Abstract

Based on the data from the Periodic Labour Force Survey (PLFS) and multiple rounds of the Consumer Pyramids Household Survey from Centre for Monitoring Indian Economy (CMIE), the paper summarises evidence on changes in the employment–unemployment scenario since the onset of the COVID-19 pandemic and related curbs on economic activity since April 2020. The paper presents evidence on how the pandemic affected pre-existing gender, caste gaps and patterns of employment by sector of production (agricultural, manufacturing, and services). The paper situates these shifts in a longer arc, comparing them to the pre-COVID employment scenario, to understand the long-term impact of the pandemic on the Indian labour market. The data show that the pandemic reinforced and deepened many of the pre-existing schisms. As economic activity is recovering, employment is increasing, but is yet to return to the pre-pandemic levels. The employment challenge is bigger than just achieving the pre-pandemic levels: there is an urgent need to boost job creation and rectify pre-pandemic deep-rooted inequalities.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Nearly 3 years since the outbreak of COVID-19, we now have a clearer view of how the pandemic disrupted economies around the world. As the world went into lockdown, businesses shut down, workers lost jobs and incomes fell, particularly in sectors that bore disproportionate impact of the need for social distancing. Subsequently, there has been recovery, but it remains uneven. In India too, the economic lives of individuals and households have seen a marked shift in this period—from how much they earn, what jobs they do, to how they save. What had started as a health emergency soon rendered millions of people, especially those from poorer households, without jobs, and by consequence, without income and struggling to secure the basic needs of life.

For the Indian economy, is the period of social and economic distress behind us? The latest Economic Survey (2022–23) has concluded that India’s economic and social indicators are not only on the path to firm recovery, but that most have surpassed pre-pandemic levels. The survey claims that “Labour markets have recovered beyond pre-Covid levels, in both urban and rural areas, as observed in supply-side and demand-side employment data.” This assessment is based on claims that labour force participation of women has increased, employment has declined, there is greater formalisation of labour, employment in organised manufacturing, particularly in large establishments, has increased, and demand for Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) has declined, suggesting reduced need for safety nets on account of a revival of employment in rural areas.

How accurate is this assessment? This paper presents a synthesis of the research that Centre for Economic Data and Analysis (CEDA) researchers have been disseminating via data narratives, since the onset of the COVID-19 pandemic in India in 2020. When the pandemic hits, the only regular source of socio-economic data was forthcoming from a private data source: the Consumer Pyramids Household Survey (CPHS) released by the Centre for Monitoring Indian Economy (CMIE). CEDA at Ashoka University started producing regular commentaries based on CMIE data, which have recently been compiled into a booklet.Footnote 1 CEDA research (including my individual research over the last 3 years) has looked at the data from CPHS at regular intervals. In addition, CEDA also carried insights from Periodic Labour Force Statistics (PLFS) data. This body of research from CEDA helps us understand not only overall shifts in employment, but also many granular and wide-ranging questions: from "what happened to employment duringthe pandemic?", to "who was hit harder by job losses during the pandemic?". CEDA commentaries examined women'sworkforce participation, youth employment patterns, and trends in agricultural and manufacturing jobs, among other issues.

Our individual research highlighted the several nuances of the impact of COVID-19 on employment, which I have summarised in this paper. This paper contains a summary of evidence from both sources of data: CPHS and PLFS. Many socio-economic indicators of people's economic lives were already on a downward trend before 2020, but the pandemic shook them profoundly. While we have seen recovery on almost all fronts, we are yet to return to levels of employment that we had before COVID-19 hit.

2 Data from PLFS and CPHS

CPHS: The CEDA-CMIE bulletins are based on data from CMIE's CPHS. The CPHS is a continuous fast-frequency survey conducted on a panel of households. Its sample consists of 178,677 households and over 875,000 household members as of 2022. The survey covers almost all states in India. A stratified multi-stage survey design was deployed by CMIE to draw its sample of households. The Primary Sampling Units (PSUs) were the villages and towns of the 2011 Census. The Ultimate Sampling Units (USUs) were the households from these PSUs. The sample currently covers over 320 towns and 3900 villages across the country.

The entire survey is conducted three times every year, yielding three waves of data per year. Each survey wave takes place over a span of four months. The survey captures data on demographics, employment, education, health, etc., of household members once in every wave. Household-level data on asset ownership, household amenities, savings and borrowing, etc., are also captured once every wave.

The CPHS also captures monthly expenses and income data. Income and expenses for the four months preceding survey interview are captured in every wave. Thus, a monthly time series is constructed for both categories. As it takes 4 months to complete the execution across the entire sample, there is a 4-month lag in availability of income and expenses data. Thus, as of November 2022, income and expenses data were available till June 2022.

Employment and savings data are captured as of the survey interview date. A representative one-fourth of the entire sample is surveyed every month and estimates of employment and savings are generated for the monthly sample. Thus, as of November 2022, employment and savings data were available till October 2022.

PLFS: After the quinquennial employment–unemployment surveys ended in 2011–12, the National Statistical Office started the annual PLFS from 2017–18. The measurement of employment and work status in PLFS is almost identical to that in the Employment-Unemployment Survey (EUS). P.C. Mohanan has written a series of articles for CEDA discussing comparability of EUS and PLFS estimates.Footnote 2 As he points out, data from rural households are collected only once, while the urban households form a panel and are visited in three continuous quarters such that one-fourth of the households are replaced every quarter with new sets of households. The main report published annually is based only on the data collected from the first visit for both rural and urban sectors. The panel survey data of urban households are used to produce quarterly reports for the urban sector. The quarterly reports for the urban sector use the current weekly status approach, while the first visit data include both the usual status approach and the current weekly status approach. Usual status uses a long reference period of 1 year to identify the employment–unemployment status of the respondents.

3 Trends in Overall Employment

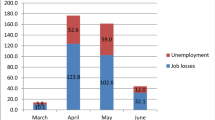

In April 2020, the first full month with a stringent lockdown, an estimated 113 million Indians lost their jobs as compared to the number of people employed in March 2020, according to CMIE CPHS data. The bulk of these job losses were recorded in rural areas, where 73 million people suffered the plight.

Despite the differences between CPHS and PLFS, estimates from PLFS show a similar magnitude of decline in the first lockdown. Kar and Mohanan (2021) show that “people actually found working during the survey period fell from 419 million in October–December to 312 million in the quarter starting April 2020, which closely corresponds to the first lockdown. This is a reduction of 107.3 million workers. They argue that “roughly half of these were persons who had work in their own establishments or had a regular job but could not work. Hopefully some of these would have regained their employment after the restrictions were eased”.

With jobs disappearing, household incomes plummeted. Rural monthly income saw a decline of 19% in April 2020 as compared to the previous month. In urban areas, the drop was 41%. This constrained households' ability to spend, and to save.

3.1 The Impact of the First Lockdown on Women’s Work

My estimates using CPHS data revealed that in the first month of the stringent nation-wide lockdown in April 2020, in absolute numbers more men lost employment than women (104 million and 17 million, respectively). This is not surprising as more men than women were employed before the pandemic hit. However, conditional on being employed pre-lockdown, women were roughly 20% points less likely to be employed in April 2020 (Deshpande 2022).

While the early evidence from the lockdown did not suggest any major shifts in the gender gaps in the labour market, there was speculation whether this pattern had changed with the steady unlocking of the economy after the first lockdown. A study released by LinkedIn, based on their internal data for India, found an increase of 7% points in women’s participation in the labour force between April and July 2020.Footnote 3 Their argument was that the normalisation of work-from-home (WFH) and flexible hours has allowed women to enter the workforce.

An important dimension that negatively affects women’s labour force participation is their predominant responsibility to get housework and domestic chores done. Across the world, women spend more time on domestic chores and care work than men.

India has amongst the most unequal gender division of household work globally. Early evidence showed that the gender gap in average hours spent on domestic work hours decreased in the first month of the lockdown due to an increase in the male distribution of hours (Deshpande 2022). Was this shift a very short-lived blip or did this decline in the gender gap persisted beyond the first month? If it was the latter, in principle, it could set the stage for a rise in female labour supply, as suggested by the LinkedIn report. Of course, whether female employment actually increases is a function of several other factors, including demand for female labour and adequate employment opportunities.

If the pandemic had, in fact, managed to shift the needle on sticky gender norms in paid and unpaid work, it would have been a massive silver lining to the dark phase of the pandemic and economic contraction. Any such shift in India has potentially significant implications for livelihoods and quality of life of a third of the world’s population. India has been struggling with slowing growth, rising inequality and significant persistent gender gaps and had the pandemic enabled the economy to break out of persistent patterns; this would have been much needed and welcome development.

As Indian women’s participation in paid work is already severely constrained by unpaid work, which includes care work and domestic chores, I investigated how this pattern shifted, if at all. The LinkedIn India report suggested that Indian women were able to increase work participation despite school and childcare facilities being closed, due to the presence of domestic help and live-in grandparents, in addition to flexible hours and the ability to work remotely, which presumably allowed them to combine care responsibility with demands of paid work. Does national-level macro-data support this shift?

Following a sharp drop in employment in April 2020, employment recovered through May–August 2020 for both men and women but started to decline thereafter. However, there is no evidence of an increase in female work participation over the 6 months of the pandemic over and above the recovery to near pre-pandemic levels. Broken down by education levels, the post-August decline in female employment was driven the decline in employment of women with very low levels of education: primary and below and illiterate. The highly educated women suffered the least in the job cuts in April, when overall employment plummeted, mean employment for this group of women declined between April and August 2020, i.e., during the recovery phase than during the contraction phase. However, between August and December 2020, the average employment is back to its pre-pandemic levels.

Examining changes in employment by social group, the largest decline in employment occurred for Scheduled Caste (SC) or Dalit men, followed by Scheduled Tribe (ST), then Other Backward Class (OBC). Upper caste men registered the smallest decline in employment. My estimates for the probability of employment show that accounting for lagged employment, the likelihood of women being employed in August 2020 was 9 percentage points lower than that for men, compared to the pre-pandemic period (April 2019). By December 2020, the gender gaps in the probability of being employed were back to the pre-pandemic levels.

The gender gap in the average hours spent on domestic work registered a decline in the first month of the lockdown (April 2020) due to an increase in male hours. However, in August male hours had declined again, though not to the pre-pandemic levels. By December 2020, women’s hours spent on domestic work had increased significantly and the male hours had declined below the pre-pandemic levels, thereby significantly worsening the gender gap. Examining caste differences in time spent on housework reveals that the spike in male hours on housework was due to an increase by Dalit men.

3.2 Secondary Sector Employment

During the pandemic, especially as domestic migrants undertook a long march back to their rural homes, agriculture ended up being the sector of last refuge for work and livelihoods. The increase in female labour force participation (FLFP) in the recent PLFS data, which the Economic Survey cites as a healthy and welcome turnaround in FLFP, is mostly on account of increase in proportion of women in unpaid agricultural work. However, over the last two decades, in line with structural transformation, the share of agriculture in total employment is declining and a distress-driven return to agriculture is not a longer-term solution to the employment problem.

As the employment share of agriculture and allied activities declines, the share of secondary and tertiary sector increases. In India, what has been the trend in secondary sector employment?

In May 2021, when India was battling the deadly second Delta wave of the pandemic, at CEDA we took a longer view of the employment situation using CPHS data from 2016.Footnote 4 We focused on seven sectors, viz. agriculture, mines, manufacturing, real estate and construction, financial services, non-financial services, and public administrative services. These sectors make up for 99% of total employment in the country.

Figure 1 shows the employment in manufacturing, real estate and construction, and mining sectors. Together these sectors accounted for 30% of all employment in 2016–17 which came down to 21% in 2020–21.

Source CEDA-CMIE bulletin (https://ceda.ashoka.edu.in/ceda-cmie-bulletin-manufacturing-employment-halves-in-5-years/)

Trends in secondary sector employment.

The CEDA-CMIE bulletin showed that while the manufacturing accounts for nearly 17% of India’s GDP, it has seen a sharp decline in employment over the last 5 years. From employing 51 million Indians in 2016–17, employment in the sector declined by 46% to reach 27.3 million in 2020–21. This indicates the severity of the employment crisis in India predating the pandemic.

On a year-on-year (YoY) basis, it employed 32% fewer people in 2020–21 over 2019–20. It had seen a growth of 1% (YoY) in 2019–20. This has happened despite the Indian government’s push to improve manufacturing in the country with the ‘Make in India’ project. Under the project, India sought to create an additional 100 million manufacturing jobs in India by 2022 and to increase manufacturing’s contribution to GDP to 20% by 2025.

However, the ground reality belies this expectation. Instead of increasing employment in the sector, we have seen a sharp decline over the last 5 years. When we look closely at industries that make the manufacturing sector, we find that this is a secular decline in employment across all sub-sectors, except chemical industries. All sub-sectors within manufacturing registered a longer-term decline.

The Economic Survey for 2022–23 cites data from the Annual Survey of Industries (ASI) which shows a steady upward trend in the number of factory workers, with a sharper increase for male workers compared to female workers. However, these numbers are not very instructive as these do not account for the growth of the labour force over the same period. We need to see if the percentage of factory workers (as a proportion of the working age population) has increased over the years.

Figure 2 shows that the real estate and construction sector has also seen a sharp dip in employment over the 5-year period from 2016–17 to 2020–21. From employing 69 million Indians in 2016–17, employment in the sector dipped by 25% to reach 53.7 million in 2020–21. The sector saw employment dip by 12% in 2020–21 (YoY) and 2.1% in 2019–20 (YoY). In recent years, the sector has been beset by issues of inventory pile up, delivery delays and developer failures. This is reflected in the employment numbers. The troubled industry has been hit further by the coronavirus pandemic in 2020–21.

Mining industry has also seen employment crash by 38% over the 5-year period between 2016–17 and 2020–21. From employing 1.4 million people in 2016–17, the sector employed only 0.88 million people in 2020–21. India’s economic slowdown may be the reason to blame for the decline in employment in the sector. With demand falling in the steel, power and construction industries, mining has suffered a hit.

While the real estate and construction sector drove employment growth between 2004–11, it saw a sharp decline between 2016–17 and 2020–21. We also see that there has been hardly any source of growth in employment in this period. This is reflected in the 7% decline in overall employment in the country from 407 million in 2016–17 to 378 million in 2020–21.

These numbers show that the employment crisis in India predates the pandemic; the COVID-19 pandemic has made the jobs plight even more severe.

4 Concluding Comments: Long-Term Prospects

After being hit hard during the initial months of the COVID-19 pandemic, employment levels are recovering but are yet to return to pre-pandemic levels, as Fig. 3 shows. Compared to January 2020, around 14 million fewer individuals—4.5 million fewer men and 9.6 million fewer women—were employed in October 2022.

Total number of people employed, age 15 and above. 2022

Women in India were less likely to be part of the formal workforce than men even before the pandemic, but as our bulletin on this subject noted, they lost employment in greater proportions when the lockdowns were imposed to check the spread of COVID-19. The months corresponding to the second wave of the COVID-19 pandemic—April and May 2021—also witnessed a significant fall in employment. The impact was predominantly in male employment with 21 million fewer males employed in April and May 2021 than in March 2021.

Overall, employment in the real estate and construction sector seems to have returned to pre-pandemic levels in 2022. Employment in manufacturing has shown slow and only partial recovery. Around 6 million fewer individuals are employed in this sector as of October 2022, compared to average employment in the sector in the years 2018 and 2019.

While the extreme distress caused by the pandemic might appear to be receding, the Indian labour market has had deep-rooted inequities along the lines of sector (rural–urban), gender, caste or social identity groups. These inequalities are in addition to the challenges posed by jobless growth, as the growth in output has not led to commensurate increase in employment. The predominantly informal nature of the Indian labour market has suffered three major shocks since 2016: demonetisation, haphazard implementation of GST regime and the COVID-19 pandemic and attendant economic slowdown. Reversing the negative consequences of these shocks would require putting employment generation as one of the central pillars of economic policy in the immediate future.

Notes

See P.C. Mohanan’s pieces on the CEDA website for comparability.

https://www.livemint.com/news/india/work-from-home-boosted-gender-parity-in-india-s-says-linkedin-

report-11601361523068.html.

References

CEDA-CMIE, Centre for Economic Data & Analysis and Centre for Monitoring Indian Economy. 2022. The impact of the COVID-19 pandemic on people’s economic lives as seen through CEDA-CMIE bulletins in 2021 and 2022. https://ceda.ashoka.edu.in/ceda-cmie-bulletin-booklet/.

Deshpande, Ashwini. 2022. The COVID-19 pandemic and gendered division of paid work, domestic chores and leisure: Evidence from India’s first wave. Economia Politica 39: 75–100. https://doi.org/10.1007/s40888-021-00235.

Kar, Aloke and P.C. Mohanan. 2022. Impact of lockdown on employment and earnings. Economic and Political Weekly 57(40)

Funding

This article is not based on any funded project.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

There is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Keynote address at the Indian Society of Labour Economics, Itanagar, 1st March 2023, Ashwini Deshpande, Professor of Economics and Director, Centre for Economic Data and Analysis (CEDA), Ashoka University. This keynote is substantially based on research that CEDA has been doing over the past 3 years. Our full findings on the impact of COVID-19 on various socio-economic indicators can be found on our website: https://ceda.ashoka.edu.in.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Deshpande, A. Long-Term Impact of COVID-19 on the Indian Labour Market. Ind. J. Labour Econ. 66, 951–959 (2023). https://doi.org/10.1007/s41027-023-00466-1

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41027-023-00466-1