Abstract

The studies involving finding a relation between oil prices and the exchange rate have often looked the relationship when the oil price was rising. Will the impact mirror for declining oil prices too? Or how the exchange rate behaves when oil prices are just volatile without any appreciable change in price. This study contributes to the literature to see the effect of oil prices on the exchange rate for different episodes for India using daily data for twenty years period. The study finds that the return of oil price and exchange rate relationship exhibit time-varying volatility in five of the total ten sub-periods in the last 20 years. GARCH and EGARCH models are then employed to study the impact of oil price shock on the nominal exchange rate for those periods. The study finds (a) not all periods have varying volatility, (b) for two of the volatile period, an increase in the oil price return leads to depreciation of the Indian currency vis-à-vis US dollar, (c) in line with other studies, we find that shocks to exchange rate have an asymmetric effect, and (d) oil price shocks have a permanent effect on exchange rate volatility.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Oil is a crucial input in the production process of any economy. The historical trend (from 1985 onwards) shows that there have been three kinds of episodes pertaining to global oil prices: (a) steady increase in oil prices, (b) steady decline in oil prices, and lastly, (c) lull in crude oil price followed by huge volatility. Of these episodes, the impact of volatile oil prices on the economy is the most severe. Such volatility indicates uncertainty, which has several debilitating effects on the economy, including delay in project investments (Henriques and Sadorsky 2011; Bernanke 1983); misallocation of resources away from oil-dependent sectors to non-oil sectors among others (Ghosh 2011; Ferderer 1996).

Economic theory suggests that there exist several channels that could contribute to an inverse relationship between oil prices and economic activity. The most basic is the classic supply-side effect where rising oil prices indicate the reduced availability of a key and primary input to production (Regnier 2007). Besides this, there are aggregate demand effect, income transfer effect, real balance effect, exchange rate effect, inflation effect, and sector adjustment effect also (Brown and Yucel 2002). Regarding the impact on the exchange rate, it has been well acknowledged that oil is a leading indicator of exchange rate movement. This is because increased oil prices reduce the wealth of oil-importing countries by transferring their income to oil-producing countries through trade balance effect (Turhan et al. 2014). Such trade balance disequilibrium results in exchange rate fluctuations (Kumar 2019).

After the pioneering work of Hamilton (1983), several studies have been carried out to see the impact of oil prices on different facets of economic activity. These include the effect of oil prices on the stock market (Kumar 2019; Sadorsky 2003, 1999; Papapetrou 2001); on real GDP (Prasad et al. 2007); on inflation (Chen and Chen 2007), on commodity prices (Nazlioglu and Soytas, 2011) and on the exchange rate (Kumar 2019, Ghosh 2011; Narayan et al. 2009; Chen and Chen 2007 among others). There are several studies which suggest that among various sources of real disturbances such as oil price, fiscal imbalance, productivity shocks, etc., oil price shocks play a major role in explaining exchange rate movements (see for example, Amano and van Norden (1998), Zhou (1995) among others).

The studies involving a relation between oil prices and the exchange rate had often looked the relationship when the oil price was rising (see for example, Ghosh 2011 for India; Narayan et al. 2009 for Fiji). The theoretical literature has also looked at the relationship when oil prices were rising (Chen and Chen 2007; Darby 1982). Will the impact mirror for declining oil prices too? Or how the exchange rate behaves when oil prices are just volatile without any appreciable change in price over a period of time. Moreover, even with increasing or decreasing oil prices, volatility in oil prices cannot be ruled out. This study contributes to the literature to see the effect of oil prices on the exchange rate in three different regimes – (a) when oil prices rise, (b) when oil prices decline, and (c) when oil prices remain steady over a period of time but with huge volatility (Guo and Kliesen 1982).

The choice of India is important for the following three reasons. The first is that crude oil represents a substantial component of India’s total imports. The second is that India now has a sufficiently long history of the market-determined exchange rate. Lastly, India is a small open economy whose size in the world oil market is relatively small (despite the third-largest importer after China and the USA) to justify the assumption that it is a price taker in the market. For the latter reason, crude oil price fluctuations might serve as an observable and essentially exogenous terms-of-trade shock for the Indian economy.

Under this backdrop, this paper aims to study the impact of international crude oil price volatility on Indian rupee-US Dollar (INR-USD) exchange rate volatility, using daily data for the last twenty-years period from 04/01/2000 to 31/12/2019. To model the relationship, the twenty years period is first divided into ten sub-periods having five different episodes involving steady or sharp rise in oil prices, steady or sharp decline in oil prices, and huge volatile prices without any substantial increase or decrease in prices. The relationship is then modeled within ordinary least squares (OLS), generalized autoregressive conditional heteroskedasticity (GARCH) and exponential GARCH (EGARCH) frameworks to determine which structure fits best. Together, these frameworks estimate a conditional mean and a conditional variance equation. The results confirm that the returns of crude oil price – exchange rate relationship exhibit time-varying volatility only in a few episodes. For these episodes, an increase in the crude oil price return leads to the depreciation of the INR vis-à-vis the US Dollar. The results also show that positive changes, i.e., an increase in oil prices have a greater impact on exchange rate volatility, then the negative shocks and the shocks are persistent.

The remaining paper is organized as follows: Sect. 2 gives the energy scenario in India with a focus on oil import, production, and demand. This is followed by a brief review of literature in Sect. 3. The methodology to see the impact of oil price volatility on exchange rate volatility in Sect. 4. Section 5 talks about the data and its brief characteristics. Section 6 provides the results. The section also compares the results with that of other studies, and the paper concludes with Sect. 7.

Energy Scenario in India

Energy has developed into a ‘strategic commodity’ and energy security a crucial driver to economic growth, particularly in the emerging economies. For instance, India’s substantial and sustained economic growth, with nearly 6% growth in the last two decades, continues to place enormous demand for its energy resources. India’s energy demand in 2040 has been estimated at 1900 million tons of oil equivalent (Mtoe) from the existing demand of 1133 Mtoe – a CAGR (compound annual growth rate) of 3.4%. Correspondingly, India’s demand for oil is set to increase by 60% from six million barrels per day (mb/d) to 9.8 mb/d, the largest projected increase among all the emerging economies (Source: World Energy Outlook 2015).

Over the last two decades (1990–2011), India’s primary energy mix has not changed much. After coal (44% share), oil is the largest energy source for the country with a share of about 30.5% in the primary energy consumption basket (Source: IEA 2015). By 2018, however, the share of oil has come down to 25%, with overall dependence on fossil fuel continuing to be around 75% (Source: Enerdata 2019). The high rate of economic growth in the Indian economy has resulted in increased demand for oil, and consequently, the import of crude oil is also growing – India is the third-largest importer of crude oil in the world after the USA and China. Since the domestic production of crude oil has not been increasing in tandem with consumption and demand for petroleum products, India relies heavily on crude imports. India imports around 70% of its oil needs (Fig. 1), mainly from countries like Saudi Arabia, Iran, Iraq, Venezuela, and Nigeria. By value, crude oil accounts for one-third of total imports, averaging around $135 billion a year since 2011–2012 (Fig. 2). Since the retail price of petroleum products, till very recently, was insulated from international crude price, change in international crude price would not affect the price of petroleum products in the domestic market that keeps the demand artificially high, which has been further amplified due to the higher economic growth of the country (Ghosh 2009). To meet the demand, the government has to import more crude irrespective of price. From (Fig. 2), we see that there is a decline in the value of crude oil import in 2014–2015 despite no fall in quantity imported (Fig. 1), which can be attributed to the sharp decline in international crude oil prices during this period (Fig. 4).

Indian refining capacity additions over the last decade, however, have outpaced domestic demand growth and turned the country into a net exporter of refined products. According to the Energy Statistics (2015), the Indian refinery industry has 22 refineries with a total oil refinery capacity of 4.4 mb/day (Source: MOSPI, 2015), which is expected to reach 7.9 mb/day by 2040, an increase of 80%.

India's crude oil basket in 2014–2015 consisted of Dubai and Oman (for the sour grade) and Brent (for the sweet grade) in the ratio of 70:30. As can be seen from (Table 1), over the past 13 years, the share of Brent has been decreasing in the Indian crude oil import basket.

Since international crude oil prices are denominated in USD and crude oil makes up for a majority of India’s import basket, change in international crude oil prices have a significant impact on the demand for foreign exchange. Given the low elasticity of demand, a high price in the international market implies more outgo of foreign exchange, thus putting pressure on the exchange rate. This is verified in (Fig. 3), which plots the trend in oil bill (in USD) and exchange rate over the last 12 years period (correlation coefficient being 0.46, significant at 1% level of significance). High oil prices also affect countries’ wealth as it leads to a transfer of income from oil importing to oil-exporting countries through a shift in terms of trade (Turhan et al. 2014).

Literature Review on Oil Prices and Exchange Rates

The theory behind the impact of oil prices on the exchange rate has a basis in the works of Krugman (1980), Darby (1982) and Golub (1983) post the first oil shock of the early 1970s, which resulted in a bout of inflation and recession in the USA and other industrialized countries. The 1970s decade witnessed two oil price shocks – in 1973–1974 and 1979–1980 with a sharp rise in oil prices. Both arguments exist, whether rising oil price would result in exchange rate appreciation or depreciation. According to Darby (1982), an increase (or decrease) in oil prices leads to an adverse (or favorable) shift in the aggregate supply curve, which results in the rise (or fall) in aggregate prices and fall (rise) in output. With an increase (decrease) in inflation, the domestic interest rate is likely to increase (decrease) to counter (cushion) the effect of inflation (deflation). In response to rise (or fall) in interest rate, there is a likely inflow (or outflow) of foreign capital, leading to an appreciation (or depreciation) of the domestic currency (under the assumption that markets and governments freely determine currency exchange rates with no intervention of the central bank). If this causation works, then whenever we see oil prices rise, we should see domestic currency to appreciate and vice versa.

Krugman (1980), Golub (1983) also looked into the possible transmission mechanism. According to them, as USA is one of the largest consumers in the world, the oil price increase would force it to buy oil at a higher price, injecting money into oil-producing countries. This would appreciate the value of their currencies against the dollar. Oil importing countries have to pay more as the price of oil goes up, thus depreciating their currencies against the dollar.

The evidence of the relationship between oil prices and the exchange rate is, however, mixed and inconclusive. Chen and Chen (2007) show that a country heavily dependent on oil encounters a greater degree of currency depreciation with an increase in oil prices. Studies by Amano and Norden (1998) for USA, Huang and Guo (2007) for China, Narayan et al. (2009) for Fiji, find appreciation of currency due to oil price shock, whereas, the studies that have found depreciation of currencies include Kutan and Wyzan (2005) for Kazakhstan, Ghosh (2011) for India, Turhan et al. (2014) for G20 countries, and Reboredo and Rivera-Castro (2014) for USA especially after post-2008 crises. Coleman et al. (2016) and Pershin et al. (2016) however find different exchange rate behavior for different net-oil importing sub-Saharan countries. Pershin et al. (2016) find that post-oil price rise, Botswana’s exchange rate appreciates, whereas Kenyan and Tanzanian currency depreciates. Reboredo and Rivera-Castro (2014) for G7 countries finds a week relationship between oil price and exchange rate. Brayek et al. (2015) also find independent relation between oil prices and exchange rate during the pre-financial crises period, but positively related post the crises.

One possible reason for different results is that the studies have used alternate methodologies, different frequencies of data, and also alternate variables to find the relationship. For example, some studies have used real exchange rate (Kumar 2019; Huang and Guo 2007; Amano and Norden 1998), whereas others have used nominal exchange rate (Narayan et al. 2009; Ghosh 2011; Reboredo and Rivera-Castro 2014). Studies have used cointegration and error correction model (Amano and von Norden 1998), cointegration and vector auto regression (VAR) models (Coleman et al. 2016; Brahmasrene et al. 2014), structural VAR models (Huang and Guo 2007), GARCH/EGARCH (Ghosh 2011; Narayan et al. 2009) and correlation and copulas (Regnier 2007; Brayek et al. 2015) to model nexus between oil prices and exchange rate.

More recent studies (Kumar 2019 and Tiwari et al. 2013 for India; Brahmasrene et al. 2014 for the USA) have argued that there is a difference in the short-run and long-run impact. These studies thus have used Granger causality test, variance decomposition, and impulse-response function using monthly data. Brahmasrene et al. (2014) find that in the short-run, the causality runs from exchange rates to oil prices, whereas in the long run, it is the other way round. Kumar (2019), using non-linear Granger causality tests and ARDL tests, finds bidirectional relation between oil and exchange rate. Tiwari et al. (2013) also find that oil prices Granger cause the exchange rate.

Ghosh (2011) uses daily data from 2007 to 2008 and employs GARCH/EGARCH model to find that an increase in the oil price has led to the depreciation of Indian currency vis-à-vis the US dollar. The study also finds that oil price shocks have a permanent effect on the exchange rate volatility. Narayan et al. (2009) also employs GARCH/EGARCH model and uses daily data from 2000 to 2006 to find that the rise in oil prices has led to an appreciation of Fijian dollar vis-à-vis US dollar.

Our approach is similar to Ghosh (2011) and Narayan et al. (2009), as we also use daily data and use the same methodology. One problem with studies that have taken a longer time period irrespective of using daily Narayan et al. (2009) or monthly data (Brahmasrene et al. 2014; Coleman et al. 2016) is that they have not included any structural break while evaluating the relationship. This implies that their results may be biased. The study by Ghosh (2011) though, picks a smaller period but is confined to the data for only one episode when oil prices had mainly risen. The study does not tell what would happen if oil prices decline or oil prices remain the same but show wide fluctuation over a reasonable period. We argue that when we take a more extended period, there may be episodes of abrupt rise, or abrupt decline in oil prices or steady rise and steady decile in oil prices or oil prices might be vacillating around a mean. The present paper differs from other studies by looking into the nexus between oil price and exchange rate return over these different episodes over the 20 years.

Methodology

The impact of oil prices on the exchange rate is assessed in two steps. In step one, we express the two variables of concern (crude oil price and INR-USD exchange rate) as returns (percentage) of oil prices and nominal exchange rate. All the studies referred above have used the relation between the returns rather than the absolute value of oil price and exchange rate. Step two involves testing the relationship between the two using first the OLS and then GARCH (p,q) and EGARCH (p,q) models following the works of Bollerslev (1986) and Nelson (1991).

The daily returns are calculated using the formulae below:

Where Crudet and Crudet-1 are the prices for crude oil in the period (t) and (t-1) respectively, and RCrudet is the return on crude price on tth date. Similarly, Excht and Excht-1 are for the exchange rate in the period (t) and (t-1), respectively, and RExcht is the return on the exchange rate on tth date. The estimation of returns of both the variables ensures that variables are stationary, which are confirmed using different tests for stationarity. The relationship between the variables is modeled by a mean equation and a variance equation as per the following.

Mean equation:

Where c is the constant, εt is white noise modelled as (0, σt2). An alternate mean equation has been considered by including GARCH in mean (GARCH-M) equation, which can be written as

The variance equation for GARCH (p, q) has the following form.

Variance equation:

For GARCH (1, 1) model, Ω > 0, |δi|< 1 and (1 − α1 −δ1) > 0. EGARCH (p, q) model can be written as:

Thus, the exchange rate volatility depends on the current as well as lagged returns of crude oil volatility. The dependence is tested at a 5% significance level. The EGARCH models allow for oscillatory behavior in the conditional variance since β coefficient can be either negative or positive. The estimation of β allows us to check whether the shock persists or not. Stationarity is ensured when |β|< 1 (Nelson, 1991). The parameter γ examines whether shocks have asymmetric or symmetric effects on volatility. A positive sign on gamma (γ) implies that positive shocks give rise to higher volatility then negative shocks and vice versa (Narayan et al. 2009).

Empirical Strategy

To begin with, we first find out which are the periods having sharp changes in crude oil prices and also period having large fluctuations around a mean value of oil prices. Correspondingly, we find the change in the exchange rate for the same period. The stationarity of the variables is then examined for each of the selected periods by subjecting them to augmented Dickey–Fuller (ADF) and Phillips–Perron (PP) test statistic. The null hypothesis for both the tests is that the series has a unit root against the alternative that the series is stationary. If the tests confirm that both the series are stationary, this will rule out the possibility of a cointegrating relationship.

Subsequently, we use ordinary least squares (OLS) technique to estimate the mean equation for each period where the estimate of RExcht in terms of RCrudet is tested at a 5% level of significance. The residuals are then subjected to tests for serial correlation, and the ARCH-LM test up to 30 lags to test the presence of ARCH effects. If the ARCH effect is present, then OLS results will be spurious, and we have to use models that correct for ARCH effect. To correct for the ARCH effect, GARCH (p, q), GARCH-M, and EGARCH (p, q) models are estimated using the maximum likelihood estimation procedure, assuming the errors to be normally distributed. The optimal order of p and q is determined using the Schwartz Bayesian Criterion (SBC). All estimations have been done in STATA 12. The results of the tests for all significant periods are discussed in Sect. 6.

Data

Though Indian basket comprises of majorly crude from Dubai and Oman, on comparing monthly average prices of Brent Crude price and price of Indian crude oil basket, we find that they move together (Fig. 4). Hence, for the present analysis, we use Brent crude oil prices only. Since the study uses daily movement in price data, as per Narayan et al. (2009), analysis of this does not require real values. This is because trading in oil markets is based on nominal values of crude oil and not on the real values, as inflation data for a country like India is available only on a weekly basis, not even at the end of the trading day. In contrast, trading decisions are made early during the day. Thus, the data used is nominal, as has been used by Ghosh 2011, and Narayan et al. 2009. Daily data on the INR-USD exchange rate has been collected from the Reserve Bank of India website (www.rbi.org.in). Daily data on Brent Crude price has been collected from the Energy Information Administration (www.eia.doe.gov) website.

Given the purpose of the study, we first identify the periods when oil prices remained the same, increased abruptly or slowly, and declined slowly and abruptly. We identify that in the last 20 years, there are ten such different episodes. Table 2 gives the period and corresponding volatilities in the crude oil price and exchange rate.

In periods 1 and 7, there hardly was any overall change in oil prices, though periods involved huge volatility. During periods 2, 5, and 10, oil prices moved steadily from low to high prices, whereas in periods 4, 6, and 8, oil prices declined dramatically from high to low in a short span, whereas in period 9, oil prices declined steadily. Figures 5 and 6 provide the period-wise Brent crude oil prices, and corresponding INR-USD exchange rates for these periods.

Oil Price (US$/bbl) trend for the selected periods (2000–2019). Pd1 Period 1 (Jan 5, 2000- Sep 14, 2001); Pd2 Period 2 (April 29, 2003- August 9, 2006); Pd3 Period 3 (Jan 12, 2007- July 11, 2008); Pd4 Period 4 (July 14, 2008- Dec 5 2008); Pd5 Period 5 (Feb 18 2009- April 11 2011); Pd6 Period 6 (March 13 2012- June 25 2012); Pd7 Period 7 (Aug 24 2012- June 18 2014); Pd8 Period 8 (June 24 2014- Jan 13 2015); Pd9 Period 9 (May 13 2015- Jan 20 2016); Pd10 Period 10 (June 20 2017- May 22 2018)

As can be seen from (Table 2), the period of maximum crude oil price volatility is not corresponding to the period of maximum exchange rate volatility. Moreover, the magnitude of deviation is much less in the exchange rate as compared to the crude oil markets. One possible reason for the low volatility of the exchange rate is though considered free-floating, to prevent high fluctuations, the central bank often intervenes (Prakash 2014).

Results

Table 3 gives period-wise descriptive statistics for both the series. As can be seen, both the mean and volatility of the oil price return is greater than that for the return on the exchange rate. In five periods, the average return on crude oil prices (column 1) has declined (period 4 and periods 6–9), whereas average exchange rate returns (column 5) have been negative for periods 3, 4, and 6, respectively. Both series display volatility and volatility clustering, although volatility clustering seems to be more in magnitude in the case of the oil price series (column 2). The higher volatility clustering is consistent with the higher standard deviation recorded for the oil price series. Figure 9 in the appendix gives the quantile–quantile plot of the two series. From the plots, we can say that oil prices and exchange rates follow similar distributions.

To start with, we conduct the ADF and PP tests to examine the integrational property of the data series. The ADF and PP tests examine the null hypothesis that the series contains a unit root. We use two models—without and with the inclusion of time trend. To select the optimal lag, the standard procedure of starting with eight lag and then using Akaike information criterion (AIC) is employed. Table 4 reports the results for each period for the ADF test. As can be seen from the table, we can reject the unit root null hypothesis for both the series for all the episodes irrespective of whether we include a time trend or not. This suggests that both series are stationary regardless of the period. The absence of non-stationarity of individual series rules the possibility of a cointegrating relationship.

OLS Model

Next, we run an OLS regression of the mean equation for each of the periods separately to see if we can draw on the OLS regression model as our preferred model. We subject the estimated models to test for ARCH effect. Table 5 reports the results for the diagnostic tests using the ARCH-LM test up to 30 lags.

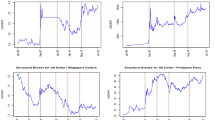

From the table, we see that of the ten periods selected, in five (period 1, 2, 3, 5, and 7), the obtained p value is either zero or close to zero. This implies that we can reject the null hypothesis of no ARCH effect for these periods. For the other five periods (period 4, 6, 8, 9, and 10), OLS results are not spurious as the null of no ARCH effect is not rejected. As can be seen from (Table 2), three of these periods are those where there is a fast decline in oil prices over a very short period (period 4, 6 and 8), whereas for the other two periods (period 9 and 10) decline and rise are somewhat slow. Thus, based on the ARCH-LM test, we conclude that the OLS regression model suffers from ARCH effect for periods 1–3, 5, and 7 only. We carry out ARCH analysis for these periods only. Before carrying out the ARCH analysis, we plot the log of return for these periods in (Figs. 7, 8). Table 7 in the appendix gives the coefficient of RCrude for periods having no ARCH effect.

To deal with the ARCH effect present in residual series, GARCH (1, 1), GARCH (1, 1)-M and EGARCH (1, 1) models have been estimated using maximum likelihood estimation procedure assuming normally distributed errors. Optimal orders of the GARCH models are determined based on SBC criteria. (Table 6) report the results.

GARCH (1, 1) and GARCH (1, 1)-M Model

As is indicated in (Table 6), the mean equation of the GARCH (1, 1) model reveals that an increase in oil price has a negative impact on the nominal exchange rate in periods 3 and 5 only. On average, a 10% increase in international crude oil prices translates into 0.17% depreciation of the INR vis-a-vis the USD in period 3 and 0.62% depreciation in period 5, respectively. The residual series is found to be free of ARCH effects and serial correlation. The results of the GARCH-M show ξ is insignificant for all periods, which indicates that exchange rate volatility has no impact on the exchange rate itself.

EGARCH (p, q) Model

From the mean equation, it is clear that RCrude is statistically significant at 5% level for periods 3 and 5 only, and a 10% increase in the oil price return leads to 0.21% and 0.66% depreciation of Indian currency vis-à-vis the USD respectively. For all the other three periods, there is no effect of oil price rise on exchange rate return. From the variance equation, we find that γ (a measure of asymmetry) is statistically significant at the 5% level for all the periods. This implies that within the sample period, the shocks to exchange rate volatility have asymmetric effects, i.e., positive and negative shocks do not have similar effects, in terms of magnitude, on exchange rate volatility. γ is positive in sign – implying that positive shocks give rise to higher volatility of exchange rates than adverse shocks. β, the term indicating volatility persistence, is statistically significant at the 5% level with a value of the coefficient close to one for all the periods. This implies that shocks to exchange rate volatility have high persistence and take a long time to die down following a shock.

The results of Q-statistics (Table 6) suggest that the null of no ARCH effects cannot be rejected, implying that the residuals do not suffer from the ARCH effects for most of the periods. Thus the models are well behaved.

Conclusion

The studies involving finding a relation between oil prices and the exchange rate have often looked the relationship when the oil price was rising (see for example, Ghosh 2011 for India; Narayan et al. 2009 for Fiji). The theoretical literature has also looked at the relationship when oil prices were rising (Chen and Chen 2007; Darby 1982). Will the impact mirror for declining oil prices too? Or how the exchange rate behaves when oil prices are just volatile without any appreciable change in price over a period of time. This study contributes to the literature to see the effect of oil prices on the exchange rate in three different regimes – (a) when oil prices rise, (b) when oil prices decline, and (c) when oil prices remain steady over a period of time but with huge volatility. This nexus between international crude oil price and the exchange rate is tested for India using daily data for twenty years period from 4/1/2000 to 31/12/2019. Given the purpose of the study, we first identify the periods when oil prices remained the same, increased abruptly or slowly, and declined slowly and abruptly. We identify that in the last 20 years, there are ten such different episodes.

The study finds that the return of oil price and exchange rate relationship exhibit time-varying volatility in five of the total ten sub-periods in the last 20 years. GARCH and EGARCH models are then employed to study the impact of oil price shock on the nominal exchange rate for those five periods (periods 1–3, 5, and 7) exhibiting volatility. The study finds (a) not all periods have varying volatility, (b) for two of the volatile period (period 3 and 5), an increase in the oil price return leads to depreciation of the Indian currency vis-à-vis US dollar, (c) in line with other studies, we find that shocks to exchange rate have an asymmetric effect, i.e., positive and negative oil price shocks have dissimilar effects, in terms of magnitude, on exchange rate volatility in India. Lastly, (d) oil price shocks have a permanent effect on exchange rate volatility in all these five periods.

This implies in period 3 and 5 only, the price-exchange rate relationship is in accordance with what other some other studies (Kutan and Wyzan (2005) for Kazakhstan, Ghosh (2011) for India, Turhan et al. (2014) for G20 countries, and Reboredo and Rivera-Castro (2014) for the USA) have found. The result is contrary to what Narayan et al. (2009) found for Fiji. For the other three periods, there is no relationship. This implies that in periods 3 and 5, an increase in international oil price forced Indian refineries to procure excess dollars to pay for costlier oil import resulting in depreciation of Indian currency.

In terms of implication of the present study, we can say that not all episodes of oil price rise or decline to be treated equally. The response of the central bank managing exchange rate should vary. In some, it leads to volatility clustering, and in others, it shows the direct impact, and in some others, there is no impact. However, for the periods when oil price shock influences the exchange rate, the nexus should have a significant effect on the stock market too. As an extension of the present work, we can examine the dynamic relationship between international oil prices and the exchange rate and the stock market. This is because players in stock market might behave differently for depreciating exchange rate. For foreign investors, a depreciation of home currency can result in a portfolio switch from home country assets to foreign assets. This is because depreciation would reduce returns when these funds are translated into domestic currency. For domestic investors who are internationally diversified, the depreciation of the Indian currency would result in investors substituting foreign assets by domestic assets. As a result, domestic stock prices would increase due to increased demand. The net effect would be worth examining.

References

Amano, R.A., and S. van Norden. 1998. Oil prices and the rise and fall of the US real exchange rate. Journal of International Money and Finance 17: 299–316.

Bernanke, B.S. 1983. Irreversibility, uncertainty, and cyclical investment. Quarterly Journal of Economics 98 (1): 85–106.

Bollerslev, T. 1986. Generalised autoregressive conditional heteroskedasticity. Quarterly Journal of Economics 31: 307–327.

Brahmasrene, T., J.C. Huang, and Y. Sissokko. 2014. Crude oil prices and exchange rate: causality, variance decomposition and impulse response. Energy Economics 44: 407–412.

Brayek, A.B., S. Sebai, and K. Naoui. 2015. A study of the interactive relationship between oil price and exchange rate: a cupola approach and a DCC-MGARCH model. The Journal of Economics Asymmetries 12 (2): 173–189.

Chen, S.-S., and H.-C. Chen. 2007. Oil prices and real exchange rate. Energy Economics 29: 390–404.

Coleman, S., J.C. Cuestas, and E. Mourelle. 2016. Investigating the oil price-exchange rate nexus: evidence from Africa 1970–2004. Economics Issues 21 (2): 53–80.

Darby, M.R. 1982. The price of oil, world inflation and recession. The American Economic Review 72: 738–751.

Enerdata (2019): Global Energy and CO2 Data, https://www.enerdata.net/research/energy-market-data-co2-emissions-database.html (Accessed in Mar 2020).

Energy Statistics (2015) Ministry of statistics and programme implementation, Government of India.

Ferderer, P.J. 1996. Oil price volatility and the macroeconomy. Journal of Macroeconomics 18 (1): 1–26.

Ghosh, S. 2009. Import demand of crude oil and economic growth: evidence from India. Energy Policy 37: 699–702.

Ghosh, S. 2011. Examining crude oil price – Exchange rate nexus for India during the period of extreme oil price volatility. Applied Energy 88: 1886–1889.

Golub, S.S. 1983. Oil prices and exchange rates. The Economic Journal 93 (371): 576–593.

Guo, H., and K.L. Kliesen. 2005. Oil price volatility and US macroeconomic activity. Federal Reserve Bank 57 (6): 669–683.

Hamilton, J.D. 1983. Oil and the Macroeconomy since World War II. Journal of Political Economy 91 (2): 228–248.

Henriques, I., and Perry Sadorsky. 2011. The effect of oil price volatility on strategic investment. Energy Economics 33 (1): 79–87.

Huang, Y., and F. Guo. 2007. The role of oil price shocks on China’s real exchange rate. China Economic Review 18 (4): 403–416.

Krugman, P. 1980. Oil and the dollar. National Bureau of Economic Research 3: 9.

Kumar, S. 2019. Asymmetric impact of oil prices on exchange rate and stock prices. The Quarterly Review of Economics and Finance 72: 41–51.

Kutan, A.M., and M.L. Wyzan. 2005. Explaining the real exchange rate in Kazakhastan, 1996–2003: Is Kazakhastan vulnerable to the Dutch disease? Economics System 29: 242–255.

Narayan, P.K., S. Narayan, and A. Prasad. 2009. Understanding the oil price – exchange rate nexus for the Fiji islands. Energy Economics 30 (5): 2686–2696.

Nazlioglu, S., and U. Soytas. 2011. World oil prices and agricultural commodity prices: evidence from an emerging market. Energy Economics 33 (3): 488–496.

Papapetrou, E. 2001. Oil price shocks, stock market, economic activity and employment in Greece. Energy Economics 23 (5): 511–532.

Pershin, V., J.C. Molero, and F.P. de Gracia. 2016. Exploring the oil prices and exchange rate nexus in some African economies. Journal of Policy Modelling 38 (1): 166–180.

Prakash, A. 2014. Major episodes of volatility in the Indian Foreign exchange market in the last two decades. Central Bank Response 33 (1–2): 162–199.

Prasad, E., R.G. Rajan, and A. Subramanian. 2007. Foreign capital and economic growth NBER. National Bureau of Economic 13: 6–19.

Regnier, E. 2007. Oil and energy price volatility. Energy Economics 29 (3): 405–427.

Reboredo, J.C., and M.A. Rivera-Castro. 2014. Wavelet-based evidence of the impact of oil prices on stock returns. International Review of Economics and Finance 29: 145–176.

Sadorsky, P. 2003. The macroeconomic determinants of technology stock price volatility. Review of Financial Economics 12 (2): 191–205.

Sadorsky, P. 1999. Oil price shocks and stock market activity. Energy Economics 21 (5): 449–469.

Tiwari, A.K., A.B. Dar, and N. Bhanja. 2013. Oil price and exchange rates: a wavelet based analysis for India. Economic Modelling 31: 414–422.

Turhan, M.T., A. Sensoy, and E. Hacihasanoglu. 2014. A comparative analysis of the dynamic relationship between oil prices and exchange rates. Journal of International Financial Markets Institutions and Money 32: 397–414.

World Energy Outlook. (India Special Report) (https://www.worldenergyoutlook.org/india/ (Accessed in Jan 2015).

Zhou, S. 1995. The response of real exchange rates to various economic shocks. Southern Journal of Economics 61 (4): 936–954.

Acknowledgements

An earlier version of the paper was presented in XIX Applied Economics Meeting held in Seville, Spain during June 9–10, 2016. We are thankful to conference participants. Our thanks to Vijay Shekhawat for comments on an earlier draft. We are also thankful to the reviewer and editor for very useful comments. The usual disclaimers apply.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Kathuria, V., Sabat, J. Is Exchange Rate Volatility Symmetric to Oil Price Volatility? An Investigation for India. J. Quant. Econ. 18, 525–550 (2020). https://doi.org/10.1007/s40953-020-00212-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40953-020-00212-0