Abstract

As the ongoing shareholding structure reform continues to reduce the level of ownership concentration of Chinese listed companies, hostile takeovers have been on the rise in China, so has the use of takeover defences. The recent high-profile case of Vanke vs Baoneng has generated an intensive social debate on the use of takeover defences and their regulation in China. This paper undertakes an in-depth study of the Chinese regime for takeover defences both in the books and in practice. From a comparative perspective, it reveals that Chinese law is a mixture of experiences transplanted from overseas jurisdictions, but functions differently due to the unique local conditions in China. It then empirically examines how takeover defences are used in practice, finding that takeover defences, particularly ex ante defences, are widely adopted by Chinese listed companies. This is a matter of concern given that takeovers have important economic functions particularly at the present stage of China’s economic development. In spite of this, the paper refutes the idea of a blanket ban on the use of takeover defences, because takeover defences have both beneficial and detrimental effects. In regulating takeover defences, there needs to be a delicate balance between allowing the use of takeover defences and protecting shareholders’ rights. It is submitted that the primary power to decide on the use of takeover defences should be vested in the hands of shareholders. Considering the local situation in China where the main agency problem of corporate governance is between majority and minority shareholders, it is further argued that the issue of takeover defences should not be left entirely to shareholders in the name of corporate autonomy, but rather need to have some legal intervention to protect the rights of shareholders, particularly minority shareholders, in relation to the use of takeover defences.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Takeovers are a significant feature of corporate life and as such have attracted enormous attention in securities laws worldwide. Although the Chinese securities market was established at the beginning of the 1990s and has since grown rapidly, hostile takeovers did not become an issue until recently. In the last 2–3 years, the weak stock market, ample funds for takeover transactions, and the less concentrated shareholding structure of Chinese listed companies together provide a favourable environment for hostile takeovers. Hostile takeovers are on the rise, so is the use of takeover defences. The recent high-profile case of Vanke vs Baoneng,Footnote 1 for example, has generated an intensive social debate on the use of takeover defences and the regulation thereof in China.

Depending on the time when takeover defences are used, they can be broadly divided into two categories, namely ex ante defences and ex post defences. Ex ante defences are introduced before the emergence of an imminent takeover offer, and they usually take the form of provisions in the articles of association of listed companies. By contrast, ex post defences are initiated after a specific takeover threat arises, and apart from constitutional provisions, there are a variety of defensive tactics. In general, ex ante defences are proactive, prophylactic and long standing, while ex post defences are reactive, targeted and one off.

Internationally, different jurisdictions have adopted different laws on the issue of takeover defences. Naturally, each regulatory model has its advantages and disadvantages, and the efficacy of any law depends very much on the particular context in which it operates. Drawing upon international experiences, China has formally established its legal regime for takeover defences since 2002. How has China transplanted foreign laws in relation to takeover defences? Are they properly adapted to the Chinese local conditions? Have they been effectively enforced in practice? How can the Chinese law be improved? This paper aims to shed light on these questions, examining both the law in the books and the law in action for takeover defences in China. It will first discuss the relevant rules governing takeover defences under Chinese law and compare them with their counterparts in overseas jurisdictions. This is followed by a comprehensive empirical enquiry into the use of takeover defences in practice, including both ex ante and ex post defences. The empirical findings will then be used to inform and anchor a theoretical analysis of the problems and prospects related to takeover defences in China.

2 A Background Discussion: The Market for Takeovers

2.1 The Rise of Hostile Takeovers: Three Preconditions

Why have hostile takeovers recently been on the rise in China? International experiences have shown that hostile takeovers will emerge if share ownership becomes sufficiently dispersed and macroeconomic factors make acquisitions attractive.Footnote 2 In Japan, for instance, the rise of hostile takeovers in the early 2000s was mainly attributed to the changes in the market environment: many public firms in Japan were traded below their asset values at that time; there was a pool of institutional shareholders that had sufficient funds and relevant expertise for hostile takeovers; and the level of institutional cross-shareholding of Japanese public firms declined precipitously.Footnote 3 This set of circumstances that are conducive to hostile takeovers is also present in China to some extent, including attractive targets, adequate funding and a favourable shareholding structure of the target. The Chinese stock market has not seen these three preconditions until very recently (in the last 2–3 years).

To start with, many Chinese listed companies have become attractive takeover targets as a result of the declining stock market. The Shanghai Composite Index recently dropped over 40% in one year, from more than 5000 in mid-June 2015 to less than 3000 in late September 2016. During this period, 59% of companies lost more than 30% of their peak stock values. The manufacturing giant China First Heavy Industries, for example, lost 72% of its market value during this period.Footnote 4 The plunging stock market even leaves some of the state’s best companies vulnerable to takeovers because a battered stock is cheaper to buy and is thus more attractive to an acquirer.

Secondly, takeover funding used to be an obstacle for potential buyers in China. There was a time when merchant banks were prevented from providing takeover funding,Footnote 5 and private loans between legal persons were prohibited.Footnote 6 These restrictions, however, were gradually removed, as part of the government efforts to improve financing services for small and micro businesses. In 2008, the China Banking Regulatory Commission prescribed that merchant banks can provide funding for takeover buyers.Footnote 7 In 2015, the Supreme Court released an important judicial interpretation, which not only removed the 10-year ban on private loans between non-financial institutions, but also upheld the validity of peer-to-peer (P2P) lending, an important form of internet finance.Footnote 8 With the rapid development of internet finance in China in the last two to three years,Footnote 9 raising funds through private placement, P2P lending, and internet insurance instruments has never become so convenient in history.

Lastly, for a hostile acquirer with sufficient money and a desirable target, the task of buying used to be very difficult in China due to the highly concentrated shareholding structure. Traditionally, many Chinese listed companies had a very high level of shareholding, usually the controlling stake, which was not allowed for trading.Footnote 10 Non-tradable shares were created by the government in the early 1990s to prevent uncontrolled sales of State-Owned Enterprises (SOEs) to the private sector, but the system artificially distorted the functioning of the market and caused many corporate governance problems such as opportunism on the part of the state majority shareholder and the inhibiting effect on hostile takeovers. In recognition of the problems associated with overly concentrated ownership patterns, the China Securities Regulatory Commission (CSRC) rolled out an innovative plan for the reform of the shareholding structure entitled Share Split Reform (Guquan Fenzhi Gaige) in 2005. Under this reform, the holder of previously non-tradable shares, notably the state, was given the right to sell the shares freely on the stock exchange. In exchange for such a right, the holder of previously non-tradable shares should pay a negotiated amount of compensation to other shareholders. The Share Split Reform had largely finished by the end of 2006.Footnote 11

The 2005 reform provides an environment that is conducive to the rise of hostile takeovers in China. By making the formerly non-tradable shares tradable, the reform has significantly reduced the level of ownership concentration in Chinese listed companies. It can be seen from Table 1 that there has been a clear decline in the shareholding of Chinese listed companies during the period between 2004 (the year immediately before the 2005 shareholding structure reform started) and 2016 (the tenth year after the reform): the mean decreases from 41.75% to 34.12%, representing a drop of about 18%; and the median slides from 39.91 to 32.00%, representing a drop of about 20%.

Figure 1 furthermore groups the companies into four categories, according to the shareholding of their largest shareholders. As Fig. 1 shows, the years after the reform witnessed a noticeable decrease in the percentages of companies with their largest shareholders holding more than 50%, and a moderate increase of companies with the largest shareholders holding less than 10% and 10–30% of the shares. Apart from the change in percentage terms, attention should also be paid to the change in absolute terms. As the total number of listed companies increased substantially during the period of 2004–2016, there are significantly more companies with the largest shareholders holding less than 30% of the shares. As shown in Fig. 2, in 2004 there were only 1297 listed companies in the sample, 35% of which had a smaller than 30% largest shareholder, and hence the number of companies in this category was 454; in 2016, even though the companies with the largest shareholders holding less than 30% accounts for 44% of all listed companies, the absolute number of this type of companies grew to 1397 (more than three times that in 2004, because the total number of listed companies jumped to 3175).

2.2 A Case Study: Vanke vs Baoneng

The hostile takeover bid for Vanke by Baoneng has attracted enormous attention both in China and internationally.Footnote 12 The case serves as a wake-up call that, with the maturity of the three pre-conditions, hostile takeovers have now become a reality in the Chinese stock market.

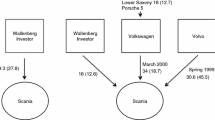

The target company, Vanke, is regarded as an icon property development company in China with large capitalization and a good reputation in terms of profitability and corporate governance, but at the time of the takeover it had quite low share price for various reasons. Unlike many listed companies in China, Vanke’s shareholding structure was highly dispersed before the case, with only six shareholders holding more than 3% of the shares and the then largest shareholder Huarun (a state-owned enterprise at the central level) owning only 15.29%. Baoneng, the acquirer, started off as an agricultural product company in Shenzhen and has developed into a corporate group branching into many businesses such as property development, finance, logistics and medical services. Compared to Vanke, Baoneng is much less well known in the business world and is much smaller in size. From July to December 2015, Baoneng continued to acquire Vanke shares through several subsidiaries, notably an insurance company called Qianhai Life Insurance. On 17 December 2015, Baoneng came to hold 23.53% of Vanke’s shares thereby becoming the largest shareholder, and on 5 July 2016 Baoneng increased its shareholding further to 24.97%. It should be noted that in funding the acquisition of Vanke shares, Baoneng aggressively raised funds from private parties through issuing corporate bonds and insurance instruments.

The chairman of Vanke, Mr Wang Shi, declared that Baoneng was an unwelcome bidder due to its private ownership and business background. Baoneng responded that the merits of the takeover deal should be judged by the market. As Vanke’s corporate charter did not contain powerful anti-takeover provisions, it resorted to the so-called ‘white knight’ strategy under which the target company invites a friendly third party to acquire the company so as to save it from the hostile acquirer. In March 2016, Vanke invited Shenzhen Metro (a state-owned enterprise at the local level) to enter into a major asset transaction, but this move was jointly opposed by Huarun and Baoneng. Further, on 19 July 2016, due to the failure of the Shenzhen Metro deal, Vanke reported to the Shenzhen Stock Exchange and the securities regulator that there were legal problems associated with the wealth management scheme that Baoneng used to fund its acquisition of Vanke shares. Clearly, this is another measure that Vanke tried to use to derail Baoneng’s hostile takeover.

On 3 December 2016, the chairman of China’s securities regulator publicly made very harsh comments on the use of the funds raised through collective investment schemes to finance transactions such as hostile takeovers. On 24 February 2017, China’s insurance regulator announced several regulatory breaches that Qihan Life had committed, including a misstatement on the source of the funding used to increase the registered capital of Qianhai Life in November 2015 and the failure to comply with relevant rules in investing insurance funding in the securities market in 2015 and 2016. The penalties imposed included fines for Qianhai Life and relevant officers as well as an order to bar the chairman of Qianhai Life from the insurance business for 10 years.

The regulatory intervention had a direct bearing on the fate of the takeover. On 12 January 2017, Huarun announced that it would transfer its shares to Shenzhen Metro and, on the next day, Baoneng announced that it would not seek control of Vanke and would act as a financial investor only. Since then, Baoneng has been incrementally selling its shares in Vanke, and as of the end of September 2018, its shareholding had been reduced to 15%.

Although the takeover battle ended in such a dramatic way and Baoneng failed to acquire Vanke, it has raised awareness of hostile takeovers in the Chinese securities market and is set to have far-reaching implications. The vulnerability of Vanke in the face of the hostile takeover is largely due to the company not having any embedded takeover defences in its constitution, thus illustrating the importance of takeover defences and the regulation thereof. Indeed, the case of Vanke vs Baoneng has prompted many listed companies to add a wide variety of ex ante takeover defences in the form of anti-takeover constitutional provisions.Footnote 13 The types of such provisions will be discussed in more detail later.Footnote 14 This situation raises a series of questions concerning the regulation of takeover defences: should takeover defences be allowed? Who should decide on the use of takeover defences? What is the role of the law in regulating takeover defences? In answering these questions, consideration must be given to the local conditions in China.

3 Regulatory Framework for Takeovers in China

3.1 The Regulator

The China Securities Regulatory Commission (CSRC) is the national securities regulator, with centralized authority to oversee China’s securities market, and hence it has jurisdiction over the takeover of listed companies. In 2006, the CSRC set up a specialised committee known as the mergers and acquisitions (M&A) and Restructuring Examination Committee (Binggou Chongzu Shenhe Weiyuanhui) to deal with takeover-related matters, including the use of takeover defences. This committee is mainly composed of relevant professionals and experts who are appointed on a part-time basis, and its function is to provide opinions on the regulation of takeovers for the CSRC.

In short, as a technocrat, the CSRC is assigned a virtually exclusive dispute resolution role with respect to takeovers. It should be noted, however, that in recent years the CSRC has been gradually reducing administrative intervention in takeover activities by partly eliminating administrative approval requirements and partly transferring some regulatory powers to the stock exchanges.

3.2 The Key Provisions

Due to the broad nature and the wide variety of takeover defences, the legal provisions governing takeover defences can be found in several laws as well as a few administrative rules promulgated by the CSRC. These include, amongst others, the 2005 Securities Law of the People’s Republic of China (hereinafter the 2005 Securities Law),Footnote 15 the 2006 Measures for Regulating Takeovers of Listed Companies (hereinafter the 2006 Takeover Measures),Footnote 16 the 2005 Company Law of the People’s Republic of China (hereinafter the 2005 Company Law),Footnote 17 and the 2005 Company Guidelines for Articles of Association of Listed Companies (hereinafter 2016 Guidelines for Articles of Association).Footnote 18

3.2.1 The 2005 Securities Law (As Amended in 2014) and the 2006 Takeover Measures (As Amended in 2014)

The 2005 Securities Law devotes a whole chapter to the issue of takeovers. This chapter has a total of 16 provisions, but no provision specifically addresses whether, and if so, to what extent takeover defences can be used. Article 101(2) authorizes the CSRC to promulgate detailed rules on takeovers. With this authorization, the CSRC has promulgated the 2006 Takeover Measures, which supersede the twin takeover regulations that the CSRC issued in 2002.

The 2006 Takeover Measures are currently the centrepiece of China’s takeover legal framework, containing two key provisions in relation to the issue of takeover defences.Footnote 19 First, Article 8 is a general rule governing the use of takeover defences by reference to the directors’ duties, stating that

The directors, supervisors and senior managers of a target company shall assume the obligation of fidelity and diligence, and shall equally treat all the purchasers that intend to take over the said company.

The decisions made and the measures taken by the board of directors of a target company for the takeover shall be good for maintaining the rights of the company and its shareholders, and shall not erect any improper obstacle to the takeover by misusing its authorities, nor may it provide any means of financial aid to the purchaser by making use of the sources of the target company or damage the lawful rights and interests of the target company or its shareholders.

Second, Article 33 specifically prohibits the use of certain takeover defences without the approval of the shareholders’ meeting, providing that

During the period after the announcement of a takeover bid and before the completion of the takeover bid, except for conducting ordinary business operations and implementing resolutions made by the general meeting of shareholders, target company management should not cause major impacts on the assets, liabilities, entitlements or business performances of the target company by disposing of assets, engaging in external investments, adjusting the main businesses, providing guarantees or loans and others.

The basic tenet of this provision is that takeover defences must not be taken unless they are approved by the shareholders at the general meeting. There are however some constraints on its application. Looking at the words of this provision, it seems that its application is subject to two conditions, including (1) takeover defences must not result in major impacts on the assets, liabilities, entitlements or business performances of the target company; and (2) takeover defences must be taken after the announcement of takeover bids.Footnote 20 There is a further exemption: the takeover defence is carried out in the ordinary business of the company. As a consequence, under Article 33 a takeover defence may be lawfully adopted even without the approval of the shareholders, as long as it does not have a significant impact on company assets and liabilities, or it is taken before the announcement of a takeover bid, or it constitutes an ordinary business operation.

3.2.2 The 2005 Company Law (As Amended in 2018)

A change of control is by its nature a major event for the company concerned, and thus it is of relevance to look at which corporate organ, the shareholders’ meeting or the board of directors, has the authority to make decisions on corporate control transactions, including the use of defensive tactics, under the company law of any given jurisdiction.

In China, the corporate governance system is basically shareholders-centred in that the shareholders’ meeting is the final decision maker in relation to major issues involving the company, including but not limited to electing and changing the directors and supervisors; making resolutions on an increase or decrease of the company’s registered capital; making resolutions on the merger, division, change of company form, disbanding, liquidation of the company; and revising the articles of association of the company.Footnote 21 In contrast, the board of directors is generally accountable to the shareholders’ meeting, with powers to elaborate major business plans and to submit them to the shareholders’ meeting for approval.Footnote 22

Allocating primary decision-making powers to the shareholders’ general meeting rather than the board of directors has important implications for the use of takeover defences in China. Many defensive measures may constitute major issues of the company and thus require the approval of the shareholders. This would effectively limit the room for management to adopt defensive measures.

Apart from the general division of power between the shareholders’ meeting and the board of directors, there are specific company law provisions that may affect the use of certain defensive tactics. For instance, the practice of the poison pill, a widely used takeover defence in the US, runs foul of Article 126 of the 2005 Company Law, which states that ‘[t]he issuance of shares shall comply with the principles of fairness and impartiality. The shares of the same class shall have the same rights and benefits. The same kind of shares issued at the same time shall be equal in price and shall be subject to the same conditions. The price of each share of the same kind purchased by any organization or individual shall be the same’.Footnote 23 In fact, even if a discriminatory issuance is permissible, the issuance of new shares still faces significant legal barriers in China. Under the merits review requirement of China’s securities offerings regulation, for the company to issue new shares it needs to meet certain substantive financial criteria and to obtain approval from the CSRC.Footnote 24

Neither can a Chinese listed company issue shares with superior voting rights under the current regulatory rules. As explicitly required by the 2005 Company Law, in the general meeting of shareholders, each share carries one voting right with it.Footnote 25 Under this mandatory rule, even if a company issues a class of shares with superior voting rights, the shares will be changed into ordinary shares in the general meeting.

Finally, before the recent 2018 revision of the 2005 Company Law, the practice of share repurchasing could hardly be used as a takeover defence because it was allowed in very limited circumstances and required shareholder approval. Under the 2018 revision, it is easier for the company to conduct share repurchases. For instance, when it is necessary for a listed company to protect corporate value and the rights and interests of the shareholders, share repurchases may be allowed subject to a special resolution of the board of directors according to the company constitution or the authorization of the shareholders’ meeting.Footnote 26

3.2.3 The 2016 Guidelines for the Articles of Association

In China, the CSRC, as the regulator of the securities market, has issued various rules over the corporate governance of listed companies. Of particular relevance to takeover defences is the 2016 Guidelines for the Articles of Association, which essentially provides a template for Chinese listed companies to draft their articles of association. In this way, the CSRC aims to ensure that the articles of association of listed companies are standard and formal, thereby enhancing the level of legal compliance and the quality of information disclosure.

It is made clear, however, that some variations are allowed to the template. Items in the 2016 Guidelines for the Articles of Associations are meant to be the basic elements of the articles of association of listed companies. Without violating the relevant laws and regulations, the listed company can, depending on its particular circumstances, add items that are not contained in the 2016 Guidelines for the Articles of Association, or adjust the wording or sequencing of the items stipulated therein. If a listed company adds to or adjusts the compulsory elements of the 2016 Guidelines for the Articles of Association in order to meet its practical needs, these variations should be highlighted when the board of directors makes public announcements to the effect that it will revise the articles of association.

Hence, it is possible for listed companies to introduce takeover defences by way of constitutional provisions, if the following two conditions are met. The first condition is a substantive rule under which the constitutional provision does not violate the relevant laws and regulations; while the second is a procedural rule requiring the proper disclosure of the constitutional provision concerned.

3.3 Chinese Law: A Mix of US and UK Experiences

Internationally, the US and UK adopt two different approaches to regulating takeover defences. The US law, as represented by Delaware law, adopts the ‘modified business judgment rule’. It is essentially ‘a presumption that in making a business decision, directors of a corporation acted on an informed basis, in good faith and in the honest belief that the action was in the best interests of the company’.Footnote 27 Under the ‘modified business judgment rule’, however, the burden of proof is shifted to the defendant. As was held in the leading case of Unocal Corp. v. Mesa Petroleum Co,Footnote 28 the directors of the target company are required ‘to show that after a “good faith and reasonable investigation”, they saw a danger to corporate policy and effectiveness, and that “[the defensive measure] must be reasonable in relation to the threat posed”.’Footnote 29 It is important to note that management has wide authority to adopt defensive measures under the modified business judgment rule. For instance, the Unocal case involved some rather controversial defensive measures, including the selective exchange offer which was outlawed by the Securities and Exchange Commission (SEC) in 2002.Footnote 30

The UK law, in contrast, is comprised of the fiduciary duty of management and the board neutrality rule, which applies to pre-bid and post-bid defences respectively. The board neutrality rule stipulated in the Takeover Code in general prevents the board from taking defensive measures to defeat an imminent takeover offer without obtaining approval from the shareholders.Footnote 31 Besides the board neutrality rule, the directors of the target company in the UK are subject to equitable principles of fiduciary law in taking pre-bid defences. This fiduciary duty-based system is conceptually similar to that of the US, but there are some nuanced differences in the contents or judicial interpretations of the amorphous notion of a fiduciary duty.Footnote 32

The Chinese regulation of takeover defences is mainly comprised of three categories of rules: the Chinese board neutrality rule, the fiduciary duty of management, and the primacy of shareholders in the allocation of powers between management and shareholders. To start with, the Chinese board neutrality rule under Article 33 of the 2006 Takeover Measures requires shareholder approval for takeover defences. Nonetheless, the Chinese board neutrality rule only applies to defensive measures that fulfil the following preconditions: (1) they must significantly change company assets and liabilities; (2) they must be taken after the announcement of takeover bids. This leaves room for management to adopt post-bid defences, which include defensive measures having no significant influences on the assets and liabilities of a company, or defensive measures adopted before the official announcement of takeover bids.

As for the fiduciary duty, the 2006 Takeover Measures reiterates the duty of care and the duty of loyalty provided in general corporate law.Footnote 33 The legal texts on directors’ duties in China are couched in simple and general terms, and the courts have not provided much further guidance on the meaning of directors’ duties.Footnote 34 Lastly, Chinese corporate law grants a wide range of powers exclusively to the general meeting of shareholders. Important examples include selecting management and determining their remuneration, approving resolutions on the issuance of securities, conglomeration and the split-up of a company, and revising the articles of association of the company.Footnote 35

In short, the main differences between the UK and US model lie in two aspects: shareholder/director decision making and the relatively narrow/wide range of defensive measures. First, in the UK, particularly under the board neutrality rule, the shareholders, rather than the directors, have the final say with respect to the employment of defensive measures. Second, some defensive measures that can be decided by management alone in the US either require shareholder approval or are simply not allowed in the UK.Footnote 36 The Chinese law resembles the UK model by adopting the shareholder primacy governance model as well as the Chinese board neutrality rule, and generally permitting a narrow range of defensive measures. However, due to the limited applicability of the Chinese board neutrality rule, this leaves considerable room for management to adopt post-bid defences.

4 The Use of Takeover Defences: Empirical Enquiries

According to the time when takeover defences are used, they can be broadly divided into two categories, namely ex ante defences and ex post defences. Ex ante defences are introduced before the emergence of an imminent takeover offer, and they usually take the form of provisions in the articles of association of listed companies. It is worth noting that in a broad sense, ex ante defences may take other forms, such as the increase of shareholdings by way of the direct acquisition of shares or cross-shareholding arrangements. These types of ex ante defences are essentially adopted by existing shareholders, and not the incumbent management of the target company. They are not the focus of the discussion here, as the legal concern over takeover defences primarily arises from the possibility of the target management abusing them for the purpose of entrenchment. In theory, constitutional provisions need to be approved by shareholders, but in practice, due to the agency costs inherent in the shareholder-management relationship, the management can exert significant influence on constitutional provisions to pursue their own interests.

By contrast, ex post defences are initiated after a specific takeover threat arises, and apart from constitutional provisions, there are a variety of defensive tactics. In general, ex ante defences are proactive, prophylactic and long standing, while ex post defences are reactive, targeted and one off.

4.1 Ex ante Defences

4.1.1 Methodology

As ex ante defences often take the form of constitutional provisions, it is necessary to examine the constitutions of listed companies in China. In a well-cited 2009 study, the researcher randomly selected 100 Chinese listed companies and then used 40 of them as the sample for empirical analysis (without clearly explaining the criteria according to which the 40 companies had been selected).Footnote 37 Inspired by this study but in an effort to produce a more accurate picture with more recent and greater data, this section randomly selects 300 Chinese listed companies, which are drawn equally from both the Shanghai Stock Exchange and the Shenzhen Stock Exchange.Footnote 38 Further, for the sake of making the picture even more comprehensive, this research also includes unsuccessful attempts to make constitutional changes in the past 12 monthsFootnote 39 that were abolished either after the company received inquiries from the stock exchange or failing to obtain approval from the general meeting.Footnote 40

4.1.2 Research Findings

There are two important findings overall. First, anti-takeover constitutional provisions are quite common amongst Chinese listed companies, particularly those with a dispersed shareholding structure. Of the companies studied, more than half of them have adopted certain defensive measures in their constitutions. Further, although the remainder of the companies in the dataset do not have anti-takeover constitutional provisions, most of them have a controlling shareholder with a shareholding of 30% or higher. Clearly, such a concentrated shareholding structure is in itself powerful in fending off hostile takeover threats.

Logically, in order to thwart a hostile takeover, the first line of defence is to prevent the acquirer from purchasing enough shares, and if this fails, the next defensive tactic is to make it difficult for the acquirer to select new board members. In theory, therefore, anti-takeover constitutional provisions can be broadly grouped into three categories: (1) obstacles to the acquirer purchasing shares; (2) obstacles to the acquirer electing new board members; (3) others. The empirical study reveals that all three categories of provisions have been adopted by Chinese listed companies.

4.1.2.1 Obstacles to the Acquirer Purchasing Shares

In the first category, the anti-takeover constitutional provision usually requires that if a shareholder comes to hold more than five or ten percent of the shares, it should notify the company and obtain approval from the board as well as the general meeting before it can acquire more shares. Historically, a failure to obtain such approval would, according to company constitutions, result in the acquirer losing certain shareholder rights. One company constitution once made it clear that without notifying the board and obtaining its approval, the shares acquired by the shareholder would not carry the rights to elect board members at the general meeting.Footnote 41

Such a direct and absolute restriction on share acquisition is problematic as it may entrench the incumbent management. In the last 2 years, obstacles to further share acquisition have taken the more subtle form of a ‘disclosure clause’. As provided in one company constitution, after reaching 1% or 3% thresholds, an acquirer should disclose details of an acquisition to the board.Footnote 42 Some companies further provide that a further acquisition of shares during this disclosure period is prohibited.Footnote 43

4.1.2.2 Obstacles to the Acquirer Electing/Dismissing Board Members

The second category contains most of the anti-takeover constitutional provisions used by Chinese listed companies and can be further divided into seven types.

a. Restricting the right to nominate board members Under Chinese company law, shareholders who individually or collectively hold more than 3% of the shares have the right to put forward proposals to the general meeting regarding the nomination of new board members.Footnote 44 Many companies seek to restrict such rights by raising the criteria over statutory bars for shareholders to exercise their rights. These companies usually require shareholders to have a 5% or higher shareholding in order to nominate board members or to have held shares for a minimum period of time (for example, 180 days). A total of 67 companies studied either have a higher shareholding threshold, or require a longer holding period, or have both requirements. Seven companies add restrictions on how shareholders nominate board members. For instance, one company constitution provides that every 15% shareholding can nominate one board member.Footnote 45

b. Restricting the right to convene a general meeting As part of the efforts to gain effective control, hostile acquirers may need to convene a general meeting in order to revise constitutions or approve share issuance plans. Under Chinese company law, shareholders who individually or collectively hold more than 10% of the shares enjoy the right to convene a general meeting if the board of directors or supervisory board have failed to do so.Footnote 46 Such a right, however, has been restricted by company constitutions by requiring a 90 or 180-day holding period for shareholders to exercise their rights.Footnote 47 Two of the companies in the research have such a restriction.

c. Prohibition on the dismissal of board members without due cause Most Chinese companies in the research provide in their constitutions that directors should not be dismissed within their term of office without due cause. The widespread use of such a provision can be explained by reference to the historical development of Chinese company law. The 1993 Company Law explicitly prohibited the dismissal of management without due cause,Footnote 48 but this provision was deleted in the 2005 Company Law revision. This means that the company can now dismiss its directors without due cause. In practice, however, most companies have chosen to retain the requirement by way of constitutional provisions.Footnote 49

d. Staggered board Further, there is a so-called ‘staggered board’ provision, under which the term of office of the director is often determined to be 3 years, and only a proportion of the incumbent directors—usually one-third—can be replaced at a general meeting of shareholders. The staggered board mechanism can cause delays and uncertainties for the acquirer to obtain control in the boardroom. Suppose a company constitution divides the board of directors into three classes and requires only one class of directors to be replaced in each general meeting. The acquirer will then have to wait for at least two general meetings in order to obtain majority seats in the boardroom. Eight companies in the research have staggered board provisions.

e. Golden parachute Under the ‘golden/silver parachutes’ provision, the incumbent management, including directors and senior managers, can obtain compensation if they are dismissed before the expiry of their term of office in the event of a takeover. The compensation may take different forms, such as cash and shares, and the value is usually substantial.Footnote 50

f. Having a qualification requirement for board members Constitutional provisions were found to impose demanding (sometimes unreasonable) qualification requirements for the chairperson and other board members. For instance, one such requirement is that for one to be elected as the chairperson of the board of directors, he must have worked within the company for a specified period of time such as 5 years.Footnote 51 Clearly, this makes it difficult for the acquirer to elect its people—who will likely be outsiders as far as the company is concerned—onto the board of the target company.

g. Having employee directors on the board One company in the research proposed to revise its constitution by requiring employee directors on the board.Footnote 52 Such a requirement will create barriers for hostile acquirers to change board members. This provision failed to obtain approval at the general meeting, however.

4.1.2.3 Others

The last two sections describe defensive measures that are frequently used and discussed in China. In recent years, new defensive strategies have arisen and some of them have been widely adopted.

a. Restricting shareholders’ right to put proposals to the general meeting Under Chinese company law, shareholders individually or collectively holding more than 3% of the shares enjoy the right to put proposals to the general meeting.Footnote 53 As a defensive measure, company constitutions will provide a higher shareholding threshold or a longer holding period as preconditions for shareholders to exercise their right to make proposals. Nine companies in the research restrict the right of shareholders to make proposals.

b. Restricting shareholders’ right to vote in the general meeting Under Chinese company law, a special resolution of the general meeting needs to be adopted by shareholders representing 2/3 or more of the voting rights of the shareholders present.Footnote 54 A resolution of the board of directors should be adopted by more than half of all the directors.Footnote 55 A total of 20 companies in the research have raised the quantitative standards to pass resolutions at the general meeting. For instance, company constitutions provide that proposals put forward by a hostile acquirer regarding corporate assets need to be approved by shareholders representing 3/4 or more of the voting rights of the shareholders present.Footnote 56

c. Empowering the board to take defensive measures without authorization from the general meeting The board of directors can certainly adopt defensive measures. However, Chinese company law is rather obscure on the extent to which the board can take defensive measures. To clarify the boundaries, some company constitutions empower the incumbent board to take defensive measures not prohibited by legislation or the company’s constitution, and not in violation of company interests. The adoption of such defensive measures does not need to be authorized by the general meeting.Footnote 57

One company constitution provides that when it is subject to a hostile takeover, except for the acquirer, any shareholder who individually or collectively holds ten percent or more of the total shares has the right to require, in writing, the board to take defensive measures which are not prohibited by the relevant laws and regulations. Without obtaining approval from the general meeting, the board can immediately employ defences after the receipt of such a written document or resolution. The board should make an announcement to the shareholders after making use of such defences.Footnote 58 Under such an authoritative clause, the board can use defences simply at the request of large shareholders.

d. Prohibiting directors from providing aid to hostile acquirers One company constitution in the research provides that directors owe fiduciary duties to the company. They should not, in violation of corporate interests, provide any aid to hostile acquirers.Footnote 59

e. Requiring large shareholders to act in concert One company constitution was found to require that the five largest shareholders must act in concert in the face of hostile takeovers. Shareholders acting otherwise should compensate other shareholders with 25% of their shareholding.Footnote 60

For the ease of reference, the various types of ex ante defences discussed above are summarized in Table 2.

4.2 Ex post Defences

4.2.1 Methodology

This section empirically examines the use of ex post defences by Chinese listed companies. In practice, for various reasons, disputes arising from the use of ex post defences have seldom been brought to the courts or the CSRC; rather, the disputants often reach a compromise and resolve the issue in private. This means that if one were to examine only those cases dealt with by the courts or the CSRC, the data would be grossly inaccurate. Hence, this section tries to gather information about the use of ex post defences from several different sources, including two widely used Chinese law databases (Beida FabaoFootnote 61 and Beida FayiFootnote 62), the website of the CSRC, media reports and the existing literature.

4.2.2 Research Findings

The research reveals that the various types of takeover defences below have been used in the Chinese securities market.

The first is the so-called ‘white knight’, a practice of inviting a friendly acquirer to make a competing bid. A good example is the takeover battle between Guangfa Zhengquan (the target company) and Zhongxin Zhengquan (the acquirer), which well illustrates how friendly acquirers can act together to defeat a takeover threat.Footnote 63 In September 2004, the hostile acquirer, Zhongxin Zhengquan, announced a takeover bid to buy the remaining shares of the target company Guangfa Zhengquan. The target company responded to the hostile bid by setting up a company called Shenzhen Jifu, the shares of which were subscribed by the management and employees of Guangfa Zhengquan. Shenzhen Jifu, along with two other companies associated with the target company, namely Liaoning Chengda and Jilin Aodong, held an aggregate of 66.67% of the shares in the target company. The hostile bidder withdrew its offer as it was impossible for it to obtain a majority of the shares even if all the remaining shareholders tendered their shares.

The second defence is to win support from minority shareholders and stakeholders for the purpose of fending off a hostile takeover threat. Generally speaking, winning support from minority shareholders can defeat a hostile takeover attempt by leaving insufficient shareholding for hostile acquirers to obtain control. Furthermore, the support of relevant stakeholders such as employees may be an important consideration in SOE-related transactions, as it may give rise to concerns over social stability, which is currently a political priority of the Chinese government.

The failed hostile takeover attempt concerning ST Meiya is a typical case in point.Footnote 64 There, the target company was an SOE which had been in severe financial distress for more than 2 years. The controlling shareholder of the company intended to transfer its 29% shareholding to Wanhe Jituan. In September 2003, without consulting the incumbent management, the controlling shareholder of ST Meiya entered into a share transfer agreement with the acquirer. The deal met with strong opposition from the management of the target company. The incumbent management claimed that the intended transfer of shares would be detrimental to long-term corporate interests, because Wanhe Jituan operated in a different industry than the target company and would thus not be competent to run the target company. In order to win support from the employees, the board of directors resolved to make a payment to their superannuation scheme, which had been put off for a long time. Soon after the target management initiated these defensive measures, the existing controlling shareholder terminated the proposed share transfer agreement.

The third defence is to file complaints to the CSRC or the courts. As the Chinese securities regulator, the CSRC is charged with reviewing takeover transactions, intervening in the transaction process and mandating the relevant participants to take certain actions. If the complaints filed by certain parties lead to certain actions taken by the CSRC, it may defeat a hostile takeover attempt.

In China’s first hostile takeover case in 1993, the takeover of Yanzhong Shiye (the target company) by Shenzhen Baoan (the acquirer), the target company management filed a complaint to the CSRC, accusing the acquirer of breaching relevant disclosure rules in relation to takeovers. The complainant also claimed that the bid was funded by bank loans, which was prohibited under Chinese law at that time. The CSRC intervened by mediating in the dispute between the two parties. The validity of the share acquisition was upheld, but the acquirer undertook to retain management employment after obtaining control.

Alternatively, a complaint may be made to the courts. The civil litigation filed by Sanlian Shangshe against Guomei Dianqi provides a recent example of this defence.Footnote 65 In February 2008, by way of a judicial auction, Longji Dao obtained 10.9% of the shares of the target company, Sanlian Shangshe, but it was later revealed that Longji Dao was only a ‘shadow’ acquirer that was being used by the real acquirer Guomei Dianqi. Soon after the purchase of shares by Longji Dao, Guomei Dianqi announced a takeover of Longji Dao and indirectly obtained control of the target company. In December 2008, the target company filed a lawsuit at the High Court of Shandong Province. The plaintiff claimed that the indirect takeover by Guomei Dianqi was initiated for malicious purposes and breached relevant disclosure rules regarding the takeover of a listed company. In March 2009, the case was thrown out by the court on the basis that it had been filed by means of an incorrect procedure and thus did not meet the necessary criteria for the case to be accepted by the court.Footnote 66

Finally, listed companies may try to revise company constitutions for the purpose of thwarting hostile takeover offers. In the hostile takeover of Aishi Gufen by Dagang Youtian, for instance, after perceiving the takeover threat, the target company management made two amendments to its constitution in May 1999.Footnote 67 The first amendment added a requirement of approval from the incumbent board for nominating new board members. Under the second amendment, the eligibility requirement was made more stringent than the statutory standard for shareholders to nominate board members: only shareholders who separately or jointly held more than 10% of the shares in the target company consecutively for more than 180 days could nominate new members of the board. The hostile acquirer filed a complaint to the CSRC against the two amendments, and the CSRC ordered that the amendments be removed.

The above four types of defensive measures have largely covered takeover defences that can be employed by Chinese management after the emergence of hostile bids. As seen in the case of Vanke vs Baoneng, although the incumbent management strongly opposed the hostile takeover, it could only resort to some less fierce defensive measures such as calling on a white knight and reporting any illegality to the CSRC. In other words, due to the limits set by the relevant Chinese law,Footnote 68 powerful ex post defensive measures such as poison pills are not permissible under Chinese law.

5 Analysis and Suggestions for Improvements

5.1 Is it a Problem that Takeover Defences are Widely Adopted?

After discovering the widespread adoption of takeover defences, the next logical step is to examine whether or not it is a problem. As takeover defences are intended to thwart hostile takeovers, it all depends on the important preliminary question of whether hostile takeovers are needed in China.

5.1.1 The Economic Effects of Takeovers

Takeovers, especially hostile takeovers, have long been regarded as an effective mechanism of monitoring the management of corporations and, as such, are beneficial to the enhancement of corporate governance. Faced with the possibility of hostile takeovers, managers have an incentive to manage more efficiently, thus creating shareholder value. This helps to align the interests of management with the interests of the shareholders and thus reduce the agency costs of management.Footnote 69 In addition, takeovers are also thought to improve the allocation efficiency of scarce social resources to the benefit of society as a whole. It ensures that the resources can be utilized by the most capable people and yield maximum returns.Footnote 70 Further, takeovers could create value for shareholders by providing them with a substantial premium upon the sale of their shares.Footnote 71

This pro-takeover argument, however, is not without criticism. A powerful counterargument is that the threat of a hostile takeover would force managers to emphasize short-term gains and ‘paper profits’.Footnote 72 Under this view, management would put the short-term concerns ahead of long-term concerns in making decisions. In other words, managers would be reluctant to devote corporate resources to research, the development of new products, technologies, and the like and thus shareholders would not receive long-term value for their investment. Apart from this, it has also been considered that hostile takeovers are likely to lead to lost productivity from business disruption, to create dangerously leveraged capital structures and cause a ‘brain drain’ by diverting the talent of managers from ‘real’ economic activity to financial reshuffling.Footnote 73 More severely, this might result in national industries losing their competitiveness on the international market.Footnote 74

The anti-takeover stance has also been attacked, however. It has been opined that all anti-takeover claims are ‘impressionistic’ and largely based on anecdotal evidence.Footnote 75 Acknowledging that those claims appear to have gained some influence, some have argued that they are untenable due to the lack of support from conclusive empirical evidence.Footnote 76 More aggressively, others, notably Easterbrook and Fischel, contend that management’s fear of takeovers would not, as the anti-takeover stance argued, necessarily give rise to short-term strategies on the ground that ‘[i]f the market perceives that management has developed a successful long-term strategy, this will be reflected in higher prices that discourage takeovers’.Footnote 77

Thus, the debate on the economic value of takeovers remains largely inconclusive and as such will continue to be so in the foreseeable future, as do the relevant empirical studies.Footnote 78 As with most other legal debates, the issue of takeovers cannot be sensibly dealt with without taking account of the specific context in which takeover activities operate. In the face of the contrasting effects associated with takeovers, we have to prioritize them taking into account the needs of the specific situations in question. In China, the problem of corporate governance is particularly serious due to various reasons. Most notably, the lack of supervision over management is generally thought to be at the heart of the issue. There are in theory at least several legal mechanisms for monitoring management in China, but all of them have proved to be inadequate in one way or another.

5.1.2 The Local Conditions in China

In the first place, according to company law, shareholders have the power to monitor managers. State-owned shares, however, occupy a high percentage of the all outstanding shares in most listed companies. Because of the problems of agency costs and an omnipresent bureaucracy, the state as the majority shareholder in these companies has long seemed to be virtually non-existent with respect to the monitoring of management. This unique phenomenon is called Guoyougu Suoyouzhe Quewei (no functional proprietor of the state-owned shares), resulting in the ‘insider control’ problem where the insiders such as directors and management have effective control of the company. In response to this issue, the Chinese government has established a specific administrative body, namely the State-owned Asset Supervision and Administration Commission of the State Council (SASAC), which has been in charge of state-owned assets since 2003. The performance of the SASAC has long been the subject of debate, however, which has been fuelled by several major scandals in recent years.Footnote 79 Presumably due to the unsatisfactory progress made so far in the area of SOE management, the Central Committee of the China Communist Party and the State Council have recently kick-started a new round of SOE reform by issuing a guiding document on 24 August 2015.Footnote 80

Second, the board of supervisors is a corporate organ specifically designed to perform checks and balances under the Chinese dual board structure. It is important to note that China’s dual board system, albeit borrowed from Germany, does not exactly follow the German system. Compared to its counterpart in Germany, the board of supervisors in China has fairly limited powers concerning the board of directors: it is not empowered to appoint and remove directors,Footnote 81 nor does it have the authority to make business decisions.Footnote 82 Furthermore, the supervisors usually lack independence because they are chosen from shareholders and employees through an election process that is tightly controlled by the controlling shareholders and the board of directors.Footnote 83 Thus, the board of supervisors is widely seen as a figurehead,Footnote 84 and after the introduction of the independent director system, there have been calls to abolish the board of supervisors.Footnote 85

Third, although China has adopted the practice of having independent directors on the board,Footnote 86 its effectiveness has been subject to criticism. For instance, the issue of independence is acute as it is difficult in China to divorce the selection process for independent directors from the influence of controlling shareholders or management.Footnote 87 The lack of industry experience is also a common problem with independent directors in China where a significant number of independent directors are academics. There are other issues surrounding the institution of independent directors in China such as insufficient remuneration and a lax liability regime. Some empirical studies suggest that the independent director system is not as effective as anticipated and many independent directors simply become ‘vase directors’.Footnote 88

Hence, given the serious inadequacies of other corporate governance mechanisms, hostile takeovers can be expected to play a bigger role in improving corporate governance in China. Furthermore, after three decades of rapid development, the Chinese economy is now at a crossroads, with the latest growth rate falling below seven percent. In order to sustain growth, China has turned to the idea of supply-side reform since late 2015. Instead of stimulating demand in the form of investment, exports and consumption as China has done in the past, the supply-side reform aims to make enterprises more vibrant, efficient and productive, through various ways such as cutting business costs and eliminating excess industrial capacity. This means that whole industries are in urgent need of being restructured to optimally employ social resources. By way of takeovers, China could improve the efficiency of management, optimize the allocation of social resources, and enhance corporate governance, as well as boosting the international competitiveness of industries as a whole. In sum, China needs to facilitate takeovers at this stage and thus limits the use of takeover defences.

5.2 Why Are Takeover Defences Widespread?

The empirical data in the previous section show that the adoption of takeover defences is widespread in the Chinese securities market. The defences can be divided into two categories, namely ex ante and ex post defences: the former mainly takes the form of anti-takeover constitutional provisions while the latter is effected through a multiplicity of ways. Also, many companies have adopted more than one type of anti-takeover constitutional provisions. Why are takeover defences widespread? Several partial explanations seem to be plausible.

To begin with, the legal framework for takeover defences is quite vague, leaving a large grey area for many takeover defences. The two key regulatory rules, namely the fiduciary duty of management and the Chinese board neutrality rule, have seemed, in many ways, to fail to clarify the legitimacy and appropriateness of takeover defences. As a result, a great deal of room is left for defensive measures to be adopted in practice.

For instance, with respect to the restrictions on shareholders bringing proposals to the general meeting, particularly the proposal to nominate new board members, the current law is unclear on the legitimacy of such restrictions. Under Article 103 of the 2005 Company Law, a shareholder who separately or jointly holds three percent or more of the shares can put forward proposals to the general meeting.Footnote 89 This right should cover the proposal to nominate new board members. There has been an ongoing debate on whether the company can raise the shareholding requirement above the statutory rule.Footnote 90 Further, the existing law is silent on the legitimacy of other types of anti-takeover constitutional provisions, including the staggered board provision and the provision imposing qualifications for new board members.

Second, there are loopholes in the Chinese law governing the use of takeover defences. As discussed earlier, Article 33 of the 2006 Takeover Measures is not applicable if the following two conditions are not satisfied: (1) takeover defences must significantly change company assets and liabilities; (2) takeover defences must be taken after the announcement of takeover bids. This opens the floodgates for the use of many takeover defences. For instance, in the case of Guangfa Zhengquan discussed earlier, the defensive tactic of the white knight was used without the approval of the shareholders, because arguably the first condition had not been satisfied, that is, the defence did not significantly change the assets, liabilities, entitlements and the business performance of the target company.

Apart from the defects in the legal provisions, the lax enforcement of the law by the regulator is also a contributing factor to the widespread adoption of takeover defences. In some cases, the adoption of takeover defences is clearly problematic, but the CSRC has not taken any action against it. It should be noted, however, that stock exchanges and the CSRC have recently begun to make enquiries and hold regulatory meetings on the use of takeover defences. After the regulatory intervention, some companies withdrew their motions to pass their anti-takeover constitutional provisions, while others insist on their plan. For instance, in December 2015, a Shenzhen-listed company called Longping Gaoke proposed to revise its constitution to introduce a restriction on the shareholders’ right to nominate directors. On 13 January 2016, Shenzhen Stock Exchange sent a letter of enquiry to the company, asking if there was any legal basis for introducing those proposed provisions. Two days later, Longping Gaoke dropped the proposal. But some other companies, such as China BaoAn and Bai Lilian, refused to give up their anti-takeover provisions after receiving letters of enquiry from stock exchanges, arguing that those provisions are necessary to fend off bad-faith takeovers.

Hence, there is a need for the CSRC or the stock exchanges to set out clearer standards on the illegality of anti-takeover constitutional provisions, and enforce them with more rigour through more formal tools.

5.3 How to Improve the Regulation of Takeover Defences?

As discussed above, it is a worrying situation that takeover defences are widely adopted in the Chinese securities markets while neither the law nor the regulator has provided clear guidance on their legitimacy. This section will explore possible ways for improving the regulation of takeover defences.

5.3.1 A Balanced Approach

The law needs to take a balanced approach in regulating anti-takeover constitutional provisions. Some commentators have argued that to facilitate takeovers in China, all ex ante takeover defensive provisions should be strictly prohibited.Footnote 91 This suggestion of a blanket ban needs to be treated with caution for the following reasons. As discussed before, the debate on the value of takeovers has still not been settled. Even though it is submitted that China should encourage takeover activities to obtain various benefits such as the efficient allocation of scarce resources, a mechanism to monitor corporate management, etc., one should not push this inclination to an unlimited extreme without considering the potential harm associated with takeovers. In fact, takeover defences could be properly used by target management for the benefit of the shareholders to thwart some genuinely undesirable takeovers.

Further, in a contested takeover some defences could be employed to instigate an auction, which would ensure that the shareholders obtain the highest possible prices for their assets.Footnote 92 Even assuming that the target’s management will act in a self-interested way, some commentators have argued that some, but not all, target stock buybacks may increase shareholder wealth as a result of the instigated auction.Footnote 93 Statistical data have shown that the takeover premiums paid for US companies are higher than those paid for European companies, which suggests that the widely used defences in the US could increase the premiums for the shareholders.Footnote 94

Thus, the issue of how to regulate takeover defences needs to be handled carefully to strike a delicate balance between eliminating the abuse of defences while at the same time preserving the use of defences for proper purposes. Indeed, encouraging takeovers to increase company value and monitor management must be balanced with protecting target shareholders from corporate raiders. This balanced approach is central to regulating takeover defences, and the discussion below will flesh out more details under this principle.

5.3.2 Allocating the Primary Decision-making Powers to Shareholders

As discussed earlier, many of the pre-bid and post-bid defences used in Chinese practice allocate primary authority to the board of directors. Based on the following three reasons, it is the shareholders who should have the primary decision-making authority in determining takeover defences.

The first consideration is to constrain management from using takeover defences for entrenchment purposes. Hostile takeovers may endanger the incumbent management as they will be threatened with unemployment or a loss of authority. Leaving management with the primary powers in taking defensive measures may lead to the use of takeover defences for entrenchment purposes. In contrast, allocating the primary decision-making powers to shareholders may curb abusive use through the scrutiny of shareholders.

The task of constraining management’s abusive use of takeover defences is especially important in China. Both the Chinese securities regulation and its market disciplinary systems are insufficiently developed. As stated previously, the Chinese fiduciary duty rules are comprised of general principles without necessary interpretation and enforcement arrangements. Meanwhile, it is rather difficult for plaintiffs to use civil litigation to curb management misbehaviour. The Chinese takeover law therefore lacks the necessary ‘infrastructure’ that exists in the US regulatory system which curbs management from abusively using takeover defences.Footnote 95

The second consideration is the Chinese legal culture, more specifically, the allocation of decision-making powers between shareholders and management in Chinese corporate law. The Chinese legal culture also justifies the allocation of primary decision-making powers to shareholders in adopting takeover defences. As discussed earlier, Chinese corporate law assigns primary and active roles to the general meeting of shareholders in making major corporate decisions.Footnote 96Allocating primary decision-making powers to shareholders also requires shareholder approval for adopting defensive measures that will have a significant impact on hostile takeovers. It is important to clarify that the requirement does not mean that shareholders should determine all corporate conduct/arrangements that have certain negative impacts on hostile takeovers. Doing so may unnecessarily limit the efficiency and flexibility of a company to defeat malicious takeover offers. It is more appropriate to limit the requirement for shareholder approval for defensive measures that can cause significant barriers to hostile takeovers.

The authors thereby propose a balanced approach in regulating hostile takeovers. To maintain such a balance, management can take ex ante and ex post defensive measures, subject to the condition that the defensive measures should not cause insurmountable barriers for hostile acquirers.

5.3.3 Balancing Corporate Autonomy and Regulatory Intervention

As discussed above, primary decision-making powers concerning takeover defences should be given to shareholders. However, if the anti-takeover constitutional provisions need to be passed at the shareholders’ meeting, it seems that this falls within the area of corporate internal affairs and thus regulatory intervention should be kept to a minimum. Indeed, if the shareholders resolve to add anti-takeover constitutional provisions which are harmful to the company, they will suffer in proportion to their shareholdings when the share price of the company drops to reflect the detrimental effects of the anti-takeover provisions. Hence, the shareholders should have every incentive to make a careful decision and there may be little need for outsiders such as the regulator to intervene.

This line of reasoning may hold true in overseas jurisdictions where the securities markets are efficient and thus the share price can properly factor in the anti-takeover provisions. According to some studies in the US, if the company adopts value-decreasing anti-takeover constitutional provisions at the initial public offering (IPO) stage, investors will impose a penalty on the company by shunning its IPO exercise.Footnote 97 But what if the company adds anti-takeover constitutional provisions after the IPO stage as is the case in China? Interestingly, having defensive measures in the company’s constitution, whether at the IPO stage or through a later amendment, does not seem to result in shareholder dissent in most circumstances. We have seen very few reported cases where the shareholders of listed companies bring an action against the introduction of anti-takeover constitutional provisions. Is this because those anti-takeover constitutional provisions are all value-creating and are thus welcomed by shareholders? A recent empirical study has examined the wealth effect of all anti-takeover announcements on the target company during the period of 1993–2012 in the Chinese securities market, finding that the cumulative abnormal return was negative, but not statistically significant.Footnote 98 This suggests that the use of takeover defences does not really increase the welfare of the shareholders of the target company and thus should be used with caution. Given that takeover defences have the effect of preventing value-creating hostile takeovers in many cases, why did the target shareholders approve them? Is this indicative of shareholder inertia or irrationality in China?

The above phenomenon may be attributed to several factors. To begin with, Chinese investors, who are generally much less experienced than their counterparts in the US, have still to fully appreciate the important role and function of hostile takeovers. By international standards, the proportion of individual investors in the Chinese securities market is remarkably high.Footnote 99 Further, individual investors in China are mostly small and medium-sized with a low level of annual income and financial literacy.Footnote 100

Due to the fact that hostile takeovers are quite a new phenomenon in China, many Chinese investors do not even know what hostile takeovers are. They may confuse hostile takeovers (Diyi Shougou) with bad-faith takeovers (Eyi Shougou) and compare hostile takeovers to barbarian invasions. Further, there seems to be no consensus in China as to whether hostile takeovers are desirable or not. Hence, shareholders do not really know whether to oppose anti-takeover constitutional provisions. For instance, in the case of Vanke vs Baoneng, commentators were divided over the economic effects of the hostile takeover. Hence, many Chinese investors might be led (or misled) into believing that hostile takeovers are not good for their companies and thus it is important to introduce anti-takeover defences to fend off hostile takeovers.

Given that the Chinese securities market is not efficient enough to deter the introduction of value-decreasing takeover defences, China should not blindly follow the overseas experiences of simply treating anti-takeover constitutional provisions within the purview of corporate autonomy.Footnote 101 Rather, it is necessary for the law to intervene in this issue with a view to protecting shareholders, particularly minority shareholders. This means that not all anti-takeover provisions can be adopted with the approval of the shareholders’ meeting which is actually controlled by majority shareholders. The next logical question is what criteria should be used in judging the permissibility of anti-takeover provisions.

5.3.4 Protecting the Fundamental Rights of Shareholders

The Chinese fiduciary duty provisions can be further developed through clarifying the lawful rights of shareholders that are protected by the law. The 2006 Takeover Measures provide that the board of directors of a target company, while making decisions or taking measures in the face of a takeover ‘…should not cause damage to the lawful rights and interests of a target company and its shareholders’.Footnote 102 The prohibitive rule should have set up a boundary between permissible takeover defences and unacceptable defensive measures. However, the current legislative provision fails to do so as it does not clarify what constitutes the lawful rights of shareholders.

There have been few discussions held in authoritative documents and academic opinions regarding the exact meaning of these lawful rights of shareholders. We argue that there are two criteria for the lawful rights of shareholders. First, the lawful rights protected by the rule should be the rights that are prescribed as mandatory rules in legislation. In other words, the protection of lawful rights should not intrude into areas that fall within the autonomy of companies. Second, the assertion of rights must have a significant influence on the occurrence and the chance of success of takeover bids. The second criterion ensures that the prohibitive rule focuses on important issues and is not expanded too broadly.Footnote 103

There are at least three shareholder rights that meet these two criteria. These include the right to put forward proposals to the general meeting (including proposals to dismiss incumbent management, proposals to nominate new board members, or proposals to amend the constitution),Footnote 104 the right to vote on major corporate issues in the general meeting,Footnote 105 and the right to call an interim general meeting.Footnote 106 These three rights are all prescribed as ‘mandatory legal rules’ in Chinese company law.

The three rights also meet the second criterion, namely the protection of these three rights having a significant influence on the success/failure of a takeover. Indeed, having the three rights are preconditions for hostile acquirers to obtain control through the use of corporate governance mechanisms. With the right to put forward proposals and the right to vote, hostile acquirers can put forward proposals to elect board members or to amend constitutions in their favour. They can further vote according to their own shares or use proxy voting to have the proposals passed in the general meeting.Footnote 107 The right to call an interim general meeting provides a remedial right for shareholders to act against the will of the board in order to protect their own interests.

In May 2018, a district court in Shanghai handed down a judgment ruling that it is illegal to add a further requirement of holding shares for more than 90 days for the exercise of the right to put forward proposals.Footnote 108 This is the first court judgment on the legality of anti-takeover constitutional provisions, which is based on the very reasoning that we have discussed above, namely, protecting the fundamental rights of shareholders.

6 Conclusion

This paper undertakes an in-depth study of the Chinese regime for takeover defences both in the books and in practice. From a comparative perspective, it examines the similarities and differences between the Chinese law and its counterparts overseas, notably the US and the UK, finding that the Chinese law is a mixture of experiences transplanted from overseas jurisdictions, but functions differently due to the unique local conditions in China. An empirical study is then conducted to investigate how takeover defences are used in practice. It has been found that takeover defences, particularly ex ante defences, are widely adopted in practice, which may have the effect of inhibiting potential hostile takeovers in the future.

In general, the paper refutes the idea of a blanket ban on the use of takeover defences, because takeover defences have both beneficial and detrimental effects: on the one hand, there is a real risk that the target’s management may abuse defensive tactics to thwart a hostile takeover for the purpose of entrenchment, regardless of whether the takeover would be beneficial to the shareholders; on the other hand, they can be used as a means to protect target shareholders from undesirable takeovers or, if the transfer of corporate control becomes inevitable, create an active auction to maximize the sale price for target shareholders. In regulating takeover defences, therefore, there needs to be a delicate balance between allowing the use of takeover defences and protecting shareholders’ rights.