Abstract

The present paper provides an evidence-based enquiry into the causes of low productivity, polarised industry structure and their relations with labour market institutions in major states of India. Unit level data of NSSO’s 73rd Round of Unincorporated Enterprise Survey for the year 2015–16 and ASI 2015–16 unit level data have been used to estimate relevant parameters and these are cross-checked by using NSSO’s 67th Round of Unincorporated Enterprise Survey for the year 2009–10 and ASI 2009–10. The debate that took place during the late 1990s and early years of the first decade of the twenty-first century was mainly centred on explaining the reasons for low productivity syndrome as pro-labour and anti-labour policies nurturing or weakening particular labour market institutions. However, the present study shows that the broader institutional environments, which are very sticky unless the state consciously makes attempts to change through mass involvement and strict laws, under which labour market institutions operate, state policies are framed and implemented play the most determining role in the evolution of industry structure and the performance of the industry. Pro-business institutional environments are lacking and anti-establishment institutions are prominent in many states where mobility of micro and small firms along the size-ladder has been highly restricted which results in polarised structure or the so-called phenomenon of “missing middle” and low productivity of a large majority of the workers.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Traditionally economists used the term “flexibility” to mean the ability of the market to change commodity prices or wage rates in order to maintain a balance between demand and supply of commodities including labour. Gradually the meaning has been widened from the market clearing process to include flexibility of the employers in employment, i.e. hiring and firing of workers. Economists have been debating whether particular labour market institutions, notably labour laws protecting employment and/or raising costs of labour retrenchment, distort industry structure, restrict productivity and output growth, obstruct industrial development through discouraging capital investment, and promote non-standard employment like contract workers. Some economists argue that pro-workers legislations not only raise tenure of employment but also promote skills, innovations and technology and thereby lead to long-term productivity growth. The debate took place both at the theoretical and empirical levels. The present paper makes a critical analysis of the literature and notes that the debate ignores the institutional environment that is central to the function of labour market institutions and in the light of that analyses the Indian situation including evolving structure of manufacturing industries across states. The Indian manufacturing industry is characterised by the predominance of micro and small firms in employment generation, overall low productivity of workers and the phenomenon of “missing middle”. However, there are significant state-wise variations in this regard, which will be analysed in the present paper.

2 Literature Review

2.1 Labour Market Institutions and Growth of Investment and Employment

Theoretical studies by Boeri (1999), Blanchard and Landier (2002), and Cahuc and Postel-Vinay (2002) pointed out that in the countries characterised by strict employment protection regulations, deregulation of temporary workers would adversely affect turnover, overall employment as well as economic welfare. In an earlier study Piore (1986) noted that high retrenchment costs would stabilise the employment path around somewhat high values although, in effect, the firm’s value would be reduced. This observation was corroborated by Bertola (1990) who noted high turnover costs due to job security provisions would reduce employment at cyclical peaks and raise at cyclical troughs and thereby stabilise employment. It was further observed, “Netting the cyclical effects out … long-run employment may actually be somewhat higher if turnover costs are due to job security provisions” (Bertola 1990, p.877).

Empirical studies by Fallon (1987), Fallon and Lucas (1991, 1993) on the effects of amendments of Employment Protection Act of India in 1976 and 1982 found that the firms covered under the acts reduced labour demand, whereas the smaller firms that were outside the ambit of the amended act witnessed an increase in employment. Because of the 1976 amendment, it was estimated, there was 17.5 per cent reduction of employment in formal manufacturing for a given level of production (Fallon and Lucas 1993). A major criticism of the estimation was found in Bhalotra (1998) who pointed out inappropriate usage of statistical techniques, particularly, inclusion of several statistically insignificant coefficients in estimating the average decline. She, however, interpreted the jobless growth of the 1980s as a result of productivity growth, growth of working hours and, to a small extent, wage growth. Further, the impact of the revised employment protection act of 1982, according to Dutta Roy (2004), was not so severe. There were some short run adjustment costs in terms of employment reduction but overall the impact was minimal. As regards labour market adjustments, Hasan et al. (2007) found positive effects of trade reforms on labour demand elasticities but the states having stringent labour regulations were characterised by lower demand elasticities, which did not change much despite trade reforms.

According to the Indian constitution, labour comes under the concurrent list and thus states have partial rights to amend their own labour-laws, which over the years widened the divergence of the regulatory environment for employing labour across states. Researchers tried to quantify state-wise variation in the regulatory environment and investigate whether such variation led to differences in investment, employment, productivity, income, and the like across states. Through a comprehensive study covering a long period from 1958 to 1992, Besley and Burgess (2004) observed that pro-worker amendments to the Industrial Disputes Act of 1947 had adverse effects on the registered manufacturing sector as it experienced reduced investment, output, employment and productivity during the period. The unregistered manufacturing sector, on the other hand, got encouragement by the same amendments. This work has been severely criticised by Bhattacharjea (2006 and 2009) on the ground that the construction of the main explanatory variable, i.e. the regulatory index, was based on a faulty premise of proper implementation of each and every amendment or labour regulation made by states.

Ashan and Pages (2008) following the approach of Besley and Burgess (2004), with some modifications in line with the suggestions made by Bhattacharjea (2006) tried to estimate the effects of temporal variations of state amendments to central labour laws on the economic outcome for the states. They identified around 45 different central legislations and a large number of state laws dealing with different aspects of employment, like dispute resolution, employment protection and restrictions on firm closure, many of which were often ineffective or counterproductive, resulted in frequent strikes and lockouts leading to substantial losses of person-days and output. Another effect was high growth of contract labour, particularly during the 1980s and 1990s, as the entrepreneurs tried to circumvent the restrictive labour laws. It was further noted that both capital-intensive and labour-intensive industries were affected but in different ways—the former industries were affected more in terms of limited investment and employment as the amendments raised costs of labour dispute resolution while the latter industries were affected by the amendments protecting employment. As regards the interests of the workers, it was observed, “some workers may benefit from employment protection legislation through higher wages, workers as a whole appear to be made worse off by both types of legislation” (Ashan and Pages 2008, pp 3–4). Goldar and Aggarwal (2010) using NSSO unit level employment-unemployment data, also found a negative relationship between the interstate differences in labour market reforms index and the proportion of casual workers in manufacturing.

The study of Besley and Burgess (2004) was vigorously criticised by many authors and in the process a large body of literature evolved intending to falsify the negative effects of pro-worker or employment protection legislations. For instance, Teitelbaum (2012), Bhattacharjea (2009, 2012 and 2019), Storm(2019) criticised it on the ground of faulty codification or indexing of legislations for quantitative analysis, resulting from the failure to distinguish between legislation and its actual implementation and thereby committing mistakes in coding. An alternative explanation of the interstate divergence was provided by Bhattacharjea (2019): “the agglomeration effects highlighted in the NEG literature can give rise to persistent and growing divergences between regions” (p 21). It is interesting to note that some recent researches, theoretical as well as empirical, highlighted several favourable effects of employment protection laws, see for example, Subramanian (2018), Adams et al (2018) indirectly supporting the conclusion derived by Piore (1986). An important observation of this group is that pro-worker legislations would ease the process of conflict resolution through the mediation of a third party like a court, which would encourage manufacturers to invest and employ workers. High retrenchment costs or job security would also encourage manufacturers to innovate and improve workers’ skill in order to make profitable use of the already employed workers, even in an adverse situation, resembling the behaviour of Japanese firms which follow the practice of lifetime employment. It thus seems the effects of labour market institutions on employment, economic growth, productivity or nature of jobs still remain inconclusive, particularly in the Indian context.

2.2 Labour Market Institutions and Bi-Modal Industry Structure

An obverse aspect of the labour market institutions is the evolution of peculiar industry structure, the so-called missing middle, which was found to be prominent in the Indian manufacturing industry (Mazumdar and Sarkar 2009) and later on it was found to be a general phenomenon, present in other sectors like trade and services (Biswas and Pohit 2015). Mazumdar and Sarkar (2009) observed “two strong modes in the distribution of employment in modern manufacturing: in the ‘500 and more’ category, and the ‘5-9’ category, with the proportion of employment in the intermediate middle size groups being conspicuously small” (p 49). Restrictive labour laws are adduced to be the major contributors of such a static dualistic structure of industries, characterised by the coexistence of some large-sized enterprises employing a large number of workers and numerous micro and small enterprises which were discouraged to grow in size raising employment (Mazumdar and Sarkar 2009; Ahsan and Pages 2008). Rather than raising the size of the enterprise in a favourable market condition, an entrepreneur would prefer to set up another new small enterprise in order to avoid labour laws—thus the smooth process of moving up the ladder of size classes by the enterprises seemed to be halted at some points. Further, associated with the dualistic structure is the wide productivity differential of the workforce between the two types of enterprises: “The gap in labour productivity between the large and the small size groups in India is of the order of 8:1, as against 3:1 in Japan, Korea and Taiwan (and even smaller in Hong Kong)” (Mazumdar and Sarkar 2009, p 48).

There are several interpretations of the persistence of this bi-modal structure and some of these interpretations are based on diametrically opposite premises. One is that the small industries are favoured vis-a-vis large industries while another is that the small industries are discriminated against vis-a-vis large industries. In the first case, the government policy of reservation of numerous items exclusively for the SSI/VSI sectors as well as several other concessions given to small producers would discourage the latter to grow in size while the larger industries facing numerous restrictions would find it costly to operate and only those who are sufficiently large could distribute the additional overhead costs over a large volume of products and operate profitably. The opposite view is that the small producers are discriminated in the credit market and therefore can neither use capital intensive high technology for production and earn reasonable profit and reinvest, nor invest more raising scale of production and as a result fail to move to middle size category. The large producers on other hand have adequate access to capital and are able to grow through profitable investment. It is also argued by some economists that this dualistic structure, inherited the remnants of pre-capitalistic structures, suits large enterprises as the mass of small producers provide cheaper intermediate inputs or semi-processed products often under sub-contracting to the large enterprises. Moreover, large enterprises on several occasions are found to wield market power to prevent small producers from growing in size (Biswas 2016). Hsieh and Olken (2014) however did not find the existence of the phenomenon called “missing middle” and according to them, the misconception arose due to grouping of enterprises into selected size classes of employment. Using data of the formal and informal segments of the manufacturing industries for India, Indonesia and Mexico, they found “the distribution of firm size is right skewed and generally smoothly declining in firm size, with no evidence of bimodality or discontinuity” (Hsieh and Olken 2014, p 93). This debate thus appears inconclusive.

2.3 Flawed Conceptualisation of Labour Market Institutions and Failure to Interpret Slow Pace of Industrial Development in Several States

While interpreting the industry structure and other economic outcomes in terms of labour market institutions, notably labour laws, economists have considered states as the units having authority to enact labour laws. It was assumed that as the labour laws vary across states, economic outcomes would also change. For econometric exercise, as described above, a number of variables representing labour laws or labour market institutions are chosen such as number of different labour laws exist, number of working days lost due to trade union movements or number of disputes/cases in labour court in a state. Similarly, economic outcomes are indicated in terms of labour productivity, number of factories/ enterprises closed, number of new factories/enterprises set up, etc. Using state-wise cross-sectional as well as temporal data on these different sets of outcome variables and labour market institutions related (explanatory) variables economists have been engaged in debate, as described above, that however still remains inconclusive. Notwithstanding inconclusiveness about the causal relationship between economic outcome and labour market institutions across the states, there is a distinct pattern of growth performance—the states with a long history of trade-union movements and anti-establishment/ anti-corporate culture fared poorly in the post-reform phase vis-a-vis those who could establish pro-business culture and could make the reforms effective (c.f. compare West Bengal or Kerala with Gujarat or Haryana). This is different from the lack of business environment, including law and order problems, which discourages even MSEs (micro and small enterprises) to set up enterprises (as in Bihar).

One of the major drawbacks of the debate is the flawed conceptualization of the labour market institutions and thus the related indicators used as explanatory variables for economic outcomes. Number of strikes, number of man-days lost or number of days required to start a new business and to close a loss making or bankrupt business are no doubt important indicators of the functioning of labour market institutions and which can be significantly influenced through legislation by a state, but the accepted behaviour of the people, including the attitude of the working class, towards businesses and profitmaking, towards corporates would change very slowly as the activities of the political parties and the intellectuals attached to the political parties or particular ideologies would tend to perpetuate attitudes of the common people and working class of the state. Even state legislators often adhere to the local ideology while making laws and those legislations that are not in consonance with the local ideology fail to get implemented. All this has important implications in terms of learning ability, acquiring skills and developing expertise as well as the overall pattern of labour supply or labour market functioning. Thus, the broader institutional environment under which labour market institutions operate ultimately determines the way workers participate, which in turn determines the structure of industries, i.e. distribution of micro, small, medium and large enterprises and their use of labour, capital and technology, and thereby significantly influences the productivity of labour. The institutional environment that evolves in each state is distinct, although may have similarities in some features with some other states. The discussion below would reflect on how the broader labour market institutions or the institutional environments shape the structure of industries and their performance in different regions in India.

3 Institutions and Divergence of Industry Structure across Indian States

3.1 Data Source and Methodology

Industry structure may be captured in terms of the size distribution of firms and the associated distribution of employment. Combining data from the Annual Survey of Industries (registered) and NSSO enterprise survey for the unincorporated sector for the year 2015–16 would help us understand the complete structure of the industry, particularly the manufacturing industry, in the recent period. The enterprises/ factories [hence forth firms] of the combined data set have been grouped into different size classes depending on the number of persons employed. There are four size classes with the number of persons employed being (1) 1–9, (2) 10–19, (3) 20–99, and (4) 100 & above. These four size classes are denoted as micro-, small-, medium- and large-sized firms, respectively. Relevant parameters have been estimated from the unit level data of ASI (for the year 2015–16) and of NSSO (73rd Round survey of unincorporated enterprises sector with the reference year 2015–16). We have also used ASI 2009–10 and NSSO 67th Round unincorporated enterprise survey data for a cross check.

3.2 Manufacturing Density, Mobility and Size Structure

For the country as a whole in the year 2015–16 over 98 per cent of the firms and 67 per cent of employment in manufacturing are found to be concentrated in the employment category 1–9, i.e. at the level of micro-firms as shown in Table 1. While comparing these figures with the corresponding figures for the year 2009–10, it is found that there is no perceptible change over the period. Thus, it reiterates the immense importance of the micro-firms, particularly in job creation, although there are substantial variations across states. It is to be noted that such a high proportion of micro-firms is not necessarily due to strong preference of the people for self-employment. Rather, lack of job opportunities, particularly in larger-sized firms, compels many people to be self-employed despite the fact that the average value added per worker in the larger firms is much higher than the micro-firms, which is discussed below. Table 1 also shows the manufacturing density in the states, measured in terms of three simple ratios: (i) number of manufacturing firms per 1000 population, (ii) number of manufacturing employment per 1000 population and (iii) share of manufacturing in GSDP. These three indicators reflect different dimensions of manufacturing density but need not move in tandem.

In order to understand industrial dynamics, including mobility across size classes of firms, based on cross-section data, it needs to see the distribution of firms and employment across size classes. Under a normal situation one can expect that a certain percentage of firms grow in size and create a pyramid like structure of the size classes of firms. It may be seen in Table 1 that in most of the states the mobility is extremely limited as the firms are primarily micro-sized units that hardly moved up the size-ladder, and this predominance of micro-firms blurs the relative distribution among other size classes. It may be seen in Table 1 that the variation of the micro-firms’ share in overall manufacturing employment is much less than that in overall number of manufacturing firms. This is quite obvious as, for instance, one per cent reduction in micro-firms’ share in number implies one percentage increase in the share of the small–medium–large firms in total number of firms and since the latter firms employ much more workers than the micro-firms, their share in employment would rise at higher rate.

Further, in order to reflect the relative distribution among small-, medium- and large-sized firms, we have recalculated the ratios by netting out the micro-sized firms. Table 2 below shows that in All-India, in the case of number of firms the relative distribution is roughly 75:17:8 across small (employing 10–19 persons), medium (employing 20–99 persons) and large (employing 100 & above persons) firms, whereas the same is 26:15:58 for employment in 2015–16. Thus, the relative distribution of firms rapidly declines from small to medium and then to large size classes, which although somehow resembles pyramid structure but does not indicate upward mobility of a sizeable proportion of firms. In order to see if there has been any significant change in the relative distribution of these three size classes we have estimated the above-mentioned ratios for the year 2009–10 using comparable data, as shown in Table 3.

Although a comparison between Table 2 and Table 3 would reveal some dynamism or upward mobility as the relative shares of medium and large firms have increased in both employment and number of firms, but in reality this is a result of decline of the number of firms and number of employment under both small and medium size classes. In fact, total number of firms under small, medium and large categories declined by 12.4%, whereas employment increased by 2.83% owing to growth of large firms during the period. It is interesting to note that the growth has taken place in the two opposite ends of the size distribution—micro and large size classes, although numerically, the micro-firms’ contribution is much more. It is noted in Biswas (2019) that among the smaller firms, self-employed ones have been able to survive and other smaller firms employing hired labour have faced tough competition—many have failed, some have moved backward and the efficient ones have moved forward in the size ladder.

Employment distribution across size classes thus remains U-shaped or bi-modal, which has also been noted in Mazumdar and Sarkar (2009) reflecting highly restricted upward mobility of the lower rank firms. Notwithstanding this overall trend of restricted mobility quite a few states have been successfully able to make their industry structure reasonably dynamic with fairly large share of medium firms’ employment. For example, Himachal Pradesh and Punjab have fairly large share of medium firms and their employment, and Haryana and Uttarakhand have low share of micro-firms in employment. How institutional environment plays a major role in determining state-wise variations as regards manufacturing density as well as size distribution of firms and their employment are discussed below.

3.2.1 Institutional Environment, Enterprise mobility and Size Structure Across States

3.2.1.1 High Manufacturing Density States

West Bengal, Tamil Nadu, Gujarat and Telangana are the states with high manufacturing density in terms of the first two parameters, i.e. employment and enterprise density parameters, but with diverse values for the third parameter, i.e. manufacturing share in GSDP (Table 1). All these states are traditionally highly industrialised, having established systems, or institutions that regenerate and propagate knowledge and skills of manufacturing, arts and crafts across generations (Biswas and Raj 1998; Biswas 2010). These institutions, need not be all formal, are however dynamic enough to adjust with time, with changes in technology, tastes or preferences. Although West Bengal has the highest manufacturing density, in terms of employment and enterprise density parameters, its manufacturing is predominated by micro-firms which contribute as much as 85% of the state’s manufacturing employment and the remaining 15% of the employment is generated by the small, medium and large firms in 2015–16 (see Tables 2, 3 for distribution among these three groups for the years 2015–16 and 2009–10). In Gujarat and Tamil Nadu, the micro-firms’ share in employment is quite low—little less than 50% in Gujarat and a little more than 54% in Tamil Nadu. Telangana’s status in this regard lies in the mid-way between Tamil Nadu and West Bengal. The other side of the story is that the contribution of the relatively larger-sized firms, i.e. with ten or more workers, to manufacturing employment is much higher in Gujarat and Tamil Nadu than in Telangana and West Bengal. This is also reflected in terms of the third parameter of manufacturing density, which shows manufacturing share in GSDP is much higher in the former two states as compared to the other two states. These structural divergences have significant implications in terms of differing labour productivity/wages (see Tables 4, 5, which display regression of labour productivity (in logarithmic terms) on state dummies excluding the dummy for Assam).

These structural divergences may be the result of differing state policies as well as differences in the functioning of the labour market institutions. Private entrepreneurs intending to make large investments in West Bengal or Telangana often face costs uncertainties due to various local, political or labour disturbances which magnify uncertainties of return on investment and the institutions that are essential to reduce these uncertainties involved in large projects are yet to evolve. These two states have a long tradition of trade-union as well as anti-establishment movements, particularly during the colonial period. Along with trade union movements, mass anti-establishment movements have been inculcated by various political and social organisations even after independence and any move for major industrialisation by the ruling political party/ coalition is thwarted by the opposition through mass mobilisation or creating labour unrest (e.g. Left Front’s effort for TATA’s investment in SingurFootnote 1 was upset by the opposition party). Not only the functioning of the labour market institutions that encouraged labour strikes and other forms of work-day losses, but also the broader institutional environment under which the former operate discouraged investors from taking up large projects. In some instances, projects were halted for long or abandoned, not at the conceptualisation stage, but in the mid-way when substantial investments were already made, because of various kinds of extraction demand by local mafia, local or higher level political groups. Abandoning projects after making substantial asset specific investments causes huge losses to the investors as their relocation is highly uneconomical.

As opposed to this, in Gujarat and Tamil Nadu anti-establishment institutions of the colonial period were largely dissipated through active involvement of the states and both the ruling and opposition parties try to promote large investments. Appropriate institutional mechanisms evolved to settle labour disputes (for example, in Tamil Nadu government and various political parties intervened to resolve labour dispute in Nokia factory in 2009 and 2010; see Cividep, 2010, Changing Industrial Relations in India’s Mobile Phone Manufacturing Industry, Amsterdam). Society appreciates entrepreneurships in these states and thus there evolved institutions promoting entrepreneurs and encouraging them to grow bigger in size. The effects are visible in the form of a sizeable share of larger firms, high share of manufacturing GSDP and the average productivity of labour close to national average for Tamil Nadu and almost double the national average in Gujarat.

The growth story of Gujarat may be debated but it has been noted that most of the coastal states have shown higher growth than the so-called BIMARU (Bihar, Madhya Pradesh, Rajasthan and UP, referring to their poor economic stand-up) states. Usually a coastal state has the twin advantages linked to greater global access and lower transportation costs. Other coastal states, such as Maharashtra and Tamil Nadu have also performed well. But sustaining faster growth for a relatively longer period of time, as Gujarat has done, is challenging. The state’s GSDP grew at a CAGR of 12.9 per cent, during 2015–16 to 2020–21.Footnote 2 About 25 per cent of India's sea cargo passes through Gujarat's ports. Gujarat has diversified its industrial structure considerably since it has acquired statehood in 1960 from the erstwhile Bombay State. Textiles and the auxiliary sectors were the major contributors to industrial economy of the state during 1960s, which was subsequently transformed in the span of over 50 years. Refinery, petrochemicals and gems & jewellery came up in a big way in the transformed scenario. There are 106 product clusters and 60 notified Special Economic Zones (SEZs)Footnote 3 that mostly support large to medium enterprises. Such a massive industrialisation could not have taken place had there been institutional environment encouraging labour disputes and anti-establishment movements.

The distribution of employment across small, medium and large firms was found to be highly polarised in West Bengal with medium firms having less than 9% share and the small and large firms have 51% and 40%, respectively, in 2015–16. In Gujarat, Tamil Nadu and Telangana the share of small firms systematically declined and that of large firms rapidly increased while the medium firms made moderate gain (Table 2). The productivity gap between small and medium firms was much more in West Bengal and Telangana than in Tamil Nadu and Gujarat indicating restricted mobility in the former states. Notwithstanding these interstate productivity differences, graduating from small to medium size would raise productivity at much higher rates than from micro to small or from medium to large firms. The problem of institutional hindrances to such mobility, both at the level of government administration and at the level of labour market, must be addressed by the respective governments.

3.2.1.2 Moderate Manufacturing Density States

States with moderate manufacturing density as per employment criterion, are Karnataka, Maharashtra, Andhra Pradesh, Punjab, UttaraKhand, Himachal Pradesh, Delhi, Haryana and Kerala, although quite a few of them have a high share of manufacturing GSDP. Many of these states have one or more regions with high manufacturing employment density and/or traditionally developed industries, for example, Mumbai and Thane in Maharashtra, Kochi in Kerala, Ludhiana in Punjab, Mangalore in Karnataka, Vijayawada, Kakinada and Guntur in Andhra Pradesh. Newly industrialised states are Himachal Pradesh, Haryana and UttaraKhand, where with the active involvement of the state industries have flourished in certain regions. In these three states, micro-firms’ share in manufacturing employment is much lower, ranges from 24% in Uttarakhand to 45% in Himachal Pradesh, which indicates that the small, medium and large firms contribute much more towards employment generation. In Uttarakhand, as part of labour market reforms, the government has given a go-ahead for an ordinance relaxing a slew of labour regulations, which includes among others, giving a free hand to new factories in the state to operate without adhering to the occupational safety and health norms. In general, in the absence of pre-existing organised trade unions and any kind of political mobilisation against large industries, together with state incentives, investors find these states as attractive destinations. Furthermore, the broader institutional environment under which labour market institutions operate plays very important role in guiding the resolution of various conflicts (for example, decade long trade union movement in Maruti plant in Haryana did not result in closure of the plant, but some working solutions were established). The favourable industrial climate enables firms to grow in size and adopt new or capital intensive technology. As a result not only the labour productivity is very high in these states but their share of manufacturing in GSDP is also very high despite being late starters in the race for industrialisation (Tables 1, 4 and 5).

It may be noted that the Haryana Government’s Industrial Policy (IP) of 1992, adopted in tandem with the economic reforms initiated by the UPA Government in 1991, was overtly an incentive centric approach to attract investment into the State. This policy was culminated to adopt an infrastructure led approach in 1997 and aimed further at promoting industrial growth in the context of overall economic value addition through private initiatives in 1999. Haryana sought to capture these opportunities, leveraging the strengths in agriculture and its comparative advantage in manufacturing, for promotion of investment and taking the industry to front ranks of global competition.Footnote 4 Further, with the adoption of the Industrial and Investment Policy of 2011 and its subsequent revisions Haryana emerged as an attractive investment destination with manufacturing stronghold in sectors like automobile and auto components, light engineering goods, IT & ITES, textiles and apparels and electrical and electronic goods. It is in this context that Haryana came out with a comprehensive Labour PolicyFootnote 5 to create affable relations between the employer and the employee. The State also facilitated social dialogue by constituting “Tripartite Committees” of employers, workers and Government representatives and promoting them as effective informal conciliation mechanisms. All this has promoted a healthy environment enabling fresh investments and upward mobility of the smaller firms.

Among the early industrialised states in this group, Maharashtra, Karnataka and Punjab could moderate trade union activism as the ruling as well as opposing political parties desisted from mobilisations against large investments including in infrastructure where land is also a major issue and thus are able to diversify and attract new industries with larger-sized firms. The distribution of the number of firms as well as employment among small, medium and large size classes are not very lopsided. In Maharashtra the share of manufacturing in state domestic product far exceeds that of the national average while Karnataka and Punjab have fairly high shares. Andhra Pradesh and Kerala despite attracting some new industries continue to be predominated by micro-firms as the recurring problems of labour unrests and mass agitations discourage large investors owing to uncertainties of costs and returns on investments (for instance recent problem of strike in Muthoot Finance company in Kerala compelling the organisation to think of relocating its operation in other states, see Rajesh Abraham, “Labour’s love lost amid biz buzz”, Indian Express, Kerala, 08.09.2019). Similar to West Bengal, these two states also have labour market institutions that are not supportive of large private investments, and have highly sophisticated traditional art and crafts skills and the artisanal crafts generate substantial employment. These traditional crafts also enjoy steady market demand. As a result, micro-firms predominate and the average productivity of manufacturing workers remains at a low level and also the contribution of manufacturing to GSDP remains much below the national average.

It is worth mentioning that there are two alternative viewpoints regarding Kerala’s industrialisation. The first line of argument notes that Kerala’s industrial backwardness is related to the high incidence of labour unrest and the active role of trade union movement (Oommen, 1979; Albin, 1990; Thampy, 1990). The second line of argument is that Kerala’s industrial slowdown is due to its weak industrial structure, which offers very little potential for interindustry inter-linkages (Subrahmanian and Pillai, 1986; Subrahmanian, 2003). Several constraining factors kept the course of Kerala’s industrialization at its low. Firstly, public investment in industry in Kerala was perpetually truncated. Secondly, the state government in Kerala, like other Indian States, had only limited policy options in industrial development, particularly due to low level of fiscal transfers from the Centre to the States. Given the high rates of unemployment in the State, there have been strong pressures from the public to protect employment in the existing industrial units which further reduced the options available to the governments in Kerala (Thomas 2005).

3.2.1.3 Low Manufacturing Density States

Among the low industrialised states, Uttar Pradesh, Orissa, Rajasthan, Madhya Pradesh, Jharkhand, Bihar and J&K have some long established industrial regions and most of the industries are traditional, barring few exceptions, such as modern industries in Noida and Kanpur in Uttar Pradesh, mining or extraction industries in some pockets of Orissa, Jharkhand, Chhattisgarh, Rajasthan and Madhya Pradesh. In fact, because of large extraction industries in Orissa, Jharkhand and Chhattisgarh the manufacturing sector’s contribution to GSDP reached close to the national average and the employment share of the large firms far exceeded that of small and medium firms. Productivity differential between small and large firms is very high. The overall industries in these low industrialised states are predominated by micro-firms, whose share in total number of firms varies between 98.6% in Orissa and 99.6% in Bihar, and in total employment ranges from 69.8% in Rajasthan to 87% in Bihar. Despite efforts by the successive governments, industrial development in these states are quite tardy, which may not be attributed to labour market institution. Rather, inadequate infrastructure and the absence of a pro-business institutional environment fail to attract large scale investments. For instance, in Bihar law and order problem together with poor infrastructure discourages investors. Rajasthan being the origin of quite a few successful business communities of India failed to attract large investments because of its inadequate infrastructure. These low industrialised states thus require not only to build up physical infrastructure but also to create institutions for attracting larger firms and provide enabling environment for the start-ups and reduce cost uncertainties.

3.2.2 Predominance of Micro-Firms, Missing Middle and Productivity

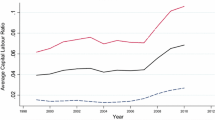

A glance over Table 4 would reveal how labour productivity (i.e. value added per worker) successively increases from micro to small, small to medium and medium to large firms for the country as a whole and for different states as well. Large firms on the average have labour productivity 16 times that of micro-firms in 2015–16 and this productivity ratio was even higher in 2009–10. A transition of the firms from micro to small would raise labour productivity by almost one and a half times, and from small to medium by more than two times as per estimates of 2015–16. It shows the importance of the mobility of firms across sizes. As much as 98.4% of the manufacturing firms belong to micro size class and 75% of the remaining 1.6% firms belong to small size class in 2015–16 and the scenario was no different in 2009–10. This simple statistics indicates the possible increase in the volume of production and jump in labour productivity if the micro and small firms can just grow in size, even without any technological progress. These lower ranked firms nearly perpetuate years after years at the same size with very limited growth opportunities or incentives.

It may be argued that variation in productivity across size classes is the result of differences in the use of capital per labour. This is nonetheless true as the elasticity of labour productivity with respect to capital intensity for the year 2015–16 is found to be 0.34 through regression exercise using pooled ASI and NSSO data (Table 6). Controlling for capital intensity, estimates of size dummies reveal substantial jump in labour productivity as size of firm increases successively from micro to small, to medium and to large. It needs to study what factors, other than capital, contribute to rising labour productivity along the size ladder.

A diagnostic exercise is conducted with respect to the specification of the regression equation. A Ramsey RESET test using powers of the independent variables rejects the null hypothesis that model has no omitted variables. It therefore suggests to add higher orders of LNK_L as regressors in order to avoid omitted variable biases. However as the implicit equation is derived from, and through linearisation of, Cobb-Douglas(CD) production function, adding higher orders of LNK_L as regressors would make it difficult to interpret the results. CES or Translog production function having higher flexibility may be technically more suitable. However, for simplicity and easier interpretation we have used CD functions.

It may be mentioned at this juncture that apart from capital, there are several factors that can contribute to labour productivity. We have already seen regional/ state specific factors, including cultural, political or policy can influence labour productivity. Other factors like population size/density, urbanisation, skill level of the workforce, industry structure, technology, vintages of capital stock, organisational structure of enterprises, existence of network of enterprises, industry clusters, among others, may significantly influence labour productivity. All these explanatory variables, other than capital, would therefore enter into the error terms magnifying specification errors of the model.

The regression exercise is first carried out for the pooled unit level ASI factory level and NSSO manufacturing enterprise level data for the year 2015–16 and then repeated for the similar ASI and NSSO data for the year 2009–10. For both the years the estimates are found to be quite similar, as may be seen in Table 6, reflecting the stability of the relations.

In order to understand the association between labour productivity and predominance of micro firms we run two correlation exercises:

(i) Between LNV_L and MIC_L and between (ii) LNMCV_L and MIC_L where LNV_L is log of value added per labour in manufacturing in a state; MIC_L is percentage share of micro-enterprises in manufacturing employment in a state; LNMCV_L is log of micro-firms’ value added per labour in a state. The estimated correlation coefficients are ( − ) 0.87 and ( − ) 0.57, respectively, and the corresponding t-values are ( − ) 8.18 and ( − ) 3.17 with the level of significance exceeding 99% in both the cases.

The simple correlation of log of value added per labour on the employment share of micro-firms for the manufacturing sector across the selected states reveals highly significantly negative association. A similar correlation between micro-firms’ value added per worker (in logarithm) and the employment share of micro-firms for the manufacturing sector of the same state yields similar result. The first correlation result is obvious, as the micro-firm workers have lower productivity and thus the state with higher weightage of micro-firm workers in manufacturing would tend to dampen overall labour productivity. The second result is all the more striking which requires explanation as to why the states with high share of micro-firms in manufacturing employment should have lower productivity of the micro-firm workers than that in the states with lower share of micro-firms in manufacturing employment. A plausible explanation is that very high share of micro-firms in manufacturing employment is not the result of strong preference of the people of some states to be self-employed, but in the absence of alternative gainful wage employment the people set up enterprises for self-employment, or continue with their traditional crafts or artisanal activities just to earn bare minimum for survival. Possibly the possession of financial capital, as well as fixed capital, of the micro-firms is quite low in the states with high share of micro-firms. As opposed to this, states having low share of micro-firms in manufacturing employment reflects mobility—either micro-firms can grow in size and often have better access to finance, or there is work opportunities in larger firms, while many set up OAEs by choice, and thus have a tendency to have higher labour productivity.

Mobility is generally not only restricted for the micro-firms, but also for the other firms, particularly small firms, which resulted in the phenomenon called “missing middle”. When a small manufacturing firm starts growing in size, expanding its activities, would draw attention of the locally powerful people, including anti-socials, politicians, government officials, trade union leaders, who would try to extract some surplus of the firm through creating various hurdles, including labour unrest, in the functioning of the firms and the process raises the costs of production, which adds to costs uncertainties and at times may make the project unviable. In these circumstances, a growing firm even if finds expanding market and high profit, would be hesitant to expand its plant size and enjoy scale economy, and rather choose to set up another small unit in order to remain unnoticed. Of course, there are other incentives to continue as small firms such as subsidised loans, tax concessions and relaxations of several government restrictions, particularly on environment and labour. Thus, institutions and government policies tend to perpetuate firms at small size. Larger firms would not only miss these incentives of subsidies and relaxed rules, but also have to shell out an extra amount for doing the business raising overhead costs. These extra costs act like fixed costs whose effect would however be lowered to a tolerable level only by firms with sufficiently large size, which result in the polarised structure of industries with thinner employment density in the middle size class. Thus, the story of the predominance of micro-firms, missing middle, overall low productivity of labour and restricted mobility along size classes in a majority of Indian states is primarily an outcome of the interplay of government policies, labour market institutions as well as the institutional environment. This observation is in conformity with Daugherty et al. (2009) who identified a set of distortions existing at several different levels that were depressing productivity. “These distortions include large fissures in performance and the concentration of production across institutional sectors, industries, size classes and business units”(ibid, p 2). According to this study India reflects the highest share of micro-enterprises among MSMEs compared to other large industrial economies. The productivity of medium firms (50–250 people) could be as much as 80–100 per cent higher than that of micro-firms (< 9 employees). It is further noted that the growth in scale allows them to invest in people (to improve skills), in better technology & processes, and in innovation (ibid).

4 Summary and Concluding Observations

The lack of flexibility of employers in hiring and firing of workers is thought of acting against the interests of the employers who cannot pursue pro-cyclical policy in employing workers and thereby fail to reduce wage costs during slumps. Labour laws on the retrenchment of workers, or more generally labour market institutions determine the degree of flexibility. Several studies relating state-wise variations in labour market institutions and industrial performance indicate adverse effects of rigid labour market institutions on the growth of investment, employment and productivity. There are also alternative views that a rigid labour market not only help stabilise the economy and employment but also incentivises technology upgradation, innovation and thereby raises labour productivity.

The broader institutional environment under which the labour market institutions operate or government policies are framed and implemented, have determining effects on the industry structure and performance of a state. The states with a long history of trade-union movements and anti-establishment/ anti-corporate culture fared poorly in the post-reform phase vis-a-vis those who could establish a pro-business culture and take advantage of the reforms. Primarily micro and small firms could run their business with a little growth prospects under such an adverse environment, along with some large firms who could bear the extra costs imposed by the unfriendly institutions. Parallel to this, many states have long traditions of arts and crafts and established systems of imparting training and regeneration of skills could maintain some industrial growth based on micro and small firms.

Productivity growth is the key ingredient to economic progress. Indian experience at the state level shows that the mid-sized to the large firms have the capability to raise productivity through improved technology, high skills and scale economies. The state-level analysis of the industry scenario points out that there is much scope to boost productivity and reduce disparity simply by better allocation of resources enabling micro and small firms to raise the scale of operation through better access to organised sources of finance as well as creating a congenial business environment. Further, raising the productivity of the micro and small firms could contain increases in wage and income inequality. This also requires effective participation of the smaller firms in the value chains via mobility of skilled personnel along with new technologies and business approaches.

Data Availability

ASI 2015–16 Unit level data and &73rd Round NSSO unit level data on unincorporated non-agricultural sector enterprises.

Code Availability

STATA15 software has been used to process unit level data. It uses simple commands.

Notes

Singur is a census town in Singur CD Block in Chandannagore subdivision of Hooghly district in West Bengal.

Ibid.

Ibid.

References

Adams, Z., Bishop, L., Deakin, S., Fenwick, C., Garzelli, S. M., and Rusconi, G. 2018. The economic significance of laws relating to employment protection and different forms of employment: analysis of a panel of 117 Countries, 1990– 2013. ECGI Working Paper Series in Law, Working Paper N° 406/2018.

Ahsan, A and Pagés, C. 2008. Are all labor regulations equal? evidence from Indian manufacturing. IZA Discussion Paper No. 3394.

Albin, Alice. 1990. Manufacturing sector in Kerala: comparative study of its growth and structure. Economic and Political Weekly 25 (37): 2059–2070.

Bertola, Giuseppe. 1990. Job security, employment and wages. European Economic Review 34 (4): 851–879.

Besley, T., and R. Burgess. 2004. Can regulation hinder economic performance? evidence from India. Quarterly Journal of Economics 119 (1): 91–134.

Bhalotra, Sonia. 1998. The puzzle of jobless growth in indian manufacturing. Oxford Bulletin of Economics & Statistics 60 (1): 5–32.

Bhattacharjea, Aditya. 2006. Labour market regulation and industrial performance in India: A critical review of the empirical evidence. The Indian Journal of Labour Economics 49 (2): 211–32.

Bhattacharjea, A. 2009. The Effects of Employment Protection Legislation on Indian Manufacturing. CDDRL Working Paper, Stanford University, available at http://cddrl.stanford.edu/publications/the_effects_of_employment_protection_legi slation_on_indian_manufacturing/

Bhattacharjea, Aditya. 2012. Did kaldor anticipate the new economic geography? yes, but. Cambridge Journal of Economics 34: 1057–1074.

Bhattacharjea, A. 2019. Labour market flexibility in Indian industry a critical survey of the literature. CDE, ISSN No. 2454 – 1427.

Biswas, P.K. 2010. Systems of education, training and skill formation: how relevant for small enterprises? In Micro and small enterprises in India: the era of reforms, ed. Keshab Das. India: Routledge.

Biswas, P.K. 2016. Corporate retailing in the advanced countries: some salient seatures. In Economic challenges for the contemporary world: essays in honour of Prabhat Patnaik, ed. Das, Mausumi, Sabyasachi Kar and Nandan Nawn. New Delhi: Sage Publications.

Biswas, P.K., and A. Raj. 1996. Skill formation in the indigenous institutions: cases from India. In Skill and technological change: society and institutions in international perspective, ed. Parthasarathi Banerjee and Yoshihiro Sato. New Delhi: Har-Anand Publications.

Biswas, P.K. and S. Pohit. 2015. Performance of informal sectors. In India: Science and Technology Volume 3, ed. CSIR-NISTADS. New Delhi: CUP.

Blanchard, O., and Augustin Landier. 2002. The Perverse effects of partial labour market reform: fixed-term contracts in France. The Economic Journal 112 (480): F214–F244. https://doi.org/10.1111/1468-0297.00047.

Boeri, Tito. 1999. Enforcement of employment security regulations, on-the-job search and unemployment duration. European Economic Review 43 (1): 65–89.

Cahuc, P., and F. Postel-Vinay. 2002. Temporary jobs, employment protection and labor market performance. Labour Economics 9 (1): 63–91.

Daugherty, S., R. Herd, and T. Chalaux. 2009. What is holding back productivity growth in India? recent microevidence. OECD Journal: Economic Studies 2009: 1–22.

Fallon, Peter R. 1987. The effects of labor regulation upon industrial employment in india. World Bank, Report No. DRD287.

Fallon, Peter R., and Robert E.B.. Lucas. 1991. The impact of changes in job security regulations in India and Zimbabwe. The World Bank Economic Review 5 (3): 395–413. https://doi.org/10.1093/wber/5.3.395.

Fallon, Peter R., and Robert E.B.. Lucas. 1993. Job security regulations and the dynamic demand for industrial labor in India and Zimbabwe. Journal of Development Economics 40 (2): 241–275.

Goldar, B., and S. Aggarwal. 2010. Informalization of industrial labour in India: Are labour market rigidities and growing import competition to blame?. Presented at the 6th Annual Conference on Economic Growth and Development, December 16–18, 2010, Indian Statistical Institute, New Delhi.

Hasan, Rana, D. Mitra, and K.V. Ramaswamy. 2007. Trade reforms, labor regulations, and labour-demand elasticities: empirical evidence from India. The Review of Economics and Statistics 89 (3): 466–481.

Hsieh, Chang-Tai., and B. Olken. 2014. The missing ‘missing middle.’ Journal of Economic Perspectives 28 (3): 89–108.

Mazumdar, Dipak, and S. Sarkar. 2009. The employment problem in India and the phenomenon of the missing middle. Indian Journal of Labour Economics 52 (1): 43–55.

Oommen, M.A. 1979. Inter-state shifting of industries: a case study of South India. Trichur: University of Calicut.

Piore, Michael. 1986. The decline of mass production and the challenge to union survival. Industrial Relations Journal 17 (3): 207–213.

Roy, S.D. 2004. Employment dynamics in indian industry: adjustment lags and the impact of job security regulations. Journal of Development Economics 73 (1): 233–256.

Storm, S. 2019. Labor laws and manufacturing performance in India: how priors trump evidence and progress gets stalled. Institute for New Economic Thinking, Working Paper 90.

Subrahmanian, K.K. 2003. Regional industrial growth under economic liberalization: a case study of selected issues with reference to Kerala State. New Delhi: Manak Publishers Private Ltd.

Subrahmanian, K.K., and P. Mohanan. Pillai. 1986. Kerala’s industrial backwardness: exploration of alternate hypotheses. Economic and Political Weekly 21 (14): 577–592.

Subramanian, K.V. 2018. Dismissal laws, innovation, and economic growth. ADBI Working Paper 846.

Teitelbaum, Emmanuel. 2012. Mobilizing restraint: democracy and industrial conflict in post-reform South Asia. New Delhi: Cambridge University Press.

Thampy, M.M. 1990. Wage cost and Kerala’s industrial stagnation: study of organized small-scale sector. Economic and Political Weekly 25 (37): 2077–2082.

Thomas, J.J 2005. Kerala’s industrial backwardness: a case of path dependence in industrialization?. ISAS Background Brief, No. 3, Dated 15th May, Institute of South Asian Studies.

Funding

Not applicable.

Author information

Authors and Affiliations

Contributions

Both contributed.

Corresponding author

Ethics declarations

Conflicts of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Biswas, P.K., Bandyopadhyay, S. Labour Market Institutions, Industry Structure and Productivity in Indian Manufacturing Sector. Ind. J. Labour Econ. 64, 999–1021 (2021). https://doi.org/10.1007/s41027-021-00339-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41027-021-00339-5