Abstract

This paper investigates how subcontracting affects collusion in public procurement. In a model in which a public buyer runs simultaneous or sequential competitive procedures we show that the stability of collusive agreements depends on the level of subcontracting share and it is not necessarily increasing in this share. In a repeated procurement in which contractors and subcontractors are involved in collusive agreements enforced by slit award and bid rotation strategies we find that simultaneous procedures induce less collusion than sequential procedures, with split award strategies allowing the less stable collusive scheme. We also find that allowing a further increase in the subcontracting share strengthens collusion when the share is low but it mitigates collusion when the share is high. Thus, the competitive format and the allowed subcontracting share must be carefully managed by the public buyer in order to prevent collusion.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Subcontracting in procurement is a practice that occurs when an economic operator (contractor), awarded a public contract, hires another company (subcontractor) to perform the execution of part(s) of the work or service composing the main contract. On January 2019, the European Commission (EC) sent a formal notice for an infringement proceeding for 14 EU-countries about the “non-conformity checks of the public procurement and concessions directive 2014/23/EU, 2014/24/EU, 2014/25/EU”. The target of the EC includes the Italian Public Contracts Code (Legislative Decree no. 50/2016) that since 2017 has been implementing the European Directives 2014/23/EU, 2014/24/EU, 2014/25/EU. EC criticizes the exogenous and compulsory ceiling of 30% imposed by the Italian Code to the subcontracting share (Art 105). EC highlights that European Directives do not entail any compulsory limit to subcontracting and are instead against any ex ante exogenous and hypothetical constraint unrelated to any previous market analysis.

In line with the concern raised by the EC our paper studies the phenomenon of subcontracting in public procurement and, in particular, how the level of the subcontracting share may affect the market integrity when collusive behaviors arise. We show that setting a ceiling to the subcontracting share has less straightforward implications an ex ante exogenous constraint may lead to predict, especially when the risk of collusion in public procurement is high.

We model both simultaneous and sequential competitive procedures and show that the stability of a collusive agreement is not an increasing function of the subcontracting share. In particular we find that (i) both high and low levels of subcontracting shares make collusive agreements less stable, and (ii) the incentive to collude is non-monotonic in the subcontracting share. In particular, allowing an increase in the share may make agreements more stable when the share is low and less stable when the share is high. Thus, our paper tackles the commonly accepted idea that a too high subcontracting share necessarily induces more collusive behaviors in public procurement. We also confirm that simultaneous procedures induce less stable collusive agreements than sequential ones.

We set up an infinitely repeated game with three firms competing for two lots in sequential and simultaneous first price auctions. For both formats we study two possible collusive strategies, bid rotation, entailing that only one firm is awarded both lots in each period, and split award, such that each firm is awarded only one lot in each period. Both collusive strategies induce the potential subcontractor to stays out the competitive procedure waiting for the subcontract of a share of each lot. In particular, the bid rotation strategy entails that the contractor gets two lots in each period by bidding the reserve price on both lots while the other contractor bids more than the reserve price. Under split award strategy, instead, each contractor only gets one lot in each period by bidding the reserve price only on that lot and bidding more on the other. The subcontractor in turn stays out and, once the competitive procedure is over, it is subcontracted a share of each lot. The colluding contractors face the trade-off between being awarded the lot(s), during the collusive path, and stealing the whole lots but being punished by an aggressive bidding thereafter. The subcontractor instead faces the trade-off between gaining the subcontracting shares, during the collusive path, and outbidding the reserve price in each lot but being punished by an aggressive bidding (and loosing any subcontract) thereafter.

We find that a simultaneous format induces less stable collusive agreements than a sequential format. In particular, simultaneous formats with split award induce the less stable agreement while the sequential format with bid rotation induces the most stable collusion. For both formats and collusive strategies, we find that increasing the subcontracting share increases the incentive to collude when the value of the share is low but it decreases this incentive when the value of the share is high. An increase in the subcontracting share, when its initial value is low, makes collusion stronger by reducing the incentive of the subcontractor to destroy the agreement. When instead the subcontracting share is already high, the contractors have the highest incentive to destroy the agreement by stealing the lots and avoiding to subcontract. In this scenario, a further increase in the subcontracting share strengthens this incentive to destroy the agreement.

To the best of our knowledge the relationship between the choice of the subcontracting share and the stability of a collusive agreement has not been deeply investigated, especially with regard to simultaneous and sequential competitive procedures. Most of the existing literature focuses either on subcontracting without a special focus on collusion in procurement contest or on the effect of sequential vs simultaneous auctions without a specific focus on subcontracting. We aim to fill this gap with the target of providing useful insights for the public procurement guidelines with respect to the allowed subcontracting share. Our result suggests that, when the risk of collusion in public procurement is high, setting the right format of a competitive procedure is more crucial than constraining the subcontract share on a specific ceiling, as for instance predicted by the Italian Public Contract Code. Public procurement authorities must be aware that the most collusive agreements are enforced under sequential formats by a bid rotation strategy, therefore simultaneous procedures are more suitable to mitigate collusion. Also, when fine tuning the subcontracting share then either high or low values of the share are preferable for any formats. An increase in the share must be allowed only when the initial share is already high while its reduction is preferable when the level is sufficiently low.

This paper contributes to the wide literature on collusion in procurement, with a particular focus on subcontracting, that has been showed having a twofold role, it may enforce the efficiency of the awarding procedures but it may also reduce competition. Our paper focuses on the second aspect. It is shown in literature that subcontracting may induce less competitive behaviors by indirectly affecting the main characteristics of the procurement process (such as participation). Recently Branzoli and Decarolis (2015) find that a first price auction induces a marked decline in both entry and subcontracting, with firms entering the auction being more likely to bid jointly in specific legal agreements (i.e. joint ventures). Conley and Decarolis (2018) empirically confirm the collusive behavior in the Italian public works finding how collusion works through the procurement format (average bid auction) and subcontracting.

Our theoretical analysis belongs to the literature studying how the competitive procedure format affects the risk of collusion. Within this line we confirm that sequential formats may facilitate collusion among bidders more than simultaneous ones (Admati and Perry 1991; Neher 1999; Baker 2002; Compte et al. 2002; Smirnov and Wait 2004; Albano and Spagnolo 2005, 2010; Albano et al. 2008).Footnote 1 In particular, Albano and Spagnolo (2010) provide a theoretical analysis of collusion in procurement with a special focus on the role a specific format (simultaneous/sequential) and lots asymmetry. The find that sequential procurement enforces collusion more than simultaneous procurement by allowing punishing deviations and fine-tune the incentive to deviate by means of the lots distribution. Our paper studies a similar procurement format where we introduce the possibility of fine-tuning the incentive to collude by allowing subcontracting. They show that the buyer may affect collusion by exploiting the asymmetry in the value of lots; we study instead how the buyer may affect collusion by fine-tuning the subcontracting share (that in turn affects the collusive value of lots).

As widely discussed by the main literature, on one hand subcontracting may improve efficiency by decreasing the procurement costs, stimulating participation and technological capacity (De Silva et al. 2012, 2017; Spiegel 1993; Atamtürk and Hochbaum 2001; Jeziorski and Krasnokutskaya 2016; Rondi and Valbonesi 2017; Moretti and Valbonesi 2015; Gil 2009; Gil and Marion 2013; Gale et al. 2000; Marion 2015; Decarolis 2018; Bouckaert and Van Moer 2017).

Further works study the relationship between contractual complexity/incompleteness and subcontracting, with a specific focus also on the bidding behaviors. This literature finds that contractual complexity (incompleteness) may be associated to more frequent subcontracting that, in turn, may induce less aggressive bidding (Monteverde and Teece 1982; Masten 1984; Masten et al. 1991; Marechal and Morand 2003; Gil 2007; Acemoglu et al. 2010; Forbes and Lederman 2009; Levin and Tadelis 2010; Lafontaine and Slade 2007; Gil and Marion 2013; Miller 2014; Marion 2015).

Section 2 introduces the model, Sect. 3 draws the main conclusions.

2 The model

A public buyer wants to procure two procurement contracts (defined as lot A and B) for an infinite number of periods, each denoted by t, with \( t=0,\ldots ,\infty \), through lowest-price sealed-bid auctions with a reserve price, either sequentially or simultaneously. Three long-lived firms, denoted by subscripts \(i=1,2\) and 3 can deliver the project.Footnote 2 All firms share the same discount factor, \(\delta \), but different production costs, \(c_{1}=c_{2}=c\le c_{3}=k\), for undertaking each of the two equivalent procurement contracts. Each firm perfectly knows its own and the rival’s cost.Footnote 3

The buyer commits to the same publicly announced reserve price, r, for each contract, with \(r>k\). Let us to define the highest profits by \(v=r-c\) for firm \(i=1,2\) and \(v_{3}=r-k\). The structures of the two competing formats are the following:

- Sequential format:

: At time t, the buyer sequentially launches the auction for each lot; participants bid first for the first lot and, once the auction for the first lot is over, they bid for the second. At the end of each auction, the buyer awards the lot to the lowest bid. At the end of each auction and subcontracting, if any, profits are realized.

- Simultaneous format:

: At time t, the buyer simultaneously launches the auction for both lots; participants simultaneously bid for both lots and each lot is awarded to the lowest bid. At the end of each auction and subcontracting, if any, profits are realized.

Each format is divided in two stages, the bidding stage where firms make the bid and an execution stage, occurring once the bidding is over. In the former, firms decide whether to participate and set their bids while in the latter firms deliver the contract and decide about the subcontracting. Each competitive format allows the possibility to subcontract a part of the lot. We assume that firm 1 and 2 are the contractors while firm 3 is the subcontractor (the role they strategically play within the two formats will be discussed when introducing the strategies of the game). Subcontracting implies that a subcontractor receives a share, \(\alpha \in \left( 0,1\right) \), of the contract from the firm awarded the lot and then it gains a profit of \(\alpha v_{3}\). When subcontracting a share \(\alpha \), the potential loss of profit for the winning contractor is \(\alpha v\), that is what it would have gained if it had delivered the entire lot. The subcontractor delivers the share \(\alpha \) of the contract at its cost k.

In public procurement the use of subcontracting is usually permitted (and sometimes also suggested) by the law to allow firms, specialized only in some contractual aspects, to participate to the tendering without being responsible for the entire contract that may be out of their financial (or technical) possibility. Subcontracting allows the buyer to exploit the expertise of such a firm, allowing to take part to the auction, without bidding for the entire contract. In our specific model, we aim to show that fine-tuning the subcontracting share allowed by the main procurement guidelines, may allow the buyer to affect the rick of collusion.

The trigger-collusive strategies we introduce are the following. In the sequential format firms apply a bid rotation strategy, denoted by \(\sigma _{R}\), whereas for the simultaneous format they apply a split-award collusive strategy, \(\sigma _{S}\). We denote by \(\sigma _{3}\) the strategy profile of the subcontractor (firm 3). We characterize the possible trigger strategies in the following definitions:Footnote 4,Footnote 5

\(\sigma _{S}:\) at time t, firm \(i=1,2\) bids \(b_{i}=r\) in lot A, \(b_{i}>r\) in lot B and subcontracts a share \(\alpha \) to firm 3 if, up to time \( t-1 \), firm \(j\ne i\) has bid \(b_{j}>r\) in lot A and firm 3 has not bid; otherwise it reverts to the bidding behavior of the static equilibrium for ever.

\(\sigma _{R}:\) at time t, firm \(i=1,2\) bids \(b_{i}=r\) in both lots and subcontracts a share of \(2\alpha \) to firm 3 and, at any time \(t+1\) it bids \(b_{i}>r\), if at time \(t-1\) firm \(j\ne i\) has bid \(b_{j}>r\) in both lots and firm 3 has not bid; otherwise it reverts to the bidding behavior of the static equilibrium for ever.

\(\sigma _{3}:\) at time t, firm 3 does not bid in any lot if up to time \( t-1\) it has been subcontracted a share of \(2\alpha \); otherwise it reverts to the bidding behavior of the static equilibrium for ever.

When suppliers decide to collude they support the ring by the threat of reverting to competitive behavior forever in case a deviation is observed. It is straightforward to show that such a punishment leads to a standard asymmetric Bertrand equilibrium with zero profits for all the firms. The per-period collusive profits are the following:

Sequential format: Under bid rotation, the winning candidate, i, gains \(2v\left( 1-\alpha \right) \) while firm 3 gains \( 2\alpha v_{3}\); under split award the winning candidate gains \( v\left( 1-\alpha \right) \) while firm 3 gains \(2\alpha v_{3}\).

Simultaneous format: The payoffs are the same of the sequential case for both bid rotation and split award strategies .

Firms may have several deviations from the equilibrium path. Firm \(i=1,2\) may stick to the collusive behavior at the bidding stage and then deviate at the execution stage where, once the auction is over, a deviation would entail not subcontracting the lot. The profits from the deviations at the bidding stage are summarized in what follows.

- Sequential format::

Under bid rotation: (a) firm 3 does not bid and (one out of) firm \(i=1,2\) deviates, in this case the contractor not expected to win any lot has the highest incentive to deviate. Its optimal deviation ensures a profit of v because it entails a bid marginally below r on one lot and no subcontracting, such a deviation is then punished in the second lot, (b) firm 3 bids when firm \(i=1,2\) colludes, in this case its optimal deviation entails no bid at the first lot, allowing a profit of \(\alpha v_{3}\), and outbids the rival at the second lot and gaining \(v_{3}\), note that such a deviation excludes the subcontract; Under split award: (a) firm 3 does not bid and (one out of) firm \(i=1,2\) deviates, in this case the optimal deviations is such that the firm awarded the first lot (the one with the highest incentive to deviate) keeps colluding at the first lot, gaining \(v\left( 1-\alpha \right) \), but it bids marginally below r on the second lot without subcontracting, gaining v, (b) firm 3 bids when firm \(i=1,2\) colludes, the optimal deviation of firm 3 is the same in the above point (b).

- Simultaneous format::

Under bid rotation: (a) firm 3 does not bid and (one out of) firm \(i=1,2\) deviates, in this case the optimal deviation entails a bid marginally below r on both lots, allowing a gain of 2v, (b) firm 3 bids when firm \(i=1,2\) colludes, such a deviation allows a gain \(2v_{3}\) under both bid rotation and split award, firm \(i^{\prime }\)s profit is zero. Under split award: (a) firm 3 does not bid and (one out of) firm \(i=1,2\) deviates, again the optimal deviation entails outbidding the rival on both lots and gaining 2v, (b) firm 3 bids when firm \(i=1,2\) colludes, in this case the optimal deviation of firm 3 is the same of the sequential format.

Consider now the deviations from the execution stage:

- Sequential format::

Under bid rotation, the most profitable deviation is for the firm expected to be awarded both lots, and it is such that the refusal of subcontracting occurs only at the second lot, in this case the deviation profit is \(v\left( 1-\alpha \right) +v\). Clearly, any possible deviation for the firm not expected to be awarded any lot any is included in the deviation at the bidding stage.

- Sequential format::

Under split award, the most profitable deviation allows a profit of v. All other deviations must work through an initial deviation at the bidding stage, therefore are included in the previous discussed.

- Simultaneous format::

Under bid rotation, the most profitable deviation is for the firm expected to be awarded both lots and it allows a deviation profit of 2v in the period of deviation. Any deviation for the firm not expected to be awarded any lot must work through an initial deviation on the bidding stage, then it is included in the one discussed for the bidding stage.

- Simultaneous format::

Under split award, a possible deviation is the one in its own lot and it induces a deviation profit of v. Other deviations work through the bidding stage and are included in the previous discussion.

Once we have the all profits for any possible scenario, we can characterize the incentive to collude. As standard for the collusive model, subgame perfect equilibria characterizing collusive agreements arise for sufficiently high value of the discount factor. We define the lowest discount factors such that each firm sticks to the collusive agreement (also defined as critical discount factors) for each auction format and strategy by \(\delta _{SimBR}\), \(\delta _{SimSA}\), \(\delta _{SeqBR}\) and \(\delta _{SeqSA}\) where the first part of the subscript denotes the auction format and the second the collusive strategy. The following Proposition gives the main result of the paper:

Proposition 1

Let \(\delta _{SimBR}\),\(\delta _{SimSA} \), \(\delta _{SeqBR}\) and \(\delta _{SeqSA}\) be:

The strategy profiles \(\sigma _{R}\), \(\sigma _{S}\) and \(\sigma _{3}\) characterize the following SNE: (i) under a sequential format when \(\delta \ge \delta _{SeqBR}\) and \(\delta \ge \delta _{SeqSA}\) and (ii) under a simultaneous format when \( \delta \ge \delta _{SimBR}\) and \(\delta \ge \delta _{SimSA}\).

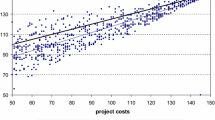

The Proposition defines the critical discount factor for each format and strategy. Formally speaking each definition describes the discount factor as the envelop of the two values within the bracket (the first term is the discount factor for firms 1 and 2 while the second indicates the discount factor for firm 3). By comparing these functions the Proposition shows that a simultaneous format induces less collusion than a sequential format. In particular, the shape of the discount factors shows that the less stable agreement occurs for simultaneous formats with split award. The highest critical discount factor over the all scenarios is in fact \(\delta _{SimSA}\), given by the upper envelop of the green (\(\frac{1+\alpha }{2}\)) and red line (\(1-\alpha \)). In the Figure are drawn the relationships between the minimum discount factor above which collusion is sustainable and the share of the lots delegated to the subcontractor in the four possible cases.

We observe that in both formats, the incentive to collude (given by the highest among the discount factors defined in the Proposition) show a non-monotonic trend in the subcontracting share. Increasing the subcontracting share increases the incentive to collude when the values of the share are low (see the downward sloping part of the discount factor) but it makes the agreement less stable for high value of the share (the upward sloping part of the discount factor). The simultaneous format with bid rotation shows a more stable collusion because \(\delta _{SimBR}\), given by the red line, that is the upper envelop of \( \sqrt{\alpha }\) and (\(1-\alpha \)), is just below \(\delta _{SimSA}\). However, as for the split award, the trend of \(\delta _{SimBR}\) shows that allowing a higher subcontracting share induces more collusion only for low values of the share whereas it reduces collusion for high values.

With simultaneous formats, when the values of the shares are low, the subcontractor’s incentive to enter the lots and destroy the agreement is the main driver of the agreement instability,Footnote 6 and this incentive is the same under both strategies. In this range of values, an increase in the share makes collusion stronger because it reduces this incentive to destroy the agreement. In this sense, this increase in the contracting share reduces the short run incentive to deviate for firm 3. For high values of the share, instead, the main driver of the agreement stability is the contractors’ incentive to destroy the agreement by stealing the lots and avoiding to subcontract.Footnote 7 In this range of values, a further increase in the initial share makes this incentive stronger by increasing the deviation profit for the contractor that finds it more profitable to outbid the other contractor and keep the entire deviation profit by avoiding subcontracting.

Under sequential formats the use of bid rotation strategies characterizes the most stable collusive agreement. Note in fact that \(\delta _{SeqBR}\), given by the lower envelop for the black (\(\frac{ \sqrt{\alpha \left( 2-\alpha \right) }}{2-\alpha }\)) and blue (\(\frac{ 1-\alpha }{1+\alpha }\)) part, is the lowest one (it is composed by the entire black line). As for the simultaneous format, split award strategies induce less collusion than bid rotation, in fact \(\delta _{SeqBR}\) is below \(\delta _{SeqSA}\), that is the lower envelop of functions \(\frac{1}{2-\alpha }\) and \( \frac{1-\alpha }{1+\alpha }\) (the decreasing black and increasing blue line). The incentive of the subcontractor to enter the auctions and steal the lots are again the same in both strategies but, for the contractors, the split award strategy implies less collusive profits and higher deviation profits. However, the main arguments for the simultaneous format still hold. For low values of the share the main driver of the agreement stability is again the incentive (that is the discount factor) of the subcontractor, for high values instead the incentive of the contractors dominates.Footnote 8 Even in the case of sequential formats there exist the non-monotonicity with respect to the subcontracting share: an increase in share induces less collusion for high values and eases collusion for low values.

We show then that subcontracting is a way to deter a potential “outsider” firm to compete on the auction market. As a result, the higher the share granted to the subcontractor, the lower its incentive to deviate. When the starting share is low, this effect is the main driver of the incentive to collude. In addition, the higher the share granted, the lower the share of the profit for the contractor, that is the firm that wins the auction. For sufficiently high values of the share this effect on the contractor is the main driver of the collusive scheme. In other terms, subcontracting works as a way to enforce side payments between firms to sustain collusion; side payments that would be illegal otherwise.

In the appendix we also solve the model for a more efficient subcontractor (the case \(c_{3}=k<c\)) and the qualitative results do not change. We obtain that, for both formats, when the subcontracting share is low, the equilibrium discount factor of firm 3 shifts up, therefore the agreement becomes less stable (the set of the discount factors enforcing collusion gets smaller). The intuition is clear, weaker the punishment for the deviating firm 3, higher the incentive for this firm to deviate from the agreement.Footnote 9

3 Conclusions

This paper studies how subcontracting may affect collusion in public procurement. In an infinitely repeated procurement scenario in which contractors and subcontractors are both involved in a collusive agreements, we find that simultaneous competitive procedures induce less collusion than sequential procedures under both slit award and bid rotation collusive scheme. In particular, a simultaneous format in which contractors and subcontractors collude on split award strategies induce the less stable collusive agreement. The most stable agreement, instead, arises under a sequential format in which the firms choose bid rotation collusive schemes. The subcontracting share also plays a crucial role to fine tune the risk of collusion. Allowing a further increase in the subcontracting share strengthens collusion when the share is low but it mitigates collusion when the share is already high. Public procurement authorities should be concerned that allowing a specific subcontracting share may have opposite effects on the willingness to collude. Increasing the share, when the initial level is low, may strengthen collusion whereas it may reduce the incentive to collude when the share is already high. An appropriate competitive format is also crucial when there exists a risk of collusion, in fact, ceteris paribus we confirm that simultaneous procedures should be preferred to sequential ones.

Notes

An analysis on simultaneous vs sequential formats without focus on subcontracting and not in a specific procurement setting is provided by Dulatre and Sherstyuk (2008). The efficiency of subcontracting in a sequential format, without focus on collusion, is analyzed by Kamien et al. (1989), Gale et al. (2000), Dudey (1992) and Spiegel (1993). Subcontracting in procurement without collusion has been studied in Wambach (2009).

Our model is similar to Albano and Spagnolo (2010), however their framework does not include subcontracting.

The assumption of complete information among participants has been commonly used in procurement because it is realistic for many procurement situations (Albano and Spagnolo 2010). The same assumption in the scenario of repeated procurement is used in Spagnolo and Calzolari (2009) and Albano et al. (2017, 2018).

Other trigger strategies in such a repeated game are clearly possible, for instance strategies totally avoiding subcontracting (i.e. a standard bid rotation collusive agreements). However, we decide to keep the subcontracting scenario to challenge the common idea behind some legal scenarios (for instance in Italy) such that a higher subcontracting share is usually a risk for collusion.

Formally speaking, the lowest discount factor such that the subcontractor does not deviate from the collusive strategy is the highest among the others.

At these higher values of the subcontracting share, the lowest discount factor such that each contractor does not deviate from the collusive strategy is the highest among the others.

Again, as above, formally speaking this means the critical discount factor for the contractor is the highest one.

In our model each lot represents a specific contract and the number of lots is even and equal to the number of firms taking part to the auction (1 and 2). Relaxing this assumption and changing the number of contracts in a simultaneous format, under both bid rotation and slip award strategies, does not affect the critical discount factor for 1 and 2 as far as they equally split the number of contracts during the collusive path. In fact, such a collusive strategy would increase the collusive and the deviation profit by the same amount. The same argument holds for firm 3. Critical discount factors may change for the sequential format as far as the auctions for each lot are not equally allocated over the two periods (more contracts auctioned in one period). Furthermore, with respect to firm 1 and 2, as far as they keep the same cost it would be even difficult to justify a collusive strategy allowing one firm on the stage with, let’s say, more contracts.

References

Acemoglu, R., Griffith, P., Aghion, F., & Zilibotti, F. (2010). Vertical integration and technology: Theory and evidence. Journal of the European Economic Association, 8(5), 989–1033.

Admati, A. R., & Perry, M. (1991). Joint projects without commitment. Review of Economic Studies, 48, 259–276.

Albano, G. L., & Spagnolo, G. (2005). The collusive drawbacks of sequential auctions, Quaderni Consip. http://www.consip.it/sites/consip.it/files/896660_Quaderni_IX_2005.pdf

Albano, G. L., Cesi, B., & Iozzi, A. (2017). Public procurement with unverifiable quality: The case for discriminatory competitive procedure. Journal of Public Economics, 145, 14–26.

Albano, G. L., Cesi, B., & Iozzi, A. (2018). Teaching an old dog a new trick: Reserve price and unverifiable quality in repeated procurement. SSRN: https://ssrn.com/abstract=3057659

Albano, G. L., & Spagnolo, G. (2010). Asymmetry and collusion in sequential procurement: A “Large Lot Last” policy. The BE: Journal of Theoretical Economics, 10, 1–18.

Albano, G. L., Spagnolo, G., & Zanza, M. (2008). Regulating joint bidding in public procurement. Journal of Competition Law & Economics, 5(2), 335–360.

Anton, J., Brusco, S., & Lopomo, G. (2010). Split-award procurement auctions with uncertain scale economies: Theory and data. Games and Economic Behavior, 69, 24–41.

Anton, J., & Yao, D. (1989). Split awards, procurement, and innovation. The Rand Journal of Economics, 20, 538–552.

Anton, J., & Yao, D. (1992). Coordination in split award auctions. The Quarterly Journal of Economics, 107, 681–707.

Atamtürk, A., & Hochbaum, S. (2001). Capacity acquisition, subcontracting, and lot sizing source. Management Science, 47(8), 1081–1100.

Baker, J. (2002). Mavericks, mergers, and exclusion: Proving coordinated competitive effectsunder the antitrust laws. New York University Law Review, 77, 135–203.

Bouckaert, J. M. C., & Van Moer, G. (2017). Horizontal subcontracting and investment in idle dispatchable power plants. International Journal of Industrial Organization, 52, 307–332.

Branzoli, N., & Decarolis, F. (2015). Entry and subcontracting in public procurement auctions. Managemt Science, 61(12), 2945–2962.

Calzolari, G., & Spagnolo, G. (2009). Relational Contracts and Competitive Screening, CEPR Discussion Paper No. DP7434

Compte, O., Jenny, F., & Rey, P. (2002). Capacity constraints, mergers and collusion. European Economic Review, 46, 1–29.

Conley, T., & Decarolis, F. (2018). Detecting bidders groups in collusive auctions. American Economic Journal: Microeconomics, 8(2), 1–38.

De Silva, D. G., Kosmopouloub, G., & Lamarcheb, C. (2012). Survival of contractors with previous subcontracting experience. Economics Letters, 117, 7–9.

De Silva, D. G., Kosmopouloub, G., & Lamarcheb, C. (2017). Subcontracting and the survival of plants in the road construction industry: A panel quantile regression analysis. Journal of Economic Behavior & Organization, 137, 113–131.

Decarolis, F. (2018). Comparing public procurement auctions. International Economic Review, 59(2), 391–419.

Dudey, M. (1992). Dynamic Edgeworth–Bertrand competition. Quarterly Journal of Economics, 57, 1661–77.

Dulatre, J., & Sherstyuk, K. (2008). Market performance and collusion in sequential and simultaneous multi-object auctions: Evidence from an ascending auctions experiment. International Journal of Industrial Organization, 26, 557–572l.

EU Directive (2014/24) EU Procurement Directive. https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex%3A32014L0024

Forbes, S. J., & Lederman, M. (2009). Adaptation and vertical integration in the airline industry. American Economic Review, 5(9), 1831–49.

Gale, L., Hausch, D. B., & Stegeman, M. (2000). Sequential procurement with subcontracting. International Economic Review, 41(4), 989–1020.

Gil, R. (2007). “Make-or-buy” in movies: Integration and ex-post renegotiation. International Journal of Industrial Organization,25(4), 643–655.

Gil, R. (2009). Revenue sharing distortions and vertical integration in the movie industry. The Journal of Law, Economics, & Organization, 25(2), 579–610.

Gil, R., & Marion, J. (2013). Self-enforcing agreements and relational contracting: Evidence from california highway procurement. The Journal of Law, Economics, and Organization, 29(2), 239–277.

Jeziorski, P., & Krasnokutskaya, E. (2016). Dynamic auction environment with subcontracting. The RAND Journal of Economics, 47(4), 751–791.

Kamien, M., Li, L., & Samet, D. (1989). Bertrand competition with subcontracting. Rand Journal of Economics, 20, 553–67.

Lafontaine, F., & Slade, M. (2007). Vertical integration and firm boundaries: The evidence. Journal of Economic Literature, 45(3), 629–685.

Levin, J., & Tadelis, D. (2010). Contracting for government services: Theory and evidence from US cities. Journal of Industrial Economics, 58(5), 507–541.

Marechal, F., & Morand, P. (2003). Pre vs. post-award subcontracting plans in procurement bidding. Economics letters, 81, 23–30.

Marion, J. (2015). Sourcing from the enemy: Horizontal subcontracting in highway procurement. The Journal of Industrial Economics, 63(1), 100–128.

Masten, S. (1984). The organization of production: Evidence from the aerospace industry. Journal of Law and Economics, 27, 403–418.

Masten, S. E., Meehan, J. W., & Snyder, E. A. (1991). Costs of organization. Journal of Law Economics and Organization, 7, 127.

Miller, D. P. (2014). Subcontracting and competitive bidding on incomplete procurement contracts. The RAND Journal of Economics, 45(4), 705–746.

Monteverde, K., & Teece, D. J. (1982). Supplier switching costs and vertical integration in the automobile industry. The Bell Journal of Economics, 13(1), 206–213.

Moretti, L., & Valbonesi, P. (2015). Firms’ qualifications and subcontracting in public procurement: An empirical investigation. The Journal of Law, Economics, and Organization, 31(3), 568–598.

Neher, D. V. (1999). Staged financing: An agency perspective. Review of Economic Studies, 66, 255–274.

Rondi, L. & Valbonesi, P. (2017). Pre and post-award outosourcing: Temporary partnership versus subcontracting in public procurement, “Marco Fanno” Working Papers 0211, Dipartimento di Scienze

Smirnov, V., & Wait, A. (2004). Hold-up and sequential specific investment. Rand Journal of Economics, 35(2), 386–400.

Spiegel, Y. (1993). Horizontal subcontracting. Rand Journal of Economics, 24(4), 570–590.

Wambach, A. (2009). How to subcontract? Economics Letters, 105, 152–155.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Proof of Proposition 1

We simply find the lowest discount factor such that collusion is stable in any format for any collusive strategy.

(1) Simultaneous format with bid rotation. Assume firm 1 gets the collusive profit at \(t=0\), then when sticking to the collusive path of \( \sigma _{R}\) its discounted profit is:

whereas when deviating the discounted profits starting from the current period of deviation are:

Note that in this case the deviation at the bidding and the execution stage give the same deviation profit, then:

Is is easy to see that we have the same discount factor for firm 2. The collusive and deviation profits for firm 3 are respectively:

and

then

(2) Simultaneous format with split award. The collusive profit for each firm, when sticking to the collusive path in \(\sigma _{S}\), is:

whereas when deviation at time \(t=0\), the discounted profits are:

where \(V^{C}\ge V^{D}\) if:

The discounted cooperative profits for firm 3 are the same in (2), its deviation profit is the same as in (3), then:

(3) Sequential format with bid rotation. The cooperative discounted profits are the same in (1), the best deviation is now that one at the execution stage by the firm awarded the contract. Thus, when deviating at the first lot, the deviation profits are:

Then:

For the firm 3 the cooperative profit is the same in (2). Its deviating profits are:

(4) Sequential format with split award. Cooperatives profits are:

the highest incentive from deviation is gained by the firm awarded the auction at the first stage (first lot), in fact, it is better off by winning the first lot, as the agreement entails, subcontracting without destroying the agreement and getting \(v\left( 1-\alpha \right) \), but then deviating at the second lot, where it obtains v.

then:

For firm 3 we have the same results of the case 3. \(\square \)

Extension to the case of an efficient subcontractor

Consider \(c>k\). In this case firm 3 is more efficient, this changes its profit in the asymmetric Bertrand equilibrium of the punishment path, that now becomes \(c-k\). The discount factors for firm \(i=1,2\) do not change. Thus in what follows we can only consider firm 3. The proof follows the steps of the proof of the Proposition 1.

(1) Simultaneous format with bid rotation. For firm 3, the collusive profit does not change but the new deviation profits are respectively:

and:

Note that in order to let the participation constraint to hold we need the assumption \(\alpha >\frac{c-k}{r-k},\) ensuring that the collusive profit is higher than the profit of the Nash equilibrium of the Bertrand equilibrium (during the punishment). Then:

with \(\beta =\frac{r-k}{r-c}>1\).

(2) Simultaneous format with split award. The discounted cooperative profits for firm 3 are the same in (2), it deviation profits are the same in (5), then the discount factor is the same of (6).

(3) Sequential format with bid rotation. For the firm 3 the cooperative profit is the same in (2). Its deviating profits are:

Note that \(\delta _{3,c}=\frac{1-\alpha }{1+\alpha -2\frac{\left( c-k\right) }{\left( r-k\right) }}>\delta _{3,c}=\frac{1-\alpha }{1+\alpha }\).

(4) Sequential format with split award. For firm 3, is the same as in the case3.

It possible to see that the new critical discount factor for firm 3 shifts up (since \(\beta >1\)). \(\square \)

Rights and permissions

About this article

Cite this article

Cesi, B., Lorusso, M. Collusion in public procurement: the role of subcontracting. Econ Polit 37, 251–265 (2020). https://doi.org/10.1007/s40888-019-00167-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40888-019-00167-3