Abstract

Net energy is the surplus energy after subtracting energy production input, which is regarded as the energy that really promotes social development. At present, a large amount of net energy analysis is concentrated in the preliminary production stage, and there are few deeper studies on energy system. This study mainly uses input–output analysis to estimate energy input (including import input, energy loss and embodied energy), and calculates EROI and Net Energy Supply of energy system in China from 1990 to 2018. The results show that EROI has shown a downward trend in the past. Among all energy sectors, Production and Supply of Electric Power and Heat Power accounts for the highest proportion of energy input, and the proportion of energy loss is gradually increasing. In addition, this study uses the simulated function to establish the relationship between net energy and GDP and makes an outlook of net energy supply and EROI in different scenarios. EROI is likely to decline in the near future, and more attention should be paid to the efficient use of net energy to achieve economic goals.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Energy is the driving force to promote social development. Energy, like other products, requires energy (electricity, petrol, etc.) and other inputs (money, labor, ecological destruction, etc.) in its own production procedures (including energy extraction, processing and delivery). Generally, people only value energy output (also known as total yield) due to abundant resources in the past. As resources gradually decrease, energy input has attracted the attention of many scholars and will have an increasing impact on energy supply. Accordingly, a comprehensive evaluation about energy supply should focus on two aspects: energy output and the net energy delivered. The concept of net energy proposed by Odum (1973) is the energy left after the costs of extracting and processing. It measures input and output, and is regarded as energy with real value to society.

In the process of net energy analysis, energy return on investment (EROI) is an important efficiency indicator, which represents the ratio of energy output to energy input. Because the calculation method is simple and easy to understand, EROI has been widely used in energy production efficiency, such as oil and gas extraction (Hall and Cleveland 1981; Grandell et al. 2011; Aucott and Melillo 2013; Hu et al. 2013; Wang et al. 2017), renewable energy generation (Kittner et al. 2016; Pickard 2017) and comparison of different energy (Raugei et al. 2012; Cheng et al. 2018; Kong et al. 2018a; Brockway et al. 2019). However, many results cannot be compared directly due to difference of boundary and level. In terms of input levels, Murphy et al. (2011) proposed five types of energy input levels, namely direct energy and material input, indirect energy and material input, labor input, supporting service input and environmental input. Actually, it is difficult to calculate the supporting service input. The existing studies generally consider direct and indirect energy and material inputs. Some scholars use different methods to quantify labor and environmental inputs when evaluating efficiency, such as emergy (Chen et al. 2017) and exergy (Chen et al. 2020; Salehi et al. 2020). On the basis of Murphy et al. (2011), Hall et al. (2014) made a clear analysis of the boundary problem of EROI. Their research based on fossil energy divided the boundary of EROI into 4 categories, namely Standard EROI (EROIst), Point of use EROI (EROIpou), extended EROI (EROIext) and societal EROI (EROIsoc). The boundaries of the four types of EROI are gradually expanded. At present, most studies calculate only EROIst, which is for the initial stage of energy extraction without considering the "downstream " energy needs for refining, distributing or using that energy.

In recent years, some scholars have noticed the relationship between net energy and social development. Mearns (2008) put forward the concept of “Net Energy Cliff”: Net energy will decrease exponentially with the gradual decline of EROI, so the space for social and economic growth is getting smaller. Hall et al. (2009) estimated that the minimum EROI for oil extraction that can meet the requirements of simply driving a car or truck is 3:1. Lambert et al. (2014) used quantitative analysis methods to explore the relationship between the EROI and the human development index of multiple countries, and the results showed that the country with high human development index has higher EROI. They estimated that the EROI required for a modern nation with health care education and so on was at least about 10:1 Fizaine and Court (2016) conducted an empirical analysis on the relationship between the proportion of energy expenditure and the economic growth rate in the United States, and found that the minimum EROI threshold for the United States is 11:1 by using energy intensity to convert energy expenditure into energy input.

In China, significant studies about EROI has been performed on fossil energy extraction and import (Hu et al. 2013; Chen et al. 20172020; Wang et al. 2017; Kong et al. 2018b), few people perform net energy analysis on energy system and different industries. Feng et al. (2018) use the input–output method to measure the EROIpou (Point of use) and net energy of China's energy system from 1987 to 2012, and analyze the future of China's economic growth by constructing an economic growth function that includes net energy factors. However, the input used for imported energy and the loss in subsequent process are ignored, and the change in the structure of China's energy supply system is not considered. In recent years, significant changes have taken place in the energy structure, in which the proportion of coal has fallen and the proportion of non-fossil energy has increased substantially. These new changes have affected net energy input considerably (especially due to increasing conversion to electricity and other energy losses) so that a new analysis of net energy is worth developing. We must undertake EROI and net energy analyses to determine if the economic goals anticipated for the future are possible. Otherwise, we are likely tob deluded about the future prospects of growth, which historically, and presumably in the future, will require substantial amounts of net, not gross, energy.

This study attempts to establish a comprehensive model to evaluate the net energy and EROI of China’s energy system. Next, using the simulated production function to establish the relationship between net energy, EROI and GDP. Finally, the outlook on EROI and net energy is conducted in the context of economy and environment.

Framework, Method, and Data

Framework

This paper mainly uses two indicators of Net Energy and EROI to conduct net energy analysis of China's energy system. The basic equations of EROI and Net energy are as follows:

Net Energy is a simple quantitative indicator that represents the energy actually delivered to society, and EROI is an important indicator from the perspective of efficiency that represents the ratio of total energy supply to energy input. The quantitative relationship between the two indicators is as follows:

Considering data limitation, this study chooses the same boundary and level as Feng et al. (2018) for net energy analysis, that is to quantify the direct and indirect input in the point of use stage, without considering the other three types of input (labor input, supporting service input and environmental input). The framework is established to analyze EROI in different links. As shown in Fig. 1, total energy supply comes from coal, oil, natural gas and primary electricity (hydropower, nuclear power, wind power, etc.), which can be divided into three links: import, extraction and processing. Three kinds of fossil energy imports and coal extraction can be analyzed separately, but oil and gas extraction and processing of all energy can only be taken as a whole because of data limitations. The total energy supply is consumed in three ways: electricity and heat, fuel, and loss during transportation and processing. When we consider the concept of net energy, part of electricity and fuel are used for the operation of the energy system itself, and part of them was used for the economic system to purchase foreign fossil energy. In addition, we regard energy loss as part of operating consumption, and this data can be collected directly. Special attention is paid to the loss here refers to the amount of loss during storage, transportation and processing when it becomes fuel. In this study, the electricity is converted based on the Equivalent Caloricity method, and the energy loss during the production process is not considered because it is energy lost as an "energy tax" when upgrading the quality. The other part of the energy input that belongs to the operation needs to be calculated as embodied energy (Palmer 2017; Feng et al. 2018; Brockway et al. 2019), and the inputs used for imported energy also need to be calculated (Fig. 2).

The schematic diagram in this study. (The black lines represent the flow of energy. The energy system promotes economic growth by providing net energy, and the economic growth goal requires net energy. The dotted line points to the research method used. Net energy analysis is used to calculate net energy and EROI, while the production function connects net energy to economic growth)

This plan of this study is as follows: Sect. 2.2 outlines the methods to quantify energy input, including the embodied energy and import input. Section 2.3 proposes a function that includes net energy elements, linking net energy to economic growth for outlook. Combining the methods and the data in Sect. 2, A comprehensive net energy analysis is performed. Section 3.1 gives the changes in the net energy supply and EROI of China's energy system from 1990 to 2018, and analyzes the various links of extraction, import and processing separately. Section 3.2 sets the economic goal and different scenarios about energy supply, and prospects the demand for net energy and EROI in future. Finally, Sect. 4 concludes the study and puts forward some thoughts on the in-depth study of net energy.

Net Energy Analysis Model

Embodied Energy

The calculation of the embodied energy in the material inputs to the extraction process (e.g., the energy used to make and deliver the steel and pumps used and so on) needs to use the Input–Output model. This model was proposed by Leontief in the 1930s. It can analyze the dependence of the various production sectors in the social system, especially the material flow (energy, money, water, etc.) between various industries (Leontief 1936). Input–Output table is divided into two types: value type and physical type. The amount of money at final demand is derived from the price per unit of the final product, while the amount of money that the final manufacturer requires for each required input is derived from the Input–Output tables for each sector of the economy. This is undertaken for several "upstream" steps. The energy required for each sector is given in energy Input–Output tables, which have to be derived from the energy use of each sector. The value-based table is widely used in academic research and the energy approach less commonly.

In the basic Input–Output model, i is the input of sector i, and j is the output of sector j, n is the total number of departments. X is the total output of the economy, Xij is the input from sector i to sector j, and Y is the total final use of intermediate products. The equation is as follow:

The main coefficients in the Input–Output analysis are the technical coefficient and complete consumption coefficients. The calculation formula of the technical coefficient is:

aij is the technical coefficient, which means the output of sector j that directly consumes one unit of the product of sector i. Equation (4) and Eq. (5) can be expressed as:

In the above formula, X is the column vector of the total output of all sectors, Y is the column vector of the final product of each sector, A is the direct consumption coefficient matrix composed of the technical coefficients. \({\left(I-A\right)}^{-1}\) is Leontief Inverse matrix and the complete consumption coefficient, which refers to the sum of the direct and indirect consumption of goods or services produced by sector i required for each unit of the product provided by sector j to the end-use sector. Use B to denote it:

The steps for calculating the embodied energy are as follows:

-

(1)

ei is the direct energy consumption coefficient of sector i (that is, the direct energy consumption per unit output value):

$${e}_{i}=\frac{{\text{Energy}} \;{\text{consumption}}\; {\text{in}} \;{\text{sector}}\,i}{{x}_{i}}$$(8) -

(2)

\(\theta\) is the complete energy consumption coefficient:

$$\theta =e\times B$$(9) -

(3)

The embodied energy consumed by the energy system can be obtained by accumulating the embodied energy of each energy sector (1, 2, …, m):

$${E}_{e}=\sum_{i=1}^{m}{\theta }_{i}\times {x}_{i}$$(10)

Import Input

In recent years, China's dependence on energy derived from foreign sources has been increasing, and the input of imported energy has also been increasing. In order to evaluate accurately the net energy supply efficiency of China's energy system, this study analyzes the energy required to generate the goods and services traded for imported oil as part of the total energy input required to generate oil. At present, scholars have conducted research on energy import EROI. Kaufmann proposed a method to measure imported oil EROI in 1986 (Lambert et al. 2014). He believes that the EROI of importing oil can be expressed by the ratio of the heat equivalent value of the oil purchased by one dollar and the energy input in the production process of the export goods or services needed to obtain this dollar. Lambert et al. (2014) established a model on this basis to calculate the EROI of importing oil in 12 countries. The formula is as follows:

In the above formula, EU(oil) is the heat equivalent value per unit of oil, Etotal is total energy consumption, I is energy intensity, and Poil is the price of imported crude oil. Considering that the unit of embodied energy is 10,000 tons standard coal equivalent, this study converts the unit of energy output and input during calculation. The formula is as follows:

In the formula, Mi is the quantity of imported energy i, θi is the factor that converts different units to TCE. EE is all embodied energy, P is total output value and Ci is the currency cost on importing energy i. Since the embodied energy is measured in a top-down manner, EE/P (the embodied energy per unit output value) can be proposed to replace I (the energy consumption per unit GDP) in order to maintain the consistency of the research caliber. By using this formula, the EROI of importing coal, oil and natural gas and the corresponding input can be measured.

The Relationship Between Net Energy and Economic Growth

In the past, the traditional economic growth theory believed that energy was a factor that could be replaced. Therefore, the traditional Cobb Douglas function only included two types of factors: capital and labor. With the increasing importance of energy, many scholars began to add energy as the third important element to the production function (Tintner et al. 1977; Kümmel et al. 1985, 2000; Nel and Cooper 2009). The results show that the energy can remove most of the unexplained residual encountered by neoclassical theory.

The energy-based Cobb Douglas production function is formed as follows:

Among them, Y is economic output, which is measured by GDP; A is the comprehensive technology level, K and L are the quantity of capital and labor, respectively, and E is energy consumption. \(\alpha\),\(\upbeta\) and \(\upgamma\) are the output elasticity of three factors, respectively, and the sum of the three is 1.

After adding energy as the third element to the Cobb Douglas production function, it is possible to conduct a more comprehensive and accurate analysis of economic growth. However, there is also a potential assumption in the application of energy-based production functions: the energy consumed by the energy system itself accounts for a relatively small proportion of the amount. This function is suitable for scenarios where fossil energy reserves are abundant and the costs of extraction are low at that time. Therefore, relevant scholars did not consider the impact of energy supply. However, the reserves of fossil energy are limited, and the negative environmental externalities of its development and utilization are gradually being valued. Under the dual constraints of fossil energy peaks and environmental protection, the energy consumption applied to the energy system itself gradually increases, which affects the accuracy of the energy-based production function. Regarding the above problems, Cleveland (1991) obtained preliminary results when studying the decoupling of energy and economy in highly industrialized countries. He found that when “useful energy” (ie, net energy) consumption is used instead of total energy consumption as an energy factor, the decoupling of energy and economy will disappear, which provides a basis for further research in the field of net energy.

Based on the research conclusions of Cleveland, Nel and Cooper (2009) believe that net energy is the energy that is truly highly correlated with economic growth, and capital investment embodies the use of energy, and labor input will be replaced by energy consumption. Therefore, capital and labor are substitutable with energy. After further decomposing energy input elements, a net energy production function is established:

where Y is economic output; \({A}_{0}{e}^{\alpha t}\) is an exponential growth function related to human ingenuity to improve end-use technology and to derive utility from available resources (Nel and Cooper 2009), We can think of it as the efficiency of net energy utilization. \({\alpha }\) is a growth exponent, t is the time variable in years, Eth,i is the total consumption of energy i, \({\mu }_{i}\left(t\right)\) is the efficiency of energy i, and \({\delta }_{i}\left(t,{E}_{i}\right)\) is the input required for the production and supply of energy i.

Nel and Cooper (2009) applied the above production function to research and analyze global net energy and economic growth. Although this function has a good simulation result, it cannot be directly applied to the study of net energy and economic growth in China because the clear data on some links are difficult to obtain, such as the production of each non-fossil energy. In addition, energy output is represented by the product of total energy consumption and the corresponding efficiency in Eq. (14), we can think of it as the difference between total energy consumption and loss. Therefore, considering the feasibility of data, this article directly analyzes the entire energy system by using energy loss instead of efficiency variables and transform the existing net energy production function form, as follows:

In the previous chapter, this article regards the loss as part of the energy input. The energy input is the sum of energy loss and energy consumption in the production and supply process. In order to correspond to the previous calculation process, the loss is still regarded as part of the energy input. Therefore, in the above formula, Etotal is total energy supply, and Ein is all energy input. It can be seen that the formula in the parentheses in Eq. (15) represents Net Energy. According to the numerical relationship between net energy supply and EROI in Eq. (3) above, the final form of the new function can be expressed as:

Data Sources

In the analysis of net energy in this study, the data about energy output include primary energy production and its composition, various energy imports, and total energy consumption and its composition. Total energy consumption is used as energy output of the energy system, and different fossil energy production is used to calculate the corresponding EROI of extraction. The processing includes the production of non-fossil energy and the processing of the fossil energy obtained from extraction and import, so we use total energy consumption as energy output. The relevant data on energy production and energy consumption are from "China Statistical Yearbook". The unit is unified to 10,000 TCE. TCE is the abbreviation of "Ton Standard Coal Equivalent ". Economic output is expressed in terms of GDP, also from China Statistical Yearbook.

In terms of import input, National Bureau of Statistics database contain data on the amount of coal and oil import from 1996 to 2018, but do not include data on natural gas import. In recent years, China’s demand for natural gas has continued to increase and imports have also increased year after year, so natural gas import input is very important for this study. After comprehensively collating the import data of China’s customs database, this study finally obtained the cost of China's natural gas import including Liquefied Natural Gas (LNG) and Pipeline Natural Gas (PNG) from 2006 to 2018. The Input–Output tables published by National Bureau of Statistics and Chinese Input–Output Association are used to calculate the embodied energy of the energy system. The energy industry includes two sectors: fossil energy extraction (coal, oil, and natural gas) and energy processing (coking, gas, electricity and heat supply). An Input–Output table is published once every five years, and an extended table will be published during the period. This article collects 13 Input–Output tables released from 1990 to 2018. Because the sector classification of energy consumption data in the "China Statistical Yearbook" is different from the Input–Output tables, the sectors need to be aggregated to maintain data consistency. Feng et al. (2018) integrated the sectors of the Input–Output table into 10 sectors, and described the flow of embodied energy between the non-energy sector and each energy sector. This study further integrates the sectors into 7 sectors on this basis. Table 2 in the appendix presents the different sector classifications and the 7 aggregated sectors.

There are three issues to note: First, each Input–Output table is compiled based on the price of the year. In order to ensure the accuracy of the research results, this study uses the price of 1978 as the benchmark to perform exponential deflation for each Input–Output table. The second is that China’s oil and natural gas extraction data are calculated together. Therefore, when conducting net energy analysis for oil and natural gas extraction, we can only analysis from other perspectives such as reserves and production. Third, in order to maintain the same price level as the embodied energy calculation, the import expenditure is also price-processed when calculating the import input, and the actual GDP based on price of 1978 is used.

Results and Discussion

Net Energy Analysis of China's Energy System

Net Energy and EROI

The EROI of the energy industry for China as a whole went from about 3.5 in 1995 to 2.5 in 210–218 (Fig. 3). The low EROI indicates that about 45 percent of all energy used in China is used directly or indirectly to get energy. The EROI for coal was about 12 and did not show a clear trend over time, and the EROI of oil and gas extraction was between 5 and 8 with a decreasing and then increasing trend (Fig. 3). The EROI of imported oil was about 2–3. The EROI of all fossil fuels collectively was about 10–16:1 with no clear trend. The EROI for all fuels considered together was about 4–8:1 with a declining trend (Fig. 4.) There is a tendency for the relative importance of indirect energy inputs, which are about half of the total energy used, to increase over time (Fig. 6).

Currently only Feng et al. (2018) have calculated the EROI of China's energy system, and compared it with different existing results of China’s EROI (Hu et al. 2013; Chen et al. 2017). But this comparison is invalid due to the difference in boundaries. This study uses the embodied energy of the energy mining industry as energy input to obtain the EROI of fossil energy extraction, and calculate the EROI of fossil energy imports by using the method mentioned in 2.1.3. Figure 4 presents the calculation results of this study and the comparison with EROI for China's conventional fossil fuels from Hu et al. (2013). Some studies are not considered as comparison objects due to their different levels of energy input (Chen et al. 2017, 2020).

Figure 4 reveals that, compared with the result from Hu et al. (2013), EROI of fossil fuels extraction in this study is smaller, especially in coal mining. The reason for the difference may be that Hu et al. (2013) did not consider all the indirect investment in the calculation process, and the method of measuring energy input by the embodied energy is more accurate. Therefore, China’s fossil energy extraction is in a worse situation. Data from the National Bureau of Statistics of China show that in 2019, the external dependency ratios of coal, oil and natural gas were below 10%, 72% and 43%. The demand for imported coal is small, but the imported EROI is higher, and the EROI of oil import is also in contrast to its demand. Although we cannot calculate the EROI of oil and natural gas extraction separately, it is obvious that the supply of crude oil and natural gas in China is under greater pressure.

Figure 5 presents the comparison of fossil energy acquisition (including extraction and import) and all energy processing. It should be noted that the energy loss was not considered in the staged analysis. Despite its high volatility, the EROI of primary fossil energy acquisition is always above 10. In energy processing (including fuel and power production, non-fossil energy is considered), the self-consumption input per unit of energy has increased significantly, leading to a significant drop in EROI. Therefore, this study preliminarily infers that the excessive increase in energy input for fuel and power production leads to a decline in the EROI of China's energy system. This is consistent with the research conclusion of Brockway et al. (2019). Compared with the initial stage, the EROI of fossil energy in the final stage (electricity is about 3, fuel is 7–9) will be very small. In addition, China’s EROI is at a low level compared to the global level. We infer that this is due to excessive investment in energy infrastructure.

Energy Inputs Among Different Links

Table 3 in the appendix illustrates the energy input consumed by each link in the energy system. Natural gas and coal imports account for a very small proportion of energy input, generally less than 1%, and oil import accounts for between 1 and 6%. Compared with the extraction, processing and loss of the energy system, the influence of energy import on energy input and net energy is too small. The proportion of inputs for coal, oil and gas extraction shows a downward trend, from 33.3% in 1990 (coal 22.8%, oil and natural gas 10.5%, excluding imported inputs) to 12.8% in 2018 (coal 9.4%, oil and natural gas 3.43%), and the subsequent refining input accounted for 20–30%. The largest increase in the proportion is in the production of electricity and heat, which has been close to 40% in recent years. In the part of energy loss, the proportion dropped to 9.5% in 2007 and then began to rise, increasing to 17.35% by 2018. At present, the energy loss caused by processing, storage and transportation has exceeded the embodied energy consumed by the extraction of fossil energy.

Figure 6 presents the ratios of indirect inputs to direct inputs in the three links. When calculate this ratio of energy loss, we put the processing loss as indirect and the loss of storage and transportation as direct. Obviously, the energy loss caused by processing has increased from 2010 to 2018, leading to the increase in the proportion of energy loss in total energy input. In addition, more direct inputs from energy consumption are demand for fossil energy extraction, while more indirect inputs from equipment purchase and site construction are demand for energy processing.

The Outlook of Net Energy and EROI

Setting Up the Future Scenarios

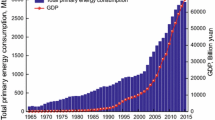

Some studies have proved the relevance of net energy or energy expenditure to the economy (Nel and Cooper 2009; Carey et al. 2016; Fizaine and Court 2016). This study uses the adjusted Eqs. (15,16) based on the equation proposed by Nel and Cooper (2009) to link net energy, EROI with the economy in China. Based on the least squares criterion, we use the results of net energy analysis from 1997 to 2018 and the first-order equation of the residuals to obtain the unknown coefficients in Eq. (16). The results show that A0 is 0.22 and \(\alpha\) is 0.036. Although the uncertainty of new policies and data lead to volatility in 1997–2002, the actual GDP and the estimated GDP generally match well, especially from 2008 to 2018 (see Fig. 7). Therefore, the outlook for net energy can be inferred from the scenarios in future by Eq. (16).

Firstly, the goal of economic growth needs to be established. The Chinese government proposes a new goal called "economic growth doubling", which is to double the total economic output and per capita level by 2035 compared with 2020. This study uses doubling of GDP as an economic goal in future (see Table 1), and sets the economic growth rate for different time periods. From the perspective of net energy, economic growth depends on the supply and utilization of net energy, which is the total energy supply, EROI and \({A}_{0}{e}^{\alpha t}\)(the efficiency of net energy utilization). In the past, China used high energy consumption to obtain rapid economic growth. However, this path will no longer be feasible due to climate change restrictions in the future. Guided by the goal of carbon neutrality, many organizations have released China’s energy forecast outlook. This study refers to the research report that gives specific scenario analysis and sets the scenarios of energy supply (ICCSD 2020).

Demand for Net Energy and EROI in Future

The achievement of economic growth goals requires a gradual increase in net energy supply, but the growth rate is diminishing. There are different demands for EROI in the three scenarios due to the different energy supply. In scenario A, the decline in EROI can be accepted under the premise of obtaining sufficient net energy before 2030, because of the ever-increasing efficiency of net energy utilization (\({A}_{0}{e}^{\alpha t}\)) and sufficient total energy supply. In scenario B, lower efficiency before 2025 leads to the need for higher EROI to achieve economic growth, and the requirements for EROI are reduced due to the improvement of efficiency from 2026 to 2030. In scenario C, the improvement of efficiency is always difficult to make up for the impact of the reduction in total energy supply, and EROI is required to keep increasing. After 2030, the changes in the total energy supply under the three scenarios all lead to the need for higher EROI to achieve economic growth (Fig. 8).

We already know the EROI that China needs in future, but how the EROI changes needs to be further explored. With Eq. (16) and the data of energy supply and GDP, the EROI in 2019–2020 is calculated to be 2.42 and 2.32, respectively, showing a downward trend again. Considering the strategic plan to reduce carbon emissions, adjusting the energy structure may increase energy requirements to get energy. It has become a consensus to reduce the use of fossil energy, but the EROI of obtaining fossil energy is still at a relatively high level (Fig. 5). Although the EROI of fossil energy converted into electricity and fuel cannot be calculated accurately, the stable proportion of energy input in the refining process can indicate the high efficiency of fossil energy. More attention should be paid to the electricity production, especially the influence from renewable energy. The comparison of fossil energy and renewable energy has frequently been discussed, but no agreement. Some studies like Hall et al. (2014) and King and Bergh (2018) identity that EROI and net energy will be affected by the transitioning to renewable electricity owing to the low efficiency of renewable energy. However, some other studies propose that there is no significant gap between fossil energy and renewable energy in the EROI at point of use (Brockway et al. 2019; Diesendorf and Wiedmann 2020). Certainly, the expansion of renewable energy will promote the improvement of technology and the reduction of costs, but this in turn will require a large amount of currency investment and thus increase indirect energy input (Fig. 6 in this study, Sers and Victor (2018) and Diesendorf and Wiedmann (2020)).

In addition, the volatility of renewable energy power generation also affects EROI. For example, a stable and continuous power supply is better than a sporadic power supply, and the resulting utility is different. If volatility is not considered, the EROI of renewable energy in existing research seems to be very high, but it will be significantly reduced after volatility is corrected (Kunz et al. 2014). In order to eliminate the influence of volatility, comprehensive energy utilization based on energy storage and smart technology is required, which is also a large amount of indirect input. The energy transition will not only increase indirect input in the energy system, but also increase energy losses due to renewable energy consumption in future. Energy losses now account for a relatively high proportion of total energy input, and there may be more in the future, affecting net energy supply.

The transition from coal to non-fossil energy needs to rely on oil and gas, which means that the internal structure of fossil energy will also change. The decrease in the proportion of coal with high EROI will reduce the EROI of fossil energy acquisition, and the positive effect of natural gas on improving the EROI of oil and gas extraction is worthy of attention. EROI of fossil energy extraction is affected by two factors: technological progress and resource depletion (Dale et al. 2011). China’s resource characteristics are “rich coal, poor oil and less gas”, and Fig. 4 presents the gap between coal and oil and gas extraction. Although the EROI of oil and natural gas extraction is rising, it seems very difficult to be at the same level as coal. Furthermore, oil and natural gas have a high degree of external dependence, and fluctuations in import prices will affect EROI and net energy supply.

In general, China's EROI faces many challenges, and it is difficult to rebound and rise in the near future. The realization of economic growth targets in scenario B and C not only requires consideration of EROI and net energy, but also the efficiency of net energy utilization (\({A}_{0}{e}^{\alpha t}\)). The efficiency is assumed to continue to grow exponentially (Nel and Cooper 2009; Feng et al. 2018). If it is further increased, it will reduce the net energy and EROI required and also be able to achieve the economic growth goal, but it will also place new requirements on population, industrial structure and development methods, etc.

Conclusion

Net energy is the real energy that can be used for social development and economic growth, and the decline in EROI will lead to a worsening of net energy. This study conducts a comprehensive analysis of net energy and makes an outlook on net energy and EROI to achieve economic growth goals.

Firstly, a comprehensive model is used to analyze net energy and EROI from 1990 to 2018, which includes energy extraction, import, and processing. Total energy input to the process of obtaining energy includes the direct use of energy on site, the embodied energy in material used, and the energy used to derive foreign exchange used to buy imported energy. Next, the simulated production function to link net energy, EROI, and GDP is used. Finally, the outlook on EROI and net energy for GDP growth is conducted by the simulated function in different scenarios of economy and environment. The results indicate the following:

-

1.

From 1990 to 2018, EROI shows a decreasing trend overall. The EROI of oil and gas extraction began to rise after 2000, and the EROI of coal extraction is higher than it. The energy input in the secondary energy processing sector (mainly the production and supply of electricity and heat) has increased significantly, especially indirect input. Otherwise, the amount of energy loss has gradually exceeded the input of Mining and Washing of Coal and has become the third highest proportion of input in recent years, of which the loss caused by processing has increased greatly. Clearly, more attention should be paid to the energy input of energy processing and the energy loss during the entire production process. It is an important issue how to make up for the difference between coal and other energy, and renewable energy needs to use effective policies (such as quota absorption) and energy storage technology to reduce unnecessary waste.

-

2.

The net energy supply determined by the total energy supply and energy input has a significant impact on the Chinese economy. In three scenarios that consider different goals of climate change, the demand for EROI is different to achieve GDP growth according to the growth of energy supply. The plan for 2℃ or 1.5℃ control will limit the total energy supply, and an increase in EROI is required to ensure sufficient net energy. However, the existing trend in energy structure due principally to depletion results in a declining EROI which would make it unlikely that efficiency of the economy as a whole can be made more efficient, so the efficiency of net energy utilization can become a new development direction. In this study and other studies (Nel and Cooper 2009; Feng et al. 2018), \({A}_{0}{e}^{\alpha t}\) in Eq. (16) is simplified as productivity, representing the factor that converts net energy into economic output. In summary, policy makers need to acknowledge the reality of the physical forces that are happening in the Chinese energy sector as a result of the depletion of our best fuels.

In this study, the EROI we calculated has a certain degree of uncertainty. First of all, the annual China Statistical Yearbook will revise historical data, and the corresponding statistical data will have small changes. Then, industry consolidation may cause certain errors in the input–output analysis. However, the impact of these uncertainties is far less than the policy. For example, low-carbon energy means a reduction in coal demand, which greatly affects the input and output of coal mining, and will also have an impact on the EROI of the energy system. This situation should be paid more attention to by scholars in the future.

Moreover, with rapid society development of Chinese society, human welfare, quality of life, and ecological benefit have been prioritized like economic growth by the government. A previous study has demonstrated the relationship between EROI, quality of life, and human welfare (Lambert et al. 2014). There is currently a lack of such study on net energy in China, which is exactly the direction we will continue to work on. More importantly, EROI of various energy used in end with the same boundary and level should be further clarified and compared. On this basis, we will consider the sustainable development goals including ecology, welfare, and quality of life and provide effective reference for policy and planning from the perspective of net energy.

References

Aucott ML, Melillo JM (2013) A preliminary energy return on investment analysis of natural gas from the Marcellus shale. J Ind Ecol 17:668–679

Brockway PE, Owen A, Brand-Correa LI, Hardt L (2019) Estimation of global final-stage energy-return-on-investment for fossil fuels with comparison to renewable energy sources. Nat Energy 4:612–621

Carey K, John M, Alyssa D (2016) Comparing world economic and net energy metrics, part 2: total economy expenditure perspective. Energies 8:12975–12996

Chen Y, Feng L, Wang J, Höök M (2017) Emergy-based energy return on investment method for evaluating energy exploitation. Energy 128:540–549

Chen Y, Feng L, Tang S, Wang J, Huang C, Höök M (2020) Extended-exergy based energy return on investment method and its application to shale gas extraction in China. J Clean Product 260:120933

Cheng C, Wang Z, Wang J, Liu M, Ren X (2018) Domestic oil and gas or imported oil and gas—an energy return on investment perspective. Resour Conserv Recycl 136:63–76

Cleveland CJ (1991) Natural resource scarcity and economic growth revisited: economic and biophysical perspectives. In: Costanza R (ed) Ecological economics: The science and management of sustainability. Columbia University Press, New York, pp 289–317

Dale M, Krumdieck S, Bodger P (2011) Net energy yield from production of conventional oil. Energy Policy 39:7095–7102

Diesendorf M, Wiedmann T (2020) Implications of Trends in Energy Return on Energy Invested (EROI) for Transitioning to Renewable Electricity. Ecol Econ 176:106726

Feng J, Feng L, Wang J, King CW (2018) Modeling the point of use EROI and its implications for economic growth in China. Energy 144:232–242

Fizaine F, Court V (2016) Energy expenditure, economic growth, and the minimum EROI of society. Energy Policy 95:172–186

Grandell L, Hall CA, Höök M (2011) Energy return on investment for Norwegian oil and gas from 1991 to 2008. Sustainability 3:2050–2070

Hall CA, Cleveland CJ (1981) Petroleum drilling and production in the United States: yield per effort and net energy analysis. Science 211:576–579

Hall CA, Balogh S, Murphy DJ (2009) What is the minimum EROI that a sustainable society must have? Energies 2:25–47

Hall CAS, Lambert JG, Balogh SB (2014) EROI of different fuels and the implications for society. Energy Policy 64:141–152

Hu Y, Hall CAS, Wang J, Feng L, Poisson A (2013) Energy return on investment (EROI) of China’s conventional fossil fuels: historical and future trends. Energy 54:352–364

ICCSD T (2020) Research on China's long-term low-carbon development strategy and transformation path. http://iccsd.tsinghua.edu.cn/.

King LC, Bergh JCJMVD (2018) Implications of net energy-return-on-investment for a low-carbon energy transition. Nat Energy 3:1

Kittner N, Gheewala SH, Kammen DM (2016) Energy return on investment (EROI) of mini-hydro and solar PV systems designed for a mini-grid. Renewable Energy 99:410–419

Kong Z, Dong X, Jiang Q (2018a) The net energy impact of substituting imported oil with coal-to-liquid in China. J Clean Prod 198:80–90

Kong Z, Lu X, Dong X, Jiang Q, Elbot N (2018b) Re-evaluation of energy return on investment (EROI) for China’s natural gas imports using an integrative approach. Energ Strat Rev 22:179–187

Kümmel R, Strassl W, Gossner A, Eichhorn W (1985) Technical progress and energy dependent production functions. J Econ 45:285–311

Kümmel R, Lindenberger D, Eichhorn W (2000) The productive power of energy and economic evolution. Indian J Appl Econ 8:1–26

Kunz H, Hagens N, Balogh S (2014) The influence of output variability from renewable electricity generation on net energy calculations. Energies 19961073(7):150–172

Lambert JG, Hall CA, Balogh S, Gupta A, Arnold M (2014) Energy, EROI and quality of life. Energy Policy 64:153–167

Leontief W (1936) Quantitative input-output relations in the economic system of the united. Oxford University Press, New York

Mearns E (2008) The global energy crises and its role in the pending collapse of the global economy. Presentation to the Royal Society of Chemists, Aberdeen, Scotland, p 29

Murphy DJ, Hall CA, Dale M, Cleveland C (2011) Order from chaos: a preliminary protocol for determining the EROI of fuels. Sustainability 3:1888–1907

Nel WP, Cooper CJ (2009) Implications of fossil fuel constraints on economic growth and global warming. Energy Policy 37:166–180

Odum HT (1973) Energy, ecology, and economics. Ambio 2:220–227

Palmer G (2017) An input-output based net-energy assessment of an electricity supply industry. Energy 141:1504–1516

Pickard WF (2017) A simple lower bound on the EROI of photovoltaic electricity generation. Energy Policy 107:488–490

Raugei M, Fullana-i-Palmer P, Fthenakis V (2012) The energy return on energy investment (EROI) of photovoltaics: methodology and comparisons with fossil fuel life cycles. Energy Policy 45:576–582

Salehi M, Khajehpour H, Saboohi Y (2020) Extended energy return on investment of multiproduct energy systems. Energy 192:116700

Sers MR, Victor PA (2018) The energy-emissions trap. Ecol Econ 151:10–21

Tintner G, Deutsch E, Rieder R, Rosner P (1977) A production function for Austria emphasizing energy. De Economist 125:75–94

Wang J, Liu M, McLellan BC, Tang X, Feng L (2017) Environmental impacts of shale gas development in China: a hybrid life cycle analysis. Resour Conserv Recycl 120:38–45

Acknowledgements

This study was supported by the National Natural Science Foundation of China (Grant No.71874201/71874202/71934006).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

We have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Yan, H., Feng, L., Wang, J. et al. A Comprehensive Net Energy Analysis and Outlook of Energy System in China. Biophys Econ Sust 6, 10 (2021). https://doi.org/10.1007/s41247-021-00091-w

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1007/s41247-021-00091-w