Abstract

We use data envelopment analysis to measure the relative efficiency among Indonesia’s provinces in using input to produce output over a 20-year period that includes the global economic crisis. We then employ the inequality decomposition technique of a Theil’s second measure to explore the extent to which the efficiency factor contributes to interprovincial income inequality. Our efficiency analysis reveals that most Indonesian provinces improved their relative inefficiency considerably in both resource utilization and allocation. Moreover, the relative inefficiency became convergent across provinces for the period. However, several provinces with serious pure technical and scale inefficiencies still exist in 2010. The province of Yogyakarta critically underperformed in resource utilization, and Central Kalimantan and Papua operate at further suboptimum scales. The former needs to develop appropriate mechanisms to efficiently use its given resources, while the latter need to mitigate business-unfriendly regulations and deal with financial constraints. The inequality decomposition analysis shows that interprovincial convergence of inequality in overall technical inefficiency largely contributed to the reduction in income inequality. The convergence of inequality in resource utilization inefficiency had a greater impact on inequality convergence in overall technical inefficiency than in resource allocation inefficiency. In 2010, pure labor productivity became a substantial new factor in determining income inequality. Since this measure is affected by per capita physical and human capital and technology, the spatial allocation imbalance of these factors has become a new concern in Indonesia.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Economic growth is inevitably uneven in its subnational impact, and thus significantly affects the income gap across subnational regions. Efficiency as well as factor endowment influence regional income. Regional development policy allocates the available resources to enhance regional income and/or to redress the considerable interregional income gap; therefore, measuring the allocation of factor endowments and efficiency in subnational regions is essential for policy makers and planners.

Because of its large size, insular geography, sizable population (the world’s fourth largest), and rich resource endowment, Indonesia consists of widely different socioeconomic subnational regions: the nation’s largest urban agglomeration (Jakarta), resource-rich provinces (Ache, Riau, East and South Kalimantan, and Papua), internationally well-known tourist destinations (Bali and Yogyakarta), emerging business cluster provinces (West and East Java), and the labor-intensive agricultural provinces (other provinces) (Kataoka 2010). Given these extraordinary regional diversities, the nation faces serious income inequality and factor endowment imbalances across provinces.

To address this issue, the Indonesian government has implemented various policies, including Five-Year Development Plans (REPELITA, Rencana Pembangunan Lima Tahun), interregional fiscal transfer programs by presidential instruction (IMPRES, Instruksi Presiden), and programs promoting internal migration (Transmigrasi); and has established integrated economic development zones (Kawasan Pengembangan Ekonomi Terpadu) (Kataoka 2012). Furthermore, Indonesia has carried out major changes in its intergovernmental budget allocation system since 1999, adopting a much more decentralized fiscal regime, to reduce the income gap across subnational regions (Kataoka and Wibowo, 2014). However, outcomes are still far below the target levels, such as the serious economic imbalance and the huge income gap between Java and the off-Java provinces (see Table 1).

Since Esmara’s (1975) pioneering work, interregional income inequality in Indonesia has frequently been the subject of theoretical discussion and empirical economic research. Several studies examine the factors underlying interregional income inequality, employing various inequality measures and factor decomposition techniques (e.g., Islam and Khan 1986; Akita 1988; Azis 1990; Akita and Lukman 1995; Garcia and Soelistianingsih 1998; Akita et al. 1999; Hill 2000; Tadjoeddin et al. 2001; Akita and Alisjahbana 2002; Hill 2002; Akita 2003; Milanovic 2005; Akita and Miyata 2008; Hill 2008; Akita and Miyata 2010; Kataoka 2010; Akita, et al. 2011; Hayashi et al. 2014). One decomposition technique for income inequality is to analyze the factors affecting gross regional domestic product (GRDP) by sectoral income source and hierarchical regional structure (Akita and Lukman 1995; Tadjoeddin et al. 2001; Akita and Alisjahbana 2002; Akita 2003; Akita and Miyata 2008, 2010; Kataoka 2010; Akita et al. 2011). Another method is to analyze the factors associated with expenditure data by household head subgroup, such as province, location, educational attainment, gender, and age (Akita et al. 1999; Akita and Miyata 2008; Hayashi et al. 2014). However, to the best of our knowledge, very few studies have examined the interregional income inequality associated with efficiency factors in Indonesia.

We address this gap in regional economic analysis, measuring the efficiency factor contributing to interprovincial income inequality in Indonesia for 1990–2010. To incorporate efficiency factors into inequality decomposition, we utilize data envelopment analysis (hereinafter referred to as DEA).

DEA is a non-parametric measurement tool for measuring relative efficiency, introduced by Charnes et al. (1978). Originally, DEA was used in productivity analysis at the micro level, but it has recently become increasingly popular at the macro level as a non-parametric alternative to growth accounting (Enflo and Hjertstrand 2009). Charnes et al. (1989) applied this technique to regional economic performance analysis, evaluating relative efficiency in terms of economic development in 28 Chinese cities. The DEA technique subsequently became a popular tool in regional economic analysis (Stimson et al. 2006; Halkos and Tzeremes 2010; Schaffer et al. 2011).

For the interprovincial income inequality decomposition, we refer to Cheng and Li’s (2006) study. They proposed the interpretive additive inequality decomposition of Theil’s second measure by causal factors, where the decomposition variable is expressed multiplicatively. Their method is an improvement over Duro and Esteban’s (1998) technique of Theil’s second measures weighted by the regional population size, in which inequality decomposition terms can take positive or negative values, although a strict Theil measure maintains a non-negative value (see Cheng and Li 2006 for more details). Applying their method to China’s post open door policy period, they found that the impact of inefficiency on interregional inequality shows a declining trend.

Applications of Cheng and Li’s (2006) method can be found in several inequality decomposition studies (Alcalde-Unzu et al. 2009; Ezcurra and Iraizoz 2009; Olaskoaga-Larrauri et al. 2011; Li and Zhao 2015; Li and Dewan 2017). Some studies, such as Ezcurra and Iraizoz (2009) and Li and Zhao (2015), incorporate efficiency factors to the inequality decomposition of economic performance. Ezcurra and Iraizoz (2009) applied this approach to 196 sample regions in the European Union for 1986–2004 in a similar way. Li and Zhao (2015) evaluated the relative efficiency of China’s provincial competitiveness and decomposed it into allocative efficiency and technical efficiency for 2005–2008.

Other studies extensively apply cross-country inequality decomposition of multiplicative social welfare variables without incorporating efficiency factors. For example, Alcalde-Unzu et al. (2009) decompose cross-country disparities in per capita healthcare expenditure into healthcare expenditure share of GRDP, labor productivity, and labor participation rate in OECD countries for 1975–2003. Olaskoaga-Larrauri et al. (2011) decompose public welfare spending per GRDP into intensity of social welfare spending, the dependent population ratio, and the inverse of per capita income in 21 developed countries for 1980–2004.

Ezcurra et al. (2009) suggest a possible extension of Cheng and Li’s (2006) technique to examine regional disparities in efficiency changes over time in European regions; however, they do not explore this empirically in their study.

The remainder of this paper is organized as follows. In the next section, we describe the method and data used in this study. In Sect. 3, we describe the empirical results, while our conclusions are presented in Sect. 4.

2 Method and data

2.1 DEA applied to multiplicative income decomposition

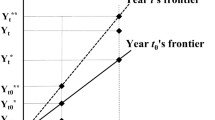

DEA is a non-parametric linear programming method to assess the decision-making units’ (DMUs’) relative efficiency in using inputs to produce outputs.Footnote 1 DEA derives a surface called a “frontier,” which follows the peak performers and envelops the remainder. The frontier connects all the DMUs with the best relative performance in the observed data, and thus represents the estimated maximum possible production that a DMU can achieve for any level of input (Cooper et al. 2006).

The DEA model has two returns-to-scale (RTS) versions with assumptions leading to different frontiers, the CCR and BCC models.Footnote 2 The CCR and BCC models are based on the assumption of constant returns to scale (CRS) and variable returns to scale (VRS), respectively. In the CRS frontier, all DMUs operate at the optimal scale, whereas in the VRS frontier, all DMUs operate at the maximum level. Imperfect competition, government regulation, financial constraints, and other factors can cause DMUs to operate at non-optimal scales. At a given scale, managerial underperformance can cause DMUs to operate below their maximum level.

Each DMU is assigned an efficiency score between zero and unity. If the score is equal to (below) one, we consider it as a sign of efficiency (inefficiency). The CCR and BCC models measure the scores for overall technical efficiency (oe) and pure technical efficiency (pe), respectively. The ratio of oe to pe is the scale efficiency (se) score. The pe score helps assess the ability of a DMU to utilize a given resource, whereas the se score helps assess the optimality of the operation size (Tsolas 2013).

A DMU is scale efficient if it operates at CRS. A DMU with an inappropriate DMU size (i.e., too large or too small) is regarded as scale inefficient and takes the form of either increasing returns to scale (IRS) or decreasing returns to scale (DRS). A DMU exhibiting IRS (DRS) operates at a suboptimal (supraoptimal) scale, due to its small (large) size of operation, in which case it may be essential to enhance its efficiency by increasing (decreasing) its scale of operations. IRS (DRS) reflects economies (diseconomies) of scale, which implies that doubling all inputs should lead to more (less) than a doubling of output (Tsolas 2013).

DEA models have two orientations: input-oriented and output-oriented. The former minimizes DMUs’ levels of inputs while keeping output unchanged, whereas the latter maximizes DMUs’ outputs while keeping inputs unchanged.

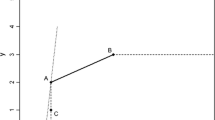

Figure 1 depicts piecewise-linear frontiers assembled by seven observed DMUs A–G. The diagonal passing through CD represents the CRS frontier, whereas ABCDEG represents the VRS frontier. All observed DMUs except F are efficient under VRS, and only a straight line passing through CD is efficient under CRS. F 1 and F 2 are projected under VRS and CRS, respectively. F 1 can still reduce its input to E, maintaining the maximum output level. The distance between E and F 1 is an input slack, which corresponds to the excess input that exists even after DMU F operates at the maximum level and eliminates the relative inefficiency in resource utilization.

We treat a province as a DMU and use output-oriented CCR and BCC models to take into account given province-specific resource endowments and the presence of economies or diseconomies of scale in Indonesia’s provinces. Suppose that each province i (i = 1,…, n) uses m inputs X ij (j = 1,…, m) to produce output Y i . In the output-oriented DEA model, Y si and Y ei are province i’s projected output without pure technical inefficiency and overall technical inefficiency, respectively. In Fig. 1, Y si and Y ei are on the VRS and CRS frontiers, respectively. To derive Y si and Y ei , we use three input variables, for physical and human capital and labor, and a single output variable proxied by GRDP.

We run the following linear programming routine to obtain the pe i0 score (=Y i /Y si) of one of the n provinces under evaluation, denoted as province i0:

where θ and z are decision variables. (1/θ) represents the pe io score, which varies between zero and unity. z is an unknown optimal weight for each province and takes a non-negative value. Removing the second-last constraint, we obtain the oe io scores (=Y i /Y ei ) under CRS. Using the se io score (=Y si /Y ei ), we express the relation of the three scores as follows:

Now, let P and L be population and labor force; and we then use per capita GRDP y (=Y/P) to decompose per capita income multiplicatively into causal elements. Then per capita income in province i is expressed as

where l = (L/P) and x = (Y/ L) are labor participation rate and labor productivity. Below the frontier level, labor productivity is decomposed as

where xe (=Y e/L) indicates pure labor productivity (i.e., labor productivity reduced by overall technical inefficiency). This is affected by the per capita level of physical and human capital and technological level, and not by inefficiency in resource utilization or allocation (Cheng and Li 2006).

2.2 Income inequality decomposition by Theil’s second measure

Let μ y , μ l , and μ x be the provincial mean values of per capita income [μ y = (1/ n) Σy i ] and its corresponding multiplicative elements [μ l = (1/ n) Σl i , μ x = (1/ n) Σx i ,]. Interprovincial inequality of per capita income is measured by Theil’s second measure as

where T represents Theil’s second measure (Theil 1967; Anand 1983).Footnote 3 Note that we use the total number of provinces, n, instead of the relative provincial population size, as the weight to derive Theil’s second measure. The population-weighted decomposition terms do not always satisfy the properties of Theil measures (see also footnote 4).

Substituting Eq. (3) into Eq. (5) and multiplying the quotient inside the natural logarithm by (μ l · μ x /μ l · μ x ) yields

where the first and second additive terms of the right-hand side are strict Theil’s second measures with non-negative values.Footnote 4 We rewrite Eq. (6) as

Each of the first and second terms in Eq. (6) is weighted by the numerator of the variables inside the natural logarithm and by (1/n), and satisfies the aforementioned property of Theil’s second measure.

Focusing on the non-Theil term in Eq. (7), we express the covariance of \(l_{i}\) and \(x_{i}\) (cov (l, x)) as follows:

Dividing both sides by (μ l · μ x ), we get

Substituting Eq. (9) into Eq. (7), we obtain

where I denotes the interaction term, which can be positive, negative, or zero if the element variables are correlated positively, correlated negatively, or not correlated.

We derive inequality decompositions in labor productivity and the oe score using Eqs. (4) and (2), respectively.

2.3 Data

We use GRDP, factor inputs (labor and physical and human capital), and the population of 26 contiguous Indonesian provinces for 1990–2010.Footnote 5 The data for provincial GRDP are sourced from Gross Regional Domestic Product of Provinces in Indonesia by Industry. The population data are sourced from Population Census and Intercensal Population Census Indonesia. The data for the provincial labor force by education attainment are sourced from Labour Force Situation in Indonesia. Average period of education of labor force is used as a proxy variable for human capital, weighted by the provincial labor force’s share of education attainment. The Central Bureau of Statistics, Indonesia, officially publishes all the aforementioned datasets; however, data on physical capital stock have not been officially published in Indonesia. Therefore, we use provincial estimates from Kataoka (2013) and Kataoka and Wibowo (2014).

Table 1, outlining input and output variables employed in our study, indicates a severe economic imbalance between the on-Java and off-Java provinces in Indonesia. Provinces located in Java Island, such as Jakarta and West and East Java, display demographic, economic, and educational prosperity, while the resource-poor off-Java peripheral provinces, such as Bengkulu, Southeast Sulawesi, West Nusa Tenggara, Maluku, and Papua lack such prosperity. With regard to per capita income and labor productivity, one of the major resource-rich provinces, East Kalimantan, demonstrates the highest values in 1990; however, in 2010, Jakarta—the nation’s political and economic center, which specializes in knowledge-intensive business services—shows the highest values. Low values are also seen in the resource-poor off-Java periphery provinces, East Nusa Tenggara. The internationally well-known tourist destination, the province of Bali, records the highest labor participation rates.

3 Empirical results

3.1 Measuring the relative efficiency by province

We measure the relative efficiency of 26 provinces for 1990–2010.Footnote 6 Table 2 displays the results by province in the first and last observation years. We found three interesting results that are noteworthy.

First, most Indonesia’s provinces considerably improved their relative inefficiency of resource utilization and allocation over the observation period. With regard to the provincial mean values, the pe and se scores increased, respectively, from 0.647 to 0.843 and from 0.794 to 0.918 over the period. This implies that provinces generally produced 84.3% of the maximum output level on provincial average and could produce 15.7% more without increasing any inputs after improving the relative inefficiency of their resource utilization in 2010. Similarly, provinces produced 91.8% of the optimal scale in 2010 and could produce 8.2% more, by adjusting their operation size.

In addition, the number of the provinces with severe inefficiencies in resource utilization and allocation decreased considerably over the period. In 1990, six provinces, Jambi (pe 0.238), Yogyakarta (pe 0.254), South Kalimantan (pe 0.322), North Sulawesi (pe 0.294), Central Sulawesi (pe 0.286), and East Nusa Tenggara (pe 0.239), operated at under half the average level of provincial performance. Three provinces, Bengkulu (se 0.217), Southeast Sulawesi (se 0.364), and West Nusa Tenggara (se 0.187), operated at under half the provincial average level, indicating suboptimal scales. In 2010, no such severe inefficiencies could be observed. These provinces have significantly improved inefficiency by ameliorating managerial underperformance and by scaling up operations over the period.

Second, several provinces with serious pure technical and scale inefficiencies still existed in 2010, although most provinces improved their relative inefficiency. In terms of the pe score, the province of Yogyakarta (pe 0.513) is far from the maximum operational level. According to the input slack values in our estimations, which are not shown in Table 2, Yogyakarta has an excess input of labor and human capital, even if it could attain maximum resource utilization. This suggests that developing appropriate mechanisms to efficiently use factor inputs and downsizing both the educated and less-educated labor force can be important policy measures for Yogyakarta.

From the se scores of 2010, we found that among all 26 provinces, 6 were scale efficient. Of the remaining 20 scale-inefficient provinces, 15 are IRS and 5 DRS provinces. The 15 IRS provinces operate at suboptimal scales and can possibly improve inefficiency by increasing factor inputs. Among them, nine IRS provinces operate at more than 90% of the optimal scale. This suggests few economies of scale are unexploited. The remaining six scale-inefficient IRS provinces operate below 90% of the optimal scale. The two provinces of Central Kalimantan (se 0.468) and Papua (se 0.557), in particular, operate far below optimal scales and need to prevent being subjected to business-unfriendly regulations and to deal with financial constraints.

On the other hand, the five scale-inefficient DRS provinces operate at supraoptimal scales due to its large size of operation and can possibly improve inefficiency by decreasing factor inputs. All such five provinces operate at more than 90% of the optimal scale. This suggests that there are few diseconomies of scale unexploited.

Third, the relative inefficiency in resource utilization and allocation tended to converge across provinces over the period. We found strong negative correlations between the efficiency scores in 1990 and the corresponding annual growth rates: −0.926 in pe scores and −0.855 in se scores. This indicates that provinces more (less) efficient in resource utilization and allocation in the initial year showed less (more) improvement over the observation period. This finding provides some advance insight on our key research questions.

3.2 Identifying the sources of interprovincial income inequality

Figures 2, 3, and 4 show the inequality decomposition in per capita income, labor productivity, and overall technical inefficiency, derived from Eqs. (10), (11), and (12), respectively. We note the most interesting findings below.

Figure 2 shows how interprovincial income inequalities are affected by inequalities in labor participation and labor productivity. Interprovincial income inequality decreased from 0.331 in 1990 to 0.220 in 2010. This decreasing trend is consistent with previous studies of Indonesia’s regional income inequality, such as Akita and Lukman (1995), Akita and Alisjahbana (2002), Akita (2003), Akita and Miyata (2010), Kataoka (2010), and Akita et al. (2011). This observation is also reasonable in light of the Asian financial crisis in 1997/1998 and the global financial crisis in 2007/2008 although neither crisis was found to mark a turning point. In 1998, the inequality figure declined by 0.7%, which was not as large as the fall in the provincial population–weighted inequality figure (−1.4%), because the impacts of the 1997/1998 crisis differed by region and were much more severe in the relatively populous high-income Java-Bali region than in other regions (Akita and Alisjahbana 2002).Footnote 7 The inequality declined by 0.3% from 2007 to 2008, which was not as sharp a drop as in the 1997/1998 crisis, because Indonesia’s performance during the 2007/2008 crisis was vastly better than during the 1997/1998 crisis and superior to that of most other countries in the East Asia region (Kuncoro et al. 2009).

In the decomposition, inequality in labor productivity has been a crucial factor in declining interprovincial income inequality for the period. Its contribution to income inequality fell from 121.7% in 1990 to 96.4% in 2010. The effects of the labor participation rate are very small. This finding is structurally similar to the results obtained by Duro and Esteban (1998) and Gisbert (2001), since this rate ranges between zero and unity, whereas productivity values exceed unity. The interaction terms take small negative values with a slight upward trend tending toward zero. Deriving the correlation coefficients for the interaction terms, between −0.481 in 1990 and 0.073 in 2010, we found that the lower-productivity provinces’ tendency to have abundant labor forces—and vice versa—has weakened.

Given that inequality in labor productivity is the major driving force behind the decline in income inequality, we analyze its sources. In Fig. 3, inequalities in overall technical inefficiency show a large decline from 0.193 to 0.028 over the period, while its contribution to inequality in labor productivity fell from 49.9% in 1991 to 12.4% in 2009. This declining trend is also observed in China for 1978–1998 (Cheng and Li 2006) and in the European Union for 1986–2004 (Ezcurra and Iraizoz 2009). Conversely, inequality in pure labor productivity increases slightly from 0.143 to 0.166 with some fluctuations, and its contribution rose from 33.8% in 1993 to 78.0% in 2010. Their interaction terms take minor positive values ranging between 0.018 and 0.087. With regard to the inequality change over 1990–2010, the declining inequality in labor productivity is largely affected by the inequality in overall technical inefficiency, which accounted for 86.6% of the former. On other hand, the increasing inequality in pure labor productivity offset only about 10% of the decreasing inequality in labor productivity. Associated with the findings in the previous section, this implies that the interprovincial convergence in overall technical inefficiencies largely contributed to the reduction in income inequality.

In 2010, pure labor productivity became a new substantial factor in determining income inequality as well as productivity inequality, due to the significantly decreasing inequality in overall technical inefficiency. Since pure labor productivity is affected by per capita physical and human capital and technology, the spatial allocation imbalances of these factors became a new concern in Indonesia.

Finally, Fig. 4 presents the inequality decomposition in overall technical inefficiency. Inequalities in pure technical inefficiency and in scale inefficiency declined from 0.127 in 1990 to 0.014 in 2010 and from 0.088 in 1991 to 0.010 in 2009, respectively. Their interaction terms take minor values ranging between −0.018 and 0.009. With regard to the inequality changes over 1990–2010, the contributions of the decreasing inequality in pure technical inefficiency and scale inefficiency accounted for 68.3 and 35.9% of the decreasing inequality in overall technical inefficiency, respectively. This implies that the inequality convergence in resource utilization inefficiencies had larger impacts than the inequality convergence in resource allocation inefficiencies.

4 Conclusion

By applying the DEA technique to inequality decomposition, we measure the relative efficiency of input–output operation in Indonesia’s provinces for 1990–2010 and explore the extent to which the efficiency factor contributes to interprovincial income inequality. Our efficiency analysis revealed that Indonesia’s provinces improved their relative inefficiencies considerably in both resource utilization and allocation. The relative inefficiency then converged across provinces over the period.

Among several severely inefficient provinces in 2010, Yogyakarta critically underperformed in resource utilization, and Central Kalimantan and Papua operate at further suboptimal scales. The former needs to develop appropriate mechanisms to make efficient use of its given resources, while the latter need to prevent being subjected to business-unfriendly regulations and to deal with their financial constraints.

In 2010, pure labor productivity became a substantial new factor in determining income inequality, due to the significantly decreasing inequality in overall technical inefficiency. Since pure labor productivity is affected by per capita physical and human capital and technology, the spatial allocation imbalances in these factors became a new concern in Indonesia.

Our work has several potential extensions. First, we can detect the factors affecting the pure technical efficiency scores related to province-specific factors such as R&D expenses, infrastructure investment, and interprovincial linkages, employing Tobit regression analysis. Tobit analysis is an appropriate method in which the dependent variable is made a censored variable with limits at zero and unity as efficiency scores range between 0 and 1 (see Cooper et al. 2006; Coelli et al. 2005). The second extension is to measure the productivity changes over time, employing the DEA-based Malmquist productivity index. This index can be multiplicatively decomposed into two components, one measuring the efficiency change and the other measuring the frontier shift (technical change). This potential extension could contribute to further discussion and a deeper understanding of policy implications. Measuring municipal governments’ fiscal efficiency resulting from fiscal decentralization reforms can be another extension. Indonesian decentralization laws place the responsibility for public spending on district governments rather than provincial governments although control over major sources of revenue remains highly centralized (Lewis and Oosterman 2009).

Change history

29 October 2017

In original publication of the article, the author’s first name and family name has been swapped incorrectly. The correct name should read as Mitsuhiko Kataoka.

Notes

Theil’s second measure, expressed by Eq. (5), is also referred to as the mean logarithmic deviation measure (MLD) and is a specific form of General Entropy Class Inequality Measures (Haughton and Khandker 2009); however, we follow Chen and Li’s (2006) expression for consistency.

Theil’s first and second measures are the distance functions that measure the divergence between the two shares. Their structure requires that the weights be given by the share in the numerator of the variables inside the natural logarithm (Gisbert 2001). Quotients inside the natural logarithm of the first and second terms in Eq. (6) are rewritten as follows:

$$\left( {{{\mu_{l} } \mathord{\left/ {\vphantom {{\mu_{l} } {l_{i} }}} \right. \kern-0pt} {l_{i} }}} \right) = {{\left( {{1 \mathord{\left/ {\vphantom {1 n}} \right. \kern-0pt} n}} \right)} \mathord{\left/ {\vphantom {{\left( {{1 \mathord{\left/ {\vphantom {1 n}} \right. \kern-0pt} n}} \right)} \, }} \right. \kern-0pt} \, }\left[ {\left( {{{l_{i} } \mathord{\left/ {\vphantom {{l_{i} } {\sum\nolimits_{i = 1}^{n} {l_{i} } }}} \right. \kern-0pt} {\sum\nolimits_{i = 1}^{n} {l_{i} } }}} \right)} \right]$$$$\left( {{{\mu_{x} } \mathord{\left/ {\vphantom {{\mu_{x} } {x_{i} }}} \right. \kern-0pt} {x_{i} }}} \right) = {{\left( {{1 \mathord{\left/ {\vphantom {1 n}} \right. \kern-0pt} n}} \right)} \mathord{\left/ {\vphantom {{\left( {{1 \mathord{\left/ {\vphantom {1 n}} \right. \kern-0pt} n}} \right)} \, }} \right. \kern-0pt} \, }\left[ {\left( {{{x_{i} } \mathord{\left/ {\vphantom {{x_{i} } {\sum\nolimits_{i = 1}^{n} {x_{i} } }}} \right. \kern-0pt} {\sum\nolimits_{i = 1}^{n} {x_{i} } }}} \right)} \right]$$Political reforms after the economic crisis in 1998 increased the number of provinces from 27 to 34. Until now, no effort has been made to adjust historical data to account for these changes; therefore, we consider only 26 provinces, aggregating data on the new and existing provinces for each year. The eight newly established provinces are as follows: North Maluku (Maluku, 1999), West Papua (Papua, 1999), Banten (West Java, 2000), Bangka-Belitung (South Sumatra, 2000), Gorontalo (North Sulawesi, 2000), the Riau Islands (Riau, 2002), West Sulawesi (South Sulawesi, 2004), and North Kalimantan (East Kalimantan, 2012). Within parentheses are the original province and the year in which the new province was established (Kataoka and Wibowo 2014).

Note that DEA efficiency analysis can be influenced by the presence of outliers. We confirm that no maximum/minimum GRDP values are in fact outliers at the 0.01 significance level, employing the Smirnov-Grubbs test.

We also calculate Theil’s second measures weighted by the relative provincial population size, which are not shown in Fig. 2. It reflects a similar trend to our empirical values, showing a correlation coefficient of 0.968.

References

Akita T (1988) Regional development and income disparities in Indonesia. Asian Econ J 2:165–191

Akita T (2003) Decomposing regional income inequality in China and Indonesia using two-stage nested Theil decomposition method. Ann Reg Sci 37:55–77

Akita T, Alisjahbana AS (2002) Regional income inequality in Indonesia and the initial impact of the economic crisis. Bull Indones Econ Stud 38(2):201–222

Akita T, Lukman RA (1995) Interregional inequalities in Indonesia: a sectoral decomposition analysis for 1975–1992. Bull Indones Econ Stud 31(2):61–81

Akita T, Miyata S (2008) Urbanization, educational expansion, and expenditures inequality in Indonesia in 1996, 1999, and 2002. J Asia Pac Econ 13(3):147–167

Akita T, Miyata S (2010) The bi-dimensional decomposition of regional inequality based on the weighted coefficient of variation. Lett Spat Resour Sci 3(3):91–100

Akita T et al (1999) Inequality in the distribution of household expenditures in Indonesia: a Theil decomposition analysis. Dev Econ 37(2):197–221

Akita T et al (2011) Structural changes and regional income inequality in Indonesia: a bidimensional decomposition analysis. Asian Econ J 25(1):55–77

Alcalde-Unzu J et al (2009) Cross-country disparities in health-care expenditure: a factor decomposition. Health Econ 18(4):479–485

Anand S (1983) Inequality and poverty in Malaysia: Measurement and decomposition. Oxford University Press, New York

Azis IJ (1990) Inpres’ role in the reduction of interregional disparity. Asian Econ J 4(2):1–27

Banker RD, Charnes A, Cooper WW (1984) Models for estimating technical and scale efficiencies in data envelopment analysis. Manag Sci 30(9):1078–1092

Charnes A, Cooper WW, Rhodes E (1978) Measuring the efficiency of decision making units. Eur J Oper Res 2:429–444

Charnes A, Cooper WW, Li S (1989) Using data envelopment analysis to evaluate efficiency in the economic performance of Chinese cities. Soc Econ Plan Sci 23:325–344

Cheng Y-S, Li S-K (2006) Income inequality and efficiency: a decomposition approach and applications to China. Econ Lett 91(1):8–14

Coelli TJ, Prasada R, Battese GE (2005) An introduction to efficiency and productivity analysis, 2nd edn. Kluwer Academic Publishers, Boston

Cooper WW, Seiford LM, Tone T (2006) Data envelopment analysis: a comprehensive text with models, applications, references and DEA-solver software. Springer, New York

Duro JA, Esteban J (1998) Factor decomposition of cross-country income inequality, 1960–1990. Econ Lett 60(3):269–275

Enflo K, Hjertstrand P (2009) Relative sources of European regional productivity convergence: a bootstrap frontier approach. Reg Stud 43(5):643–659

Esmara H (1975) Regional income disparities. Bull Indones Econ Studies 11(1):41–57

Ezcurra R, Iraizoz B (2009) Spatial inequality in the European Union: does regional efficiency matter? Econ Bull 29(4):2648–2655

Ezcurra R et al (2009) Total factor productivity, efficiency, and technological change in the European regions: a nonparametric approach. Environ Plan A 41(5):1152–1170

Garcia JG, Soelistianingsih L (1998) Why do differences in provincial incomes persist in Indonesia? Bull Indones Econ Stud 34(1):95–120

Gisbert GFJ (2001) On factor decomposition of cross-country income inequality: some extensions and qualifications. Econ Lett 70(3):303–309

Halkos GE, Tzeremes NG (2010) Measuring regional economic efficiency: the case of Greek prefectures. Ann Reg Sci 45(3):603–632

Hayashi M, Katoka M, Akita T (2014) Expenditure inequality in Indonesia, 2008–2010: a spatial decomposition analysis and the role of education. Asian Econ J 28(4):389–411

Hill H (2000) The Indonesian economy. Cambridge University Press, Cambridge

Hill H (2002) Spatial disparities in developing East Asia: a survey. Asia Pac Econ Lit 16:10–35

Hill H (2008) Globalization, inequality, and local-level dynamics: Indonesia and the Philippines. Asian Econ Policy Rev 3:42–61

Islam I, Khan H (1986) Spatial patterns of inequality and poverty in Indonesia. Bull Indones Econ Stud 22(2):80–102

Kataoka M (2010) Factor decomposition of interregional income inequality before and after Indonesia’s economic crisis. Stud Reg Sci 40(4):1061–1072

Kataoka M (2012) Economic growth and interregional resource allocation in Indonesia. Stud Reg Sci 42(4):911–920

Kataoka M (2013) Capital stock estimates by province and interprovincial distribution in Indonesia. Asian Econ J 27(4):409–428

Kataoka M, Wibowo K (2014) Spatial allocation policy of public investment in Indonesia and Japan. In: Fahmi M, Yusuf AA, Purnagunawan RM, Resosudarmo BP, and Priyarsono D S (ed) Government and communities: Sharing Indonesia’s common goals, Indonesian Regional Science Association (IRSA) book series on regional development, No. 12, Indonesian Regional Science Association, Bandon, pp 193–213

Kuncoro M et al (2009) Survey of recent developments. Bull Indones Econ Stud 45(2):151–176

Lewis BD, Oosterman A (2009) The impact of decentralization on subnational government fiscal slack in Indonesia. Publ Budg Financ 29:27–47

Li B, Dewan H (2017) Efficiency differences among China’s resource-based cities and their determinants. Resour Pol 51:31–38

Li SK, Zhao L (2015) The competitiveness and development strategies of provinces in China: a data envelopment analysis approach. J Prod Anal 44(3):293–307

Milanovic B (2005) Half a world: regional inequality in five great federations. J Asia Pacific Econ 10:408–445

Olaskoaga-Larrauri J et al (2011) Determinant factors in the convergence of welfare effort in OECD countries: a decomposition of the Theil indices. App Econ Lett 18(13–15):1263–1266

Schaffer A et al (2011) Decomposing regional efficiency. J Reg Sci 51(5):931–947

Stimson RJ, Stough RR, Roberts BH (2006) Regional economic development: Analysis and planning strategy. Springer, Heidelberg

Tadjoeddin MZ, Suharyo WI, Mishra S (2001) Regional disparity and vertical conflict in Indonesia. J Asia Pacific Econ 6:283–304

Theil H (1967) Economics and information theory. North-Holland, Amsterdam

Tsolas IE (2013) Modeling profitability and stock market performance of listed construction firms on the Athens exchange: two-stage DEA approach. J Constr Eng Manag 139(1):111–119

Acknowledgements

This work is supported by Grant-in-Aid for Scientific Research C (26380308) from the Japan Society of the Promotion of Science. I gratefully acknowledge the critical review by Dr. Shunsuke SEGI on an earlier version of the manuscript. I also thank the two anonymous referees for their constructive comments. The author is solely responsible for any remaining errors.

Author information

Authors and Affiliations

Corresponding author

Additional information

The original article has been revised and the author name is corrected.

About this article

Cite this article

Kataoka, M. Inequality convergence in inefficiency and interprovincial income inequality in Indonesia for 1990–2010. Asia-Pac J Reg Sci 2, 297–313 (2018). https://doi.org/10.1007/s41685-017-0051-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41685-017-0051-3