Abstract

Nowadays innovation is a key issue in all business sectors, maintaining a positive correlation with the countries’ economic development. The banking sector stands out among the different economic sectors, as globalization has pushed banks into tough competition. Hence, banks within this competitive framework must innovate by developing new products to be competitive and survive. The innovation in banking products is usually sorted as incremental or disruptive. Therefore, this paper aims to evaluate the innovation policies for the European Banking Sector by analyzing incremental and disruptive innovation policies. The novelty of the paper is to propose a set of dimensions and criteria for the innovation policies of European banking industry and to construct a hybrid decision-making model based on interval type-2 fuzzy sets. Accordingly, a comparative analysis of the top five GDP European countries has been carried out using a multiple criteria decision model (MCDM). The MCDM defines different criteria for incremental and disruptive innovations according to the specialized literature. Interval type-2 fuzzy DEMATEL (IT2 FDEMATEL) is used for weighting factors, and interval type-2 fuzzy VIKOR (IT2 FVIKOR) and interval type-2 fuzzy TOPSIS (IT2 FTOPSIS) are considered for ranking alternatives in the integrated modeling. Eventually, the findings highlight the most important criteria in this analysis and the results demonstrate that the comparative analysis of IT2 FVIKOR and IT2 FTOPSIS provides comprehensive and coherent results to select the best country in the innovation policies. In addition, the need to redesign the European banking system with necessary regulations to contribute to the development of the innovations is pointed out.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Innovation has become one of the fastest growing concepts in business, especially in recent years. It can be defined as using new methods in social, cultural and managerial environments. It is believed that there is a positive correlation between innovation and a country’s economic development. Due to this situation, governments encourage innovation in many ways. As such, innovation also has a positive influence on company improvement. By presenting innovative products, companies can attract the attention of customers. Thus, this process increases the profitability of these companies [1].

Innovation has an important role for the banking industry within the competitive market environment. Notably, the global strategies and competition in the banking industry require innovative policies to increase their local and international market potential. As a result, global competitors are gradually developing international banking operations based on sustainable changes. And also, large-scale banks are dominant at the innovation policies and drive the competencies of competitive market more effectively. So, local banks should be able to survive against the global competitors of the banking industry by generating new ideas and innovative products.

Innovative products in the banking sector can be classified into two different categories. First of all, incremental innovation refers to improving or innovating existing products. In other words, it means making small improvements to the banks’ current products to increase efficiency and get competitive power. On the other hand, disruptive innovation can be explained as developing a new product or service that has not been used before [2]. It can be said that incremental innovation is used more in the banking sector in comparison with disruptive innovation, whereas disruptive innovation has much more of an impact on the market if it is successful [2, 3].

The European banking sector is also experiencing very serious competition. Hence, European banks try to develop many different strategies to increase their competitiveness [3]. For this purpose, these banks have made different innovations over the last few years. For example, according to the Innovation and Retail Banking Report prepared by the companies Efma and Infosys, UniCredit developed a biometric security system. In addition to this issue, ActivoBank developed a system that allows peer-to-peer payment using social media channels. It can be observed that European banks give a lot of importance to making sure innovations become permanent in the market.

The main contributions of this study are to propose the incremental and disruptive innovation policies for the European banking industry and provide several policy recommendations to develop the most appropriate innovations of the banking industry in the Europe. In addition, it is aimed to construct a hybrid extended multi-criteria decision-making approach based on interval type-2 fuzzy sets. Thus, a comparative analysis regarding incremental and disruptive innovation policies is performed. Within this scope, five different European Union member countries (Germany, United Kingdom, France Italy, Spain) are evaluated. The main selection criterion of these countries is having more than 1000 billion USD nominal GDP in 2017 according to IMF statistics. Two dimensions and eight criteria that show the innovation performance of these banks are also determined. IT2 FDEMATEL is used to weigh the dimensions and criteria. Moreover, IT2 FTOPSIS and IT2 FVIKOR approaches are considered to rank the selected European countries.

This study is structured as follows: in Sect. 2, significant studies in the literature are assessed. In Sect. 3, IT2 fuzzy sets, IT2 FDEMATEL, IT2 FTOPSIS and IT2 FVIKOR approaches are discussed. In addition, Sect. 4 focuses on the application of integrated analysis with the previous IT2 Fuzzy Models on European banking industry. Eventually, in Sect. 5 several recommendations are identified to improve the performance of this industry.

2 Literature Review

Innovation concept was evaluated with various concepts. Most of the studies are related to the effects of innovation on financial performance. Kostopoulos et al. [4] analyzed the relationship between these variables. For this scope, a survey analysis was conducted with a sample of 461 Greek companies. It has been concluded that effective innovation positively affects the financial performance of these companies. Faems et al. [5], Zahra and Das [6], Aspara et al. [7] and Merton [8] also reached a similar conclusion with the help of different methodologies. In addition, Liao and Rice [9] also examined the innovation performance of Australian SMEs. While using a sample of 449 manufacturing companies, they identified that effective innovation policies lead to efficiency in investment that in turn contributes to financial profitability. Also, Ramanathan et al. [10] and Ho et al. [11] underlined the importance of innovation on the effectiveness of the investments.

In addition, some studies also considered the positive influence of the innovation on the competitive powers of the companies. For instance, Salunke et al. [12] aimed to understand the relationship between innovation and competitive power. They conducted a survey analysis with Australian and US project-oriented firms. As a result, we can see that innovation positively affects the competitive power of these companies. Furthermore, Wu and Chiu [13], Hinterhuber and Liozu [14], Herrera [15] and Anning-Dorson [16] also evaluated the relationship between these variables and concluded that effective innovation increases the competitive powers of the companies. Moreover, Chen et al. [17] also made an analysis for Chinese companies. Using results from questionnaires that were sent out to 138 CEOs, they determined that effective innovation increases the information technology performance of the companies. Similarly, this situation increases the competitive power of these companies.

Furthermore, the relationship between innovation and customer satisfaction has also been taken into consideration in many different studies. As an example, Rubera and Kirca [18] have tried to find the effects of innovation on customer satisfaction. A hierarchical linear modeling was considered with 85 companies between 1999 and 2011. They defined that effective innovation positively affects customer satisfaction. In line with this study, Lun et al. [19], Bellingkrodt and Wallenburg [20], Oyner and Korelina [21] and Subramanian et al. [22] focused on this subject using other analysis techniques. They demonstrated that when companies give importance to the innovation, these new products increase customer satisfaction. On the other hand, Gassmann et al. [23] and Zhang et al. [24] underlined the necessity of understanding customer expectation in the implementation process to increase customer satisfaction.

Moreover, some researchers have also aimed to evaluate the relationship between the innovation and risk management. Xu and Tang [25] focused on this relationship in their study. They highlighted that risk management should be considered when making innovation. Otherwise, innovative products or service may affect the financial performance of the companies in a negative manner. In addition, Bowers and Khorakian [26], Nikolova et al. [27] and Gurd and Helliar [28] also highlighted the significance of this issue. Some studies have also analyzed the influence of the innovation on effective risk management of the companies. Kwak et al. [29], Ali et al. [30] and Penning-Rowsell et al. [31] identified that innovation positively affects risk management.

Some researchers have also evaluated the effects of innovation on economic growth. As an example, Sohag et al. [32] focused on the relationship between technological innovation and economic improvement in Malaysia. Within this scope, the data between the years of 1985 and 2012 were examined using the ARDL methodology. It was concluded that GDP per capita can be increased with the help of innovation. Malecki [33], Pradhan et al. [34], Pece et al. [35] and Capello and Lenzi [36] all reached similar conclusions. In addition, some other studies also considered the effect of economic development on the innovation performance. Galindo and Méndez [37] tried to analyze this relationship in 13 developed countries. It is concluded that countries that have high economic development have a tendency to make more innovative changes. This condition was also emphasized in other studies [38,39,40].

In the literature, there are several extensions of DEMATEL, VIKOR, and TOPSIS. Pishdar [41] evaluated environmental factors with the IT2 FDEMATEL method. Baykasoğlu and Gölcük [42] and Hosseini and Tarokh [43] also carried out a study regarding this approach. However, DEMATEL are also used in the topics of innovation and banking industry. Patent analysis [44], quality and [45] supply chain management [46] and information system [47] are the main research topics of innovation applied with DEMATEL. However, the use of the DEMATEL method is extremely limited in the banking industry [48,49,50].

In addition, IT2 FVIKOR was also considered in some subjects, such as the risk evaluation of project investments [51], selection of the best projects [52] and supplier selection [53]. Furthermore, Cevik Onar et al. [54], Dymova et al. [55], Liao [56] and Sang and Liu [57] are also the studies that have used the IT2 FTOPSIS method for different purposes like supplier selection, public transportation, material selection and risk assessment. The studies on innovation using TOPSIS generally deal with green practices [58,59,60], energy [61] and manufacturing technologies [62]. However, the use of the VIKOR method for innovation is quite infrequent in the literature [63,64,65]. Similarly, the banking application of the VIKOR method is not well-known [66, 67] while TOPSIS has been relatively extensive applied to, including the banking industry [68,69,70]. Dincer and Yuksel [71] and Wu et al. [72] each apply the comparative analysis using VIKOR and TOPSIS to the banking industry.

As a result, it is understood that innovation has been evaluated using various concepts. The relationship between innovation with economic growth and risk management, the influences of innovation on financial performance, competitive power and customer satisfaction are all examples of topics that have been studied. While similar methods are generally considered in these studies such as regression, ARDL, survey analysis, the extensions of DEMATEL; VIKOR and TOPSIS based on interval type 2 fuzzy sets are novel for banking industry. Thus, this study could provide several contributions to the literature by analyzing the incremental and disruptive innovation strategies in the European banking industry and proposing an extended hybrid multi-criteria decision-,making model with trapezoidal fuzzy numbers.

3 Methodology

In this section, we further explained the different concepts and approaches that are used in our proposal starting with Interval Type 2 Fuzzy Sets (IT2FS) and the three decision-making approaches utilized in our analysis, namely IT2 Fuzzy DEMATEL, IT2 Fuzzy VIKOR and IT2 Fuzzy TOPSIS.

3.1 IT2 Fuzzy Sets (IT2FS)

IT2FS are generated from type-1 fuzzy sets. \(\widetilde{P}\) represents type-2 fuzzy sets. \(\mu_{{\widetilde{P}\left( {x,u} \right)}}\) defines the membership function based on IT2 with values from 0 to 1. The fuzzy set is defined as [73, 74]

In Eq. (1), \(\smallint \smallint\) explains the union of all x and u. If the membership function is equal to 1, IT2FS are demonstrated as Eq. (2).

On the other hand, the upper trapezoidal membership function is represented by \(\widetilde{P}_{\iota }^{\lambda }\) whereas \(\widetilde{P}_{\iota }^{\nu }\) explains the lower trapezoidal membership function. This situation is demonstrated in Eq. (3).

In Eq. (3), \(\rho_{\iota 1}^{\lambda } , \ldots ,\rho_{\iota 4}^{\nu }\) represent the reference values. Furthermore, the type-1 fuzzy sets are given by \(\tilde{P}_{\iota }^{\lambda }\) and \(\tilde{P}_{\iota }^{\nu }\). Moreover, \(\varGamma_{\kappa } \left( {\tilde{P}_{\iota }^{\lambda } } \right)\) and \(\varGamma_{\kappa } \left( {\tilde{P}_{\iota }^{\nu } } \right)\) refer to the membership values. The essential operations of IT2FS are defined in Eqs. (4)–(8).

3.2 IT2 FDEMATEL

The term of DEMATEL deals with the decision-making trial and the evaluation laboratory in the multi-criteria process. It aims to evaluate the interdependence among the items. In addition, the importance levels of these items can be defined using this methodology. IT2 FDEMATEL is an approach for complex decision-making problems. This process can be identified in five different steps [75, 76]:

- (1)

Collect decision-makers’ priorities. Obtained evaluations are defined as the interval fuzzy sets.

- (2)

Employ the initial direct-relation matrix. In this process, the evaluations of each expert are considered collectively. In the following process, the matrix \(\tilde{P}\) is generated with the average scores. This condition is further detailed in Eqs. (9) and (10).

$$\widetilde{P} = \left[ {\begin{array}{*{20}c} 0 & {\tilde{p}_{12} } & \cdots & {} & \cdots & {\tilde{p}_{1n} } \\ {\tilde{p}_{21} } & 0 & \cdots & {} & \cdots & {\tilde{p}_{2n} } \\ \vdots & \vdots & \ddots & {} & \cdots & \cdots \\ \vdots & \vdots & \vdots & {} & \ddots & \vdots \\ {\tilde{p}_{n1} } & {\tilde{p}_{n2} } & \cdots & {} & \cdots & 0 \\ \end{array} } \right]$$(9)$$\widetilde{P} = \frac{{\widetilde{P}^{1} + \widetilde{P}^{2} + \widetilde{P}^{3} + \cdots + \widetilde{P}^{n} }}{n}$$(10) - (3)

The pairwise matrix is normalized by considering Eqs. (11)–(13).

$$\tilde{X} = \left[ {\begin{array}{*{20}c} {\tilde{p}_{11} } & {\tilde{p}_{12} } & \cdots & {} & \cdots & {\tilde{p}_{1n} } \\ {\tilde{p}_{21} } & {\tilde{p}_{22} } & \cdots & {} & \cdots & {\tilde{p}_{2n} } \\ \vdots & \vdots & \ddots & {} & \cdots & \cdots \\ \vdots & \vdots & \vdots & {} & \ddots & \vdots \\ {\tilde{p}_{n1} } & {\tilde{p}_{n2} } & \cdots & {} & \cdots & {\tilde{p}_{nn} } \\ \end{array} } \right]$$(11)$$\tilde{x}_{\iota \kappa } = \frac{{\tilde{P}_{\iota \kappa } }}{r} = \left( {\frac{{\rho_{{\alpha_{\iota \kappa } }} }}{r},\frac{{\rho_{{\beta_{\iota \kappa } }} }}{r},\frac{{\rho_{{\gamma_{\iota \kappa } }} }}{r},\frac{{\rho_{{\delta_{\iota \kappa } }} }}{r};\varGamma_{1} \left( {P_{\iota \kappa }^{\lambda } } \right),\varGamma_{2} \left( {P_{\iota \kappa }^{\lambda } } \right)} \right),\left( {\frac{{\rho_{{\varepsilon_{\iota \kappa } }} }}{r},\frac{{\rho_{{ \in_{\iota \kappa } }} }}{r},\frac{{\rho_{{\zeta_{\iota \kappa } }} }}{r},\frac{{\rho_{{\eta_{\iota \kappa } }} }}{r};\varGamma_{1} \left( {P_{\iota \kappa }^{\nu } } \right),\varGamma_{2} \left( {P_{\iota \kappa }^{\nu } } \right)} \right)$$(12)$$r = \hbox{max} \left( {\max_{1 \le \iota \le n} \sum\limits_{\kappa = 1}^{n} {\rho_{{d_{\iota \kappa } }} ,\max_{1 \le \iota \le n} } \sum\limits_{\kappa = 1}^{n} {\rho_{{d_{\iota \kappa } }} } } \right)$$(13) - (4)

This step generates the total degrees of influence as

$$X_{\alpha } = \left[ {\begin{array}{*{20}c} 0 & {\alpha^{\prime}_{12} } & \cdots & {} & \cdots & {\alpha^{\prime}_{1n} } \\ {\alpha^{\prime}_{21} } & 0 & \cdots & {} & \cdots & {\alpha^{\prime}_{2n} } \\ \vdots & \vdots & \ddots & {} & \cdots & \cdots \\ \vdots & \vdots & \vdots & {} & \ddots & \vdots \\ {\alpha^{\prime}_{n1} } & {\alpha '_{n2} } & \cdots & {} & \cdots & 0 \\ \end{array} } \right], \ldots ,X_{\eta } = \left[ {\begin{array}{*{20}c} 0 & {\eta^{\prime}_{12} } & \cdots & {} & \cdots & {\eta^{\prime}_{1n} } \\ {\eta^{\prime}_{21} } & 0 & \cdots & {} & \cdots & {\eta^{\prime}_{2n} } \\ \vdots & \vdots & \ddots & {} & \cdots & \cdots \\ \vdots & \vdots & \vdots & {} & \ddots & \vdots \\ {\eta^{\prime}_{n1} } & {\eta^{\prime}_{n2} } & \cdots & {} & \cdots & 0 \\ \end{array} } \right]$$(14)$$\tilde{A} = \mathop {\lim }\limits_{t \to \infty } \tilde{X} + \tilde{X}^{2} + \cdots + \tilde{X}^{t}$$(15)$$\tilde{A} = \left[ {\begin{array}{*{20}c} {\tilde{a}_{11} } & {\tilde{a}_{12} } & \cdots & {} & \cdots & {\tilde{a}_{1n} } \\ {\tilde{a}_{21} } & {\tilde{a}_{22} } & \cdots & {} & \cdots & {\tilde{a}_{2n} } \\ \vdots & \vdots & \ddots & {} & \cdots & \cdots \\ \vdots & \vdots & \vdots & {} & \ddots & \vdots \\ {\tilde{a}_{n1} } & {\tilde{a}_{n2} } & \cdots & {} & \cdots & {\tilde{a}_{nn} } \\ \end{array} } \right]$$(16)$$\tilde{a}_{\iota \kappa } = \left( {\alpha^{\prime\prime}_{\iota \kappa } ,\beta^{\prime\prime}_{\iota \kappa } ,\gamma^{\prime\prime}_{\iota \kappa } ,\delta^{\prime\prime}_{\iota \kappa } ;\varGamma_{1} \left( {\tilde{a}_{\iota \kappa }^{\lambda } } \right),\varGamma_{2} \left( {\tilde{a}_{\iota \kappa }^{\lambda } } \right)} \right),\left( {\varepsilon^{\prime\prime}_{\iota \kappa } , \in^{\prime\prime}_{\iota \kappa } ,\zeta^{\prime\prime}_{\iota \kappa } ,\eta^{\prime\prime}_{\iota \kappa } ;\varGamma_{1} \left( {\tilde{a}_{\iota \kappa }^{\nu } } \right),\varGamma_{2} \tilde{a}_{\iota \kappa }^{\nu } } \right)$$(17)$$\left[ {\alpha^{\prime\prime}_{\iota \kappa } } \right] = X_{\alpha } \times \left( {1 - X_{\alpha } } \right)^{ - 1} , \ldots ,\left[ {\eta^{\prime\prime}_{\iota \kappa } } \right] = X_{\eta } \times \left( {1 - X_{\eta } } \right)^{ - 1}$$(18) - 5)

The defuzzified total influence matrix is calculated in the last step. For this issue, formulas (19)–(22) are considered.

$${\text{Def}}_{A} = \frac{{\frac{{\left( {\lambda_{\varLambda } - \nu_{N} } \right) + \left( {\beta_{\varLambda } \times m_{1\varLambda } - \nu_{\varLambda } } \right) + \left( {\alpha_{U} \times m_{2U} - l_{U} } \right)}}{4} + l_{U} + \left[ {\frac{{\left( {\lambda_{\varLambda } - \nu_{N} } \right) + \left( {\beta_{N} \times m_{1N} - \nu_{N} } \right) + \left( {\alpha_{N} \times m_{2N} - l_{N} } \right)}}{4} + \nu_{N} } \right]}}{2}$$(19)$$Def_{A} = \left[ {a_{\iota \kappa } } \right]_{n \times n} ,\quad \kappa = 1,2, \ldots ,n$$(20)$$\tilde{R}_{i}^{\text{def}} = R = \left[ {\sum\limits_{\kappa = 1}^{n} {a_{\iota \kappa } } } \right]_{n \times 1} = \left( {R_{\iota } } \right)_{n \times 1} = \left( {R_{1} , \ldots ,R_{\iota } , \ldots ,R_{n} } \right)$$(21)$$\tilde{Y}_{i}^{\text{def}} = Y = \left[ {\sum\limits_{\iota = 1}^{n} {a_{\iota \kappa } } } \right]_{1 \times n}^{{\prime }} = \left( {Y_{\kappa } } \right)_{1 \times n}^{{\prime }} = \left( {\left( {Y_{1} , \ldots ,Y_{\iota } , \ldots ,Y_{n} } \right)} \right)$$(22)After that, using the values of \(\left( {\tilde{R}_{i} + \tilde{Y}_{i} } \right)^{\text{def}}\) and \(\left( {\tilde{R}_{i} - \tilde{Y}_{i} } \right)^{\text{def}}\), the defuzzification is employed. Furthermore, the sum of all vector rows is shown as \(\tilde{R}_{i}^{\text{def}}\) and \(\tilde{Y}_{i}^{\text{def}}\) explains the sum of all vector columns. Hence, in case of a high \(\left( {\tilde{R}_{i} + \tilde{Y}_{i} } \right)^{\text{def}}\) value, it means that it becomes closer to the central point. The degree of the causality is also shown as \(\left( {\tilde{R}_{i} - \tilde{Y}_{i} } \right)^{\text{def}}\). In this circumstance, the positive value means that this criterion affects others.

3.3 IT2 Fuzzy VIKOR

The name VIKOR stands for “VlseKriterijumska Optimizacija I Kompromisno Resenje” and was introduced by [77]. Multi-criteria optimization is made with the help of this approach. In this process, the choice that is closest to the ideal result is calculated. The IT2 FVIKOR method can be explained in five different steps [76]:

Step 1: The decision matrix is generated by converting the values to the IT2 fuzzy numbers. As a result, a fuzzy decision matrix can be provided and averaged values of the decision-makers’ evaluations are calculated. In this matrix, \(P_{\iota \kappa }\) states the aggregated fuzzy ratings. The matrix is defined as

(23)$$\text{P}_{\iota \kappa } = \frac{1}{D}\left[ {\sum\limits_{e = 1}^{n} {p_{\iota \kappa }^{e} } } \right],\quad \iota = 1,2,3, \ldots ,m$$(24)

(23)$$\text{P}_{\iota \kappa } = \frac{1}{D}\left[ {\sum\limits_{e = 1}^{n} {p_{\iota \kappa }^{e} } } \right],\quad \iota = 1,2,3, \ldots ,m$$(24)where \(H\) defines the alternative, \(G\) is the criterion set for the decision matrix. D is the number of decision makers. \(1 \le o \le 3,\)

Step 2: A defuzzified fuzzy decision matrix for IT2 fuzzy sets is calculated. In this circumstance, the ranking method is considered. The details are given in Eqs. (25)–(28).

$$\begin{aligned} {\text{Def}}\left( {p_{\iota \kappa } } \right) = {\text{Rank}}\left( {\tilde{p}_{\iota \kappa } } \right)_{m \times n} & = \varPi_{1} \left( {{\tilde{\text{P}}}_{\iota }^{\lambda } } \right) + \varPi_{1} \left( {{\tilde{\text{P}}}_{\iota }^{\nu } } \right) + \varPi_{2} \left( {{\tilde{\text{P}}}_{\iota }^{\lambda } } \right) + \varPi_{2} \left( {{\tilde{\text{P}}}_{\iota }^{\nu } } \right) + \varPi_{3} \left( {{\tilde{\text{P}}}_{\iota }^{\lambda } } \right) + \varPi_{3} \left( {{\tilde{\text{P}}}_{\iota }^{\nu } } \right)\varUpsilon_{q} \left( {\tilde{P}_{\iota }^{\kappa } } \right) & = \sqrt {\frac{1}{2}\sum\nolimits_{i = q}^{q + 1} {\left( {p_{\iota i}^{\kappa } - \frac{1}{2}\sum\nolimits_{i = q}^{q + 1} {p_{\iota i}^{\kappa } } } \right)^{2} } } \\ & \quad - \frac{1}{4}\left( {\varUpsilon_{1} \left( {\tilde{P}_{\iota }^{\lambda } } \right) + \varUpsilon_{1} \left( {\tilde{P}_{\iota }^{\nu } } \right) + \varUpsilon_{2} \left( {\tilde{P}_{\iota }^{\lambda } } \right) + \varUpsilon_{2} \left( {\tilde{P}_{\iota }^{\nu } } \right) + \varUpsilon_{3} \left( {\tilde{P}_{\iota }^{\lambda } } \right) + \varUpsilon_{3} \left( {\tilde{P}_{\iota }^{\nu } } \right) + \varUpsilon_{4} \left( {\tilde{P}_{\iota }^{\lambda } } \right) + \varUpsilon_{4} \left( {\tilde{P}_{\iota }^{\nu } } \right)} \right) + \varPi_{1} \left( {\tilde{P}_{\iota }^{\lambda } } \right) \\ & \quad + \varPi_{1} \left( {\tilde{P}_{\iota }^{\nu } } \right) + \varPi_{2} \left( {\tilde{P}_{\iota }^{\lambda } } \right) + \varPi_{2} \left( {\tilde{P}_{\iota }^{\nu } } \right) \\ \end{aligned}$$(25)$$\varPi_{p} \left( {\tilde{P}_{\iota }^{\kappa } } \right) = \left( {p_{\iota o}^{\kappa } + p_{{\iota \left( {o + 1} \right)}}^{\kappa } } \right)/2$$(26)where \(\varPi_{o} \left( {\tilde{P}_{\iota }^{\kappa } } \right)\) is the average of the elements \(p_{\iota o}^{\kappa }\) and \(\left( {p_{{\iota \left( {o + 1} \right)}}^{\kappa } } \right)\), \(1 \le o \le 3,\)

$$\varUpsilon_{q} \left( {\tilde{P}_{\iota }^{\kappa } } \right) = \sqrt {\frac{1}{2}\sum\limits_{i = q}^{q + 1} {\left( {p_{\iota i}^{\kappa } - \frac{1}{2}\sum\limits_{i = q}^{q + 1} {p_{\iota i}^{\kappa } } } \right)^{2} } }$$(27)where is the standard deviation of \(p_{\iota q}^{\kappa }\) and \(p_{{\iota \left( {q + 1} \right)}}^{\kappa }\), \(1 \le q \le 3,\)

$$\varUpsilon_{4} \left( {\tilde{P}_{\iota }^{\kappa } } \right) = \sqrt {\frac{1}{4}\sum\nolimits_{i = 1}^{4} {\left( {p_{\iota i}^{\kappa } - \frac{1}{4}\sum\nolimits_{i = 1}^{4} {p_{\iota i}^{\kappa } } } \right)^{2} } }$$(28)\(\varPi_{o} \left( {{\tilde{\text{P}}}_{\iota }^{\kappa } } \right)\) is the membership value of \(\varPi_{o} \left( {p_{{\iota \left( {o + 1} \right)}}^{\kappa } } \right)\), and \(\tilde{P}_{\iota }^{\kappa } ,\;\;1 \le o \le 2,\;\;\kappa \in \left\{ {\lambda ,\nu } \right\}1 \le \iota \le n.\)

Step 3: The fuzzy best value (f*j) and worst value (f−j) are computed with the help of Eq. (29).

$$f_{j}^{*} = \mathop {\hbox{max} }\limits_{i} p_{ij} \;{\text{and}}\;f_{j}^{ - } = \mathop {\hbox{min} }\limits_{i} p_{ij}$$(29)Step 4: Si and Ri are calculated with Eqs. (30) and (31).

$$S_{i} = \sum\limits_{i = 1}^{n} {w_{j} \frac{{\left( {\left| {f_{j}^{*} - p_{ij} } \right|} \right)}}{{\left( {\left| {f_{j}^{*} - f_{j}^{ - } } \right|} \right)}}}$$(30)$$R_{i} = \hbox{max} j\left[ {w_{j} \frac{{\left( {\left| {f_{j}^{*} - p_{ij} } \right|} \right)}}{{\left( {\left| {f_{j}^{*} - f_{j}^{ - } } \right|} \right)}}} \right]$$(31)In Eq. (31), wj show the weights of the criteria identified with the IT2 FDEMATEL method.

Step 5: The value of Qi is computed by considering Eq. (32).

$$\tilde{Q}_{i} = \frac{{\nu \left( {S_{i} - S^{*} } \right)}}{{\left( {S^{ - } - S^{*} } \right)}} + \left( {1 - \nu } \right)\frac{{\left( {R_{i} - R^{*} } \right)}}{{\left( {R^{ - } - R^{*} } \right)}}$$(32)In Eq. (32), S* and R* represent minimum values whereas S− and R− demonstrate maximum values. Nevertheless, maximum group utility is shown as v. This value is assumed to be 0.5 in this study. In addition, the value of (1 − v) indicates the degree of individual regret. For this situation, there are two different conditions. The condition (1), which is also referred to as acceptable advantage, is given in Eq. (33).

$$Q\left( {A^{\left( 2 \right)} } \right) - Q\left( {A^{\left( 1 \right)} } \right) \ge {1 \mathord{\left/ {\vphantom {1 {\left( {j - 1} \right)}}} \right. \kern-0pt} {\left( {j - 1} \right)}}$$(33)where A(2) represents the second highest alternative. Moreover, condition 2 is also referred to as acceptable stability. It means that the best score of either S or R should be included in the best alternative. If condition 2 is not confirmed, the solution becomes the composition of A(1) and A(2). On the other hand, the alternatives of Q(A1), Q(A2), …, Q(AM) are taken into the consideration. In this process, Eq. (34) is used.

$$Q\left( {A^{\left( M \right)} } \right) - Q\left( {A^{\left( 1 \right)} } \right) < \frac{1}{{\left( {j - 1} \right)}}$$(34)

3.4 IT2 Fuzzy TOPSIS

The TOPSIS is a method introduced by Yoon and Hwang and is used to rank the priorities by their similarity to the ideal solution [78]. This approach aims to order the alternatives and the ideal solutions negatively and positively are defined. After that, the best alternative is determined according to the distance from this ideal solution. The first three steps of the IT2 FTOPSIS approach are the same as in IT2 FVIKOR. The remaining steps of this extended method are detailed below [76]:

Step 4: The positive \((A^{ + } )\) and negative \((A^{ - } )\) ideal solutions are calculated. In this process, the weighted values of the defuzzified matrix are used, as given in Eq. (35).

$$A^{ + } = \hbox{max} \left( {\nu_{1} ,\nu_{2} ,\nu_{3} , \ldots ,v_{n} } \right);A^{ - } = \hbox{min} \left( {\nu_{1} ,\nu_{2} ,\nu_{3} , \ldots ,\nu_{n} } \right)$$(35)In this equation, \(\nu_{ij}\) refers to the weighted values of the defuzzified matrix.

Step 5: D+ and D− values are computed. In this process, Eqs. (36) and (37) are taken into consideration.

$$D_{i}^{ + } = \sqrt {\sum\limits_{i = 1}^{m} {\left( {\nu_{i} - A_{i}^{ + } } \right)^{2} } }$$(36)$$D_{i}^{ - } = \sqrt {\sum\limits_{i = 1}^{m} {\left( {\nu_{i} - A_{i}^{ - } } \right)^{2} } }$$(37)Step 6: The closeness coefficient (CCi) is calculated using Eq. (38).

$${\text{CC}}_{i} = \frac{{D_{i}^{ - } }}{{D_{i}^{ + } + D_{i}^{ - } }}$$(38)

4 An Analysis of the European Banking Sector

To achieve our aim of analyzing the European Banking sector, an integrated analysis of the IT2 Fuzzy Models is developed. As such, the model is measured comparatively using IT2 FDEMATEL-TOPSIS and IT2 FDEMATEL-VIKOR and the results are discussed to determine policy recommendations and the applicability of models. Figure 1 explains the flowchart of the comparative analysis.

Stage 1: Constructing the factors and linguistic evaluations

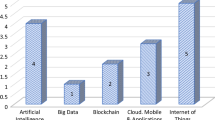

Step 1: Define the problem of innovation policies in the European banking sector. Incremental and disruptive innovations are defined as a set of dimensions. Four criteria are also appointed to each dimension with the supported literature. However, five countries are selected for ranking the innovation policies in their banking sectors. Selected countries have the first 5 seats at the GDP among the European region, and these are Germany (A1), France (A2), Italy (A3), England (A4), and Spain (A5). Table 1 represents the dimensions and criteria of the innovation policies for the European banking sector.

Table 1 states that innovation policies are mainly classified into two different dimensions: incremental (D1) and disruptive (D2). With respect to the incremental innovation, the diversification policies of the companies (C1) are selected to be the first criterion. Moreover, it is believed that providing affordable technological services and products with the economies of scale (C2) can have an effect on the performance of innovation policies. Also, when the capacity of technology followers (C3) is higher, there is an increase in innovation. Finally, having competing projects in sector (C4) means that incremental innovation increases.

In addition to the incremental innovation, four different criteria are also identified with respect to the disruptive innovation. The concentration level, alongside the unique service and products (C5) give information regarding the increase in disruptive innovation. On the other hand, disruptive innovation performance goes up when there is growth in high-tech companies (C6). In addition, it is also believed that there is a positive relationship between disruptive innovation and the potential of the first entrants (C7). Furthermore, providing scope economies with the inventions (C8) is the last criterion of the disruptive innovation. It explains that with the help of radical innovation, banks will have the advantage of providing different services easily.

Step 2: Collect the linguistic evaluations for the dimensions, criteria and alternatives. In the analysis process, three decision makers are appointed to evaluate the factors and alternatives. They give their scores by considering the linguistic scales given in Tables 2 and 3, respectively.

Also, linguistic evaluations provided from the decision makers are represented in Tables 4, 5, 6 and 7.

Stage 2: Weighting the dimensions and criteria

Step 1: Compute the weights of dimensions. Linguistic scores are converted to the IT2 fuzzy numbers and the computing processes of IT2 FDEMATEL are applied the weights of dimensions. Tables 8, 9, 10 and 11 show the initial, normalized, total, and defuzzified relation matrix, respectively.

Step 2: Calculate the weights of the criteria. Similar procedures of dimensions are also computed for the criteria of each dimension in Tables 12, 13, 14, 15, 16, 17, 18 and 19.

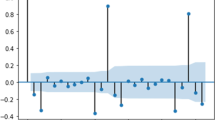

Step 3: Define the local and global weights. Global and local weights for the innovation policies are calculated using the weights of dimensions and criteria provided from IT2 FDEMATEL. The details are shown in Table 20.

Table 20 indicates that both dimensions have equal weights of (0.50). In addition, while considering global weights it can be understood that providing scope economies with the inventions (C8) is the most important criterion. Moreover, the capacity of technology followers (C3) and the competing projects in sector (C4) are other criteria that are highly significant. These results show that banks should mainly consider scope economies. The logic of providing different products and services that are much easier to use has a positive influence on innovation performance. This issue has also been emphasized in many different studies [93,94,95]. Tsai et al. [83], Ernst et al. [84], Cassanelli et al. [85] and Neimark [86] also reached similar conclusions in the literature.

Stage 3: Ranking the alternatives

Step 1: Developing the fuzzy decision matrix. Linguistic evaluations of each expert are converted to the IT2 fuzzy numbers. In addition, the average values are considered for the alternatives to construct the fuzzy decision matrix as seen in Table 21. After that, the fuzzy decision matrix is defuzzified to rank the alternatives.

In addition to this issue, Table 22 defines the defuzzified values of the decision matrix.

Step 2: Rank the alternatives with IT2 FVIKOR. Defuzzified vales are used to calculate the values of Si, Ri and Qi. The results and ranking scores are presented in Table 23.

Table 23 shows that England (A4) is the best country with respect to innovation performance. In addition, Germany (A1) is ranked second-best. We can also see that Spain (A5) is ranked last.

Step 3: Rank the alternatives with IT2 FTOPSIS. The values of defuzzified decision matrix are multiplied with the weights of the criteria obtained from the IT2 FDEMATEL and the weighted decision matrix is constructed in Table 24.

The values of D+, D−, Ci, and the ranking results are computed as seen in Table 25.

IT2 FVIKOR and IT2 FTOPSIS give same ranking results. England (A4) is selected as the best country for innovation policies of the European banking sector while Spain (A5) has the worst performance in the innovative banking policies. The results demonstrate that the comparative analysis of IT2 FVIKOR and IT2 FTOPSIS provides comprehensive and coherent results for the IT2-based hybrid decision-making models.

5 Conclusion

Innovation in the banking sector has increased dramatically with the effect of globalization. Due to this fact, banks have been forced to develop new products and/or services to be competitive regarding their rivals. For this purpose, innovation plays a crucial role for the banking sector. Innovative products can be provided for the banking sector in two different ways. Incremental innovation means innovating current products or bank services. On the other hand, developing a new product or service which has not been used before can be defined as disruptive innovation.

This study has carried out a comparative analysis of incremental and disruptive innovation policies in the European banking sector. For this purpose, eight different criteria for two dimensions were selected. In this context, five European Union member countries that have the highest nominal GDP (Germany, United Kingdom, France Italy, and Spain) are taken into the consideration. In addition, IT2 FDEMATEL is employed with the aim of weighting the dimensions and criteria, and IT2 FTOPSIS and VIKOR approaches are used to rank these countries.

It is concluded that both dimensions have equal weights (0.50). Furthermore, it is also identified that providing scope economies with the inventions (C8) is the most important out of all criteria. In addition, the criteria of the capacity of technology followers (C3) and the competing projects in the sector (C4) are amongst the first rankings. It is recommended that scope economies should be the first concern of these banks. Moreover, the European banking system should be redesigned with the implication of the necessary regulations. These actions contribute to the development of the innovations.

This study focuses on a very significant subject for the European banking sector. Nevertheless, in future studies, different regions could be analyzed. For example, a new analysis could be conducted for developing economies. In addition, different methodologies could be considered in other studies. For instance, as a new method, IT2 FQUALIFLEX could be used to enhance the originality of any new studies.

References

Naranjo-Valencia, J.C., Jiménez-Jiméne, D., Sanz-Valle, R.: Studying the links between organizational culture, innovation, and performance in Spanish companies. Revista Latinoamericana de Psicología 48(1), 30–41 (2016)

Osiyevskyy, O., Dewald, J.: Explorative versus exploitative business model change: the cognitive antecedents of firm-level responses to disruptive innovation. Strateg Entrep. J. 9(1), 58–78 (2015)

Fiordelisi, F., Mare, D.S.: Competition and financial stability in European cooperative banks. J. Int. Money Finan. 45, 1–16 (2014)

Kostopoulos, K., Papalexandris, A., Papachroni, M., Ioannou, G.: Absorptive capacity, innovation, and financial performance. J. Bus. Res. 64(12), 1335–1343 (2011)

Faems, D., De Visser, M., Andries, P., Van Looy, B.: Technology alliance portfolios and financial performance: value-enhancing and cost-increasing effects of open innovation. J. Prod. Innov. Manag. 27(6), 785–796 (2010)

Zahra, S.A., Das, S.R.: Innovation strategy and financial performance in manufacturing companies: An empirical study. Prod. oper. Manag. 2(1), 15–37 (1993)

Aspara, J., Hietanen, J., Tikkanen, H.: Business model innovation vs replication: financial performance implications of strategic emphases. J. Strateg. Market. 18(1), 39–56 (2010)

Merton, R.C.: Financial innovation and economic performance. J. Appl. Corp. Finan. 4(4), 12–22 (1992)

Liao, T.S., Rice, J.: Innovation investments, market engagement and financial performance: A study among Australian manufacturing SMEs. Res. Policy 39(1), 117–125 (2010)

Ramanathan, R., Ramanathan, U., Bentley, Y.: The debate on flexibility of environmental regulations, innovation capabilities and financial performance—a novel use of DEA. Omega 75, 131–138 (2018)

Ho, K.L.P., Nguyen, C.N., Adhikari, R., Miles, M.P., Bonney, L.: Exploring market orientation, innovation, and financial performance in agricultural value chains in emerging economies. J. Innov. Knowl. 3(3), 154–163 (2018)

Salunke, S., Weerawardena, J., McColl-Kennedy. J.R.: The central role of knowledge integration capability in service innovation-based competitive strategy. Ind. Market. Manag. 76, 144–156 (2019)

Wu, L., Chiu, M.L.: Organizational applications of IT innovation and firm’s competitive performance: A resource-based view and the innovation diffusion approach. J. Eng. Tech. Manage. 35, 25–44 (2015)

Hinterhuber, A., Liozu, S.M.: Is innovation in pricing your next source of competitive advantage? 1. Innovation in Pricing, pp. 11–27. Routledge, Abingdon (2017)

Herrera, M.E.B.: Creating competitive advantage by institutionalizing corporate social innovation. J. Bus. Res. 68(7), 1468–1474 (2015)

Anning-Dorson, T.: Innovation and competitive advantage creation: the role of organisational leadership in service firms from emerging markets. Int. Market. Rev. 34(4), 580–600 (2018)

Chen, Y., Wang, Y., Nevo, S., Benitez-Amado, J., Kou, G.: IT capabilities and product innovation performance: the roles of corporate entrepreneurship and competitive intensity. Inf. Manag. 52(6), 643–657 (2015)

Rubera, G., Kirca, A.H.: You gotta serve somebody: the effects of firm innovation on customer satisfaction and firm value. J. Acad. Mark. Sci. 45(5), 741–761 (2017)

Lun, Y.V., Shang, K.C., Lai, K.H., Cheng, T.C.E.: Examining the influence of organizational capability in innovative business operations and the mediation of profitability on customer satisfaction: an application in intermodal transport operators in Taiwan. Int. J. Prod. Econ. 171, 179–188 (2016)

Bellingkrodt, S., Wallenburg, C.M.: The role of customer relations for innovativeness and customer satisfaction: a comparison of service industries. Int. J. Logist. Manag. 26(2), 254–274 (2015)

Oyner, O., Korelina, A.: The influence of customer engagement in value co-creation on customer satisfaction: searching for new forms of co-creation in the Russian hotel industry. Worldw. Hosp. Tour. Themes 8(3), 327–345 (2016)

Subramanian, N., Gunasekaran, A., Gao, Y.: Innovative service satisfaction and customer promotion behaviour in the Chinese budget hotel: an empirical study. Int. J. Prod. Econ. 171, 201–210 (2016)

Gassmann, O., Schuhmacher, A., von Zedtwitz, M., Reepmeyer, G.: Future directions and trends. Leading Pharmaceutical Innovation, pp. 155–163. Springer, Cham (2018)

Zhang, H., Liang, X., Wang, S.: Customer value anticipation, product innovativeness, and customer lifetime value: the moderating role of advertising strategy. J. Bus. Res. 69(9), 3725–3730 (2016)

Xu L, Tang S: Technology innovation-oriented complex product systems R&D investment and financing risk management: an integrated review. In: Proceedings of the Tenth International Conference on Management Science and Engineering Management, pp 1653–1663, Springer, Singapore, (2017)

Bowers, J., Khorakian, A.: Integrating risk management in the innovation project. Eur. J. Innov. Manag. 17(1), 25–40 (2014)

Nikolova, L.V., Kuporov, J.J., Rodionov, D.G.: Risk management of innovation projects in the context of globalization. Int. J. Econ. Financ. Issues 5(3S), 73–79 (2015)

Gurd, B., Helliar, C.: Looking for leaders: ‘Balancing’ innovation, risk and management control systems. Br. Account. Rev. 49(1), 91–102 (2017)

Kwak, D.W., Seo, Y.J., Mason, R.: Investigating the relationship between supply chain innovation, risk management capabilities and competitive advantage in global supply chains. Int. J. Oper. Prod. Manag. 38(1), 2–21 (2018)

Ali, A., Warren, D., Mathiassen, L.: Cloud-based business services innovation: a risk management model. Int. J. Inf. Manag. 37(6), 639–649 (2017)

Penning-Rowsell, E.C., De Vries, W.S., Parker, D.J., Zanuttigh, B., Simmonds, D., Trifonova, E., Hissel, F., Monbaliu, J., Lendzion, J., Ohle, N., Diaz, P.: Innovation in coastal risk management: an exploratory analysis of risk governance issues at eight THESEUS study sites. Coast. Eng. 87, 210–217 (2014)

Sohag, K., Begum, R.A., Abdullah, S.M.S., Jaafar, M.: Dynamics of energy use, technological innovation, economic growth and trade openness in Malaysia. Energy 90, 1497–1507 (2015)

Malecki, E.J.: Technological innovation and paths to regional economic growth. Growth Policy in the Age of High Technology, pp. 97–126. Routledge, Abingdon (2018)

Pradhan, R.P., Arvin, M.B., Hall, J.H., Nair, M.: Innovation, financial development and economic growth in Eurozone countries. Appl. Econ. Lett. 23(16), 1141–1144 (2016)

Pece, A.M., Simona, O.E.O., Salisteanu, F.: Innovation and economic growth: an empirical analysis for CEE countries. Procedia Econ. Financ. 26, 461–466 (2015)

Capello, R., Lenzi, C.: Spatial heterogeneity in knowledge, innovation, and economic growth nexus: conceptual reflections and empirical evidence. J. Reg. Sci. 54(2), 186–214 (2014)

Galindo, M.Á., Méndez, M.T.: Entrepreneurship, economic growth, and innovation: are feedback effects at work? J. Bus. Res. 67(5), 825–829 (2014)

Rafindadi, A.A.: Does the need for economic growth influence energy consumption and CO2 emissions in Nigeria? Evidence from the innovation accounting test. Renew. Sustain. Energy Rev. 62, 1209–1225 (2016)

Song, C., Oh, W.: Determinants of innovation in energy intensive industry and implications for energy policy. Energy Policy 81, 122–130 (2015)

Kamasak, R.: Determinants of innovation performance: a resource-based study. Procedia Soc. Behav. Sci. 195, 1330–1337 (2015)

Pishdar, M.: Application of interval type-2 Fuzzy DEMATEL for evaluation of environmental good governance components. Int. J. Resist. Econ. 3(4), 27–44 (2015)

Baykasoğlu, A., Gölcük, İ.: Development of an interval type-2 fuzzy sets based hierarchical MADM model by combining DEMATEL and TOPSIS. Expert Syst. Appl. 70, 37–51 (2017)

Hosseini, M.B., Tarokh, M.J.: Interval type-2 fuzzy set extension of DEMATEL method. Computational Intelligence and Information Technology, pp. 157–165. Springer, Berlin (2011)

Lin, Z.C., Hong, G.E., Cheng, P.: F: a study of patent analysis of LED bicycle light by using modified DEMATEL and life span. Adv. Eng. Inform. 34, 136–151 (2017)

Chen, J.K., Chen, I.: S: A network hierarchical feedback system for Taiwanese universities based on the integration of total quality management and innovation. Appl. Soft Comput. 12(8), 2394–2408 (2012)

Zhu, Q., Sarkis, J., Lai, K.H.: Supply chain-based barriers for truck-engine remanufacturing in China. Transp. Res. Part E Logist. Transp. Rev. 68, 103–117 (2014)

Ahmadi, H., Nilashi, M., Ibrahim, O.: Organizational decision to adopt hospital information system: an empirical investigation in the case of Malaysian public hospitals. Int. J. Med. Inf. 84(3), 166–188 (2015)

Asad, M.M., Mohajerani, N.S., Nourseresh, M.: Prioritizing factors affecting customer satisfaction in the internet banking system based on cause and effect relationships. Procedia Econ. Finan. 36(16), 210–219 (2016)

Wu, H.Y.: Constructing a strategy map for banking institutions with key performance indicators of the balanced scorecard. Eval. Progr. Plann. 35(3), 303–320 (2012)

Dinçer, H., Yüksel, S., Martínez, L.: Analysis of balanced scorecard-based SERVQUAL criteria based on hesitant decision-making approaches. Comput. Ind. Eng. 131, 1–12 (2019)

Qin, J., Liu, X., Pedrycz, W.: An extended VIKOR method based on prospect theory for multiple attribute decision making under interval type-2 fuzzy environment. Knowl. Based Syst. 86, 116–130 (2015)

Ghorabaee, M.K., Amiri, M., Sadaghiani, J.S., Zavadskas, E.K.: Multi-criteria project selection using an extended VIKOR method with interval type-2 fuzzy sets. Int. J. Inf. Technol. Decis. Mak. 14(05), 993–1016 (2015)

Liu, K., Liu, Y., Qin, J.: An integrated ANP-VIKOR methodology for sustainable supplier selection with interval type-2 fuzzy sets. Granul. Comput. 3, 1–16 (2018)

Cevik Onar, S., Oztaysi, B., Kahraman, C.: Strategic decision selection using hesitant fuzzy TOPSIS and interval type-2 fuzzy AHP: a case study. Int. J. Comput. Intell. Syst. 7(5), 1002–1021 (2014)

Dymova, L., Sevastjanov, P., Tikhonenko, A.: An interval type-2 fuzzy extension of the TOPSIS method using alpha cuts. Knowl. Based Syst. 83, 116–127 (2015)

Liao, T.W.: Two interval type 2 fuzzy TOPSIS material selection methods. Mater. Des. 88, 1088–1099 (2015)

Sang, X., Liu, X.: An analytical solution to the TOPSIS model with interval type-2 fuzzy sets. Soft. Comput. 20(3), 1213–1230 (2016)

Gupta, H., Barua, M.: K: A framework to overcome barriers to green innovation in SMEs using BWM and Fuzzy TOPSIS. Sci. Total Environ. 633, 122–139 (2018)

Sun, L.Y., Miao, C.L., Yang, L.: Ecological-economic efficiency evaluation of green technology innovation in strategic emerging industries based on entropy weighted TOPSIS method. Ecol. Indic. 73, 554–558 (2017)

Gupta, H., Barua, M.K.: Supplier selection among SMEs on the basis of their green innovation ability using BWM and fuzzy TOPSIS. J. Clean. Prod. 152, 242–258 (2017)

Lu, Z., Gao, Y.: & Zhao, W: A TODIM-based approach for environmental impact assessment of pumped hydro energy storage plant. J. Clean. Prod. 248, 119265 (2020)

Nath, S., Sarkar, B.: Performance evaluation of advanced manufacturing technologies: a De novo approach. Comput. Ind. Eng. 110, 364–378 (2017)

Wu, H.Y., Chen, J.K., Chen, I.S.: Innovation capital indicator assessment of Taiwanese Universities: a hybrid fuzzy model application. Expert Syst. Appl. 37(2), 1635–1642 (2010)

Chen, J.K., Chen, I.: S: Aviatic innovation system construction using a hybrid fuzzy MCDM model. Expert Syst. Appl. 37(12), 8387–8394 (2010)

Yin, S.: & Li, B: Academic research institutes–construction enterprises linkages for the development of urban green building: Selecting management of green building technologies innovation partner. Sustain. Cities Soc. 48, 101555 (2019)

Wu, M., Li, C., Fan, J., Wang, X., Wu, Z.: Assessing the global productive efficiency of Chinese banks using the cross-efficiency interval and VIKOR. Emerg. Mark. Rev. 34, 77–86 (2018)

Liang, D., Zhang, Y., Xu, Z., Jamaldeen, A.: Pythagorean fuzzy VIKOR approaches based on TODIM for evaluating internet banking website quality of Ghanaian banking industry. Appl. Soft. Comput. 78, 583–594 (2019)

Wanke, P., Azad, A.K.: Emrouznejad, A: Efficiency in BRICS banking under data vagueness: a two-stage fuzzy approach. Glob. Financ. J. 35, 58–71 (2018)

Seçme, N.Y., Bayrakdaroğlu, A., Kahraman, C.: Fuzzy performance evaluation in Turkish banking sector using analytic hierarchy process and TOPSIS. Expert Syst. Appl. 36(9), 11699–11709 (2009)

Wanke, P., Azad, M.A.K., Barros, C.P.: Predicting efficiency in Malaysian Islamic banks: a two-stage TOPSIS and neural networks approach. Res. Int. Bus. Financ. 36, 485–498 (2016)

Dinçer, H., Yüksel, S.: An integrated stochastic fuzzy MCDM approach to the balanced scorecard-based service evaluation. Math. Comput. Simul. 166, 93–112 (2019)

Wu, H.Y., Tzeng, G.H., Chen, Y.: H: A fuzzy MCDM approach for evaluating banking performance based on Balanced Scorecard. Expert Syst. Appl. 36(6), 10135–10147 (2009)

Chen, S.M., Barman, D.: Adaptive weighted fuzzy interpolative reasoning based on representative values and similarity measures of interval type-2 fuzzy sets. Inf. Sci. 478, 167–185 (2019)

Lee, L.W., Chen, S.M: A new method for fuzzy multiple attributes group decision-making based on the arithmetic operations of interval type-2 fuzzy sets. In: 2008 International conference on machine learning and cybernetics, vol. 6, pp. 3084-3089. IEEE, New York (2008)

Akyuz, E., Celik, E.: A fuzzy DEMATEL method to evaluate critical operational hazards during gas freeing process in crude oil tankers. J. Loss. Prev. Process. Ind. 38, 243–253 (2015)

Dinçer, H., Yüksel, S., Martínez, L.: Interval type 2-based hybrid fuzzy evaluation of financial services in E7 economies with DEMATEL-ANP and MOORA methods. Appl. Soft. Comput. 79, 186–202 (2019)

Opricović, S.: VIKOR method. Multicriteria Optimization of Civil Engineering Systems, pp. 142–175. University of Belgrade-Faculty of Civil Engineering, Belgrade (1998)

Yoon, K., Hwang, C.L.: TOPSIS (technique for order preference by similarity to ideal solution)—a Multiple Attribute Decision Making, w: Multiple Attribute Decision Making—Methods and Applications, A State-of-the-at Survey. Springer Verlag, Berlin (1981)

Hartmann, D.: The economic diversification and innovation system of Turkey from a global comparative perspective. International Innovation Networks and Knowledge Migration, pp. 53–71. Routledge, Abingdon (2016)

Fan JP, Huang J, Oberholzer-Gee F, Zhao M: Bureaucrats as managers and their roles in corporate diversification. J. Corp. Financ. (2017)

Kim, N.S., Park, B., Lee, K.D.: A knowledge based freight management decision support system incorporating economies of scale: multimodal minimum cost flow optimization approach. Inf. Technol. Manag. 17(1), 81–94 (2016)

Banoun, A., Dufour, L., Andiappan, M.: Evolution of a service ecosystem: longitudinal evidence from multiple shared services centers based on the economies of worth framework. J. Bus. Res. 69(8), 2990–2998 (2016)

Tsai, J.M., Chang, C.C., Hung, S.W.: Technology acquisition models for fast followers in high-technological markets: an empirical analysis of the LED industry. Technol. Anal. Strateg. Manag. 30(2), 198–210 (2018)

Ernst, H., Conley, J., Omland, N.: How to create commercial value from patents: the role of patent management. R&D Manag. 46(S2), 677–690 (2016)

Cassanelli, A.N., Fernandez-Sanchez, G., Guiridlian, M.C.: Principal researcher and project manager: who should drive R&D projects? R&D Manag. 47(2), 277–287 (2017)

Neimark, B.D.: Biofuel imaginaries: the emerging politics surrounding ‘inclusive’ private sector development in Madagascar. J. Rural Stud. 45, 146–156 (2016)

Witell, L., Snyder, H., Gustafsson, A., Fombelle, P., Kristensson, P.: Defining service innovation: a review and synthesis. J. Bus. Res. 69(8), 2863–2872 (2016)

Tang, T.W., Wang, M.C.H., Tang, Y.Y.: Developing service innovation capability in the hotel industry. Serv. Bus. 9(1), 97–113 (2015)

Grilli, L., Murtinu, S.: Government, venture capital and the growth of European high-tech entrepreneurial firms. Res. Policy 43(9), 1523–1543 (2014)

Hsia, J.W., Chang, C.C., Tseng, A.H.: Effects of individuals’ locus of control and computer self-efficacy on their e-learning acceptance in high-tech companies. Behav. Inf. Technol. 33(1), 51–64 (2014)

Gomez, J., Lanzolla, G., Maicas, J.P.: The role of industry dynamics in the persistence of first mover advantages. Long Range Plan. 49(2), 265–281 (2016)

Wilkie, D.C., Johnson, L.W.: Is there a negative relationship between the order-of-brand entry and market share? Mark. Lett. 27(2), 211–222 (2016)

Romano, G., Guerrini, A., Marques, R.C.: European Water Utility Management: promoting efficiency, innovation and knowledge in the water industry. Water Resour. Manag. 31(8), 2349–2353 (2017)

Carneiro, J., Bamiatzi, V., Cavusgil, S.T.: Organizational slack as an enabler of internationalization: the case of large Brazilian firms. Int. Bus. Rev. 27, 1057–1064 (2018)

Subramanian, A.M., Soh, P.H.: Linking alliance portfolios to recombinant innovation: the combined effects of diversity and alliance experience. Long Range Plan. 50(5), 636–652 (2017)

Acknowledgements

The work was partly supported by the Spanish National research project PGC2018-099402-B-I00 and ERDF funds.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interest

The authors of this paper declare that they have no conflict of interest and certify that they have NO affiliations with or involvement in any organization or entity with any financial interest, or non-financial interest in the subject matter or materials discussed in this manuscript.

Rights and permissions

About this article

Cite this article

Dinçer, H., Yüksel, S. & Martínez, L. A Comparative Analysis of Incremental and Disruptive Innovation Policies in the European Banking Sector with Hybrid Interval Type-2 Fuzzy Decision-Making Models. Int. J. Fuzzy Syst. 22, 1158–1176 (2020). https://doi.org/10.1007/s40815-020-00851-8

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40815-020-00851-8