residential units may attract speculative investors from surrounding regions. As the core region’s real estate market is booming, investments including business, transportation and other types will be attracted to this core region instead of being invested in the surrounding areas. This backwash effect from an increase in real estate prices in a core region may cause the surrounding regions’ real estate prices to decline. Given that real estate construction projects can take longer than 1 year, there is ample opportunity for a backwash effect. The reason for the positive current spatial effect and negative time-lagged spatial effect is that purchases take a relatively short time, while construction will usually take a longer amount of time. Therefore, high prices in a core region may push real estate purchasers to surrounding regions and attract real estate companies and other capital investors from surrounding regions. Furthermore, the estimated models in this section satisfy the stability condition of the dynamic SAR model in (7), \( \theta + \psi + \rho < 1 \) (Elhorst 2012).

Spatial models capture the complex dependencies among geographic units. Impacts from changes in any one of the explanatory variables can be passed to neighboring regions and then may return to the region itself due to the mutual dependencies among geographic units. Therefore, total marginal effects from changes in explanatory variables are expected to be larger than the estimated coefficients in the dynamic SAR models. The direct marginal effect is the effect on prices from changes in the explanatory variables of the region itself. The indirect marginal effect is the changes in prices due to the mutual spatial influences between the region and its neighboring regions. Table 5 reports direct-, indirect- and total marginal effects for both the short and long terms. The need to distinguish between short- and long-term effects is due to the inclusion of time-lagged price in the models. Changes in an explanatory variable can change current prices which, in turn, will change future prices. The long-term effects can be computed over an infinite time horizon.

In Table 5, all the marginal effects of the deed tax rate on prices are statistically significant and negative in the models for prices of pooled real estate and residential units. These results are consistent with the results in Tables 3 and 4. The magnitudes increase when moving from short-term to long-term effects.

This pattern is consistent with the results from the corresponding short-term and long-term effects determined in the dynamic models. However, the long-term marginal effect of the deed tax rate on residential unit prices is − 0.67 and is much stronger than the corresponding long-term marginal effect of − 0.28 found in the dynamic model. The same pattern holds for the pooled units. These differences indicate that spatial dependence plays an important role in influencing prices in the Chinese real estate market. For the market of office-use units, no significant deed tax effects are found. For business-use units, a weak short-term direct effect from the deed tax rate is observed with the magnitude of about − 0.06 and it only being significant at the 10% level. For the land market, direct short-term and long-term effects from the deed tax rate are found, but not indirect effects. The deed tax rate does not provide spillover effects on the prices of land use rights. GDP per capita provides significant short-term and long-term marginal effects on all types of real estate units, except for the short-term indirect effect in the office-use market and the long-term indirect effect in the business-use market. GDP per capita has much stronger short-term effects on prices of residential units than on prices of business-use and office-use units. This may be attributed to the fact that the residential market is the largest one among all types of real estate units with an average of 84% market share in the 30 regions over the 10-year period in the sample. A 1% increase in GDP per capita increases residential unit prices by about 1.15%. GDP per capita does not significantly affect prices of land use rights but does provide a long-term indirect effect. The market for land use rights may be different from the residential, office-use, and business-use markets as there are many more government interventions in land transactions as compared with the commercial real estate transactions.

5 Conclusions and policy implications

The escalation in real estate prices during this century has drawn a great deal of attention from Chinese authorities and households. We find that increasing per capita GDP exhibits a very strong positive effect on real estate prices in China. Beyond that economic effect, there are several policy changes that have implemented to stabilize real estate markets, especially the residential market. Changes in deed tax policy have created variation in average deed tax rates over time and space and that allows us to investigate effects on real estate prices. We have shown that increases in the average deed tax rate have a negative effect on pre-tax prices in a stock-flow market framework. By estimating dynamic models and dynamic spatial models, we find that increases in the average deed tax rate have a significant negative effect on prices of the pooled real estate units, residential units, and land use rights. However, increases in the average deed tax rate have no significant effect on prices of office-use or business-use units. Changes in deed tax rates significantly affect residential units rather than other types of real estate, consistent with the fact that all changes in deed tax rates have applied to residential transactions only. We also find that deed tax rate increases also affect prices of land use rights through the derived demand for land in the residential market.

Significant and positive autocorrelations of prices over time and across space are observed in Chinese real estate markets. Spillover effects from average deed tax rates on prices are also found in the residential market. The effects are larger in the long term. Our findings provide evidence that policy changes involving the deed tax do affect real estate prices, and do so in the intended policy direction. Increases in the deed tax rate reduce home prices. For example, the decrease in deed tax rates for first-time home buyers in 2008 likely contributed to the trend of increasing house prices. The increase in deed tax rates for multiple-home buyers or large-home buyers in 2010 likely contributed to a slowdown in price increases, and even price decreases, in some regions between 2010 and 2011. What should attract policymakers’ attention is that the attempt to reduce home buyers’ tax liability by reducing the tax rates may increase the market prices of housing properties, increasing the total cost of home purchases. Furthermore, policymakers should not only look at the immediate and local effects of changes in tax policy and other economic factors on prices, but also pay attention to intertemporal and spatial effects since significant intertemporal and spatial correlation in residential prices were found in this study.

Deed tax policy is important not only for its ability to stabilize real estate markets but also generate revenue for local governments. The share of deed tax revenue has increased over time. Deed tax revenue constituted 4.3% of local government revenue in 2003 and its share of local government revenue had increased to 7.5% in 2010. From the perspective of income inequality, the deed tax liability is low for low-income people who tend to purchase small homes but large for high-income persons who tend to purchase larger homes or invest more in residential property. Meanwhile, deed tax revenues can be used to construct affordable homes for low-income persons or to subsidize home purchases for low-income households. Imposing a high deed tax rate for large residential units and multiple residential units not only discourages speculative demand but also generates more tax revenue for local governments and reduces income inequality among individuals.

Changes in deed tax policy also affect preferences for residential real estate and change the market supply structure. Lower deed tax liabilities on smaller properties compared with larger properties is expected to encourage the sales of small homes, especially homes with less than 90 m2.Footnote 17 Therefore, the deed tax promotes preferences for small homes rather than large homes among buyers, resulting in more construction and sales of small homes rather than large homes. This phenomenon should be beneficial for China due to the large national population and fixed supply of land, especially in the fast-growing cities.

The property tax is also a potential tool for the Chinese government to stabilize the real estate market. The analysis of deed taxes also has implications for the reforms of property taxes since these two taxes are both paid by consumers. A reform regarding property tax has been implemented in three pilot cities including Shanghai, Chongqing, and Hangzhou. Starting from January 27, 2011, newly purchased second homes or luxury residential property purchases are subject to a property tax at an ad valorem tax rate of 0.6% in Shanghai and 0.5–1.2% in Chongqing. While a nation-wide move to ad valorem property taxation to support local governments is not imminent, these pilot projects may lead to such an eventuality.

The Chinese government encourages households to own housing property but also discourages speculative demand for residential real estate. The reforms to taxation of property ownership are expected to increase the cost of possessing property and create downward pressure on real estate prices through decreases in investment-oriented and speculative demand for real estate. The negative effect of deed taxes on real estate prices implies that property taxes might also potentially have a negative effect on residential prices. Therefore, increases in the property tax liabilities are expected to reduce market prices or at least slow down the escalation of the market prices in the residential market. The theoretical results derived in this paper and empirical results found for the deed tax support the idea that property tax reform could also effectively restrain speculative demand for residential units and relieve upward pressure on residential prices in China.

While we have emphasized the role of deed taxes in altering residential property prices, another interpretation of the Chinese government use of deed taxes is that they are a mechanism of rent extraction. The government may simply want to capture a share of the appreciation in real estate prices. This may be a plausible rationale, but it does not comport well with the reductions in deed tax rates for the purchase of first homes or the reductions in deed tax rates in cities other than Beijing, Shanghai, Guangzhou, and Shenzhen. Consequently, we believe that manipulation of deed taxes has been a policy instrument used to alter the relative prices of real estate assets rather than to merely extract rents.

Notes

See Fang et al. (2015) for additional insights on residential real estate price dynamics in China.

Source: "Deed Tax." Taxation in China. Encyclopedia.com. 18 Jul. 2018, http://www.encyclopedia.com. Lower tax rates may be applied to residential real estate units.

Data are obtained from China Statistical Yearbook for each year between 2004 and 2013. The China Statistical Yearbook reports national and regional average selling prices of commercialized buildings. Commercialized building units are buildings, apartments, or any other kinds of real estate units sold at market prices. In this paper, we refer to the market of commercialized building units as the real estate market. The 30 regions do not include Tibet, Hong Kong, Macau and Taiwan.

The economically affordable housing is provided to middle- and low-income families by subsidizing commercial housing purchases or by offering low-rent public (social) housing.

We control for the effects of other policies implemented in Chinese real estate market during the estimation time period by including the regional fixed effects in the empirical analysis. We drop the year fixed effects as none of the year dummy variables are significant in any of the estimations as specified by Eq. (6).

"Deed Tax." Taxation in China. Encyclopedia.com. 18 Jul. 2018, http://www.encyclopedia.com.

In the China Statistical Yearbook, residential units are units used for residential purposes, including villas, apartments, government-owned enterprises staff dormitories, etc.; office-use units refers to units used for administration purposes by enterprises, public institutes, governments, schools, hospitals, etc.; Business-use units are units for commercial use, such as hotels, restaurants, shopping malls, bookstores, gas stations, grocery stores, etc. The statistical yearbook also reports data on real estate units used for other purposes. Given that its sales only constitute about 2% of the total commercialized real estate sold between 2004 and 2013 in China, we do not include real estate units used for other purposes in this paper.

A consequence of our data limitations is that we are unable to conduct an event study, Difference-in-Difference analysis, or regression discontinuity (RD) design.

In reality, it is more likely to be the case that there is a tax at time t − 1 and a change in tax policy at time t. However, introducing different taxes in both previous and current time periods only complicates the mathematical derivation of the results but leads to no difference from the case in which there is no tax in the previous period and the government starts to impose a tax in the current period.

The effect of the tax paid by producers is also analyzed in this model framework. We find that the tax paid by producers has a positive effect on the market price, \( p_{t} \). The market price in this case is the tax-inclusive price as producers take into consideration the tax on them when they establish the market price they charge for the real estate units.

We use provincial-level data as deed tax revenues are not publicly available for a majority of the cities in our sample.

Land space pending for development refers to the area of land with its use rights already approved by authorities and obtained by real estate development companies, but the land development has not started yet.

The statutory deed tax rate ranges from 1 to 5%. Our calculation of the average deed tax rate yields 289 of 300 observations within that range. In the calculation of the rate, the total value of real estate transactions may be biased downward since the total value of real estate transactions does not include transfers of owner-occupied real estate due to data limitations. The bias in total value of real estate transactions may bias the rate upward.

Spatially weighted explanatory variables and spatially autocorrelated error terms were also considered but neither extension proved to be a useful addition to the empirical performance of the dynamic SAR specification.

We also estimated dynamic SAR models using a spectral-normalized weight matrix where each element is divided by the modulus of the largest eigenvalue of the matrix. The results of that estimation are consistent with those reported in Table 4.

For the theory of tax incidence in imperfectly competitive markets, including an explanation of Seade’s E, see Myles (1995, pp. 358–363).

On October 22, 2008, the deed tax rate is lowered from 1.5 to 1% for the individual’s first purchase of a residential real estate unit that does not exceed 90 m2. From 2007 to 2008, the percentage of the unit sales of residential real estate unit that does not exceed 90 m2 was increased from 32 to 42%.

References

Altshuler R, Grubert H, Newlon TS (2000) Has U.S. investment abroad become more sensitive to tax rates? International taxation and multinational activity. University of Chicago Press, Illinois, pp 9–38

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297

Best MC, Kleven HJ (2015) Housing market responses to transaction taxes: evidence from notches and stimulus in the UK. Working paper

Capozza DR, Green RK, Hendershott PH (1996) Economic effects of fundamental tax reform. Brookings Institution Press, Washington, pp 171–210

Cohen J, Ioannides YM, Thanapisitiku W (2016) Spatial effects and house price dynamics in the USA. J Hous Econ 31:1–13

Dutkowsky DH, Sullivan RS (2014) Exercise taxes, consumer demand, over-shifting, and tax revenue. Public Budg Financ 34(3):111–125

Elhorst JP (2012) Dynamic spatial panels: models, methods, and inferences. J Geogr Syst 14(1):5–28

Fang H, Gu Q, Xiong W, Zhou L-A (2015) Demystifying the Chinese housing boom. In: Eichenbaum M, Parker J (eds) NBER Macroeconomics Annual, vol 30. University of Chicago Press, Illinois, pp 105–166

Hanson AR, Sullivan RS (2009) The incidence of tobacco taxation: evidence from geographic micro-level data. Natl Tax J 62(4):677–698

Kopczuk W, Munroe DJ (2014) Mansion tax: the effect of transfer taxes on the residential real estate market. NBER Working paper

Krantz DP, Weaver RD, Alter TR (1982) Residential property tax capitalization: consistent estimates using micro-level data. Land Econ 58(4):488–496

Kuang W, Ma Y (2010) Property tax, elasticity of supply and demand, and housing price. China Soft Sci 12:27–35

Myles G (1995) Public economics. Cambridge University Press, Cambridge

Myrdal G (1957) Economic theory of underdeveloped regions. Duckworth, London

Nanda A, Yeh J-H (2014) Spatio-temporal diffusion of residential land prices across Taipei regions. SpringPlus 3(1):505–519

Oikarinen E (2004) The diffusion of housing price movements from center to surrounding areas. J Hous Res 15(1):3–28

Poterba J (1984) Tax subsidies to owner-occupied housing: an asset market approach. Q J Econ 99(4):729–752

Slemrod J, Weber C, Shan H (2016) The behavioral response to housing transfer taxes: evidence from a notched change in D.C. policy. Working paper

Sullivan RS, Dutkowsky D (2012) The effect of cigarette taxation on prices: an empirical analysis using local-level data. Public Financ Rev 40(6):687–711

Wang H, Pan A, Zhao W (2014) Empirical investigation on the diffusion of housing prices across space and over time. Econ Rev 2014(4):85–95

Yamarik S (2000) Can tax policy help explain state-level macroeconomic growth? Econ Lett 68(2):211–215

Young DJ, Bielinska-Kwapisz A (2002) Alcohol taxes and beverage prices. Natl Tax J 55(1):57–73

Yu J, de Jong R, Lee L (2008) Quasi-maximum likelihood estimators for spatial dynamic panel data with fixed effects when both n and T are large. J Econom 146(1):118–134

Zhang W (2009) Evaluation of the measures of tax regulation of real estate industry which have been implemented since 2003—based on Poterba’s model. J Hum Inst Humanit Sci Technol 107(2):61–64

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

About this article

Cite this article

Li, W., Anderson, J.E. & Schmidt, J.R. The effect of deed taxes on real estate prices in China. Asia-Pac J Reg Sci 4, 317–341 (2020). https://doi.org/10.1007/s41685-020-00147-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41685-020-00147-7