Abstract

This paper examines the impact of religion (i.e. Buddhism and Taoism on the whole) on corporate tax compliance in China. Using a sample of 13,743 firm-year observations from the Chinese stock market for the period of 2008–2016, we find that firms headquartered in locations with stronger religious atmosphere are more likely to do better in tax compliance. Moreover, the tax compliance effect is moderated by pecuniary motivation and religious intensity, and varies with heterogeneity in formal institutions. The effect is weakened when the pecuniary motivation is strong, such as firms with more institutional ownership or less state ownership. The effect gets strengthened in firms with more female managers, while weakened in firms located in coastal regions which are more vulnerable to culture shocks. The effect is also more pronounced in regions with weaker formal institutions, such as worse legal environment or laxer tax enforcement. Our findings are robust to a battery of robustness checks, and shed light on the role of religion in disciplining corporate tax behaviors.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Religiosity is believed to have profound impacts on micro decision-making activities and macro-economy results for its links with individual risk preference, trust and restraints on unethical business practices (Iannaccone 1998; Barro and McCleary 2003; Guiso et al. 2003; Bénabou et al. 2015). Existing literature has documented that religiosity has a significant association with (1) risk-taking decisions (Kumar et al. 2011; Adhikari and Agrawal 2016), (2) firm performance and risk (Hilary and Hui 2009; Callen and Fang 2015), (3) accounting information quality (Riahi-Belkaoui 2004), (4) financial policies such as capital structure, innovation, corporate social responsibility (CSR) or misconduct (Jiang et al. 2015). However, few studies have addressed the important role of religion in shaping tax compliance.Footnote 1 Tax compliance is widely depicted in economic models as the risk-averse agent dominated by pecuniary motivations trading off benefit against cost, and some researchers begin to investigate factors that promote voluntary tax compliance, such as nonpecuniary motivations embedded in culture or intrinsic willingness (Allingham and Sandmo 1972; Luttmer and Singhal 2014; Slemrod 2019). Corporate tax compliance is highly related with risk-takings and ethical considerations, which is substantially influenced by not only formal institutions (e.g., laws and regulations) but also informal ones (e.g., social norms and persuasions). We propose that religiosity has a prominent effect on tax compliance.

Empirical tests about the impact of religiosity on tax compliance is relatively scare, with only few studies focusing on the western religions but ignoring the influence of eastern religions such as Buddhism and others with large number of followers. For example, Boone et al. (2012) introduced the factor of religiosity into the analysis of tax compliance and provided evidence that firms or individuals located in more religious U.S. counties are associated with lower tax avoidance. Eugster and Parchet (2019) examined the culture-specific preferences on desired tax levels by comparing the difference situations in French-speaking and German-speaking Swiss municipalities. However, the heterogeneous characteristics between western religions and eastern ones and the heterogeneity in institutions require more detailed analyses (Barsky et al. 1997). More analyses on the association between religion and tax compliance is needed for further theoretical validity and generality. China is confronted by severe tax compliance problems as other countries despite its difference in culture and institutions with the west world (Fisman and Wei 2004; Cai and Liu 2009). Buddhism and Taoism, partially embedded in Chinese traditional culture in a long history, have profound influences on corporate governance in modern China (Du 2013; Du et al. 2015; Jia and Zhang 2017). Exploring the impact of religiosity on tax compliance and its possible interactions with other motivations in the context of China will be of great theoretical value and policy significance.

This paper empirically examines the effect of eastern religions (i.e. Buddhism and Taoism on the whole) on corporate tax compliance in China. Using a sample of non-financial firms listed on Shanghai and Shenzhen Stock Exchanges within the period of 2008–2016, we find that firms located in regions with stronger religious atmosphere would exhibit higher levels of tax compliance. Risk-averse attitudes and nonpecuniary motivation internalized in religiosity help to prohibit firms from opportunistic or unethical behaviors such as tax avoidance or evasion. Following Hilary and Hui (2009), we use the geographic information about the location and distance to construct our religious variables. Specifically, we mainly measure the religiosity by counting the number of the Buddhist and Taoist temples within a radius of 100 (200, 300) km in the center of the firm location using ARCGIS software.

We then discuss the moderating effect of pecuniary motivation and religious intensity on corporate tax compliance. We find that firms with more state (institutional) ownership have less (more) pecuniary motivation to avoid tax, acting as a positive (negative) effect on the association between religion and tax compliance. Moreover, the relation varies with religious intensity, and the tax compliance effect is more pronounced in firms with more female managers who are more malleable in social preferences (Croson and Gneezy 2009; Zhang et al. 2013), but weakened in firms located in coastal cities suffering from more culture shocks. Last, we find the positive association between religion and tax compliance is more noticeable in areas with worse legal environment and weaker tax enforcement, suggesting a substitution effect of informal institution (religion) and formal one (laws or regulations) in our study.

Our findings are robust to a battery of tests alleviating the endogeneity concerns. First, the measure of religiosity is a predetermined variable based on historical facts which helps us to address the reverse causality problem. Second, various levels of fixed effects, control variables and restricted subsamples are used to deal with challenges from omitted variables. Third, the redefined sample, three alternative measures of religiosity and two alternative measures of corporate tax compliance are applied to minimize the measuring errors. All the results confirm that our findings are reliable.

This paper contributes to the literature in several ways. First, we provide unique empirical evidence on the consequences of eastern religion (Buddhism and Taoism) on tax behavior. The existing studies on the impact of religion on tax compliance mainly focus on western religion (Boone et al. 2012). While those investigating the effect of religiosity in China talk little on corporate tax compliance (Jia and Zhang 2017; Du 2013; Du et al. 2015). We enrich such literature from a wider range. Second, this paper complements the increasing researches investigating the determinants of corporate tax compliance from the perspective of nonpecuniary motivation (Luttmer and Singhal 2014; Slemrod 2019). Last but not the least, the findings also shed light on the relationship between nonpecuniary and pecuniary motivation, informal and formal institutions in tax compliance, which provides a comprehensive understanding of the impact of religion.

The remaining of this paper proceeds as follows. Section 2 introduces the literature and hypotheses. Section 3 describes the data, variables and empirical methodology. Section 4 reports the empirical results and robustness checks. Finally, Sect. 5 concludes.

2 Literature review and hypotheses development

Tax compliance problem has been a pervasive phenomenon in most countries. The canonical model proposed by Allingham and Sandmo (1972) creatively formalized the marginal benefit, detection probability and penalties to be the main determinants of tax compliance. The subsequent literature has extended it to the analysis of firm tax behavior based on the agency theory (Crocker and Slemrod 2005). The cost–benefit analysis focusing on pecuniary motivations is popular on corporate tax behavior (Hanlon and Heitzman 2010; Slemrod 2019). Several economic determinants have been identified, such as tax enforcement (Besley and McLaren 1993), market competition (Cai and Liu 2009), internal governance and ownership structure (McGuire et al. 2012; Khan et al. 2016), compensation schemes (Desai and Dharmapala 2006; Gaertner 2014) and so forth. Given the extra gains in tax avoidance or evasion, tax compliance would be ignored if the firm manager has strong tolerance of unethical behavior or weak moral sentiment. Tax compliance through enforcement by formal institutions is not free. Psychological and social factors functioning as informal institutions in increasing voluntary tax compliance are getting more and more attention (Andreoni et al. 1998; Luttmer and Singhal 2014; Slemrod 2019).

Among the informal institutions, religion is an indispensable part and plays a prominent role in individual behavior and social interactions (Miller and Hoffmann 1995; Hilary and Hui 2009). There are about two main channels that religion may exert influence. The first perspective is based on risk attitudes. Evidence shows that individuals believing in religion show more risk aversion, make more conservative investment decisions and do less gambling (Miller and Hoffmann 1995; Miller 2000; Dehejia et al. 2007; Kumar et al. 2011). Jiang et al. (2015) found that family firms with religious founders have less risk, reflected as lower leverage and less investment in both tangible and intangible assets. Hilary and Hui (2009) elaborated that firms located in areas with sound religious atmosphere would engage in less risk-taking and aggressive activities. Tax evasion or avoidance is widely considered as risky activities which may incur substantial costs once detected, such as large amounts of penalties, reputation losses and other legal sentences (Wilson 2009).

The second perspective on religion emphasizes the nonpecuniary motivations and its interactions with other institutions. The doctrinal tenets of religion typically steer individuals to behave ethically and honestly, which is also viewed as the internal moral constraint (Anderson 1988; Du 2013, 2014). McGuire et al. (2012) documented that religion has a significant role in establishing moral and ethical prescriptions to discipline individual behaviors. Longenecker et al. (2004) and Brammer et al. (2007) linked religion to business ethics, suggesting that firms influenced by religion would exhibit better ethical decision makings and a greater level of orientation to CSR. In addition to the individual-level impacts, it may also have an effect by creating a good atmosphere at the firm level (Hilary and Hui 2009). This view has been verified that religious perception/doctrine reinforce local culture traditions in limiting opportunism or unethical behaviors in business entities (Grasmick and Bursik 1990; Dyreng et al. 2010). Tax evasion or avoidance is unethical in most societies. Thus, religion may serve as kind of social norms strengthening nonpecuniary motivations to discipline the unethical behaviors.

More specifically, Boone et al. (2012) investigated the impact of religiosity based on American survey data, while Eugster and Parchet (2019) shed light on tax preference embedded in culture by providing Swiss evidence. However, Boone et al. (2012) talked little on the interactions between religiosity and pecuniary motivations (or formal institutions) in disciplining tax behaviors. What is more, the evidence is mainly based on western religions such as Protestant and Catholic in the context of America. Compared with western believers, Taoists and Buddhists have stronger appeal for the instrumental purpose of religious activities and paranormal beliefs (Shiah et al. 2013). In order to improve theoretical validity and generality of the study, more analyses on intrinsic motivations in different institutional backgrounds are necessary.

Tax compliance problem is prevalent in China due to its weak formal institutions (Fisman and Wei 2004; Cai and Liu 2009; Tang et al. 2017). As a developing country, China is quite different from western countries in institutions and cultures. Other than formal institutions (e.g., laws or regulation), informal institutions (e.g. culture or social norms) may play a more prominent role in shaping corporate tax behavior in China. Buddhism and Taoism, acting as an indispensable part of Chinese cultures, are worshiped by ordinary people collectively. Those believers hold the doctrine of moderation and conservation, suggesting a lower level of risk-taking intention. Instead of going to churches as the main forms of participating in religious activities in western countries, Buddhists and Taoists are more likely to go to some specific famous and ancient temples to pray. The famous and ancient temples are believed to be palaces or temporary palaces of the gods believed in, which are the real channels for the prayers to be heard rather than ordinary temples in the setting of China. The religious atmosphere aroused by such famous temples where firms locate may have far-reaching influence on firm tax behavior. We propose that religion has a restraining impact on corporate tax evasion or avoidance, and exerts a positive effect on tax compliance. Thus, we have the following hypothesis:

H1

Firms headquartered in areas with stronger religious atmosphere would show higher levels of tax compliance.

The nonpecuniary motivation and risk-aversion may encourage firm engage in tax compliance, while the pecuniary motivation may discourage it. Accordingly, we propose that the relation between religion and tax compliance varies with pecuniary considerations. Firms with more state ownership may be weak in pecuniary motivation for its special relationships with the government. On the contrary, firms with more institutional investors may have stronger pecuniary motivations for the benefits from avoiding tax. Accordingly, we propose the hypotheses 2a and 2b:

H2a

The positive association between religion and tax compliance is weakened in firms with more state ownership.

H2b

The positive association between religion and tax compliance is strengthened in firms with more institutional ownership.

Further, the intensity of impact exerted by religion may be different due to heterogeneous individual and regional factors. We investigate the religious intensity from the perspective of gender difference and culture shocks. Compared to males, females are more malleable in social preferences and care more about CSR (Croson and Gneezy 2009; Zhang et al. 2013), thus the religion-tax compliance effect is expected to be stronger in firms with more female managers. While culture shocks would mitigate the impact of religion (Stulz and Williamson 2003), the positive association may be mitigated in firms located in coastal cities higher in openness. Accordingly, we propose the hypotheses 3a and 3b:

H3a

The positive association between religion and tax compliance is strengthened in firms with more female managers.

H3b

The positive association between religion and tax compliance is weakened in areas with more culture shocks.

3 Sample and methodology

3.1 Sample and data

We use the Chinese A-listed firms within the period of 2008–2016 as our initial sample. Firm-level information is obtained from the China Stock Market & Accounting Research Database (CSMAR) and Wind Database. Regional data is derived from the China Statistical Yearbook. We manually collect the geographic location information of the listed firms and temples (i.e., the longitude and latitude) to construct the religion variable.

We screen our sample as follows: (1) we exclude financial firms because their accounting information and corporate tax practices are different from non-financial firms; (2) we drop firm-year observations with missing variables; (3) we drop the firms labeled as special treatment (ST or ST*) by China Securities Regulatory Commission (CSRC) because their financial conditions are different from normal ones; (4) we also drop the observations with missing tax rate and negative pre-tax income. This procedure yields a final sample of 13,743 firm-year observations.

3.2 Variable construction

3.2.1 Measure of tax compliance

We measure corporate tax compliance by calculating the corporate effective tax rate (ETR). The ETR captures consequences of broad tax avoidance practices by measuring the actual tax burden as a percentage of pre-tax income in a period, which is widely used in the literature (Tang et al. 2017; Hanlon and Heitzman 2010; Chen et al. 2010). Following Dyreng et al. (2010), we drop the observations with ETR beyond the range of zero and one. Lower ETR indicates higher tax avoidance and lower tax compliance.

3.2.2 Measure of religion

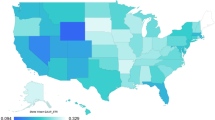

Following the existing literature (Hilary and Hui 2009; McGuire et al. 2012), we construct religion variable by capturing the extent of religious atmosphere where firm is headquartered. We focus on the famous and ancient temples authorized by State Council of the People’s Republic of China in 1983.Footnote 2 These temples consist of Buddhist and Taoist temples with a long history and a large number of followers. For example, a Buddhist temple Fayuansi in Beijing was established in 645 A.D., a Taoist temple Baiyunguan was established in 739 A.D. All those temples are prosperous and enjoy a good reputation. Two steps are taken to construct our independent variable. First, we manually collect the location information of listed firms and the famous temples, namely the longitudes and latitudes; Second, we calculate the number of temples within a radius of 100 (200, 300) kilometers in the center of the firm location using ARCGIS software. We take the logarithm of the number and label it as Religion (Religion200, Religion300) as the proxy for religious atmosphere where a firm is located.

3.2.3 Measure of moderating variables

As proposed by the hypotheses, we aim to test the moderating effects on the association between religion and corporate tax compliance from the perspective of economic factors (State_own and Inst_own) and the strength of religion impact (R_female and S_culture). State_own is the proportion of the state-owned shareholdings, and Inst_own is the ratio of institutional ownership. R_female is defined to be the number of female managers divided by total number of top managers, which measure the gender difference. S_culture is a dummy variable set equal to one if the firm is located at the coastal cities, and zero otherwise.Footnote 3

3.2.4 Control variables

Following Dyreng et al. (2008) and Chen et al. (2010), we include several firm-level variables to control for the potential influence on tax compliance. Firm size (Size) is defined as the logarithm of total assets. On one hand, large firms are more likely to be taxed effectively for better information accessibility. On the other hand, large firms may benefit from tax planning and political lobbying, which results in lower effective income tax rate. Firm leverage (Lev) is the liabilities divided by total assets. The effect of the tax shield implies that highly leveraged firms have a lower tax burden (Mills 1998). Firm profits (ROA) is the profit before tax divided by total assets (Wu et al. 2007). Loss is an indicator equals one if the previous net profits are negative, and zero otherwise. Since prior losses can offset current profits in the calculation of taxable income, firms with a loss in the prior year are likely to have lower effective tax rates at the current year. SOE equals one if the firm is state-owned enterprises, and zero otherwise. The level of tax compliance in SOEs depends on the potential tax benefits, incentives and information superiority. Rate is corporate statutory tax rate, which must be controlled because there is significant heterogeneity in statutory tax rates for firms in China (Wu et al. 2007). Firm growth (Growth) is the sales in year t minus sales in year t − 1 and then divided by sales in year t − 1. Existing literature shows that firm growth is positively or negatively correlated to corporate tax compliance (Gupta and Newberry 1997; Derashid and Zhang 2003). Capital intensity (PPE) equals the fixed assets divided by total assets, which may be positively related or unrelated with tax avoidance (Dyreng et al. 2008; Wu et al. 2007). Intangible assets (Intangible) equals the intangible assets divided by total assets. Besides, we also control some demographic characteristics at province level: the logarithm of provincial GDP in the previous year (GDP) and the growth rate of GDP at province level (GDPgr).

We also control year-, industry- and province- fixed effects, as well as industry-year- and province- effects in various settings. The standard errors are clustered at the firm level to correct for within-firm correlations. All the variables are Winsorized at the 1% and 99% levels. The detailed variable definitions are provided in panel A of Table 1.

3.3 Empirical model

This paper aims to investigate the impact of religion on corporate tax compliance (H1), and the moderating effects on the association between religion and corporate tax compliance (H2a, H2a, H3a, H3b). Therefore, we run the following model (1) to test the first hypothesis. Based on the model (1), we add the moderators and the interactions to construct the model (2) to address the second object.

where \(ETR_{ijkt}\) denotes the tax compliance of corporate i of industry j in region k at year t, measured by effective tax rate. Religion denotes the religiosity confronted by firm, measured mainly by the number of famous temples surrounding the location of a firm. M stands for the moderating indicators while \(Control_{ijkt}\) for the control variables listed above. Fixed effect at multi-level listed previously are used contingent on analysis. In model (1), β1 captures the effect of religion on tax compliance. If the religious atmosphere helps to discipline firm behavior and mitigate corporate misconduct, we would expect β1 to be significantly positive. In model (2), α2 stands for the coefficients of moderating indicators, and we expect α2 to be significantly positive for Religion × State_own and Religion × R_female, while significantly negative for Religion × Inst_own and Religion × S_culture.

4 Empirical results

4.1 Summary statistics

Panel B of Table 1 tabulates the summary statistics of our main variables. The mean of the ETR is 0.1645, with a standard deviation of 0.0891. The maximum and minimum of ETR is 0.5273 and 0.0020. On average, there are about 5 (e1.57) temples located within the radius of 100 km centered around a firm. There are 14 (e2.71) temples at most, and no temples at least within the given distance. The average value of State_own is about 0.0703, and the maximum is 0.9219. As for institutional ownership, the mean of Inst_own is 0.4031. The ratio of female managers (R_female) accounts for 0.1494, and about 31.64% firms are located in coastal cities (S_culture = 1). For other firm-level variables in our sample, we have an average size (Size) of 22.0411 (with the assets around 3.7 billion), leverage (Lev) of 0.4313, pre-tax profit (ROA) of 0.0673, corporate statutory tax rate (Rate) of 0.1923, firm growth (Growth) of 0.2373, capital intensity (PPE) of 0.2203, intangible intensity (Intangible) of 0.0461. Moreover, there are about 6% observations experienced profit losses in the previous year (Loss = 1), and state-owned enterprises take up 41% (SOE = 1) in our sample. In addition, the summary statistics of GDP and GDPgr are also within reasonable ranges.

4.2 Baseline regression results

Table 2 reports the OLS regression results. In column (1), we only include Religion, industry- and year- fixed effects in the regression. The coefficient on Religion is positive and statistically significant at the 5% level. The result is not sensitive to adding the control variables or province dummies as shown in columns (2)–(3). The coefficient of Religion is 0.0033 in column (2) and 0.0045 in column (3). To further exclude possible omitted variables, we controlled industry-year and province- fixed effects, and the coefficients of Religion in columns (4) and (5) are 0.0044 and 0.0045, which are still significant at the 5% levels. The results confirm that religiosity is helpful to increase corporate tax compliance.

The results of the control variables are generally consistent with our expectations and existing literature. Size and Lev are consistently negatively associated with ETR, indicating that larger and highly leveraged firms are more inclined to avoid tax. A firm’s tax burden is expected to be aggravated with higher statutory corporate tax rate, which is supported by the significantly positive coefficient of Rate. Firms experienced losses in the previous year are associated with lower ETR given the prior losses can offset the current profits in taxable income, as shown by the negative coefficient of Loss. We also find that lower ETR is associated with higher tangible assets (PPE).

To drill further into the data, we re-count the number of temples within a radius of 200 and 300 km instead of 100 to construct the religion variables, which are denoted as Religion200 and Religion 300 respectively. We re-estimate the model (1) by regressing Religion200 (Religion300) on ETR. The results are presented in Table 3. We find that the coefficients of our key variables (Religion200 and Religion300) are not significant in statistics. This is reasonable after considering the religious atmosphere will become weaker as the distance increases. If the famous temples located too far away, it’s difficult for them to have substantial effects on corporate tax behaviors.

4.3 Results for moderating effects

Our baseline results show that firms with locations surrounded by more famous temples exhibit higher levels of corporate tax compliance. In this subsection, we will investigate different dimensions on the effect. First, we examine the economic considerations on the association between religion and corporate tax compliance. Table 4 presents the regression results. In columns (1) and (3), we control the year-, industry- and province- fixed effects, whereas in columns (2) and (4), we control industry-year and province- fixed effects. The results in columns (1) and (2) show that coefficients for the interaction of Religion × State_own are significantly positive, indicating that the impact of religion is stronger for firms with more state ownership. As for columns (3) and (4), the coefficients for the interaction of Religion × Inst_own are significantly negative, showing that higher levels of institutional ownership would weaken the impact of religion. The results are in line with our hypotheses H2a and H2b on motivation, indicating the effect of religion on tax compliance, as kind of nonpecuniary motivation, is more (less) pronounced when the pecuniary motivation is weaker (stronger).

Second, we examine the moderating effects of religious intensity from the aspects of gender difference (R_female) and culture shocks (S_culture). Table 5 reports the regression results. In columns (1) and (2), the coefficients for Religion × R_female are positive and significant at the 1% level when controlling for the industry-, year-, province- fixed effects and industry-year, province- fixed effects respectively, indicating that the positive impact of religion on tax compliance is more pronounced in firms with more female managers. In columns (3) and (4), we find that the coefficients of Religion × S_culture are negative and significant at the 5% level, indicating that the positive effect of religion on tax compliance is mitigated by culture shocks. The above results verify our hypotheses H3a and H3b on religious intensity.

4.4 Further analyses on formal institution

In this section, we further drill into the effect of formal institution on the association between religion and tax compliance. According to the seminal model proposed by Allingham and Sandmo (1972), a higher detection probability and more severe punishment will increase tax compliance. We propose the religion-tax compliance effect is more pronounced in regions with worse legal environment and laxer tax enforcement, for religion may play a decisive role in disciplining corporate behaviors when formal institutions are weak. We separate our sample into two groups according to the legal development index (Legal_Index) constructed by Wang et al. (2017) and tax enforcement index (TE) estimated by this paper following a widely-used residual method (Mertens 2003; Xu et al. 2011).Footnote 4 Higher legal development index means better legal environment while higher tax enforcement index means relatively stricter tax enforcement.

Table 6 reports the empirical results. As shown in panel A, the coefficients of Religion are only positive and significant in the subsample with worse legal environment (Low Legal_Index), and not significant in the subsample with better legal environment (High Legal_Index). Similarly, we find the positive effect of religion on tax compliance only exists in the subsample of regions with laxer tax enforcement (Low TE) as presented in panel B. The results suggest that religion (informal institution) and regulatory system (formal institution) act as the substitution effect in shaping corporate tax compliance.

4.5 Robustness checks

Following an approach to measure the religiosity by counting the number of predetermined ancient temples surrounded by firms, our findings seem to be less challenged by reversal causality problems, especially considering that firms have weak incentives to move to regions with higher tax burdens. To further ensure the validity of our conclusion, we carry out a series of robustness checks.

4.5.1 The redefined sample

We re-estimate our model using restricted subsamples. Considering that China is a multi-ethnic state, firms in different regions may be influenced by other local social norms and cultural factors. Thus, we exclude six provinces dominated by ethical minorities (Xinjiang, Mongolia, Guangxi, Ningxia, Tibet) and two provinces with no temples (Gansu, Haikou). The regression results are presented in panel A of Table 7, from which we can see that the coefficients remain positive and significant in statistics.

4.5.2 Alternative measurements of religion

We use three alternative measurements to reconstruct religion variable. To begin with, we use the distance of the nearest temple located surrounding the firm to capture the religious impact. We take the inverse value of the distance and denote it as Religion_distance. Higher value of Religion_distance means stronger effect of religion. The significantly positive coefficients of Religion_distance in columns (1) and (2) in panel B of Table 7 confirm our previous findings. Then, we reconstruct religion variable at the province level to capture the influence of religion on corporate tax compliance. The logarithm of the number of famous temples in the province where firms locate are constructed to capture the extent of religion, which is denoted as Religion_pro. We re-estimate the model (1) with the standard error clustered at the province level, and our conclusion still hold, see columns (3) and (4) in panel B of Table 7. Last, we use the residents survey data from Chinese General Social Survey (CGSS) to measure religion.Footnote 5 The data are obtained by random survey investigation, which is reliable and accurate for our research. We calculate the percentage of respondents claiming to believe in the religion at provincial level as the proxy of religion (Religion_ratio). Higher ratio means stronger impacts of the religion. We can only get the survey of year 2012 and 2013 due to the data limitation, and the sample reduces accordingly. The results in columns (5) and (6) in panel B of Table 7 indicate that our results remain unchanged after using the individual-level data as the proxy for religion atmosphere, which is in line with the idea of McGuire et al. (2012).

4.5.3 Alternative measurements of tax compliance

We take two other methods to measure corporate tax compliance. One alternative measurement is a variant of effective tax rate measured in different method, which we label as ETR2.Footnote 6 In columns (1) and (2) in panel C of Table 7, the regression results show that the religion has a significantly positive effect on corporate tax compliance. The other one is a variable defined by the book-tax gap following Desai and Dharmapala (2009). This approach captures tax avoidance by calculating the gap between firm’s inferred tax income and reported pre-tax income. We construct the book-tax gap variable (BTD) using the firm’s inferred tax income subtracted from the firm’s reported pre-tax income and then averaged by the lagged book value of total assets. Higher BTD suggests a lower level of tax compliance. The results in columns (3) and (4) in panel C of Table 7 show that the religion has a significantly negative effect on corporate tax avoidance (positive effect on tax compliance). Our findings are robust to alternative measures of tax compliance.

4.6 Findings

We find that religion (i.e., Buddhism and Taoism on the whole) has a positive effect on corporate tax compliance, and the religion-tax compliance effect is moderated by both pecuniary motivations and religious intensity. The effect is weakened (strengthened) when pecuniary motivation is strong (weaker), such as firms with more institutional ownership (more state ownership). The effect is strengthened in firms with more female managers who are more malleable, while weakened in coastal regions vulnerable to culture shocks. The findings are consistent with the literature claiming females to be moral and more malleable in social preferences (Croson and Gneezy 2009; Zhang et al. 2013), and the view of negative shocks from other cultures (Stulz and Williamson 2003). Moreover, the association is more noticeable in areas with weaker formal institutions, such as worse legal environment or laxer tax enforcement, suggesting the substitution effect between religion (kind of informal institution) and formal institutions.

5 Conclusion

Based on a novel firm-level dataset from China, this study sheds light on the impact of religion on corporate tax behaviors by providing unique analyses and evidence from Chinese Taoism and Buddhism. We find that firms headquartered in locations with stronger Buddhism and Taoism religious atmosphere exhibit higher levels of tax compliance, which is in line with the evidence of western religion such as Protestant and Catholic in the context of America supplied by Boone et al. (2012). In addition, we further explore the heterogeneous effect of religion on tax compliance condition on pecuniary motivations, religious intensity and formal institutions. Our findings still hold after a series of robustness checks addressing the possible endogeneity problems.

Our study bears several contributions. First, our findings contribute to the growing studies on nonpecuniary motivations in increasing voluntary tax compliance, such as researches on culture, social norms and many other social and psychological factors (Luttmer and Singhal 2014; Slemrod 2019). Boone et al. (2012) introduced the religiosity into analysis of tax compliance but little is known about the effect of non-western religion in the context of developing countries. Second, by providing the in-depth analyses and reliable evidence of the relation between nonpecuniary and pecuniary motivations, informal and formal institutions in disciplining corporate tax compliance, this paper complements the extant literature on the effect of religion on corporate behaviors (Andreoni et al. 1998; Riahi-Belkaoui 2004; Hilary and Hui 2009; Boone et al. 2012; Du 2013; Callen and Fang 2015; Jiang et al. 2015; Jia and Zhang 2017). Most early studies talk little about the interaction effect of different motivations and institutional backgrounds. In addition, the findings are conducive to a better understanding of the corporate tax compliance and broad impacts of religion in transitional China.

Our findings also have strong policy implications. For tax administrators, this study implicates that voluntary tax compliance could be increased if the religion function properly, saving the costs of increasing tax enforcement through formal institution to some extent. This is especially true for developing counties where formal institutions are usually weak and traditional factors are still strong in economy and society.

With respect to future research, some extensions could be taken into account. The religiosity is encouraged to be measured by exploiting data rich in firm-specific religious information. Also, the research on economic consequences of religion could be broadened to include irregularities, philanthropy and other corporate misbehaviors, which would contribute to a comprehensive understanding of the impacts of religion in economies.

Notes

We use tax compliance to capture the extent of tax payment. A higher level of tax compliance indicates a lower level of tax avoidance or evasion.

In 1983, the document titled “A report of the determination of key Buddhist and Taoist monasteries in Han regions by the state council’s bureau of religious affairs” was approved by the state council of the People’s Republic of China. According to the report, there are 148 temples related in total, and we name them as “famous temples” in the following text.

The coastal cities include: Shenzhen, Zhuhai, Shantou, Xiamen, Haikou, Dalian, Qinhuangdao, Tianjin, Yantai, Qingdao, Lianyungang, Nantong, Shanghai, Ningbo, Wenzhou, Fuzhou, Guangzhou.

Specifically, we use the residuals of regression following Eq. (3) as the proxy for local tax enforcement. Equation (3):

$${T}_{it}/{Y}_{it}={\alpha }_{0}+{\alpha }_{1}{per\_GDP}_{it}+{\alpha }_{2}{IND1}_{it}+{\alpha }_{3}{IND2}_{it}+{\alpha }_{4}{Open}_{it}+{\varepsilon }_{it}, $$(3)where \({T}_{it}\) is the total tax revenues for province i in year t, and \({Y}_{it}\) stands for the local GDP. \({per\_GDP}_{it}\) is the logarithm of GDP per capita, and \({IND1}_{it}\) and \({IND2}_{it}\) denote the proportion of the first and second industry in GDP. \({Open}_{it}\) is the total volume of import and export divided by local GDP. \({\varepsilon }_{it}\) stands for random errors.

The Chinese General Social Survey (CGSS) is a national, comprehensive and continuous academic survey project in China. The project uses random survey method to collect information at multiple levels, such as individual, family, community and so on.

ETR2 = The corporate income tax expenses/ [pre-tax income- (deferred income tax/ statutory income tax rate)].

References

Adhikari, B. K., & Agrawal, A. (2016). Religion, gambling attitudes and corporate innovation. Journal of Corporate Finance, 37, 229–248.

Allingham, M. G., & Sandmo, A. (1972). Income tax evasion: A theoretical analysis. Journal of Public Economics, 1(3–4), 323–338.

Anderson, G. M. (1988). Mr. Smith and the preachers: The economics of religion in the wealth of nations. Journal of Political Economy, 96(5), 1066–1088.

Andreoni, J., Erard, B., & Feinstein, J. (1998). Tax compliance. Journal of Economic Literature, 36(2), 818–860.

Barro, R. J., & Mccleary, R. M. (2003). Religion and economic growth across countries. American Sociological Review, 68(5), 760–781.

Barsky, R. B., Juster, F. T., Kimball, M. S., & Shapiro, M. D. (1997). Preference parameters and behavioral heterogeneity: An experimental approach in the health and retirement study. The Quarterly Journal of Economics, 112(2), 537–579.

Bénabou, R., Ticchi, D., & Vindigni, A. (2015). Religion and innovation. American Economic Review, 105(5), 346–351.

Besley, T., & Mclaren, J. (1993). Taxes and bribery: The role of wage incentives. Economic Journal, 103(416), 119–141.

Boone, J. P., Khurana, I. K., & Raman, K. K. (2012). Religiosity and tax avoidance. The Journal of the American Taxation Association, 35(1), 53–84.

Brammer, S., Williams, G., & Zinkin, W. J. (2007). Religion and attitudes to corporate social responsibility in a large cross-country sample. Journal of Business Ethics, 71(3), 229–243.

Cai, H., & Liu, Q. (2009). Competition and corporate tax avoidance: Evidence from Chinese industrial firms. The Economic Journal, 119(537), 764–795.

Callen, J. L., & Fang, X. (2015). Religion and stock price crash risk. Journal of Financial and Quantitative Analysis, 50(1–2), 169–195.

Chen, S., Chen, X., Cheng, Q., & Shevlin, T. (2010). Are family firms more tax aggressive than non-family firms? Journal of Financial Economics, 95(1), 41–61.

Crocker, K. J., & Slemrod, J. (2005). Corporate tax evasion with agency cost. Journal of Public Economics, 89(9), 1593–1610.

Croson, R., & Gneezy, U. (2009). Gender differences in preferences. Journal of Economic literature, 47(2), 448–474.

Dehejia, R., Deleire, T., & Luttmer, E. F. P. (2007). Insuring consumption and happiness through religious organizations. Journal of Public Economics, 91(1–2), 259–279.

Derashid, C., & Zhang, H. (2003). Effective tax rates and the “industrial policy” hypothesis: Evidence from Malaysia. Journal of International Accounting Auditing and Taxation, 12(1), 45–62.

Desai, M. A., & Dharmapala, D. (2006). Corporate tax avoidance and high-powered incentives. Journal of Financial Economics, 79(1), 145–179.

Desai, M. A., & Dharmapala, D. (2009). Corporate tax avoidance and firm value. Review of Economics and Statistics, 91(3), 537–546.

Du, X. (2013). Does religion matter to owner-manager agency costs? Evidence from China. Journal of Business Ethics, 118(2), 319–347.

Du, X. (2014). Does religion mitigate tunneling? Evidence from Chinese Buddhism. Journal of Business Ethics, 125(2), 299–327.

Du, X., Jian, W., Lai, S., Du, Y., & Pei, H. (2015). Does religion mitigate earnings management? Evidence from China. Journal of Business Ethics, 131(3), 699–749.

Dyreng, S. D., Hanlon, M., & Maydew, E. L. (2008). Long-run corporate tax avoidance. Accounting Review, 83(1), 61–82.

Dyreng, S. D., Hanlon, M., & Maydew, E. L. (2010). The effects of executives on corporate tax avoidance. The Accounting Review, 85(4), 1163–1189.

Eugster, B., & Parchet, R. (2019). Culture and taxes. Journal of Political Economy, 127(1), 296–337.

Fisman, R., & Wei, S. (2004). Tax rates and tax evasion: Evidence from “missing imports” in China. Journal of Political Economy, 112(2), 471–496.

Gaertner, F. B. (2014). CEO after-tax compensation incentives and corporate tax avoidance. Contemporary Accounting Research, 31(4), 1077–1102.

Grasmick, H. G., & Bursik, R. J. (1990). Conscience, significant others, and rational choice: Extending the deterrence model. Law and Society Review, 24(3), 837–861.

Guiso, L., Sapienza, P., & Zingales, L. (2003). People’s opium? Religion and economic attitudes. Journal of Monetary Economics, 50(1), 225–282.

Gupta, S., & Newberry, K. (1997). Determinants of the variability in corporate effective tax rates: Evidence from longitudinal data. Journal of Accounting and Public Policy, 16(1), 1–34.

Hanlon, M., & Heitzman, S. (2010). A review of tax research. Journal of Accounting and Economics, 50(2), 127–178.

Hilary, G., & Hui, K. W. (2009). Does religion matter in corporate decision making in America? Journal of Financial Economics, 93(3), 455–473.

Iannaccone, L. R. (1998). Introduction to the economics of religion. Journal of Economic Literature, 36(3), 1465–1495.

Jia, F., & Zhang, Y. (2017). The impact of religiosity on corporate loans and maturity structure: Evidence from China. Pacific Accounting Review, 29(3), 307–329.

Jiang, F., Jiang, Z., Kim, K. A., & Zhang, M. (2015). Family-firm risk-taking: Does religion matter? Journal of Corporate Finance, 33, 260–278.

Khan, M., Srinivasan, S., & Tan, L. (2016). Institutional ownership and corporate tax avoidance: New evidence. The Accounting Review, 92(2), 101–122.

Kumar, A., Page, J. K., & Spalt, O. G. (2011). Religious beliefs, gambling attitudes, and financial market outcomes. Journal of Financial Economics, 102(3), 671–708.

Longenecker, J. G., Mckinney, J., & Moore, M. K. W. (2004). Religious intensity, evangelical Christianity, and business ethics: An empirical study. Journal of Business Ethics, 55(4), 373–386.

Luttmer, E., & Singhal, M. (2014). Tax morale. The Journal of Economic Perspectives, 28(4), 149–168.

McGuire, S. T., Omer, T. C., & Wang, D. (2012). Tax avoidance: Does tax-specific industry expertise make a difference? The Accounting Review, 87(3), 975–1003.

Mertens, J. B. (2003). Measuring tax effort in Central and Eastern Europe. Public Finance and Management, 3, 530–563.

Miller, A. S. (2000). Going to hell in Asia: the relationship between risk and religion in a cross-culture setting. Review of Religious Research, 42(1), 5–18.

Miller, A. S., & Hoffmann, J. P. (1995). Risk and religion: An explanation of gender differences in religiosity. Journal for the Scientific Study of Religion, 34(1), 63–75.

Mills, L. F. (1998). Book-tax differences and internal revenue service adjustments. Journal of Accounting Research, 36(2), 343–356.

Riahi-Belkaoui, A. (2004). Law, religiosity and earnings opacity internationally. International Journal of Accounting Auditing, and Performance Evaluation, 1(4), 493–502.

Shiah, Y., Chang, F., Tam, W. C., Chuang, S., & Yeh, L. (2013). I don’t believe but I pray: Spirituality, instrumentality, or paranormal belief? Journal of Applied Social Psychology, 43(8), 1704–1716.

Slemrod, J. (2019). Tax compliance and enforcement. Journal of Economic Literature, 57(4), 904–954.

Stulz, R. M., & Williamson, R. (2003). Culture, openness, and finance. Journal of Financial Economics, 70(3), 313–349.

Tang, T., Mo, P. L. L., & Chan, K. H. (2017). Tax collector or tax avoider? An investigation of intergovernmental agency conflicts. The Accounting Review, 92(2), 247–270.

Wang, X. L., Fan, G., & Yu, J. W. (2017). Report on marketization index of provinces in China (2016). Beijing: Social Sciences Academic Press.

Wilson, R. J. (2009). An examination of corporate tax shelter participants. The Accounting Review, 84(3), 969–999.

Wu, L., Wang, Y., Lin, B. X., Li, C., & Chen, S. (2007). Local tax rebates, corporate tax burdens, and firm migration: Evidence from China. Journal of Accounting and Public Policy, 26(5), 555–583.

Xu, W., Zeng, Y., & Zhang, J. (2011). Tax enforcement as a corporate governance mechanism: Empirical evidence from China. Corporate Governance: An International Review, 19(1), 25–40.

Zhang, J. Q., Zhu, H., & Ding, H. (2013). Board composition and corporate social responsibility: An empirical investigation in the post Sarbanes-Oxley era. Journal of Business Ethics, 114(3), 381–392.

Acknowledgements

Lu acknowledges to the support from the Youth Fund Project of Humanity and Social Sciences Research of Ministry of Education of China (No.18YJC790111). We also acknowledge the support from “A Project Funded by the Priority Academic Program Development of Jiangsu Higher Education Institutions (PAPD).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Wang, J., Lu, J. Religion and corporate tax compliance: evidence from Chinese Taoism and Buddhism. Eurasian Bus Rev 11, 327–347 (2021). https://doi.org/10.1007/s40821-020-00153-x

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40821-020-00153-x