Abstract

This paper investigates volatility linkages and financial contagion via the asset price channel from the US and Europe to East Asia during the 2007–2011 global financial crisis. Following crisis contingent theories, financial contagion is modeled as the structural change in transmission mechanism after a shock in one country (shift-contagion). Using Markov-switching vector autoregression and multivariate unconditional correlation tests, this study not only addresses the theoretical assumptions about multiple equilibria and nonlinear linkages, but also handles the problems of heteroskedasticity, endogeneity, simultaneous equations and sample selection bias. The empirical results show a significant nonlinear dynamic behaviour of asset returns and volatility interactions across-countries. The volatility spillovers from the US and Europe to East Asian financial markets were mainly caused by fundamental links, apart from in Thailand, which experienced shift-contagion caused by investor behaviours. There is also evidence of the intensified intra-regional linkages in the event of an external shock.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The liberalisation of capital markets around the world has allowed free movements of information and capital flows, driving international asset prices and volatility linkages. The literature on the historical financial crises during the past decades has suggested the important role of asset prices in the transmission of idiosyncratic shock across countries (Kindleberger and Aliber 2011). This has been confirmed by the stylised facts of the 2007–2011 global financial crisis, in which several equity price indices in advanced economies (AEs) as well as emerging markets (EMEs) fell sharply following the collapse of the US subprime mortgage market in 2007, with the consequent downward pressure of the Standard and Poor’s 500 Index (S&P500), causing widespread propagation of financial shocks all over the world.Footnote 1 Even the resilient financial markets of Asia were not immune from volatility spillovers. It should be noted that since the East Asian crisis in 1997, all countries in this region have conducted fundamental reforms in their financial systems, especially in the banking sector. Therefore, they entered the global financial crisis with relatively healthy financial positions and strong capital buffers. In addition, as the financial institutions in the region have limited exposure to subprime-related instruments, it might be expected that East Asian financial markets would successfully decouple from the global financial turmoil. Despite the fact that East Asia stayed resilient during 2007 and the first half of 2008, financially the region gave into the stream of negative news from the collapse of Lehman Brothers in September 2008.

This paper investigates empirically volatility linkages in assets prices and financial contagion from the US and Europe to seven East Asian countriesFootnote 2 during the 2007–2009 global financial crisis and the subsequent 2010–2011 European debt crisis. A large body of research has tested for asset price volatility linkages and evidence of financial contagion across countries. The theoretical literature suggests that co-movements in asset prices may be linked to either “common shocks” and “interdependence” of fundamentals, or “shift-contagion” caused by investor behaviour. While interdependence refers to the stable cross-market linkages, the shift contagion addresses the nonlinear nature of financial interaction. However, the empirical role for shift-contagion appears to be relatively limited. Additionally, different methodologies have been used; each is subject to some specific econometric problems, making it difficult to assess the significance of asset price channels in shock transmission. In an effort to seek more robust evidence of contagion in recent financial crises, this study aims to answer the following research questions:

1. How do asset prices facilitate the transmission of volatility shock across borders?

2. How do empirical estimates of asset price volatility linkages relate to theoretical assumptions as generally used in the literature on shift-contagion which is caused by investor behaviour?

Applying the methodology suggested by Mandilaras and Bird (2010), we test for volatility spillovers and contagion effects with the two-step econometric procedure. In the first step, the Markov-switching vector autoregression (MS-VAR) framework is used to endogenously identify crisis and non-crisis periods of the financial time series. The second step follows with multivariate unconditional correlation tests to verify evidence of shift-contagion. This helps to address the crisis-contingent theories, in which financial contagion is modeled as the structural change in the transmission mechanisms, specifically an increase in cross-market linkages after a volatility shock in one country. The shift in cross market linkages conveys an important assumption that the underlying distribution of asset prices and returns yields multiple equilibria. Moreover, this methodology tackles several econometric concerns, such as heteroskedasticity, endogeneity, simultaneous equations and sample selection bias.

We analyse the proxies for general stress in the equity market, foreign exchange market and sovereign debt market, as these three financial market segments have been generally considered to be more related to global risk premia and capital flows, implying susceptibility to global financial conditions. Therefore, the fall in stock price, pressure on exchange rates, increasing sovereign spreads and the associated volatility increase might not only indicate the depth of the crisis, but also gauge the diffusion of idiosyncratic shock across countries.

The structure of this paper is as follows. Section 2 provides the theoretical and empirical framework of volatility linkages and financial contagion. In Sect. 3, the econometric methodologies are discussed. Data description and preliminary analysis will be presented in Sect. 4, while Sect. 5 will provide some discussion on empirical results. Section 6 concludes the study.

2 Theoretical and empirical literature of volatility linkages and financial contagion

2.1 Non-crisis contingent theories vs. crisis contingent theories

The East Asian crisis in 1997–1998 sparked the widespread use of the term “contagion” to refer to the spread of financial market turmoil across countries. Since then, a vast number of studies have attempted to explain the theory with different approaches, either focusing on direct fundamental linkages (non-crisis contingent theories) or indirect linkages via investor behaviour (crisis-contingent theories) (Claessens and Forbes 2004; Forbes and Rigobon 2001, 2002).

2.1.1 Non-crisis-contingent theories

Non-crisis contingent theories explain shock propagation through fundamental links (i.e. common shocks, trade links and direct financial links) and assume that there is no significant difference in the transmission mechanism before and after financial crises (Forbes and Rigobon 2002). A common or global shock, such as a slowdown in world aggregate demand, a shift in international interest rates, changes in commodity prices or bilateral exchange rates between major world economies can simultaneously affect the fundamentals of several economies, which thereafter leads to the co-movements of asset prices and/or capital flows in the affected countries.

Trade links can transmit shocks from one country to another through income effects and price competitiveness. If a country undergoes a financial crisis, it will suffer an economic slowdown and income deterioration, leading to a fall in its import demand. This will directly affect firms that export products to that country. Trade links also magnify shock propagation through competitive devaluation when two countries are trading partners or compete with each other in a third foreign market. A financial shock that causes exchange rate depreciation in one country will deteriorate the other country’s export competitiveness, making the affected county devaluate its currency to re-balance the external sectors (Gerlach and Smets 1995).

Another fundamental cause of financial contagion relates to direct financial linkages. The global integration and expansion of large complex financial institutions that engage in interbank contracts, syndicated loan insurance, equity and bonds and OTC derivatives make economies become more and more integrated through international financial systems. This type of interconnectedness increases liquidity spillovers not only in the banking sector but also in non-banking sectors. For example, during the US subprime mortgage credit crisis, direct financial contagion related to the large losses and greater degree of financial distress in European banks which held large amounts of US mortgage-backed securities and were highly dependent on dollar funding.

2.1.2 Crisis-contingent theories

The second strand of theory focuses on investor-based contagion or “pure contagion” (Kumar and Persaud 2002; Masson 1999), introducing shock propagation unrelated to fundamentals but generated by the change in investor behaviours. The most common explanation for pure contagion is associated with theories of multiple equilibria arising as a result of changes in investors’ self-fulfilling expectations. This was explained by the bank run model of Diamond and Dybvig (1983), in which a large number of customers suddenly withdraw their deposits from a bank if they believe that it is or might become insolvent. In other words, individual depositors need to form an expectation of the behaviours of other depositors: if the others run, then it is vital for an individual to run too. The bank run will exhaust a bank’s liquid assets, which encourages further withdrawals and leads to bank bankruptcy.

Contagion may also occur because of liquidity problems and portfolio rebalancing. A negative shock in one economy may lead to deterioration in the value of leveraged investors’ collateral, leading them to liquidate assets in unaffected economies to meet margin calls. Banks from a common creditor can also face liquidity problems when they experience a marked deterioration in the quality of their loans in one country, hence they attempt to reduce the overall risk of their loan portfolios by reducing their exposure in other high-risk investments in EMEs. The standard portfolio theory explains portfolio rebalancing based on the fact that international investors decide how much to invest in a risky foreign country by weighing the expected return against the associated risks. If a structural-uncertainty parameter of an economy changes, investor portfolios shift to reflect the new equilibrium prices of risk.

Investor-based contagion may also be caused by information asymmetries and herding behaviour. In the absence of a perfect market and information, investors do not have a complete picture of a country’s fundamentals and its true state of vulnerabilities. They therefore make their investment decisions based on the actions of other investors, causing herding behaviour or financial panic. Calvo and Mendoza (2000) theoretically prove that because it is expensive to gather and process country-specific information, less informed and uninformed investors will obtain cost-effective benefits by observing and copying informed investors who act early in adjusting their portfolios. If informed investors move to a bad equilibrium, then uninformed investors, by following informed ones, cause another bad equilibrium.

In conclusion, financial contagion caused by fundamental channels can in principle be predicted and manageable, while it is more challenging to predict and quantify investor-based contagion in a world of multiple equilibria, imperfect markets and information asymmetries. These kinds of investor behaviour do not exist during stable periods, but occur after an initial shock elsewhere, causing shifts in transmission mechanisms and jumps in financial asset price distribution. Forbes and Rigobon (2002) term this “shift-contagion” and categorise the theories explaining the shifts as crisis-contingent theories. Accordingly, contagion is defined as a significant increase in cross-market linkages after a negative shock in an individual country (or group of countries).

2.2 Empirical tests and evidence

There are extensive empirical tests of financial contagion. Different methodologies have been developed, each subject to some specific econometric problems (e.g. heteroskedasticity, non-linearity, simultaneous equations, endogeneity, and arbitrary choice of crisis window), causing variability of results and difficulty in assessing evidence for contagion. Depending on how contagion is specifically defined, empirical tests can be classified into the following groups: (1) tests based on the conditional probability of a crisis and its transmission mechanism; (2) tests measuring change in volatility and volatility spillovers; (3) cross-country correlation and correlation breakdown tests; and (4) multiple equilibria testing with the Hamilton switching model.

The first group investigates fundamental-based contagion and aims to test the importance of several fundamental transmission mechanisms as well as their contributions to the probability of the occurrence of a crisis. Probability models such as probit and logit models are the most common methods to test contagion without assuming any structural break in cross-market linkages (Caramazza et al. 2000; Eichengreen et al. 1996; Haile and Pozo 2008). One of the advantages of this methodology is that it can estimate the probability of spreads of financial crises and identify channels through which contagion occurs. However, this approach has several shortcomings, such as the ad hoc selection of fundamental variables; the relatively small data sample for crisis event investigation; and the loss of sample information from constructing crisis dummy variables which may reduce the power of the contagion test (Dungey et al. 2005).

The second test identifies contagion as volatility spillovers from one market to another with an ARCH or GARCH framework. The test examines whether conditional variances of financial variables are related to each other across asset classes and/or across countries (Chancharoenchai and Dibooglu 2006; Edwards 1998; Hamao et al. 1990; Tanai and Lin 2013). GARCH models help to tackle the problem of autoregressive and heteroskedastic dynamics and allow testing for contagion in the first and second moments of price changes. However, in line with conditional probability approach, they do not assume any kind of structural break in the data generating process caused by the crisis. Neither do these testing approaches control for fundamentals and thus do not distinguish between fundamental-based contagion and pure contagion.

The most common method for testing contagion is correlation breakdown tests, in which the correlation coefficients of asset returns are estimated for crisis and non-crisis periods, and then tested if there is a significant change in correlations across regimes. This is not only the most straightforward testing for shift-contagion, but also provides a very important implication for the effectiveness of international diversification. King and Wadhwani (1990) were the first to apply this approach to analyse structural changes in cross-market linkages in the US, UK and Japan after the 1987 stock market crash. They found that the contagion coefficients increased during and immediately after the crash in response to the rise in volatility, which implies there is a transmission mechanism which cannot be explained by a fully-revealing fundamental model. Baig and Goldfajn (1998) also provide evidence about the significant increase in cross-country correlations of currencies and sovereign spreads of five East Asian countries during the period from July 1997 to May 1998 compared to other periods. However, the traditional correlation breakdown tests are subject to the heteroskedasticity problem, since correlation coefficients between asset returns are affected by their volatilities, which are extremely high during crisis (Forbes and Rigobon 2002; Rigobon 2003). Forbes and Rigobon (2002) therefore introduce an unconditional correlation to tackle this problem. By analysing the daily stock market returns and short term interest rates of different industrial economies and EMEs in three financial crisis episodes (the American stock market crash in 1987, the Mexican crisis in 1994 and the Asian crisis in 1997), they find that after the correlations are adjusted for increased volatility, the hypothesis of correlation breakdown is rejected in most of the cases. This leads to much criticism of many empirical works which test contagion without adjustment for heteroskedasticity, which may suggest the presence of contagion but in fact the transmission mechanism was fairly stable in most of the financial crises in the 1990s. Although cross-market linkages are surprisingly high in many parts of the world, they are simply a continuation of the strong linkages which existed in the stable period. Therefore, shocks are mostly transmitted through non-crisis contingent channels.

Although widely applied in testing contagion, the adjusted correlation has received some criticism. According to Corsetti et al. (2005), the increase in variance of the crisis market may be caused by both idiosyncratic components and non-observable variables. Without capturing those effects, the measure of adjusted coefficients is biased. They therefore solve this problem by weighting the increasing factor for each component of shocks. Their empirical tests provide some evidence of contagion and some interdependence. However, this study prefers the measure suggested by Forbes and Rigobon since our support is consistent with their arguments that if there are common unobservable shocks, they must be homoscedastic or their contribution to the increasing variance should be negligible, compared to that of the idiosyncratic shocks. Another caveat in Forbes and Rigobon’s approach is sample selection bias caused by an a priori identification of the crisis period and by assuming the non-crisis period as the total sample. This leads to overlapping data and a small crisis sample size, making the test’s assumption unrealistic. One more problem is that this methodology is only suitable for bivariate testing. Therefore, Dungey et al. (2005) propose a multivariate version of the Forbes and Rigobon test in a regression framework, scaling the asset returns and correcting for endogeneity bias. This test is equivalent to the Chow test for a structural break in the regression slope.

The theoretical arguments for financial crises and contagion stress the existence of multiple equilibria caused by the change in investors’ expectations and hence their behaviour during a crisis. These changes reveal a very important implication that the underlying distribution of asset returns should in general be multimodal, which may lead to discontinuities in the data-generating process. One approach for testing multiple equilibria is based on the Markov switching (MS) model developed by Hamilton (1989). The model specifies a number of regimes for relevant financial variables and estimates the probabilities of switching from one regime to another. Ismail and Rahman (2009) evaluate the potential of the MS model in their study of the relationship between US and Asian stock markets and find evidence to support the pre-eminence of non-linear MS-VAR over linear VAR in modelling asset return interactions across countries. Within an MS-VAR framework, Guo and Stepanyan (2011) investigate contagion effects between the stock market, real estate market, CDS market, and energy market in the US. The MS specifications show the presence of contagion effects from these markets, characterised by nonlinearity with two distinct regimes. The regime-dependent impulse response functions reveal that all financial markets respond more significantly to economic shocks when a highly volatile regime is dominant. Mandilaras and Bird (2010) study contagion in the Exchange Rate Mechanism of the European Monetary System. They use MS-VAR to determine crisis and non-crisis observations and subsequently multivariate correlation test to detect contagion effects.

Although the MS approach has the drawback that the number of regimes is arbitrarily fixed, empirical studies that employ the MS model can potentially overcome several drawbacks from other methodologies in testing contagion. First, the MS model is able to cope with theoretical arguments in terms of economic fundamentals associated with multiple equilibria and non-linearity in financial market interaction. Second, it takes into account several time-series properties of asset returns, such as non-normality and fat-tailedness, time-varying volatility or heteroskedasticity. Third, this model does not require an a priori breakdown of the sample data into crisis and non-crisis periods as the correlation test does; instead, crisis periods are endogenously determined. Finally, like the probit model, this methodology can provide an explicit measure of the probability of a crisis, and specifically enables us to calculate the probability of a shift between different regimes, as well as the duration of the shift.

In conclusion, the review of theoretical and empirical literature on financial contagion provides some important implications:

-

As it is challenging to have a clear distinction between fundamental-based (or spillover effects) and investor-based contagion, and as both these types of contagion interact with each other to amplify shocks, this study is primarily interested in testing shift-contagion. This approach helps to avoid direct measurement of and differentiation between various transmission channels, while still providing evidence to support or argue against certain theories of transmission (Forbes and Rigobon 2002).

-

The literature on currency crises and investor-based contagion implies the role of multiple equilibria and non-linearity in international shock propagation. Moreover, during periods of crisis, financial markets exhibit a common characteristic of extremely high volatility in asset returns. Integrating these features in asset pricing and contagion modeling, we hypothesise that there is a simultaneous rise in asset return volatility in different markets, associated with the jumps between different volatility regimes and the consequent changes in cross-market linkages in times of financial turmoil.

-

Empirical evidence of financial contagion appears to be very sensitive to the data sets and testing methods which are subject to a series of problems such as heteroskedasticity, simultaneous equations, omitted variables, non-linearity, time series and cross-sectional clustering. We attempt to deal with these statistical concerns in the empirical methodologies.

3 Empirical methodologies

In order to accommodate the theoretical and empirical implications of financial contagion, this study employs the two-step econometric procedure suggested by Mandilaras and Bird (2010). First, the MS-VAR framework is utilised to assess the potential dynamic behaviour of East Asian financial markets in which asset price and return volatilities are expected to be subject to regime shifts following financial shocks in the US and Europe. Second, the analysis of shift-contagion is made by employing Dungey et al. (2005)’s multivariate version of Forbes and Rigobon (2002)’s unconditional correlation test to understand whether there are significant increases in cross-market linkages after an initial shock in one country. This may help identify the driving forces behind the asset price volatility adjustments, either from fundamental-based or investor-based contagion.

Specifically, we aim to test the hypothesis of volatility spillovers and financial contagion as a situation in which:

1. The asset prices show volatility break synchronization across countries, in which high volatile regime coincides with the timing of the US subprime-mortgage crisis and the European debt crisis.

2. The contemporaneous correlations between US, European and East Asian asset prices increase significantly when these countries switch to a high volatility regime (crisis regime) from a low volatility one (stable regime).

3.1 Markov-switching vector autoregressions

MS-VAR was introduced by Krolzig (1998), based on the assumption that the observed time series y t in the VAR system depends upon the unobservable regime variable s t , which represents the probability of being in a different state of the world. The MS-VAR model allows for a variety of exogenous regime switches: the Markov-switching mean (MSM), switching in intercept (MSI), switching in the autoregressive coefficients (MSA), and Markov-switching heteroskedasticity (MSH). For empirical applications, it is useful to allow some of the parameters in the model to be conditioned on the state of the Markov chain, while other parameters are regime-invariant to avoid complicated estimation. The stylised fact in international financial markets showed an immediate jump to new levels of asset prices during the crisis, accompanied by an unprecedented rise in volatility. Therefore, the heteroskedastic mean switch model is applied in this paper. Denote m the number of feasible regimes, so that \( s_{t} \in \left\{ {1, \ldots , m} \right\} \), the MSMH(m)-VAR(p) can be expressed as follows:

where y t = (y 1t , … , y nt ) is an n dimensional time series vector of variables which are financial asset returns of the US, Europe and East Asian countries; \( \mu (s_{t} ) \) is the vector of regime-dependent means; A j are the matrices containing the pth autoregressive parameters; ɛ t is a zero-mean white noise process with a variance–covariance matrix \( \varSigma \left( {s_{t} } \right)\varvec{ } \).

The unobservable states \( s_{t} \) are assumed to be generated by a discrete, irreducible, and ergodic first-order Markov chain:

where the information set \( {\mathcal{F}}_{t} = \left\{ {y_{j} } \right\}_{j = 1}^{t} \); \( p_{ij,t} \) is the generic [i, j] element of the transition matrix P:

Transition probabilities also contain important information about the expected duration (D j ) the system will stay in a certain regime (j), such that:

We assume two discrete regimes: a non-crisis regime with low volatility (regime 1); and a crisis regime with higher volatility (regime 2). Although the choice of number of regimes appears to be subjective, it is suitable for the analysis of shift-contagion and crisis-contingent theories. Accordingly, contagion is defined as a significant increase in cross-market linkages between normal and crisis periods, given the support of the observed time series of asset prices that showed the prevalence of either a stable stage with relatively less volatile movement or a crisis state with strong adjustments. Moreover, the literature debates several caveats against particular statistical criteria in determining the number of regimes (Hamilton 2008; Psaradakis and Spagnolo 2003).Footnote 3

MS-VAR is set up in the analysis framework based on the assumption that the probability of switching from one state to another is not affected by exogenous variables (i.e. there is no fundamentals control).Footnote 4 The population parameters of the MS-VAR models are estimated using direct maximisation of log likelihood function. The full log likelihood function of the model is given by:

which \( f(y_{t} |s_{t} = j,\varTheta ) \) is the likelihood function for state j conditional on a set of parameters (Θ).

The probabilistic inferences about the unobservable states are made using nonlinear filter and smoother. “Filtered” probabilities are inferences about s t conditional on the information up to time t, while “smoothed” probabilities use all the information in the data. All computations were implemented by adapting the msvarsetup procedures in RATS.

3.2 Multivariate unconditional correlation tests

If the MS-VAR system displays significant evidence of asset prices’ volatility break synchronization across countries during the US subprime-mortgage crisis and the European debt crisis, the analysis is extended to investigate the structural change in cross-market linkage between different regimes. There is an expectation of asymmetrical effects in market performances, including sign reversals or differential speeds of adjustment to the shocks.

Dungey et al. (2005)’s multivariate regression framework of the unconditional correlation test is applied by estimating the following system of equations:

where y t represents asset prices/returns at time t, a pooled data set by stacking the non-crisis and crisis observations. The subscripts A, US and EU denote Asian, US and European countries, respectively. y t is scaled by the non-crisis standard deviation σ 1 as suggested by Forbes and Rigobon (2002) to adjust for volatility increase.

d t is a dummy variable taking the value of 1 for crisis observations and 0 for non-crisis observations obtained from MS-VAR regime classification;

ω i,t are disturbance terms.

β and θ are the vectors of coefficients of asset returns between two countries, while θ captures the additional contribution of information on asset returns in Asian country i to the non-crisis regression and conveys the ideas of contagion effects. If there is no change in the relationship, the dummy variables provide no new additional information during the crisis state, resulting in θ = 0.

Therefore, the Forbes and Rigobon (2002) correlation test of shift contagion can be implemented by estimating Eq. 2 with OLS and performing a one-side t test of: \( H_{0} : \theta_{i,j} = 0 \).

When testing shift-contagion for the FOREX series, two variables are added in the right hand side of Eq. 2 to control for external shocks which triggered the jumps in East Asian foreign exchange rates. These are: (1) the S&P500 volatility index (VIX), and (2) TED spreads (TED). VIX is a key measure of a market’s expectation of short-term (up to 30 days) volatility, and has therefore been considered as the world’s premier barometer of investor sentiment. TED is widely used as an indicator to measure liquidity and credit risk, since the interbank rate represents banks’ perception of the creditworthiness of other financial institutions and the availability of funds for lending purposes, compared with risk free investment in government securities. The assumption is that volatility in global financial markets and liquidity tension trigger massive sell-offs by international investors, causing capital outflows and depreciation pressure on local currencies. VIX and TED enter the regression with a lag.

4 Data and preliminary analysis

Contagion effects are analysed in different financial market segments: equity markets, foreign exchange markets and sovereign debt markets. The different sets of asset price variables entered into the models are as follows:

4.1 Equity markets

Composite stock price indices of the sample countries were chosen from the national leading markets: US: S&P500; Eurozone: Euro Stoxx; Hong Kong: Hang Seng Index (HSI); Singapore: Straits Times Index (STI); Korea: Korea Composite Stock Price Index (KOSPI); Malaysia: Kuala Lumpur Composite Index (KLCI); Philippines: Philippines Stock Exchange Index (PCOMP); Indonesia: Jakarta Composite Index (JCI) and Thailand: Stock Exchange of Thailand Index (SET). US-dollar denominated indices are used to facilitate analysis of contagion effects from global investors’ perspectives and to disentangle the overlapping effects of currency risks. The indices are simple average weekly data calculated from daily closing prices for the period from 1st January 2004 to 31st December 2011.

4.2 Foreign exchange markets

Weekly nominal foreign exchange rates of domestic currencies against the US dollar are used, namely the Singapore dollar (SGD), Thai baht (THB), Malaysian ringgit (MYR), Philippine peso (PHP), Indonesia rupiah (IDR) and Korean won (KRW). The Hong Kong dollar is not included as Hong Kong has fixed its currency to the USD since 1983 and the average return on its exchange rate is close to zero. The data sample is from 1st January 2005 to 31st December 2011.

The stock prices and foreign exchange rates are converted into returns series (denoted as SR and FOREX respectively) by taking the logarithms of the indices ratio between two consecutive sessions multiplied by 100.

4.3 Sovereign debt markets

Weekly data on changes in sovereign CDS spreads (CDS) on 5-year sovereign bonds for eight selected markets were collected from 1st September 2006 to 30th September 2010. The US is considered as the originator of the subprime mortgage crisis and Greece as the originator of the European debt crisis. CDS with maturities of 5 years are used since they are the most liquid contracts and constitute over 85 % of the entire CDS market. However, 7-year CDS spreads are used for the US since the 5-year CDS data are only available from 11th December 2007, and also the level and movement of the 7-year CDS are almost identical to those of 5-year ones.Footnote 5

The data are mostly retrieved from Datastream International. Although a higher frequency of daily data is available, weekly data are chosen in this study since the daily data contains too much noisy information, which tends to produce less powerful results. Additionally, weekly price analysis helps avoid non-synchronous trading time horizons among countries.

Summary statistics of variables reported in Tables 1, 2, and 3 show the considerable cross-country heterogeneity in market performance during the period covering the global financial crisis. The mean values of stock return vary significantly across countries (Table 1). EMEs have higher returns than AEs, and the highest one corresponds to Indonesia with its mean of 0.394. Euro Stoxx is the only one with a negative average return, implying that the stock index faced a downward trend over the period. Standard deviations are higher in Korea and Indonesia (4.84 and 4.53 respectively), indicating the existence of higher risk in those countries than the others. In the foreign exchange rates statistics (Table 2), while most of the East Asian countries’ currencies have overall appreciation trend, the KRW shows downward pressure over the period, evidenced by a positive mean value. The KRW also has the highest standard deviations, implying they are more volatile than the rest in the group. CDS data series of all countries are very highly volatile (Table 3). Greece experienced the highest average change in CDS spreads, which is consistent with the sovereign debt crisis in this country from 2009. The high level of kurtosis evidences the existence of large shocks (of either sign) in all markets. The low probability of the Jaque–Bera statistics in all cases rejects the normality of the data at any level of statistical significance and the presence of non-linearities. These features justify our choice of MS-VAR models and multivariate unconditional correlation tests to capture the role of volatility shocks and non-linearity interactions, as well as the time series and cross-sectional clustering that is commonly found in the literature.

Prior to proceeding with the model estimations, the stationarity in time series data are checked with the Augmented Dickey-Fuller (ADF) test at level and first difference. The unit root test results in Table 4 suggest that the null hypothesis of a unit root in SR and FOREX is rejected in both the level and first difference. However, the CDS series are non-stationary on their levels, while they are stationary on their first differences. Therefore, the log differenced series of CDS are used in the estimation of the MS-VAR model.

5 Empirical results

5.1 Structural break in volatility and volatility spillovers with MS-VAR estimations

This section explores the nonlinear interactions between East Asian financial markets and those of the US and Europe by assuming that all the series are regime-dependent. Tables 5, 6 and 7 show the estimated parameters of MSMH(2)-VAR(p) for different financial market segments, which include the switching means \( \mu_{1} , \mu_{2} \); switching variances \( \sigma_{1}^{2} , \sigma_{2}^{2} ; \) the probability of state in each regime \( p_{11} ,p_{22} ; \) and the expected duration \( D_{{s_{1} }} ,D_{{s_{2} }} \). The autoregressive parameters (up to lag 1) are also reported to show the dynamic relationship between variables. The AIC is used to select the optimal lag length in the models, which suggests one lag for SR and CDS, and three lags for FOREX series. In all cases, the statistical results indicate that the data sets fit the model specifications. The LR-test statistics show that the hypotheses of linear specification are rejected at a significant level of 1 %, which supports the hypothesis of the regime-switching behaviour in variables. This may also imply the better fit of the MS model compared with the existing linear models, which have been widely used to study the relationships and linkages between financial markets.

5.1.1 Equity markets

Volatility breaks are one of the defining characteristics of the stock markets in every country. The models significantly differentiate two trends in SR series: (1) state 1, with positive means and low variances, corresponding to a stable regime; and (2) state 2, with negative means and high variances, representing a crisis regime. The jump in mean is also associated with the switch in variances, marked with especially high \( \upsigma_{2}^{2} \) (around 2–8 times higher than \( \upsigma_{1}^{2} ), \) varying across countries. Korea experienced the highest volatility during the crisis, as well as the highest variation in volatility between the two regimes, even higher than the crisis-trigger. This result may be explained by the stylised fact that Korea had accumulated a very large portfolio flow before the crisis, making this country highly susceptible to changes in global market sentiments and the consequent deleveraging effects. The jump in means and variance is also quite drastic in Hong Kong and Singapore, as these two developed markets have a high proportion of foreign factors and tend to have stronger integration with AEs in North America and Europe. On the contrary, the degree of international integration is weaker for EMEs (Thailand, Indonesia, Philippines and Malaysia). This is consistent with the financial literature which suggest that the higher the globalisation of an economy, the greater the incidence of volatility transmission as a result of the information generating process (Aragó-Manzana and Fernández-Izquierdo 2007).

The transition matrix evidence that both regimes are quite stable and the probability of staying in regime 2 is lower than in regime 1, which means that crisis regime is less persistent. The expected duration of crisis regime is 6 weeks, compared to 25 weeks for the series to stay in non-crisis regime. The results also show strong lead-lag interactions between East Asia and the US. All East Asian stock market returns are significantly affected by the previous one week return in the US market, but there is less significant evidence of interactions with European markets.

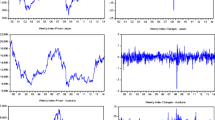

The graph of smoothed regime probabilities (Fig. 1) captures the stages of the global financial crisis 2007–2011 appropriately. The shifts occurred at three important points of time. One happened in late 2007, around the event of the suspension of the three funds of BNP Paribas in August 2007. The major shift, which appears to be the most persistent one, followed the collapse of Lehman Brothers in September 2008. The third one occurred in mid-2011, at the height of the European debt crisis. This may suggest integration between international stock markets and rapid transmission of information, which cause structural changes in prices in many markets simultaneously. It seems that an adverse shock in the US might have destabilising impacts on the stock markets of many Asian economies via a deleveraging process.

5.1.2 Foreign exchange markets

The returns in exchange rates are also associated with regime switches. Stable regime is characterised by negative means and low variances, implying a slight appreciation of the domestic currency against the US dollar. The switch to crisis regime is associated with positive average returns accompanied by a higher level of volatility, suggesting mounting pressures on the foreign exchange rates. Capital flows out of the region as a consequence of massive sell-offs by international investors, and the continued reversal of the carry trade, may explain the sharp depreciation of local currencies across countries, although to a different extent. Currency volatility shocks appear to be more serious in Korea, as the shift in the KRW is the most drastic, marked by the highest difference in mean and an especially high variance in regime 2, as well as the largest spread between \( \upsigma_{2}^{2} \) and \( \upsigma_{1}^{2} \) (more than 14 times). Indonesia is also a country with high variation in volatility between the two regimes (more than 10 times). There is a persistence to stay in regimes rather than to switch, since p11 and p22 are all high (more than 0.8) and significant at the level of 1 %.

The expected duration in the stable regime is around 20 weeks and in the crisis regime around 5 weeks. As the parameters of the FOREX series appear to be consistent with those of the SR series, this may indicate the interrelation between the stock and foreign exchange markets. There may be volatility spillovers between these two market segments. This is consistent with the findings of Maghrebi et al. (2006), who provide evidence for the dynamic relationship between stock market volatility and foreign exchange fluctuation in Asia Pacific countries. The estimated results in Table 6 also confirm the lead-lag interaction of Asian local currencies. In particular, the strength of the SGD has some predictive power on other currencies in the region, as its lagged coefficients with the others are all positive and significant at a level of 1 %.

The regime smooth probabilities in Fig. 2 capture well the period of global financial market turbulence. The most obvious shift occurs at the depth of the US subprime crisis in late 2008. There is also a jump in late 2005, which have been caused by local shock, but it is not particularly persistent. However, compared to stock markets, foreign exchange rates appear to be more stable after the first half of 2009. The reason is that immediately after the Lehman affair, authorities in Asian countries made time-line intervention to stabilise foreign exchange markets, such as use of official reserves, arranging stand-by loans from the World Bank and ADB, introducing foreign exchange swap facilities and lowering reserve requirements in foreign currency deposits (Filardo et al. 2010).

5.1.3 Credit derivative markets

CDS series also experienced volatility breaks, while the structural change in mean is not always significant at conventional levels. The variances in regime 2 are significantly higher than those of regime 1 in all countries. There is a remarkable variation in variances between the two regimes in the crisis generator (the US), where \( \sigma_{2}^{2} \) is 82 times higher than \( \sigma_{1}^{2} \). The variations are around 8–10 times in emerging Asia, but they are quite limited in Hong Kong (around 1.5 times). As a net creditor economy supported by strong fundamentals, Hong Kong has been highly rated and suffered moderate increases in sovereign CDS spreads. On the other hand, emerging East Asian countries have net debtor economies, which have been evaluated as being more risky and therefore saw an unprecedented surge in CDS spreads in the aftermath of the bankruptcy of Lehman Brothers. The model estimation delivers 88.5 % for p 11 and 32.8 % for p 22, implying that there is a higher probability for regime 2 to switch to regime 1 than to stay in that regime. On average, the market spends 8.5 successive weeks in the stable regime, while time in the crisis regime would end after about 1.5 weeks (Fig. 3).

The smooth probabilities also confirm that during the period from September 2007 to the end of 2008, the high volatility regime rose steeply; therefore, it was not particularly persistent. Weeks with positive means and high volatilities cluster with weeks with negative means and low volatilities. The high volatility regime returns in mid-2010, which coincides with the debt crisis in Greece. However, it occurs over a very short period of time and then rapidly switches to a stable regime. The estimated autoregressive parameters show no significant evidence of lead-lag interactions between CDS markets in East Asia and those of the US and Greece.

5.2 Testing for “shift-contagion” effects

Although the volatility regime switching analysis with MS-VAR provides insight into the impact and volatility spillovers from the US subprime credit crisis to East Asian financial markets, it does not persuasively indicate the presence of a shift-contagion effect. The reason behind these abnormally high variance episodes may be the continuality of financial interdependence which existed in the tranquil period or the common shock that simultaneously leads to deterioration in the fundamentals in several economies. Therefore, in order to justify the contagion effects, the extended multivariate version of unconditional correlation tests is applied by estimating the system of Eq. 2 as seemingly unrelated regression while controlling for heteroscedasticity and contemporaneous correlations. Tables 8, 9 and 10 show the estimated parameters for coefficient vectors θ which capture contagion effects. They all indicate that there is no robust evidence of “shift contagion” from the US and Europe to East Asian countries. Instead, East Asian asset return volatility regimes during the US subprime mortgage crisis and the European debt crisis are more likely to be caused by normal interdependence, common shock and/or country-specific risk factors.

Three exceptional cases are observed in stock return estimations in Thailand, Korea and Malaysia. The simultaneous correlations between S&P500 and SET; Euro Stoxx and KLCI; and Euro Stoxx and KOSPI increased significantly in the high volatility regime, which justifies the shift-contagion from the US to Thailand and from European to Malaysian and Korean equity markets. The outcome of “shift-contagion” in Thailand following volatility shock in the US lends support to Mullainathan (2002), who explains that investors may imperfectly recall past events. A negative shock triggers investors’ memories, inducing them to assign a higher probability of a bad state for countries which have experienced financial crisis before, even if their current fundamentals are not correlated with the crisis-originator. Korea is consistent with the analysis in MS-VAR, which shows a drastic jump in the country’s asset return volatilities. Due to the large proportion of foreign factors in the domestic market, Korea appears to be very sensitive to global investors’ sentiments, as it experienced a structural shift in its interdependence with the US, EU and Thailand. However, it is surprising to find that unconditional correlations between Thailand and the EU, Philippines and the US and Korea and the US decline significantly when they all enter a high-volatility period. This may explain why cross-country portfolio diversification strategies are still attractive.

Although the empirical results have not provided convincing support of structural changes in transmission mechanisms between AEs in the US and Europe and East Asia, there is some evidence to confirm that regional stock market integration intensifies during crisis periods. Table 8 shows that the unconditional correlations in contemporaneous stock returns between Malaysia and Thailand, and Hong Kong and Indonesia, are significantly strengthened in a highly volatile regime compared to a normal one. Thai volatility shock is also contagious to Korea, while pressure on the Philippine stock market may trigger a significant downward trend in stock returns in Indonesia and Malaysia. The results also suggest that Hong Kong tends to export its volatility shock to Singapore, while it may suffer some contagion effects from Indonesia via transmission channels that did not exist during the tranquil period.

In foreign exchange markets, the estimated parameters demonstrate comprehensive evidence of strong regional transmission effects. This suggests distinctive features of local currency integration and competitive adjustments in exchange rates. Table 9 shows the overall improvement in correlation coefficients in the crisis regime between many pairs of local currencies. For example, THB and MYR appear to have a causal relationship with each other. MYR also has a significant influence on SGD, whereas the depreciation of the PHP may have triggered the depreciation of KRW. The IDR significantly strengthens its correlation with the THB when the market encounters volatility shock. Central bank interventions may play an important role in the collective behaviours in regional exchange rate networks (Feng et al. 2010).

Regarding CDS markets, there is no shift-contagion from the rising sovereign risks of the US to East Asian economies. In other words, international transmission mechanisms remain unchanged and volatility spillovers via the CDS market are just a reaction to common shock. However, shift-contagion occurred in Indonesia, Malaysia and Hong Kong following the sovereign debt crisis in Europe, as their contemporaneous correlations with Greece significantly intensified in the high volatility regime. Shift-contagion also appears in the cluster of countries with similar fundamentals. For example, the correlations between Indonesia and Thailand, Indonesia and Korea, and Philippines and Malaysia improve significantly following the volatility shock. Philippines and Korea also show the evolution of integration with Malaysia during the crisis. This may reflect that markets have the same assessment of country credit risk in the region and external shocks seem to have strengthened the correlation structures between markets.

6 Conclusions

This study empirically investigates financial contagion via asset prices during the 2007–2011 global financial crisis. It focuses on the US and Europe as the source countries (US as the subprime crisis originator and Europe as the epicenter of the sovereign debt crisis) which exported their financial volatility to East Asia. Using the MS-VAR model and multivariate unconditional correlation test, this study not only addresses the theoretical assumptions about multiple equilibria and nonlinear linkages, but also handles the problems of heteroskedasticity, endogeneity, simultaneous equation and sample selection bias. The empirical results within the MS-VAR framework evidence the structural changes in volatility across different regimes in all variable series and confirm that the increase in financial market volatility coincided with the global financial crisis of 2007–2011. Despite the strong fundamentals and more resilient financial systems that have been built up since the 1997 financial crisis, East Asia is still very vulnerable to external shock. However, there is cross-country heterogeneity in the nature and severity of the spillovers to East Asia financial markets.

The estimated parameters from unconditional correlation multivariate testing explain that international volatility spillovers are more likely to be caused by real linkages or interdependence rather than shift contagion. This means that transmission mechanisms remain unchanged and the observed increased co-movement of asset returns after major market corrections arises due to the change in covariate structure. However, there is some evidence of a significant increase in cross-market linkages in some pairs of East Asian countries after volatility shock elsewhere. In some cases, asset return correlations between markets even decrease significantly during the crisis regime, which implies that international portfolio diversification still benefits international investors, but that they need to take a different kind of risk into account for their portfolio choices after negative shocks.

In general, fundamental-based contagion is more common than investor-based contagion (or shift-contagion) which may imply that the most important strategy to mitigate the contagion effect is to strengthen domestic economies. Countries should ensure that both their fundamentals are sound and are widely perceived to be sound by global investors.

Notes

The East Asian countries examined in this study are Hong Kong (HK), Singapore (SG), Korea (KR), Malaysia (ML), Indonesia (ID), Philippines (PH) and Thailand (TL).

Determining number of regimes basing on hypothesis testing is problematic since it fails to satisfy the usual regularity conditions arising from unidentified parameters (Hamilton 2008). On the other hand, state selection procedures using complexity-penalised likelihood criteria (AIC, BIC or HCQ) are subject to poor performance under small sample size and parameter changes, constant autoregressive coefficients and when the Markov chain is not persistent (Psaradakis and Spagnolo 2003).

King and Wadhwani (1990) argue that changes in asset price correlations across markets are driven primarily by unobservable variables. This is consistent with the concept of shift-contagion as well as investor-based contagion.

According to Wang and Moore (2012), the US 5- and 7-year CDS spreads have nearly perfect correlations (0.998) over the crisis period from December 2007 to November 2009. Therefore, the difference in degree of shock transmission of either 5- or 7-year CDS spreads would be very marginal.

References

Aragó-Manzana, V., & Fernández-Izquierdo, M. Á. (2007). Influence of structural changes in transmission of information between stock markets: a European empirical study. Journal of Multinational Financial Management, 17(2), 112–124.

Artikis, P., & Nifora, G. (2011). The industry effect on the relationship between leverage and returns. Eurasian Business Review, 1(2), 125–144.

Baig, T., & Goldfajn, I. (1998). Financial market contagion in the Asian crisis.

Calvo, G. A., & Mendoza, E. G. (2000). Rational contagion and the globalization of securities markets. Journal of International Economics, 51(1), 79–113.

Caramazza, F., Ricci, L.A., & Salgado, R. (2000). Trade and financial contagion in currency crises. International Monetary Fund.

Chancharoenchai, K., & Dibooglu, S. (2006). Volatility spillovers and contagion during the Asian crisis: evidence from six Southeast Asian stock markets. Emerging Markets Finance and Trade, 42(2), 4–17.

Claessens, S., & Forbes, K. (2004). International financial contagion: the theory. Paper presented at the Evidence and Policy Implications/Conference ‘The IMFs Role in Emerging Market Economies: Reassessing the Adequacy of its Resources’ organized by RBWC, DNB and WEF in Amsterdam on November.

Corsetti, G., Pericoli, M., & Sbracia, M. (2005). ‘Some contagion, some interdependence’: more pitfalls in tests of financial contagion. Journal of International Money and Finance, 24(8), 1177–1199.

Diamond, D.W., & Dybvig, P.H. (1983). Bank runs, deposit insurance, and liquidity. The Journal of Political Economy, 401–419.

Dungey, M., Fry, R., González-Hermosillo, B., & Martin, V. L. (2005). Empirical modelling of contagion: a review of methodologies. Quantitative Finance, 5(1), 9–24.

Edwards, S. (1998). Openness, productivity and growth: what do we really know? The Economic Journal, 108(447), 383–398.

Eichengreen, B., Rose, A.K., & Wyplosz, C. (1996). Contagious currency crises. National Bureau of Economic Research.

Feng, X., Hu, H., & Wang, X. (2010). The evolutionary synchronization of the exchange rate system in. Physica A: Statistical Mechanics and its Applications, 389(24), 5785–5793.

Filardo, A., George, J., Loretan, M., Ma, G., Munro, A., Shim, I., Zhu, H. (2010). The international financial crisis: timeline, impact and policy responses in Asia and the Pacific. BIS Papers, 52, 21–82.

Forbes, K.J., & Rigobon, R. (2001). Measuring contagion: conceptual and empirical issues. International Financial Contagion, 43–66. (Springer).

Forbes, K. J., & Rigobon, R. (2002). No contagion, only interdependence: measuring stock market comovements. The Journal of Finance, 57(5), 2223–2261.

Gerlach, S., & Smets, F. (1995). Contagious speculative attacks. European Journal of Political Economy, 11(1), 45–63.

Guo, K., & Stepanyan, V. (2011). Determinants of bank credit in emerging market economies. IMF Working Papers, 1–20.

Haile, F., & Pozo, S. (2008). Currency crisis contagion and the identification of transmission channels. International Review of Economics and Finance, 17(4), 572–588.

Hamao, Y., Masulis, R. W., & Ng, V. (1990). Correlations in price changes and volatility across international stock markets. Review of Financial studies, 3(2), 281–307.

Hamilton, J.D. (1989). A new approach to the economic analysis of nonstationary time series and the business cycle. Econometrica: Journal of the Econometric Society, 357–384.

Hamilton, J.D. (2008). Regime-switching models. The New Palgrave Dictionary of Economics, 2.

Ismail, M. T., & Rahman, R. A. (2009). Modelling the relationships between US and selected Asian stock markets. World Applied Sciences Journal, 7(11), 1412–1418.

Kindleberger, C.P., & Aliber, R.Z. (2011). Manias, panics and crashes: a history of financial crises: Palgrave Macmillan.

King, M. A., & Wadhwani, S. (1990). Transmission of volatility between stock markets. Review of Financial Studies, 3(1), 5–33.

Krolzig, H.-M. (1998). Econometric modelling of Markov-switching vector autoregressions using MSVAR for Ox.

Kumar, M. S., & Persaud, A. (2002). Pure contagion and investors’ shifting risk appetite: analytical issues and empirical evidence. International Finance, 5(3), 401–436.

Lian, Y., Sepehri, M., & Foley, M. (2011). Corporate cash holdings and financial crisis: an empirical study of Chinese companies. Eurasian Business Review, 1(2), 112–124.

Maghrebi, N., Holmes, M. J., & Pentecost, E. J. (2006). Are there asymmetries in the relationship between exchange rate fluctuations and stock market volatility in Pacific Basin countries? Review of Pacific Basin Financial Markets and Policies, 9(02), 229–256.

Mandilaras, A., & Bird, G. (2010). A Markov switching analysis of contagion in the EMS. Journal of International Money and Finance, 29(6), 1062–1075.

Masson, P.R. (1999). Multiple equilibria, contagion, and the emerging market crises. International Monetary Fund.

Mullainathan, S. (2002). A memory-based model of bounded rationality. The Quarterly Journal of Economics, 117(3), 735–774.

Psaradakis, Z., & Spagnolo, N. (2003). On the determination of the number of regimes in Markov-switching autoregressive models. Journal of time series analysis, 24(2), 237–252.

Rigobon, R. (2003). On the measurement of the international propagation of shocks: is the transmission stable? Journal of International Economics, 61(2), 261–283.

Tanai, Y., & Lin, K.-P. (2013). Mongolian and World Equity Markets: Volatilities and Correlations. Eurasian Economic Review, 3(2), 136–164.

Wang, P., & Moore, T. (2012). The integration of the credit default swap markets during the US subprime crisis: dynamic correlation analysis. Journal of International Financial Markets Institutions and Money, 22(1), 1–15.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Le, C., David, D. Asset price volatility and financial contagion: analysis using the MS-VAR framework. Eurasian Econ Rev 4, 133–162 (2014). https://doi.org/10.1007/s40822-014-0009-y

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40822-014-0009-y