Abstract

Trade liberalization in transition economies has been followed by a significant reduction in government revenue from trade taxes. This paper empirically tests whether and to what extent domestic tax revenue has actually compensated for the trade tax revenue lost by looking at the experience in a panel of 33 transition countries in Eastern Europe, the former Soviet Union, and North Africa and the Middle East. The paper finds evidence of strong revenue replacement for total domestic tax revenue. The contribution of the different taxes to the replacement strategy is, as expected leaded by the Value-added Tax, followed by a lower contribution from the personal income tax (PIT). The paper also provides some empirical evidence suggesting that replacement may have been higher for countries in the run-up to the EU, and that countries with a high tax revenue effort may have relied relatively more on the PIT to replace trade taxes.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

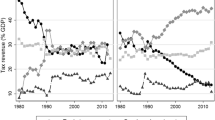

Trade liberalization has been a key component in the fundamental liberalization, privatization and stabilization reform process in transition economies in Eastern Europe, the Former Soviet Union, and the Middle East and North African regions. At the start of transition, most of the formerly socialist economies dismantled the bulk of the export and import controls and licensing arrangements that were in place under the old central planning system, reduced the dispersion of tariff rates applied to imports and lowered their (trade weighted) average level, rationalized and unified their exchange rates, and introduced more accommodating policies towards foreign direct investment. Later on, association agreements were signed between the EU and countries in Eastern Europe and North Africa and the Middle East that further lifted remaining trade controls, including by gradually reducing tariffs.Footnote 1 As a result, import tariffs have almost halved, while trade flows have increased substantially—both imports and exports are higher by about 10 percentage points of GDP, on average (Fig. 1, Panel A).

Trade liberalization policies in transition countries have been also accompanied by a significant reduction in government revenue from trade taxes,Footnote 2 from about 3 percentage points of GDP, on average, in the early 1990s to about 1.5 percentage points of GDP at present (Fig. 1, Panel B). This revenue loss has been a matter of concern for these countries, as it creates a source of fiscal instability. With trade taxes being still an important source of revenue in many transition countries, it remains also a relevant issue as they consider further liberalizing trade. While trade taxes represent only about 3 percent of total tax revenue collection (less than a ½ percentage point of GDP) in East Europe, it still accounts for more than 10 percent of tax revenue (about 2 percentage points of GDP) in Former Soviet countries and other transition countries in North Africa and the Middle East.

Besides trade liberalization, the dramatic transformation of transition economies included significant institutional reform, in areas such as governance, competition policy, labor markets, privatization, and enterprise restructuring (IMF 2014). Subsequent reforms to their tax systems have not been less frequent in this context, including among others the adoption of value-added taxes, and a deep transformation of the concept of income taxation. This reform attempts affected tax revenue collection in the early stages of implementation of structural reforms (Coricelli 1998; Ebrill and Havrylyshyn 1999; Martinez-Vazquez and McNab 2000). Before the transition, the main sources of tax revenue came from taxes levied almost only on state-owned enterprises; the tax on profits and the turnover tax being by large the most important revenue sources. The tax on profits was collected mostly on the basis of negotiations between large enterprises and government officials (Buiter 1997), with tax rates adjusted frequently, and the tax burden usually being different depending on the industry. Turnover taxes were levied mainly on goods, collected at wholesale or retail level, and often used as a mechanism to regulate prices and support allocation of resources set in the plan. The transition towards market economy resulted in a significant decline in tax revenue collections usually related to the decline in the traditional tax bases—in part due to trade liberalization—and deterioration in the capacity of the tax administration. It is clear that the unsophisticated nature of the pre-transition tax administration, dealing with a few large state-owned enterprises, was not prepared to face a completely new environment and, therefore, prospects for tax evasion rose (Tanzi and Tsibouris 2000).

In this context of challenging institutional reform, and with further trade liberalization potentially adding additional pressure on trade tax revenue, a concern arises as to whether this revenue stream can be replaced with other domestic tax sources.Footnote 3 This question has been empirically tested most prominently by Baunsgaard and Keen (2010), who analyze if—and to what extent—the loss in trade tax revenue has been recouped from domestic tax revenue in a panel covering 117 countries over the period 1975–2006. While this study is the most comprehensive available to date,Footnote 4 it does not cover the experience in post socialist transition economies in Eastern Europe and the CIS, where trade liberalization has been substantial, and sustainability of public finances must have created a need to find a substitute for the lost trade tax revenue. Indeed, a data plot of trade and domestic tax revenue for 33 transition countries confirms that over time, countries have increasingly replaced trade tax revenue with domestic revenue (Fig. 2).

Besides exploring whether countries have been able to recover the lost trade tax revenue with domestic taxation as a whole, a key remaining issue, however, is the assessment of the replacement strategy. In this regard, most of the literature has focused on identifying the alternative tax instruments that should be used—from a theoretical perspective—to replace the lost trade tax revenue, mostly on the basis of relative efficiency and equity impacts of those tax instruments. Keen and Ligthart (2001) argue in favor of broad-base consumption taxes—in particular the value-added tax (VAT)—to replace tariffs, as they find that for a small and competitive economy, this will lead to increased production efficiency and welfare, without affecting government revenue.Footnote 5 Other studies have favored taxes on corporate profits (Haque and Mukherjee 2005; Mujumder 2004). While no theoretical considerations have been put forward for or against the personal income tax, political economy considerations may favor this against consumption taxes in the grounds of progressivity of the tax system (Cnossen and Bird 1990).

Very little empirical attention has been given, however, to which tax instruments actually have supported revenue collection along with trade liberalization. Baunsgaard and Keen (2010) focus only on the aggregate replacement of lost trade tax revenue through domestic revenue collection but do not analyze the impact of the alternative tax instruments. The authors only include a dummy on VAT adoption but find no evidence of stronger recovery associated to VAT. In contrast, Buettner et al. (2006) find evidence for the VAT to have contributed to the revenue recovery in 20 developing countries that adopted a VAT at the time of the WTO accession. Besides these examples, no empirical analysis exist on the extent to which domestic tax instruments—VAT, taxes on profits (CIT), or personal income taxes (PIT)—have replaced trade tax revenue, or what could have explained the choice of alternative tax instruments. This paper seeks to fill this gap in the literature by analyzing the experience in transition economies.

The main reason for the scarcity of available empirical work on this subject is mostly related to the lack of reliable data on tax revenue components in transition economies and the length of the data series, usually too short to produce reliable results in the early stages of transition. This paper uses a constructed broad (unbalanced) panel dataset for 33 transition countries during 1991–2010, that covers the major tax revenue sources. The main purpose of the paper is thus twofold: (1) to assess whether and to what extent there has been revenue replacement between trade and domestic tax revenue as a whole in transition countries, and (2) to examine more in detail the actual replacement strategy, by analyzing the relationship between trade tax revenue and the main domestic tax revenue components. The paper follows the same empirical specification as in Baunsgaard and Keen (2010) but extends the analysis, first, by covering the experience in transition economies, and most importantly, by considering explicitly the importance of the different tax instruments in the replacement strategy.Footnote 6 In this context, additional extensions to previous work include also an assessment of how trade tax revenue replacement has evolved over time, considering how the reform momentum has change among transition economies. In addition, the replacement strategy may have been influenced by the several institutional arrangements that have likely affected the extent of the replacement and choice of the tax instruments, such as (1) the run-up to enter the European Union, which may have influenced the speed of the tax reform and ultimately positively impacted revenue performance (2) the extent of the replacement need, measured by the actual reduction in trade tax revenue over the sample period, and (3) the country’s initial conditions, measured by the total tax-to-GDP ratio. Finally, special attention is given to tax revenue compliance, not only affecting revenue collection but also likely affecting the extent of the trade tax replacement and the use of different tax instruments.

The rest of the paper is organized as follows. Section 2 describes the dataset in more detail and sets out the empirical approach. Section 3 presents the main empirical results, with further robustness analysis reported in Sect. 4. Section 5 summarizes the results and concludes.

2 Data and methodology

2.1 Data

The dataset comprises an unbalanced panel of 33 transition economiesFootnote 7 for the period covering 1991–2010. Data on tax revenues are drawn from the Government Financial Statistics (GFS) produced by the International Monetary Fund (IMF) as well as from the annual consultation reports of the IMF with its member countries. While GFS is the most complete source of data, it suffers from a number of problems, particularly in the case of former socialist countries, including most prominently missing variables for some years. The present paper addresses this problem by complementing GFS with detailed revenue information provided in published IMF’s “Article IV” consultation reports with member countries.Footnote 8 This methodology was originally used in Baunsgaard and Keen (2010) for total domestic tax revenue, as well as the trade tax revenue series. More recently, Crivelli (2013) applied this methodology for a sample of transition countries, and extended the coverage of the tax revenue database by disaggregating it to cover taxes on goods and services and taxes on corporate profits. In the present paper, the Crivelli (2013) database has been further extended to include six transition countries in the Middle East and North African regions and further disaggregated to cover the value-added tax and the personal income tax. Filling the gaps in GFS with data from country reports has helped increasing the length of the database: while the final dataset for total tax revenue includes 538 observations, the original GFS database had included only 387 data points.

Figure 3, Panel A shows 5-year averages of domestic tax revenues and trade tax revenues (relative to GDP) in this new dataset. All in all, and despite presenting differences across countries in the sample, domestic tax revenue has increased by about 2½ percentage points of GDP, from 14.8 percent of GDP, on average, during the early 1990s to 17.3 percent of GDP, during the period 2006–10, and appears to have over-compensated for the observed downward trend in trade tax revenue. Figure 3, Panel B illustrates trends in the composition of the major domestic taxes covered in the dataset. The major contribution to the increase in domestic tax revenue has been provided by the value-added tax. Also the personal income tax has presented a steady increase over the sample period. Not surprisingly, the contribution from taxes on corporate profits has decreased overtime, which is generally considered the outcome of intensive tax competition, including cuts in tax rates and the adoption of generous tax incentive regimes that have led to serious erosions of tax bases.

The following control variables were included based on extensive empirical literature on the determinants of tax effort (for example, Sen Gupta 2007; Rodrik 1998, or Tanzi 1987): GDP per capita, potentially affecting the demand for public services and thus the need for higher government revenues, and in reflection of a higher degree of economic and institutional sophistication. Trade openness, measured as the sum of the shares of imports and exports in GDP. Rodrik (1998) argues that more open countries are vulnerable to risks and, given the need for social insurance, tend to have bigger governments. Moreover, since trade taxes are easier to collect, especially in developing countries, a positive relationship between trade openness and revenues can be expected. However, higher trade openness could be the result of trade liberalization through tariff reductions. This would be consistent with a negative relationship between trade openness and revenue. Inflation, which was significant in the first years of transition, may have important revenue effects through both unindexed tax systems and the generation of seigniorage. The share of agriculture in GDP, which is found to be negatively associated with tax revenues, due to the fact that agriculture is usually a sector that is very difficult to tax.

Other control variables include: an indicator to capture the depth of privatization, which has been found negatively associated with tax revenue in transition economies (Crivelli 2013). This indicator is constructed as in Gouret (2007), based on the simple average of three indicators of the European Bank of Reconstruction and Development (EBRD) database: the two subjective indexesFootnote 9 of large scale privatization and small scale privatization, and the private sector share of GDP. The privatization indicator has been rescaled to take values between 0 and 1, and varies by country and on a yearly basis. Total natural resources rents, relative to GDP, to capture the potential negative influence of natural-resource revenues on domestic tax effort (Crivelli and Gupta 2014). Finally, to control for the quality of institutions, Transparency International’s Corruption Perception index is included in all regressions, transformed to take the value 0 (high corruption) to 100 (low corruption). Full details of the dataset and summary statistics are provided in “Appendix A”.

2.2 Empirical specification and estimation

To empirically test the relationship between trade and domestic tax revenues, the estimating Eq. (1) considers a dependent variable D as a function of trade tax revenue T, and a set of control variables in X. Also including a lagged dependent variable to allow for plausible dynamics in policy adjustment (the empirics showing significant serial correlation in its absence), and allowing for interactions, this leads to an estimating equation of the form:

where the dependent variable D represents domestic tax revenue (DTAX) relative to GDP, and trade tax revenue T also expressed relative to GDP, while i = 1,…,N and t = 1,…,L are respectively country- and time-indicators (so that α i and μ t are country- and time-specific effects). Equation (1) is regressed separately for total domestic tax revenue (DTAX) as well as for the value-added tax (VAT), tax on corporate profits (CIT), and the personal income tax (PIT). The cotemporaneous effect of an increase in domestic tax revenue for a reduction in trade tax revenue is captured by β 2 , whereas the ultimate or long-run effect is captured by \( \theta \equiv \frac{{\beta_{2} }}{{(1 - \beta_{1} )}} \), with θ towards unity (in absolute value) implying full recovery of lost trade tax revenues from domestic taxes.

Equation (1) is estimated using ordinary least squares with country and time fixed effects (OLS-FE), which is also the baseline estimator for the robustness analysis presented subsequently in the paper. To provide a sense of robustness across alternative estimators, “Appendix B” presents the main results for the two stage least squares (2SLS) on the levels of Eq. (1), and the Blundell and Bond (1998) system generalized method of moments (GMM).

3 Main results

Results on the replacement of trade tax revenues through total domestic tax revenue are presented in Table 1. Column (1) reports the results for all countries in the sample but without including time fixed effects or control variables, which are then included in Columns (2–4). The results in Columns (3–4) investigate whether the replacement of trade tax revenue differs among East European and former Soviet Union countries (EUR + CIS) and MENA countries. This is done in Column (3) by interacting the trade tax revenue variable with a regional dummy variable for MENA countries, which identifies the differential impact vis-à-vis the other countries in the sample. Finally, column (4) presents the results for EUR + CIS countries only.

In all cases, trade tax revenue is negatively and significantly related to domestic tax revenue, and the magnitude of the replacement is similar across alternative specifications. The inclusion of control variables in Columns (2–4) reduces the number of available observations, covering the period 1994–2010.Footnote 10

On the magnitude of the replacement, it is noteworthy that the coefficient estimate for the contemporaneous replacement is large, with domestic revenue increasing by about 0.3 percentage points of GDP for each percentage point of GDP of trade tax revenue lost. The coefficient estimates are about twice as high as for middle income countries in Baunsgaard and Keen (2010)—which may be indicative of a comprehensive tax reform taking place in parallel to trade liberalization. Ultimate or long-run replacement is also significant (50–60 %) thought the size of the θs do not differ substantially from those found in previous literature.

The results in Column (3) suggest that replacement of trade tax revenue among MENA countries has been broadly similar to that of Eastern European and former Soviet Union countries, as coefficient estimates of the trade tax revenue variable interacted with the regional MENA variable is statistically insignificant. Also the estimated coefficients for only EUR + CIS countries (Column 4) do not differ substantially from those for the full sample.

Turning to the control variables, the pattern of coefficients is broadly as expected, which confirms that the structure of the economy matters for tax revenue. The share of agriculture in GDP, when significant, is negatively related to tax revenue, whereas GDP per capita is positively related. Trade openness is insignificant, which reflects the impact of opposed effects as explained in Sect. 2.1, and inflation is negatively related to tax revenue. Privatization appears to be negatively related to tax revenue collection as suggested in previous literature, as well as the level of corruption (recall that a higher value of the corruption indicator is indicative of a lower level of corruption). Finally, oil rents appear to be negatively associated with revenue collection, though the variable is not statistically significant.

Attention focus now on the revenue replacement strategy by analyzing the impact of trade tax revenue on the major tax revenue sources. For this purpose, Table 2 presents the results for the VAT (Column 1), PIT (Column 2), and CIT (Column 3), using OLS-FE (“Appendix B” presents results for 2SLS and system-GMM). As for total tax revenue, the trade tax revenue variable is interacted with a regional dummy variable for MENA countries in Columns (1–3), which aims to identify any potential differential impact vis-à-vis the other countries in the sample. Also column (4–6) presents the results for EUR + CIS countries only. In estimating the replacement strategy among the different taxes, potential trade-offs may exist across all the main alternative tax instruments available at the time of replacement, implying a system of simultaneous equations. To deal with this, we control for the revenue collected under alternative tax instruments (the CIT for VAT and PIT estimations; and PIT for CIT estimations).

The coefficient estimates for trade tax revenue indicate that contemporaneous replacement emerges as significant for the VAT and PIT, whereas the relationship between trade tax and the CIT is not statistically significant. For each percentage point of GDP of trade tax revenue lost, VAT revenue increases by 0.17 percentage point of GDP and PIT revenue increases by 0.05 percentage points of GDP. The same result is found for the ultimate replacement, with the estimated θ for VAT twice as high as the estimated θ for the PIT; and with both estimated θs broadly adding up to the replacement estimates for total domestic revenue in Table 1. For each percentage point reduction in trade tax revenue, there is a long-run replacement in domestic tax revenue of about 50 percent, explained by VAT and PIT revenue increases.

As in Table 1, it appears that replacement among the main taxes in MENA countries has been broadly similar to those of EUR + CIS, as coefficient estimates of the trade tax revenue variable interacted with the regional MENA variable is statistically insignificant. Also the estimated contemporaneous and ultimate replacement among EUR + CIS countries only (columns 4–6) are not statistically significant from those estimated for the full sample.

The leading role of the VAT in the revenue replacement strategy—confirmed here by a large estimated coefficient—confirms the successful experience with the early introduction of VAT taxes in most of the transition economies. Besides the apparent superiority of broad-based consumption taxes in terms of efficiency and welfare gains, reliance on the VAT has help strengthening the tax administration, thus improving revenue collection altogether. The result on the PIT, also contributing to the replacement, may appear less straightforward given the more complex nature of the tax that requires a more sophisticated capacity to deal efficiently with its collection. However, progressivity considerations or the extent of the replacement need may have created the need to strengthen income taxation along with the introduction of the VAT. The apparent lack of contribution of taxes on corporate profits to the revenue replacement following trade liberalization could be the result of intensive tax competition for the allocation of foreign direct investment, which has caused a race to the bottom on CIT rates and created continuous pressure on governments to provide tax incentives to prospective investors (Cass 2007).

Also interesting is how trade tax revenue replacement has evolved over time, considering how the reform momentum has change among transition economies. To do this, the trade tax revenue variable in Eq. (1) is replaced by a set of interactions between the trade tax revenue variable and the year fixed effects. Results are presented in Table 3 for total domestic revenue, as well as the main taxes.

The estimated coefficients for total revenue (Column 1) indicate a pattern of trade tax revenue replacement overtime that can be broadly identified with four different periods through which transition countries have advanced reforms at quite a different pace (IMF 2014). In the initial period—1994 to 1996—there was considerable advance in both policies and economic outcomes among transition countries in Eastern Europe and former Soviet Union countries. Generally, this was a period when most countries made progress in market reforms, including liberalization of prices, trade, and foreign exchange. The latter part of the 1990s—1997 to 2000—was a period of major crises in emerging markets. The emerging European economies were vulnerable in this environment, with macroeconomic stability not fully secured, nascent market institutions, and fragile financial systems. A number of countries that had progressed less in establishing robust market-based frameworks were affected, which in turn resulted in slower implementation of the needed structural reforms. A third period—2001 to 2007—saw extremely rapid growth across the region, spurred by the benign global environment. Growth during this period, however, was mostly driven by external borrowing that became increasingly unsustainable, whereas the pace of economic reform slowed considerably. The last identified period—2008 to 2009—was characterized by the effects of the global financial crisis, hitting many transition countries, in particular those that had built large imbalances during the early 2000s, to which they were highly vulnerable. After the crisis, many of this countries implemented significant fiscal consolidation, coupled with economic recovery.

These four periods in which economic transformation and structural reform advanced at very different paces is also reflected in the different pace at which reform of the tax systems was implemented. In the initial period, trade liberalization was significant, translating into large trade tax revenue losses. This required an equivalent effort in terms of adopting efficient tax systems. As a result, most of the transition countries adopted VAT systems during this period. In the latter part of the 1990s, and until 2008, the generally completed trade liberalization reforms coupled with rapid economic growth, reduced significantly the need and willingness for additional tax reform. This changed after 2008 due to the large fiscal consolidation needs that countries were facing which resulted in further tax policy reform and strengthening of tax administrations.

The pattern of trade tax revenue replacement implied in the estimated coefficients in Table 3 can be broadly identified with these alterative periods. This is also illustrated in Fig. 4. During the first period—1994 to 1996—domestic revenue increased, on average, by 0.77 percentage points of GDP for each percentage point of GDP of tax revenue lost. During the second period—1997 to 2000—the increase in domestic revenue slowed, on average, to 0.5 percentage points of GDP, for each percentage point of GDP of tax revenue lost. During the third period—2001 to 2007—trade tax revenue replacement decelerated considerably, to about half the level achieved in the previous period (0.25 percentage points of GDP, on average). In the last period, a slight reversal can be identified, suggesting an increase in the trade tax revenue replacement to about 0.4 percentage points of GDP, on average. As for the different taxes, the pattern is broadly similar, showing a much larger replacement of trade tax revenue in the early period that appears to be generally significant for all three taxes. Later on, however, in particular during the 2000s, the replacement strategy appears skewed towards the VAT, which continues to contribute steadily to the trade tax replacement need, supporting the results presented earlier in Table 2.

Revenue Replacement over time. Source Author’s own calculations based on estimated coefficients in Table 3 (Column 1)

4 Further results

This section focuses on alternative model specifications with the purpose of providing additional robustness to the results presented above.

4.1 Large replacement needs

Some countries have experienced a significant reduction in trade tax revenue along with trade liberalization. A first robustness check thus consists in identifying whether the replacement strategy was influenced by the magnitude of the required adjustment. This issue is explored in Table 4 by adding to the basic specification of the previous section a dummy that identifies countries with trade tax revenue losses above average over the sample period—above 1 percentage point of GDP—in interaction with trade tax revenue.Footnote 11

The result for total domestic revenue (Column 1) appears to indicate that contemporaneous and ultimate replacement is not significantly different in countries with large adjustment needs to that elsewhere—the interaction term is not statistically significant. The results for the different taxes, however, provide a much richer insight into the chosen replacement strategy among countries with large replacement needs. While replacement of lost trade tax revenue using the PIT does not seem to differ among countries with large replacement needs, the estimated coefficients for contemporaneous as well as ultimate replacement indicate that the VAT was used to a larger extent (both coefficients being larger than those presented in Table 2) among those countries—possibly indicating that this group of countries simply relied more heavily on the VAT for their trade tax replacement strategy. Also noteworthy, these countries appear to have also relied on the CIT for their replacement strategy, with the estimated coefficients indicating that countries with large replacement needs ultimately increased CIT revenue by about 0.3 percentage points of GDP for each percentage point in trade tax revenue lost.

4.2 Run-up to the European Union

An additional robustness check consists of analyzing the potential impact that the run-up to join the European Union (EU) may have had on the revenue replacement strategy, as it has been argued that the EU run-up has proven essential in accelerating fiscal reforms, including reforms to the tax systems, in the years preceding final admission to the EU (Albuquerque 2011). This raises the empirical question as to whether the eleven Eastern European countries that joined the EU in 2004 (and those that joined in 2007 plus Croatia that joined in 2013) have shown a more successful (or simply different) pattern of tax revenue recovery than those outside the EU. Indeed, tax policy reforms may have included the adoption of minimum tax rates, reform of tax codes, or elimination of tax exemptions required for joining the EU, and that may have positively impacted tax revenue. This issue is explored in Table 5 by replicating the analysis presented in Table 3 for this group of eleven economies.

The estimated coefficients for total domestic revenue (Table 5, Column 1) indicate a pattern of statistically significant trade tax revenue replacement in the early 2000s until 2003 and then in 2006–2007, which is broadly consistent with the assumption of adoption of tax reforms in the years preceding final admission to the EU. When considering the different taxes, this pattern of trade tax revenue replacement and tax reform is also clear for the VAT. For the rest, there is no clear indication of the PIT or CIT contributing significantly to the replacement, and in particular neither in years preceding EU admission.

4.3 Initial conditions in tax revenue effort

A further robustness test consist in estimating Eq. (1) for countries with domestic tax revenue below and above the average—about 15 percent of GDP. The expectation here is that countries with a relatively high domestic tax revenue effort will have engaged earlier in the much needed tax reforms and will thus have more sophisticated tax administrations allowing them for a larger reliance on income taxes for the replacement of lost trade tax revenue. This is reflected to some extent in the estimated coefficients for contemporaneous as well as ultimate revenue replacement in Table 6, where the trade tax revenue variable is interacted with a dummy for countries with high tax-to-GDP ratios, indicating the differential replacement effect vis-à-vis the group of low tax revenue effort.

While contemporaneous total revenue replacement is statistically identical for both groups of countries (the interacted variable is not statistically significant), the estimated ultimate effect is larger among countries with lower tax-to-GDP ratios, suggesting that these countries may have been in larger need to implement tax reforms to allow them to replace the lost trade tax revenue. The choice of tax instruments in the replacement strategy appears to be different, however. In fact, while both countries have equally relied on the VAT, countries with a higher tax revenue effort have relied substantially more on the PIT, with an ultimate increase in PIT revenue by about 0.7 percentage points of GDP for each percentage point of lost trade tax revenue; and to some extent have also relied on the CIT. In contrast, countries with a relatively low tax revenue effort have ultimately relied equally on the VAT and PIT, but this last on a lesser extent than countries with higher tax-to-GDP ratios.

4.4 Considering tax compliance

A related question of interest is how the issue of tax compliance may affect the replacement strategy. Schaffer and Turley (2001) find that tax enforcement of the main taxes (VAT, CIT, and Social Security Contributions) is substantially lower among 25 transition countries as compared to the average EU countries. The issue of tax arrears, particularly high during the 1990s, is also a reflection of this lack of effectiveness in tax collection. To understand how revenue compliance may have influenced the replacement strategy, a measure of revenue productivity of the main taxes under study is included in the regressions, and interacted with the trade tax revenue variable. For the VAT, several papers (Ebrill et al. 2001; Aizenman and Jinjirak 2005) have focused on the “C-efficiency,” defined as the ratio of VAT revenue to aggregate consumption, divided by the standard rate of VAT. Under a uniform single rate VAT, perfectly enforced, C-efficiency would be unity. For the CIT and PIT, similar measures have been used but taking revenue to GDP instead, as it is usually a better proxy for their tax base. The advantage of analyzing tax efficiency is that it is relatively easily measured, giving the possibility of a reasonably large data set. The results are presented in Table 7 for the VAT, PIT, and CIT (Columns 1–3), and also for EUR + CIS countries only (Columns 4–6).

The chosen measure of tax compliance is significantly positively related to tax revenue collection for all taxes, suggesting that, as expected, any efforts in strengthening revenue administration can have a sizeable impact on revenue collection, regardless of the replacement strategy of lost trade tax revenue.

Regarding the replacement strategy, it appears that an increase in the tax compliance effort is associated with a higher reliance on the VAT but a lower reliance on the PIT/CIT in the replacement of lost trade tax revenue. The net estimated replacement—once the trade tax variable and the interacted term are combined—is consistent for the PIT and CIT to the one obtained in Table 2, but larger for the VAT. This result again suggests that for increasing levels of tax compliance, replacement of lost trade tax revenue increasingly follows the standard prescription in favor of using broad-base consumption taxes in the replacement strategy. The tax revenue erosion due to low compliance requires the use of other tax instruments to substitute for the lost trade revenue.

5 Concluding remarks

With trade taxes still being an important source of revenue in many transition economies, and the potential risk of losing this revenue in the event of further trade liberalization, the assessment on whether it could be replaced and what are the most efficient options available to do so, remain very relevant policy concerns.

By looking at the unique experience of 33 transition countries in Eastern Europe, the CIS, and North African and Middle East regions over the period 1991–2010, this paper has found evidence that replacement of lost trade tax revenue with other sources of domestic tax revenue has occurred, indeed to a significant extent. Interestingly in the context of transition, the pattern of trade tax replacement over time can be broadly identified with periods in which economic transformation and structural reform advanced at very different paces, which is ultimately also reflected in the different pace at which reform of the tax systems was implemented. This is also true when focusing explicitly on countries in the run-up to gain access to the European Union, for which the pattern is broadly consistent with the adoption of tax reforms in the years preceding final admission to the EU.

In addition, an assessment of the actual replacement strategy has provided further evidence of a strong contribution of the VAT, as well as the personal income tax in recovering the lost trade tax revenue, but no evidence of substantial contribution by the tax on corporate profits. Further results show that countries with larger replacement needs, as well as countries with a higher tax revenue effort have relied relatively more on the income taxes to recover the loss from trade taxes.

The case for the VAT as the most appropriate tax instrument in the replacement strategy has been stressed on theoretical and practical grounds, but the limited empirical evidence has not always supported this. While the tax on corporate profits has been considered—on efficiency grounds—a potentially superior instrument to broad-based consumption taxes, in particular in cases of imperfect competition, reality has come in contradiction, with countries struggling to raise revenue due to intensified international tax competition, which would help justify the findings in this paper. While no theoretical considerations have been put forward for or against the personal income tax, political concerns about the progressivity of the tax system may have moved countries to choose to strengthen its collection. The evidence suggesting that countries with higher tax-to-GDP ratios have relied more on income taxes—particularly the PIT—in their trade tax replacement strategy confirms these can prove to be difficult to collect at the early stages of tax system reform.

Notes

Besides widespread use of bilateral free trade agreements (FTAs) in the region, the most prominent multilateral FTAs include among CIS countries, The Eurasian Economic Community (1996) and The Common Economic Zone (2003); among Balkan countries, The Central European FTA (2006); and among North African-Middle East countries, The Pan-Arab FTA (1997). Also important are the EU negotiated agreements with several countries, in particular with Morocco (1996), Tunisia (1995), Egypt (2001), and Jordan (1997).

While trade tax revenue appears to follow a downward trend for each individual country over the sample period, the impact of trade liberalization on trade tax revenue does not need to be necessarily negative. Blejer and Cheasty (1990), conclude that ultimately the net impact of trade reform on revenue is an empirical matter. Ebrill et al. (1999) discuss possible minor revenue consequences in the early stages of trade liberalization.

Khattry and Rao (2002) use simple correlations to also study the extent of replacement for 80 countries over the period 1970–98.

This argument becomes less apparent in models that allow for imperfect competition (Keen and Ligthart 2005).

While Crivelli (2013) looks at disaggregated tax revenues in transition countries, the focus there is on the impact of privatization on the revenue from different taxes and not on replacement of trade tax revenue.

Appendix A lists the countries included in the sample.

Also, these data have the potential of being more reliable, since in some cases GFS differs from revenue figures that seem reasonable. Data for general government is used for most of the countries but central government data is used whenever the former is not available.

Both taking the value 1 when there is little private ownership and up to the value 4 when more than 50 percent of state-owned enterprises are in private ownership and significant progress has been achieved at the level of corporate governance. The difference between the two indicators is based on the size of the enterprises under consideration.

At the cost of missing observations, the shorter time period may actually provide more robust results due to data quality considerations in the early period of transition (see, for example, Djankov and Freund 2002). Further sensitivity analysis covering only the period 1999–2010 provides qualitatively and quantitatively similar results.

Countries in this group are indicated in Appendix A.

Countries indicated with an asterisk are those that experienced a reduction in trade tax revenue over 1 percentage point of GDP over the sample period.

We present both statistics only in cases where there appears to be a potential issue with instrument proliferation. The Hansen statistic’s p value should be high enough to reject correlation between the instruments and the errors but not too high because it weakens confidence in the test. The Sargan test, in contrast, is less vulnerable to instrument proliferation, but not robust to heteroscedasticity.

References

Agbeyegbe, T., Stotsky, J., and Woldemariam, A. (2004). Trade liberalization, exchange rate changes, and tax revenue in Sub-Saharan Africa. IMF Working Paper 04/178 (Washington: International Monetary Fund).

Aizenman, J., and Jinjirak, Y. (2005). The collection efficiency of the VAT: Theory and international evidence. NBER Working Paper No. 11539 (Cambridge, Massachusetts: National Bureau of Economic Research).

Albuquerque, B. (2011). Fiscal institutions and public spending volatility in Europe. Economic Modeling, 28, 2544–2559.

Arellano, M., & Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. The Review of Economic Studies, 58, 277–297.

Baunsgaard, T., & Keen, M. (2010). Tax revenue and (or?) trade liberalization. Journal of Public Economics, 94, 563–577.

Blejer, M., & Cheasty, A. (1990). Fiscal Implications of trade liberalization. In V. Tanzi (Ed.), Fiscal Policy in Open Developing Economies. Washington: International Monetary Fund.

Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87, 115–143.

Buettner, T., Hertz, R. and Nam, C. (2006). VAT introduction and WTO membership: The experience in developing and transition countries. mimeo, Ifo Institute.

Buiter, W. (1997). Aspects of fiscal performance in some transition economies under fund-supported programs. IMF Working Paper 97/31 (Washington: International Monetary Fund).

Cass, F. (2007). Attracting FDI to transition countries: the use of incentives and promotion agencies. Transnational Corporations, 16, 77–122.

Cnossen, S., & Bird, R. (1990). The personal income tax: Phoenix from the Ashes?. The Netherlands: North-Holland.

Coricelli, F. (1998). Macroeconomic policies and the development of markets in transition economies. Budapest: Central European University Press.

Crivelli, E. (2013). Fiscal impact of privatization revisited: The role of tax revenues in transition economies. Economic Systems, 37, 217–232.

Crivelli, E., & Gupta, S. (2014). Resource blessing, revenue curse? Domestic revenue effort in resource-rich countries. European Journal of Political Economy, 35, 88–101.

Dahlberg, S., Holmberg, S., Rothstein, B., Hartmann, F., Svensson, R. (2015). The Quality of Government Basic Dataset: Version Jan 15. University of Gothenburg, The Quality of Government Institute. http://www.qog.pol.gu.se.

Djankov, S., & Freund, C. (2002). New borders: Evidence from the former Soviet Union. Review of World Economics, 138(3), 493–508.

Ebrill, L., & Havrylyshyn, O. (1999). Tax reform in the Baltics, Russia, and other countries of the former Soviet Union, IMF Occasional Paper 182. Washington: International Monetary Fund.

Ebrill, L., Keen, M., Bodin, J., & Summers, V. (2001). The modern VAT. Washington: International Monetary Fund.

Ebrill, L., Stotsky, J., & Gropp, R. (1999). Revenue Implications of Trade Liberalization, Occasional Paper 180. Washington: International Monetary Fund.

Gouret, F. (2007). Privatization and output behavior during the transition: Methods matter! Journal of Comparative Economics, 35, 3–34.

Haque, M., & Mukherjee, A. (2005). On the revenue implications of trade liberalization under imperfect competition. Economics Letters, 88, 27–31.

International Monetary Fund. (2014). 25 Years of transition: Post-communist Europe and the IMF, regional economic issues, special report, October. Washington: International Monetary Fund.

Keen, M., & Ligthart, J. (2001). Coordinating tariff reductions and domestic tax reform. Journal of International Economics, 56, 407–425.

Keen, M., & Ligthart, J. (2005). Coordinating tariff reduction and domestic tax reform under imperfect competition. Review of International Economics, 13, 385–390.

Khattry, B., & Rao, M. (2002). Fiscal faux pas? An analysis of the revenue implications of trade liberalization. World Development, 30, 1431–1444.

Martinez-Vazquez, J., & McNab, R. (2000). The tax reform experiment in transition countries. National Tax Journal, 53, 117–133.

Mujumder, S. (2004). Revenue implications of trade liberalization under imperfect competition. Economics Letters, 82, 83–89.

Rodrik, D. (1998). Why do more open economies have bigger governments? Journal of Political Economy, 106, 997–1032.

Roodman, D. (2009). A note on the theme of too many instruments. Oxford Bulletin of Economics and Statistics, 71(1), 135–158.

Schaffer, M., & Turley, G. (2001). Effective versus statutory taxation: measuring effective tax administration in transition economies, EBRD Working Paper 62, European Bank for Reconstruction and Development.

Sen Gupta, A. (2007). Determinants of tax revenue efforts in developing countries, IMF Working Paper 07/184 (Washington: International Monetary Fund).

Tanzi, V. (1987). Quantitative characteristics of the tax systems of developing countries. In D. Newbery & N. Stern (Eds.), The theory of taxation for developing countries (pp. 205–241). Oxford: Oxford University Press.

Tanzi, V., & Tsibouris, G., (2000). Fiscal reform over ten years of transition. IMF Working Paper 00/113, Washington, DC.

Acknowledgments

I would like to thank the Editor Hakan Danis, and anonymous referees for excellent suggestions. Helpful comments were received from Nina Budina, Pamela Madrid Angers, Ghada Fayad, and Johannes Wiegand on an earlier draft. I am mostly grateful for comments and suggestions received from participants at a seminar hosted by the Central Bank of Kosovo. The views expressed herein are those of the author, and should not be attributed to the IMF, its executive board, or its management.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A: Data

The 33 countries in the sample are the followingFootnote 12: Albania*, Armenia, Azerbaijan, Belarus, Bosnia and Herzegovina*, Bulgaria, Croatia*, Czech Republic, Egypt*, Estonia, Georgia*, Hungary*, Jordan*, Kazakhstan*, Kosovo, Latvia, Libya*, Lithuania, Macedonia, Moldova, Mongolia, Morocco*, Poland*, Romania*, Russian Federation, Serbia, Slovak Republic*, Slovenia*, Tajikistan*, Tunisia*, Turkey, Ukraine, and Yemen*.

Data on total domestic tax revenue, VAT, corporate income tax, personal income tax, and trade tax revenue are taken from the IMF’s Government Financial Statistics (GFS) database, and IMF country documents, as discussed in Sect. 2, relative to GDP.

Share of agriculture in aggregate value added is taken from the World Bank’s World Development Indicators (WDI) database. Trade openness is calculated as imports plus exports in percent of GDP, taken from the IMF’s International Financial Statistics (IFS) database. Per capita GDP is calculated in constant (year 2000) U.S. dollars, taken from the WDI database, expressed in logs. Inflation is the annual change in the CPI, taken from the IFS database. The privatization indicator is constructed as indicated in the text, based on large scale and short-scale privatization indicators and the share of the private sector in GDP, all of them taken from the European Bank of Reconstruction and Development Database (EBRD). Total natural resources rents, relative to GDP, taken from the WDI database. Transparency International’s Corruption Perception index, transformed to take the value 0 (high corruption) to 100 (low corruption), available online at http://www.qog.pol.gu.se, from Dahlberg et al. (Dahlberg et al. 2015). Table 8 summarizes the data.

Appendix B: instrumental variables and system-GMM estimation

The presence of the lagged dependent variable in Eq. (1) may create difficulties for the fixed effects estimator: dynamic panel bias from the correlation between D t-1 and the fixed effect, and bias from any serial correlation in the ε it . A different concern arises with the use of the fixed-effects estimator, in particular the potential endogeneity of domestic tax revenues. It might be the case that the failure to boost other sources of revenue and to achieve macroeconomic stability compromised trade reform, thus reducing the speed of the trade tax revenue loss. To address these issues, results are reported for the two stage least squares (2SLS) on the levels of Eq. (1), and the Blundell and Bond (1998) system generalized method of moments (GMM), which in contrast to the fixed-effects estimator should be fully consistent.Footnote 13 The 2SLS estimator uses as instruments the first and second lag of T. To the extent that these instruments are valid (as indicated by the Sargan test) this should deal with the potential endogeneity problem. The system-GMM takes Eq. (1) in differences and levels as a system, using lagged changes as instruments in the latter, and lagged levels as instrument for changes in the former. To test the validity of the instruments we present not only the Hansen statistic, but also the Sargan statistic, which is less vulnerable to instrument proliferation (Roodman 2009).Footnote 14

Appendix Table 9 reports the results using 2SLS whereas Appendix Table 10 reports the results using system-GMM. Instrument validity for the 2SLS does not seem to be a problem, as suggested by the Sargan test. Similarly, the diagnostics for the system-GMM estimator are satisfactory, with a tolerable value for the Hansen test, and with the Arellano and Bond (1991) test for first and second order serial correlation (M1 and M2) suggesting that the former is present but the later is not, which is consistent with the underlying assumptions.

In both cases the results are qualitatively similar to those obtained in Tables 1 and 2, with statistically significant replacement of lost trade tax revenue with domestic tax revenue, and major contribution from the VAT and PIT in the replacement strategy. The main difference in the two alternative estimation techniques is in the size of the estimated contemporaneous replacement, which appears to be larger with the system-GMM estimator.

Rights and permissions

About this article

Cite this article

Crivelli, E. Trade liberalization and tax revenue in transition: an empirical analysis of the replacement strategy. Eurasian Econ Rev 6, 1–25 (2016). https://doi.org/10.1007/s40822-015-0032-7

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40822-015-0032-7