Abstract

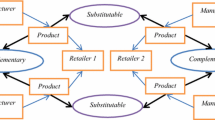

A supply chain model comprising of one manufacturer and two retailers have been discussed in the proposed model, where the manufacturer acts as leader. It has been assumed that both the retailers offer service facilities to the customers. The optimal pricing strategy of the members of the supply chain have been derived analytically in three situations, namely, Cournot situation, Collusion situation and Stackelberg situation. In Cournot situation, both the retailers set independently the unit selling prices on the wholesale price set by the manufacturer. In Collusion situation, both the retailers agree to set their unit selling prices which maximizes the total profit of the retailers. In case of Stackelberg situation, one of the two retailers acts as leader and the other retailer is the follower. It has been observed that in Collusion situation, the retailer-1 incurs highest profit, whereas, in Stackelberg situation, the retailer-2 achieves highest profit. In the Collusion situation, the retailer-2 can charge higher selling price, but due to more service expenses, the corresponding profit of the retailer-2 is lower than that of retailer-1. The model is solved analytically and the solution has been illustrated with the help of two numerical examples.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

It is a common belief that customers are attracted to buy more when unit price of item is reduced. But customers purchasing behavior do not only depends on the unit price of the items, but also on the service level offered by the retailers/manufacturer. Rosen [17] estimated that more than 50% of the added value in a manufacturing company can be attributed to the service components. Each member of a supply chain tries to balance between revenue and cost while making any decision of setting of unit selling price. Reduction of unit selling price as a demand enhancing tool was discussed by several researchers. Dorfman and Steiner [6] and Spence [18] were the first to argue that demand function can not only be dependent on unit selling price. Demand of items may be dependent on other factors like service and quality of the product. Tsay and Agrawal [19] proposed a model where service is provided by a retailer under a contract. Service by the manufacturer through a network of maintenance branches established in various areas was discussed by Lu et al. [11]. A general equilibrium model for an oligopoly was discussed by Bernstein and Federgruen [2] when demand is dependent on unit selling price and service distribution. Investment in service as demand enhancing tool was discussed by Xia and Gilbert [20], where the strategic interaction between the manufacturer and the dealers were analyzed. In their proposed model, it was assumed that the service efficiency of the manufacturer as well as all the retailers were equal. In our proposed model, we have assumed that the service efficiencies of all the retailers are not same.

Value-adding service as demand enhancing tool was examined by Mukhopadhyay [13], where information sharing was discussed in a mixed hi tech supply chain. Xiao and Yang [21] investigated a price service competition model considering service provided by the retailers in two competing supply chains to obtain the optimal strategies of the retailers. But, manufacturer channel strategy was not considered in the above proposed model. Forecast information in consumer’s willingness to pay and traditional retailers performance in a dual channel competitive market was discussed by Yan and Ghose [22].

A three channel power strategy considering manufacturer as the sole service provider was discussed by several researchers like Lu et al. [11] and Pan et al. [15] etc. The impact of bargaining power on supply chain members’ decision was discussed by Lu et al. [11]. The revenue-sharing verses wholesale price mechanism under different channel power strategies were investigated by Pan et al. [15]. The implementation of online channel strategies was discussed by Amrouche and Yan [1]. They investigated whether online store can be used as a countermeasure to the downstream retailer’s private level information. Supply chain channel strategies with quality and marketing effort dependent demand was discussed by Ma et al. [12]. Two-echelon manufacturer-retailers supply chain strategies with price, quality and promotional effort sensitive demand was discussed by Pal et al. [14].

In any manufacturer-retailer supply chain model, there may be three different channel power structures: (i) manufacturer-stackelberg supply chain, (ii) vertical-Nash supply chain, (iii) retailer-stackelberg supply chain. In a manufacturer-stackelberg supply chain model, the manufacturer acts as stackelberg leader. The decision taken by the manufacturer is then used by the retailers to obtain their decisions. In case of vertical supply chain model, neither the manufacturer nor the retailer leads the market and the manufacturer and the retailers together make decisions simultaneously. In case of retailer-stackelberg supply chain model, the retailers act as leader and the manufacturer reacts on the retailer’s decision to make his own decision. The manufacturer-stackelberg supply chain model occur in case of monopolistic or oligopolistic market, where the manufacture sets his own decisions independently and their decisions were used retailers to make their decisions. This type of supply chains are also called manufacturer-driven channels. A notable contribution in this direction was discussed by several researchers like Corbett et al. [5], Ertek and Griffin [7], Lau et al. [8] etc. The vertical-Nash supply chain occurs in a small or medium sized manufacturers and retailers. In this situation, the manufacturer can not dominate the supply chain. The decisions taken by the manufacturer is conditional to determine the decisions of the the retailers. Researchers like Choi [3, 4], Lu et al. [11] and others contributed in this direction. The retailer-stackelberg supply chain is common in situations like newly launched products. The retailers have one advantage that they are closest to the final customers and the decisions like setting of unit selling price by the retailers are reacted by the manufacture to set his decision like setting of wholesale unit price. Channel coordination in the presence of dominated retailer was discussed by Raju and Zhang [16]. Price and volume discount by a dominated retailer was discussed by Lau et al. [9] when uncertain manufacturing cost is uncertain. Lau et al. [10] showed how a dominant retailer might design a purchase contract for a newsvendor type product with price sensitive demand.

In our proposed model, manufacturer-stackelberg supply chain consisting of one manufacturer and two retailers have been considered, where the manufacturer acts as a stackelberg leader and a two retailers act as stackelberg follower. The manufacturer first decides the wholesale price. Having obtained the wholesale price of the manufacturer, the retailers sets retail prices, respective order quantities independently competing in a common market and service levels to the final customers. The retail quantity is determined by the market demand, the wholesale price of the manufacturer, the sale price of the retailers and the service proved by the retailers. It has been assumed that the manufacturer sells a single product to the retailers and the retailers finally sell the products to the final customers. The proposed model is solved when the retailers compete in different way. The following three situations have been considered in the proposed model; (i) Cournot situation, i.e., the situation when selling price, retail quantity and service levels are independently set by each retailers competing in different way considering his competitor’s selling price as a parameter. In this case two retailers act in the caurnot situation. (ii) Collusion situation, i.e., the situation when total profit of the retailers has been maximized and both the retailers agree to determine their selling price together. (iii) Stackelberg situation, i.e., when one retailer acts as a leader and the other retailer acts a follower. The proposed model has been considered assuming the service to the final customers as a demand enhancing tool rather than reduction in unit price.

Assumptions and Notations

The following assumptions have been used in the proposed model:

-

1.

A single item is considered;

-

2.

The supply chain consist of one manufacturer and two retailers;

-

3.

The retailers are the only service provider to the final customers;

-

4.

Among the members of the supply chain, manufacturer acts as leader and the retailers act as follower;

The following notations have been used in the proposed model:

- \(G_{R_{i}}\) :

-

: the profit of the retailer \(\hbox {i}, \hbox {i}=1,2\);

- \(G_{M}\) :

-

: the profit of the manufacturer

- \(p_{i}\) :

-

: the unit selling price of the retailer \(i, i=1,2\);

- w :

-

: the unit wholesale price of the manufacturer to the retailers;

- c :

-

: the unit production cost;

- \(Q_{i}\) :

-

: the order quantity of the retailer \(\hbox {i}, \hbox {i}=1,2\), where \(Q_{i}=D_{i}-{\alpha }_{i}w-{\beta }_{i}p_{i}+\theta p_{j}+{\gamma }_{i}s_{i}, i \ne j, D_{i}(>0)\) is the market demand of the retailer \(\hbox {i}, \hbox {i}=1,2\), \({\alpha }_{i}(>0), 0<\theta <{\beta }_{i}\);

- Q :

-

: sum of all order quantities of the retailers, i.e., \(Q=Q_{1}+Q_{2}\);

Formulation of the Model

A supply chain model comprising of one manufacturer and two retailers have been considered in the present paper. It has been assumed that the manufacturer produces and sells a single item to two retailers. In the present model, it has been assumed that the manufacturer is the leader and the retailers are the followers. The manufacturer first sets up the wholesale price and then the retailers set their selling price. this type of supply chain is also called manufacturer stackelberg supply chain model. After determination of the retail prices by the retailers, the retail quantities are determined by the market demand, the selling price of the retailers and the service level. The inventory carrying cost and transportation cost of the retailers were ignored for simplicity. Consider that a retailer has \(I_{0}\) units of perishable food at the beginning of the sales cycle. The services are provided by two retailers to the final customers. Consequently, there must be some cost associated due to engagement of more manpower, investment in infrastructure such as device and technology etc. This service cost is increasing and convex in service level \(s_i\) and therefore can be considered as the quadratic function \(\frac{1}{2}{\lambda }_{i}{(s_i)}^{2}, {\lambda }_{i}>0\) is the efficiency measure of service provision of the i-th retailer, \(\hbox {i}=1,2\). This type of quadratic cost function reflects diminishing returns on service investment and has been widely used by prior literature like Tsay and Agrawal [19], Xiao and Yang [21] etc.

Therefore, the profit function for the retailer-i and the manufacturer are given by the following respective equations.

Our problem is to determine the optimal retail prices set by the retailers, optimal wholesale price of the manufacture, optimal service levels of the retailers and the economic order quantities of the retailers.

Optimal Solution of Model

In this section, we shall solve analytically the formulated model. The three different situations have been considered and the optimal solutions in each case have been derived. The three different situations are (i) Cournout situation, i.e., when the unit selling prices of each retailers and the order quantities are set by each retailer independently assuming competitor’s selling price and service level as variables; (ii) Collusion situation, i.e., when both the retailers agreed to determine their selling price together maximizing total profit of the retailers; (iii) Stackelberg situation, i.e., when one of the two retailers acts as a leader and the other retailer acts as follower.

Optimal Solution of the Model When Two Retailers Act in Cournot Situation

In this case, the profit of the retailer-i is dependent on his unit selling price and the provided service level to the customers. Considering the unit selling price and the service level as decision variables, the necessary conditions for the retailer-i to make maximum profit are \(\frac{\partial G_{R_{i}}}{\partial p_{i}}=0\) and \(\frac{\partial G_{R_{i}}}{\partial s_{i}}=0\). From the above two relations, we get

Considering above two relations for \(i=1,2\), we get

Eliminating \(s_{1}\) from Eqs. (4) and (5) we get

Similarly, eliminating \(s_{2}\) from Eqs. (6) and (7) we get

Solving for \(p_{1}\) and \(p_{2}\) from Eqs. (8) and (9) we get

and

Putting the values of \({p_{1}}^{*}\) and \({p_{2}}^{*}\) from Eqs. (10) and (11) in the expression of order quantity of the retailer-i \(Q_{i}=D_{i}-{\alpha }_{i}w-{\beta }_{i}p_{i}+\theta p_{j}+{\gamma }_{i}s_{i}, i \ne j, i=1,2 \) we easily obtain the optimal retail quantities \({Q_{1}}^{*}\) and \({Q_{2}}^{*}\).

Equations (10) and (11) also represent optimal reaction function of the duopolistic retailers when the wholesale price w is set by the manufacture. After setting the wholesale price of the manufacture, the retailers reaction function can be obtained by the manufacture. After substituting the values of \({s_{1}}^{*}\) and \({s_{1}}^{*}\) in terms of \({p_{1}}^{*}\) and \({p_{2}}^{*}\) [using Eqs. (5) and (7)] in Eq. (2) and then substituting the values of \({p_{1}}^{*}\) and \({p_{2}}^{*}\) from Eqs. (10) and (11), we get \(G_{M}\) as a function of single variable w. The optimal wholesale price set by the manufacturer is obtained by setting \(\frac{dG_{M}}{dw}=0\) provided \(\frac{d^2G_{M}}{dw^2}<0\). Now, \(\frac{dG_{M}}{dw}=0\) implies

The optimal value of w can be obtained from Eq. (12). This optimal value of w can be used to find the optimal values of unit selling prices of the retailers using the Eqs. (10) and (11). The proposed values of \({p_{1}}^*\) and \({p_{2}}^*\) makes \(G_{M}\) maximum if

The rest of the terms vanishes since \(\frac{d^2p_{1}}{dw^2}=\frac{d^2p_{2}}{dw^2}=0\) at their optimal values.

Optimal Solution of the Model When Duopolistic Retailers Act in Collusion Situation

In this case, two retailers agree to to determine their optimal selling prices which maximizes the total profit of the retailers. The total profit of the retailers is given by

Now, the \(G_{R}\) is a function of \(p_{1}, p_{2},s_{1}\) and \(s_{2}\). The necessary conditions for \(G_{R}\) is to be maximum are \(\frac{G_{R}}{dp_{1}}=0, \frac{G_{R}}{dp_{2}}=0, \frac{G_{R}}{ds_{1}}=0, \frac{G_{R}}{ds_{2}}=0\). From the above equations, after eliminating \(s_{1}\) and \(s_{2}\), we get

The above proposed solution \({p_{1}}^*\) and \({p_{2}}^*\) gives maximum value of \(G_{M}\) provided the corresponding Hessian (H) matrix is negative definite, where,

The optimal values of \({p_{1}}^*\) and \({p_{2}}^*\) are used to find the corresponding optimal retail quantities using \(Q_{i}=D_{i}-{\alpha }_{i}w-{\beta }_{i}p_{i}+\theta p_{j}+{\gamma }_{i}s_{i}, i=1,2, i \ne j\). As before, using the values of \({s_{1}}^{*}, {s_{2}}^{*}, {p_{1}}^{*}, {p_{1}}^{*}\) in \(G_{M}\) (given by Eq. 2), we get \(G_{M}\) to be a function of w only. The optimal wholesale price set by the manufacturer is obtained by setting \(\frac{dG_{M}}{dw}=0\) provided \(\frac{d^2G_{M}}{dw^2}<0\). Now, \(\frac{dG_{M}}{dw}=0\) implies

The optimal value of w can be obtained from Eq. (18). This optimal value of w can be used to find the optimal values of unit selling prices of the retailers using the Eqs. (15) and (16). The proposed values of \({p_{1}}^{*}\) and \({p_{2}}^{*}\) makes \(G_{M}\) maximum if

The rest of the terms vanishes since \(\frac{d^2p_{1}}{dw^2}=\frac{d^2p_{2}}{dw^2}=0\) at their optimal values.

After getting the optimal values of \({p_{1}}^{*}\) and \({p_{2}}^{*}\), the corresponding profits of the duopolistic retailers and manufacturer can be obtained.

Optimal Solution of the Model When Two Retailers Act in Stackelberg Situation

At this situation, it has been assumed that one of the retailers, say, retailer-1 acts as a leader and the other retailer, retailer-2 acts as follower. The reaction function for the retailer-2 is given by \(\frac{d{G_{R}}_{2}}{dp_{2}}=0\). This implies that

In this case, the retailer-2 sets his selling price \({p_{2}}^{*}\) on the basis of the selling price \({p_{1}}^{*}\) of the retailer-1. Depending upon the reaction function of retailer-2, retailer-1 maximizes his total profit. Putting the above value of \({p_{2}}^{*}\), in terms of \({p_{1}}^{*}\) in the profit function \({G_{R}}_{1}\) of the retailer-1, we get \({G_{R}}_{1}\) to be functions of \({p_{1}}^{*}\) and \({s_{1}}^{*}\). Now, the necessary conditions for \({G_{R}}_{1}\) to be maximum are \(\frac{d{G_{R}}_{1}}{dp_{1}}=0\) and \(\frac{d{G_{R}}_{1}}{ds_{1}}=0\). From these equations and using Eq. (20), we get

Putting this value of \({p_{1}}^{*}\) in Eq. (21), we get the optimal selling price \({p_{2}}^{*}\) of the retailer-2.

The retailer’s reaction functions \({p_{1}}^{*}\) and \({p_{2}}^{*}\) are then used by the manufacturer to obtain the profit function \(G_{M}\) of the manufacturer which is given by

Now, after substituting the values of \({p_{1}}^{*}, {p_{2}}^{*}, {s_{1}}^{*}, {s_{2}}^{*}\), in the profit function of the manufacture \(G_{M}\) becomes a function of the single variable w. The optimal wholesale price set by the manufacturer is obtained by setting \(\frac{dG_{M}}{dw}=0\) provided \(\frac{d^2G_{M}}{dw^2}<0\). Now, \(\frac{dG_{M}}{dw}=0\) implies

The optimal value of w can be obtained from Eq. (19). This optimal value of w can be used to find the optimal values of unit selling prices of the retailers using the Eqs. (16) and (17). The proposed values of \({p_{1}}^{*}\) and \({p_{2}}^{*}\) makes \(G_{M}\) maximum if

The rest of the terms vanishes since \(\frac{d^2p_{1}}{dw^2}=\frac{d^2p_{2}}{dw^2}=0\) at their optimal values.

Optimal Solution of the Model for a Special Case

Let \(D_{1}=D_{2}=D, {\alpha }_{1}= {\alpha }_{2}={\alpha }, {\beta }_{1}={\beta }_{2}={\beta }, {\gamma }_{1}={\gamma }_{2}={\gamma }, {\lambda }_{1}={\lambda }_{2}={\lambda }\).

In this case, the the optimal selling prices of the retailers \({G_{R}}_{1}\) and \({G_{R}}_{2}\) in Cournot, Collusion and Stackelberg situations are given by the following:

For Cournot situation:

For Collusion situation:

For Stackelberg situation

Numerical Examples

Example 1: Let \(D_{1}=30, D_{2}=25, {\alpha }_{1}=3, {\alpha }_{2}=2, {\beta }_{1}=2, {\beta }_{2}=1.5, c=1, {\theta }=1, {\gamma }_{1}=1, {\gamma }_{2}=0.75, {\lambda }_{1}=1.5, {\lambda }_{2}=1\). The optimal selling prices of the retailers in Cournot situation are given by \({p_{1}}^{*}=10.35, {p_{2}}^{*}=12.43\). The optimal service levels for the retailers are \({s_{1}}^{*}=3.73, {s_{2}}^{*}=5.75\) units. The corresponding optimal wholesale price of the manufacturer is given by \(w^*=4.76\) in appropriate units. The profits incurred by retailers and manufacturer are given by \({{G_{R}}_{1}}^*=52.19, {{G_{R}}_{2}}^*=71.68, {G_{M}}^*=104.71\) in appropriate units.

Taking the same parameter values, the optimal selling prices of the retailers in Collusion situation is given by \({p_{1}}^{*}=17.51\), \({p_{2}}^{*}=24.44\). The optimal service levels for the retailers are \({s_{1}}^{*}=8.48\), \({s_{2}}^{*}=14.74\) units. The corresponding optimal wholesale price of the manufacturer is given by \(w^*=4.79\) in appropriate units. The profits incurred by retailers and manufacturer are given by \({{G_{R}}_{1}}^*=119.80, {{G_{R}}_{2}}^*=36.74, {G_{M}}^*=111.88\) in appropriate units.

Using the same parameter values, the optimal selling prices of the retailers, in Stackelberg situation, considering retailer-1 as the leader and the retailer-2 as the follower is given by \({p_{1}}^{*}=15.33, {p_{2}}^{*}=17.68\). The optimal service levels for the retailers are \({s_{1}}^{*}=7.10\), \({s_{2}}^{*}=9.76\) units. The corresponding optimal wholesale price of the manufacturer is given by \(w^*=4.67\) in appropriate units.

The profits incurred by retailers and manufacturer are given by \({{G_{R}}_{1}}^*=69.90, {{G_{R}}_{2}}^*=105.62, {G_{M}}^*=108.54\) in appropriate units.

The results can be summarize as in a tabular form given by the Table 1.

The following inferences can be observed from Table 1:

-

(i)

Depending upon the different competitive behavior of the retailers, the manufacturer charges different wholesale price.

-

(ii)

Among all the three behaviors of the retailers, in Collusion situation, the retailer-1 incurs highest profit, whereas, in Stackelberg situation, the retailer-2 gains highest profit.

-

(iii)

Although, in the Collusion situation, the retailer-2, charges highest selling price, due to more service expenses, the corresponding profit of the retailer-2 is lower than that of retailer-1.

-

(iv)

Whatever game behavior the retailers choose, the variations of the profit of the manufacturer is minor.

Example 2: Let \(D_{1}=D_{2}=D=30, {\alpha }_{1}={\alpha }_{2}={\alpha }=2, {\beta }_{1}={\beta }_{2}={\beta }=2.0, c=1, {\theta }=1, {\gamma }_{1}={\gamma }_{2}={\gamma }=1, {\lambda }_{1}={\lambda }_{2}={\lambda }=1.5\). The optimal selling prices of the retailers in Cournot situation are given by \({p_{1}}^*={p_{2}}^*=9.82\). The optimal service levels for the retailers are \({s_{1}}^*={s_{2}}^*=3.71\) units. The corresponding optimal wholesale price of the manufacturer is given by \(w^*=4.25\) in appropriate units. The profits incurred by retailers and manufacturer are given by \({{G_{R}}_{1}}^*=75.41, {{G_{R}}_{2}}^*=75.41, {G_{M}}^*=100.05\) in appropriate units.

Taking the same parameter values, the optimal selling prices of the retailers in Collusion situation is given by \({p_{1}}^*={p_{2}}^*=8.68\). The optimal service levels for the retailers are \({s_{1}}^*={s_{2}}^*=2.23\) units. The corresponding optimal wholesale price of the manufacturer is given by \(w^*=5.33\) in appropriate units. The profits incurred by retailers and manufacturer are given by \({{G_{R}}_{1}}^*=39.39, {{G_{R}}_{2}}^*=36.74, {G_{M}}^*=154.99\) in appropriate units.

Using the same parameter values, the optimal selling prices of the retailers, in Stackelberg situation, considering retailer-1 as the leader and the retailer-2 as the follower is given by \({p_{1}}^*=6.94, {p_{2}}^*=8.93\). The optimal service levels for the retailers are \({s_{1}}^*=1.75, {s_{2}}^*=3.08\) units.The corresponding optimal wholesale price of the manufacturer is given by \(w^*=4.31\) in appropriate units.

The profits incurred by retailers and manufacturer are given by \({{G_{R}}_{1}}^*=34.19, {{G_{R}}_{2}}^*=51.78, {G_{M}}^*=97.90\) in appropriate units.

The results can be summarize as in a tabular form given by the Table 2.

Concluding Remarks

A manufacturer-stackelberg supply chain consisting of one manufacturer and two retailers is proposed in this paper when manufacture acts as stackelberg leaded and retailers acts as stackelberg follower. Considering different constraints of the manufacturer, he first decides the wholesale price. This wholesale price is then used by the retailers to determine their unit selling prices, optimum order quantities and optimum service levels offered by the them. The proposed model is solved when the retailers compete in three different ways, namely (i) Cournot situation, (ii) Collusion situation and (iii) Stackelberg situation. In case of Cournot situation, the retailers set their unit selling prices independently after knowing the wholesale price of the manufacture. In case of Collusion situation, both the retailers agree to determine their unit selling price which maximizes the total profit of the retailers. In Stackelberg situation, any one of the retailers acts as a leader and the other acts as follower. Therefor, the leader first decide his unit selling price. The unit selling price of the leader was used to determine the unit selling price of the follower. Although, the price of item was used as demand enhancing tool in several previous literatures, none studied joint pricing and servicing to the final customers as demand enhancing tool considering Cournot, Collusion and Stackelberg situations. It has been observed that the retailer-1 gains highest profit in case of Collusion situation and retailer-2 gains highest profit in case of Stackelberg situation with retailer-1 as leader and retailer-2 as follower.

The proposed model can be extended by several ways like considering multi-item, allowing two/ more classes of customers and incorporating transportation costs.

References

Amrouch, N., Yan, R.: Implementing online store for national brand competing against private lebel. J. Bus. Res. 65, 325–332 (2012)

Bernstein, F., Federgruen, A.: A general equilibrium model for industries with price and service competition. Oper. Res. 52, 868–886 (2004)

Choi, S.C.: Price competition in a channel structure with a common retailer. Mark. Sci. 10, 271–296 (1991)

Choi, S.C.: Price competition in a duopoly common retailer channel. J. Retail. 72, 117–134 (1996)

Corbett, C.J., Zhou, D., Tang, C.S.: Designing supply contracts: contract type and information asymmetry. Manag. Sci. 50, 550–559 (2004)

Dorfman, R.B., Steiner, P.D.: Optimal advertising and optimal quality. Am. Econ. Rev. 44, 826–836 (1995)

Ertek, G., Griffin, P.M.: Supply and buyer-driven channels in a two-stage supply chain. IIE Trans. 34, 691–700 (2002)

Lau, A.H., Lau, H.S., Zhou, Y.W.: An stchastic and assymmetric-information framework for a dominant-manufacturer supply chain. Eur. J. Oper. Res. 176, 295–316 (2007a)

Lau, A.H., Lau, H.S., Wang, J.C.: Pricing and volume discounting for a dominant retailer with uncertain manufacturing cost information. Eur. J. Oper. Res. 183, 848–870 (2007b)

Lau, A.H., Lau, H.S., Wang, J.C.: How a dominant retailer might design a puchase contract for a newsvendor-type product with price sensitive demand. Eur. J. Oper. Res. 190, 443–458 (2008)

Lu, J.C., Tsao, Y.C., Charoensiriwath, C.: Competition under manufacturer service and retail price. Econ. Model. 28, 1256–1264 (2011)

Ma, P., Wang, H., Shang, J.: Supply chain channel strategies with quality and marketting effort-dependent demand. Intern. J. Prod. Econ. 144(2), 572–581 (2013)

Mukhopadhyay, S.K., Yao, D.Q., Yue, X.: information sharing of value-adding retailer in a mixed channel hi-tech supply chain. J. Bus. Res. 61, 950–958 (2008)

Pal, B., Sana, S.S., Chaudhuri, K.: Two-echelon manufacturer-retailer supply chain strategies with price, quality and promotional effort sensitive demand. Int. Trans. Oper. Res. 22(6), 1071–1095 (2015)

Pan, K., Lai, K.K., Leung, S.C.H., Xiao, D.: Revenue-sharing versus wholesale price mechanisms under different channel power structure. Eur. J. Oper. Res. 203, 532–538 (2010)

Raju, J.S., Zhang, Z.J.: Channel coordination in the presence of of a dominant retailer. Mark. Sci. 24, 254–262 (2005)

Rosen, L.D.: The next frontier. Hosp. Mater. Manag. Q. 19, 29–34 (1998)

Spence, A.M.: Monopoly, quality and regulation. Bell J. Econ. 6, 417–429 (1975)

Tsay, A.A., Agrawal, N.: Channel dynamics under price and service competition. Manuf. Serv. Oper. Manag. 2, 372–391 (2000)

Xia, Y., Gilbert, S.M.: Strategic interaction between channel sructure and demand enhancing services. Eur. J. Oper. Res. 181, 252–265 (2007)

Xiao, T., Yang, D.: Price and sevice competition of supply chains with risk-averse retailers under demand uncertainty. Int. J. Prod. Econ. 114, 187–200 (2008)

Yan, R., Ghose, S.: Forecast information and traditional retailer performance in a dual-channel competitive market. J. Bus. Res. 63, 77–83 (2010)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Ghosh, S.K. Optimal Pricing Strategy of a Two-Echelon Supply Chain Consisting of One Manufacturer and Two Retailers with Price and Service Sensitive Demand. Int. J. Appl. Comput. Math 4, 1 (2018). https://doi.org/10.1007/s40819-017-0445-y

Published:

DOI: https://doi.org/10.1007/s40819-017-0445-y