Abstract

India is the second-largest producer and consumer of sugar and sugarcane-based products. Changes in sugar production in India affect domestic and global markets of sugar and related industries. In this paper, a simultaneous equation model is developed to understand the interrelationship between sugar supply and demand in India using time-series data over 44 years from 1970–1971 to 2013–2014. Three-stage least square regression model was used to estimate the elasticities of supply and demand equations of sugar. Results revealed that price of sugar affected sugar supply positively and demand negatively. Recovery rate and amount of cane crushed have positive relationship with sugar production. Changes in current year area harvested, yield and FRP determine the future area under sugarcane cultivation. Rainfall and technology have supported to increase the yield. Sugar consumption has direct relationship with population rate. These results suggest that technological development, external trade and appropriate sugar policy measures are the primary choice to resolve the sugar complexities in future.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Analysing the role of market forces and governments on balancing sugar supply and demand in the market is important for the following four reasons. First, the Indian sugar market has experienced a series of policy changes affecting farmer—producers of sugarcane to processors to consumers. Second, India is the second-largest producer and consumer of sugar and sugarcane-based products. Hence, changes in sugar production not only affect the Indian sugar market but also distort the global market. Third, sugarcane and its derivatives are extensively used as raw materials in more than 25 industries, such as food, agriculture, energy, transportation, and education (Yadav and Solomon 2006). A shock in any sub-units of the sugar sector will affect the welfare of farmers, processors, and consumers. Fourth, energy security and environmental concerns over CO2 emission in recent decades call for relying upon zero pollutant resources; sugarcane is one such resource that provides highest energy-to-volume ratio, and its by-product ethanol is used in the automobile sector (Yadav and Solomon 2006; Walter et al. 2014; Jaiswal et al. 2017; Manochio et al. 2017)

Regardless of importance, fluctuations in sugar price and consequent profits/losses to farmers and processors (sugar mills) are not just concerns among researchers and academics but also a serious social and political issue in India. Such adverse situations arise due to asymmetric information and inefficient functioning of the market system. It is generally known that efficient marketing of agricultural products must ensure (1) remunerative price to farmers; (2) reasonable price to consumers; and (3) margin for processors and traders. Such a fair functioning of marketing system safeguards the interests of all stakeholders in the supply chain (Acharya and Agarwal 2011). Any imperfection in price allocation leads to poor gains for each participant in the marketing channel. Sugar marketing in India is a complex system with unpredictability in the nature of supply and price. In this situation, it is important to know the cause and effect between various market actors. Addressing the extent of causal effects transmitted among farmers, processors, retailers, and government agencies is imperative to identify the degree of market conduct and performance.

Indian sugar sector

Sugar is one of the essential food commodities and is treated as a prime sweetening agent in India. About 30% of total sugar production is consumed directly by the households, and the rest is used as raw material in many food industries (Abnave and Babu 2017). Sugarcane is the major source for about 90% of total sugar consumed in India. The sector contributes around 10% to the total agricultural GDP, supports nearly 50 million farmers and their families, and provides direct employment to over 0.5 million skilled and semi-skilled persons in sugar mills and associated industries (Indian Sugar Mill Association 2017). It is the second-largest producer after Brazil, with shares of nearly 15% and 25%, respectively, of sugar and sugarcane. With 735 operating sugar mills, India accounts for around 20% of the sugar mills in the world. In addition, there are 328 distilleries and 210 cogeneration plants, and numerous pulp, paper, and chemical making units. The industry produces around 350 million tons of cane, 22 million tons of white sugar, and 8 million tonnes of jaggery. Besides these, about 2.7 billion litres of alcohol and 2300 MW power, and many chemicals are produced from sugar industries. The industry is expected to export around 1300 MW of power to the grid in the future.

Given the constant demand and large proportion of domestic consumption (more than 90% of total production), surplus production of sugar results in decline of its prices and profitability of sugar industries. Thus, sugarcane farming and sugar industry are gripped with problems of excess production that results in market glut and delayed payment of dues to farmers. This further creates amount of ‘arrears’ to farmers, increasing cost of sugar production to sugar industries and burden on state governments to subsidise or to pay the statuary price for sugarcane. As a result, farmers are not only unpaid timely for their cane supply but also become not interested in sugarcane farming. This creates years of shortages, at least for the subsequent 2–3 years. As a consequence, sugar production in India has turned out to be cyclical. This kind of instability and unpredictability in sugarcane and sugar production has prevented the sector from achieving its full potential (Sharma et al. 2015). Thus, year-to-year fluctuation in sugarcane and sugar production is crucial for farmers and mill owners. On the other hand, production of sugarcane and sugar is technically constrained with many factors at individual farm–factory level. For instance, water does crucial role in sugarcane cultivation technically. As being the annual crop (12–16 months), cost of irrigation water in sugarcane farming covers 6–10% of total cost of cultivation, after labour hours (about 50%) (GoI 2017). Eventually, scarcity in water and labour during all round of the crop season and associated higher cost affect the choice of sugarcane and quantity supply at farm level. However, the present paper is primarily concerned with the cause and effect of macro-variables, as availability of historical information on water and labour use and cost is limited at national level.

Apart from sugar industries, numerous jaggery units are functioning in India. Jaggery industry has been enjoying the privileges of the absence of interventions from the public sector over a long period and ability to absorb sugarcane when reasonable prices for cane are not available from sugar mills. Till 1980s, more than 70% of the harvested sugarcane was used in jaggery production. Since then, the proportion has declined and greater demand has emerged for sugar production due to changes in per capita sugar consumption.

To safeguard the welfare of farmers and consumers, the Indian government has introduced periodically various price policy measures. Such interventions include the Sugar Industry (Protection) Act, 1932; Essential Commodity Act, 1955; Minimum Support Price (in the 1960s); Sugar (Control) Order, 1966; State Advisory Prices, 1970; Sugar Development Fund, 1982; Sugar Cess Act, 1982; Jute Packaging Material Act, 1987; Delicencing Sugar Sector, 1998; Ethanol Blending Programme, 2012; and Scheme for extending Financial Assistance to Sugar Undertakings in 2014. Experts have indicated that such interventions distort market equilibrium and result in crisis in sugar production (Shroff and Kajale 2014). In particular, imposition of levy under the Essential Commodity Act (1955) and FRP for cane at fixed rate created a state of no-linkage among cane price, sugar price, and the amount of supply and demand of sugar in the country (Meriot 2015; Sharma et al. 2015; Abnave and Babu 2017). Considering these difficulties, the Rangarajan Committee (2013) recommended partial decontrol of sugar sector to overcome market disequilibrium, and accordingly the Government of India removed levy quota and levy price from 2012 to 2013; let the sugar mills sell all their ex-mill sugar production in the open market.

In recent times, energy safety and environmental problems have inspired the use of ethanol in the automobile sector across the world. For example, Brazil, the USA, Europe, Australia, Canada, and Japan have followed fuel ethanol blending technology to reduce carbon emission. Government of India has set a target to reach ethanol blending with petroleum by 20%, but only 3.3% of the target was achieved in 2016 (Debnath and Babu 2018). It is expected that surplus sugarcane and sugar production can satisfy the raw material requirement of ethanol industry and thereby help to avoid the unpredictability of the sugar cycle.

Thus, sugarcane farming and sugar industry are gradually transforming into sugar complexes by involving different kinds of actors and stakeholders in different stages of production, processing, marketing, and consumption. Supply and demand of sugar in the country are constrained by many factors, such as technology, policy interventions, population, urbanisation, and development of food industries and super-markets. To assess the effect of key factors, such as changes in prices, technology, and policy reforms on sugar market, it is important to have more empirical research. The present study, therefore, attempted to estimate cause and effect of different components of sugar production under simultaneous equation model incorporating sugar demand, supply, sugarcane production, international trade, and government interventions.

The rest of the paper is organised as follows: “Review of empirical literature” section reviews empirical work related to supply and demand of food commodities and associated estimation problems. “Methodology” section deals with the data and methodology employed in the present study. “Results and discussion” section presents the results of the study and discusses the sugar sector, and “Conclusion and recommendations” section summarises and concludes the results of the study.

Review of empirical literature

In general, agricultural markets are assumed to be competitive, that is, there are large numbers of buyers and sellers for a single commodity. There are complex linkages between them that are distorted by many factors, including policy options and technologies (Borychowski and Czyżewski 2015). Marketing of an agricultural product is not unidirectional but an economic system, where cause and effects are represented by a set of equations. Interrelationship between these equations and coefficients is estimated together as a change in the parameters of an equation is expected to affect the state of other variables in another equation simultaneously (Greene 2003; Gujarati and Porter 2004). In other words, the explained variable is not only affected by explanatory variables but also affects the same explanatory variables within the system. Such interdependence between the variables is called two-way causation; in such a situation, applying a single-equation model with one-way cause and effect seems to be neither appropriate nor unbiased (Acharya and Madnani 1988). Hence, a system of equation models is necessary to represent the interrelationship between supply and demand functions of an agricultural product.

Most studies, however, have relied upon unidirectional single-equation model for estimating supply of and demand for agricultural commodities. Many estimated supply of and demand for food commodities separately in single-equation settings (Hossain 1997; Chowdhury and Herndon 2000; Umanath et al. 2018; Kumar et al. 2017). Supply response model in general is unidirectionally determined by price of own and competitive crops and some other specific factors relating to technology, weather, economic structure, and macro-constraints (Nerlove and Bachman 1960; Rao 1989) using time-series data. The concept of supply response has a long history in the literature (Nerlove 1956; Houck and Ryan 1972; Lee and Helmberger 1985). On the other hand, most studies used single-equation model for demand and price analysis (Lee and Helmberger 1985; Prestemon and Buongiorno 1993; Wear and Lee 1993; Brooks 1995; Chas-Amil and Buongiorno 2000; Hemmasi et al. 2006). Kangas and Baudin (2003), attempting to estimate the supply and demand of forest products in domestic and international market, employed single-equation method for each function in the market. A few have concentrated on factors explaining food prices (Westcott and Hoffman 1999; Monteiro et al. 2012; Ekananda and Suryanto 2018). Besides, Almost Ideal Demand System (AIDS) and its next-level models (e.g. Quadratic AIDS model) have also been found to estimate the demand of food commodities (Chengappa et al. 2016; Umanath et al. 2016).

Simultaneous equation models have been used to solve the complex system of price, supply, trade, and demand market (Lin 2008; Roberts and Schlenker 2009). Bayramoğlu et al. (2016) used simultaneous equations system, including equation for supply and demand of corn, bioethanol, and corn price. Dority and Tenkorang (2016) tried to estimate the impact of US and Brazilian ethanol production on world food prices and found that energy price had a significant impact in determining the world food price. Lamm Jr and Westcott (1981) examined the relationship between prices of factors of production and retail prices of food articles by applying three-stage least squares (3SLS) and found that increased factor prices affect food prices.

Only a few studies have attempted to study market behaviour and price determination in sugar sector under various situations (Mustafa and Khan 1982; Ribeiro and Oliveira 2011; Kumawat and Prasad 2012; Hamulczuk and Szajner 2015; Pastpipatkul et al. 2016). Specifically, Senthilnathan and Ramasamy (1996) in India and Keerthipala (2002) in Sri Lanka have tried to solve the sugar complex with the help of simultaneous equation settings. However, they are not sufficient in considering jaggery and other allied units of sugar industry. There is a paucity of the literature exploring the impact of sub-sectors of sugar industry on the supply and demand of sugar and their interrelationships in India.

Methodology

Sugar sector model framework

In this study, simultaneous equation model was used to estimate the interrelationship between demand and supply of sugar in India. The following simultaneous equation system represents the Indian sugar sector model by including various market situations of production, consumption, sugar price, and international trade, to find out the interrelationships among these variables.

Production:

Consumption:

Sugar price:

Trade:

SPN = sugar production in million tons; RER = recovery rate in percentage; ARE = sugarcane area in million hectare; YID = sugarcane yield in tons/ha; MOP = molasses production in million tons; POP = population in million; SUC = sugar consumption in million tons; PCSUC = per capita sugar consumption in tons; RAF = rainfall normalised by normal rainfall in millimetre; SUE = sugar export in million tons; STB = beginning stock in million tons; CAC = cane crushed in million tons; GCA = gross cropped area in million hectare; LEP = levy in percentage; VOP = value of other crops; SUP = sugar price in ₹/qtl; SPD = price of sugar in public distribution system in ₹/kg; PGD = per capita GDP in billion crore; PDQ = squared per capita GDP in billion crore; FRP = fair & remunerative price ₹/qtl; JAG = jaggery price in ₹/kg; INP = international price in $/ton; MCP = mill capacity in tons; EXR = real effective exchange rate; a0 to a7; b0 to b2; c0 to c5; d0 to d2; e0 to e5; f0 to f4; g0 to g4 are parameters to be estimated; and t = time.

The first equation represents sugar production, where the level of production is influenced by factors such as sugar price, cane crushed, molasses production, recovery rate, jaggery price, and levy (per cent). As per economic theory, the level of production is concerned mostly with prices of the main product, competitive products, and by-products. Hence, to represent the competitiveness between sugar and its derivatives, we included the prices of sugar and jaggery, and the level of molasses production, in the sugar production equation. Similarly, technical factors which directly affect sugar production level, such as recovery rate and amount of cane crushed, were included in sugar equation to capture impact of technology on sugar production. We used a separate equation for cane crushed as it is assumed to have endogenous effects in sugar production equation, where yield and area are expected to affect the cane crushed separately. Moreover, area under sugarcane and yield can be endogenous and determined by other factors. Area is a function of factors such as previous year area harvested, yield, FRP, gross irrigated area, and value of other field crops. This kind of area adoption under a crop can be estimated by employing Nerlovian area response model (Nerlove 1958). Similarly, yield is a function of variables such as technology and rainfall. On the other hand, consumption is expected to be affected by sugar price, income, and size of population. Since the sugar industry is confronted by numerous price policy measures, we included fair and remunerative price (FRP), sugar price in the public distribution system, beginning stock of sugar, and amount of export, in the price equation. In the export equation, domestic and international sugar price, exchange rate, and beginning stock were taken as explanatory variables. Diagrammatic representation of interrelationships between variables can be seen in Fig. 1.

All these equations were estimated simultaneously using 3SLS regression method so as to control for the endogeneity bias and cross-equation correlation of the residuals. It is generally known that any regression with any variables having unit root would result in spurious regression. To control this bias, non-stationary variables can be made stationary by differencing. But this method will remove information about the long-run effect of the variables (Hsiao and Fujiki 1998). Further, it is necessary to add an error-correction term if the variables are cointegrated so that long-term relationship and causalities can be identified appropriately (Engle and Granger 1987).

In simultaneous equation models, either the presence or absence of cointegration among the variables is supposed to be preassumed from the way the model is specified (Hsiao 1997). Also, a dynamic structure introduces trivial cointegration between the current and lagged variables (Hsiao and Fujiki 1998). Hence, testing for cointegration of the variables using a sample Augmented Dickey–Fuller test on the residuals is not relevant. Moreover, for structural dynamic models of non-stationary and cointegrated variables, Hsiao (1997) and Hsiao and Fujiki (1998) have demonstrated that conventional structure equation estimators such as two-stage least square (2SLS) and 3SLS still possess desirable statistical properties under certain conditions. For these reasons, we employed 3SLS regression method in the present study without discussing the stationarity problems on the residuals. The same procedure was followed by Rossi et al. (2009) to estimate the impact of export control policy measures.

Data

Data on all the variables used for the analysis were collected from various issues of the ISMA [Indian Sugar Mills Association], Cooperative Sugar, and Indian Sugar journals from 1970–1971 to 2013–2014, which gives us enough leverage to apply the model for analysis. Price and other economic variables were deflated by consumer price index (base year: 1986–1987) to convert them into real terms.

Descriptive statistics of variables included in the model

Sugar production shows an upward trend over the years, with some minor and major fluctuations in 1977–1978, 2006–2007, 2010–2011, and 2014–2015, with 4.71% annual compound growth rate (ACGR) (Fig. 2). Highest sugar production was recorded in 2006–2007 with about 28 million tons, which is 7.6-fold of 1970–1971.

Prices of sugar and jaggery are anticipated to affect the quantity production of sugar at factory level. Prices of sugar and jaggery, adjusted for inflation, show decreasing trend over the years—− 2.11 and − 1.48% of ACGR, respectively (Figs. 3, 4). It is assumed that quantity supply of sugar may be positively related to price of sugar and negatively to price of jaggery, the latter being considered as competitive by the sugar factory for its raw cane materials. FRP is a kind of support price, legally designated for sugarcane in India, to ensure a reasonable price for farmers and safeguarding them from unforeseen fluctuations. This not only determines the choice of sugarcane but also affects the cost of production of sugar positively at factory level as FRP accounts for 70% of the costs in sugar production. In the past three decades, FRP has been increasing exponentially (Fig. 5).

Similar to jaggery, molasses production affects the supply of sugar negatively. There has been an increasing trend in molasses production, with frequent ups and downs over the years—production of molasses was high (13.11 million tons) in 2006–2007, which then declined to 6.55 million tons in 2008–2009, and thereafter increased to 12.48 million tons during 2014–2015 (Fig. 6). Molasses production has been fluctuating since the 1970s and is expected to affect sugar production negatively. Recovery rate is another non-price factor affecting the level of sugar production. Increased recovery rate is expected to increase sugar production. The average recovery rate was 10.37% in 2014–2015. Over the years, however, sugar recovery rate seems to have fluctuated around 10% in India (Fig. 7). Imposing a levy on sugar probably reduces sugar supply in the market and affects the proper functioning of sugar factories. Since the establishment of the first sugar mill in India, levy on ex-mill sugar has been used as a major policy instrument to regulate sugar distribution to the ultimate consumer; its pros and cons, with respect to the welfare of farmers and mill owners, have been discussed intensively. Levy rate was reduced from 70% in the 1970s to 40% in the 2000s, 10% in the 2010s, and 0% from 2014 (Fig. 8).

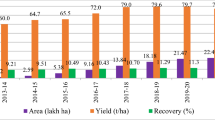

The production of sugar in India is directly related to the cane crushed. About 70% of produced sugar is obtained from sugarcane juice. The production of cane juice is further dependent on area adoption and yield. Figure 9 shows an upward trend in area under sugarcane, with a growth rate of 1.55%. However, the annual compound growth rate (ACGR) of sugarcane yield has been stagnant (0.84%), despite tremendous improvement in yield level from 1970s to 2014 (Fig. 10). The up-and-down trend of yield and area under sugarcane is due to various reasons: previous year yield, FRP, rainfall, and remuneration obtained from other crops are attributed as major factors explaining the extent of area under sugarcane, while rainfall and technologies, such as seed varieties and fertilizers, have been major drivers of yield improvement. Value of output of other crops (VOP) is another major factor that explains the area adoption of sugarcane, as farmers’ decision on choice of sugarcane is relative to remuneration from other crops. VOP shows a declining trend (− 0.34% ACGR) (Fig. 11). Sugarcane is a water-intensive crop, and hence, rainfall would affect yield at current period technically and the choice of area under sugarcane in the next year. Figure 12 reveals the uneven distribution of rainfall over the years.

Consumption of sugar seems to be affected by per capita income, price of sugar and jaggery, and population. As per economic law, price of sugar is likely to affect sugar consumption negatively and jaggery price positively. Also, it is anticipated that consumption of sugar would be positively related to the per capita income and population because increased population and their purchasing power might encourage food processing industry forward, where the use of sugar and sugar-based derivatives is indispensable. Both population and per capita income have increased exponentially over the years (Figs. 13, 14), and also, there is an increasing trend in the domestic per capita and total sugar consumption. Sugar consumption was about only 4.02 million tons in 1970–1971, and it has increased about 15.67% in 2014 (Fig. 15).

Since more than 90% of total sugar production is consumed by domestic population, it is expected that there would not be any significant relationship among these variables. However, we were interested in estimating the cause and effect of major variables, such as real effective exchange rate (Fig. 16), domestic sugar price, international sugar price (Fig. 17), and beginning stock (Fig. 18), which are expected to determine the international market for sugar in India. Total sugar export was less than 1.11 million tons until 2005. Maximum sugar export (4.96 million tons) was observed during 2007–2008; it declined to 2.30 million tons in 2014 (Fig. 19). In addition, the trend and growth rate of price of sugar in PDS, cane crushed, gross cropped area and mill capacity were presented in Figs. 20, 21, 22 and 23, respectively.

Results and discussion

Reliability test of the present model

The present study followed the recursive system of simultaneous equation model to estimate the demand and supply elasticities of sugarcane and sugar derivatives in India. Here, we used couple of tests to choose an appropriate simultaneous equation model, as estimation with simultaneous equations is often vulnerable to endogeneity and simultaneity problems in the model. Relevancy (a high correlation between instrument variable and endogenous regressors that cannot be explained by other instruments) and exogeneity (no correlation with the innovations in the dependent variable) were tested by using multiple correlation and Durbin–Wu–Hausman test of endogeneity.

Correlation test found high correlation of: the endogenous variable sugar production with per capita GDP (0.768) and jaggery price (0.766); cane crushed with molasses production (0.999) and population (0.933); sugar export with molasses production (0.649) and world sugar price (0.641); yield with gross irrigated area (0.893) and time (0.878); and sugarcane area with cane crushed (0.980), molasses production (978), and gross cropped area (0.945). All these indicate that all the instrument variables included in the model satisfy the relevancy test with their respective endogenous variables (Table 1). Durbin–Wu–Hausman test was used to find exogeneity. Results of Durbin’s Chi-square value and Wu–Hausman’s F-statistics for all the seven equations are insignificant, indicating that there was no endogenous variable in the right-hand side of all equations (Table 2). From the results of weak instrument tests, robust F-statistics of all the seven equations were found significant, indicating that instruments included in the present study are very strong (Table 3). All these results emphasise that the model given in the previous section is appropriate for simultaneous equation analysis.

Estimated equation of 3SLS

The choice of method for estimating the coefficients of any simultaneous equation model depends on its identifiability. As given in Table 4, order and rank conditions for identification problem indicated that the model presented from Eqs. 1 to 7 was over identified and suggested to employ the 3SLS to estimate the effect of macroeconomic policy variables on Indian sugar sector. Goodness of fit (R-square values) for all the seven equations was appropriate and significant at 1% level (F-test). Out of 34 estimated parameters in the model, 61% were statistically significant at 5% probability level (Table 5).

Estimated elasticities

In order to know the responsiveness of sugar supply and demand and all other endogenous variables, we estimated elasticity at mean level of respective explanatory variables. Estimated elasticity for all variables in all equations is presented in Table 6. Accordingly, in the sugar production equation, amount of cane crushed in a year is positive (1.03) and significant, indicating that 1% increase in the amount of sugarcane crushed would lead to increase in sugar production by 1.03%. Also, sugar production with respect to cane crushed is elastic, implying that the use of crushed cane for sugar production is increasing, rather than being diverted towards the production of other derivatives of sugarcane, such as jaggery and molasses. On the other hand, recovery rate shows a positive and highly elastic relationship with sugar production (1.52), that is, 1% change in recovery rate would result in 1.52% increase in sugar production. In general, recovery rate is percentage of sugar produced per ton of sugarcane crushed. Recovery rate represents both quality of sugarcane production and efficiency of sugar production at factory level. Hence, any marginal improvement in the quality of cane production can be expected to result in higher sugar production. Imposing of levy quota by the government on sugar production appeared to be negative but inelastic (− 0.03) on the sugar production equation.

In the cane crushed equation, area harvested appeared to be positive and highly elastic (5.62)—1% increase in area harvested would increase the amount of cane crushed by 5.62%. Since the change in amount of cane crushed is highly responsive to area harvested, any fluctuation in area under sugarcane due to various reasons (climatic factors, policy measures, or market fluctuation) can be expected to affect sugar production and its stability adversely. Surprisingly, quantity of cane crushed is observed to have a significant negative relationship to the changes in sugarcane yield with higher elasticity (0.92).

Area harvested and yield in the cane crushed equation are treated as endogenous variables, which are affected by some other exogenous variables, such as price of own, FRP, and prices of competing crops, lagged area, rainfall, and yield. It is found that 1-year lagged area under sugarcane, FRP, yield, rainfall, and value of competing crops have affected the adoption of area under sugarcane. For instance, 1% change in previous year area, yield, FRP, and rainfall would increase the area adoption under sugarcane in current year by 0.18, 0.76, 0.01, and 0.30%, respectively. Among these variables, non-price factor yield shows relatively higher responsiveness than price factor FRP, indicating that yield might be a key factor for determining the adoption of area under sugarcane in subsequent years. Moreover, the value of other field crops shows indirect relationship to the adoption of area under sugarcane with elasticity − 0.68%, indicating that all other field crops exhibit competitive relationship with sugarcane. In other words, increase in the prices or value of output of the field crops is expected to reduce the area harvested under sugarcane. It is well known that sugarcane is a commercial field crop that requires more amount of water and other inputs, such as capital, labour, and fertilizers, and is cultivated in all seasons in a year. Also, sugarcane cultivation is associated with more capital flow and income risk. Hence, the chance of getting more remuneration from other crops would result in area reduction under sugarcane.

In the yield equation, both rainfall and time trend (proxy for technologies) variables appeared to have positive and significant impact on the yield. Specifically, change in yield is less responsive to technological change (with elasticity of 0.06%). This indicates sluggishness in technological development to improve the yield of sugarcane. As indicated in the descriptive section, the ACGR of yield in India is only 0.14%. According to FAO report (2017), India ranks 37th with respect to yield per hectare (69.74 tons). It is about 50% less than the world’s top productivity (Peru with 121.25 tons per ha), and slightly less than the average productivity of world (70.89 tons), Europe (74.30 tons), Latin American countries (73.4 tons), and leading producer Brazil (74.48). All these figures point to the need to exploit yield potential through technological development in India.

On the consumption side, sugar price shows expected negative effect with sugar demand (− 0.27). Population appears to have positive and high elastic effect on sugar consumption, suggesting that demand for sugar and sugar-based food products would keep pace with increased population size. Increased population combined with food consumption transition towards processed foods and beverages is expected to trigger the sugar industry to move forward.

The elasticity of sugar price to jaggery price changes is positive and responsive (with elasticity of 0.90%), indicating that changes in unorganised sector of jaggery unit would affect the level of sugar price moderately. Jaggery units can absorb the excess supply of sugarcane during a time of surplus production; Indian jaggery has its own traditional value and quality, with constant demand for jaggery products in the domestic market over the years, in addition to demand from neighbouring countries. As expected, the price of sugar is negative but less responsive to changes in sugar stock at current period (− 0.09). It is a general fact that a higher level of stock increases total sugar supply in the market, and consequently, sugar price declines. The responsiveness of sugar price with respect to changes in export is significant at 10% level, indicating that higher price for sugar in the international market may help to increase the profitability of sugar mills and subsequently to reduce domestic sugar price.

Interestingly, no variable is statistically significant in export equation, indicating that international trade with respect to sugar production in India is irrelevant as more than 90% of total sugar production in India is consumed by the domestic population.

Conclusion and recommendations

This study attempted to develop and analyse the simultaneous equation model for sugar sector as the sector is often considered complex and interdependent between different sectors. The results obtained from the model mostly corroborate with real phenomena—for instance, sugar production was significantly influenced by recovery rate and price; sugar consumption was positively related to population and negatively related to sugar price; decision on greater adoption of sugarcane was dependent on previous year area, yield, FRP, and rainfall; technology-supported higher yield. However, the sugarcane farming and sugar industry are gripped by problems of frequent fluctuation in sugar production, i.e. there exists an imbalance in demand and supply. It causes delay of payments to sugarcane farmers from sugar factories and increased financial burden on state governments, viz. to subsidise or to pay the statutory price and lend soft loans to industry to clear payment dues, in addition to diversion of precious surface water and groundwater resources to cultivate sugarcane. All these apparently indicate that there is mismanagement or lack of proper planning in sugarcane production and sugar sectors in the country. This situation calls for increasing the production efficiency as well as reduced the cost incurred in production of sugarcane at farm level and sugar at factory level.

Policy measures to consider are: (1) develop improved technology that supports for high recovery rate, productivity, resistant to drought and water stress conditions. The average rate of recovery in India is less than 10%, which is quite low compared to other major sugar producers, such as Java, Hawaii, and Australia (14–16%). So there is an ample scope to increase sugar production in India by increasing the recovery rate, with the help of high sugar recovery varieties, and consequently reduce the cost of production at farm and factory levels; (2) create awareness about the importance of sugar recovery rate and proper post-harvest management and crushing practices to the concerned stakeholders. Giving incentives to farmers for every additional rate of recovery will help sugar mills to produce sugar at minimum cost.

Also, the results of the study revealed no significant external trade effect on the domestic supply and demand of sugar in India. This might be because more than 90% of sugar produced in the country is consumed by domestically. So, leveraging the sugar sector towards international trade might help the sector overcome unforeseen situations, particularly during excess production. Likewise, the food industry, specifically the food processing sector which relies on sugar, has been growing rapidly over decades across world. Further, there is a growing demand for ethanol production from sugarcane. Thus, post-harvest managements and quality standards for international market and technology and infrastructure development with respect to biofuel production are expected to play a major role in balancing sugar supply and demand in the country.

Inputs-use pattern and its cost, specifically with respect to water use, and the cause and effect of these factors on the sugar sector are not dealt extensively in the present study because time-series data on the cost of cultivation and water usage at farm level are unavailable. Moreover, the scope of the present paper is limited to study only the interrelationship between supply and demand of sugar and major factors determining trade and policy variables at the macro-level. Hence, future research may undertake general/partial equilibrium and simulation framework by incorporating farm-level and macroeconomic factors to address the influence of input-use pattern and other farm characteristics on sugar supply and demand and cost–benefit analysis at farm and factory levels.

References

Abnave VB, Babu MD (2017) State intervention: a gift or threat to India’s sugarcane sector? ISEC Working Paper 385. Institute for Social and Economic Change, Bengaluru

Acharya SS, Agarwal NL (2011) Agricultural marketing in India, 5th edn. Oxford and IBH Publishing Company, New Delhi

Acharya SS, Madnani GMK (1988) Applied econometrics for agricultural economists. Himansu Publication, Udaipur

Bayramoğlu AT, Çetin M, Karabulut G (2016) The impact of biofuels demand on agricultural commodity prices: evidence from US corn market. J Econ Dev Stud 4(2):189–206

Borychowski M, Czyżewski A (2015) Determinants of prices increase of agricultural commodities in a global context. Management 19(2):152–167. https://doi.org/10.1515/manment-2015-0020

Brooks, DJ, Baudin A, Schwarzbauer P (1995). Modeling forest products demand, supply and trade. ECE/TIM/DP5 UN-ECE/FAO timber and forest discussion papers. United Nations Economic Commission for Europe and Food and Agricultural Organization, Geneva

Chas-Amil ML, Buongiorno J (2000) The demand for paper and paperboard: econometric models for the European Union. Appl Econ 32(8):987–999

Chengappa PG, Umanath M, Vijayasarathy K, Babu P, Manjunatha AV (2016) Changing demand for livestock food products: an evidence from Indian households. Indian J Anim Sci 86(9):1055–1060

Chowdhury AAF, Herndon CW Jr (2000) Supply response of farm program in rice-growing states. Int Adv Econ Res 6(4):771–781

Debnath D, Babu SC (2018) What does it take to stabilize India’s sugar market? Econ Political Wkly 53(36):16–18

Dority BL, Tenkorang F (2016) Ethanol production and food price: simultaneous estimation of food demand and supply. J Agric Econ Rev 17(1):97–106

Ekananda M, Suryanto T (2018) The autoregressive distributed lag model to analyze soybean prices in Indonesia. In: MATEC web of conferences: EDP sciences

Engle RF, Granger CWJ (1987) Co-integration and error correction: representation, estimation, and testing. Econometrica 55(2):251–276

Food, F. A. O. Agriculture Organisation (2017) The future of food and agriculture: trends and challenges

Government of India (2017) Cost of cultivation and production related data: 2016–17. Directorate of Economics and Statistics, Ministry of Agriculture, Government of India, New Delhi

Greene WH (2003) Econometric analysis. Pearson Education India, New Delhi

Gujarati D, Porter DC (2004) Basic econometrics, 4th edn. McGraw-Hill, New York

Hamulczuk M, Szajner P (2015) Sugar prices in Poland and their determinants. J Probl Agr Econ 4(345):59–79

Hemmasi AH, Ghaffari F, Hamidi K, Biranvand A (2006) Demand function estimation and consumption projection of newsprint in Iran. J Agric Sci 12(3):635–645

Hossain M (1997) Rice supply and demand in Asia: a socioeconomic and biophysical analysis. In: Teng PS, Kropff MJ, Ten Berge HFM, Dent JB, Lansigan FP, van Laar HH (eds) Applications of systems approaches at the farm and regional levels volume 1. Systems approaches for sustainable agricultural development, vol 5. Springer, Dordrecht

Houck JP, Ryan ME (1972) Supply analysis for corn in the United States: the impact of changing government programs. Am J Agric Econ 54(2):184–191

Hsiao C (1997) Cointegration and dynamic simultaneous equations model. Econometrica 65(3):647–670

Hsiao C, Fujiki H (1998) Nonstationary time-series modeling versus structural equation modeling: with an application to Japanese money demand. Monet Econ Stud 16(1):57–80

India Sugar Mills Association (2017) Handbook of sugar statistics, 2016–2017, New Delhi

Jaiswal D, De Souza AP, Larsen S, LeBauer DS, Miguez FE, Sparovek G, Bollero G, Buckeridge MS, Long SP (2017) Brazilian sugarcane ethanol as an expandable green alternative to crude oil use. Nat Clim Change 7(11):788–792

Kangas K, Baudin A (2003) Modelling and projections of forest products demand, supply and trade in Europe. ECE/TIM/DP30 UN-ECE/FAO timber and forest discussion papers. United Nations Economic Commission for Europe and Food and Agricultural Organization, Geneva

Keerthipala AP (2002) Impact of macro-economic policies on the sugar sector of Sri Lanka. Sugar Tech 4(3–4):87–96

Kumar P, Joshi PK, Parappurathu S (2017) Changing consumption patterns and roles of pulses in nutrition, and future demand projections. In: Roy D, Joshi PK, Chandra R (eds) Pulses for nutrition in India: changing patterns from farm to fork. International Food Policy Research Institute, Washington, pp 21–61. https://doi.org/10.2499/9780896292567_02

Kumawat L, Prasad K (2012) Supply response of sugarcane in India: results from all-India and state-level data. Indian J Agric Econ 67(4):1–15

Lamm RM Jr, Westcott PC (1981) The effects of changing input costs on food prices. Am J Agric Econ 63(2):187–196

Lee DR, Helmberger PG (1985) Estimating supply response in the presence of farm programs. Am J Agric Econ 67(2):193–203

Lin CYC (2008) Estimating supply and demand in the world oil market. Working Paper 225893, University of California, Department of Agricultural and Resource Economics, Davis

Manochio C, Andrade BR, Rodriguez RP, Moraes BS (2017) Ethanol from biomass: a comparative overview. Renew Sustain Energy Rev 80:743–755

Meriot A (2015) Thailand’s sugar policy: government drives production and export expansion. Sugar Expertise, Bethesda for American Sugar Alliance, Arlington

Monteiro N, Altman I, Lahiri S (2012) The impact of ethanol production on food prices: the role of interplay between the US and Brazil. Energy Policy 41(C):193–199

Mustafa K, Khan AS (1982) Sugarcane procurement price and its determinants: an economic analysis of time series data in the Punjab [Pakistan]. Pak Econ Soc Rev XX(1):71–78

Nerlove M (1956) Estimates of the elasticities of supply of selected agricultural commodities. J Farm Econ 38(2):496–509

Nerlove M (1958) The dynamics of supply: estimation of farmers’ response to price. The Johns Hopkins Press, Baltimore

Nerlove M, Bachman KL (1960) The analysis of changes in agricultural supply: problems and approaches. J Farm Econ 42(3):531–554

Pastpipatkul P, Panthamit N, Yamaka W, Sriboochitta S (2016). A copula-based Markov switching seemingly unrelated regression approach for analysis the demand and supply on sugar market. In: Huynh V, Inuiguchi M, Le B, Le BN, Denoeux T (eds) IUKM 2016: integrated uncertainty in knowledge modelling and decision making. 5th international symposium, Da Nang, November 30–December 2, 2016. Lecture notes in computer science. Springer, Heidelberg

Prestemon JP, Buongiorno J (1993) Elasticities of demand for forest products based on time-series and cross-section data. In: Proceedings of meeting on forest sector analysis. In: Quelles sources statistiques pour une modélisation de la filière forêt-bois? CREGE, University of Bordeaux

Rao JM (1989) Agricultural supply response: a survey. J Agric Econ 3(1):1–22

Ribeiro F, Oliveira J (2011) Factors influencing proprioception: what do they reveal? In: Klika V (ed) Biomechanics in applications. IntechOpen, London. https://doi.org/10.5772/20335

Roberts MJ, Schlenker W (2009) World supply and demand of food commodity calories. Am J Agric Econ 91(5):1235–1242

Rossi P, Kagatsume M, Prosperi M (2009) Impact of export control policy measures in an attempt to mitigate Argentina’s inflation. In: Canavari M, Cantore N, Castellini A, Pignatti E, Spadoni R (eds) International marketing and trade of quality food products. Wageningen Academic Publishers, Wageningen, pp 115–128

Senthilnathan S, Ramasamy C (1996) Econometric analysis of sugar market. In: Kainth GS (ed) Export potential of indian agriculture. Daya Books, New Delhi

Sharma AK, Prakash B, Sachan A, Ashfaque M (2015) Inter- and intra-sectoral linkages and priorities for transforming sugar sector of India. Agric Econ Res Rev 28:55–67

Shroff S, Kajale J (2014) Sugar sector: is it sustained by subsidies? Indian J Agric Econ 69(3):275–384

Umanath M, Chengappa PG, Vijayasarathy K (2016) Consumption pattern and nutritional intake of pulses by segregated income groups in India. Agric Econ Res Rev 29:53–64

Umanath M, Balasubramaniam R, Paramasivam R (2018) Millets’ consumption probability and demand in India: an application of Heckman sample selection model. Econ Aff 63(4):1033–1044

Walter A, Galdos MV, Scarpare FV, Leal MRLV, Seabra JEA, da Cunha MP, Picoli MCA, de Oliveira COF (2014) Brazilian sugarcane ethanol: developments so far and challenges for the future. WIREs Energy Environ 3(1):70–92

Wear DN, Lee KJ (1993) US policy and Canadian lumber: effects of the 1986 memorandum of understanding. For Sci 39(4):799–815

Westcott PC, Hoffman LA (1999) Price determination for corn and wheat: the role of market factors and government programs. Technical Bulletin 33581, United States Department of Agriculture, Economic Research Service

Yadav RL, Solomon S (2006) Potential of developing sugarcane by-product based industries in India. Sugar Tech 8(2–3):104–111

Acknowledgements

This material is based upon work supported by National Institute of Agricultural Economics and Policy Research, ICAR, New Delhi.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Malaiarasan, U., Paramasivam, R., Thomas Felix, K. et al. Simultaneous equation model for Indian sugar sector. J. Soc. Econ. Dev. 22, 113–141 (2020). https://doi.org/10.1007/s40847-020-00095-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40847-020-00095-0