Abstract

In the last few years Bitcoin price dynamics has been the subject of intense research. One of the main stream of investigation is the identification of relevant factors affecting its returns and volatility; empirical evidence suggests a positive association between returns and sentiment proxies about the Bitcoin network, such as Wikipedia inquiries, internet search intensity on the topic, trading volume in main exchanges or sentiment measures obtained via natural language processing algorithms applied on specialized forums comments or social media posts on the theme. In this paper we investigate the association of trading volume and internet search intensity with Bitcoin returns and volatility, complementing the outcomes in Figá-Talamanca and Patacca (Decis Econ Fin ISSN: 1129-6569, https://doi.org/10.1007/s10203-019-00258-7, 2019) and Urquhart (Econ Lett 166:40–44, ISSN: 0165-1765, https://doi.org/10.1016/j.econlet.2018.02.017, 2018): we find no direct relationship between the two market attention measures and returns while both the trading volume and the internet search intensity affect positively Bitcoin volatility. Conversely, an increase in Bitcoin returns does increase both trading volume and internet search intensity, evidencing an inverse relationship between returns and attention measures. As a byproduct, we also detect a positive association between trading volume and the internet search intensity and no reverse relationship. Since market attention, especially internet search volume, do increase around relevant events and corresponding news or announcements for the Bitcoin market, we also analyze whether and to which extent the above relationships change, after specific events are taken into account. Indeed, by applying two different approaches, we show that the relationships may change significantly.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction and literature review

Bitcoin is a digital currency, built on a peer-to peer network and on the blockchain, a public ledger where all transactions are recorded and made available to all nodes. Bitcoin relies on cryptography and on a consensus protocol for the network rather than on trust for the counter-party, as it happens in traditional banking transactions. The whole network is based on an open source software created in 2009 by Satoshi Nakamoto, whose real identity is still unknown. Bitcoin is not subject to the control of any central authority and transactions in the network are pseudonymousFootnote 1 and irreversible; hence, Bitcoin is claimed by its creator(s) to be an independent currency.

The important question, on whether Bitcoin or altcoinsFootnote 2 should be considered as currencies, commodities, or investment vehicles, has been the subject of many economic papers, yet no conclusive answer has been given to date, see Yermack (2015), Baek and Elbeck (2015) and Gregoriou (2019). Besides, high returns and volatility have attracted research towards the analysis of Bitcoin price efficiency, such as Almudhaf (2018) and Urquhart (2016) and Nadarajah and Chu (2017). Yet, if cryptocurrencies are used to build investment portfolios, it is important to identify relevant factors affecting the dynamics of their prices and returns. This has been the subject of many papers in the last few years; a non-exhaustive list is Kristoufek (2013), Kristoufek (2015), Bukovina and Martiček (2016), Dyhrberg (2016), Ciaian et al. (2016), Katsiampa (2017), Blau (2017), Cretarola et al. (2018), Bistarelli et al. (2018), Ahn and Kim (2019), Cretarola et al. (2019), Mbanga (2019), Bistarelli et al. (2019) and Cretarola and Figà-Talamanca (2019).

Among the above quoted papers, several suggest a positive association between Bitcoin returns and sentiment proxies about the Bitcoin network. In Ciaian et al. (2016) the authors find a significant dependence of Bitcoin price on various market forces jointly: supply and demand for Bitcoins, some variables related to global macroeconomic and financial development such as Stock market indices and oil price, and attractiveness factors. Specifically, they measure attractiveness of Bitcoin by means of the number of Wikipedia inquiries on the topic, the number of new users and the number of posts in the online forum https://bitcointalk.org/. By estimating Vector AutoRegressive and Vector Error Correction models, they find that such attractiveness variables are positively associated to an increase in Bitcoin prices.

In Bukovina and Martiček (2016) sentiment data are obtained from http://sentdex.com/, an online platform specialized on natural language processing algorithms to deliver a positive, neutral or negative feeling about a specific topic. Similarly, Ahn and Kim (2019) employ textual sentiment analysis techniques to study the excessive price fluctuation in the cryptocurrency market. Their findings evidence that high volatility and jumps in Bitcoin prices are associated with investors’ attention and sentiment disagreement.

Moreover, many empirical papers prove that Bitcoin returns and volatility are affected by investor attention when measured by the volume of transactions or, alternatively, by the internet search volume on specific platforms like Google or Wikipedia (Kristoufek 2013, 2015; Figá-Talamanca and Patacca 2019). The choice of either the trading volume or the internet search intensity is not new to financial research; both measures have been already adopted in traditional financial stock markets as proxies for the attention of investors. Indeed, the trading volume is a classical measure of attention for financial stocks; among others, Barber and Odean (2007), Gervais et al. (2001) and Hou et al. (2009) analyze the power of trading volume in predicting future price direction, traders buying behaviour and price momentum effects, respectively. Besides, the massive use of internet and internet based search engines have suggested the use of online search volume for specific keywords as a direct measure of attention, at least that of retail investors which are prone to look for information on the web rather that on more specialized journals; Da et al. (2011) point out: “the search volume is likely to be representative of the internet search behavior of the general population and more critically, search is a revealed attention measure: if you search for a stock in Google, you are undoubtedly paying attention to it. Therefore, aggregate search frequency in Google is a direct and unambiguous measure of attention”.

Since the quoted pioneering paper, the number of searches on online engines for specific keywords, such as the name or tag of a chosen stock, has become a key factor, together with the more traditional trading volume, in explaining the stock returns and volatility, see e.g. Chronopoulos et al. (2018) and Dimpfl and Jank (2016). An interesting application of internet based attention measures in the Forex market is given in Smith (2012), in which seven currency pairs are considered: the author show that Google search volume data for the keywords economic crisis + financial crisis, and recession are significantly related to a week-ahead volatility. Note that, the used keywords in this case are not directly related to the FX market.

The internet search volume should be especially suitable to measure investor attention for the cryptocurrency sector, since this asset class has risen thanks to the web. Further, the authors in Da et al. (2011) evidence a strong association between internet search volume intensity and small capitalization stocks; hence, due to the tiny exchange volume in the cryptocurrency asset class with respect to the financial stock market, we may expect a strong positive dependence between the Google Search Volume Index (SVI) and Bitcoin returns. The relationship between the trading volume, the SVI index and Bitcoin returns and volatility has been addressed specifically in Figá-Talamanca and Patacca (2019) and Urquhart (2018). In the former paper, the dependence between Bitcoin returns/volatility and both the total trading volume and the search volume intensity for the keyword “Bitcoin” is analyzed during the sample period from January 2012 to December 2017. More precisely, the authors perform a model selection among several time series model specifications where the lagged trading volume and SVI Google index, suitably transformed, are included among the explanatory factors: it is evidenced that the mean of Bitcoin returns is significantly and positively related to the trading volume level in the previous day and their conditional volatility is positively and significantly affected by the first differences of both the trading volume and the SVI index, again observed in the previous day.Footnote 3 Moreover, taking into account attention measures in the model specification also makes forecasts more accurate.

A different approach is considered in the latter contribution, where the author investigates the relationship between the SVI Google index and Bitcoin returnsFootnote 4 within a vector autoregressive (VAR) bi-dimensional model, estimated on daily times series ranging from August 2010 to July 2017. On the one hand, Urquhart (2018) finds a consistent result with Figá-Talamanca and Patacca (2019) in that the SVI level observed in the previous day does not affect mean Bitcoin returns, yet it does when higher lags are taken into account; in addition, he shows that Bitcoin lagged returns also affect the level of the SVI index, thus evidencing a bidirectional causality, confirmed by the outcomes of the Granger causality test.Footnote 5 On the other hand, he addresses a different yet complementary research question with respect to Figá-Talamanca and Patacca (2019) by modeling the vector of Bitcoin realized volatility and the SVI index;Footnote 6 he proves that the SVI index level does not significantly affect Bitcoin volatility while the converse holds and the SVI level is Granger-caused by the realized volatility of Bitcoin returns. Differently from Figá-Talamanca and Patacca (2019) and Urquhart (2018) does not consider the SVI first differences in his analysis.

In this paper we consider a VAR-EGARCH model setting, extending the approach in Figá-Talamanca and Patacca (2019), in order to analyze the relationship between Bitcoin and the two attention measures within a multivariate setting. Specifically, in order to investigate Granger causality and reverse causality among the three-dimensional vector of Bitcoin returns, Bitcoin trading volume and the SVI index for the keyword “Bitcoin” are described by a three dimensional VAR model.Footnote 7 Since it is not methodologically sound to build a multivariate linear model where returns and their volatility are jointly considered, the model is not augmented with the realized volatility. Instead, the time series of Bitcoin conditional variance, together with the variances of the trading volume and the SVI, are filtered by assuming EGARCH residuals in the VAR equation. If a significant association is found between any two variables, the Granger causality test is also applied to disclose the direction of the association.

Precisely, we test the following hypotheses:

- H1a:

The trading volume is positively associated with Bitcoin returns.

- H1b:

The trading volume is positively associated with Bitcoin volatility.Footnote 8

- H2a:

The SVI index is positively associated with Bitcoin returns.

- H2b:

The SVI index is positively associated with Bitcoin volatility.

- H3:

The SVI index is positively associated with the trading Volume.

Overall, during the time period 2012–2018, the trading volume and the SVI level do not affect Bitcoin returns while a very strong negative reverse causality is evidenced. Indeed, a positive and significant dependence is found between both attention measures and Bitcoin volatility: an increase in the search intensity or in the trading volume do increase Bitcoin volatility.

However, internet search volume increases substantially during days around important events: it may be the case that the positive relationship found between SVI and Bitcoin volatility is due to specific events related to the Bitcoin network, rather than to a direct association between the variables. To this extend, SVI may be interpreted as a mediator variable representing the indirect effect of relevant events on Bitcoin volatility.

Hence, we also verify the following hypothesis

- H4:

The SVI index mediates the relationship between Bitcoin volatility and relevant events within the Bitcoin network/market.

Among important breakthrough events, we mention the arrest of the owner of Silk Road,Footnote 9 the hack attack to Mt. GoxFootnote 10 leading to its bankruptcy, the creation of new cryptocurrencies and the launch of Bitcoin futures in United States major market exchanges.

In order to verify hypothesis H4 we adopt two approaches: first, we introduce a dummy variable explicitly in the model setting with unit value on dates where a relevant event is recorded; then, alternatively, we split the sample according to breakpoints selected by applying the methodology in Bai and Perron (1998, 2003).

We show that selected events do affect previous conclusions confirming our conjecture that SVI acts as mediator between important events and Bitcoin volatility.

Further, by focusing on seemingly disrupting events which induce structural changes in the time series of Bitcoin returns we are able to appreciate how the causality or reverse causality relation between market attention and Bitcoin returns varies across sub-periods, see Table 15 for an overview of the outcomes.

The paper is organized as follows: in Sect. 2 we describe the model specification, in Sect. 3, after a preliminary data analysis, we address hypotheses H1–H3 while Sect. 4 is devoted to the assessment of the hypothesis H4. Finally, Sect. 5 gives some concluding remarks.

2 Model specification

In order to answer our research questions, we consider a Vector AutoRegressive (VAR) model for the vector process \(\mathbf {y_t}=(r_t,v_t,s_t) \mbox{ where } r,v \mbox{ and } s\), respectively denote Bitcoin returns, trading volume and SVI, possibly augmented with a dummy variables representing relevant events. The full model specification is given by

where \({\upmu }=(\mu _r,\mu _v,\mu _s)\) is a vector of intercepts , \(\varPhi\) is the coefficients matrixFootnote 11 and \(\epsilon _t=(\epsilon ^r_t,\epsilon ^v_t,\epsilon ^s_t)\) is the error process; \(I_{t}\) is a dummy variables which takes unity values on selected events dates as listed in Table 4. To answer hypotheses H1a, H2a and H3 the parameter \(\delta =(\delta _r,\delta _v,\delta _s)\), representing the coefficients of the dummy variable, is set to zero i.e. the dummy variable is included only to verify H4.

Since we also want to investigate the relationship between market attention and Bitcoin volatility, we assume that the VAR residuals are modeled through an EGARCH process,Footnote 12 augmented with the market attention explanatory variables and, when addressing hypothesis H4 by also including the event-related dummy variable above defined.

Precisely, we assume that \(\epsilon _t= (\epsilon ^r_t,\epsilon ^v_t,\epsilon ^s_t )\), where the error terms \(\epsilon ^r_t=\sqrt{h_t^r}\eta ^r_t\), \(\epsilon ^v_t=\sqrt{h_t^v}\eta ^{v}_t,\epsilon ^{s}_t=\sqrt{h_t^s}\eta ^{s}_t\) are described by following equations:

and

with constant parameters \(\alpha _{j0},\alpha _{j1},\beta _j\), \(\lambda _j\), \(\theta _j\) and \(\gamma _{ju}\), for \(j,u=r,v,s\), describing the conditional variances of the three variables.Footnote 13

The estimation of model parameters is performed in two steps: first we estimate the VAR model in (1), then we fit the EGARCH model specifications in (2)–(4) respectively on corresponding residuals.

An alternative approach would be to consider a full multivariate VAR-GARCH model, see among others Jeantheau (1998) and Ding and Engle (2001), where the error process is given by \(\epsilon _t=\sqrt{H_t}\eta _t\), with \(H_t\) representing the conditional covariance matrix and being \(\eta _t\) a random vector of Gaussian noise. In Jeantheau (1998) the covariance matrix is decomposed into

where \(D_t=I \,\mathbf {h}_t\), with \(\mathbf {h}_t:= (h^r_t,h^v_t,h^s_t )\) and I the identity matrix, and R is the constant conditional correlation matrix; this model specification is known as extended constant conditional correlation model (E-CCC). This representation allows to write the conditional variances \(\mathbf {h}_t\) as a GARCH(p,q) model. For the simple GARCH(1,1) specification we may write

where \(\omega \in \mathbb {R^n}\), A and B are \(N\times N\) matrices, and \(\odot\) denotes the Hadamard product.Footnote 14 In Ding and Engle (2001) a more general framework is considered to model the reciprocal dependence within terms in the conditional variance matrix. However, both models would describe the mutual relationship between the conditional variances of \((r_r,v_t,s_t)\) instead of measuring the influence of both attention levels \((v_t,s_t)\) on the variance of returns, which is under investigation in this paper. Hence, the application of the full multivariate VAR-GARCH model is not well suited for the scope of this research.

3 Assessing the relationship between Bitcoin returns and volatility and market attention measures

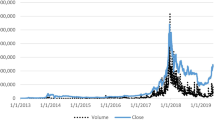

The time series of Bitcoin daily pricesFootnote 15 and trading volume are downloaded from the website https://blockchain.info/ for the time period January 2012 to December 2018. The Google search volume index (SVI) is provided by Google through the website https://trends.google.it/trends/ and represents the relative volume of searches, from 0 to 100, for one or more queries in the Google browser and over a defined date range.Footnote 16 It is computed daily as the ratio between the number of search queries and its maximum value within the considered time period, multiplied by 100. In our case we downloaded the SVI time series for the word “Bitcoin”. It is important to remark that Googletrends provides daily observations for up to one quarter; in order to gather data for the whole period under investigation we need to download overlapping available time series for shorter periods and adjust data to recover the 0–100 values for a longer time series, by applying a suitable basis change of index numbers.

In Table 1 summary statistics are summed up for the three variables; both trading volume and SVI time series are transformed in logarithmic scale to reduce skewness and kurtosis.

Outcomes in the table evidence that normality is rejected for Bitcoin returns as well as for attention measures, as the Jarque Bera (JB) test p value indicates. Stationarity of above variables is tested via the Augmented Dickey Fuller (ADF) test by applying the functions jbtest.m and adftest.m provided in the Statistics and Econometrics Toolboxes of Matlab\(^{\circledR }\). The test outcomes show that Bitcoin returns are stationary while the trading volume and the Google SVI are stationary with a non-zero constant. In addition, the low correlation between the trading volume and the SVI index (0.028) guarantee the absence of possible multi-collinearity effects in model estimation.

The model specification in Sect. 2 is fitted to the daily time series of Bitcoin returns, trading volume and Google search volume intensity (SVI). Estimated coefficients are reported as well as their standard deviation in Tables 2, 3, 4, 5 and 6. In order to assess their relative importance in the model specification we perform the standard t test for significance; the t stat and the p value of the test are also shown in the tables.

Table 2 report the estimation results for the VAR model when the dummy variable is not included. By looking at this table we are able to verify hypotheses H1a, H2a and H3. Note that \(\varPhi _{r v},\varPhi _{r s}\) are not significant while \(\varPhi _{v r}\) and \(\varPhi _{s r}\) are positive and significant. Hence, the trading volume and SVI do not affect Bitcoin returns which in turn do influence both the trading volume and the SVI levels. The Granger tests confirm a reverse causality effect between both attention measures and Bitcoin returns. This finding is consistent with evidences in Urquhart (2018) and Figá-Talamanca and Patacca (2019), though a shorter time series is analyzed in the quoted papers.

In addition, differently than for returns of other financial assets, the autoregressive coefficient \(\varPhi _{r r}\) is also strongly significant; the autoregression coefficients are extremely significant also for the trading volume and the SVI levels.

As for hypothesis H3 we can conclude that the internet search volume is strongly affected by the trading volume in Bitcoin while the converse is not true, as also reported in Urquhart (2018).

The second stage estimation outcomes are shown in Table 3 where coefficients for the EGARCH specification are summed up, again without including the dummy variable. By looking at the outcomes it is possible to check hypotheses H1b and H2b for Bitcoin volatility.

Since \(\gamma _{rv},\gamma _{rs}\) are positive and significant we argue that both the trading volume and the SVI index do affect Bitcoin returns variance, hence confirming H1b and H2b. No reverse causality is evidenced in this case. Again, these results are qualitatively consistent with findings in Figá-Talamanca and Patacca (2019) and in Urquhart (2018), despite a different specification of Bitcoin volatility in the latter.

4 Detecting changes when relevant events are taken into account

In order to verify the hypothesis H4 we adopt two different approaches: first, we estimate the full specification model described in (1)–(4), then, alternatively, we split the sample according to breakpoints selected by applying the methodology in Bai and Perron (1998, 2003).

4.1 Selection of relevant events

In order to define the dummy variable to be included in (1)–(4), we need to select events that may have affected the price or the volatility of Bitcoin. Of course, the identification of important events is arbitrary: we intentionally considered 3 events per year (in mean) for a total of 21 events. Among possible relevant events: the launch date of altcoins, such as Ethereum and Ripple; reputational shocks in the overall system, such as the Silk Road owner arrest and the Bank of China ban; increased risk perception due to hacked exchanges, such as Mt. Gox, which then filed for bankruptcy, or other main exchanges; regulation announcements; protocol changes such as forks in Bitcoin blockchain. Further, events which may increase visibility and trust in Bitcoin and the whole cryptocurrency sector are included, such as the introduction of Bitcoin futures in established financial exchanges or announcements of Government backed tokens. Selected events occurred during the considered life span of Bitcoin are listed, together with corresponding reference dates, in Table 4.

To take into account the influence of above events on Bitcoin returns and volatility, a dummy variable is added to the usual VAR model specification as described in Sect. 2.

In Tables 5 and 6 estimations results are reported for the full specification case: the coefficients of the dummy variable in the mean (\(\delta _r\)) and in the volatility (\(\theta _r\)) equations are strongly significant and substantial in value.

In addition, the introduction of the dummy variable strongly reduces the magnitude and the significance of the coefficients of both attention measures. Precisely, the values \(\gamma _{rv},\gamma _{rs}\) almost vanish and the former is no longer significant. Overall, it seems that the introduction of an indicator for relevant events strongly reduces the influence of market attention measures on Bitcoin volatility, supporting hypothesis H4. On the contrary, the introduction of the dummy variable has no effect on the variance of the two attention measures.

4.2 Selection of disrupting events

As an alternative method to address hypothesis H4, we investigate whether any breakthrough event occurred during the life time of Bitcoin, is able to change the relationships hypothesized in H1–H3.

This is done by formally looking for structural breaks in Bitcoin returns time series and by associating the statistical results to important events among those listed in Table 4. Once these breakthrough events are identified, the model specification in (1)–(4), without including the dummy variable, is estimated in corresponding sub-samples.

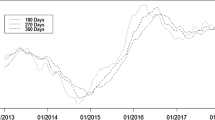

The time series breakpoints are obtained by applying the function breakpoint.r available in the package strucchange for the open source R software Kleiber et al. (2002), based on Bai and Perron (1998, 2003).

The methodology identifies three breakpoints within the whole time series: November 4, 2013, September 23, 2016 and October 11, 2017. Though the exact dates cannot be immediately related to one of the events listed in Table 4, we can safely link the first breakpoint to a reputation break due to the Silk Road owner arrest and after the Central Bank of China banned the use of Bitcoin transactions to domestic financial institutions. The second breakpoint is possibly related to regulatory issues, after intervention of the Internal Revenue Service (IRS) on US based Bitcoin Exchanges. Finally, the third breakpoint is clearly related to announcements on the forthcoming launch of Bitcoin futures in the Chicago Board Options Exchange (CBOE).

Four non-overlapping sub-samples are defined by the above breakpoints; for the sake of completeness we also report in Tables 7 and 8 basic summary statistics for the selected sub-samples of considered time-series.

In Table 8 descriptive statistics are summed up for the corresponding sub-samples of attention measures.

The augmented Dickey Fuller (ADF) tests are also reported in the tables: the trading volume is stationary with a non zero constant for all of the sub-samples while the SVI Google index is stationary for the first and second sub-samples and it is stationary around a deterministic trend in the third and fourth ones. We don’t expect any multicollinearity effect in the estimation, being the correlation of the trading volume and the SVI quite low across all samples.

Empirical results are fully reported only for the first and fourth sub-samples, see Tables 9, 10, 11, 12 and 13, while outcomes for the other cases are briefly discussed.Footnote 17 In Table 11 we also display the p values of the Granger causality test, for each pair of variables within r, v, s, for the four sub-sample as well as the whole time period.

Note that, the attention variables do not influence Bitcoin returns in any of the sub-samples, being \(\varPhi _{r v}\) and \(\varPhi _{r s}\) non significant. Similarly, Bitcoin returns do not affect neither the trading volume nor the internet search intensity, being also \(\varPhi _{v r}\) and \(\varPhi _{s r}\) non significant. By looking at Table 11, we may conclude that no causality effects are present between market attention measures and Bitcoin returns, in any direction. Hence H1a and H2a do not hold, in any sign, when disrupting events are taken into consideration. In addition, the reverse causality found between SVI index and Bitcoin returns in the full time series seems to be due only to the third sub-period under analysis, which corresponds to the period of exponential increase of the price of Bitcoin.

As for hypothesis H3, the SVI index and the volume are weakly or non related at all in the first and third sub-samples while a bidirectional causality effect, with opposite signs, is evidenced between the two attention measures in both the second and fourth samples. Such evidence is confirmed by the Granger causality test, see Table 11.

As for Bitcoin volatility, Hypotheses H1b and H2b on Bitcoin volatility may be addressed by looking at Tables 12 and 13, where estimation results are summed up for the conditional variance in the first and the last sub-periods,Footnote 18 respectively.

Outcomes show that in the first three periods the volatility of Bitcoin is significantly affected by the SVI index while the converse is nor true, thus supporting hypothesis H2b. On the contrary, the level of the trading volume is not significant in Bitcoin variance while Bitcoin returns do influence the trading volume variance, hence hypothesis H1b is no longer valid within the sub-samples, but a reverse dependence is evidenced.

For the fourth sub-sample we find opposite results: indeed, the SVI is not significant in explaining Bitcoin variance while returns are significant in the SVI variance and returns; in addition, trading volume level affects Bitcoin variance, and Bitcoin returns affect the trading volume variance in a kind of mutual association.

It is worth noticing that the variance of the volume is also strongly affected by the SVI level in all sub-samples, differently from the whole sample case. This results show that hypothesis H3 holds when structural changes in the data are accounted for.

To further investigate the hypothesis H4, the values of the SVI coefficient \(\gamma _{rs}\) in (2), estimated on the full sample and the four sub-periods, are displayed in Table 14. It is fully confirmed that the SVI index acts as a kind of mediator variable between events and Bitcoin volatility, being all the values in the sub-samples lower than the corresponding estimates in the whole sample, less significant in the third sub-sample and not significant at all in the last period.

A summary on the validity of hypotheses H1–H3 in the whole sample and in the four sub-samples obtained by selecting breakpoint dates, is reported in Table 15. Though hypotheses statements are defined as direct positive associations within the text, direct and reverse relationships assessments are displayed in the table for the sake of completeness; further, when a significant association is found (yes), its sign, positive (+) or negative (−), it is also reported.

5 Concluding remarks

In this paper we contribute to the research on the relationship between market attention and Bitcoin returns and volatility. This is done by considering a multivariate VAR-EGARCH model setting, which is estimated in two steps. This approach generalizes the one in Figá-Talamanca and Patacca (2019) and is complementary to that in Urquhart (2018) where Bitcoin volatility is proxied by the so called realized volatility, computed via intraday Bitcoin returns, and the SVI effect on other variables is measured individually. We find that neither trading volume nor SVI level affect Bitcoin returns while a very strong negative reverse causality is evidenced between the SVI index and the trading volume. In addition, a positive and significant dependence is detected between both attention measures and Bitcoin volatility.

Since important events occurred during Bitcoin lifetime have possibly affected its price dynamics, they may have also influenced the relationships which are subject of our study. Important breakthrough events are, for example, the arrest of the owner of Silk Road, the hack attack, and following bankruptcy, of Mt. Gox, and the launch of Bitcoin futures in the CBOE.

Hence, we select a list of 21 relevant events and account for a dummy variable in the model specification, with unit value on corresponding dates; estimated parameters confirm that the SVI index may be seen as a mediator variable between selected events and Bitcoin volatility.

In order to further investigate the dependence of the verified hypotheses H1–H3 on specific events, we identify three structural breaks dates in the time series of Bitcoin returns which may be attributed to reputation shocks, regulatory issues and to the launch of Bitcoin futures, proved to be disrupting events for the Bitcoin system. By splitting the whole time series accordingly, and estimating our model specification on each sub-period separately, we are able to appreciate how the dependence between market attention and Bitcoin returns and volatility varies across different time spans. Table 15 summarizes hypotheses assessments across all sub-periods in comparison to the whole time series.

It would be interesting to investigate whether the introduction of event related dummies or breakpoints improves either the forecasting performance or the computation of risk measures within the considered models, by applying a conditional approach in line with Bellini and Figà-Talamanca (2007). These issues will be addressed in future research. Besides, events are selected arbitrarily in this study; an alternative approach, which deserves further study, is to rank events importance by counting the number of records for specific keywords/topics in the media.Footnote 19

Notes

The term pseudonymous, rather than anonymous, is meant to stress the fact that sender and receiver addresses as well as currency amounts of all transactions recorded in the blockchain are completely disclosed, though the physical identities of the users are unknown.

Altcoins is the term commonly used for cryptocurrencies other than Bitcoin.

When the time span is split in two non overlapping sub-samples of equal size outcomes are analogous for the first sub-period while the level of SVI is the only significant attention measure in the mean and volatility of Bitcoin.

When the time span is split in two non overlapping sub-samples outcomes are quite different since no causality is evidenced in any direction for the first sub-period while only reverse causality is detected in the second sub-sample.

For the sake of parsimony only one lag is considered for the three variables.

Within the whole paper we treat variance and volatility (the variance square-root) as synonyms. Though they aren’t, the relationships under investigation is the same for both variables, being them positively related.

Silk Road was an online black market exchanging Bitcoins for drugs and other illegal goods.

Mt. Gox was a major exchange in the early years of Bitcoin lifetime.

For the sake of comprehension we use the letters (r, v, s) related to the variables under investigation, instead of numerical subscripts; for instance \(\varPhi _{rs}\) represents the coefficient of variable \(s_t\) in the equation describing the variable \(r_t\).

Since we are mainly interested in qualitative results it is beyond our aims to consider all possible GARCH specifications among the many possible choices; in addition, the EGARCH was selected as best model specification in Figá-Talamanca and Patacca (2019).

For the sake of comprehension we use the letters (r, v, s) related to the variables under investigation, instead of numerical subscripts; for instance \(\gamma _{rv}\) represents the coefficient of the variable \(v_t\) in the equation describing the conditional variance \(h^r_t\) of variable \(r_t\).

Given two \(m \times n\) matrices \(U = (u_{ij})\) and \(V = (v_{ij})\), the Hadamard product is defined as the \(m \times n\) matrix of elementwise products \(U \odot V = (u_{ij} v_{ij})\).

Closing price at 00:00 GMT.

The search volume can also be limited to specific countries.

Detailed results for all sub-samples are available upon request.

Tables for the second and third sub-samples are not reported here but are available upon request.

For instance, by applying textual analysis algorithms on news headline or on specialized forums.

References

Ahn, Y., & Kim, D. (2019). Sentiment disagreement and Bitcoin price fluctuations: A psycholinguistic approach. Applied Economics Letters. https://doi.org/10.1080/13504851.2019.1619013. (ISSN 1466-4291).

Almudhaf, F. (2018). Pricing efficiency of Bitcoin trusts. Applied Economics Letters, 25(7), 504–508.

Baek, C., & Elbeck, M. (2015). Bitcoins as an investment or speculative vehicle? A first look. Applied Economics Letters, 22(1), 30–34.

Bai, J., & Perron, P. (1998). Estimating and testing linear models with multiple structural changes. Econometrica, 66, 47–78.

Bai, J., & Perron, P. (2003). Computation and analysis of multiple structural change models. Journal of applied econometrics, 18(1), 1–22.

Barber, B. M., & Odean, T. (2007). All that glitters: The effect of attention and news on the buying behavior of individual and institutional investors. The Review of Financial Studies, 21(2), 785–818.

Bellini, F., & Figà-Talamanca, G. (2007). Conditional tail behaviour and value at risk. Quantitative Finance, 7(6), 599–607.

Bistarelli, S., Cretarola, A., Figà-Talamanca, G., Mercanti, I., & Patacca, M. (2018). Is arbitrage possible in the Bitcoin market? (work-in-progress paper). In M. Coppola, E. Carlini, D. D’Agostino, J. Altmann, & J. Á. Bañares (Eds.), Economics of grids, clouds, systems, and services (pp. 243–251). Cham: Springer.

Bistarelli, S., Cretarola, A., Figà-Talamanca, G., & Patacca, M. (2019). Model-based arbitrage in multi-exchange models for Bitcoin price dynamics. Digital Finance. https://doi.org/10.1007/s42521-019-00001-2. (ISSN 2524-6186).

Blau, B. M. (2017). Price dynamics and speculative trading in Bitcoin. Research in International Business and Finance, 41(Supplement C), 493–499. https://doi.org/10.1016/j.ribaf.2017.05.010. (ISSN 0275-5319).

Bukovina, J., & Martiček, M. (2016). Sentiment and Bitcoin volatility. Technical report, Mendel University in Brno, Faculty of Business and Economics.

Chronopoulos, D. K., Papadimitriou, F. I., & Vlastakis, N. (2018). Information demand and stock return predictability. Journal of International Money and Finance, 80, 59–74. https://doi.org/10.1016/j.jimonfin.2017.10.001. (ISSN 0261-5606).

Ciaian, P., Rajcaniova, M., & Kancs, A. (2016). The economics of Bitcoin price formation. Applied Economics, 48(19), 1799–1815.

Cretarola, A., & Figà-Talamanca, G. (2019). Detecting bubbles in Bitcoin price dynamics via market exuberance. Annals of Operations Research. https://doi.org/10.1007/s10479-019-03321-z. (ISSN 1572-9338).

Cretarola, A., Figà-Talamanca, G., & Patacca, M. (2018). A continuous time model for Bitcoin price dynamics. In M. Corazza, M. Durbán, A. Grané, C. Perna, & M. Sibillo (Eds.), Mathematical and statistical methods for actuarial sciences and finance: MAF 2018 (pp. 273–277). Cham: Springer.

Cretarola, A., Figà-Talamanca, G., & Patacca, M. (2019). Market attention and Bitcoin price modeling: Theory, estimation and option pricing. Decisions in Economics and Finance. https://doi.org/10.1007/s10203-019-00262-x. (ISSN 1129-6569).

Da, Z., Engelberg, J., & Gao, P. (2011). In search of attention. The Journal of Finance, 66(5), 1461–1499.

Dimpfl, T., & Jank, S. (2016). Can internet search queries help to predict stock market volatility? European Financial Management, 22(2), 171–192.

Ding, Z., & Engle, R.F. (2001). Large scale conditional covariance matrix modeling, estimation and testing. NYU working paper No. Fin-01-029, 2001. Available at SSRN 1294569.

Dyhrberg, A. H. (2016). Bitcoin, gold and the dollar—a garch volatility analysis. Finance Research Letters, 16(Supplement C), 85–92. https://doi.org/10.1016/j.frl.2015.10.008. (ISSN 1544-6123).

Figá-Talamanca, G., & Patacca, M. (2019). Does market attention affect Bitcoin returns and volatility? Decisions in Economics and Finance. https://doi.org/10.1007/s10203-019-00258-7. (ISSN 1129-6569).

Gervais, S., Kaniel, R., & Mingelgrin, D. H. (2001). The high-volume return premium. The Journal of Finance, 56(3), 877–919.

Gregoriou, A. (2019). Cryptocurrencies and asset pricing. Applied Economics Letters, 26(12), 995–998.

Hou, K., Xiong, W., & Peng, L. (2009). A tale of two anomalies: The implications of investor attention for price and earnings momentum. Unpublished paper, available at SSRN 976394.

Jeantheau, T. (1998). Strong consistency of estimators for multivariate arch models. Econometric Theory, 14(1), 70–86.

Katsiampa, P. (2017). Volatility estimation for Bitcoin: A comparison of garch models. Economics Letters, 158(Supplement C), 3–6. https://doi.org/10.1016/j.econlet.2017.06.023. (SSN 0165-1765).

Kleiber, C., Hornik, K., Leisch, F., & Zeileis, A. (2002). Strucchange: An r package for testing for structural change in linear regression models. Journal of Statistical Software, 7(2), 1–38.

Kristoufek, L. (2013). BitCoin meets Google Trends and Wikipedia: Quantifying the relationship between phenomena of the Internet era. Scientific Reports, 3, 3415.

Kristoufek, L. (2015). What are the main drivers of the Bitcoin price? Evidence from wavelet coherence analysis. PLoS One, 10(4), e0123923.

Mbanga, C. L. (2019). The day-of-the-week pattern of price clustering in Bitcoin. Applied Economics Letters, 26(10), 807–811.

Nadarajah, S., & Chu, J. (2017). On the inefficiency of Bitcoin. Economics Letters, 150(Supplement C), 6–9. https://doi.org/10.1016/j.econlet.2016.10.033. (ISSN 0165-1765).

Smith, G. P. (2012). Google internet search activity and volatility prediction in the market for foreign currency. Finance Research Letters, 9(2), 103–110.

Urquhart, A. (2016). The inefficiency of Bitcoin. Economics Letters, 148(Supplement C), 80–82. https://doi.org/10.1016/j.econlet.2016.09.019. (ISSN 0165-1765).

Urquhart, A. (2018). What causes the attention of Bitcoin? Economics Letters, 166, 40–44. https://doi.org/10.1016/j.econlet.2018.02.017. (ISSN 0165-1765).

Yermack, D. (2015). Is Bitcoin a real currency? An economic appraisal. In D. L. K. Chuen (Ed.), Handbook of digital currency (pp. 31–43). Elsevier.

Acknowledgements

The authors wish to thank the participants of EURO 2018 and iCare 2018 Conferences, especially Carol Alexander and Dmitri Vinogradov, for interesting discussion on the topics of the paper and the anonymous reviewer whose comments and suggestions helped to substantially improve the paper. This research is partially supported by Fondazione Cassa di Risparmio di Perugia, Grant no. 2018.0247.021, and FRB Grant from University of Perugia (FRB 2018).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Figà-Talamanca, G., Patacca, M. Disentangling the relationship between Bitcoin and market attention measures. J. Ind. Bus. Econ. 47, 71–91 (2020). https://doi.org/10.1007/s40812-019-00133-x

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40812-019-00133-x