Abstract

Drug addiction is a chronic, relapsing health problem that is associated with the degree to which individuals choose small, immediate monetary outcomes over larger, delayed outcomes. This study was a secondary analysis exploring the relation between financial choices and drug use in opioid-dependent adults in a therapeutic workplace intervention. Sixty-seven participants were randomly assigned to a condition in which access to paid job training was contingent upon naltrexone adherence (N = 35) or independent of naltrexone adherence (N = 32). Participants could earn approximately $10 per hour for 4 hours every weekday and could exchange earnings for gift cards or bill payments each weekday. Urine was collected and tested for opiates and cocaine thrice weekly. Participants’ earning, spending, and drug use were not related to measures of delay discounting obtained prior to the intervention. When financial choices were categorized based on drug use during the intervention, however, those with less frequent drug use or frequent use of one drug spent a smaller proportion of their daily earnings and maintained a higher daily balance than those who frequently tested positive for both drugs (i.e., opiates and cocaine). Several patterns described the relation between cumulative earning and spending including no saving, periods of saving, and sustained saving. One destructive effect of drug use may be that it creates a perpetual zero-balance situation in the lives of users, which in turn prevents them from gaining materials that could help to break the cycle of addiction.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Drug addiction is a chronic health condition characterized by persistent drug use in the face of undesirable physical, social, or economic consequences. This impaired decision making is reflected in other maladaptive choices like financial mismanagement (Hamilton & Potenza, 2012). In one study, individuals with substance dependence were twice as likely to carry financial debt than individuals who did not have substance dependence, despite similar incomes between groups (Jenkins et al., 2008). Descriptive studies on drug use in substance-dependent populations (Satel, Reuter, Hartley, Rosenheck, & Mintz, 1997; Swartz, Hsieh, & Baumohl, 2003) reported that drug use was elevated when paychecks or disability payments were scheduled and that financial gains predicted noncompliance with standard drug-abuse treatment (see Rosen, 2012, for a review).

Financial mismanagement and drug use involve choices between rewards varying in quality, delay, and magnitude. An individual might choose to spend a small amount of money immediately rather than saving for a larger amount in the future. Likewise, an individual might choose to use drugs immediately rather than abstain to avoid health problems in the future. Delay discounting is the extent to which individuals forgo those large, delayed rewards for immediate, small rewards (Rachlin & Green, 1972). Studies described a continuum of elevated discounting (i.e., a tendency to choose the smaller, immediate reward) to low discounting (i.e., a tendency to choose the larger, later reward); found similar discounting across real, potentially real, and hypothetical rewards; and validated the discounting task across several populations (see Bickel & Marsch, 2001, for a review).

Delay discounting differs as a function of drug use and financial mismanagement (Carroll, Anker, Mach, Newman, & Perry, 2010; Hamilton & Potenza, 2012). Drug abusing populations have been shown to discount monetary outcomes more than populations who do not abuse those drugs (Bickel, Odum, & Madden, 1999; Kirby, Petry, & Bickel, 1999; MacKillop et al., 2011; Madden, Petry, Badger, & Bickel, 1997) and risky drug-seeking behavior, such as a willingness to share needles, is associated with elevated delay discounting (Odum, Madden, Badger, & Bickel, 2000). Delay discounting is associated with financial mismanagement, although the relation is relatively underexplored in comparison to drug use. In studies assessing delay discounting with large samples of non-drug-dependent adults, those with elevated discounting of monetary rewards were more likely to have credit card debt and less likely to pay credit card bills in full than those with lower discounting rates (Chabris, Laibson, Morris, Schuldt, & Taubinsky, 2008; Meier & Sprenger, 2010).

A better understanding of the relation between drug use and financial choices may inform the design of substance abuse treatment. Tucker and colleagues (Tucker, Foushee, & Black, 2008; Tucker, Roth, Vignolo, & Westfall, 2009; Tucker, Vuchinich, Black, & Rippens, 2006; Tucker, Vuchinich, & Rippens, 2002) found that financial choices are a consistent predictor of treatment success. Specifically, allocating a greater amount of money to savings relative to alcohol expenditures predicted alcohol moderation at 1- and 2-year follow ups after participants made a resolution to moderate their drinking (Tucker et al., 2002). In an intervention targeting financial behavior (Rosen, Carroll, Stafanoivics, & Rosenheck, 2009), veterans with recent alcohol or cocaine use were randomly assigned to a money management intervention or a control group. Those participants receiving the intervention were invited to attend sessions with a money manager who stored funds, trained appropriate financial choices, and helped develop treatment goals to improve money management and encourage abstinence. Participants in the control group were given a workbook, were asked to construct a budget and track expenses, and were invited to attend sessions with a counselor to support the use of the workbook. Participants receiving the intervention were more likely to engage with counselors and complete money management activities than control participants. Incidentally, participants completing the money management intervention decreased in addiction severity on self-reported measures but did not differ from the control group in rates of cocaine and alcohol abstinence. Black and Rosen (2011) used the same money management intervention with psychiatric patients with histories of drug use and found that the intervention was associated with decreases in delay discounting and drug use compared to patients in a control condition.

Drug use and financial mismanagement are clearly interrelated, as demonstrated by the correlation between the two variables (e.g., Jenkins et al., 2008), the relation of each variable to delay discounting (e.g., Meier & Springer, 2010; MacKillop et al., 2011), and the relation of each variable to treatment outcomes (e.g., Black & Rosen, 2011). However, studies have yet to investigate the relation between financial choices and drug use within the same individuals over time. Employment-based reinforcement interventions for drug abstinence (e.g., Silverman et al., 2007) or treatment adherence (e.g., Dunn et al., 2013) measure drug use over an extended period and provide individuals with opportunities to earn money for job-skills training and education. As such, they offer an abundance of data on day-to-day financial choices and drug use in drug-dependent adults.

In an employment-based treatment intervention called the therapeutic workplace, participants receive financial incentives based on performance in job-skills training programs or work and objective evidence of drug abstinence or treatment adherence (see Silverman, DeFulio, & Sigurdsson, 2012; Silverman, Holtyn, & Morrison, 2016, for reviews). In one study of the therapeutic workplace intervention (Dunn et al., 2013), earnings were deposited in an electronic account, and participants could exchange money in their accounts for gift cards or bill payments each weekday. Gift cards and direct payment to vendors were used instead of cash to reduce the likelihood that earnings could be used to purchase drugs. Saving money allowed participants to buy high-value items or pay relatively large expenses. Thus, maintaining a high average daily account balance may have indicated a pattern of sound financial choices and were hypothesized to positively correlate with abstinence outcomes. The present secondary analysis was conducted to describe the relation between financial choices and drug use in injection drug users who participated in the Dunn et al. (2013) evaluation of the therapeutic workplace. To accomplish this goal, the study explored relations between participant characteristics, delay discounting, and frequency of drug use; determined whether drug use was related to financial choices as hypothesized; and illustrated patterns of earning and spending.

Method

Setting and Participants

This study is a secondary analysis of data obtained during a randomized trial of employment-based reinforcement of naltrexone adherence in opioid-dependent injection drug users in a therapeutic workplace intervention (Dunn et al., 2013). Participants were adults recruited from opiate detoxification programs in Baltimore, Maryland, and through street outreach. Individuals were eligible for the clinical trial if they were between the ages of 18 and 65 years old, were unemployed within the last 30 days, reported injection drug use with visible evidence of track marks, provided a urine sample that tested positive for opiates and cocaine, met diagnostic criteria for opioid dependence, were medically approved by the study physician, and lived in Baltimore City or the surrounding area. Participants were mostly male, middle-aged, and Black. The median self-reported income during the month prior to study intake was $654.00 (interquartile range $185.00–$1,240.00). Average grade levels in reading, spelling, and arithmetic were between the sixth and ninth grades, but a majority of participants reported having a high school diploma or GED. Most participants reported injection to be the primary route of heroin administration.

Procedure

Intake

Interested volunteers completed intake procedures consisting of surveys, interviews, and behavioral tasks. Those assessments pertinent to the present analysis are listed below.

Surveys and Interviews

Several surveys and interviews were used to assess psychosocial variables related to financial choices and drug use. Participants completed the Addiction Severity Index–Lite (McLellan et al., 1985), which provided measures of self-reported substance abuse (e.g., number of days of cocaine use in the past month and number of days of heroin use in the past month), income, employment, and education histories. The Composite International Diagnostic Interview, Second Edition (Cottler, 1991) screened for psychiatric disorders such as substance abuse and dependence. Participants completed the Wide Range Achievement Test, Fourth Edition (WRAT-4; Wilkinson, 1993), which provided grade levels in reading, spelling, and math skills. The Beck Depression Inventory-II (BDI-II; Beck, Steer, & Brown, 1996) was administered to evaluate psychosocial functioning.

Delay Discounting

During intake, participants completed a delay discounting task on a desktop computer (see Johnson & Bickel, 2002, for task details). The computer presented repeated choices between gaining a relatively small amount of money immediately, or gaining $1,000 after a delay. The computer determined the level at which the subjective value of the smaller-sooner reward was equal to the $1,000 reward (i.e., indifference point) across seven delays: 1 day, 1 week, 1 month, 6 months, 1 year, 5 years, and 25 years. Participants were presented with a series of questions using a single delay, with an adjusting smaller, immediate amount. The computer program adjusted the monetary value of the smaller, more immediate option using a double-limit procedure employed by Johnson and Bickel (2002). This procedure determined an indifference point for each delay based on the reliability of participants’ choices for the smaller, immediate option. Indifference points were the proportion of the monetary value of the immediate option to $1,000. Once the indifference point was determined, then the computer moved on to the next delay, progressing through all seven delays in an ascending order.

Therapeutic Workplace

This section describes the general procedures of the 30-week therapeutic workplace intervention, which can be found in more detail elsewhere (e.g., Dunn et al., 2013; Silverman et al., 2007).

Following intake, eligible participants were invited to attend the therapeutic workplace for 4 hours per day, 5 days per week. Upon arrival at the workplace on Mondays, Wednesdays, and Fridays, urine samples were collected under direct staff observation and tested for opiates and cocaine. At the start of each workday, participants reported to an assigned workroom and workstation. A therapeutic workplace staff member swiped the participant’s ID card through a card reader, which clocked the participant in or out of the workroom. Participants earned an average of $10 per hour ($8.00 per hour in base pay and approximately $2.00 per hour in productivity pay for engaging with and progressing through training programs) and earned a paid, 5-min break for every 55 min worked. If participants requested money from their accounts, payment was delivered in the form of gift cards or checks paid to specific vendors (e.g., landlord, utility company) and was available at the end of each workday.

Participants were inducted onto oral naltrexone prior to randomization into the 26-week main study. In the main study, participants were randomly assigned to two groups. Participants randomly assigned to the prescription group (N = 32) were provided with a supply of oral naltrexone every 30 days and could attend the workplace independent of naltrexone ingestion. Participants randomly assigned to the contingency group (N = 35) were required to ingest naltrexone under staff observation to continue attending the workplace and maintain maximum pay.

Dependent Variables and Data Analysis

Two dependent measures were derived from delay discounting. First, area under the curve (AUC) of the seven indifference points was calculated according to Myerson, Green, and Warusawitharana (2001). AUC values ranged from zero to one, with values close to zero representing more discounting (i.e., frequent choices for the small, immediate outcome) and higher values representing less discounting. Second, the degree of discounting was quantified using a hyperbolic equation (Bickel et al., 1999; Mazur, 1987):

where V is the subjective value (i.e., indifference point), A is the amount of the delayed reward, k is an empirically derived constant representing the degree of discounting as a function of delay, and D is the delay to the larger reward. We log-transformed k prior to parametric analyses due to its typical positive skew.

Nonsystematic delay discounting data were screened and removed from analyses using an algorithm established by Johnson and Bickel (2008). Data were considered nonsystematic if one or both of the following criteria from Johnson and Bickel were met: (1) if any indifference point (starting with the second delay) was greater than the preceding indifference point by a magnitude greater than 20% of the larger later reward (i.e., $200); (2) if the last (i.e., 25-yr) indifference point was not less than the first (1 day) indifference point by at least a magnitude equal to 10% of the larger later reward (i.e., $100). (p. 267)

Following data screening, 17 participants were found to have nonsystematic delay discounting and AUC values were interpretable from a total of 50 participants (23 contingency, 27 prescription). Equation 1 failed to account for variance in the distribution of indifference points for seven other participants. The distribution of variance accounted for by Equation 1 (VAC) for the remaining participants was skewed, with a median VAC of 0.90 (interquartile range 0.83–0.95). Values of k were interpreted for the 43 participants (19 contingency, 24 prescription) for whom Equation 1 accounted for variance in indifference points.

The measures of earning, spending, and saving analyzed in the present study were collected across the 4-week induction period and the 26-week main study. The primary measures of saving and spending were derived from participants’ daily earnings in the therapeutic workplace and from the dollar value of gift cards or checks that participants requested each weekday. Average daily balance (earnings – spending) was used as a summary measure of reserved money. Percentage of daily balance spent (average daily balance/average daily spending × 100) normalized spending across participants who earned various amounts of money. The amount of money participants earned and spent was cumulated each day to examine patterns of spending across the study.

Thrice-weekly urine samples provided measures of drug use during induction and following randomization. Urine samples were considered positive for opiates or cocaine if the urinary morphine or benzoylecgonine concentration, respectively, exceeded 300 ng/ml or if the participant missed a scheduled urinalysis (i.e., a missing-positive approach). Drug abstinence was expressed as the percentage of urine samples negative for a drug (negative samples/total possible samples × 100) and was calculated separately for cocaine and opiates. Overall percentage of negative urine samples was used to categorize participants by relative frequency of drug use. Infrequent users (N = 31) were those participants with more than 50% of urine samples negative for cocaine and opiates. On average, infrequent users had 82% (SE = 2.44%) and 85% (SE = 2.27%) of samples negative for cocaine and opiates, respectively. Frequent users of one drug (N = 16) were those participants with more than 50% of samples negative for cocaine or opiates and less than 50% of samples negative for the other drug. On average, frequent users of one drug had 41% (SE = 8.28%) and 51% (SE = 7.68%) of samples negative for cocaine and opiates, respectively. Frequent users of two drugs (N = 20) were those participants with less than 50% of samples negative for cocaine and opiates. On average, frequent users of two drugs had 19% (SE = 3.52%) and 24% (SE = 3.45%) of samples negative for cocaine and opiates, respectively.

Another approach to calculating the frequency of drug use is to disregard missing urinalysis data and calculate the percentage of negative samples using the total samples participants provided as the denominator (i.e., negative samples/total samples provided × 100). When drug-frequency groups were based on this missing-missing approach, the group sizes were more unequal, and within-group variability was greater than when groups were based on a missing-positive approach. On average, infrequent users (N = 31) had 89% (SE = 2.63%) and 92% (SE = 2.23%) of samples negative for cocaine and opiates, respectively. Frequent users of one drug (N = 22) had a mean of 38% (SE = 7.33%) and 68% (SE = 7.25%) of samples negative for cocaine and opiates, respectively. On average, frequent users of two drugs (N = 7) had 19% (SE = 6.66%) and 18% (SE = 6.44%) of samples negative for cocaine and opiates, respectively.

One criticism of the missing-positive approach is that it is confounded with attendance, which may have affected spending and saving. A one-way analysis of variance (ANOVA) with the total number of hours worked as the dependent variable and frequency of drug use as the independent variable confirmed that drug use categories differed on the basis of workplace attendance when a missing-positive approach was used, F(2, 64) = 6.24, p < .05, ηP 2 = 0.16. Tukey honest significant difference (HSD) post hoc tests indicated that participants with a relatively low frequency of drug use (M = 316.31 hours, SE = 22.38 hours) and frequent use of one drug (M = 339.25 hours, SE = 31.15 hours) worked more hours than those who used two drugs with high frequency (M = 208.21 hours, SE = 27.86 hours). The total number of hours worked was entered into another ANOVA with drug use frequency determined by the missing-missing approach as the independent variable; there was no significant difference in attendance between groups, F(2, 64) = 0.55, p > .05, ηP 2 = 0.02. Infrequent users (M = 293.43 hours, SE = 21.91 hours), frequent users of one drug (M = 270.03 hours, SE = 28.80 hours), and frequent users of two drugs (M = 329.53 hours, SE = 51.05 hours) worked roughly the same number of hours when a missing-missing approach was used.

The missing-missing approach assumes that urinalysis data are missing completely at random and can lead to biases toward negative urinalysis results; the missing-positive approach assumes that participants miss urinalysis because of drug use, leading to biases toward positive urinalysis results based on attendance (McPherson, Barbosa-Leiker, Burns, Howell, & Roll, 2012). Although those biases may have been confirmed in this sample, drug-use frequency group assignment was relatively consistent across procedures. Fifty-two participants (78% of sample) had the same drug-use frequency category by the missing-missing and missing-positive approaches. Of the participants whose category switched, eight were categorized as frequent users of one drug with the missing-missing approach but were categorized as frequent users of two drugs with the missing-positive approach; five were categorized as infrequent users with the missing-missing approach but were categorized as frequent users of two drugs with the missing-positive approach; finally, two were categorized as infrequent users with the missing-missing approach, but were categorized as frequent users of one drug with the missing-positive approach. In general the pattern of results was similar across drug use frequency groups categorized using the missing-positive and missing-missing approaches. Therefore, the results are displayed graphically for the missing-positive approach and described in text and graphed for the missing-missing approach if the results of statistical tests differed across approaches.

Results

Summary measures of earning and spending (i.e., average daily balance and percentage of daily balance spent) and drug use (i.e., percentage of drug-free urine samples) averaged across the entire study are listed in Table 1. The only statistically significant difference between contingency and prescription groups was in the percentage of negative opiate samples calculated using a missing-positive (Mann Whitney U = 278.50, p < .001) and missing-missing (Mann Whitney U = 263.00, p < .001) approach. Thus, the remaining analyses collapse across contingency and prescription groups.

One objective of the present study was to determine whether participant characteristics or behaviors were related to financial choices. Average daily balance, percentage of daily balance spent, and percentage of cocaine- and opiate-negative samples were not statistically significantly related to age, sex, years of education, income, self-reported drug use on the ASI delivered at intake (i.e., the number of days in the past month that the participant reported to use heroin or cocaine), performance on the WRAT, or depression scores obtained from the BDI. Delay discounting area under the curve and log-transformed k values were negatively correlated with each other (r = -0.86, p < .05) but were not statistically significantly correlated with average daily balance, percentage of daily balance spent, or percentage of drug-free samples. There were no differences between participants with systematic (N = 50) and nonsystematic (N = 17) discounting results (per Johnson & Bickel, 2008) on age, sex, education, WRAT performance, income, BDI scores, average daily balance, percentage of daily balance spent, or self-reported and urinalysis-determined drug use.

Although summary measures of delay discounting did not relate to measures of earning, spending, and drug use, the shape of discounting functions may have differed based on participants’ financial choices and frequency of drug use. To compare entire discounting functions based on those factors, we divided participants into two groups based on median average daily balance (high and low balance) and two groups based on median percentage of daily balance spent (savers and spenders). To categorize discounting according to drug use, we divided participants into three categories of drug use frequency (infrequent, frequent use of one drug, and frequent use of cocaine and opiates) based on results of cocaine and opiate urinalysis tests. Figure 1 shows discounting functions, indifference points as a function of delay to the larger outcome, for the full sample, high and low daily balance, spenders and savers, and by frequency of drug use. Delay discounting functions were overlapping and not significantly different (p > .05) for each measure of earning, spending, and drug use.

Median indifference points are plotted as a function of delay in years to larger, later monetary gain for the total sample; infrequent or frequent users of one or two drugs; participants with a relatively low or high average daily balance; and participants with relatively low or high percentage of daily balance spent. Dashed, dotted, and solid curves are hyperbolic discounting functions (Equation 1) fit to group medians, where k is the degree of discounting and VAC is variance accounted for by Equation 1

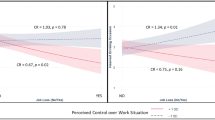

Similar measures of delay discounting were obtained regardless of earning, saving, and drug use, but drug use and saving were related. Figure 2 shows average daily balance and percentage of daily balance spent as a function of drug use frequency categories based on missing-positive (left) and missing-missing (right) approaches. Average daily balance was entered into an ANOVA with drug use frequency category per the missing-positive approach as the factor. Average daily balance differed across category, F(2, 64) = 3.24, p < .05, ηP 2 = 0.09. Because there were unequal variances in average daily balance between groups (Levene’s test p = 0.046), Dunnett post hoc tests were used and revealed that average daily balance was significantly higher for participants with a low frequency of drug use (M = $189.57, SE = $34.20) than those who used two drugs with high frequency (M = $50.69, SE = $42.58). Participants who used one drug with high frequency did not statistically significantly differ from the other groups in average daily balance (M = $126.76, SE = $47.61). Percentage of daily balance spent was entered into an ANOVA with drug-use frequency category per the missing-positive approach as the factor. Percentage of daily balance spent differed across category, F(2, 64) = 3.44, p < .05, ηP 2 = 0.10. Tukey HSD post hoc tests indicated that participants with a relatively low frequency of drug use spent a smaller percentage of their daily balance (M = 35.18%, SE = 4.99%) than those who used two drugs with high frequency (M = 55.67%, SE = 6.21%). Participants who used one drug with high frequency did not statistically significantly differ from the other groups in percentage of daily balance spent (M = 47.30%, SE = 6.94%). The ANOVA comparing average daily balance and percentage of balance spent were repeated using drug-use frequency groups based on a missing-missing approach. Results of the ANOVAs were not statistically significant (ps > .05), but Fig. 2 shows that the trends between groups determined by the missing-missing approach (right) were similar to the results based on the missing-positive approach (left).

Bars are mean average daily balance (top) and mean percentage of daily balance spent (bottom) as a function of drug use category determined by a missing-positive (M-P) approach (left) or a missing-missing (M-M) approach (right). Categories were frequent users of two drugs (>50% of samples positive for cocaine and opiates), frequent users of one drug (>50% samples positive for cocaine or opiates), or a relatively low frequency of drug use (>50% samples negative for cocaine and opiates). Each data point is a single participant. Values of p < .05 indicate significant differences between drug use category using post hoc t tests

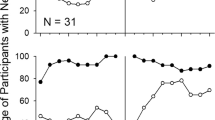

Another objective of this study was to identify patterns of earning and spending money in opioid-dependent adults. Figures 3, 4 and 5 illustrate spending patterns for participants with infrequent drug use, frequent use of one drug, and frequent use of both drugs determined by a missing-positive approach, respectively, up to the first $1000 earned in the therapeutic workplace. Each graph in Figs. 3, 4 and 5 shows cumulative spending plotted as a function of cumulative earning for a single participant. The solid line with a slope of one represents the cumulative record if participants spent 100% of their earnings. Figures are collapsed across contingency and prescription groups, but group assignment is coded (i.e., “C” for contingency or a “P” for prescription) in participant numbers. The figures show spending patterns up to the first $1,000 earned in the therapeutic workplace because most participants earned at least $1,000 and because there were contingencies to spend earnings toward the end of the study (i.e., participants were required to spend all their earnings within a short period of time after the end of the study). On average, participants earned their first $1,000 in 27.44 workdays (SE = 2.23 workdays). An independent-samples t test found no significant difference between contingency and prescription group participants in the number of workdays to earn $1,000 (p > .05), and the number of workdays to earn $1,000 was not significantly correlated with average daily balance or percentage of balance spent (ps > .05).

Cumulative spending as a function of cumulative earning up to the first $1,000 earned in the workplace for participants with infrequent drug use categorized as greater than 50% of samples negative for cocaine and opiates following a missing-positive approach. The solid identity line represents zero savings

Cumulative spending as a function of cumulative earning up to the first $1,000 earned in the workplace for participants with frequent use of one drug categorized as greater than 50% of samples negative for one drug and less than 50% of samples negative for the other drug following a missing-positive approach. The solid identity line represents zero savings

Cumulative spending as a function of cumulative earning up to the first $1,000 earned in the workplace for participants with frequent use of two drug categorized as less than 50% of samples negative for cocaine and opiates following a missing-positive approach. The solid identity line represents zero savings

Visual inspection of graphs within Figs. 3, 4 and 5 was used to identify patterns of spending money. Some participants (e.g., C14, C24, P17, P18) spent most of their money as soon as they earned it; spending functions tracked the identity line. Some participants (e.g., C6, C34, P12, P19) alternated between spending and saving and have scalloped or stepwise spending functions. Other participants (e.g., C8, C35, P2, P7) saved most of their earnings and have nearly horizontal spending functions. On average, participants spent 69.62% of their first $1,000 earnings (range: 9.34%–96.38%). Participants in the contingency group spent 70.64% of their first $1,000 (SE = 0.61%), while those in the prescription group spent 66.42% of their first $1000 (SE = 0.52%), a difference that was not statistically significant according to an independent samples t test (p > .05). ANOVA revealed that there were no statistically significant differences between infrequent drug users (M = 66.56%, SE = 3.07%), frequent users of one drug (M = 74.18%, SE = 4.04%), and frequent users of two drugs (M = 62.37%, SE = 7.16%) on the percentage of the first $1,000 spent (ps > .05).

Discussion

This study measured earning, spending, and drug use in opioid-dependent adults who participated in a therapeutic workplace intervention for 30 weeks. Frequency of drug use was related to participants’ financial choices to save or spend their money. Namely, those participants who used opiates and cocaine infrequently maintained a higher daily balance and spent a relatively smaller percentage of their daily balance than those participants who frequently used cocaine and opiates. This result is consistent with prior studies demonstrating that financial choices are related to substance abuse treatment outcomes (Black & Rosen 2011; Tucker et al., 2002).

The results add to the literature on monetary choices in drug users by identifying significant relations between daily financial management and drug use and characterizing different patterns of spending money within a population of drug users over time. Many participants’ cumulative spending had clear scalloped or break-and-run patterns. Rather than exchanging all daily earnings for gift cards, many participants saved money for larger gift cards or bill payments after a delay. One participant, C35, spent only $136 of his first $1864 (7%) and used his initial earnings to pay rent. Incidentally, 88 out of 88 of C35’s urine samples were negative for cocaine and opiates. Not all participants were successful in maintaining abstinence and controlling spending. For example, P18 spent most of the money he earned and only had 32 out of 72 samples negative for opiates and 20 out of 72 samples negative for cocaine. There were also individual differences in spending functions that were not related to participants’ drug use frequency categories. Future research can be conducted to quantify spending patterns and identify whether those patterns relate to drug use or other measures of impulsive choice. This analysis can be used to evaluate interventions designed to improve financial choices in drug users (e.g., Black & Rosen, 2011; Rosen et al., 2009). One target of a money-management intervention might be to increase breaks in cumulative spending functions.

The present study found no significant relations between participant characteristics and measures of earning, spending, and drug use. A particularly interesting result was that delay discounting at intake did not predict daily earning, spending, or drug use during the study. One reason for this null finding was that only 75% of the sample (N = 50) had interpretable discounting functions at intake, a relatively high percentage when compared to a previous use of the screening procedure (Johnson & Bickel, 2008) that may have decreased power to detect differences in financial choices and drug use. However, the 17 participants with nonsystematic discounting data did not differ in participant characteristics, earning, spending, or drug use, from those with interpretable discounting data. Previous research (Heil, Johnson, Higgins, & Bickel, 2006) found no differences in discounting functions in currently abstinent and currently using cocaine-dependent participants but found differences in discounting between those groups and non-drug-using matched controls. Similarly, we found that there were no differences in discounting based on other, theoretically related behavior within our relatively homogenous group of opioid-dependent participants. Future research can be conducted with matched non-opioid-dependent controls, staff-delivered discounting assessments, or real monetary rewards to determine if those factors lead to discounting functions that predict financial choices and drug use during the intervention.

One avenue for future research is to determine the appropriate approach in calculating drug-use frequency. The present study used missing-positive and missing-missing approaches and found similar patterns in earning and spending regardless of approach. However, statistically significant differences in average daily balance and percentage of daily balance spent based on drug use frequency were observed when a missing-positive approach was used but were not observed using a missing-missing approach. One reason for this difference was that group sizes were more unequal when a missing-missing, rather than a missing-positive, approach was used. Conducting the same analysis on a larger sample could increase the power to detect differences between groups, if differences exist. Another reason that the two approaches yielded different results is that the missing-positive approach is confounded with retention. Some participants may have been categorized as frequent users of two drugs because they did not consistently attend the workplace and provide urine samples. A missing-positive approach would be appropriate if those participants did not show up to the workplace because they were using drugs. However, a missing-missing approach would be more appropriate if those participants did not show up to the workplace for other reasons (e.g., obtaining employment in the community, financial windfall, other illness). Studies that use urinalysis results as a measure of drug use could collect information on why participants did not provide samples. Unfortunately, it is difficult to gain that information if participants who do not provide samples also avoid communicating with research staff. Nonetheless, it is critical to determine whether and when missing-positive and missing-missing analyses are more appropriate to avoid erroneous conclusions about the effectiveness of an intervention.

A limitation of the present study is that it did not directly manipulate independent variables to identify functional relations between earning, spending, and drug use. Because effects were correlational, the possibility that drug use leads to increased spending, high spending causes drug use, or that a third variable like trait impulsivity determines financial and drug-related choices cannot be ruled out. Participants in the present study had long histories of unemployment and were living in poverty. Immediate spending in this population may have been a function of necessary expenses rather than “impulsive” financial choices. Participants also reported a low monthly income (median $654.00, interquartile range $185.00–$1240.00), which limited a thorough evaluation of financial pressure. As such, income was not related to average daily balance or percentage of balance spent. Future research can determine whether environmental pressures like low income and debt predict financial choices. Future clinical research can also help isolate these mechanisms through behavioral or pharmacological interventions targeting money management, drug abstinence, and impulsive behavior generally. Nevertheless, one destructive effect of drug use may be that it creates a perpetual zero-balance situation in the lives of users, which in turn prevents them from gaining materials that could help to break the cycle of addiction.

References

Beck, A. T., Steer, R. A., & Brown, G. K. (1996). Manual for Beck Depression Inventory-II (BDI-II). San Antonio: Psychology Corporation.

Bickel, W. K., & Marsch, L. A. (2001). Toward a behavioral economic understanding of drug dependence: delay discounting processes. Addiction, 96(1), 73–86. doi:10.1046/j.1360-0443.2001.961736.x.

Bickel, W. K., Odum, A. L., & Madden, G. J. (1999). Impulsivity and cigarette smoking: delay discounting in current, never, and ex-smokers. Psychopharmacology, 146, 447–454.

Black, A. C., & Rosen, M. I. (2011). A money management-based substance use treatment increases valuation of future rewards. Addictive Behaviors, 36(1), 125–128. doi:10.1016/j.addbeh.2010.08.014.

Carroll, M. E., Anker, J. J., Mach, J. L., Newman, J. L., & Perry, J. L. (2010). Delay discounting as a predictor of drug abuse. In G. J. Madden & W. K. Bickel (Eds.), Impulsivity: The behavioral and neurological science of discounting (pp. 243–271). Washington, DC: American Psychological Association.

Chabris, C. F., Laibson, D., Morris, C. L., Schuldt, J. P., & Taubinsky, D. (2008). Individual laboratory-measured discount rates predict field behavior. Journal of Risk and Uncertainty, 37(2/3), 237–269. doi:10.1007/s11166-008-9053-x.

Cottler, L. B. (1991). The CIDI and CIDI-substance abuse module (SAM): Cross-cultural instruments for assessing DSM-III, DSM-III-R, and ICD-10 criteria. In L. S. Harris (Ed.), Proceedings of the Committee on Problems of Drug Dependence 1990 (NIDA Research Monograph 105, DHHS Pub. No. ADM 91-1754 (pp. 167–177). Rockville: Department of Health and Human Services.

Dunn, K. E., Defulio, A., Everly, J. J., Donlin, W. D., Aklin, W. M., Nuzzo, P. A., & Silverman, K. (2013). Employment-based reinforcement of adherence to oral naltrexone treatment in unemployed injection drug users. Experimental and Clinical Psychopharmacology, 21(1), 74–83. doi:10.1037/a0030743.

Hamilton, K. R., & Potenza, M. N. (2012). Relations among delay discounting, addictions, and money mismanagement: implications and future directions. The American Journal of Drug and Alcohol Abuse, 38(1), 30–42. doi:10.3109/00952990.2011.643978.

Heil, S. H., Johnson, M. W., Higgins, S. T., & Bickel, W. K. (2006). Delay discounting in currently using and currently abstinent cocaine-dependent outpatients and non-drug-using matched controls. Addictive Behaviors, 31(7), 1290–1294. doi:10.1016/j.addbeh.2005.09.005.

Jenkins, R., Bhugra, D., Bebbington, P., Brugha, T., Farrell, M., Coid, J., & Meltzer, H. (2008). Debt, income and mental disorder in the general population. Psychological Medicine, 38(10), 1485–1493. doi:10.1017/S0033291707002516.

Johnson, M. W., & Bickel, W. K. (2002). Within-subject comparison of real and hypothetical money rewards in delay discounting. Journal of the Experimental Analysis of Behavior, 77, 129–146. doi:10.1901/jeab.2002.77-129.

Johnson, M. W., & Bickel, W. K. (2008). An algorithm for identifying nonsystematic delay-discounting data. Experimental and Clinical Psychopharmacology, 16(3), 264–274. doi:10.1037/1064-1297.16.4.321.

Kirby, K. N., Petry, N. M., & Bickel, W. K. (1999). Heroin addicts have higher discount rates for delayed rewards than non-drug-using controls. Journal of Experimental Psychology: General, 128(1), 78–87. doi:10.1037/0096-3445.128.1.78.

MacKillop, J., Amlung, M. T., Few, L. R., Ray, L. A., Sweet, L. H., & Munafò, M. R. (2011). Delayed reward discounting and addictive behavior: a meta-analysis. Psychopharmacology, 216(3), 305–321. doi:10.1007/s00213-011-2229-0.

Madden, G. J., Petry, N. M., Badger, G. J., & Bickel, W. K. (1997). Impulsive and self-control choices in opioid-dependent patients and non-drug-using control patients: drug and monetary rewards. Experimental and Clinical Psychopharmacology, 5(3), 256–262. doi:10.1037/1064-1297.5.3.256.

Mazur, J. E. (1987). An adjusting procedure for studying delayed reinforcement. In M. L. Commons, J. E. Mazur, J. A. Nevin, & H. Rachlin (Eds.), Quantitative analysis of behavior: The effect of delay and intervening events on reinforcement value (pp. 55–73). Hillsdale: Erlbaum.

McLellan, A. T., Luborsky, L., Cacciola, J., Griffith, J., Evans, F., & Barr, H. L. (1985). New data from the addiction severity index: reliability and validity in three centers. The Journal of Nervous and Mental Disease, 173(7), 412–423. doi:10.1097/00005053-198507000-00005.

McPherson, S., Barbosa-Leiker, C., Burns, G. L., Howell, D., & Roll, J. (2012). Missing data in substance abuse treatment research: current methods and modern approaches. Experimental and Clinical Psychopharmacology, 20(3), 243–250. doi:10.1037/a0027146.

Meier, S., & Sprenger, C. (2010). Present-biased preferences and credit card borrowing. American Economic Journal: Applied Economics, 2(1), 193–210. doi:10.1257/app.2.1.193.

Myerson, J., Green, L., & Warusawitharana, M. (2001). Area under the curve as a measure of discounting. Journal of the Experimental Analysis of Behavior, 76, 235–243. doi:10.1901/jeab.2001.76-235.

Odum, A. L., Madden, G. J., Badger, G. J., & Bickel, W. K. (2000). Needle sharing in opioid-dependent outpatients: psychological processes underlying risk. Drug and Alcohol Dependence, 60, 259–266. doi:10.1016/S0376-8716(00)00111-3.

Rachlin, H., & Green, L. (1972). Commitment, choice and self‐control. Journal of the Experimental Analysis of Behavior, 17(1), 15–22. doi:10.1901/jeab.1972.17-15.

Rosen, M. I. (2012). Overview of special sub-section on money management articles: cross-disciplinary perspectives on money management by addicts. The American Journal of Drug and Alcohol Abuse, 38(1), 2–7. doi:10.3109/00952990.2011.644366.

Rosen, M. I., Carroll, K. M., Stefanovics, E., & Rosenheck, R. A. (2009). A randomized controlled trial of a money management-based substance use intervention. Psychiatric Services, 60(4), 498–504. doi:10.1176/appi.ps.60.4.498.

Satel, S., Reuter, P., Hartley, D., Rosenheck, R., & Mintz, J. (1997). Influence of retroactive disability payments on recipients' compliance with substance abuse treatment. Psychiatric Services, 48(6), 796–799.

Silverman, K., DeFulio, A., & Sigurdsson, S. O. (2012). Maintenance of reinforcement to address the chronic nature of drug addiction. Preventive medicine, 55, S46–S53. doi: 10.1016/j.ypmed.2012.03.013

Silverman, K., Holtyn, A. F., & Morrison, R. (2016). The therapeutic utility of employment in treating drug addiction: science to application. Translational Issues in Psychological Science, 2(2), 203–212. doi:10.1037/tps0000061.

Silverman, K., Wong, C. J., Needham, M., Diemer, K. N., Knealing, T., Crone‐Todd, D., & Kolodner, K. (2007). A randomized trial of employment‐based reinforcement of cocaine abstinence in injection drug users. Journal of Applied Behavior Analysis, 40(3), 387–410. doi:10.1901/jaba.2007.40-387.

Swartz, J. A., Hsieh, C. M., & Baumohl, J. (2003). Disability payments, drug use and representative payees: an analysis of the relationships. Addiction, 98(7), 965–975. doi:10.1046/j.1360-0443.2003.00414.x.

Tucker, J. A., Foushee, H. R., & Black, B. C. (2008). Behavioral economic analysis of natural resolution of drinking problems using IVR self-monitoring. Experimental and Clinical Psychopharmacology, 16(4), 332–340. doi:10.1037/a0012834.

Tucker, J. A., Roth, D. L., Vignolo, M. J., & Westfall, A. O. (2009). A behavioral economic reward index predicts drinking resolutions: moderation revisited and compared with other outcomes. Journal of Consulting and Clinical Psychology, 77(2), 219–228. doi:10.1037/a0014968.

Tucker, J. A., Vuchinich, R. E., Black, B. C., & Rippens, P. D. (2006). Significance of a behavioral economic index of reward value in predicting drinking problem resolution. Journal of Consulting and Clinical Psychology, 74(2), 317–326. doi:10.1037/0022-006X.74.2.317.

Tucker, J. A., Vuchinich, R. E., & Rippens, P. D. (2002). Predicting natural resolution of alcohol-related problems: a prospective behavioral economic analysis. Experimental and Clinical Psychopharmacology, 10(3), 248–257. doi:10.1037/1064-1297.10.3.248.

Wilkinson, G. (1993). The wide range achievement test (WRAT-3): Administration manual. Wilmington: Wide Range Inc.

Acknowledgements

This research was supported by Grants R01DA019386, R01DA23864, and T32DA07209 from the National Institute on Drug Abuse. The authors wish to thank Peter Causey for assistance with collecting the data.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interest Statement

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Rights and permissions

About this article

Cite this article

Subramaniam, S., DeFulio, A., Jarvis, B.P. et al. Earning, Spending, and Drug Use in a Therapeutic Workplace. Psychol Rec 67, 273–283 (2017). https://doi.org/10.1007/s40732-017-0237-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40732-017-0237-0