Abstract

In this paper, we examine the price discovery and volatility spillovers between eight mature market economies (MMEs) and eight emerging market economies (EMEs) from January 2003 to July 2014, covering three sub-periods—prior to the 2007–09 global financial crisis (GFC), during the crisis, and post-crisis. The results of price discovery indicate that MMEs lead EMEs in the pre-crisis and post-crisis periods. All MMEs are cointegrated with China in the pre-crisis period but not in the post-crisis period. Dynamic cointegration results reconfirm our findings from Johansen’s co-integration test. The asymmetric dynamic conditional correlation (ADCC-GARCH) coefficients suggest a regional pattern among MMEs and EMEs, except in the case of European MMEs with South Africa. Employing BEKK-GARCH model, we find that volatility spillovers of MMEs with China and of Italy with EMEs weakened in the post-crisis period as compared to the pre-crisis period implying that the GFC damaged the information transmission process, particularly for China and Italy. While China is a large economy with strong trade linkages with the rest of the world, Italy is one of the larger European economies which was in relatively greater distress during the EDC. The findings have implications for policy makers and investors.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

In the period before the subprime crisis, a combination of factors such as spurt in growth, high commodity prices, export competitiveness, and financial market liberalization led to a rise in the economic and financial power and influence of emerging market economies (EMEs). When USA and the larger European Union (EU) economies of Germany and France went into recession as a result of the global financial crisis (GFC) and subsequent European debt crisis (EDC), it was EMEs that sustained world gross domestic product (GDP) and kept the hope of recovery alive. Presently, opinion is divided on whether the economic power and influence of mature market economies (MMEs) is waning. As larger EMEs such as China, Brazil and Russia are grappling with their own challenges, MMEs are scripting a comeback of sorts to keep the world economy going.

MMEs are developed countries with a high level of GDP per capita, significant degree of industrialization, and deep institutional underpinnings. However, EMEs have more than made up for their lack in the above areas with advantages of liberalization, younger workforce and abundance of natural resources. The four largest and rapidly developing EMEs are the BRICFootnote 1 countries (Brazil, Russia, India and China). Including South Africa, BRICS are projected to contribute 33% of the world GDP by year 2020.Footnote 2 While investing in EMEs is riskier than the average investment, their rapid economic growth means a higher return potential. On the other hand, it is MMEs that have led the recovery process in the post-crisis period due to more stable financial conditions as compared to EMEs. Hence, an intelligent investor would hold a mix of both emerging and mature market stocks in their portfolio for better risk hedging and prudent asset allocation.

This study attempts to examine return and volatility transmissions between sixteen EMEs and MMEs in light of the 2007–09 GFC. Several financial crises in the last two decades originated from EMEs such as the 1994 economic crisis in Mexico, 1997 Asian Financial Crisis, 1998 crisis in Russia, and Argentine economic crisis from 1999–2002. However, the subprime crisis was the result of inefficient regulatory supervision that ignored faulty financial practices of large and complex financial institutions domiciled in advanced economies. In the aftermath, consumer confidence was hit, demand for products from MMEs reduced, financial and real sectors of both MMEs and EMEs shrank, and the world economy plunged into severe recession.

The GFC motivated academics to add to the volume of research on return and volatility spillovers among EMEs and MMEs. The present study contributes to existing literature in that it examines sixteen major equity markets—top eight EMEs based on size of economy and stock market, and eight MMEs (G-7 economies plus Australia)—across years 2003–2014. The choice and diversity of methods to analyze return and volatility spillovers is another contribution of this study. We have used Johansen’s cointegration and dynamic cointegration to study price discovery, and ADCC-GARCH and BEKK-GARCH models to examine volatility spillover among the sample markets. Also, the analysis is segmented into pre-crisis, crisis, and post-crisis periods.

The objectives of the study are:

-

(i)

To study price discovery process between sample EMEs and MMEs, for identifying dominant markets;

-

(ii)

To examine volatility spillovers among sample markets for managing risk and allocating assets strategically

The findings of the study attest to a damaged information transmission process amongst sample economies due to the GFC. In the price discovery analysis, MMEs lead EMEs in the pre-crisis and post-crisis periods, and this is supported by a dynamic cointegration test. ADCC coefficients reveal a regional effect to the correlations among MMEs and EMEs, except in the case of high correlations between the EU MMEs in the sample and South Africa. BEKK-GARCH estimations for the sub-periods show weakened volatility spillover effects among the sample economies on account of the GFC.

The study is organized as follows. Review of the literature on information linkages is given in Sect. 2. Section 3 describes the data. Methodologies and results of price discovery and volatility spillover are discussed in Sects. 4 and 5, respectively. Section 6 provides summary and policy implications.

Literature Review

Several studies have examined long-run and short-run linkages among equity market returns using cointegration analysis. Hashmi and Xingyun (2001) document significant influence of US on Asian stock markets. Manning (2002) finds two common trends between US and nine Asian equity markets. Fernandez-Serrano and Sosvilla-Revero (2003) find mixed evidence of cointegration among US and Latin America. Yang et al. (2003) report increased integration among US, Japan and Asian stock markets in the post-1997 Asian crisis period. Phylaktis and Ravazzolo (2005) detect no effect of Asian crisis on linkages among US, Japan and Pacific-Basin markets. Results of Yang et al. (2006) indicate stronger linkages among US, Germany, and Eastern European emerging markets, in the post-1998 Russian crisis period. Fadhlaoui et al. (2009) find no evidence of cointegration among G-7 and Czech Republic, Hungary, and Poland. Kenourgios and Padhi (2012) find that the 1998 Russian crisis and 2007 GFC impacted emerging and developed economies in their sample regardless of their economic integration. Nikkinen et al. (2012) document that the Baltic stock markets of Estonia, Latvia, and Lithuania became highly cross-correlated during GFC and that the developed European markets impact their volatility.

Another strand of literature employs multivariate GARCH models to analyze volatility spillovers. Wei et al. (1995) find greater influence of USA than Japan on the Taiwanese and Hong Kong equity markets. Ng (2000) reports impact of both regional and global factors on volatility transmission from Japan and US to Pacific-Basin equity markets. Chan-Lau and Ivaschenko (2003) conclude that US is a source of price and volatility spillovers for Asia-Pacific countries, prior to, during, and after the 1998–2000 tech bubble. Miyakoshi (2003) documents US influence on Asian market returns, and Japanese influence on Asian market volatilities. Caporale et al. (2006) find that, as opposed to bidirectional spillovers prior to 1997 Asian crisis, volatility transmissions moved from Asia to other markets after the crisis. Chuang et al. (2007) document volatility spillovers among six developed and emerging East Asian stock markets, especially during the 1997 Asian crisis. Olusi and Abdul-Majid (2008) find very low correlations between EU and MENA markets. Ajayi et al. (2010) document increased return and volatility transmissions from US, UK and Japan to seven Middle Eastern EMEs in their sample. Mukherjee and Mishra (2010) find bi-directional contemporaneous intraday return spillover between India and other Asian markets in their sample. Wang and Wang (2010) report no influence of US on China, but weak evidence of volatility spillover from Japan to Shanghai A-share market. Barba and Ceretta (2011) document no volatility transmission from US to Latin America before GFC, but increased spillovers in the post-crisis period. Egert and Kocenda (2011) report strong correlations among France, Germany and UK, but weak correlations across emerging and developed markets during 2003–06. Li (2012) documents increased market linkages between China, Korea and Japan, but weak interdependence between China and US. Sakthivel et al. (2012) report bi-directional volatility spillover between US and India, and uni-directional spillover from UK and Japan to India. Abbas et al. (2013) report unidirectional volatility transmission from developed markets to equity markets of Pakistan, Sri Lanka, India, and China. Ahmad et al. (2013) find contagious effects of five troubled EU economies and US, UK and Japan on the BRIICKS markets. Awartani et al. (2013) document an increase in net transmissions from US and Saudi markets to Gulf Cooperation Council equity markets during GFC. Horvath and Petrovski (2013) find greater integration of Western European stock markets with Central Europe as compared to South Eastern Europe. Hemche et al. (2014) find increased co-movements between US and ten developed and emerging stock markets after the 2007/08 GFC. Li and Giles (2015) report unidirectional volatility spillovers from USA to Asian equity markets, including Japan. Yarovaya et al. (2016) find stronger information spillovers among developed markets than between emerging and developed markets.

This paper contributes to existing literature in the following ways. First, we examine information transmission for the top eight EMEs after double sorting on GDP and market capitalization-to-GDP as measures of economic and financial market size. The G-7 plus Australia comprise our sample MMEs. Second, the study analyzes returns and volatilities among sample equity markets prior to, during, and after the GFC. Third, the analysis is conducted for a recent time period of 2003–2014. And finally, we employ various tools to check the robustness of the findings.

Data

The study examines price discovery and volatility spillover for stock markets of eight EMEs—Brazil, China, India, Indonesia, Mexico, Russia, South Africa, and Turkey—and eight MMEs—Australia, France, Germany, Italy, Japan, United Kingdom, and United States of America. We consider the economies classified as ‘advanced’ and ‘emerging’ by the IMF and rank them by GDP for the categories of MME and EME, respectively. The top eight advanced economies are identified and their stock markets are included in our sample. Since most of the EMEs may not have very large and active stock markets, the top ten EMEs ranked by GDP are further sorted on the basis of market capitalization-to-GDP ratio,Footnote 3 and the top eight EME stock markets are identified and included in our sample. The sixteen stock indices used in the study are profiled in Exhibit A. MSCI World Index accounts for the global factor.

Exhibit A: sample stock markets and their indices

Country | Symbol used | Stock Market Index | Index description |

|---|---|---|---|

EMEs | |||

Brazil | BRZ | IBOVESPA50 | Gross total return index weighted by traded volume |

China | CHN | SSE50 | Weighted by total market capitalization and trading value |

India | IND | NIFTY | Weighted by market capitalization |

Indonesia | INDO | LQ45 | Weighted by market capitalization |

Mexico | MEX | IPC35 | Weighted by market capitalization |

Russia | RUS | MICEX50 | Weighted by market capitalization |

South Africa | SAF | FTSE/JSE TOP40 | Weighted by market capitalization |

Turkey | TUR | ISE30 | Weighted by market capitalization |

MMEs | |||

Australia | AUS | ASX50 | Weighted by market capitalization |

Canada | CAN | S&P/TSX60 | Weighted by market capitalization |

France | FRA | CAC40 | Weighted by market capitalization |

Germany | GER | DAX30 | Total Return index weighted by capitalization |

Italy | ITA | MIB40 | Weighted by market capitalization |

Japan | JAP | TOPIX CORE30 | Weighted by market capitalization |

United Kingdom | UK | FTSE100 | Capitalization-weighted index |

United States of America | USA | DJIA30 | Price-weighted average |

We retrieve daily stock index closing prices (denominated in US Dollars) from the Bloomberg database for January 1, 2003 to June 30, 2014 (2964 observations). The sample period has been divided into three sub-periods: pre-crisis—January 1, 2003 to August 8, 2007; crisis—August 9, 2007 to October 18, 2009 [in line with Trichet (2010), Asongu (2011), Angelini et al. (2007)Footnote 4, and Ahmad et al. (2013)Footnote 5]; and post-crisis—October 19, 2009 to June 30, 2014.

Price Discovery

Methodology

We apply cointegration techniques to gain insight into the price discovery process among the sample markets. Each sample series is found to be integrated of order 1,Footnote 6 using the Augmented Dickey-Fuller (ADF), Phillips-Perron (PP), and Kwiatkowski–Phillips–Schmidt–Shin (KPSS) tests. Applying the procedure advanced by Johansen (1991), we test for presence and number of cointegration vectors among the sample markets on a vector error correction model (VECM). Short-run dynamics are estimated using VECM and causality is examined by applying Granger’s causality test.

To study the time-varying nature of cointegration, we perform a dynamic cointegration test, keeping the sample size static at 750 observations,Footnote 7 in line with Mylonidis and Kollias (2010), Pascual (2003), and Fung et al. (2008), and move the sample period ahead one observation at a time. Cointegration is said to exist if trace statistics, after scaling by their 5% critical value, are greater than one; standardized trace statistic of less than or equal to one indicates no cointegration (Gilmore et al. 2008).

Empirical Results

Descriptive statistics for return series of sample equity indices for the three sub-periods are shown in Table 1.

In pre-crisis period, BRZ and GER have highest mean daily return among EME and MME groups respectively, with lowest in case of SAF and USA respectively. TUR and JAP are most volatile and MEX and USA are least volatile. Mean returns and standard deviations for EMEs are greater than for MMEs. During crisis period, except BRZ, IND, INDO, all EMEs and MMEs have negative mean. BRZ and CAN have highest mean daily return while RUS among EMEs, and ITA and JAP among MMEs have lowest mean daily return. RUS and CAN are most volatile while CHN and USA are least volatile. In post-crisis period, highest mean daily return is observed in case of MEX and USA, while BRZ and ITA have lowest return. Volatility is highest for TUR and ITA and lowest for CHN and USA Through the sub-periods, largely all indices exhibit the common characteristics of financial time series - non-normality, serial correlation in squared terms and significant ARCH statistics.

The results for Johansen’s cointegration test are given in Table 2. In the pre-crisis period, all MMEs are cointegrated with CHN and almost all MMEs are cointegrated with INDO. CAN and FRA are cointegrated with both BRZ and IND. BRZ is also cointegrated with GER. During the crisis period, AUS, CAN, GER and ITA are cointegrated with SAF. CAN is also cointegrated with MEX and RUS. In the post-crisis period, AUS, CAN, FRA and ITA are cointegrated with SAF. Additionally, AUS-MEX, ITA-INDO, ITA-RUS and USA-BRZ are cointegrated. Overall, CHN is cointegrated with all MMEs in the pre-crisis period, while during and after the crisis period it is SAF that is common to the cointegration relationships among EMEs and MMEs. In the VECM analysis,Footnote 8 in the pre-crisis and post-crisis periods, largely the MMEs lead EMEs in the price discovery process. During the crisis period, SAF leads MMEs in the price discovery process. Granger causality test results are largely in consonance with those of VECM. Since BRICS markets are an important subset of EMEs, interrelationship of the sample MMEs with BRICS countries collectively, is of special interest. In pre-crisis period and post-crisis periods, BRICS are seen to be lagging the MMEs, while during the crisis BRICS are leading MMEs in the price discovery process.

In sum, in pre-crisis and post-crisis periods, largely MMEs lead EMEs in price discovery, reflecting the power and influence of MMEs in a buoyant world economy prior to the crisis, driven by availability of easy credit. The results for the post-crisis period suggest greater resilience and more stable financial conditions for MMEs, particularly Australia, Canada and US, vis-à-vis EMEs, amid onset of EDC and rising uncertainty and volatility in world financial markets. Australia and Canada, being resource-driven economies were relatively isolated from the effects of the crisis and US was on the recovery path in post-GFC period. During crisis period, South Africa leads price discovery process. This could be explained by the weakened influence of MMEs due to the crisis, the increasing role of South Africa among EMEs in the run-up to the BRIC membership, and the relatively well-regulated and capitalized banking and financial sector in South Africa.Footnote 9

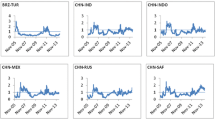

The plots of standardized trace statistics over time are displayed in Fig. 1. In line with results of static cointegration test, all MMEs are cointegrated with CHN in the pre-crisis period. AUS and GER are cointegrated with SAF during the crisis period. In the post-crisis period, intermittent cointegration is observed between markets. For almost all market pairs, standardized trace statistics exceed one in mid-2008, reflecting the contagion effect of the deepening subprime crisis. Overall, by examining market convergence as a dynamic and on-going process (Mylonidis and Kollias 2010) the findings of the dynamic cointegration analysis complement the results of the static Johansen cointegration test.

Volatility Spillover

Methodology

We use ADCC (Asymmetric Dynamic Conditional Correlation) model with exponential GARCH (EGARCH) specification of Cappiello et al. (2006), to infer the time-varying correlation patterns of the sample returns.Footnote 10 The mean equation for the EGARCH(1,1) specification is

where \(r_t =\left( {r_{1,t} ,r_{2,t} ,\ldots ,r_{n,t} } \right) {\prime }\), n = 16; \(\varepsilon _t =\left( {\varepsilon _{1,t,} \varepsilon _{2,t} ,\ldots \varepsilon _{n,t} } \right) ^{{\prime }};\varepsilon | \Omega _{t-1} \sim N\left( {0,H_t } \right) \)

The BEKK (Baba et al. xxx, n.d.) parameterization of GARCH, proposed by Engle and Kroner (1995) is used to model the volatility spillovers between the stock markets. The time-varying variance-covariance matrix \(H_t =\left[ {h_{ij,t} } \right] \) can be decomposed as:

where \(C=\left[ {{\begin{array}{ll} {c_{11} }&{} 0 \\ {c_{21} }&{} {c_{22} } \\ \end{array} }} \right] \) is a symmetric (2\(\times \)2) lower triangular parameter matrix to represent the constant components; \(A=\left[ {{\begin{array}{ll} {\alpha _{11} }&{} {\alpha _{12} } \\ {\alpha _{21} }&{} {\alpha _{22} } \\ \end{array} }} \right] \) is an unrestricted (\(2\times 2\)) matrix of parameters and indicates the extent to which conditional variances are correlated to past squared errors; and \(B=\left[ {{\begin{array}{ll} {\beta _{11} }&{} {\beta _{12} } \\ {\beta _{21} }&{} {\beta _{22} } \\ \end{array} }} \right] \) is a (\(2\times 2\)) matrix of parameters indicating the extent to which current levels of conditional variances are related to those of past conditional variances. The diagonal parameters in A (\(\alpha _{11}\) and \(\alpha _{22})\) and B (\(\beta _{11}\) and \(\beta _{22}\)) measure the effect of past shocks (ARCH effect) and past volatility (GARCH effect) on conditional volatility, respectively. The off-diagonal parameters in A (\(\alpha _{12}\) and \(\alpha _{21}\)) and B (\(\beta _{12}\) and \(\beta _{21}\)) measure cross-market effects of shock spillovers and volatility spillovers, respectively.

Empirical Results

Table 3 contains the pair-wise average correlation coefficients obtained for the sample markets. For the full sample period and largely for all sub-periods as well, AUS and JAP are most correlated with INDO. Australia, Japan and Indonesia are members of G-20, are located in Asia-Pacific region, and have close trade and economic ties with each other. FRA, GER, ITA and UK are most correlated with SAF. There is strong bilateral relationship between EU and South Africa—South Africa is EU’s largest trading partner in Africa and EU is South Africa’s biggest investor. CAN is most correlated with BRZ and USA is most correlated with MEX. The remaining MMEs are negatively correlated with MEX. Brazil, Canada, Mexico and US are part of the Americas, and have important trade and investment links by virtue of the North American Free Trade Agreement (NAFTA),Footnote 11 and membership of G-20. In sum, geographical proximity and robust trade linkages seem to influence the correlations between the sample EMEs and MMEs. Specific to the BRICS markets, BRZ is most correlated with CAN while CHN and IND are most correlated with both AUS and JAP. RUS and SAF are most correlated with the EU MMEs. This reconfirms a regional effect in correlations.

Table 4 reports the results of pairwise estimations of the GARCH-BEKK model to examine volatility spillovers amongst the sample markets.Footnote 12 In case of almost all market pairs, volatility clustering and volatility persistence, i.e. ARCH and GARCH effects (as indicated by diagonal elements of matrices A and B) are observed largely across all sub-periods.

The off-diagonal elements of matrices A and G measure cross-market shock spillover and cross-market volatility spillover effects, respectively, for the market pairs. In case of both AUS and CAN, largely all the estimated coefficients for all market pairs are significant across sub-periods, suggesting that Australia and Canada, by virtue of their being resource-driven economies, and relatively better regulated banking sectors, are buffered from variations in volatility transmission with the sample EMEs across sub-periods. Considering FRA, cross-market shock and volatility spillovers effects are observed in all pairs except INDO and TUR in pre-crisis period, BRZ and SAF during crisis period, and CHN, RUS, SAF and TUR in post-crisis period. In case of GER, in the pre-crisis period, no shock and volatility spillovers are observed for IND, MEX and SAF. None of the estimated coefficients are significant for CHN, RUS and TUR during crisis period. In the post-crisis period, cross-market volatility spillover effects are not observed for INDO, SAF and TUR. Considering ITA, largely none of the estimated coefficients are significant for MEX during crisis and post-crisis periods. Apart from that, volatility spillover effects are not observed for INDO and TUR in post-crisis period. In case of JAP, coefficients for cross-market shock spillovers are not significant in almost all pairs in post-crisis period. In case of UK, almost all the estimated coefficients are not significant for BRZ, CHN and TUR in post-crisis period. Considering USA, coefficients for cross-market shock and volatility spillover are not significant for BRZ, CHN, RUS, SAF and TUR in pre-crisis period. Volatility spillover effects are not observed for CHN, IND and MEX in crisis period and post-crisis period. The BRICS markets are linked via volatility with AUS and CAN across sub-periods. Apart from that, causality-in-variance between BRICS and sample EU MMEs, except ITA, is observed across almost all sub-periods.

In sum, the BEKK-GARCH results suggest that spillovers for China weakened due to the crisis as off-diagonal coefficients in almost all market pairs during crisis and post-crisis periods are not significant. In fact, spillovers are not observed for China across sub-periods in case of Canada, Italy, Japan and USA, and Australia, France and the UK in post-crisis period. This indicates that economic dominance does not translate into financial supremacy as the Chinese financial sector has not been able to keep pace with economic reforms undertaken in the country (see Glick and Hutchison 2013). Additionally, no shock spillovers and volatility spillovers are observed for Italy with almost all EMEs in post-crisis period. Italy is the third largest Eurozone economy (after Germany and France) and it was the largest of the ‘distressed’ EU economies at the time on account of factors such as the falling GDP and tax collections, and rising unemployment and public debt (see Quirico 2010; Morsy and Sgherri 2010). Overall, the results show weakened volatility spillover among sample markets in the post-crisis period vis-à-vis pre-crisis period, implying that the GFC damaged the information transmission process.

Summary and Policy Implications

The study examines price discovery and volatility spillover effects among stock indices of 16 EMEs and MMEs for the time period 2003–2014. MMEs lead the price discovery process, in pre- and post-crisis periods. Causality test results are largely in consonance with findings of VECM. Dynamic cointegration results show evidence of contagion in mid-2008. The results of cointegration analyses complement each other. ADCC coefficients are not very high between EMEs and MMEs and there is a regional effect evident in market correlations. BEKK-GARCH estimations show that volatility linkages of MMEs and EMEs in post-crisis period vis-à-vis pre-crisis period were weakened, particularly for China with all MMEs, and for Italy with almost all EMEs. This implies that the GFC affected volatility transmission among the sample markets—China has significant economic influence on other markets, while Italy has been in considerable financial distress since some time, more so after the subprime crisis and the EDC. Both ADCC-GARCH and BEKK-GARCH uncover a regional pattern to the transmission of volatility, and the impact of the crisis on volatility spillovers among EMEs and MMEs. South Africa is an exception to this. It has strong trade and investment linkages with EU MMEs regardless of geography, which manifests in the high correlations across the full sample period, but the volatility spillovers weaken in the post-crisis period, reconfirming that the GFC dented the financial integration process amongst market economies.

Previous empirical studies of the interrelationship of world stock price indexes provide varying findings, depending on the choice of markets, the sample period, the frequency of observations, and the different methodologies employed. Earliest studies emphasized that Japan and U.S. were dominant in transmitting causality-in-return and variance to other stock markets. In contrast to many studies, see e.g. Wei et al. (1995), Ng (2000), Kim (2005) and Li and Giles (2015), the findings of the present study reveal weakened dominance of the USA in the information transmission process in the aftermath of the GFC, highlighting the damaged financial integration amongst market economies. EMEs, particularly BRICS, show signs of waning integration with other EMEs and MMEs, not least due to their domestic political and economic woes. For instance, Brazil, Russia and South Africa are commodity-reliant countries and benefited from the upswing in commodity prices during 2003–2008, but the end of the commodity supercycle coupled with political and economic troubles at home led to a weakening of the financial and economic system in these countries. Significant political intervention and bureaucratic constraints in the case of India hampered its prospects, though there are signs of recovery under the new political regime since mid-2014, while China suffers from an imbalance between investment and consumption as a share of GDP, leading to overcapacity in key sectors.Footnote 13

The research has policy implications. We discuss these implications in two separate yet connected dimensions. First, what measures need to be taken to strengthen the financial integration process amongst economies in tranquil times so that they are able to better withstand the impact of a crisis, and second, in the event of a financial crisis, what steps can be taken to prevent further damage to the integration process.

An important feature of financially integrated economies is international trade and investment flows. In the period prior to the crisis, EMEs were on a growth path led by exports, while unflagging domestic consumption and infrastructure growth contributed to their dynamism during and after the crisis. Combined with sound fiscal, monetary and financial positions, EMEs were able to pursue countercyclical macroeconomic and fiscal policies during the worst of the downturn, and consequently partially offset the global shock (see Didier et al. 2012). Hence, EMEs, as well as MMEs, must continue to expand trade links with other economies as it provides them with a mechanism for growth perseverance, even though it may expose them to greater risk of shock transmission from affected countries in times of financial crises. EMEs must also take steps to deepen their financial markets, supported by sound regulatory and institutional architecture to facilitate greater access to international capital flows, which act as a buffer during turbulent times (see Reinhart and Reinhart 2008).

The twin crises were a result of excessive credit growth and unchecked financial practices of systemically important financial institutions (SIFIs) in advanced economies. Stronger prudential regulation and higher standards of bank as well as non-bank supervision are required to offset this. Equipping central banks with macroprudential powers and tools such as bail-ins, liquidation, temporary public ownership, the power to set up a “bridge institution”, segregating an institution into a “good bank and bad bank”,Footnote 14 might strengthen their supervisory role. This may also act as a barrier to a SIFI reaching the resolution stage. Additionally, regional-level integration among economies must be promoted through open and rapid sharing of information and harmonizing regulations between countries.Footnote 15

The study also has implications for investors, who must examine EMEs with respect to their institutional and regulatory architecture, market sophistication, trade openness and economic strength before taking investment decisions (see Sehgal et al. 2016b). The sample EMEs lack homogeneity among themselves, while the MMEs reflect a strong regional effect in their associations with EMEs. This suggests diversification opportunities for investors. The present study contributes to the information transmission and market efficiency literature for emerging as well as mature market economies.

Notes

The term ‘BRIC’ was coined by Jim O’Neill of Golman Sachs Global Investment Research in 2001.

IMF Working Paper “Emerging Powers and Global Governance: Whither the IMF?”, October 2015.

As per World Development Indicators, World Bank 2012, http://data.worldbank.org/indicator/CM.MKT.LCAP.GD.ZS/countries?order=wbapi_data_value_2012+wbapi_data_value+wbapi_data_value-last&sort=desc.

The Guardian (http://www.theguardian.com/business/2012/aug/07/credit-crunch-boom-bust-timeline) and the BBC (http://news.bbc.co.uk/2/hi/business/7521250.stm) timelines corroborate this.

The EDC follows soon after GFC and to avoid a gap in their study period, (Ahmad et al. 2013) begin EDC period on October 19, 2009. Hence, in the present study, end date for GFC has been taken as October 18, 2009.

Results of stationarity testing are available upon request.

According to Fung et al. (2008), a wider window of three years is better to capture the long-run relationship in the cointegration measure.

Due to space constraints, results of VECM and Granger causality test are not shown in the paper. The results are available upon request.

BRIC Foreign Ministers at their meeting in New York on 21st September 2010 agreed that South Africa may be invited to join BRIC. Accordingly, South Africa was invited to attend the 3rd BRICS Summit in Sanya on 14 April 2011. The Global Competitiveness Index of September 2013 by World Economic Forum ranked South Africa at 53rd position out of 148 nations surveyed. The report noted South Africa’s strong ties to advanced economies, notably the Euro area, making it more vulnerable to their economic slowdown.

NAFTA includes US, Canada and Mexico.

Due to paucity of space, the other coefficients obtained through the BEKK-GARCH estimation have been omitted. They are available upon request.

Insight on “Emerging Markets: As the Tide Goes Out”, Investment Strategy Group in the Investment Management Division of Goldman Sachs, December 2013 http://www.goldmansachs.com/what-we-do/investment-management/private-wealth-management/intellectual-capital/isg-insight-2013.pdf.

Report of the Working Group on Resolution Regime for Financial Institutions, Reserve Bank of India, January 2014 https://rbi.org.in/Scripts/PublicationReportDetails.aspx?UrlPage=&ID=767.

Opening Address at 4th IMF Hitotsubashi Seminar “Advances and Challenges in Regional Integration” by Mitsuhiro Furusawa, Deputy Managing Director, IMF, on March 3rd, 2016 https://www.imf.org/external/np/speeches/2016/030316.htm.

References

Abbas, Q., S. Khan, and S.Z. Shah. 2013. Volatility Transmission in Regional Asian Stock Markets. Emerging Markets Review 16: 66–77. doi:10.1016/j.ememar.2013.04.004.

Ahmad, W., S. Sehgal, and N. Bhanumurthy. 2013. Eurozone Crisis and BRIICKS stock markets: Contagion or Market Interdependence? Economic Modelling 33: 209–225.

Ajayi, R. A., S. Mehdian, and M. J. Perry. 2010. The relative influence of the East and the West on Middle Eastern emerging stock markets: an empirical investigation. Applied Financial Economics, 407-415.

Angelini, P., A. Nobili, and C. Picillo. 2011. The Interbank Market after August 2007: What Has Changes, and Why? Journal of Money, Credit and Banking 43 (5): 923–958.

Asongu, S. A. 2011 April. Globalization, financial crisis and contagion: time-dynamic evidence from financial markets of developing countries. African Governance and Development Institute Working Paper, 1-13.

Awartani, B., A. I. Maghyereh, and M. Al Shiab. 2013. Directional spillovers from the U.S. and the Saudi market to equities in the Gulf Cooperation Council countries. Journal of International Financial Markets, Institutions and Money, 224-242.

Baba, Y., R. Engle, D. Kraft, and K. Kroner (n.d.). Multivariate Simultaneous Generalized ARCH. Unpublished Manuscript.

Barba, F. G., and P. S. Ceretta. 2011. Risk transmission between Latin America stock markets and the US: impacts of the 2007/2008 crisis. Economics Bulletin, 1025-1037.

Caporale, G. M., N. Pittis, and N. Spagnolo. 2006. Volatility Transmission and Financial Crisis. Journal of Economics and Finance, 376-390.

Cappiello, L., R. Engle, and K. Sheppard. 2006. Asymmetric Dynamics in the Correlations of Global Equity and Bond Returns. Journal of Financial Econometrics, 537-572.

Chan-Lau, J. A., and I. Ivaschenko. 2003. Asian Flu or Wall Street virus? Tech and non-tech spillovers in the United States and Asia. Journal of Multinational Financial Management, 303-322.

Chuang, I.-Y., J.-R. Lu, and K. Tswei. 2007. Interdependence of international equity variances: Evidence from East Asian markets. Emerging Markets Review, 311-327.

Didier, T., C. Hevia, and S. L. Schmukler. 2012. How resilient and countercyclical were emerging economies during the global financial crisis? Journal of International Money and Finance?, 31, 2052-77.

Egert, B., and E. Kocenda. 2011. Time-varying synchronization of European stock markets. Empir Econ, 393-407.

Engle, R. F. 2002. Dynamic conditional correlation: a simple class of multivariate generalised autoregressive conditional heteroskedasticity models. Journal of Business and Economic Statistics, 339-350.

Engle, R. F., and K. F. Kroner. 1995. Multivariate Simultaneous Generalized ARCH. Econometric Theory, 122-150.

Fadhlaoui, K., M. Bellalah, A. Dherry, and M. Zouaouii. 2009. An Empirical Examination of International Diversification Benefitsin Central European Emerging Equity Markets. International Journal of Business, 163-173.

Fernandez-Serrano, J. L., and S. Sosvilla-Revero. 2003. Modelling the linkages between US and Latin American stock markets. Applied Economics, 1423-1434.

Fung, L. K.-p., C.-s. Tam, and I.-w. Yu. 2008, October. Assessing the integration of Asia’s equity and bond markets. BIS Paper No. 42. doi:10.2139/ssrn.1331277

Gilmore, C. G., B. M. Lucey, and G. M. McManus. 2008. The dynamics of Central European equity market comovements. The Quarterly Review of Economics and Finance, 605-622.

Glick, R., and M. Hutchison. 2013. China’s financial linkages with Asia and the global financial crisis. Journal of International Money and Finance 39: 186–206.

Hashmi, A., and L. Xingyun. 2001. Interlinkages among South East Asian stock markets (A comparison between pre- and post-1997-crisis periods). Working Paper presented at the 10th International Tor Vergata Financial Conference, December 2001. Retrieved from http://www.chass.utoronto.ca/~ahashmi/pdffiles/HashmiECO2401.pdf

Hemche, O., F. Jawadi, S. B. Maliki, and A. I. Cheffou. 2014. On the study of contagion in the context of the subprime crisis: A dynamic conditional correlation-multivariate GARCH approach. Economic Modelling. Retrieved from http://dx.doi.org/10.1016/j.econmod.2014.09.004

Horvath, R., and D. Petrovski. 2013. International stock market integration: Central and South Eastern Europe compared. Economic Systems(37), 81-91.

Johansen, S. 1991. Estimation and Hypothesis Testing of Cointegration Vectors in Gaussian Vector Autoregressive Models. Econometrica 59 (6): 1551–1580.

Kenourgios, D., and P. Padhi. 2012. Emerging Markets and Financial Crises: Regional, Global or Isolated Shocks? Journal of Multinational Financial Management, 24-38.

Kim, S.-j. 2005. Information leadership in the advanced Asia-Pacific stock markets: Return, volatility and volume information spillovers from the U.S. and Japan. Journal of the Japanese and International Economies, 338-365.

Li, H. 2012. The impact of China’s stock market reform on its international stock China’s stock market reform on its international stock 358-368.

Li, Y., and D. E. Giles. 2015. Modelling Volatility Spillover Effects Between Developed Stock Markets and Asian Emerging Stock Markets. International Journal of Finance & Economics(20), 155-177. doi:10.1002/ijfe.1506

Manning, N. 2002. Common trends and convergence? South East Asian equity markets 1988-1999. Journal of International Money and Finance, 183-202.

Miyakoshi, T. 2003. Spillovers of stock return volatility to Asian equity markets from Japan and the US. Journal of International Financial Markets, Insitutions and Money, 383-399.

Morsy, H., and S. Sgherri. 2010. After the Crisis: Assessing the Damage in Italy. IMF Working Paper WP/10/244 .

Mukherjee, K. n., R. K. Mishra. 2010. Stock market integration and volatility spillover: India and its major Asian counterparts. Research in International Business and Finance, 235-251.

Mylonidis, N., and C. Kollias. 2010. Dynamic European Stock Market Convergence: Evidence from rolling cointegration analysis in the first euro-decade. Journal of Banking & Finance, 2056-2064.

Nelson, D. 1991. Conditional Heteroskedasticity in Asset Returns. Econometrica, 347-370.

Ng, A. 2000. Volatility spillover effects from Japan and the US to the Pacific-Basin. Journal of International Money and Finance, 207-233.

Nikkinen, J., V. Piljak, and J. Aijo. 2012. Baltic stock markets and the financial crisis of 2008-2009. Research in International Business and Finance, 398-409.

Olusi, O., and H. Abdul-Majid. 2008. Diversification prospects in Middle East and North Africa (MENA) equity markets: a synthesis and an update . Applied Financial Economics, 1451-1463.

Pascual, A.G. 2003. Assessing European stock markets (co)integration. Economics Letters 78: 197–203.

Phylaktis, K., and F. Ravazzolo. 2005. Stock Market Linkages in Emerging Markets: Implications for International Portfolio Diversification. Journal of International Financial Markets, Institutions and Money, 91-106.

Quirico, R. D. 2010. Italy and the Global Economic Crisis. Bulletin of Italian Politics, 3-19.

Reinhart, C. M., and V. R. Reinhart. 2008, September. Capital Flow Bonanzas: An Encompassing View of the Past and the Present. National Bureau of Economic Research Working Paper 14321, 1-68. http://www.nber.org/papers/w14321

Sakthivel, P., N. Bodkhe, and B. Kamaiah. 2012. Correlation and Volatility Transmission across International Stock Markets: A Bivariate GARCH Analysis. International Journal of Economics and Finance, 253-264.

Sehgal, S., P. Pandey, and F. Deisting. 2016b. Stock Market Integration Dynamics and its Determinants in the East Asian Economic Community Region. Working Paper, Department of Financial Studies, University of Delhi. Retrieved from http://ssrn.com/abstract=2768106

Trichet, J.-C. 2010. State of the Union: The Financial Crisis and the ECB’s Response between 2007 and 2009. Journal of Common Market Studies 48: 7–19.

Wang, P., and P. Wang. 2010. Price and volatility spillovers between the Greater China Markets and the developed markets of US and Japan. Global Finance Journal, 304-317.

Wei, K.J., Y.-J. Liu, C.-C. Yang, and G.-S. Chaung. 1995. Volatility and price change spillover effects across the developed and emerging markets. Pacific-Basin Finance Journal 3: 113–136.

Yang, J., C. Hsiao, Q. Li, and Z. Wang. 2006. The Emerging Market Crisis and Stock Market Linkages: Further Evidence. Journal of Applied Econometrics, 727-744.

Yang, J., J.W. Kolari, and I. Min. 2003. Stock market integration and financial crises: the case of Asia. Applied Financial Economics 477–486: doi:10.1080/09603100210161965.

Yarovaya, L., J. Brzeszczynski, and C. K. Marco Lau. 2016. Intra- and inter-regional return and volatility spillovers across emerging and developed markets: Evidence from stock indices and stock index futures. International Review of Financial Analysis, 96-114.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Sehgal, S., Jain, P. & Deisting, F. Information Transmission between Mature and Emerging Equity Markets During Normal and Crisis Periods: An Empirical Examination. J. Quant. Econ. 16, 185–225 (2018). https://doi.org/10.1007/s40953-016-0067-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40953-016-0067-y