Abstract

Mass Rapid Transit (MRT) can greatly improve the accessibility of the area and bring capitalization benefits to the surrounding land value. Due to financial budget constraints, the government often uses Land Value Capture for investment and financing. However, the research on the spatial variations in the influence of MRT on land value improvement at different stages is relatively rare. Therefore, in this paper, the spatial interpolation of Inverse Distance Weighted (IDW) in GIS spatial analysis and the hedonic price model based on ordinary least square (OLS) are used to establish a model based on Geographically Weighted Regression, so as to explore the impact of LRT on residential and commercial land prices along the LRT line from time and space dimensions. The results are: (I) there are significant spatial variations in the influence of Kaohsiung LRT on the land prices along the line at different stages. During the announcement period, the residential land prices will increase by an average of 0.08% for every 1% of the distance near the LRT station within 400 m of the line. In the construction period, the effect of LRT on residential and commercial land prices is basically the same. In the operation period, LRT only has a significant negative impact on residential land prices of the area from the Kaohsiung Exhibition Hall Station (C8) to Hamaxing Station (C14). (II) The GWR models have better local estimation effect than the global regression OLS models, and can better reflect the complex spatial changes.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

With the continuous urban expansion, the urban rail transportation system has gradually become the mainstream of urban transportation system owing to its characteristics such as large passenger capacity, comfort, convenience, and non-pollution. Urban rail transportation system plays the most important role in increasing regional accessibility. In addition, urban rail transit has brought other benefits, such as alleviating congestion, improving passenger flow management, reducing road traffic accidents, and decreasing greenhouse gas emissions [3, 5, 7, 8, 19]. In addition to the above advantages, the most crucial indirect benefit of rail transit construction is to improve the value of land along the transportation lines. Related studies have shown that rail transit system has obvious positive and external benefits [16, 18]. However, rail transit construction is costly, and is one of the most complex and far-reaching investment decisions [11]. In many cases, the government has budget constraints on public transit infrastructure. Thus, Land Value Capture has been proposed as the primary means of addressing budget constraints. It is a potential financing policy mainly based on the expected increase in land value brought by public transit infrastructure. In an era of widespread fiscal austerity, Land Value Capture and other alternative capital sources have become increasingly attractive options for public transit financing [10, 14]. Therefore, to ensure the feasibility of Land Value Capture policy, it is necessary to quantitatively evaluate the value-added effect of urban rail transit system on the prices of land around or along the transportation lines, so as to achieve a virtuous circle of finance for the construction of urban rail transit system.

The operation of the red and orange lines of Mass Rapid Transit (MRT) has not only greatly improved the quality of public transportation in the Kaohsiung metropolitan area, but also has a significant positive impact on housing prices along the lines [2, 4]. To cope with the problem caused by the merger of Kaohsiung city and county and overcome the insufficient connection between the MRT red and orange lines, the Kaohsiung City Government has proposed a loop LRT plan. The first phase of LRT was officially opened to traffic in November 2017, and the external space effects of LRT in different phases are still unknown. At the same time, most previous studies focus on the spatial range of the impact of urban rail transit system on real-estate prices along the transportation lines or station areas [1, 9], while studies on the influence of urban rail transit system on the real-estate prices along the lines or station areas based on time and space dimensions are relatively rare. After the opening of the first phase of LRT in Kaohsiung, which is also the first LRT in Taiwan, the external benefits brought by it provide indicators for the future construction and operation of the second phase of LRT.

To explore whether the capitalization benefits brought by LRT to the land prices along the line can promote the development of surrounding areas, this study will focus on the spatial distribution characteristics of land prices in the first phase of LRT in three different periods, namely LRT announcement period, construction period, and operation period, and quantitatively estimate the external benefits of LRT accessibility on land prices along the lines, which will help to evaluate the potential of future investment in LRT construction. Besides, since land prices are affected by various influencing factors, such as land characteristics, traffic accessibility, and work accessibility [12, 15], this study will use the hedonic price model to explore the differences between different influencing factors. Meanwhile, considering that Geographically Weighted Regression (GWR) models are a feasible way to solve spatial non-stationarity that is influenced by the differences in the degree of impact of LRT accessibility on different locations, this study will construct a hedonic price model based on GWR to investigate the differences in the impact of LRT on residential and commercial land prices along the lines. The results will help policy makers to ensure that Land Value Capture policies can capture the actual changes caused by LRT to different land use prices along the lines; thus, more accurate potential financing mechanisms and tax systems in different periods can be proposed to solve insufficient financial resources for the investment in construction.

Based on the above research background, this study hopes to explore the impact of LRT on residential and commercial land prices along LRT line from the time and space dimensions through GWR models. The purpose of this study is to (I) apply spatial exploratory analysis tools to analyze the spatial distribution characteristics and evolution process of residential and commercial land prices along the LRT line during the announcement period, construction period and operation period of LRT in Kaohsiung; (II) explore the influence of LRT accessibility on the spatial variations of residential and commercial land prices along LRT line in the announcement period, construction period and operation period; (III) compare the applicability of hedonic price models based on ordinary least square (hereinafter referred to as OLS models) and GWR models.

Literature Review

Research on the influence of MRT on land prices. There are few studies on the impact of LRT on housing prices/land prices, and most of them just reviewed the effects of MRT on housing prices/land prices. In terms of research methods, existing studies mainly used OLS models and GWR models, and proved that GWR models are superior to OLS models in the explanation of housing prices/land prices (see Supplementary Table 1 for details). Most of the conclusions of the analysis of OLS models are that the influence range of MRT varies in different cities. At the same time, the benefits of the impact of MRT are greater than those of LRT, but there is a spatial homogeneity in the estimated results of land prices or housing prices. The GWR models confirmed that the impact of the MRT system on housing prices/land prices has a spatial heterogeneity, which is consistent with the nature of the land. That is, the degree of influence of the MRT system on housing prices/land prices varies with location, but in the existing research, time cross section has not yet been added for comparison. Regarding spatial and temporal differences (see Supplementary Table 1 for details), most of the studies show that the operation period and 2 years of operation have the most significant influence on housing prices/land prices along the MRT lines, contributing to the highest increase of land prices. The announcement period has larger influence than the construction period, but the impact is still small. And the construction period will have a negative impact on the surrounding housing prices/land prices, mainly due to the noise and traffic inconvenience caused by the construction. In addition, the range of influence of each study is different, but most of the analyses using GWR models only focus on the spatial level, and time cross section is not included for comparison. Therefore, this study will add the time cross section of LRT to analyze the differences in the spatial impact effects in different periods, so as to improve the land price model.

Theoretical basis and analysis of influencing factors: The selection of influencing factors in this paper is mainly based on relevant theories and previous studies. The theoretical basis currently focuses on land supply and demand theory, Bid rent theory, and Hedonic price theory. Land supply and demand theory is the main factor that determines the land prices, and there are differences in supply and demand at different time points. Bid rent theory reflects that accessibility determines land prices. Hedonic price theory explains how the characteristics of land itself affect land prices, including the influence of economic factors, social factors, technological factors, policy factors, public interests, land property rights, and developers’ preferences. According to relevant theories and previous studies, the influencing factors mainly involve the characteristics of the house itself, location, and neighborhood characteristics (column 5 of Supplementary Table 1). First, the characteristics of the house itself include factors such as house type, area, building form, floor, land use type, and age of the house; second, the location characteristics include factors such as distance to MRT station, distance to LRT station, distance to railway station, distance to access road, etc. Finally, the neighborhood characteristics cover factors such as distance to public facilities, distance to parks, distance to schools, distance to CBD, distance to the city's sub-center, distance to the new development zone, road width, and the proportion of various land uses in the surrounding areas.

In general, in terms of research methods, domestic and foreign research mainly focuses on OLS models and GWR models, and this research further proves that GWR models are better than OLS models in housing/land price research. In terms of research objects, most studies focus on housing prices rather than land prices. Therefore, this research has further improved the research along the light rail line with land prices as the research object. In terms of temporal and spatial differences, most of the studies using GWR models only focus on the spatial level and do not include the comparison of time cross-sections. This study will add the time cross section of the light rail to analyze the differences in the spatial impact effects of different periods, so as to improve the land price model.

Method

Data Processing

Considering that it is difficult to quantify the factors that affect housing prices, such as room type and decoration, land price is selected as the research object. The space samples are from “Taiwan’s Land Administration’s real-estate transaction log-in database”, and samples from three periods: LRT announcement period, construction period, and operation period are selected. The attributes of the data include land transaction price, land area, land use, coordinates, etc., and “point data” are used as samples to analyze the regression model. The smallest statistical area uses the alignment and zoning of streets and lanes, house addresses, or latitude and longitude, and divides them into rural areas according to the population density and slope of the village, and builds the smallest statistical area basic map information. The standard for urban planning is: the population density of the village is greater than or equal to 1,000 people per square kilometer. The detailed designation principles include: the ideal upper limit of the population is 450; the ideal upper limit of the number of GIS houses is 200; the area is less than 0.1 hectares; and the population is less than 100 and the number of houses is less than 100, choose the smallest statistical area to merge. Mountainous areas are not taken into consideration and those with a population of 0 must have an area greater than 1 hectare. In terms of the social and economic variables, the smallest statistical area in Kaohsiung City is chosen as the data space unit, and there are a total of 6872 smallest statistical areas within the scope of this study. To meet the requirements of spatial analysis and modeling of land price data, it is necessary to revise the research data and remove abnormal sample points. First, adjustments are made through the Consumer Price Index (CPI); second, outliers in research data need to be tested and removed. Finally, a total of 4415 samples are retained, among which there are a total of 3149 transactions of residential land, including 867 transactions in announcement period, 1,359 transactions in the construction period, and 923 transactions in operation period, as shown in Fig. 1a; there are a total of 1266 transactions of commercial land use, including 299 transactions in announcement period, 570 transactions in construction period, and 397 transactions in the operation period, as shown in Fig. 1b.

Research Methods

In this study, comprehensive modeling is conducted based on OLS models and GWR models. OLS models are pretty mature for research on land prices/housing prices, and believe that land prices are composed of many hidden values. GWR models inherit the theory of OLS models, believing that land prices still consist of different hidden prices, but, at the same time, emphasize the difference in the spatial distribution of land prices. Therefore, this paper uses OLS models to establish influencing variables, and then uses GWR models to estimate the correlation between land prices and variables.

Hedonic Price Model Based on Ordinary Least Square (OLS)

In this study, by establishing OLS models, the basic sample data are constructed as the regression model based on Hedonic price theory. The influencing functions include four forms: linear, semi-logarithmic, inverse semi-logarithmic, and double-logarithmic functions. Through observing the model's overall explanatory ability R2, F statistic test, the significance level of the t value of individual independent variables, and autocorrelation, etc., the optimal function is selected as the final model.

The hedonic price model of land price is as follows:

where P is the transaction price of land in the market; S (Structure) is the structural feature variable of land; L (Location) is the feature variable of location (accessibility) of land; N (Neighborhood) is the feature variable of the land neighborhood; in the related research of the hedonic price model, the multiple regression analysis method based on ordinary least square (OLS) is often used to estimate the parameter \({\beta }_{\mathrm{i}}\), that is, the marginal utility of each feature.

Brunsdon (1999) explored the relationship between UK house prices and floor area, and compared with Ordinary Least Square (OLS) models, and found that Geographically Weighted Regression (GWR) models are better. GWR models are essentially based on the deformation of the spatial parameters of the traditional linear regression model, and estimate the parameters in a local way. Due to the inherent characteristics of the land, it has spatial heterogeneity, and the principle of land valuation is consistent with the principle of Tobler's first law of geography followed by GWR. That is to say, GWR can deal with spatial dependence and spatial heterogeneity at the same time, has better interpretive ability for spatial samples, and can present and test various coefficients estimated in space, which is suitable for this research topic. Due to the spatial heterogeneity of land prices, and GWR models are suitable for dealing with spatial heterogeneity, and the calculation method is similar to OLS models, and the difference results can be presented more intuitively. Therefore, GWR models are determined as the main method of this research. In the aspect of case study, this study further compares the differences between the two methods and verifies the superiority of GWR models.

Construction of Geographically Weighted Regression (GWR) Models

In this paper, the optimal function form determined by OLS models is adopted as the main function to build GWR models that are essentially the transformation of traditional linear regression models based on spatial parameters, where the parameters are estimated in a local manner. GWR can simultaneously process spatial dependence and spatial heterogeneity, with better ability to explain spatial samples, and it can display and verify the coefficients estimated in space. The formula of the model is as follows:

where \(\left({u}_{i},{v}_{i}\right)\) is the spatial coordinate of the ith sample point, \({\beta }_{k}\left({u}_{i},{v}_{i}\right)\) is the value of the continuous function \({\beta }_{k}\left(u,v\right)\) at point i; if the value of i of \({\beta }_{k}\left({u}_{i},{v}_{i}\right)\) is the same at any point in the space, the function becomes the global regression model.

When GWR is used for analysis, the determination of spatial weight matrix and bandwidth function are the two most important steps. The spatial weight matrix is established for each sample point i. In practice, Gauss function and Bisquare function are often used for determination. The bandwidth is mainly estimated by Akaike Information Criterion (AICc) [6]. When the AICc of the GWR models is the smallest, bandwidth is the optimal.

The estimated coefficients of GWR vary in different spatial locations. Each coefficient can be tested by DIFF of Criterion. If the value of DIFF of criterion is negative, the corresponding variable coefficient is spatially unstable.

Research Framework

In this study, the impact of LRT on land prices along the line is the main research motivation. The analysis framework is established by methods such as OLS models and GWR models, and is mainly divided into two parts (Fig. 2). In the first part, data and index parameters are constructed. First, land prices and GIS related data need to be built. Because the research time of this study covers announcement period, construction period, and operation period, multiple administrative districts are involved; thus, the land prices need to be adjusted in different time and district. In addition, statistical analysis and spatial interpolation in GIS spatial analysis are employed to preliminarily analyze the number of land samples, the value of different types of land, land transfer area, and spatial evolution characteristics of land prices. Second, the variables that affect land prices are determined through the literature review, including accessibility variable, neighborhood structure variable, and structural feature variable. Since there may be a high degree of correlation between the independent variables, correlation analysis of each independent variable is required to avoid collinearity. The data and index parameters constructed can be used as the basis for the next regression analysis. In the second part, the model is constructed for analysis. First, this study uses the hedonic price model based on ordinary least square as a pre-operation to establish GWR models, verifies each independent variable through OLS models, and chooses the model with the optimal explanatory ability from four function forms: linear, semi-logarithmic, inverse semi-logarithmic, and double-logarithmic functions as the basis of research and discussion. Second, according to the influencing variables determined by OLS models, the correlation between land price and variables is estimated through GWR models, and spatial autocorrelation and spatial heterogeneity are handled to improve the explanatory ability of the linear model and display the spatial laws of the influence of LRT on the surrounding land prices, such as the spatial variations of residential and commercial land prices, and the spatial distribution characteristics and evolution of residential and commercial land prices along the LRT line.

Index Measurement

This study explores the impact of LRT on land prices along the LRT line. The selection of indicators aims to fully reflect the hypothesis and the purpose of the research, and the availability and representativeness of the indicators are also taken into account. Therefore, through literature review, the variables in this study are divided into three major attributes: accessibility variable, neighborhood structure variable, and structural feature variable (as shown in Table 1). The details are as follows:

Dependent Variables

In this study, land transaction prices are used as the dependent variables of the regression equation.

Independent Variables

Accessibility Variable

Distance to nearest LRT station, Distance to nearest MRT station, Distance to nearest train station, Distance to nearest Expressway.

In this study, GIS is used to calculate the closest linear distance between the land sample points and the variables. According to previous studies, the closer to the LRT station or MRT station, the better the traffic accessibility, and the higher the land price. Therefore, the expected relationship between them and land price is negative. At the same time, the closer to the railway station, the better the traffic accessibility, and the more obvious the spillover effect on land prices. However, due to the noise pollution brought by trains to the surrounding environment, and the crowds and high crime rate, the relationship between them may be positive or negative. In this study, there are 6 entrances and exits of the access road. The main access road can increase inter-regional exchanges and improve accessibility and convenience, exerting a positive impact on land prices. Therefore, the relationship between the distance to the nearest Expressway and land prices is negative.

Neighborhood Structure Variable

Distance to CBD (Central Business District), Distance to the nearest park.

In this study, GIS is used to calculate the closest linear distance between the land sample points and the variables. Previous studies have identified Sanduo Shopping District as Kaohsiung’s CBD, and the research results show that the closer to the Sanduo Shopping District, the higher the housing prices [13], thus CBD has a significant positive influence on land prices and housing prices. At the same time, parks are extremely important public facilities in the city, which can provide people with a place to relax, and can also improve the quality of environment; thus, they positively affect land prices. Therefore, there is a negative relationship between variable and land prices.

The width of the road is located in the school district.

Existing studies have confirmed that increasing the width of roads facing the street will improve housing prices and land prices. Meanwhile, school is an important factor influencing land prices, and well-known school districts play more significant role in improving residential land prices. Therefore, there is a positive relationship between variable and land prices.

Proportion of pure residential land use around parcels, Proportion of commercial land use around parcels, Proportion of residential mixed use land around parcels, Proportion of industrial land use around parcels, Proportion of free land around parcels.

They are expressed by the proportion of the area of the variables in the smallest statistical area where the transaction plot is located in the smallest statistical area. According to the literature, the higher the proportion of pure residential land use, the better the living environment; the higher the proportion of commercial land, the more complete the surrounding living functions, the more the people flow, and the higher the corresponding surrounding land prices; the higher the proportion of mixed residential and commercial land use, the better the functions of community life, which has a positive effect on surrounding land prices. At the same time, the higher the proportion of industrial land use, the greater the impact of noise and pollution on the surrounding living environment; the higher the proportion of open spaces, the less perfect the surrounding living functions, and there are no aggregation effects. Therefore, it has a negative influence on surrounding land prices.

Structural Feature Variable

Population density, Floor area ratio, Area.

The increase in population may not only promote the demand for residential land, but also encourages the use of commercial land; the larger the volume, the greater the volume available for development, which has a positive influence on land prices; the area here refers to the area of the transaction plot. The larger the plot area, the greater the development and use, and the higher the price. Therefore, the expected relationship between variables and land prices is positive.

Empirical Analysis

Research Scope

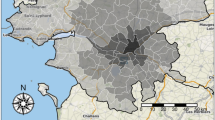

The loop LRT plan in Taiwan's Kaohsiung is divided into two stages, and it will connect major construction bases in the future to facilitate transfer. In the first phase of LRT, as of February 2019, the monthly average daily traffic volume was 15,413. The construction of the second phase of LRT started in March 2017. It was originally expected to be completed and opened to traffic by the end of 2021. However, the effect of LRT with incomplete independent right of way of MRT in Kaohsiung on housing or land prices along the line has not yet been understood. This study aims to explore the impact of Kaohsiung's LRT (Phase 1) on its surrounding land prices. Two aspects are considered in the scope of the study. First, the administrative districts through which LRT passes are selected, including Qianzhen District, Lingya District, Qianjin District, Yancheng District, and Gushan District; second, the limitation of the sample data of land transactions and the construction of the second phase of LRT may also have potential influence on the first phase, so four administrative districts including Zuoying District, Sanmin District, Xinxing District, and Fengshan District are also included in the scope of the study; as shown in Fig. 3.

Analysis of Spatial Distribution Characteristics of Land Prices

The statistical characteristics (Fig. 4) show that the transaction prices of residential land and commercial land along the LRT line decrease from the announcement period to the operation period over time, but the decline in commercial land prices is smaller than that in residential land prices. The average price of both the residential land and commercial land increases first and then decreases over time, reaching the highest during the construction period. The average transfer area of both residential and commercial land along the LRT line decreases from the announcement period to the operation period over time.

In terms of the geospatial distribution characteristics, this study uses IDW to perform spatial interpolation on the land price data in the research area, and constructs a digital model of land prices in three different periods of LRT (announcement period, construction period, and operation period). The residential land prices (Fig. 5a–c) present an overall dual-core structure and a typical center-periphery distribution pattern. The high-value areas of residential land are all close to commercial districts, MRT stations, and large public facilities. From the announcement period to the construction period, the influence scope with Kaohsiung Museum of Fine Arts and Kaohsiung Arena as the center of peak residential land price gradually expands, while the influence scope with Sanduo Shopping District as the center of peak residential land price gradually decreases; from construction period to operation period, the overall land prices show a downward trend. The commercial land prices (Fig. 5d–f) present an overall multi-core structure with spatial continuity. The land price peak areas show a layered gradient diffusion distribution centered on Sanduo Shopping District, Kaohsiung Museum of Fine Arts, Kaohsiung Arena, and Kaohsiung MRT Wukuaicuo Station. From announcement period to construction period, the multi-core structure continues to spread. The scope of influence with Sanduo Shopping District as the center of commercial land price peak gradually spreads to the south of it, and a new core centered on MRT Shijia Station is formed. From construction period to operation period, the overall land price is in a downward trend. However, the influence scope with Kaohsiung Museum of Fine Arts and Kaohsiung Arena as the center of peak commercial land price gradually expands and the land price increases; while the influence range of the center of commercial land price peak south of the Kaohsiung Railway Station is gradually narrowing.

OLS Model Analysis

Pearson correlation coefficient analysis shows that the correlation coefficients between all variables of the residential and commercial samples are not greater than 0.8; thus, all independent variables will be included in the subsequent hedonic price model. Based on the construction of the hedonic price model, the hedonic price model uses the Ordinary Least Square method to establish linear, semi-logarithmic, inverse semi-logarithmic, and double-logarithmic functions for the estimation of dependent variables and independent variables, respectively. The optimal fit function model is selected to construct subsequent GWR models. The analysis results show (Table 2) that the double-logarithmic function model has the highest explanatory ability. A number of previous studies have also confirmed that the double-logarithmic model has better explanatory ability [5, 9, 12].

It can be seen from the OLS regression results that with respect to the residential land prices, during the announcement period, LnLRT shows a significant negative correlation with the residential land prices along the LRT line, that is, for every 1% distance close to the LRT station, the land prices will be increased by 0.08%. However, the LnLRT coefficient is not significant during the construction period, which may be due to the noise pollution and traffic congestion caused by construction. In the operation period, LnLRT shows a significant positive correlation with the residential land prices along the line. For every 1% distance away from LRT station, the land prices will increase by 0.42%. The reason may be that the current operating volume in the first phase of LRT is lower than the expected level, the employment accessibility along the LRT line has not been improved, and LRT is mainly sightseeing-oriented. Citizens still choose private transportation means for traveling, which has no significant impact on LRT accessibility. In terms of the commercial land prices, the LnLRT coefficient is not significant during the announcement period and operation period. In the construction period, LnLRT has a significant positive correlation with the residential land prices along the line. For every 1% distance away from the LRT, the land prices will increase by 0.17%. This may be due to the fact that LRT is based on a flat road design, which will hinder the transportation accessibility during the construction period, thereby exerting a negative influence on commercial land prices.

The regression R2 in three periods has good explanatory ability (Table 3), but the residuals of the models of three periods all have heterogeneous variability, residual non-independence, and show that residuals do not meet the normal distribution, which means that the 0LS regression hypothesis is not met, leading to the error of the estimation results. Therefore, the spatial weighting of GWR models will be applied to solve the heterogeneous variability of residuals.

GWR Model Analysis

After the estimation of the residential and commercial land prices in different periods of LRT through GWR models, it is found that the GWR models are superior to OLS models in terms of R2, AICc value, and residual space autocorrelation test (except that R2 of GWR is slightly smaller than that of OLS during the operation period), and the models have more accurate estimation results (see Table 4 for details). The explanation of the impact of various independent variables on land prices from the local perspective can more reflect the fact that land prices have spatial heterogeneity (all local regression coefficients can be presented on a map).

Residential Land Prices

The impact of LRT on land prices along the LRT line in announcement period, construction period, and operation period has obvious spatial non-stationarity. The LRT announcement period has the greatest influence on the land prices along the line, followed by the operation period, and finally the construction period.

During the announcement period, 86.62% of the land transaction price of areas along the Kaohsiung loop LRT line (the ratio of t value is greater than 1.65 or less than − 1.65, the following is the same) is significantly affected by the LRT, and an overall negative correlation is presented, that is, the closer to the LRT station, the higher the residential land prices (Fig. 6a). Particularly, the residential land prices within 400 m of LRT are more affected by the accessibility of LRT than those within 400–800 m of LRT line, that is, for every 1% distance close to the LRT station within the 400-m range of LRT, the residential land prices will increase by 0.209–0.297%, and within the range of 400–800 m of the LRT line, the residential land prices will increase by 0.116–0.208%; in addition, from the perspective of the spatial distribution of regression coefficients, within 800 m of the LRT line, the residential land prices of the area between the Health Bureau Station (C33) to Lizai Station (C1) are more affected by the availability of LRT than those between United Hospital Station (C22) and Wanzai Inner Station (C26). The regression coefficient of the area outside the 800-m range of LRT also shows a negative value, especially in Zuoying District, Qianzhen District, and Fengshan District. The area near Kaohsiung MRT Fengshan Junior High Station and Taiwan Railway Fengshan Station exhibits the largest absolute regression coefficients, followed by Zuoying High-speed Railway Station, area near Kaohsiung Arena and Qianzhen District.

During the construction of the first phase of LRT, 45.00% of the land transaction price along the Kaohsiung loop LRT is significantly affected by the construction of LRT, and half positive and half negative correlation is presented (Fig. 6b). There is no significant difference in the LnLRT regression coefficient between the 400-m range and the 400–800-m range of the LRT loop line. Within 800 m of the LRT loop line, the regression coefficient of the area from Travel Center Station (C9) to Art Park Station (C20) shows a significant positive correlation; the regression coefficient of the area from LRT Jianxing Road Station (C29) to Universal Studio Station (C31) shows a significant negative correlation, that is, for every 1% distance close to the LRT station, the residential land prices will increase by 0.088–0.179%; the significant regression coefficient of Zuoying District outside the 800-m range of the LRT loop line also shows a negative value, that is, for every 1% distance close to the MRT Arena station and the MRT Zuoying Station, the residential land prices will increase by 0.088–0.179%.

During the operation period of the first phase of LRT, 58.12% of the land transaction prices of the areas along the Kaohsiung LRT loop line are significantly affected by LRT, but most of them show positive correlation (Fig. 6c). The significant regression coefficients of LnLRT within the range of 400 m of the LRT loop line and within the range of 400–800 m have no difference and are positive. After the operation of the first phase of LRT, the regression coefficients of LnLRT within 800 m from Kaohsiung Exhibition Hall Station (C8) to Hamaxing Station (C14) are significantly positively correlated, which is different from the results of the previous studies [5, 17]. The operation of the first phase of LRT has no positive impact on residential land prices of the areas along the LRT line in the second phase. The regression coefficient of LnLRT within 800 m from Hamaxing Station (C14) to Dingshan Station (C27) is significantly positively correlated. The significant regression coefficient of the Qianzhen District outside the 800-m range of the LRT loop line presents a negative value. For every 1% distance near the MRT Qianzhen Junior High School Station to the MRT Caoya Station, the residential land prices will increase by 0.49–1.01%.

Commercial Land Price

The impact of LRT on the land prices along LRT line in the announcement period, construction period, and operation period also has obvious spatial non-stationarity. The construction period of the LRT has the greatest effect on land prices along the line, while the announcement period and operation period have no effect.

During the announcement period, only 3.67% of the land transaction prices of areas along the Kaohsiung LRT loop line are significantly affected by the LRT announcement period, indicating that this stage of LRT has almost no influence on commercial land prices (Fig. 6d).

During the construction period of the LRT, 58.84% of the land transaction prices of the areas along the Kaohsiung LRT loop line are significantly affected by the construction of LRT, and show a positive correlation (Fig. 6e). Within the 800-m range of the LRT loop line, the samples whose regression coefficients have a significant positive correlation are mainly concentrated on the area from the LRT Travel Center Station (C9) to the Office Station in Gushan District (C17), that is, the farther away from the LRT, the higher the land prices. The significant regression coefficients outside the 800-m range of the LRT loop line also mainly present positive values, and are concentrated around Kaohsiung Railway Station and MRT Beautiful Island Station.

During the LRT operation period, 2.51% of the land transaction prices of the areas along the Kaohsiung loop LRT are significantly affected by the LRT operation period, indicating that LRT has little effect on commercial land prices at this stage (Fig. 6f).

Conclusion

In this study, through OLS models and GWR models, the impact of LRT on residential and commercial land prices along the LRT line is explored from time and space dimensions. The main conclusions are as follows:

(I) Residential land prices show a dual-core structure in space, while commercial land prices present a multi-core structure. This study uses the spatial interpolation of GIS Inverse Distance Weighted (IDW) to construct a digital model map, so as to analyze the overall and local spatial distribution pattern and evolution of land prices of different land use at different time nodes of LRT. The results show that the overall spatial distribution pattern of residential and commercial land prices is different; the residential land prices generally present a dual-core structure in space, with the contour line showing a circle-level gradient diffusion, constituting a typical center-periphery distribution pattern. The commercial land prices have a multi-core structure as a whole with strong centrality.

(II) The indicators such as R2, AIC, residual sum of squares, residual spatial autocorrelation, and basic hypothesis of OLS regression confirm that GWR models are superior to the global regression model in terms of explanatory ability, which is consistent with the previous research results. And GWR models break the "homogenization effect" of the global regression model. That is, there is spatial non-stationarity in the impact of LRT on the land prices along the line. At the same time, this study uses GWR models to comparatively analyze the spatial effects of LRT on different types of land prices in different periods. At present, GWR models have not been used to analyze the land prices from both time and space dimensions. Therefore, this study has improved the land price estimation model.

(III) There are spatial variations in the influence of LRT accessibility on residential land prices along the line in different periods. OLS results reveal that LRT has different impacts on the land prices along the line in the announcement period, construction period, and operation period. It has a significant positive influence during the announcement period. For every 1% distance near the LRT station, the residential land prices will increase by 0.08%, which is similar to the previous research results [17]; it shows no impact in the construction period; it exerts a significant negative impact during the operation period, which is different from the previous research results [5, 17]. It can be found from the local parameters estimation through GWR models that the influence of LRT on residential land prices at different spatial locations in different periods has significant spatial variations. In the announcement period, LRT has a significantly larger positive impact on low- and middle-income regions than high-income regions. In the announcement period, LRT has a greater significant positive impact on low- and middle-income areas than that on high-income areas. During the construction period, it shows a significant negative influence on the areas from Travel Center station (C9) to Hamaxing Station (C14), while there is no significant impact on other areas near the stations. In the operation period, it has a significant negative impact on the areas from Kaohsiung Exhibition Hall Station (C8) to Hamaxing Station (C14), while there is no significant effect on other areas along the stations.

(IV) There are spatial variations in the impact of LRT accessibility on commercial land prices along the line in different periods. The OLS results reveal that LRT has different influence on the land prices along the line in the announcement period, construction period, and operation period. There is no significant effect in the announcement period and operation period, but it has a significant negative impact in the construction period. It is estimated from the local parameters through the GWR models that there are prominent spatial variations in the influence of LRT on commercial land prices at different spatial locations in different periods. In the announcement period, LRT shows no significant influence on the commercial land prices along the line. During the construction period, it has a significant negative impact on the areas from Travel Center Station (C9) to Hamaxing Station (C14), while it has no significant impact on other areas along the stations. In the operation period, LRT also shows no significant impact on commercial land prices along the line.

There are still some limitations in this study, and follow-up studies can make improvements in the following aspects. (I) Due to the limitation of data, there is a deviation between the spatial position of some data and the actual position, which results in a certain error in the results. Therefore, subsequent research can improve the accuracy of the spatial data of land prices to reduce the error of spatial estimation. (II) The external benefits of LRT are not significant. In addition to the low transportation volume, semi-structured interviews can be added in the future to explore the reasons why LRT has not reached the expected effect. (II) In this study, due to the limitation of the current data, the variables representing local economic conditions are not added to the independent variables, such as the household income and the number of employed population in each space unit. Variables related to local economic development can be added in the future research.

References

Armstrong RJ, Rodríguez DA (2006) An evaluation of the accessibility benefits of commuter railin eastern Massachusetts using spatial hedonic price functions. Transportation 33(1):21–43. https://doi.org/10.1007/s11116-005-0949-x

Chen Y (2014) The impact of kaohsiung mrt's opening on regional house prices—also on the impact of mainland visitors to taiwan. National Central University.

Chen Y, Whalley A (2012) Green infrastructure: the effects of urban rail transit on air quality. Am Econ J Econ Pol 4(1):58–97. https://doi.org/10.1257/pol.4.1.58

Dai G (2012) The reexamination of the impact of metro system on residential housing values in taipei metropolitan. National Chengchi University.

Dziauddin MF (2019) Estimating land value uplift around light rail transit stations in greater kuala lumpur: An empirical study based on geographically weighted regression (gwr). Res Transp Econ 74:10–20. https://doi.org/10.1016/j.retrec.2019.01.003

Fotheringham A, Brunsdon C, Charlton M (2002) Geographically weighted regression: the analysis of spatially varying relationships. Wiley, pp 13.

Li S, Brooks JJ, Jacob J, Ghasemiesfe A, Marrinan GB (2018) Not all sagittal band tears come with extensor instability: a case report with radiological and operative correlation. Skeletal Radiol 47(4):593–596. https://doi.org/10.1007/s00256-017-2820-5

Li S, Lyu D, Liu X, Tan Z, Gao F, Huang G, Wu Z (2020) The varying patterns of rail transit ridership and their relationships with fine-scale built environment factors: big data analytics from guangzhou. Cities 99:102580. https://doi.org/10.1016/j.cities.2019.102580

Malaitham S, Fukuda A, Vichiensan V, Wasuntarasook V (2020) Hedonic pricing model of assessed and market land values: a case study in bangkok metropolitan area, thailand. Case Stud Trans Policy 8(1):153–162. https://doi.org/10.1016/j.cstp.2018.09.008

Medda F (2012) Land value capture finance for transport accessibility: a review. J Transp Geogr 25:154–161. https://doi.org/10.1016/j.jtrangeo.2012.07.013

Mulley C (2014) Accessibility and residential land value uplift: Identifying spatial variations in the accessibility impacts of a bus transitway. Urban Stud 51(8):1707–1724. https://doi.org/10.1177/0042098013499082

Mulley C, Tsai C-H, Ma L (2018) Does residential property price benefit from light rail in sydney? Res Transp Econ 67:3–10. https://doi.org/10.1016/j.retrec.2016.11.002

Shyr O, Andersson D, Wang J, Huang T, Liu O (2013) Where do home buyers pay most for relative transit accessibility? Hong kong, taipei and kaohsiung compared. Urban Stud 50:2553–2568. https://doi.org/10.1177/0042098012474510

Smith JJ, Gihring TA (2006) Financing transit systems through value capture: an annotated bibliography. Am J Econ Sociol 65(3):751–786

So HM, Tse RYC, Ganesan S (1997) Estimating the influence of transport on house prices: Evidence from hong kong. J Prop Valuat Invest 15(1):40–47. https://doi.org/10.1108/14635789710163793

Wang X, Tong D, Gao J, Chen Y (2019) The reshaping of land development density through rail transit: the stories of central areas vs. suburbs in Shenzhen, China. Cities 89:35–45. https://doi.org/10.1016/j.cities.2019.01.013

Yen BTH, Mulley C, Shearer H, Burke M (2018) Announcement, construction or delivery: when does value uplift occur for residential properties? Evidence from the gold coast light rail system in australia. Land Use Policy 73:412–422. https://doi.org/10.1016/j.landusepol.2018.02.007

Zhang J, Wang M (2019) Transportation functionality vulnerability of urban rail transit networks based on movingblock: the case of nanjing metro. Physica A 535:122367. https://doi.org/10.1016/j.physa.2019.122367

Zhao L, Shen L (2019) The impacts of rail transit on future urban land use development: a case study in Wuhan, China. Transp Policy 81:396–405. https://doi.org/10.1016/j.tranpol.2018.05.004

Funding

National Natural Science Foundation of China, Research on urban public service facilities reconfiguration in the Information Era—Case studies on Guangzhou and Fuzhou, No. 41801160; Open project State Key Laboratory of Subtropical Building Science, Spatial evolution and planning control of public service facility distribution based on Big data analysis, No.2020ZB12.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interest

The authors declare no conflicts of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Shi, M., Su, Q. & Zeng, X. Estimating the Effects of Light Rail Transit (LRT) on Land Price in Kaohsiung Using Geographically Weighted Regression. Transp. in Dev. Econ. 8, 9 (2022). https://doi.org/10.1007/s40890-021-00147-y

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s40890-021-00147-y