Abstract

International conglomerates often take financial risks by investing funds in potential projects without conducting comprehensive assessments of the uncertainties associated with economic and political factors, which contribute to overall international business risks. In this study, an analytic hierarchy process (AHP) based approach has been developed as a practical decision-making tool for project selection in project management. The AHP enables the identification of the most valuable projects among various potential options, ensuring that investors benefit from the proposed advantages outlined in the project business plans. The capital expenditure (CAPEX), operating expenditure (OPEX), environment, social and governance (ESG) and ease of business (EOB) are the criteria selected and organised into a hierarchical framework of the AHP. The projects under each criterion are prioritised by assigning overall weights through pairwise matrix comparisons. To ensure the reliability and consistency of the pairwise comparisons, the eigenvector method is employed to evaluate the consistency of the economic freedom sub-criterion under EOB. Similarly, the AHP is applied to the CAPEX, OPEX and ESG criteria using consistent scoring and rating systems for pairwise comparisons, which enables the determination of their overall weights. Based on the analysis, the relative weightage of each decision criterion has been identified, and the score of each project has been estimated. LNG import and re-gasification terminal in Southwest India is chosen as the project with the greatest potential to fulfil the diverse requirements of the companies. Capital cost contributes the most to this decision because the projects considered in this case are highly capital intensive. At the same time, the overall scores of four projects are comparable, and thus, the final decision selection may also be based on the specific priorities of the investors.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Project selection is the process of evaluating and selecting projects that correspond with an organisation’s goals which in return, improves productivity of the organisation. In the era of globalisation, the shortage of project ideas can be concluded to being non-existent. Instead, the main problem faced by many organisations is the over-generation of too many ideas. Screening of these project ideas has never been tougher than before due to the long queue of submissions waiting to be reviewed by the upper echelon of the project management team. Given the vast scope and complexity of projects, as well as resource constraints such as time and budget, finding the right combination of projects that will produce the best results is proven to be a hurdle for the project management sector. Furthermore, it is proven that selecting and pursuing a project must be done in a careful manner to avoid project failures which affect international business.

Due to the obstacle, project portfolio management (PPM), has been introduced as an integration procedure of project execution with a high-level business strategy. PPM is carried out by incorporating critical aspects such as selection and prioritisation. It has been reported that 37 percent of project failures occur due to a lack of clearly defined objectives and discipline when implementing strategies (EcoSys 2018). The practise of rating or evaluating projects based on a set of criteria to determine their execution sequence is known as prioritisation. Due to the interconnection between the two processes, the terms “prioritisation” and “selection” are frequently misunderstood.

When conducting project selection and prioritisation, a strong strategy has to be devised to ensure the project produces various benefits. These benefits include, but are not limited to, bigger and better return of investments (ROI), shorter time to market products, successful project deliveries and better environmental and safety performance.

The energy sector is a conglomerate of companies that produce and distribute energy. It also includes companies that explore, produce, refine, market, store and transport oil and gas, coal and other consumable fuels, according to the Global Business Classification Standard, (CFI 2021). The energy sector is extremely vulnerable to the business cycle as it is cyclical in nature. Because of the cyclical nature of the energy industry, its earnings are likewise volatile (Bertelsen and Sedlacek 2014).

The energy industry is nearing the end of its expansion cycle. The fact that the industry is dominated by a few large, well-established corporations such as Exxon-Mobil, Petronas, Royal Dutch Shell and BP shows that it is extremely difficult to establish a new company to rival the big-game players. However, there are new opportunities rising for the energy sector due to the emergence of new trends such as making activities such as drilling and exporting oil more expensive for corporations involved, resulting in lower long-term profitability. Secondly, the most significant new trend is the understanding of the Paris Agreement, where harmful consequences of carbon footprint are driven by the release of greenhouse gases (GHG), on our ecosystem, which is leading to a move away from fossil fuels and petroleum.

If a company were to consider about branching out into the energy and chemical industries, a general understanding on the trends provides the company insights on looking into a variety of projects throughout the world. By doing so, the company would want to invest in projects that generate the highest value. The catch to this is that if the management feels confident in its capacity to borrow money at a competitive rate, any project may be adopted and pursued by the company. Nonetheless, if the company wants to look at project investment from an opportunity standpoint, the aspects to be focused on are listed below:

-

1)

Analyse the prospects and screen out infeasible ones in a logical fashion

-

2)

Conduct a coarse screening on the remaining prospects and choose an end product which provides maximum value

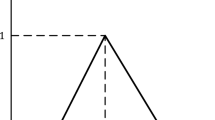

Decision-making is a process where choices were made by identifying a decision after gathering all the necessary and relevant information, followed by detailed assessment of different alternatives. In order to assure the good quality of the decision, understanding on the requirements of a good decision is important. This can be illustrated as the decision quality (DQ) framework, which can be dissected into 6 different elements as shown in Fig. 1. This framework is applied during the decision-making of the prospects.

Developed by Thomas L. Saaty during the 1970s, the analytic hierarchy process (AHP) is a basic decision-making methodology (Saaty 1987). It is designed to handle both the rational and intuitive parts of deciding on the best option from a range of alternatives based on a set of criteria. In AHP, the decision maker makes simple pairwise comparison judgments, which are then used to create overall priorities for ranking the possibilities. The AHP allows for judgement inconsistency while also giving a mechanism to increase consistency. The AHP was created in such a way that the human mind may employ hierarchical decomposition of complex systems as a fundamental strategy for dealing with diversity. From the broad, at the top of the hierarchy, to the precise, at the bottom, the elements influencing the decision are organised in progressive degrees. The purpose of the structure is to evaluate the importance of things at one level with respect to some or all of the elements at the level above. After the structuring is complete, the AHP is fairly simple to use as a decision-making tool for various scenarios. Therefore, AHP applies vividly in the case of selecting the most economically feasible prospect, where a lot of considerations to be made during the selection process. It uses a multi-level hierarchical structure of goals, criteria, sub-criteria and alternatives as shown in Fig. 2. By conducting pairwise comparisons, the weights of importance of the decision criteria will be determined, along with the relative performance measures of alternatives in terms of each individual decision criterion (Tan et al. 2014). Along with its variants such as fuzzy AHP, these methods can also be used in making decisions on non-quantitative targets (Tan et al. 2016). In the case where the comparisons are not consistent, mechanisms for improving the consistency were introduced (Triantaphyllou and Mann 1995). AHP is widely applied in multi-criteria decision-making, resource allocation and planning as well as in resolving conflict (Saaty 1987). Some of the notable applications of these tools include the design of extraction processes (Ten et al. 2021), simultaneous consideration of process and molecular design (Ooi et al. 2018) and microalgae harvesting process (Tan et al. 2016). In an important contribution, a methodology to use AHP for project evaluation and selection has been illustrated with a proof-of-concept example (Palcic & Lalic 2009). In this work, an MS Excel-based tool has been developed for performing the analysis. In another contribution, AHP has been used as a tool for project selection by targeting sustainable development (Jurik et al. 2022). This work has highlighted the subjective nature of decision-making during project selection and proposed a more accurate approach based on AHP. Another approach has combined AHP with a linear programming model to select the among a set of construction projects (Parvaneh & El-Sayegh, 2016). This approach offers a unique combination of qualitative and quantitative approaches for project selection.

While multi-criteria decision-making tools have been extensively employed for project selection, they often lack integration with the key value drivers, especially when dealing with projects of significantly different scopes. In this work, we have developed an approach for systematically assessing the potential of various investment options in the energy sector for International Conglomerates. This methodology not only facilitates the comparison of diverse investment options but also allows for evaluations based on the specific priorities of the investing parties.

Methodology

In the early phase of concept selection, it is crucial to decide the guidelines or basis to be applied when assessing the different prospects. In this section, two main techniques, namely the decision quality and analytic hierarchy process (AHP), will be analysed for better understanding before applying during the concept selection. The decision-making process had a multi-lobed structure. It consisted of a series of workshops and brainstorming sessions whose intention was to rely on expert knowledge to identify the following items:

-

1.

Decision parameters,

-

2.

Risks and issues associated with individual industrial projects,

-

3.

Success criteria specific to individual industrial projects which were selected based on the risks and issues identified in the previous step,

-

4.

Strategy table based on decision parameters.

The DQ framework provides an easily accessible, yet general framework to conduct a decision-making process which is agnostic to the industry type. The workshops and brainstorming sessions are intended to fit the DQ framework to the specific industrial projects which form the portfolio. The AHP meanwhile acts as a tool within the DQ framework for the decision-making process.

The selection of the experts needed for the process is not covered in the paper. In general, subject matter expert (SME) level knowledge is recommended for individuals pertaining to specific components. For example, to create a “low CAPEX” strategy table for the industrial project, someone with a background in project development and/or facilities engineering and/or cost engineering is recommended. Variations might also be required for specific industries; for example, someone with expertise in ethanol manufacturing would be able to provide input for ethanol manufacturing project, wherein someone with expertise in oil and gas industry might be selected for oil and gas project. Where needed, a poll can be conducted to capture differing opinions.

The overview of the entire process selection is shown in Fig. 3, and each of these will be carried out in the following sections.

As illustrated in Fig. 3, objectives, key value drivers, success criteria and issues were identified for each project. The objective of a project reflects what we want to achieve by the end of the project, which can be translated into deliverables, assets or other forms. Besides, key value drivers are the factors that can increase the value or worth of the project. Success criteria are the variables that measure and determine whether the outcome of a project is successful (Lamprou and Vagiona 2018). On the other hand, issues are problems that might be encountered during the execution of the project.

The next step is the concept identification and screening. In this step, each prospect needs to be screened thoroughly by conducting literature research. For each of the projects, the objectives, key value drivers, success criteria and issues were identified. Since the objective is to identify the project with the highest return on investment, the project that can achieve maximum profit with the lowest risk needs to be identified. Besides, the operation of the plant must be also safe, environmentally friendly and sustainable. Project on schedule is also crucial to ensure smooth operation without delays since delays will incur more cost and time. In the next stage, the key value drivers of the potential projects need to be identified. Some of the typical value drivers are shown in Table 1. Low capital and operating cost will help in maximising the net profit generated. With high ease of business, proven technology and high marketability of products, these will reduce the risk and ensure that our products are marketable. In addition, to govern the safety, both environmental and social, adherence to ESG and HSE is highly encouraged. Good control of the project schedule and making sure the progress is on the right track are crucial steps in project management to make sure there is no delay in the schedule of the project.

For all the prospects, there are success criteria and issues that are affecting the feasibility of each project. Therefore, before choosing any of the prospects, it is important to focus on the difficulty to decide whether mitigations can be taken to reduce the risk of issues from occurring. The typical success criteria are.

-

1.

High income or revenue obtained

-

2.

Continuous exploration and development

-

3.

Improvement of technology

-

4.

Reduction of greenhouse gas (GHG) emissions

-

5.

Safety and environmental improvements

The first element for a good decision is setting up the appropriate frame by clearly defining the purpose of decision-making, the scope and the perspective of the decision maker(s) (Spetzler et al. 2016). A decision problem may be framed broadly or narrowly. However, for a decision with broad frame, it will consume longer time as well as have significant impact on more parties involved. For example, the stakeholders and other relevant parties will be involved when a company decides to launch a new product. With the involvement of several parties, it is crucial that the frame set is agreed by everyone.

The second element is creative alternatives, where consideration was made on different possible solutions. If there are no alternatives, no decision is required to make. Therefore, it is worth the time and effort to create and brainstorm better ideas or alternatives since DQ needs good alternatives. When various alternatives are generated, relevant information should be collected from reliable sources to make comparison between them. Relevant information includes the important details that we know, should know and would like to know about the outcomes of the decision. The information should be gathered from reliable information to avoid biases. In addition, information collected should be associated with uncertainties, which can be either expressed as possibilities or probabilities of certain events from occurring (Spetzler et al. 2016).

Furthermore, values, which describe what we are aiming for, should be clear for every party so that a quality decision can be reached easily. However, when making a decision, it is usual to have multiple targets, such as greater shareholder value, environmental sustainability and a positive brand impact. Thus, trade-offs should be done to decide how much of one value the decision maker is willing to give up so that it is possible to get more of another. The last two elements in the DQ framework are sound reasoning and commitment to action. Sound reasoning will incorporate all the information collected and analyse in order to get the alternative which is able to deliver the most of what we want. In the case where uncertainty is crucial, tools such as tornado diagrams and decision trees can be used in this process. Lastly, commitment to action refers to the action to be taken once the decision is made so that real values can be created. Without effective action, all the time and effort in decision-making will be wasted (Spetzler et al. 2016).

To select the project from a list of promising options, analytic hierarchy process (AHP) has been applied. In this step, the decision problems are divided into three major components, namely goal, alternatives and criteria. The definition of a goal of the problem is the comprehensive objective which drives the decision problem. Next, the alternatives are referring to various choices that are being weighed in the decision. Lastly, the criteria are the factors being utilised for the evaluation of the alternatives towards the goal of the decision problem. If more differentiation is required, sub-criteria can be specified (Kluhto 2013). However, it is to be noted that not every criterion requires sub-criteria, nor do those with sub-criteria require the same number of sub-criteria.

The process of developing an AHP can be described into 5 steps:

-

1.

The main problem is determined.

-

2.

A decision hierarchy is structured from the top with the goal of the decision.

-

3.

Next, the criteria and alternatives are identified and structured.

-

4.

The pairwise comparison matrices are developed. For every criterion, a set of sub-criteria were identified and compared between one another.

-

5.

The weightage obtained for the criteria is utilised for weighing the sub-criteria. This is repeated for each criterion and the weighing process is continued until the final score of the alternative is obtained.

In summary, the mathematical representation of AHP is as follows, a decision maker has n objectives and m alternatives. During the first stage of AHP, a weight wi is generated for the ith objective. Next, a score sik of the kth alternative is given on the ith objective. Lastly, the final score of the kth alternative is then evaluated using the Eq. 1 below (Nguyen 2014):

For the pairwise comparisons, a fundamental scale which is used in the AHP evaluation is important to indicate how many times more dominant one element is to another element with respect to the criterion on which they are compared. Table 2 depicts the fundamental scale which is utilised in the AHP for prospect selection in the latter part (Saaty 2008).

The core steps in applying AHP calculations are as follows (Nguyen 2014):

-

1.

The pairwise comparison matrix for a decision maker with n objectives is an n x n matrix \(A=[{\alpha }_{ij}]\):

A matrix \(A\) which fulfils condition (a) is defined as a positive matrix whereas condition (b) as a reciprocal matrix. Besides that, Eqs. (2) and (3) also indicate that \({\alpha }_{ii}=1\) for \(i=1,\dots ,n\).\({\alpha }_{ij}\) entry in \(A\) represents the importance of objective i compared to the objective j. Hence, the \({\alpha }_{ij}\) entry can be estimated in Eq. 5.

-

2.

A consistent pairwise comparison matrix \(A\) which satisfies the conditions above is shown in Eq. 4.

where \({w}_{i}\) is the weight of objective i and \({w}_{j}\) is the weight of objective j. The above equality is true only if the decision maker is consistent.

-

3.

The pairwise comparison matrix A of a consistent decision maker can be summarised in Eq. 6.

where \({w}_{i}>0\) and \({\sum }_{i=1}^{n}{w}_{i}=1\).

-

4.

The weight vector w of a decision maker is estimated as shown in Eq. 7.

where \({w}_{i}>0\) and \({\sum }_{i=1}^{n}{w}_{i}=1\).

The definitions 1 to 4 are then led to two important theorems in AHP.

Theorem 1: If a decision maker is consistent and has n objectives, let \(A\) be the corresponding pairwise comparison matrix, and w be the weight vector. Then, w is an eigenvector of \(A\) with corresponding eigenvalue \(\lambda =n\) as shown in Eqs. 8 and 9.

Theorem 2: The normalised form of any column of the matrix \(A=\left[\frac{{w}_{i}}{{w}_{j}}\right]\) is a solution to the eigenvalue problem \(Aw=nw\), where \(w={\left[\begin{array}{ccc}{w}_{1}& \cdots & {w}_{n}\end{array}\right]}^{T}\) is the weight vector solution and n is the number of objectives.

For inconsistent decision maker, the eigenvalue problem can be represented by Eq. 10.

where \({\lambda }_{max}\) is the unique largest eigenvalue for \(A\) and \({w}_{0}\) is the corresponding eigenvector.

Since the decision makers do not normally make “perfect” judgement when doing the pairwise comparison, it is possible to produce a result where transitivity property is not satisfied, eventually leading to an inconsistent outcome (Alonso and Lamata, 2006). Hence, to ensure the transitivity property is always fulfilled, it is important to check the consistency of the result. To check for the consistency of the outcomes from AHP, consistency index (CI), random index (RI) and consistency ratio (CR) should be calculated. As suggested by Triantaphyllou and Mann (1995), the result is said to be consistent only if the corresponding CR value is lower than 10%, which is also in agreement with Rass et al. (2020).

Equation 11 shows the consistency index, which can be further divided into the definition for RI and CR.

Random index is the average value of CI calculated from a huge set of randomly generated reciprocal matrices. With the expansion of both CR and RI, consistency ratio is introduced which will indicate the consistency of the matrix as shown in Eq. 12. It is the ratio of CI (A): RI (A), where RI(A) is the random index for matrices of size n. Random index values for matrices of order 1 to 10 are presented in Table 3 (Saaty, 1987). For values higher than 10%, the comparison and ratio matrix will be revised, and re-evaluation will be done (Kluhto 2013).

Once the relative weights are estimated, the selection of the project is done based on the total score and the individual scores which depend on the designers’ choice.

Case Study

In this work, various past potential prospects in manufacturing and oil and gas exploration and development worldwide which were considered by international conglomerates were explored.

The brief description of each prospect is presented in Table 4.

If these projects are to be invested as an opportunity, it can be concluded as a short-term investment than a long-term investment. All the key value drivers mentioned in the methodology are relevant for all six potential projects.

For all the prospects, there are success criteria and issues that are affecting the feasibility of each project, which are listed in Tables 5 and 6. Therefore, before choosing any of the prospects, it is important to focus on the difficulty to decide whether mitigations can be taken to reduce the risk of issues from occurring.

To apply the decision quality framework to each project, it is necessary to list out the possible outcomes for different aspects, such as in terms of feedstock(s) and end-product(s). The detailed data listed out can be found in the Appendix. From the key value drivers mentioned in the “Methodology” section, 4 of the most important drivers shown were used to form the strategy tables by using the decision hierarchy data in the Appendix. These drivers are low capital cost, low operating cost, environmental, social and governance and ease of doing business which are presented in Tables 7, 8, 9 and 10.

For each of the strategies, the raw data in the decision hierarchy are selected in order to achieve to the respective strategy. For instance, for project 1, the mode of transportation with the lowest CAPEX is by using existing pipelines, which is the cheapest out of the options given in the decision hierarchy tables.

By applying AHP in the prospect selection in this work, the relative importance given during the pairwise comparison is determined by referring to the quantification tools available for various criteria. For example, indexes are available to compare the ease of business and political situation in various countries, which can be used to quantify these criteria, which are otherwise difficult to assess. The pairwise comparison has been performed by a team of industrial practitioners and academic researchers. Consensus on the scoring was achieved through brainstorming sessions for each pair. The hierarchical structure of this problem is presented in Fig. 4.

In order to determine the weightage of each strategy relative to each other, ratings were given as shown in Table 11. It can be seen that CAPEX is having the highest global weightage, followed by ease of business, OPEX and ESG. The outcome of this pairwise comparison is also reasonable since all these projects are CAPEX intensive, so it is crucial to consider CAPEX during the selection process. The highest weightage indicates that it is the most important strategy as it has the most significant effect on the final decision.

For CAPEX pairwise comparison between the projects, estimation of cost for each project was based on the existing plants in the country. In order to ensure reliable comparison, the estimated cost was divided by the production capacity provided. The capital cost estimated is illustrated in Table 12. With these values, it is used as the basis for pairwise comparison for low CAPEX as shown in Table 13.

Referring to Table 13, it can be observed that project 1 has the highest weightage, followed by project 4, project 3, project 2, project 5 and project 6. The reason that project 6 scores the lowest is because of its high CAPEX since refineries usually require lots of distillation columns, while for project 5, the cost of electrolyser is very high even though there are subsidies from the government. With the high CAPEX incurred, it will be very challenging to obtain a good return. For project 1, the process is mainly focusing on the purification of oil extracted, and it only requires relatively cheap equipment such as separators.

The results of pairwise comparison for other strategies, such as OPEX, ease of business, environmental, social and governance (ESG), are shown in the Appendix. As a summary, based on Table 14, project 1 to project 4 have relatively similar final weightage after comparing them in terms of strategies. On the other hand, project 6 scores the lowest as the CAPEX incurred for this project is remarkably higher than the rest. With the final weightage, the ranking of projects was done, whereby project 4 scores the first, followed by projects 1, 3, 2, 5 and 6.

With the application of decision quality framework, decision hierarchy and AHP, it has enabled the selection of best concept. As a sequel to this study, project 4, LNG import and re-gasification terminal in Southwest India, is chosen as the final project for further study. This is also supported by the trend of LNG observed in India in the recent years, especially when India is promoting natural gas as a “transition fuel”, which is also one of the commitment under the 2015 Paris Agreement to reduce the greenhouse gas (GHG) emission intensity of its gross domestic product (GDP) by 33 to 35% by 2030 (Lopes 2021). Natural gas, which is a cleaner fuel than oil and coal, plays an extremely role in transitioning from fossil fuels to other energy sources (Pospíšil et al., 2019).

Besides, as of September 2021, natural gas made up 6.5% of India’s energy mix, and the share of natural gas in its energy mix is expected to be 15% by 2030. In 2020, India’s government had announced the “One Nation One Gas Grid” program to expand the country’s LNG infrastructure. As a result, more than 15,000 km of gas pipelines, which can cover 407 districts, is scheduled for completion by 2023 (Lopes 2021). With the positive rise in demand of natural gas as well as support from the government, project 4 has the best potential for further consideration. At the same time, projects 1, 2 and 3 also have similar scores to project 4. However, the relative weights of individual criteria are significantly different. Since the overall scores are comparable for these three projects, the investors can make the final decision based on the specific priorities.

As observed from the AHP outcome, every multi-criteria decision-making (MCDM) strategy can be used to break down complex problems into manageable components. With the use of MCDM in the AHP, several dimensions that are relevant for the decision-making context can be considered and evaluated one at a time. Using group decision-making procedures such as the pair-wise matrix comparison, the scores obtained from the various grading methods can be gathered and integrated into the final scoring system which produces a final score compromising of all existing data to aid the final decision of selecting a project. Although all projects are not the best in all categories, as long the project does not score poorly in any high-scoring criteria, it has a higher chance of being selected.

Conclusions

Project management demands various discerning talents and strategies in order to make sound conclusions in complex decision-making scenarios. The AHP is described in the paper as a decision-making process that permits several factors to be considered when undergoing the screening process implemented in the first gate of the stage gate process. To show the detailed use of AHP in project management, a detailed example of AHP on project selection was constructed. This was done to demonstrate that by considering key factors into several criteria in the AHP and analysing them accurately based on a wide range of data instead of approximations, a complex decision involving multi-criteria decision-making process can produce a clear-cut answer for decision makers instead of uncertain answers. By doing so, project management experts will be more inclined to incorporate the use of AHP as a powerful decision-making tool.

Based on the AHP study carried out, the major achievements that have made this study a success are that the overall decision-making ability from the preliminary AHP has been enhanced greatly to produce clear-cut answers. Secondly, the uncertainties present in the preliminary AHP which may hinder a decision-maker’s ability to select a valuable project have been mitigated. Furthermore, the AHP can be considered to be robust as the methods and techniques used to conduct pair-wise comparisons are able to produce consistent, reliable ratings which can be trusted by future decision makers if they decide to use this tool.

Data Availability

Not available.

Code Availability

Not available.

References

Alcalá P (2021) Is austerity creating safety concerns for PEMEX?. Mexico Business News. Retrieved from: https://mexicobusiness.news/oilandgas/news/austerity-creating-safety-concerns-pemex

Alcántara-Ayala I (2009) Disasters in Mexico and Central America. A little bit more than a century of natural hazards. Dev Earth Surface Process 13(C):75–97. https://doi.org/10.1016/S0928-2025(08)10004-9

Alonso JA, Lamata MT (2006) Consistency in the analytic hierarchy process: A new approach. International Journal of Uncertainty, Fuzziness and Knowlege-Based Systems 14(4):445–459. https://doi.org/10.1142/S0218488506004114

Aydin U (2019) Energy insecurity and renewable energy sources: Prospects and challenges for Azerbaijan. In: ADBI working paper 992. Asian Development Bank Institute, Tokyo. Retrieved from: https://www.adb.org/publications/energy-insecurity-renewable-energysources-challenges-azerbaijan

Basak M, Perrons RK, Coffey V (2019) Schedule overruns as a barrier for liquefied natural gas projects: a review of the literature and research agenda. Energy Rep 5:210–220. https://doi.org/10.1016/j.egyr.2019.01.008

Bertelsen K, Sedlacek M (2014) Energy sector overview. Retrieved from: https://s3.wp.wsu.edu/uploads/sites/606/2015/02/SectorOverview_ENE_Spring2014.pdf

Boruff B et al (2003) Tornado hazards in the United States. Clim Res 24:103–117. https://doi.org/10.3354/cr024103

CFI (2021) Energy sector - overview, components, and factors. Retrieved from: https://corporatefinanceinstitute.com/resources/careers/jobs/energy-sector/. Accessed 11 Dec 2021

Coleman N (2021) Kashagan operator battles sea level drop with new dredging project. S&P Global. Retrieved from: https://www.spglobal.com/commodityinsights/pt/market-insights/latest-news/oil/040921-kazakhstans-kashagan-oiloperator-battles-sea-level-drop-with-new-dredging-project

Cordes EE, Jones Daniel OB, Schlacher Thomas A, Amon Diva J, Bernardino Angelo F, Sandra B, Robert C, DeLeo Danielle M, Dunlop Katherine M, Escobar-Briones Elva G, Gates Andrew R, Luciana G, Judith G, Lea-Anne H, Santiago H, Sarah H, Mandy J, Salit K, Mestre Nélia C et al (2016) Environmental impacts of the deep-water oil and gas industry: a review to guide management strategies. Front Environ Sci 4. https://doi.org/10.3389/fenvs.2016.00058

Czech K, Niftiyev I (2021) The impact of oil price shocks on oil-dependent countries’ currencies: The case of Azerbaijan and Kazakhstan. J Risk Financ Management 14:431. https://doi.org/10.3390/jrfm14090431

Delamaide E, Moreno WP (2015) Enhanced oil recovery of heavy oil in reservoirs with bottom aquifer. In: Paper presented at the SPE western regional meeting, Garden Grove. https://doi.org/10.2118/174050-MS

Diggs A (2012) The expiration of the ethanol tax credit: an analysis of costs and benefits. Policy Perspect 19(Phaaneuf 2007):47. https://doi.org/10.4079/pp.v19i0.10425

EcoSys (2018) Project selection: A guide to project prioritization and selection | EcoSys. Retrieved from: https://www.ecosys.net/blog/project-selection-prioritization-guide/. Accessed 11 Dec 2021

Hanaki K, Portugal-Pereira J (2018) The effect of biofuel production on greenhouse gas emission reductions. In: Takeuchi K, Shiroyama H, Saito O, Matsuura M. (eds) Biofuels and sustainability. Science for Sustainable Societies. Springer, Tokyo. https://doi.org/10.1007/978-4-431-54895-9_6

International Trade Adminstration (2021) Mexico - country commercial guide. Retrieved from: https://www.trade.gov/country-commercial-guides/mexico-oil-and-gas. Accessed 23 Nov 2021

Iwaszczuk N, Wolak J, Iwaszczuk A (2021) Turkmenistan’s gas sector development scenarios based on econometric and swot analysis. Energies 14(10):1–18. https://doi.org/10.3390/en14102740

Jayakumar K, Panda RC, Panday A (2017) ‘A review: state-of-the-art LPG sweetening process. Int J Greenhouse Gas Control 9(2):175–206

Jurík L, Horňáková N, Šantavá E et al (2022) Application of AHP method for project selection in the context of sustainable development. Wireless Netw 28:893–902. https://doi.org/10.1007/s11276-020-02322-2

Kar SK, Vaid M (2016) India advancing LNG projects to bridge gas-supply gap. Oil Gas J 114:76–76

Kluhto S (2013) Mathematical decision making an overview of the analytic hierarchy process. Retrieved from: https://www.whitman.edu/Documents/Academics/Mathematics/Kluhto.pdf.

Lamprou A, Vagiona D (2018) Success criteria and critical success factors in project success: a literature review. Int J Real Estate Land Plan 1:2623–4807

Lopes F (2021) How natural gas could thwart or support India’s renewables progress. Business Standard. Retrieved from: https://www.business-standard.com/article/current-affairs/how-natural-gas-could-thwart-or-supportindia-s-renewables-progress-121101900140_1.html

Media (2020) Mexico’s new refinery quest draws criminal attention. Retrieved from: https://www.argusmedia.com/en/news/2128426-mexicos-new-refinery-quest-draws-criminal-attention

Mokhatab S, Mak JY, Valappil JV, Wood DA (2014) LNG fundamentals in handbook of liquefied natural gas. Gulf Professional Publishing, pp 1–106. https://doi.org/10.1016/B978-0-12-404585-9.00001-5

Molavi-Arabshahi M, Arpe K, Leroy SAG (2016) Precipitation and temperature of the southwest Caspian Sea region during the last 55 years: their trends and teleconnections with large-scale atmospheric phenomena. Int J Climatol 36(5):2156–2172. https://doi.org/10.1002/joc.4483

Nguyen GH (2014) The analytic hierarchy process: a mathematical model for decision making problems. Senior Independent Study Theses [Preprint]

Ooi J, Ng DKS, Chemmangattuvalappil NG (2018) Optimal molecular design towards an environmental friendly solvent recovery process. Comput Chem Eng 117:391–409. https://doi.org/10.1016/j.compchemeng.2018.06.008

Oxford Business Group (2019) Mexico’s plans to upgrade existing new oil refineries and build a new facility. Retrieved from: https://oxfordbusinessgroup.com/analysis/capacity-boost-government-plansupgradecountry’s-six-refineries-and-construct-new-facility

Palcic I, Lalic B (2009) Analytical hierarchy process as a tool for selecting and evaluating projects. Int J Simul Model 8:16–26. https://doi.org/10.2507/IJSIMM08(1)2.112

Parvaneh F, El-Sayegh SM (2016) Project selection using the combined approach of AHP and LP. J Financ Manag Prop Constr 21(1):39–53. https://doi.org/10.1108/JFMPC-09-2015-0034

Petroleum and Natural Gas Regulatory Board (2019) Petroleum and natural gas regulatory board notifications, New Delhi. Retrieved from: https://www.pngrb.gov.in/OurRegulation/pdf/Gazette-Regulation/English/GSR808(E)-E.pdf

Petrović AM (2021) Challenges of reliable power supply with an emphasis on renewables. In: Leal Filho W, Marisa Azul A, Brandli L, Lange Salvia A, Wall T (eds) Affordable and clean energy. Encyclopedia of the UN sustainable development goals. Springer, Cham. https://doi.org/10.1007/978-3-319-95864-4_95

Pinedale (2016) Hazards of natural gas. Retrieved from: https://www.pinedalegas.com/index.php?option=com_content&view=article&id=76&Itemid=493

Pospíšil J et al (2018) (2019) Energy demand of liquefaction and regasification of natural gas and the potential of LNG for operative thermal energy storage. Renew Sustain Energ Rev 99:1–15. https://doi.org/10.1016/j.rser.2018.09.027

Rakheja H (2021) What is green hydrogen? Can India make it affordable? Retrieved from: https://www.business-standard.com/podcast/current-affairs/what-is-green-hydrogen-can-india-makeitaffordable-121112500012_1.html

Rass S et al (2020) Mathematical decision making. Advanced Sciences and Technologies for Security Applications 43–78. https://doi.org/10.1007/978-3-030-46908-5_3

Renshaw J, Kelly S (2021) Exclusive: U.S. oil industry seeks unusual alliance with Farm Belt to fight Biden electric vehicle agenda. Reuters. Retrieved from: https://www.reuters.com/article/us-usa-biden-electriccars-exclusive-idUSKBN29X2O8

Saaty RW (1987) The analytic hierarchy process-what it is and how it is used. Math Model 9(3–5):161–176. https://doi.org/10.1016/0270-0255(87)90473-8

Saaty TL (2008) Decision making with the analytic hierarchy process. Int J Services Sciences 1(1):83–98

Shiva Kumar S, Himabindu V (2019) Hydrogen production by PEM water electrolysis – a review. Mater Sci Energ Technol 2(3):442–454. https://doi.org/10.1016/j.mset.2019.03.002

Singh G, Sharma D, Jain C (2021) Impact of inflation and GDP Of India and the United States on its current foreign exchange currency market rate. Int J Sci Res Publ (IJSRP) 11(2):474–485. https://doi.org/10.29322/ijsrp.11.02.2021.p11057

Snell W (2021) U.S. and global food price inflation, economic and policy update. Retrieved from: https://agecon.ca.uky.edu/files/u.s._and_global_food_price_inflation.pdf.

Spetzler C, Winter H, Meyer J (2016) The requirements for decision quality. In Decision quality value creation from better business decisions. John Wiley & Sons, Ltd, pp 11–20. https://doi.org/10.1002/9781119176657

Strong CB (2018) The oil and gas law review. Retrieved from: https://thelawreviews.co.uk/title/theoil-and-gas-law-review

Tan RR, Aviso KB, Huelgas AP, Promentilla MAB (2014) Fuzzy AHP approach to selection problems in process engineering involving quantitative and qualitative aspects. Process Saf Environ Prot 92:467–475. https://doi.org/10.1016/j.psep.2013.11.005

Tan J, Low KY, Sulaiman NMN, Tan RR, Promentilla MAB (2016) Fuzzy analytic hierarchy process (FAHP) for multi-criteria selection of microalgae harvesting and drying processes. Clean Technol Environ Policy 18:2049–2063. https://doi.org/10.1007/s10098-016-1163-6

Ten JY, Liew ZH, Oh XY et al (2021) Computer-aided molecular design of optimal sustainable solvent for liquid-liquid extraction. Process Integr Optim Sustain 5:269–284. https://doi.org/10.1007/s41660-021-00166-7

Tenenbaum DJ (2008) Food vs. fuel: diversion of crops could cause more hunger. Environ Health Perspect 116(6):A254–A257. https://doi.org/10.1289/ehp.116-a254

The Global Economy (2020) Political stability by country. Available at: https://www.theglobaleconomy.com/rankings/wb_political_stability/. Accessed 19 Nov 2021

The Associated Press (2021) At least 17 killed. dozens missing as heavy rains hit southern India. NBC News. Retrieved from: https://www.nbcnews.com/news/world/least-17-killeddozensmissing-heavy-rains-hit-southern-india-rcna6233

The World Bank (2006) Implementation completion and results report guidelines. Republic of Azerbaijan, Operations Policy and Country Services (OPCS). Retrieved from: http://wwwwds.worldbank.org/external/default/WDSContentServer/WDSP/IB/2012/12/24/000386194_20121224050237/Rendered/PDF/NonAsciiFileName0.pdf

The World Bank (2011) Analysis of disaster risk management in Columbia: A contribution to the creation of public policies. Retrieved from: https://openknowledge.worldbank.org/handle/10986/12308

Triantaphyllou E, Mann SH (1995) Using the analytic hierarchy process for decision making in engineering applications: some challenges. Int J Ind EngTheory Appl Pract 2(1):35–44

Wainberg M (2009) Hydrocarbon production update : Colombia, Brazil, Mexico and Venezuela. International Association for Energy Economics, pp 21–25

Zaretskaya (2020) Growth in India’s LNG imports will depend on completion of connecting pipelines. U.S, Energy Information Administration. Retrieved from: https://www.eia.gov/todayinenergy/detail.php?id=43655

Zavala-Araiza D et al (2021) A tale of two regions: Methane emissions from oil and gas production in offshore/onshore Mexico. Environ Res Lett 16(2). https://doi.org/10.1088/1748-9326/abceeb

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing Interests

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix

Table 15.

Application of Analytic Hierarchy Process

The outcomes of AHP for different aspects, namely OPEX, ESG and ease of business are shown here.

-

OPEX

For OPEX pairwise comparison, estimation of cost for each project was based on the existing plants in the country. In order to ensure reliable comparison, the estimated cost was divided by the production capacity provided. The operating cost estimated is illustrated in Table 16. With these values, they are used as the basis for pairwise comparison for low OPEX.

Referring to Table 17, it can be observed that project 4 has the highest weightage, followed by project 1, project 3, project 2, project 6 and project 5. The reason that project 5 scores the lowest is because of its high OPEX in operating the electrolyser for the production of green hydrogen. On the other hand, project 6 is having high OPEX compared to projects 1, 2, 3 and 4 since it is a refinery industry, which is expected to have higher operating costs. The estimation of cost for project 6 is taken from the annual report from the existing refinery company in Mexico, Pemex.

-

ESG

For environmental, social and governance (ESG), several aspects were considered, namely the political, social stability, economic freedom and environmental performance index (EPI) ranking, as shown in Table 18. Based on Table 19, project 2 scores the highest since the USA has better ranking in economic freedom and EPI ranking compared to the remaining countries. The weightage for projects 1, 3, 5 and 6 are considered comparable as they are quite close to each other.

-

Ease of Business

In terms of ease of business, it is ranked based on the global ranking of the countries, which is collected from The Global Economy (2020), as can be seen in Table 20. It was believed that the higher the global ranking, the easier it was to start a business in the country. Table 21 is the summarised version of the pairwise comparison for ease of business.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Lee, H.Y., Heng, Y.P., Selvanathan, K. et al. Multi-Criteria Decision-Making Tools for Project Selection by International Conglomerates. Process Integr Optim Sustain 8, 375–393 (2024). https://doi.org/10.1007/s41660-023-00376-1

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41660-023-00376-1