Abstract

Drawing on resource dependence and social network theories, we explore the relationship between social networks, financial constraints, and corporate innovation. We employ a two-way fixed-effect panel model based on Chinese A-share listed corporations from 2008 to 2020. We find that financial constraints have a negative relationship with corporate innovation, social networks promote corporate innovation, and financial constraints mediate this relationship. In addition, our findings suggest that social networks have a significantly positive effect on exploratory innovation and a negative effect on exploitative innovation; financial constraints mediate these relationships. Moreover, our findings are heterogeneous for different regions (west, central, and east) and corporate sizes (large and small). Therefore, our findings improve the understanding of the impact of social networks and funds on corporate innovation, shed light on the approach to enhancing corporate innovation, and further expand resource dependence and social network theories.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Corporate innovation is a crucial output for corporations (Liao & Wu, 2010) and a source of value creation (Meroño-Cerdan & López-Nicolas, 2013). Previous studies explore the influence factors of corporate innovation from the perspectives of the environment (Bibi et al., 2020), corporate characteristics (Khan et al., 2020), manager characteristics (Khan et al., 2020; Xie et al., 2021; Yuan & Wen, 2018), internal management (Bibi et al., 2022; Sierra, 2019), organizational relationships (Qi et al., 2020), and resource availability (Ferreira et al., 2013; Hewitt-Dundas, 2006). Scholars also explore the relationship between influence factors and innovation through different methods, such as multivariate analysis (Fombang & Adjasi, 2018; Su et al., 2019; Toivanen & Hyytinen, 2005), different-in-different model (Helmers et al., 2017), structural model (Li, 2011), bivariate probit model (García-Quevedo et al., 2018), and dynamic binary discrete random process (Giraudo et al., 2019). They find that funds and information are widely accepted as the most important external resources and director social networks affect the flow of information. Resource dependence theory (hereafter cited as RDT) developed by Pfeffer (1978) suggest that access to external resources is crucial for innovation activities (Mina et al., 2013), especially in developing countries like China, where prevails high uncertainty, information asymmetry, and lack of collateral (Bolton et al., 2006; Li et al., 2009; Toivanen & Hyytinen, 2005).

Along this stream, financial constraint refers to the difference between internal and external financing costs and is argued to inhibit corporate innovation activities (Acharya & Xu, 2017; Li, 2011) by suppressing initiative and intensity (Nanda & Nicholas, 2014; Pang & Wang, 2020). Information transmission refers to the informal exchange of information between individuals working for different and sometimes competing corporations and reduces uncertainty surrounding innovation by increasing the diversity and quality of information (Chuluun et al., 2017; Dahl & Pedersen, 2005). Meanwhile, social networks refer to the association between individuals or organizations and are the resource brought by people's position in the social structure (Schuchter & Levi, 2016, 2019). It can help corporations access more information (Drees & Heugens, 2013; Helmers et al., 2017), reduce transaction costs (Doh & Acs, 2010), obtain essential resources (Zona et al., 2018), and minimize various external uncertainties (Hillman et al., 2009), thereby increasing innovation funding. Interestingly, few studies relate the above-mentioned requirements and source of resources to corporate innovation and leave questions insufficiently addressed: whether and how social network promotes corporate innovation activities (such as, solely by alleviating financial constraints, or simultaneously by other channels).

To answer these questions, we focus on the relationship between interlocking directors' social networks, financial constraints, and corporate innovation constructing a two-way fixed effects model. To explore the impact mechanism on innovation, we further constructed a mediation effect model and a moderation effect model, following the local studies of He et al. (2019b) and Sun et al. (2019). This study utilized the comprehensive value of four dimensions of interlocking directors' social networks—betweenness centrality, closeness centrality, degree centrality, and structural holes—as measures of social networks to discuss the problem mentioned above. We found a negative relationship between financial constraints and corporate innovation. Social networks promote corporate innovation. Further, financial constraints mediate the relationship between social networks and corporate innovation, and financial constraints play a partial mediating role.

Furthermore, because different types of innovation may require various resources, we explore the impact of social networks on different innovation strategies (exploratory and exploitative innovation). From the perspective of resource dependence, we find that financial constraints have a negative relationship with exploratory innovation. Social networks have a positive relationship with exploratory innovation, which is mediated by financial constraints. Financial constraints play a partial mediating role in this relationship. However, exploitative innovation has different impacts. Financial constraints are positively related to exploitative innovation. Social networks have a negative relationship with exploitative innovation, which is mediated by financial constraints. Our results differ from those of Yan and Guan (2018), who emphasize how individual social capital affects exploratory and exploitative innovation from the perspective of network dynamics.

In addition, analyzing the impact of different regions (west, central, and east) and corporate sizes (large and small), we found that (1) regional development will significantly impact the relationship between social networks, financial constraints, and corporate innovation. (2) large corporations have sufficient resources to promote innovation, and resources brought by social networks have no significant impact on corporate innovation, while small corporations are more influenced by financing constraints and need the support of social networks. In addition, we discuss the impact of heterogeneity.

This study extends social network theory to financial constraints and corporate innovation (El-Khatib et al., 2015; Tao et al., 2019). This study contributes to the literature by exploring the various economic factors that drive corporate innovation by combining organizational behavior theory, RDT, and social network theory in corporate innovation. In addition, this study emphasizes the influence of different regions and corporate sizes on the relationship between social networks, financial constraints, and corporate innovation in China. Furthermore, this study supplements the literature on corporate governance and funding behavior in different environments and provides financial strategies for corporate innovation.

The remainder of this paper is organized as follows. The literature and hypotheses are presented in Sect. 2. Section 3 presents the data sample and research design. Section 4 presents the empirical results and Sect. 5 concludes the study.

2 Literature review and research hypotheses

2.1 Resource dependence theory

Pfeffer (1978) initially developed the RDT, which suggests that firms rely on external organizations to obtain their key resources. This theory points out the interdependence between organizations to explain why independent organizations still engage in inter-organizational arrangements (Drees & Heugens, 2013). RDT shows that firms can minimize environmental dependence and deter environmental uncertainty through five actions: mergers (Deng & Yang, 2015), joint ventures (Sun & Lee, 2013), interlocks (Zona et al., 2018), alliances (Pangarkar & Wu, 2013), and in-sourcing (Nguyen et al., 2021).

The use of interlocking directors to reduce environmental uncertainty and resource dependence is a major approach employed by many corporations (Au et al., 2000). Prior research on boards of directors shows that RDT is the most influential theory than other board perspectives (Hillman et al., 2009). RDT addresses the ability of board interlocks to bring resources to corporations (Zona et al., 2018). Interlocking directors are usually linked to the external environment through their social networks. Such networks are valuable for information transfer across corporations, fostering communication, and obtaining resources for corporate operations (Shaw et al., 2016). Thus, board social networks are an important channel for connecting corporations with key information and resources (such as external budgets, funds, and other social capital) in the external environment (Au et al., 2000; Chen et al., 2013; Zona et al., 2018).

In the context of Chinese culture, people prefer to rely on their relationships to solve various problems. Therefore, RDT is more suitable for studying interlocking directors in China. More outside directors, especially those with social networks, have greater corporate value when firms suffer financial uncertainty or distress (Joh & Jung, 2018). Furthermore, the resources acquired by interlocking directors through experience and connections increase research and development (R&D) intensity (Bravo & Reguera-Alvarado, 2017).

2.2 Hypotheses development

2.2.1 Financial constraints and corporate innovation

Innovation is the process of recombination of various elements (Bibi et al., 2020; Xie et al., 2021). Research shows that corporate innovation is a high-risk investment that is resource-consuming and relies on strong funding resources (Acharya & Xu, 2017). According to RDT, external resources (such as funds and budget) are important sources of corporate R&D (Czarnitzki & Hottenrott, 2011). Lack or malfunctioning external sources of funding will impact corporate innovation (Sierra, 2019). However, corporations encounter various financial difficulties in their innovation activities (Mina et al., 2013).

On the one hand, many corporations and investors are reluctant to finance innovation activities because of uncertainty, a large amount of capital investment, and the long periodicity of innovation (Landry et al., 2002; Zhang & Zheng, 2020). Innovation activities require a long period, are more sensitive to internal funding in the design phase, and are more sensitive to external funding in the execution stage (García-Quevedo et al., 2018). In addition, the unequal time between the input and output of innovation activities limits the persistence of investments by corporations with financial constraints. Generally, when corporations consider optimal investment, they choose to minimize the long-run cost of investment (Efthyvoulou & Vahter, 2016).

On the other hand, due to high uncertainty, information asymmetry, and a lack of collateral, it is difficult for corporations to obtain sufficient funds for innovation (Acharya & Xu, 2017; Pang & Wang, 2020; Toivanen & Hyytinen, 2005). In China, because innovation activities are associated with high information asymmetry and risk, lenders prefer to ask for a higher rate of return or more collateral, which further increases the financial cost of innovation and induces underinvestment in innovation activities (García-Quevedo et al., 2018). Moreover, the uncertainty and distribution of innovation investment returns make investors more cautious when choosing investments in innovation activities.

Overall, due to the externality, information asymmetry, long periodicity, and distribution of R&D investment returns, financial constraints have become one of the most significant factors corporate innovation faces (García-Quevedo et al., 2018). Following the RDT, corporations are less likely to undertake innovation activities without financial support (Elking et al., 2017). Therefore, alleviating financial constraints may facilitate innovation activities (Cao & Zhang, 2021; Howell, 2016). Thus, we propose the following hypothesis:

Hypothesis 1

Financial constraints have a negative impact on corporate innovation.

2.2.2 Social network, financial constraints, and corporate innovation

Corporations can alleviate resource dependence by connecting them to external sources. Based on the analysis above, financing resources are essential in the process of corporate innovation. In China, interlocking directors' social network is one of the most important external resources that could provide various resources, such as information, funds, and capital (Au et al., 2000; Zona et al., 2018). Therefore, social networks may alleviate the relationship between financial constraints and corporate innovation.

In Chinese, social networks, called guanxi, also refer to connections or connectedness (Cohen et al., 2008; Khanna et al., 2015; Kuang & Lee, 2017). It refers to the association between individuals or organizations and is the resource brought by people's position in the social structure (Schuchter & Levi, 2016, 2019). Therefore, social networks are important external resource channels in China, where exist financial repression and weak corporate governance (Cao & Zhang, 2021; Lin & Lin, 2016).

Social networks can alleviate some critical resources (such as finance, knowledge, and information) concerning corporate innovation, mainly through information sharing (Chuluun et al., 2017; He et al., 2019a), trust (Nguyen et al., 2021; Shaw et al., 2016), and resource acquisition (Tsai et al., 2019).

Social networks can provide new ways to circulate information (Chai et al., 2019; Dahl & Pedersen, 2005; Lai et al., 2019). The information channel implies that social networks are economically meaningful information-sharing processes (Javakhadze et al., 2016). Information asymmetry in the financial markets leads to failed financial connections and high search costs. Therefore, social networks increase the availability of capital and knowledge diffusion in innovation activities. Moreover, social networks provide information for innovative corporations and facilitate information diffusion in their innovation (Chuluun et al., 2017).

Social networks are social ties with high trust and independence from third parties (Burt & Burzynska, 2017). This leads corporations to strengthen their connections with the external environment and increase resource acquisition and operational efficiency to facilitate their innovation activities (Shaw et al., 2016). Based on mutual trust, social networks also serve as insurance to mitigate the ex-post risk of innovation failure, as friends may provide reemployment as a backup (Faleye et al., 2014). These relationships decrease penalties for failure and create a moderate environment for innovative corporations.

Therefore, we propose the following hypothesis:

Hypothesis 2

Social network has a positive impact on corporate innovation.

Social networks also promote inter-organizational resource acquisition and facilitate resource allocation, which can help corporations obtain funds from more sources or at a lower cost (Dahl & Pedersen, 2005; Lu et al., 2012). The higher the network centrality of a private corporation, the more it alleviates financial constraints (Peng et al., 2019). The relationship between corporations and banks helps corporations obtain more loans or longer durations (Engelberg et al., 2012; Pham & Talavera, 2018) and provides sufficient financial support for innovation activities. Furthermore, social networks increase the availability of capital and credit, which are vital resources for implementing innovation activities. Therefore, corporations have access to larger financial resources from social networks and boost innovation activities. Thus, we propose the following hypothesis:

Hypothesis 3

Financial constraints mediate the relationship between social networks and corporate innovation.

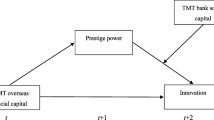

The research framework is presented in Fig. 1

3 Research design

3.1 Variables and measures

3.1.1 Dependent variable: innovation

There are three primary measures of corporate innovation: (1) number of patent applications, (2) number of patent grants, and (3) number of patent citations. Instead of the number of patent grants applied by some researchers (Mirvis et al., 2016; Phelps et al., 2012), we chose the number of patent applications as a measure of corporate innovation, following Acharya and Xu (2017), Yuan and Wen (2018), and Pang and Wang (2020). Corporate innovation is measured by the logarithm of the number of patent applications plus one (\(\mathrm{ln}{Apply}_{it}\)).

This measure was chosen because of the time lag. On the one hand, the granting duration depends on the efficiency of the government, which often lasts several years, thus making the patent-grant measure less precise (Yan & Guan, 2018), especially considering the rapid economic development and underdevelopment of patent censorship in China. On the other hand, the number of patent citations is mostly used in developed countries where intelligent infrastructure is well constructed, whereas less data on patent citations are available in China (Pang & Wang, 2020).

3.1.2 Independent variable: social network

As many scholars have recognized strength as a critical and considerable factor influencing relationships (El-Khatib et al., 2015; Kuang & Lee, 2017), the strength of connectedness was considered and measured as network centrality. Four dimensions of network centrality are introduced: betweenness, closeness, degree, and structural holes.

We choose the data of interlocking directors' social networks and construct a comprehensive connectedness strength index in two steps:

-

(1) Four annual percentile centrality indices were generated by calculating four dimensions of centrality based on the four different network centralities of each chief executive officer (CEO) and director every year. These four percentile indices denoted 1 being the least central and 100 being the most central. This percentile transformation preserves the rank order of the network centrality importance of each CEO and director, making the size of the network irrelevant and thus comparable across years (El-Khatib et al., 2015). Moreover, according to El-Khatib et al. (2015), it is assumed that once formed, connections persist until one party of the pair dies, which means that the network grows monotonically larger over time.

-

(2) Corporation-level network centrality indices were generated based on the four annual percentile centrality indices. We calculated the comprehensive corporation-level centrality index by averaging the four annual percentile indices each year (Tao et al., 2019).

Thus, considering this perspective, we choose the average of each corporation's four annual percentile indices as our measure of the social network. The following equation represents this.

where \(i\) denotes the corporation, \(t\) denotes the year, and \(j\) denotes the interlocking directors employed by the corporation \(i\). \(Po\) denotes the percentile of the network centrality; \(\mathrm{Degree}\), \(\mathrm{Betweenness}\), \(\mathrm{Closeness}\), and \(\mathrm{StructuralHoles}\) denote degree centrality, betweenness centrality, closeness centrality, and structural holes, respectively.

3.1.3 Mediating and moderating variable: financial constraints

The WW index is a comprehensive value of six variables: cash flow, firm size, leverage, industry sales growth, firm sales growth, and dividend payer dummy (Hadlock & Pierce, 2010). The WW index was applied and calculated according to the measurement process of Whited and Wu (2006) to measure the severity of the financial constraints. Corporations with a higher WW index are more financially constrained than those with a lower index.

3.1.4 Control variables

Four types of control variables were considered in this study: corporate characteristics, corporate finance, corporate governance, and financial market. Fixed effects are also introduced. The details of the control variables are as follows:

First, we examine corporate characteristics. In this study, the duration and ownership of corporations were controlled for individual differences between corporations. Recent literature argues that the competitive and innovation strategies adopted by corporations in different development stages are different (Giraudo et al., 2019; Lin et al., 2017; Su et al., 2019; Zheng et al., 2018); and the duration is measured by years of establishment, represented by \(EstbDuratio{n}_{it}\). Furthermore, ownership was controlled by adding state-owned dummies (\({SOE}_{it}\), state-owned equals 1, otherwise equals 0) and institutional holding dummies (\({InstOwn}_{it}\), equals 1 for institutional holdings; otherwise equals 0), following Czarnitzki and Hottenrott (2011). The corporate social network range was controlled by adding supplier concentration, measured by the supplier's Herfindahl index of the supplier ((\({PCHHI}_{it}\)). Regional factors were controlled by adding categorical variables of region (\(region\), if the corporation is headquartered in western China, it equals 1; if it is headquartered in central China, it equals 2; if it is headquartered in eastern China, it equals 3).

The second factor is corporate finances. Corporations with better financial performance often have more resources and are less financially constrained; thus, they can bear more innovation costs and risks (Giraudo et al., 2019; Hottenrott & Richstein, 2020). Following Giebel and Kraft (2019), Su et al. (2019), Fang et al. (2018), and Chuluun et al. (2017), two sets of control variables relating to corporate finance were considered: leverage and profitability. Leverage was measured by dividing total liabilities by total assets (\(Leverag{e}_{it}\)). Profitability is denoted by ROA (\(RO{A}_{it}\)).

Third, corporate governance also exists. Corporations with a high level of corporate governance are usually faced with less information asymmetry, fewer financial constraints, and higher operational efficiency and innovation efficiency (Giraudo et al., 2019; Hottenrott & Richstein, 2020). Three groups of variables were used (Chuluun et al., 2017; Fang et al., 2018; Peng et al., 2019), including those relating to CEOs, directors, and auditors. Variables about the CEO include the CEO's age (\({Age}_{it}\)) and duality (\({Duality}_{it}\)). Variables relating to the director include director size (\(ln{DBSize}_{it}\)) and director independence (\({IndDrctRatio}_{it}\)). Variables relating to auditors include the number of auditors (\({AuditNo}_{it}\)) and the dummy variable \({Big4}_{it}\) (equals 1 if auditors belong to the Big Four audit corporations; otherwise, it equals 0).

Fourth, considering the financial market, the TobinQ (\({TobinQ}_{it}\)) value was employed as the corporate replacement cost (Fang et al., 2018). The market-to-book ratio (\({BM}_{it}\)) was used in our models (Chuluun et al., 2017) as the market recognition of listed companies was also considered. The number of analysts (\({Analysist}_{it}\)) is used to observe the level of market attention.

Lastly, fixed effect. Corporation, year, and industry are used as control variables to control for fixed effects. Year and industry were used as dummy variables, recorded as \({yr}_{it}\) and \({ind}_{ij}\). Industrial fixed effects were considered because different industries usually require different scales of initial and continuing investments, incubation duration, and payback duration, thus demanding external finance and facing different trade-offs between costs and benefits toward innovation (Acharya & Xu, 2017).

3.2 Sample and data

Corporations listed on the Chinese A-share from 2008 to 2020 were chosen as the sample. The data were obtained from the China Stock Market and Accounting Research (CSMAR) database. After collection, a two-tailed 1% winsorization was applied to avoid abnormal data, and data that could not be filled or had obvious mistakes were deleted. After cleaning the data, there were 21,305 year-corporation observations. It is noteworthy that the main observations are 15,871, owing to the one-lagged period of the variables to avoid endogeneity. Table 1 provides a summary of the statistics.

3.3 Model and method

3.3.1 Baseline model setting and estimating method

Based on the year-corporation panel data, a semi-logarithmic model with a two-way fixed effect was constructed as in Model (1), where \({\varvec{C}}{\varvec{o}}{\varvec{n}}{\varvec{t}}{\varvec{r}}{\varvec{o}}{{\varvec{l}}}_{{\varvec{i}}{\varvec{t}}}\) denotes the vector of the control variables, including the abovementioned control variables and fixed effects. Fixed effects were included across all the regressions (Faleye et al., 2014; Fang et al., 2018). Moreover, one-year lagged right-hand-side variables were introduced to avoid the potential problem of endogeneity (Faleye et al., 2014; Fang et al., 2018).

3.3.2 Mediation test method

According to Baron and Kenny (1986), Guo et al. (2014), and Hongdao et al. (2019), a standard testing process was followed to investigate mediation effects. Models (1) and (2) are employed, and their results are compared with those of Model (1).

The mediation effect test can be divided into three steps: first, checking whether the social network can promote corporate innovation, that is, whether the coefficient \({\beta }_{1}\) in Model (2) is statistically significant; second, exploring whether social networks can alleviate the financial constraints of corporations, that is, the coefficient \({c}_{1}\) in Model (3) is statistically significant; and third, we test whether social networks and financial constraints affect corporate innovation simultaneously, that is, the coefficients \({\alpha }_{1}\) and \({\alpha }_{2}\) in model (1).

According to the method of the mediation effects test, the coefficients \({\beta }_{1}\), \({c}_{1}\), and \({\alpha }_{2}\), all being statistically significant, are the conditions for the existence of the mediation effect of financial constraints. Furthermore, if \({\alpha }_{1}\) is significant, financial constraints are partial mediators. If \({\alpha }_{1}\) is not, financial constraints are complete mediators.

3.3.3 Moderation test method

According to the local study of Sun et al. (2019), we introduce the interaction of social networks and financial constraints based on the baseline model to test the moderation effect of social networks and financial constraints on corporate innovation. The following model is employed:

4 Results and analysis

4.1 Main results

Table 2 presents the results of social networks and financial constraints on corporate innovation. Models (1), (2), and (3) present the results of the three-step mediation test without the moderating effect of financial constraints. Model (4) is a full model and includes the moderating effect of financial constraints. The main results are shown in Fig. 2.

First, there is a negative relationship between financial constraints and corporate innovation, supporting Hypothesis 1. The coefficient of \(WW\) is − 0.9972, which is statistically significant in Model (3). The larger the WW index, the more severe the corporate financial constraints. This result indicates that less severe financial constraints can promote corporate innovation. This study also provides evidence that financial resources are essential for corporate innovation.

Second, social networks promote corporate innovation, supporting Hypothesis 2. In Model (1) of Table 2, the coefficient of \(MeanP\) is 0.2576 and statistically significant, suggesting that the total effect of social networks on corporate innovation is positive. Meanwhile, the coefficient of \(MeanP\) is 0.2669 and statistically significant, suggesting that the direct effect of social networks on corporate innovation is positive in Model (3). Therefore, these results partially verify the local research of He et al. (2019b) suggesting the successful promotion of corporate innovation by CEOs' rich experiences.

Finally, social networks promote corporate innovation, and financial constraints mediate this relationship, supporting Hypothesis 3. Furthermore, financial constraints partially mediate this relationship. Models (1), (2), and (3) in Table 2 show the results of the three-step method, which is used to judge the mediation effect. The significance of all the coefficients in Models (1)–(3) shows that financial constraints partially mediate the relationship between social networks and corporate innovation. These results also indicate that social networks promote corporate innovation by alleviating financial constraints. In addition, the coefficient of \(MeanPWW\) in Model (4) was not significant, showing no evidence of a moderating effect.

4.2 Further analysis

4.2.1 Different innovation strategies

Different types of innovation are necessary for corporations (Liao & Wu, 2010). Different types of innovation may require various resources. Thus, following Yan and Guan (2018) and Zhang and Luo (2020), we consider two types of innovation strategies (exploratory and exploitative) in this section. Exploratory innovation mainly attempts to combine knowledge elements and products in a novel manner to transform a business; it involves creating and discovering. Exploitative innovation refers to reconfiguring existing combinations to enable novel implementation, use, and application (Fang et al., 2018).

There are three types of patents granted in China: invention, utility, and design patents (Pang & Wang, 2020). In this study, exploratory innovation (\(lnIApply\)) is measured by the logarithm of applying invention number plus one, while exploitative innovation (\(\mathrm{ln}SApply\)) is measured by the logarithm of applying utility and design number plus one.

The results of the different innovation strategies are presented in Table 3.

First, there is a positive relationship between social networks and exploratory innovation and a negative relationship between financial constraints and exploratory innovation. Financial constraints partially mediate this relationship. Furthermore, financial constraints mediate the relationship between social networks and exploratory innovation. The coefficient of \(MeanP\) was positive and statistically significant in Model (3) of Table 3. This indicates that social networks have a positive effect on exploratory innovation. The coefficient of \(WW\) is negative and statistically significant in Model (3). Given that the higher the WW index, the more severe the financial constraints, this suggests that fewer financial constraints can promote exploratory innovation. In addition, the results of Models (1), (2), and (3) show that financial constraints play a partial mediating role. This suggests that social networks promote exploratory innovation by alleviating financial constraints.

Second, a negative relationship exists between social networks and exploitative innovation. The positive relationship between financial constraints and exploitative innovation. Furthermore, financial constraints played a partial mediating role in the relationship between social networks and exploitative innovation. The coefficient of \(MeanP\) is negative and statistically significant in Model (7). This indicates that complex social networks may take up too many resources and restrain corporate investment in exploitative innovation. The coefficient of \(WW\) is positive and statistically significant in Models (6) and (7) in Table 3. This result suggests that corporations will increase capital utilization efficiency in exploitative innovation under severe financial constraints. The results of Models (1), (5), and (7) show that financial constraints play a partial mediating role. In addition, the coefficient of \(MeanPWW\) is negative and statistically significant in Model (7), showing that financial constraints also moderate the relationship between social networks and exploitative innovation. Evidence suggests a crowding-out effect between social networks and exploitative innovation in the context of severe financial constraints.

4.2.2 Heterogeneous analysis

-

(1)

Different region

With accelerated economic development, Chinese social networks and corporate innovations have apparent regional characteristics. To investigate the regional correlation between social networks, financial constraints, and corporate innovation, we divided the full sample into three regions: west, central, and east (Li & Jin, 2021). Each region was divided according to Chinese standards. The results are presented in Table 4.

In Panel A, the empirical results for western China show that financial constraints have a negative relationship with corporate innovation, and social networks have a significantly positive effect on corporate innovation in western China. Furthermore, financial constraints play a partial mediating role in the relationship between social networks and corporate innovation. The results for western China are consistent with the leading results. These results also indicate that both social networks and the alleviation of financial constraints can promote corporate innovation during the relatively slow development of Western China.

In Panel B, the empirical results for central China show that social networks have a significantly positive relationship with corporate innovation. The coefficient of financial constraints is negative but not significant. The results of the mediation effect test suggest that the mediation effect of financial constraints is statistically insignificant in the central region. These results indicate that corporations in the central region pay more attention to developing inter-organisational relationships.

In Panel C, only financial constraints have a negative relationship with corporate innovation in eastern China. Social networks have no significant impact on innovation activities. This result is also realistic. The eastern region is relatively developed and plays a leading role in China's economic development. Corporations in the eastern region have abundant resources to promote innovation, and resources brought by social networks have a small significant impact on corporate innovation. In contrast, financial constraints still have a significant negative effect on innovation.

Table 4 Impact of social networks on corporate innovation in different regions -

(2)

The effects of corporate size

To investigate the differential effects across the size of corporations, we divided the sample into two main groups: small and large corporations (Álvarez & Crespi, 2015). The results for the subsample are listed in Table 5. Corporations larger than the average size are included in the group of large corporations, whereas others are included in the group of small corporations.

We find that the results are interesting because the impact of social networks on corporate innovation differs across corporate sizes. The results for small corporations are consistent with those for the full sample, whereas those for large corporations show differences. Evidence suggests that social networks on corporate innovation mainly bind to small corporations. For large corporations, the coefficient of social networks is positive but not significant. The coefficients of financial constraints are negative and significant for small and large firms. This may be because large corporations have sufficient resources to promote innovation, and resources brought by social networks have a small significant impact on corporate innovation. In addition, small corporations rely on social networks to smooth innovation, and financial resources mediate this relationship (see Table 5). This result suggests that financing constraints influence small corporations and require social network support.

Table 5 Results of different sizes of the corporations

4.3 Robustness test

4.3.1 Alternative measure of social network

According to resource-based theory, corporations develop favorable resources to accumulate competitive advantages. This propensity may also exist in social capital; corporations tend to exploit existing social capital instead of exploring new ones. Thus, employees with higher social network centrality may matter more to corporations, and the maximum centrality of employees should better measure a corporation's social centrality.

Thus, considering this perspective, an alternative measure of the social network was applied. Instead of averaging the percentile of each centrality, the most important network centrality was used for measurement. We used \(MaxP\) to express this, which denotes the maximum percentile of each centrality.

where \(i\) denotes the corporation, \(t\) denotes the year, and \(j\) denotes the interlocking directors employed by the corporation \(i\). \(Po\) denotes the percentile of the network centrality; \(Degree\), \(Betweenness\), \(Closeness\), and \(StructuralHoles\) denote degree centrality, betweenness centrality, closeness centrality, and structural holes, respectively. The main results of the alternative measures of social networks are presented in Table 6. These results are consistent with the main results of the baseline model, suggesting the robustness of the major conclusions. In other words, financial constraints have a negative effect on corporate innovation, social networks have a positive effect on corporate innovation, and financial constraints mediate this relationship. However, there was no evidence of a moderation effect.

4.3.2 Alternative measure of financial constraints

According to previous research, the FC index is a popular measure of financial constraints (Fee et al., 2009). Therefore, we choose the FC index as an alternative measure of financial constraints.

The main results of the social network alternative measures are listed in Table 7. Models (1), (2), and (3) show the mediating effect of financial constraints on social networks and corporate innovation. Given that the higher the FC index, the greater the financial constraints, financial constraints still negatively affect corporate innovation. These results are consistent with the main results, suggesting the robustness of the above mentioned major conclusions. In other words, financial constraints have a negative effect on corporate innovation, social networks have a positive effect on corporate innovation, and financial constraints mediate this relationship. However, there was no evidence of a moderation effect.

4.3.3 Endogeneity

To address the endogenous problems resulting from selection or survivor bias, we consider corporate ownership and divide the full sample into state-owned enterprises (hereafter cited as SOEs) and non-state-owned enterprises (hereafter cited as non-SOEs) (Zhang & Luo, 2020). Corporations with state ownership have higher credit lines and are more likely to obtain financial support at a lower cost. Additionally, they may have stronger social networks. Their social networks and finance may more directly impact investments in innovation for SOEs than for non-SOEs. SOEs and non-SOEs in China provide a natural setting to investigate this issue. Table 8 presents the results for the two groups.

The results are interesting because the impact of financial constraints on corporate innovation differs across agents. Both SOEs and non-SOEs rely on social networks to smooth innovation, and financial resources mediate this relationship (Table 8). In addition, because the coefficient of MeanP is not significant in Model (3) of Panel A, financial constraints play a complete mediating role. This result suggests that social networks promote corporate innovation by alleviating SOEs' financial constraints.

For non-SOEs, social networks positively affect corporate innovation and alleviate financial constraints. Since the WW index is not significant in Model (3) of Panel B and cannot directly judge the mediation effect, we choose the bootstrap test to test the mediation effect. Panel B of Table 8 shows the bootstrapping bias-corrected 95% confidence interval (CI) results. The results of the bootstrap test show that social networks have a significant indirect impact on corporate innovation (CI = [0.0068, 0.0366]), and the indirect effect is positive (Effect = 0.0205). This result indicates that social networks promote corporate innovation by alleviating financial constraints for non-SOEs and that financial constraints play a partial mediating role.

Overall, the main results were robust. Social networks promote corporate innovation by alleviating the financial constraints of both SOEs and non-SOEs. However, financial constraints play a complete mediating role in SOEs and a partial mediating role for non-SOEs. These results suggest that social networks provide financial resources and other related resources for the innovation of non-SOEs.

5 Discussion and conclusion

This study explores the relationship between social networks, financial constraints, and corporate innovation and interprets their interacting mechanisms by considering the mediation and moderation effects. A two-way fixed effects panel model was constructed based on Chinese A-share listed corporations from 2008 to 2020.

Our research highlights the impact mechanism of social networks on corporate innovation and the mediating role of financial constraints. Specifically, first, our findings show a negative relationship between financial constraints and corporate innovation. This finding confirms the dependence of innovation activities on resources. It also indicates that a stable funds supply is needed to achieve the sustainability of the corporate innovation activities. Second, we find that social networks have a positive effect on corporate innovation, whereas financial constraints mediate the relationship between social networks and corporate innovation. The idea here is that corporations can obtain more resources through social networks to alleviate financial constraints in innovative activities. Our findings extend the research of Su et al. (2019) that political connections tend to enhance corporate innovation, and the research of Li (2011) that firms with financial constraints are more likely to suspend/discontinue their R&D projects. This finding guides corporations in accessing financial resources by improving their social networks to increase innovation investment.

Considering the impact of different corporate innovation strategies, we find that social networks have a positive effect on exploratory innovation and a negative effect on exploitative innovation. It can be explained that exploratory innovation is the combination of existing elements and products, and rich social networks can provide more resources and create a good environment for exploratory innovation. Moreover, exploitative innovation needs to spend more energy and resource to reconfigure elements to obtain novel things, and the cost of maintaining social networks will crowd out exploitative innovation. In addition, we also find that financial constraints mediate the relationship between social networks and exploratory innovation; the same result holds for social networks and exploitative innovation. Moreover, severe financial constraints restrict exploratory innovation and promote exploitative innovation. These findings suggest that the characteristics of exploratory innovation determine that it needs more resources to support it, and social networks facilitate exploratory innovation by providing financial support. Meanwhile, social networks promote exploitative innovation, and further financial constraints prompt corporations to achieve efficient use of limited resources through exploitative innovation. Our findings differ from those of Yan and Guan (2018) who emphasize how individual social capital affects exploratory and exploitative innovation from the perspective of network dynamics. The reason may be that we analyze the relationship between social networks and corporate innovation from the perspective of resource dependence and consider the factors of financial constraints.

In addition, several corporate-level heterogeneities were considered. First, our study suggests that different regions have different effects on the relationship between social networks, financial constraints, and corporate innovation. The main results of the baseline model are robust in western China. Social networks have a significantly positive effect on corporate innovation in central China but have no significant effect in eastern China. Financial constraints still have a negative relationship with corporate innovation in the eastern region. These findings indicate that corporate innovation activities need financial support in all regions of China. Furthermore, since the development of central and western regions of China is relatively slow, the resources brought by social networks can significantly promote corporate innovation activities; while the eastern region is relatively developed and social networks have no significant impact on corporate innovation activities. Second, differentiating corporations according to size, we find that the results for small corporations are consistent with those of the full sample, while those for large corporations show differences. Small corporations are influenced more by financing constraints and require the support of social networks. Large corporations have sufficient resources to promote innovation, and the resources brought by social networks have a small significant impact on corporate innovation.

This study contributes to the literature as follows:

First, it enriches the literature on influencing factors and their mechanisms in corporate innovation (Helmers et al., 2017; Li, 2011; Su et al., 2019). Our research contributes to the literature by providing evidence that alleviating financial constraints through social networks impacts corporate innovation. Further, we find that social networks have a crowding-out effect on exploitative innovation.

Second, this study enriches the RDT and social network theory. It extends social network theory to financial constraints and corporate innovation (El-Khatib et al., 2015; Tao et al., 2019). This study also extends Guo et al. (2014) research on corporate innovation motivation by verifying different strategies' roles and mechanism differences.

Finally, this study supplements the literature on corporate governance and funding behavior in different environments and supports corporate innovation activities. This study emphasizes the influence of different regions and corporate sizes on the relationship between social networks, financial constraints, and corporate innovation in China. Our empirical results guide corporations in adopting different strategies to promote innovation in different environments.

However, some limitations of this study remain to be resolved. First, our study focuses on the social networks of interlocking directors; therefore, the findings may not be generalizable to all employees' social networks. Furthermore, although we find the impact mechanism of social networks on corporate innovation in China, this does not mean that social networks could impact corporate innovations in a different country through financial constraints. Future research should include these factors to understand better how social networks affect corporate innovation.

Availability of data and material

All data and materials support our published claims and comply with field standards.

References

Acharya, V., & Xu, Z. (2017). Financial dependence and innovation: The case of public versus private firms. Journal of Financial Economics, 124(2), 223–243. https://doi.org/10.1016/j.jfineco.2016.02.010

Álvarez, R., & Crespi, G. A. (2015). Heterogeneous effects of financial constraints on innovation: Evidence from Chile. Science & Public Policy, 42(5), 711–724. https://doi.org/10.1093/scipol/scu091

Au, K., Peng, M. W., & Wang, D. (2000). Interlocking directorates, firm strategies, and performance in Hong Kong Towards a research agenda. Asia Pacific Journal of Management, 1(17), 28–47.

Baron, R. M., & Kenny, D. A. (1986). The moderator-mediator variable distinction in social psychological-research: conceptual, strategic, and statistical considerations. Journal of Personality and Social Psychology, 51(6), 1173–1182. https://doi.org/10.1037/0022-3514.51.6.1173

Bibi, S., Khan, A., Hayat, H., Panniello, U., Alam, M., & Farid, T. (2022). Do hotel employees really care for corporate social responsibility (CSR): A happiness approach to employee innovativeness. Current Issues in Tourism, 25(4), 541–558. https://doi.org/10.1080/13683500.2021.1889482

Bibi, S., Khan, A., Qian, H., Garavelli, A. C., Natalicchio, A., & Capolupo, P. (2020). Innovative Climate, a Determinant of Competitiveness and Business Performance in Chinese Law Firms: The Role of Firm Size and Age. Sustainability, 12(12), 4948. https://doi.org/10.3390/su12124948

Bolton, P., Schernkman, J., & Xiong, W. (2006). Executive Compensation and Short-Termist Behaviour in Speculative Markets. The Review of Economic Studies, 73(3), 577–610. https://doi.org/10.1111/j.1467-937x.2006.00388.x

Bravo, F., & Reguera-Alvarado, N. (2017). The effect of board of directors on R&D intensity: Board tenure and multiple directorships. R & D Management, 5(47), 701–714.

Burt, R. S., & Burzynska, K. (2017). Chinese Entrepreneurs, Social Networks, andGuanxi. Management and Organization Review, 13(2), 221–260. https://doi.org/10.1017/mor.2017.6

Cao, G., & Zhang, J. (2021). Guanxi, overconfidence and corporate fraud in China. Chinese Management Studies. https://doi.org/10.1108/CMS-04-2020-0166. ahead-of-print.

Chai, S., Chen, Y., Huang, B., Ye, D., Li, P. P., Xie, E., Lew, S. C., Sato, Y., & Lui, S. (2019). Social networks and informal financial inclusion in China. Asia Pacific Journal of Management, 36(2), 529–563. https://doi.org/10.1007/s10490-017-9557-5

Chen, H., Ho, M. H., & Hsu, W. (2013). Does board social capital influence chief executive officers’ investment decisions in research and development? R & D Management, 43(4), 381–393. https://doi.org/10.1111/radm.12025

Chuluun, T., Prevost, A., & Upadhyay, A. (2017). Firm network structure and innovation. Journal of Corporate Finance, 44, 193–214. https://doi.org/10.1016/j.jcorpfin.2017.03.009

Cohen, L., Frazzini, A., & Malloy, C. (2008). The Small World of Investing: Board Connections and Mutual Fund Returns. Journal of Political Economy, 116(5), 951–979. https://doi.org/10.1086/592415

Czarnitzki, D., & Hottenrott, H. (2011). R&D investment and financing constraints of small and medium-sized firms. Small Business Economics, 36(1), 65–83. https://doi.org/10.1007/s11187-009-9189-3

Dahl, M. S., & Pedersen, C. (2005). Social networks in the R&D process: The case of the wireless communication industry around Aalborg, Denmark. Journal of Engineering and Technology Management, 22(1–2), 75–92. https://doi.org/10.1016/j.jengtecman.2004.11.001

Deng, P., & Yang, M. (2015). Cross-border mergers and acquisitions by emerging market firms: A comparative investigation. International Business Review, 24(1), 157–172. https://doi.org/10.1016/j.ibusrev.2014.07.005

Doh, S., & Acs, Z. J. (2010). Innovation and Social Capital: A Cross-Country Investigation. Industry and Innovation, 17(3), 241–262. https://doi.org/10.1080/13662711003790569

Drees, J. M., & Heugens, P. P. (2013). Synthesizing and Extending Resource Dependence Theory a Meta-Analysis. Journal of Management, 39, 1666–1698.

Efthyvoulou, G., & Vahter, P. (2016). Financial Constraints, Innovation Performance and Sectoral Disaggregation. The Manchester School, 84(2), 125–158. https://doi.org/10.1111/manc.12089

El-Khatib, R., Fogel, K., & Jandik, T. (2015). CEO network centrality and merger performance. Journal of Financial Economics, 116(2), 349–382. https://doi.org/10.1016/j.jfineco.2015.01.001

Elking, I., Paraskevas, J. P., Grimm, C., Corsi, T., & Steven, A. (2017). Financial Dependence, Lean Inventory Strategy, and Firm Performance. The Journal of Supply Chain Management, 53(2), 22–38. https://doi.org/10.1111/jscm.12136

Engelberg, J., Gao, P., & Parsons, C. A. (2012). Friends with money. Journal of Financial Economics, 103(1), 169–188. https://doi.org/10.1016/j.jfineco.2011.08.003

Faleye, O., Kovacs, T., & Venkateswaran, A. (2014). Do Better-Connected CEOs Innovate More? Journal of Financial and Quantitative Analysis, 49(5–6), 1201–1225. https://doi.org/10.1017/S0022109014000714

Fang, Y., Francis, B., & Hasan, I. (2018). Differences make a difference: Diversity in social learning and value creation. Journal of Corporate Finance (amsterdam, Netherlands), 48, 474–491. https://doi.org/10.1016/j.jcorpfin.2017.11.015

Fee, C. E., Hadlock, C. J., & Pierce, J. R. (2009). Investment, Financing Constraints, and Internal Capital Markets: Evidence from the Advertising Expenditures of Multinational Firms. Review of Financial Studies, 22(6), 2361–2392. https://doi.org/10.1093/rfs/hhn059

Ferreira, D., Manso, G., & Silva, A. C. (2013). Incentives to Innovate and the Decision to Go Public or Private. Review of Financial Studies, 27(1), 256–300. https://doi.org/10.1093/rfs/hhs070

Fombang, M. S., & Adjasi, C. K. (2018). Access to finance and firm innovation. Journal of Financial Economic Policy, 10(1), 73–94. https://doi.org/10.1108/JFEP-10-2016-0070

García-Quevedo, J., Segarra-Blasco, A., & Teruel, M. (2018). Financial constraints and the failure of innovation projects. Technological Forecasting & Social Change, 127, 127–140. https://doi.org/10.1016/j.techfore.2017.05.029

Giebel, M., & Kraft, K. (2019). External Financing Constraints and Firm Innovation. The Journal of Industrial Economics, 67(1), 91–126. https://doi.org/10.1111/joie.12197

Giraudo, E., Giudici, G., & Grilli, L. (2019). Entrepreneurship policy and the financing of young innovative companies: Evidence from the Italian Startup Act. Research Policy, 48(9), 103801. https://doi.org/10.1016/j.respol.2019.05.010

Guo, H., Xu, E., & Jacobs, M. (2014). Managerial political ties and firm performance during institutional transitions: An analysis of mediating mechanisms. Journal of Business Research, 67(2), 116–127. https://doi.org/10.1016/j.jbusres.2012.11.009

Hadlock, C. J., & Pierce, J. R. (2010). New Evidence on Measuring Financial Constraints: Moving Beyond the KZ Index. Review of Financial Studies, 23(5), 1909–1940. https://doi.org/10.1093/rfs/hhq009

He, Y., Xu, L., & McIver, R. P. (2019a). How does political connection affect firm financial distress and resolution in China? Applied Economics, 51(26), 2770–2792. https://doi.org/10.1080/00036846.2018.1558358

He, Y., Yu, W., Dai, Y., & Wang, Y. (2019b). Managers’ professional experience and enterprise innovation. Journal of Managing World, 35(11), 174–192.

Helmers, C., Patnam, M., & Rau, P. R. (2017). Do board interlocks increase innovation? Evidence from a corporate governance reform in India. Journal of Banking & Finance, 80, 51–70. https://doi.org/10.1016/j.jbankfin.2017.04.001

Hewitt-Dundas, N. (2006). Resource and Capability Constraints to Innovation in Small and Large Plants. Small Business Economics, 26(3), 257–277. https://doi.org/10.1007/s11187-005-2140-3

Hillman, A. J., Withers, M. C., & Collins, B. J. (2009). Resource Dependence Theory: A Review. Journal of Management, 35(6), 1404–1427. https://doi.org/10.1177/0149206309343469

Hongdao, Q., Bibi, S., Khan, A., Ardito, L., & Nurunnabi, M. (2019). Does What Goes Around Really Comes Around? The Mediating Effect of CSR on the Relationship between Transformational Leadership and Employee’s Job Performance in Law Firms. Sustainability, 11(12), 3366. https://doi.org/10.3390/su11123366

Hottenrott, H., & Richstein, R. (2020). Start-up subsidies: Does the policy instrument matter? Research Policy, 49(1), 103888. https://doi.org/10.1016/j.respol.2019.103888

Howell, A. (2016). Firm R&D, innovation and easing financial constraints in China: Does corporate tax reform matter? Research Policy, 45(10), 1996–2007. https://doi.org/10.1016/j.respol.2016.07.002

Javakhadze, D., Ferris, S. P., & French, D. W. (2016). Social capital, investments, and external financing. Journal of Corporate Finance (amsterdam, Netherlands), 37, 38–55. https://doi.org/10.1016/j.jcorpfin.2015.12.001

Joh, S. W., & Jung, J. (2018). When do firms benefit from affiliated outside directors? Evidence from Korea. Corporate Governance: An International Review, 26(6), 397–413. https://doi.org/10.1111/corg.12224

Khan, A., Bibi, S., Lyu, J., Garavelli, A. C., Pontrandolfo, P., & Perez Sanchez, M. D. A. (2020). Uncovering Innovativeness in Spanish Tourism Firms: The Role of Transformational Leadership, OCB, Firm Size, and Age. Sustainability, 12(10), 3989. https://doi.org/10.3390/su12103989

Khanna, V., Kim, E. H., & Lu, Y. (2015). CEO Connectedness and Corporate Fraud. The Journal of Finance, 70(3), 1203–1252. https://doi.org/10.1111/jofi.12243

Kuang, Y. F., & Lee, G. (2017). Corporate fraud and external social connectedness of independent directors. Journal of Corporate Finance, 45, 401–427. https://doi.org/10.1016/j.jcorpfin.2017.05.014

Lai, J., Chen, L., & Song, S. (2019). How outside directors’ human and social capital create value for corporate international investments. Journal of World Business, 54(2), 93–106. https://doi.org/10.1016/j.jwb.2018.11.006

Landry, R., Amara, N., & Lamari, M. (2002). Does social capital determine innovation? To what extent? Technological Forecasting & Social Change, 69(7), 681–701. https://doi.org/10.1016/s0040-1625(01)00170-6

Li, D. (2011). Financial Constraints, R&D Investment, and Stock Returns. Review of Financial studies, 24(9), 2974–3007. https://doi.org/10.1093/rfs/hhr043

Li, X., & Jin, Y. (2021). Do political connections improve corporate performance? Evidence from Chinese listed companies. Finance Research Letters, 41, 101871. https://doi.org/10.1016/j.frl.2020.101871

Li, K., Yue, H., & Zhao, L. (2009). Ownership, institutions, and capital structure: Evidence from China. Journal of Comparative Economics, 3(37), 471–490.

Liao, S., & Wu, C. (2010). System perspective of knowledge management, organizational learning, and organizational innovation. Expert Systems with Applications, 37(2), 1096–1103. https://doi.org/10.1016/j.eswa.2009.06.109

Lin, F., & Lin, Y. (2016). The effect of network relationship on the performance of SMEs. Journal of Business Research, 69(5), 1780–1784. https://doi.org/10.1016/j.jbusres.2015.10.055

Lin, Z. J., Liu, S., & Sun, F. (2017). The Impact of Financing Constraints and Agency Costs on Corporate R&D Investment: Evidence from China. International Review of Finance, 17(1), 3–42. https://doi.org/10.1111/irfi.12108

Lu, Z., Zhu, J., & Zhang, W. (2012). Bank discrimination, holding bank ownership, and economic consequences: Evidence from China. Journal of Banking & Finance, 36(2), 341–354. https://doi.org/10.1016/j.jbankfin.2011.07.012

Meroño-Cerdan, A. L., & López-Nicolas, C. (2013). Understanding the drivers of organizational innovations. The Service Industries Journal, 33(13–14), 1312–1325. https://doi.org/10.1080/02642069.2013.815736

Mina, A., Lahr, H., & Hughes, A. (2013). The demand and supply of external finance for innovative firms. Industrial and Corporate Change, 22(4), 869–901. https://doi.org/10.1093/icc/dtt020

Mirvis, P., Herrera, M. E. B., Googins, B., & Albareda, L. (2016). Corporate social innovation: How firms learn to innovate for the greater good. Journal of Business Research, 69(11), 5014–5021. https://doi.org/10.1016/j.jbusres.2016.04.073

Nanda, R., & Nicholas, T. (2014). Did bank distress stifle innovation during the Great Depression? Journal of Financial Economics, 114(2), 273–292. https://doi.org/10.1016/j.jfineco.2014.07.006

Nguyen, B., Do, H., & Le, C. (2021). How much state ownership do hybrid firms need for better performance? Small Business Economics. https://doi.org/10.1007/s11187-021-00556-8

Pang, C., & Wang, Y. (2020). Stock pledge, risk of losing control and corporate innovation. Journal of Corporate Finance, 60, 101534. https://doi.org/10.1016/j.jcorpfin.2019.101534

Pangarkar, N., & Wu, J. (2013). Alliance formation, partner diversity, and performance of Singapore startups. Asia Pacific Journal of Management, 30(3), 791–807. https://doi.org/10.1007/s10490-012-9305-9

Peng, Z., Sha, H., Lan, H., & Chen, X. (2019). Cross-shareholding and financing constraints of private firms: Based on the perspective of social network. Physica a: Statistical Mechanics and Its Applications, 520, 381–389. https://doi.org/10.1016/j.physa.2019.01.049

Pfeffer, J., & Salancik, G. R. (1978). The external control of organizations: A resource dependence perspective. Harper & Row.

Pham, T., & Talavera, O. (2018). Discrimination, Social Capital, and Financial Constraints: The Case of Viet Nam. World Development, 102, 228–242. https://doi.org/10.1016/j.worlddev.2017.10.005

Phelps, C., Heidl, R., & Wadhwa, A. (2012). Knowledge, Networks, and Knowledge Networks: A Review and Research Agenda. Journal of Management, 38(4), 1115–1166. https://doi.org/10.1177/0149206311432640

Qi, T., Li, J., Xie, W., & Ding, H. (2020). Alumni Networks and Investment Strategy: Evidence from Chinese Mutual Funds. Emerging Markets Finance & Trade, 56(11), 2639–2655. https://doi.org/10.1080/1540496X.2019.1643321

Schuchter, A., & Levi, M. (2016). The Fraud Triangle revisited. Security Journal, 29(2), 107–121. https://doi.org/10.1057/sj.2013.1

Schuchter, A., & Levi, M. (2019). Beyond the fraud triangle: Swiss and Austrian elite fraudsters. Accounting Forum, 39(3), 176–187. https://doi.org/10.1016/j.accfor.2014.12.001

Shaw, T. S., Cordeiro, J. J., & Saravanan, P. (2016). Director network resources and firm performance: Evidence from Indian corporate governance reforms. Asian Business & Management, 15(3), 165–200. https://doi.org/10.1057/s41291-016-0003-1

Sierra, J. (2019). How financial systems and firm strategy impact the choice of innovation funding. European Journal of Innovation Management, 23(2), 251–272. https://doi.org/10.1108/EJIM-07-2018-0147

Su, Z., Xiao, Z., & Yu, L. (2019). Do political connections enhance or impede corporate innovation? International Review of Economics & Finance, 63, 94–110. https://doi.org/10.1016/j.iref.2018.08.012

Sun, S. L., & Lee, R. P. (2013). Enhancing Innovation Through International Joint Venture Portfolios: From the Emerging Firm Perspective. Journal of international marketing (East Lansing, Mich.), 21(3), 1–21. https://doi.org/10.1509/jim.13.0016

Sun, B., Liu, S., Jiang, J., Ge, C., & Zhou, H. (2019). Corporate financing constraints and innovation performance: From the perspective of human capital social network. Chinese Journal of Management Science, 27(04), 179–189.

Tao, Q., Li, H., Wu, Q., Zhang, T., & Zhu, Y. (2019). The dark side of board network centrality: Evidence from merger performance. Journal of Business Research, 104, 215–232. https://doi.org/10.1016/j.jbusres.2019.07.019

Toivanen, O., & Hyytinen, A. (2005). Do financial constraints hold back innovation and growth?: Evidence on the role of public policy. Research Policy, 34(9), 1385–1403.

Tsai, L., Zhang, R., & Zhao, C. (2019). Political connections, network centrality and firm innovation. Finance Research Letters, 28, 180–184. https://doi.org/10.1016/j.frl.2018.04.016

Whited, T. M., & Wu, G. (2006). Financial Constraints Risk. Review of Financial Studies, 19(2), 531–559. https://doi.org/10.1093/rfs/hhj012

Xie, H., Zou, J., & Mu, L. (2021). Multiple networks and enterprise innovation based on the perspective of middle managers. Knowledge Management Research & Practice, 19(3), 387–395. https://doi.org/10.1080/14778238.2020.1774432

Yan, Y., & Guan, J. (2018). Social capital, exploitative and exploratory innovations: The mediating roles of ego-network dynamics. Technological Forecasting and Social Change, 126, 244–258. https://doi.org/10.1016/j.techfore.2017.09.004

Yuan, R., & Wen, W. (2018). Managerial foreign experience and corporate innovation. Journal of Corporate Finance, 48, 752–770. https://doi.org/10.1016/j.jcorpfin.2017.12.015

Zhang, Z., & Luo, T. (2020). Network capital, exploitative and exploratory innovations-from the perspective of network dynamics. Technological Forecasting and Social Change. https://doi.org/10.1016/j.techfore.2020.119910

Zhang, D., & Zheng, W. (2020). Does Financial Constraint Impede the Innovative Investment? Micro Evidence from China. Emerging Markets Finance & Trade, 56(7), 1423–1446. https://doi.org/10.1080/1540496X.2018.1542594

Zheng, G., Wang, S., & Xu, Y. (2018). Monetary stimulation, bank relationship and innovation: Evidence from China. Journal of Banking & Finance, 89, 237–248. https://doi.org/10.1016/j.jbankfin.2018.02.010

Zona, F., Gomez-Mejia, L. R., & Withers, M. C. (2018). Board Interlocks and Firm Performance: Toward a Combined Agency-Resource Dependence Perspective. Journal of Management, 44(2), 589–618. https://doi.org/10.1177/0149206315579512

Funding

This research is supported by the Fundamental Research Funds for the Central Universities (Project NO. 2020CDJSK02PT04). This research is supported by the Natural Science Foundation of Chongqing (Project NO. cstc2020jcyj-msxmX0817).

Author information

Authors and Affiliations

Contributions

All authors contributed to the study conception and design. Material preparation, data collection and analysis were performed by CG, LQ. The first draft of the manuscript was written by GW and ZJ. All authors commented on previous versions of the manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Conflict of interest

All authors declare no conflict of interest.

Ethical approval

This article has not been published and is not being considered for publication elsewhere. Results are presented clearly, honestly, and without fabrication, falsification or inappropriate data manipulation. We adhere to discipline-specific rules for acquiring, selecting and processing data.

Consent to participate

All authors agree to participate in the process of writing and publishing this article.

Consent for publication

All authors have approved the submission of the manuscript, and agree to publish this article.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Cao, G., Geng, W., Zhang, J. et al. Social network, financial constraint, and corporate innovation. Eurasian Bus Rev 13, 667–692 (2023). https://doi.org/10.1007/s40821-023-00245-4

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40821-023-00245-4