Abstract

This paper presents new results on the welfare effects of third-degree price discrimination under constant elasticity demand. We show that when both the share of the strong market under uniform pricing and the elasticity difference between markets are high enough, then price discrimination not only can increase social welfare but also consumer surplus. We also obtain new bounds on the welfare change for log-convex demands.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The criteria developed in the literature for characterizing the effects of third-degree price discrimination on output and welfare have little to say about the case of constant elasticity demand (see, for example, Robinson 1933; Schmalensee 1981; Varian 1985; Schwartz 1990; Shih et al. 1988; Cheung and Wang 1994; and, more recently, Cowan 2007, Aguirre et al. 2010 ACV henceforth, and Cowan 2012). ACV state that if both the inverse and direct demands in the weak market (the lower price market) are more convex than in the strong market (the higher price one) then total output rises with discrimination. Unfortunately, with constant elasticity demands this sufficient condition cannot be applied because the direct demand is more convex in the weak market than in the strong market, while the inverse demand is more convex in the strong market. ACV also obtain sufficient conditions for price discrimination to increase welfare that are, again, not satisfied by constant elasticity demands. So, what is it known about the effect of price discrimination on output and welfare under constant elasticity? ACV prove that output increases with discrimination,Footnote 1 and also provide a negative result for welfare: if the elasticity difference is less than one then welfare falls with discrimination.Footnote 2 After presenting the model in Sect. 2 and characterizing the effect of price discrimination on output and prices, we show in Sect. 3 that when both the share of the strong market under uniform pricing and the elasticity difference are high enough third-degree price discrimination increases social welfare. Moreover, consumer surplus can also increase but, as expected, only under more stringent conditions as Sect. 4 shows. We also relate, in Sect. 5, the effect of price discrimination on consumer surplus to Varian’s upper and lower bounds and obtain new upper and lower bounds for the welfare change. Section 6 concludes.

2 The model

Consider a monopolist selling a good in two separated markets whose demands exhibit constant elasticity: \(D_i ( {p_i })=a_i (p_i )^{-\varepsilon _i }\), where \(\varepsilon _i >1\) is the elasticity and \(a_i \), \(i=1,2,\) is a measure of market size. Assume that \(\varepsilon _2 =\varepsilon _1 +\theta \), where \(\theta >0\) so that market 2 will be the one with the lower discriminatory price and that unit cost is constant \(c>0\). The profit function in market \(i\) is \(\pi _i ( {p_i })=(p_i -c)a_i (p_i )^{-\varepsilon _i }\), \(i=1,2.\) This profit function is not concave,Footnote 3 but is single-peaked, reaching its unique maximum at \(p_i^*=\varepsilon _i c/(\varepsilon _i -1)\), \(i=1,2\), the optimal discriminatory price, with \(q_i^*=a_i (p_i^*)^{-\varepsilon _i }\) the output in market \(i\) and \(q^*=\mathop \sum \nolimits a_i (p_i^*)^{-\varepsilon _i }\) the total output. The profit function under uniform pricing \(\pi ( p)=(p-c)\mathop \sum \nolimits a_i (p)^{-\varepsilon _i }\) is not necessarily quasi-concave and thus may have more than one local maximum.Footnote 4 The second derivative of the profit function is \(\pi ^{''}( p)=\mathop \sum \nolimits ^ \varepsilon _i a_i (p)^{-(\varepsilon _i +1)}[( {\varepsilon _i -1})-\frac{(\varepsilon _i +1)}{p}c]\). But from Theorem 1 by Nahata et al. (1990), we state that the optimal uniform price, \(p^0\) is such that \(p_1^*>p^0>p_2^*\) and satisfies the FOC \(\pi ^{\prime }( {p^0})=0\) Footnote 5. The Lerner index is \((p^0-c)/ p^0=1/\varepsilon (p^0)\), where \(\varepsilon (p^0)\) is the elasticity of the aggregate demand at \(p^0\). From the FOC, this elasticity is the weighted average elasticity \(\varepsilon ( {p^0})=\mathop \sum \nolimits ^ \alpha _i ( {p^0})\varepsilon _i \), where the elasticity of market \(i\) is weighted by the “share” of that market \(\alpha _i ( {p^0})=D_i ( {p^0})/\mathop \sum \nolimits D_i ( {p^0})\). Following Formby et al. (1983) and Aguirre (2006), we normalize, for the sake of simplicity, the optimal uniform price to be one, \(p^0=1\). This allows us to obtain explicitly the quantity sold in each market, \(q_i^0 =a_i \), \(i=1,2\), and the total output \(q^0=a_1 +a_2 \). Define \(\alpha =a_1 /(a_1 +a_2 )\) and \(1-\alpha \) as the shares of market 1 and market 2 under uniform pricing, respectively. Given \(\varepsilon (p^0)\) and \(p^0=1\), the marginal cost is \(c=\left[ {\varepsilon _1 +( {1-\alpha })\theta -1} \right] /[\varepsilon _1 +( {1-\alpha })\theta ]\). Price discrimination decreases output in market 1 and increases output in market 2, \(\Delta q_1 <0\) and \(\Delta q_2 >0\), and the change in the total output is \(\Delta q=\Delta q_1 +\Delta q_2 =\sum a_i [( {p_i^*})^{-\varepsilon _i }-1]\). The next assumption allows us to bypass the problem that the profit function is not necessarily quasi-concave.

Assumption 1

The elasticity difference belongs to an interval \(\theta \in [0,\tilde{\theta }(\varepsilon _1 )]\) such that \(p^0=1\) is the global maximizer under uniform pricing.

Assumption 1 ensures that even if there are several local maxima, \(p^0=1\) is the global maximizer. The critical value depends also on \(\alpha \), and, for simplicity we define \(\tilde{\theta }(\varepsilon _1 )\) as the higher elasticity difference such that \(p^0=1\) is the global maximizer regardless of the value of \(\alpha .\) Footnote 6 As Table 1 illustrates the range of elasticity difference such that \(p^0=1\) is the global maximizer is much wider than the range of values of \(\theta \) such that \(\theta <\varepsilon _1 -1\), which is the sufficient condition for concavity. Note also that \(\tilde{\theta }^{\prime }( {\varepsilon _1 })>0\).

3 Effects of price discrimination on welfare

A move from uniform pricing to price discrimination generates a welfare change of \(\Delta W=\Delta u_1 +\Delta u_2 -c\Delta q\), where \(\Delta u_i =u_i ( {q_i^*})-u_i ( {q_i^0 })\), \(i=1,2\).Footnote 7 As output decreases in the strong market and increases in the weak market, welfare decreases in the strong market and increases in the weak market. The change in welfare in terms of \(\varepsilon _1 \), \(\alpha \) and \(\theta \) is:

The following lemmas characterize the relationship between the change in welfare and the share of the strong market under uniform pricing.

Lemma 1

The change in social welfare, \(\Delta W\) , is a convex–concave function of \(\alpha \) ; that is, there exists \(\tilde{\alpha }\in (0,1)\) such that \(\Delta W\) is convex for \(\alpha <\tilde{\alpha }\) and concave for \(\alpha >\tilde{\alpha }.\) Footnote 8

Proof

We check numerically that \(\frac{\partial ^2\Delta W}{\partial \alpha ^2}>0\) for \(\alpha <\tilde{\alpha }\) and \(\frac{\partial ^2\Delta W}{\partial \alpha ^2}<0\) for \(\alpha >\tilde{\alpha }\) for all the parameters compatible with Assumption 1 (see Appendix). \(\square \)

Lemma 2

Single Crossing Property. Given \(\varepsilon _1 \)and \(\theta \) the change in social welfare, \(\Delta W\), crosses at most once the \(\Delta W=0\)-axis for \(\alpha \in (0,1).\)

Proof

This follows immediately from Lemma 1, given that \(\Delta W( {\varepsilon _1 ,\alpha ,\theta })=0\) at \(\alpha \in \{0,1\}\). \(\square \)

We now consider the effect on the change in social welfare of a small change in \(\alpha \). The derivative of the change in social welfare with respect to \(\alpha \), evaluated at \(\alpha =1\), is:

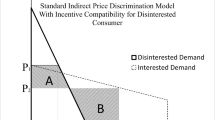

Figure 1 illustrates our strategy to obtain the existence result in this section: the change in welfare is a convex–concave function, and so the sign of \(\frac{\partial \Delta W( {\varepsilon _1 ,\alpha =1,\theta })}{\partial \alpha }\) is sufficient to evaluate the feasibility of a welfare improvement. Denote by \({\underline{\theta }}(\varepsilon _1 )\) the elasticity difference such that \(\frac{\partial \Delta W( {\varepsilon _1 ,\alpha =1,{\underline{\theta }}})}{\partial \alpha }=0\).Footnote 9 From numerical computations, we obtain that the cross derivative \(\frac{\partial ^2\Delta W( {\varepsilon _1 ,\alpha =1,\theta })}{\partial \alpha \partial \theta }\) is zero at \(\theta =\hat{\theta }(\varepsilon _1 )\) and \(\frac{\partial ^2\Delta W( {\varepsilon _1 ,\alpha =1,\theta })}{\partial \alpha \partial \theta }>0\) (\(<0)\) if \(\theta <\hat{\theta }(\varepsilon _1 )\) (\(\theta >\hat{\theta }(\varepsilon _1 ))\) where \(\hat{\theta }( {\varepsilon _1 })<{\underline{\theta }}(\varepsilon _1 )\). This guarantees that \(\frac{\partial \Delta W( {\varepsilon _1 ,\alpha =1,\theta })}{\partial \alpha }<0\) if \(\theta >{\underline{\theta }}(\varepsilon _1 )\) and \(\frac{\partial \Delta W( {\varepsilon _1 ,\alpha =1,\theta })}{\partial \alpha }>0\) if \(\hat{\theta }(\varepsilon _1 )<\theta <{\theta }(\varepsilon _1 )\). It can be checked numerically that \(\frac{\partial \Delta W( {\varepsilon _1 ,\alpha =1,\theta })}{\partial \alpha }>0\) for \(\theta \le \hat{\theta }(\varepsilon _1 )\), even though \(\frac{\partial ^2\Delta W( {\varepsilon _1 ,\alpha =1,\theta })}{\partial \alpha \partial \theta }\ge 0\) for \(\theta \le \hat{\theta }(\varepsilon _1 )\). Therefore, we have that:

Since \(\Delta W( {\varepsilon _1 ,\alpha =1,\theta })=0\) and, given that \(\frac{\partial \Delta W( {\varepsilon _1 ,\alpha =1,\theta })}{\partial \alpha }<0\) when \(\theta >{\underline{\theta }}(\varepsilon _1 )\), there exists a cutoff value \({\overline{\alpha }} \equiv {\overline{\alpha }} (\varepsilon _{1},{\theta }\) such that if \(\alpha >{\overline{\alpha }}\) price discrimination increases welfare. The next proposition summarizes the results.

Proposition 1

If \(\theta \in [{\theta }( {\varepsilon _1 }), \tilde{\theta }(\varepsilon _1 )]\) where \({\theta }( {\varepsilon _1 })>1\), then there exists a cutoff value \({\overline{\alpha }} \equiv {\overline{\alpha }} (\varepsilon _{1},{\theta }\) such that:Footnote 10 (i) when \(\alpha <{\overline{\alpha }}\) price discrimination reduces welfare, (ii) when \(\alpha = {\overline{\alpha }}\) welfare remains unchanged, (iii) when \(\alpha >{\overline{\alpha }}\) price discrimination increases welfare.

Note that the ACV negative result is a special case of the analysis here: \(\frac{\partial \Delta W( {\varepsilon _1 ,\alpha =1,\theta })}{\partial \alpha }>0\) when \(\theta \le 1\) which implies (given the single-crossing property) that price discrimination reduces welfare when the elasticity difference is not high enough. Table 2 in Aguirre and Cowan (2013) provides the critical value of the share of market 1 \({\overline{\alpha }(\varepsilon _{1}, \theta )}\) above which price discrimination increases welfare. The critical value is a U-shaped function of the elasticity difference: first the critical value decreases with \(\theta \) but then (for a high enough elasticity in market 1) increases with \(\theta \). It is also possible to show that the critical value is a U-shaped function of the elasticity ratio and the pass-through ratio (that is, the ratio of the slope of inverse demand to the slope of marginal revenue).Footnote 11

To provide some more intuition, note that from ACV (Proposition 6) a necessary condition for welfare to be higher with discrimination is that \(\alpha \theta >1\). Now allow \(p^0\) to change. Since \(\alpha =\frac{a_1 ( {p^0})^{-\varepsilon _1 }}{a_1 ( {p^0})^{-\varepsilon _1 }+a_2 ( {p^0})^{-\varepsilon _1 -\theta }}=\frac{a_1 ( {p^0})^\theta }{a_1 ( {p^0})^\theta +a_2 }\), the share of the strong market is larger the higher is the uniform price, \(p^0\). In turn the uniform price is increasing in \(c\) and in the relative size parameter \(a_1 /a_2 \).

4 Effects on consumer surplus

Consumer surplus in market \(i\) is \(CS_i ( {q_i })=u_i ( {q_i })-p_i (q_i )q_i \), so the change in consumer surplus is given by:

Consider again the effect of a small change in \(\alpha \) on consumer surplus at \(\alpha =1\):

Denote by \({{\underline{\underline{\theta }}}}(\varepsilon _1 )\) the elasticity difference such that \(\frac{\partial (\Delta \mathrm{CS}( {\varepsilon _1 ,\alpha =1,\theta )})}{\partial \alpha }=0\). Hence, we have:

Since \(\Delta \mathrm{CS}({\varepsilon _1 ,\alpha =1,\theta })=0\) and given that \(\frac{\partial (\Delta \mathrm{CS}(\varepsilon _{1} ,\alpha =1,\theta ))}{\partial \alpha }<0\) when \(\theta >{\underline{\underline{\theta }}}(\varepsilon _{1})\), there exists a cutoff value \({\overline{\overline{\alpha }}} \equiv {\overline{\overline{\alpha }}} (\varepsilon _{1} ,\theta )\) such that if \(\alpha > {\overline{\overline{\alpha }}}\) consumer surplus increases with price discrimination. Again the change in consumer surplus satisfies a single-crossing property and so we can state that when \(\alpha <{\overline{\overline{\alpha }}} \) price discrimination reduces consumer surplus. Since price discrimination increases profits, necessarily \({{\underline{\underline{\theta }}}}( {\varepsilon _{1}})> {\underline{\underline{\theta }}}(\varepsilon _{1} )\): to increase consumer surplus the elasticity difference must be greater than the difference needed to increase welfare. The following proposition summarizes the results.

Proposition 2

if \(\theta \in [{\underline{\underline{\theta }}}( {\varepsilon _1 }), \tilde{\theta }(\varepsilon _1 )]\) , then there exists a cutoff value \(\overline{\overline{{\alpha }}} \equiv \overline{\overline{{\alpha }}} ( {\varepsilon _1 ,\theta })>{\overline{\alpha }}\) such that:Footnote 12 (i) when \(\alpha <\overline{\overline{{\alpha }}} \) price discrimination reduces consumer surplus, (ii) when \(\alpha =\overline{\overline{{\alpha }}} \) consumer surplus remains unchanged, (iii) when \(\alpha >\overline{\overline{{\alpha }}}\) price discrimination increases consumer surplus.

Table 4 in Aguirre and Cowan (2013) illustrates the critical value for the share of market 1 under uniform pricing above which the consumer surplus increases with price discrimination. As expected, for consumer surplus to increase, we need a cutoff value for the share of market 1 higher than the one needed for welfare to increase (see also their Table 2).

5 New bounds on the change in welfare under log-convex demand

We next relate the change in consumer surplus due to a move from uniform pricing to price discrimination to Varian (1985) upper bound (VUB) and lower bound (VLB) which under constant elasticity are:

We will use the property that strictly log-convex demand functions exhibit what Mrázová and Neary (2013) call “Super-Pass-Through”: the optimal price rises by more than the increase in marginal cost. The next lemma states the property.

Lemma 3

The cost pass-through coefficient exceeds 1, \(\frac{p_i^{\prime }({q_i})}{r_i^{\prime \prime } ( {q_i })}>1\) , when demand functions are strictly log-convex.Footnote 13

Proof

Amir et al. (2004) were the first to get this result (see also Weyl and Fabinger 2013, and Mrázová and Neary 2013). Note that

if and only if \(p_i^{\prime }({q_i })+q_i p_i^{''} ( {q_i })>0\) (given strictly concavity of the profit function, \(2p_i^{\prime } ( {q_i })+q_i p_i^{''} ( {q_i })<0)\).

The direct demand is defined as \(q_i \equiv D_i (p_i ( {q_i }))\). Differentiating once gives \(1=D_i^{\prime }(p_i ( {q_i }))p_i^{\prime }( {q_i })\), and twice yields (omitting arguments) \(0=D_i^{''} \left[ {p_i^{\prime }} \right] ^2+D_i^{\prime } p_i^{''} \). When direct demand \(D_i \) is strictly log-convex (that is \(\text{ log }D_i \) is strictly convex) then \(D_i^{''} D_i -\left[ {D_i^{\prime }} \right] ^2>0\). But, using second derivative of the demand identity we get: \(D_i^{''} D_i -( {D_i^{\prime }})^2=-\frac{D_i^{\prime }}{( {p_i^{\prime }})^2}\left[ {p_i^{\prime }+D_i p_i^{''} } \right] \) and immediately we obtain the result. \(\square \)

The next lemma shows that there are bounds to the change in consumer surplus for all demand functions which are strictly log-convex and have decreasing marginal revenue. Constant elasticity demand satisfies both conditions. Another class of demands that satisfies both conditions is when inverse demand in each market is an affine function of a constant elasticity inverse demand (i.e., \(p_i ( {q_i })=A_i +b_i ( {q_i })^{-\frac{1}{\varepsilon _i }}\), with \(\varepsilon _i >1)\).Footnote 14

Lemma 4

When demand functions are strictly log-convex and marginal revenues are strictly decreasing, the change in consumer surplus satisfies:

with strict inequalities if \(\Delta q_i \ne 0, i=1,2\).Footnote 15

Proof

Let consumer surplus as a function of quantity be \(\mathrm{CS}_i ( {q_i })=u_i ( {q_i })-p_i (q_i )q_i \).Footnote 16 It follows that \(\mathrm{CS}_i^{\prime }( {q_i })=p_i (q_i )-r_i^{\prime }( {q_i })\) where \(r_i^{\prime }({q_i })\equiv p_i ( {q_i })+q_i p_i^{\prime }( {q_i })\) is the marginal revenue and \(\mathrm{CS}_i^{''} ( {q_i })=p_i^{\prime }( {q_i })-r_i^{''}( {q_i })=r_i^{''} ( {q_i })\left( {\frac{p_i^{\prime }( {q_i })}{r_i^{''}( {q_i })}-1}\right) \). The ratio \(\frac{p_i^{\prime }({q_i })}{r_i^{''} ( {q_i })}\), the cost pass-through coefficient, with strict log-convexity exceeds 1 (see Lemma 3) so \(\mathrm{CS}_i^{''} ( {q_i })<0\) (provided that \(r_i^{''} ( {q_i })<0)\). By concavity of consumer surplus, the change in aggregate consumer surplus is bounded above:

and below

This last expression follows because marginal revenue equals marginal cost with discrimination. \(\square \)

Lemma 4 can be used to provide conditions for consumer surplus to be higher with discrimination. It also provides tighter bounds for welfare than Varian’s original bounds by simply adding the change in profits to condition (9), as stated in the next proposition.

Proposition 3

When demand functions are strictly log-convex and marginal revenues are strictly decreasing, the change in welfare has an upper bound and a lower bound:

The welfare lower bound in Proposition 3 is tighter than Varian’s lower bound (because the change in profits is positive). The upper bound is also tighter than Varian’s upper bound since decreasing marginal revenue guarantees \(\Delta \pi -\mathop \sum \nolimits {\pi }_{i^{\prime }} ( {q_i^0 })\Delta q_i <0\).Footnote 17

Under constant elasticity the new upper bound (NUB) and lower bound (NLB) are:

Figure 2 represents the social welfare change, Varian’s upper and lower bounds, and the NUB and NLB when \(\varepsilon _1=2\) and \(\theta =4\). Varian’s upper bound is always positive because price discrimination increases output under constant elasticity, so his necessary condition for welfare improvement always is satisfied. However, our necessary condition only would be satisfied if \(\alpha \) were (more or less) higher than 60 %. Similarly, Varian’s lower bound is negative for any \(\alpha \) but our NLB indicates that if \(\alpha \) were higher than about 86 % then the sufficient condition for welfare improvement would be satisfied.

6 Concluding remarks

The possibility that third-degree price discrimination generates a welfare improvement increases with the elasticity difference and the share of the strong market under uniform pricing. The critical value of the share of the strong market above which price discrimination increases welfare is a U-shaped function of the elasticity difference, the elasticity ratio and the pass-through ratio. Price discrimination may also increase consumer surplus but, of course, under more stringent conditions. We also generalize a property satisfied by constant elasticity demands to obtain new upper and lower bounds on social welfare when demand functions are strictly log-convex.

Notes

There is some previous research on this aspect. Greenhut and Ohta (1976) show numerically that price discrimination may increase output, and Ippolito (1980) finds that total output increases in all his numerical simulations. Formby et al. (1983) use Lagrangean techniques to show that discrimination increases total output over a wide range of constant elasticities. Finally, Aguirre (2006) provides an analytical proof using an inequality due to Bernoulli and ACV simplify and slightly generalize the proof (which uses the fact that demand is convex in the reciprocal of the price).

Ippolito (1980) shows using numerical simulations that price discrimination can increase social welfare and consumer surplus.

Nahata et al. (1990) show that the profit function is concave for prices below \(\bar{p}=(\varepsilon _i +1)c/(\varepsilon _i -1)\) and convex for higher prices.

The aggregate profit function would be concave (and therefore quasi-concave) in the relevant range of prices if \(\pi ^{''}( p) <0 \forall p\in [p_2^*,p_1^*]\). Note that \(\pi ^{''}( p) < 0 \forall p\in [p_2^*,\bar{p}_2 ]\) given the shape of the profit function in market 2. Therefore, a sufficient condition for concavity of the profit function is \(p_1^*\le \bar{p}_2 \) or, alternatively, \(\varepsilon _2 \le 2\varepsilon _1 -1\).

All markets are automatically served under uniform pricing.

For example, when \(\varepsilon _1 =4\) if the elasticity difference is \(\theta =17\) then for \(\alpha \in ({0,0.797})\mathop \cup \nolimits (0.9,0.999)\) the global maximizer is \(p=1\). When \(\alpha \in ({0.797, 0.9})\) the optimal uniform price can be higher or lower than \(p=1\). As Table 1 indicates, when \(\varepsilon _1 =4\) and \(\theta \in (0,16.9)\) the aggregate profit function reaches a global maximum at \(p=1\).

We consider the case of quasi-linear utility function with an aggregate utility function of the form \(\mathop \sum \nolimits u_i ( {q_i })+y_i \), where \(q_i \) is consumption in market \(i \)and \(y_i \) is the amount to be spent on other goods. The sub-utilities \(u_i \), \(i=1,2\), are increasing and strictly concave.

See Quah and Strulovici (2012).

Of course, \(\tilde{\theta }(\varepsilon _1 )>{\underline{\theta }}(\varepsilon _1)\). For instance, \(\tilde{\theta }( 2)=7>1.3102={\underline{\theta }}(2)\) or \(\tilde{\theta }( 3)=11.9>1.3616={\underline{\theta }}(3)\).

See Weyl and Fabinger (2013) for an extensive analysis of pass-through.

Of course, \(\tilde{\theta }(\varepsilon _1 )>{{\underline{\underline{\theta }}}}(\varepsilon _1 )\). For instance, \(\tilde{\theta }( 2)=7>2.4091={{\underline{\underline{\theta }}}}(2)\) or \(\tilde{\theta }( 3)=11.9>5.1699={{\underline{\underline{\theta }}}}(3)\).

Lemma 3 might be equivalently enunciated in terms of inverse demand. That is, the cost pass-through coefficient exceeds 1 when \(p_i ( {q_i })-c\) is strictly log-convex. Amir (1996) uses the same property but to guarantee in a context of Cournot oligopoly that the game is log supermodular.

The strictly log-convex demand family is much wider than constant elasticity demand family. Mrázová and Neary (2013) classify strictly log-convex demands or demands with Super-Pass-Through taking as a base the family of constant elasticity demands (CES demands). They consider three types of strictly log-convex demands: strictly super convex demands, constant elasticity demands and strictly sub convex demands. Super convexity of a demand function at an arbitrary point is equivalent to the function being more convex at that point than a CES demand function with the same elasticity.

The lower bound for consumer surplus is the same as Varian’s lower bound for welfare.

Bulow and Klemperer (2012) illustrate how consumer surplus equals the area between the inverse demand curve and the marginal revenue curve up to a given quantity.

Note that the assumption \(\varepsilon _i >1, i=1,2\), guarantees that the profit function in market \(i \) (as a function of output) is strictly concave under constant elasticity demand.

References

Aguirre, I.: Monopolistic price discrimination and output effect under conditions of constant elasticity demand. Econom. Bull. 23(4), 1–6 (2006)

Aguirre, I., Cowan, S., Vickers, J.: Monopoly price discrimination and demand curvature. Am. Econ. Rev. 100, 1601–1615 (2010)

Aguirre, I., Cowan, S.: Monopoly price discrimination with constant elasticity demand. Ikerlanak Working Paper Series IL 74/13, University of the Basque Country UPV/EHU (2013)

Amir, R.: Cournot oligopoly and the theory of supermodular games. Games Econ. Behav. 15, 132–148 (1996)

Amir, R., Maret, I., Troege, M.: On taxation pass-through for a monopoly firm. Ann. D’Econ. Statisq. 75(76), 155–172 (2004)

Bulow, J., Klemperer, P.: Regulated prices, rent seeking, and consumer surplus. J. Polit. Econ. 120, 160–186 (2012)

Cheung, F., Wang, X.: Adjusted concavity and the output effect under monopolistic price discrimination. South. Econ. J. 60, 1048–1054 (1994)

Cowan, S.: The welfare effects of third-degree price discrimination with nonlinear demand functions. Rand J. Econ. 32, 419–428 (2007)

Cowan, S.: Third-degree price discrimination and consumer surplus. J. Ind. Econ 60, 333–345 (2012)

Formby, J.P., Layson, S., Smith, W.J.: Price discrimination, adjusted concavity, and output changes under conditions of constant elasticity. Econ. J. 93, 892–899 (1983)

Greenhut, M.L., Ohta, H.: Joan Robinson’s criterion for deciding whether market discrimination reduces output. Econ. J. 86, 96–97 (1976)

Ippolito, R.: Welfare effects of price discrimination when demand curves are constant elasticity. Atl. Econ. J. 8, 89–93 (1980)

Mrázová, M., Neary, J.P.: Not so demanding: preference structure, firm behavior, and welfare. Discussion Paper Series No. 691, University of Oxford (2013)

Nahata, B., Ostaszewski, K., Sahoo, P.K.: Direction of price changes in third-degree price discrimination. Am. Econ. Rev. 80, 1254–1262 (1990)

Pigou, A.C.: The economics of welfare, 3rd edn. Macmillan, London (1920)

Quah, John K.-H., Strulovici, Bruno: Aggregating the single crossing property. Econometrica 80, 2333–2348 (2012)

Robinson, J.: The economics of imperfect competition. Macmillan, London (1933)

Schmalensee, R.: Output and welfare implications of monopolistic third-degree price discrimination. Am. Econ. Rev. 71, 242–247 (1981)

Schwartz, M.: Third-degree price discrimination and output: generalizing a welfare result. Am. Econ. Rev. 80, 1259–1262 (1990)

Shih, J., Mai, C., Liu, J.: A general analysis of the output effect under third-degree price discrimination. Econ. J. 98, 149–158 (1988)

Varian, H.R.: Price discrimination and social welfare. Am. Econ. Rev. 75, 870–875 (1985)

Weyl, G., Fabinger, M.: Pass-through as an economic tool: principles of incidence under imperfect competition. J. Polit. Econ. 121, 528–583 (2013)

Acknowledgments

Financial support from the Ministerio de Economía y Competitividad (ECO2012-31626), and from the Departamento de Educación, Política Lingüística y Cultura del Gobierno Vasco (IT869-13) is gratefully acknowledged. We would like to thank Ilaski Barañano, Preston McAfee, Ignacio Palacios-Huerta and an anonymous referee for helpful comments.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Proof of Lemma 1

where \(\Psi =\frac{\theta }{[\varepsilon _1 +( {1-\alpha })\theta -1]}\). It can be checked by numerical computations that \(\frac{\partial ^2\Delta W}{\partial \alpha ^2}\) crosses at most once the horizontal axis (we have checked numerically for \(\varepsilon _1 \in \{1.5,2,3,4,\ldots ,10\}\) and for any elasticity difference compatible with Assumption 1): this guarantees that the change in welfare is a convex–concave function of \(\alpha \).

Cross Derivative

where \(\Gamma =( {\frac{\varepsilon _1 (\varepsilon _1 +\theta -1)}{(\varepsilon _1 -1)(\varepsilon _1 +\theta )}})^{\varepsilon _1 +\theta -1}\). We have checked numerically that:

\(\square \)

Rights and permissions

About this article

Cite this article

Aguirre, I., Cowan, S.G. Monopoly price discrimination with constant elasticity demand. Econ Theory Bull 3, 329–340 (2015). https://doi.org/10.1007/s40505-014-0063-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40505-014-0063-3