Abstract

This paper investigates whether implied volatility index can be predicted and whether the prediction of implied volatility index can improve option trading performances by checking Hang Seng Index Volatility (VHSI). The results indicate that VHSI can be predicted more accurately when considering day-of-week effect and spillover effect. Furthermore, this paper uses straddle to examine the trading performance with the real data from Hong Kong option trading market. The results suggest that option trading based on the prediction of VHSI can generate extra returns, and model specifications with day-of-week and spillover effects perform better than ones without these two effects. The results also suggest that the prediction of VHSI adds value to practical investors.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Implied volatility index, derived from the market price of traded index options, has attracted much attention in recent years because of its importance in financial markets. Professional option traders such as hedge funds and banks’ proprietary traders are interested primarily in volatility implied by an option’s market price when making buy and sell decisions. Researchers pay their attention on the interaction between implied volatility index and financial markets as well as examining the indicative functions to market risk and future returns. For example, Whaley (2000) named S&P (implied) Volatility Index (VIX) as “the investor fear gauge” according to the significant negative relationship between VIX changes and expected returns. Giot (2005a) involved VIX into a daily market risk evaluation framework. According to the negative relationship between implied volatility index and stock price, implied volatility index can be designed for hedging risk. As a measure of market risk, implied volatility index can also be considered as a useful tool for asset pricing, and its value can assist in making portfolio management decisions. Due to these considerations, exploring the characteristics of implied volatility can provide added value to practitioners and retail investors alike.

The first aim of this paper is to explore whether implied volatility index can be predicted based on Autoregressive Integrated Moving Average (ARIMA) model and heterogeneous autoregressive (HAR) model considering day-of-week effect, spillover effect and the returns of stock index by checking Hang Seng Index Volatility (VHSI). To this end, this paper sets four different model specifications based on ARIMA and HAR using time series data of VHSI from January 2001 to December 2010. The result of parameter estimates shows significant impacts from day-of-week effect, spillover effect and the returns of Hang Seng Index (HSI). This paper also tests the stability of coefficients by setting two sub-samples with different data fluctuation characteristics, and the result indicates that estimated coefficients are stable for both kinds of models. This paper compares the forecasting performances of different model specifications by displaying Mean Squared Errors (MSEs) and correct direct prediction, the result shows model specifications with day-of-week and spillover effects perform better than ones without these explanatory variables. Diebold–Mariano (DM) test, which is used to investigate whether the differences between the MSEs are statistically significant, indicates that model specifications with explanatory variables indeed improve the forecasting performances.

In a further step, this paper tests whether exploring the characteristics of implied volatility provide insights into real option trading. The directional predictions are used to simulate option trades with Hang Seng Index option prices. The simulated trading strategy is straddle which makes buy and sell decisions based on the expected changes of underlying asset’s volatility. Transaction costs are also considered by setting filters to eliminate small transacting signals. The result suggests that VHSI forecasting can provide added values to investors and the trading performances of model specifications with day-of-week effect, spillover effect and the returns of HSI are even better.

Finally, this paper makes contributions to the literature in several ways. Firstly, relatively little work has been done on modeling and forecasting implied volatility index itself, compared with the extensive mass of literature on forecasting future volatility and returns based on implied volatility index. The representative works just include the researches of Konstantinidi et al. (2008), Ahoniemi (2008), Dunis et al. (2013). Secondly, this paper could serve as a guide for further studies on the implied volatility of emerging markets, since there are a few works on volatility indices of financial markets other than American financial markets. For emerging financial markets, compared to VIX, research has been inadequate. Most research still focuses on the realized volatility of equity market, such as Tanai and Lin (2013) and Le and David (2014).

The rest of this paper is organized as follows: the second section describes the data series used in the analysis. In the third section, we model VHSI with ARIMA models with and without considering day-of-week effect, spillover effect and one day lagged HSI returns. The fourth section examines the heterogeneous characteristics of VHSI with HAR and HARX (HAR model specifications with explanatory variables) models. The fifth section compares the forecasting performance of above models. Finally, we test the option trading performances of the proposed model specifications.

2 Data

2.1 Hang Seng index volatility (VHSI)

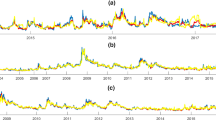

VHSI is the implied volatility index examined in this research and the data is obtained from the website of Hang Seng Indexes Company Limited (HSIL). For modeling VHSI, the data spans from 2 January 2001 to 31 December 2010, and for examining the forecasting performances, the data spans from 2 January 2001 to 30 December 2011, the latest date when this research was conducted. The time series data of VHSI from 2 January 2001 to 30 December 2011 are shown in Fig. 1. It shows that VHSI exhibited fewer fluctuations from January 2003 to March 2007, and stood at around 20 in most of the period, but VHSI became more fluctuant after the subprime mortgage crisis and increased dramatically after the bankruptcy of Lehman Brothers. In order to test the robustness of the coefficients, this research sets two sample periods,Footnote 1 based on macroeconomic trends and the fluctuation features of VHSI with similar numbers of observations.

Descriptive statistics of VHSI are provided in Table 1. Logarithm difference of VHSI in each sample period is also provided since logarithm returns (changes) approximately equal to the percentage changes of financial index and logarithm return is consistent with the idea of continuous compound returns.

The largest daily changes in the VHSI were experienced in the sub-period B; a gain of 28.92 % and a drop of 15.70 %. The largest gain occurred during the fiscal turbulences in several European countries, along with scandals related to capital adequacy of many global banks. Actually, the last drop occurs on the day just after the largest gain. The data from both periods are skewed to the right, and the logarithm changes display sizeable excess kurtosis.

The VHSI is a very persistent time series as its daily levels display high autocorrelation (Table 1). A unit root is rejected by the ADF test for the differenced time series at one-percent level of significance (Fig. 2), but the unit root cannot be rejected by the ADF test for the level of VHSI in the full sample period and the second sub-period.

As noted in Simon (2003), the use of logs is consistent with positive skewness in implied volatility data. Fleming et al. (1995) argued that both academics and practitioners are interested primarily in changes in expected volatility. Moreover, given the high level of autocorrelation in VIX level series, Fleming et al. (1995) remarked that inferences in finite sample can be adversely affected. The last but not the least, using logarithm changes of VHSI avoids negative forecasts of volatility. In light of this evidence, the models in this study are built for log difference of VHSI rather than levels.

2.2 Other data

Many variables such as returns of the stock market, including returns in other countries (testing the spillover effect from other financial markets), have been used to model VIX or implied volatility (Franks and Schwartz 1991; Fleming et al. 1995; Ahoniemi 2008).

It is well documented that returns and volatility affect each other, with large returns and high volatility going hand-in-hand. Simon (2003) showed that the Nasdaq volatility Index (VXN) is inversely correlated with Nasdaq index returns in the same day, using data from January 1995 to May 2002. Based on FTSE 100 and VFTSE (volatility index of FTSE 100) Siriopoulos and Fassas (2008) found that a increase in the implied volatility index results in a decline in the stock index. Chen and Lai (2013) found a negative and asymmetric contemporaneous relationship between VHSI changes and HSI returns using Kalman filter. Fleming et al. (1995) noted a large negative contemporaneous correlation between the value of VIX and the underlying stock index level, suggesting an inverse relationship between expected volatility and stock market prices. Regarding to the indicative role of volatility index, Giot (2005b) investigated the relationship between the level of the implied volatility indexes (VIX and VXN) at a given time and the forward-looking stock market returns (S&P 100 and Nasdaq). He pointed out that extremely high levels of implied volatility indicated an oversold market. In the light of the interaction between implied volatility and stock returns, Ahoniemi (2008) modeled and forecasted VIX with lagged log return of the S&P 500 index, and found that among the various financial and macroeconomic indicators he estimated, only lagged log return of the S&P 500 index was statistically significant.

Many researchers also believe that returns of stock markets in other countries may have some spillover effects on the US market. For example, returns of the MSCI EAFE (Europe, Australia and Far East) stock index in particular are believed to have some effect on changes in the VIX. Ahoniemi (2008) used returns of MSCI EAFE (Europe, Australia and Far East) index to examine the impact from other economies. As an open financial market, Hong Kong stock market is usually affected by the world economy. The US market, as the largest economy in the world, tends to dominate global financial trends and events, and so it is reasonable to believe that returns of US stock markets have some spillover effects on the Hong Kong stock market. Moreover, returns of the S&P 500 index have been shown to be a good explanatory variable to estimate investor sentiment in Hong Kong (Chen and Tai-Leung 2010).

As implied volatility has been found to exhibit weekly seasonality (or day-of-week effect) (i.e. Harvey and Whaley 1992; Brooks and Oozeer 2002), this research investigates whether there are any seasonal patterns in the VHSI time series with day-of-week dummy variables. We also get the same results as Ahoniemi (2008), i.e. the VHSI index displays a clear weekly pattern, with the highest average index level on Mondays and the lowest average index level on Fridays (see Table 2). Therefore, it could be expected that a day-of-week dummy would most likely be significant for Mondays and Fridays.

According to the aim of this research, variables similar to those listed above are used to construct a number of explanatory variables for VHSI time series models. These variables are logarithm returns of both Hang Seng index and S&P 500 indexFootnote 2 at one day earlier, together with dummy variables for Monday and Friday.

Data of Hang Seng Index and S&P 500 Index are collected from Bloomberg. These are used to test whether these variables can explain variations in the VHSI. All variables are in Logarithm form. The p-values from the Augmented Dickey-Fuller (ADF) test indicate that the null hypothesis of a unit root cannot be rejected at the one-percent significance level for Hang Seng index and the S&P 500 index without differencing Table 3. In addition, returns must be used for the Hang Seng index and the S&P 500 index due to the same non-stationary issues.

3 ARIMA and ARIMAX model

3.1 Model specification

One full sample period and two sub-sample periods are used in the model-building phase to determine the robustness of the results and stability of coefficients over time. The full sample period includes data from 2 January 2001 to 31 December 2010, or 2,470 observations. Two sub-sample periods are derived from the full sample period by dividing it based on the first sign of subprime crisis and the characteristic of time series. The first corresponding sample is an in-sample period (2 January 2003–31 March 2007), which contains a relatively stable time series of VHSI index. The second corresponding sample is also an in-sample period (2 April 2007–31 December 2010), which contains a fluctuating time series of VHSI index. Both sample periods are selected in order to see whether the explanatory variables impact VHSI index differently in different periods.

This paper identifies the order of an ARIMA model by comparing the values of both Akaike information criterion (AIC) and Bayesian information criterion (BIC) of different ARIMA specifications. Both AIC and BIC are measures for model selection among a finite set of models. Since the large order of ARIMA model can lead over fitting and increase the difficulty of estimation, by considering both AIC values and BIC values in Table 4, an ARIMA (1, 1, 1) specification was found to be the best fit for the logarithm changes of VHSI or ARMA (1, 1) specification for the logarithm changes of VHSI.

To set an ARIMA model with explanatory variables, logarithm returns of both the Hang Seng index and the S&P 500 indexFootnote 3 at one day earlier, dummy variables for Monday and Friday are included in the regression to see whether they improve ARIMA models of the VHSI. The estimated linear equation is

where \( \Delta \,{\text{LnVHSI}}_{t} \) is the logarithmic change of VHSI, x i is the ith explanatory variable other than AR and MA components, the weekday dummy variable D k receives value of 1 on day k and zero otherwise. The model is a first-order model throughout, as no second lags turned out to be statistically significant.

3.2 Estimation results

Results of estimation of day-of-the-week effect for the full period and two in-sample periods are presented in Table 5. The full period estimation is consistent with earlier evidence on weekly seasonality in implied volatility in equities markets (Harvey and Whaley 1992; Ahoniemi and Lanne 2009); dummy variables for Monday and Friday are statistically significant. Based on the full period, weekday dummies have the expected signs: the positive Monday dummy (γ 1) is consistent with the VHSI tending to rise on Mondays and the negative Friday dummy (γ 5) is consistent with the drop that the VHSI experiences on average on Fridays. However, using the data of sub-period 03/2007–12/2010, which contains a fluctuating time series of VHSI, only the Monday dummy variable is significant. Ahoniemi (2008) used VIX data from 1990 to 2002 and indicated that both Monday and Friday dummy variables are significant in the full sample period and in-sample period, but in his sample, the range of VIX is only 36.43, the maximum change is only 9.92, and the minimum change is only −7.8. All of them are less than the corresponding data of the full sample period and the second in-sample period in this study. Harvey and Whaley (1992) suggested that Monday’s implied volatility should be higher than volatility on other days since traders open positions on the first trading day of the week, meaning that there is excess buying pressure on Mondays, resulting in higher volatility. This pheromone would be true in the long run but in a relatively short time window with unstable macroeconomic environment, news which can impact investors’ sentiments comes out every day, and as a result, the Fridays effect won’t impact the change of VHSI significantly.

The estimation results also show that spillover effect is statistically significant for the full period and the two in-sample periods. Many researchers have found a negative correlation between the change of VIX and the contemporaneous index return (Bollen and Whaley 2004; Low 2004) but from the perspective of forecasting, the use of lagged returns is essential in the context of this study as the models are later used for forecasting. Although Fleming et al. (1995) also found VIX and stock returns to have a strong negative contemporaneous correlation, they estimated a slightly positive correlation between the current change in expected volatility and past stock index returns, which is consistent with the positive coefficient in this study.

The positive coefficient for Hang Seng index returns suggests that a positive return in the previous trading day raises the VHSI on the following day, and a negative return equivalently lowers the VHSI. Fleming et al. (1995) attributed this positive association to mean reverting. When investors regard the market as mean reverting, the higher the past stock return is, the more the investors fear the market to fall and, as a result, investors are more likely to buy put options or sell call options to hedge the risk. This also indicates a high expected volatility of the market. Simon (2003) discussed why the VXN tends to fall when the return is expected to be positive and to rise when the return is expected to be negative. When investors expect a market decline, they have more of an inclination to buy put options to hedge the risk, thus raise IV through increased options demand. On the other hand, according to mean-reverting effect, investors expect a rise in the underlying index level after the market declines, and more probably options with a higher strike price become at-the-money (ATM) options. Due to the well-documented volatility skew in equities options implied volatilities, these higher-strike options have lower IVs than options that were previously ATM. Leland (1996) demonstrates that investors who believe market returns are less mean-reverting than the average investor are inclined to buy options, while investors who believe market returns are more mean-reverting than the average investor are inclined to sell options.

The results also indicate that log returns of the S&P 500 index at one day earlier impact the change of VHSI negatively, which means that a negative return over the previous trading dayFootnote 4 raises the VHSI on the following day, and a positive return equivalently lowers the VHSI. The significant effect from US market demonstrates the spillover effect of US market to Hong Kong market. The “spillover effect” shows that a turbulent capital market makes investors in other capital markets change their investment behaviors, and thus passes fluctuations on to other capital markets. As shown in Table 5, log returns of the S&P 500 index at one day earlier increase at 1 %, changes of VHSI decrease by 1.1 % (ψ 2).

4 Heterogeneous autoregressive model (HAR)

4.1 Model specification

Corsi (2008) argued that HAR specifications are particularly suitable for modeling and forecasting both realized and implied volatilities because they are able to capture the long-range dependence that arises from the asymmetric propagation of volatility between long and short horizons. An additive cascade of different partial volatilities is included in HAR model to implicit the actions of distinct types of market participants (Müller et al. 1995). At each level of the cascade (or time scale), the corresponding unobserved partial volatility process is a function not only of its past value, but also of the expected values of the other partial volatilities. By straightforward recursive substitutions, Corsi (2008) showed that this additive structure of the volatility cascade leads to a simple restricted linear autoregressive model featuring volatilities realized over different time horizons. The heterogeneous character is derived from the partial volatility which relies on the different autoregressive structures at each time scale in this model. Let \( \bar{y}_{t}^{(h)} = {{(1} \mathord{\left/ {\vphantom {{(1} h}} \right. \kern-0pt} h})\sum\nolimits_{s = 1}^{h} {y_{t - s + 1} } \) and \( \bar{Y}_{t - 1} = \left( {1,\bar{y}_{t}^{{(h_{1} )}} , \ldots ,\bar{y}_{t}^{{(h_{p} )}} } \right)^{'} \in {\mathbb{R}}^{p + 1} \) for some vector of indices \( H = \left( {h_{1} , \ldots ,h_{p} } \right)^{{\mathbf{\prime }}} \in {\mathbb{Z}}_{ + }^{p} \). The HAR can be given by:

where ɛ t is a Gaussian white noise process with zero mean and variance σ 2 ɛ . A typical choice in the literature for the index vector is H = (1, 5, 22)′ so as to represent the daily, weekly and monthly components of the volatility process.

4.2 Estimation results

Referring to modeling and forecasting VHSI, y t is the logarithmic change of VHSI and \( \bar{Y}_{t - 1} \) is the average of logarithmic changes of VHSI over different time horizons. In order to identify of index vector, we first expand the index vector by adding a biweekly and a quarterly component to the usual one so that H = (1, 5, 10, 22, 66)′. With an examination of the significance of each element in β based on the whole sample period, it concludes that only β 1 and β 5 are significant in the regression, that is, we identify a HAR specification taking H = (1, 66)′ as the index vector without constant in this paper.

HAR model with explanatory variables is also included in the examination. The model is as presented below:

where x i and D k have the same meaning as in Eq. (1). Also, in this section we use the same explanatory variables as in ARIMAX model, that is, the daily returns of HSI and S&P 500 at one day earlier, the dummy variables that indicate Money and Friday. In order to test the robustness and stability of the parameters, two sub periods are taken into consideration. The estimation results are shown in Table 6.

The estimations of the index vector are not stable no matter the explanatory variables are involved or not. If VHSI is in a stable pattern, the explanatory variables and the long term components contain more information than the near term components. Conversely, if VHSI is fluctuant, the explanatory variables and the near term components contain more information than the long term components.

5 Forecasting performance

In this section, we analyze forecasting performance of the four model specifications described above. The whole data series is split into in-sample data from January 2001 to December 2008 and out-of-sample data from January 2009 to December 2011. The out-of-sample period is expected to enhance robustness of the result. The forecasts are calculated from rolling samples, adding new sample data with time. In other words, after calculating each forecast, observations for the most recent day are included in the sample, and the parameters values are re-estimated. The updated parameter values are then used together with values of day T to predict VHSI changes from day T to day T + 1. The dummy variables are treated differently, i.e. day T + 1 dummy variables are used when forecasting the change in VIX from day T to day T + 1.

Traders believe that successful forecasting of IV primarily involves forecasting the direction of IV correctly rather than the correct magnitude of the change, because option positions such as the straddle generate a profit if the IV moves in the correct direction and keep other factors invariable. The magnitude of change just affects the size of the profit. Forecasting accuracy of various models is first evaluated based on the sign: how many times the sign of the change in VHSI corresponds to the direction forecast by the model. The point forecast is also evaluated on mean squared errors (MSE), since accurate point forecast can be valuable, for example, in risk management and asset pricing application.

Table 7 presents the forecast performance of various models, measured with the correct direction of change and mean squared errors. Including explanatory variables in the model does improve the directional accuracy of the forecasts.

When assessing point forecast with MSEs, model specifications with explanatory variables perform better than those without explanatory variables for both in-sample and out-of-sample data. If we just compare models using out-of-sample data, HAR has smaller MSE. Considering the correct directional prediction, HAR models perform better than ARIMA models when we include explanatory variables. When we do not consider any explanatory variables, ARIMA is better than HAR.

In the next step the Diebold-Mariano (DM) test is conducted to investigate whether the differences between the MSEs are statistically significant. The DM test does not reject the null hypothesis of equal predictive accuracy for ARIMA and HAR, ARIMAX and HARX when using in-sample data (see Table 8). In other words, there is no statistically significant difference for those two pairs of models when evaluated with mean squared errors. Based on both the in-sample and out-of-sample data, model specifications with explanatory variables perform better than those without explanatory variables. Moreover, DM test rejected the null hypothesis for ARIMAX and HARX considering out-of-sample data, which means there is statistically significant difference between them.

6 Option trading performance

The trading performance investigation provides a way to assess the forecasting ability of the above time series models along with economic significance. Correct directional prediction over 50 % is valuable for option traders, since traders can hold long positions when volatility index rises and hold short positions when volatility falls. In this section the directional predictions from the models presented above are used to simulate option trades with Hang Seng Index option prices. The simulated trading strategy is straddle, which involves buying or selling an equal amount of call and put options.

An out-of-sample option trading simulation, with trades executed based on forecasts for the VHSI, requires daily close quotes of near-the-money Hang Seng Index options. The Hang Seng Index option quotes were obtained from Hong Kong Exchanges and Clearing Limited for the out-of-sample period from 1 April 2011 to 30 December 2011. In practice, near-the-money options have the highest trading volume (Buraschi and Jackwerth 2001) and VHSI is derived from near-the-money options with a selection range of ±20 %. Ni et al. (2008) found that investors with a view on volatility are more likely to trade in near-the-money options than in-the-money or out-of-money options. Moreover, Bollen and Whaley (2004) suggested that at-the-money options have the highest sensitivity to volatility. Options with the nearest expiration date were used, up to fourteen calendar days prior to the expiration of the nearby option, when trading was rolled over to the next expiration date. This is necessary as the implied volatility of an option close to maturity may behave erratically. Poon and Pope (2002) analyzed S&P 100 and S&P 500 option trading data for a period of 1,160 trading days and pointed out that contracts with 5–30 days to maturity have the highest number of transactions and largest trading volumes. Daily straddle positions are simulated with prices of near-the-money options in the near and next term by utilizing the out-of-sample forecasts from the six models presented above.

The option positions are opened with the close quotes on day T and closed with the close quotes on day T + 1, which is the day for which the directional prediction is made. This strategy allows us to use options that are near-the-money on each given day. The strike price is chosen such that the gap between the actual closing quote of the Hang Seng index from the previous day (day T) and the option’s strike price is as small as possible. The exception is that when there was zero trading volume for the closest-to-the money options on either day T or day T + 1, the next-closest contract was used in the simulation.

The option positions are technically not delta neutral, which means that trading returns are sensitive to large changes in the value of the options’ underlying asset, or the Hang Seng Index, during the course of the day. However, this problem is not deemed critical for this analysis. The deltas of at-the-money call and put options nearly offset each other (Noh et al. 1994), so that the positions are close to delta neutral when they are opened at the start of each day. The deviations from delta neutrality in this research come primarily from the fact that strikes are only available at certain fixed intervals. The positions are updated daily, so the strike price used can be changed each day. Also, Engle and Rosenberg (2000) and Ni et al. (2008) noted that straddle is sensitive to changes in volatility but insensitive to changes in the price of the options’ underlying asset. Driessen and Maenhout (2007) pointed out that the correlation between at-the-money straddle returns and equity returns is only −0.07 for S&P 500 index.

In practice, if the forecasted direction of VHSI changes was positive, near-the-money calls and near-the-money puts were bought. Equivalently, if the forecast direction of VHSI changes was negative, near-the-money calls and near-the-money puts were sold. The number of contracts to be bought or sold was calculated separately for each day. The return from a long straddle is calculated by Eq. (4), and the return from a short straddle is shown in Eq. (5). In this analysis, the profits from selling a straddle are not invested during the day and are held with zero interest.

where C t is the close quote of a near-the-money call option, P t is the close quote of a near-the-money put option (with same strike price and maturity as the call option), C t+1and P t+1 are the close quotes of the same options at the end of the next trading day.

Although the emphasis is on directional accuracy, filters were also used in option trading simulations. Three filters were considered in this research to indicate the different levels of trading signals, since very small changes may not be as reliable in the directional sense as trading signals. Harvey and Whaley (1992) and Noh et al. (1994) used two filters to leave out the smallest predictions of changes. Poon and Pope (2002) set three filters to take transaction costs into account. In fact, the use of filters can be regarded as a way to account for transaction costs, as very small changes in the volatility index may lead to option trading profits so small that they are eaten away by transaction costs. To this end, three filters (0.1, 0.2 and 0.5 %) are used to filter out trading signals smaller than these filters in three simulations.

An initial capital of 5,000 HKD is assumed in this simulation, and in each trading only two option contracts is bought or sold. The option trading profits can be reinvested, and losses reduce the capital. The ultimate return ratio is the total returns divided by the initial capital and the winning ratio is the winning times divided by the trading times. Sharpe ratio is also calculated to evaluate the trading performance. To avoid disturbance in trading and lack of liquidity, we only trade the near-term options 5 days before maturity. In a particular way, on 25 April 2011, the near-term options are the options with maturity dates of 30 May 2011, instead of 30 April 2011, and we begin to trade options with maturity date of 30 May 2011. The trading results are shown in Table 9.

The trading simulation shows that models with explanatory variables beat those without explanatory variables. The numbers of trades decrease as filter value rises. Moreover, the changing patterns of return ratios according to different filters are reasonable for ARIMAX, HAR and HARX: less return ratios are obtained when there is no filter, and then largest return ratios arise when filter equals 0.1 %, finally return ratios decline when filter value increases. The reason is that when filter equals 0.1 %, very small changes are not considered as trading signals, which can avoid misunderstanding of market; when filter increases, which implies that transaction costs are bigger and bigger, return ratios decline since part of the returns should cover the transaction costs. The changing patterns of Sharpe ratios for ARIMAX and HARX are similar to the changing patterns of return ratios. In the end, HARX only performs better than ARIMAX when filter equals 0.5 %, HAR performs better than ARIMA when filter equals 0 and 0.1 %. In other cases HAR models don’t show any advantages compared to ARIMA models.

The descriptive statistics for return ratios and returns of each trading are shown in Tables 10 and 11. They manifest that model specifications with explanatory variables are better than specifications without explanatory variables. They also display that all the specifications have the similar standard deviations.

In light of the forecast evaluation in the last section and the above analysis of option returns, also considering the transaction cost, it’s better to use model specification with explanatory variables and if the transaction costs are expensive, HARX is better than ARIMAX. In short the most important finding of this research is that using the prediction of direction changes of VHSI to trade options with straddle can generate extra returns.

7 Conclusion

Exploring characteristics of implied volatility is of interest to options market practitioners, as well as investors with portfolio risk management concerns. This paper models and forecasts VHSI based on ARIMA and HAR to answer whether the implied volatility index can be predicted. This research suggest returns of the Hang Seng Index and the S&P 500 index at the previous day are statistically significant explanatory variables for the first difference of the VHSI for all the three alternative sample periods. The positive coefficient of the Hang Seng Index at the previous day indicates that investors tend to believe the market is mean-reverting. The negative coefficient of S&P 500 index at previous day suggests a significant spillover effect of the S&P 500 Index on Hang Seng Index. The weekday dummies have the expected signs: the positive Monday dummy (γ 1) indicates that VHSI tends to rise on Mondays and the negative Friday dummy (γ 5) indicates the drop VHSI experiences (on average) on Fridays. However, in the 03/2007-12/2010 sub-period only the Monday dummy variable is significant. Although Harvey and Whaley (1992) attribute higher volatility on Mondays to excessive buying pressure, this research suggests that in a relatively short time window with unstable macroeconomic environment, news causing turbulence in investor sentiment come out every day and, as a result, VHSI may not drop continuously on other days. As expected, in the light of previous research, it seems that the direction of change of the VHSI can be predicted to a certain degree. The forecasting evaluation confirms the importance of considering explanatory variables in modeling VHSI index.

Since the predictability of VHSI changes can potentially be exploited profitably by options traders, this paper investigates whether the prediction of implied volatility can provide added value to option trading. To this end, an option trading strategy with straddle is investigated based on predictions of VHSI changes. Although the trading simulation results do not suggest any significant differences between ARIMAX and HARX, it is noticeable to find option trading based on VHSI prediction is practical for options traders and using the prediction of direction changes of VHSI to trade options with straddle can get extra returns.

Notes

This paper set the first sample period to start from Jan 2003 with the consideration of 9/11 terrorist attack. During that period the political crisis was huge in United States which impacted the financial markets of the whole world. The fluctuation of stock market is not representative.

The S&P 500 is a free-float capitalization-weighted index of prices of 500 large-cap common stocks actively traded in the United States. The stocks included in the S&P 500 are those of large publicly held companies that trade on either of the two largest American stock market exchanges: the New York Stock Exchange and the NASDAQ. Different from the Dow Jones index, which focuses on the performance of different industry sectors, Nasdaq is an indicator of performance of stocks of technology and growth companies.

The S&P 500 is a free-float capitalization-weighted index of prices of 500 large-cap common stocks actively traded in the United States. The stocks included in the S&P 500 are those of large publicly held companies that trade on either of the two largest American stock market exchanges: the New York Stock Exchange and the NASDAQ. Different from the Dow Jones index, which focuses on the performance of different industry sectors, Nasdaq is an indicator of performance of stocks of technology and growth companies.

The time difference between opening of the Hong Kong stock market and closure of the New York Stock Market during weekdays is only 5 h.

References

Ahoniemi, K. (2008) Modeling and Forecasting the VIX Index. Unpublished working paper.

Ahoniemi, K., & Lanne, M. (2009). Joint modeling of call and put implied volatility. International Journal of Forecasting, 25(2), 239–258.

Bollen, N. P. B., & Whaley, R. E. (2004). Does net buying pressure affect the shape of implied volatility functions? The Journal of Finance, 59(2), 711–753.

Brooks, C. & Oozeer, M. C. (2002). Modelling the implied volatility of options on long gilt futures. Journal of Business Finance and Accounting, 29(1–2), 111–37.

Buraschi, A., & Jackwerth, J. (2001). The price of a smile: hedging and spanning in option markets. Review of Financial Studies, 14(2), 495–527.

Chen, Y., & Lai, K. K. (2013). Examination on the relationship between VHSI, HSI and future realized volatility with Kalman filter. Eurasian Business Review, 3(2), 200–216.

Chen, H., & Tai-Leung, C. (2010). A principal-component approach to measuring investor sentiment. Quantitative Finance, 10(4), 339–347.

Corsi, F. (2008). A simple approximate long-memory model of realized volatility. Journal of Financial Econometrics, 7(2), 174–196.

Driessen, J., & Maenhout, P. (2007). An empirical portfolio perspective on option pricing anomalies. Review of Finance, 11(4), 561–603.

Dunis, C., Kellard, N. M., & Snaith, S. (2013). Forecasting EUR–USD implied volatility: the case of intraday data. Journal of Banking and Finance, 37(12), 4943–4957.

Engle, R. F., & Rosenberg, J. V. (2000). Testing the volatility term structure using option hedging criteria. The Journal of Derivatives, 8(1), 10–28.

Fleming, J., Ostdiek, B., & Whaley, R. E. (1995). Predicting stock market volatility: a new measure. Journal of Futures Markets, 15(3), 265–302.

Franks, J. R., & Schwartz, E. S. (1991). The stochastic behaviour of market variance implied in the prices of index options. The Economic Journal, 101(409), 1460–1475.

Giot, P. (2005a). Implied volatility indexes and daily value at risk models. The Journal of Derivatives, 12(4), 54–64.

Giot, P. (2005b). Relationships between implied volatility indexes and stock index returns. The Journal of Portfolio Management, 31(3), 92–100.

Harvey, C. R., & Whaley, R. E. (1992). Market volatility prediction and the efficiency of the S&P 100 index option market. Journal of Financial Economics, 31(1), 43–73.

Konstantinidi, E., Skiadopoulos, G., & Tzagkaraki, E. (2008). Can the evolution of implied volatility be forecasted? Evidence from European and US implied volatility indices. Journal of Banking and Finance, 32(11), 2401–2411.

Le, C. & David, D. (2014) Asset price volatility and financial contagion: analysis using the MS-VAR framework. Eurasian Economic Review, 4(2), 1–30.

Low, C. (2004). The fear and exuberance from implied volatility of S&P 100 index options. The Journal of Business, 77(3), 527–546.

Müller, U. A., Dacorogna, M. M., Davé, R., Pictet, O. V., Olsen, R. B., & Ward, J. (1995). Fractals and intrinsic time: a challenge to econometricians. Olsen and Associates preprint, 3, 9–11.

Ni, S. X., Pan, J., & Poteshman, A. M. (2008). Volatility information trading in the option market. The Journal of Finance, 63(3), 1059–1091.

Noh, J., Engle, R. F., & Kane, A. (1994). Forecasting volatility and option prices of the S&P 500 index. The Journal of Derivatives, 2(1), 17–30.

Poon, S. H., & Pope, P. (2002). Trading volatility spreads: a test of index option market efficiency. European Financial Management, 6(2), 235–260.

Simon, D. P. (2003). The Nasdaq volatility index during and after the bubble. The Journal of Derivatives, 11(2), 9–24.

Siriopoulos, C. & Fassas, A. (2008). The Information Content of VFTSE. http://ssrn.com/abstract=1307702

Tanai, Y. & Lin, K.-P. (2013). Mongolian and world equity markets: volatilities and correlations. Eurasian Economic Review, 4(1), 136–64.

Whaley, R. E. (2000). The investor fear gauge. The Journal of Portfolio Management, 26(3), 12–17.

Acknowledgments

We are particularly grateful to two anonymous referees, Dr. Hakan Danis and Merve Aricilar, editors of Eurasian Economic Review, for their constructive comments on the final version of this paper.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Chen, Y., Lai, K.K. & Du, J. Modeling and forecasting Hang Seng index volatility with day-of-week effect, spillover effect based on ARIMA and HAR. Eurasian Econ Rev 4, 113–132 (2014). https://doi.org/10.1007/s40822-015-0013-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40822-015-0013-x