Abstract

Janssen et al. (Exp Econ 14:547–566, 2014) studied an asymmetric, finitely repeated common-pool resource dilemma with free-form communication in which subjects made decisions about investments in an infrastructure, and about extraction from a resource made available by this infrastructure. They found that infrastructure provision and joint payoffs converged to high levels because structurally advantaged head-enders tend to behave fairly by restricting themselves voluntarily at the extraction stage, and structurally disadvantaged “tail-enders” reciprocate by investing. This paper reports a fully independent, pre-registered, double-blind replication attempt conducted in a different lab, that also supplies elevated statistical power and adheres to the highest principles of scientific transparency and openness. We find that the key results of Janssen et al. not only re-appear qualitatively but are quantitatively and statistically strengthened. The conclusions drawn from the results are therefore robust, and the basic design can be confidently used for follow-up research.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In a laboratory experiment, Janssen et al. (2011) studied an asymmetric, finitely repeated common-pool resource dilemma with free-form communication in which subjects made decisions about investments in an infrastructure, and about extraction from a resource made available by this infrastructure. The key feature is that the players in a group occupy distinct positions regarding resource access priority, such that the double problem of cooperation and coordination is elevated compared to a symmetric setting because upstream players (“head-enders”) have material interest to exploit their advantaged position and disadvantaged downstream players (“tail-enders”) hence have a particularly weak incentive to invest.Footnote 1 Nevertheless, infrastructure provision and joint payoffs converged to high levels in the experiment. The key result underlying this outcome is that downstream players tended to condition their investment positively on their share of resource extraction in the previous period. Janssen et al. interpret this as evidence for a reciprocity relationship in which head-enders behave fairly by restricting themselves voluntarily at the extraction stage, and tail-enders respond in kind by investing.

The results are interesting and policy relevant. But the data basis of six groups (of five players each) in the main experiment, gathered in a single lab, leaves scope for concern. First, the experimental game is more complex than standard public good or common-pool resource games, involving real-time interaction, a challenging user interface, and free-form communication. This can potentially produce quite unique group dynamics and give specific lab procedures and local sampling population characteristics a pivotal role. Second, the key result mentioned above is not based on treatment-induced variance, but derived from econometric analysis, and the estimation methods used are designed for larger datasets.

The aim of the study reported in this paper was to check (1) whether the key findings of Janssen et al. are replicable in a fully independent, pre-registered, double-blind replication attempt conducted in a different lab, (2) to provide elevated statistical power, and to (3) adhere to the highest principles of scientific transparency and openness by making all procedural documents, experimental materials, and anonymized data publicly accessible.

2 Methods and procedures

The original experiment of Janssen et al. (2011) was done in the Computer Assisted Research Laboratory (CARL) at the Institute for Social Science Research at Arizona State University (Tempe, Arizona, USA) between November 2007 and February 2008. The replication experiment reported here was conducted in the Research Laboratory of the Faculty of Business, Economics, and Social Sciences (WISO Lab) at Universität Hamburg (Hamburg, Germany) on September 8th and 9th, 2021. Both experiments were computerized, anonymous, and involved monetary payoffs conditioned on game outcomes. Details follow.

2.1 Experimental game

Like in the original study, the experiment is framed in terms of a “downloading” game. The game is repeated for ten rounds,Footnote 2 with fixed groups, which involve five players located in distinct positions: A, B, C, D, and E.Footnote 3 Positions are assigned randomly and remain fixed throughout all rounds. Each round begins with a 60 s period in which players can exchange free-form messages through a chat window. After that period, players get an endowment of ten tokens each, and then independently and simultaneously invest integer amounts into a public infrastructure. Joint (i.e. the sum of) investments determine the “bandwidth” of the infrastructure for the current round, measured in kilobytes per second (kB/s), according to a sigmoid production function that is shown in Table 1.

After submission of the investments, players are informed about how much each member of their group invested, and how much bandwidth was created based on their joint investment. Then, there is a 100 s period during which players can “download” between zero and ten “files” of 100 kilobytes (kB) each in real time, by clicking on respective buttons on-screen. Independently from the bandwidth, the maximum downloading speed for each player is limited to 25 kB/s, such that one download takes at least four seconds. However, player A has priority access to the available bandwidth over player B, such that the amount of bandwidth which is not used by player A is available for player B. Likewise, player B has priority access over player C, and so on. Thus if 40 kB/s is available, and player A is downloading, 15 kB/s is available for player B, and nothing for players C through E. An animated on-screen dashboard, shown in Fig. 1 (see the Electronic Supplementary Material to this paper for further details), shows the players all the information about bandwidth and downloads in real time.

The payoffs from the downloading stage depend sigmoidally on the number of files downloaded, as shown in Table 2. The total payoff for a player in a round is the endowment minus investment plus the amount of tokens earned by downloading files (“downloading payoff”). The total payoff for a player in the experiment is the payoffs summed over all ten rounds.

2.2 Procedures

The replication study was fully independent, that is, we used only the published report of the original study and the Electronic Supplementary Material, which includes a single file containing a brief description of procedures and a transcript of the experimental instructions but no data.Footnote 4 Based on this information, we devoted great care in re-constructing the original experimental setup as close as possible, including the experimental instructions and the on-screen user interface. Notably, there is a major inconsistency in the original study: in the paper, Janssen et al. write that the size of each file is 250 kb, whereas in their experimental instructions, subjects are explained that the files are 100 kb. We assume that the instructions are correct. Some further minor procedural details were not transparent from the published material, such as the exact on-screen presentation of the experimental instructions. On those details we had to make our own decisions. The experiment was implemented in oTree (Chen et al., 2016) with a hypertext markup language (HTML) user interface, and administered with hroot (Bock et al., 2014). The experimental instructions and screenshots of the in-game user interface are provided in the Electronic Supplementary Material to this paper. All original screens (in zipped HTML and Java Script) are also available online in the OSF replication pack (Jarke-Neuert 2022).

An extensive study pre-registration including basic study information, a design plan, a sampling plan, a variables description, and an analysis plan was crafted by the author of this paper, peer-reviewed by three competent researchers between February 24th and March 2nd, 2020, and registered with the Center of Science (Charlottesville, Virginia, USA) using the Open Science Framework (OSF). The local IRB approved the study on February 25th, 2020. Additional review by the BRANY SRB IRB (Lake Success, New York, USA) was completed by August 28th, 2020, granting exempt status under applicable US research ethics law. All documents are available online in the OSF replication pack (Jarke-Neuert 2022).

Except for a delay in data collection due to the COVID-19 pandemic the experiment was conducted as planned, and in compliance with applicable health protection provisions and under supplementary safety measures. Subjects were recruited by electronic invitation from the WISO Lab database that contains a large and diverse set of students from the Universität Hamburg. Subjects self-selected into one of the four sessions until they were full. A session breakdown is shown in Table 3.

Upon entering the laboratory, subjects were randomly assigned (by physically drawing cards with seat numbers) to computer terminals. Terminals were then randomly matched electronically (by pseudo-random number generation) into groups and to roles (positions A through E). Booths separated the participants visually, ensuring that they made their decisions anonymously and independently. Direct communication among them was strictly forbidden for the duration of the entire session. Furthermore, subjects did not receive any information on the personal identity of any other participant, neither before, nor during or after the experiment.

At the beginning of the experiment, that is, before any decisions were made, subjects received detailed written instructions that explained the exact structure of the game and the procedural rules. The same instructions as in the original study were used, except minor adjustments, such as the currency and exchange rate. The instructions were shown on screen (see the Electronic Supplementary Material for the full instructions), a summary was also provided on paper.

The experiment began with two practice rounds. Subjects were informed that these rounds did not count for their monetary earnings. Then the first of the ten rounds of the experimental game began. Groups were not re-matched after the practice periods, and subjects were reminded that decisions from that point on count towards their earnings.

After the end of the final period of the experimental game, subjects were informed about their payoffs, and then individually called to the experimenter booth, paid out (per random number matched to their decisions; no personal identities were used throughout the whole experiment) and dismissed. The exchange rate was €0.08 per token. A session took about an hour. Average earnings were €17.99 (minimum €8.08, maximum €21.04), including a show-up fee of €4.Footnote 5

The data analyst and author of this paper was not present in the lab during the experimental sessions but only received the anonymized data. This procedure rules out any interference with the data collection process.

2.3 Hypothesis

The Nash equilibrium investments under the assumptions that the players have zero reaction time and maximize their earnings are zero: upstream participants (“head-enders”) have an incentive to free-ride on the investments of the downstream participants (“tail-enders”) by downloading as much as possible and investing as little as possible, hence tail-enders will not invest given they expect the head-enders will not leave them a return, such that the investment incentive collapses for all.Footnote 6 By backwards induction, it is clear that this outcome is independent of the number of rounds the game is repeated, as long as the number is finite.

Based on the extant experimental literature, Janssen et al. (2011) reasoned about how groups might escape the Nash outcome: tail-ender subjects could be willing to increase investments in public infrastructure provision under the condition that they receive a fair share of the resulting resource flows from previous rounds of the game. They tested this hypothesis with a mixed-effects linear regression model that uses investment levels in the public infrastructure as the dependent variable, and the position of the individual, the round number, and the share of tokens earned at the downloading stage in the previous round as independent variables. The hypothesis implies that the interaction effect between position and the payoff share being positive, that is, if tail-enders get a higher share, they invest more in the shared infrastructure in the next round. Janssen et al. (2011) found the interaction effect indeed to be positive (see Table 5). The present study re-tests this hypothesis.

3 Results

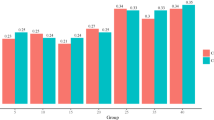

A comparison of the basic experimental outcome statistics across the original and the replication studies is listed in Table 4. The investment patterns are remarkably close. In both studies, the average subject invests a considerable amount, although tail-enders invest somewhat less than head-enders. Regarding downloads, the pattern is similar in both studies as well, although in the replication study subjects in any position manage to download a few more files within the 100 s period, and the inequality between head-enders and tail-enders is a bit less pronounced.Footnote 7 The latter facts are also reflected in the payoffs, shown in the right-hand columns.

The key results for replication are maximum likelihood estimates of a mixed-effects regression model of investment that captures important behavioral dynamics (Janssen et al. 2011, p. 561). The regression has the individual investment amount (in tokens) as a dependent variable and includes individual-level and group-level random intercept components in addition to a constant. The predicting terms are a round counter (\(1,2,\ldots ,10\)), a position indicator (\(A = 1\), \(B=2\), \(\ldots\), \(E =5\)), the download payoff by the respective subject in the previous period as a fraction of the joint group download payoff in the previous period (“lagged share”, a real number in the unit interval), and an interaction between lagged share and position.

For easy comparison, the estimates of the original study are re-listed in the “original” column of Table 5. The negative sign of the position coefficient means that the further downstream the position of the player, the smaller the investment, all else equal. The lagged share and interaction term coefficients jointly mean that head-enders (player A) tend to reduce investment in response to a higher previous period share, whereas it is the other way around for the players downstream. Specifically, the positive sign of the interaction term coefficient means that this positive response is the greater the further downstream the player is located. Janssen et al. (2011, p. 562) interpret this as evidence for the reciprocity relationship outlined in the introduction of this paper, or in greater detail in the introduction of the original paper.Footnote 8

As evident from the “replication” column of Table 5, the qualitative results re-appear in our replication study, and are quantitatively and statistically even stronger than in the original study. This fact also applies to the regressions with downloading payoffs as a dependent variable, as shown in Table 6.Footnote 9 Here, “lagged share” is replaced by “investment share”, which is the investment by the respective subject as a fraction of the joint group investment in the current period (a real number in the unit interval), and the current bandwidth is included as an additional control variable. The coefficients of the investment share variable and the interaction with the position variable are much greater in absolute value, and statistically much more robust.Footnote 10 Again, it is the positive sign of the interaction term that can be interpreted as evidence for the reciprocity relationship outlined in the introduction (Janssen et al. 2011, p. 563), as tail-enders seem to get instantly rewarded for their investment. Thus, both the key results and the interpretation of Janssen et al. (2011) are consistent with the present replication results.

Notes

There are many examples of common-pool resource dilemmas with inherent access asymmetry, but Janssen et al. (2011) motivate the setting in terms of irrigation systems.

The experiment included two practice rounds that did not contribute to final payoffs. See Sect. 2.2 below.

Janssen et al. also implemented a two-player version of game and another version of the five-player game in which partly downloaded files were lost if an upstream subject completely blocked access to the bandwidth by downloading a file. We do not consider those variations here.

Both are available under https://doi.org/10.1007/s10683-011-9281-9.

In the original study average earnings were USD 18.40, which corresponds (at an exchange rate of EUR 0.68 per USD on January 1st, 2008, the middle of the original study period) to EUR 12.51 at current prices at that time. Adjusting for historical inflation in the Euro area between 2008 and 2021 (approx. 18%), average earnings in the original study amount to EUR 14.76 at 2021 prices.

The joint payoff if nobody invests is 50 tokens (10 tokens for each player), but there are investments above the inflection point level (30 tokens) that yield higher payoffs. For example, with a joint investment of 31 tokens, the bandwidth is 23 kb/s, such that 23 files can be downloaded in total; if three players download 5 files each, and two 4 files each, the joint payoff is \(50-31+38=57\) tokens. The socially optimal (in the sense of the highest possible joint payoff) joint investments are 37 or 38 tokens. With an investment of 37 tokens the bandwidth is 36 kb/s, leading to five combinations of collecting 91 tokens from downloading 8 files by one player and 7 files by the others. A 38 tokens investment gives a 37 kb/s bandwidth, allowing for 10 combinations of collecting 92 tokens from downloading 8 files by two players and 7 files by three players. The joint payoff is 104 tokens in both cases. However, those outcomes are off Nash equilibrium under the stated assumptions, because head-enders have an incentive to download more files (i. e. the maximum of 10) and to free-ride on the investments of the tail-enders. See Janssen et al. (2011) for further discussion.

Recall that in the original paper the file size is reported to be 250 kb, whereas in the original experimental instructions subjects are explained that the files are 100 kb. A possible explanation for the differences in downloads and payoffs between the studies despite similar investment levels may be that the file size was in fact 250 kb in the original experiment. Participants in the replication study might also be more concerned with payoff equality.

The specification of the regression equation chosen by Janssen et al. (2011) essentially assumes that position and round are metric variables, such that the coefficients represent the slopes of a continuous, linear relationship. However, position and round are actually discrete variables that are more appropriately included in the regression as factor variables (i. e., dummy batteries). We provide estimates of this specification in Table 7 in the appendix. This is not only a technical issue, but we believe the results are clearer and easier to interpret. In particular, it uncovers that the effects for position E players are much greater than for the other downstream players. In Table 7 we also provide restricted maximum likelihood estimates, which are more robust for the relatively small number of groups at hand.

Again, we provide maximum likelihood and restricted maximum likelihood estimates of a specification with position and round being included as factor variables (i. e., dummy batteries) in Table 8 in the appendix.

It seems that in the original study part of this effect is picked up by the round coefficient.

References

Bock, O., Baetge, I., & Nicklisch, A. (2014). hroot: Hamburg registration and organization online tool. European Economic Review, 71, 117–120.

Chen, D. L., Schonger, M., & Wickens, C. (2016). otree-an open-source platform for laboratory, online, and field experiments. Journal of Behavioral and Experimental Finance, 9, 88–97.

Janssen, M. A., Anderies, J. M., & Joshi, S. R. (2011). Coordination and cooperation in asymmetric commons dilemmas. Experimental Economics, 14, 547–566.

Jarke-Neuert, J. (2022). Replication pack to the paper “Coordination and cooperation in asymmetric commons dilemmas: A replication study”, by Johannes Jarke-Neuert. Open Science Framework (OSF). https://doi.org/10.17605/OSF.IO/4NSA5 or https://osf.io/4nsa5/.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This article draws on funding from the United States Department of Defense through an award to the Center of Open Science (Charlottesville, Virginia, USA) under the Defense Advanced Research Projects Agency (DARPA) program Systematizing Confidence in Open Research and Evidence (SCORE), the Deutsche Forschungsgemeinschaft (DFG) via Excellence Cluster CLICCS (EXC 2037, 390683824), and the HelmholtzGemeinschaft (HGF) via Helmholtz Energy project RESUR. The replication material for the study is available at OSF under DOI https://doi.org/10.17605/OSF.IO/4NSA5 or URL https://osf.io/4nsa5/. The author thanks Cornelia E. Neuert, the COS team, and the WISO Lab team, especially David Lucius, for valuable support. Helpful comments from the editors Maria Bigoni and Dirk Engelmann, and two anonymous reviewers are gratefully appreciated. All remaining errors are the author’s.

Supplementary Information

Below is the link to the electronic supplementary material.

Appendix

Appendix

Table 7 shows a full factorial specification version of the regression shown in Table 5, and Table 8 a full factorial specification version of the regression shown in Table 6. Both are estimated by maximum likelihood estimation (MLE) and restricted maximum likelihood estimation (REML).

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Jarke-Neuert, J. Coordination and cooperation in asymmetric commons dilemmas: a replication study. J Econ Sci Assoc 9, 123–135 (2023). https://doi.org/10.1007/s40881-023-00131-9

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40881-023-00131-9